ACCT6006 Auditing: A Deep Dive into Dick Smith's Financial Issues

VerifiedAdded on 2023/06/09

|16

|3955

|403

Report

AI Summary

This report provides an in-depth analysis of the Dick Smith Electronics Ltd. collapse, examining breaches of Australian Accounting Standards, director responsibilities, and the role of the auditor. It begins with a brief history of the company and its eventual liquidation in 2016, highlighting key factors such as faulty inventory management and issues related to private equity. The report identifies several breaches of AASB standards, particularly concerning inventory and rebate management, and discusses how directors failed to implement adequate systems. A detailed analysis of Dick Smith's annual reports reveals financial manipulations, including inflated sales figures and stock inventories, leading to operational inefficiencies. The report also highlights signs of a going concern problem, such as declining earnings per share and gross profit, and touches upon the potential liability of the auditor towards third parties. The analysis concludes that financial indiscipline and manipulations significantly contributed to the company's downfall after its listing on the Australian Securities Exchange.

Running head: AUDITING THEORY AND PRACTICE

Auditing Theory and Practice

Name of the Student

Name of the University

Author note

Auditing Theory and Practice

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING THEORY AND PRACTICE

Table of Contents

Introduction:...............................................................................................................................3

Brief History and Collapse:........................................................................................................3

Breach of Australian Accounting Standards:.............................................................................5

Breach by Directors:..............................................................................................................5

Brief Analysis of the Annual Report:.........................................................................................6

Signs of Going Concern problem:..............................................................................................8

Cause of Unmodified Audit Report:..........................................................................................9

Liability of Auditor towards third parties:...........................................................................10

Some related observations:..................................................................................................10

Conclusion:..............................................................................................................................11

References:...............................................................................................................................12

Table of Contents

Introduction:...............................................................................................................................3

Brief History and Collapse:........................................................................................................3

Breach of Australian Accounting Standards:.............................................................................5

Breach by Directors:..............................................................................................................5

Brief Analysis of the Annual Report:.........................................................................................6

Signs of Going Concern problem:..............................................................................................8

Cause of Unmodified Audit Report:..........................................................................................9

Liability of Auditor towards third parties:...........................................................................10

Some related observations:..................................................................................................10

Conclusion:..............................................................................................................................11

References:...............................................................................................................................12

2AUDITING THEORY AND PRACTICE

Executive Summary:

Dick Smith was one of the most recognisable electronic retail companies of Australia.

During the initial phase of the company, it had garnered an enormous fan following and had

already become a household name in Australian household. Although due to a series of

financial manipulations and mal practices, the company suffered, which led to its untimely

dissolution. In this report, an analytical approach has been adopted for looking into this

matter. This report has been divided into various sections, including a Brief History and

Collapse, Breach of Australian Accounting Standards, including an enquiry into the causes of

the unmodified report by the auditors.

Executive Summary:

Dick Smith was one of the most recognisable electronic retail companies of Australia.

During the initial phase of the company, it had garnered an enormous fan following and had

already become a household name in Australian household. Although due to a series of

financial manipulations and mal practices, the company suffered, which led to its untimely

dissolution. In this report, an analytical approach has been adopted for looking into this

matter. This report has been divided into various sections, including a Brief History and

Collapse, Breach of Australian Accounting Standards, including an enquiry into the causes of

the unmodified report by the auditors.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING THEORY AND PRACTICE

Introduction:

Dick Smith is one of the most reputed electronics companies, to have ever been come

out of Australia. Of late it had been entangled itself in a series of financial problems, which

proved too much for the company. These problems led to the eventual downfall of the

company, and the company had finally found itself liquidated in the year 2016. These had

some large scale implications, even putting the work of is chief auditor Deloitte in question.

The financial malpractices and manipulations had been called into some serious questioning,

which led to the preparation of this report, where a detailed and analytical view has been

adopted for the purpose of looking into this delicate matter, which had caused a major uproar

in the Australian retail market.

Brief History and Collapse:

DSHE Holding Limited, which was earlier known by the name of Dick Smith

Holding Limited, was an Australian retailer of consumer electronic products and services. It

was one of the most popular chains of retail stores based company, which used to sell

electronic goods, electronic components and project kits. Australia’s success had led to the

creation of New Zealand. This electronic based company was founded in the year 1968 by Mr

Dick Smith, and was also owned by him and his wife (Www.DickSmith.com, 2018). The

company had primarily two different segments, for ensuring convenient operations; one was

the Dick Smith Australia and Dick Smith New Zealand. The company used to connect and

communicate with its large number of customers mainly with the help of the four physical

mediums, namely the Dick Smith, Move, David Jones Electronics Powered by Dick Smith

itself and MOVE by Dick Smith Sydney International Airport. The company boasted of a

strong network of roughly around three ninety three stores spanning across Australia and

New Zealand. This vast network of stores included at least three fifty one Dick Smith Stores,

Introduction:

Dick Smith is one of the most reputed electronics companies, to have ever been come

out of Australia. Of late it had been entangled itself in a series of financial problems, which

proved too much for the company. These problems led to the eventual downfall of the

company, and the company had finally found itself liquidated in the year 2016. These had

some large scale implications, even putting the work of is chief auditor Deloitte in question.

The financial malpractices and manipulations had been called into some serious questioning,

which led to the preparation of this report, where a detailed and analytical view has been

adopted for the purpose of looking into this delicate matter, which had caused a major uproar

in the Australian retail market.

Brief History and Collapse:

DSHE Holding Limited, which was earlier known by the name of Dick Smith

Holding Limited, was an Australian retailer of consumer electronic products and services. It

was one of the most popular chains of retail stores based company, which used to sell

electronic goods, electronic components and project kits. Australia’s success had led to the

creation of New Zealand. This electronic based company was founded in the year 1968 by Mr

Dick Smith, and was also owned by him and his wife (Www.DickSmith.com, 2018). The

company had primarily two different segments, for ensuring convenient operations; one was

the Dick Smith Australia and Dick Smith New Zealand. The company used to connect and

communicate with its large number of customers mainly with the help of the four physical

mediums, namely the Dick Smith, Move, David Jones Electronics Powered by Dick Smith

itself and MOVE by Dick Smith Sydney International Airport. The company boasted of a

strong network of roughly around three ninety three stores spanning across Australia and

New Zealand. This vast network of stores included at least three fifty one Dick Smith Stores,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING THEORY AND PRACTICE

10 MOVE Stores, at least four MOVE Stores by Dick Smith and roughly around twenty eight

David Jones Electronics stores, powered by Dick Smith Stores. The company had ceased its

operations, in the year 2016, and had filed for its liquidation on the 25th of July, of the same

year.

This huge electronic company, which used to be one of the most sought after companies in

the electronic arena of Australia and New Zealand had liquidated itself on the 25th of July, in

the year 2016, leading to the loss of, one of Australia’s very own companies in the electronics

arena. For the untimely collapse of this giant, it has only itself to blame (Akbar & Ahsan,

2014). The various reasons for the collapse of this electronic giant are as follows:

Faulty management of inventory: One of the most important causes of the downfall

of the company has been the inefficient management of its inventory, which had

causes accumulation of large number of stocks, which had remained unsold. Faulty

implementation and short-sightedness are some of the major issues in this section.

The inventory problems of the company had started during the second half of 2015,

where it had to write down the value of inventory by 20% by approximately $60

million.

Problem of private equity: The purchase of Dick Smith from Woolworths by

Anchorage Capital had sown the seeds of dissension and discord, which was one of

the prime reasons for its downfall. The parties had not agreed on the book value of the

company’ inventory at the time of the sale, the parties also had opposing accounting

for the sale and most importantly, Anchorage had floated the capital with a market

valuation of $520million, which was clearly ridiculously high, considering the initial

price with which it was sold initially by its founder to Woolworths, valued at just $25

million.

10 MOVE Stores, at least four MOVE Stores by Dick Smith and roughly around twenty eight

David Jones Electronics stores, powered by Dick Smith Stores. The company had ceased its

operations, in the year 2016, and had filed for its liquidation on the 25th of July, of the same

year.

This huge electronic company, which used to be one of the most sought after companies in

the electronic arena of Australia and New Zealand had liquidated itself on the 25th of July, in

the year 2016, leading to the loss of, one of Australia’s very own companies in the electronics

arena. For the untimely collapse of this giant, it has only itself to blame (Akbar & Ahsan,

2014). The various reasons for the collapse of this electronic giant are as follows:

Faulty management of inventory: One of the most important causes of the downfall

of the company has been the inefficient management of its inventory, which had

causes accumulation of large number of stocks, which had remained unsold. Faulty

implementation and short-sightedness are some of the major issues in this section.

The inventory problems of the company had started during the second half of 2015,

where it had to write down the value of inventory by 20% by approximately $60

million.

Problem of private equity: The purchase of Dick Smith from Woolworths by

Anchorage Capital had sown the seeds of dissension and discord, which was one of

the prime reasons for its downfall. The parties had not agreed on the book value of the

company’ inventory at the time of the sale, the parties also had opposing accounting

for the sale and most importantly, Anchorage had floated the capital with a market

valuation of $520million, which was clearly ridiculously high, considering the initial

price with which it was sold initially by its founder to Woolworths, valued at just $25

million.

5AUDITING THEORY AND PRACTICE

Breach of Australian Accounting Standards:

The company had breached many provisions of the Australian Accounting Standards,

not only once, but on a number of occasions. The blatant breach of the Accounting standards,

had taken place (Rahman, 2013). The role of rebates from the suppliers of the company, their

excessive indulgence and influence on the purchasing decisions of the management and their

masking of the actual earnings figures has been pretty much clear.

Breach by Directors:

The directors had a major role to play in the collapse of the company, as they had

breached many different provisions of the Australian Accounting Standards. Former directors

consisting of Bill Wavish, Phil Cave, Rob Murray, Jamie Tomlinson and Company

Executives Nick Abboud and Michael Potts, breached their duties and various provisions of

the Australian Accounting Standards, by failing to install adequate systems in relation to

rebates and inventory management. This is a clear breach of the AASB 102, where it states

adequate steps must be taken in case of fair treatment of inventory and rebates must be

properly treated in the books of accounts (Www.afr.com, 2018). In the year 2014-15, a

staggering amount) of $72 million had been reported as earnings before interest, taxes,

depreciation and amortisation. It had led to the breaching of ASA 240, whereby usage of

fraudulent mechanisms had been seen (Www.aasb.gov.au, 2018). In the case of Sick Smith,

the former directors had tried to choose the products for the purpose of maximising rebates,

which actually is the money retailers receive from the suppliers for stocking and promoting

goods, rather than on the products and goods, which the consumers had actually wanted to

buy. Receiver Company Ferrier Hodgson, had also alleged that the directors of Dick Smith

had breached the Australian Accounting Standards, by booking its rebates much before the

Breach of Australian Accounting Standards:

The company had breached many provisions of the Australian Accounting Standards,

not only once, but on a number of occasions. The blatant breach of the Accounting standards,

had taken place (Rahman, 2013). The role of rebates from the suppliers of the company, their

excessive indulgence and influence on the purchasing decisions of the management and their

masking of the actual earnings figures has been pretty much clear.

Breach by Directors:

The directors had a major role to play in the collapse of the company, as they had

breached many different provisions of the Australian Accounting Standards. Former directors

consisting of Bill Wavish, Phil Cave, Rob Murray, Jamie Tomlinson and Company

Executives Nick Abboud and Michael Potts, breached their duties and various provisions of

the Australian Accounting Standards, by failing to install adequate systems in relation to

rebates and inventory management. This is a clear breach of the AASB 102, where it states

adequate steps must be taken in case of fair treatment of inventory and rebates must be

properly treated in the books of accounts (Www.afr.com, 2018). In the year 2014-15, a

staggering amount) of $72 million had been reported as earnings before interest, taxes,

depreciation and amortisation. It had led to the breaching of ASA 240, whereby usage of

fraudulent mechanisms had been seen (Www.aasb.gov.au, 2018). In the case of Sick Smith,

the former directors had tried to choose the products for the purpose of maximising rebates,

which actually is the money retailers receive from the suppliers for stocking and promoting

goods, rather than on the products and goods, which the consumers had actually wanted to

buy. Receiver Company Ferrier Hodgson, had also alleged that the directors of Dick Smith

had breached the Australian Accounting Standards, by booking its rebates much before the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING THEORY AND PRACTICE

actual products were sold and money was paid. The company had continued to chase rebates,

for the purpose of inflating the profits, which has led to breach of the trust of the fiduciary

relationship between the company and its stakeholders (Www.abc.net.au, 2018). The

accounting treatment of the rebates had some repercussions on the financial and overall well-

being of the company, which has been regarded by experts as one of the chief reasons for the

downfall and collapse of the electronic giant. Thus, in these ways, the directors of the

company has been able to breach the Australian Accounting Standards.

Brief Analysis of the Annual Report:

The financial statement of any company helps in understanding and gauging the

correct state of affairs of the company. The financial statements of any company help in

presenting the facts and figures about the various operations, undertaken by the company,

throughout the year. At the end of it all, it shows the amount of profit or loss earned or

incurred at the end of the year. It also helps in stating the financial implications of any wrong

move, strategy undertaken by the company. This is also true on the part of Australian

electronic giant Dick Smith. There have been various instances, where the deliberate errors

and manipulations had been visible.

: The financial manipulations:

The company had increased the marketing and sales cost by a staggering $17,609

million, through the use of the rebates provided it throughout by its suppliers. It was intended

by the suppliers for supporting them in increasing their marketing cost. On the contrary, the

company had decreased its occupancy and rental expenses, by $14, 031, while the other

expenses of the company had increased by $15,899 (Www.nzherald.co.nz, 2018). Thus, we

could see manipulations of varying degree. Here the practices, involved manipulation of sales

actual products were sold and money was paid. The company had continued to chase rebates,

for the purpose of inflating the profits, which has led to breach of the trust of the fiduciary

relationship between the company and its stakeholders (Www.abc.net.au, 2018). The

accounting treatment of the rebates had some repercussions on the financial and overall well-

being of the company, which has been regarded by experts as one of the chief reasons for the

downfall and collapse of the electronic giant. Thus, in these ways, the directors of the

company has been able to breach the Australian Accounting Standards.

Brief Analysis of the Annual Report:

The financial statement of any company helps in understanding and gauging the

correct state of affairs of the company. The financial statements of any company help in

presenting the facts and figures about the various operations, undertaken by the company,

throughout the year. At the end of it all, it shows the amount of profit or loss earned or

incurred at the end of the year. It also helps in stating the financial implications of any wrong

move, strategy undertaken by the company. This is also true on the part of Australian

electronic giant Dick Smith. There have been various instances, where the deliberate errors

and manipulations had been visible.

: The financial manipulations:

The company had increased the marketing and sales cost by a staggering $17,609

million, through the use of the rebates provided it throughout by its suppliers. It was intended

by the suppliers for supporting them in increasing their marketing cost. On the contrary, the

company had decreased its occupancy and rental expenses, by $14, 031, while the other

expenses of the company had increased by $15,899 (Www.nzherald.co.nz, 2018). Thus, we

could see manipulations of varying degree. Here the practices, involved manipulation of sales

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING THEORY AND PRACTICE

figures and stock inventories which provided the scope to Dick Smith for purchasing

unnecessary amounts of inventory for the purpose of filling the rapid expansion of stores and

bank rebates from suppliers for the purpose of boosting its earnings. There have been many

more indications of the operations inefficiency of the company, which perhaps were one of

the many reasons, which had led to the fall of this electronic giant (Low, 2018). The cash

flow statement, which again, is one of the most important financial statements of any

company, which helps in showing the cash position of the business at the end of year, had its

own share of complications. It has revealed negative balance of cash emanating operating

activities which additionally confirms the operational incompetence and inadequacy of its

business. The aggregate debts of the business had also increased which is seen in the annual

reports of the business. There are some other indications as well. There has been a substantial

amount of increase in the total amount of debt in the aggregate capital and financing structure

of the business. There should be proper parity in the capital structure of a business, consisting

of the right balance of capital structure with the proper balance of equity and debt capital.

Such kind of semblance or parity was nowhere to be seen in the financial statements of Dick

Smith. On the contrary, there was an increase in the debt capital by $70,500 million, lease

liabilities had also increased by $543 million (Www.news.com.au, 2018).

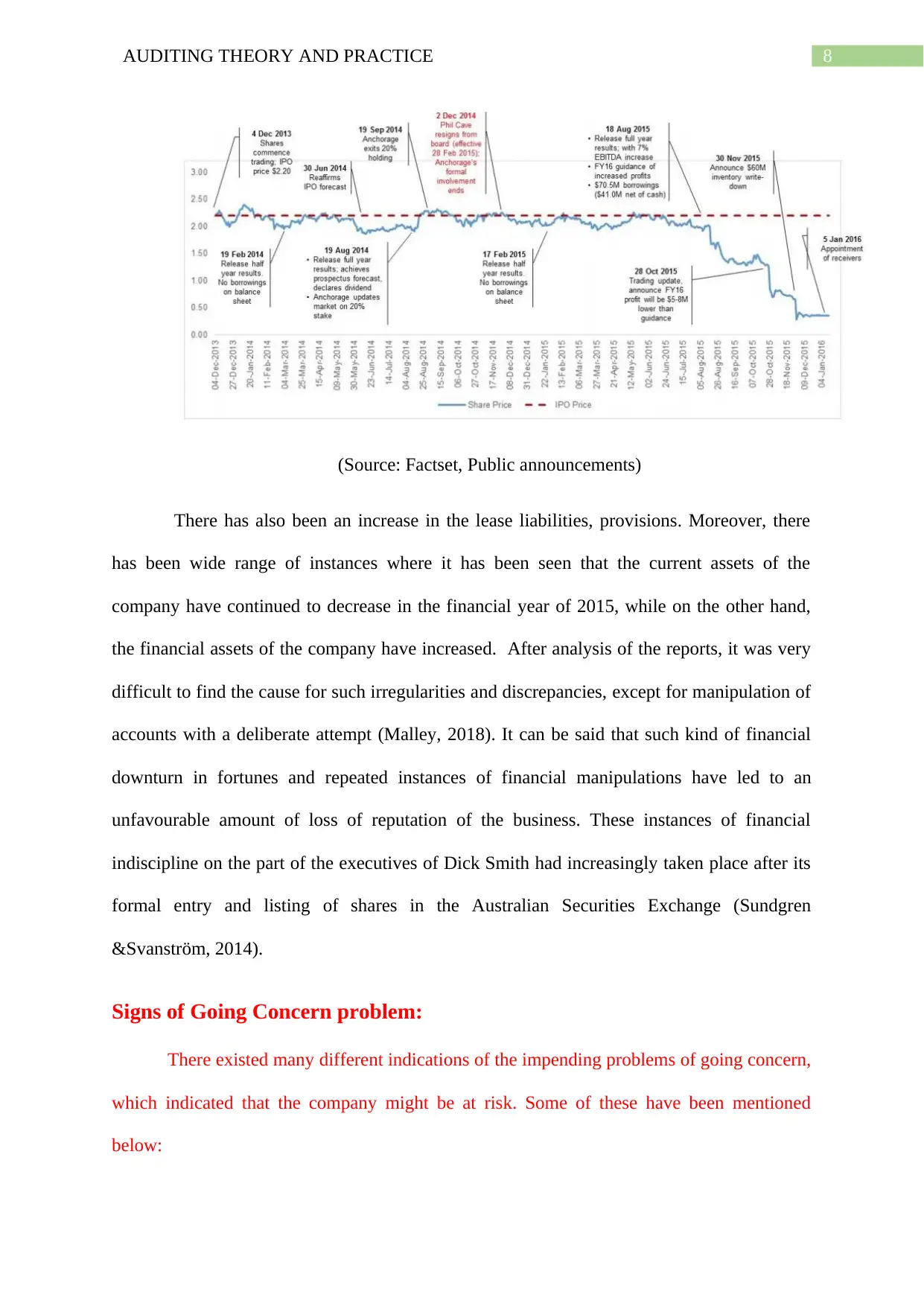

A share price trading history of Dick Smith has been provided below, showing the

various anomalies, since the company had first become public:

figures and stock inventories which provided the scope to Dick Smith for purchasing

unnecessary amounts of inventory for the purpose of filling the rapid expansion of stores and

bank rebates from suppliers for the purpose of boosting its earnings. There have been many

more indications of the operations inefficiency of the company, which perhaps were one of

the many reasons, which had led to the fall of this electronic giant (Low, 2018). The cash

flow statement, which again, is one of the most important financial statements of any

company, which helps in showing the cash position of the business at the end of year, had its

own share of complications. It has revealed negative balance of cash emanating operating

activities which additionally confirms the operational incompetence and inadequacy of its

business. The aggregate debts of the business had also increased which is seen in the annual

reports of the business. There are some other indications as well. There has been a substantial

amount of increase in the total amount of debt in the aggregate capital and financing structure

of the business. There should be proper parity in the capital structure of a business, consisting

of the right balance of capital structure with the proper balance of equity and debt capital.

Such kind of semblance or parity was nowhere to be seen in the financial statements of Dick

Smith. On the contrary, there was an increase in the debt capital by $70,500 million, lease

liabilities had also increased by $543 million (Www.news.com.au, 2018).

A share price trading history of Dick Smith has been provided below, showing the

various anomalies, since the company had first become public:

8AUDITING THEORY AND PRACTICE

(Source: Factset, Public announcements)

There has also been an increase in the lease liabilities, provisions. Moreover, there

has been wide range of instances where it has been seen that the current assets of the

company have continued to decrease in the financial year of 2015, while on the other hand,

the financial assets of the company have increased. After analysis of the reports, it was very

difficult to find the cause for such irregularities and discrepancies, except for manipulation of

accounts with a deliberate attempt (Malley, 2018). It can be said that such kind of financial

downturn in fortunes and repeated instances of financial manipulations have led to an

unfavourable amount of loss of reputation of the business. These instances of financial

indiscipline on the part of the executives of Dick Smith had increasingly taken place after its

formal entry and listing of shares in the Australian Securities Exchange (Sundgren

&Svanström, 2014).

Signs of Going Concern problem:

There existed many different indications of the impending problems of going concern,

which indicated that the company might be at risk. Some of these have been mentioned

below:

(Source: Factset, Public announcements)

There has also been an increase in the lease liabilities, provisions. Moreover, there

has been wide range of instances where it has been seen that the current assets of the

company have continued to decrease in the financial year of 2015, while on the other hand,

the financial assets of the company have increased. After analysis of the reports, it was very

difficult to find the cause for such irregularities and discrepancies, except for manipulation of

accounts with a deliberate attempt (Malley, 2018). It can be said that such kind of financial

downturn in fortunes and repeated instances of financial manipulations have led to an

unfavourable amount of loss of reputation of the business. These instances of financial

indiscipline on the part of the executives of Dick Smith had increasingly taken place after its

formal entry and listing of shares in the Australian Securities Exchange (Sundgren

&Svanström, 2014).

Signs of Going Concern problem:

There existed many different indications of the impending problems of going concern,

which indicated that the company might be at risk. Some of these have been mentioned

below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING THEORY AND PRACTICE

Drastic fall in the earnings per share from $0.59 to $0.05, from 2014 to 2015.

Fall in the gross profit of the company from $308,002 in 2014 to $184,397 in 2015.

One of the most important reasons, which indicated a problem of going concern was

the excessive fall in the net profit of the electronic business form $140,190 in 2014 to

$19,826 in 2015 and another appalling point which indicated the problem of going

concern was the fall in the total comprehensive income of the company from $146,

484 to $19,442 (Www.asx.com.au, 2018). These were some of the interesting

observations, which could indicate the problems of going concern, which was faced

by the company.

Cause of Unmodified Audit Report:

Audit report is one of the most important aspects of the audit which is

conducted by any outside Audit Company on the concerned organisation. The audit report

can be regarded as the ‘Holy Grail’, which is heavily pursued by the stakeholders, specially

the investors of any company (Akbar & Ahsan, 2014). This is because the audit report helps

in decoding the financial well-being of the company, where they are all going to put their

money. In the case of Dick Smith, it is not an exception either. Here, the company which is

responsible for conducting the audit of the company is Deloitte, which is one of the largest

audit companies in the world. It is also included in the list of the big four audit companies in

the world, namely, KPMG, PWC and E&Y. Thus, the stakes becomes high, in cases, where

the audit is conducted by such a big company, chances of foul play also increases, when the

company which has been audited has been in the public spotlight for all the wrong reasons.

Here a couple of interesting observations had been revealed, which must not have escaped the

eyes of Deloitte. Some of these interesting observations included, the expansion plan, which

was aimed at improving the sales of the business as well as the net profit of the business;

however it wasn’t true at all. None of it happened, on the contrary, the company went down

Drastic fall in the earnings per share from $0.59 to $0.05, from 2014 to 2015.

Fall in the gross profit of the company from $308,002 in 2014 to $184,397 in 2015.

One of the most important reasons, which indicated a problem of going concern was

the excessive fall in the net profit of the electronic business form $140,190 in 2014 to

$19,826 in 2015 and another appalling point which indicated the problem of going

concern was the fall in the total comprehensive income of the company from $146,

484 to $19,442 (Www.asx.com.au, 2018). These were some of the interesting

observations, which could indicate the problems of going concern, which was faced

by the company.

Cause of Unmodified Audit Report:

Audit report is one of the most important aspects of the audit which is

conducted by any outside Audit Company on the concerned organisation. The audit report

can be regarded as the ‘Holy Grail’, which is heavily pursued by the stakeholders, specially

the investors of any company (Akbar & Ahsan, 2014). This is because the audit report helps

in decoding the financial well-being of the company, where they are all going to put their

money. In the case of Dick Smith, it is not an exception either. Here, the company which is

responsible for conducting the audit of the company is Deloitte, which is one of the largest

audit companies in the world. It is also included in the list of the big four audit companies in

the world, namely, KPMG, PWC and E&Y. Thus, the stakes becomes high, in cases, where

the audit is conducted by such a big company, chances of foul play also increases, when the

company which has been audited has been in the public spotlight for all the wrong reasons.

Here a couple of interesting observations had been revealed, which must not have escaped the

eyes of Deloitte. Some of these interesting observations included, the expansion plan, which

was aimed at improving the sales of the business as well as the net profit of the business;

however it wasn’t true at all. None of it happened, on the contrary, the company went down

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING THEORY AND PRACTICE

with its corrupt inventory strategies (Www.nbr.co.nz, 2018). These corrupt and ineffective

inventory management strategies of the electronic giant and its overvalued obsolete stocks

had been continuously taking place and were being carried out by the business from the year

2014. These corrupt practices and strategies had started to create some serious implications

upon the electronic business and the same had resulted in the untimely closure of this large

business (Www.theconversation.com, 2018). The key troubles and problems for the business

had started way back in the year 2014, when this electronic company, had ceased to be a

subsidiary of Woolworths Company and had become public by listing itself in the Australian

stock exchange. The troubles of ineffective and inefficient handling and management of the

inventory management of the business is one of the reason due to which the business faced

liquidation at such an untimely manner.

Liability of Auditor towards third parties:

Deloitte being the auditor of Dick Smith has the legal liability of answering the

questions, as to why they had provided an unmodified report on the 30th of June, 2015. An

auditor of any company has the legal responsibility to provide an explanation of the report

provided by them after examining and auditing different aspects of the performance of their

clients. The auditors have a limited legal liability towards the third parties, who are going to

use their financial audit reports before investing in their clients. The auditors have a special

relationship with the different third parties, based on the reasonable amount of foresight,

exercised by them, while preparing the audit report. Thus it can be seen that the auditors not

only have an obligation to bring out the deficiencies in their client’s internal control systems,

to the attention of the management of their clients, but also towards their third parties, who

use their reports for taking important financial decisions, which might impact their future.

with its corrupt inventory strategies (Www.nbr.co.nz, 2018). These corrupt and ineffective

inventory management strategies of the electronic giant and its overvalued obsolete stocks

had been continuously taking place and were being carried out by the business from the year

2014. These corrupt practices and strategies had started to create some serious implications

upon the electronic business and the same had resulted in the untimely closure of this large

business (Www.theconversation.com, 2018). The key troubles and problems for the business

had started way back in the year 2014, when this electronic company, had ceased to be a

subsidiary of Woolworths Company and had become public by listing itself in the Australian

stock exchange. The troubles of ineffective and inefficient handling and management of the

inventory management of the business is one of the reason due to which the business faced

liquidation at such an untimely manner.

Liability of Auditor towards third parties:

Deloitte being the auditor of Dick Smith has the legal liability of answering the

questions, as to why they had provided an unmodified report on the 30th of June, 2015. An

auditor of any company has the legal responsibility to provide an explanation of the report

provided by them after examining and auditing different aspects of the performance of their

clients. The auditors have a limited legal liability towards the third parties, who are going to

use their financial audit reports before investing in their clients. The auditors have a special

relationship with the different third parties, based on the reasonable amount of foresight,

exercised by them, while preparing the audit report. Thus it can be seen that the auditors not

only have an obligation to bring out the deficiencies in their client’s internal control systems,

to the attention of the management of their clients, but also towards their third parties, who

use their reports for taking important financial decisions, which might impact their future.

11AUDITING THEORY AND PRACTICE

Some related observations:

The finances of the company had been disorganised and had been in total disarray, for

well over a decade, which is why the role of the auditor, whose responsibility is to investigate

into such disorganisation of finance, comes into question (Blay & Geiger, 2013). Deloitte,

being one of the most sought out auditors, has been Dick Smith's auditor since 2013. Before

that, Deloitte looked after the electronic company’s financial statements, reports and working

as a part of Woolworths, whose accounts Deloitte has audited for well over a decade. Deloitte

had taken a total of $1.3 million as fees for its services, from Dick Smith for the 2013-14

financial years, including a staggering amount of $784,000 for conducting investigation into

the accounting services leading up to Anchorage Capital's contentious floating of the retail

group in the Australian Securities Exchange (Reid, 2018). The clearance which was given to

the company by the publication of an unmodified audit report, which perhaps had acted as a

clean chit, has been called into question. Experts suggest that there has been a financial foul

play and payment of the exorbitant fees has been an indication of the financial corruption,

which might have crept in the investigation and audit of the financials of the Dick Smith.

Conclusion:

One of the most important aspects of any financial audit is financial fair play, which is

expected to be kept in mind while preparing the financial reports of any company. Perhaps

this was not the case with Dick Smith and its Auditor Deloitte. The company went down

because of its corrupt malpractices, improper management of its inventory, excessive

inflation of its sales, financial manipulations and many other similar reasons. These kinds of

financial improper management and manipulations must be kept in check, in order to ensure

financial fair play, which would ensure the faith on the fiduciary relationship which the

company has with all of its financial as well as non-financial stakeholders. The electronics

company wouldn’t have been in dire straits, if it had looked after the long term implications

Some related observations:

The finances of the company had been disorganised and had been in total disarray, for

well over a decade, which is why the role of the auditor, whose responsibility is to investigate

into such disorganisation of finance, comes into question (Blay & Geiger, 2013). Deloitte,

being one of the most sought out auditors, has been Dick Smith's auditor since 2013. Before

that, Deloitte looked after the electronic company’s financial statements, reports and working

as a part of Woolworths, whose accounts Deloitte has audited for well over a decade. Deloitte

had taken a total of $1.3 million as fees for its services, from Dick Smith for the 2013-14

financial years, including a staggering amount of $784,000 for conducting investigation into

the accounting services leading up to Anchorage Capital's contentious floating of the retail

group in the Australian Securities Exchange (Reid, 2018). The clearance which was given to

the company by the publication of an unmodified audit report, which perhaps had acted as a

clean chit, has been called into question. Experts suggest that there has been a financial foul

play and payment of the exorbitant fees has been an indication of the financial corruption,

which might have crept in the investigation and audit of the financials of the Dick Smith.

Conclusion:

One of the most important aspects of any financial audit is financial fair play, which is

expected to be kept in mind while preparing the financial reports of any company. Perhaps

this was not the case with Dick Smith and its Auditor Deloitte. The company went down

because of its corrupt malpractices, improper management of its inventory, excessive

inflation of its sales, financial manipulations and many other similar reasons. These kinds of

financial improper management and manipulations must be kept in check, in order to ensure

financial fair play, which would ensure the faith on the fiduciary relationship which the

company has with all of its financial as well as non-financial stakeholders. The electronics

company wouldn’t have been in dire straits, if it had looked after the long term implications

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.