Dividend Growth Model: A Method of Valuation of a Company’s Share Price

2 Pages786 Words467 Views

Added on 2023-04-25

About This Document

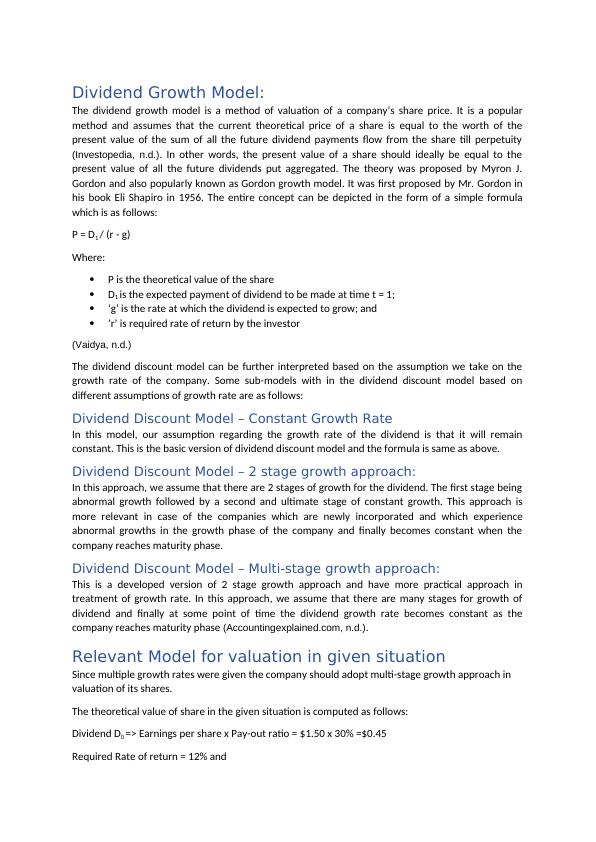

The dividend growth model is a method of valuation of a company’s share price. It assumes that the current theoretical price of a share is equal to the worth of the present value of the sum of all the future dividend payments flow from the share till perpetuity. The theory was proposed by Myron J. Gordon and also popularly known as Gordon growth model. The document explains the different sub-models of the dividend discount model based on different assumptions of growth rate and the relevant model for valuation in a given situation.

Dividend Growth Model: A Method of Valuation of a Company’s Share Price

Added on 2023-04-25

ShareRelated Documents

End of preview

Want to access all the pages? Upload your documents or become a member.

Growth Rate of Future Dividend Assignment

|6

|2146

|28

Assignment on Stock Valuation and Capital Budgeting Techniques

|18

|4135

|106

Valuing Shares: Dividend Discount Models

|6

|1982

|122

Fundamentals of Finance: Valuation Models, Shareholder Returns, and Market Efficiency

|12

|3552

|47

Valuation of McPherson's Limited using Gordon Growth Model

|5

|1224

|296

Investment Analysis Assignment : CAPM

|10

|1731

|24