Research Proposal: Dividend Policy Impact on Shell Plc Performance

VerifiedAdded on 2023/05/30

|13

|3137

|361

AI Summary

This research proposal investigates the impact of dividend policy on firm performance, focusing on Shell Plc as a case study. It begins by establishing the background of the study, highlighting the importance of dividend decisions in maximizing shareholder wealth and addressing the unresolved questions surrounding the relationship between dividend policy and organizational performance. The proposal outlines the study's objectives, which include determining the impact of dividend policy on firm performance and exploring how it affects Shell Plc's earnings per share and profitability. The scope of the study involves analyzing Shell's performance data over a ten-year period (2007-2017), considering profitability, earnings per share, dividend per share, return on equity, stock prices, and retention ratio. The literature review examines financial performance measures, dividend policy definitions, and historical perspectives on the topic, including studies conducted in various countries. It also discusses relevant theories such as agency theory, the residual theory of dividends, and the bird in the hand theory. The methodology section details the research philosophy (pragmatism), approach (deductive), strategy (case study), choice (quantitative), and design. Secondary financial data will be used for analysis. The proposal aims to contribute to the existing literature by examining the impact of dividend policy on the financial performance of Shell Plc.

Research Proposal 1

Research Proposal

by Name

Class &Course

Professor

University

City & State

Date

Research Proposal

by Name

Class &Course

Professor

University

City & State

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research Proposal 2

Table of Contents

1. Terms of Reference...........................................................................................................2

1.1. Background of study....................................................................................................2

1.2. Problem Statement.......................................................................................................2

1.3. The objective of the study............................................................................................3

1.4. The scope of your study...............................................................................................3

2. Relevant Literature...........................................................................................................3

2.1. Financial performance................................................................................................3

2.2. Dividend Policy...........................................................................................................4

2.4. Theoretical review.......................................................................................................6

a) Agency theory.............................................................................................................6

b) Residual theory of dividends.......................................................................................6

c) Bird in the hand theory................................................................................................6

3. Methodology......................................................................................................................8

3.1. A statement of the methodology...................................................................................8

3.1.1. Research Philosophy............................................................................................8

3.1.2. Research Approach..............................................................................................8

3.1.3. Research strategy.................................................................................................9

3.1.4. Research choice....................................................................................................9

3.1.5. Research design....................................................................................................9

3.2. Data Source.................................................................................................................9

3.3. Data analysis.............................................................................................................10

References List.......................................................................................................................11

Table of Contents

1. Terms of Reference...........................................................................................................2

1.1. Background of study....................................................................................................2

1.2. Problem Statement.......................................................................................................2

1.3. The objective of the study............................................................................................3

1.4. The scope of your study...............................................................................................3

2. Relevant Literature...........................................................................................................3

2.1. Financial performance................................................................................................3

2.2. Dividend Policy...........................................................................................................4

2.4. Theoretical review.......................................................................................................6

a) Agency theory.............................................................................................................6

b) Residual theory of dividends.......................................................................................6

c) Bird in the hand theory................................................................................................6

3. Methodology......................................................................................................................8

3.1. A statement of the methodology...................................................................................8

3.1.1. Research Philosophy............................................................................................8

3.1.2. Research Approach..............................................................................................8

3.1.3. Research strategy.................................................................................................9

3.1.4. Research choice....................................................................................................9

3.1.5. Research design....................................................................................................9

3.2. Data Source.................................................................................................................9

3.3. Data analysis.............................................................................................................10

References List.......................................................................................................................11

Research Proposal 3

Title:

The impact of dividend policy on firm performance: Shell Plc

1. Terms of Reference

1.1. Background of study

Organisations mainly focus on maximising their values and shareholders' wealth. Generally,

there are three types of decisions that have an impact on a company's value. The decisions

are; financial decisions, dividend decisions, and investment decisions. The three decisions are

related to each other. For example, an investment decision determines the firm's future gains

as well as the amount of dividend earned. As such dividend policy influence the capital

structure and cost as well (Browne, 2016. p, 69). There is a wide view globally that dividend

policy affects a firm's performance. The global attention on the impact of dividend policy has

increased so is the study seeking to ascertain the existence of such an impact.

1.2. Problem Statement

Amid the increasing interest on the topic, the impact that dividend policy has on

organisational performance remain unresolved. Studies conducted in different countries have

shown different results. Moreover, researchers have always ignored studies conducted in

developing countries or in less developed industries. Potential investors pay special attention

to the firm's value and how best is the firm in maximising the shareholders' wealth (Gitman,

et al., 2015, p. 113). Considering that the three types of firm decision are connected, it is

important to explore the impact of dividend policy on firm performance. Moreover, most

studies focus on a general impact of dividend policy without narrowing down to a specific

industry or company. This study seeks to resolve the unresolved issues surrounding the

relationship between the two variables by a focus on the Shell Plc. as the case study.

Title:

The impact of dividend policy on firm performance: Shell Plc

1. Terms of Reference

1.1. Background of study

Organisations mainly focus on maximising their values and shareholders' wealth. Generally,

there are three types of decisions that have an impact on a company's value. The decisions

are; financial decisions, dividend decisions, and investment decisions. The three decisions are

related to each other. For example, an investment decision determines the firm's future gains

as well as the amount of dividend earned. As such dividend policy influence the capital

structure and cost as well (Browne, 2016. p, 69). There is a wide view globally that dividend

policy affects a firm's performance. The global attention on the impact of dividend policy has

increased so is the study seeking to ascertain the existence of such an impact.

1.2. Problem Statement

Amid the increasing interest on the topic, the impact that dividend policy has on

organisational performance remain unresolved. Studies conducted in different countries have

shown different results. Moreover, researchers have always ignored studies conducted in

developing countries or in less developed industries. Potential investors pay special attention

to the firm's value and how best is the firm in maximising the shareholders' wealth (Gitman,

et al., 2015, p. 113). Considering that the three types of firm decision are connected, it is

important to explore the impact of dividend policy on firm performance. Moreover, most

studies focus on a general impact of dividend policy without narrowing down to a specific

industry or company. This study seeks to resolve the unresolved issues surrounding the

relationship between the two variables by a focus on the Shell Plc. as the case study.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research Proposal 4

1.3. The objective of the study

The main objective of the study is to determine the impact of dividend policy on firm

performance. The specific objective is to explore how dividend policy affects Shell Plc.

earnings per share and profitability.

The research question to be answered is: Does dividend policy impact the performance of

Shell Plc.?

Research hypothesis: Dividend policy has a significant impact on firm performance.

1.4. The scope of your study

The objective of the study is to determine the impact of dividend policy on firm performance.

The study will examine whether or not dividend policy impacts the performance of Shell Plc.

Data on the performance of the Shell Company over the recent ten year period will be

analysed to test the research hypothesis. The study will be considered the profitability of the

company, earning per share, dividend per share, return on equity, stock prices in the market

and retention ratio over the 2007 to 2017 study period.

2. Relevant Literature

2.1. Financial performance

There are different ways of measuring a firm's financial performance. The methods of

measuring performance include sales growth, market to book value, cash flow and

profitability. After every financial year, investors are interested in knowing the amount to

earn that will be retained for reinvestment and the amount that will be paid to them in the

form of dividends. Profitability is the most common measure of a firm's performance; an

increase in profitability indicate a positive performance. Some ratios used to measure the

1.3. The objective of the study

The main objective of the study is to determine the impact of dividend policy on firm

performance. The specific objective is to explore how dividend policy affects Shell Plc.

earnings per share and profitability.

The research question to be answered is: Does dividend policy impact the performance of

Shell Plc.?

Research hypothesis: Dividend policy has a significant impact on firm performance.

1.4. The scope of your study

The objective of the study is to determine the impact of dividend policy on firm performance.

The study will examine whether or not dividend policy impacts the performance of Shell Plc.

Data on the performance of the Shell Company over the recent ten year period will be

analysed to test the research hypothesis. The study will be considered the profitability of the

company, earning per share, dividend per share, return on equity, stock prices in the market

and retention ratio over the 2007 to 2017 study period.

2. Relevant Literature

2.1. Financial performance

There are different ways of measuring a firm's financial performance. The methods of

measuring performance include sales growth, market to book value, cash flow and

profitability. After every financial year, investors are interested in knowing the amount to

earn that will be retained for reinvestment and the amount that will be paid to them in the

form of dividends. Profitability is the most common measure of a firm's performance; an

increase in profitability indicate a positive performance. Some ratios used to measure the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research Proposal 5

level of a firm's performance include the return on investments, return on assets, and return

on equity (Moyer, et al., 2017, p. 51).

2.2. Dividend Policy

Dividend policy is defined as the guidelines or used by companies to determine the amount of

profit paid to the shareholders, the time to pay dividends, the form of a dividend to pay, and

the payment intervals. According to Demirgüneş (2015, pp. 418-426), there is a correlation

between payments and dividends and a firm's market value. Other studies have shown that

dividend policy is a guideline used by organisations to distribute wealth to their shareholders.

Dividend policies differ from one firm to another although sustainable dividend pay-out

system signifies good management (Echchabi & Azouzi, 2016, p. 349).

2.3. Historical perspective of the topic

There are numerous studies that have been conducted on the impact of dividend policy on

firm performance. This section analyses the historical perspective held by other researchers

on the topic. Moreover, theories relating to the topic are also under consideration.

Farrukh, et al. (2017) studied the impact of dividend policy on shareholders wealth

and firm performance in Pakistan. The sample of 51 organisation was obtained from the PSX

index using the common constant effect model between a time periods of 2006- 2015. The

study found out that there is a positive correlation between dividend policy and share price

and earning per share. The study further established a positive relationship between dividend

policy and return on equity.

Oppong (2015) studied the relationship between dividend policy and firms' performance in

the listed Banks in Ghana. The study used a sample size of seven listed banks in Ghana.

Oppong (2015) found out that dividend policy had significant on the performance of the

level of a firm's performance include the return on investments, return on assets, and return

on equity (Moyer, et al., 2017, p. 51).

2.2. Dividend Policy

Dividend policy is defined as the guidelines or used by companies to determine the amount of

profit paid to the shareholders, the time to pay dividends, the form of a dividend to pay, and

the payment intervals. According to Demirgüneş (2015, pp. 418-426), there is a correlation

between payments and dividends and a firm's market value. Other studies have shown that

dividend policy is a guideline used by organisations to distribute wealth to their shareholders.

Dividend policies differ from one firm to another although sustainable dividend pay-out

system signifies good management (Echchabi & Azouzi, 2016, p. 349).

2.3. Historical perspective of the topic

There are numerous studies that have been conducted on the impact of dividend policy on

firm performance. This section analyses the historical perspective held by other researchers

on the topic. Moreover, theories relating to the topic are also under consideration.

Farrukh, et al. (2017) studied the impact of dividend policy on shareholders wealth

and firm performance in Pakistan. The sample of 51 organisation was obtained from the PSX

index using the common constant effect model between a time periods of 2006- 2015. The

study found out that there is a positive correlation between dividend policy and share price

and earning per share. The study further established a positive relationship between dividend

policy and return on equity.

Oppong (2015) studied the relationship between dividend policy and firms' performance in

the listed Banks in Ghana. The study used a sample size of seven listed banks in Ghana.

Oppong (2015) found out that dividend policy had significant on the performance of the

Research Proposal 6

banks. The study further established that banks paid strict attention to their dividend policies

so as to realise better financial performance results. Therefore management spent more time

to draft dividend policies that were appealing to the shareholders are a way of thanking for

choosing to invest in the bank.

Musyoka, (2015) studied the effect of dividend policy on the financial performance of firms

listed at the Nairobi Securities Exchange (NSE). The study has a sample size of twenty

companies listed at the NSE. Musyoka used variables such as types of dividend payments, the

timing of dividend payment, leverage and the size of the firms. According to the study

findings, timing and form of dividend payments had a positive impact on the firms' financial

performance. However, leverage and firm size had an insignificant impact on the firms'

financial performance (Copur, 2015, p. 91). Therefore, organisations should put in place

stable dividend policies which would contribute to better financial performance.

Uwuigbe (2012) studied the relationship between dividend policy and firm performance in

the listed firms in Nigeria. The study tested three hypothesis, however, the first study in the

most appropriate for this study. Testing the first hypothesis, the study found out that the

financial performance of organisations had a significant impact on dividend payout to

shareholders. In other words, an increase in the financial performance resulted into increase if

dividend payout level.

The previous empirical studies have proved the existence a relationship between dividend

policy and firm performance. The significance relationship is mostly found by studies

conducted in developed countries. This study seek to add to the existing literature on the

relationship of the two variables. In doing so, the study seek to examine whether or not the

general impact of dividend policy on firm performance can be found in the financial

performance of Shell Plc. over years.

banks. The study further established that banks paid strict attention to their dividend policies

so as to realise better financial performance results. Therefore management spent more time

to draft dividend policies that were appealing to the shareholders are a way of thanking for

choosing to invest in the bank.

Musyoka, (2015) studied the effect of dividend policy on the financial performance of firms

listed at the Nairobi Securities Exchange (NSE). The study has a sample size of twenty

companies listed at the NSE. Musyoka used variables such as types of dividend payments, the

timing of dividend payment, leverage and the size of the firms. According to the study

findings, timing and form of dividend payments had a positive impact on the firms' financial

performance. However, leverage and firm size had an insignificant impact on the firms'

financial performance (Copur, 2015, p. 91). Therefore, organisations should put in place

stable dividend policies which would contribute to better financial performance.

Uwuigbe (2012) studied the relationship between dividend policy and firm performance in

the listed firms in Nigeria. The study tested three hypothesis, however, the first study in the

most appropriate for this study. Testing the first hypothesis, the study found out that the

financial performance of organisations had a significant impact on dividend payout to

shareholders. In other words, an increase in the financial performance resulted into increase if

dividend payout level.

The previous empirical studies have proved the existence a relationship between dividend

policy and firm performance. The significance relationship is mostly found by studies

conducted in developed countries. This study seek to add to the existing literature on the

relationship of the two variables. In doing so, the study seek to examine whether or not the

general impact of dividend policy on firm performance can be found in the financial

performance of Shell Plc. over years.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research Proposal 7

2.4. Theoretical review

There are several theories that can be used to explain issues surrounding dividend policy.

This study discusses three theories which are agency theory, the residual theory of dividends

and bird in the hand theory.

a) Agency theory

Agency theory is generated from the contractual relationship between shareholders and

managers. Agency costs arise from the conflicts between the two parties. It is common

practice by firms to distribute free cash flow to the shareholders to reduce the agency cost and

increase dividend paid out. Markets tend to positively value firms that pay high dividends

while incurring low agency cost. Studies have shown that firms apply the agency theory to

increase dividend pay-out and decrease the agency cost (Urban, 2015, p. 99).

b) Residual theory of dividends

The theory states that dividends are paid out from the residual profit after deducting the

required investment funds. In other words, the management is more interested in investments

and not paying dividends to the shareholder. The management believes that shareholders

wealth can only be maximised through reinvesting profits and not paying dividends (Harun,

2016, p. 1669). The residual theory of dividends treats dividend policy as irrelevant therefore

dividends can only be paid when the retained earnings is in excess of the required amount for

reinvestment. In financial perspective, payment of dividends can be used to indicate

improved financial performance by organisations.

c) Bird in the hand theory

The theory states that dividends are paid out from the residual profit after deducting the

required investment funds. In other words, the management is more interested in investments

2.4. Theoretical review

There are several theories that can be used to explain issues surrounding dividend policy.

This study discusses three theories which are agency theory, the residual theory of dividends

and bird in the hand theory.

a) Agency theory

Agency theory is generated from the contractual relationship between shareholders and

managers. Agency costs arise from the conflicts between the two parties. It is common

practice by firms to distribute free cash flow to the shareholders to reduce the agency cost and

increase dividend paid out. Markets tend to positively value firms that pay high dividends

while incurring low agency cost. Studies have shown that firms apply the agency theory to

increase dividend pay-out and decrease the agency cost (Urban, 2015, p. 99).

b) Residual theory of dividends

The theory states that dividends are paid out from the residual profit after deducting the

required investment funds. In other words, the management is more interested in investments

and not paying dividends to the shareholder. The management believes that shareholders

wealth can only be maximised through reinvesting profits and not paying dividends (Harun,

2016, p. 1669). The residual theory of dividends treats dividend policy as irrelevant therefore

dividends can only be paid when the retained earnings is in excess of the required amount for

reinvestment. In financial perspective, payment of dividends can be used to indicate

improved financial performance by organisations.

c) Bird in the hand theory

The theory states that dividends are paid out from the residual profit after deducting the

required investment funds. In other words, the management is more interested in investments

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research Proposal 8

and not paying dividends to the shareholder. The management believes that shareholders’

wealth can only be maximised through reinvesting profits and not paying dividends (Farrukh,

et al., 2017, p. 167). The residual theory of dividends treats dividend policy as irrelevant

therefore dividends can only be paid when the retained earnings are in excess of the required

amount for reinvestment. In the financial perspective, payment of dividends can be used to

indicate improved financial performance by organisations (Ghosh & Sun, 2013, p. 249).

2.5. Conclusion

Both the literature and theoretical reviews show the significance of the research topic. The

previous studies established significance relationship between dividend pay-out and value of

the firm. While dividend pay-out is determined by dividend policy, the value of a firm is

influenced by its financial performance in the market. Therefore, the literature has established

that dividend policy has an impact on the firm performance. This study seeks to expand on

the existing literature by investigating the impact how the two variables of the study relate in

the performance of Shell Plc.

2.6. Importance of the research

The previous empirical studies have proved the existence a relationship between dividend

policy and firm performance. The significance relationship is mostly found by studies

conducted in developed countries. This study seeks to add to the existing literature on the

relationship of the two variables. In doing so, the study seeks to examine whether or not the

general impact of dividend policy on firm performance can be found in the financial

performance of Shell Plc. over years.

and not paying dividends to the shareholder. The management believes that shareholders’

wealth can only be maximised through reinvesting profits and not paying dividends (Farrukh,

et al., 2017, p. 167). The residual theory of dividends treats dividend policy as irrelevant

therefore dividends can only be paid when the retained earnings are in excess of the required

amount for reinvestment. In the financial perspective, payment of dividends can be used to

indicate improved financial performance by organisations (Ghosh & Sun, 2013, p. 249).

2.5. Conclusion

Both the literature and theoretical reviews show the significance of the research topic. The

previous studies established significance relationship between dividend pay-out and value of

the firm. While dividend pay-out is determined by dividend policy, the value of a firm is

influenced by its financial performance in the market. Therefore, the literature has established

that dividend policy has an impact on the firm performance. This study seeks to expand on

the existing literature by investigating the impact how the two variables of the study relate in

the performance of Shell Plc.

2.6. Importance of the research

The previous empirical studies have proved the existence a relationship between dividend

policy and firm performance. The significance relationship is mostly found by studies

conducted in developed countries. This study seeks to add to the existing literature on the

relationship of the two variables. In doing so, the study seeks to examine whether or not the

general impact of dividend policy on firm performance can be found in the financial

performance of Shell Plc. over years.

Research Proposal 9

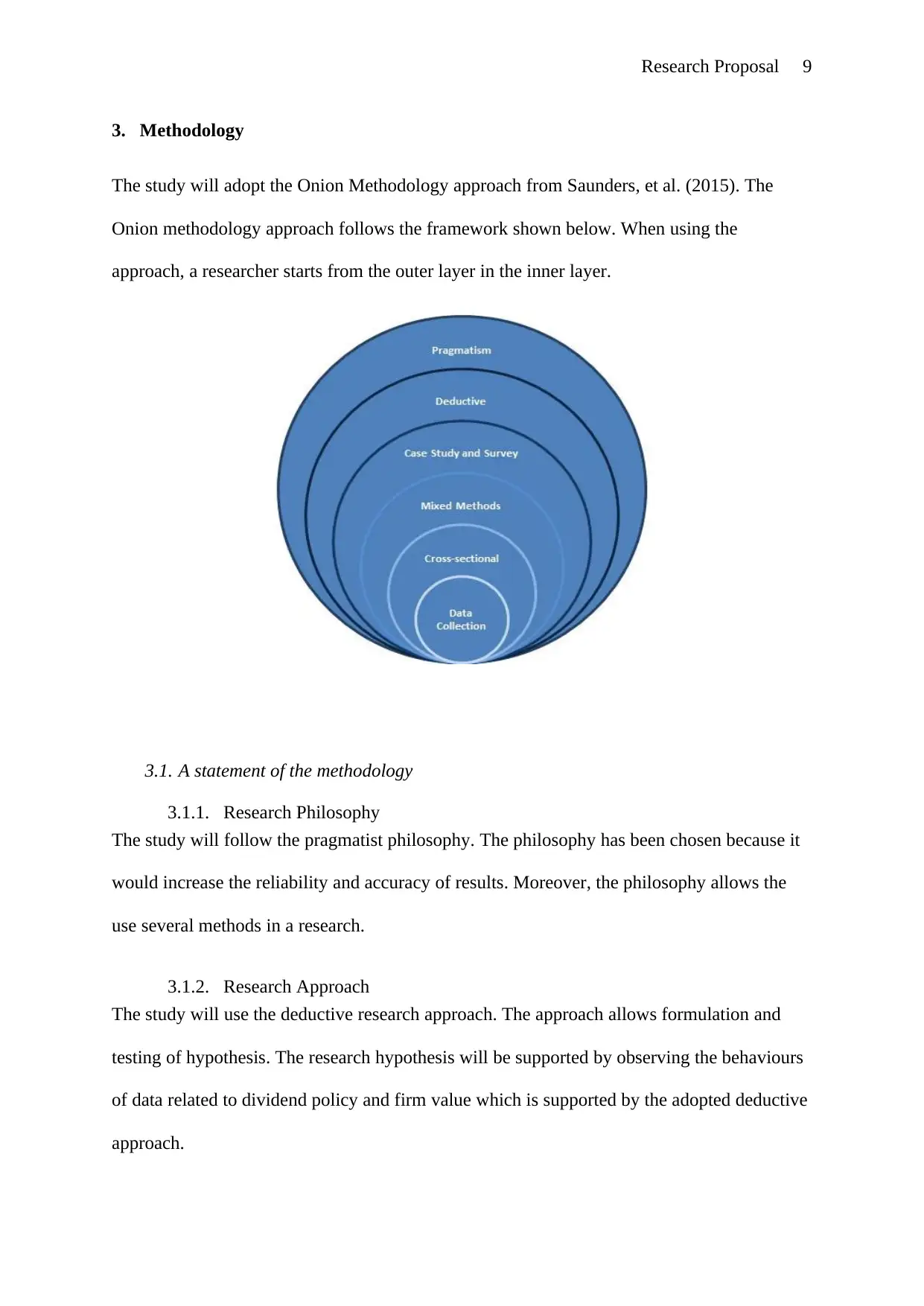

3. Methodology

The study will adopt the Onion Methodology approach from Saunders, et al. (2015). The

Onion methodology approach follows the framework shown below. When using the

approach, a researcher starts from the outer layer in the inner layer.

3.1. A statement of the methodology

3.1.1. Research Philosophy

The study will follow the pragmatist philosophy. The philosophy has been chosen because it

would increase the reliability and accuracy of results. Moreover, the philosophy allows the

use several methods in a research.

3.1.2. Research Approach

The study will use the deductive research approach. The approach allows formulation and

testing of hypothesis. The research hypothesis will be supported by observing the behaviours

of data related to dividend policy and firm value which is supported by the adopted deductive

approach.

3. Methodology

The study will adopt the Onion Methodology approach from Saunders, et al. (2015). The

Onion methodology approach follows the framework shown below. When using the

approach, a researcher starts from the outer layer in the inner layer.

3.1. A statement of the methodology

3.1.1. Research Philosophy

The study will follow the pragmatist philosophy. The philosophy has been chosen because it

would increase the reliability and accuracy of results. Moreover, the philosophy allows the

use several methods in a research.

3.1.2. Research Approach

The study will use the deductive research approach. The approach allows formulation and

testing of hypothesis. The research hypothesis will be supported by observing the behaviours

of data related to dividend policy and firm value which is supported by the adopted deductive

approach.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research Proposal 10

3.1.3. Research strategy

Research strategy refers to the approach that would be used to collect data. This research will

follow a case study approach because it would allow detained understanding of the

organisation of focus (Shell Plc.). The study will use secondary financial data to test the

hypothesis in reference to the performance of Shell Plc over the last one decade (Saunders, et

al., 2015).

3.1.4. Research choice

The study will follow a quantitative approach which is supported by the deductive approach.

Quantitative approach focuses on analysing secondary data, hence the researcher will have

narrow the research focus. The approach allows in-depth analysis of the research variables.

3.1.5. Research design

The study will employ a descriptive research design. This design is appropriate for the

proposed study because it will help to determine the relationship between the study variables,

that is, dividend policy and firm performance. Likewise, the design is valid, generalizable and

dependable which support the collection and analysis of data (Saunders, et al., 2015, p. 145).

3.2. Data Source

The study will use secondary data. Audited financial reports for Shell Plc. for the time period

of 2007 to 2017 will be obtained from the company's website. The information that will be

extracted from the company's financial statement includes the net income level of Shell Plc.

and it will be used to determine the financial performance of the company (dependent

variable). On the other hand, information on the total asset, dividends paid, total debts and

total equity of Shell Plc. will be used to determine dividend policy (independent variable). In

addition, information such as the number and form of dividend payments per year will be

obtained from the company's website as well (Bryman & Bell, 2015, p. 79).

3.1.3. Research strategy

Research strategy refers to the approach that would be used to collect data. This research will

follow a case study approach because it would allow detained understanding of the

organisation of focus (Shell Plc.). The study will use secondary financial data to test the

hypothesis in reference to the performance of Shell Plc over the last one decade (Saunders, et

al., 2015).

3.1.4. Research choice

The study will follow a quantitative approach which is supported by the deductive approach.

Quantitative approach focuses on analysing secondary data, hence the researcher will have

narrow the research focus. The approach allows in-depth analysis of the research variables.

3.1.5. Research design

The study will employ a descriptive research design. This design is appropriate for the

proposed study because it will help to determine the relationship between the study variables,

that is, dividend policy and firm performance. Likewise, the design is valid, generalizable and

dependable which support the collection and analysis of data (Saunders, et al., 2015, p. 145).

3.2. Data Source

The study will use secondary data. Audited financial reports for Shell Plc. for the time period

of 2007 to 2017 will be obtained from the company's website. The information that will be

extracted from the company's financial statement includes the net income level of Shell Plc.

and it will be used to determine the financial performance of the company (dependent

variable). On the other hand, information on the total asset, dividends paid, total debts and

total equity of Shell Plc. will be used to determine dividend policy (independent variable). In

addition, information such as the number and form of dividend payments per year will be

obtained from the company's website as well (Bryman & Bell, 2015, p. 79).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research Proposal 11

3.3. Data analysis

After has been collected, the analysis process will follow. The analysis will be conducted

with an aim of investigating the impact of dividend policy of Shell's financial performance

over the ten year time period. Regression analysis will be performed on the data to test the

impact of the independent variable on the dependent variable. After the analysis, the results

will be interpreted and a conclusion arrived at followed by appropriate recommendations to

the company.

3.3. Data analysis

After has been collected, the analysis process will follow. The analysis will be conducted

with an aim of investigating the impact of dividend policy of Shell's financial performance

over the ten year time period. Regression analysis will be performed on the data to test the

impact of the independent variable on the dependent variable. After the analysis, the results

will be interpreted and a conclusion arrived at followed by appropriate recommendations to

the company.

Research Proposal 12

References List

Blumberg, B., Cooper, D. R. & Schindler , P. S. S., 2014. Business Research Methods. New

York: McGraw Hill.

Browne, C. H., 2016. The Little Book of Value Investing. New York: John Wiley & Sons.

Bryman, A. & Bell, E., 2015. Business Research Methods. 3rd ed. Chicago: Oxford

University Press.

Copur, Z., 2015. Handbook of Research on Behavioral Finance and Investment Strategies:

Decision Making in the Financial Industry: Decision Making in the Financial Industry. New

Delhi: IGI Global.

Demirgüneş, K., 2015. Determinants of Target Dividend Payout Ratio: A Panel

Autoregressive Distributed Lag Analysis. International Journal of Economics and Financial

Issues, 5(2), pp. 418-426.

Echchabi, A. & Azouzi, D., 2016. Determinants of Dividend Payout Ratios In Tunusia:

Insights In Light of The Jasmine Revolution. Journal of Accounting, Finance and Auditing

Studies, 2(1), pp. 1-13.

Farrukh, Khadija; Irshad, Sadia ; Khakwani, Maria Shams ; Ishaque, Sadia ; Ansari, Nabil,

2017. Impact of dividend policy on shareholders wealth and firm performance in Pakistan,

Pakistan: Cogent Business & Management.

Ghosh, C. & Sun, J., 2013. Agency Cost, Dividend Policy and Growth: The Special Case of

REITs. Journal of Real Estate Finance and Economics, 48(4), pp. 660-708.

Gitman, L. J., Juchau, R. & Flanagan, J., 2015. Why do firms pay dividend?. Sydney: Pearson

Higher Education .

Hair, J. F., 2015. Essentials of Business Research Methods. New York: M.E. Sharpe.

References List

Blumberg, B., Cooper, D. R. & Schindler , P. S. S., 2014. Business Research Methods. New

York: McGraw Hill.

Browne, C. H., 2016. The Little Book of Value Investing. New York: John Wiley & Sons.

Bryman, A. & Bell, E., 2015. Business Research Methods. 3rd ed. Chicago: Oxford

University Press.

Copur, Z., 2015. Handbook of Research on Behavioral Finance and Investment Strategies:

Decision Making in the Financial Industry: Decision Making in the Financial Industry. New

Delhi: IGI Global.

Demirgüneş, K., 2015. Determinants of Target Dividend Payout Ratio: A Panel

Autoregressive Distributed Lag Analysis. International Journal of Economics and Financial

Issues, 5(2), pp. 418-426.

Echchabi, A. & Azouzi, D., 2016. Determinants of Dividend Payout Ratios In Tunusia:

Insights In Light of The Jasmine Revolution. Journal of Accounting, Finance and Auditing

Studies, 2(1), pp. 1-13.

Farrukh, Khadija; Irshad, Sadia ; Khakwani, Maria Shams ; Ishaque, Sadia ; Ansari, Nabil,

2017. Impact of dividend policy on shareholders wealth and firm performance in Pakistan,

Pakistan: Cogent Business & Management.

Ghosh, C. & Sun, J., 2013. Agency Cost, Dividend Policy and Growth: The Special Case of

REITs. Journal of Real Estate Finance and Economics, 48(4), pp. 660-708.

Gitman, L. J., Juchau, R. & Flanagan, J., 2015. Why do firms pay dividend?. Sydney: Pearson

Higher Education .

Hair, J. F., 2015. Essentials of Business Research Methods. New York: M.E. Sharpe.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.