PA301 Corporate Financial Management: Dividend Policy & EasyJet

VerifiedAdded on 2023/06/11

|21

|4550

|401

Report

AI Summary

This report critically assesses dividend policy theories, including the dividend relevance theory of Gordon and Walter and the dividend irrelevance theory of Miller and Modigliani, using empirical evidence. It also analyzes the capital structure of EasyJet over a five-year period (2013-2017), examining its financial performance, debt capacity, and financial risks. The analysis includes profitability ratios (gross margin, net margin, ROCE) and liquidity ratios (current ratio, quick ratio) to evaluate EasyJet's operational efficiency and financial health. The report concludes with recommendations for an optimal capital mix for EasyJet, considering its financial and business risks. Desklib provides access to similar solved assignments and study resources for students.

Running head: CORPORATE FINANCIAL MANAGEMENT

Corporate Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Corporate Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE FINANCIAL MANAGEMENT

Table of Contents

Task A:.............................................................................................................................................2

1. Introduction:............................................................................................................................2

2. Dividend policy:......................................................................................................................2

3. Dividend relevancy theories and their assumptions:...............................................................3

4. Dividend irrelevance theory of Miller and Modigliani and its assumptions:..........................5

5. Differences between dividend relevant and irrelevant theories:..............................................6

6. Conclusion:..............................................................................................................................7

Task B:.............................................................................................................................................7

Introduction:................................................................................................................................7

a. Recent financial performance of Easy Jet Airline:..................................................................7

b. Debt capacity (gearing level) of Easy Jet Airline:.................................................................11

c. Financial and business risks facing Easy Jet Airline:............................................................12

d. Recommendation and justification of optimal capital mix of Easy Jet Airline:....................13

Conclusion:................................................................................................................................14

References:....................................................................................................................................15

Appendices:...................................................................................................................................18

Table of Contents

Task A:.............................................................................................................................................2

1. Introduction:............................................................................................................................2

2. Dividend policy:......................................................................................................................2

3. Dividend relevancy theories and their assumptions:...............................................................3

4. Dividend irrelevance theory of Miller and Modigliani and its assumptions:..........................5

5. Differences between dividend relevant and irrelevant theories:..............................................6

6. Conclusion:..............................................................................................................................7

Task B:.............................................................................................................................................7

Introduction:................................................................................................................................7

a. Recent financial performance of Easy Jet Airline:..................................................................7

b. Debt capacity (gearing level) of Easy Jet Airline:.................................................................11

c. Financial and business risks facing Easy Jet Airline:............................................................12

d. Recommendation and justification of optimal capital mix of Easy Jet Airline:....................13

Conclusion:................................................................................................................................14

References:....................................................................................................................................15

Appendices:...................................................................................................................................18

2CORPORATE FINANCIAL MANAGEMENT

Task A:

1. Introduction:

A significant part of a business organisation is capital requirement and capital is deemed

to be of five types. They include social capital, human capital, manufactured capital, natural

capital and finance capital. Finance capital could be segregated further into debt capital and

equity capital. The primary accountability of the management is to establish value for the

shareholders and owners of the organisation. Many experts believe that the firm value is depicted

in the share price of the organisation. It has been argued further that the share price of the

organisation is reliant on the payment of dividend and hence, from the logical point of view,

interrelation is observed between organisational value and dividend payment (Michaely and Qian

2017).

In this section, effort is made to gain an overview of the dividend policy by assessing the

current theories on dividend policy along with their empirical findings. Another thing that has

been taken into consideration is that the analysts value the firm based on its dividend policy by

taking into account dividend irrelevance.

2. Dividend policy:

Dividend policy is considered as the guidelines used by an organisation in determining

the profit amount to be distributed in the form of dividend to the shareholders (Kajola, Adewumi

and Oworu 2015). The board of directors announces the quantum of dividend and once it is

ascertained, it is considered as the debt of the organisation, which could not be revoked easily.

Certain factors affect the dividend policy of an organisation like future earnings expectations,

liquidity position, legal obligations and presence of investment opportunity.

Task A:

1. Introduction:

A significant part of a business organisation is capital requirement and capital is deemed

to be of five types. They include social capital, human capital, manufactured capital, natural

capital and finance capital. Finance capital could be segregated further into debt capital and

equity capital. The primary accountability of the management is to establish value for the

shareholders and owners of the organisation. Many experts believe that the firm value is depicted

in the share price of the organisation. It has been argued further that the share price of the

organisation is reliant on the payment of dividend and hence, from the logical point of view,

interrelation is observed between organisational value and dividend payment (Michaely and Qian

2017).

In this section, effort is made to gain an overview of the dividend policy by assessing the

current theories on dividend policy along with their empirical findings. Another thing that has

been taken into consideration is that the analysts value the firm based on its dividend policy by

taking into account dividend irrelevance.

2. Dividend policy:

Dividend policy is considered as the guidelines used by an organisation in determining

the profit amount to be distributed in the form of dividend to the shareholders (Kajola, Adewumi

and Oworu 2015). The board of directors announces the quantum of dividend and once it is

ascertained, it is considered as the debt of the organisation, which could not be revoked easily.

Certain factors affect the dividend policy of an organisation like future earnings expectations,

liquidity position, legal obligations and presence of investment opportunity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE FINANCIAL MANAGEMENT

The dividend policy of an organisation could be classified further into three categories

based on the dividend paid and frequency of payments and they are summarised as follows:

Stable dividend policy:

In this policy, the organisation pays a stable dividend each year. It is the widely used

dividend policy, since it provides the shareholders the lowest possible uncertainty regarding

future dividend level (Jacob and Michaely 2017).

Constant dividend policy:

Under this policy, a fixed percent of income is announced as dividend each year. The

dividend payment is extremely volatile due to its direct association with the company earnings.

However, this policy is yet to gain popularity among the shareholders and organisations.

Residual dividend policy:

In this policy, the organisation pays dividend from fund, which is left after it is used for

profitable projects. With the help of this policy, the management could undertake several

investment projects; however, in this policy, volatility is high in case of dividend payments,

since the firm value might be affected. Hence, it is necessary for the management to take into

account that the unexpected change in payment of dividend might affect the perspective of the

business performance, which would have impact on the firm value (Caliskan and Doukas 2015).

3. Dividend relevancy theories and their assumptions:

The dividend policy theories are categorised primarily into two classifications based on

the relationship between dividend and firm value. According to few scholars, dividend does not

influence the firm value, which is reflected in Modigliani and Miller dividend irrelevance theory.

The dividend policy of an organisation could be classified further into three categories

based on the dividend paid and frequency of payments and they are summarised as follows:

Stable dividend policy:

In this policy, the organisation pays a stable dividend each year. It is the widely used

dividend policy, since it provides the shareholders the lowest possible uncertainty regarding

future dividend level (Jacob and Michaely 2017).

Constant dividend policy:

Under this policy, a fixed percent of income is announced as dividend each year. The

dividend payment is extremely volatile due to its direct association with the company earnings.

However, this policy is yet to gain popularity among the shareholders and organisations.

Residual dividend policy:

In this policy, the organisation pays dividend from fund, which is left after it is used for

profitable projects. With the help of this policy, the management could undertake several

investment projects; however, in this policy, volatility is high in case of dividend payments,

since the firm value might be affected. Hence, it is necessary for the management to take into

account that the unexpected change in payment of dividend might affect the perspective of the

business performance, which would have impact on the firm value (Caliskan and Doukas 2015).

3. Dividend relevancy theories and their assumptions:

The dividend policy theories are categorised primarily into two classifications based on

the relationship between dividend and firm value. According to few scholars, dividend does not

influence the firm value, which is reflected in Modigliani and Miller dividend irrelevance theory.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE FINANCIAL MANAGEMENT

On the other hand, few scholars state that the firm value is affected by the dividend payment,

which is supported by dividend relevance theory of Gordon and Walter.

According to the Walter model, the stock price of an organisation is affected by dividend

and the formula for computing it is provided as follows:

P = D/k + {r x (E – D)/k}/k

P = Market value per share

D = Dividend per share

E = Earnings per share

K = Cost of capital

For instance, firm A has earnings per share of £15 with an applicable market discount

rate of 12.5%. The dividend payment is £5 per share and the internal rate of return is 10%. In this

case, the market value per share would be computed as follows:

P = 5/0.125 + {10 x (15 – 5)/0.125}/0.125 = £104

The Gordon model reflects that dividend influences the share price of the organisation.

The formula is depicted as follows:

P = {EPS x (1 – b)}/(k – g)

P = Market value per share

EPS = Earnings per share

b = Firm retention ratio

On the other hand, few scholars state that the firm value is affected by the dividend payment,

which is supported by dividend relevance theory of Gordon and Walter.

According to the Walter model, the stock price of an organisation is affected by dividend

and the formula for computing it is provided as follows:

P = D/k + {r x (E – D)/k}/k

P = Market value per share

D = Dividend per share

E = Earnings per share

K = Cost of capital

For instance, firm A has earnings per share of £15 with an applicable market discount

rate of 12.5%. The dividend payment is £5 per share and the internal rate of return is 10%. In this

case, the market value per share would be computed as follows:

P = 5/0.125 + {10 x (15 – 5)/0.125}/0.125 = £104

The Gordon model reflects that dividend influences the share price of the organisation.

The formula is depicted as follows:

P = {EPS x (1 – b)}/(k – g)

P = Market value per share

EPS = Earnings per share

b = Firm retention ratio

5CORPORATE FINANCIAL MANAGEMENT

(1 – b) = Firm payout ratio

k = Firm’s cost of capital

g = Firm growth rate

For instance, it is assumed that Company X has EPS of £15 with a retention ratio of 70%.

The cost of capital is 12% and growth rate of the organisation is 10% respectively. The market

value per share in accordance with the Gordon model is reflected as follows:

P = {15 x (1 – 0.70)}/(12 – 10) = £225

4. Dividend irrelevance theory of Miller and Modigliani and its assumptions:

Before the proposition of this theory, it was believed that the firm value increases with

rise in dividend. However, this theory challenged the accepted opinion and it proposed a

suggestion that dividend does not affect the firm value (Koo, Ramalingegowda and Yu 2017).

Instead, it depends on the capability of the organisation to accept risks along with earning

money. This theory is dependent on a group of assumptions, which are depicted as follows:

Perfect capital markets

Absence of taxes

Absence of floatation or transactions cost

Fixed investment policy

In this theory, if an organisation concentrates on retained earnings rather than distributing the

same as dividend, the shareholders would enjoy capital appreciation equivalent to retained

profits. On the contrary, if it distributes profit in the form of dividend, the shareholders would

enjoy dividend equivalent to foregone capital appreciation (Jacob, Michaely and Alstadsæter

(1 – b) = Firm payout ratio

k = Firm’s cost of capital

g = Firm growth rate

For instance, it is assumed that Company X has EPS of £15 with a retention ratio of 70%.

The cost of capital is 12% and growth rate of the organisation is 10% respectively. The market

value per share in accordance with the Gordon model is reflected as follows:

P = {15 x (1 – 0.70)}/(12 – 10) = £225

4. Dividend irrelevance theory of Miller and Modigliani and its assumptions:

Before the proposition of this theory, it was believed that the firm value increases with

rise in dividend. However, this theory challenged the accepted opinion and it proposed a

suggestion that dividend does not affect the firm value (Koo, Ramalingegowda and Yu 2017).

Instead, it depends on the capability of the organisation to accept risks along with earning

money. This theory is dependent on a group of assumptions, which are depicted as follows:

Perfect capital markets

Absence of taxes

Absence of floatation or transactions cost

Fixed investment policy

In this theory, if an organisation concentrates on retained earnings rather than distributing the

same as dividend, the shareholders would enjoy capital appreciation equivalent to retained

profits. On the contrary, if it distributes profit in the form of dividend, the shareholders would

enjoy dividend equivalent to foregone capital appreciation (Jacob, Michaely and Alstadsæter

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE FINANCIAL MANAGEMENT

2015). Thus, this theory infers that earning division between retained profit and dividend has no

impact on firm value.

Dividend irrelevant theory states that there is existence of perfect capital markets;

however, in reality, the capital markets are not perfect. In addition, the company is not needed to

pay tax under this theory is not realistic. However, rejecting this theory based on these unrealistic

assumptions might not be correct (Baker and Weigand 2015). For verifying this theory, Black

and Scholes carried out a study on 25 companies listed on the New York Stock Exchange in

1974 for deciding the association between stock return and dividend yield. After the study was

completed, it was found that no relationship is inherent between stock returns and dividend yield

(Al-Najjar and Kilincarslan 2016). Therefore, it could be inferred that the study outcome was

unswerving with this theory, which implies that dividend policy does not influence share price of

the organisation.

5. Differences between dividend relevant and irrelevant theories:

According to dividend relevance theory, dividend policy influences firm value, while

dividend irrelevance theory states that the firm value is not affected by dividend (Renneboog and

Szilagyi 2015). In addition, dividend irrelevance theory states that rise in firm value due to

dividend payment would be set off because of the external financing payment; thus, there would

be no change in shareholder wealth. However, the Gordon dividend model states that investors

prefer current dividend more compared to future capital appreciation and hence, the firm value

would be increased to dividend payment (Florackis, Kanas and Kostakis 2015).

For instance, if an organisation intends to make dividend payment of £2 per share, it

would have no impact on the firm value, as per dividend irrelevance theory. Since the

organisation distributes fund in the form of dividend, additional funds need to be obtained from

2015). Thus, this theory infers that earning division between retained profit and dividend has no

impact on firm value.

Dividend irrelevant theory states that there is existence of perfect capital markets;

however, in reality, the capital markets are not perfect. In addition, the company is not needed to

pay tax under this theory is not realistic. However, rejecting this theory based on these unrealistic

assumptions might not be correct (Baker and Weigand 2015). For verifying this theory, Black

and Scholes carried out a study on 25 companies listed on the New York Stock Exchange in

1974 for deciding the association between stock return and dividend yield. After the study was

completed, it was found that no relationship is inherent between stock returns and dividend yield

(Al-Najjar and Kilincarslan 2016). Therefore, it could be inferred that the study outcome was

unswerving with this theory, which implies that dividend policy does not influence share price of

the organisation.

5. Differences between dividend relevant and irrelevant theories:

According to dividend relevance theory, dividend policy influences firm value, while

dividend irrelevance theory states that the firm value is not affected by dividend (Renneboog and

Szilagyi 2015). In addition, dividend irrelevance theory states that rise in firm value due to

dividend payment would be set off because of the external financing payment; thus, there would

be no change in shareholder wealth. However, the Gordon dividend model states that investors

prefer current dividend more compared to future capital appreciation and hence, the firm value

would be increased to dividend payment (Florackis, Kanas and Kostakis 2015).

For instance, if an organisation intends to make dividend payment of £2 per share, it

would have no impact on the firm value, as per dividend irrelevance theory. Since the

organisation distributes fund in the form of dividend, additional funds need to be obtained from

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE FINANCIAL MANAGEMENT

outside sources for funding the project leading to rise in interest payment. By considering the

same example, dividend relevance theory states that the shareholders of the organisation would

value the dividend payments more, which would appreciate the firm value eventually.

6. Conclusion:

After evaluating dividend irrelevance theory along with empirical evidences, it could be

inferred that the theory is not correct fully; however, the theory argues that dividend policy and

share price is not related to each other. Hence, depending on the theory and empirical evidences,

the valuation need not be reliant on dividend policy. Moreover, the analysts use dividend policy

to value the correct firm value; however, it is recommended to the analysts that such practice

need not be avoided by taking into consideration the dividend irrelevance theory.

Task B:

Introduction:

Easy Jet is one of the leading low cost European airlines headquartered in London, UK.

The airline operates in above 800 routes covering 30 nations throughout Europe. The airline has

enjoyed competitive advantage over the years due to its network design linking various cities,

capability of maximising asset utilisation, cost advantage and its financial strength (Easyjet.com

2018).

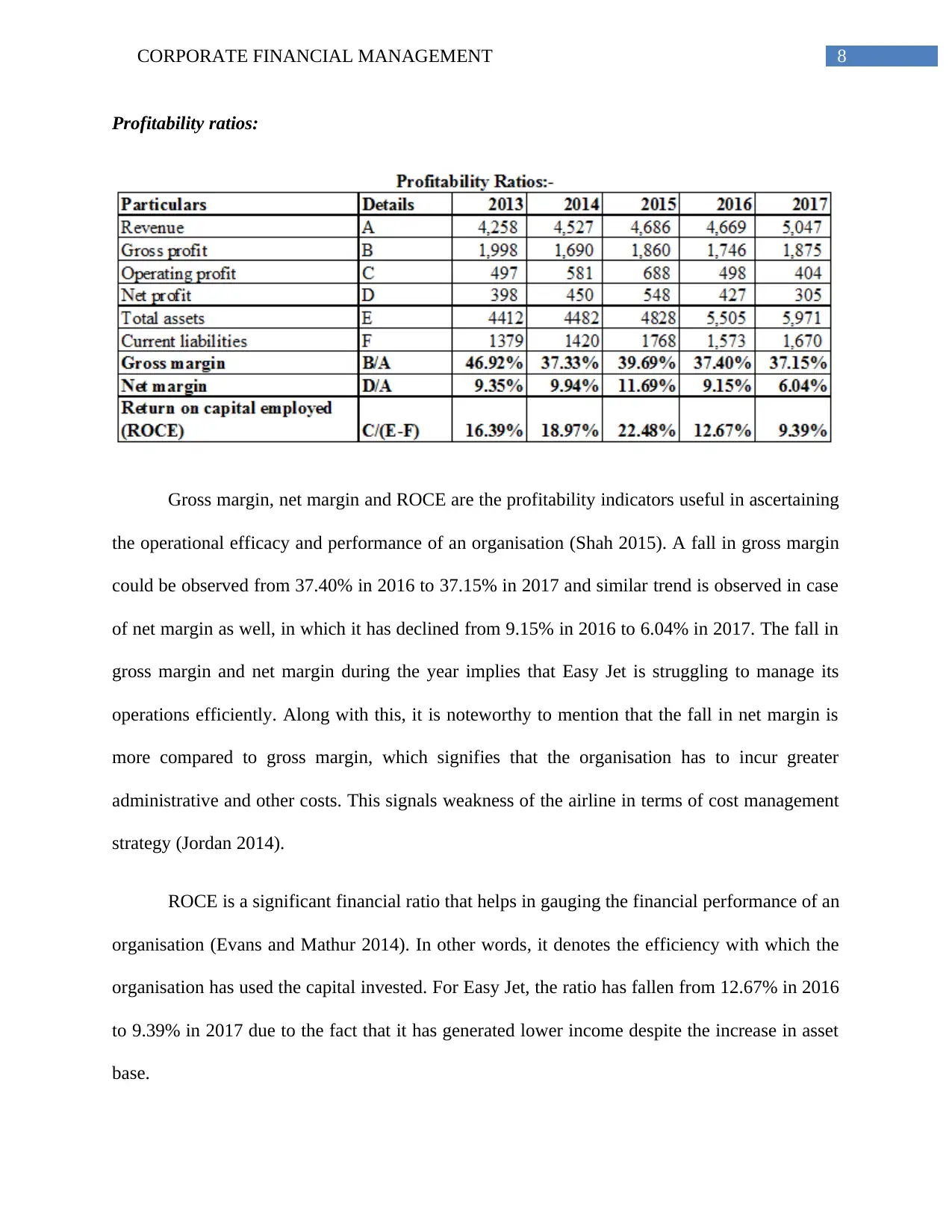

a. Recent financial performance of Easy Jet Airline:

In this section, the financial analysis of Easy Jet is performed for the years 2013-2017

based on its annual reports. On assessing the financial statements of the organisation, it could be

found that the revenue has increased by 8.10% in 2017; however, it has not managed to increase

its profit in the year due to increase in cost (Corporate.easyjet.com 2018).

outside sources for funding the project leading to rise in interest payment. By considering the

same example, dividend relevance theory states that the shareholders of the organisation would

value the dividend payments more, which would appreciate the firm value eventually.

6. Conclusion:

After evaluating dividend irrelevance theory along with empirical evidences, it could be

inferred that the theory is not correct fully; however, the theory argues that dividend policy and

share price is not related to each other. Hence, depending on the theory and empirical evidences,

the valuation need not be reliant on dividend policy. Moreover, the analysts use dividend policy

to value the correct firm value; however, it is recommended to the analysts that such practice

need not be avoided by taking into consideration the dividend irrelevance theory.

Task B:

Introduction:

Easy Jet is one of the leading low cost European airlines headquartered in London, UK.

The airline operates in above 800 routes covering 30 nations throughout Europe. The airline has

enjoyed competitive advantage over the years due to its network design linking various cities,

capability of maximising asset utilisation, cost advantage and its financial strength (Easyjet.com

2018).

a. Recent financial performance of Easy Jet Airline:

In this section, the financial analysis of Easy Jet is performed for the years 2013-2017

based on its annual reports. On assessing the financial statements of the organisation, it could be

found that the revenue has increased by 8.10% in 2017; however, it has not managed to increase

its profit in the year due to increase in cost (Corporate.easyjet.com 2018).

8CORPORATE FINANCIAL MANAGEMENT

Profitability ratios:

Gross margin, net margin and ROCE are the profitability indicators useful in ascertaining

the operational efficacy and performance of an organisation (Shah 2015). A fall in gross margin

could be observed from 37.40% in 2016 to 37.15% in 2017 and similar trend is observed in case

of net margin as well, in which it has declined from 9.15% in 2016 to 6.04% in 2017. The fall in

gross margin and net margin during the year implies that Easy Jet is struggling to manage its

operations efficiently. Along with this, it is noteworthy to mention that the fall in net margin is

more compared to gross margin, which signifies that the organisation has to incur greater

administrative and other costs. This signals weakness of the airline in terms of cost management

strategy (Jordan 2014).

ROCE is a significant financial ratio that helps in gauging the financial performance of an

organisation (Evans and Mathur 2014). In other words, it denotes the efficiency with which the

organisation has used the capital invested. For Easy Jet, the ratio has fallen from 12.67% in 2016

to 9.39% in 2017 due to the fact that it has generated lower income despite the increase in asset

base.

Profitability ratios:

Gross margin, net margin and ROCE are the profitability indicators useful in ascertaining

the operational efficacy and performance of an organisation (Shah 2015). A fall in gross margin

could be observed from 37.40% in 2016 to 37.15% in 2017 and similar trend is observed in case

of net margin as well, in which it has declined from 9.15% in 2016 to 6.04% in 2017. The fall in

gross margin and net margin during the year implies that Easy Jet is struggling to manage its

operations efficiently. Along with this, it is noteworthy to mention that the fall in net margin is

more compared to gross margin, which signifies that the organisation has to incur greater

administrative and other costs. This signals weakness of the airline in terms of cost management

strategy (Jordan 2014).

ROCE is a significant financial ratio that helps in gauging the financial performance of an

organisation (Evans and Mathur 2014). In other words, it denotes the efficiency with which the

organisation has used the capital invested. For Easy Jet, the ratio has fallen from 12.67% in 2016

to 9.39% in 2017 due to the fact that it has generated lower income despite the increase in asset

base.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CORPORATE FINANCIAL MANAGEMENT

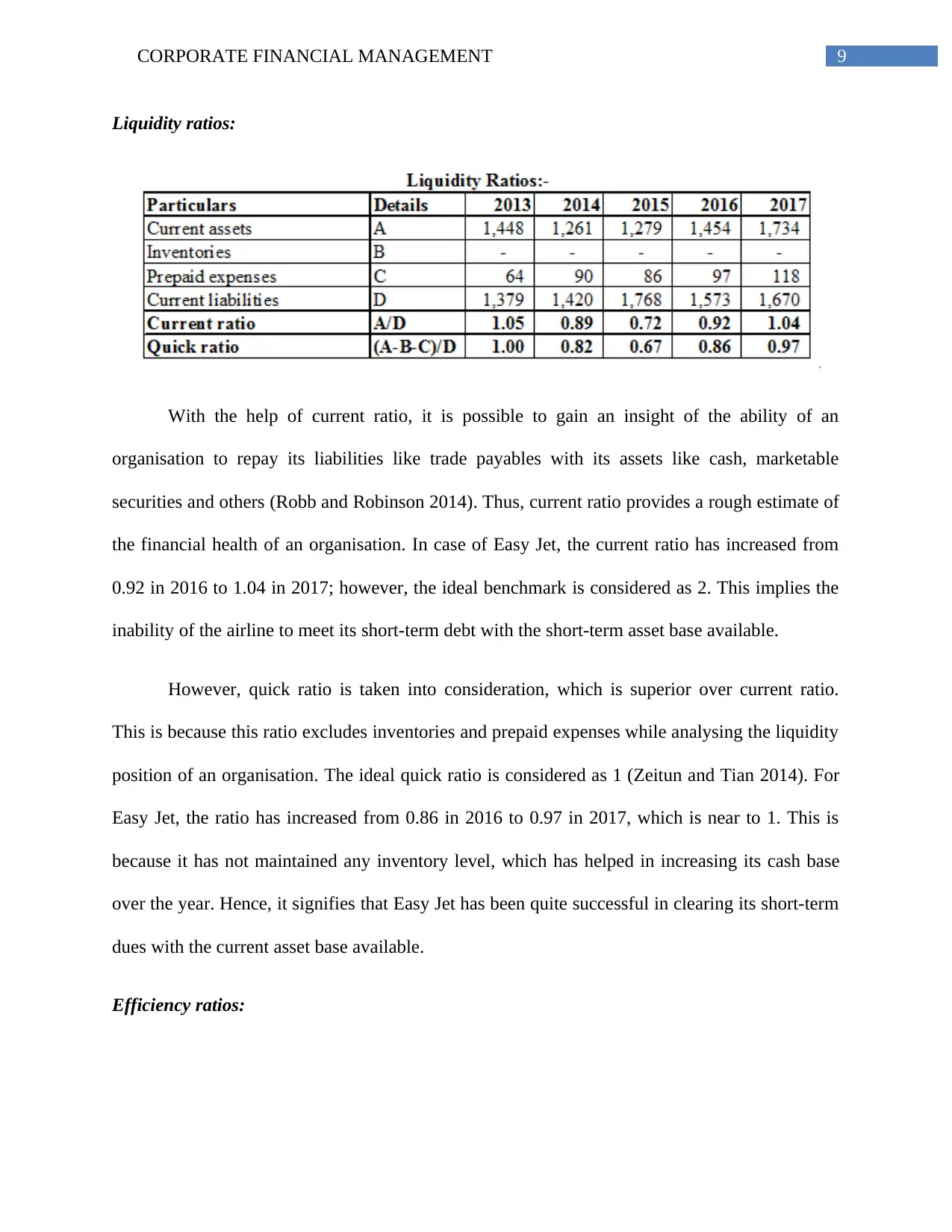

Liquidity ratios:

With the help of current ratio, it is possible to gain an insight of the ability of an

organisation to repay its liabilities like trade payables with its assets like cash, marketable

securities and others (Robb and Robinson 2014). Thus, current ratio provides a rough estimate of

the financial health of an organisation. In case of Easy Jet, the current ratio has increased from

0.92 in 2016 to 1.04 in 2017; however, the ideal benchmark is considered as 2. This implies the

inability of the airline to meet its short-term debt with the short-term asset base available.

However, quick ratio is taken into consideration, which is superior over current ratio.

This is because this ratio excludes inventories and prepaid expenses while analysing the liquidity

position of an organisation. The ideal quick ratio is considered as 1 (Zeitun and Tian 2014). For

Easy Jet, the ratio has increased from 0.86 in 2016 to 0.97 in 2017, which is near to 1. This is

because it has not maintained any inventory level, which has helped in increasing its cash base

over the year. Hence, it signifies that Easy Jet has been quite successful in clearing its short-term

dues with the current asset base available.

Efficiency ratios:

Liquidity ratios:

With the help of current ratio, it is possible to gain an insight of the ability of an

organisation to repay its liabilities like trade payables with its assets like cash, marketable

securities and others (Robb and Robinson 2014). Thus, current ratio provides a rough estimate of

the financial health of an organisation. In case of Easy Jet, the current ratio has increased from

0.92 in 2016 to 1.04 in 2017; however, the ideal benchmark is considered as 2. This implies the

inability of the airline to meet its short-term debt with the short-term asset base available.

However, quick ratio is taken into consideration, which is superior over current ratio.

This is because this ratio excludes inventories and prepaid expenses while analysing the liquidity

position of an organisation. The ideal quick ratio is considered as 1 (Zeitun and Tian 2014). For

Easy Jet, the ratio has increased from 0.86 in 2016 to 0.97 in 2017, which is near to 1. This is

because it has not maintained any inventory level, which has helped in increasing its cash base

over the year. Hence, it signifies that Easy Jet has been quite successful in clearing its short-term

dues with the current asset base available.

Efficiency ratios:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CORPORATE FINANCIAL MANAGEMENT

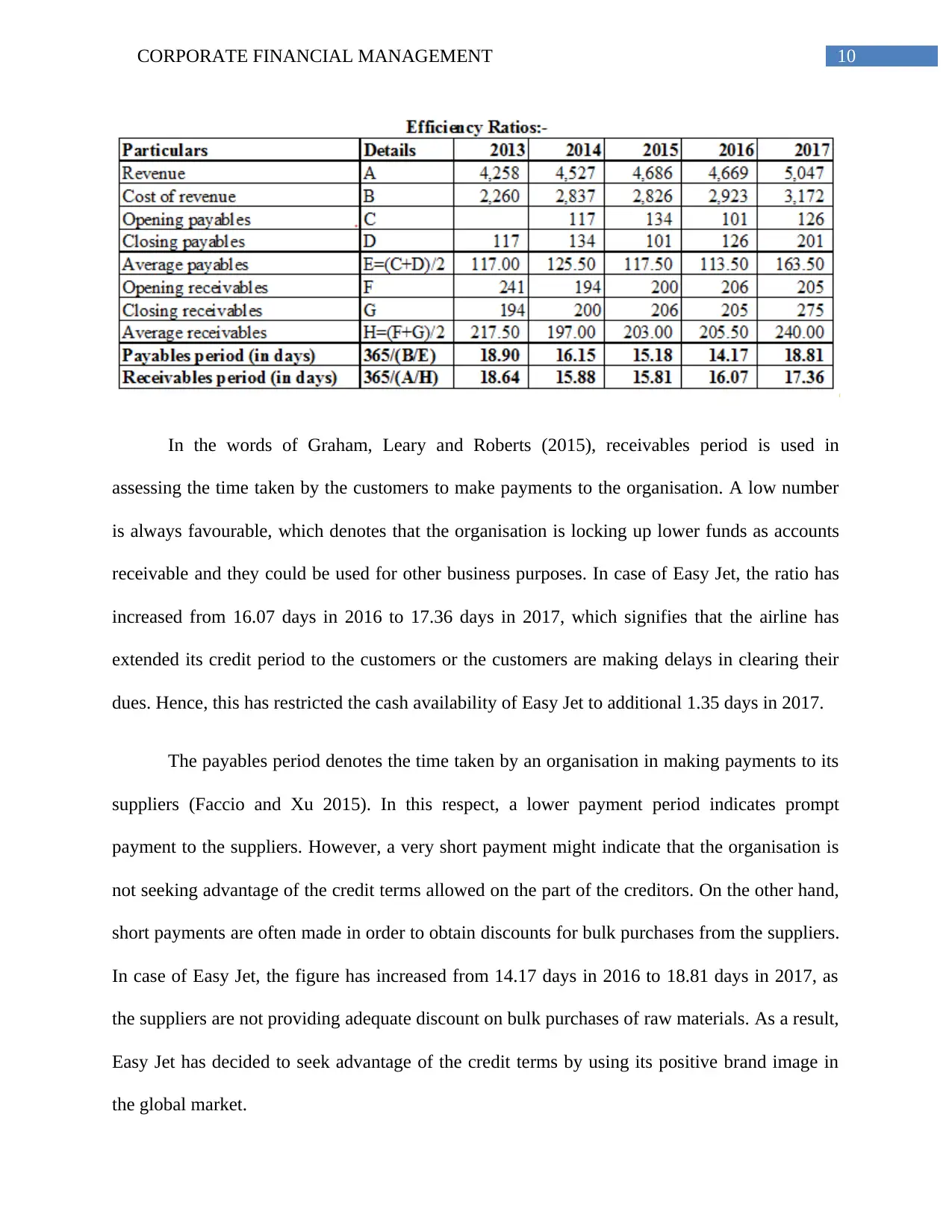

In the words of Graham, Leary and Roberts (2015), receivables period is used in

assessing the time taken by the customers to make payments to the organisation. A low number

is always favourable, which denotes that the organisation is locking up lower funds as accounts

receivable and they could be used for other business purposes. In case of Easy Jet, the ratio has

increased from 16.07 days in 2016 to 17.36 days in 2017, which signifies that the airline has

extended its credit period to the customers or the customers are making delays in clearing their

dues. Hence, this has restricted the cash availability of Easy Jet to additional 1.35 days in 2017.

The payables period denotes the time taken by an organisation in making payments to its

suppliers (Faccio and Xu 2015). In this respect, a lower payment period indicates prompt

payment to the suppliers. However, a very short payment might indicate that the organisation is

not seeking advantage of the credit terms allowed on the part of the creditors. On the other hand,

short payments are often made in order to obtain discounts for bulk purchases from the suppliers.

In case of Easy Jet, the figure has increased from 14.17 days in 2016 to 18.81 days in 2017, as

the suppliers are not providing adequate discount on bulk purchases of raw materials. As a result,

Easy Jet has decided to seek advantage of the credit terms by using its positive brand image in

the global market.

In the words of Graham, Leary and Roberts (2015), receivables period is used in

assessing the time taken by the customers to make payments to the organisation. A low number

is always favourable, which denotes that the organisation is locking up lower funds as accounts

receivable and they could be used for other business purposes. In case of Easy Jet, the ratio has

increased from 16.07 days in 2016 to 17.36 days in 2017, which signifies that the airline has

extended its credit period to the customers or the customers are making delays in clearing their

dues. Hence, this has restricted the cash availability of Easy Jet to additional 1.35 days in 2017.

The payables period denotes the time taken by an organisation in making payments to its

suppliers (Faccio and Xu 2015). In this respect, a lower payment period indicates prompt

payment to the suppliers. However, a very short payment might indicate that the organisation is

not seeking advantage of the credit terms allowed on the part of the creditors. On the other hand,

short payments are often made in order to obtain discounts for bulk purchases from the suppliers.

In case of Easy Jet, the figure has increased from 14.17 days in 2016 to 18.81 days in 2017, as

the suppliers are not providing adequate discount on bulk purchases of raw materials. As a result,

Easy Jet has decided to seek advantage of the credit terms by using its positive brand image in

the global market.

11CORPORATE FINANCIAL MANAGEMENT

Cash flow statement analysis:

After assessing the cash flow statement of Easy Jet based on its annual report in 2017, in

which positive operating cash flows are observed in both 2016 and 2017. The net cash flows

from operations have risen from £387 million in 2016 to £663 million in 2017, which is a

positive signal. The net cash used in investing activities has been negative in both the years,

since it has heavy investment for purchasing 20 aircrafts. This is a positive is signal, since it

denotes that the airline has increased the overall operational capability. The cash flows used in

financing activities has increased in 2017 and it is positive in both the years because of the fall in

money market deposits (Raviv et al. 2017). The deposits in money market signify the unearned

revenue of the tickets sold on the part of Easy Jet, which signifies positive cash flow position of

the airline.

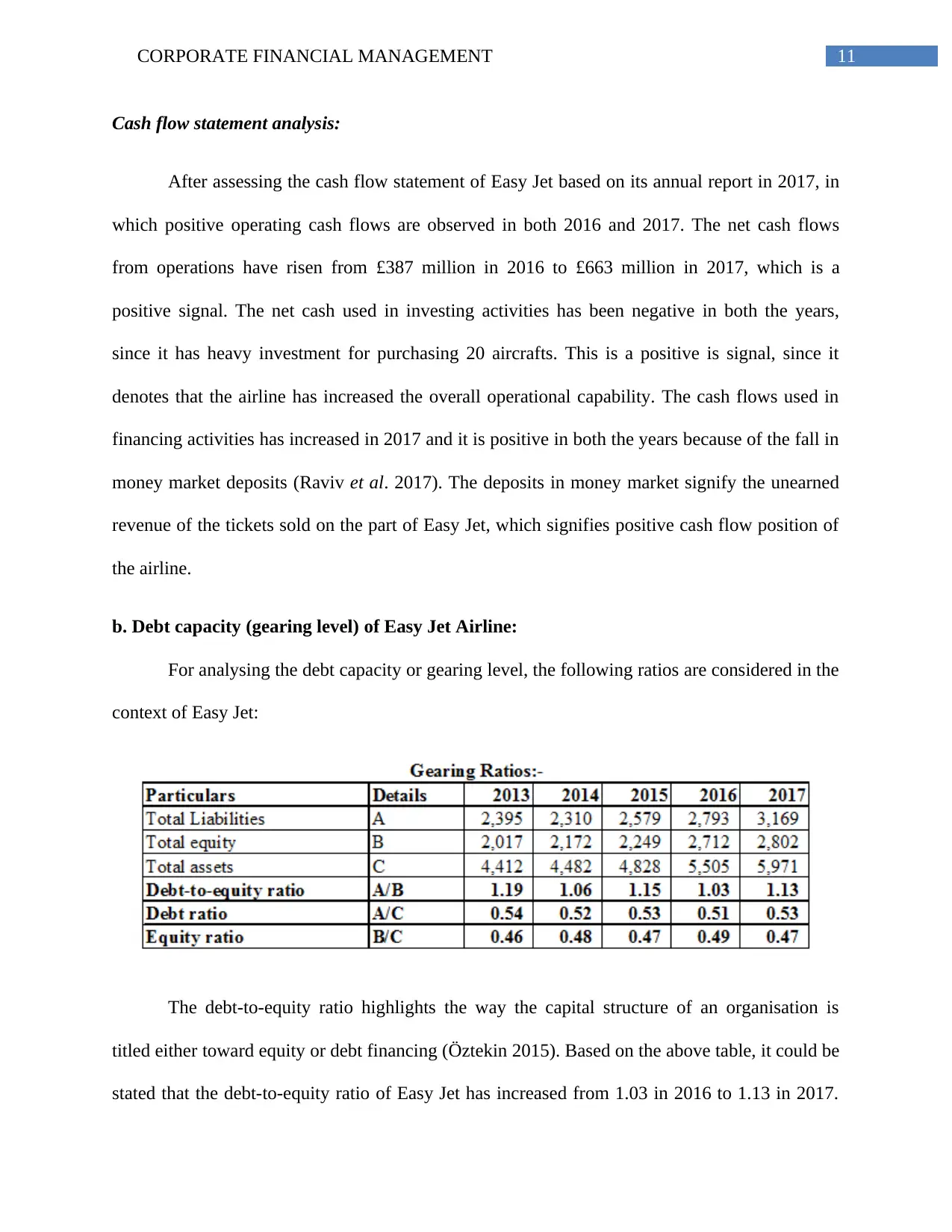

b. Debt capacity (gearing level) of Easy Jet Airline:

For analysing the debt capacity or gearing level, the following ratios are considered in the

context of Easy Jet:

The debt-to-equity ratio highlights the way the capital structure of an organisation is

titled either toward equity or debt financing (Öztekin 2015). Based on the above table, it could be

stated that the debt-to-equity ratio of Easy Jet has increased from 1.03 in 2016 to 1.13 in 2017.

Cash flow statement analysis:

After assessing the cash flow statement of Easy Jet based on its annual report in 2017, in

which positive operating cash flows are observed in both 2016 and 2017. The net cash flows

from operations have risen from £387 million in 2016 to £663 million in 2017, which is a

positive signal. The net cash used in investing activities has been negative in both the years,

since it has heavy investment for purchasing 20 aircrafts. This is a positive is signal, since it

denotes that the airline has increased the overall operational capability. The cash flows used in

financing activities has increased in 2017 and it is positive in both the years because of the fall in

money market deposits (Raviv et al. 2017). The deposits in money market signify the unearned

revenue of the tickets sold on the part of Easy Jet, which signifies positive cash flow position of

the airline.

b. Debt capacity (gearing level) of Easy Jet Airline:

For analysing the debt capacity or gearing level, the following ratios are considered in the

context of Easy Jet:

The debt-to-equity ratio highlights the way the capital structure of an organisation is

titled either toward equity or debt financing (Öztekin 2015). Based on the above table, it could be

stated that the debt-to-equity ratio of Easy Jet has increased from 1.03 in 2016 to 1.13 in 2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.