Management Accounting: Costing and Budgeting Techniques Report

VerifiedAdded on 2020/01/07

|15

|3543

|220

Report

AI Summary

This report delves into the crucial aspects of management accounting, focusing on costing and budgeting. It begins by defining different types of costs, including those based on expense nature, functional activities, and behavioral patterns, and then explores various costing methods such as unit ...

MANAGEMENT

ACCOUNTING:

COSTING AND

BUDGETING

ACCOUNTING:

COSTING AND

BUDGETING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION....................................................................................................................... 1

TASK 1....................................................................................................................................... 1

1.1 Different types of cost................................................................................................... 1

1.2 Different costing methods............................................................................................. 1

1.3 Calculation of costs using appropriate technique...........................................................2

1.4 Analysis of costs using appropriate technique...............................................................2

TASK 2....................................................................................................................................... 2

2.1 Routine cost reports...................................................................................................... 2

2.2 Performance indicators to identify potential improvements...........................................2

2.3 Improvements to reduce costs, enhance value and quality.............................................3

TASK 3....................................................................................................................................... 3

3.1 Purpose and nature of budgeting process.......................................................................3

3.2 Budgeting methods and its needs..................................................................................4

3.3 Budget preparation according to activity based budgeting method................................4

3.4 Cash budget.................................................................................................................. 5

TASK 4....................................................................................................................................... 6

4.1 Variances...................................................................................................................... 6

4.2 Operating statement reconciling budgeted and actual sales...........................................7

4.3 Responsibility centres................................................................................................... 7

CONCLUSION............................................................................................................................ 7

REFERENCES............................................................................................................................ 9

INTRODUCTION....................................................................................................................... 1

TASK 1....................................................................................................................................... 1

1.1 Different types of cost................................................................................................... 1

1.2 Different costing methods............................................................................................. 1

1.3 Calculation of costs using appropriate technique...........................................................2

1.4 Analysis of costs using appropriate technique...............................................................2

TASK 2....................................................................................................................................... 2

2.1 Routine cost reports...................................................................................................... 2

2.2 Performance indicators to identify potential improvements...........................................2

2.3 Improvements to reduce costs, enhance value and quality.............................................3

TASK 3....................................................................................................................................... 3

3.1 Purpose and nature of budgeting process.......................................................................3

3.2 Budgeting methods and its needs..................................................................................4

3.3 Budget preparation according to activity based budgeting method................................4

3.4 Cash budget.................................................................................................................. 5

TASK 4....................................................................................................................................... 6

4.1 Variances...................................................................................................................... 6

4.2 Operating statement reconciling budgeted and actual sales...........................................7

4.3 Responsibility centres................................................................................................... 7

CONCLUSION............................................................................................................................ 7

REFERENCES............................................................................................................................ 9

·INTRODUCTION

Cost is a sensitive element of a business entity which is incurred by a firm in producing

goods and services. Budgeting is also very important element of the business which helps to

estimate the expenses and incomes. In the present report first and second parts rely with costing

while third and fourth parts rely with budgeting. The report describes about the various costs and

costing methods as well as it present performance indicators which helps to identify potential

improvements and strategies to reduce cost and improve quality. It describes about the budgeting

and responsibility centres. The activity based budgeting and cash budget are also describes.

·TASK 1

·1.1 Different types of cost

Cost is a sensitive element of every business whether it is manufacturing business or

service based. Cost is that which is incurred in producing goods or services. In the business there

are various types of costs on the basis of specific purpose or as per the nature of cost. Various

types of costs on the basis of specific purpose are given as below:

·On the basis of expense nature: In the business as per the nature of expenses there are various

expenses incurred to produce products and services (Kaplan and Atkinson, 2015). Various

expenses according to the expense nature are such as labour cost, material costs etc.

·On the basis of functional costs: In the organisation different functions are there which are

included in cost of production. Different expenses or costs on the basis of activities of functional

are such as production cost, finance cost, administration cost, research and development cost,

selling and distribution cost, advertisement cost etc.

·On the basis of behavioural costs: As per the behavioural the costs incurred in business entity

are such as direct costs, indirect costs, variable costs, fixed costs, semi-variable costs etc. The

direct costs are those which directly incurred with the production while indirect costs are not

affects products directly. On the other side the fixed costs are that costs which are constant in the

business and variable costs are varied with production level. When production level change then

the variable costs are also changed. Operating costs are those costs which attached with the

production process and products and services. These are incurred in total cost of products and

services.

1

Cost is a sensitive element of a business entity which is incurred by a firm in producing

goods and services. Budgeting is also very important element of the business which helps to

estimate the expenses and incomes. In the present report first and second parts rely with costing

while third and fourth parts rely with budgeting. The report describes about the various costs and

costing methods as well as it present performance indicators which helps to identify potential

improvements and strategies to reduce cost and improve quality. It describes about the budgeting

and responsibility centres. The activity based budgeting and cash budget are also describes.

·TASK 1

·1.1 Different types of cost

Cost is a sensitive element of every business whether it is manufacturing business or

service based. Cost is that which is incurred in producing goods or services. In the business there

are various types of costs on the basis of specific purpose or as per the nature of cost. Various

types of costs on the basis of specific purpose are given as below:

·On the basis of expense nature: In the business as per the nature of expenses there are various

expenses incurred to produce products and services (Kaplan and Atkinson, 2015). Various

expenses according to the expense nature are such as labour cost, material costs etc.

·On the basis of functional costs: In the organisation different functions are there which are

included in cost of production. Different expenses or costs on the basis of activities of functional

are such as production cost, finance cost, administration cost, research and development cost,

selling and distribution cost, advertisement cost etc.

·On the basis of behavioural costs: As per the behavioural the costs incurred in business entity

are such as direct costs, indirect costs, variable costs, fixed costs, semi-variable costs etc. The

direct costs are those which directly incurred with the production while indirect costs are not

affects products directly. On the other side the fixed costs are that costs which are constant in the

business and variable costs are varied with production level. When production level change then

the variable costs are also changed. Operating costs are those costs which attached with the

production process and products and services. These are incurred in total cost of products and

services.

1

You're viewing a preview

Unlock full access by subscribing today!

·1.2 Different costing methods

In the organisation various costs are incurred to produce goods and services. For derive

the total cost of a product costing method is used by management (Otley and Emmanuel, 2013).

There are various methods of costing by which a firm determine cost of a product. Various

costing methods are such as follows:

·Unit costing: Unit costing is a method of costing where cost is determined of a unit of products

or services. The method is used by management in order to determine cost of a unit produced. In

this total cost of production is divided with the total number of units produced. It is mostly used

in the manufacturing companies.

·Process costing: According to the process costing method the cost is determined as per the

various processes of manufacturing (Fullerton, Kennedy and Widener, 2013). The method is

used my majorly manufacturing entities where goods and services are producing step by step.

The cost is calculated step by step of production process. For example in textile industry, car

manufacturing industry etc.

·Batch costing: Under the batch costing costs of similar products are determined. In batch

costing similar products are separated and then calculate the costs. The products are separated as

per the nature of products or design of the product.

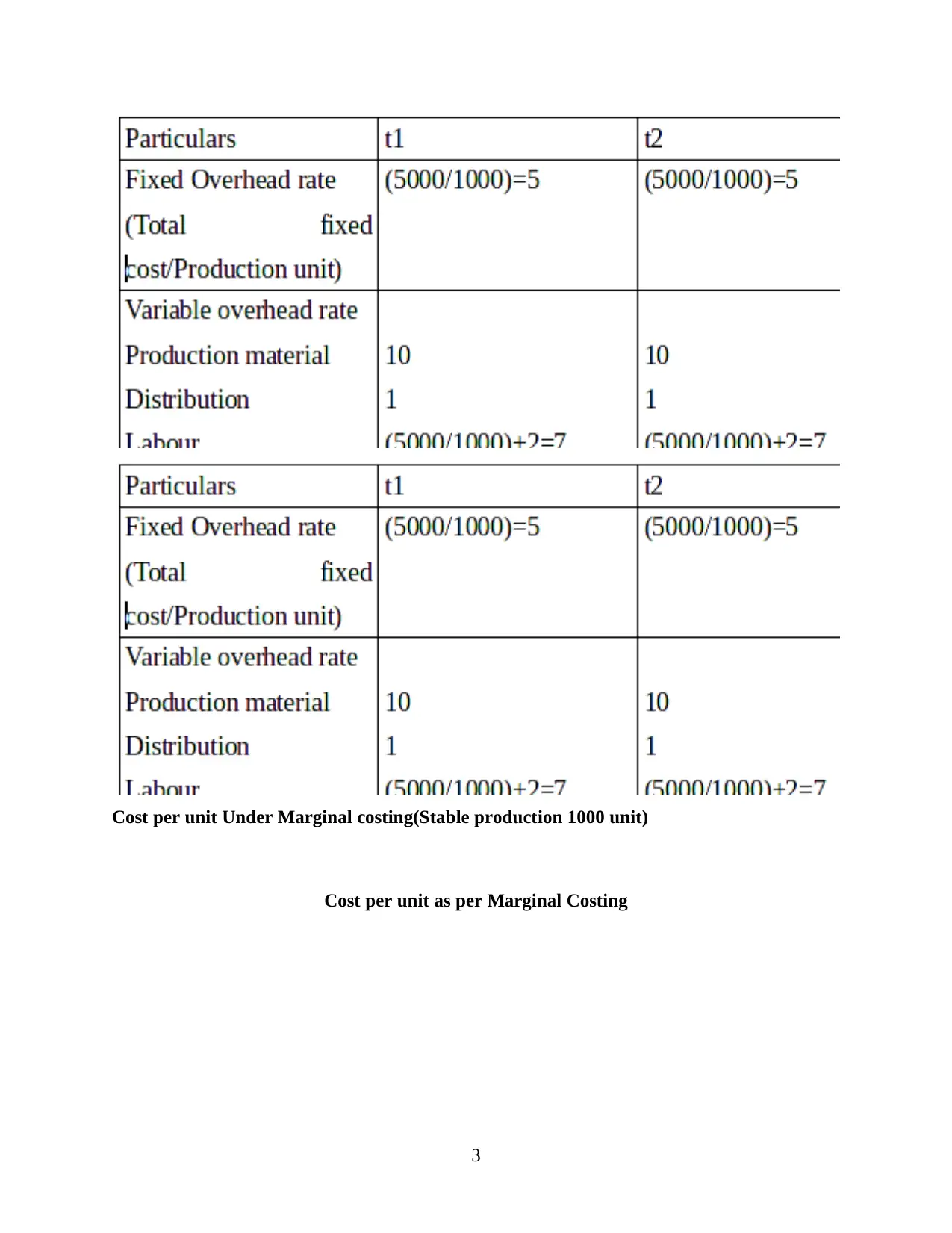

·1.3 Calculation of costs using appropriate technique

Cost per unit Under Absorption costing(Stable production 1000 unit)

Cost per unit costing Absorption Costing

2

In the organisation various costs are incurred to produce goods and services. For derive

the total cost of a product costing method is used by management (Otley and Emmanuel, 2013).

There are various methods of costing by which a firm determine cost of a product. Various

costing methods are such as follows:

·Unit costing: Unit costing is a method of costing where cost is determined of a unit of products

or services. The method is used by management in order to determine cost of a unit produced. In

this total cost of production is divided with the total number of units produced. It is mostly used

in the manufacturing companies.

·Process costing: According to the process costing method the cost is determined as per the

various processes of manufacturing (Fullerton, Kennedy and Widener, 2013). The method is

used my majorly manufacturing entities where goods and services are producing step by step.

The cost is calculated step by step of production process. For example in textile industry, car

manufacturing industry etc.

·Batch costing: Under the batch costing costs of similar products are determined. In batch

costing similar products are separated and then calculate the costs. The products are separated as

per the nature of products or design of the product.

·1.3 Calculation of costs using appropriate technique

Cost per unit Under Absorption costing(Stable production 1000 unit)

Cost per unit costing Absorption Costing

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

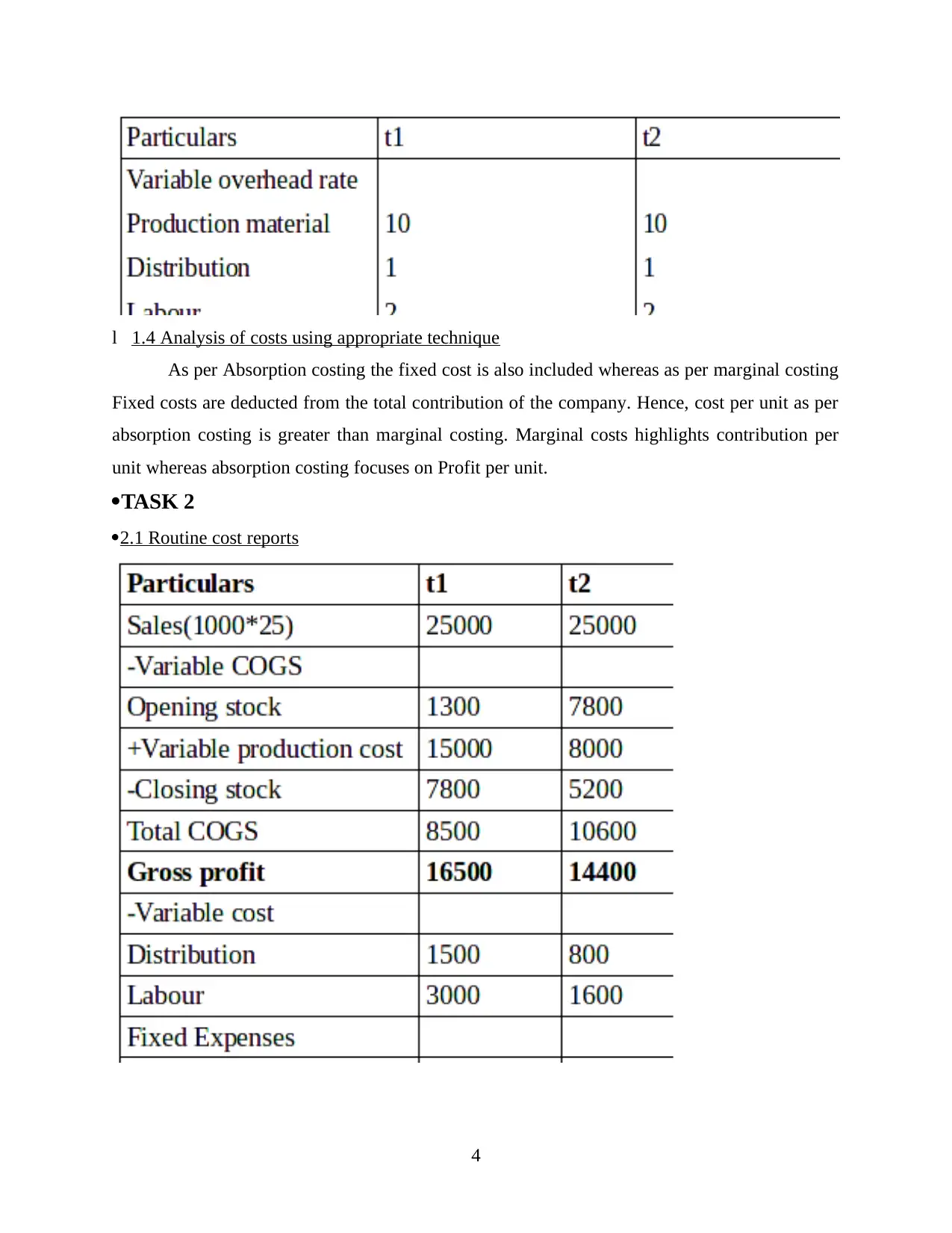

Cost per unit Under Marginal costing(Stable production 1000 unit)

Cost per unit as per Marginal Costing

3

Cost per unit as per Marginal Costing

3

l壱1.4 Analysis of costs using appropriate technique

As per Absorption costing the fixed cost is also included whereas as per marginal costing

Fixed costs are deducted from the total contribution of the company. Hence, cost per unit as per

absorption costing is greater than marginal costing. Marginal costs highlights contribution per

unit whereas absorption costing focuses on Profit per unit.

·TASK 2

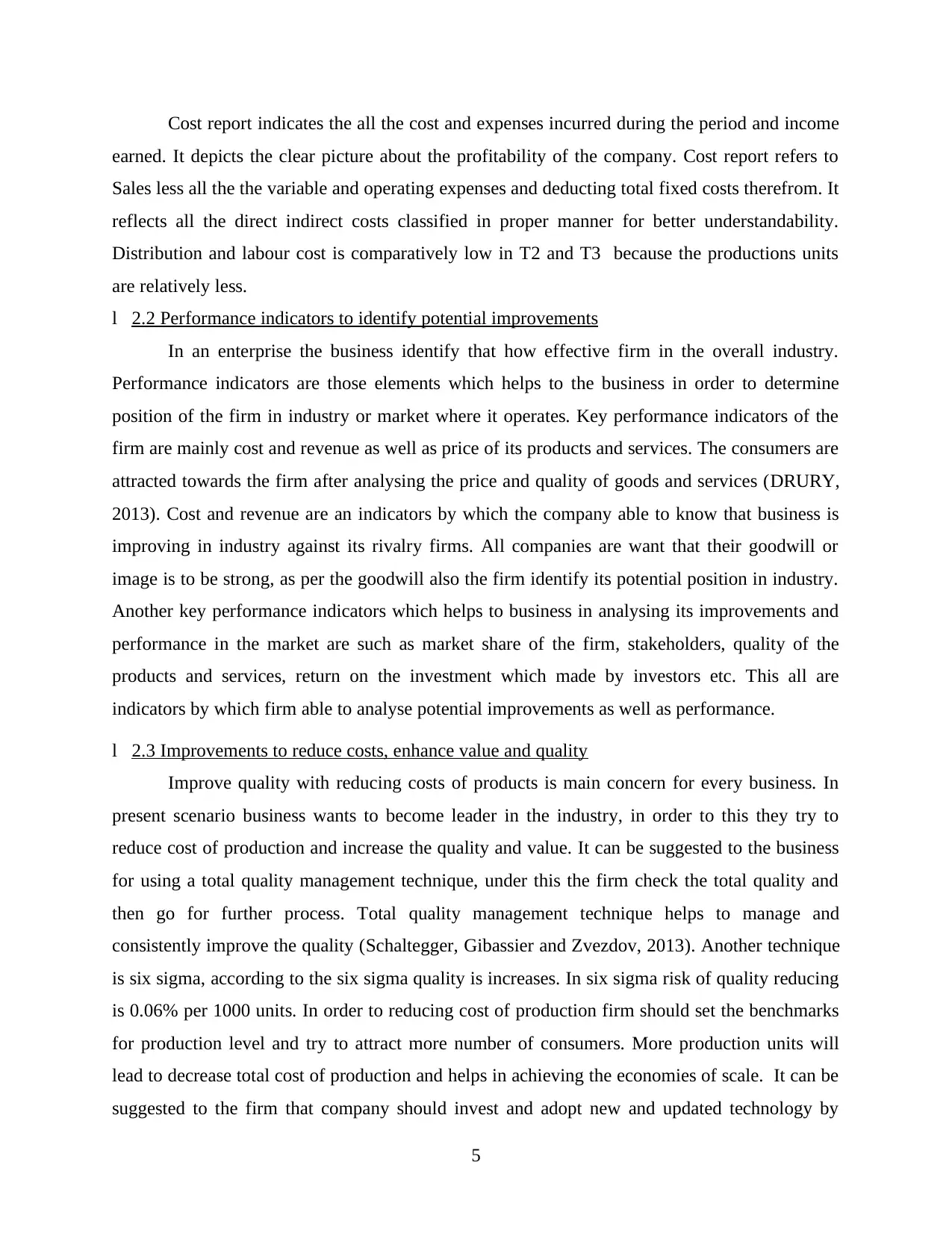

·2.1 Routine cost reports

4

As per Absorption costing the fixed cost is also included whereas as per marginal costing

Fixed costs are deducted from the total contribution of the company. Hence, cost per unit as per

absorption costing is greater than marginal costing. Marginal costs highlights contribution per

unit whereas absorption costing focuses on Profit per unit.

·TASK 2

·2.1 Routine cost reports

4

You're viewing a preview

Unlock full access by subscribing today!

Cost report indicates the all the cost and expenses incurred during the period and income

earned. It depicts the clear picture about the profitability of the company. Cost report refers to

Sales less all the the variable and operating expenses and deducting total fixed costs therefrom. It

reflects all the direct indirect costs classified in proper manner for better understandability.

Distribution and labour cost is comparatively low in T2 and T3 because the productions units

are relatively less.

l壱2.2 Performance indicators to identify potential improvements

In an enterprise the business identify that how effective firm in the overall industry.

Performance indicators are those elements which helps to the business in order to determine

position of the firm in industry or market where it operates. Key performance indicators of the

firm are mainly cost and revenue as well as price of its products and services. The consumers are

attracted towards the firm after analysing the price and quality of goods and services (DRURY,

2013). Cost and revenue are an indicators by which the company able to know that business is

improving in industry against its rivalry firms. All companies are want that their goodwill or

image is to be strong, as per the goodwill also the firm identify its potential position in industry.

Another key performance indicators which helps to business in analysing its improvements and

performance in the market are such as market share of the firm, stakeholders, quality of the

products and services, return on the investment which made by investors etc. This all are

indicators by which firm able to analyse potential improvements as well as performance.

l壱2.3 Improvements to reduce costs, enhance value and quality

Improve quality with reducing costs of products is main concern for every business. In

present scenario business wants to become leader in the industry, in order to this they try to

reduce cost of production and increase the quality and value. It can be suggested to the business

for using a total quality management technique, under this the firm check the total quality and

then go for further process. Total quality management technique helps to manage and

consistently improve the quality (Schaltegger, Gibassier and Zvezdov, 2013). Another technique

is six sigma, according to the six sigma quality is increases. In six sigma risk of quality reducing

is 0.06% per 1000 units. In order to reducing cost of production firm should set the benchmarks

for production level and try to attract more number of consumers. More production units will

lead to decrease total cost of production and helps in achieving the economies of scale. It can be

suggested to the firm that company should invest and adopt new and updated technology by

5

earned. It depicts the clear picture about the profitability of the company. Cost report refers to

Sales less all the the variable and operating expenses and deducting total fixed costs therefrom. It

reflects all the direct indirect costs classified in proper manner for better understandability.

Distribution and labour cost is comparatively low in T2 and T3 because the productions units

are relatively less.

l壱2.2 Performance indicators to identify potential improvements

In an enterprise the business identify that how effective firm in the overall industry.

Performance indicators are those elements which helps to the business in order to determine

position of the firm in industry or market where it operates. Key performance indicators of the

firm are mainly cost and revenue as well as price of its products and services. The consumers are

attracted towards the firm after analysing the price and quality of goods and services (DRURY,

2013). Cost and revenue are an indicators by which the company able to know that business is

improving in industry against its rivalry firms. All companies are want that their goodwill or

image is to be strong, as per the goodwill also the firm identify its potential position in industry.

Another key performance indicators which helps to business in analysing its improvements and

performance in the market are such as market share of the firm, stakeholders, quality of the

products and services, return on the investment which made by investors etc. This all are

indicators by which firm able to analyse potential improvements as well as performance.

l壱2.3 Improvements to reduce costs, enhance value and quality

Improve quality with reducing costs of products is main concern for every business. In

present scenario business wants to become leader in the industry, in order to this they try to

reduce cost of production and increase the quality and value. It can be suggested to the business

for using a total quality management technique, under this the firm check the total quality and

then go for further process. Total quality management technique helps to manage and

consistently improve the quality (Schaltegger, Gibassier and Zvezdov, 2013). Another technique

is six sigma, according to the six sigma quality is increases. In six sigma risk of quality reducing

is 0.06% per 1000 units. In order to reducing cost of production firm should set the benchmarks

for production level and try to attract more number of consumers. More production units will

lead to decrease total cost of production and helps in achieving the economies of scale. It can be

suggested to the firm that company should invest and adopt new and updated technology by

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

which less time will be taken as well as quality will also increase. When the firm provide better

quality products at the lower cost in comparison to rivalry firms then automatically more number

of consumers will attract and simultaneously value of the firm and products will increase in the

industry.

·TASK 3

·3.1 Purpose and nature of budgeting process

Budget is a process under which the firm estimate about the future incomes and

outcomes. Budget prepared in monetary terms and helpful to the management and organisation

as well (Arjaliès and Mundy, 2013). There are various purpose to prepare the budget and various

nature of budgeting are as follows:

Purpose of Budgeting process: Different purposes of budgeting process are given as below:

·Budget helps to management in estimating the future expenses of production, helps to derive

the income for upcoming year as well as future profit of the firm.

·It gives the framework of finance which lead to formulate and prepare proper business

strategies. From the proper sttrategy management able to take perfect decisions.

·Another purpose of budgeting process is that managers able to make comparison between the

budgeted data and actual results in the firm.

Nature of Budgeting process: Various nature of the budgeting process are as below:

·The budget is prepared or estimated on the basis of past performance of the firm.

·It determines that how many expenses will be incurred in the production.

·On the basis of past performance budget is estimated for the current year.

·Budget give overview that the situation will be of surplus or deficit on the basis of estimated

expenses and estimated revenue.

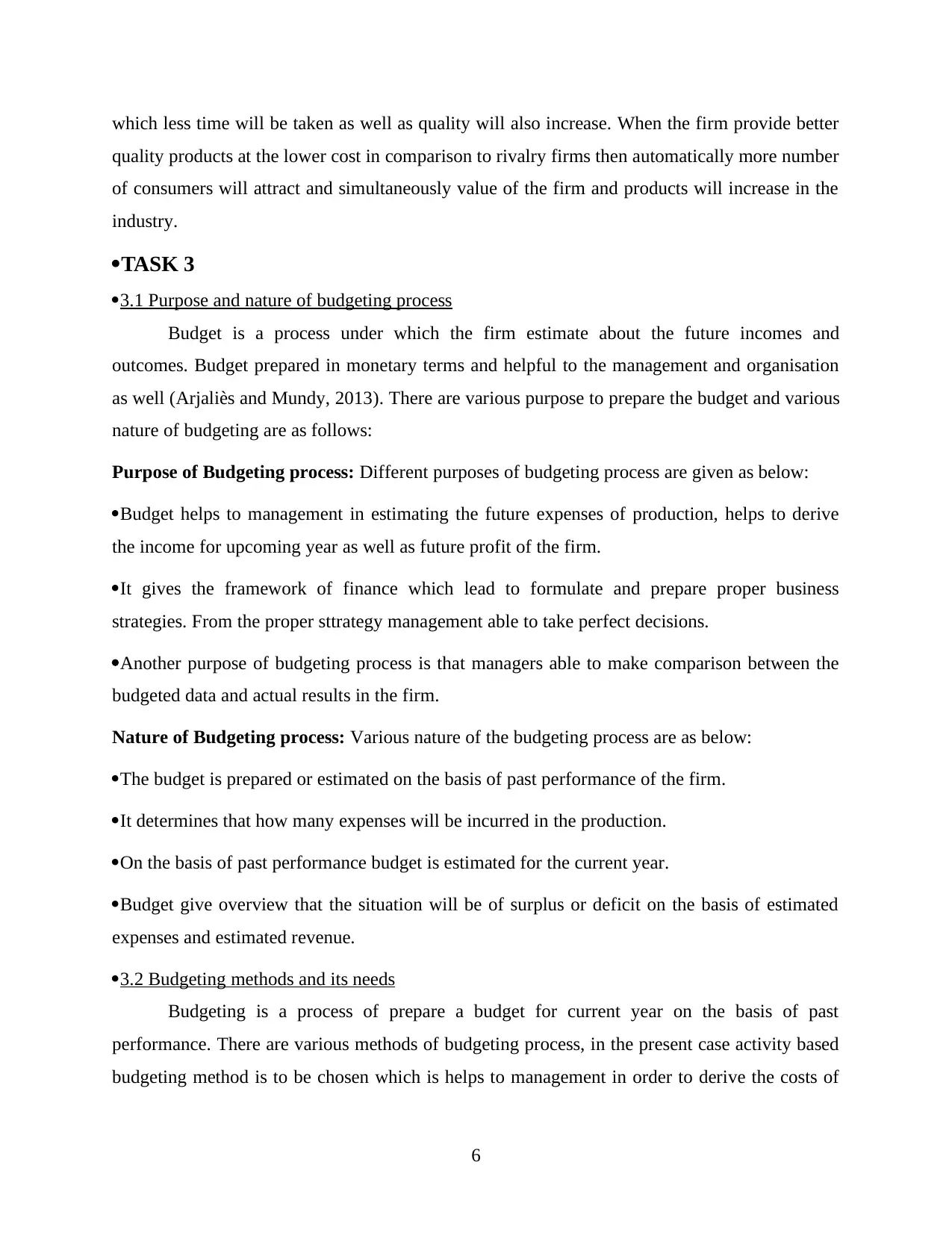

·3.2 Budgeting methods and its needs

Budgeting is a process of prepare a budget for current year on the basis of past

performance. There are various methods of budgeting process, in the present case activity based

budgeting method is to be chosen which is helps to management in order to derive the costs of

6

quality products at the lower cost in comparison to rivalry firms then automatically more number

of consumers will attract and simultaneously value of the firm and products will increase in the

industry.

·TASK 3

·3.1 Purpose and nature of budgeting process

Budget is a process under which the firm estimate about the future incomes and

outcomes. Budget prepared in monetary terms and helpful to the management and organisation

as well (Arjaliès and Mundy, 2013). There are various purpose to prepare the budget and various

nature of budgeting are as follows:

Purpose of Budgeting process: Different purposes of budgeting process are given as below:

·Budget helps to management in estimating the future expenses of production, helps to derive

the income for upcoming year as well as future profit of the firm.

·It gives the framework of finance which lead to formulate and prepare proper business

strategies. From the proper sttrategy management able to take perfect decisions.

·Another purpose of budgeting process is that managers able to make comparison between the

budgeted data and actual results in the firm.

Nature of Budgeting process: Various nature of the budgeting process are as below:

·The budget is prepared or estimated on the basis of past performance of the firm.

·It determines that how many expenses will be incurred in the production.

·On the basis of past performance budget is estimated for the current year.

·Budget give overview that the situation will be of surplus or deficit on the basis of estimated

expenses and estimated revenue.

·3.2 Budgeting methods and its needs

Budgeting is a process of prepare a budget for current year on the basis of past

performance. There are various methods of budgeting process, in the present case activity based

budgeting method is to be chosen which is helps to management in order to derive the costs of

6

goods and services (CPIM, 2014). In activity based budgeting method the costs incurred as per

the activities of business are recorder to derive the total cost.

On the basis of activity based budgeting method the managers are able to determine total

costs which incurred step by step of production process. Primary need of the budget for the

organisation is to derive the cost of production. It helps to management in allocating resources

effectively in every function of business. By which resources are effectively utilized and

productivity will increase. The budgeting process is helps to managers in order to determine

price of products and services. Need of the activity budget is to analyse performance of every

activity that whether it is performing as per the plan or not. It helps to business for analysing and

comparing actual and estimated data of every activity and functional area of the business.

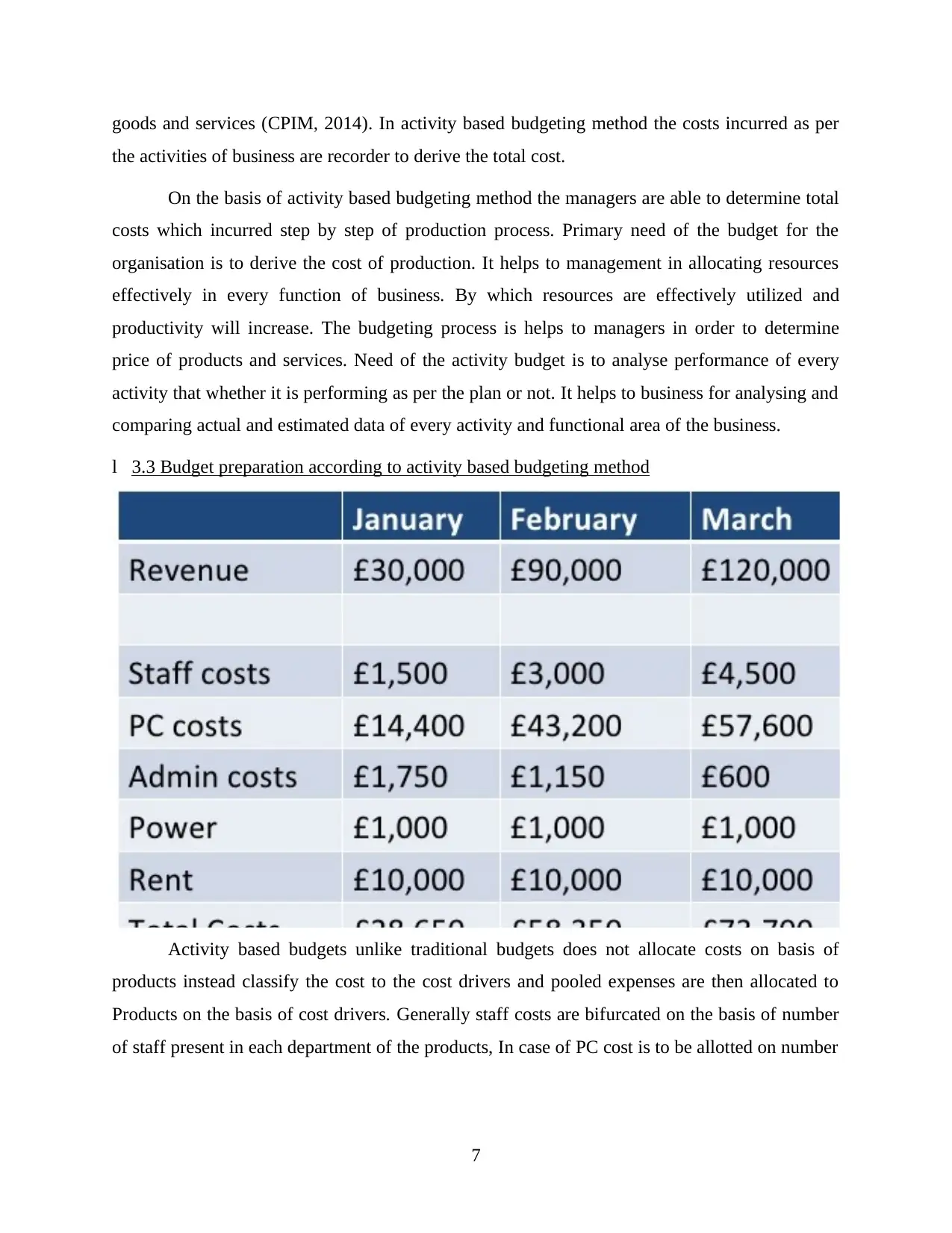

l壱3.3 Budget preparation according to activity based budgeting method

Activity based budgets unlike traditional budgets does not allocate costs on basis of

products instead classify the cost to the cost drivers and pooled expenses are then allocated to

Products on the basis of cost drivers. Generally staff costs are bifurcated on the basis of number

of staff present in each department of the products, In case of PC cost is to be allotted on number

7

the activities of business are recorder to derive the total cost.

On the basis of activity based budgeting method the managers are able to determine total

costs which incurred step by step of production process. Primary need of the budget for the

organisation is to derive the cost of production. It helps to management in allocating resources

effectively in every function of business. By which resources are effectively utilized and

productivity will increase. The budgeting process is helps to managers in order to determine

price of products and services. Need of the activity budget is to analyse performance of every

activity that whether it is performing as per the plan or not. It helps to business for analysing and

comparing actual and estimated data of every activity and functional area of the business.

l壱3.3 Budget preparation according to activity based budgeting method

Activity based budgets unlike traditional budgets does not allocate costs on basis of

products instead classify the cost to the cost drivers and pooled expenses are then allocated to

Products on the basis of cost drivers. Generally staff costs are bifurcated on the basis of number

of staff present in each department of the products, In case of PC cost is to be allotted on number

7

You're viewing a preview

Unlock full access by subscribing today!

of Pc's in department related to each product. Also rent is allocated on bais of floor area

occupied by each product. Therefore this is scientific method of allocation of cost.

8

occupied by each product. Therefore this is scientific method of allocation of cost.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

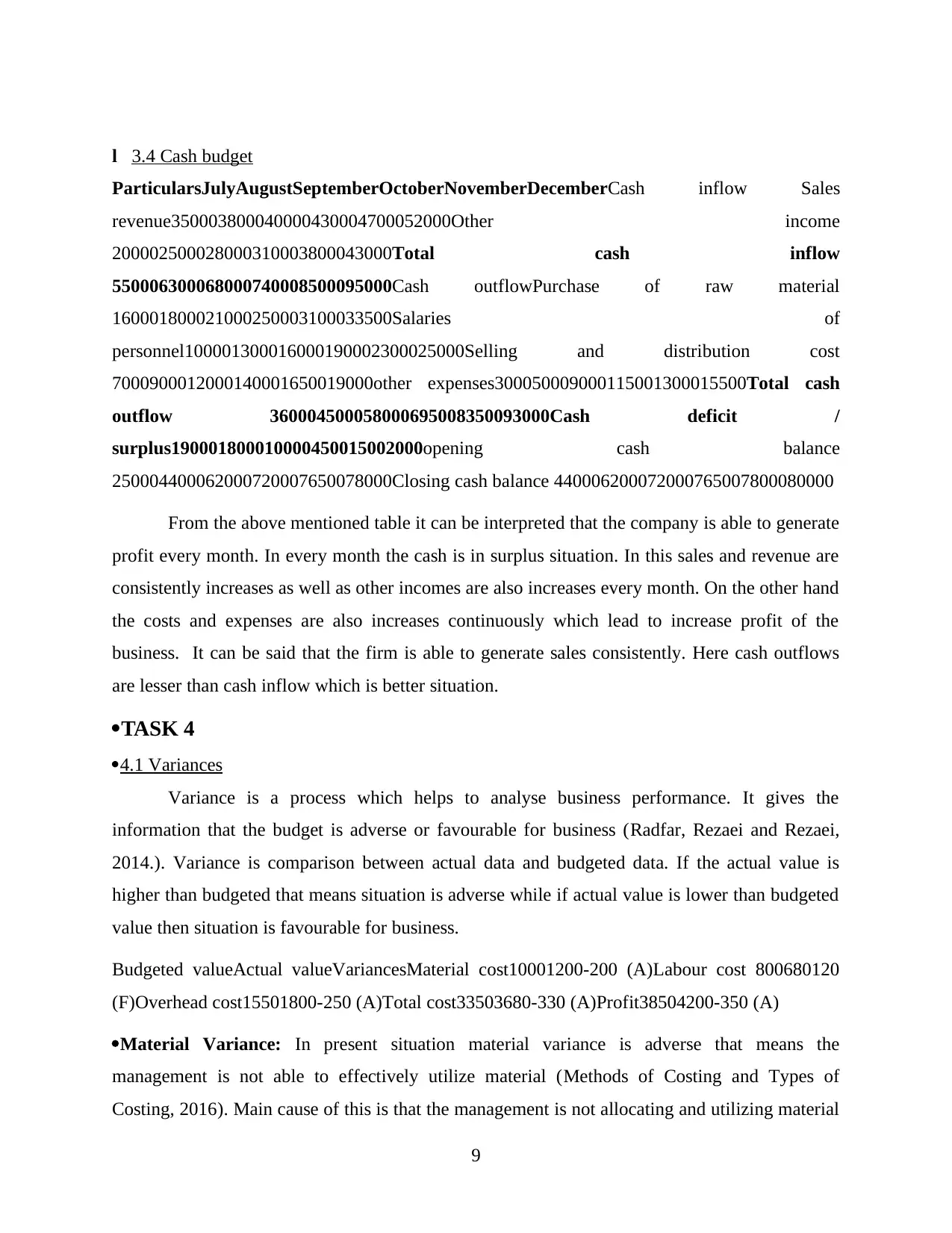

l壱3.4 Cash budget

ParticularsJulyAugustSeptemberOctoberNovemberDecemberCash inflow Sales

revenue350003800040000430004700052000Other income

200002500028000310003800043000Total cash inflow

550006300068000740008500095000Cash outflowPurchase of raw material

160001800021000250003100033500Salaries of

personnel100001300016000190002300025000Selling and distribution cost

7000900012000140001650019000other expenses300050009000115001300015500Total cash

outflow 360004500058000695008350093000Cash deficit /

surplus190001800010000450015002000opening cash balance

250004400062000720007650078000Closing cash balance 440006200072000765007800080000

From the above mentioned table it can be interpreted that the company is able to generate

profit every month. In every month the cash is in surplus situation. In this sales and revenue are

consistently increases as well as other incomes are also increases every month. On the other hand

the costs and expenses are also increases continuously which lead to increase profit of the

business. It can be said that the firm is able to generate sales consistently. Here cash outflows

are lesser than cash inflow which is better situation.

·TASK 4

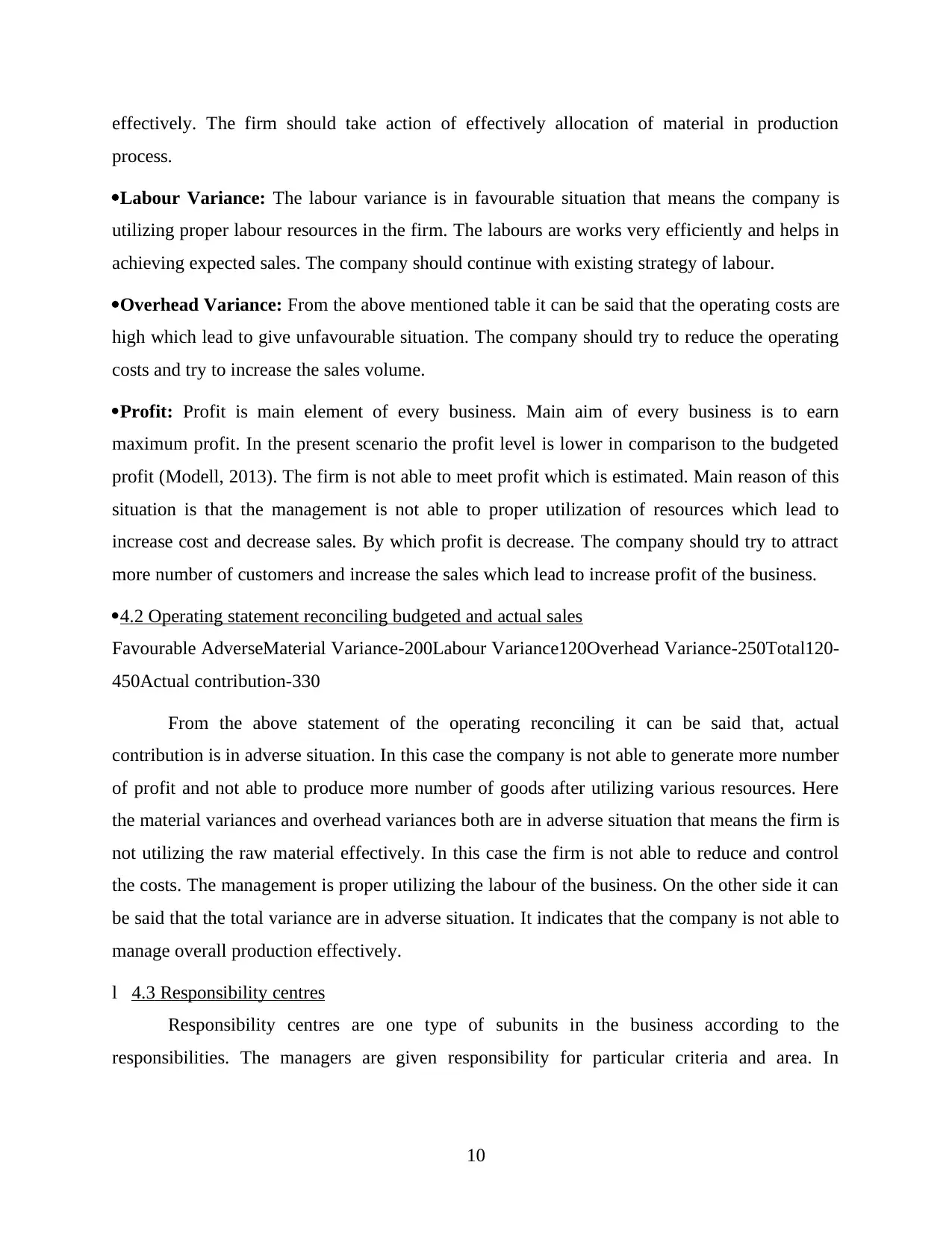

·4.1 Variances

Variance is a process which helps to analyse business performance. It gives the

information that the budget is adverse or favourable for business (Radfar, Rezaei and Rezaei,

2014.). Variance is comparison between actual data and budgeted data. If the actual value is

higher than budgeted that means situation is adverse while if actual value is lower than budgeted

value then situation is favourable for business.

Budgeted valueActual valueVariancesMaterial cost10001200-200 (A)Labour cost 800680120

(F)Overhead cost15501800-250 (A)Total cost33503680-330 (A)Profit38504200-350 (A)

·Material Variance: In present situation material variance is adverse that means the

management is not able to effectively utilize material (Methods of Costing and Types of

Costing, 2016). Main cause of this is that the management is not allocating and utilizing material

9

ParticularsJulyAugustSeptemberOctoberNovemberDecemberCash inflow Sales

revenue350003800040000430004700052000Other income

200002500028000310003800043000Total cash inflow

550006300068000740008500095000Cash outflowPurchase of raw material

160001800021000250003100033500Salaries of

personnel100001300016000190002300025000Selling and distribution cost

7000900012000140001650019000other expenses300050009000115001300015500Total cash

outflow 360004500058000695008350093000Cash deficit /

surplus190001800010000450015002000opening cash balance

250004400062000720007650078000Closing cash balance 440006200072000765007800080000

From the above mentioned table it can be interpreted that the company is able to generate

profit every month. In every month the cash is in surplus situation. In this sales and revenue are

consistently increases as well as other incomes are also increases every month. On the other hand

the costs and expenses are also increases continuously which lead to increase profit of the

business. It can be said that the firm is able to generate sales consistently. Here cash outflows

are lesser than cash inflow which is better situation.

·TASK 4

·4.1 Variances

Variance is a process which helps to analyse business performance. It gives the

information that the budget is adverse or favourable for business (Radfar, Rezaei and Rezaei,

2014.). Variance is comparison between actual data and budgeted data. If the actual value is

higher than budgeted that means situation is adverse while if actual value is lower than budgeted

value then situation is favourable for business.

Budgeted valueActual valueVariancesMaterial cost10001200-200 (A)Labour cost 800680120

(F)Overhead cost15501800-250 (A)Total cost33503680-330 (A)Profit38504200-350 (A)

·Material Variance: In present situation material variance is adverse that means the

management is not able to effectively utilize material (Methods of Costing and Types of

Costing, 2016). Main cause of this is that the management is not allocating and utilizing material

9

effectively. The firm should take action of effectively allocation of material in production

process.

·Labour Variance: The labour variance is in favourable situation that means the company is

utilizing proper labour resources in the firm. The labours are works very efficiently and helps in

achieving expected sales. The company should continue with existing strategy of labour.

·Overhead Variance: From the above mentioned table it can be said that the operating costs are

high which lead to give unfavourable situation. The company should try to reduce the operating

costs and try to increase the sales volume.

·Profit: Profit is main element of every business. Main aim of every business is to earn

maximum profit. In the present scenario the profit level is lower in comparison to the budgeted

profit (Modell, 2013). The firm is not able to meet profit which is estimated. Main reason of this

situation is that the management is not able to proper utilization of resources which lead to

increase cost and decrease sales. By which profit is decrease. The company should try to attract

more number of customers and increase the sales which lead to increase profit of the business.

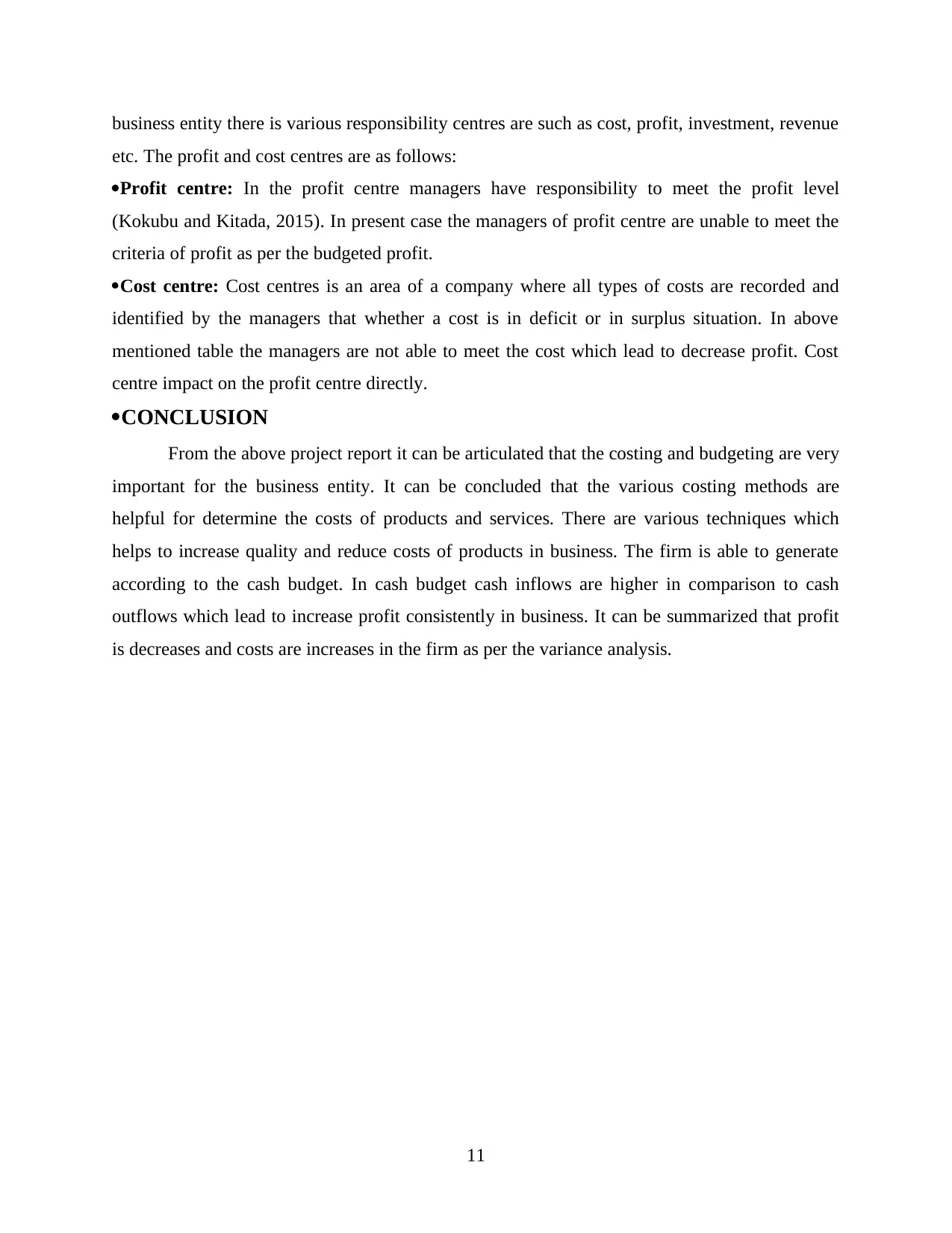

·4.2 Operating statement reconciling budgeted and actual sales

Favourable AdverseMaterial Variance-200Labour Variance120Overhead Variance-250Total120-

450Actual contribution-330

From the above statement of the operating reconciling it can be said that, actual

contribution is in adverse situation. In this case the company is not able to generate more number

of profit and not able to produce more number of goods after utilizing various resources. Here

the material variances and overhead variances both are in adverse situation that means the firm is

not utilizing the raw material effectively. In this case the firm is not able to reduce and control

the costs. The management is proper utilizing the labour of the business. On the other side it can

be said that the total variance are in adverse situation. It indicates that the company is not able to

manage overall production effectively.

l壱4.3 Responsibility centres

Responsibility centres are one type of subunits in the business according to the

responsibilities. The managers are given responsibility for particular criteria and area. In

10

process.

·Labour Variance: The labour variance is in favourable situation that means the company is

utilizing proper labour resources in the firm. The labours are works very efficiently and helps in

achieving expected sales. The company should continue with existing strategy of labour.

·Overhead Variance: From the above mentioned table it can be said that the operating costs are

high which lead to give unfavourable situation. The company should try to reduce the operating

costs and try to increase the sales volume.

·Profit: Profit is main element of every business. Main aim of every business is to earn

maximum profit. In the present scenario the profit level is lower in comparison to the budgeted

profit (Modell, 2013). The firm is not able to meet profit which is estimated. Main reason of this

situation is that the management is not able to proper utilization of resources which lead to

increase cost and decrease sales. By which profit is decrease. The company should try to attract

more number of customers and increase the sales which lead to increase profit of the business.

·4.2 Operating statement reconciling budgeted and actual sales

Favourable AdverseMaterial Variance-200Labour Variance120Overhead Variance-250Total120-

450Actual contribution-330

From the above statement of the operating reconciling it can be said that, actual

contribution is in adverse situation. In this case the company is not able to generate more number

of profit and not able to produce more number of goods after utilizing various resources. Here

the material variances and overhead variances both are in adverse situation that means the firm is

not utilizing the raw material effectively. In this case the firm is not able to reduce and control

the costs. The management is proper utilizing the labour of the business. On the other side it can

be said that the total variance are in adverse situation. It indicates that the company is not able to

manage overall production effectively.

l壱4.3 Responsibility centres

Responsibility centres are one type of subunits in the business according to the

responsibilities. The managers are given responsibility for particular criteria and area. In

10

You're viewing a preview

Unlock full access by subscribing today!

business entity there is various responsibility centres are such as cost, profit, investment, revenue

etc. The profit and cost centres are as follows:

·Profit centre: In the profit centre managers have responsibility to meet the profit level

(Kokubu and Kitada, 2015). In present case the managers of profit centre are unable to meet the

criteria of profit as per the budgeted profit.

·Cost centre: Cost centres is an area of a company where all types of costs are recorded and

identified by the managers that whether a cost is in deficit or in surplus situation. In above

mentioned table the managers are not able to meet the cost which lead to decrease profit. Cost

centre impact on the profit centre directly.

·CONCLUSION

From the above project report it can be articulated that the costing and budgeting are very

important for the business entity. It can be concluded that the various costing methods are

helpful for determine the costs of products and services. There are various techniques which

helps to increase quality and reduce costs of products in business. The firm is able to generate

according to the cash budget. In cash budget cash inflows are higher in comparison to cash

outflows which lead to increase profit consistently in business. It can be summarized that profit

is decreases and costs are increases in the firm as per the variance analysis.

11

etc. The profit and cost centres are as follows:

·Profit centre: In the profit centre managers have responsibility to meet the profit level

(Kokubu and Kitada, 2015). In present case the managers of profit centre are unable to meet the

criteria of profit as per the budgeted profit.

·Cost centre: Cost centres is an area of a company where all types of costs are recorded and

identified by the managers that whether a cost is in deficit or in surplus situation. In above

mentioned table the managers are not able to meet the cost which lead to decrease profit. Cost

centre impact on the profit centre directly.

·CONCLUSION

From the above project report it can be articulated that the costing and budgeting are very

important for the business entity. It can be concluded that the various costing methods are

helpful for determine the costs of products and services. There are various techniques which

helps to increase quality and reduce costs of products in business. The firm is able to generate

according to the cash budget. In cash budget cash inflows are higher in comparison to cash

outflows which lead to increase profit consistently in business. It can be summarized that profit

is decreases and costs are increases in the firm as per the variance analysis.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

·REFERENCES

Books & Journals

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

Otley, D. and Emmanuel, K. M. C., 2013. Readings in accounting for management control.

Springer.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2013. Management accounting and control

practices in a lean manufacturing environment. Accounting, Organizations and Society.

38(1). pp.50-71.

DRURY, C. M., 2013. Management and cost accounting. Springer.

Schaltegger, S., Gibassier, D. and Zvezdov, D., 2013. Is environmental management accounting

a discipline? A bibliometric literature review. Meditari Accountancy Research. 21(1).

pp.4-31.

Arjaliès, D. L. and Mundy, J., 2013. The use of management control systems to manage CSR

strategy: A levers of control perspective. Management Accounting Research. 24(4).

pp.284-300.

CPIM, G. C., 2014. Top 7 trends in management accounting, Part 2. Strategic Finance. 95(7).

p.41.

Radfar, R., Rezaei, M. N. and Rezaei, M. M., 2014. Evaluation Improving Financial Operations

by Implementing Knowledge Management System.

Modell, S., 2013. Making sense of social practice: theoretical pluralism in public sector

accounting research: a comment. Financial Accountability & Management. 29(1). pp.99-

110.

Kokubu, K. and Kitada, H., 2015. Material flow cost accounting and existing management

perspectives. Journal of Cleaner Production. 108. pp.1279-1288.

Hopper, T. and Bui, B., 2016. Has management accounting research been critical?. Management

Accounting Research. 31. pp.10-30.

12

Books & Journals

Kaplan, R. S. and Atkinson, A. A., 2015. Advanced management accounting. PHI Learning.

Otley, D. and Emmanuel, K. M. C., 2013. Readings in accounting for management control.

Springer.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2013. Management accounting and control

practices in a lean manufacturing environment. Accounting, Organizations and Society.

38(1). pp.50-71.

DRURY, C. M., 2013. Management and cost accounting. Springer.

Schaltegger, S., Gibassier, D. and Zvezdov, D., 2013. Is environmental management accounting

a discipline? A bibliometric literature review. Meditari Accountancy Research. 21(1).

pp.4-31.

Arjaliès, D. L. and Mundy, J., 2013. The use of management control systems to manage CSR

strategy: A levers of control perspective. Management Accounting Research. 24(4).

pp.284-300.

CPIM, G. C., 2014. Top 7 trends in management accounting, Part 2. Strategic Finance. 95(7).

p.41.

Radfar, R., Rezaei, M. N. and Rezaei, M. M., 2014. Evaluation Improving Financial Operations

by Implementing Knowledge Management System.

Modell, S., 2013. Making sense of social practice: theoretical pluralism in public sector

accounting research: a comment. Financial Accountability & Management. 29(1). pp.99-

110.

Kokubu, K. and Kitada, H., 2015. Material flow cost accounting and existing management

perspectives. Journal of Cleaner Production. 108. pp.1279-1288.

Hopper, T. and Bui, B., 2016. Has management accounting research been critical?. Management

Accounting Research. 31. pp.10-30.

12

Mahesha, V. and Akash, S. B., 2013. Management Accounting Benefits: ERP Environment.

SCMS Journal of Indian Management. 10(3).

Alnawayseh, M. A. A., 2013. The extent of applying strategic management accounting tools in

Jordanian banks. International Journal of Business and Management. 8(19). p.32.

Online

Methods of Costing and Types of Costing, 2016. [Online]. Available through:

<https://toughnickel.com/business/Methods-of-Costing> [Accessed on 19th December

2016].

13

SCMS Journal of Indian Management. 10(3).

Alnawayseh, M. A. A., 2013. The extent of applying strategic management accounting tools in

Jordanian banks. International Journal of Business and Management. 8(19). p.32.

Online

Methods of Costing and Types of Costing, 2016. [Online]. Available through:

<https://toughnickel.com/business/Methods-of-Costing> [Accessed on 19th December

2016].

13

You're viewing a preview

Unlock full access by subscribing today!

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.