Accounting Project: Dual Entry Accounting, Bank Reconciliation

VerifiedAdded on 2023/06/09

|18

|3752

|53

Homework Assignment

AI Summary

This accounting project delves into the fundamental principles of accounting, emphasizing the dual-entry system. It meticulously details the process of recording, summarizing, and analyzing financial transactions within an organization. The project covers the creation of journal entries, the use of ledgers to organize transactions, and the preparation of a trial balance to ensure the mathematical accuracy of the accounting records. Furthermore, it includes a bank reconciliation statement to reconcile the company's cash balance with the bank's records. The project also addresses the roles of control and suspense accounts and reconciles accounts receivable and payable, providing a comprehensive overview of essential accounting practices. The project demonstrates the practical application of accounting methods to monetary transactions, showing how these methods are used to manage financial events for smooth business operations.

UNIT 10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

P1 Recording dual entry accounting written records in a well-timed and accurate way.......3

2 A range of organization transactions with the help of dual entry accounting, journals and

ledgers.....................................................................................................................................5

Ledgers of Tenney York company :.......................................................................................6

Extract the ledger balances and record the transactions in Trial Balance............................11

Prepare Bank Reconciliation Statement...............................................................................13

The roles and differences b/w control and suspense accounts.......................................14

RECONCILIATION OF ACCOUNTS RECEIVABLE AND PAYABLE...................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

P1 Recording dual entry accounting written records in a well-timed and accurate way.......3

2 A range of organization transactions with the help of dual entry accounting, journals and

ledgers.....................................................................................................................................5

Ledgers of Tenney York company :.......................................................................................6

Extract the ledger balances and record the transactions in Trial Balance............................11

Prepare Bank Reconciliation Statement...............................................................................13

The roles and differences b/w control and suspense accounts.......................................14

RECONCILIATION OF ACCOUNTS RECEIVABLE AND PAYABLE...................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

The accounting procedure is defined as the act of recording, summarising and analysing

financial transactions pertaining to a specific period of any type of organisation. In layman terms

the accounting procedure defines the management of monetary events which leads to smooth and

potent running of business. This procedure is not only beneficial for entities but also of great

significance for the government, oversight agencies and tax collection authorities (Arismaya,

2022). It chiefly is used for used for keeping track of all internal proceedings occurring in an

organization, which protects the employees along with the users of financial information from

any misconduct leading to impactful losses. The accounting is mainly implemented via three

core documents that are: Cash flow statement or a document defining all cash transactions,

Comprehensive Income Statement which summarizes standard net income and other income,

Balance Sheet or statement defining assets and liabilities and Equity Statements which

concentrates on Owner's Equity. In the following project, all of the essential principles related to

accounting are defined as well as an analysis related to transactions made in course of

furtherance of business. The most important aspect of accounting is to efficiently strike a balance

between assets and liabilities which is also discussed later via journal entries, ledgers, trial

balance and bank reconciliation in context to dual entry system of accounting. Through this

project, an individual will be able to implement and understand basic accounting methods to

monetary transactions. However, it should be noted that to perform efficient and effective

accounting for an organization, proper books of accounts and skilled personnels are required

(Centobelli and et.al., 2021). The underlying examples, simply provide a brief explanation or

summary about what the essence of accounting is all about, like for instance, how different types

of invoices, orders, statements, receipts are recorded and used for further assessment in

previously mentioned documents.

MAIN BODY

P1 Recording dual entry accounting written records in a well-timed and accurate way

Recording items or written records is essential to a enterprise corporate statements and a central

obligations of department of accounting. Not only will this assist for legal purposes, but it could

also prevent any disputes with your customers. Transactions can change the balances of the

accounts that occurs in any organization.

The accounting procedure is defined as the act of recording, summarising and analysing

financial transactions pertaining to a specific period of any type of organisation. In layman terms

the accounting procedure defines the management of monetary events which leads to smooth and

potent running of business. This procedure is not only beneficial for entities but also of great

significance for the government, oversight agencies and tax collection authorities (Arismaya,

2022). It chiefly is used for used for keeping track of all internal proceedings occurring in an

organization, which protects the employees along with the users of financial information from

any misconduct leading to impactful losses. The accounting is mainly implemented via three

core documents that are: Cash flow statement or a document defining all cash transactions,

Comprehensive Income Statement which summarizes standard net income and other income,

Balance Sheet or statement defining assets and liabilities and Equity Statements which

concentrates on Owner's Equity. In the following project, all of the essential principles related to

accounting are defined as well as an analysis related to transactions made in course of

furtherance of business. The most important aspect of accounting is to efficiently strike a balance

between assets and liabilities which is also discussed later via journal entries, ledgers, trial

balance and bank reconciliation in context to dual entry system of accounting. Through this

project, an individual will be able to implement and understand basic accounting methods to

monetary transactions. However, it should be noted that to perform efficient and effective

accounting for an organization, proper books of accounts and skilled personnels are required

(Centobelli and et.al., 2021). The underlying examples, simply provide a brief explanation or

summary about what the essence of accounting is all about, like for instance, how different types

of invoices, orders, statements, receipts are recorded and used for further assessment in

previously mentioned documents.

MAIN BODY

P1 Recording dual entry accounting written records in a well-timed and accurate way

Recording items or written records is essential to a enterprise corporate statements and a central

obligations of department of accounting. Not only will this assist for legal purposes, but it could

also prevent any disputes with your customers. Transactions can change the balances of the

accounts that occurs in any organization.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is an accounting method which used to recorded the transactions in more than one account.

The total of debit and credit side must be equal or balance. A debited entry shows on the left side

of the account and credited transactions shows on the right side of an account (Duţescu, 2019).

Either these transactions help to increase the account balance or decrease. Its totally depends on

the account.

It has multi steps to record the business enterprise transactions or items.

To examine the items is a first step of this method. It helps to decide that which account will be

affected more.

To decide the category of account i.e. what will be debited or credited.

Documentation of the transaction in journal.

There are 3 golden rules for recording the transactions:

receiver to the debited, given to the credited. (Personal A/C)

What comes in- debit, what goes out- credit. (Real A/C)

All the expenses and losses are debited, all the income and profit are credited. (Nominal

A/C)

Journal is a main entry book or an original entry book in which the event is first entered in

a linear order or sequence. As all transactions are originally documented in it, the document is

called the Book of Original Entry. The process by which the transaction is reported in the journal

is called journalising. The benefit of a report is the compilation of financial data in chronological

order. The journal's only drawback is that it is difficult to document all the heavy and

unmanageable transactions (Habibu Umar, 2021).

In the ledger, all accounts opens in different pages. All related transactions are collected in

register. Trial balance might be prepare with the help of its balances which assists to measure the

accounts in monetary terms and income and expenses A/C can be planned. For the purpose of

reflect the business's corporate conditions, a balance sheet can also be prepared. There are many

rules of posting the transactions in ledger that are discussed below :

1. All the related items account should be recorded at one side. There is no more than

one opening balance with same items accounts. These all should be assembled in one account.

2. In journal entry, there is any account which is debited so it will be record in same side

in ledger as same with the credited account.

The total of debit and credit side must be equal or balance. A debited entry shows on the left side

of the account and credited transactions shows on the right side of an account (Duţescu, 2019).

Either these transactions help to increase the account balance or decrease. Its totally depends on

the account.

It has multi steps to record the business enterprise transactions or items.

To examine the items is a first step of this method. It helps to decide that which account will be

affected more.

To decide the category of account i.e. what will be debited or credited.

Documentation of the transaction in journal.

There are 3 golden rules for recording the transactions:

receiver to the debited, given to the credited. (Personal A/C)

What comes in- debit, what goes out- credit. (Real A/C)

All the expenses and losses are debited, all the income and profit are credited. (Nominal

A/C)

Journal is a main entry book or an original entry book in which the event is first entered in

a linear order or sequence. As all transactions are originally documented in it, the document is

called the Book of Original Entry. The process by which the transaction is reported in the journal

is called journalising. The benefit of a report is the compilation of financial data in chronological

order. The journal's only drawback is that it is difficult to document all the heavy and

unmanageable transactions (Habibu Umar, 2021).

In the ledger, all accounts opens in different pages. All related transactions are collected in

register. Trial balance might be prepare with the help of its balances which assists to measure the

accounts in monetary terms and income and expenses A/C can be planned. For the purpose of

reflect the business's corporate conditions, a balance sheet can also be prepared. There are many

rules of posting the transactions in ledger that are discussed below :

1. All the related items account should be recorded at one side. There is no more than

one opening balance with same items accounts. These all should be assembled in one account.

2. In journal entry, there is any account which is debited so it will be record in same side

in ledger as same with the credited account.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

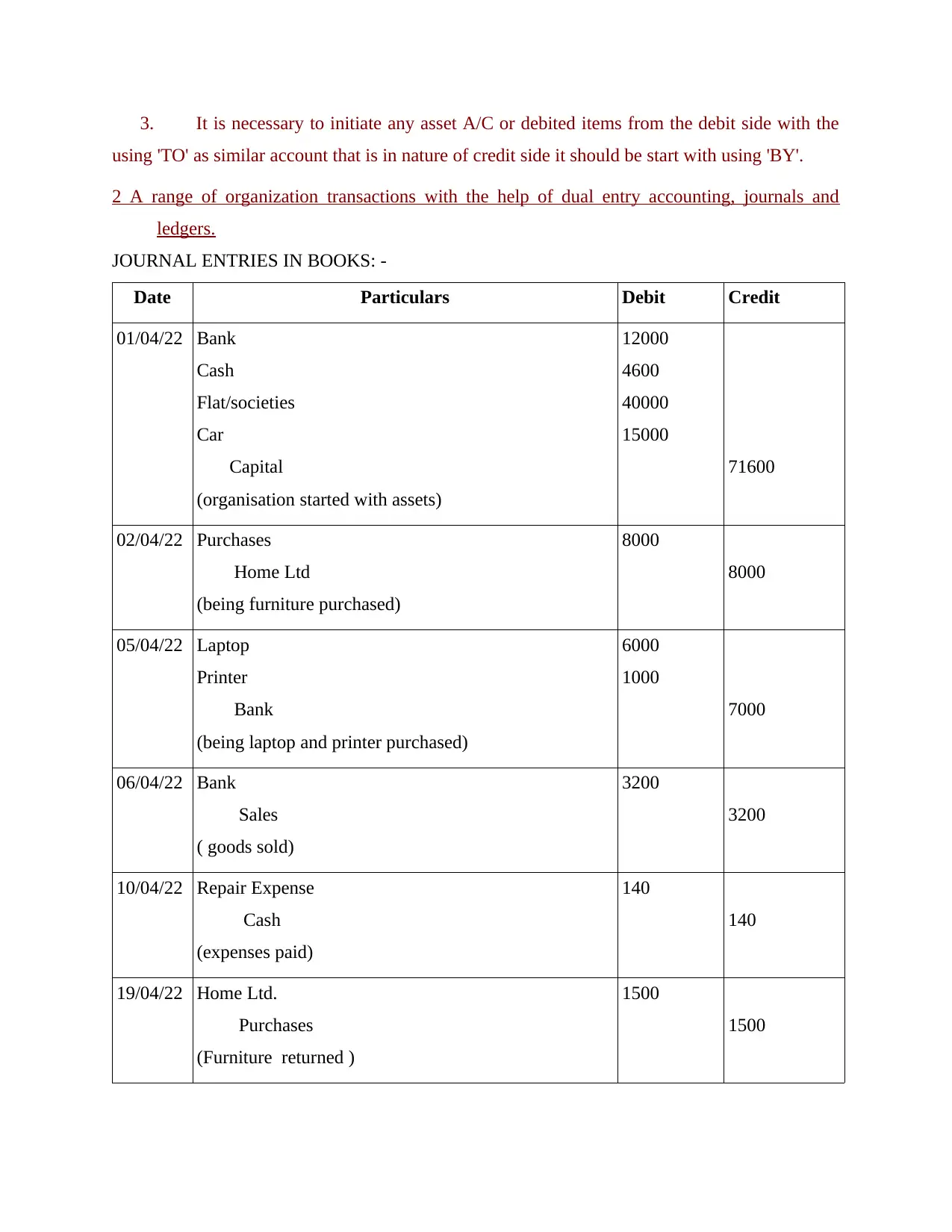

3. It is necessary to initiate any asset A/C or debited items from the debit side with the

using 'TO' as similar account that is in nature of credit side it should be start with using 'BY'.

2 A range of organization transactions with the help of dual entry accounting, journals and

ledgers.

JOURNAL ENTRIES IN BOOKS: -

Date Particulars Debit Credit

01/04/22 Bank

Cash

Flat/societies

Car

Capital

(organisation started with assets)

12000

4600

40000

15000

71600

02/04/22 Purchases

Home Ltd

(being furniture purchased)

8000

8000

05/04/22 Laptop

Printer

Bank

(being laptop and printer purchased)

6000

1000

7000

06/04/22 Bank

Sales

( goods sold)

3200

3200

10/04/22 Repair Expense

Cash

(expenses paid)

140

140

19/04/22 Home Ltd.

Purchases

(Furniture returned )

1500

1500

using 'TO' as similar account that is in nature of credit side it should be start with using 'BY'.

2 A range of organization transactions with the help of dual entry accounting, journals and

ledgers.

JOURNAL ENTRIES IN BOOKS: -

Date Particulars Debit Credit

01/04/22 Bank

Cash

Flat/societies

Car

Capital

(organisation started with assets)

12000

4600

40000

15000

71600

02/04/22 Purchases

Home Ltd

(being furniture purchased)

8000

8000

05/04/22 Laptop

Printer

Bank

(being laptop and printer purchased)

6000

1000

7000

06/04/22 Bank

Sales

( goods sold)

3200

3200

10/04/22 Repair Expense

Cash

(expenses paid)

140

140

19/04/22 Home Ltd.

Purchases

(Furniture returned )

1500

1500

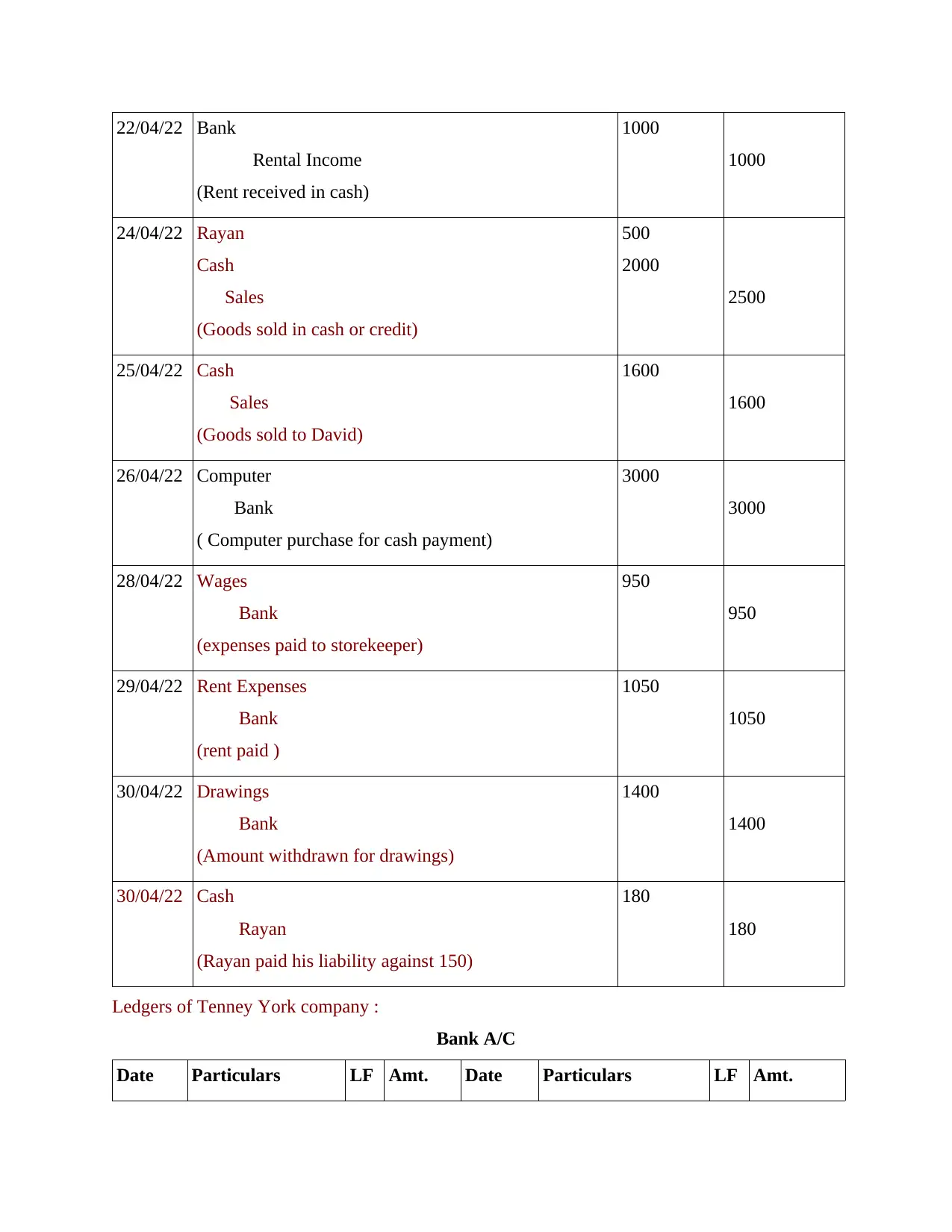

22/04/22 Bank

Rental Income

(Rent received in cash)

1000

1000

24/04/22 Rayan

Cash

Sales

(Goods sold in cash or credit)

500

2000

2500

25/04/22 Cash

Sales

(Goods sold to David)

1600

1600

26/04/22 Computer

Bank

( Computer purchase for cash payment)

3000

3000

28/04/22 Wages

Bank

(expenses paid to storekeeper)

950

950

29/04/22 Rent Expenses

Bank

(rent paid )

1050

1050

30/04/22 Drawings

Bank

(Amount withdrawn for drawings)

1400

1400

30/04/22 Cash

Rayan

(Rayan paid his liability against 150)

180

180

Ledgers of Tenney York company :

Bank A/C

Date Particulars LF Amt. Date Particulars LF Amt.

Rental Income

(Rent received in cash)

1000

1000

24/04/22 Rayan

Cash

Sales

(Goods sold in cash or credit)

500

2000

2500

25/04/22 Cash

Sales

(Goods sold to David)

1600

1600

26/04/22 Computer

Bank

( Computer purchase for cash payment)

3000

3000

28/04/22 Wages

Bank

(expenses paid to storekeeper)

950

950

29/04/22 Rent Expenses

Bank

(rent paid )

1050

1050

30/04/22 Drawings

Bank

(Amount withdrawn for drawings)

1400

1400

30/04/22 Cash

Rayan

(Rayan paid his liability against 150)

180

180

Ledgers of Tenney York company :

Bank A/C

Date Particulars LF Amt. Date Particulars LF Amt.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

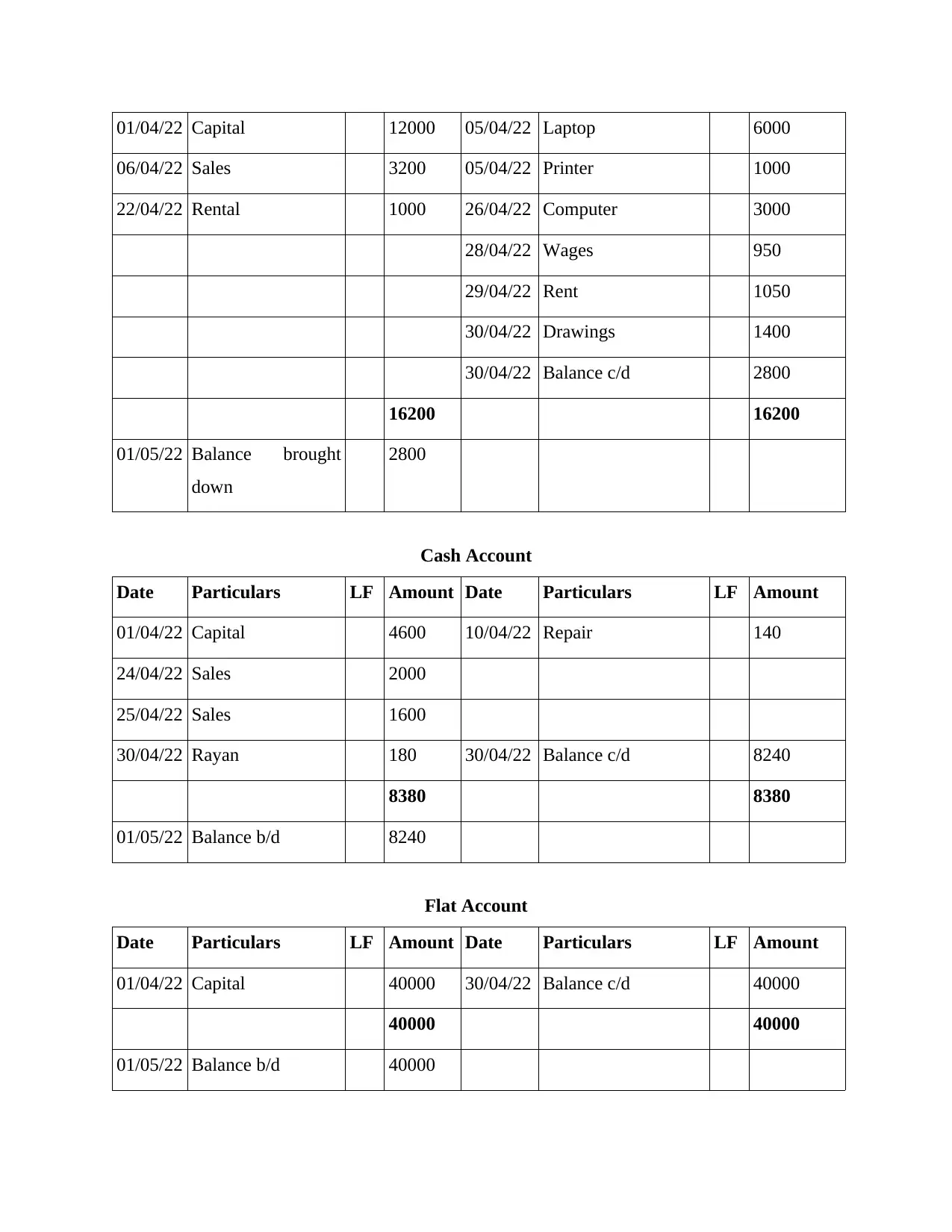

01/04/22 Capital 12000 05/04/22 Laptop 6000

06/04/22 Sales 3200 05/04/22 Printer 1000

22/04/22 Rental 1000 26/04/22 Computer 3000

28/04/22 Wages 950

29/04/22 Rent 1050

30/04/22 Drawings 1400

30/04/22 Balance c/d 2800

16200 16200

01/05/22 Balance brought

down

2800

Cash Account

Date Particulars LF Amount Date Particulars LF Amount

01/04/22 Capital 4600 10/04/22 Repair 140

24/04/22 Sales 2000

25/04/22 Sales 1600

30/04/22 Rayan 180 30/04/22 Balance c/d 8240

8380 8380

01/05/22 Balance b/d 8240

Flat Account

Date Particulars LF Amount Date Particulars LF Amount

01/04/22 Capital 40000 30/04/22 Balance c/d 40000

40000 40000

01/05/22 Balance b/d 40000

06/04/22 Sales 3200 05/04/22 Printer 1000

22/04/22 Rental 1000 26/04/22 Computer 3000

28/04/22 Wages 950

29/04/22 Rent 1050

30/04/22 Drawings 1400

30/04/22 Balance c/d 2800

16200 16200

01/05/22 Balance brought

down

2800

Cash Account

Date Particulars LF Amount Date Particulars LF Amount

01/04/22 Capital 4600 10/04/22 Repair 140

24/04/22 Sales 2000

25/04/22 Sales 1600

30/04/22 Rayan 180 30/04/22 Balance c/d 8240

8380 8380

01/05/22 Balance b/d 8240

Flat Account

Date Particulars LF Amount Date Particulars LF Amount

01/04/22 Capital 40000 30/04/22 Balance c/d 40000

40000 40000

01/05/22 Balance b/d 40000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

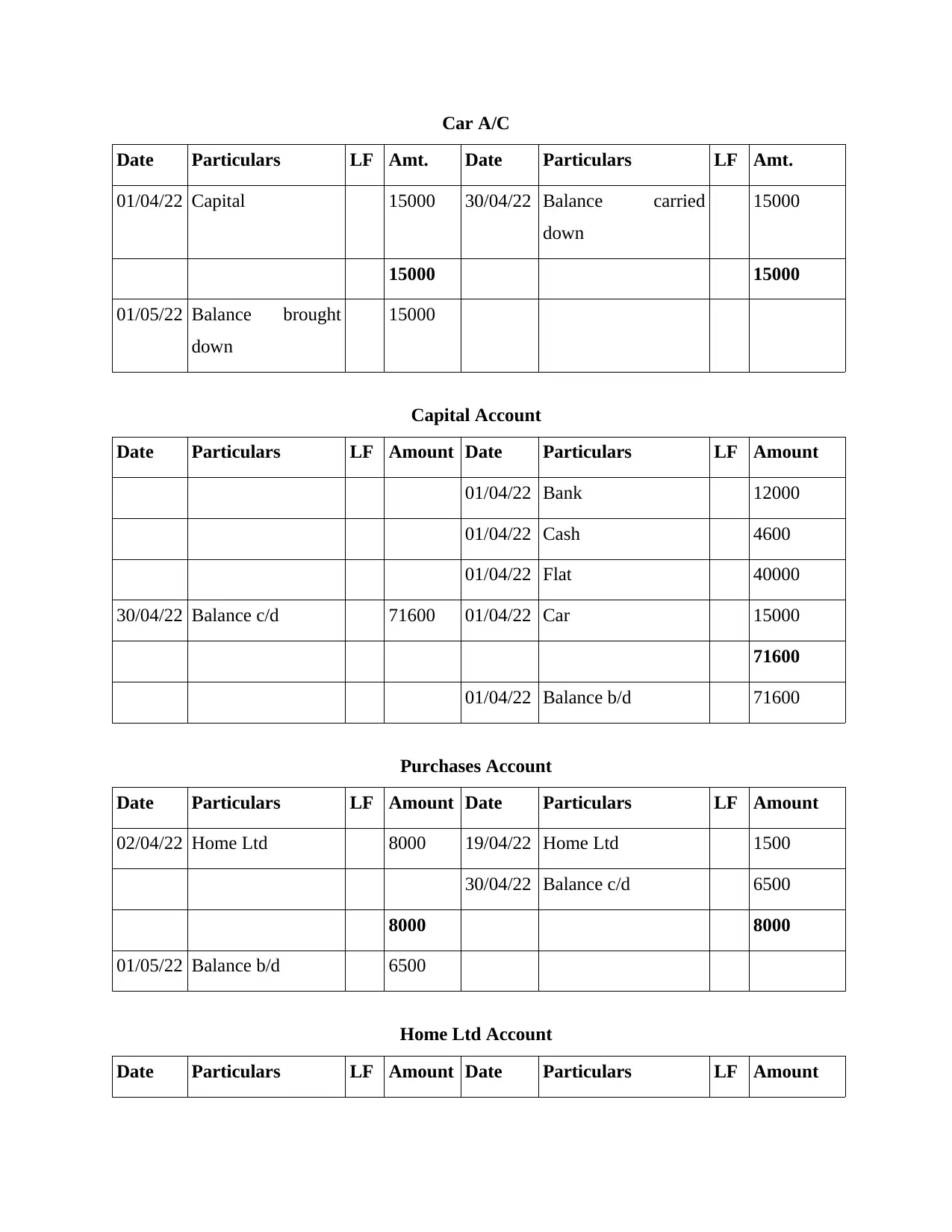

Car A/C

Date Particulars LF Amt. Date Particulars LF Amt.

01/04/22 Capital 15000 30/04/22 Balance carried

down

15000

15000 15000

01/05/22 Balance brought

down

15000

Capital Account

Date Particulars LF Amount Date Particulars LF Amount

01/04/22 Bank 12000

01/04/22 Cash 4600

01/04/22 Flat 40000

30/04/22 Balance c/d 71600 01/04/22 Car 15000

71600

01/04/22 Balance b/d 71600

Purchases Account

Date Particulars LF Amount Date Particulars LF Amount

02/04/22 Home Ltd 8000 19/04/22 Home Ltd 1500

30/04/22 Balance c/d 6500

8000 8000

01/05/22 Balance b/d 6500

Home Ltd Account

Date Particulars LF Amount Date Particulars LF Amount

Date Particulars LF Amt. Date Particulars LF Amt.

01/04/22 Capital 15000 30/04/22 Balance carried

down

15000

15000 15000

01/05/22 Balance brought

down

15000

Capital Account

Date Particulars LF Amount Date Particulars LF Amount

01/04/22 Bank 12000

01/04/22 Cash 4600

01/04/22 Flat 40000

30/04/22 Balance c/d 71600 01/04/22 Car 15000

71600

01/04/22 Balance b/d 71600

Purchases Account

Date Particulars LF Amount Date Particulars LF Amount

02/04/22 Home Ltd 8000 19/04/22 Home Ltd 1500

30/04/22 Balance c/d 6500

8000 8000

01/05/22 Balance b/d 6500

Home Ltd Account

Date Particulars LF Amount Date Particulars LF Amount

19/04/22 Purchases 1500 02/04/22 Purchases 8000

30/04/22 Balance c/d 6500

8000 8000

01/05/22 Balance b/d 6500

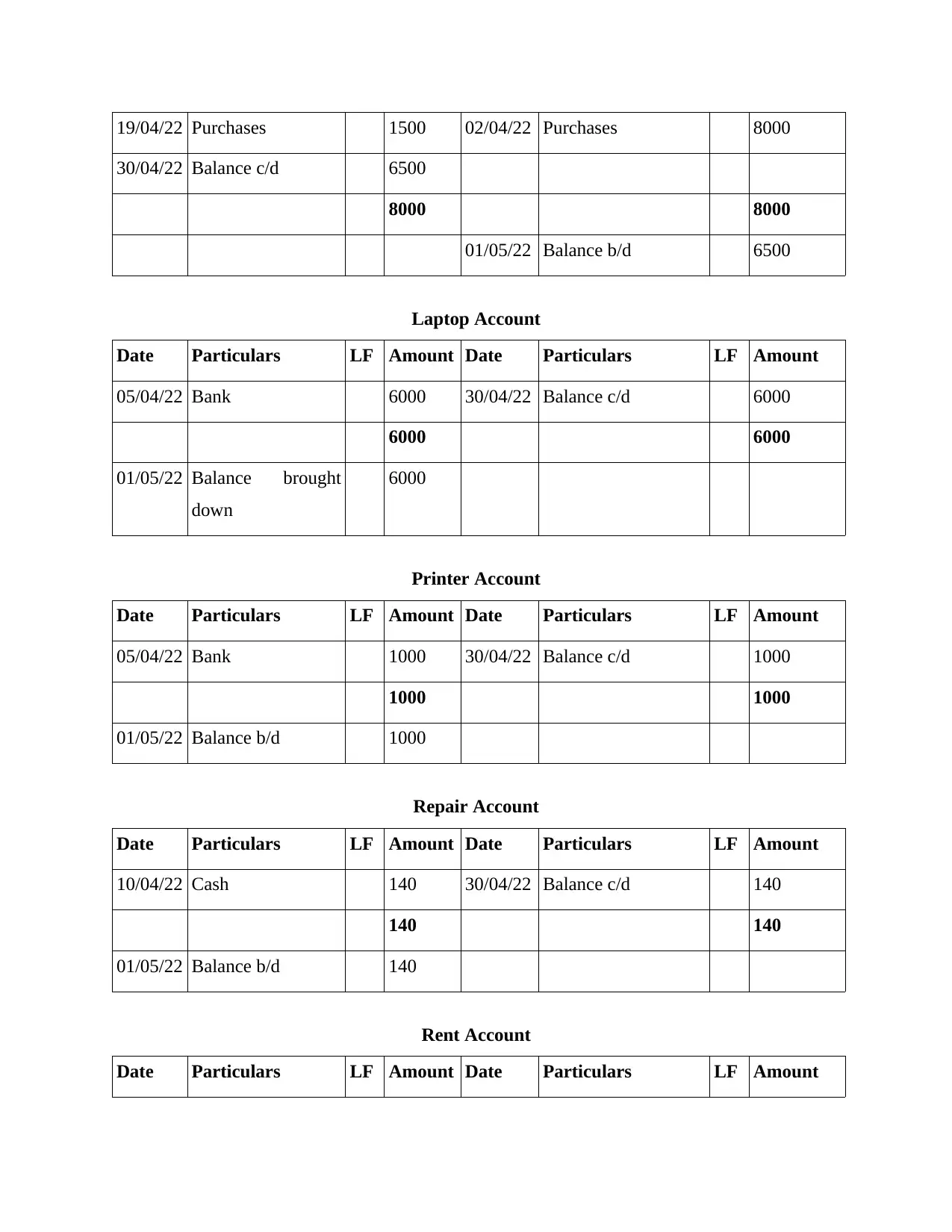

Laptop Account

Date Particulars LF Amount Date Particulars LF Amount

05/04/22 Bank 6000 30/04/22 Balance c/d 6000

6000 6000

01/05/22 Balance brought

down

6000

Printer Account

Date Particulars LF Amount Date Particulars LF Amount

05/04/22 Bank 1000 30/04/22 Balance c/d 1000

1000 1000

01/05/22 Balance b/d 1000

Repair Account

Date Particulars LF Amount Date Particulars LF Amount

10/04/22 Cash 140 30/04/22 Balance c/d 140

140 140

01/05/22 Balance b/d 140

Rent Account

Date Particulars LF Amount Date Particulars LF Amount

30/04/22 Balance c/d 6500

8000 8000

01/05/22 Balance b/d 6500

Laptop Account

Date Particulars LF Amount Date Particulars LF Amount

05/04/22 Bank 6000 30/04/22 Balance c/d 6000

6000 6000

01/05/22 Balance brought

down

6000

Printer Account

Date Particulars LF Amount Date Particulars LF Amount

05/04/22 Bank 1000 30/04/22 Balance c/d 1000

1000 1000

01/05/22 Balance b/d 1000

Repair Account

Date Particulars LF Amount Date Particulars LF Amount

10/04/22 Cash 140 30/04/22 Balance c/d 140

140 140

01/05/22 Balance b/d 140

Rent Account

Date Particulars LF Amount Date Particulars LF Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

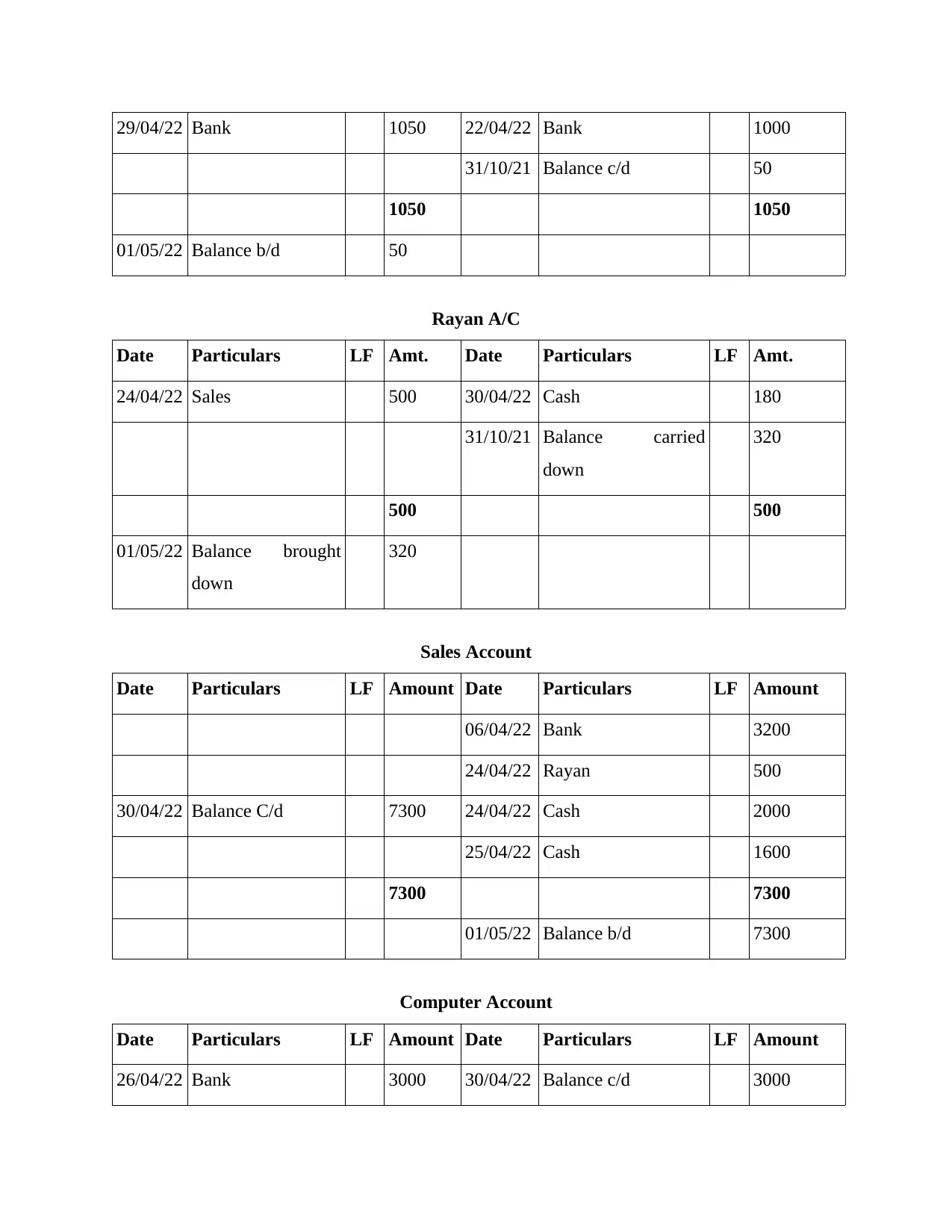

29/04/22 Bank 1050 22/04/22 Bank 1000

31/10/21 Balance c/d 50

1050 1050

01/05/22 Balance b/d 50

Rayan A/C

Date Particulars LF Amt. Date Particulars LF Amt.

24/04/22 Sales 500 30/04/22 Cash 180

31/10/21 Balance carried

down

320

500 500

01/05/22 Balance brought

down

320

Sales Account

Date Particulars LF Amount Date Particulars LF Amount

06/04/22 Bank 3200

24/04/22 Rayan 500

30/04/22 Balance C/d 7300 24/04/22 Cash 2000

25/04/22 Cash 1600

7300 7300

01/05/22 Balance b/d 7300

Computer Account

Date Particulars LF Amount Date Particulars LF Amount

26/04/22 Bank 3000 30/04/22 Balance c/d 3000

31/10/21 Balance c/d 50

1050 1050

01/05/22 Balance b/d 50

Rayan A/C

Date Particulars LF Amt. Date Particulars LF Amt.

24/04/22 Sales 500 30/04/22 Cash 180

31/10/21 Balance carried

down

320

500 500

01/05/22 Balance brought

down

320

Sales Account

Date Particulars LF Amount Date Particulars LF Amount

06/04/22 Bank 3200

24/04/22 Rayan 500

30/04/22 Balance C/d 7300 24/04/22 Cash 2000

25/04/22 Cash 1600

7300 7300

01/05/22 Balance b/d 7300

Computer Account

Date Particulars LF Amount Date Particulars LF Amount

26/04/22 Bank 3000 30/04/22 Balance c/d 3000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

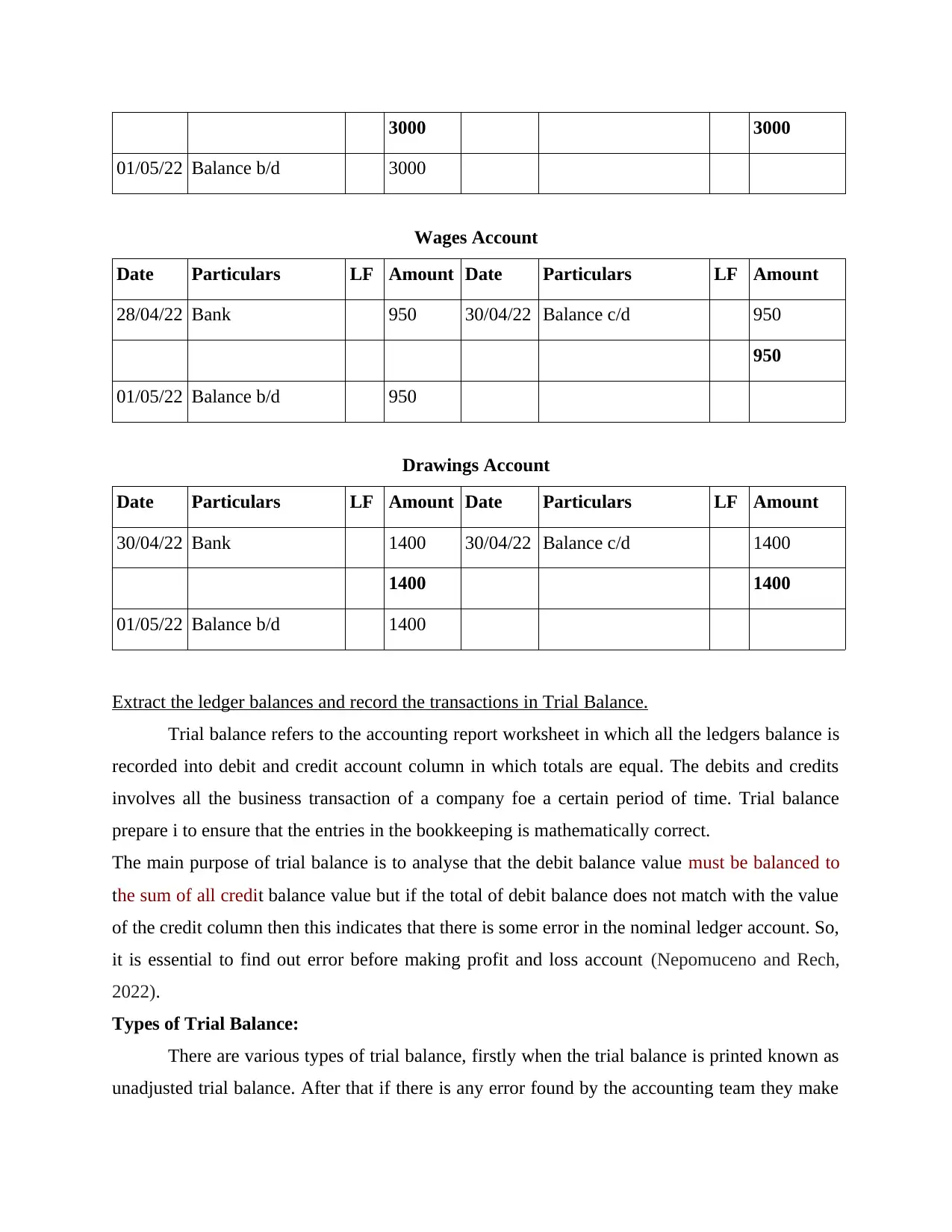

3000 3000

01/05/22 Balance b/d 3000

Wages Account

Date Particulars LF Amount Date Particulars LF Amount

28/04/22 Bank 950 30/04/22 Balance c/d 950

950

01/05/22 Balance b/d 950

Drawings Account

Date Particulars LF Amount Date Particulars LF Amount

30/04/22 Bank 1400 30/04/22 Balance c/d 1400

1400 1400

01/05/22 Balance b/d 1400

Extract the ledger balances and record the transactions in Trial Balance.

Trial balance refers to the accounting report worksheet in which all the ledgers balance is

recorded into debit and credit account column in which totals are equal. The debits and credits

involves all the business transaction of a company foe a certain period of time. Trial balance

prepare i to ensure that the entries in the bookkeeping is mathematically correct.

The main purpose of trial balance is to analyse that the debit balance value must be balanced to

the sum of all credit balance value but if the total of debit balance does not match with the value

of the credit column then this indicates that there is some error in the nominal ledger account. So,

it is essential to find out error before making profit and loss account (Nepomuceno and Rech,

2022).

Types of Trial Balance:

There are various types of trial balance, firstly when the trial balance is printed known as

unadjusted trial balance. After that if there is any error found by the accounting team they make

01/05/22 Balance b/d 3000

Wages Account

Date Particulars LF Amount Date Particulars LF Amount

28/04/22 Bank 950 30/04/22 Balance c/d 950

950

01/05/22 Balance b/d 950

Drawings Account

Date Particulars LF Amount Date Particulars LF Amount

30/04/22 Bank 1400 30/04/22 Balance c/d 1400

1400 1400

01/05/22 Balance b/d 1400

Extract the ledger balances and record the transactions in Trial Balance.

Trial balance refers to the accounting report worksheet in which all the ledgers balance is

recorded into debit and credit account column in which totals are equal. The debits and credits

involves all the business transaction of a company foe a certain period of time. Trial balance

prepare i to ensure that the entries in the bookkeeping is mathematically correct.

The main purpose of trial balance is to analyse that the debit balance value must be balanced to

the sum of all credit balance value but if the total of debit balance does not match with the value

of the credit column then this indicates that there is some error in the nominal ledger account. So,

it is essential to find out error before making profit and loss account (Nepomuceno and Rech,

2022).

Types of Trial Balance:

There are various types of trial balance, firstly when the trial balance is printed known as

unadjusted trial balance. After that if there is any error found by the accounting team they make

adjustments to match the financial statements into the compliance with the accounting

framework known as adjusted trial balance. In the Last period closed and the report known as

post-closing trial balance (Pacini, Rogers and Swingen, 2002).

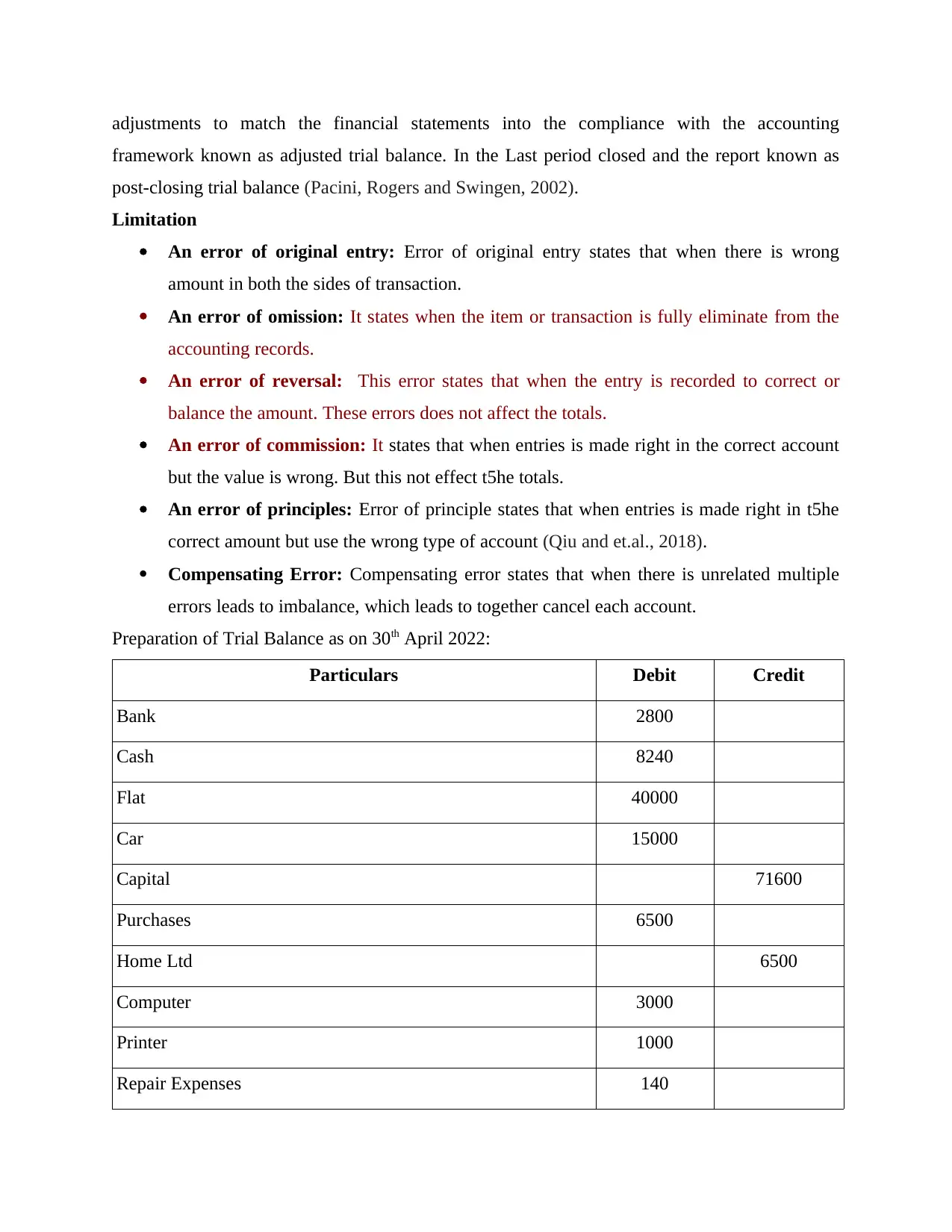

Limitation

An error of original entry: Error of original entry states that when there is wrong

amount in both the sides of transaction.

An error of omission: It states when the item or transaction is fully eliminate from the

accounting records.

An error of reversal: This error states that when the entry is recorded to correct or

balance the amount. These errors does not affect the totals.

An error of commission: It states that when entries is made right in the correct account

but the value is wrong. But this not effect t5he totals.

An error of principles: Error of principle states that when entries is made right in t5he

correct amount but use the wrong type of account (Qiu and et.al., 2018).

Compensating Error: Compensating error states that when there is unrelated multiple

errors leads to imbalance, which leads to together cancel each account.

Preparation of Trial Balance as on 30th April 2022:

Particulars Debit Credit

Bank 2800

Cash 8240

Flat 40000

Car 15000

Capital 71600

Purchases 6500

Home Ltd 6500

Computer 3000

Printer 1000

Repair Expenses 140

framework known as adjusted trial balance. In the Last period closed and the report known as

post-closing trial balance (Pacini, Rogers and Swingen, 2002).

Limitation

An error of original entry: Error of original entry states that when there is wrong

amount in both the sides of transaction.

An error of omission: It states when the item or transaction is fully eliminate from the

accounting records.

An error of reversal: This error states that when the entry is recorded to correct or

balance the amount. These errors does not affect the totals.

An error of commission: It states that when entries is made right in the correct account

but the value is wrong. But this not effect t5he totals.

An error of principles: Error of principle states that when entries is made right in t5he

correct amount but use the wrong type of account (Qiu and et.al., 2018).

Compensating Error: Compensating error states that when there is unrelated multiple

errors leads to imbalance, which leads to together cancel each account.

Preparation of Trial Balance as on 30th April 2022:

Particulars Debit Credit

Bank 2800

Cash 8240

Flat 40000

Car 15000

Capital 71600

Purchases 6500

Home Ltd 6500

Computer 3000

Printer 1000

Repair Expenses 140

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.