An Evaluation of the Economic Dynamics Between Australia and the USA

VerifiedAdded on 2020/04/01

|13

|3483

|34

Report

AI Summary

This report provides an in-depth analysis of the economic relationship between Australia and the USA, two developed nations with strong international ties. The study examines the influence of the USA on the Australian economy, considering historical data on key macroeconomic indicators like real GDP, FDI flows, interest rate movements, net exports, and exchange rates. The analysis highlights similarities in GDP movements, significant investment flows between the two countries, and the increasing trade volume. The report also explores the impact of the USA's recession on the Australian economy, emphasizing Australia's ability to mitigate risks. The report uses tables and figures to illustrate the economic dynamics, offering a comprehensive overview of the economic interdependence between the two nations. The report also investigates the dependency debate, outlining the impact of economic power on the smaller economy. The report is valuable for students and researchers interested in international economics and trade relations.

Running head: ECONOMIC ASSIGNMENT

Economic assignment

Name of the Student

Name of the University

Author note

Economic assignment

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIC ASSIGNMENT

Executive Summary

The report aims at evaluating the dynamics of relationship between Australia and USA. Both the nations

are considered as developed nation and shared a strong international relationship. This leads to the

assertion that growth or fluctuation in USA affects the Australian economy by causing expansion and

contraction of the economy. One rationale behind such claim is the relatively large of USA economy.

This claim is evaluated considering historical data on some major macroeconomic indicators. The first

indicator considered is the real GDP. A comparative analysis is made on GDP movement. The analysis

further goes on by focusing on variables such as FDI flows, interest rate movement, net export and

movement of the exchange rate. In GDP analysis, there are some common point of GDP movements.

To closely evaluate the points FDI flows are considered and it is seen that USA makes major investment

in Australia and similarly Australia’s investment in USA is also significant. Trade volume between USA

and Australia had increased continuously. One striking fact is the impact effect of USA recession on

Australian economy. Australia has escaped from the recession and mitigate the risk as minimum as

possible.

Executive Summary

The report aims at evaluating the dynamics of relationship between Australia and USA. Both the nations

are considered as developed nation and shared a strong international relationship. This leads to the

assertion that growth or fluctuation in USA affects the Australian economy by causing expansion and

contraction of the economy. One rationale behind such claim is the relatively large of USA economy.

This claim is evaluated considering historical data on some major macroeconomic indicators. The first

indicator considered is the real GDP. A comparative analysis is made on GDP movement. The analysis

further goes on by focusing on variables such as FDI flows, interest rate movement, net export and

movement of the exchange rate. In GDP analysis, there are some common point of GDP movements.

To closely evaluate the points FDI flows are considered and it is seen that USA makes major investment

in Australia and similarly Australia’s investment in USA is also significant. Trade volume between USA

and Australia had increased continuously. One striking fact is the impact effect of USA recession on

Australian economy. Australia has escaped from the recession and mitigate the risk as minimum as

possible.

2ECONOMIC ASSIGNMENT

Table of Contents

Introduction.................................................................................................................................................3

Defining economic relation; USA and Australia...........................................................................................3

Dependency debate....................................................................................................................................3

Real GDP Analysis; Australia and USA..........................................................................................................4

Investment relation.....................................................................................................................................6

Net export and exchange rate.....................................................................................................................7

Great recession in USA and its impact on Australia...................................................................................10

Conclusion.................................................................................................................................................10

References.................................................................................................................................................11

Table of Contents

Introduction.................................................................................................................................................3

Defining economic relation; USA and Australia...........................................................................................3

Dependency debate....................................................................................................................................3

Real GDP Analysis; Australia and USA..........................................................................................................4

Investment relation.....................................................................................................................................6

Net export and exchange rate.....................................................................................................................7

Great recession in USA and its impact on Australia...................................................................................10

Conclusion.................................................................................................................................................10

References.................................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIC ASSIGNMENT

Introduction

In a globalized world, nations become increasingly interrelated with each other. Interaction

among nations is not only in terms of visible trade but also in terms of invisible trade that is trade of

services. The relation becomes stronger when countries make investment in each other market, loan

give abroad and capital repayment. The cross border transaction and hence international relationship

becomes an integral part of globe. National generally benefitted from transaction take place on

international platform. In the process, the dependency among nations increases especially for small

nations. The small here not only points to the geographical size but to the economic power. The greater

economic power a country has, the more it has impact on other nations.

One such economy having considerable global power is USA. The single nation has control over

many nations, comparatively small sized. USA and Australia are two nations sharing a strong economic

relation. They traded goods and services and invests significant amount on each other market. However,

Australia is comparatively small size as compared to USA. For this reason, many commentators opine

that USA can have large impact on Australian economy. When real GDP in USA changes then there are

possibilities that is causes an expansion and contraction of Australian economy. Many related factors

here needs to be considered such as trend in et export, movement if exchange rate or interest rate. The

report examines this assertion in light of economic theories and historical data.

Defining economic relation; USA and Australia

There are many large economic players impacting on global scenario through their fiscal,

monetary and international monetary framework. United States of America and Australia are two such

nations that are two dominating player in the international world. Apart from their impact on other

nations these two nations share political shared political and socio economic relation with each other.

Goods and services are traded and there are both way flows of funds between nations. The international

relationship established between the nations went on stronger day by day signifying an economic

dependence (Dowding and Martin 2017). USA ranks fourth in the list of Australia’s importers. Goods

from Australia overflow Australia market and contribute to job growth in Australia. In return, Australia

also imported considerable amount of goods and services from USA. This shows the mutually beneficial

trade relation between the USA and Australia. The bilateral trade agreement between USA and Australia

that came into effect on 2005 strengthen the relationship between nations. USA always maintains a

positive trade balance in trade with Australia. USA is second largest importer of Australia. The trade

agreement removes all the trade barriers such as tariff, quota and other restrictions. Therefore, all the

hurdles of trade between nations eliminated further strengthening the trade relation.

The FDI from USA to Australia has significant impact on Australia’s economy. The funds flow

from Australia to abroad the largest share is acquired by USA. The productive investments positively

contribute to growth and prosperity of both the nations. Australia has a favorable business environment

attracting foreign funds. US firms operate in Australia for over 100 years and generate jobs for many

Australian (Mukulu, Hettihewa and Wright 2014).

Dependency debate

International trade relation and resulted dependency is an interesting area of research. The

above section shoes relation between Australia and USA in Terms of visible and invisible trade and

relation and capital investment. The friendly relation between the nations is one reason for assuming

Introduction

In a globalized world, nations become increasingly interrelated with each other. Interaction

among nations is not only in terms of visible trade but also in terms of invisible trade that is trade of

services. The relation becomes stronger when countries make investment in each other market, loan

give abroad and capital repayment. The cross border transaction and hence international relationship

becomes an integral part of globe. National generally benefitted from transaction take place on

international platform. In the process, the dependency among nations increases especially for small

nations. The small here not only points to the geographical size but to the economic power. The greater

economic power a country has, the more it has impact on other nations.

One such economy having considerable global power is USA. The single nation has control over

many nations, comparatively small sized. USA and Australia are two nations sharing a strong economic

relation. They traded goods and services and invests significant amount on each other market. However,

Australia is comparatively small size as compared to USA. For this reason, many commentators opine

that USA can have large impact on Australian economy. When real GDP in USA changes then there are

possibilities that is causes an expansion and contraction of Australian economy. Many related factors

here needs to be considered such as trend in et export, movement if exchange rate or interest rate. The

report examines this assertion in light of economic theories and historical data.

Defining economic relation; USA and Australia

There are many large economic players impacting on global scenario through their fiscal,

monetary and international monetary framework. United States of America and Australia are two such

nations that are two dominating player in the international world. Apart from their impact on other

nations these two nations share political shared political and socio economic relation with each other.

Goods and services are traded and there are both way flows of funds between nations. The international

relationship established between the nations went on stronger day by day signifying an economic

dependence (Dowding and Martin 2017). USA ranks fourth in the list of Australia’s importers. Goods

from Australia overflow Australia market and contribute to job growth in Australia. In return, Australia

also imported considerable amount of goods and services from USA. This shows the mutually beneficial

trade relation between the USA and Australia. The bilateral trade agreement between USA and Australia

that came into effect on 2005 strengthen the relationship between nations. USA always maintains a

positive trade balance in trade with Australia. USA is second largest importer of Australia. The trade

agreement removes all the trade barriers such as tariff, quota and other restrictions. Therefore, all the

hurdles of trade between nations eliminated further strengthening the trade relation.

The FDI from USA to Australia has significant impact on Australia’s economy. The funds flow

from Australia to abroad the largest share is acquired by USA. The productive investments positively

contribute to growth and prosperity of both the nations. Australia has a favorable business environment

attracting foreign funds. US firms operate in Australia for over 100 years and generate jobs for many

Australian (Mukulu, Hettihewa and Wright 2014).

Dependency debate

International trade relation and resulted dependency is an interesting area of research. The

above section shoes relation between Australia and USA in Terms of visible and invisible trade and

relation and capital investment. The friendly relation between the nations is one reason for assuming

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIC ASSIGNMENT

the dependency on each other. USA, for its relatively large size of the economy influences many

economies. The growing trade and investment relation is suggests an obvious dependence between the

nations.

This belier resulted in an ongoing debate. There are one group of commentators believing that

international relation exits in terms of economic dependence. Hence, when GDP of USA changes is

causes a change in economy of Australia causing expansion or contraction of the economy. However,

many do not believe that. GDP of a nation depend on a number of factors. Therefore, considering only

GDP as an indicator of dependence does not got give right assertion. Flow of investment, net export,

movement of exchange rate and interest rate are factors that need to be considered. Historical data for

a significantly long period are considered for evaluation.

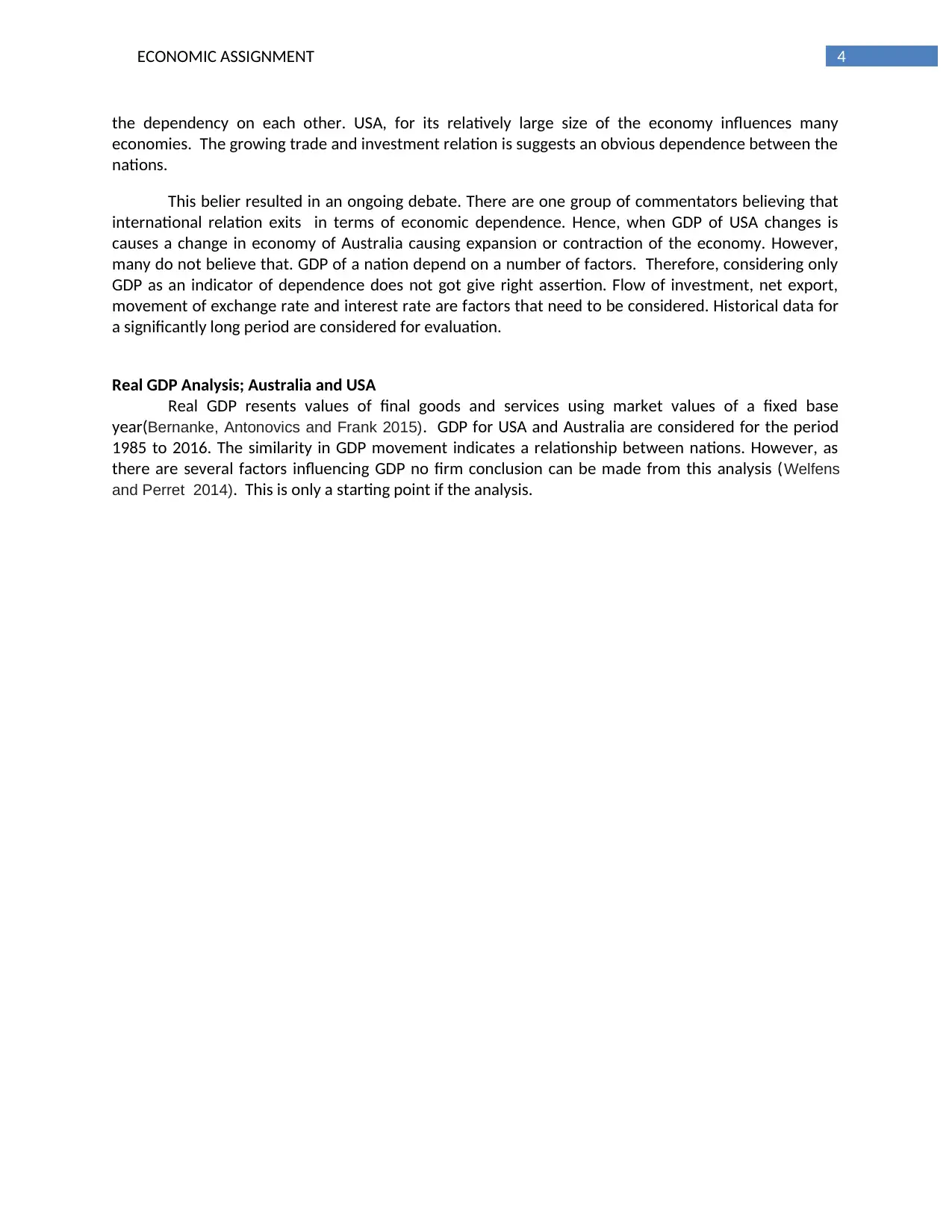

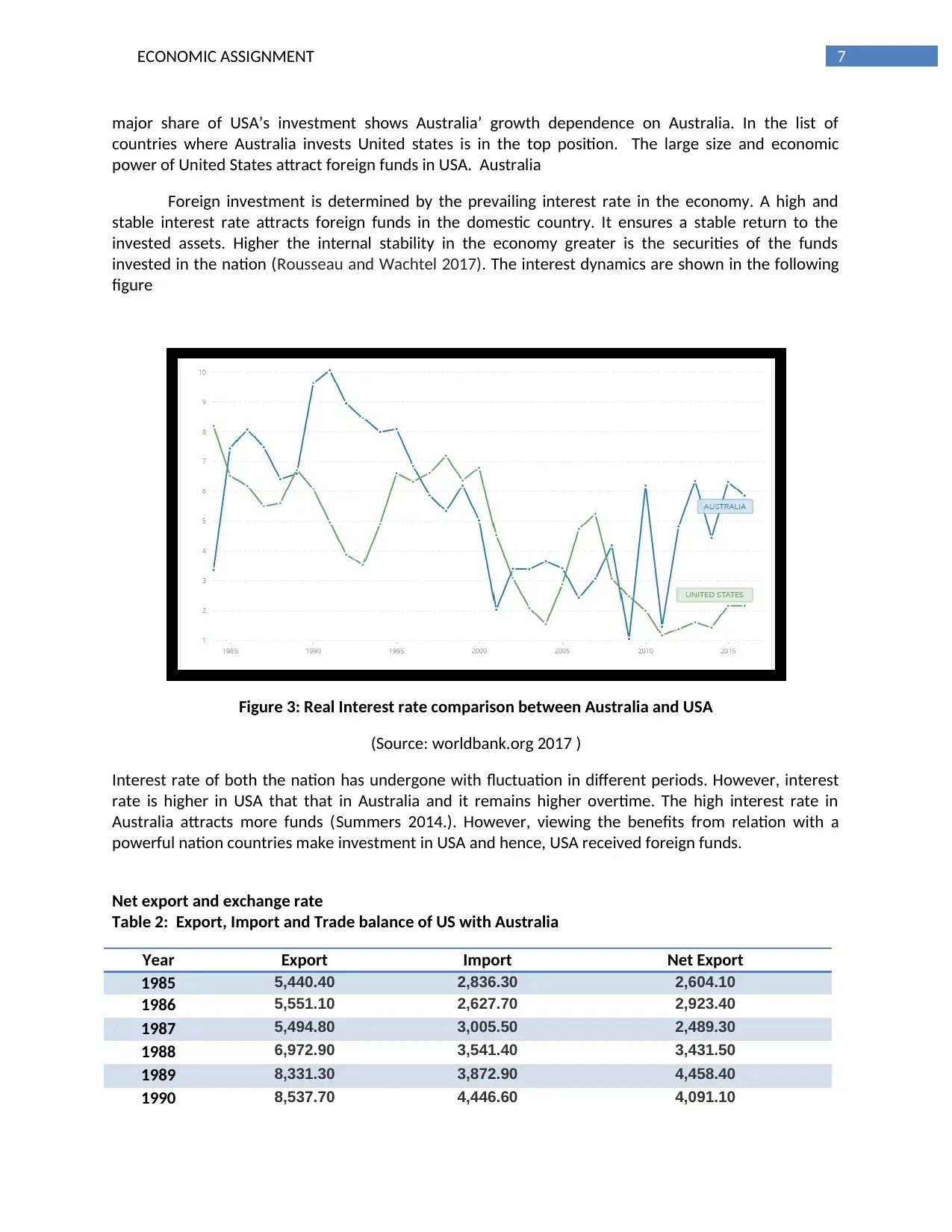

Real GDP Analysis; Australia and USA

Real GDP resents values of final goods and services using market values of a fixed base

year(Bernanke, Antonovics and Frank 2015). GDP for USA and Australia are considered for the period

1985 to 2016. The similarity in GDP movement indicates a relationship between nations. However, as

there are several factors influencing GDP no firm conclusion can be made from this analysis (Welfens

and Perret 2014). This is only a starting point if the analysis.

the dependency on each other. USA, for its relatively large size of the economy influences many

economies. The growing trade and investment relation is suggests an obvious dependence between the

nations.

This belier resulted in an ongoing debate. There are one group of commentators believing that

international relation exits in terms of economic dependence. Hence, when GDP of USA changes is

causes a change in economy of Australia causing expansion or contraction of the economy. However,

many do not believe that. GDP of a nation depend on a number of factors. Therefore, considering only

GDP as an indicator of dependence does not got give right assertion. Flow of investment, net export,

movement of exchange rate and interest rate are factors that need to be considered. Historical data for

a significantly long period are considered for evaluation.

Real GDP Analysis; Australia and USA

Real GDP resents values of final goods and services using market values of a fixed base

year(Bernanke, Antonovics and Frank 2015). GDP for USA and Australia are considered for the period

1985 to 2016. The similarity in GDP movement indicates a relationship between nations. However, as

there are several factors influencing GDP no firm conclusion can be made from this analysis (Welfens

and Perret 2014). This is only a starting point if the analysis.

5ECONOMIC ASSIGNMENT

Figure 1: GDP of USA and Australia

(Source: stlouisfed.org 2017)

The above figure shows some similarity in GDP movement between USA and Australia. The GDP in USA

is higher than Australia over the entire period. The intensity of fluctuation is grater for USA than that for

Australia. In 1991, GDP of both the nation declined from the previous year. The grow rate in USA was -

3% to -4% while that in Australia was -1% to -2% (Lindert and Williamson 2016). GDP in Australia

peaked up to 3% in 1997 in Australia. I the corresponding year USA also experiences a high growth rate

where growth rate exceeds 5% . Again in 2000-2002 growth rate of both the nations falls and accounted

growth rat almost same for both the nations. The accounted growth rate during this time is just below

0%. The similar growth trend is observed in 2003-2004. During 2008, USA experienced great recession

that affects the GDP and GDP in USA fell to -8% to – 9%. Australia in this time also faced a negative rate

of growth. However, the growth rate is not that much lower than USA. The growth rate in Australia in

that year was between 0 to -1% (Abdullah 2017). Therefore, analysis of GDP indicates some common

point of fluctuation.

Two important component o GDP is net export and investment.

Figure 1: GDP of USA and Australia

(Source: stlouisfed.org 2017)

The above figure shows some similarity in GDP movement between USA and Australia. The GDP in USA

is higher than Australia over the entire period. The intensity of fluctuation is grater for USA than that for

Australia. In 1991, GDP of both the nation declined from the previous year. The grow rate in USA was -

3% to -4% while that in Australia was -1% to -2% (Lindert and Williamson 2016). GDP in Australia

peaked up to 3% in 1997 in Australia. I the corresponding year USA also experiences a high growth rate

where growth rate exceeds 5% . Again in 2000-2002 growth rate of both the nations falls and accounted

growth rat almost same for both the nations. The accounted growth rate during this time is just below

0%. The similar growth trend is observed in 2003-2004. During 2008, USA experienced great recession

that affects the GDP and GDP in USA fell to -8% to – 9%. Australia in this time also faced a negative rate

of growth. However, the growth rate is not that much lower than USA. The growth rate in Australia in

that year was between 0 to -1% (Abdullah 2017). Therefore, analysis of GDP indicates some common

point of fluctuation.

Two important component o GDP is net export and investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIC ASSIGNMENT

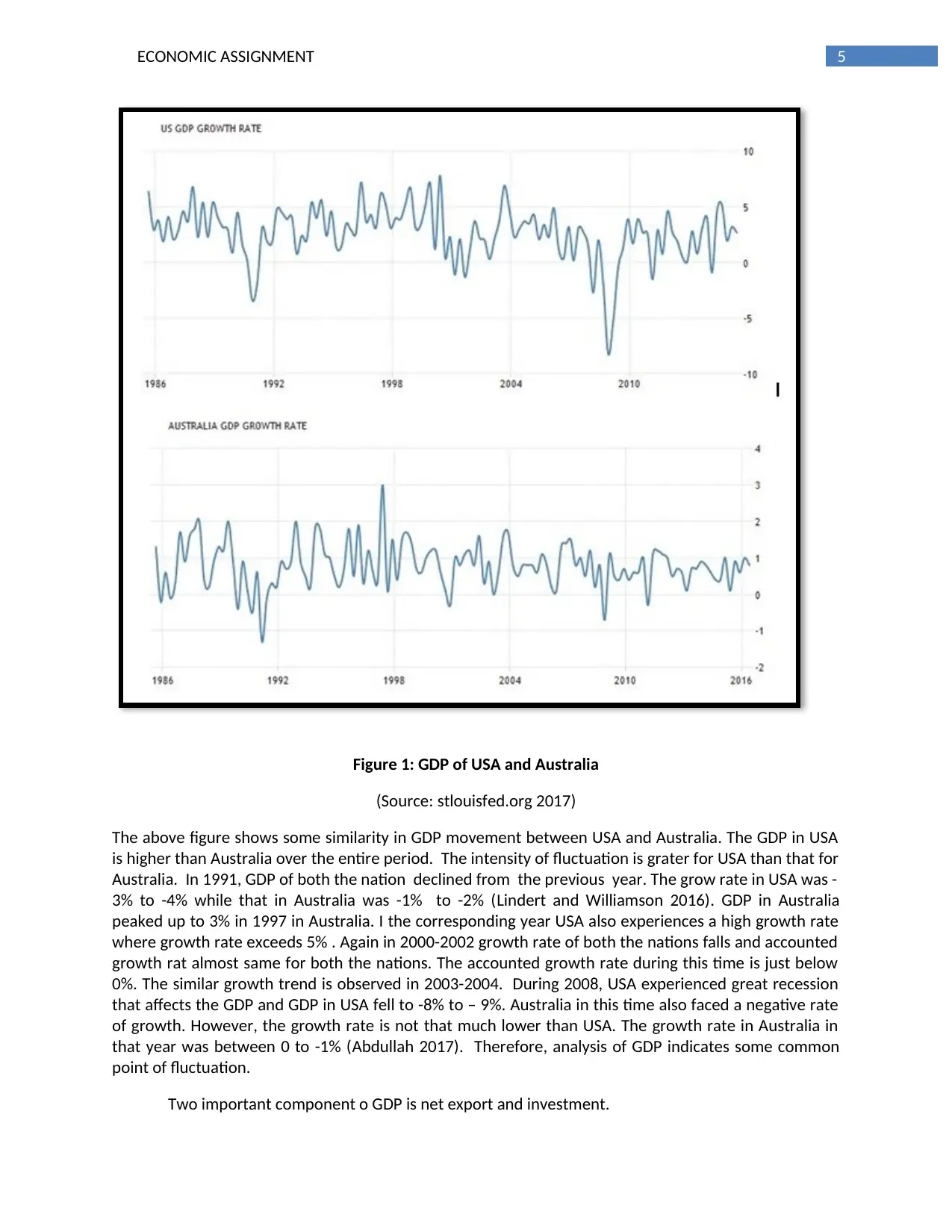

Investment relation

Figure 2: Share of foreign investment in Australia

(Source: stlouisfed.org 2017)

Table 1: list of countries where Australia invests

(Source: stlouisfed.org 2017)

Every year United States made major investment go to in Australia. Australia received significant

investment assistance from USA. The share of investment grows overtime. Investment in an economy is

an important determinant of growth and productivity (Hirst, Thompson and Bromley 2015). Therefore,

Investment relation

Figure 2: Share of foreign investment in Australia

(Source: stlouisfed.org 2017)

Table 1: list of countries where Australia invests

(Source: stlouisfed.org 2017)

Every year United States made major investment go to in Australia. Australia received significant

investment assistance from USA. The share of investment grows overtime. Investment in an economy is

an important determinant of growth and productivity (Hirst, Thompson and Bromley 2015). Therefore,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIC ASSIGNMENT

major share of USA’s investment shows Australia’ growth dependence on Australia. In the list of

countries where Australia invests United states is in the top position. The large size and economic

power of United States attract foreign funds in USA. Australia

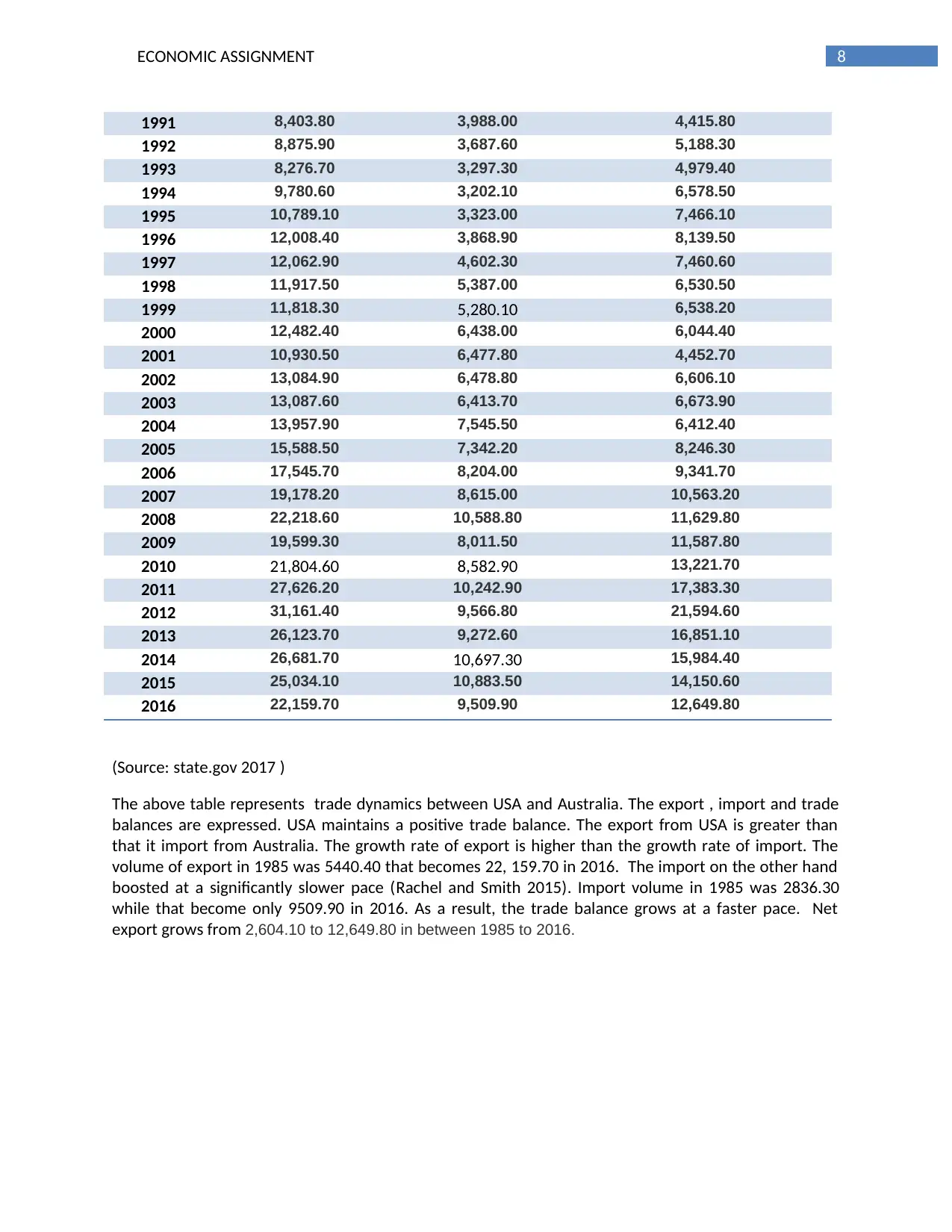

Foreign investment is determined by the prevailing interest rate in the economy. A high and

stable interest rate attracts foreign funds in the domestic country. It ensures a stable return to the

invested assets. Higher the internal stability in the economy greater is the securities of the funds

invested in the nation (Rousseau and Wachtel 2017). The interest dynamics are shown in the following

figure

Figure 3: Real Interest rate comparison between Australia and USA

(Source: worldbank.org 2017 )

Interest rate of both the nation has undergone with fluctuation in different periods. However, interest

rate is higher in USA that that in Australia and it remains higher overtime. The high interest rate in

Australia attracts more funds (Summers 2014.). However, viewing the benefits from relation with a

powerful nation countries make investment in USA and hence, USA received foreign funds.

Net export and exchange rate

Table 2: Export, Import and Trade balance of US with Australia

Year Export Import Net Export

1985 5,440.40 2,836.30 2,604.10

1986 5,551.10 2,627.70 2,923.40

1987 5,494.80 3,005.50 2,489.30

1988 6,972.90 3,541.40 3,431.50

1989 8,331.30 3,872.90 4,458.40

1990 8,537.70 4,446.60 4,091.10

major share of USA’s investment shows Australia’ growth dependence on Australia. In the list of

countries where Australia invests United states is in the top position. The large size and economic

power of United States attract foreign funds in USA. Australia

Foreign investment is determined by the prevailing interest rate in the economy. A high and

stable interest rate attracts foreign funds in the domestic country. It ensures a stable return to the

invested assets. Higher the internal stability in the economy greater is the securities of the funds

invested in the nation (Rousseau and Wachtel 2017). The interest dynamics are shown in the following

figure

Figure 3: Real Interest rate comparison between Australia and USA

(Source: worldbank.org 2017 )

Interest rate of both the nation has undergone with fluctuation in different periods. However, interest

rate is higher in USA that that in Australia and it remains higher overtime. The high interest rate in

Australia attracts more funds (Summers 2014.). However, viewing the benefits from relation with a

powerful nation countries make investment in USA and hence, USA received foreign funds.

Net export and exchange rate

Table 2: Export, Import and Trade balance of US with Australia

Year Export Import Net Export

1985 5,440.40 2,836.30 2,604.10

1986 5,551.10 2,627.70 2,923.40

1987 5,494.80 3,005.50 2,489.30

1988 6,972.90 3,541.40 3,431.50

1989 8,331.30 3,872.90 4,458.40

1990 8,537.70 4,446.60 4,091.10

8ECONOMIC ASSIGNMENT

1991 8,403.80 3,988.00 4,415.80

1992 8,875.90 3,687.60 5,188.30

1993 8,276.70 3,297.30 4,979.40

1994 9,780.60 3,202.10 6,578.50

1995 10,789.10 3,323.00 7,466.10

1996 12,008.40 3,868.90 8,139.50

1997 12,062.90 4,602.30 7,460.60

1998 11,917.50 5,387.00 6,530.50

1999 11,818.30 5,280.10 6,538.20

2000 12,482.40 6,438.00 6,044.40

2001 10,930.50 6,477.80 4,452.70

2002 13,084.90 6,478.80 6,606.10

2003 13,087.60 6,413.70 6,673.90

2004 13,957.90 7,545.50 6,412.40

2005 15,588.50 7,342.20 8,246.30

2006 17,545.70 8,204.00 9,341.70

2007 19,178.20 8,615.00 10,563.20

2008 22,218.60 10,588.80 11,629.80

2009 19,599.30 8,011.50 11,587.80

2010 21,804.60 8,582.90 13,221.70

2011 27,626.20 10,242.90 17,383.30

2012 31,161.40 9,566.80 21,594.60

2013 26,123.70 9,272.60 16,851.10

2014 26,681.70 10,697.30 15,984.40

2015 25,034.10 10,883.50 14,150.60

2016 22,159.70 9,509.90 12,649.80

(Source: state.gov 2017 )

The above table represents trade dynamics between USA and Australia. The export , import and trade

balances are expressed. USA maintains a positive trade balance. The export from USA is greater than

that it import from Australia. The growth rate of export is higher than the growth rate of import. The

volume of export in 1985 was 5440.40 that becomes 22, 159.70 in 2016. The import on the other hand

boosted at a significantly slower pace (Rachel and Smith 2015). Import volume in 1985 was 2836.30

while that become only 9509.90 in 2016. As a result, the trade balance grows at a faster pace. Net

export grows from 2,604.10 to 12,649.80 in between 1985 to 2016.

1991 8,403.80 3,988.00 4,415.80

1992 8,875.90 3,687.60 5,188.30

1993 8,276.70 3,297.30 4,979.40

1994 9,780.60 3,202.10 6,578.50

1995 10,789.10 3,323.00 7,466.10

1996 12,008.40 3,868.90 8,139.50

1997 12,062.90 4,602.30 7,460.60

1998 11,917.50 5,387.00 6,530.50

1999 11,818.30 5,280.10 6,538.20

2000 12,482.40 6,438.00 6,044.40

2001 10,930.50 6,477.80 4,452.70

2002 13,084.90 6,478.80 6,606.10

2003 13,087.60 6,413.70 6,673.90

2004 13,957.90 7,545.50 6,412.40

2005 15,588.50 7,342.20 8,246.30

2006 17,545.70 8,204.00 9,341.70

2007 19,178.20 8,615.00 10,563.20

2008 22,218.60 10,588.80 11,629.80

2009 19,599.30 8,011.50 11,587.80

2010 21,804.60 8,582.90 13,221.70

2011 27,626.20 10,242.90 17,383.30

2012 31,161.40 9,566.80 21,594.60

2013 26,123.70 9,272.60 16,851.10

2014 26,681.70 10,697.30 15,984.40

2015 25,034.10 10,883.50 14,150.60

2016 22,159.70 9,509.90 12,649.80

(Source: state.gov 2017 )

The above table represents trade dynamics between USA and Australia. The export , import and trade

balances are expressed. USA maintains a positive trade balance. The export from USA is greater than

that it import from Australia. The growth rate of export is higher than the growth rate of import. The

volume of export in 1985 was 5440.40 that becomes 22, 159.70 in 2016. The import on the other hand

boosted at a significantly slower pace (Rachel and Smith 2015). Import volume in 1985 was 2836.30

while that become only 9509.90 in 2016. As a result, the trade balance grows at a faster pace. Net

export grows from 2,604.10 to 12,649.80 in between 1985 to 2016.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMIC ASSIGNMENT

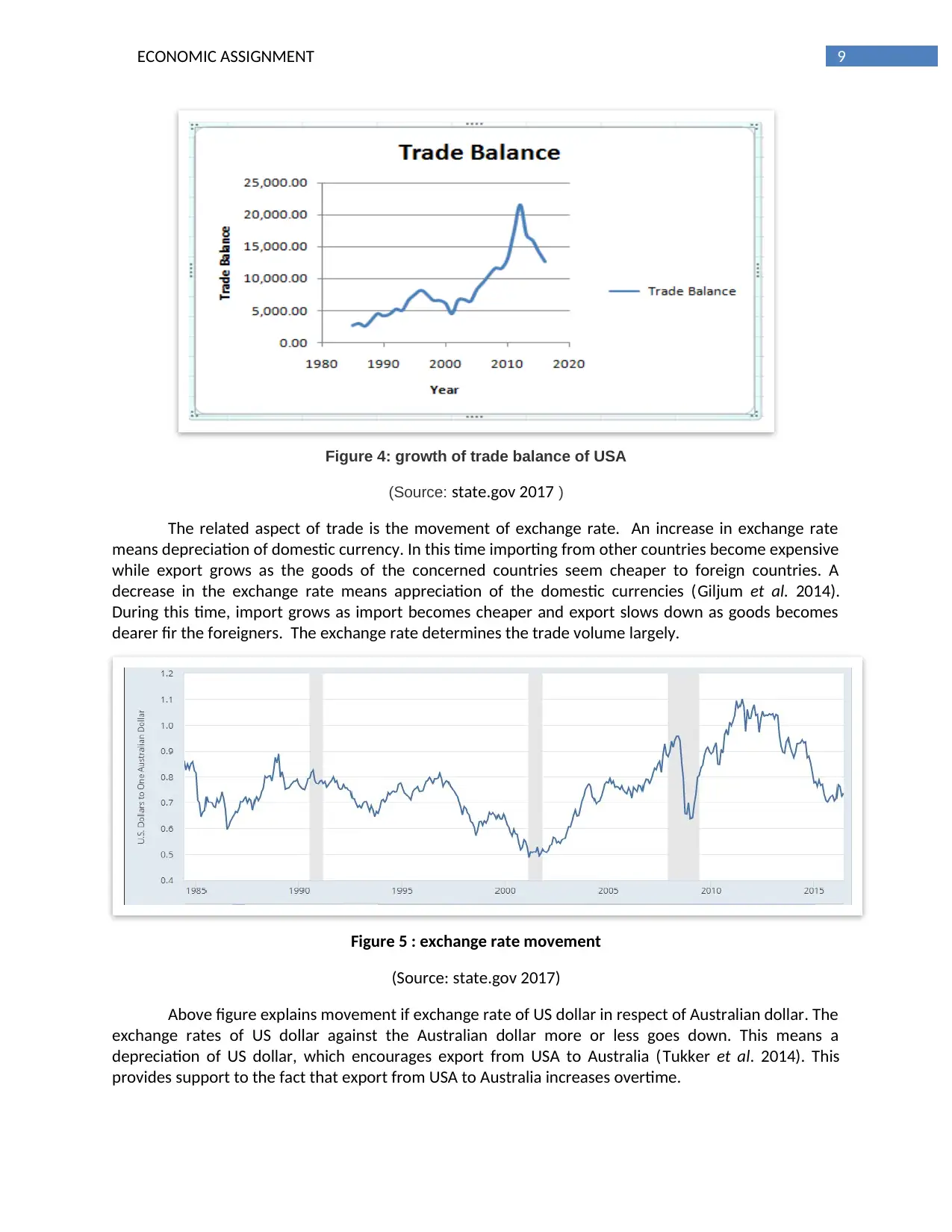

Figure 4: growth of trade balance of USA

(Source: state.gov 2017 )

The related aspect of trade is the movement of exchange rate. An increase in exchange rate

means depreciation of domestic currency. In this time importing from other countries become expensive

while export grows as the goods of the concerned countries seem cheaper to foreign countries. A

decrease in the exchange rate means appreciation of the domestic currencies (Giljum et al. 2014).

During this time, import grows as import becomes cheaper and export slows down as goods becomes

dearer fir the foreigners. The exchange rate determines the trade volume largely.

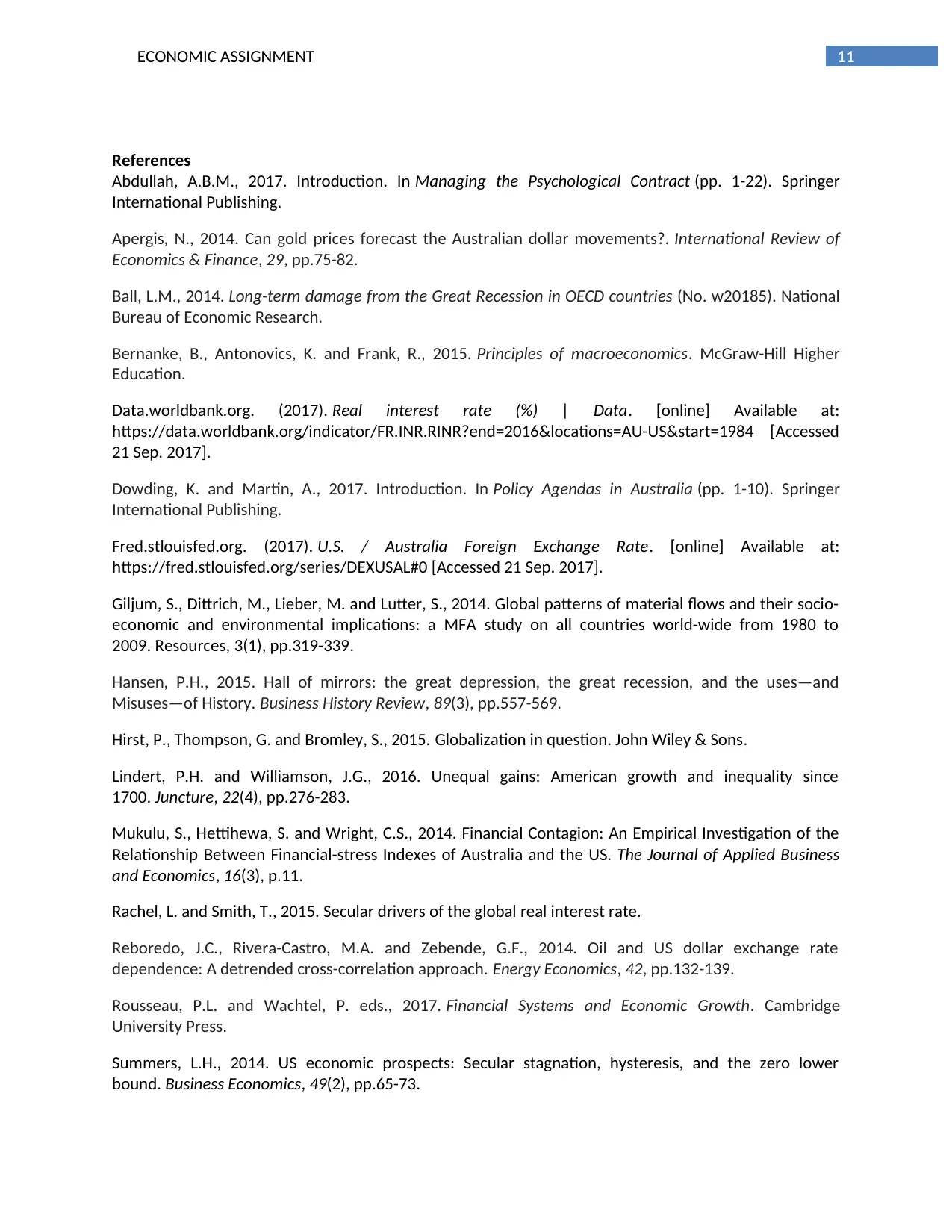

Figure 5 : exchange rate movement

(Source: state.gov 2017)

Above figure explains movement if exchange rate of US dollar in respect of Australian dollar. The

exchange rates of US dollar against the Australian dollar more or less goes down. This means a

depreciation of US dollar, which encourages export from USA to Australia ( Tukker et al. 2014). This

provides support to the fact that export from USA to Australia increases overtime.

Figure 4: growth of trade balance of USA

(Source: state.gov 2017 )

The related aspect of trade is the movement of exchange rate. An increase in exchange rate

means depreciation of domestic currency. In this time importing from other countries become expensive

while export grows as the goods of the concerned countries seem cheaper to foreign countries. A

decrease in the exchange rate means appreciation of the domestic currencies (Giljum et al. 2014).

During this time, import grows as import becomes cheaper and export slows down as goods becomes

dearer fir the foreigners. The exchange rate determines the trade volume largely.

Figure 5 : exchange rate movement

(Source: state.gov 2017)

Above figure explains movement if exchange rate of US dollar in respect of Australian dollar. The

exchange rates of US dollar against the Australian dollar more or less goes down. This means a

depreciation of US dollar, which encourages export from USA to Australia ( Tukker et al. 2014). This

provides support to the fact that export from USA to Australia increases overtime.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMIC ASSIGNMENT

Great recession in USA and its impact on Australia

If there are strong relation between Australia and USA and string interdependence then the

great recession that intensively affect USA should have similar kind of impact on Australian economy as

well. The great recession in Australia took place in 2008 due to sub-prime mortgage and crisis in the

housing market (Apergis 2014). Because of a low and volatile interest rate the bubbles build in the

housing market suddenly burst affecting USA economy on a broad spectrum. The large size of USA

economy makes the crisis to trickle down to other nations as well. Housing price goes down in USA

during this time (Hansen 2015).

The economy of Australia escapes from this recession on a surprising manner. The housing

market is Australia remain stable. Interest rate in Australia did not constitute and sudden downfall. In

the housing market of USA and other contemporary nations, inflation adjusted prices went up

(Reboredo, Rivera-Castro and Zebende 2014). While Australia had showed an upward trend in housing

prices as contrasting to other nation and the general assertion.

There is no change major change in Australia’s performance trend. One factor is that apart from

USA, Australia builds is international relationship with other nations as well ( Ball 2014). There are trade

relation and investment relation among Australia and other nations. This helps the nation to mitigate

risk generated from USA recession. When a nation engaged in multilateral trade relation then the

vulnerability to shock to any one trading partners automatically reduces. Additionally, Australia grows

stronger overtime. Different sectors of the economy are now performing well and hence provide

security to the growth and development of the nation (Yilmazer, Babiarz and Liu 2015). The financial

sector of Australia is one such sector that shows outstanding performance and rescues the economy

from shocks and recession occurred in USA.

Conclusion

The report critically evaluates the relation between USA and Australia. Relation builds on

international platform has implication for growth and development of a nation. The interrelation often

implies when country is in growing or declining phase of growth then related nations are affected from

this. One such assertion is made about relation between Australia and USA. The belief here is that the

Real GDP movement in USA causes expansion or contraction of Australia economy. In order to validate

the statement, historical data on real GDP for both the nation are first considered. From the analysis

there turn out some common fluctuation point between USA and Australia. However, the common

points are not enough for drawing any conclusion. Foreign investment flows from both the nations are

next indicators to be considered. The statistics shows that USA is the major investors of Australia.

Similarly, Australia also invests as much as possible in USA. In fact, the lion share of Australia fund is

invested in USA. Related aspect of investment is the dynamics of interest rate. Interest rate in Australia

is higher and less volatile attracting foreign funds for the economy. The trade volume between USA and

Australia rises overtime and USA maintains a positive trade balance. The exchange rate movement

between US dollar and Australian dollar though volatile but decreasing in nature, raising the export flow

from USA to Australia. Finally, the impact of great recession in USA on Australian economy is analyzed.

The effect of great recession in USA has an ambiguous impact of Australia. Therefore, the claim cannot

be completely supported and the relation dynamics remains versatile.

Great recession in USA and its impact on Australia

If there are strong relation between Australia and USA and string interdependence then the

great recession that intensively affect USA should have similar kind of impact on Australian economy as

well. The great recession in Australia took place in 2008 due to sub-prime mortgage and crisis in the

housing market (Apergis 2014). Because of a low and volatile interest rate the bubbles build in the

housing market suddenly burst affecting USA economy on a broad spectrum. The large size of USA

economy makes the crisis to trickle down to other nations as well. Housing price goes down in USA

during this time (Hansen 2015).

The economy of Australia escapes from this recession on a surprising manner. The housing

market is Australia remain stable. Interest rate in Australia did not constitute and sudden downfall. In

the housing market of USA and other contemporary nations, inflation adjusted prices went up

(Reboredo, Rivera-Castro and Zebende 2014). While Australia had showed an upward trend in housing

prices as contrasting to other nation and the general assertion.

There is no change major change in Australia’s performance trend. One factor is that apart from

USA, Australia builds is international relationship with other nations as well ( Ball 2014). There are trade

relation and investment relation among Australia and other nations. This helps the nation to mitigate

risk generated from USA recession. When a nation engaged in multilateral trade relation then the

vulnerability to shock to any one trading partners automatically reduces. Additionally, Australia grows

stronger overtime. Different sectors of the economy are now performing well and hence provide

security to the growth and development of the nation (Yilmazer, Babiarz and Liu 2015). The financial

sector of Australia is one such sector that shows outstanding performance and rescues the economy

from shocks and recession occurred in USA.

Conclusion

The report critically evaluates the relation between USA and Australia. Relation builds on

international platform has implication for growth and development of a nation. The interrelation often

implies when country is in growing or declining phase of growth then related nations are affected from

this. One such assertion is made about relation between Australia and USA. The belief here is that the

Real GDP movement in USA causes expansion or contraction of Australia economy. In order to validate

the statement, historical data on real GDP for both the nation are first considered. From the analysis

there turn out some common fluctuation point between USA and Australia. However, the common

points are not enough for drawing any conclusion. Foreign investment flows from both the nations are

next indicators to be considered. The statistics shows that USA is the major investors of Australia.

Similarly, Australia also invests as much as possible in USA. In fact, the lion share of Australia fund is

invested in USA. Related aspect of investment is the dynamics of interest rate. Interest rate in Australia

is higher and less volatile attracting foreign funds for the economy. The trade volume between USA and

Australia rises overtime and USA maintains a positive trade balance. The exchange rate movement

between US dollar and Australian dollar though volatile but decreasing in nature, raising the export flow

from USA to Australia. Finally, the impact of great recession in USA on Australian economy is analyzed.

The effect of great recession in USA has an ambiguous impact of Australia. Therefore, the claim cannot

be completely supported and the relation dynamics remains versatile.

11ECONOMIC ASSIGNMENT

References

Abdullah, A.B.M., 2017. Introduction. In Managing the Psychological Contract (pp. 1-22). Springer

International Publishing.

Apergis, N., 2014. Can gold prices forecast the Australian dollar movements?. International Review of

Economics & Finance, 29, pp.75-82.

Ball, L.M., 2014. Long-term damage from the Great Recession in OECD countries (No. w20185). National

Bureau of Economic Research.

Bernanke, B., Antonovics, K. and Frank, R., 2015. Principles of macroeconomics. McGraw-Hill Higher

Education.

Data.worldbank.org. (2017). Real interest rate (%) | Data. [online] Available at:

https://data.worldbank.org/indicator/FR.INR.RINR?end=2016&locations=AU-US&start=1984 [Accessed

21 Sep. 2017].

Dowding, K. and Martin, A., 2017. Introduction. In Policy Agendas in Australia (pp. 1-10). Springer

International Publishing.

Fred.stlouisfed.org. (2017). U.S. / Australia Foreign Exchange Rate. [online] Available at:

https://fred.stlouisfed.org/series/DEXUSAL#0 [Accessed 21 Sep. 2017].

Giljum, S., Dittrich, M., Lieber, M. and Lutter, S., 2014. Global patterns of material flows and their socio-

economic and environmental implications: a MFA study on all countries world-wide from 1980 to

2009. Resources, 3(1), pp.319-339.

Hansen, P.H., 2015. Hall of mirrors: the great depression, the great recession, and the uses—and

Misuses—of History. Business History Review, 89(3), pp.557-569.

Hirst, P., Thompson, G. and Bromley, S., 2015. Globalization in question. John Wiley & Sons.

Lindert, P.H. and Williamson, J.G., 2016. Unequal gains: American growth and inequality since

1700. Juncture, 22(4), pp.276-283.

Mukulu, S., Hettihewa, S. and Wright, C.S., 2014. Financial Contagion: An Empirical Investigation of the

Relationship Between Financial-stress Indexes of Australia and the US. The Journal of Applied Business

and Economics, 16(3), p.11.

Rachel, L. and Smith, T., 2015. Secular drivers of the global real interest rate.

Reboredo, J.C., Rivera-Castro, M.A. and Zebende, G.F., 2014. Oil and US dollar exchange rate

dependence: A detrended cross-correlation approach. Energy Economics, 42, pp.132-139.

Rousseau, P.L. and Wachtel, P. eds., 2017. Financial Systems and Economic Growth. Cambridge

University Press.

Summers, L.H., 2014. US economic prospects: Secular stagnation, hysteresis, and the zero lower

bound. Business Economics, 49(2), pp.65-73.

References

Abdullah, A.B.M., 2017. Introduction. In Managing the Psychological Contract (pp. 1-22). Springer

International Publishing.

Apergis, N., 2014. Can gold prices forecast the Australian dollar movements?. International Review of

Economics & Finance, 29, pp.75-82.

Ball, L.M., 2014. Long-term damage from the Great Recession in OECD countries (No. w20185). National

Bureau of Economic Research.

Bernanke, B., Antonovics, K. and Frank, R., 2015. Principles of macroeconomics. McGraw-Hill Higher

Education.

Data.worldbank.org. (2017). Real interest rate (%) | Data. [online] Available at:

https://data.worldbank.org/indicator/FR.INR.RINR?end=2016&locations=AU-US&start=1984 [Accessed

21 Sep. 2017].

Dowding, K. and Martin, A., 2017. Introduction. In Policy Agendas in Australia (pp. 1-10). Springer

International Publishing.

Fred.stlouisfed.org. (2017). U.S. / Australia Foreign Exchange Rate. [online] Available at:

https://fred.stlouisfed.org/series/DEXUSAL#0 [Accessed 21 Sep. 2017].

Giljum, S., Dittrich, M., Lieber, M. and Lutter, S., 2014. Global patterns of material flows and their socio-

economic and environmental implications: a MFA study on all countries world-wide from 1980 to

2009. Resources, 3(1), pp.319-339.

Hansen, P.H., 2015. Hall of mirrors: the great depression, the great recession, and the uses—and

Misuses—of History. Business History Review, 89(3), pp.557-569.

Hirst, P., Thompson, G. and Bromley, S., 2015. Globalization in question. John Wiley & Sons.

Lindert, P.H. and Williamson, J.G., 2016. Unequal gains: American growth and inequality since

1700. Juncture, 22(4), pp.276-283.

Mukulu, S., Hettihewa, S. and Wright, C.S., 2014. Financial Contagion: An Empirical Investigation of the

Relationship Between Financial-stress Indexes of Australia and the US. The Journal of Applied Business

and Economics, 16(3), p.11.

Rachel, L. and Smith, T., 2015. Secular drivers of the global real interest rate.

Reboredo, J.C., Rivera-Castro, M.A. and Zebende, G.F., 2014. Oil and US dollar exchange rate

dependence: A detrended cross-correlation approach. Energy Economics, 42, pp.132-139.

Rousseau, P.L. and Wachtel, P. eds., 2017. Financial Systems and Economic Growth. Cambridge

University Press.

Summers, L.H., 2014. US economic prospects: Secular stagnation, hysteresis, and the zero lower

bound. Business Economics, 49(2), pp.65-73.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.