Machine Learning Models for Banks' Early Warning Indicators

VerifiedAdded on 2023/06/15

|16

|6475

|185

Report

AI Summary

This report explores the use of supervised machine learning models to provide banks with early warnings of liquidity stress using market-based indicators. By transforming market stress into a classification problem, the study utilizes publicly available data from 2007 to 2021, encompassing the 2007-2008 Global Financial Crisis and the COVID-19 crisis, to train the models. The St. Louis Fed Financial Stress Index is used to define market stress levels, assigning a red-amber-green (RAG) status to each trading day to identify risk levels. An ensemble model with a random under-sampling boosting algorithm (RUSBoost) is employed to address the challenge of imbalanced data due to the limited number of "red" status days. Initial results demonstrate the model's ability to predict 83% of "red" risk days, with back-testing during the COVID-19 crisis triggering "amber" and "red" statuses as the crisis unfolded, showcasing the potential for enhanced bank risk management.

Constructing Early Warning Indicators for the Banks Using Machine

Learning Models

a

Abstract:

This work contributes to bank liquidity risk management by applying supervised machine learning

models to provide banks with early warnings of liquidity stress using market base indicators.

Identifying increasing levels of stress as early as possible provides management with a crucial

window of time in which to assess and develop a potential response. In this study, market stress was

transformed into a classification problem. Publicly available data from 2007 to 2021 was used to

train the machine learning model; this period covers two severe stress periods, namely the 2007-

2008 Global Financial Crisis and the COVID-19 crisis. The St. Louis Fed Financial Stress Index

was used to define the level of stress in the market. Each day trading was assigned a red-amber-

green (RAG) status to identify the risk level for that day. Machine learning models were then

applied to predict the RAG status of each day. Due to a significantly limited number of “red” status

days, modelling became more challenging. An ensemble model with a random under-sampling

boosting algorithm (RUSBoost) was used to improve predictions from imbalanced data. Initial

results show the machine learning model used in this study can predict 83% of “red” risk days. The

current version of the developed model has been back-tested using data from the COVID-19 crisis

and it was able to trigger “amber” and “red” statuses as the crisis was unfolding. These findings

show that the ensemble model with the RUSBoost algorithm predicts “red” and “amber” days and

average of 21% more than the average of other machine learning models and can contribute to bank

risk management.

Keywords: Early Warning Indicators, Financial Stress, Machine Learning, Ensemble model,

Liquidity Risk, Crisis Management, Covid-19 Crisis

JEL Codes: C51, C88, G21

a

? Director of Graduate School of Social Sciences, Yildiz Technical University, Turkey

Email: donduran@yildiz.edu.tr ORCID ID: 0000-0001-8514-5513

Disclaimer: The views and opinions expressed in this paper are those of the authors and they do not necessarily

reflect the views of the HSBC Group or Yildiz Technical University. The initial version of this paper presented at the 7 th

International Conference (ICE-TEA Conference) on April 9-11,2021.

Learning Models

a

Abstract:

This work contributes to bank liquidity risk management by applying supervised machine learning

models to provide banks with early warnings of liquidity stress using market base indicators.

Identifying increasing levels of stress as early as possible provides management with a crucial

window of time in which to assess and develop a potential response. In this study, market stress was

transformed into a classification problem. Publicly available data from 2007 to 2021 was used to

train the machine learning model; this period covers two severe stress periods, namely the 2007-

2008 Global Financial Crisis and the COVID-19 crisis. The St. Louis Fed Financial Stress Index

was used to define the level of stress in the market. Each day trading was assigned a red-amber-

green (RAG) status to identify the risk level for that day. Machine learning models were then

applied to predict the RAG status of each day. Due to a significantly limited number of “red” status

days, modelling became more challenging. An ensemble model with a random under-sampling

boosting algorithm (RUSBoost) was used to improve predictions from imbalanced data. Initial

results show the machine learning model used in this study can predict 83% of “red” risk days. The

current version of the developed model has been back-tested using data from the COVID-19 crisis

and it was able to trigger “amber” and “red” statuses as the crisis was unfolding. These findings

show that the ensemble model with the RUSBoost algorithm predicts “red” and “amber” days and

average of 21% more than the average of other machine learning models and can contribute to bank

risk management.

Keywords: Early Warning Indicators, Financial Stress, Machine Learning, Ensemble model,

Liquidity Risk, Crisis Management, Covid-19 Crisis

JEL Codes: C51, C88, G21

a

? Director of Graduate School of Social Sciences, Yildiz Technical University, Turkey

Email: donduran@yildiz.edu.tr ORCID ID: 0000-0001-8514-5513

Disclaimer: The views and opinions expressed in this paper are those of the authors and they do not necessarily

reflect the views of the HSBC Group or Yildiz Technical University. The initial version of this paper presented at the 7 th

International Conference (ICE-TEA Conference) on April 9-11,2021.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. Introduction

Bank risk management has become more complicated with the evolving regulatory framework

following the 2007-2008 global financial crisis. With increased regulation and advancements in risk

management practices, it is expected banks and the wider financial system will be more resilient to

shocks. However, any new crisis may unfold uniquely which will require management to be on alert

if the market stress level changes unexpectedly.

Banks have adapted to the current relatively complex environment with large costly investments.

Extensive transformation projects have been implemented for systems, reporting, modelling and

governance. The granularity of the risk data produced and reported has thus increased significantly.

Producing and reporting a significant amount of information does not necessarily give all the

answers, however. A few questions remain open on an ongoing basis, e.g. what are the stress levels

in the market, what is the perception of the clients and counterparties for a specific bank’s risk

level, and in the very short term, is there any emerging stress? These questions all need an answer to

define an alert level for any development in the market which may jeopardise banks survival in a

stress environment. For this reason, banks regularly monitor the market and internal bank indicators

to have a view of developing events.

Indicators, providing early detection of developing stress, will be referred to as Early Warning

Indicators (EWIs). It is a standard practice to monitor several indicators with defined thresholds to

inform management stress levels of the market. However, this study will bring a novel way of

looking at these indicators by using supervised machine learning models and transforming them

into a classification problem without creating another stress index.

There are three main motivations behind this study. Firstly, early warning indicators research in the

literature is often focussed on the policymaker perspective, but not the perspective of a bank as an

individual agent in the financial system. Secondly, research using machine learning models to

detect financial stress levels is in its early stages and still developing, therefore the addition of the

Ensemble classifier with a random under sampling algorithm, as applied by this study, will provide

a unique contribution to the field. Lastly, this study focusses on the immediate nature of the warning

based on daily data available publicly, which links real time market data and an institution’s internal

EWIs. This last item is specifically important in the variable selection, since different frequency and

granularity of data is available for the specific institution compared to the policymakers. In addition,

the flexibility of the proposed supervised machine learning model makes it possible to be used in

different markets and by different stakeholders such as investors, regulators, or central banks.

This study is organised as follows: Section 2 contains a review of existing literature; Section 3

provides definitions of and a framework for early warning indicators; Section 4 outlines the data

selected for this study and summarises the data transformation process; Section 5 outlines the

methodology of this study, while Section 6 discusses the results of this study. Section 7 summarises

the findings of the empirical analysis and discusses its policy implications.

2. Literature Review

According to Leo, Sharma and Maddulety (2019) bank in the current era is rapid growth

and development which require firm to pay attention on having significant information regarding

prevailing risk so that higher profitability can be derived. There are several components which can

be assessed by using different kinds of the models of machine learning. It helps in receiving number

Bank risk management has become more complicated with the evolving regulatory framework

following the 2007-2008 global financial crisis. With increased regulation and advancements in risk

management practices, it is expected banks and the wider financial system will be more resilient to

shocks. However, any new crisis may unfold uniquely which will require management to be on alert

if the market stress level changes unexpectedly.

Banks have adapted to the current relatively complex environment with large costly investments.

Extensive transformation projects have been implemented for systems, reporting, modelling and

governance. The granularity of the risk data produced and reported has thus increased significantly.

Producing and reporting a significant amount of information does not necessarily give all the

answers, however. A few questions remain open on an ongoing basis, e.g. what are the stress levels

in the market, what is the perception of the clients and counterparties for a specific bank’s risk

level, and in the very short term, is there any emerging stress? These questions all need an answer to

define an alert level for any development in the market which may jeopardise banks survival in a

stress environment. For this reason, banks regularly monitor the market and internal bank indicators

to have a view of developing events.

Indicators, providing early detection of developing stress, will be referred to as Early Warning

Indicators (EWIs). It is a standard practice to monitor several indicators with defined thresholds to

inform management stress levels of the market. However, this study will bring a novel way of

looking at these indicators by using supervised machine learning models and transforming them

into a classification problem without creating another stress index.

There are three main motivations behind this study. Firstly, early warning indicators research in the

literature is often focussed on the policymaker perspective, but not the perspective of a bank as an

individual agent in the financial system. Secondly, research using machine learning models to

detect financial stress levels is in its early stages and still developing, therefore the addition of the

Ensemble classifier with a random under sampling algorithm, as applied by this study, will provide

a unique contribution to the field. Lastly, this study focusses on the immediate nature of the warning

based on daily data available publicly, which links real time market data and an institution’s internal

EWIs. This last item is specifically important in the variable selection, since different frequency and

granularity of data is available for the specific institution compared to the policymakers. In addition,

the flexibility of the proposed supervised machine learning model makes it possible to be used in

different markets and by different stakeholders such as investors, regulators, or central banks.

This study is organised as follows: Section 2 contains a review of existing literature; Section 3

provides definitions of and a framework for early warning indicators; Section 4 outlines the data

selected for this study and summarises the data transformation process; Section 5 outlines the

methodology of this study, while Section 6 discusses the results of this study. Section 7 summarises

the findings of the empirical analysis and discusses its policy implications.

2. Literature Review

According to Leo, Sharma and Maddulety (2019) bank in the current era is rapid growth

and development which require firm to pay attention on having significant information regarding

prevailing risk so that higher profitability can be derived. There are several components which can

be assessed by using different kinds of the models of machine learning. It helps in receiving number

of benefits like automation of everything, wide rage of application and scope of improvement. In

against to this, Loisel, Piette and Tsai (2021) depicted that machine learning is one of the crucial

technique that is helpful in assessing particular pattern which gives insights regarding certain

pattern so that set of data can be obtained. It contributes in identifying the crucial aspects which are

helpful in getting additional intelligence so that risk providing factor can be identified and

eliminated. On the other side, Paltrinieri, Comfort and Reniers (2019) articulated that in banking

sector there is need to pay attention on managing risk by adopting appropriate machine learning

method so that significant ability to detect fraud of lending, regulatory compliance, etc. can be

identified.

In the views of Ghorbanzadeh and et.al., (2019) there are number of factors which lead to

threat the smooth functioning of the bank. In order to successfully operate and functioning of the

banking sector it is highly essential for the organization to concentrate on the factors that lead to

hinder performance. It includes factors like credit, operational, market, etc are few factors that has

impact on the business. For having relevant functioning and processing banking sector with help of

machine learning can derive proper information regarding this aspects so that relevant course of

action can be taken to modify performance. On the other side, Bussmann and et.al., (2021) said that

important aspects which lead to influence the functioning of the organization so that moral hazard,

reputation, business, systematic, etc. These component has adverse impact on the functioning of

baking. The main reason behind such course of action includes possibility of high error, data

acquisition and time & space. These are the crucial disadvantages so that appropriate action to take

improvement can become possible. In contrast to this, Kushwaha and et.al., (2020) there are number

of benefits which can be derived by involving, machine learning model in banking activities such as

faster work, mobility of labour, algorithm selection, heavy & delicate work. These advantages tend

to give significant impact on the processing of the organization which allows to greater extent of

efficiency so that objective can be fulfilled.

In the views of Yu and et.al., (2021) exponential growth in the sector can be achieved by

adopting appropriate computing power & data availability so that new opportunities can be derived.

It has three type involve supervised, unsupervised and semi supervised learning. It aids in risk

responding planning, monitoring & control, etc. On the other side, Tripathi and et.al., 2021 there are

several methods which are taken into consideration by organization for overcoming risk

management in turn deep, visual recognition, natural language processing, etc. For handling the

issues like non crucial aspects business is required to pay attention on evaluating this method as

well machine learning does not allow getting proper functioning. On contrast to this, Chen and

Chen (2021)articulated that with machine learning to provide financial services can be done

against to this, Loisel, Piette and Tsai (2021) depicted that machine learning is one of the crucial

technique that is helpful in assessing particular pattern which gives insights regarding certain

pattern so that set of data can be obtained. It contributes in identifying the crucial aspects which are

helpful in getting additional intelligence so that risk providing factor can be identified and

eliminated. On the other side, Paltrinieri, Comfort and Reniers (2019) articulated that in banking

sector there is need to pay attention on managing risk by adopting appropriate machine learning

method so that significant ability to detect fraud of lending, regulatory compliance, etc. can be

identified.

In the views of Ghorbanzadeh and et.al., (2019) there are number of factors which lead to

threat the smooth functioning of the bank. In order to successfully operate and functioning of the

banking sector it is highly essential for the organization to concentrate on the factors that lead to

hinder performance. It includes factors like credit, operational, market, etc are few factors that has

impact on the business. For having relevant functioning and processing banking sector with help of

machine learning can derive proper information regarding this aspects so that relevant course of

action can be taken to modify performance. On the other side, Bussmann and et.al., (2021) said that

important aspects which lead to influence the functioning of the organization so that moral hazard,

reputation, business, systematic, etc. These component has adverse impact on the functioning of

baking. The main reason behind such course of action includes possibility of high error, data

acquisition and time & space. These are the crucial disadvantages so that appropriate action to take

improvement can become possible. In contrast to this, Kushwaha and et.al., (2020) there are number

of benefits which can be derived by involving, machine learning model in banking activities such as

faster work, mobility of labour, algorithm selection, heavy & delicate work. These advantages tend

to give significant impact on the processing of the organization which allows to greater extent of

efficiency so that objective can be fulfilled.

In the views of Yu and et.al., (2021) exponential growth in the sector can be achieved by

adopting appropriate computing power & data availability so that new opportunities can be derived.

It has three type involve supervised, unsupervised and semi supervised learning. It aids in risk

responding planning, monitoring & control, etc. On the other side, Tripathi and et.al., 2021 there are

several methods which are taken into consideration by organization for overcoming risk

management in turn deep, visual recognition, natural language processing, etc. For handling the

issues like non crucial aspects business is required to pay attention on evaluating this method as

well machine learning does not allow getting proper functioning. On contrast to this, Chen and

Chen (2021)articulated that with machine learning to provide financial services can be done

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

effectively. The main reason behind this is to get the appropriate level of ability to recognize

prevailing financial lacking area. It focuses on receiving competitive advantages include customer

service, accurate bank operations, financial advisor, fraud detecting, compliance with customer

service, etc. On the basis of this, it can be identified that financial advisory with having automated

trading is found to be crucial in overcoming practices so that operating practices without being

explicitly programmed.

According to Khan and Malaika (2021) there are number of actions which can be taken into

practice by the banking sector for having significant improvement action in order to construct

relevant strategy to ensure sustainability. It can be improved by ensuring relevant feature selection,

ensemble learning algorithms, handling missing value, etc. This can be modified by ensuring that

proper application is exerted by avoiding such aspects so that higher customer satisfaction can be

derived. On the other side, Van Greuning and Bratanovic (2020) depicted that risk management for

constructing relevant strategy becomes possible by having automated tedious task like organizing

information, reporting trends, organizing information, etc so that sound decision to plan functioning

for business can become possible. In against to this, Permatasari (2021) stated that classification of

problem is one of the significant action that contribute in achieving the relevant processing so that

higher profitability by eliminating non crucial aspects can become possible. On the basis of the

provided information it can be specified that constructing appropriate policy with help of machine

learning model helps in managing prevailing risk.

3. Early Warning Indicators (EWIs) Definitions and Framework

In this study, EWIs are defined as any data or information used to predict a potential stress event.

This can be numerical or categorical data. Market-based indicators reflect the health of the

economy, bank and firm, and can predict changes in financial conditions (Kliesen & McCracken,

2020).

Examples of EWIs include, but are not limited to, the following:

Market EWIs: These are mainly external data sources such as equity prices, interest rates,

spreads, commodity prices, macroeconomic variables, credit ratings, futures, foreign

exchange rates, policy rates, stock indices, volatility indices, and secured funding spreads.

Internal EWIs: These are bank-specific measures including capital position, deposit

outflows, maturity mismatch, stress test results, bank own credit rating and CDS spread,

credit losses measures, liquidity and funding metrics, market sentiment, share price, funding

spread compare to peers, concentration metrics, negative publicity, and increasing currency

mismatches.

prevailing financial lacking area. It focuses on receiving competitive advantages include customer

service, accurate bank operations, financial advisor, fraud detecting, compliance with customer

service, etc. On the basis of this, it can be identified that financial advisory with having automated

trading is found to be crucial in overcoming practices so that operating practices without being

explicitly programmed.

According to Khan and Malaika (2021) there are number of actions which can be taken into

practice by the banking sector for having significant improvement action in order to construct

relevant strategy to ensure sustainability. It can be improved by ensuring relevant feature selection,

ensemble learning algorithms, handling missing value, etc. This can be modified by ensuring that

proper application is exerted by avoiding such aspects so that higher customer satisfaction can be

derived. On the other side, Van Greuning and Bratanovic (2020) depicted that risk management for

constructing relevant strategy becomes possible by having automated tedious task like organizing

information, reporting trends, organizing information, etc so that sound decision to plan functioning

for business can become possible. In against to this, Permatasari (2021) stated that classification of

problem is one of the significant action that contribute in achieving the relevant processing so that

higher profitability by eliminating non crucial aspects can become possible. On the basis of the

provided information it can be specified that constructing appropriate policy with help of machine

learning model helps in managing prevailing risk.

3. Early Warning Indicators (EWIs) Definitions and Framework

In this study, EWIs are defined as any data or information used to predict a potential stress event.

This can be numerical or categorical data. Market-based indicators reflect the health of the

economy, bank and firm, and can predict changes in financial conditions (Kliesen & McCracken,

2020).

Examples of EWIs include, but are not limited to, the following:

Market EWIs: These are mainly external data sources such as equity prices, interest rates,

spreads, commodity prices, macroeconomic variables, credit ratings, futures, foreign

exchange rates, policy rates, stock indices, volatility indices, and secured funding spreads.

Internal EWIs: These are bank-specific measures including capital position, deposit

outflows, maturity mismatch, stress test results, bank own credit rating and CDS spread,

credit losses measures, liquidity and funding metrics, market sentiment, share price, funding

spread compare to peers, concentration metrics, negative publicity, and increasing currency

mismatches.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

A comprehensive list of Market and Internal EWIs can be seen in Venkat and Baird(2016) chapter 6

(authored by Bruce Choy and Girish Adake) and the BIS (2008) suggested EWIs for liquidity risk.

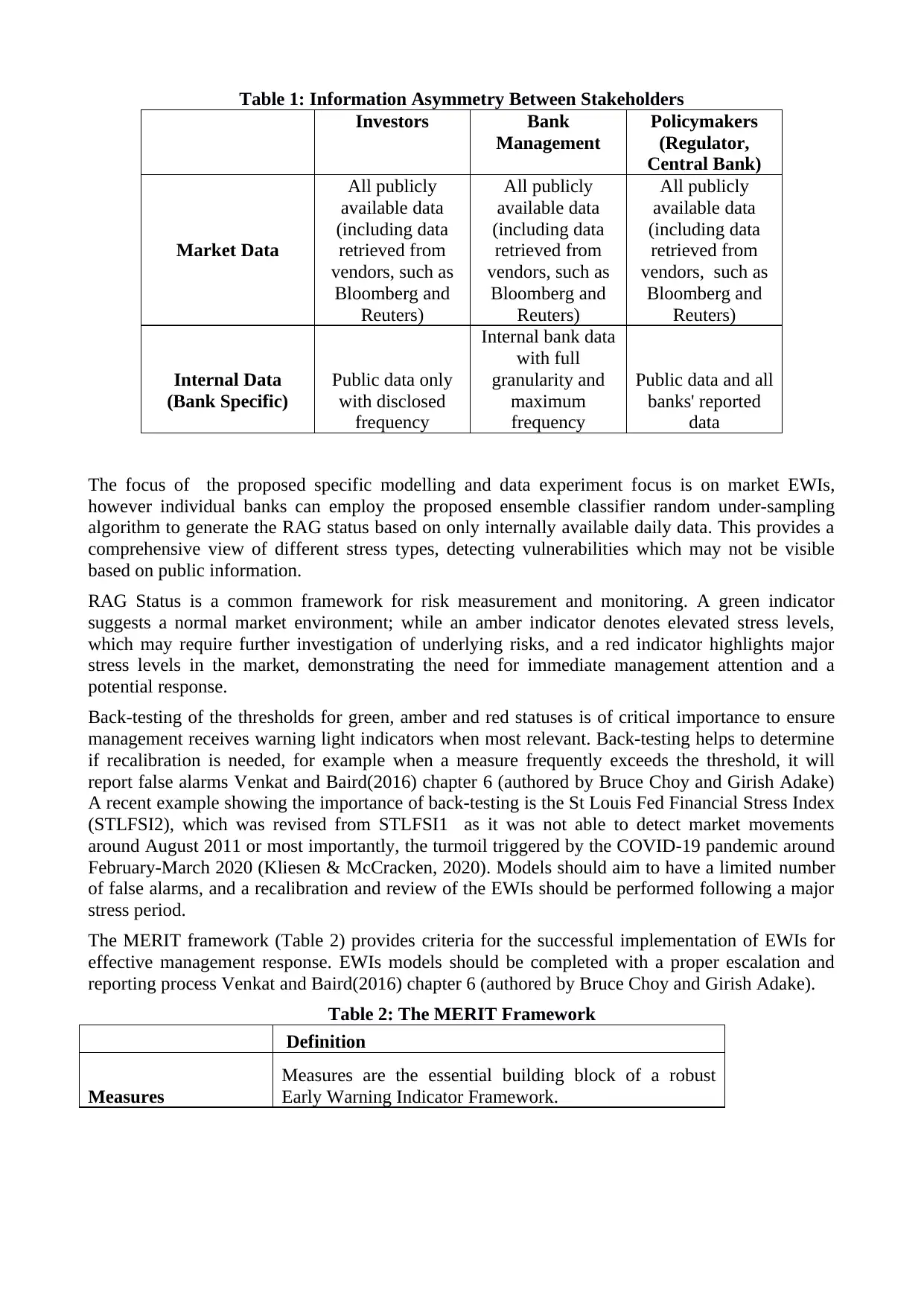

The following table (Table 1) summarises data asymmetry in the modelling literature on EWIs.

Data asymmetry is important since it defines which EWIs can be used in the modelling depending

on the stakeholders’ perspective. For instance, individual banks cannot build models which include

other banks’ daily risk data, which is only available to the other banks with production frequency

and to the regulator with reporting frequency.

(authored by Bruce Choy and Girish Adake) and the BIS (2008) suggested EWIs for liquidity risk.

The following table (Table 1) summarises data asymmetry in the modelling literature on EWIs.

Data asymmetry is important since it defines which EWIs can be used in the modelling depending

on the stakeholders’ perspective. For instance, individual banks cannot build models which include

other banks’ daily risk data, which is only available to the other banks with production frequency

and to the regulator with reporting frequency.

Table 1: Information Asymmetry Between Stakeholders

Investors Bank

Management

Policymakers

(Regulator,

Central Bank)

Market Data

All publicly

available data

(including data

retrieved from

vendors, such as

Bloomberg and

Reuters)

All publicly

available data

(including data

retrieved from

vendors, such as

Bloomberg and

Reuters)

All publicly

available data

(including data

retrieved from

vendors, such as

Bloomberg and

Reuters)

Internal Data

(Bank Specific)

Public data only

with disclosed

frequency

Internal bank data

with full

granularity and

maximum

frequency

Public data and all

banks' reported

data

The focus of the proposed specific modelling and data experiment focus is on market EWIs,

however individual banks can employ the proposed ensemble classifier random under-sampling

algorithm to generate the RAG status based on only internally available daily data. This provides a

comprehensive view of different stress types, detecting vulnerabilities which may not be visible

based on public information.

RAG Status is a common framework for risk measurement and monitoring. A green indicator

suggests a normal market environment; while an amber indicator denotes elevated stress levels,

which may require further investigation of underlying risks, and a red indicator highlights major

stress levels in the market, demonstrating the need for immediate management attention and a

potential response.

Back-testing of the thresholds for green, amber and red statuses is of critical importance to ensure

management receives warning light indicators when most relevant. Back-testing helps to determine

if recalibration is needed, for example when a measure frequently exceeds the threshold, it will

report false alarms Venkat and Baird(2016) chapter 6 (authored by Bruce Choy and Girish Adake)

A recent example showing the importance of back-testing is the St Louis Fed Financial Stress Index

(STLFSI2), which was revised from STLFSI1 as it was not able to detect market movements

around August 2011 or most importantly, the turmoil triggered by the COVID-19 pandemic around

February-March 2020 (Kliesen & McCracken, 2020). Models should aim to have a limited number

of false alarms, and a recalibration and review of the EWIs should be performed following a major

stress period.

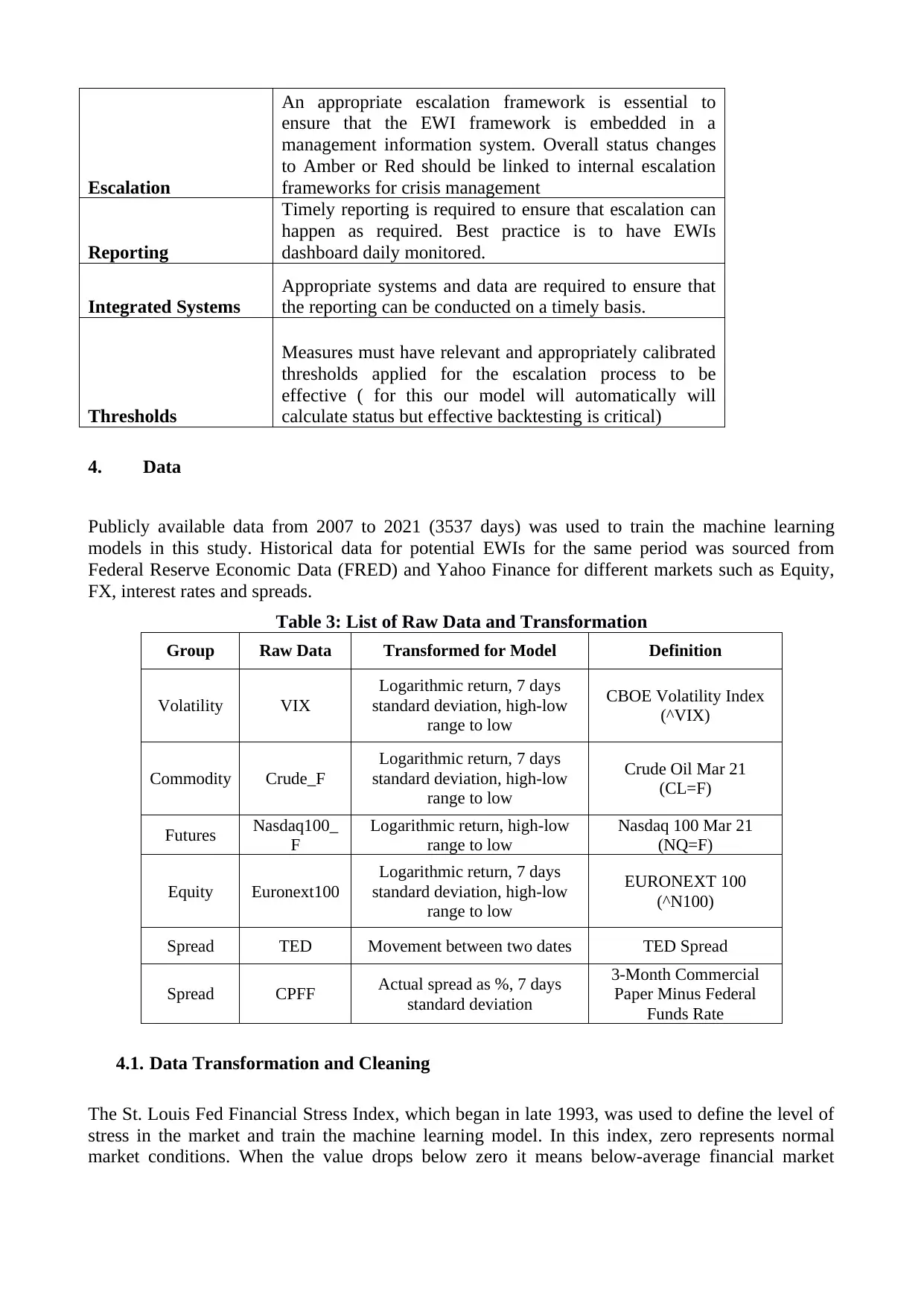

The MERIT framework (Table 2) provides criteria for the successful implementation of EWIs for

effective management response. EWIs models should be completed with a proper escalation and

reporting process Venkat and Baird(2016) chapter 6 (authored by Bruce Choy and Girish Adake).

Table 2: The MERIT Framework

Definition

Measures

Measures are the essential building block of a robust

Early Warning Indicator Framework.

Investors Bank

Management

Policymakers

(Regulator,

Central Bank)

Market Data

All publicly

available data

(including data

retrieved from

vendors, such as

Bloomberg and

Reuters)

All publicly

available data

(including data

retrieved from

vendors, such as

Bloomberg and

Reuters)

All publicly

available data

(including data

retrieved from

vendors, such as

Bloomberg and

Reuters)

Internal Data

(Bank Specific)

Public data only

with disclosed

frequency

Internal bank data

with full

granularity and

maximum

frequency

Public data and all

banks' reported

data

The focus of the proposed specific modelling and data experiment focus is on market EWIs,

however individual banks can employ the proposed ensemble classifier random under-sampling

algorithm to generate the RAG status based on only internally available daily data. This provides a

comprehensive view of different stress types, detecting vulnerabilities which may not be visible

based on public information.

RAG Status is a common framework for risk measurement and monitoring. A green indicator

suggests a normal market environment; while an amber indicator denotes elevated stress levels,

which may require further investigation of underlying risks, and a red indicator highlights major

stress levels in the market, demonstrating the need for immediate management attention and a

potential response.

Back-testing of the thresholds for green, amber and red statuses is of critical importance to ensure

management receives warning light indicators when most relevant. Back-testing helps to determine

if recalibration is needed, for example when a measure frequently exceeds the threshold, it will

report false alarms Venkat and Baird(2016) chapter 6 (authored by Bruce Choy and Girish Adake)

A recent example showing the importance of back-testing is the St Louis Fed Financial Stress Index

(STLFSI2), which was revised from STLFSI1 as it was not able to detect market movements

around August 2011 or most importantly, the turmoil triggered by the COVID-19 pandemic around

February-March 2020 (Kliesen & McCracken, 2020). Models should aim to have a limited number

of false alarms, and a recalibration and review of the EWIs should be performed following a major

stress period.

The MERIT framework (Table 2) provides criteria for the successful implementation of EWIs for

effective management response. EWIs models should be completed with a proper escalation and

reporting process Venkat and Baird(2016) chapter 6 (authored by Bruce Choy and Girish Adake).

Table 2: The MERIT Framework

Definition

Measures

Measures are the essential building block of a robust

Early Warning Indicator Framework.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Escalation

An appropriate escalation framework is essential to

ensure that the EWI framework is embedded in a

management information system. Overall status changes

to Amber or Red should be linked to internal escalation

frameworks for crisis management

Reporting

Timely reporting is required to ensure that escalation can

happen as required. Best practice is to have EWIs

dashboard daily monitored.

Integrated Systems

Appropriate systems and data are required to ensure that

the reporting can be conducted on a timely basis.

Thresholds

Measures must have relevant and appropriately calibrated

thresholds applied for the escalation process to be

effective ( for this our model will automatically will

calculate status but effective backtesting is critical)

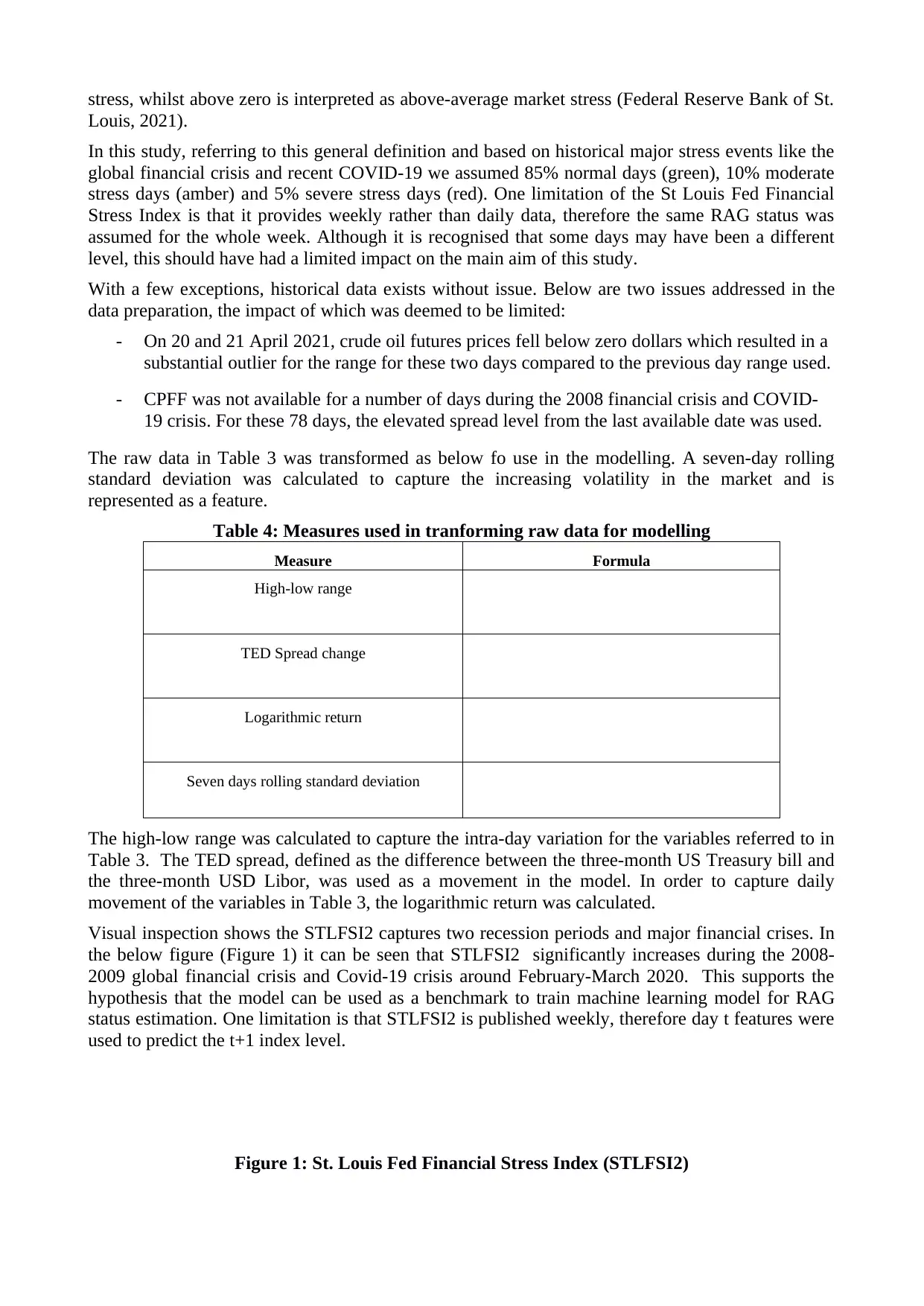

4. Data

Publicly available data from 2007 to 2021 (3537 days) was used to train the machine learning

models in this study. Historical data for potential EWIs for the same period was sourced from

Federal Reserve Economic Data (FRED) and Yahoo Finance for different markets such as Equity,

FX, interest rates and spreads.

Table 3: List of Raw Data and Transformation

Group Raw Data Transformed for Model Definition

Volatility VIX

Logarithmic return, 7 days

standard deviation, high-low

range to low

CBOE Volatility Index

(^VIX)

Commodity Crude_F

Logarithmic return, 7 days

standard deviation, high-low

range to low

Crude Oil Mar 21

(CL=F)

Futures Nasdaq100_

F

Logarithmic return, high-low

range to low

Nasdaq 100 Mar 21

(NQ=F)

Equity Euronext100

Logarithmic return, 7 days

standard deviation, high-low

range to low

EURONEXT 100

(^N100)

Spread TED Movement between two dates TED Spread

Spread CPFF Actual spread as %, 7 days

standard deviation

3-Month Commercial

Paper Minus Federal

Funds Rate

4.1. Data Transformation and Cleaning

The St. Louis Fed Financial Stress Index, which began in late 1993, was used to define the level of

stress in the market and train the machine learning model. In this index, zero represents normal

market conditions. When the value drops below zero it means below-average financial market

An appropriate escalation framework is essential to

ensure that the EWI framework is embedded in a

management information system. Overall status changes

to Amber or Red should be linked to internal escalation

frameworks for crisis management

Reporting

Timely reporting is required to ensure that escalation can

happen as required. Best practice is to have EWIs

dashboard daily monitored.

Integrated Systems

Appropriate systems and data are required to ensure that

the reporting can be conducted on a timely basis.

Thresholds

Measures must have relevant and appropriately calibrated

thresholds applied for the escalation process to be

effective ( for this our model will automatically will

calculate status but effective backtesting is critical)

4. Data

Publicly available data from 2007 to 2021 (3537 days) was used to train the machine learning

models in this study. Historical data for potential EWIs for the same period was sourced from

Federal Reserve Economic Data (FRED) and Yahoo Finance for different markets such as Equity,

FX, interest rates and spreads.

Table 3: List of Raw Data and Transformation

Group Raw Data Transformed for Model Definition

Volatility VIX

Logarithmic return, 7 days

standard deviation, high-low

range to low

CBOE Volatility Index

(^VIX)

Commodity Crude_F

Logarithmic return, 7 days

standard deviation, high-low

range to low

Crude Oil Mar 21

(CL=F)

Futures Nasdaq100_

F

Logarithmic return, high-low

range to low

Nasdaq 100 Mar 21

(NQ=F)

Equity Euronext100

Logarithmic return, 7 days

standard deviation, high-low

range to low

EURONEXT 100

(^N100)

Spread TED Movement between two dates TED Spread

Spread CPFF Actual spread as %, 7 days

standard deviation

3-Month Commercial

Paper Minus Federal

Funds Rate

4.1. Data Transformation and Cleaning

The St. Louis Fed Financial Stress Index, which began in late 1993, was used to define the level of

stress in the market and train the machine learning model. In this index, zero represents normal

market conditions. When the value drops below zero it means below-average financial market

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

stress, whilst above zero is interpreted as above-average market stress (Federal Reserve Bank of St.

Louis, 2021).

In this study, referring to this general definition and based on historical major stress events like the

global financial crisis and recent COVID-19 we assumed 85% normal days (green), 10% moderate

stress days (amber) and 5% severe stress days (red). One limitation of the St Louis Fed Financial

Stress Index is that it provides weekly rather than daily data, therefore the same RAG status was

assumed for the whole week. Although it is recognised that some days may have been a different

level, this should have had a limited impact on the main aim of this study.

With a few exceptions, historical data exists without issue. Below are two issues addressed in the

data preparation, the impact of which was deemed to be limited:

- On 20 and 21 April 2021, crude oil futures prices fell below zero dollars which resulted in a

substantial outlier for the range for these two days compared to the previous day range used.

- CPFF was not available for a number of days during the 2008 financial crisis and COVID-

19 crisis. For these 78 days, the elevated spread level from the last available date was used.

The raw data in Table 3 was transformed as below fo use in the modelling. A seven-day rolling

standard deviation was calculated to capture the increasing volatility in the market and is

represented as a feature.

Table 4: Measures used in tranforming raw data for modelling

Measure Formula

High-low range

TED Spread change

Logarithmic return

Seven days rolling standard deviation

The high-low range was calculated to capture the intra-day variation for the variables referred to in

Table 3. The TED spread, defined as the difference between the three-month US Treasury bill and

the three-month USD Libor, was used as a movement in the model. In order to capture daily

movement of the variables in Table 3, the logarithmic return was calculated.

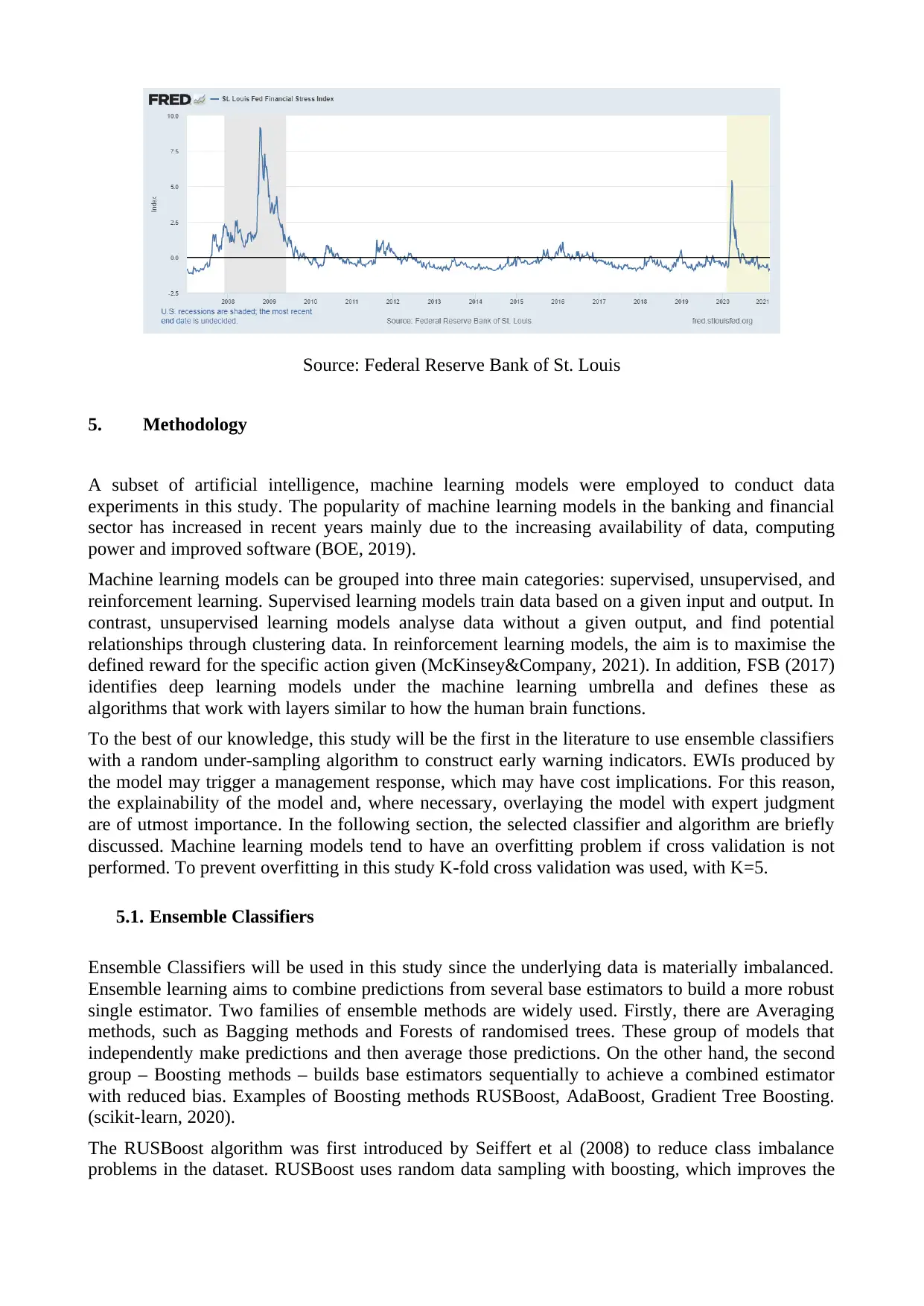

Visual inspection shows the STLFSI2 captures two recession periods and major financial crises. In

the below figure (Figure 1) it can be seen that STLFSI2 significantly increases during the 2008-

2009 global financial crisis and Covid-19 crisis around February-March 2020. This supports the

hypothesis that the model can be used as a benchmark to train machine learning model for RAG

status estimation. One limitation is that STLFSI2 is published weekly, therefore day t features were

used to predict the t+1 index level.

Figure 1: St. Louis Fed Financial Stress Index (STLFSI2)

Louis, 2021).

In this study, referring to this general definition and based on historical major stress events like the

global financial crisis and recent COVID-19 we assumed 85% normal days (green), 10% moderate

stress days (amber) and 5% severe stress days (red). One limitation of the St Louis Fed Financial

Stress Index is that it provides weekly rather than daily data, therefore the same RAG status was

assumed for the whole week. Although it is recognised that some days may have been a different

level, this should have had a limited impact on the main aim of this study.

With a few exceptions, historical data exists without issue. Below are two issues addressed in the

data preparation, the impact of which was deemed to be limited:

- On 20 and 21 April 2021, crude oil futures prices fell below zero dollars which resulted in a

substantial outlier for the range for these two days compared to the previous day range used.

- CPFF was not available for a number of days during the 2008 financial crisis and COVID-

19 crisis. For these 78 days, the elevated spread level from the last available date was used.

The raw data in Table 3 was transformed as below fo use in the modelling. A seven-day rolling

standard deviation was calculated to capture the increasing volatility in the market and is

represented as a feature.

Table 4: Measures used in tranforming raw data for modelling

Measure Formula

High-low range

TED Spread change

Logarithmic return

Seven days rolling standard deviation

The high-low range was calculated to capture the intra-day variation for the variables referred to in

Table 3. The TED spread, defined as the difference between the three-month US Treasury bill and

the three-month USD Libor, was used as a movement in the model. In order to capture daily

movement of the variables in Table 3, the logarithmic return was calculated.

Visual inspection shows the STLFSI2 captures two recession periods and major financial crises. In

the below figure (Figure 1) it can be seen that STLFSI2 significantly increases during the 2008-

2009 global financial crisis and Covid-19 crisis around February-March 2020. This supports the

hypothesis that the model can be used as a benchmark to train machine learning model for RAG

status estimation. One limitation is that STLFSI2 is published weekly, therefore day t features were

used to predict the t+1 index level.

Figure 1: St. Louis Fed Financial Stress Index (STLFSI2)

Source: Federal Reserve Bank of St. Louis

5. Methodology

A subset of artificial intelligence, machine learning models were employed to conduct data

experiments in this study. The popularity of machine learning models in the banking and financial

sector has increased in recent years mainly due to the increasing availability of data, computing

power and improved software (BOE, 2019).

Machine learning models can be grouped into three main categories: supervised, unsupervised, and

reinforcement learning. Supervised learning models train data based on a given input and output. In

contrast, unsupervised learning models analyse data without a given output, and find potential

relationships through clustering data. In reinforcement learning models, the aim is to maximise the

defined reward for the specific action given (McKinsey&Company, 2021). In addition, FSB (2017)

identifies deep learning models under the machine learning umbrella and defines these as

algorithms that work with layers similar to how the human brain functions.

To the best of our knowledge, this study will be the first in the literature to use ensemble classifiers

with a random under-sampling algorithm to construct early warning indicators. EWIs produced by

the model may trigger a management response, which may have cost implications. For this reason,

the explainability of the model and, where necessary, overlaying the model with expert judgment

are of utmost importance. In the following section, the selected classifier and algorithm are briefly

discussed. Machine learning models tend to have an overfitting problem if cross validation is not

performed. To prevent overfitting in this study K-fold cross validation was used, with K=5.

5.1. Ensemble Classifiers

Ensemble Classifiers will be used in this study since the underlying data is materially imbalanced.

Ensemble learning aims to combine predictions from several base estimators to build a more robust

single estimator. Two families of ensemble methods are widely used. Firstly, there are Averaging

methods, such as Bagging methods and Forests of randomised trees. These group of models that

independently make predictions and then average those predictions. On the other hand, the second

group – Boosting methods – builds base estimators sequentially to achieve a combined estimator

with reduced bias. Examples of Boosting methods RUSBoost, AdaBoost, Gradient Tree Boosting.

(scikit-learn, 2020).

The RUSBoost algorithm was first introduced by Seiffert et al (2008) to reduce class imbalance

problems in the dataset. RUSBoost uses random data sampling with boosting, which improves the

5. Methodology

A subset of artificial intelligence, machine learning models were employed to conduct data

experiments in this study. The popularity of machine learning models in the banking and financial

sector has increased in recent years mainly due to the increasing availability of data, computing

power and improved software (BOE, 2019).

Machine learning models can be grouped into three main categories: supervised, unsupervised, and

reinforcement learning. Supervised learning models train data based on a given input and output. In

contrast, unsupervised learning models analyse data without a given output, and find potential

relationships through clustering data. In reinforcement learning models, the aim is to maximise the

defined reward for the specific action given (McKinsey&Company, 2021). In addition, FSB (2017)

identifies deep learning models under the machine learning umbrella and defines these as

algorithms that work with layers similar to how the human brain functions.

To the best of our knowledge, this study will be the first in the literature to use ensemble classifiers

with a random under-sampling algorithm to construct early warning indicators. EWIs produced by

the model may trigger a management response, which may have cost implications. For this reason,

the explainability of the model and, where necessary, overlaying the model with expert judgment

are of utmost importance. In the following section, the selected classifier and algorithm are briefly

discussed. Machine learning models tend to have an overfitting problem if cross validation is not

performed. To prevent overfitting in this study K-fold cross validation was used, with K=5.

5.1. Ensemble Classifiers

Ensemble Classifiers will be used in this study since the underlying data is materially imbalanced.

Ensemble learning aims to combine predictions from several base estimators to build a more robust

single estimator. Two families of ensemble methods are widely used. Firstly, there are Averaging

methods, such as Bagging methods and Forests of randomised trees. These group of models that

independently make predictions and then average those predictions. On the other hand, the second

group – Boosting methods – builds base estimators sequentially to achieve a combined estimator

with reduced bias. Examples of Boosting methods RUSBoost, AdaBoost, Gradient Tree Boosting.

(scikit-learn, 2020).

The RUSBoost algorithm was first introduced by Seiffert et al (2008) to reduce class imbalance

problems in the dataset. RUSBoost uses random data sampling with boosting, which improves the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

classification performance of the training data. Financial stress or distress bank classification

problems have imbalanced data, wherein one class has far fewer members than others. For this

reason, the RUSBoost algorithm is used for the modelling in this study. For a comprehensive

overview of the RUSBoost algorithm, please refer to Seiffert et al (2010).

Matlab 2019a version is used for the implementation of the models which has eleven ensemble

learning algorithms. Out of these eleven methods, Random Undersampling Boosting (RUSBoost

method) is a better fit for imbalanced data and can be used for binary and multiclass classification.

Matlab’s random under-sampling algorithm takes the same number of observations from each class

of data, which is the same as the number of the minority class. Following sampling, adaptive

boosting is applied to construct the ensemble. For full details see Matlab documentation under

Ensemble Algorithms (MATLAB, Ensemble Algorithms, 2019).

The boosting procedure for RUSBoost applies adaptive boosting for multiclass classification in

calibrating weights and constructing ensembles. Adaptive boosting for multiclass classification in

MATLAB uses weighted pseudo-loss for N observation and K classes. Calculated pseudo-loss is

used as a measure of classification accuracy (MATLAB, Ensemble Algorithms, 2019).

- Each step represented by t, k represents class, N number of observations, K classes

- is a vector of predictor values for observation n,

- represents the true class value taking one of the

- represents the prediction of the learner for each step t

- is the confidence of learner prediction at step t, class k range from zeo to one,

- represents observation weights of class k in step t

5.2. Performance Evaluation Metrics and Definitions

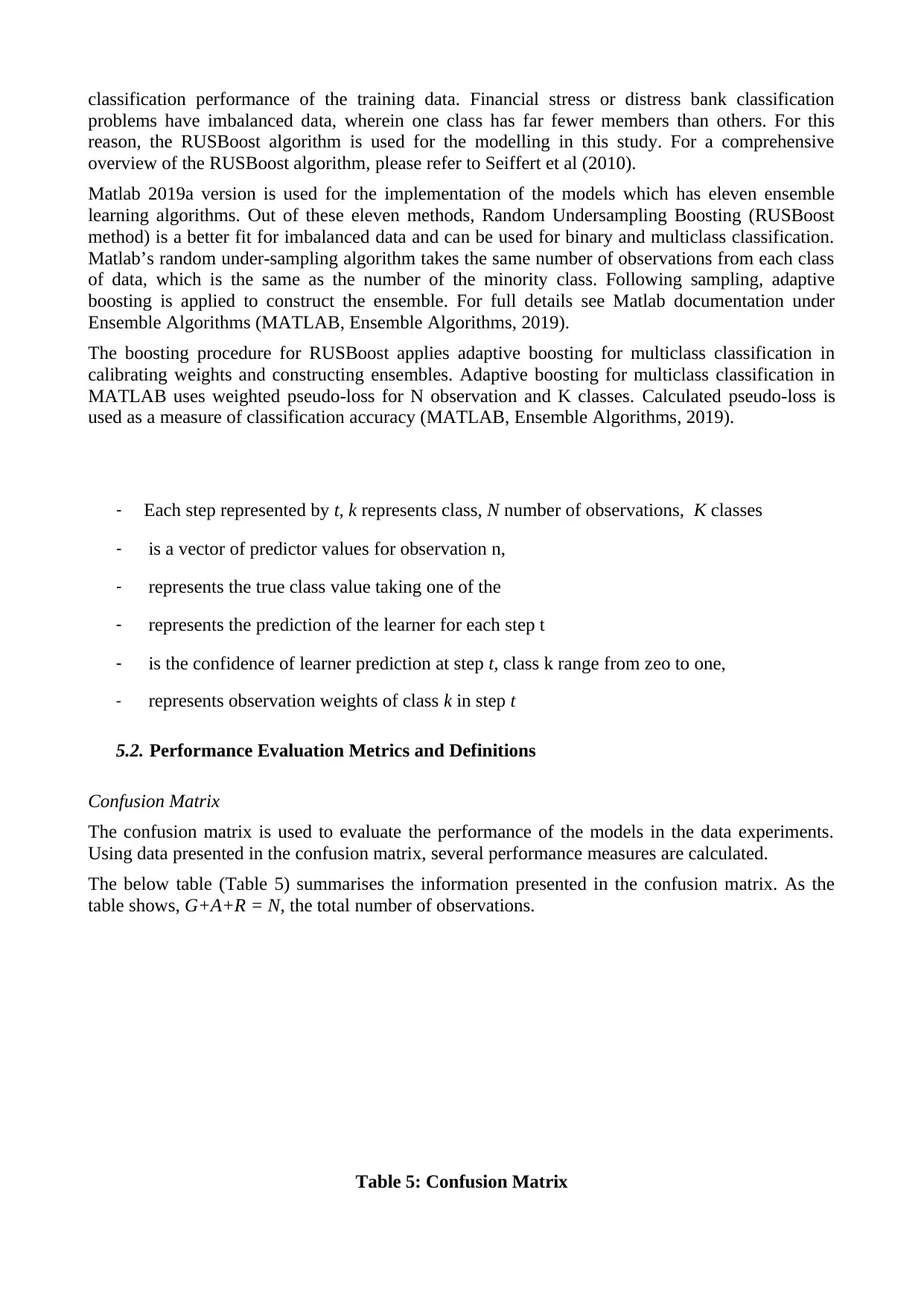

Confusion Matrix

The confusion matrix is used to evaluate the performance of the models in the data experiments.

Using data presented in the confusion matrix, several performance measures are calculated.

The below table (Table 5) summarises the information presented in the confusion matrix. As the

table shows, G+A+R = N, the total number of observations.

Table 5: Confusion Matrix

problems have imbalanced data, wherein one class has far fewer members than others. For this

reason, the RUSBoost algorithm is used for the modelling in this study. For a comprehensive

overview of the RUSBoost algorithm, please refer to Seiffert et al (2010).

Matlab 2019a version is used for the implementation of the models which has eleven ensemble

learning algorithms. Out of these eleven methods, Random Undersampling Boosting (RUSBoost

method) is a better fit for imbalanced data and can be used for binary and multiclass classification.

Matlab’s random under-sampling algorithm takes the same number of observations from each class

of data, which is the same as the number of the minority class. Following sampling, adaptive

boosting is applied to construct the ensemble. For full details see Matlab documentation under

Ensemble Algorithms (MATLAB, Ensemble Algorithms, 2019).

The boosting procedure for RUSBoost applies adaptive boosting for multiclass classification in

calibrating weights and constructing ensembles. Adaptive boosting for multiclass classification in

MATLAB uses weighted pseudo-loss for N observation and K classes. Calculated pseudo-loss is

used as a measure of classification accuracy (MATLAB, Ensemble Algorithms, 2019).

- Each step represented by t, k represents class, N number of observations, K classes

- is a vector of predictor values for observation n,

- represents the true class value taking one of the

- represents the prediction of the learner for each step t

- is the confidence of learner prediction at step t, class k range from zeo to one,

- represents observation weights of class k in step t

5.2. Performance Evaluation Metrics and Definitions

Confusion Matrix

The confusion matrix is used to evaluate the performance of the models in the data experiments.

Using data presented in the confusion matrix, several performance measures are calculated.

The below table (Table 5) summarises the information presented in the confusion matrix. As the

table shows, G+A+R = N, the total number of observations.

Table 5: Confusion Matrix

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

RAG Status Predicted

Class

RAG

Status

Actual

Class

Green Amber Red Total

Green True Green (TG) False Amber_1

(FA1)

False Red_1

(FR1) G

Amber False Green_1

(FG1) True Amber (TA) False Red_2

(FR2) A

Red False Green_2

(FG2)

False Amber_2

(FA2) True Red (TR) R

Total G* A* R* N

Formulas for the measures above are outlined below:

Accuracy (Acc) = . This metric measures the percentage of true class predictions in all

observations.

Error (Err) = . This metric provides the misclassification percentage.

In this study, we will extend two measures that can be used specifically for predicting the RAG

status of EWIs:

Warning Score (WS) = . The rationale behind this score is that an institution would at least

like to be warned of elevated stress levels. Once a Warning Score is received in combination

with another internal measure, final management status can be decided. This measure will

ignore misclassification between Red and Amber days,

Weighted Warning Score (WWS) = . This is a slightly revised version of the Warning

Score. It applies weight less than 1 to FR2 and FA2 for misclassification. In this study 0.5

used as a weight.

True Red Accuracy (TRA) = . This is to control accuracy of red status days, since red

days are most impacted by the imbalanced data, for instance if overall AUC is very high but

TRA below 50%, model may not be fit for EWIs usage.

ROC Curves

Another method used for analysing a model’s results performance is receiver operating

characteristics (ROC) curve. ROC curves represent true positive rates versus false positive rates to

show the trade-off between a correctly identified and false prediction. The area under the curve

(AUC) is used to compare the models’ classification performance (Seiffert et al, 2010).

6. Empirical Results

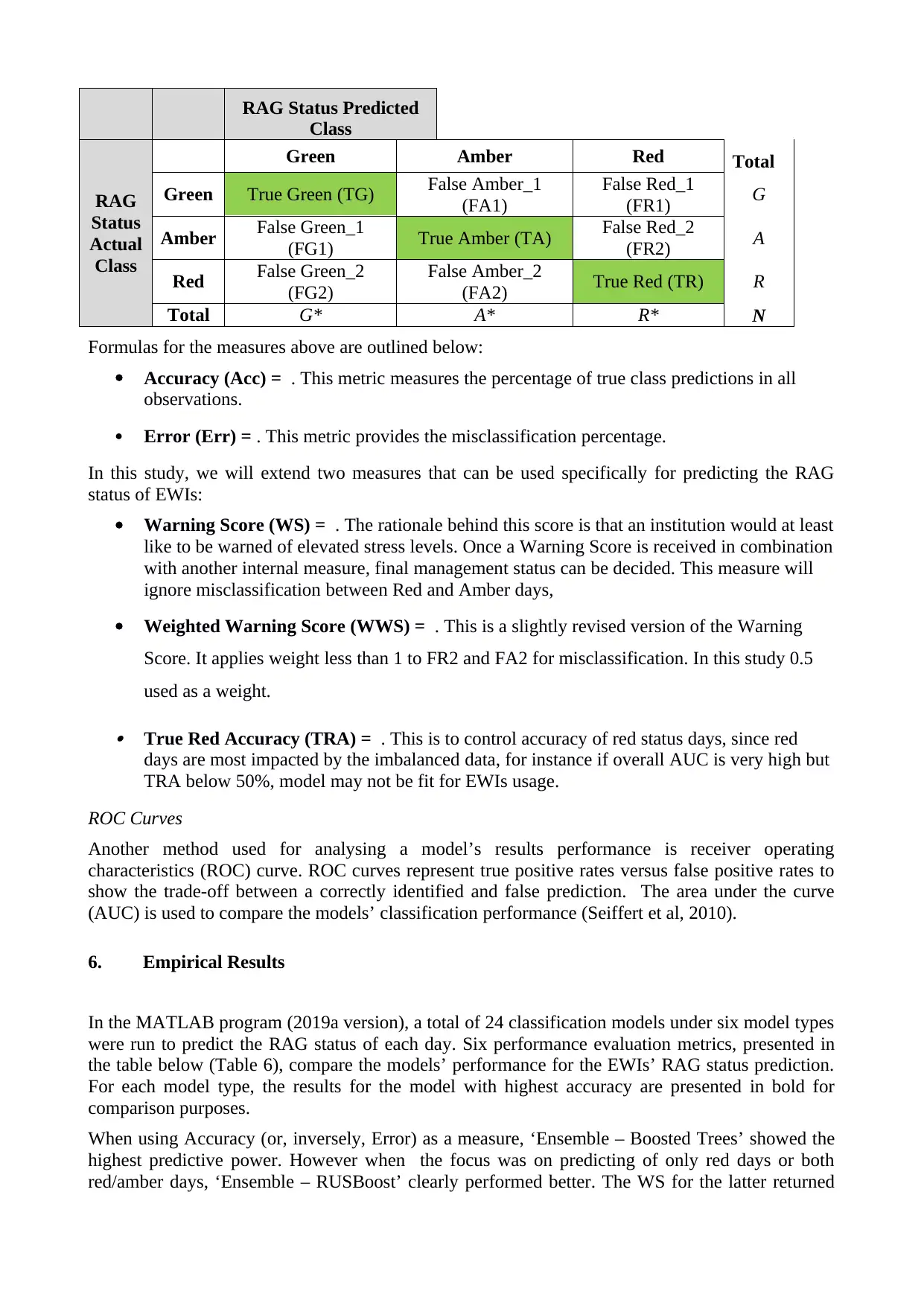

In the MATLAB program (2019a version), a total of 24 classification models under six model types

were run to predict the RAG status of each day. Six performance evaluation metrics, presented in

the table below (Table 6), compare the models’ performance for the EWIs’ RAG status prediction.

For each model type, the results for the model with highest accuracy are presented in bold for

comparison purposes.

When using Accuracy (or, inversely, Error) as a measure, ‘Ensemble – Boosted Trees’ showed the

highest predictive power. However when the focus was on predicting of only red days or both

red/amber days, ‘Ensemble – RUSBoost’ clearly performed better. The WS for the latter returned

Class

RAG

Status

Actual

Class

Green Amber Red Total

Green True Green (TG) False Amber_1

(FA1)

False Red_1

(FR1) G

Amber False Green_1

(FG1) True Amber (TA) False Red_2

(FR2) A

Red False Green_2

(FG2)

False Amber_2

(FA2) True Red (TR) R

Total G* A* R* N

Formulas for the measures above are outlined below:

Accuracy (Acc) = . This metric measures the percentage of true class predictions in all

observations.

Error (Err) = . This metric provides the misclassification percentage.

In this study, we will extend two measures that can be used specifically for predicting the RAG

status of EWIs:

Warning Score (WS) = . The rationale behind this score is that an institution would at least

like to be warned of elevated stress levels. Once a Warning Score is received in combination

with another internal measure, final management status can be decided. This measure will

ignore misclassification between Red and Amber days,

Weighted Warning Score (WWS) = . This is a slightly revised version of the Warning

Score. It applies weight less than 1 to FR2 and FA2 for misclassification. In this study 0.5

used as a weight.

True Red Accuracy (TRA) = . This is to control accuracy of red status days, since red

days are most impacted by the imbalanced data, for instance if overall AUC is very high but

TRA below 50%, model may not be fit for EWIs usage.

ROC Curves

Another method used for analysing a model’s results performance is receiver operating

characteristics (ROC) curve. ROC curves represent true positive rates versus false positive rates to

show the trade-off between a correctly identified and false prediction. The area under the curve

(AUC) is used to compare the models’ classification performance (Seiffert et al, 2010).

6. Empirical Results

In the MATLAB program (2019a version), a total of 24 classification models under six model types

were run to predict the RAG status of each day. Six performance evaluation metrics, presented in

the table below (Table 6), compare the models’ performance for the EWIs’ RAG status prediction.

For each model type, the results for the model with highest accuracy are presented in bold for

comparison purposes.

When using Accuracy (or, inversely, Error) as a measure, ‘Ensemble – Boosted Trees’ showed the

highest predictive power. However when the focus was on predicting of only red days or both

red/amber days, ‘Ensemble – RUSBoost’ clearly performed better. The WS for the latter returned

95% accuracy, compared to an average of just 74% for the other best performing models. This trend

was supported by the TRA measure.

It must be noted that k-fold cross-validation was performed to prevent overfitting. Without cross

validation, in-sample accuracy would be very high but at the cost of sacrificing the ability to make

predictions beyond the sample.

Table 6: Comparison of Models

MATLAB Model Name Acc Err WS WWS TRA AUC

Ensemble – RUSBoost 88% 12% 95% 89% 83% 0.98

Average of below models 91% 9% 74% 69% 70% 0.97

Tree – Medium Tree 92% 8% 73% 68% 77% 0.97

Quadratic Discriminant 89% 11% 74% 65% 60% 0.96

Naïve Bayes 90% 10% 85% 77% 73% 0.94

Support Vector Machine –

Quadratic 93% 7% 79% 73% 71% 0.96

k-Nearest Neighbor (weighted

KNN) 92% 8% 58% 54% 62% 0.98

Ensemble – Boosted Trees 94% 6% 78% 73% 78% 0.99

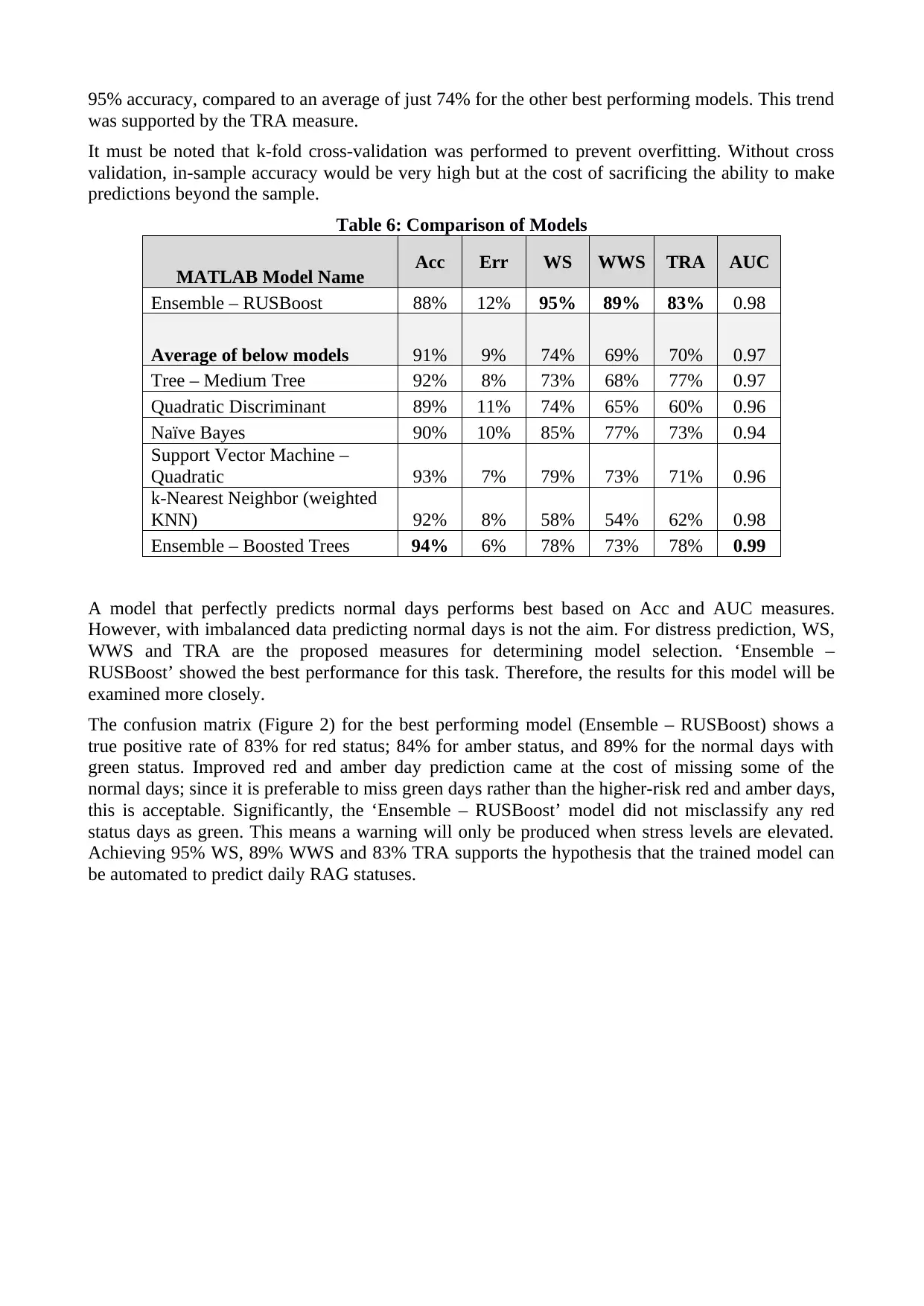

A model that perfectly predicts normal days performs best based on Acc and AUC measures.

However, with imbalanced data predicting normal days is not the aim. For distress prediction, WS,

WWS and TRA are the proposed measures for determining model selection. ‘Ensemble –

RUSBoost’ showed the best performance for this task. Therefore, the results for this model will be

examined more closely.

The confusion matrix (Figure 2) for the best performing model (Ensemble – RUSBoost) shows a

true positive rate of 83% for red status; 84% for amber status, and 89% for the normal days with

green status. Improved red and amber day prediction came at the cost of missing some of the

normal days; since it is preferable to miss green days rather than the higher-risk red and amber days,

this is acceptable. Significantly, the ‘Ensemble – RUSBoost’ model did not misclassify any red

status days as green. This means a warning will only be produced when stress levels are elevated.

Achieving 95% WS, 89% WWS and 83% TRA supports the hypothesis that the trained model can

be automated to predict daily RAG statuses.

was supported by the TRA measure.

It must be noted that k-fold cross-validation was performed to prevent overfitting. Without cross

validation, in-sample accuracy would be very high but at the cost of sacrificing the ability to make

predictions beyond the sample.

Table 6: Comparison of Models

MATLAB Model Name Acc Err WS WWS TRA AUC

Ensemble – RUSBoost 88% 12% 95% 89% 83% 0.98

Average of below models 91% 9% 74% 69% 70% 0.97

Tree – Medium Tree 92% 8% 73% 68% 77% 0.97

Quadratic Discriminant 89% 11% 74% 65% 60% 0.96

Naïve Bayes 90% 10% 85% 77% 73% 0.94

Support Vector Machine –

Quadratic 93% 7% 79% 73% 71% 0.96

k-Nearest Neighbor (weighted

KNN) 92% 8% 58% 54% 62% 0.98

Ensemble – Boosted Trees 94% 6% 78% 73% 78% 0.99

A model that perfectly predicts normal days performs best based on Acc and AUC measures.

However, with imbalanced data predicting normal days is not the aim. For distress prediction, WS,

WWS and TRA are the proposed measures for determining model selection. ‘Ensemble –

RUSBoost’ showed the best performance for this task. Therefore, the results for this model will be

examined more closely.

The confusion matrix (Figure 2) for the best performing model (Ensemble – RUSBoost) shows a

true positive rate of 83% for red status; 84% for amber status, and 89% for the normal days with

green status. Improved red and amber day prediction came at the cost of missing some of the

normal days; since it is preferable to miss green days rather than the higher-risk red and amber days,

this is acceptable. Significantly, the ‘Ensemble – RUSBoost’ model did not misclassify any red

status days as green. This means a warning will only be produced when stress levels are elevated.

Achieving 95% WS, 89% WWS and 83% TRA supports the hypothesis that the trained model can

be automated to predict daily RAG statuses.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.