ECN70104: Malaysia's Challenges in Escaping the Middle Income Trap

VerifiedAdded on 2023/04/11

|21

|6816

|104

Report

AI Summary

This report examines Malaysia's persistent struggle with the middle-income trap, a situation where the country has been unable to transition from middle-income to high-income status despite decades of economic development. It reviews the background of Malaysia’s economy, defines the Middle Income Trap (MIT), identifies factors contributing to Malaysia's entrapment, such as stagnating Total Factor Productivity (TFP) growth and a reliance on labor-intensive industries, and explores potential strategies for escaping it. The analysis covers Malaysia's economic evolution from a commodity-based economy to a service-oriented one, the impact of economic policies like the New Economic Policy (NEP) and New Economic Model (NEM), and the challenges in achieving higher income levels due to factors like slow wage growth and the need for deeper industrialization and technological advancement. The report concludes by emphasizing the need for Malaysia to transform its economic strategies to achieve high-income status.

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

MALAYSIA IN A MIDDLE INCOME TRAP

Abstract: -

Malaysia continues to struggle in addressing the identified challenges that are preventing or

delaying the country’s shift from middle income to high-income status. Malaysia progressed

from lower middle to upper middle income status in 1992 and has been stagnating in a middle

income-status for 55 years since 1960. Malaysia is caught in the middle trap right now and

getting it out is going to be challenging. The term ‘middle-income trap’ was first brought to

attention by Gill and Kharas (2007), to highlight growth slowdowns in many East Asian

economies. These countries experienced rapid growth, enabling them to reach the middle

income status but have not been able to catch up with developed countries and achieve high

income status. (Gill and Kharas, 2007). The paper conducts a review on the existing

literature on the background of Malaysia’s economy, the definition on Middle Income Trap

(MIT), factors which lead Malaysia to fall into the middle income trap and suggested ways

and method to escape from the middle income Trap.

Keywords:-

Submitted by: Anand Sharvanandan (0337677) Page 1

MALAYSIA IN A MIDDLE INCOME TRAP

Abstract: -

Malaysia continues to struggle in addressing the identified challenges that are preventing or

delaying the country’s shift from middle income to high-income status. Malaysia progressed

from lower middle to upper middle income status in 1992 and has been stagnating in a middle

income-status for 55 years since 1960. Malaysia is caught in the middle trap right now and

getting it out is going to be challenging. The term ‘middle-income trap’ was first brought to

attention by Gill and Kharas (2007), to highlight growth slowdowns in many East Asian

economies. These countries experienced rapid growth, enabling them to reach the middle

income status but have not been able to catch up with developed countries and achieve high

income status. (Gill and Kharas, 2007). The paper conducts a review on the existing

literature on the background of Malaysia’s economy, the definition on Middle Income Trap

(MIT), factors which lead Malaysia to fall into the middle income trap and suggested ways

and method to escape from the middle income Trap.

Keywords:-

Submitted by: Anand Sharvanandan (0337677) Page 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

1. INTRODUCTION

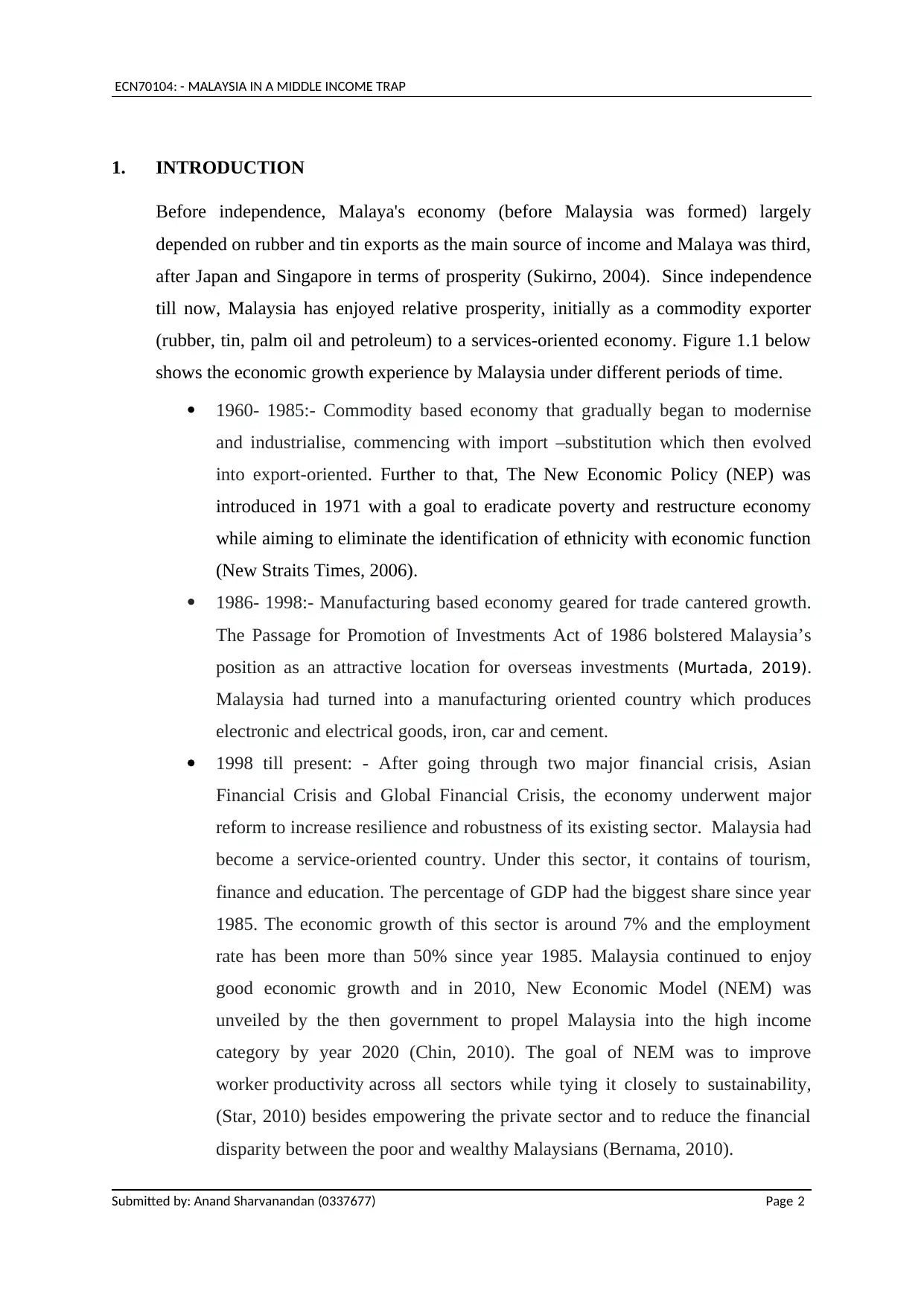

Before independence, Malaya's economy (before Malaysia was formed) largely

depended on rubber and tin exports as the main source of income and Malaya was third,

after Japan and Singapore in terms of prosperity (Sukirno, 2004). Since independence

till now, Malaysia has enjoyed relative prosperity, initially as a commodity exporter

(rubber, tin, palm oil and petroleum) to a services-oriented economy. Figure 1.1 below

shows the economic growth experience by Malaysia under different periods of time.

1960- 1985:- Commodity based economy that gradually began to modernise

and industrialise, commencing with import –substitution which then evolved

into export-oriented. Further to that, The New Economic Policy (NEP) was

introduced in 1971 with a goal to eradicate poverty and restructure economy

while aiming to eliminate the identification of ethnicity with economic function

(New Straits Times, 2006).

1986- 1998:- Manufacturing based economy geared for trade cantered growth.

The Passage for Promotion of Investments Act of 1986 bolstered Malaysia’s

position as an attractive location for overseas investments (Murtada, 2019).

Malaysia had turned into a manufacturing oriented country which produces

electronic and electrical goods, iron, car and cement.

1998 till present: - After going through two major financial crisis, Asian

Financial Crisis and Global Financial Crisis, the economy underwent major

reform to increase resilience and robustness of its existing sector. Malaysia had

become a service-oriented country. Under this sector, it contains of tourism,

finance and education. The percentage of GDP had the biggest share since year

1985. The economic growth of this sector is around 7% and the employment

rate has been more than 50% since year 1985. Malaysia continued to enjoy

good economic growth and in 2010, New Economic Model (NEM) was

unveiled by the then government to propel Malaysia into the high income

category by year 2020 (Chin, 2010). The goal of NEM was to improve

worker productivity across all sectors while tying it closely to sustainability,

(Star, 2010) besides empowering the private sector and to reduce the financial

disparity between the poor and wealthy Malaysians (Bernama, 2010).

Submitted by: Anand Sharvanandan (0337677) Page 2

1. INTRODUCTION

Before independence, Malaya's economy (before Malaysia was formed) largely

depended on rubber and tin exports as the main source of income and Malaya was third,

after Japan and Singapore in terms of prosperity (Sukirno, 2004). Since independence

till now, Malaysia has enjoyed relative prosperity, initially as a commodity exporter

(rubber, tin, palm oil and petroleum) to a services-oriented economy. Figure 1.1 below

shows the economic growth experience by Malaysia under different periods of time.

1960- 1985:- Commodity based economy that gradually began to modernise

and industrialise, commencing with import –substitution which then evolved

into export-oriented. Further to that, The New Economic Policy (NEP) was

introduced in 1971 with a goal to eradicate poverty and restructure economy

while aiming to eliminate the identification of ethnicity with economic function

(New Straits Times, 2006).

1986- 1998:- Manufacturing based economy geared for trade cantered growth.

The Passage for Promotion of Investments Act of 1986 bolstered Malaysia’s

position as an attractive location for overseas investments (Murtada, 2019).

Malaysia had turned into a manufacturing oriented country which produces

electronic and electrical goods, iron, car and cement.

1998 till present: - After going through two major financial crisis, Asian

Financial Crisis and Global Financial Crisis, the economy underwent major

reform to increase resilience and robustness of its existing sector. Malaysia had

become a service-oriented country. Under this sector, it contains of tourism,

finance and education. The percentage of GDP had the biggest share since year

1985. The economic growth of this sector is around 7% and the employment

rate has been more than 50% since year 1985. Malaysia continued to enjoy

good economic growth and in 2010, New Economic Model (NEM) was

unveiled by the then government to propel Malaysia into the high income

category by year 2020 (Chin, 2010). The goal of NEM was to improve

worker productivity across all sectors while tying it closely to sustainability,

(Star, 2010) besides empowering the private sector and to reduce the financial

disparity between the poor and wealthy Malaysians (Bernama, 2010).

Submitted by: Anand Sharvanandan (0337677) Page 2

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

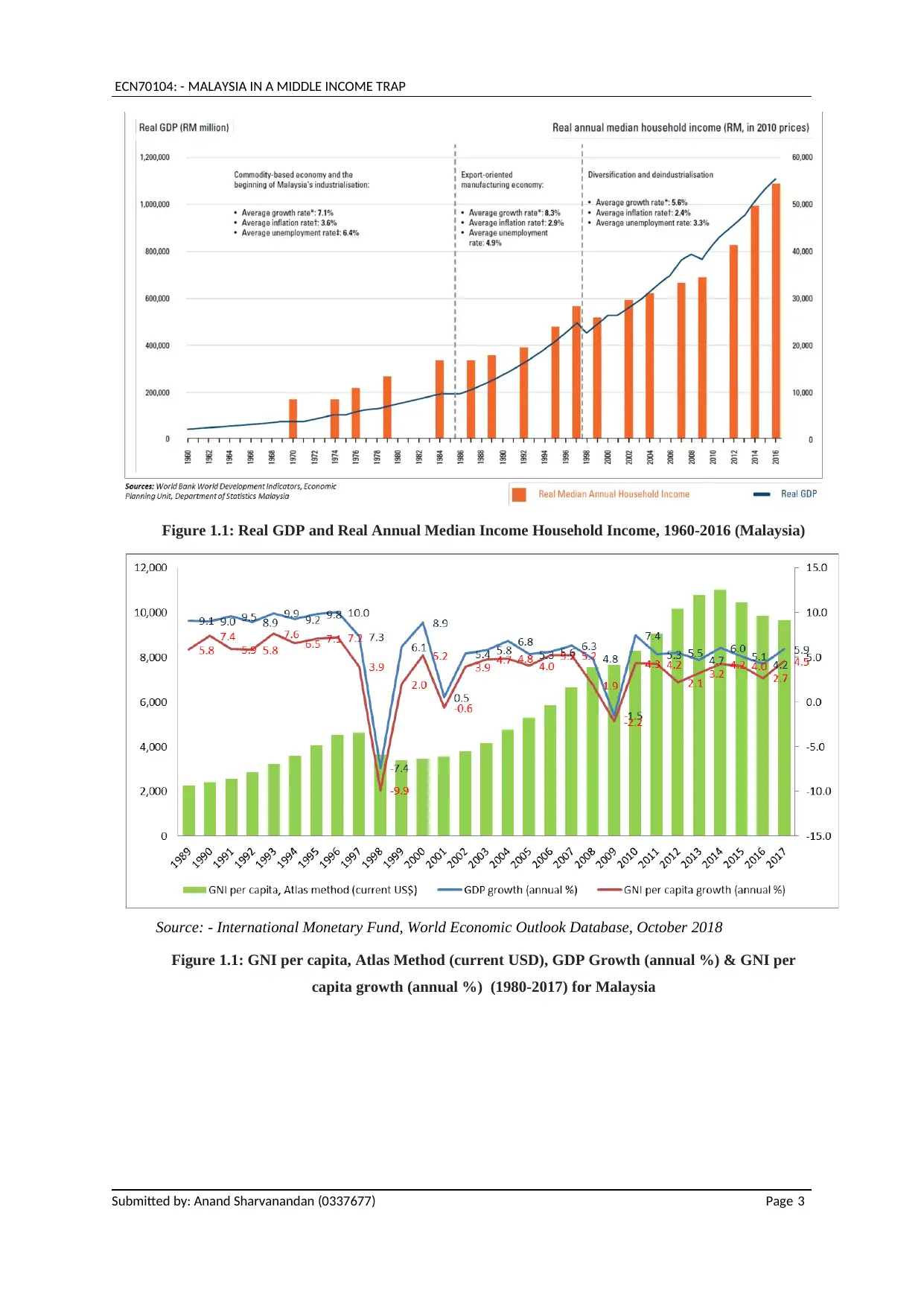

Figure 1.1: Real GDP and Real Annual Median Income Household Income, 1960-2016 (Malaysia)

Source: - International Monetary Fund, World Economic Outlook Database, October 2018

Figure 1.1: GNI per capita, Atlas Method (current USD), GDP Growth (annual %) & GNI per

capita growth (annual %) (1980-2017) for Malaysia

Submitted by: Anand Sharvanandan (0337677) Page 3

Figure 1.1: Real GDP and Real Annual Median Income Household Income, 1960-2016 (Malaysia)

Source: - International Monetary Fund, World Economic Outlook Database, October 2018

Figure 1.1: GNI per capita, Atlas Method (current USD), GDP Growth (annual %) & GNI per

capita growth (annual %) (1980-2017) for Malaysia

Submitted by: Anand Sharvanandan (0337677) Page 3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

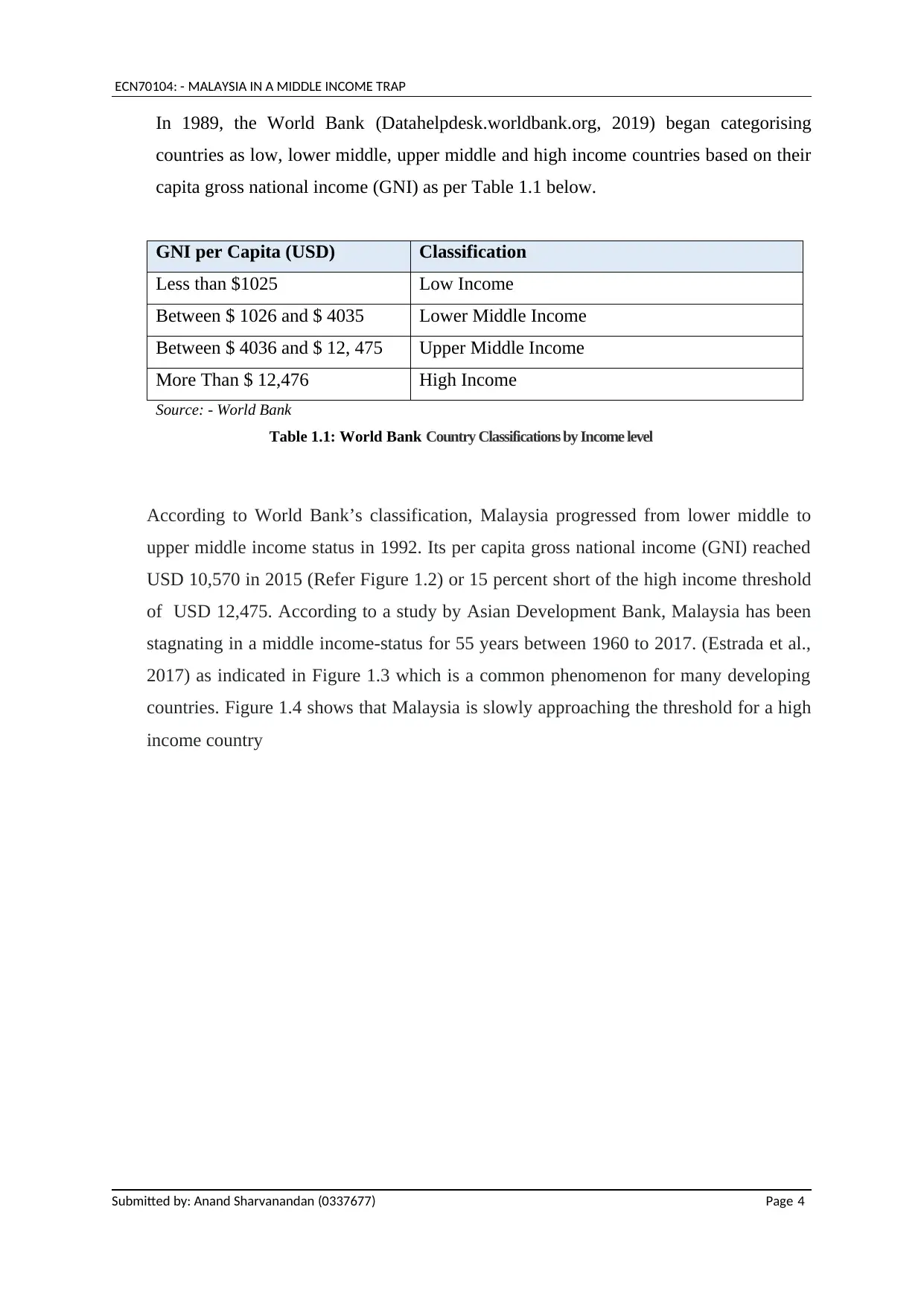

In 1989, the World Bank (Datahelpdesk.worldbank.org, 2019) began categorising

countries as low, lower middle, upper middle and high income countries based on their

capita gross national income (GNI) as per Table 1.1 below.

GNI per Capita (USD) Classification

Less than $1025 Low Income

Between $ 1026 and $ 4035 Lower Middle Income

Between $ 4036 and $ 12, 475 Upper Middle Income

More Than $ 12,476 High Income

Source: - World Bank

Table 1.1: World Bank Country Classifications by Income level

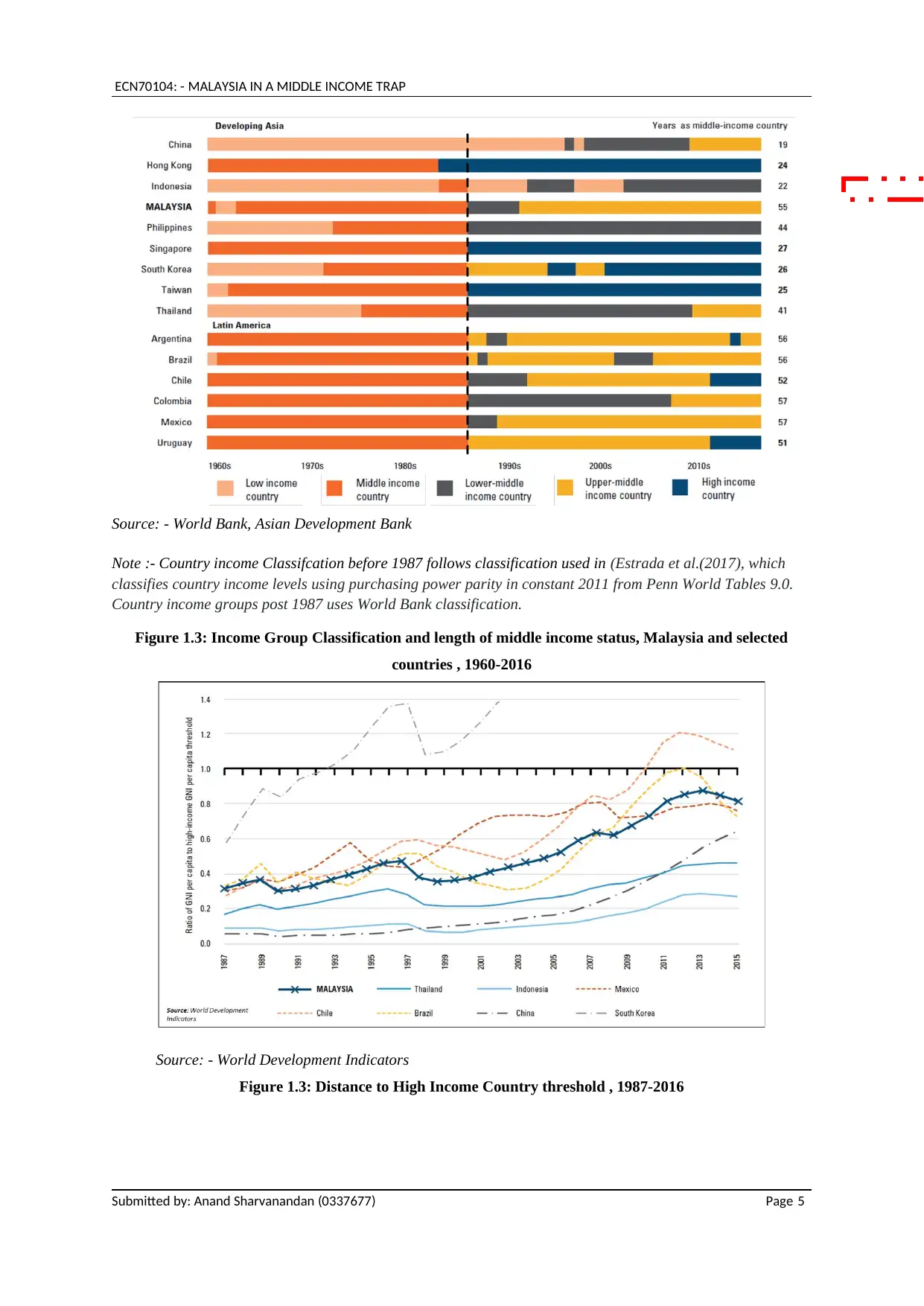

According to World Bank’s classification, Malaysia progressed from lower middle to

upper middle income status in 1992. Its per capita gross national income (GNI) reached

USD 10,570 in 2015 (Refer Figure 1.2) or 15 percent short of the high income threshold

of USD 12,475. According to a study by Asian Development Bank, Malaysia has been

stagnating in a middle income-status for 55 years between 1960 to 2017. (Estrada et al.,

2017) as indicated in Figure 1.3 which is a common phenomenon for many developing

countries. Figure 1.4 shows that Malaysia is slowly approaching the threshold for a high

income country

Submitted by: Anand Sharvanandan (0337677) Page 4

In 1989, the World Bank (Datahelpdesk.worldbank.org, 2019) began categorising

countries as low, lower middle, upper middle and high income countries based on their

capita gross national income (GNI) as per Table 1.1 below.

GNI per Capita (USD) Classification

Less than $1025 Low Income

Between $ 1026 and $ 4035 Lower Middle Income

Between $ 4036 and $ 12, 475 Upper Middle Income

More Than $ 12,476 High Income

Source: - World Bank

Table 1.1: World Bank Country Classifications by Income level

According to World Bank’s classification, Malaysia progressed from lower middle to

upper middle income status in 1992. Its per capita gross national income (GNI) reached

USD 10,570 in 2015 (Refer Figure 1.2) or 15 percent short of the high income threshold

of USD 12,475. According to a study by Asian Development Bank, Malaysia has been

stagnating in a middle income-status for 55 years between 1960 to 2017. (Estrada et al.,

2017) as indicated in Figure 1.3 which is a common phenomenon for many developing

countries. Figure 1.4 shows that Malaysia is slowly approaching the threshold for a high

income country

Submitted by: Anand Sharvanandan (0337677) Page 4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

Source: - World Bank, Asian Development Bank

Note :- Country income Classifcation before 1987 follows classification used in (Estrada et al.(2017), which

classifies country income levels using purchasing power parity in constant 2011 from Penn World Tables 9.0.

Country income groups post 1987 uses World Bank classification.

Figure 1.3: Income Group Classification and length of middle income status, Malaysia and selected

countries , 1960-2016

Source: - World Development Indicators

Figure 1.3: Distance to High Income Country threshold , 1987-2016

Submitted by: Anand Sharvanandan (0337677) Page 5

Source: - World Bank, Asian Development Bank

Note :- Country income Classifcation before 1987 follows classification used in (Estrada et al.(2017), which

classifies country income levels using purchasing power parity in constant 2011 from Penn World Tables 9.0.

Country income groups post 1987 uses World Bank classification.

Figure 1.3: Income Group Classification and length of middle income status, Malaysia and selected

countries , 1960-2016

Source: - World Development Indicators

Figure 1.3: Distance to High Income Country threshold , 1987-2016

Submitted by: Anand Sharvanandan (0337677) Page 5

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

MIDDLE INCOME TRAP (MIT)

The term ‘middle-income trap’ was first brought to attention by Gill and Kharas (2007), to

highlight growth slowdowns in many East Asian economies. These countries experienced

rapid growth, enabling them to reach the middle income status but have not been able to

catch up with developed countries and achieve high income status. (Gill and Kharas, 2007).

When a country in stuck in between a low wage poor country which dominates in mature

industries and a rich country which dominates in rapid technological change industries, that

country can also be characterised as a Middle Income Trap country (Gill and Kharas, 2007).

They argued that three transformations were required for emerging Asian countries

(middle-income countries) to continue their growth: (1) transformation from diversification

to more specialization in production and employment; (2) transformation from a focus on

investment to a focus on innovation; and (3) a shift from equipping workers with skills to

adjust to new technologies to preparing them to shape new products and processes. (Gill

and Kharas, 2007).

For instance, Kharas and Kohli (2011) state that there seems to be a connection between

experiencing poverty and the MIT. Although there is no broadly agreed definition, the MIT is

also refers to a situation in which a middle-income country (MIC) falls into economic

stagnation and becomes unable to advance its economy to a high-income level for certain

reasons specific to MICs (Egawa, 2013). Egawa (2013) further suggests that a delay or

failure to change the economic structure from an input driven growth model into a

productivity-driven growth model is a factor in triggering the risk of a MIT.

In addition, Rigg et al. (2014) state that the MIT refers to countries that experience a growth

slow-down when they achieve middle-income status. Glawe and Wagner, 2016 states as per

definition, the Middle Income Trap is seen as sustained slowdown of growth for at least fifty

(50) years. In other words, Middle Income Trap can also be defined as a kind of political

failure whereby institutional and structural reforms are missing.

In order to analyse Middle Income Trap among middle income countries, World Bank

conducted a study in 2012 and found that out of 101 middle income countries in 1960, only

Submitted by: Anand Sharvanandan (0337677) Page 6

MIDDLE INCOME TRAP (MIT)

The term ‘middle-income trap’ was first brought to attention by Gill and Kharas (2007), to

highlight growth slowdowns in many East Asian economies. These countries experienced

rapid growth, enabling them to reach the middle income status but have not been able to

catch up with developed countries and achieve high income status. (Gill and Kharas, 2007).

When a country in stuck in between a low wage poor country which dominates in mature

industries and a rich country which dominates in rapid technological change industries, that

country can also be characterised as a Middle Income Trap country (Gill and Kharas, 2007).

They argued that three transformations were required for emerging Asian countries

(middle-income countries) to continue their growth: (1) transformation from diversification

to more specialization in production and employment; (2) transformation from a focus on

investment to a focus on innovation; and (3) a shift from equipping workers with skills to

adjust to new technologies to preparing them to shape new products and processes. (Gill

and Kharas, 2007).

For instance, Kharas and Kohli (2011) state that there seems to be a connection between

experiencing poverty and the MIT. Although there is no broadly agreed definition, the MIT is

also refers to a situation in which a middle-income country (MIC) falls into economic

stagnation and becomes unable to advance its economy to a high-income level for certain

reasons specific to MICs (Egawa, 2013). Egawa (2013) further suggests that a delay or

failure to change the economic structure from an input driven growth model into a

productivity-driven growth model is a factor in triggering the risk of a MIT.

In addition, Rigg et al. (2014) state that the MIT refers to countries that experience a growth

slow-down when they achieve middle-income status. Glawe and Wagner, 2016 states as per

definition, the Middle Income Trap is seen as sustained slowdown of growth for at least fifty

(50) years. In other words, Middle Income Trap can also be defined as a kind of political

failure whereby institutional and structural reforms are missing.

In order to analyse Middle Income Trap among middle income countries, World Bank

conducted a study in 2012 and found that out of 101 middle income countries in 1960, only

Submitted by: Anand Sharvanandan (0337677) Page 6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

13 were able to achieve high income status by 2008. This phenomenon primarily hit East

Asian and Latin American countries and Malaysia is one of them.

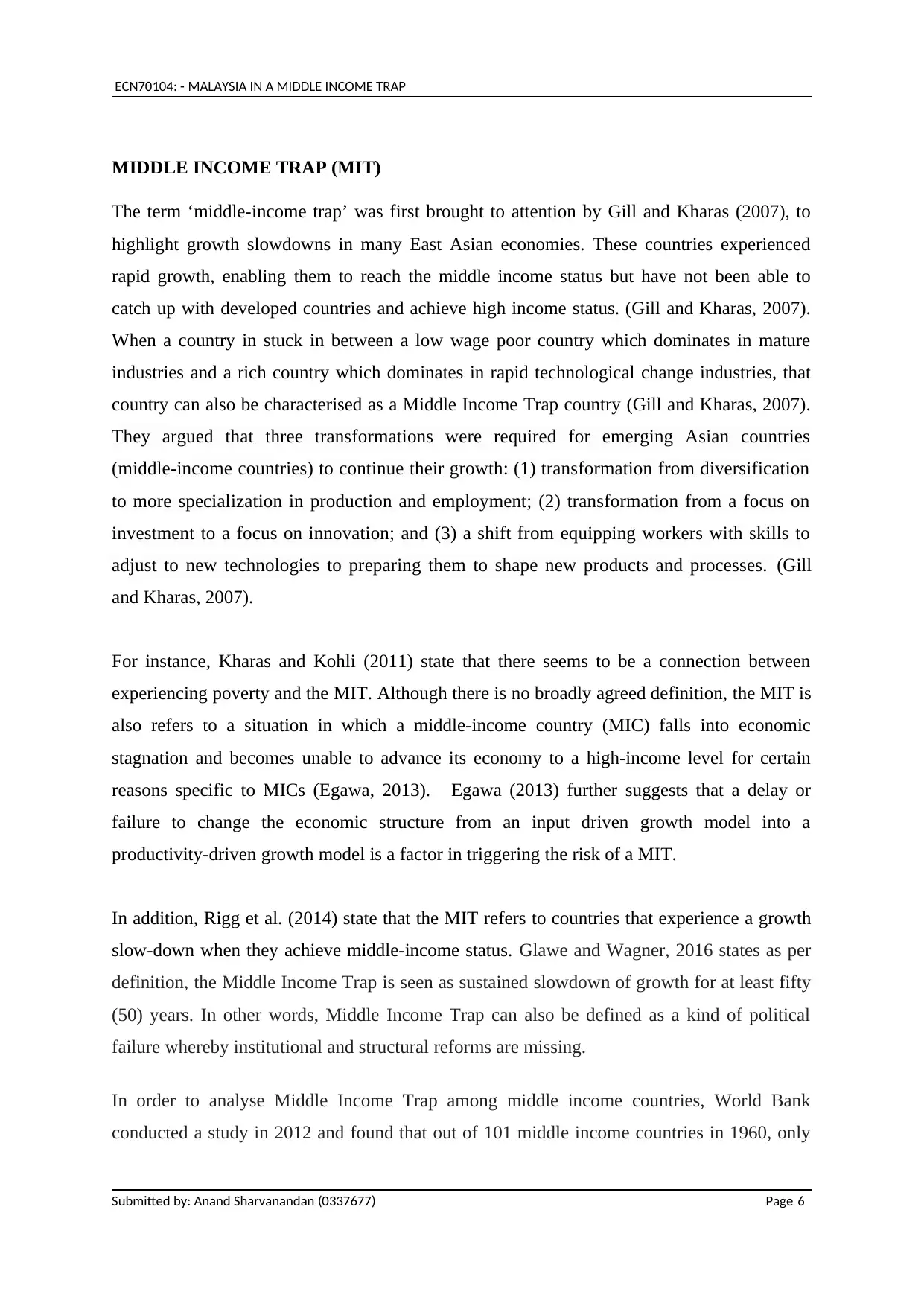

Tho (2013) tabulates the factors behind triggering and getting stuck in the MIT as follows:

WHAT MADE MALAYSIA FALL INTO THE MIDDLE INCOME TRAP

There are various explanations that have been put forward to explain what causes the

Malaysia to fall into the middle income trap. The economic growth is closely linked to

the amount of human capital, physical capital and technology that people in the country

have accessed to.

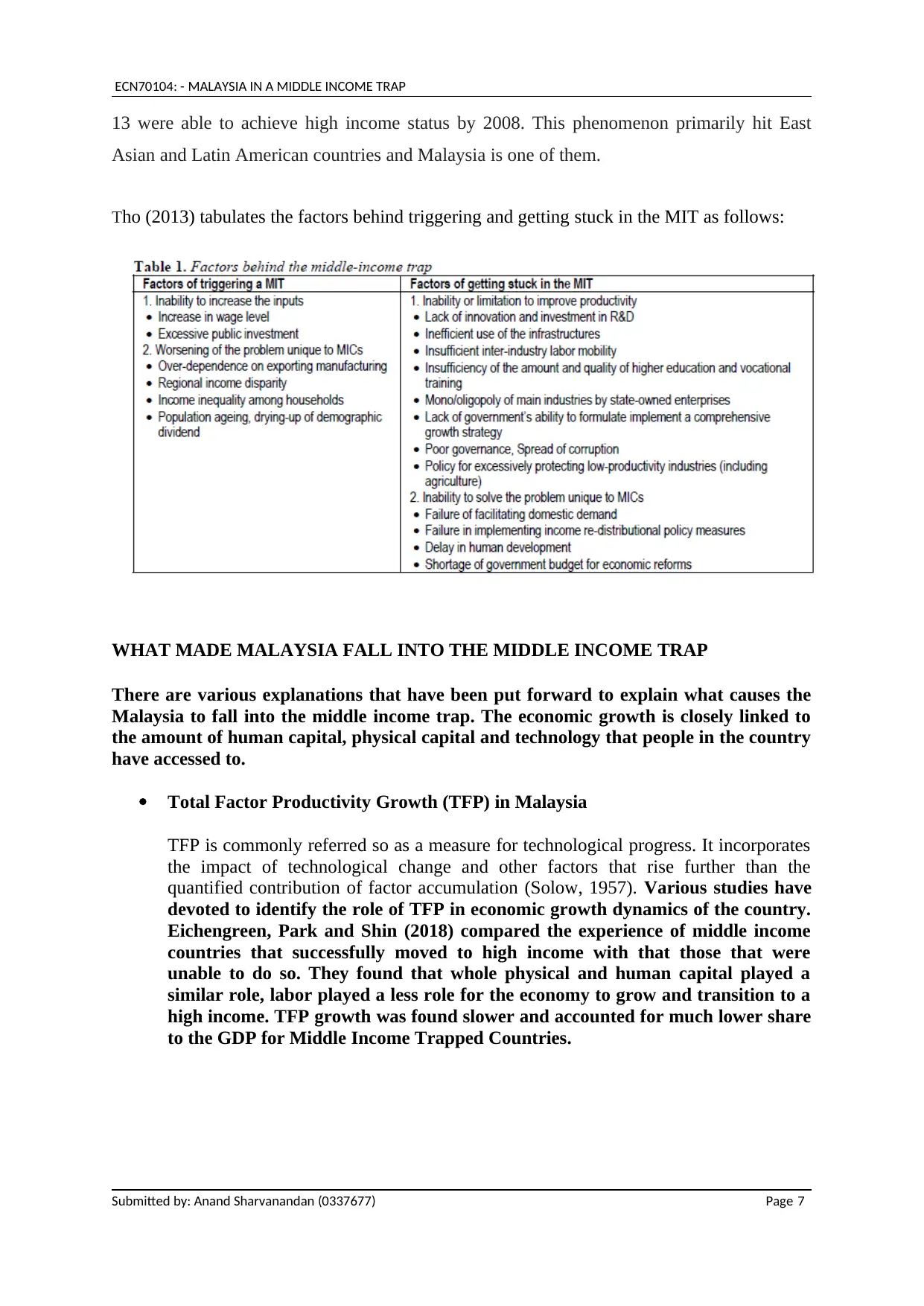

Total Factor Productivity Growth (TFP) in Malaysia

TFP is commonly referred so as a measure for technological progress. It incorporates

the impact of technological change and other factors that rise further than the

quantified contribution of factor accumulation (Solow, 1957). Various studies have

devoted to identify the role of TFP in economic growth dynamics of the country.

Eichengreen, Park and Shin (2018) compared the experience of middle income

countries that successfully moved to high income with that those that were

unable to do so. They found that whole physical and human capital played a

similar role, labor played a less role for the economy to grow and transition to a

high income. TFP growth was found slower and accounted for much lower share

to the GDP for Middle Income Trapped Countries.

Submitted by: Anand Sharvanandan (0337677) Page 7

13 were able to achieve high income status by 2008. This phenomenon primarily hit East

Asian and Latin American countries and Malaysia is one of them.

Tho (2013) tabulates the factors behind triggering and getting stuck in the MIT as follows:

WHAT MADE MALAYSIA FALL INTO THE MIDDLE INCOME TRAP

There are various explanations that have been put forward to explain what causes the

Malaysia to fall into the middle income trap. The economic growth is closely linked to

the amount of human capital, physical capital and technology that people in the country

have accessed to.

Total Factor Productivity Growth (TFP) in Malaysia

TFP is commonly referred so as a measure for technological progress. It incorporates

the impact of technological change and other factors that rise further than the

quantified contribution of factor accumulation (Solow, 1957). Various studies have

devoted to identify the role of TFP in economic growth dynamics of the country.

Eichengreen, Park and Shin (2018) compared the experience of middle income

countries that successfully moved to high income with that those that were

unable to do so. They found that whole physical and human capital played a

similar role, labor played a less role for the economy to grow and transition to a

high income. TFP growth was found slower and accounted for much lower share

to the GDP for Middle Income Trapped Countries.

Submitted by: Anand Sharvanandan (0337677) Page 7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

Malaysia is caught in the middle trap right now and getting it out is going

to be tough. With an income that is not too high and not low, Malaysian

find it hard to reach a higher level of income. To really get out from the

middle income trap, Malaysia needs to change what it has been doing

economically for the past 40 years. Middle income trap concept refers to

an easy transition of a low income to a middle income economy due to its

competitive nature in terms of cheap wages and labour- intensive

industries. It is easy to transit from low income to middle income but it will

be hard to transit from middle income to high income due to several

factors. Malaysia is getting into middle income trap and is likely to

experience a small change in factor- price ratio. This means that wages

received by both skilled and unskilled labour does not increase a lot and

doesn’t reach high income level.

In our research paper, we will divide into the four main parts. First, we

discuss the background of Malaysia’s economy and then the factors which

lead Malaysia to fall into the middle income trap, in this part we find out

that there are about six factors which lead Malaysia into the trap. After

that, we discuss on people who are affected due to the middle income

trap. Lastly, ways or method to escape from the middle income trap is

also our main concern. We have some ways to implement to make

developing nations can graduate into becoming fully advanced

economies.

When we look at our economic background, we can clearly see that from

independence to the 1980s, Malaysia progressed rapidly. From an

agricultural society in the 1950s, it evolved into an Asian Tiger Economy

by the 1980s, mainly labour- intensive industrialisation. However,

subsequent effort in deepen our industrialisation make our economic to

remain stagnant while other countries continue to expand rapidly.

Submitted by: Anand Sharvanandan (0337677) Page 8

Malaysia is caught in the middle trap right now and getting it out is going

to be tough. With an income that is not too high and not low, Malaysian

find it hard to reach a higher level of income. To really get out from the

middle income trap, Malaysia needs to change what it has been doing

economically for the past 40 years. Middle income trap concept refers to

an easy transition of a low income to a middle income economy due to its

competitive nature in terms of cheap wages and labour- intensive

industries. It is easy to transit from low income to middle income but it will

be hard to transit from middle income to high income due to several

factors. Malaysia is getting into middle income trap and is likely to

experience a small change in factor- price ratio. This means that wages

received by both skilled and unskilled labour does not increase a lot and

doesn’t reach high income level.

In our research paper, we will divide into the four main parts. First, we

discuss the background of Malaysia’s economy and then the factors which

lead Malaysia to fall into the middle income trap, in this part we find out

that there are about six factors which lead Malaysia into the trap. After

that, we discuss on people who are affected due to the middle income

trap. Lastly, ways or method to escape from the middle income trap is

also our main concern. We have some ways to implement to make

developing nations can graduate into becoming fully advanced

economies.

When we look at our economic background, we can clearly see that from

independence to the 1980s, Malaysia progressed rapidly. From an

agricultural society in the 1950s, it evolved into an Asian Tiger Economy

by the 1980s, mainly labour- intensive industrialisation. However,

subsequent effort in deepen our industrialisation make our economic to

remain stagnant while other countries continue to expand rapidly.

Submitted by: Anand Sharvanandan (0337677) Page 8

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

Recently, country’s performance has been disappointing with GDP growth

rate declining to 5.5 percent in 2002 to 2008 from 9.1 percent in 1990-

1997. In the past 1970, about 50% of Malaysian live in absolute poverty

but now decrease to less than 4%. However, Malaysian feels that they are

stuck from increasing where GDP growth has slowed up. However, when

we look at other countries for example Korea, they are at one time the

poorest country in the world but they are growing both economic and

politic. Reason that their economic can grow is because they have higher

purchasing power compared to Malaysia. This is because they receive

averagely higher income and with higher income they will have more

spending power which will boost their economy. Countries such as

Cambodia and Vietnam have very low wages while Malaysia traps in the

middle ground.

How to get into middle income trap

One of the factors Malaysia trapped into the middle income is due to over

dependence on FDI and lack of doing research and development (R&D).

Multinational companies will only provide instant of capital, expertise and

technology into Malaysia but they will not develop or improving Malaysia’s

product. Malaysia’s businessmen seem to be satisfied in making profit by

serving the MNCs and maintaining their original, assembly- based

business models. Besides, labour productivity is growing quite slow than

in the 1990s. Manufacturing in Malaysia has a low value added and had

spent a very low R&D spending. For example, Malaysia had spent only

0.6% of GDP in R&D compared to South Korea which is 3.5%. South Korea

is probably the best example of a developing country which shifts to a

advance country. Companies in Korea like Samsung and LG dominates in

the market. Taiwan is also not far behind. China’s policymakers are aware

that they need to suit with the changes in market if the labor costs rise.

With a low tech manufacturing industries and lack of skilled labour

compared to country such as Singapore, the production in Malaysia is less

competitive and thus less profit which means lower wages paid to the

workers.

Migrant workers which depress wages also one of the factors which cause

Malaysia to fall into the middle income trap. It is a mistake in letting

migrant workers to overflow in Malaysia and depresses wages. This will

limit the improvements of the productivity. Malaysia has too huge amount

of foreign workers which is reportedly has 1.9 million registered workers

and another 600000 unregistered ones accounting for nearly one- fifth of

the working population. These workers are not confined to the so- called

3D jobs where the jobs are difficult, dirty and dangerous that the locals

are unwilling to do those kinds of jobs. Too many of unskilled labour will

lead to low value added in the productivity. Malaysian worker are forced

to receive low wages since competition with the migrant workers are keen

because the migrant workers are willing to accept lower wages and longer

Submitted by: Anand Sharvanandan (0337677) Page 9

Recently, country’s performance has been disappointing with GDP growth

rate declining to 5.5 percent in 2002 to 2008 from 9.1 percent in 1990-

1997. In the past 1970, about 50% of Malaysian live in absolute poverty

but now decrease to less than 4%. However, Malaysian feels that they are

stuck from increasing where GDP growth has slowed up. However, when

we look at other countries for example Korea, they are at one time the

poorest country in the world but they are growing both economic and

politic. Reason that their economic can grow is because they have higher

purchasing power compared to Malaysia. This is because they receive

averagely higher income and with higher income they will have more

spending power which will boost their economy. Countries such as

Cambodia and Vietnam have very low wages while Malaysia traps in the

middle ground.

How to get into middle income trap

One of the factors Malaysia trapped into the middle income is due to over

dependence on FDI and lack of doing research and development (R&D).

Multinational companies will only provide instant of capital, expertise and

technology into Malaysia but they will not develop or improving Malaysia’s

product. Malaysia’s businessmen seem to be satisfied in making profit by

serving the MNCs and maintaining their original, assembly- based

business models. Besides, labour productivity is growing quite slow than

in the 1990s. Manufacturing in Malaysia has a low value added and had

spent a very low R&D spending. For example, Malaysia had spent only

0.6% of GDP in R&D compared to South Korea which is 3.5%. South Korea

is probably the best example of a developing country which shifts to a

advance country. Companies in Korea like Samsung and LG dominates in

the market. Taiwan is also not far behind. China’s policymakers are aware

that they need to suit with the changes in market if the labor costs rise.

With a low tech manufacturing industries and lack of skilled labour

compared to country such as Singapore, the production in Malaysia is less

competitive and thus less profit which means lower wages paid to the

workers.

Migrant workers which depress wages also one of the factors which cause

Malaysia to fall into the middle income trap. It is a mistake in letting

migrant workers to overflow in Malaysia and depresses wages. This will

limit the improvements of the productivity. Malaysia has too huge amount

of foreign workers which is reportedly has 1.9 million registered workers

and another 600000 unregistered ones accounting for nearly one- fifth of

the working population. These workers are not confined to the so- called

3D jobs where the jobs are difficult, dirty and dangerous that the locals

are unwilling to do those kinds of jobs. Too many of unskilled labour will

lead to low value added in the productivity. Malaysian worker are forced

to receive low wages since competition with the migrant workers are keen

because the migrant workers are willing to accept lower wages and longer

Submitted by: Anand Sharvanandan (0337677) Page 9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

hours of working. Besides, when we take account the negative

externalities which associates with the excessive presence of migrant

workers, we found that migrant worker is a burden to Malaysia’s economy

as the migrant workforce turns out to be a costly affair. There are cases

where the migrant workers cause social problem in Malaysia and there

were also cases where the migrant workers are abused by their employer.

They are also forced to receive low wages since there is no law to protect

their rights. It is not denied that Malaysia needs the services of foreign

workers, both skilled and unskilled but government need to ensure that

they are well treated and wages should be increased align to the local

wages so that Malaysian wages can be raised higher. In the case of

Malaysia, high wage need not mean high labour costs if an increase of

wages are backed by an increase in productivity. In the other words, low

wages does not mean lower labour costs if the productivity declines.

Apart from that, over subsidies of the subsidised item leads to middle

income trap. Subsidy was implemented in 1961 under the Control Act

1961 and subsidised items include petrol, sugar, gas, rice, salt and other

basic items. Subsidy of these items has made the Government spending

to increase and it is too heavy for government to continue to bear the

cost. For example, the oil price in 1970s was under US$12 per barrel.

However, it increases to almost US$75 per barrel which causes a cost that

is unbearable to the government. Moreover, over subsidies in local

industries for example proton is a burden to the government spending. If

compared to South Korea, such industry had do the same thing in the

beginning but they were weaned off from the government subsidy much

earlier and where Proton is still now subsidised. The high cost of subsidies

restrains the government ability to upgrade infrastructures and involve in

more research and development which increase the productivity and

competitiveness in order to become a high income country.

Price control has been one of the major causes of falling into middle

income trap. The policy where government enforced price control in

Malaya to avoid hardships after World war2 holds until today. Price control

items include basic necessities such as rice, flour, sugar, milk and even

taxi fares. Price of commodities in Malaysia is much cheaper because of

the controls compared to other countries. The problem with the price

control is that workers’ annual pay raises are linked to the nation’s CPI

which is consumer price index. This mean that with a low CPI, the salary

received by the worker remain low and a shift to a higher income will be

very hard. Since 1980s, Malaysian wages have fallen behind wages of the

rest of the world. For an example, a graduate policeman earn at RM 2300

per month compared to RM4400 in Singapore. Apart from restraining

Malaysian wages, price controls also sternly distort domestic economic

factor proportions which cause many factories ending up in inefficient

economic production processes. When we compared through GDP, South

Korea has a GDP per capita of US$16450, Singapore US$34,346, while

Submitted by: Anand Sharvanandan (0337677) Page

10

hours of working. Besides, when we take account the negative

externalities which associates with the excessive presence of migrant

workers, we found that migrant worker is a burden to Malaysia’s economy

as the migrant workforce turns out to be a costly affair. There are cases

where the migrant workers cause social problem in Malaysia and there

were also cases where the migrant workers are abused by their employer.

They are also forced to receive low wages since there is no law to protect

their rights. It is not denied that Malaysia needs the services of foreign

workers, both skilled and unskilled but government need to ensure that

they are well treated and wages should be increased align to the local

wages so that Malaysian wages can be raised higher. In the case of

Malaysia, high wage need not mean high labour costs if an increase of

wages are backed by an increase in productivity. In the other words, low

wages does not mean lower labour costs if the productivity declines.

Apart from that, over subsidies of the subsidised item leads to middle

income trap. Subsidy was implemented in 1961 under the Control Act

1961 and subsidised items include petrol, sugar, gas, rice, salt and other

basic items. Subsidy of these items has made the Government spending

to increase and it is too heavy for government to continue to bear the

cost. For example, the oil price in 1970s was under US$12 per barrel.

However, it increases to almost US$75 per barrel which causes a cost that

is unbearable to the government. Moreover, over subsidies in local

industries for example proton is a burden to the government spending. If

compared to South Korea, such industry had do the same thing in the

beginning but they were weaned off from the government subsidy much

earlier and where Proton is still now subsidised. The high cost of subsidies

restrains the government ability to upgrade infrastructures and involve in

more research and development which increase the productivity and

competitiveness in order to become a high income country.

Price control has been one of the major causes of falling into middle

income trap. The policy where government enforced price control in

Malaya to avoid hardships after World war2 holds until today. Price control

items include basic necessities such as rice, flour, sugar, milk and even

taxi fares. Price of commodities in Malaysia is much cheaper because of

the controls compared to other countries. The problem with the price

control is that workers’ annual pay raises are linked to the nation’s CPI

which is consumer price index. This mean that with a low CPI, the salary

received by the worker remain low and a shift to a higher income will be

very hard. Since 1980s, Malaysian wages have fallen behind wages of the

rest of the world. For an example, a graduate policeman earn at RM 2300

per month compared to RM4400 in Singapore. Apart from restraining

Malaysian wages, price controls also sternly distort domestic economic

factor proportions which cause many factories ending up in inefficient

economic production processes. When we compared through GDP, South

Korea has a GDP per capita of US$16450, Singapore US$34,346, while

Submitted by: Anand Sharvanandan (0337677) Page

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

Malaysia still remain at US$7469. The table below shows that the

breakdown weightage allocated for the different categories of items

consumed on a daily basis. For example, “Food and non- alcoholic

beverages” and “Housing, water, electricity, gas and fuels” make up over

52.8% of the weightage. We can see that most of the items are heavily

subsidised or price controlled. Apart from the raw materials, value added

items such cooked food and beverages are always levied at the market

price but not captured in the CPI. Besides, transport which contribute

15.9% of the weightage does not include hire purchase for cars and

motorcycle or the cost of imported spare part for repairing. Some

construction materials such cement and clinker maybe price controlled

but for certain price of rental are determined at market rate.

http://greglopez.files.wordpress.com/2010/06/n5-1.jpg?w=300

Low inflation rate causes wages to be artificially suppressed and it creates

a wide gap between Malaysian working domestically and those workers

who work abroad. With low wages, we will be unable to attract talent from

other countries even though our product and services are relatively

cheaper. Moreover, low or middle income creates a technology gap

making Malaysia to be uncompetitive. Technology goods and services

have become more expensive for Malaysian to purchase including items

such as Iphone, laptop which it is common nowadays. With a cheap

currency, we find it difficult to purchase the most advanced technology to

improve productivity.

Malaysia was emphasizing on agriculture sector in the early 1950s but

when Malaysia’s economic had shift from agriculture sector to

manufacturing sector, agriculture sector had became a drag to the

economy. The dominance of oil palm and rubber in the agriculture sector

is unfortunately a significant drag and had caused the nation’s to cease

from shifting to a high income economy. Those plantation terrain, paddy

harvesting and rubber tapping are not easily mechanised and remaining

done by manual. Agriculture sector with high technology and mechanised

makes more profit by having much efficient and more productivity. Until

today, agriculture with manual worker still remain as low wage activities

and most of the agriculture depend a lot on foreign labour. For example,

textile industry hires most of the workers from Bangladesh since the local

workers are not willing to work in this sector because of the low wages.

The mobility of the foreign workers in plantation is also easy and they

move from estates to factories which mean it is hard for government to

disallow the foreign workers to work in the non- plantation sector. The

cumulative effect is that there are now about 2.3 million low- skill foreign

workers in Malaysia, making up about 20% of the workforce. They are in

the manufacturing, petroleum, construction and domestic- help sectors.

Lately, they are also involving in retailing, food and beverage, tourism and

hotel industries. Such a massive inflow of foreign workers into those

Submitted by: Anand Sharvanandan (0337677) Page

11

Malaysia still remain at US$7469. The table below shows that the

breakdown weightage allocated for the different categories of items

consumed on a daily basis. For example, “Food and non- alcoholic

beverages” and “Housing, water, electricity, gas and fuels” make up over

52.8% of the weightage. We can see that most of the items are heavily

subsidised or price controlled. Apart from the raw materials, value added

items such cooked food and beverages are always levied at the market

price but not captured in the CPI. Besides, transport which contribute

15.9% of the weightage does not include hire purchase for cars and

motorcycle or the cost of imported spare part for repairing. Some

construction materials such cement and clinker maybe price controlled

but for certain price of rental are determined at market rate.

http://greglopez.files.wordpress.com/2010/06/n5-1.jpg?w=300

Low inflation rate causes wages to be artificially suppressed and it creates

a wide gap between Malaysian working domestically and those workers

who work abroad. With low wages, we will be unable to attract talent from

other countries even though our product and services are relatively

cheaper. Moreover, low or middle income creates a technology gap

making Malaysia to be uncompetitive. Technology goods and services

have become more expensive for Malaysian to purchase including items

such as Iphone, laptop which it is common nowadays. With a cheap

currency, we find it difficult to purchase the most advanced technology to

improve productivity.

Malaysia was emphasizing on agriculture sector in the early 1950s but

when Malaysia’s economic had shift from agriculture sector to

manufacturing sector, agriculture sector had became a drag to the

economy. The dominance of oil palm and rubber in the agriculture sector

is unfortunately a significant drag and had caused the nation’s to cease

from shifting to a high income economy. Those plantation terrain, paddy

harvesting and rubber tapping are not easily mechanised and remaining

done by manual. Agriculture sector with high technology and mechanised

makes more profit by having much efficient and more productivity. Until

today, agriculture with manual worker still remain as low wage activities

and most of the agriculture depend a lot on foreign labour. For example,

textile industry hires most of the workers from Bangladesh since the local

workers are not willing to work in this sector because of the low wages.

The mobility of the foreign workers in plantation is also easy and they

move from estates to factories which mean it is hard for government to

disallow the foreign workers to work in the non- plantation sector. The

cumulative effect is that there are now about 2.3 million low- skill foreign

workers in Malaysia, making up about 20% of the workforce. They are in

the manufacturing, petroleum, construction and domestic- help sectors.

Lately, they are also involving in retailing, food and beverage, tourism and

hotel industries. Such a massive inflow of foreign workers into those

Submitted by: Anand Sharvanandan (0337677) Page

11

ECN70104: - MALAYSIA IN A MIDDLE INCOME TRAP

industries will therefore suppress wages in Malaysia and causes middle

income trap.

Effects of the Middle Income Trap

Malaysia’s caught in the “middle-income trap” right now give awareness

to our policymakers that the export-led growth strategy, according to

some, is no longer an optimal development strategy for developing

countries especially Malaysia. Continued emphasis on export-led growth

will, among other things, increase the reliance of developing countries on

the developed world and dampen domestic market growth. Many export-

dependent developing countries started tweaking their growth strategies

especially after external demand for their exports dried up on account of

the current global financial and economic crisis. Though Malaysia’s growth

strategy had started emphasizing domestic demand since about a decade

back, it still remains largely dependent on external demand for its

economic growth (Quah, 2009). Ex-World Bank chief economist and

Brookings Institution’s Wolfensohn Centre for Development, Global

Economy and Development’s senior fellow, Homi J. Kharas, said there was

an impetus for change and rethinking on policies and strategies in

Malaysia every 10 years based on economic developments. “Malaysia has

been very successful as an exporting nation but has also been very export

dependent. About 90% (of products) are being exported to the United

States, Europe and Japan,” he said, adding that Malaysia needed to

diversify its exports (Malaysia needs to be high-income economy, 2009).

However, the main challenge is domestic market of Malaysia is too limited

due to only 28 million of populations. That’s why we are facing the

dilemma of the exploration of external and domestic market. However,

2010 GDP performance sets strong momentum for a robust 2011. Given

the marked improvement in economic growth in the first half of the year,

domestic demand was clearly the chief momentum driver for the

recovery. Moving forward, the country is anticipated to register a robust

GDP growth of 5.6% in 2011, with domestic demand once again acting as

the back-bone for momentum (RAM Rating Services, 2011).

Besides, middle-income trap also lead to declining private investments.

The old growth model provided three decades of outstanding

performance, permitting Malaysia to provide for the health and education

of its people, largely eradicate poverty, build a world-class infrastructure

and become a major exporter globally. But the progress we have made

over the past half-century has slowed and economic growth prospects

have weakened considerably. We are caught in a middle income trap.

Malaysia has been susceptible to external shocks, as seen during the past

crises. Increases in international commodity prices, like fuel or food, have

direct impact on domestic prices. Similarly, unless production costs and

productivity in Malaysia can keep pace with those abroad, exports are

Submitted by: Anand Sharvanandan (0337677) Page

12

industries will therefore suppress wages in Malaysia and causes middle

income trap.

Effects of the Middle Income Trap

Malaysia’s caught in the “middle-income trap” right now give awareness

to our policymakers that the export-led growth strategy, according to

some, is no longer an optimal development strategy for developing

countries especially Malaysia. Continued emphasis on export-led growth

will, among other things, increase the reliance of developing countries on

the developed world and dampen domestic market growth. Many export-

dependent developing countries started tweaking their growth strategies

especially after external demand for their exports dried up on account of

the current global financial and economic crisis. Though Malaysia’s growth

strategy had started emphasizing domestic demand since about a decade

back, it still remains largely dependent on external demand for its

economic growth (Quah, 2009). Ex-World Bank chief economist and

Brookings Institution’s Wolfensohn Centre for Development, Global

Economy and Development’s senior fellow, Homi J. Kharas, said there was

an impetus for change and rethinking on policies and strategies in

Malaysia every 10 years based on economic developments. “Malaysia has

been very successful as an exporting nation but has also been very export

dependent. About 90% (of products) are being exported to the United

States, Europe and Japan,” he said, adding that Malaysia needed to

diversify its exports (Malaysia needs to be high-income economy, 2009).

However, the main challenge is domestic market of Malaysia is too limited

due to only 28 million of populations. That’s why we are facing the

dilemma of the exploration of external and domestic market. However,

2010 GDP performance sets strong momentum for a robust 2011. Given

the marked improvement in economic growth in the first half of the year,

domestic demand was clearly the chief momentum driver for the

recovery. Moving forward, the country is anticipated to register a robust

GDP growth of 5.6% in 2011, with domestic demand once again acting as

the back-bone for momentum (RAM Rating Services, 2011).

Besides, middle-income trap also lead to declining private investments.

The old growth model provided three decades of outstanding

performance, permitting Malaysia to provide for the health and education

of its people, largely eradicate poverty, build a world-class infrastructure

and become a major exporter globally. But the progress we have made

over the past half-century has slowed and economic growth prospects

have weakened considerably. We are caught in a middle income trap.

Malaysia has been susceptible to external shocks, as seen during the past

crises. Increases in international commodity prices, like fuel or food, have

direct impact on domestic prices. Similarly, unless production costs and

productivity in Malaysia can keep pace with those abroad, exports are

Submitted by: Anand Sharvanandan (0337677) Page

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.