ECON 5313: Decisions and Strategies - Module 7 Homework

This video lecture discusses the concept of organizational design and how to align the incentives of employees with the goals of the firm. It also introduces principal-agent models and their application in managing incentive conflicts and agency costs.

4 Pages1352 Words53 Views

Added on 2023-06-15

About This Document

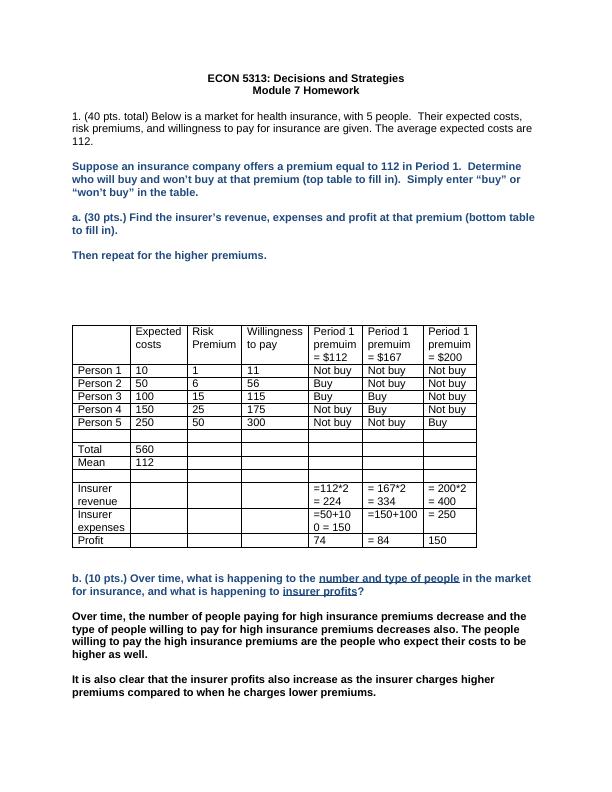

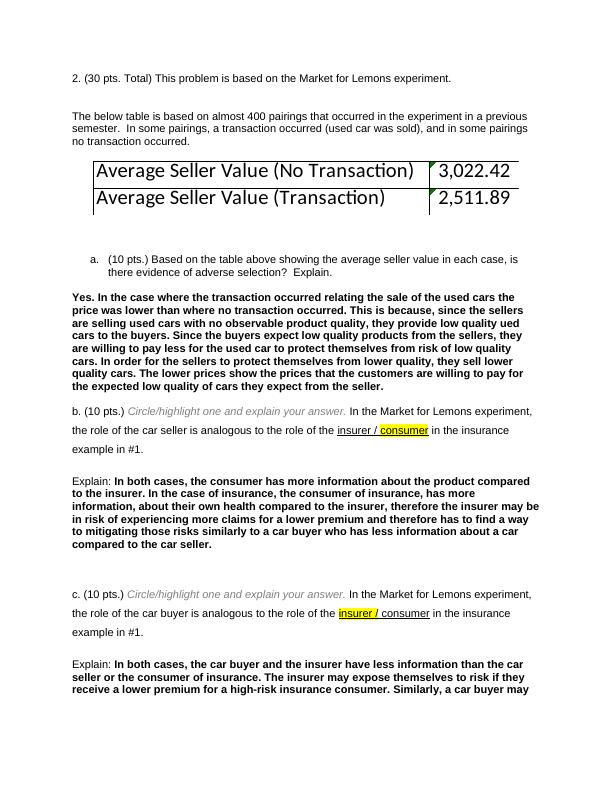

This homework includes solved problems on the market for health insurance, Market for Lemons experiment, and Principal Agent experiment with asymmetric information for ECON 5313: Decisions and Strategies - Module 7. The market for health insurance problem involves determining who will buy and won’t buy at different premiums and finding the insurer’s revenue, expenses, and profit at each premium. The Market for Lemons experiment problem involves analyzing the average seller value and evidence of adverse selection. The Principal Agent experiment with asymmetric information problem involves finding the minimum bonus that will induce the worker to exert high effort and determining if the boss’s payoff will be higher under high effort than under low effort.

ECON 5313: Decisions and Strategies - Module 7 Homework

This video lecture discusses the concept of organizational design and how to align the incentives of employees with the goals of the firm. It also introduces principal-agent models and their application in managing incentive conflicts and agency costs.

Added on 2023-06-15

ShareRelated Documents

End of preview

Want to access all the pages? Upload your documents or become a member.