ECON20039 - Perfect Competition vs. Monopoly: A Comparative Study

VerifiedAdded on 2023/04/22

|16

|4513

|222

Essay

AI Summary

This essay provides a comparative analysis of different market structures, primarily focusing on perfect competition and monopoly. It elucidates the key features of each market, including the number of sellers, product types, and entry conditions. The essay examines how profits and losses arise in both the short run and long run, using diagrams to illustrate these concepts. It further compares the two market structures in terms of price, quantity, consumer surplus, producer surplus, and deadweight loss, supported by graphical representations. Additionally, the essay explores the characteristics of oligopoly, using the Australian supermarket industry as an example, and discusses the role of advertising in such markets. It also briefly touches upon the housing affordability crisis in Australia and the effects of first home owners’ subsidies. This document is a student contribution available on Desklib, a platform offering a range of AI-based study tools and resources for students.

1

ECON20039- ECONOMICS FOR MANAGERS

ECON20039- ECONOMICS FOR MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Contents

1.0 Question (a)..........................................................................................................................3

A feature of perfect competition................................................................................................3

A feature of monopoly...............................................................................................................3

Changes in the short run and long run profits............................................................................3

Short and long-run profit of a competitive firm.........................................................................3

Short and long-run profit of a monopolist..................................................................................5

Comparison in terms of price, quantity and surplus..................................................................6

Price Comparison.......................................................................................................................7

Quantity Comparison.................................................................................................................7

Surplus comparison....................................................................................................................8

2.0 Question (b)..........................................................................................................................8

Oligopoly and its features..........................................................................................................8

Role of advertisement in oligopoly............................................................................................9

Australian supermarket industry................................................................................................9

Impact of advertisement in Australian supermarket industry..................................................10

3.0 Question (c)........................................................................................................................11

Housing affordability crisis in Australia..................................................................................11

Solutions...................................................................................................................................12

Effects of first home owners’ subsidy......................................................................................12

Reference..................................................................................................................................14

Contents

1.0 Question (a)..........................................................................................................................3

A feature of perfect competition................................................................................................3

A feature of monopoly...............................................................................................................3

Changes in the short run and long run profits............................................................................3

Short and long-run profit of a competitive firm.........................................................................3

Short and long-run profit of a monopolist..................................................................................5

Comparison in terms of price, quantity and surplus..................................................................6

Price Comparison.......................................................................................................................7

Quantity Comparison.................................................................................................................7

Surplus comparison....................................................................................................................8

2.0 Question (b)..........................................................................................................................8

Oligopoly and its features..........................................................................................................8

Role of advertisement in oligopoly............................................................................................9

Australian supermarket industry................................................................................................9

Impact of advertisement in Australian supermarket industry..................................................10

3.0 Question (c)........................................................................................................................11

Housing affordability crisis in Australia..................................................................................11

Solutions...................................................................................................................................12

Effects of first home owners’ subsidy......................................................................................12

Reference..................................................................................................................................14

3

1.0 Question (a)

A feature of perfect competition

The perfect competition is a market structure where the number of sellers and the buyers are

huge in number. The size of the seller and buyer in a perfectly competitive market is so huge

that none of the individual buyer or seller has control over the price. One of the important

features of a perfectly competitive market is the homogenous products which are sold by all

the sellers in the market (Friedman, 2017). That means products are identical in nature and

hence sellers do not have the option to mark their price upon the basis of the nature of the

product they sell. The entry and exit into a perfectly competitive market are free. Therefore,

whenever there is a supernormal profit, a new firm may enter and extract that.

Feature of monopoly

Monopoly rests at the other extreme position of the same spectrum as perfect competition

does. In a monopoly market, there is just one seller who produces and supplies goods and

services to all the customers of the market. There are no alternative options in terms of good

for the customers of the market and hence monopolist enjoys a huge power over the price of

the product. Unlike a perfectly competitive market, where sellers are price takers, a

monopolist is a price setter and sets the price above the marginal cost in order to earn a higher

profit for the company (Dean & Green, 2017). Entry to and exit from the market is restricted

either by the structure of the market or by the policies of the government. The government

can sometimes use policies to restrict entries into a monopoly market in order to keep a low

average cost of production.

Changes in the short run and long run profits

Short and long-run profit of a competitive firm

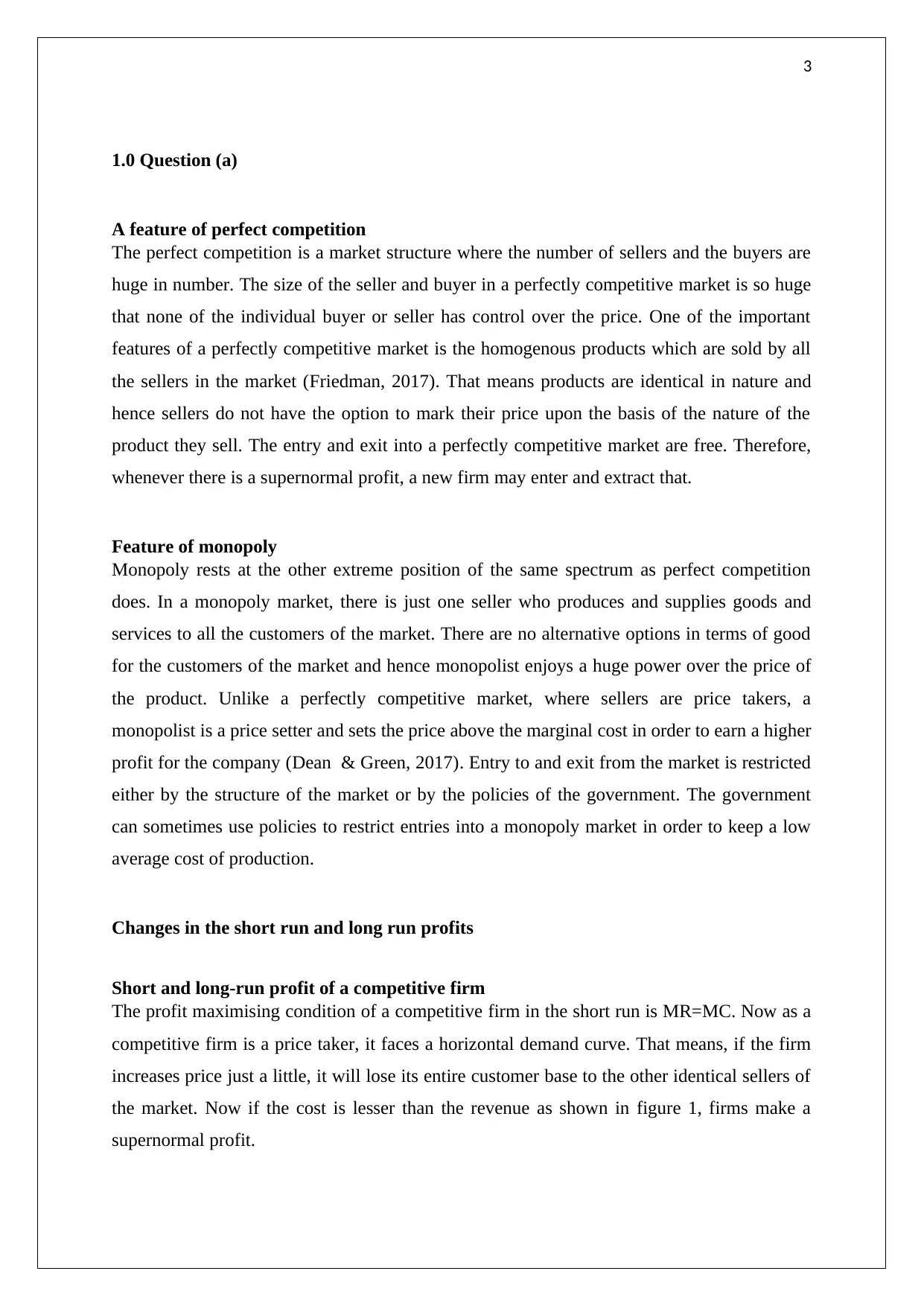

The profit maximising condition of a competitive firm in the short run is MR=MC. Now as a

competitive firm is a price taker, it faces a horizontal demand curve. That means, if the firm

increases price just a little, it will lose its entire customer base to the other identical sellers of

the market. Now if the cost is lesser than the revenue as shown in figure 1, firms make a

supernormal profit.

1.0 Question (a)

A feature of perfect competition

The perfect competition is a market structure where the number of sellers and the buyers are

huge in number. The size of the seller and buyer in a perfectly competitive market is so huge

that none of the individual buyer or seller has control over the price. One of the important

features of a perfectly competitive market is the homogenous products which are sold by all

the sellers in the market (Friedman, 2017). That means products are identical in nature and

hence sellers do not have the option to mark their price upon the basis of the nature of the

product they sell. The entry and exit into a perfectly competitive market are free. Therefore,

whenever there is a supernormal profit, a new firm may enter and extract that.

Feature of monopoly

Monopoly rests at the other extreme position of the same spectrum as perfect competition

does. In a monopoly market, there is just one seller who produces and supplies goods and

services to all the customers of the market. There are no alternative options in terms of good

for the customers of the market and hence monopolist enjoys a huge power over the price of

the product. Unlike a perfectly competitive market, where sellers are price takers, a

monopolist is a price setter and sets the price above the marginal cost in order to earn a higher

profit for the company (Dean & Green, 2017). Entry to and exit from the market is restricted

either by the structure of the market or by the policies of the government. The government

can sometimes use policies to restrict entries into a monopoly market in order to keep a low

average cost of production.

Changes in the short run and long run profits

Short and long-run profit of a competitive firm

The profit maximising condition of a competitive firm in the short run is MR=MC. Now as a

competitive firm is a price taker, it faces a horizontal demand curve. That means, if the firm

increases price just a little, it will lose its entire customer base to the other identical sellers of

the market. Now if the cost is lesser than the revenue as shown in figure 1, firms make a

supernormal profit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Figure 1: The supernormal profit in the short run

(Source: Jensen & Pareja-Eastaway, 2018)

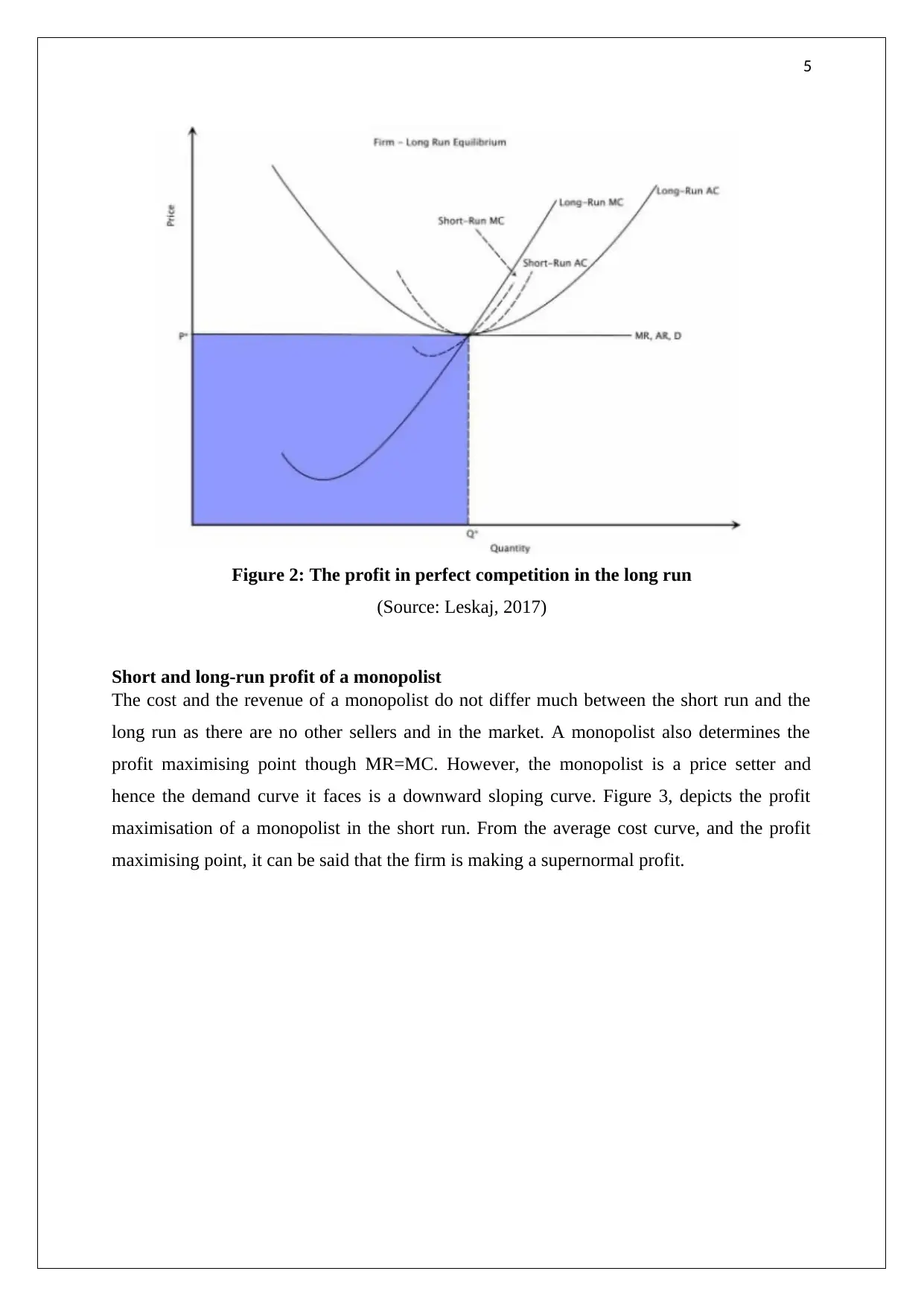

In the long run, if the incumbent sellers make a profit, more and more seller enters the market

until; each of the firms makes only a normal profit. If the incumbent sellers make losses, a

number of sellers exit the market until the profit becomes normal. The figure 2 shows the

profit maximising output is determined by the interaction of LRMR=LRMC= LRAC, at this

point the firm's cost including the time cost is equal to the revenue and hence the firms earn

no supernormal profit.

Figure 1: The supernormal profit in the short run

(Source: Jensen & Pareja-Eastaway, 2018)

In the long run, if the incumbent sellers make a profit, more and more seller enters the market

until; each of the firms makes only a normal profit. If the incumbent sellers make losses, a

number of sellers exit the market until the profit becomes normal. The figure 2 shows the

profit maximising output is determined by the interaction of LRMR=LRMC= LRAC, at this

point the firm's cost including the time cost is equal to the revenue and hence the firms earn

no supernormal profit.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

Figure 2: The profit in perfect competition in the long run

(Source: Leskaj, 2017)

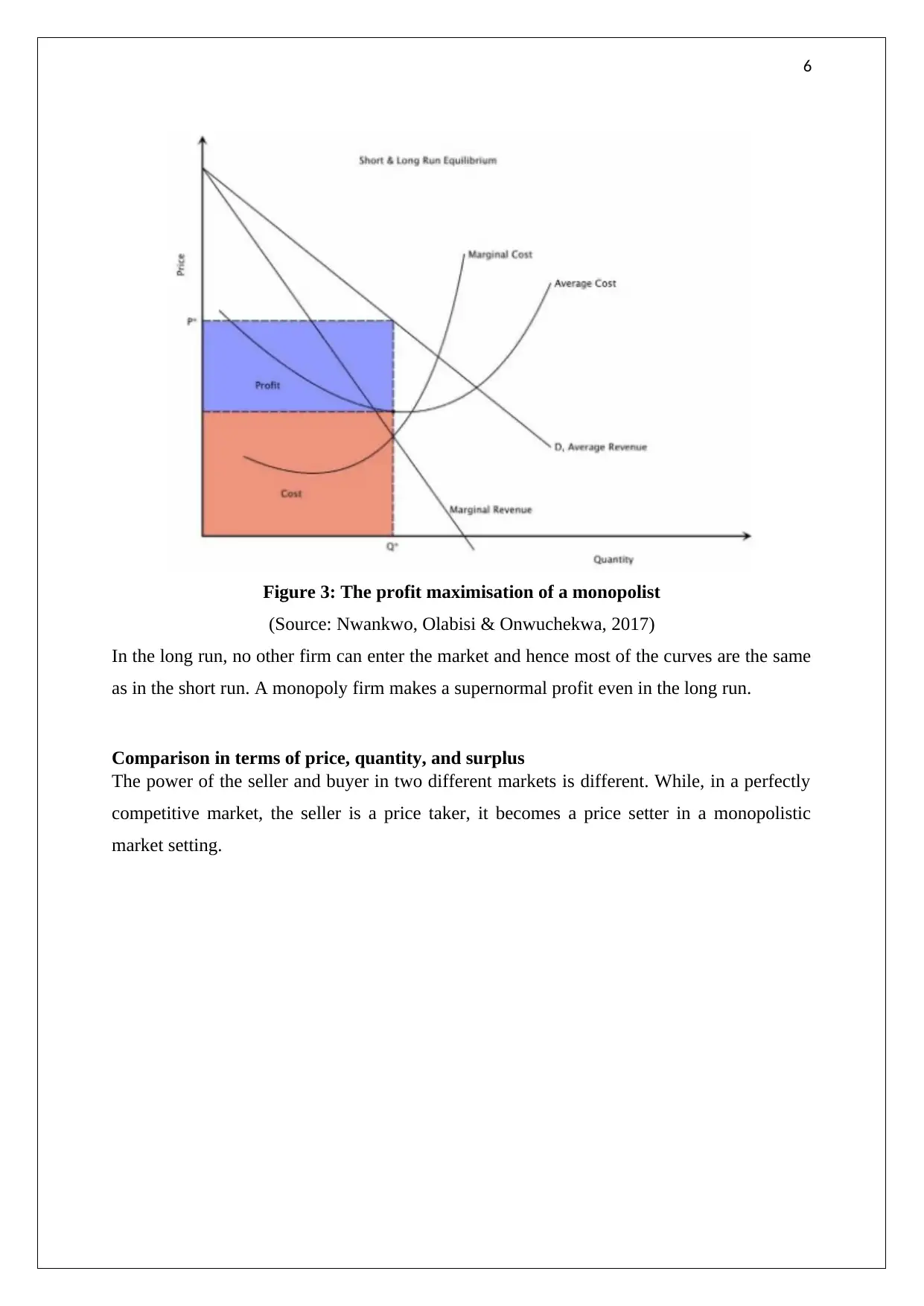

Short and long-run profit of a monopolist

The cost and the revenue of a monopolist do not differ much between the short run and the

long run as there are no other sellers and in the market. A monopolist also determines the

profit maximising point though MR=MC. However, the monopolist is a price setter and

hence the demand curve it faces is a downward sloping curve. Figure 3, depicts the profit

maximisation of a monopolist in the short run. From the average cost curve, and the profit

maximising point, it can be said that the firm is making a supernormal profit.

Figure 2: The profit in perfect competition in the long run

(Source: Leskaj, 2017)

Short and long-run profit of a monopolist

The cost and the revenue of a monopolist do not differ much between the short run and the

long run as there are no other sellers and in the market. A monopolist also determines the

profit maximising point though MR=MC. However, the monopolist is a price setter and

hence the demand curve it faces is a downward sloping curve. Figure 3, depicts the profit

maximisation of a monopolist in the short run. From the average cost curve, and the profit

maximising point, it can be said that the firm is making a supernormal profit.

6

Figure 3: The profit maximisation of a monopolist

(Source: Nwankwo, Olabisi & Onwuchekwa, 2017)

In the long run, no other firm can enter the market and hence most of the curves are the same

as in the short run. A monopoly firm makes a supernormal profit even in the long run.

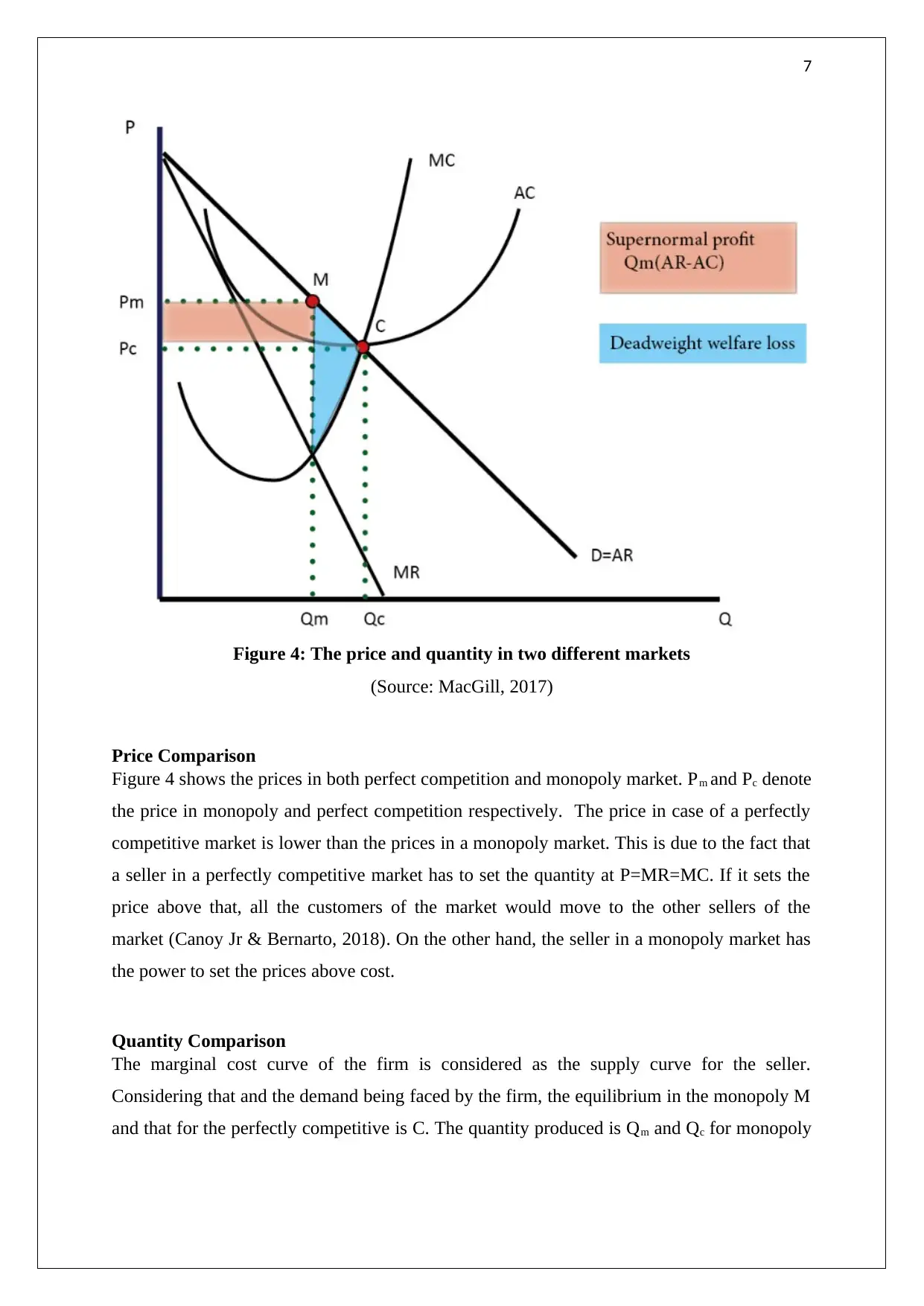

Comparison in terms of price, quantity, and surplus

The power of the seller and buyer in two different markets is different. While, in a perfectly

competitive market, the seller is a price taker, it becomes a price setter in a monopolistic

market setting.

Figure 3: The profit maximisation of a monopolist

(Source: Nwankwo, Olabisi & Onwuchekwa, 2017)

In the long run, no other firm can enter the market and hence most of the curves are the same

as in the short run. A monopoly firm makes a supernormal profit even in the long run.

Comparison in terms of price, quantity, and surplus

The power of the seller and buyer in two different markets is different. While, in a perfectly

competitive market, the seller is a price taker, it becomes a price setter in a monopolistic

market setting.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

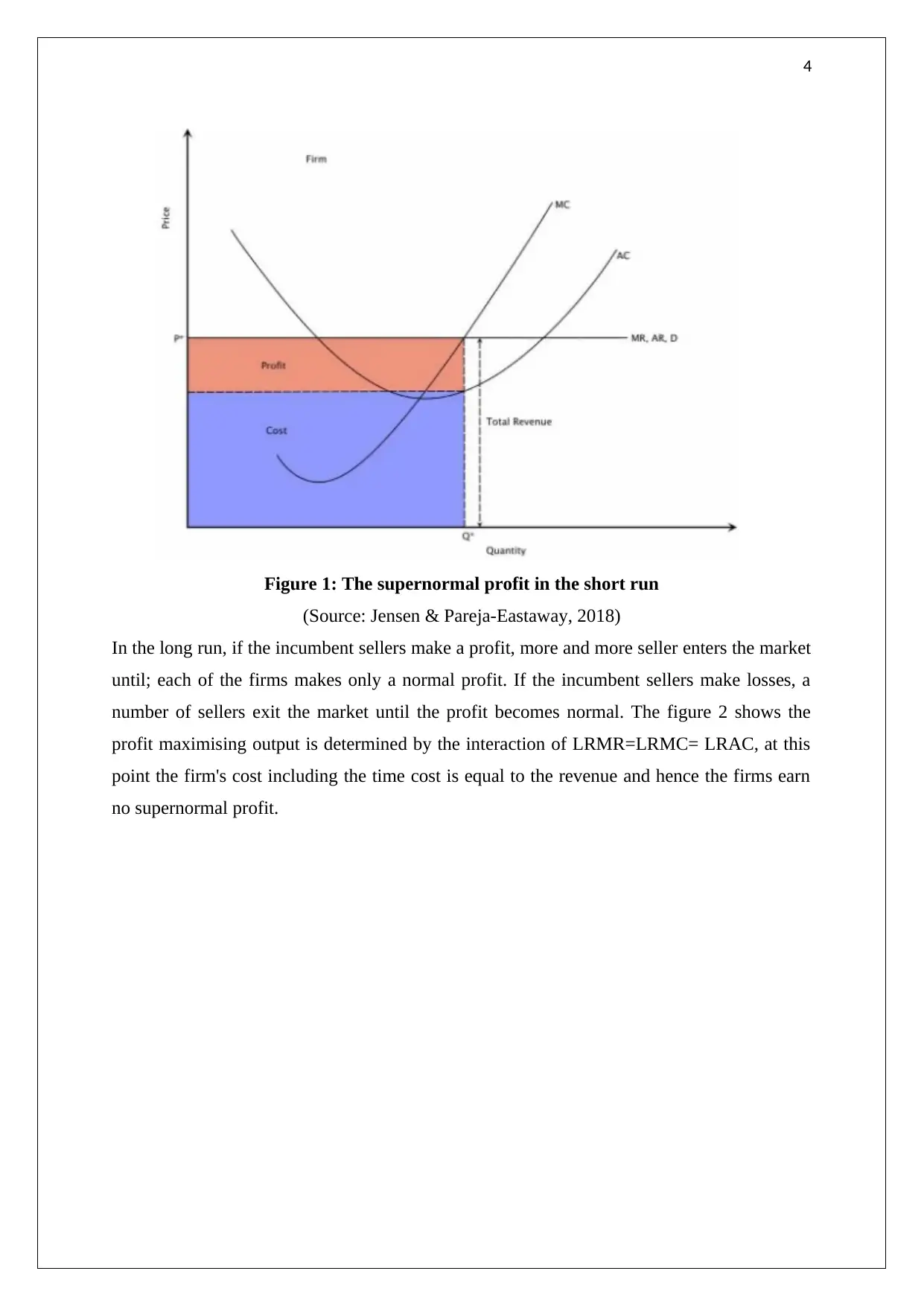

Figure 4: The price and quantity in two different markets

(Source: MacGill, 2017)

Price Comparison

Figure 4 shows the prices in both perfect competition and monopoly market. Pm and Pc denote

the price in monopoly and perfect competition respectively. The price in case of a perfectly

competitive market is lower than the prices in a monopoly market. This is due to the fact that

a seller in a perfectly competitive market has to set the quantity at P=MR=MC. If it sets the

price above that, all the customers of the market would move to the other sellers of the

market (Canoy Jr & Bernarto, 2018). On the other hand, the seller in a monopoly market has

the power to set the prices above cost.

Quantity Comparison

The marginal cost curve of the firm is considered as the supply curve for the seller.

Considering that and the demand being faced by the firm, the equilibrium in the monopoly M

and that for the perfectly competitive is C. The quantity produced is Qm and Qc for monopoly

Figure 4: The price and quantity in two different markets

(Source: MacGill, 2017)

Price Comparison

Figure 4 shows the prices in both perfect competition and monopoly market. Pm and Pc denote

the price in monopoly and perfect competition respectively. The price in case of a perfectly

competitive market is lower than the prices in a monopoly market. This is due to the fact that

a seller in a perfectly competitive market has to set the quantity at P=MR=MC. If it sets the

price above that, all the customers of the market would move to the other sellers of the

market (Canoy Jr & Bernarto, 2018). On the other hand, the seller in a monopoly market has

the power to set the prices above cost.

Quantity Comparison

The marginal cost curve of the firm is considered as the supply curve for the seller.

Considering that and the demand being faced by the firm, the equilibrium in the monopoly M

and that for the perfectly competitive is C. The quantity produced is Qm and Qc for monopoly

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

and perfect competition respectively. Thus, the seller in a monopoly market produces less

than that of a perfectly competitive market.

Surplus comparison

Again, from the demand and supply from figure 4 show that welfare is shared equally

between the consumers and the sellers in case of a perfectly competitive market. Now, as a

perfect competition moves to a monopoly market, the number of sellers reduces and the price

rises to Pm to Pc. Now due to the movement from perfect competition to the monopoly the

consumers’ surplus reduces by PmPcCM rectangle. The producers surplus reduces by (Qm-

Qc)*Pc and increases by the orange square shown in figure 4. Thus, while the surplus reduces

for the consumers, surplus for producers depend on the elasticity of that product being sold in

the market (Rao, 2018). If the demand for the product is inelastic then producers’ surplus

increases and if the demand is elastic, the producers' surplus reduces after moving to a

monopoly from perfect competition.

Figure 4 also highlights a blue area is a deadweight loss which is commonly lost by both the

sellers and consumers of the market. In perfect competition, there was no deadweight loss

and hence movement to a monopoly would result in a loss of welfare for the society.

2.0 Question (b)

Supermarket chain industry of Australia is a clear example of oligopoly where around 76% of

the market is controlled by Coles and Woolworths. The rest of the market is captured by

small sellers and local market.

Oligopoly and its features

Now, oligopoly is a market structure where the numbers of sellers are very small but more

than two. The number of the buyer in an oligopolistic market is high same as a perfectly

competitive market. The products being sold in an oligopolistic market can either be

homogenous or heterogeneous. In the case of the Australian supermarket chain industry, the

products and services are slightly different from each other. Pulker, Trapp, Scott & Pollard

(2018) stated that the position of the oligopolistic market is between monopoly and

monopolistic competition as a small number of sellers dominate the market while others have

no power over the prices. Apart from that, the action of one seller is highly dependent on the

and perfect competition respectively. Thus, the seller in a monopoly market produces less

than that of a perfectly competitive market.

Surplus comparison

Again, from the demand and supply from figure 4 show that welfare is shared equally

between the consumers and the sellers in case of a perfectly competitive market. Now, as a

perfect competition moves to a monopoly market, the number of sellers reduces and the price

rises to Pm to Pc. Now due to the movement from perfect competition to the monopoly the

consumers’ surplus reduces by PmPcCM rectangle. The producers surplus reduces by (Qm-

Qc)*Pc and increases by the orange square shown in figure 4. Thus, while the surplus reduces

for the consumers, surplus for producers depend on the elasticity of that product being sold in

the market (Rao, 2018). If the demand for the product is inelastic then producers’ surplus

increases and if the demand is elastic, the producers' surplus reduces after moving to a

monopoly from perfect competition.

Figure 4 also highlights a blue area is a deadweight loss which is commonly lost by both the

sellers and consumers of the market. In perfect competition, there was no deadweight loss

and hence movement to a monopoly would result in a loss of welfare for the society.

2.0 Question (b)

Supermarket chain industry of Australia is a clear example of oligopoly where around 76% of

the market is controlled by Coles and Woolworths. The rest of the market is captured by

small sellers and local market.

Oligopoly and its features

Now, oligopoly is a market structure where the numbers of sellers are very small but more

than two. The number of the buyer in an oligopolistic market is high same as a perfectly

competitive market. The products being sold in an oligopolistic market can either be

homogenous or heterogeneous. In the case of the Australian supermarket chain industry, the

products and services are slightly different from each other. Pulker, Trapp, Scott & Pollard

(2018) stated that the position of the oligopolistic market is between monopoly and

monopolistic competition as a small number of sellers dominate the market while others have

no power over the prices. Apart from that, the action of one seller is highly dependent on the

9

strategy of the other seller. There are a still moderate entry and exit barrier that makes it

tough for the sellers to enter and exit the market in the short run.

Role of advertisement in oligopoly

As discussed above, products sold in the market may either be homogenous or

heterogeneous. In the case of the supermarket chain of the Australian market, the goods are

generally slightly different from the other. Each of the products of both the companies is

different in extra additives, flavours and many more. Therefore, it is important for the firms

to make the customers aware regarding the description of their respective products. The

advertisement also allows the firms to stay connected with the customer base of the market as

well (Azavedo & Walsh, 2018). For example, among the two players, if one advertises

heavily and the other does not, customers would think the firm which does not advertise has

gone out of business or scaled their production down.

Australian supermarket industry

As stated above, the Australian supermarket industry presented in this study is a close

example of an oligopoly. Most of the market share is captured by two of the biggest

organisation in the industry, Coles, and Woolworths. Both the giant organisations often

compete through the price war. Undercutting the prices of each other is a common mean of

increasing market share. Grimmer (2018) highlighted that the respective market share keeps

on changing from time to time; however, they stay mostly the same throughout the year. One

of the important features of the industry is that price levels have reduced significantly since

the large player started operating in this industry. According to the data, the overall prices

have reduced by 2.4% in the third quarter of 2018 since the second quarter.

Woolworths, in the year 2018 has mainly concentrated on improving the customers' service

while Cole tried to refurbish the stores in order to increase customer satisfaction. However,

Bray, Buddle & Ankeny (2017) pointed out that, aggressive policies and heavy marketing

strategy from the side of Woolworths cost the annual revenue of Coles. The annual revenue

of Coles reduced by 7% compared to the annual revenue of the previous year. Apart from

that, the expansionary strategy of Woolworths has also put pressure on the sales of Coles that

have grown only by 0.3% over the years. Therefore, the market share of Coles is expected to

reduce in the year 2019, owing to greater market activity and brand recognition of

Woolworths.

strategy of the other seller. There are a still moderate entry and exit barrier that makes it

tough for the sellers to enter and exit the market in the short run.

Role of advertisement in oligopoly

As discussed above, products sold in the market may either be homogenous or

heterogeneous. In the case of the supermarket chain of the Australian market, the goods are

generally slightly different from the other. Each of the products of both the companies is

different in extra additives, flavours and many more. Therefore, it is important for the firms

to make the customers aware regarding the description of their respective products. The

advertisement also allows the firms to stay connected with the customer base of the market as

well (Azavedo & Walsh, 2018). For example, among the two players, if one advertises

heavily and the other does not, customers would think the firm which does not advertise has

gone out of business or scaled their production down.

Australian supermarket industry

As stated above, the Australian supermarket industry presented in this study is a close

example of an oligopoly. Most of the market share is captured by two of the biggest

organisation in the industry, Coles, and Woolworths. Both the giant organisations often

compete through the price war. Undercutting the prices of each other is a common mean of

increasing market share. Grimmer (2018) highlighted that the respective market share keeps

on changing from time to time; however, they stay mostly the same throughout the year. One

of the important features of the industry is that price levels have reduced significantly since

the large player started operating in this industry. According to the data, the overall prices

have reduced by 2.4% in the third quarter of 2018 since the second quarter.

Woolworths, in the year 2018 has mainly concentrated on improving the customers' service

while Cole tried to refurbish the stores in order to increase customer satisfaction. However,

Bray, Buddle & Ankeny (2017) pointed out that, aggressive policies and heavy marketing

strategy from the side of Woolworths cost the annual revenue of Coles. The annual revenue

of Coles reduced by 7% compared to the annual revenue of the previous year. Apart from

that, the expansionary strategy of Woolworths has also put pressure on the sales of Coles that

have grown only by 0.3% over the years. Therefore, the market share of Coles is expected to

reduce in the year 2019, owing to greater market activity and brand recognition of

Woolworths.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

Apart from Coles and Woolworths, there are other small and medium-sized companies are in

the market as well. However, these companies have a very low share and hence have limited

control over the prices of the products being sold in the market. Aldi, for example, is the third

largest company in the supermarket chain industry of Australia with a market share of 9.2%

(Fels & Lees, 2018). In the last year, the company has increased the number of stores amount

which has reached around 500. In addition to that, individual and other small players of the

market operate in the market through Metcash Network Stores. However, these small players

are consistently losing the market share due to the excessive power of Coles and Woolworths

over the prices of the market. According to the data, the market shares of Metcash Network

Stores have reduced by 0.7% in the year 2018 and the group of stores has lost a huge number

of individual sellers in the last year due to lack of profitability.

Impact of advertisement in the Australian supermarket industry

The advertisement is not only an impressive tool to promote the products of the company, but

it also a great way to put across the company message to the customers of the market. In the

Australian supermarket industry, both the giant companies have spent heavily on

advertisement over the years. However, interestingly, both Woolworths and Coles have been

reported to reduce their advertisement spending by 27% and 19% respectively. Miller (2018)

in this context commented that the large players like Coles have already developed a brand

reputation in the industry and therefore, it gives them the opportunity to spend on other

aspects of the business. Both the company spent heavily on customer satisfaction in the year

2018.

Nevertheless, before that year, both Coles and Woolworths spent heavily on the

advertisement. Woolworth’s market share in the year 2006 was way more than Coles.

However, with the advertisement, Coles managed to be at par with the operation of

Woolworths within the next few years. In the year 2008, both the company had almost the

same market share in the supermarket industry of Australia. Advertisement helped Coles to

put across a message that they strongly exist in the market and they have the capability to

combat a big player like Woolworths. Parker, Carey & Scrinis (2018) stated that price wars

between the two companies were fruitful due to advertisements. Both the companies

increased awareness among the customers regarding their offers and reduction in prices of

goods. Aldi has also benefitted from the advertisements as well. At the point of time, there

were only Coles and Woolworths dominating the market and Aldi had only 4.2% of the

market share. Aldi significantly increased their advertisement spending in the subsequent

Apart from Coles and Woolworths, there are other small and medium-sized companies are in

the market as well. However, these companies have a very low share and hence have limited

control over the prices of the products being sold in the market. Aldi, for example, is the third

largest company in the supermarket chain industry of Australia with a market share of 9.2%

(Fels & Lees, 2018). In the last year, the company has increased the number of stores amount

which has reached around 500. In addition to that, individual and other small players of the

market operate in the market through Metcash Network Stores. However, these small players

are consistently losing the market share due to the excessive power of Coles and Woolworths

over the prices of the market. According to the data, the market shares of Metcash Network

Stores have reduced by 0.7% in the year 2018 and the group of stores has lost a huge number

of individual sellers in the last year due to lack of profitability.

Impact of advertisement in the Australian supermarket industry

The advertisement is not only an impressive tool to promote the products of the company, but

it also a great way to put across the company message to the customers of the market. In the

Australian supermarket industry, both the giant companies have spent heavily on

advertisement over the years. However, interestingly, both Woolworths and Coles have been

reported to reduce their advertisement spending by 27% and 19% respectively. Miller (2018)

in this context commented that the large players like Coles have already developed a brand

reputation in the industry and therefore, it gives them the opportunity to spend on other

aspects of the business. Both the company spent heavily on customer satisfaction in the year

2018.

Nevertheless, before that year, both Coles and Woolworths spent heavily on the

advertisement. Woolworth’s market share in the year 2006 was way more than Coles.

However, with the advertisement, Coles managed to be at par with the operation of

Woolworths within the next few years. In the year 2008, both the company had almost the

same market share in the supermarket industry of Australia. Advertisement helped Coles to

put across a message that they strongly exist in the market and they have the capability to

combat a big player like Woolworths. Parker, Carey & Scrinis (2018) stated that price wars

between the two companies were fruitful due to advertisements. Both the companies

increased awareness among the customers regarding their offers and reduction in prices of

goods. Aldi has also benefitted from the advertisements as well. At the point of time, there

were only Coles and Woolworths dominating the market and Aldi had only 4.2% of the

market share. Aldi significantly increased their advertisement spending in the subsequent

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

years and matched recognition of the giant firms. According to the data, Aldi managed to

increase their market share to 9.7% within 3 years. However, Ariyawardana, Ganegodage &

Mortlock (2017) highlighted that the small scale of operation of Aldi did not allow them to

increase their competence further to match with the dominance of Coles and Woolworths.

3.0 Question (c)

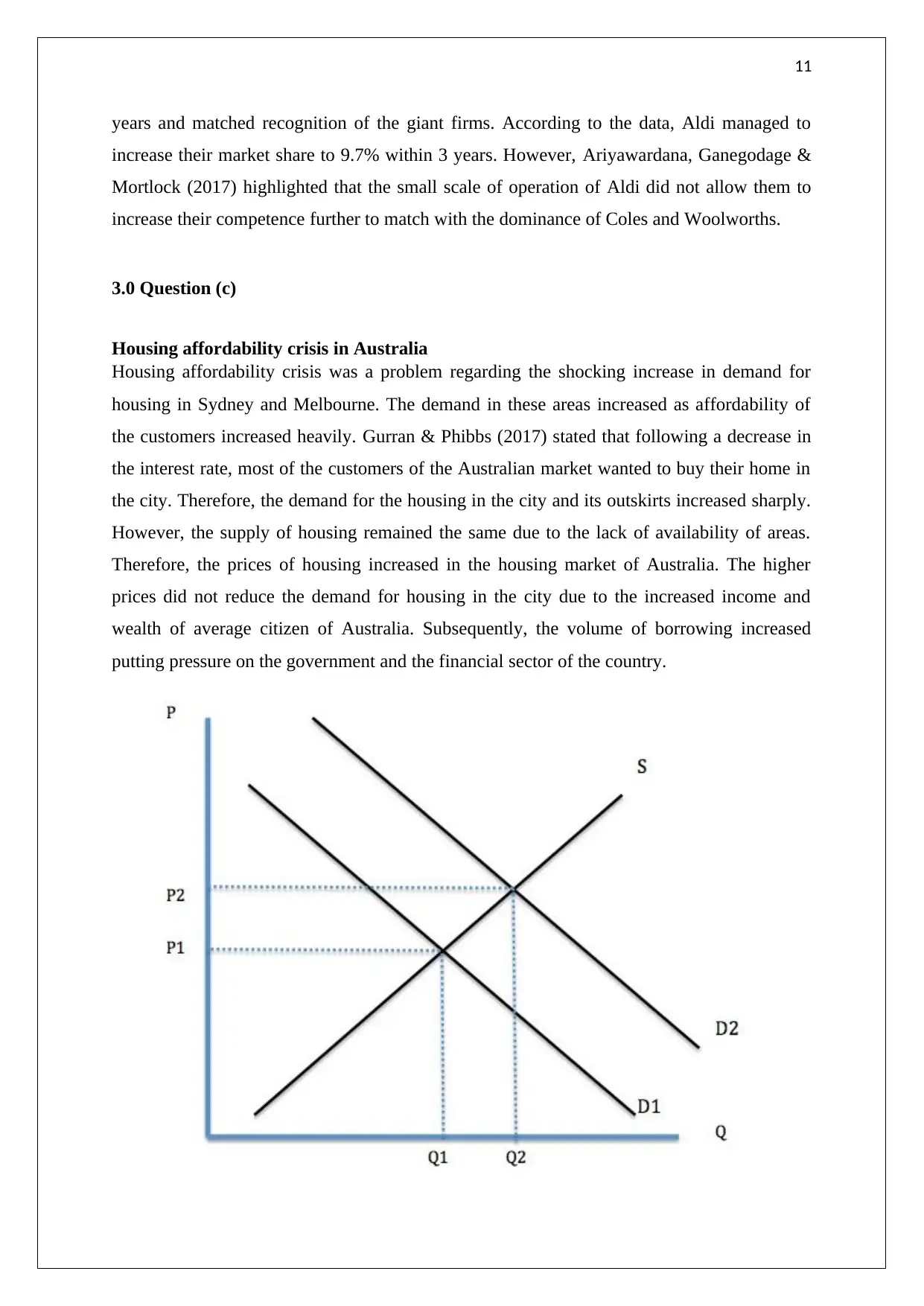

Housing affordability crisis in Australia

Housing affordability crisis was a problem regarding the shocking increase in demand for

housing in Sydney and Melbourne. The demand in these areas increased as affordability of

the customers increased heavily. Gurran & Phibbs (2017) stated that following a decrease in

the interest rate, most of the customers of the Australian market wanted to buy their home in

the city. Therefore, the demand for the housing in the city and its outskirts increased sharply.

However, the supply of housing remained the same due to the lack of availability of areas.

Therefore, the prices of housing increased in the housing market of Australia. The higher

prices did not reduce the demand for housing in the city due to the increased income and

wealth of average citizen of Australia. Subsequently, the volume of borrowing increased

putting pressure on the government and the financial sector of the country.

years and matched recognition of the giant firms. According to the data, Aldi managed to

increase their market share to 9.7% within 3 years. However, Ariyawardana, Ganegodage &

Mortlock (2017) highlighted that the small scale of operation of Aldi did not allow them to

increase their competence further to match with the dominance of Coles and Woolworths.

3.0 Question (c)

Housing affordability crisis in Australia

Housing affordability crisis was a problem regarding the shocking increase in demand for

housing in Sydney and Melbourne. The demand in these areas increased as affordability of

the customers increased heavily. Gurran & Phibbs (2017) stated that following a decrease in

the interest rate, most of the customers of the Australian market wanted to buy their home in

the city. Therefore, the demand for the housing in the city and its outskirts increased sharply.

However, the supply of housing remained the same due to the lack of availability of areas.

Therefore, the prices of housing increased in the housing market of Australia. The higher

prices did not reduce the demand for housing in the city due to the increased income and

wealth of average citizen of Australia. Subsequently, the volume of borrowing increased

putting pressure on the government and the financial sector of the country.

12

Figure 5: The demand and supply in the housing market of Australia

(Source: Birrell & Healy, 2018)

In terms of economics, the demand curve for the housing shifted to the right side mainly due

to the reduced interest rate and increased affordability of the consumers of the market.

Meanwhile, the supply-side of the market remained the same as new housing development

takes time. The new equilibrium showed a higher price for housing which was followed by

the customers of the market. This pressure in the demand and the supply market for housing

then transferred to the financial market and led to pressure in the credit market of the country.

Solutions

To tackle the increased demand for housing and the rising prices in Australia, the government

of Australia immediately allowed foreign investment in the housing industry of the country.

Foreign companies started investing in the housing projects and in within a few years, the

supply of housing increased. Chappell & Campbell (2018) stated that the government also

introduced specialised policies to improve infrastructure in suburban areas of the cities. As a

result of the supply curve also shifted to the right side leading to a reduction in the prices of

housing in the country. Apart from that, the government of Australia also provided housing at

a subsidised rate for a selected income group in order to reduce the pressure from the demand

side (Bennett, 2018). This resulted in a temporary reduction in the demand for housing and

the demand curve shifted to the left and led to decreased housing prices in the cities of

Australia. The government of Australia also reduced the paperwork for the housing

registration in the city which not only increased the time of possession but also the cost of

owning a house in the city. Therefore, more and more company, owing to the low cost of

production started to invest in the housing development that paced up the supply side

changes. Morris (2018) highlighted that the outskirts during that time grew rapidly and more

and more foreign funds flew into the economy.

In addition to that, the government of Australia also decentralised a few of the governing

mechanisms in order to save the cost for the sellers of the market. However, this

decentralisation of governing mechanism in the city led to huge revenue loss for the

government. Wetzstein (2017) criticised that this strategy from the side of the government in

the future may contribute to loan default and illegal possessions in the cities. However, this

decision hugely impacted the supply side of the market and housing development increased

within a few months.

Figure 5: The demand and supply in the housing market of Australia

(Source: Birrell & Healy, 2018)

In terms of economics, the demand curve for the housing shifted to the right side mainly due

to the reduced interest rate and increased affordability of the consumers of the market.

Meanwhile, the supply-side of the market remained the same as new housing development

takes time. The new equilibrium showed a higher price for housing which was followed by

the customers of the market. This pressure in the demand and the supply market for housing

then transferred to the financial market and led to pressure in the credit market of the country.

Solutions

To tackle the increased demand for housing and the rising prices in Australia, the government

of Australia immediately allowed foreign investment in the housing industry of the country.

Foreign companies started investing in the housing projects and in within a few years, the

supply of housing increased. Chappell & Campbell (2018) stated that the government also

introduced specialised policies to improve infrastructure in suburban areas of the cities. As a

result of the supply curve also shifted to the right side leading to a reduction in the prices of

housing in the country. Apart from that, the government of Australia also provided housing at

a subsidised rate for a selected income group in order to reduce the pressure from the demand

side (Bennett, 2018). This resulted in a temporary reduction in the demand for housing and

the demand curve shifted to the left and led to decreased housing prices in the cities of

Australia. The government of Australia also reduced the paperwork for the housing

registration in the city which not only increased the time of possession but also the cost of

owning a house in the city. Therefore, more and more company, owing to the low cost of

production started to invest in the housing development that paced up the supply side

changes. Morris (2018) highlighted that the outskirts during that time grew rapidly and more

and more foreign funds flew into the economy.

In addition to that, the government of Australia also decentralised a few of the governing

mechanisms in order to save the cost for the sellers of the market. However, this

decentralisation of governing mechanism in the city led to huge revenue loss for the

government. Wetzstein (2017) criticised that this strategy from the side of the government in

the future may contribute to loan default and illegal possessions in the cities. However, this

decision hugely impacted the supply side of the market and housing development increased

within a few months.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.