Econometrics Assignment: Market Analysis, Income Impact, Share Value

VerifiedAdded on 2023/06/11

|8

|1235

|136

Homework Assignment

AI Summary

This econometrics assignment delves into the analysis of market dynamics, income inequality, and share prices using statistical modeling techniques. The analysis utilizes datasets such as MARKET2022, OECDINCOME2022, and SHAREPRICE2022 to explore relationships between key variables. The M...

Econometrics

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

TASK...............................................................................................................................................3

4. File related is MARKET2022..................................................................................................3

5. OECDINCOME2022 is related with the income and expenditure of the people....................4

6. SHAREPRICE2022 is related with the variable of ShareA and ShareB.................................6

REFERENCES................................................................................................................................8

TASK...............................................................................................................................................3

4. File related is MARKET2022..................................................................................................3

5. OECDINCOME2022 is related with the income and expenditure of the people....................4

6. SHAREPRICE2022 is related with the variable of ShareA and ShareB.................................6

REFERENCES................................................................................................................................8

TASK

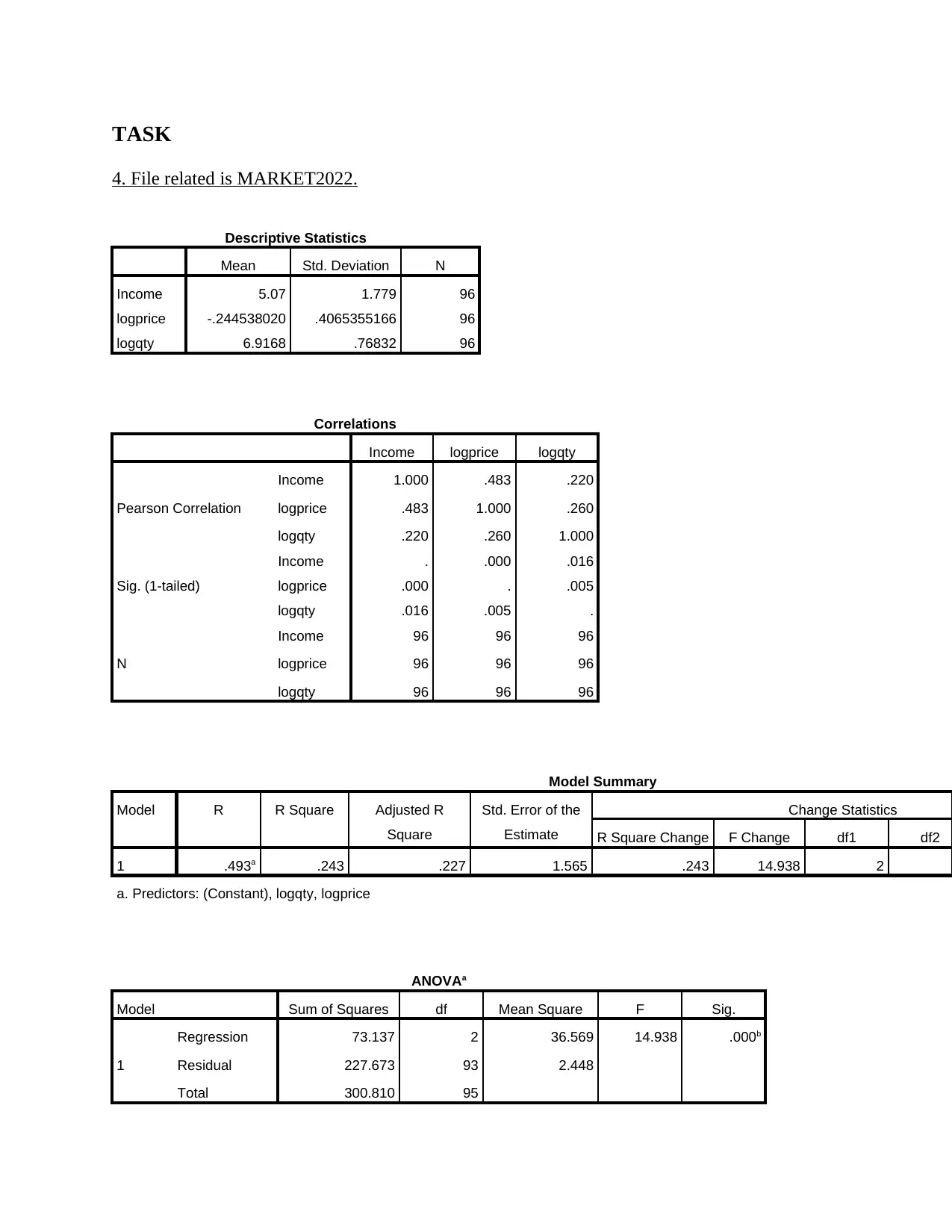

4. File related is MARKET2022.

Descriptive Statistics

Mean Std. Deviation N

Income 5.07 1.779 96

logprice -.244538020 .4065355166 96

logqty 6.9168 .76832 96

Correlations

Income logprice logqty

Pearson Correlation

Income 1.000 .483 .220

logprice .483 1.000 .260

logqty .220 .260 1.000

Sig. (1-tailed)

Income . .000 .016

logprice .000 . .005

logqty .016 .005 .

N

Income 96 96 96

logprice 96 96 96

logqty 96 96 96

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

Change Statistics

R Square Change F Change df1 df2

1 .493a .243 .227 1.565 .243 14.938 2 9

a. Predictors: (Constant), logqty, logprice

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1

Regression 73.137 2 36.569 14.938 .000b

Residual 227.673 93 2.448

Total 300.810 95

4. File related is MARKET2022.

Descriptive Statistics

Mean Std. Deviation N

Income 5.07 1.779 96

logprice -.244538020 .4065355166 96

logqty 6.9168 .76832 96

Correlations

Income logprice logqty

Pearson Correlation

Income 1.000 .483 .220

logprice .483 1.000 .260

logqty .220 .260 1.000

Sig. (1-tailed)

Income . .000 .016

logprice .000 . .005

logqty .016 .005 .

N

Income 96 96 96

logprice 96 96 96

logqty 96 96 96

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

Change Statistics

R Square Change F Change df1 df2

1 .493a .243 .227 1.565 .243 14.938 2 9

a. Predictors: (Constant), logqty, logprice

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1

Regression 73.137 2 36.569 14.938 .000b

Residual 227.673 93 2.448

Total 300.810 95

You're viewing a preview

Unlock full access by subscribing today!

a. Dependent Variable: Income

b. Predictors: (Constant), logqty, logprice

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) 3.938 1.534 2.567 .012

logprice 2.000 .409 .457 4.891 .000

logqty .234 .216 .101 1.082 .282

a. Dependent Variable: Income

Interpretation: From the above run test it can be interpreted and predicted that the supply

equation which is denoted as logqty and demand equation which is quoted as logprices show that

there is a significant relationship existing between both variables. The two equation system takes

in account logprices and logqty which indicates the quantity being supplied and demand being

generated in relation with the prices. Yes, the supply equation is being identified which is logqty

indicating how much the quantity is being demanded and served by the consumers and facilitated

by company. It is observed that there is a moderate impact assessed between two equations

which also helps in predicting values in relation to another element. The supply equation is also

identified as logqty which would help to know the quantity of goods being supplied. There is

always a related change observed when the price of product changes which also would impact

the quantity being supplied in the market. Such impact can be examined with the help of

regression equation explaining the impact of price change on quantity being demanded and

supplied (Pauwels, 2018).

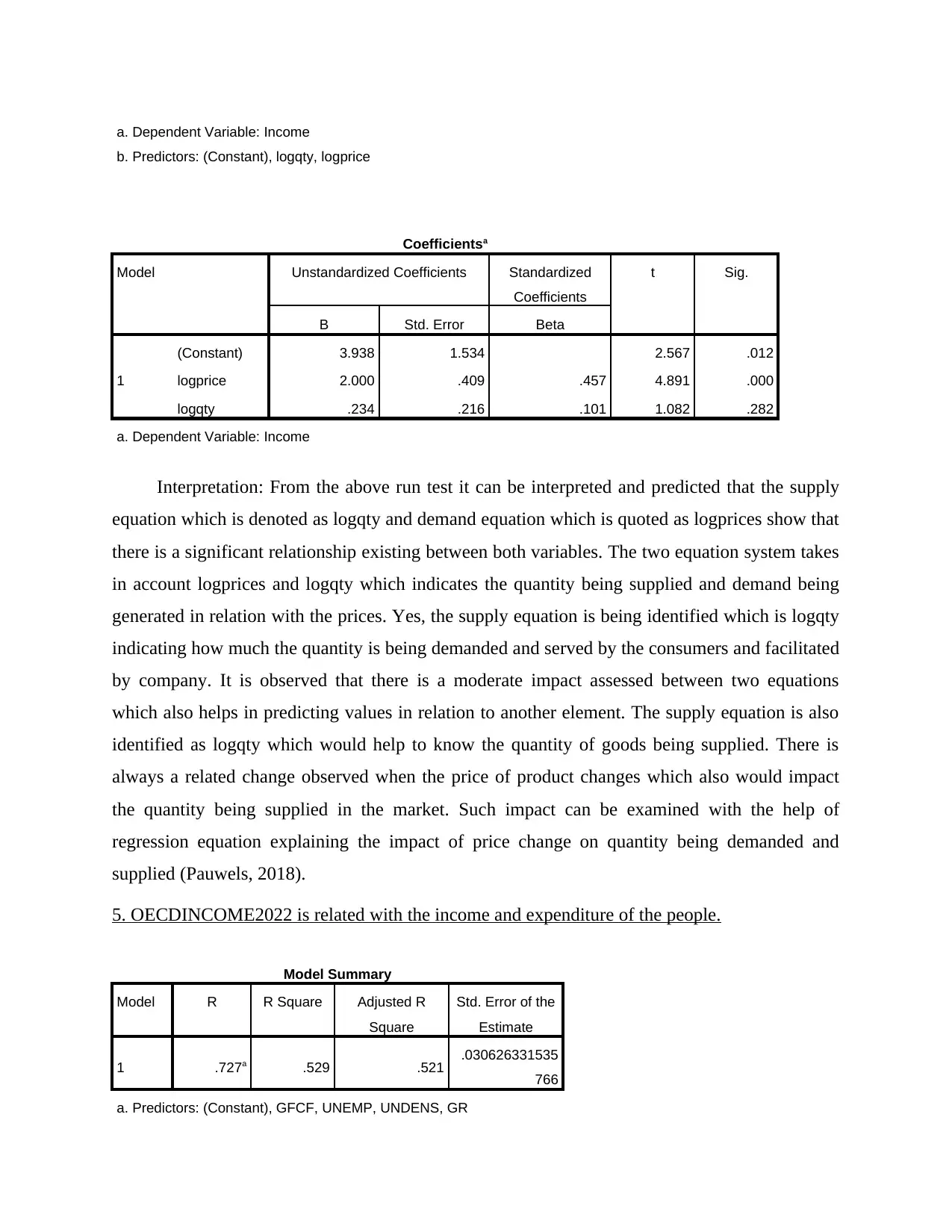

5. OECDINCOME2022 is related with the income and expenditure of the people.

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 .727a .529 .521 .030626331535

766

a. Predictors: (Constant), GFCF, UNEMP, UNDENS, GR

b. Predictors: (Constant), logqty, logprice

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) 3.938 1.534 2.567 .012

logprice 2.000 .409 .457 4.891 .000

logqty .234 .216 .101 1.082 .282

a. Dependent Variable: Income

Interpretation: From the above run test it can be interpreted and predicted that the supply

equation which is denoted as logqty and demand equation which is quoted as logprices show that

there is a significant relationship existing between both variables. The two equation system takes

in account logprices and logqty which indicates the quantity being supplied and demand being

generated in relation with the prices. Yes, the supply equation is being identified which is logqty

indicating how much the quantity is being demanded and served by the consumers and facilitated

by company. It is observed that there is a moderate impact assessed between two equations

which also helps in predicting values in relation to another element. The supply equation is also

identified as logqty which would help to know the quantity of goods being supplied. There is

always a related change observed when the price of product changes which also would impact

the quantity being supplied in the market. Such impact can be examined with the help of

regression equation explaining the impact of price change on quantity being demanded and

supplied (Pauwels, 2018).

5. OECDINCOME2022 is related with the income and expenditure of the people.

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 .727a .529 .521 .030626331535

766

a. Predictors: (Constant), GFCF, UNEMP, UNDENS, GR

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1

Regression .247 4 .062 65.921 .000b

Residual .220 235 .001

Total .468 239

a. Dependent Variable: INEQ

b. Predictors: (Constant), GFCF, UNEMP, UNDENS, GR

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) .481 .088 5.440 .000

GR -.018 .009 -.123 -2.163 .032

UNEMP .002 .000 .214 4.179 .000

UNDENS .000 .000 -.192 -3.411 .001

GFCF 4.076E-014 .000 .609 11.236 .000

a. Dependent Variable: INEQ

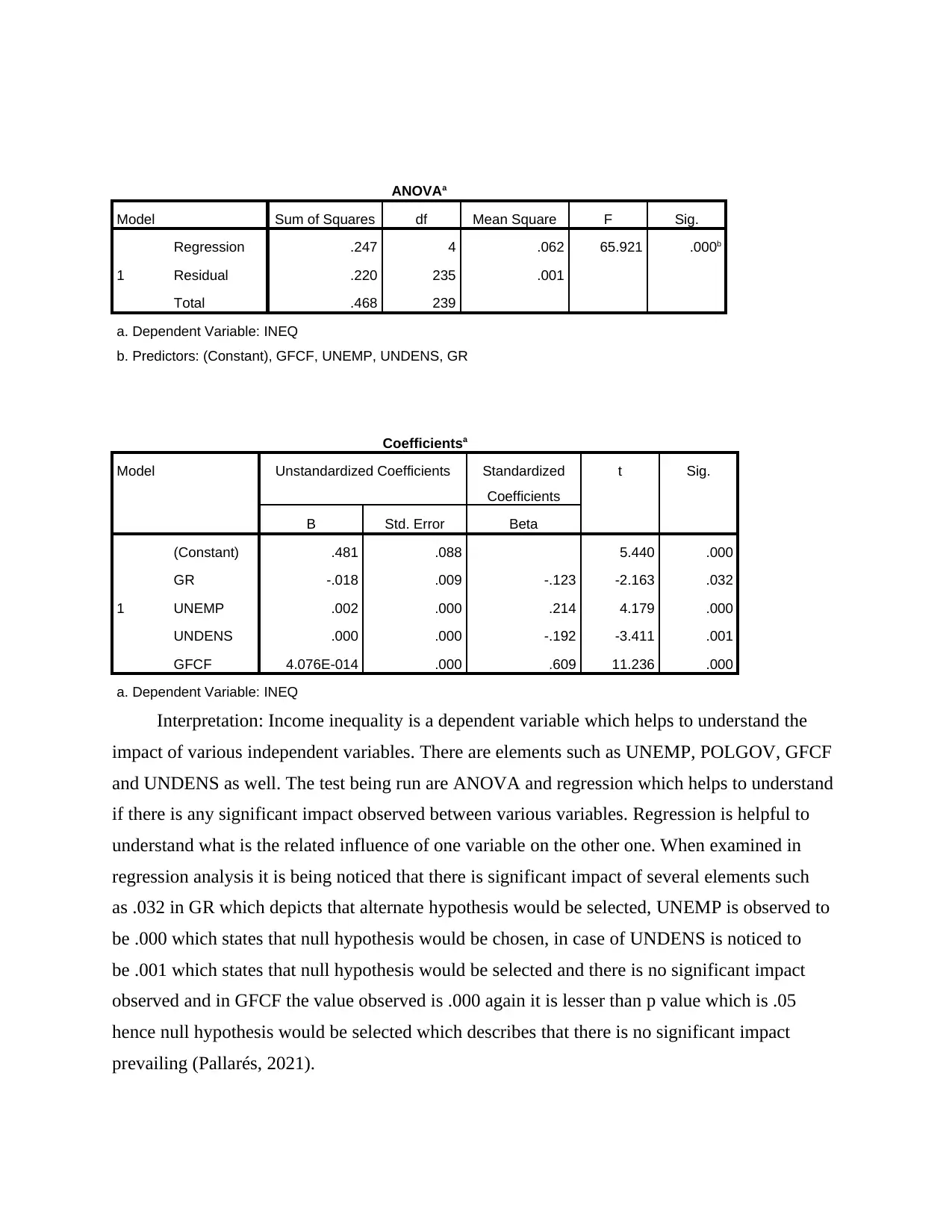

Interpretation: Income inequality is a dependent variable which helps to understand the

impact of various independent variables. There are elements such as UNEMP, POLGOV, GFCF

and UNDENS as well. The test being run are ANOVA and regression which helps to understand

if there is any significant impact observed between various variables. Regression is helpful to

understand what is the related influence of one variable on the other one. When examined in

regression analysis it is being noticed that there is significant impact of several elements such

as .032 in GR which depicts that alternate hypothesis would be selected, UNEMP is observed to

be .000 which states that null hypothesis would be chosen, in case of UNDENS is noticed to

be .001 which states that null hypothesis would be selected and there is no significant impact

observed and in GFCF the value observed is .000 again it is lesser than p value which is .05

hence null hypothesis would be selected which describes that there is no significant impact

prevailing (Pallarés, 2021).

Model Sum of Squares df Mean Square F Sig.

1

Regression .247 4 .062 65.921 .000b

Residual .220 235 .001

Total .468 239

a. Dependent Variable: INEQ

b. Predictors: (Constant), GFCF, UNEMP, UNDENS, GR

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) .481 .088 5.440 .000

GR -.018 .009 -.123 -2.163 .032

UNEMP .002 .000 .214 4.179 .000

UNDENS .000 .000 -.192 -3.411 .001

GFCF 4.076E-014 .000 .609 11.236 .000

a. Dependent Variable: INEQ

Interpretation: Income inequality is a dependent variable which helps to understand the

impact of various independent variables. There are elements such as UNEMP, POLGOV, GFCF

and UNDENS as well. The test being run are ANOVA and regression which helps to understand

if there is any significant impact observed between various variables. Regression is helpful to

understand what is the related influence of one variable on the other one. When examined in

regression analysis it is being noticed that there is significant impact of several elements such

as .032 in GR which depicts that alternate hypothesis would be selected, UNEMP is observed to

be .000 which states that null hypothesis would be chosen, in case of UNDENS is noticed to

be .001 which states that null hypothesis would be selected and there is no significant impact

observed and in GFCF the value observed is .000 again it is lesser than p value which is .05

hence null hypothesis would be selected which describes that there is no significant impact

prevailing (Pallarés, 2021).

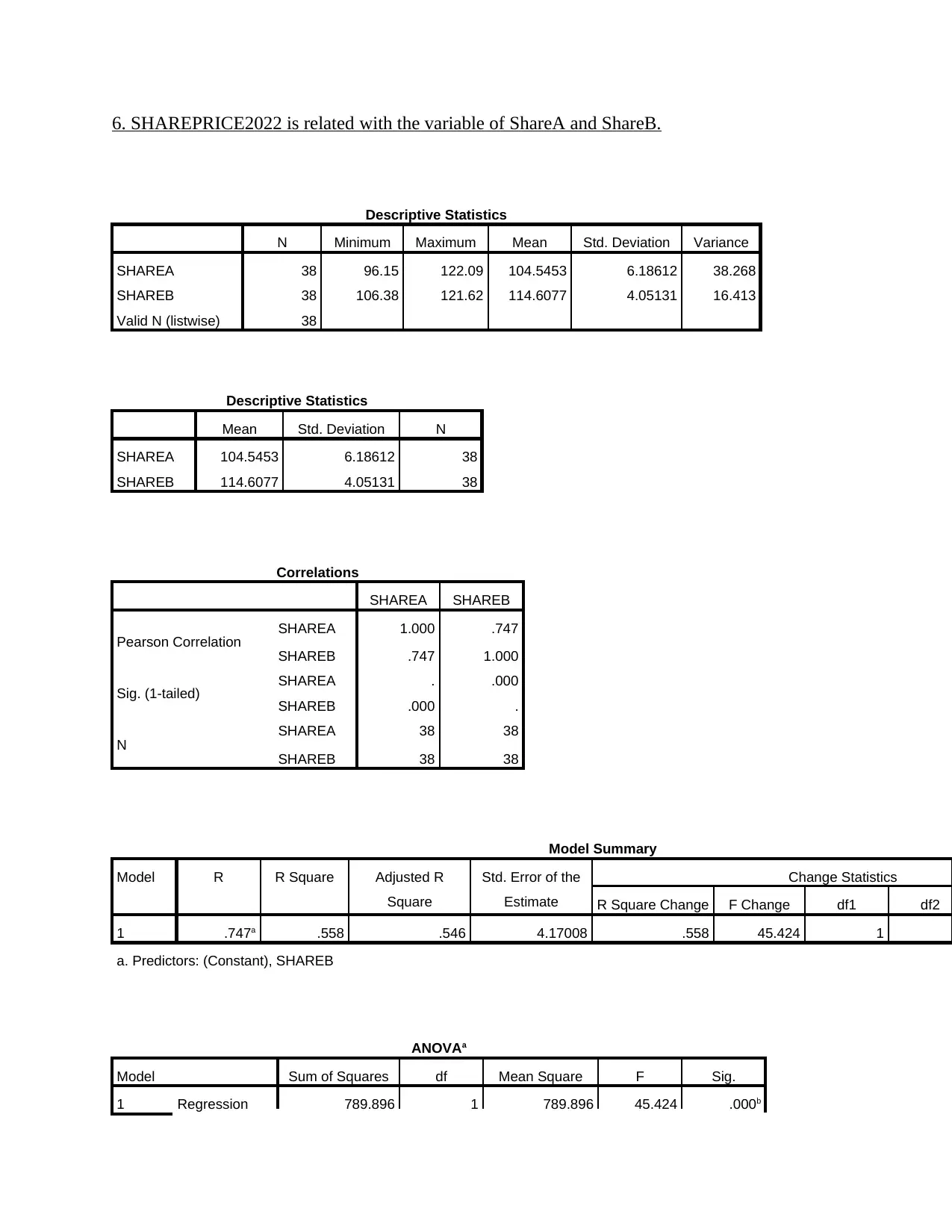

6. SHAREPRICE2022 is related with the variable of ShareA and ShareB.

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation Variance

SHAREA 38 96.15 122.09 104.5453 6.18612 38.268

SHAREB 38 106.38 121.62 114.6077 4.05131 16.413

Valid N (listwise) 38

Descriptive Statistics

Mean Std. Deviation N

SHAREA 104.5453 6.18612 38

SHAREB 114.6077 4.05131 38

Correlations

SHAREA SHAREB

Pearson Correlation SHAREA 1.000 .747

SHAREB .747 1.000

Sig. (1-tailed) SHAREA . .000

SHAREB .000 .

N SHAREA 38 38

SHAREB 38 38

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

Change Statistics

R Square Change F Change df1 df2

1 .747a .558 .546 4.17008 .558 45.424 1 3

a. Predictors: (Constant), SHAREB

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression 789.896 1 789.896 45.424 .000b

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation Variance

SHAREA 38 96.15 122.09 104.5453 6.18612 38.268

SHAREB 38 106.38 121.62 114.6077 4.05131 16.413

Valid N (listwise) 38

Descriptive Statistics

Mean Std. Deviation N

SHAREA 104.5453 6.18612 38

SHAREB 114.6077 4.05131 38

Correlations

SHAREA SHAREB

Pearson Correlation SHAREA 1.000 .747

SHAREB .747 1.000

Sig. (1-tailed) SHAREA . .000

SHAREB .000 .

N SHAREA 38 38

SHAREB 38 38

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

Change Statistics

R Square Change F Change df1 df2

1 .747a .558 .546 4.17008 .558 45.424 1 3

a. Predictors: (Constant), SHAREB

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression 789.896 1 789.896 45.424 .000b

You're viewing a preview

Unlock full access by subscribing today!

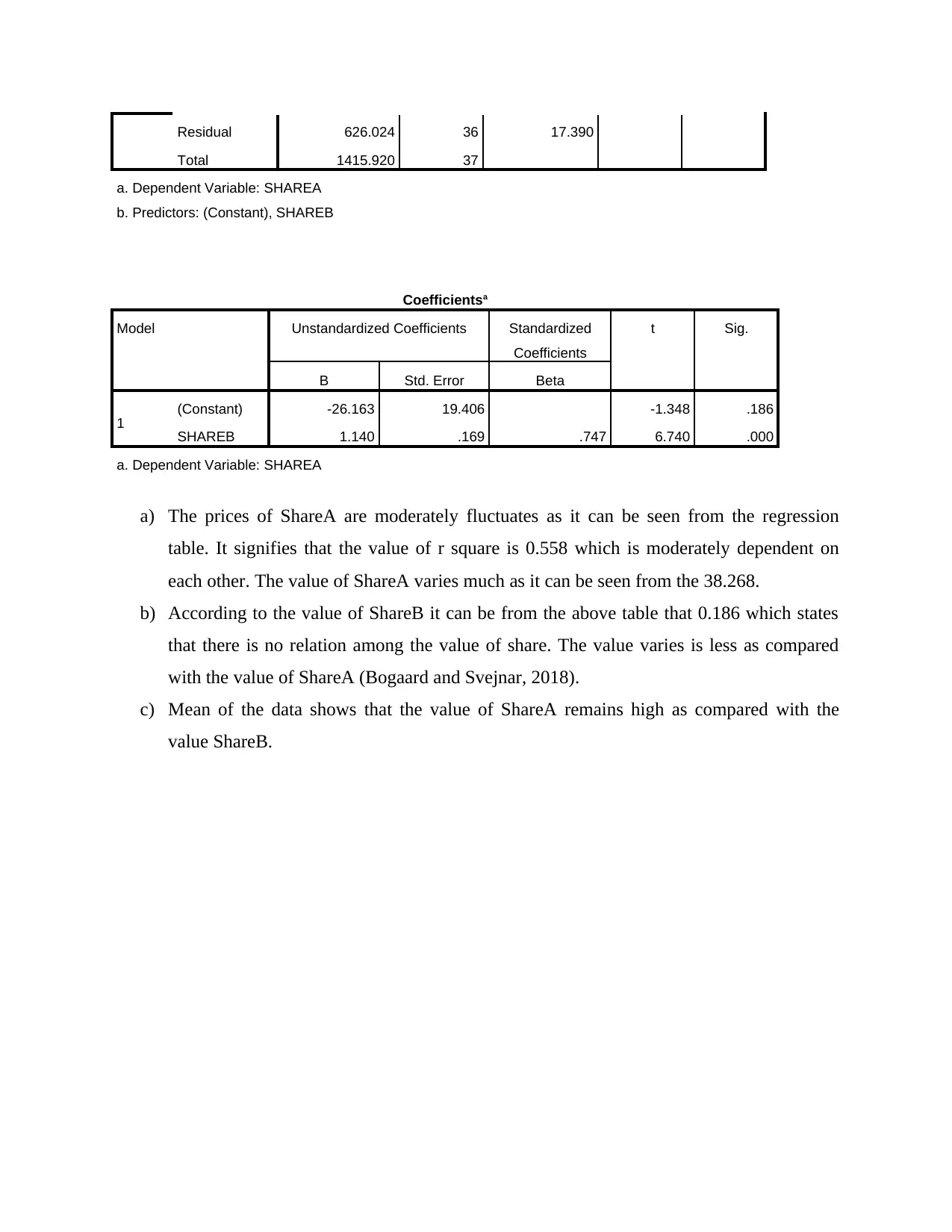

Residual 626.024 36 17.390

Total 1415.920 37

a. Dependent Variable: SHAREA

b. Predictors: (Constant), SHAREB

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) -26.163 19.406 -1.348 .186

SHAREB 1.140 .169 .747 6.740 .000

a. Dependent Variable: SHAREA

a) The prices of ShareA are moderately fluctuates as it can be seen from the regression

table. It signifies that the value of r square is 0.558 which is moderately dependent on

each other. The value of ShareA varies much as it can be seen from the 38.268.

b) According to the value of ShareB it can be from the above table that 0.186 which states

that there is no relation among the value of share. The value varies is less as compared

with the value of ShareA (Bogaard and Svejnar, 2018).

c) Mean of the data shows that the value of ShareA remains high as compared with the

value ShareB.

Total 1415.920 37

a. Dependent Variable: SHAREA

b. Predictors: (Constant), SHAREB

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) -26.163 19.406 -1.348 .186

SHAREB 1.140 .169 .747 6.740 .000

a. Dependent Variable: SHAREA

a) The prices of ShareA are moderately fluctuates as it can be seen from the regression

table. It signifies that the value of r square is 0.558 which is moderately dependent on

each other. The value of ShareA varies much as it can be seen from the 38.268.

b) According to the value of ShareB it can be from the above table that 0.186 which states

that there is no relation among the value of share. The value varies is less as compared

with the value of ShareA (Bogaard and Svejnar, 2018).

c) Mean of the data shows that the value of ShareA remains high as compared with the

value ShareB.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Bogaard, H. and Svejnar, J., 2018. Incentive pay and performance: Insider econometrics in a

multi-unit firm. Labour Economics. 54. pp.100-115.

Koopman, S.J. and et.al., 2019. A., “Dynamic Discrete Copula Models for High Frequency Stock

Price Changes”, Journal of Applied Econometrics, forthcoming.

Nguyen, H.P., 2018. Why Hammerstein-Type Block Models Are so Efficient: Case Study of

Financial Econometrics. Beyond Traditional Probabilistic Methods in Economics. 809.

p.129.

Pallarés, N., 2021. Three Essays in Applied Econometrics.

Pauwels, K., 2018. How time series econometrics helped Inofec quantify online and offline

funnel progression and reallocate marketing budgets for higher profits. In Handbook of

Marketing Analytics. Edward Elgar Publishing.

Books and Journals

Bogaard, H. and Svejnar, J., 2018. Incentive pay and performance: Insider econometrics in a

multi-unit firm. Labour Economics. 54. pp.100-115.

Koopman, S.J. and et.al., 2019. A., “Dynamic Discrete Copula Models for High Frequency Stock

Price Changes”, Journal of Applied Econometrics, forthcoming.

Nguyen, H.P., 2018. Why Hammerstein-Type Block Models Are so Efficient: Case Study of

Financial Econometrics. Beyond Traditional Probabilistic Methods in Economics. 809.

p.129.

Pallarés, N., 2021. Three Essays in Applied Econometrics.

Pauwels, K., 2018. How time series econometrics helped Inofec quantify online and offline

funnel progression and reallocate marketing budgets for higher profits. In Handbook of

Marketing Analytics. Edward Elgar Publishing.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.