Economics Assignment: Tax Incidence, Market Structures & Analysis

VerifiedAdded on 2023/06/12

|14

|2965

|219

Homework Assignment

AI Summary

This economics assignment delves into various topics, starting with an analysis of excise tax on tobacco products in Australia, including the calculation of pre-tax prices and an explanation of how the tax burden is divided between buyers and sellers based on price elasticity of demand. It uses demand and supply models to illustrate the impact of the tax. The assignment further examines a perfectly competitive firm's output decisions, cost analysis, and short-run vs. long-run profitability. It also contrasts marketers' and economists' perspectives on market definition, differentiating between oligopoly and monopolistic competition, highlighting differences in price competition, entry barriers, and long-run profit potential. Finally, the assignment discusses the economic rationale behind state government mergers with local governments in Australia, focusing on fiscal federalism, economies of scale, and local government capacity, supported by real-world examples and graphical illustrations. Desklib is a platform where students can find a wealth of study resources, including solved assignments and past papers.

Running Head: ECONOMIC ASSIGNMENT

Economic Assignment

Name of the Student

Name of the University

Author note

Economic Assignment

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIC ASSIGNMENT

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................4

Answer a.................................................................................................................................4

Answer b................................................................................................................................5

Oligopoly................................................................................................................................5

Monopolistic competition......................................................................................................6

Difference between oligopoly and monopolistic competition...............................................6

Answer 3....................................................................................................................................7

References................................................................................................................................11

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................4

Answer a.................................................................................................................................4

Answer b................................................................................................................................5

Oligopoly................................................................................................................................5

Monopolistic competition......................................................................................................6

Difference between oligopoly and monopolistic competition...............................................6

Answer 3....................................................................................................................................7

References................................................................................................................................11

2ECONOMIC ASSIGNMENT

Answer 1

In Australia, an exercise tax of 0.71046 is applicable on per sticks of Tobacco weighting less

than 0.8 gram. (ato.gov.au, 2018).

Tax for a pack of 20 cigarettes is therefore ($20*0.71046) = $14.2092

The packet is sold for $30. Hence, the price without tax is

( $ 30−$ 14.2092 )=$ 15.79

Hence, the pre-tax price of the packet of cigarette is $15.79.

In case of an indirect tax like sales or exercise tax, sellers by pass the tax burden to

the buyers. As a result the tax burden is divided between buyers and sellers. The burden

however is not equally divided between buyers and sellers. The price elasticity of demand has

a major role play here. The price elasticity of demand measures the proportionate change in

demand of a good in response to the proportionate change in price. A high value of elasticity

implies a greater flexibility of demand and vice versa. Commodities are said to have a

relatively elastic demand if the magnitude of demand change is greater than the

corresponding change in price. The measured elasticity is here greater than one (Mankiw &

Cosgrove, 2014). The slight change in price then leads to a greater change in demand. If

demand is relatively elastic in nature, an increased price because of imposition of tax lead to

a greater reduction in demand on part of the consumers. Hence, buyers have to bear a

relatively less burden of tax. Opposite is the case for a relatively inelastic demand. A

relatively inelastic demand in one where demand cannot adjust much despite change in price.

The measured elasticity here is less than one. If tax is imposed on goods having a relatively

inelastic demand then buyers have to bear a greater burden of tax because of stringent nature

of demand. Therefore, the effect of exercise tax on tobacco product depends on the nature of

demand. Tobacco products are considered as addictive items. People do not have much

Answer 1

In Australia, an exercise tax of 0.71046 is applicable on per sticks of Tobacco weighting less

than 0.8 gram. (ato.gov.au, 2018).

Tax for a pack of 20 cigarettes is therefore ($20*0.71046) = $14.2092

The packet is sold for $30. Hence, the price without tax is

( $ 30−$ 14.2092 )=$ 15.79

Hence, the pre-tax price of the packet of cigarette is $15.79.

In case of an indirect tax like sales or exercise tax, sellers by pass the tax burden to

the buyers. As a result the tax burden is divided between buyers and sellers. The burden

however is not equally divided between buyers and sellers. The price elasticity of demand has

a major role play here. The price elasticity of demand measures the proportionate change in

demand of a good in response to the proportionate change in price. A high value of elasticity

implies a greater flexibility of demand and vice versa. Commodities are said to have a

relatively elastic demand if the magnitude of demand change is greater than the

corresponding change in price. The measured elasticity is here greater than one (Mankiw &

Cosgrove, 2014). The slight change in price then leads to a greater change in demand. If

demand is relatively elastic in nature, an increased price because of imposition of tax lead to

a greater reduction in demand on part of the consumers. Hence, buyers have to bear a

relatively less burden of tax. Opposite is the case for a relatively inelastic demand. A

relatively inelastic demand in one where demand cannot adjust much despite change in price.

The measured elasticity here is less than one. If tax is imposed on goods having a relatively

inelastic demand then buyers have to bear a greater burden of tax because of stringent nature

of demand. Therefore, the effect of exercise tax on tobacco product depends on the nature of

demand. Tobacco products are considered as addictive items. People do not have much

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIC ASSIGNMENT

incentive to reduce demand in response to a high price. Studies found that for tobacco

products the proportionate change in demand is less than the change in price (aph.gov.au

2018). The effect of an imposed tax on tobacco seller is described in the figure below.

Figure 1: Impact of exercise tax on tobacco market

(Source: as created by Author)

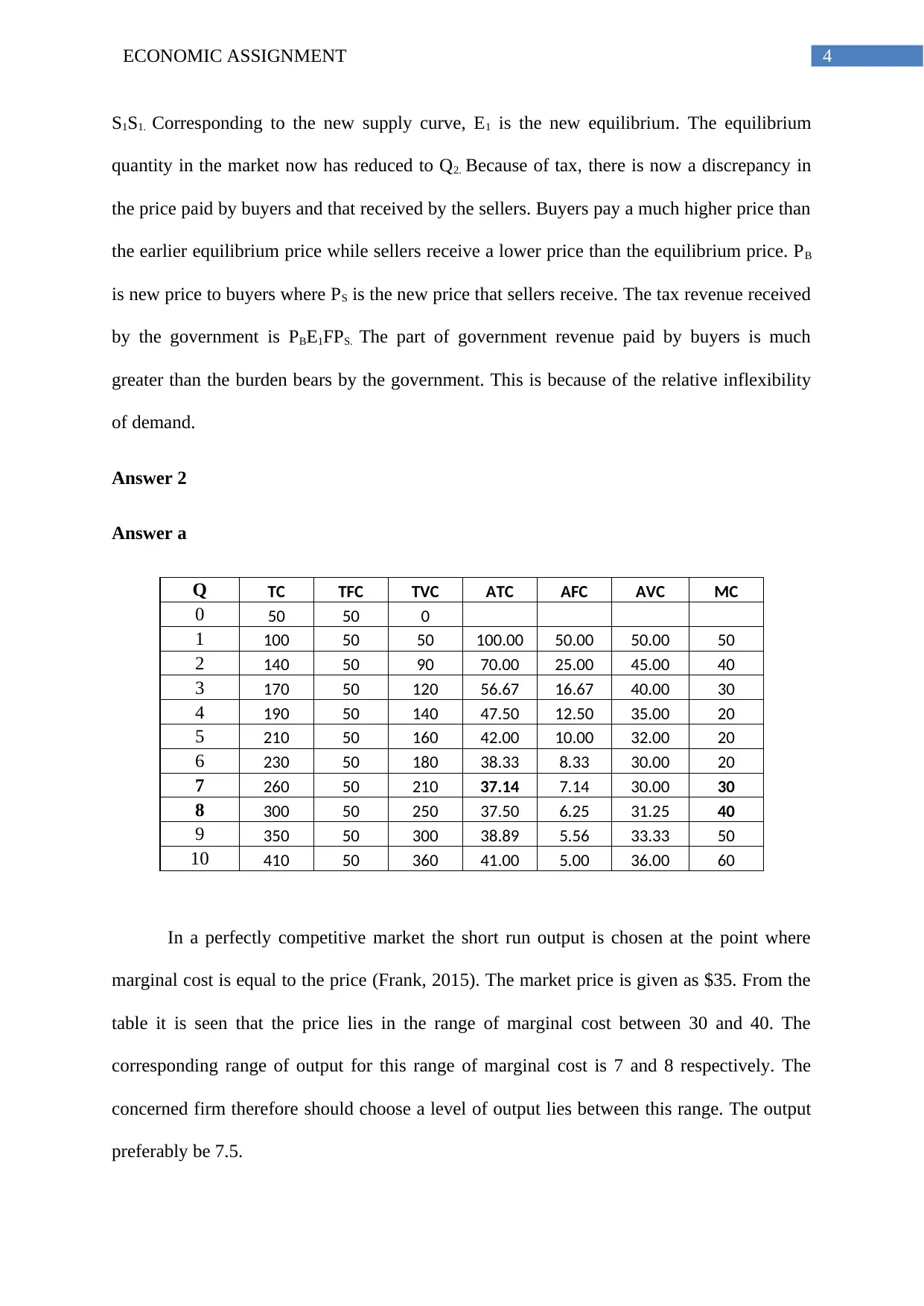

The demand and supply curve for tobacco products is given by DD and SS. Because of a

relatively inelastic demand if tobacco products, the demand curve is steeper than the supply

curve. Before tax, price and quantity in the market is determined by the intersection of

demand and supply curve. E is the equilibrium point with an associated equilibrium price and

quantity of P1 and Q1 respectively. Now consider a tax of the amount ‘t’ is imposed on seller.

As the tax imposed on seller the immediate effect of tax is on the supply curve. Tax on seller

discourages seller leading to a reduction in the effective supply (Taylor et al, 2014). This is

shown by a leftward shift of the supply curve by the amount of tax. The new supply curve is

incentive to reduce demand in response to a high price. Studies found that for tobacco

products the proportionate change in demand is less than the change in price (aph.gov.au

2018). The effect of an imposed tax on tobacco seller is described in the figure below.

Figure 1: Impact of exercise tax on tobacco market

(Source: as created by Author)

The demand and supply curve for tobacco products is given by DD and SS. Because of a

relatively inelastic demand if tobacco products, the demand curve is steeper than the supply

curve. Before tax, price and quantity in the market is determined by the intersection of

demand and supply curve. E is the equilibrium point with an associated equilibrium price and

quantity of P1 and Q1 respectively. Now consider a tax of the amount ‘t’ is imposed on seller.

As the tax imposed on seller the immediate effect of tax is on the supply curve. Tax on seller

discourages seller leading to a reduction in the effective supply (Taylor et al, 2014). This is

shown by a leftward shift of the supply curve by the amount of tax. The new supply curve is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIC ASSIGNMENT

S1S1. Corresponding to the new supply curve, E1 is the new equilibrium. The equilibrium

quantity in the market now has reduced to Q2. Because of tax, there is now a discrepancy in

the price paid by buyers and that received by the sellers. Buyers pay a much higher price than

the earlier equilibrium price while sellers receive a lower price than the equilibrium price. PB

is new price to buyers where PS is the new price that sellers receive. The tax revenue received

by the government is PBE1FPS. The part of government revenue paid by buyers is much

greater than the burden bears by the government. This is because of the relative inflexibility

of demand.

Answer 2

Answer a

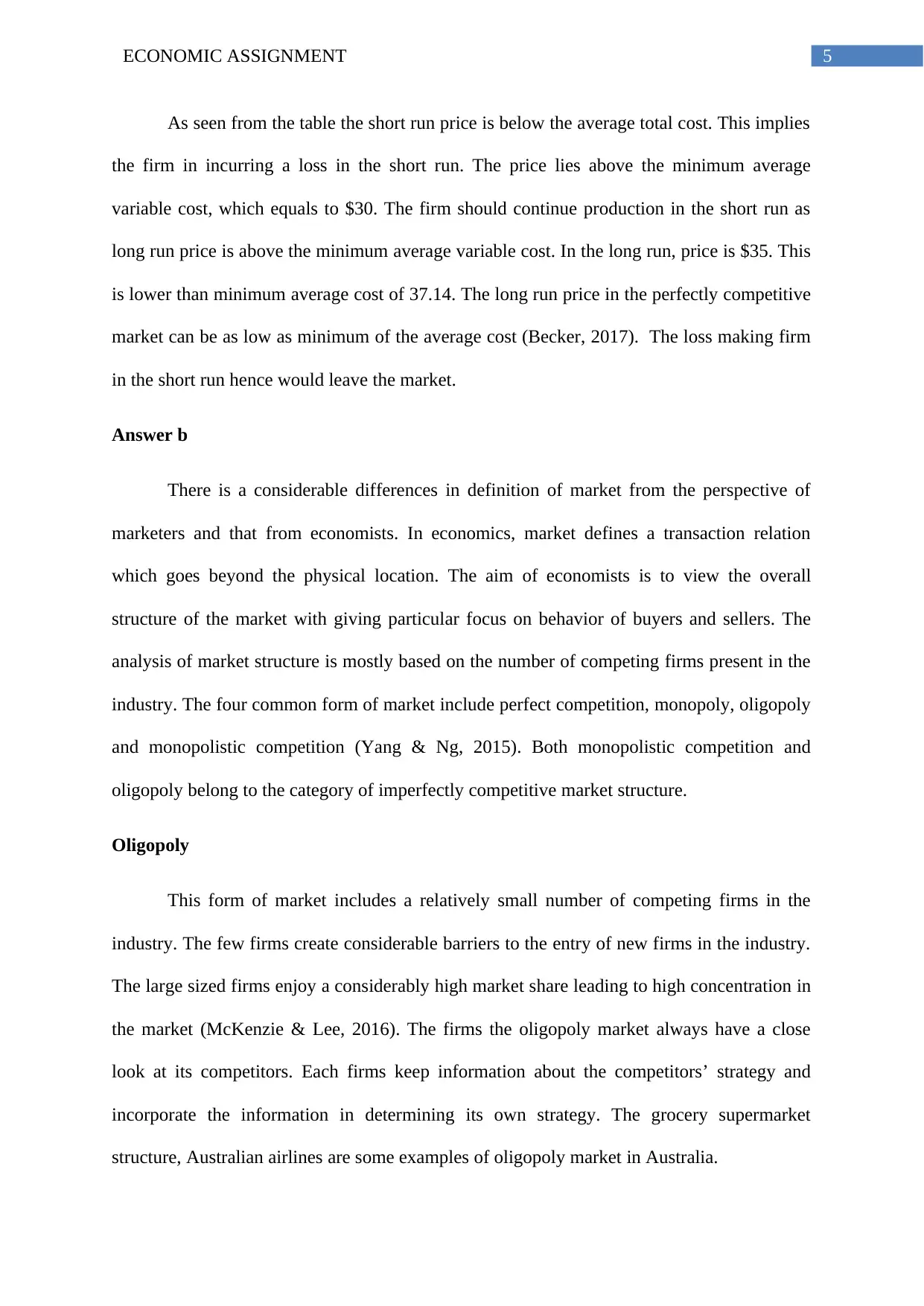

Q TC TFC TVC ATC AFC AVC MC

0 50 50 0

1 100 50 50 100.00 50.00 50.00 50

2 140 50 90 70.00 25.00 45.00 40

3 170 50 120 56.67 16.67 40.00 30

4 190 50 140 47.50 12.50 35.00 20

5 210 50 160 42.00 10.00 32.00 20

6 230 50 180 38.33 8.33 30.00 20

7 260 50 210 37.14 7.14 30.00 30

8 300 50 250 37.50 6.25 31.25 40

9 350 50 300 38.89 5.56 33.33 50

10 410 50 360 41.00 5.00 36.00 60

In a perfectly competitive market the short run output is chosen at the point where

marginal cost is equal to the price (Frank, 2015). The market price is given as $35. From the

table it is seen that the price lies in the range of marginal cost between 30 and 40. The

corresponding range of output for this range of marginal cost is 7 and 8 respectively. The

concerned firm therefore should choose a level of output lies between this range. The output

preferably be 7.5.

S1S1. Corresponding to the new supply curve, E1 is the new equilibrium. The equilibrium

quantity in the market now has reduced to Q2. Because of tax, there is now a discrepancy in

the price paid by buyers and that received by the sellers. Buyers pay a much higher price than

the earlier equilibrium price while sellers receive a lower price than the equilibrium price. PB

is new price to buyers where PS is the new price that sellers receive. The tax revenue received

by the government is PBE1FPS. The part of government revenue paid by buyers is much

greater than the burden bears by the government. This is because of the relative inflexibility

of demand.

Answer 2

Answer a

Q TC TFC TVC ATC AFC AVC MC

0 50 50 0

1 100 50 50 100.00 50.00 50.00 50

2 140 50 90 70.00 25.00 45.00 40

3 170 50 120 56.67 16.67 40.00 30

4 190 50 140 47.50 12.50 35.00 20

5 210 50 160 42.00 10.00 32.00 20

6 230 50 180 38.33 8.33 30.00 20

7 260 50 210 37.14 7.14 30.00 30

8 300 50 250 37.50 6.25 31.25 40

9 350 50 300 38.89 5.56 33.33 50

10 410 50 360 41.00 5.00 36.00 60

In a perfectly competitive market the short run output is chosen at the point where

marginal cost is equal to the price (Frank, 2015). The market price is given as $35. From the

table it is seen that the price lies in the range of marginal cost between 30 and 40. The

corresponding range of output for this range of marginal cost is 7 and 8 respectively. The

concerned firm therefore should choose a level of output lies between this range. The output

preferably be 7.5.

5ECONOMIC ASSIGNMENT

As seen from the table the short run price is below the average total cost. This implies

the firm in incurring a loss in the short run. The price lies above the minimum average

variable cost, which equals to $30. The firm should continue production in the short run as

long run price is above the minimum average variable cost. In the long run, price is $35. This

is lower than minimum average cost of 37.14. The long run price in the perfectly competitive

market can be as low as minimum of the average cost (Becker, 2017). The loss making firm

in the short run hence would leave the market.

Answer b

There is a considerable differences in definition of market from the perspective of

marketers and that from economists. In economics, market defines a transaction relation

which goes beyond the physical location. The aim of economists is to view the overall

structure of the market with giving particular focus on behavior of buyers and sellers. The

analysis of market structure is mostly based on the number of competing firms present in the

industry. The four common form of market include perfect competition, monopoly, oligopoly

and monopolistic competition (Yang & Ng, 2015). Both monopolistic competition and

oligopoly belong to the category of imperfectly competitive market structure.

Oligopoly

This form of market includes a relatively small number of competing firms in the

industry. The few firms create considerable barriers to the entry of new firms in the industry.

The large sized firms enjoy a considerably high market share leading to high concentration in

the market (McKenzie & Lee, 2016). The firms the oligopoly market always have a close

look at its competitors. Each firms keep information about the competitors’ strategy and

incorporate the information in determining its own strategy. The grocery supermarket

structure, Australian airlines are some examples of oligopoly market in Australia.

As seen from the table the short run price is below the average total cost. This implies

the firm in incurring a loss in the short run. The price lies above the minimum average

variable cost, which equals to $30. The firm should continue production in the short run as

long run price is above the minimum average variable cost. In the long run, price is $35. This

is lower than minimum average cost of 37.14. The long run price in the perfectly competitive

market can be as low as minimum of the average cost (Becker, 2017). The loss making firm

in the short run hence would leave the market.

Answer b

There is a considerable differences in definition of market from the perspective of

marketers and that from economists. In economics, market defines a transaction relation

which goes beyond the physical location. The aim of economists is to view the overall

structure of the market with giving particular focus on behavior of buyers and sellers. The

analysis of market structure is mostly based on the number of competing firms present in the

industry. The four common form of market include perfect competition, monopoly, oligopoly

and monopolistic competition (Yang & Ng, 2015). Both monopolistic competition and

oligopoly belong to the category of imperfectly competitive market structure.

Oligopoly

This form of market includes a relatively small number of competing firms in the

industry. The few firms create considerable barriers to the entry of new firms in the industry.

The large sized firms enjoy a considerably high market share leading to high concentration in

the market (McKenzie & Lee, 2016). The firms the oligopoly market always have a close

look at its competitors. Each firms keep information about the competitors’ strategy and

incorporate the information in determining its own strategy. The grocery supermarket

structure, Australian airlines are some examples of oligopoly market in Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIC ASSIGNMENT

Monopolistic competition

As suggested by the name, monopolistic competition is a form of market having

features of both monopoly and competitive market. Like competitive market, a large number

of firms present in the market. In a monopolistic competition, there are different brands

selling a differentiated product (Devine et al., 2018). Each brand owner behaves like a

monopolist and takes independent decision. Some common examples of monopolistic

competition include coffee shops, dry cleaners, furniture stores, pharmacies and the like.

Difference between oligopoly and monopolistic competition

Price competition

Strategic interdependence is one major feature of oligopoly market. Any strategy

taken by one firm is immediately followed by its rival firms. For example, if one firm reduces

price of its products, the other firms follow the same. This kind of price competition in the

oligopoly market results in a price war (Moulin, 2014). For example, if Texaco plans to lower

it product price to grab a higher market share then has to consider the fact that other rivals

like British petroleum will also follow the same to counteract the strategy.

In monopolistic competition, as all the firms are selling similar kind of products. They

never engage in price competition. Non-price competition in the form of product

differentiation, advertising and improvement in product quality are more prevalent here

(Dollery, Kortt & De Souza, 2015).

Entry barriers

In monopolistic competition firm can freely enter or exit the industry. In times of

economic profit new firm enter the market while during economic loss firms leave the

industry. In the oligopoly market there exist high barriers to entry of new firms. The

Monopolistic competition

As suggested by the name, monopolistic competition is a form of market having

features of both monopoly and competitive market. Like competitive market, a large number

of firms present in the market. In a monopolistic competition, there are different brands

selling a differentiated product (Devine et al., 2018). Each brand owner behaves like a

monopolist and takes independent decision. Some common examples of monopolistic

competition include coffee shops, dry cleaners, furniture stores, pharmacies and the like.

Difference between oligopoly and monopolistic competition

Price competition

Strategic interdependence is one major feature of oligopoly market. Any strategy

taken by one firm is immediately followed by its rival firms. For example, if one firm reduces

price of its products, the other firms follow the same. This kind of price competition in the

oligopoly market results in a price war (Moulin, 2014). For example, if Texaco plans to lower

it product price to grab a higher market share then has to consider the fact that other rivals

like British petroleum will also follow the same to counteract the strategy.

In monopolistic competition, as all the firms are selling similar kind of products. They

never engage in price competition. Non-price competition in the form of product

differentiation, advertising and improvement in product quality are more prevalent here

(Dollery, Kortt & De Souza, 2015).

Entry barriers

In monopolistic competition firm can freely enter or exit the industry. In times of

economic profit new firm enter the market while during economic loss firms leave the

industry. In the oligopoly market there exist high barriers to entry of new firms. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIC ASSIGNMENT

oligopoly market is often formed with government authorization with a limited number of

firms (Frank, 2015). The ownership over strategy resources, presence of high fixed cost often

work as an entry barriers in the market.

Long run profit

The monopolistically competitive firms in the long run can earn only a normal profit.

In the short run firms might enjoy an economic profit or suffer from an economic loss. If

there exists an economic profit, then new firms enter the market reducing profit. Firms

continue to enter unless profit reduced to a normal profit (Mankiw & Cosgrove, 2014).

In the oligopoly market however, high barriers to entry help the firms to restore a

supernormal profit even in the long run.

Answer 3

The decision of State government to merge with local government has resulted in a

substantial reduction in the number of local councils in Australia. The main rationale for such

merger is that substantial economic benefits are derived from a consolidated government

(Sarala et al., 2016). The economic rationale for such policies are as follows

Theory of fiscal federalism and optimum size of the community

The theory of fiscal federalism address the issue of whether the specific public goods

or services should be offered in a federation like Australia on a centralized or decentralized

manner. The main issue here is which public goods should be provided by which levels of

government (central, state and government). This is known as principle of correspondence.

As per this principle, the public goods should be provided by the lowest level that is local

government (Verhoest et al., 2016). The local government however provides public goods to

a specific region only. The benefits of some public goods extends beyond the local boundary.

oligopoly market is often formed with government authorization with a limited number of

firms (Frank, 2015). The ownership over strategy resources, presence of high fixed cost often

work as an entry barriers in the market.

Long run profit

The monopolistically competitive firms in the long run can earn only a normal profit.

In the short run firms might enjoy an economic profit or suffer from an economic loss. If

there exists an economic profit, then new firms enter the market reducing profit. Firms

continue to enter unless profit reduced to a normal profit (Mankiw & Cosgrove, 2014).

In the oligopoly market however, high barriers to entry help the firms to restore a

supernormal profit even in the long run.

Answer 3

The decision of State government to merge with local government has resulted in a

substantial reduction in the number of local councils in Australia. The main rationale for such

merger is that substantial economic benefits are derived from a consolidated government

(Sarala et al., 2016). The economic rationale for such policies are as follows

Theory of fiscal federalism and optimum size of the community

The theory of fiscal federalism address the issue of whether the specific public goods

or services should be offered in a federation like Australia on a centralized or decentralized

manner. The main issue here is which public goods should be provided by which levels of

government (central, state and government). This is known as principle of correspondence.

As per this principle, the public goods should be provided by the lowest level that is local

government (Verhoest et al., 2016). The local government however provides public goods to

a specific region only. The benefits of some public goods extends beyond the local boundary.

8ECONOMIC ASSIGNMENT

The benefit region of specific public goods thus provides rationale for an optimal community

size and hence for government amalgamation. The local government merger was conducted

in 2016 between Bankstown City and Canterbury city councils (strongercouncils.nsw.gov.au

2018). Following the merger 484 new community projects and services have been undertaken

benefitting public. The merged council has increased housing affordability of workers.

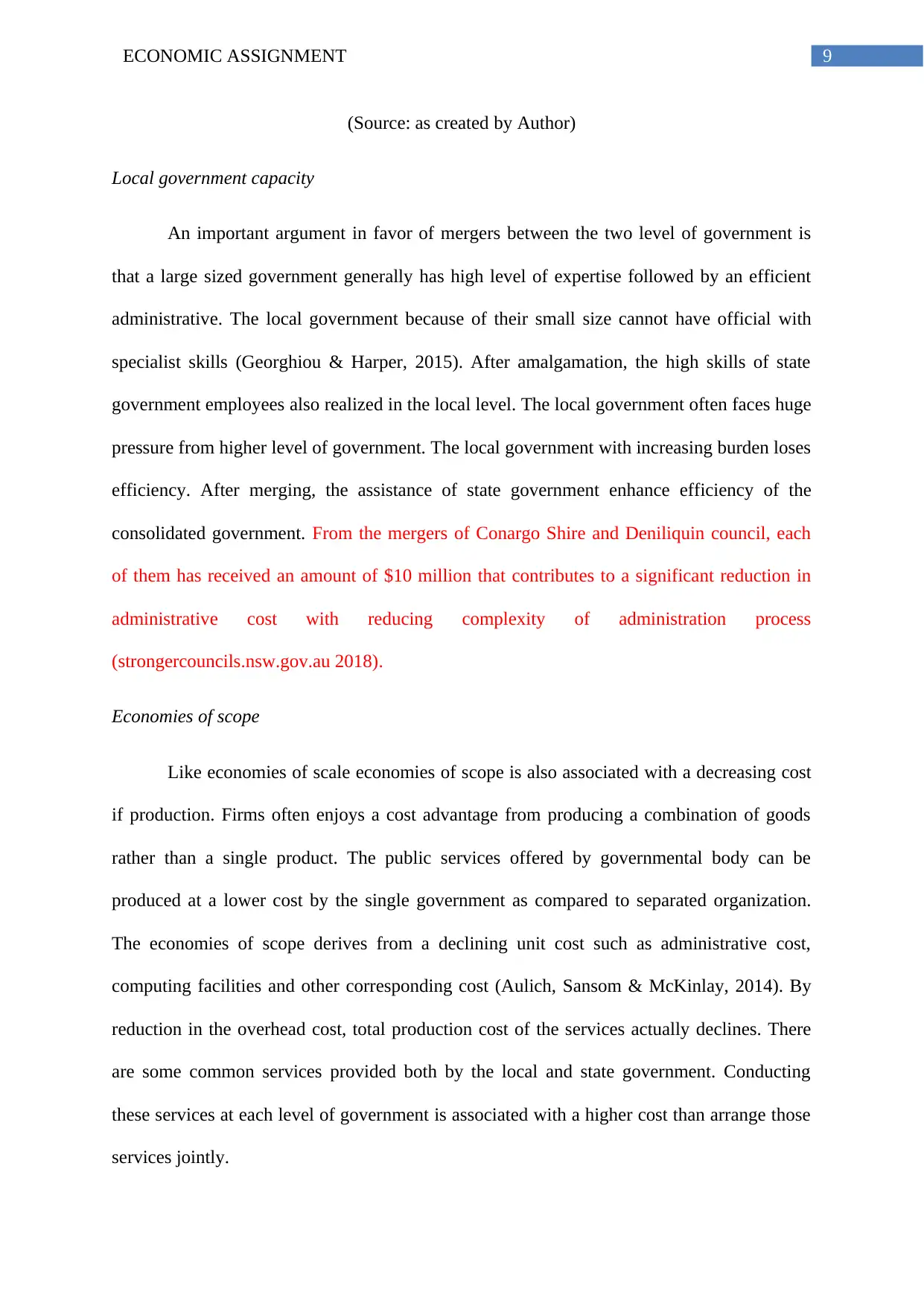

Economies of Scale

With increasing scale of operation firms often realize cost benefits where increasing

output associated with a decreasing average cost. For government amalgamation economies

of scale indicates a situation where the cost of government services decline along with

increases in set of population (Masser, 2014). After merger between local and state

government the increased jurisdiction size reduces per unit cost of the provided service both

by the consolidated government. By mergers Centerbury – Banksdown council is expected to

save $90 million over a period of ten years (strongercouncils.nsw.gov.au 2018).

Figure 2: Economies of scale from mergers

The benefit region of specific public goods thus provides rationale for an optimal community

size and hence for government amalgamation. The local government merger was conducted

in 2016 between Bankstown City and Canterbury city councils (strongercouncils.nsw.gov.au

2018). Following the merger 484 new community projects and services have been undertaken

benefitting public. The merged council has increased housing affordability of workers.

Economies of Scale

With increasing scale of operation firms often realize cost benefits where increasing

output associated with a decreasing average cost. For government amalgamation economies

of scale indicates a situation where the cost of government services decline along with

increases in set of population (Masser, 2014). After merger between local and state

government the increased jurisdiction size reduces per unit cost of the provided service both

by the consolidated government. By mergers Centerbury – Banksdown council is expected to

save $90 million over a period of ten years (strongercouncils.nsw.gov.au 2018).

Figure 2: Economies of scale from mergers

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMIC ASSIGNMENT

(Source: as created by Author)

Local government capacity

An important argument in favor of mergers between the two level of government is

that a large sized government generally has high level of expertise followed by an efficient

administrative. The local government because of their small size cannot have official with

specialist skills (Georghiou & Harper, 2015). After amalgamation, the high skills of state

government employees also realized in the local level. The local government often faces huge

pressure from higher level of government. The local government with increasing burden loses

efficiency. After merging, the assistance of state government enhance efficiency of the

consolidated government. From the mergers of Conargo Shire and Deniliquin council, each

of them has received an amount of $10 million that contributes to a significant reduction in

administrative cost with reducing complexity of administration process

(strongercouncils.nsw.gov.au 2018).

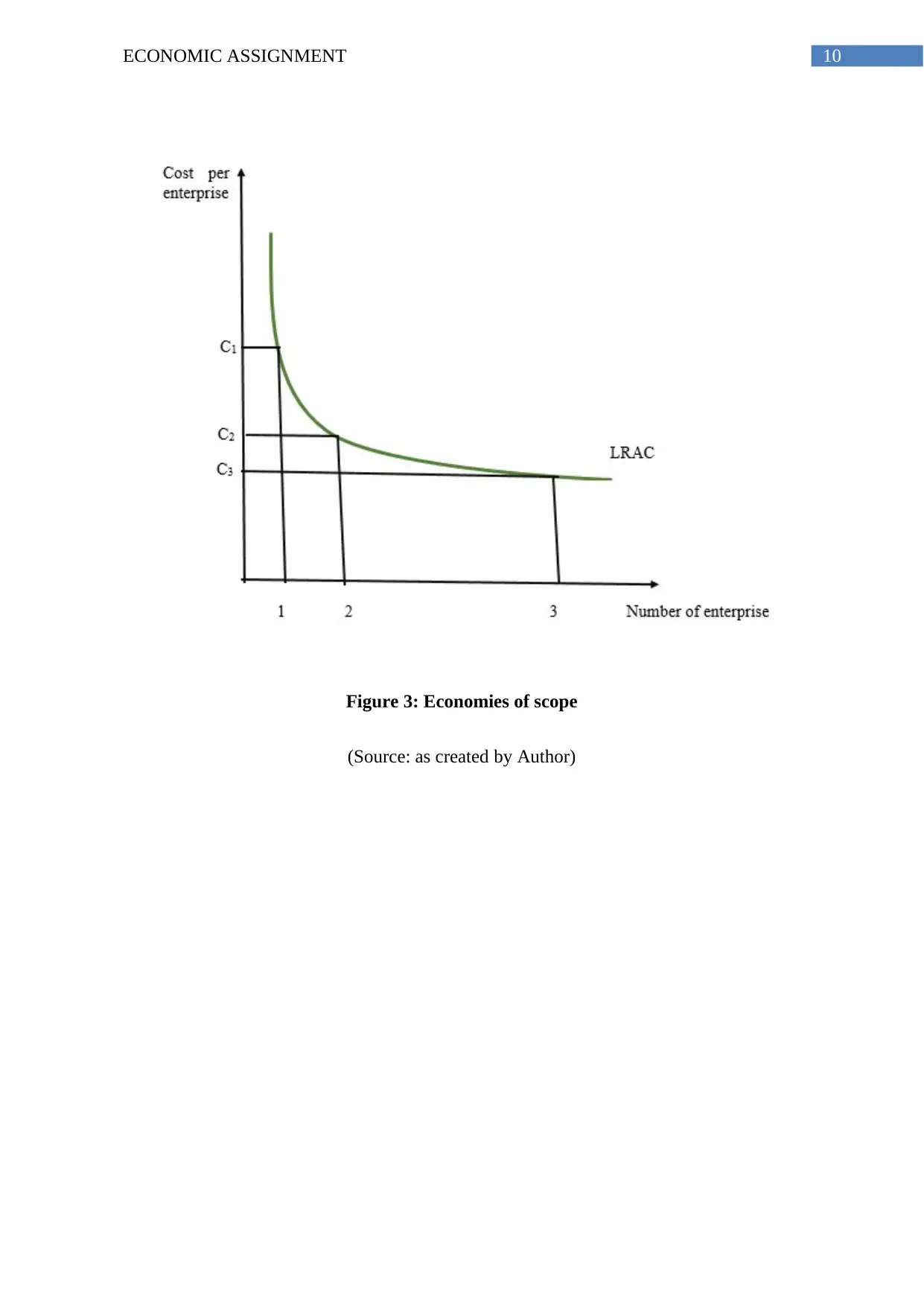

Economies of scope

Like economies of scale economies of scope is also associated with a decreasing cost

if production. Firms often enjoys a cost advantage from producing a combination of goods

rather than a single product. The public services offered by governmental body can be

produced at a lower cost by the single government as compared to separated organization.

The economies of scope derives from a declining unit cost such as administrative cost,

computing facilities and other corresponding cost (Aulich, Sansom & McKinlay, 2014). By

reduction in the overhead cost, total production cost of the services actually declines. There

are some common services provided both by the local and state government. Conducting

these services at each level of government is associated with a higher cost than arrange those

services jointly.

(Source: as created by Author)

Local government capacity

An important argument in favor of mergers between the two level of government is

that a large sized government generally has high level of expertise followed by an efficient

administrative. The local government because of their small size cannot have official with

specialist skills (Georghiou & Harper, 2015). After amalgamation, the high skills of state

government employees also realized in the local level. The local government often faces huge

pressure from higher level of government. The local government with increasing burden loses

efficiency. After merging, the assistance of state government enhance efficiency of the

consolidated government. From the mergers of Conargo Shire and Deniliquin council, each

of them has received an amount of $10 million that contributes to a significant reduction in

administrative cost with reducing complexity of administration process

(strongercouncils.nsw.gov.au 2018).

Economies of scope

Like economies of scale economies of scope is also associated with a decreasing cost

if production. Firms often enjoys a cost advantage from producing a combination of goods

rather than a single product. The public services offered by governmental body can be

produced at a lower cost by the single government as compared to separated organization.

The economies of scope derives from a declining unit cost such as administrative cost,

computing facilities and other corresponding cost (Aulich, Sansom & McKinlay, 2014). By

reduction in the overhead cost, total production cost of the services actually declines. There

are some common services provided both by the local and state government. Conducting

these services at each level of government is associated with a higher cost than arrange those

services jointly.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMIC ASSIGNMENT

Figure 3: Economies of scope

(Source: as created by Author)

Figure 3: Economies of scope

(Source: as created by Author)

11ECONOMIC ASSIGNMENT

References

Aulich, C., Sansom, G., & McKinlay, P. (2014). A fresh look at municipal consolidation in

Australia. Local Government Studies, 40(1), 1-20.

Becker, G. S. (2017). Economic theory. Routledge.

Devine, P. J., Tyson, W. J., Lee, N., & Jones, R. M. (2018). An introduction to industrial

economics. Routledge.

Dollery, B. E., Kortt, M. A., & De Souza, S. (2015). Policy analysis capacity and Australian

local government. Policy Analysis in Australia, Policy Press, Bristol, 105-20.

Excise rates for tobacco. (2018). Ato.gov.au. Retrieved 19 April 2018, from

https://www.ato.gov.au/Business/Excise-and-excise-equivalent-goods/Tobacco-

excise/Excise-rates-for-tobacco/

Frank, R. H. (2015). Principles of microeconomics, brief edition. Mcgraw-Hill.

Georghiou, L., & Harper, J. C. (2015). Mergers and alliances in context. In Mergers and

Alliances in Higher Education (pp. 1-14). Springer, Cham.

Mankiw, N., & Cosgrove, S. (2014). Principles of microeconomics. Stamford, CT: Cengage

Learning.

Masser, I. (2014). Governments and geographic information. CRC Press.

McKenzie, R. B., & Lee, D. R. (2016). Microeconomics for MBAs: The economic way of

thinking for managers. Cambridge University Press.

Moulin, H. (2014). Cooperative microeconomics: a game-theoretic introduction. Princeton

University Press.

References

Aulich, C., Sansom, G., & McKinlay, P. (2014). A fresh look at municipal consolidation in

Australia. Local Government Studies, 40(1), 1-20.

Becker, G. S. (2017). Economic theory. Routledge.

Devine, P. J., Tyson, W. J., Lee, N., & Jones, R. M. (2018). An introduction to industrial

economics. Routledge.

Dollery, B. E., Kortt, M. A., & De Souza, S. (2015). Policy analysis capacity and Australian

local government. Policy Analysis in Australia, Policy Press, Bristol, 105-20.

Excise rates for tobacco. (2018). Ato.gov.au. Retrieved 19 April 2018, from

https://www.ato.gov.au/Business/Excise-and-excise-equivalent-goods/Tobacco-

excise/Excise-rates-for-tobacco/

Frank, R. H. (2015). Principles of microeconomics, brief edition. Mcgraw-Hill.

Georghiou, L., & Harper, J. C. (2015). Mergers and alliances in context. In Mergers and

Alliances in Higher Education (pp. 1-14). Springer, Cham.

Mankiw, N., & Cosgrove, S. (2014). Principles of microeconomics. Stamford, CT: Cengage

Learning.

Masser, I. (2014). Governments and geographic information. CRC Press.

McKenzie, R. B., & Lee, D. R. (2016). Microeconomics for MBAs: The economic way of

thinking for managers. Cambridge University Press.

Moulin, H. (2014). Cooperative microeconomics: a game-theoretic introduction. Princeton

University Press.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.