ECO10001 Economic Principles: Market Analysis & Case Study

VerifiedAdded on 2023/06/10

|12

|1779

|476

Case Study

AI Summary

This case study examines economic principles through two scenarios: the impact of rising petrol prices on the equilibrium price and quantity of motor cars, and the price elasticity of demand for petrol. The first scenario uses competitive market theory to illustrate how increased petrol prices shift the demand curve for cars, leading to new equilibrium points. It identifies geopolitical risks and supply cuts as key determinants influencing these changes. The second scenario calculates the price elasticity of demand for petrol, determining it to be inelastic, and discusses the implications for government taxation policies. It also explores reasons for the inelasticity, such as the lack of close substitutes and the relatively low proportion of consumer income spent on petrol. The study concludes that various factors influence product prices and quantities, and that suppliers consider price elasticity of demand when setting prices. Desklib provides access to similar solved assignments and study resources for students.

Running head: ECONOMIC CASE STUDY

ECONOMIC CASE STUDY

Name of the Student

Name of the University

Author’s Note

ECONOMIC CASE STUDY

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIC CASE STUDY

Table of Contents

Introduction................................................................................................................................2

Scenario One..............................................................................................................................2

Scenario Two.............................................................................................................................6

Conclusion..................................................................................................................................9

References................................................................................................................................10

Table of Contents

Introduction................................................................................................................................2

Scenario One..............................................................................................................................2

Scenario Two.............................................................................................................................6

Conclusion..................................................................................................................................9

References................................................................................................................................10

2ECONOMIC CASE STUDY

Introduction

The purpose of this assessment is to analyse economic principles and models. The

decision making by individuals, enterprise and government is evaluated by using economic

concepts and knowledge. The economic outcomes in market and its impact by the market

structure and macroeconomic environment is described in this study. This assessment focuses

on two scenarios. The first scenario highlights on how increase in petrol prices impact the

equilibrium price and equilibrium quantity for motor cars. This scenario is explained with the

help of competitive market theory. The second scenario explains about the price elasticity of

demand for petrol.

Scenario One

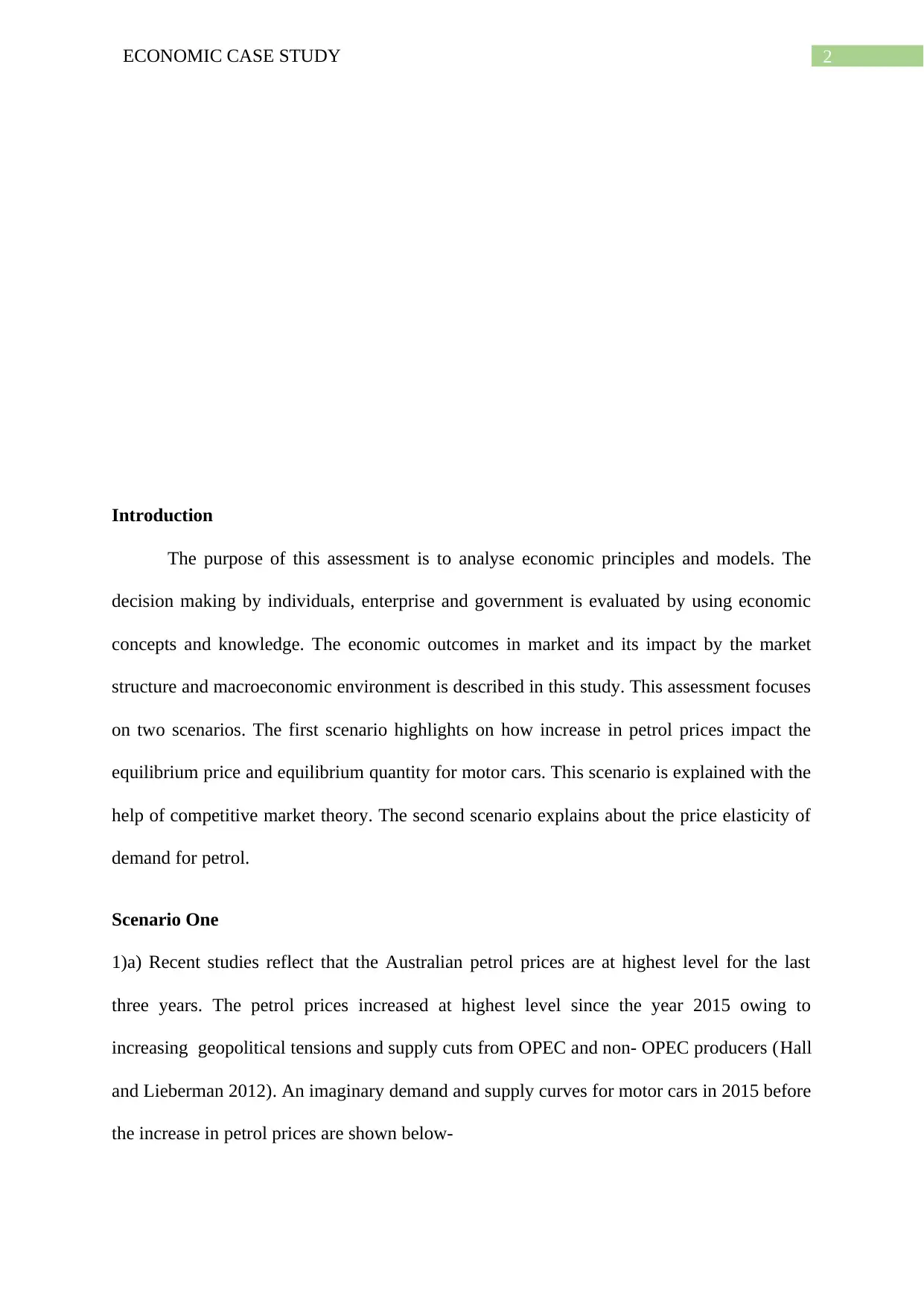

1)a) Recent studies reflect that the Australian petrol prices are at highest level for the last

three years. The petrol prices increased at highest level since the year 2015 owing to

increasing geopolitical tensions and supply cuts from OPEC and non- OPEC producers (Hall

and Lieberman 2012). An imaginary demand and supply curves for motor cars in 2015 before

the increase in petrol prices are shown below-

Introduction

The purpose of this assessment is to analyse economic principles and models. The

decision making by individuals, enterprise and government is evaluated by using economic

concepts and knowledge. The economic outcomes in market and its impact by the market

structure and macroeconomic environment is described in this study. This assessment focuses

on two scenarios. The first scenario highlights on how increase in petrol prices impact the

equilibrium price and equilibrium quantity for motor cars. This scenario is explained with the

help of competitive market theory. The second scenario explains about the price elasticity of

demand for petrol.

Scenario One

1)a) Recent studies reflect that the Australian petrol prices are at highest level for the last

three years. The petrol prices increased at highest level since the year 2015 owing to

increasing geopolitical tensions and supply cuts from OPEC and non- OPEC producers (Hall

and Lieberman 2012). An imaginary demand and supply curves for motor cars in 2015 before

the increase in petrol prices are shown below-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIC CASE STUDY

Quantity

Price S

S

D

D

Q*

P*

E

Figure 1: Imaginary demand and supply curve for motor cars

Source: (As created by author)

The above figure reflects that equilibrium occurs at the point E where demand curve (DD)

and supply curve (SS) intersects each other. The corresponding equilibrium price of cars is

P* and equilibrium quantity of cars is Q*.

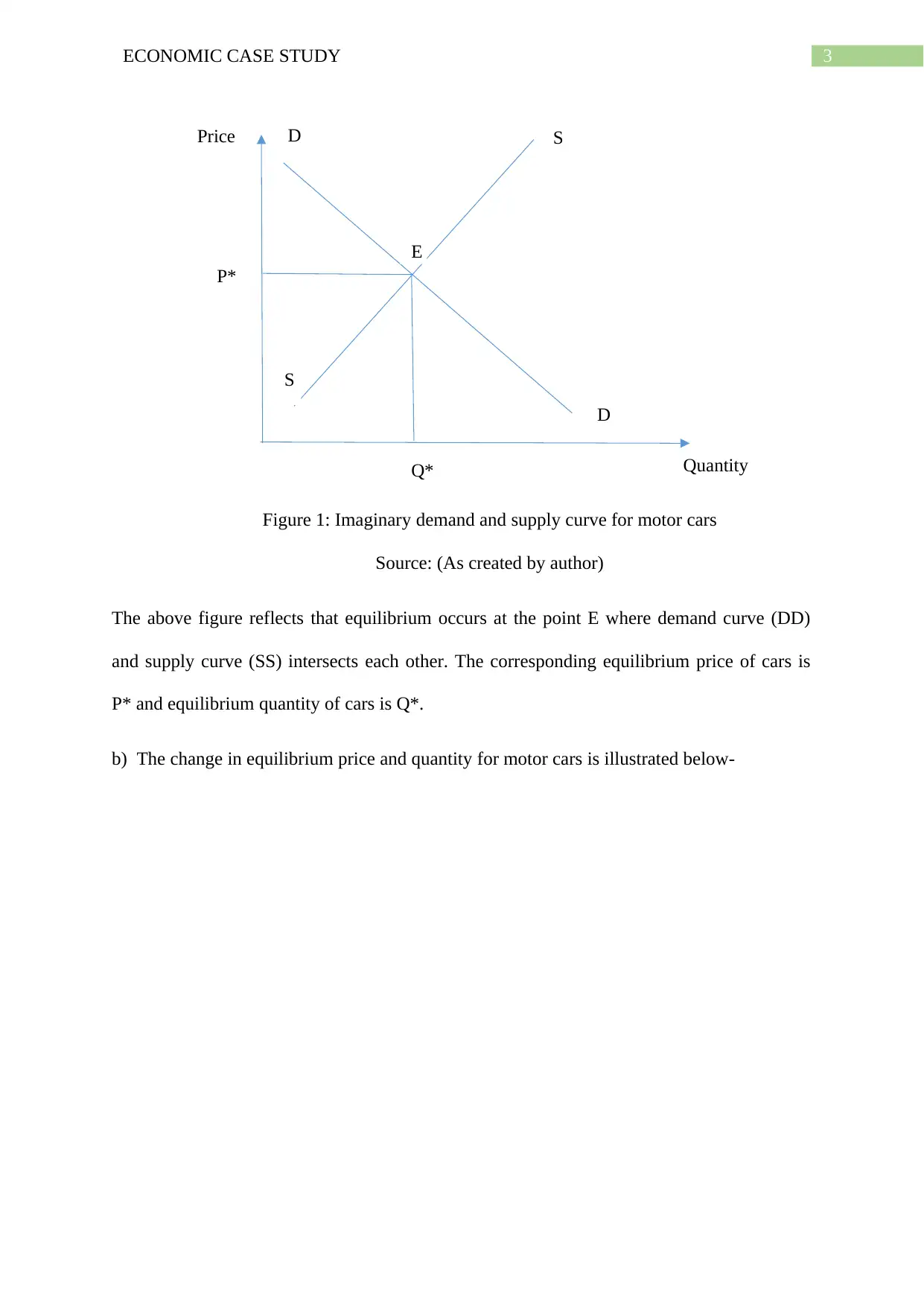

b) The change in equilibrium price and quantity for motor cars is illustrated below-

Quantity

Price S

S

D

D

Q*

P*

E

Figure 1: Imaginary demand and supply curve for motor cars

Source: (As created by author)

The above figure reflects that equilibrium occurs at the point E where demand curve (DD)

and supply curve (SS) intersects each other. The corresponding equilibrium price of cars is

P* and equilibrium quantity of cars is Q*.

b) The change in equilibrium price and quantity for motor cars is illustrated below-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIC CASE STUDY

Quantity

Price

S

S

D1

D1

Q1

P1

E

P*

Q*

D

D

P2

E1

Q2

Figure 2: Change in equilibrium quantity and price for cars

Source: (As created by author)

The equilibrium point is ‘E’ where initial demand curve (DD) and supply curve (SS) cut

each other at which equilibrium price is P*and equilibrium quantity is Q*. Increasing

geopolitical tensions and cut in supply of petrol from OPEC and non- OPEC producers

creates upward pressure for price of oil. Rise in price of petrol reduces the demand for motor

cars. As a result, the demand curve shifts leftward from DD to D1D1. The new equilibrium

point occurs at point E1 where initial supply curve (SS) cuts new demand curve (D1D1). As a

result, the price decreases to P1 and quantity decreases to Q1. But most of the sellers were

not willing to sell the cars at price P1 and thus wanted to sell the cars at price P2 (Taussig

2013).

Quantity

Price

S

S

D1

D1

Q1

P1

E

P*

Q*

D

D

P2

E1

Q2

Figure 2: Change in equilibrium quantity and price for cars

Source: (As created by author)

The equilibrium point is ‘E’ where initial demand curve (DD) and supply curve (SS) cut

each other at which equilibrium price is P*and equilibrium quantity is Q*. Increasing

geopolitical tensions and cut in supply of petrol from OPEC and non- OPEC producers

creates upward pressure for price of oil. Rise in price of petrol reduces the demand for motor

cars. As a result, the demand curve shifts leftward from DD to D1D1. The new equilibrium

point occurs at point E1 where initial supply curve (SS) cuts new demand curve (D1D1). As a

result, the price decreases to P1 and quantity decreases to Q1. But most of the sellers were

not willing to sell the cars at price P1 and thus wanted to sell the cars at price P2 (Taussig

2013).

5ECONOMIC CASE STUDY

Quantity

Price

S

S

D1

D1

Q1

P1

E

P*

Q*

D

D

P2

E1

Q2

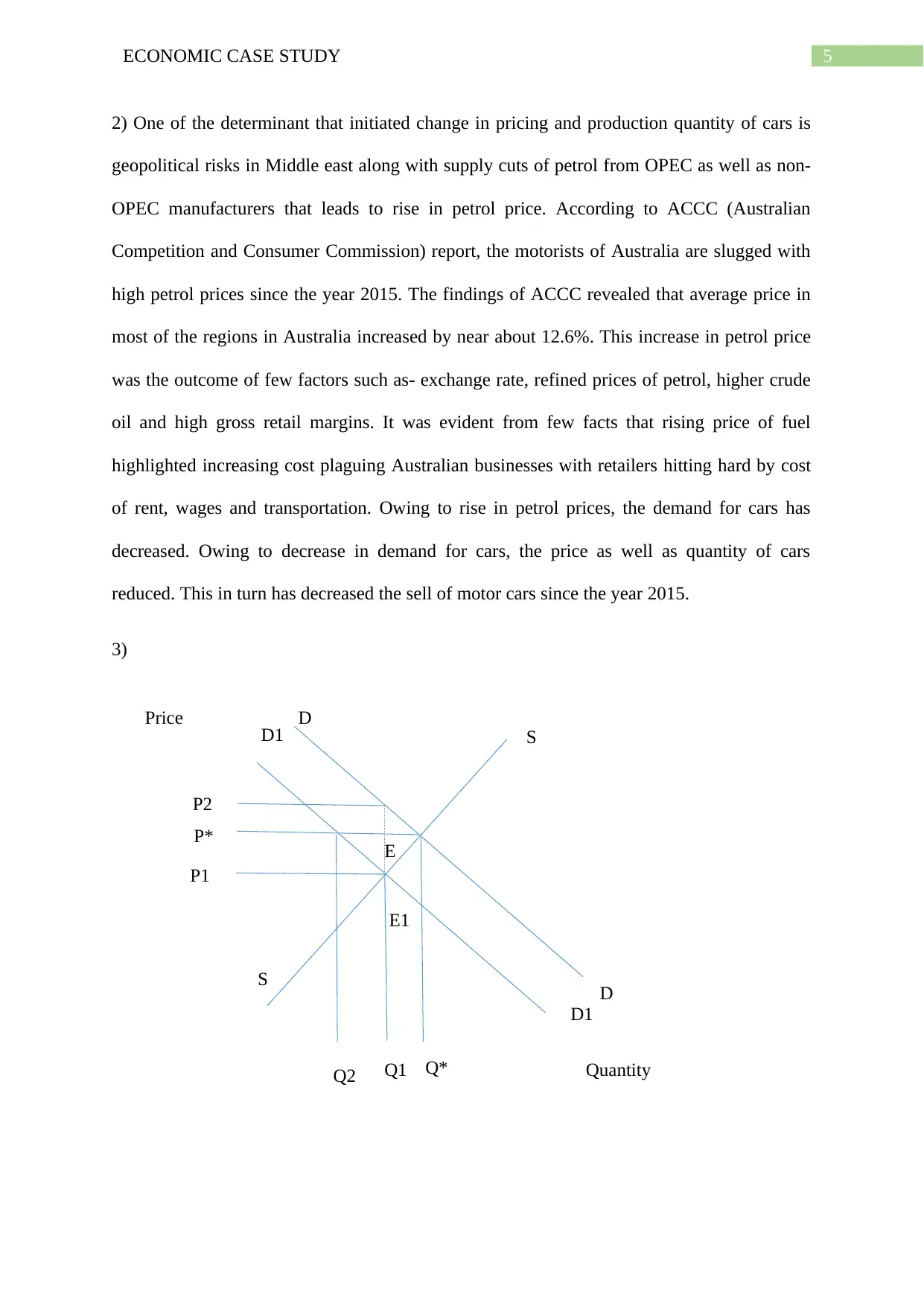

2) One of the determinant that initiated change in pricing and production quantity of cars is

geopolitical risks in Middle east along with supply cuts of petrol from OPEC as well as non-

OPEC manufacturers that leads to rise in petrol price. According to ACCC (Australian

Competition and Consumer Commission) report, the motorists of Australia are slugged with

high petrol prices since the year 2015. The findings of ACCC revealed that average price in

most of the regions in Australia increased by near about 12.6%. This increase in petrol price

was the outcome of few factors such as- exchange rate, refined prices of petrol, higher crude

oil and high gross retail margins. It was evident from few facts that rising price of fuel

highlighted increasing cost plaguing Australian businesses with retailers hitting hard by cost

of rent, wages and transportation. Owing to rise in petrol prices, the demand for cars has

decreased. Owing to decrease in demand for cars, the price as well as quantity of cars

reduced. This in turn has decreased the sell of motor cars since the year 2015.

3)

Quantity

Price

S

S

D1

D1

Q1

P1

E

P*

Q*

D

D

P2

E1

Q2

2) One of the determinant that initiated change in pricing and production quantity of cars is

geopolitical risks in Middle east along with supply cuts of petrol from OPEC as well as non-

OPEC manufacturers that leads to rise in petrol price. According to ACCC (Australian

Competition and Consumer Commission) report, the motorists of Australia are slugged with

high petrol prices since the year 2015. The findings of ACCC revealed that average price in

most of the regions in Australia increased by near about 12.6%. This increase in petrol price

was the outcome of few factors such as- exchange rate, refined prices of petrol, higher crude

oil and high gross retail margins. It was evident from few facts that rising price of fuel

highlighted increasing cost plaguing Australian businesses with retailers hitting hard by cost

of rent, wages and transportation. Owing to rise in petrol prices, the demand for cars has

decreased. Owing to decrease in demand for cars, the price as well as quantity of cars

reduced. This in turn has decreased the sell of motor cars since the year 2015.

3)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIC CASE STUDY

Quantity

Price

Q*

P*

S

S

S1

S1 D

D

D1

D1

P1

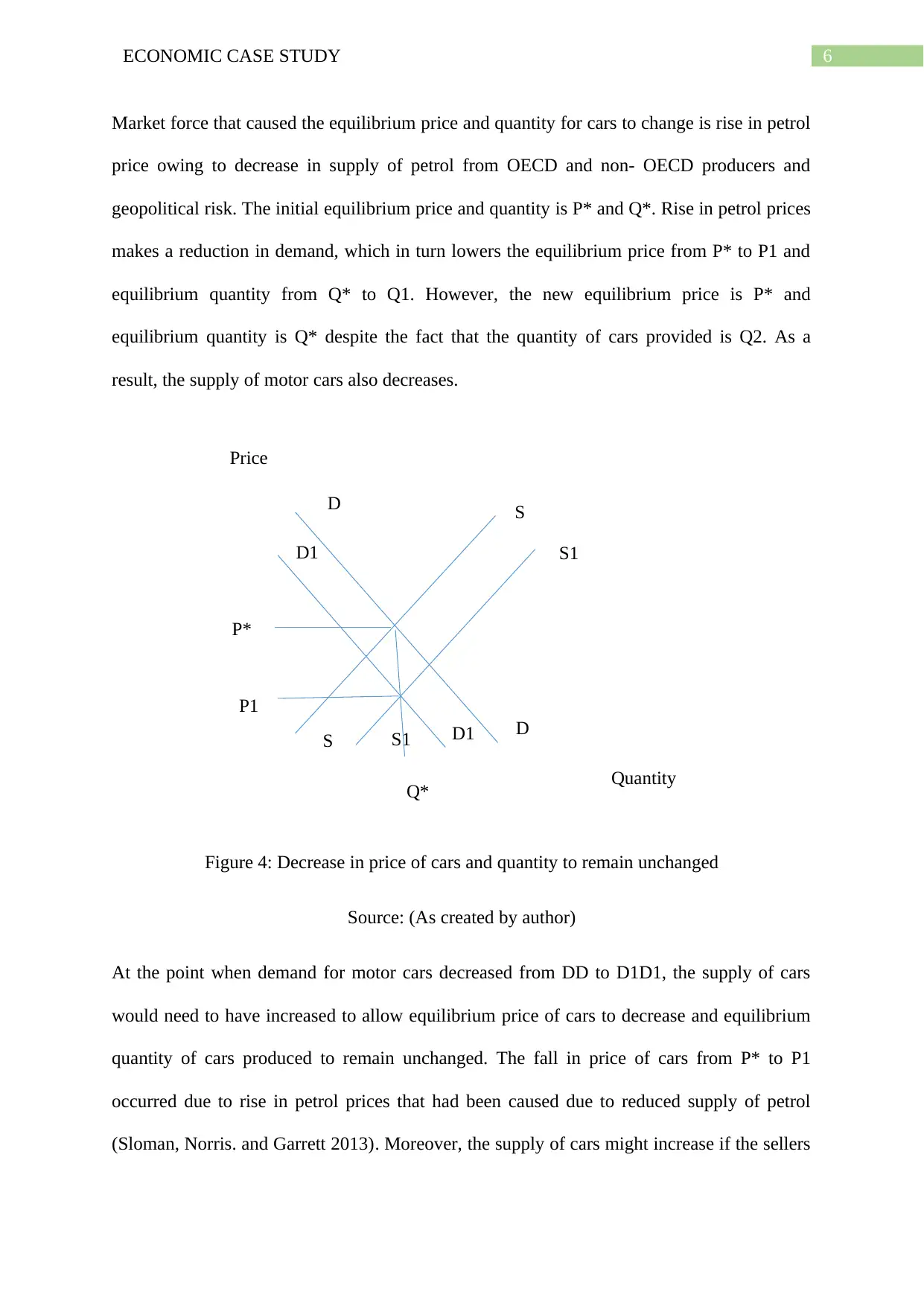

Market force that caused the equilibrium price and quantity for cars to change is rise in petrol

price owing to decrease in supply of petrol from OECD and non- OECD producers and

geopolitical risk. The initial equilibrium price and quantity is P* and Q*. Rise in petrol prices

makes a reduction in demand, which in turn lowers the equilibrium price from P* to P1 and

equilibrium quantity from Q* to Q1. However, the new equilibrium price is P* and

equilibrium quantity is Q* despite the fact that the quantity of cars provided is Q2. As a

result, the supply of motor cars also decreases.

Figure 4: Decrease in price of cars and quantity to remain unchanged

Source: (As created by author)

At the point when demand for motor cars decreased from DD to D1D1, the supply of cars

would need to have increased to allow equilibrium price of cars to decrease and equilibrium

quantity of cars produced to remain unchanged. The fall in price of cars from P* to P1

occurred due to rise in petrol prices that had been caused due to reduced supply of petrol

(Sloman, Norris. and Garrett 2013). Moreover, the supply of cars might increase if the sellers

Quantity

Price

Q*

P*

S

S

S1

S1 D

D

D1

D1

P1

Market force that caused the equilibrium price and quantity for cars to change is rise in petrol

price owing to decrease in supply of petrol from OECD and non- OECD producers and

geopolitical risk. The initial equilibrium price and quantity is P* and Q*. Rise in petrol prices

makes a reduction in demand, which in turn lowers the equilibrium price from P* to P1 and

equilibrium quantity from Q* to Q1. However, the new equilibrium price is P* and

equilibrium quantity is Q* despite the fact that the quantity of cars provided is Q2. As a

result, the supply of motor cars also decreases.

Figure 4: Decrease in price of cars and quantity to remain unchanged

Source: (As created by author)

At the point when demand for motor cars decreased from DD to D1D1, the supply of cars

would need to have increased to allow equilibrium price of cars to decrease and equilibrium

quantity of cars produced to remain unchanged. The fall in price of cars from P* to P1

occurred due to rise in petrol prices that had been caused due to reduced supply of petrol

(Sloman, Norris. and Garrett 2013). Moreover, the supply of cars might increase if the sellers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIC CASE STUDY

continue to sell the cars at low price. Thus, the quantity of motor cars might remain

unchanged even if its demand decreases.

Scenario Two

1)a) Price elasticity of demand for petrol signifies the sensitivity of percentage change in

quantity demanded of motor cars to the percentage change in price of motor cars. The

coefficient of elasticity mainly captures elasticity response between the two variables. The

formula is written as-

Price elasticity of demand (PED) = percentage change in demand for quantity/percentage

change in price of product

PED= change in the quantity demanded /change in price* price /quantity

The common formula for coefficient of price elasticity between the variables A and B is

shown below-

Coefficient of elasticity = percentage change in the variable B/ percentage change in the

variable A

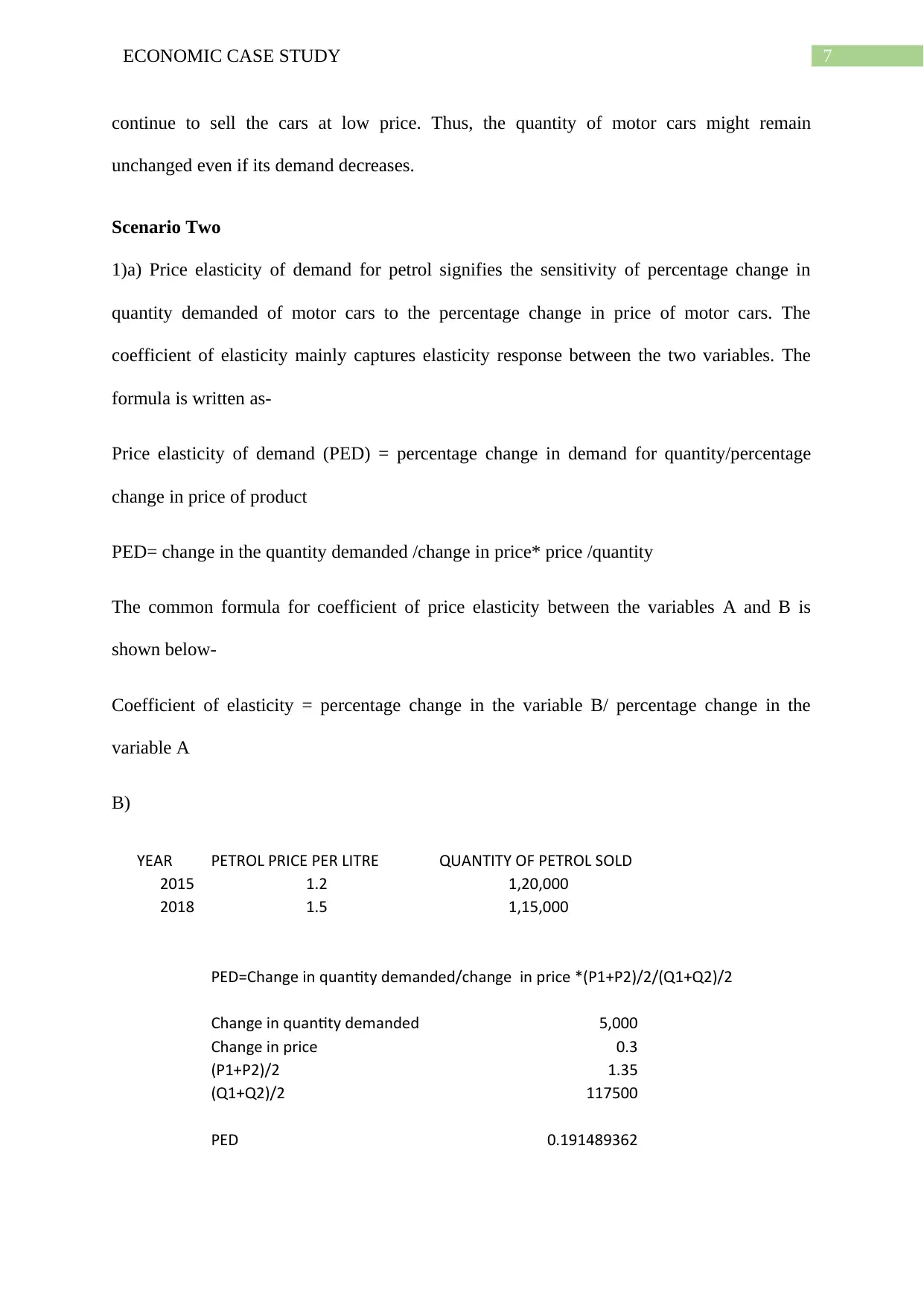

B)

YEAR PETROL PRICE PER LITRE QUANTITY OF PETROL SOLD

2015 1.2 1,20,000

2018 1.5 1,15,000

PED=Change in quantity demanded/change in price *(P1+P2)/2/(Q1+Q2)/2

Change in quantity demanded 5,000

Change in price 0.3

(P1+P2)/2 1.35

(Q1+Q2)/2 117500

PED 0.191489362

continue to sell the cars at low price. Thus, the quantity of motor cars might remain

unchanged even if its demand decreases.

Scenario Two

1)a) Price elasticity of demand for petrol signifies the sensitivity of percentage change in

quantity demanded of motor cars to the percentage change in price of motor cars. The

coefficient of elasticity mainly captures elasticity response between the two variables. The

formula is written as-

Price elasticity of demand (PED) = percentage change in demand for quantity/percentage

change in price of product

PED= change in the quantity demanded /change in price* price /quantity

The common formula for coefficient of price elasticity between the variables A and B is

shown below-

Coefficient of elasticity = percentage change in the variable B/ percentage change in the

variable A

B)

YEAR PETROL PRICE PER LITRE QUANTITY OF PETROL SOLD

2015 1.2 1,20,000

2018 1.5 1,15,000

PED=Change in quantity demanded/change in price *(P1+P2)/2/(Q1+Q2)/2

Change in quantity demanded 5,000

Change in price 0.3

(P1+P2)/2 1.35

(Q1+Q2)/2 117500

PED 0.191489362

8ECONOMIC CASE STUDY

Quantity

Price

D

D

P0

P1

Q0 Q1

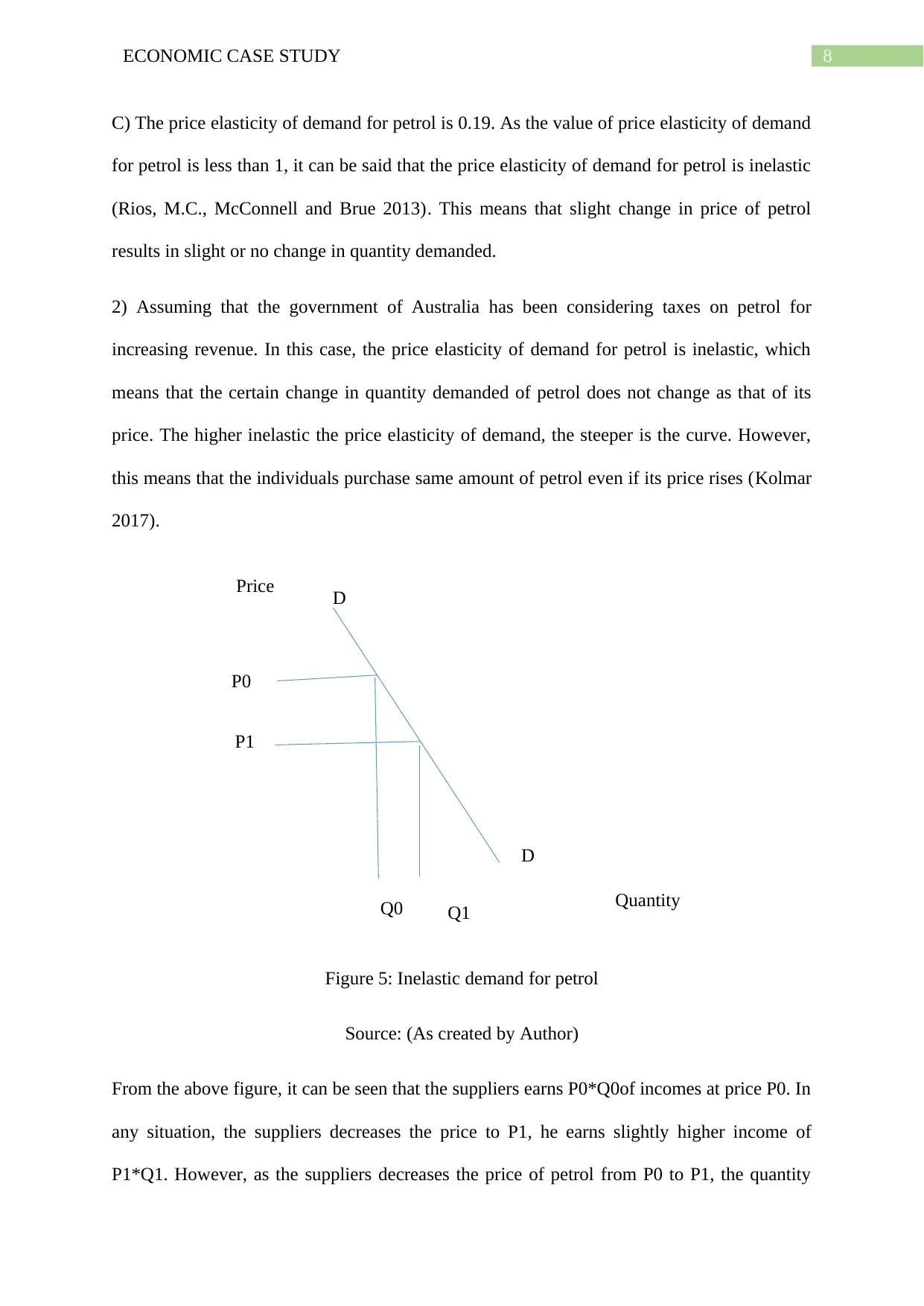

C) The price elasticity of demand for petrol is 0.19. As the value of price elasticity of demand

for petrol is less than 1, it can be said that the price elasticity of demand for petrol is inelastic

(Rios, M.C., McConnell and Brue 2013). This means that slight change in price of petrol

results in slight or no change in quantity demanded.

2) Assuming that the government of Australia has been considering taxes on petrol for

increasing revenue. In this case, the price elasticity of demand for petrol is inelastic, which

means that the certain change in quantity demanded of petrol does not change as that of its

price. The higher inelastic the price elasticity of demand, the steeper is the curve. However,

this means that the individuals purchase same amount of petrol even if its price rises (Kolmar

2017).

Figure 5: Inelastic demand for petrol

Source: (As created by Author)

From the above figure, it can be seen that the suppliers earns P0*Q0of incomes at price P0. In

any situation, the suppliers decreases the price to P1, he earns slightly higher income of

P1*Q1. However, as the suppliers decreases the price of petrol from P0 to P1, the quantity

Quantity

Price

D

D

P0

P1

Q0 Q1

C) The price elasticity of demand for petrol is 0.19. As the value of price elasticity of demand

for petrol is less than 1, it can be said that the price elasticity of demand for petrol is inelastic

(Rios, M.C., McConnell and Brue 2013). This means that slight change in price of petrol

results in slight or no change in quantity demanded.

2) Assuming that the government of Australia has been considering taxes on petrol for

increasing revenue. In this case, the price elasticity of demand for petrol is inelastic, which

means that the certain change in quantity demanded of petrol does not change as that of its

price. The higher inelastic the price elasticity of demand, the steeper is the curve. However,

this means that the individuals purchase same amount of petrol even if its price rises (Kolmar

2017).

Figure 5: Inelastic demand for petrol

Source: (As created by Author)

From the above figure, it can be seen that the suppliers earns P0*Q0of incomes at price P0. In

any situation, the suppliers decreases the price to P1, he earns slightly higher income of

P1*Q1. However, as the suppliers decreases the price of petrol from P0 to P1, the quantity

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMIC CASE STUDY

demanded for petrol might increase slightly by Q0 to Q1. As a result, the suppliers can attain

less profits from this product. Now, if the government increases tax on petrol, the tax revenue

will slightly increase in case of inelastic demand.

3) Two reasons behind which the price elasticity of demand for petrol could be inelastic are

described below-

a) No close substitute-this is one of the vital reason in case of petrol as there is no other

option but to purchase petrol for filling up car. However, the firm can increase car price with

decrease in its demand for petrol (Reisman 2013).

b) Lower percentage of consumers income- lower proportion of income leads to inelastic prce

elastic of demand. Thus, higher the income proportion spent on the good, higher will be its

price.

Conclusion

From the above discussion, it can be concluded that there are several factors that leads

to change in price and quantity of product. Moreover, there are few factors that impact price

elasticity of demand for a product. In addition to this, the suppliers also reviews the product

price depending on price elasticity of demand.

demanded for petrol might increase slightly by Q0 to Q1. As a result, the suppliers can attain

less profits from this product. Now, if the government increases tax on petrol, the tax revenue

will slightly increase in case of inelastic demand.

3) Two reasons behind which the price elasticity of demand for petrol could be inelastic are

described below-

a) No close substitute-this is one of the vital reason in case of petrol as there is no other

option but to purchase petrol for filling up car. However, the firm can increase car price with

decrease in its demand for petrol (Reisman 2013).

b) Lower percentage of consumers income- lower proportion of income leads to inelastic prce

elastic of demand. Thus, higher the income proportion spent on the good, higher will be its

price.

Conclusion

From the above discussion, it can be concluded that there are several factors that leads

to change in price and quantity of product. Moreover, there are few factors that impact price

elasticity of demand for a product. In addition to this, the suppliers also reviews the product

price depending on price elasticity of demand.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMIC CASE STUDY

References

Hall, R.E. and Lieberman, M., 2012. Microeconomics: Principles and applications. Cengage

Learning.

Kolmar, M., 2017. Principles of Microeconomics. Springer International Publishing.

Reisman, D., 2013. The Economics of Alfred Marshall (Routledge Revivals). Routledge.

Rios, M.C., McConnell, C.R. and Brue, S.L., 2013. Economics: Principles, problems, and

policies. McGraw-Hill.

Sloman, J., Norris, K. and Garrett, D., 2013. Principles of economics. Pearson Higher

Education AU.

Taussig, F.W., 2013. Principles of economics (Vol. 2). Cosimo, Inc..

References

Hall, R.E. and Lieberman, M., 2012. Microeconomics: Principles and applications. Cengage

Learning.

Kolmar, M., 2017. Principles of Microeconomics. Springer International Publishing.

Reisman, D., 2013. The Economics of Alfred Marshall (Routledge Revivals). Routledge.

Rios, M.C., McConnell, C.R. and Brue, S.L., 2013. Economics: Principles, problems, and

policies. McGraw-Hill.

Sloman, J., Norris, K. and Garrett, D., 2013. Principles of economics. Pearson Higher

Education AU.

Taussig, F.W., 2013. Principles of economics (Vol. 2). Cosimo, Inc..

11ECONOMIC CASE STUDY

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.