ECO3EGS: Theory and Evidence in Economic Growth and Stability

VerifiedAdded on 2023/06/03

|15

|3835

|81

Homework Assignment

AI Summary

This assignment provides a detailed analysis of economic growth and stability, focusing on the Solow growth model, its theoretical underpinnings, and empirical evidence. It begins by examining the division of income between labor and capital based on marginal productivity, deriving the law of motion and exploring steady-state conditions. The analysis includes computations of output per worker, consumption per effective worker, and capital per worker at steady state. Furthermore, the assignment delves into the Golden Rule steady state, unemployment's impact on the Solow model, and computational work involving changes in saving rates. It also discusses the Solow model's extension to include human capital, highlighting the model's equations and modifications for a more comprehensive understanding of economic growth. The assignment concludes with graphical representations and interpretations of the relationships between key economic variables, along with references to relevant academic research.

ECONOMIC GROWTH AND STABILITY1

Economic Growth and Stability: Theory and Evidence

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Economic Growth and Stability: Theory and Evidence

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMIC GROWTH AND STABILITY2

Part A: Analytical Work

a) It is divided between labor and capital income according to their marginal

productivity. That is to say, from; yt = F (Kt, AtLt) = Kαt (AtLt) 1-α

So, from St = It = sYt . By making everything into the per effective worker terms, we

divide by AtLt:

We have, Kt+1 /At+1Lt+1 = s F (Kt, Lt)/AtLt AtLt/At+1Lt+1 + (1- α) Kt/AtL AtLt/Bt+1Lt+1

Yt+1 = αK αt + (1- α) Kt/ {(1 + g) (1 + n) = φ (Kt)

Therefore, 𝑦 ̃ t= (1- α) Kt/AtLt = Yt/AtLt = Kt / AtLt

b)

From the law of motion it can be asserted that; Kt+1 – Kt = sYt – 𝛿Kt

From the transformation; Kt+1 – Kt≡ change in Kt ≡ it – (n + g + 𝛿)Kt = s Kαt – (n +g+𝛿)Kt

It< (n + g + 𝛿) Kt ⤇⧍Kt< 0

It = (n + g + 𝛿) Kt ⤇⧍Kt = 0 ⤇ Kss

It > (n + g + 𝛿) Kt ⤇⧍Kt> 0

C)

At steady state, dkt+1 = 0,

K⧍ t = 0 s K⤇ α – (n + g + gn + 𝛿) Kt = 0

Now solving for the value of K gives:

K = [s/ (n + g + gn + 𝛿)] 1/ (1-α).

To effectively check for the overall stability of the steady sate, we need to check its

limit if it is less than unity. That is to say; lim K as Kt tends to infinity should be less than one

(Acemoglu 2009)

Part A: Analytical Work

a) It is divided between labor and capital income according to their marginal

productivity. That is to say, from; yt = F (Kt, AtLt) = Kαt (AtLt) 1-α

So, from St = It = sYt . By making everything into the per effective worker terms, we

divide by AtLt:

We have, Kt+1 /At+1Lt+1 = s F (Kt, Lt)/AtLt AtLt/At+1Lt+1 + (1- α) Kt/AtL AtLt/Bt+1Lt+1

Yt+1 = αK αt + (1- α) Kt/ {(1 + g) (1 + n) = φ (Kt)

Therefore, 𝑦 ̃ t= (1- α) Kt/AtLt = Yt/AtLt = Kt / AtLt

b)

From the law of motion it can be asserted that; Kt+1 – Kt = sYt – 𝛿Kt

From the transformation; Kt+1 – Kt≡ change in Kt ≡ it – (n + g + 𝛿)Kt = s Kαt – (n +g+𝛿)Kt

It< (n + g + 𝛿) Kt ⤇⧍Kt< 0

It = (n + g + 𝛿) Kt ⤇⧍Kt = 0 ⤇ Kss

It > (n + g + 𝛿) Kt ⤇⧍Kt> 0

C)

At steady state, dkt+1 = 0,

K⧍ t = 0 s K⤇ α – (n + g + gn + 𝛿) Kt = 0

Now solving for the value of K gives:

K = [s/ (n + g + gn + 𝛿)] 1/ (1-α).

To effectively check for the overall stability of the steady sate, we need to check its

limit if it is less than unity. That is to say; lim K as Kt tends to infinity should be less than one

(Acemoglu 2009)

ECONOMIC GROWTH AND STABILITY3

For output per worker

From the growth rate of output per worker, yt – Yt/ Lt in steady state is gives the

following expression (Acemoglu 2009)

Yt/Lt = [Kαt (AtLt) 1-α]/Lt = (Kt/Lt) α At1-α = (Kt/AtLt) α At = KtαAt

Therefore, as the economy reaches the steady state then;

Ytss = KαBt

Now, from above we get;

yt+1ss/ytss – 1 = At+1/At – 1 =g. Similarly, by taking natural logs on both terms gives the

following;

Logyt+1ss – log ytss – log At+1 – log At ≡ g

The consumption per effective worker

Under the steady state, the consumption per effective worker is obtained from the general

equation as (Acemoglu 2009); yt = ct + it, where it = syt and also ct = (1-s) yt. Therefore, in the

steady state;

C = (1-s) y = (1 – s) A1/1-α (s/ 𝛿 + n) α/1- α

Capital per worker at steady state is obtained from; Kt+1ss = Ktss = K. it implies that at

steady state, yk = 0. Now getting the K from the expression of ykt gives (Noel and Mark 2017)

D)

K = (sA/ 𝛿 + n) 1/ (1-α)

Therefore, the growth rate of output per worker is given as; Kt+1 = 1-α (sA/ 𝛿 + n)

For output per worker

From the growth rate of output per worker, yt – Yt/ Lt in steady state is gives the

following expression (Acemoglu 2009)

Yt/Lt = [Kαt (AtLt) 1-α]/Lt = (Kt/Lt) α At1-α = (Kt/AtLt) α At = KtαAt

Therefore, as the economy reaches the steady state then;

Ytss = KαBt

Now, from above we get;

yt+1ss/ytss – 1 = At+1/At – 1 =g. Similarly, by taking natural logs on both terms gives the

following;

Logyt+1ss – log ytss – log At+1 – log At ≡ g

The consumption per effective worker

Under the steady state, the consumption per effective worker is obtained from the general

equation as (Acemoglu 2009); yt = ct + it, where it = syt and also ct = (1-s) yt. Therefore, in the

steady state;

C = (1-s) y = (1 – s) A1/1-α (s/ 𝛿 + n) α/1- α

Capital per worker at steady state is obtained from; Kt+1ss = Ktss = K. it implies that at

steady state, yk = 0. Now getting the K from the expression of ykt gives (Noel and Mark 2017)

D)

K = (sA/ 𝛿 + n) 1/ (1-α)

Therefore, the growth rate of output per worker is given as; Kt+1 = 1-α (sA/ 𝛿 + n)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMIC GROWTH AND STABILITY4

Also from the capital per effective worker, K = [s/ (n + g + gn + 𝛿)] 1/ (1-α). Taking natural

logs where Kt/Lt = AtKt , where the Kt = Kt/ (AtLt).Now defining the per capita stock of capital as

kt =Kt / Lt:

It then gives;

Kt/Lt = kt = ktAt. By taking logarithms to get the growth rate of capital gives;

Log kt+1 – log kt = log At+1 – log At ≡ g(Noel and Mark 2017

E) The Golden –Rule Steady State

The value of 𝑘 ̃ at the golden rule in the steady state is the capital stock per worker which

maximizes the consumption at the steady state (Haine etal 2006). Therefore, from;

Ct = (1-s) yt = f (kt) –sf(kt).

It is believed that there is now way one can maximize consumption in all the states

(Haine etal 2006). This is because consumption is a function of f (kt) that is not bounded (Haine

et.al, 2006). Therefore, with such a reason, a corner solution is only obtained as kt = 0 that is true

when stationary points are obtained first. But the steady state condition is given as;

Sf (k) = (n + 𝛿) k. Hence it is true for all steady states because ct = f(kt) – sf(Kt) in steady

states (Halsmayer etal 2016).

In simple terms; c = f (k) – (n + 𝛿) k. The maximization problem now becomes;

∂c/ ∂k = f’ (k) – (n + 𝛿) = 0 f’ (k’) = n +⤇ 𝛿

Where y = Akα a closed form of solution for K’ can be obtained as’

f’ (k’) = αA(k’)α-1 = n + 𝛿

Also from the capital per effective worker, K = [s/ (n + g + gn + 𝛿)] 1/ (1-α). Taking natural

logs where Kt/Lt = AtKt , where the Kt = Kt/ (AtLt).Now defining the per capita stock of capital as

kt =Kt / Lt:

It then gives;

Kt/Lt = kt = ktAt. By taking logarithms to get the growth rate of capital gives;

Log kt+1 – log kt = log At+1 – log At ≡ g(Noel and Mark 2017

E) The Golden –Rule Steady State

The value of 𝑘 ̃ at the golden rule in the steady state is the capital stock per worker which

maximizes the consumption at the steady state (Haine etal 2006). Therefore, from;

Ct = (1-s) yt = f (kt) –sf(kt).

It is believed that there is now way one can maximize consumption in all the states

(Haine etal 2006). This is because consumption is a function of f (kt) that is not bounded (Haine

et.al, 2006). Therefore, with such a reason, a corner solution is only obtained as kt = 0 that is true

when stationary points are obtained first. But the steady state condition is given as;

Sf (k) = (n + 𝛿) k. Hence it is true for all steady states because ct = f(kt) – sf(Kt) in steady

states (Halsmayer etal 2016).

In simple terms; c = f (k) – (n + 𝛿) k. The maximization problem now becomes;

∂c/ ∂k = f’ (k) – (n + 𝛿) = 0 f’ (k’) = n +⤇ 𝛿

Where y = Akα a closed form of solution for K’ can be obtained as’

f’ (k’) = αA(k’)α-1 = n + 𝛿

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMIC GROWTH AND STABILITY5

k’ =[(αA/n + 𝛿)]1/(1-α)

While 𝑦’ = Akα = A (sA/n + 𝛿) α/1-α

And now consumption becomes; 𝑐̃= [(αA/n + 𝛿)] 1/ (1-α) + A (sA/n + 𝛿) α/1-α

Unemployment in the Solow Model

F) The output per effective worker yt = Yt/Lt as the function of capital per effective

worker Kt+1 = Kt/Lt and the natural rate of the unemployment u is obtained by

dividing the total output by the number of workers (Haine etal 2006).

Therefore from; yt ≡ f (kt) = Ktα [(1-u) Lt] 1-α/(Lt)

This gives, kαt (1-u) 1-α

𝑦 ̃ t = kαt (1-u) 1-α

From Kt+1 = It + (1- 𝛿) Kt and the law of motion as Kt+1 = sYt + (1- 𝛿) Kt.

Kt+1 = s { kαt (1-u)1-α }+ (1- 𝛿) Kt.

∂Kt+1/ ∂Kt = αs kα-1t + (1- 𝛿) but at steady state, ∂Kt+1/ ∂Kt = 0

αs kα-1t + (1- 𝛿) = 0 (Breton 2013).

k = {(𝛿 – 1)( 1-u)1-α/αs}1/α-1

Also, ∂yt/ ∂Kt = αKtα-1 (1-u)1-α

𝑦 ̃ ∗ = αKtα-1 (1-u) 1-α /Lt as the growth rate of output per effective worker. This

unemployment will affect his economy in the way that the job separation rate s in this case will

increase and there are high chances of losing the job (Haine etal 2006).

Part B: Computational Work

G) The value of y

k’ =[(αA/n + 𝛿)]1/(1-α)

While 𝑦’ = Akα = A (sA/n + 𝛿) α/1-α

And now consumption becomes; 𝑐̃= [(αA/n + 𝛿)] 1/ (1-α) + A (sA/n + 𝛿) α/1-α

Unemployment in the Solow Model

F) The output per effective worker yt = Yt/Lt as the function of capital per effective

worker Kt+1 = Kt/Lt and the natural rate of the unemployment u is obtained by

dividing the total output by the number of workers (Haine etal 2006).

Therefore from; yt ≡ f (kt) = Ktα [(1-u) Lt] 1-α/(Lt)

This gives, kαt (1-u) 1-α

𝑦 ̃ t = kαt (1-u) 1-α

From Kt+1 = It + (1- 𝛿) Kt and the law of motion as Kt+1 = sYt + (1- 𝛿) Kt.

Kt+1 = s { kαt (1-u)1-α }+ (1- 𝛿) Kt.

∂Kt+1/ ∂Kt = αs kα-1t + (1- 𝛿) but at steady state, ∂Kt+1/ ∂Kt = 0

αs kα-1t + (1- 𝛿) = 0 (Breton 2013).

k = {(𝛿 – 1)( 1-u)1-α/αs}1/α-1

Also, ∂yt/ ∂Kt = αKtα-1 (1-u)1-α

𝑦 ̃ ∗ = αKtα-1 (1-u) 1-α /Lt as the growth rate of output per effective worker. This

unemployment will affect his economy in the way that the job separation rate s in this case will

increase and there are high chances of losing the job (Haine etal 2006).

Part B: Computational Work

G) The value of y

ECONOMIC GROWTH AND STABILITY6

Ḱ* = {0.2/ (0.02 + 0.025 + 0.05)} 1/ (1-0.33) = (2.11)1.5 = 3.064952

ỹ = Ḱα = 3.0649521/3 = 1.452584

Ṡt = s ỹt = 0.2 *1.122497 = 0.224499

Ct = 1-0.2 (1.122497)

= 0.897992

p) Kold* = {0.12/(0.02 + 0.025 + 0.05)}1/(1-0.3333) = (1.26)1.5 = 1.414346

C old = (1-sold) yt = 1-0.12 (1.122497) = 0.988

Kold ={0.12/(/(0.02 + 0.025 + 0.05)} 1/(1-0.3333) = 1.414346.

therefore, yold becomes

1

1

*~

gn

s

k

tt ysc ~1~

1

1

*~

gn

s

k old

old

Ḱ* = {0.2/ (0.02 + 0.025 + 0.05)} 1/ (1-0.33) = (2.11)1.5 = 3.064952

ỹ = Ḱα = 3.0649521/3 = 1.452584

Ṡt = s ỹt = 0.2 *1.122497 = 0.224499

Ct = 1-0.2 (1.122497)

= 0.897992

p) Kold* = {0.12/(0.02 + 0.025 + 0.05)}1/(1-0.3333) = (1.26)1.5 = 1.414346

C old = (1-sold) yt = 1-0.12 (1.122497) = 0.988

Kold ={0.12/(/(0.02 + 0.025 + 0.05)} 1/(1-0.3333) = 1.414346.

therefore, yold becomes

1

1

*~

gn

s

k

tt ysc ~1~

1

1

*~

gn

s

k old

old

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMIC GROWTH AND STABILITY7

Yold= Ḱα = 1.4143461/3 = 1.122497

-4.00000000000

-2.00000000000

0.00000000000

2.00000000000

4.00000000000

6.00000000000

8.00000000000

10.00000000000

12.00000000000

14.00000000000

1

19

37

55

73

91

109

127

145

163

181

199

217

235

253

271

289

k~_t

y~_t

s~_t

c~_t

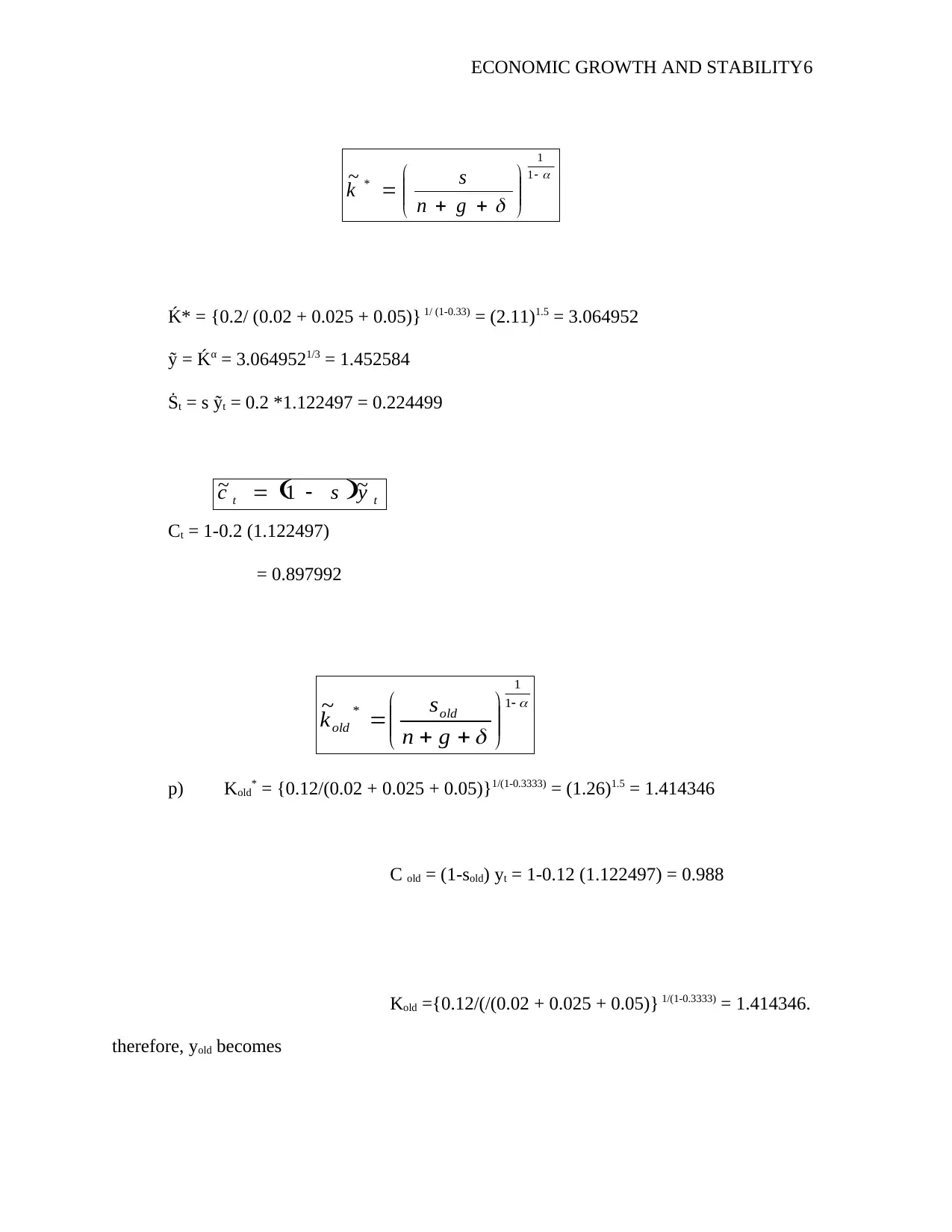

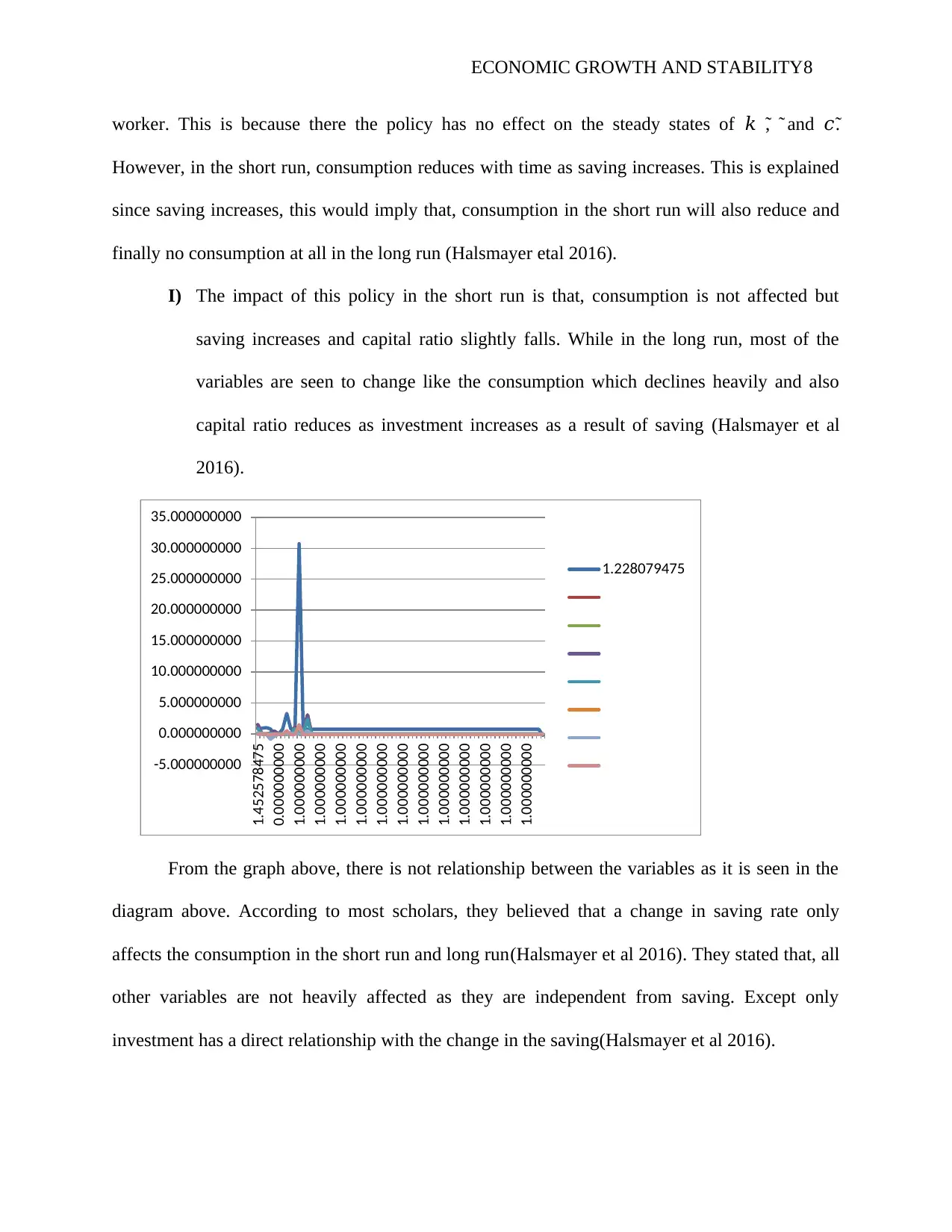

The line graph shows that there is no significant relationship between the three variables

of kt, yt and ct. It is observed that from the data, there deviations from when time is o to time are

7. From that point there is no correlation as all the variables are kept constant (Halsmayer etal

2016)

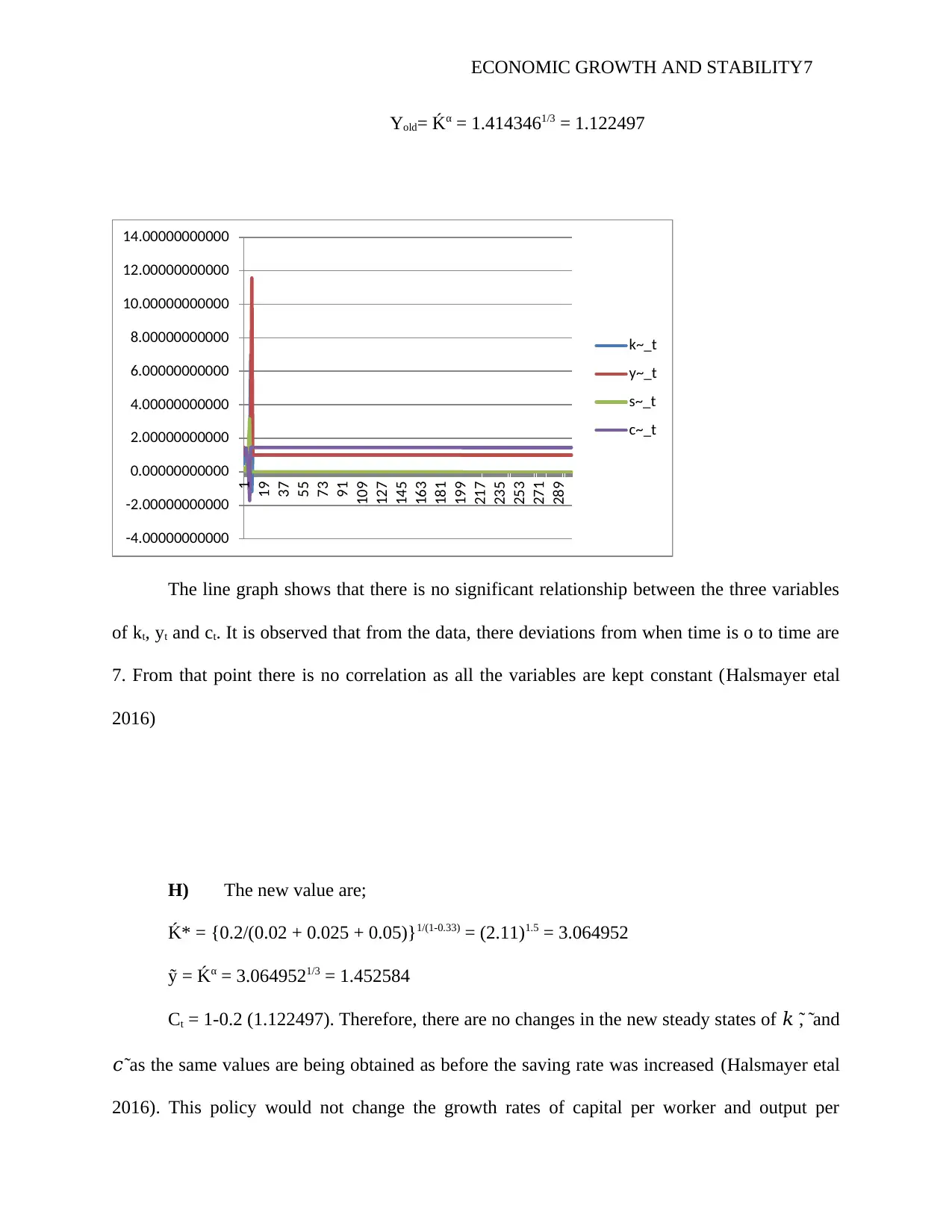

H) The new value are;

Ḱ* = {0.2/(0.02 + 0.025 + 0.05)}1/(1-0.33) = (2.11)1.5 = 3.064952

ỹ = Ḱα = 3.0649521/3 = 1.452584

Ct = 1-0.2 (1.122497). Therefore, there are no changes in the new steady states of 𝑘 ̃ , ̃ and

𝑐̃ as the same values are being obtained as before the saving rate was increased (Halsmayer etal

2016). This policy would not change the growth rates of capital per worker and output per

Yold= Ḱα = 1.4143461/3 = 1.122497

-4.00000000000

-2.00000000000

0.00000000000

2.00000000000

4.00000000000

6.00000000000

8.00000000000

10.00000000000

12.00000000000

14.00000000000

1

19

37

55

73

91

109

127

145

163

181

199

217

235

253

271

289

k~_t

y~_t

s~_t

c~_t

The line graph shows that there is no significant relationship between the three variables

of kt, yt and ct. It is observed that from the data, there deviations from when time is o to time are

7. From that point there is no correlation as all the variables are kept constant (Halsmayer etal

2016)

H) The new value are;

Ḱ* = {0.2/(0.02 + 0.025 + 0.05)}1/(1-0.33) = (2.11)1.5 = 3.064952

ỹ = Ḱα = 3.0649521/3 = 1.452584

Ct = 1-0.2 (1.122497). Therefore, there are no changes in the new steady states of 𝑘 ̃ , ̃ and

𝑐̃ as the same values are being obtained as before the saving rate was increased (Halsmayer etal

2016). This policy would not change the growth rates of capital per worker and output per

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMIC GROWTH AND STABILITY8

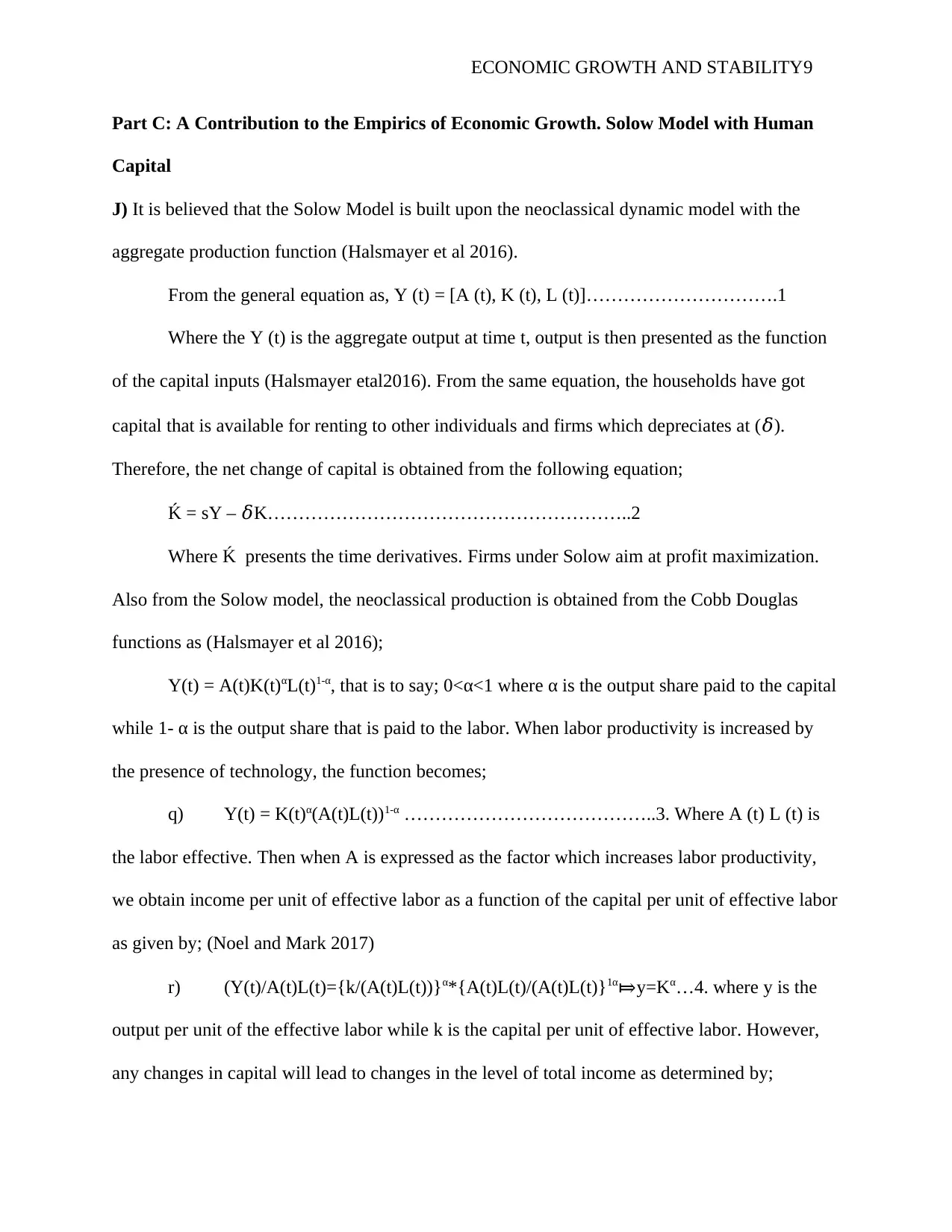

worker. This is because there the policy has no effect on the steady states of 𝑘 ̃ , ̃ and 𝑐̃.

However, in the short run, consumption reduces with time as saving increases. This is explained

since saving increases, this would imply that, consumption in the short run will also reduce and

finally no consumption at all in the long run (Halsmayer etal 2016).

I) The impact of this policy in the short run is that, consumption is not affected but

saving increases and capital ratio slightly falls. While in the long run, most of the

variables are seen to change like the consumption which declines heavily and also

capital ratio reduces as investment increases as a result of saving (Halsmayer et al

2016).

-5.000000000

0.000000000

5.000000000

10.000000000

15.000000000

20.000000000

25.000000000

30.000000000

35.000000000

1.452578475

0.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.228079475

From the graph above, there is not relationship between the variables as it is seen in the

diagram above. According to most scholars, they believed that a change in saving rate only

affects the consumption in the short run and long run(Halsmayer et al 2016). They stated that, all

other variables are not heavily affected as they are independent from saving. Except only

investment has a direct relationship with the change in the saving(Halsmayer et al 2016).

worker. This is because there the policy has no effect on the steady states of 𝑘 ̃ , ̃ and 𝑐̃.

However, in the short run, consumption reduces with time as saving increases. This is explained

since saving increases, this would imply that, consumption in the short run will also reduce and

finally no consumption at all in the long run (Halsmayer etal 2016).

I) The impact of this policy in the short run is that, consumption is not affected but

saving increases and capital ratio slightly falls. While in the long run, most of the

variables are seen to change like the consumption which declines heavily and also

capital ratio reduces as investment increases as a result of saving (Halsmayer et al

2016).

-5.000000000

0.000000000

5.000000000

10.000000000

15.000000000

20.000000000

25.000000000

30.000000000

35.000000000

1.452578475

0.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.000000000

1.228079475

From the graph above, there is not relationship between the variables as it is seen in the

diagram above. According to most scholars, they believed that a change in saving rate only

affects the consumption in the short run and long run(Halsmayer et al 2016). They stated that, all

other variables are not heavily affected as they are independent from saving. Except only

investment has a direct relationship with the change in the saving(Halsmayer et al 2016).

ECONOMIC GROWTH AND STABILITY9

Part C: A Contribution to the Empirics of Economic Growth. Solow Model with Human

Capital

J) It is believed that the Solow Model is built upon the neoclassical dynamic model with the

aggregate production function (Halsmayer et al 2016).

From the general equation as, Y (t) = [A (t), K (t), L (t)]………………………….1

Where the Y (t) is the aggregate output at time t, output is then presented as the function

of the capital inputs (Halsmayer etal2016). From the same equation, the households have got

capital that is available for renting to other individuals and firms which depreciates at (𝛿).

Therefore, the net change of capital is obtained from the following equation;

Ḱ = sY – 𝛿K…………………………………………………..2

Where Ḱ presents the time derivatives. Firms under Solow aim at profit maximization.

Also from the Solow model, the neoclassical production is obtained from the Cobb Douglas

functions as (Halsmayer et al 2016);

Y(t) = A(t)K(t)αL(t)1-α, that is to say; 0<α<1 where α is the output share paid to the capital

while 1- α is the output share that is paid to the labor. When labor productivity is increased by

the presence of technology, the function becomes;

q) Y(t) = K(t)α(A(t)L(t))1-α …………………………………..3. Where A (t) L (t) is

the labor effective. Then when A is expressed as the factor which increases labor productivity,

we obtain income per unit of effective labor as a function of the capital per unit of effective labor

as given by; (Noel and Mark 2017)

r) (Y(t)/A(t)L(t)={k/(A(t)L(t))}α*{A(t)L(t)/(A(t)L(t)}1α⤇y=Kα…4. where y is the

output per unit of the effective labor while k is the capital per unit of effective labor. However,

any changes in capital will lead to changes in the level of total income as determined by;

Part C: A Contribution to the Empirics of Economic Growth. Solow Model with Human

Capital

J) It is believed that the Solow Model is built upon the neoclassical dynamic model with the

aggregate production function (Halsmayer et al 2016).

From the general equation as, Y (t) = [A (t), K (t), L (t)]………………………….1

Where the Y (t) is the aggregate output at time t, output is then presented as the function

of the capital inputs (Halsmayer etal2016). From the same equation, the households have got

capital that is available for renting to other individuals and firms which depreciates at (𝛿).

Therefore, the net change of capital is obtained from the following equation;

Ḱ = sY – 𝛿K…………………………………………………..2

Where Ḱ presents the time derivatives. Firms under Solow aim at profit maximization.

Also from the Solow model, the neoclassical production is obtained from the Cobb Douglas

functions as (Halsmayer et al 2016);

Y(t) = A(t)K(t)αL(t)1-α, that is to say; 0<α<1 where α is the output share paid to the capital

while 1- α is the output share that is paid to the labor. When labor productivity is increased by

the presence of technology, the function becomes;

q) Y(t) = K(t)α(A(t)L(t))1-α …………………………………..3. Where A (t) L (t) is

the labor effective. Then when A is expressed as the factor which increases labor productivity,

we obtain income per unit of effective labor as a function of the capital per unit of effective labor

as given by; (Noel and Mark 2017)

r) (Y(t)/A(t)L(t)={k/(A(t)L(t))}α*{A(t)L(t)/(A(t)L(t)}1α⤇y=Kα…4. where y is the

output per unit of the effective labor while k is the capital per unit of effective labor. However,

any changes in capital will lead to changes in the level of total income as determined by;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMIC GROWTH AND STABILITY10

Ḱ = sf (k) – (n+g+𝛿) K, where sf (k) is the income fraction saved. But similarly, capital

change per unit effective worker finally will become zero, that is to say;

s) Ḱ=0 sf(k)=(n+g+⤇ 𝛿)K…………………………………………………………….

5.This marks the point at which capital no longer accumulates but the capital ratio becomes

constant. Thus the growth of income is seen to stabilize with the steady stae being reached with

the output per effective worker. Inserting the expression into the steady sate equation gives the

production function ( Yi Man and Yi Lut 2013).

t)

.

Yss = fss (k) = {s/ (n+g+ 𝛿)} α/1-α ………………………………………6. However, the

Solow model was further modified by introducing in the concept of human capital (Field &

Alexander, 2011). Then the equation becomes;

Y(t) = K(t)α H(t)β(A(t)L(t))1-α-β ………………………………7. Where H represents the

human capital stock and β represents the income fraction paid to the human capital stock (Field

2011).

J) The predicted elasticity’s of income per capita is obtained as follows

Yt = Ktα (AtHt) 1-α

Yt = Ct + It

Ct = (1-s) Yt

Ḱt= It - 𝛿Kt

Ảt/At = g

L’t/Lt = n

Ḱ = sf (k) – (n+g+𝛿) K, where sf (k) is the income fraction saved. But similarly, capital

change per unit effective worker finally will become zero, that is to say;

s) Ḱ=0 sf(k)=(n+g+⤇ 𝛿)K…………………………………………………………….

5.This marks the point at which capital no longer accumulates but the capital ratio becomes

constant. Thus the growth of income is seen to stabilize with the steady stae being reached with

the output per effective worker. Inserting the expression into the steady sate equation gives the

production function ( Yi Man and Yi Lut 2013).

t)

.

Yss = fss (k) = {s/ (n+g+ 𝛿)} α/1-α ………………………………………6. However, the

Solow model was further modified by introducing in the concept of human capital (Field &

Alexander, 2011). Then the equation becomes;

Y(t) = K(t)α H(t)β(A(t)L(t))1-α-β ………………………………7. Where H represents the

human capital stock and β represents the income fraction paid to the human capital stock (Field

2011).

J) The predicted elasticity’s of income per capita is obtained as follows

Yt = Ktα (AtHt) 1-α

Yt = Ct + It

Ct = (1-s) Yt

Ḱt= It - 𝛿Kt

Ảt/At = g

L’t/Lt = n

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMIC GROWTH AND STABILITY11

Therefore, growth becomes n+ g+ 𝛿.

u) But also, S= sYt( Robert and Xavier. 2004)

(Wall and Griffiths2008)

∂It/ ∂St = ∂/ ∂St (Kt +sYt) (n+g+ 𝛿) Lt

= (Kt + YT) (n+g+ 𝛿Kt).

K) The authors believe that these coefficients supports the Solow model predictions

because they knew that once the specification turns out of a large aspect of the problem due to

systematic differences would not affect the Solow model predictions (Field 2011). Since the

versions of the Solow model studied was abstract from achieving the predictions. However, the

model as estimated is not completely successful because it needs improvements in its empirical

performance (Field 2011). The empirical performance was not attained as expected thus

improvement is needed (Agénor 2004).

L) The authors propose to improve the empirical performance of the Solow model as

its performance was not so good to the standard. They also proposed to improve its significance

by modifying it version and introducing in more variables like the human labor and capital

(Breton 2013).

M) Defining x = X/L as per worker term;

Therefore, growth becomes n+ g+ 𝛿.

u) But also, S= sYt( Robert and Xavier. 2004)

(Wall and Griffiths2008)

∂It/ ∂St = ∂/ ∂St (Kt +sYt) (n+g+ 𝛿) Lt

= (Kt + YT) (n+g+ 𝛿Kt).

K) The authors believe that these coefficients supports the Solow model predictions

because they knew that once the specification turns out of a large aspect of the problem due to

systematic differences would not affect the Solow model predictions (Field 2011). Since the

versions of the Solow model studied was abstract from achieving the predictions. However, the

model as estimated is not completely successful because it needs improvements in its empirical

performance (Field 2011). The empirical performance was not attained as expected thus

improvement is needed (Agénor 2004).

L) The authors propose to improve the empirical performance of the Solow model as

its performance was not so good to the standard. They also proposed to improve its significance

by modifying it version and introducing in more variables like the human labor and capital

(Breton 2013).

M) Defining x = X/L as per worker term;

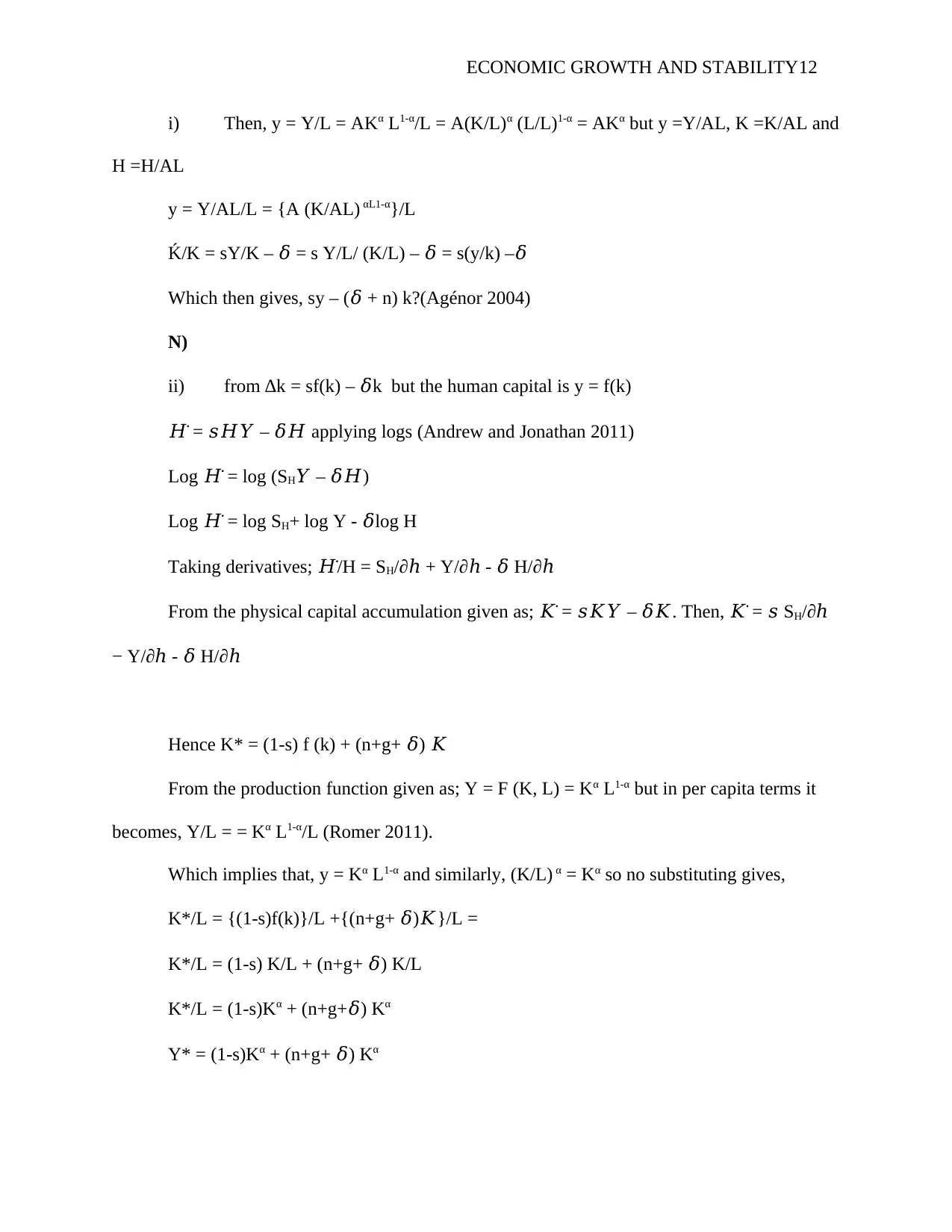

ECONOMIC GROWTH AND STABILITY12

i) Then, y = Y/L = AKα L1-α/L = A(K/L)α (L/L)1-α = AKα but y =Y/AL, K =K/AL and

H =H/AL

y = Y/AL/L = {A (K/AL) αL1-α}/L

Ḱ/K = sY/K – 𝛿 = s Y/L/ (K/L) – 𝛿 = s(y/k) –𝛿

Which then gives, sy – (𝛿 + n) k?(Agénor 2004)

N)

ii) from ∆k = sf(k) – 𝛿k but the human capital is y = f(k)

𝐻̇ = 𝑠𝐻𝑌 – 𝛿𝐻 applying logs (Andrew and Jonathan 2011)

Log 𝐻̇ = log (SH𝑌 – 𝛿𝐻)

Log 𝐻̇ = log SH+ log Y - 𝛿log H

Taking derivatives; 𝐻̇/H = SH/∂ℎ + Y/∂ℎ - 𝛿 H/∂ℎ

From the physical capital accumulation given as; 𝐾̇ = 𝑠𝐾𝑌 – 𝛿𝐾. Then, 𝐾̇ = 𝑠 SH/∂ℎ

− Y/∂ -ℎ 𝛿 H/∂ℎ

Hence K* = (1-s) f (k) + (n+g+ 𝛿) 𝐾

From the production function given as; Y = F (K, L) = Kα L1-α but in per capita terms it

becomes, Y/L = = Kα L1-α/L (Romer 2011).

Which implies that, y = Kα L1-α and similarly, (K/L) α = Kα so no substituting gives,

K*/L = {(1-s)f(k)}/L +{(n+g+ 𝛿)𝐾}/L =

K*/L = (1-s) K/L + (n+g+ 𝛿) K/L

K*/L = (1-s)Kα + (n+g+𝛿) Kα

Y* = (1-s)Kα + (n+g+ 𝛿) Kα

i) Then, y = Y/L = AKα L1-α/L = A(K/L)α (L/L)1-α = AKα but y =Y/AL, K =K/AL and

H =H/AL

y = Y/AL/L = {A (K/AL) αL1-α}/L

Ḱ/K = sY/K – 𝛿 = s Y/L/ (K/L) – 𝛿 = s(y/k) –𝛿

Which then gives, sy – (𝛿 + n) k?(Agénor 2004)

N)

ii) from ∆k = sf(k) – 𝛿k but the human capital is y = f(k)

𝐻̇ = 𝑠𝐻𝑌 – 𝛿𝐻 applying logs (Andrew and Jonathan 2011)

Log 𝐻̇ = log (SH𝑌 – 𝛿𝐻)

Log 𝐻̇ = log SH+ log Y - 𝛿log H

Taking derivatives; 𝐻̇/H = SH/∂ℎ + Y/∂ℎ - 𝛿 H/∂ℎ

From the physical capital accumulation given as; 𝐾̇ = 𝑠𝐾𝑌 – 𝛿𝐾. Then, 𝐾̇ = 𝑠 SH/∂ℎ

− Y/∂ -ℎ 𝛿 H/∂ℎ

Hence K* = (1-s) f (k) + (n+g+ 𝛿) 𝐾

From the production function given as; Y = F (K, L) = Kα L1-α but in per capita terms it

becomes, Y/L = = Kα L1-α/L (Romer 2011).

Which implies that, y = Kα L1-α and similarly, (K/L) α = Kα so no substituting gives,

K*/L = {(1-s)f(k)}/L +{(n+g+ 𝛿)𝐾}/L =

K*/L = (1-s) K/L + (n+g+ 𝛿) K/L

K*/L = (1-s)Kα + (n+g+𝛿) Kα

Y* = (1-s)Kα + (n+g+ 𝛿) Kα

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.