Economic Impacts and Regulatory Framework: Finance Report

VerifiedAdded on 2022/11/28

|16

|5723

|362

Report

AI Summary

This report presents a comprehensive analysis of various economic aspects and regulatory frameworks within the financial sector. Section A delves into the Reserve Bank of Australia's (RBA) monetary measures and their impact on individuals' financial goals, discussing the roles of regulatory authorities like ASIC, APRA, ASX, ACCC, and AUSTRAC in maintaining GDP growth and managing unemployment rates. Question 2 explores the regulatory framework governing financial service providers, emphasizing data protection, customer rights, and fraud prevention, along with obligations and compliance. The report also examines sequencing risk in investments, its impact on retirement planning, and strategies for mitigation. Section B focuses on legislative and regulatory requirements within the financial industry, providing a holistic view of the financial landscape.

ECONOMIC IMPACTS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

SECTION A.....................................................................................................................................3

Question 1...................................................................................................................................3

Question 2...................................................................................................................................5

Question 3...................................................................................................................................6

Question 4.................................................................................................................................10

Section B........................................................................................................................................11

(A).............................................................................................................................................11

(b)..............................................................................................................................................12

(C).............................................................................................................................................13

(D).............................................................................................................................................13

(e)..............................................................................................................................................14

REFERENCES..............................................................................................................................15

SECTION A.....................................................................................................................................3

Question 1...................................................................................................................................3

Question 2...................................................................................................................................5

Question 3...................................................................................................................................6

Question 4.................................................................................................................................10

Section B........................................................................................................................................11

(A).............................................................................................................................................11

(b)..............................................................................................................................................12

(C).............................................................................................................................................13

(D).............................................................................................................................................13

(e)..............................................................................................................................................14

REFERENCES..............................................................................................................................15

SECTION A

Question 1

a. The measures of RBA impacting Jill and Marcus

With help of the new package of monetary measures announced by reserve Bank of

Australia name the support job creation and recovery of Australian economy from the pandemic

included many different aspects under the package. The major changes listed within this package

were to reduce the cash rate target 20.1 %. In addition to this also there was a reduction within

the target for the yield over the three years Australian government bond to around is 0.1 %.

Along with this the package also highlighted the reduction within the interest rate of new

drawings under the term funding facility 20.1 percent (Qi and Zhang, 2018). Moreover A

reduction of the interest rate over the exchange settlement balances was to zero. Furthermore the

purchase of dollar hundred billion of the government bond of maturity of 5 to 10 years over the

next six month. All these changes and measures might impact Jill and markers goal and

objective. The major concern of Jain was the financial well-being of a parent's gel and markers

as they are both 62 years old and are about to retire. The parents of Jane are having the aspiration

of retirement as they are 62 years old. Marcus is working as a construction worker home and

project manager having income before tax $150000 per annum. Along with this is working as an

administrative assistant and earn $50000 per annum before tax. Now Jane is worried that when

their parents will retire then how they will have their living expense of 60000 per annum will be

managed. Thanks for this approach to a financial planner for seeking the advice. All these

changes by the reserve Bank of Australia will not much effectively goal and objective of Marcus

and Jill. This is particularly because of the reason that the major objective of Marcus and is to

purchase a small house and for this they are having some money and the proceedings of the

earlier house being sold.

B

Discussing role and function of different regulatory authorities

ASIC- The ASIC that is Australian securities and investment commission is an

independent Australian government body. The Australian securities and investment

commission is an independent commission of the Australian government which AIMS at

Question 1

a. The measures of RBA impacting Jill and Marcus

With help of the new package of monetary measures announced by reserve Bank of

Australia name the support job creation and recovery of Australian economy from the pandemic

included many different aspects under the package. The major changes listed within this package

were to reduce the cash rate target 20.1 %. In addition to this also there was a reduction within

the target for the yield over the three years Australian government bond to around is 0.1 %.

Along with this the package also highlighted the reduction within the interest rate of new

drawings under the term funding facility 20.1 percent (Qi and Zhang, 2018). Moreover A

reduction of the interest rate over the exchange settlement balances was to zero. Furthermore the

purchase of dollar hundred billion of the government bond of maturity of 5 to 10 years over the

next six month. All these changes and measures might impact Jill and markers goal and

objective. The major concern of Jain was the financial well-being of a parent's gel and markers

as they are both 62 years old and are about to retire. The parents of Jane are having the aspiration

of retirement as they are 62 years old. Marcus is working as a construction worker home and

project manager having income before tax $150000 per annum. Along with this is working as an

administrative assistant and earn $50000 per annum before tax. Now Jane is worried that when

their parents will retire then how they will have their living expense of 60000 per annum will be

managed. Thanks for this approach to a financial planner for seeking the advice. All these

changes by the reserve Bank of Australia will not much effectively goal and objective of Marcus

and Jill. This is particularly because of the reason that the major objective of Marcus and is to

purchase a small house and for this they are having some money and the proceedings of the

earlier house being sold.

B

Discussing role and function of different regulatory authorities

ASIC- The ASIC that is Australian securities and investment commission is an

independent Australian government body. The Australian securities and investment

commission is an independent commission of the Australian government which AIMS at

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

managing the national corporate regulator first of the major role of ESIC is to regulate the

company and financial services in order to enforce laws to protect the Australian

consumers and creditors along with investor’s (Sun and Drakeman, 2021).

APRA- the APRA that is Australian prudential regulation authority is an independent

statutory authority which is aimed at supervising the institutions within the banking

insurance and superannuation filled in Australia. The major in of the APRA is to promote

the financial system stability within Australia.

ASX- the ASX stands for Australian Securities Exchange and was created by the merger

of the Australian stock exchange and the Sydney futures exchange. The ASX is an

integrated exchange the offering the listing, trading and settlement and post trade

services.

ACCC- the ACCC that is Australian competition and consumer commission is an

independent started the authority. The major role of this authority is to enforce the

competition and consumer act 2010 and the range of different legislations relating to fair

trading and promoting competition.

AUSTRAC- AUSTRAC is the Australian government agency which is responsible for

detection differing and disrupting the criminal abuse of the financial systems. This is

being undertaken to protect the community from the serious and financial crimes being

undertaken (Schofield, Shrestha and Cunich, 2018). The main aim of AUSTRAC is to

engage with reporting requirements in order to improve the value of the financial

intelligence being provided to the partner agencies.

Role of regulatory authorities in maintaining GDP growth and unemployment rate

ASIC- The ASIC has a major role in maintaining or increasing the GDP growth as

suggested by the RBA statement. The reason behind this fact is that this will guide

working within the securities market and will result in increasing profitability.

APRA- This can also contribute within the aim of RBA in increasing the GDP of the

country. This is pertaining to the fact that this authority regulates working within the

banking sector and it can increase the GDP of the country.

ASX- This can also assist in attaining the objective of the RBA that is increasing the

GDP and reducing the unemployment rate. This is pertaining to the fact that ASX guides

company and financial services in order to enforce laws to protect the Australian

consumers and creditors along with investor’s (Sun and Drakeman, 2021).

APRA- the APRA that is Australian prudential regulation authority is an independent

statutory authority which is aimed at supervising the institutions within the banking

insurance and superannuation filled in Australia. The major in of the APRA is to promote

the financial system stability within Australia.

ASX- the ASX stands for Australian Securities Exchange and was created by the merger

of the Australian stock exchange and the Sydney futures exchange. The ASX is an

integrated exchange the offering the listing, trading and settlement and post trade

services.

ACCC- the ACCC that is Australian competition and consumer commission is an

independent started the authority. The major role of this authority is to enforce the

competition and consumer act 2010 and the range of different legislations relating to fair

trading and promoting competition.

AUSTRAC- AUSTRAC is the Australian government agency which is responsible for

detection differing and disrupting the criminal abuse of the financial systems. This is

being undertaken to protect the community from the serious and financial crimes being

undertaken (Schofield, Shrestha and Cunich, 2018). The main aim of AUSTRAC is to

engage with reporting requirements in order to improve the value of the financial

intelligence being provided to the partner agencies.

Role of regulatory authorities in maintaining GDP growth and unemployment rate

ASIC- The ASIC has a major role in maintaining or increasing the GDP growth as

suggested by the RBA statement. The reason behind this fact is that this will guide

working within the securities market and will result in increasing profitability.

APRA- This can also contribute within the aim of RBA in increasing the GDP of the

country. This is pertaining to the fact that this authority regulates working within the

banking sector and it can increase the GDP of the country.

ASX- This can also assist in attaining the objective of the RBA that is increasing the

GDP and reducing the unemployment rate. This is pertaining to the fact that ASX guides

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

every company how to deal in share market and this will assist in proper management

and effective increase in profitability.

ACCC- This regulatory body can also assist in increasing the GDP of the country. The

reason behind this fact is that when the competition will be e-management proper and

effective manner than this will result in increased and profitability of all the companies

which will result in increase and national income of the country.

AUSTRAC- They can also assist in increasing the GDP or managing the unemployment.

Question 2

Regulatory framework is the legislations that needed to ensure by the financial service

provider in against to deliver the professional level of business practices. The financial service

provides require to fulfil the data protection related requirements. This is about to protect the

personal information. This is a responsibility of the financial service provider to protect the

personal information of the client related to the personal identity or the income related or any

other personal information of the client. This is the legal right of the customers to ensure the

complete security with the personal information of the client in against to undertake the financial

consultancy from the professional. The data privacy is also among the mandatory requirement

that financial serve provider are required to meet in any given situation (Jensen and et.al., 2019).

Data privacy is the legal right of the people undertake the financial or any other kind of service.

The other legislations are such like the consultant should not refer wrong or inappropriate

consultancy. This is also a part of the legal advice. This is a legal right of the customer or the

client to get the proper guidance against undertaking the financial consultancy. Customer has its

own right of getting the right product. In against to undertake the financial consultancy customer

or the client has a legal right to get a proper guidance or the consultancy. In case the entity or the

financial consultant provide the wrong consultancy or the inappropriate consultancy just to earn

more return customer has legal right to sue the consultancy against misleading the fact and

providing the wrong information in against to deliver the consultancy. This is a legislative right

of the customer for getting the right consultancy and not faces any type of fraud.

The fraud related legislation is also applicable over the financial consultant. This is a

legal service that involves financial investment and also related to time. This is a legal right of

the customer for getting the proper and true guidance against utilising the financial resources.

Financial consultant should not get involved in any type of fraudulent actions. Many times the

and effective increase in profitability.

ACCC- This regulatory body can also assist in increasing the GDP of the country. The

reason behind this fact is that when the competition will be e-management proper and

effective manner than this will result in increased and profitability of all the companies

which will result in increase and national income of the country.

AUSTRAC- They can also assist in increasing the GDP or managing the unemployment.

Question 2

Regulatory framework is the legislations that needed to ensure by the financial service

provider in against to deliver the professional level of business practices. The financial service

provides require to fulfil the data protection related requirements. This is about to protect the

personal information. This is a responsibility of the financial service provider to protect the

personal information of the client related to the personal identity or the income related or any

other personal information of the client. This is the legal right of the customers to ensure the

complete security with the personal information of the client in against to undertake the financial

consultancy from the professional. The data privacy is also among the mandatory requirement

that financial serve provider are required to meet in any given situation (Jensen and et.al., 2019).

Data privacy is the legal right of the people undertake the financial or any other kind of service.

The other legislations are such like the consultant should not refer wrong or inappropriate

consultancy. This is also a part of the legal advice. This is a legal right of the customer or the

client to get the proper guidance against undertaking the financial consultancy. Customer has its

own right of getting the right product. In against to undertake the financial consultancy customer

or the client has a legal right to get a proper guidance or the consultancy. In case the entity or the

financial consultant provide the wrong consultancy or the inappropriate consultancy just to earn

more return customer has legal right to sue the consultancy against misleading the fact and

providing the wrong information in against to deliver the consultancy. This is a legislative right

of the customer for getting the right consultancy and not faces any type of fraud.

The fraud related legislation is also applicable over the financial consultant. This is a

legal service that involves financial investment and also related to time. This is a legal right of

the customer for getting the proper and true guidance against utilising the financial resources.

Financial consultant should not get involved in any type of fraudulent actions. Many times the

consultant takes bribe to influence the investment decision making of the client or the customer.

This is an ethical responsibility of the financial consultant to not being involved in any of the

fraudulent activity or action in against to undertake the financial constancy. Contract act is also

applicable over tge financial consultancy service (Fisk, Livingstone and Pit, 2020). Every time

the client or the customer get involved in the consultancy this create a contract between the

consultant and the customer or the investor. The client put a money on the risk of the guidance or

the consultancy suggested. This creates an agreement between both the parties involved in the

consultancy. This is one of the key legislative application apply over the firm and the agreement

made with the client. All the legislation mentioned are the key legislative requirements

applicable over the client and the firm being involved under the financial consultancy.

Obligation

The different obligations like the compliances are very complicated to adopt.

The second obligation is it is a time consuming process.

The third obligation is related to the capital requirements in meeting up the compliances

The fourth one is risk related obligation.

Customer protection is always on the priority list when it comes to fulfilling the

compliances.

All these are developed in such way that customers of company get the complete

advantage against the rights and the authority they own.

Question 3

The sequencing risk is being defined as the risk with auto and timing of the client’s

investment returns are unfavourable which may result in less of money for the retirement. It can

also be defined as the danger that the timing of withdrawal from the retirement account will have

a negative impact on the overall rate of return available to the investors. A diversified portfolio

can protect the savings against the sequence risk (Sultana and et.al., 2020). Hence it is very

essential for the person to have a diversified portfolio so that at time of the retirement they can

use the savings wisely and order to maintain their standard of living. In addition to this the

withdrawal from the account must be during the bear market is more costly than the same

withdrawal which is undertaken when the Bull market. This sequence risk has a lesser impact

over three safest retirement investments. this type of risk is present in those investment options

This is an ethical responsibility of the financial consultant to not being involved in any of the

fraudulent activity or action in against to undertake the financial constancy. Contract act is also

applicable over tge financial consultancy service (Fisk, Livingstone and Pit, 2020). Every time

the client or the customer get involved in the consultancy this create a contract between the

consultant and the customer or the investor. The client put a money on the risk of the guidance or

the consultancy suggested. This creates an agreement between both the parties involved in the

consultancy. This is one of the key legislative application apply over the firm and the agreement

made with the client. All the legislation mentioned are the key legislative requirements

applicable over the client and the firm being involved under the financial consultancy.

Obligation

The different obligations like the compliances are very complicated to adopt.

The second obligation is it is a time consuming process.

The third obligation is related to the capital requirements in meeting up the compliances

The fourth one is risk related obligation.

Customer protection is always on the priority list when it comes to fulfilling the

compliances.

All these are developed in such way that customers of company get the complete

advantage against the rights and the authority they own.

Question 3

The sequencing risk is being defined as the risk with auto and timing of the client’s

investment returns are unfavourable which may result in less of money for the retirement. It can

also be defined as the danger that the timing of withdrawal from the retirement account will have

a negative impact on the overall rate of return available to the investors. A diversified portfolio

can protect the savings against the sequence risk (Sultana and et.al., 2020). Hence it is very

essential for the person to have a diversified portfolio so that at time of the retirement they can

use the savings wisely and order to maintain their standard of living. In addition to this the

withdrawal from the account must be during the bear market is more costly than the same

withdrawal which is undertaken when the Bull market. This sequence risk has a lesser impact

over three safest retirement investments. this type of risk is present in those investment options

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

which have probability of going up and down over the time for instance stock gold or real estate.

This sequence is just a matter of luck. Supporting to the fact that if a person is retiring in the

bullish market then there a possibility that the account may grow larger enough to sustain a

subsequent downturn. In against of this if the person is retiring within the bearish market then

there are chances that the account balances me never recover. In addition to this the sequencing

risk occurs when there is volatility within the market and the cash flows from the investment

portfolio is well. In addition to this sequencing risk occurs when there is presence in both the

accumulation and their retirement faces. This is pertaining to the fact that because the market

volatility and the cash flow from the investment exists in both of the cases that is accumulation

and retirement. in addition to this the sequencing this can also mean that the client is in position

to cut the average retirement spending significantly (Nepal and Paija, 2020).

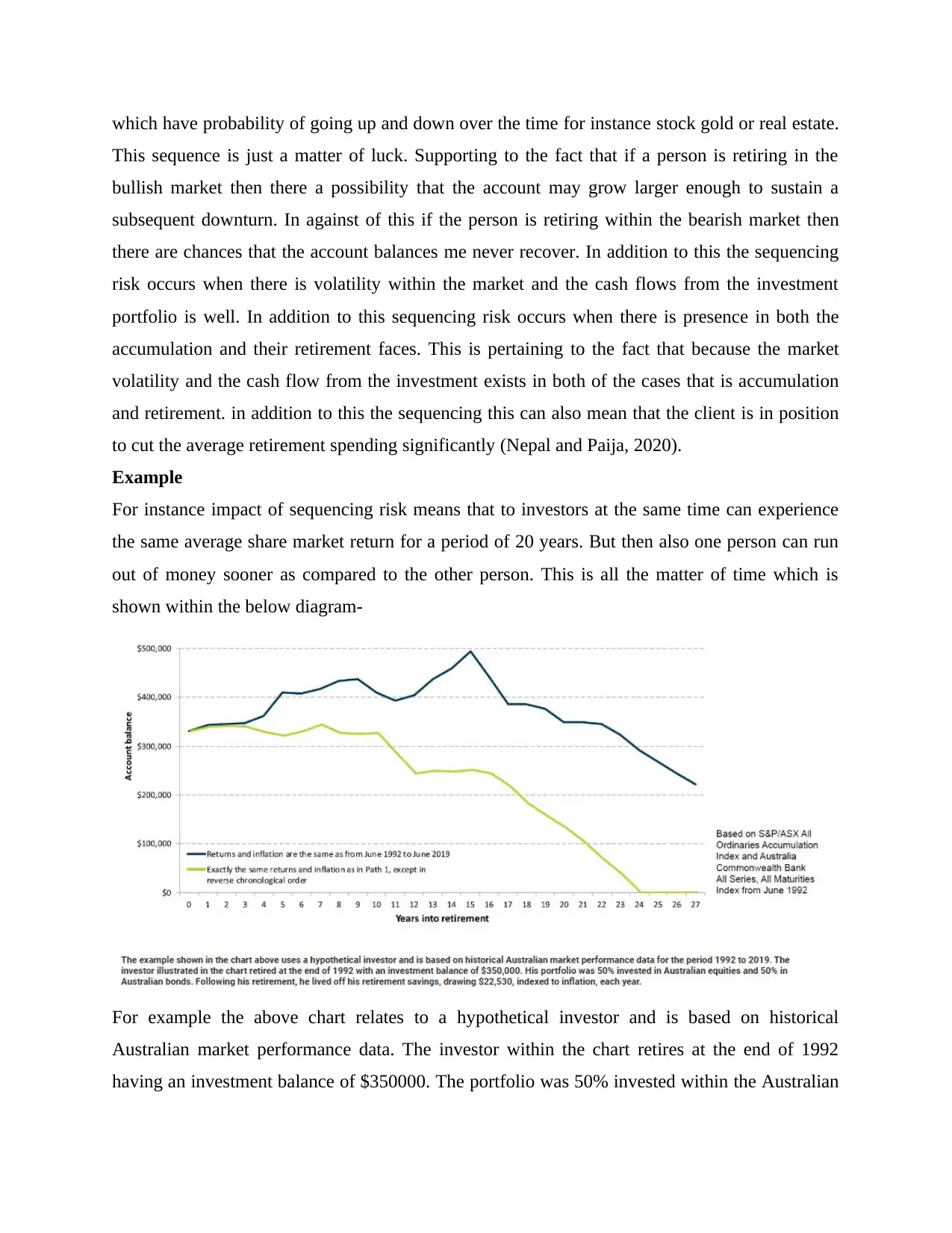

Example

For instance impact of sequencing risk means that to investors at the same time can experience

the same average share market return for a period of 20 years. But then also one person can run

out of money sooner as compared to the other person. This is all the matter of time which is

shown within the below diagram-

For example the above chart relates to a hypothetical investor and is based on historical

Australian market performance data. The investor within the chart retires at the end of 1992

having an investment balance of $350000. The portfolio was 50% invested within the Australian

This sequence is just a matter of luck. Supporting to the fact that if a person is retiring in the

bullish market then there a possibility that the account may grow larger enough to sustain a

subsequent downturn. In against of this if the person is retiring within the bearish market then

there are chances that the account balances me never recover. In addition to this the sequencing

risk occurs when there is volatility within the market and the cash flows from the investment

portfolio is well. In addition to this sequencing risk occurs when there is presence in both the

accumulation and their retirement faces. This is pertaining to the fact that because the market

volatility and the cash flow from the investment exists in both of the cases that is accumulation

and retirement. in addition to this the sequencing this can also mean that the client is in position

to cut the average retirement spending significantly (Nepal and Paija, 2020).

Example

For instance impact of sequencing risk means that to investors at the same time can experience

the same average share market return for a period of 20 years. But then also one person can run

out of money sooner as compared to the other person. This is all the matter of time which is

shown within the below diagram-

For example the above chart relates to a hypothetical investor and is based on historical

Australian market performance data. The investor within the chart retires at the end of 1992

having an investment balance of $350000. The portfolio was 50% invested within the Australian

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

equities and the remaining within the Australian bonds. Following the retirement he lived of his

retirement savings by drawing $22530 index to inflation every year. Hence with us it can be

stated that the returns from the investment portfolio faces the sequencing risk to a great extent. It

is very essential for them to control the performance of the portfolio but this is not possible

because it is filled with the share market and the share market is not in control of a person.

Strategies for mitigation of sequencing risk

The first and foremost method for managing the sequence risk is to spend conservatively.

This is the first option for the management of the sequence risk within the retirement

period. This is pertaining to the fact that every person will spend conservatively that is by

thinking wisely then they can mitigate the sequence risk and have money for their

consumption.

In addition to this another major strategy for the mitigation of theme sequence risk at

time of retirement is the use of home equity. This home equity is one of the largest

retirement assets which exist to a person (Feng, 2018). This is pertaining to the fact that

home equity involves the large assets which the person is processing and is included in

their wealth. Hence this is the acid which belongs to that person only who is retiring and

they can use it as and when they require. In this is a good method to mitigate the

sequence risk.

Moreover another major strategy for the effective mitigation of the sequencing risk is the

use of cash reserve bucketing strategies. The marketing strategy was popularised during

the time frame of 1980 and 1990. This is a strategy with regards to the retirement income

planning. In accordance to this strategy the person can have separate assets into bucket of

money for different time periods. The more conservative assets like cash are stored for

the short-term needs (Earl and Burbury, 2019). The mixed investment portfolio can be

stored for the next time period and the equities can be stored for the longer requirement

for longer time duration. This is also good strategy in order to mitigate sequencing risk.

This is pertaining to the fact that when the person is having a variety of different assets

for different time durations then they will use those as it's only within that time duration.

Hence the sequencing risk can be mitigated with help of this bucketing strategy

effectively.

retirement savings by drawing $22530 index to inflation every year. Hence with us it can be

stated that the returns from the investment portfolio faces the sequencing risk to a great extent. It

is very essential for them to control the performance of the portfolio but this is not possible

because it is filled with the share market and the share market is not in control of a person.

Strategies for mitigation of sequencing risk

The first and foremost method for managing the sequence risk is to spend conservatively.

This is the first option for the management of the sequence risk within the retirement

period. This is pertaining to the fact that every person will spend conservatively that is by

thinking wisely then they can mitigate the sequence risk and have money for their

consumption.

In addition to this another major strategy for the mitigation of theme sequence risk at

time of retirement is the use of home equity. This home equity is one of the largest

retirement assets which exist to a person (Feng, 2018). This is pertaining to the fact that

home equity involves the large assets which the person is processing and is included in

their wealth. Hence this is the acid which belongs to that person only who is retiring and

they can use it as and when they require. In this is a good method to mitigate the

sequence risk.

Moreover another major strategy for the effective mitigation of the sequencing risk is the

use of cash reserve bucketing strategies. The marketing strategy was popularised during

the time frame of 1980 and 1990. This is a strategy with regards to the retirement income

planning. In accordance to this strategy the person can have separate assets into bucket of

money for different time periods. The more conservative assets like cash are stored for

the short-term needs (Earl and Burbury, 2019). The mixed investment portfolio can be

stored for the next time period and the equities can be stored for the longer requirement

for longer time duration. This is also good strategy in order to mitigate sequencing risk.

This is pertaining to the fact that when the person is having a variety of different assets

for different time durations then they will use those as it's only within that time duration.

Hence the sequencing risk can be mitigated with help of this bucketing strategy

effectively.

With the help of further analysis of another strategy identified for mitigating the sequence

risk is the use of buffer asset. This is a good strategy where anything management of

sequence risk is to be used by other is it available outside the financial portfolio which is

drawn after the market downturn. The return on these assets must be correlated with the

financial portfolio for stop the purpose of this proper asset is to support the spending of

the portfolio in situation the portfolio’s value is down. This is a safe strategy in order to

mitigate the sequence risk at the time of retirement.

Analysis of Jill and Marcus situation with respect to current pandemic

With the help of the above analysis it is clear that sequencing risk affects the person's

retirement life to a great extent. In case of the Jill and markers as well the sequencing risk will

affect the retirement period. This is pertaining to the fact that in case both of them will not be

able to buy the house then they will have to suffer for living. In addition to this the proceeds

from the family home have been reserved for the purchase of their smaller property and the funds

which will be left over will be kept as an emergency reserve. Hence there are possibilities that

the parents of Jane might face the sequencing risk. In addition to this their cost of living after the

retirement will be around 60000 for annum (Eagers and et.al., 2018). Hence it is not necessary

that they will be in position to have this much of amount after their retirement.

So it is necessary for them to invest their money and diversify portfolio so that they can

have effective returns time to time which will assist them in managing their retirement life. In

addition to this the use of diversified portfolio will also assist people and managing the expenses

and proper and effective manner. The use of diversified portfolio suggested because in a

diversify portfolio there is a combination of different assets and investment option (Ford and

et.al., 2018). It is not necessary that each and every asset within the portfolio will face the

downside at a single time.

Implication of Jill and Marcus situation with respect to current pandemic

Hence the major implication of market force is that in case if some assets are not working

in proper manner then the people are having some other assets which will be increasing their

profitability. Thus with help of this diversified portfolio Jill and Marcus can spend their

retirement life easily and without any problem. Hence with respect to the current impact of

pandemic over the financial market it is not necessary that and markers will get proper returns

over all the different assets within which they have invested the money.

risk is the use of buffer asset. This is a good strategy where anything management of

sequence risk is to be used by other is it available outside the financial portfolio which is

drawn after the market downturn. The return on these assets must be correlated with the

financial portfolio for stop the purpose of this proper asset is to support the spending of

the portfolio in situation the portfolio’s value is down. This is a safe strategy in order to

mitigate the sequence risk at the time of retirement.

Analysis of Jill and Marcus situation with respect to current pandemic

With the help of the above analysis it is clear that sequencing risk affects the person's

retirement life to a great extent. In case of the Jill and markers as well the sequencing risk will

affect the retirement period. This is pertaining to the fact that in case both of them will not be

able to buy the house then they will have to suffer for living. In addition to this the proceeds

from the family home have been reserved for the purchase of their smaller property and the funds

which will be left over will be kept as an emergency reserve. Hence there are possibilities that

the parents of Jane might face the sequencing risk. In addition to this their cost of living after the

retirement will be around 60000 for annum (Eagers and et.al., 2018). Hence it is not necessary

that they will be in position to have this much of amount after their retirement.

So it is necessary for them to invest their money and diversify portfolio so that they can

have effective returns time to time which will assist them in managing their retirement life. In

addition to this the use of diversified portfolio will also assist people and managing the expenses

and proper and effective manner. The use of diversified portfolio suggested because in a

diversify portfolio there is a combination of different assets and investment option (Ford and

et.al., 2018). It is not necessary that each and every asset within the portfolio will face the

downside at a single time.

Implication of Jill and Marcus situation with respect to current pandemic

Hence the major implication of market force is that in case if some assets are not working

in proper manner then the people are having some other assets which will be increasing their

profitability. Thus with help of this diversified portfolio Jill and Marcus can spend their

retirement life easily and without any problem. Hence with respect to the current impact of

pandemic over the financial market it is not necessary that and markers will get proper returns

over all the different assets within which they have invested the money.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question 4

Superannuation system

1

The major impact of changes to the superannuation system made during 2020 to increase the

work test age. With respect to July 2020 person can make voluntary contribution into super

without having to meet the fork test. After the age of 67 compare to the previous age limit of 65.

in addition to this there is also an increase to age limit for the spouse contribution for stop the

government has extended the age limit to allow people up to age of 75 to receive their spouse

contribution. Both these have impacted the superannuation system in effective manner.

2

The potential range of future changes to superannuation is beneficial. The reason underlying this

factors that this will make the retirement of the person easier.

3

These potential future changes will affect Jill and Marcus in an effective manner. The reason

underlying this factors that now Marcus or Jill can have the benefit of the superannuation till the

age of 75.

Social security system

1

The social security in Australia referred to as the system of social welfare payment which is

provided by Australian government to eligible Australian citizen and permanent residence. These

payments are always administered by Centrelink a program of services Australia. There were

different changes being announced by the government with respect to the social services (Ford

and et.al., 2018). The major change was the reduction in the corona virus supplement amount

from dollar 552 dollar 250 per fortnight. In addition to this changes to the job seeker payment

and use allowance income test and the end of some temporary eligibility changes. For the lower

rate of the supplement will reduce the work disincentives which arises from the design of the

payment.

2

The potential range of thing future changes relating to social security within Australia is that

most income support payments like pension and allowance will be increased. This will assist the

people suffering from the current pandemic and will assist them to grow. In addition to this the

Superannuation system

1

The major impact of changes to the superannuation system made during 2020 to increase the

work test age. With respect to July 2020 person can make voluntary contribution into super

without having to meet the fork test. After the age of 67 compare to the previous age limit of 65.

in addition to this there is also an increase to age limit for the spouse contribution for stop the

government has extended the age limit to allow people up to age of 75 to receive their spouse

contribution. Both these have impacted the superannuation system in effective manner.

2

The potential range of future changes to superannuation is beneficial. The reason underlying this

factors that this will make the retirement of the person easier.

3

These potential future changes will affect Jill and Marcus in an effective manner. The reason

underlying this factors that now Marcus or Jill can have the benefit of the superannuation till the

age of 75.

Social security system

1

The social security in Australia referred to as the system of social welfare payment which is

provided by Australian government to eligible Australian citizen and permanent residence. These

payments are always administered by Centrelink a program of services Australia. There were

different changes being announced by the government with respect to the social services (Ford

and et.al., 2018). The major change was the reduction in the corona virus supplement amount

from dollar 552 dollar 250 per fortnight. In addition to this changes to the job seeker payment

and use allowance income test and the end of some temporary eligibility changes. For the lower

rate of the supplement will reduce the work disincentives which arises from the design of the

payment.

2

The potential range of thing future changes relating to social security within Australia is that

most income support payments like pension and allowance will be increased. This will assist the

people suffering from the current pandemic and will assist them to grow. In addition to this the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

family payment such as family tax benefit and child care subsidy will also be improved under the

social security scheme. Hence this will improve the future working of the people who are retiring

and will assist them to have good social security (Kuzich and et.al., 2020).

3

All this potential future changes will affect Jill and Marcus retirement planning. The reason

underlying this fact is that at time of retirement planning they can undertake the benefits which

are being provided by the social security provided by Australian government. And this will

improve the working and the life of both gel and Marcus after retiring.

Section B

(A)

On the basis of the Australia legal structure and system based on Australia Finance

Service License (AFSL). The organisation is liable to allot the license to different financial

institutions or the organisations that are engaged in catering the financial services and practices

to its customers. The role of the organisation has been crucial and essential as it allocates the

services or practices that authorises the business entities to allocate the various finance related

services and practices. The organisation is being involved in catering authorities to the business

ventures for allocating the financial services and practices. The aim of the organisation is to

deliver the potential services in form of licensing and authorising the business ventures and

stakeholders to allocate potential services for aching the competitive advantage in the respective

market. Every business venture when look after to start the business operations it seek legal

authorisation from the authorities of government to start the respective practice (Stone, 2017).

The authorisation is done in form of the registration and such like practices. The authorisation is

the primary requirements and need of the business venture that needed to start the business

functions or operations. Licensing practices have been started by the government in Australia

many years back to legalise the whole system. This practice could also favour the government to

conserve the tax income of the government. Bettina and Gordon also require taking the

authorisation from the AFSL in case of starting up the business venture. This would support the

stakeholder to initiate the business operation legally. This is essential for starting up the business

venture to legalise the whole system. This would support the investors and the firm to completely

take the legal ownership over the brand and also will allow the business entity to get an approval

social security scheme. Hence this will improve the future working of the people who are retiring

and will assist them to have good social security (Kuzich and et.al., 2020).

3

All this potential future changes will affect Jill and Marcus retirement planning. The reason

underlying this fact is that at time of retirement planning they can undertake the benefits which

are being provided by the social security provided by Australian government. And this will

improve the working and the life of both gel and Marcus after retiring.

Section B

(A)

On the basis of the Australia legal structure and system based on Australia Finance

Service License (AFSL). The organisation is liable to allot the license to different financial

institutions or the organisations that are engaged in catering the financial services and practices

to its customers. The role of the organisation has been crucial and essential as it allocates the

services or practices that authorises the business entities to allocate the various finance related

services and practices. The organisation is being involved in catering authorities to the business

ventures for allocating the financial services and practices. The aim of the organisation is to

deliver the potential services in form of licensing and authorising the business ventures and

stakeholders to allocate potential services for aching the competitive advantage in the respective

market. Every business venture when look after to start the business operations it seek legal

authorisation from the authorities of government to start the respective practice (Stone, 2017).

The authorisation is done in form of the registration and such like practices. The authorisation is

the primary requirements and need of the business venture that needed to start the business

functions or operations. Licensing practices have been started by the government in Australia

many years back to legalise the whole system. This practice could also favour the government to

conserve the tax income of the government. Bettina and Gordon also require taking the

authorisation from the AFSL in case of starting up the business venture. This would support the

stakeholder to initiate the business operation legally. This is essential for starting up the business

venture to legalise the whole system. This would support the investors and the firm to completely

take the legal ownership over the brand and also will allow the business entity to get an approval

from the authorities to start up the whole business idea. Authority in from the registration will be

granted. This would also be required in paying the taxes and all other duties to the government in

against to channelize the business operations.

(b)

(1) Training and competencies

Training and competencies are the credentials to start up a new business venture under

the finance service and professional practices. This is an authorised training program or courses

that make the individual more professional or competent to achieve the best level of knowledge

and ability to meet up the necessary requirements being a finance consultant. The qualification is

always required for the professionals to hold before they proceed further for working as a

professional or to start up a business venture where the professional level of knowledge is

granted to consult the individuals and customers about various financial products. This is a

professional level of training program that convert a finance students into a financial consultant

or a professional (Moynihan and et.al., 2020). Training and competencies is an essential

requirement that professional or the finance consultant needed to fulfil in any given situation.

This is more like an authorisation against starting up a business venture to allocate the financial

services and practices. Training and competencies are the authorised qualification that makes the

professional more capable to deliver the best level of consultancy practices to meet up the client

and customers requirements. The training and qualification is done under the affiliation of the

AFSL. Any institute that is affiliated with the AFSL can conduct the courses. Professional can

jin the courses to get a professional level of training and competencies to achieve the best level

of professional level of skills and ability as a professional.

(2) Expertise and experience required

To obtain a professional level of training and competency courses affiliated by the AFSL

this is important for the professional to hold a experience of minimum 2 years as a financial

professional. This is a key or necessary requirements that professional seek before approaching

for the training course. The professional level of degree in MBA or any other must be hold to get

admission under the courses (Batterbury and Toscano, 2018). As the aim of the course or the

training and competencies program is to allocate the professional level of knowledge and

guidance as finance professional. The professionals can only take advantage if they hold the

basic qualification as finance professional. The basic qualification like MBA would allow the

granted. This would also be required in paying the taxes and all other duties to the government in

against to channelize the business operations.

(b)

(1) Training and competencies

Training and competencies are the credentials to start up a new business venture under

the finance service and professional practices. This is an authorised training program or courses

that make the individual more professional or competent to achieve the best level of knowledge

and ability to meet up the necessary requirements being a finance consultant. The qualification is

always required for the professionals to hold before they proceed further for working as a

professional or to start up a business venture where the professional level of knowledge is

granted to consult the individuals and customers about various financial products. This is a

professional level of training program that convert a finance students into a financial consultant

or a professional (Moynihan and et.al., 2020). Training and competencies is an essential

requirement that professional or the finance consultant needed to fulfil in any given situation.

This is more like an authorisation against starting up a business venture to allocate the financial

services and practices. Training and competencies are the authorised qualification that makes the

professional more capable to deliver the best level of consultancy practices to meet up the client

and customers requirements. The training and qualification is done under the affiliation of the

AFSL. Any institute that is affiliated with the AFSL can conduct the courses. Professional can

jin the courses to get a professional level of training and competencies to achieve the best level

of professional level of skills and ability as a professional.

(2) Expertise and experience required

To obtain a professional level of training and competency courses affiliated by the AFSL

this is important for the professional to hold a experience of minimum 2 years as a financial

professional. This is a key or necessary requirements that professional seek before approaching

for the training course. The professional level of degree in MBA or any other must be hold to get

admission under the courses (Batterbury and Toscano, 2018). As the aim of the course or the

training and competencies program is to allocate the professional level of knowledge and

guidance as finance professional. The professionals can only take advantage if they hold the

basic qualification as finance professional. The basic qualification like MBA would allow the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.