Economics Assignment: Analysis of Economic Indicators for Australia and New Zealand

VerifiedAdded on 2023/06/08

|13

|4241

|413

AI Summary

This report analyzes the trend movement in different economic indicators for Australia and New Zealand from 1995 to 2015. It covers real GDP growth, inflation, unemployment rate, cash rate, and official cash rate. The report also provides an economic outlook for both countries.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: ECONOMICS ASSIGNMENT

Economics Assignment

Name of the Student

Name of the University

Course ID

Economics Assignment

Name of the Student

Name of the University

Course ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ECONOMICS ASSIGNMENT

Executive Summary

The report concernes with trend movement in different economic indicators for the two

developed nations – Australia and New Zealand. The period of time chosen for evaluation

extended from 1995 to 2015. Economic growth is measured with the trend movement in growth

of real GDP growth. Price level and labor market condition are portaited with inflation and

unemployment rate respectively. The movement of cash rate and official cash rate are observed

to evalaute to monetary policy design of Australia and New Zealand. In both the economy

inflation moves in the opposote direction of GDP growth. Monetary policy plays an important

role in controlling inflation in both the nation. Unemployment in Australia is higher than that in

New Zealand. Based on past and present performance of these economy, a positive forecast has

been madeconcerning future economic performance of the nations.

Executive Summary

The report concernes with trend movement in different economic indicators for the two

developed nations – Australia and New Zealand. The period of time chosen for evaluation

extended from 1995 to 2015. Economic growth is measured with the trend movement in growth

of real GDP growth. Price level and labor market condition are portaited with inflation and

unemployment rate respectively. The movement of cash rate and official cash rate are observed

to evalaute to monetary policy design of Australia and New Zealand. In both the economy

inflation moves in the opposote direction of GDP growth. Monetary policy plays an important

role in controlling inflation in both the nation. Unemployment in Australia is higher than that in

New Zealand. Based on past and present performance of these economy, a positive forecast has

been madeconcerning future economic performance of the nations.

2ECONOMICS ASSIGNMENT

Table of Contents

Introduction......................................................................................................................................3

Inflation and real GDP growth rate.................................................................................................3

Analysis of unemployment rate in Australia and New Zealand......................................................6

Cash rate and Official Cash rate......................................................................................................8

Economic outlook for Australia and New Zealand.........................................................................9

Conclusion.....................................................................................................................................10

References list................................................................................................................................11

Table of Contents

Introduction......................................................................................................................................3

Inflation and real GDP growth rate.................................................................................................3

Analysis of unemployment rate in Australia and New Zealand......................................................6

Cash rate and Official Cash rate......................................................................................................8

Economic outlook for Australia and New Zealand.........................................................................9

Conclusion.....................................................................................................................................10

References list................................................................................................................................11

3ECONOMICS ASSIGNMENT

Introduction

Australian economy has long been experienced a steady growth. This is the only

exceptional economy that escaped from global recession in 2008. The economy in recent years

however experienced a relatively slow economic growth sourced from unfavorable weather

condition and slowing investment in mining and housing sector. The strong economic position is

still maintained by the business investment, government spending and large scale export. New

Zealand is an economy that maintained a free market environment. After the recessionary shock

in 2008, the economy was able to make a fast recovery and continued to grow at a rate of 2.1

percent since 2010 (Easterly and Levine, 2016) The paper prepares a brief report summarizing

performance of the economy from 1995 to 2015. The relation between different economic

variables are examined by observing trend overtime.

Inflation and real GDP growth rate

Gross Domestic Product is a convenient tool for analyzing aggregate output of a nation. It

is a measure that represents the market value of produced aggregate output in an economy. There

are two methods of computing GDP of a nation (Ellis, 2018). One is to use current year market

prices and other is to compute GDP at constant prices. GDP at current year prices is termed as

nominal GDP wile GDP at the constant prices is termed as real GDP. Now, real GDP growth rate

measures the change in GDP from one year to another presented in percentage terms. It actually

reflects the rate at which economy grows overtime. The movement in the economy’s price level

is captured by the measured inflation rate. It is computed as a change in living cost index in two

separate periods. Increase in real GDP might increase inflation by increasing demand side

pressure (Goodwin, et al., 2015). Cost-push inflation on the other hand might have a detrimental

impact on GDP growth as is disrupts production by increasing cost. The direction of relation

between inflation and growth in real GDP depends on economic structure and policy

intervention.

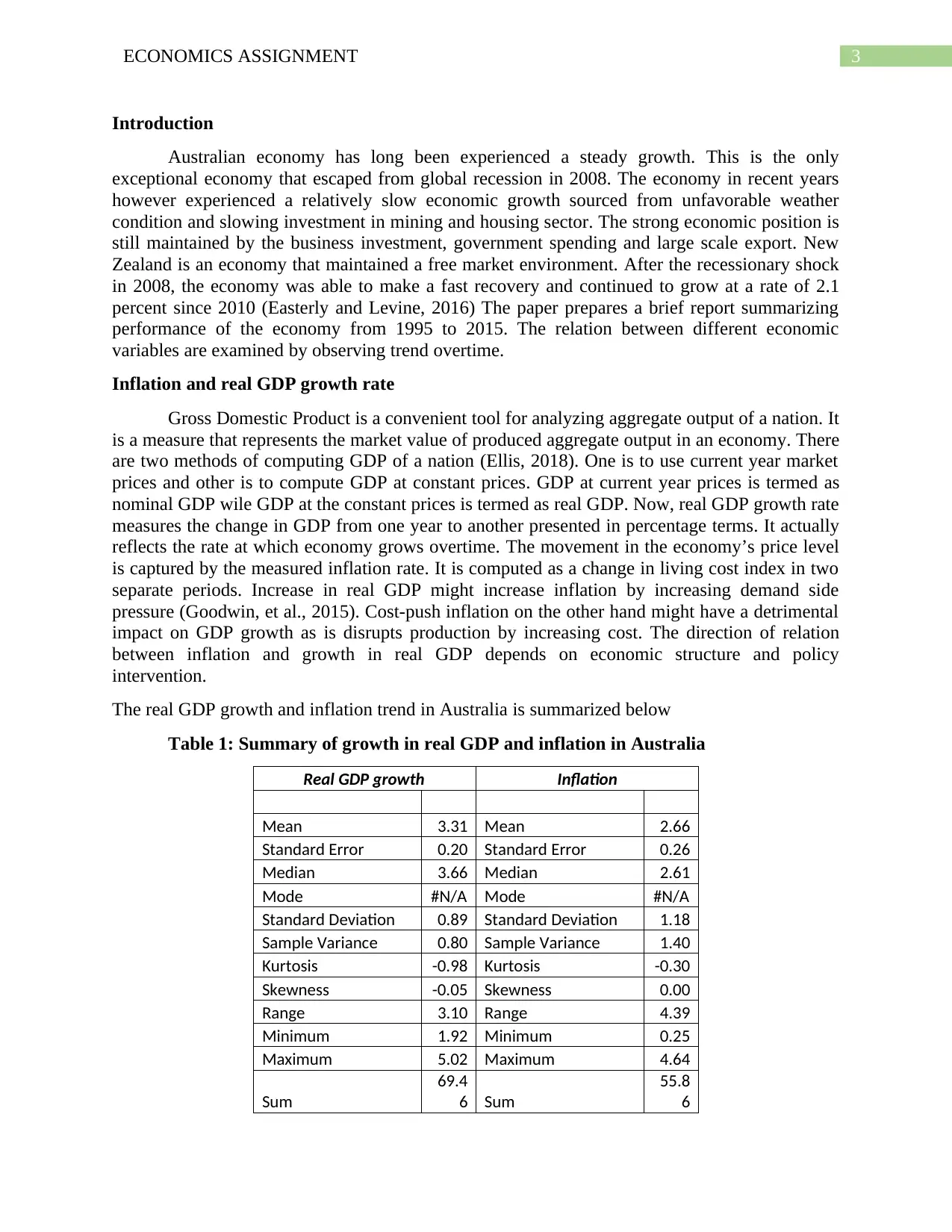

The real GDP growth and inflation trend in Australia is summarized below

Table 1: Summary of growth in real GDP and inflation in Australia

Real GDP growth Inflation

Mean 3.31 Mean 2.66

Standard Error 0.20 Standard Error 0.26

Median 3.66 Median 2.61

Mode #N/A Mode #N/A

Standard Deviation 0.89 Standard Deviation 1.18

Sample Variance 0.80 Sample Variance 1.40

Kurtosis -0.98 Kurtosis -0.30

Skewness -0.05 Skewness 0.00

Range 3.10 Range 4.39

Minimum 1.92 Minimum 0.25

Maximum 5.02 Maximum 4.64

Sum

69.4

6 Sum

55.8

6

Introduction

Australian economy has long been experienced a steady growth. This is the only

exceptional economy that escaped from global recession in 2008. The economy in recent years

however experienced a relatively slow economic growth sourced from unfavorable weather

condition and slowing investment in mining and housing sector. The strong economic position is

still maintained by the business investment, government spending and large scale export. New

Zealand is an economy that maintained a free market environment. After the recessionary shock

in 2008, the economy was able to make a fast recovery and continued to grow at a rate of 2.1

percent since 2010 (Easterly and Levine, 2016) The paper prepares a brief report summarizing

performance of the economy from 1995 to 2015. The relation between different economic

variables are examined by observing trend overtime.

Inflation and real GDP growth rate

Gross Domestic Product is a convenient tool for analyzing aggregate output of a nation. It

is a measure that represents the market value of produced aggregate output in an economy. There

are two methods of computing GDP of a nation (Ellis, 2018). One is to use current year market

prices and other is to compute GDP at constant prices. GDP at current year prices is termed as

nominal GDP wile GDP at the constant prices is termed as real GDP. Now, real GDP growth rate

measures the change in GDP from one year to another presented in percentage terms. It actually

reflects the rate at which economy grows overtime. The movement in the economy’s price level

is captured by the measured inflation rate. It is computed as a change in living cost index in two

separate periods. Increase in real GDP might increase inflation by increasing demand side

pressure (Goodwin, et al., 2015). Cost-push inflation on the other hand might have a detrimental

impact on GDP growth as is disrupts production by increasing cost. The direction of relation

between inflation and growth in real GDP depends on economic structure and policy

intervention.

The real GDP growth and inflation trend in Australia is summarized below

Table 1: Summary of growth in real GDP and inflation in Australia

Real GDP growth Inflation

Mean 3.31 Mean 2.66

Standard Error 0.20 Standard Error 0.26

Median 3.66 Median 2.61

Mode #N/A Mode #N/A

Standard Deviation 0.89 Standard Deviation 1.18

Sample Variance 0.80 Sample Variance 1.40

Kurtosis -0.98 Kurtosis -0.30

Skewness -0.05 Skewness 0.00

Range 3.10 Range 4.39

Minimum 1.92 Minimum 0.25

Maximum 5.02 Maximum 4.64

Sum

69.4

6 Sum

55.8

6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ECONOMICS ASSIGNMENT

Count 21 Count 21

Australian average growth rate from 1995 to 2015 is estimated to be 3.31. In the

summary statistics, the estimated standard deviation measures the fluctuation in the growth rate

overtime. Standard deviation of the GDP growth series for the taken period is 0.89. The

relatively small standard deviation means that GDP growth remains almost stable over the

chosen period. The highest GDP growth was recorded in 1999 with rate being 5.02 percent. The

lowest growth rate is recorded in 2009 with a rate being 1.92 percent. For inflation the mean

inflation rate in the studied period is 2.66. The inflation series constitutes a stable trend as

reflected from smaller standard deviation value of 1.18 (The World Bank, 2018). Australian

economy in the chosen time frame experienced inflation rate as high as 4.64 percent in the year

in 1995. The lowest inflation is recorded in the year 1997 with the rate of 0.25 percent.

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0.00

1.00

2.00

3.00

4.00

5.00

6.00

Australia

Real GDP growth Inflation

Year

Growth rate, inflation rate

Figure 1: Growth in GDP and inflation in Australia (1995-2015)

The graph above summarizes movement of GDP and inflation in Australia. The

accounted GDP growth in the year 1995 was 3.83 percent. The corresponding inflation rate in

that year was 4.64 percent. Growth continued to increase until 1999. Growth rate in that year was

5.02 percent. Inflation on the other hand continued to decrease indicating growth to be negatively

related with inflation rate. In the beginning of twenty first century, growth rate declined to 1.93

percent. Inflation however increased to 4.38 percent in 2000 (Manalo, Perera and Rees, 2015).

Growth rate again picked up after that with average growth rate remaining around 3 percent. The

economy grew at the slowest pace in 2009. This is because of the hit of global financial crisis.

Price level was also at a relatively low level to 1.82 percent. Both growth and price level

recovered since 2010 (Kenourgios and Dimitriou, 2015). The current monetary policy

framework for Australia aims maintain a stable price level. The successful implementation of

RBA’s monetary policy now achieves a targeted growth rate with a stable growth rate.

The real GDP growth and inflation trend in New Zealand is summarized below

Count 21 Count 21

Australian average growth rate from 1995 to 2015 is estimated to be 3.31. In the

summary statistics, the estimated standard deviation measures the fluctuation in the growth rate

overtime. Standard deviation of the GDP growth series for the taken period is 0.89. The

relatively small standard deviation means that GDP growth remains almost stable over the

chosen period. The highest GDP growth was recorded in 1999 with rate being 5.02 percent. The

lowest growth rate is recorded in 2009 with a rate being 1.92 percent. For inflation the mean

inflation rate in the studied period is 2.66. The inflation series constitutes a stable trend as

reflected from smaller standard deviation value of 1.18 (The World Bank, 2018). Australian

economy in the chosen time frame experienced inflation rate as high as 4.64 percent in the year

in 1995. The lowest inflation is recorded in the year 1997 with the rate of 0.25 percent.

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0.00

1.00

2.00

3.00

4.00

5.00

6.00

Australia

Real GDP growth Inflation

Year

Growth rate, inflation rate

Figure 1: Growth in GDP and inflation in Australia (1995-2015)

The graph above summarizes movement of GDP and inflation in Australia. The

accounted GDP growth in the year 1995 was 3.83 percent. The corresponding inflation rate in

that year was 4.64 percent. Growth continued to increase until 1999. Growth rate in that year was

5.02 percent. Inflation on the other hand continued to decrease indicating growth to be negatively

related with inflation rate. In the beginning of twenty first century, growth rate declined to 1.93

percent. Inflation however increased to 4.38 percent in 2000 (Manalo, Perera and Rees, 2015).

Growth rate again picked up after that with average growth rate remaining around 3 percent. The

economy grew at the slowest pace in 2009. This is because of the hit of global financial crisis.

Price level was also at a relatively low level to 1.82 percent. Both growth and price level

recovered since 2010 (Kenourgios and Dimitriou, 2015). The current monetary policy

framework for Australia aims maintain a stable price level. The successful implementation of

RBA’s monetary policy now achieves a targeted growth rate with a stable growth rate.

The real GDP growth and inflation trend in New Zealand is summarized below

5ECONOMICS ASSIGNMENT

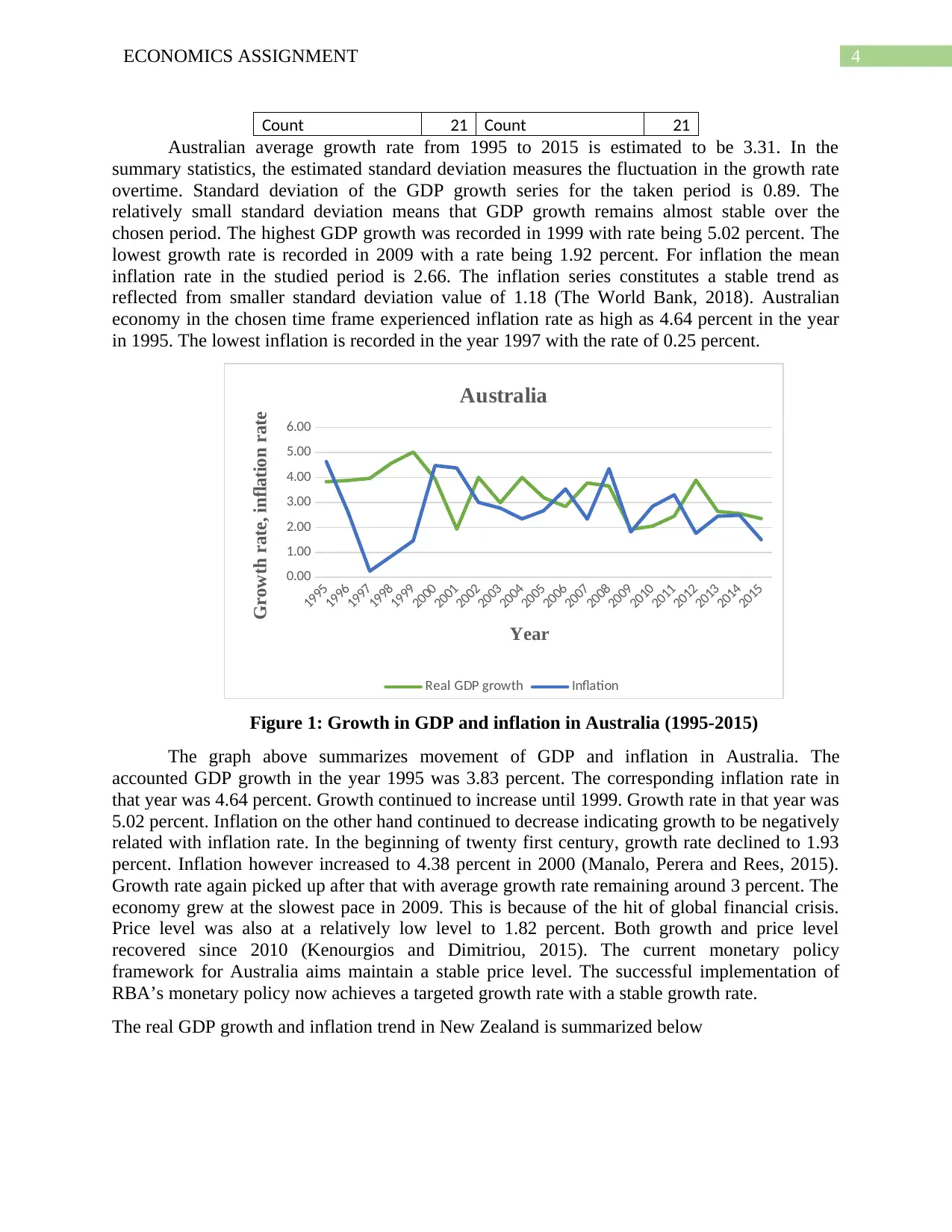

Table 2: Summary of growth in real GDP and inflation in New Zealand

Real GDP growth Inflation

Mean 2.97 Mean 2.16

Standard Error 0.34 Standard Error 0.26

Median 3.27 Median 2.29

Mode #N/A Mode #N/A

Standard Deviation 1.57 Standard Deviation 1.18

Sample Variance 2.47 Sample Variance 1.40

Kurtosis 2.10 Kurtosis -0.79

Skewness -1.09 Skewness 0.15

Range 6.74 Range 4.15

Minimum -1.55 Minimum 0.28

Maximum 5.19 Maximum 4.43

Sum

62.3

4 Sum

45.3

6

Count 21 Count 21

In New Zealand, average growth rate from 1995 to 2015 is estimated to be 2.96. In the

summary measures, the estimated standard deviation measures the fluctuation in the growth rate

overtime. Standard deviation of the GDP growth series for the taken period is 1.57. The

relatively small standard deviation means that GDP growth remains almost stable over the

chosen period. The highest GDP growth was recorded in 1995 with rate being 4.58 percent. The

lowest growth rate is recorded in 2008. During this year, the economy recorded a negative

growth rate of -1.55 percent. For inflation the mean inflation rate in the studied period is 2.15

(The World Bank, 2018). The inflation series constitutes a stable trend as reflected from smaller

standard deviation value of 1.18. New Zealand’s economy in the chosen time frame experienced

inflation rate as high as 4.43 percent in the year in 2011. The lowest inflation is recorded in the

year 1999 with the rate of 0.28 percent.

Table 2: Summary of growth in real GDP and inflation in New Zealand

Real GDP growth Inflation

Mean 2.97 Mean 2.16

Standard Error 0.34 Standard Error 0.26

Median 3.27 Median 2.29

Mode #N/A Mode #N/A

Standard Deviation 1.57 Standard Deviation 1.18

Sample Variance 2.47 Sample Variance 1.40

Kurtosis 2.10 Kurtosis -0.79

Skewness -1.09 Skewness 0.15

Range 6.74 Range 4.15

Minimum -1.55 Minimum 0.28

Maximum 5.19 Maximum 4.43

Sum

62.3

4 Sum

45.3

6

Count 21 Count 21

In New Zealand, average growth rate from 1995 to 2015 is estimated to be 2.96. In the

summary measures, the estimated standard deviation measures the fluctuation in the growth rate

overtime. Standard deviation of the GDP growth series for the taken period is 1.57. The

relatively small standard deviation means that GDP growth remains almost stable over the

chosen period. The highest GDP growth was recorded in 1995 with rate being 4.58 percent. The

lowest growth rate is recorded in 2008. During this year, the economy recorded a negative

growth rate of -1.55 percent. For inflation the mean inflation rate in the studied period is 2.15

(The World Bank, 2018). The inflation series constitutes a stable trend as reflected from smaller

standard deviation value of 1.18. New Zealand’s economy in the chosen time frame experienced

inflation rate as high as 4.43 percent in the year in 2011. The lowest inflation is recorded in the

year 1999 with the rate of 0.28 percent.

6ECONOMICS ASSIGNMENT

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

-2.00

-1.00

0.00

1.00

2.00

3.00

4.00

5.00

6.00

New Zealand

Real GDP growth Inflation

Year

Growth rate, inflation rate

Figure 2: Growth in GDP and inflation in New Zealand (1995-2015)

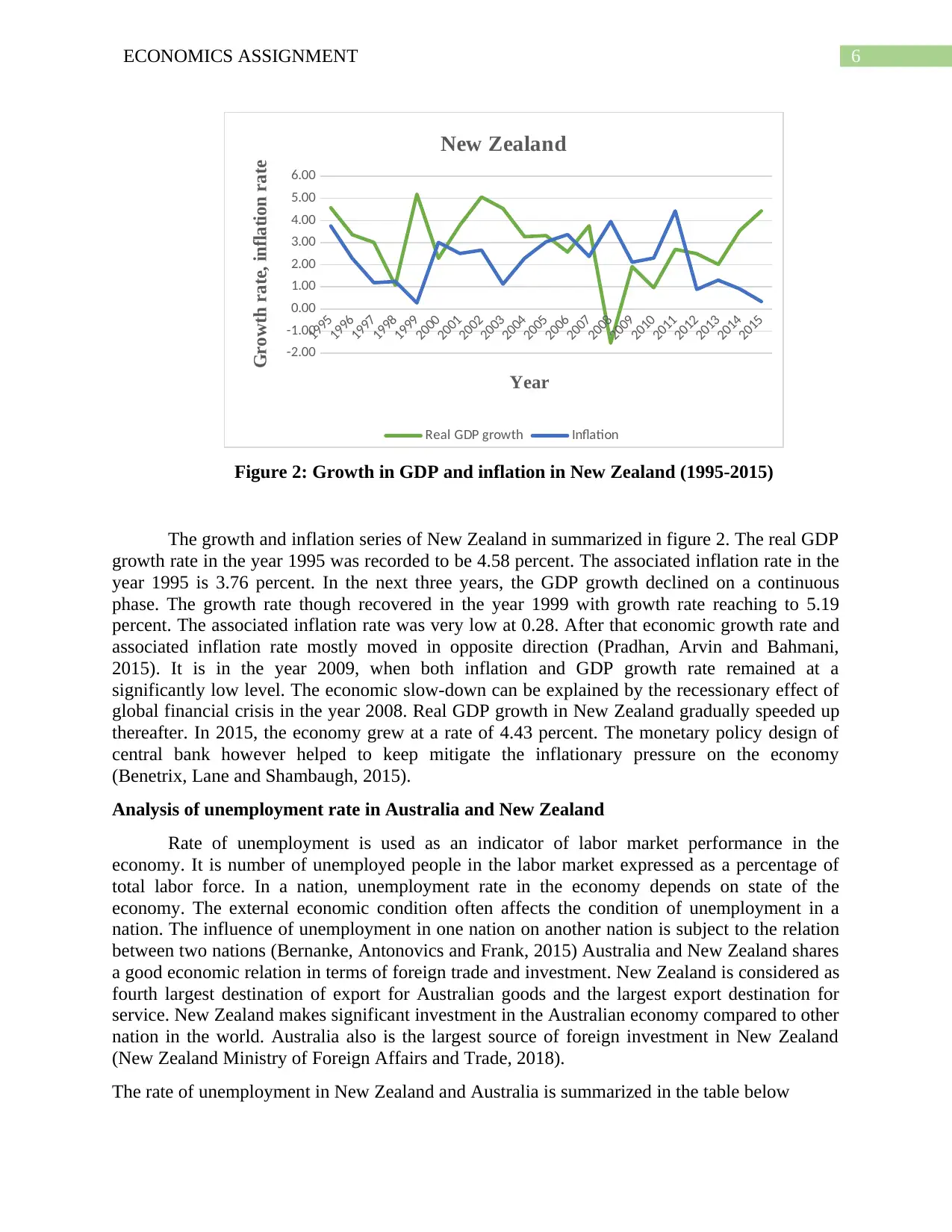

The growth and inflation series of New Zealand in summarized in figure 2. The real GDP

growth rate in the year 1995 was recorded to be 4.58 percent. The associated inflation rate in the

year 1995 is 3.76 percent. In the next three years, the GDP growth declined on a continuous

phase. The growth rate though recovered in the year 1999 with growth rate reaching to 5.19

percent. The associated inflation rate was very low at 0.28. After that economic growth rate and

associated inflation rate mostly moved in opposite direction (Pradhan, Arvin and Bahmani,

2015). It is in the year 2009, when both inflation and GDP growth rate remained at a

significantly low level. The economic slow-down can be explained by the recessionary effect of

global financial crisis in the year 2008. Real GDP growth in New Zealand gradually speeded up

thereafter. In 2015, the economy grew at a rate of 4.43 percent. The monetary policy design of

central bank however helped to keep mitigate the inflationary pressure on the economy

(Benetrix, Lane and Shambaugh, 2015).

Analysis of unemployment rate in Australia and New Zealand

Rate of unemployment is used as an indicator of labor market performance in the

economy. It is number of unemployed people in the labor market expressed as a percentage of

total labor force. In a nation, unemployment rate in the economy depends on state of the

economy. The external economic condition often affects the condition of unemployment in a

nation. The influence of unemployment in one nation on another nation is subject to the relation

between two nations (Bernanke, Antonovics and Frank, 2015) Australia and New Zealand shares

a good economic relation in terms of foreign trade and investment. New Zealand is considered as

fourth largest destination of export for Australian goods and the largest export destination for

service. New Zealand makes significant investment in the Australian economy compared to other

nation in the world. Australia also is the largest source of foreign investment in New Zealand

(New Zealand Ministry of Foreign Affairs and Trade, 2018).

The rate of unemployment in New Zealand and Australia is summarized in the table below

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

-2.00

-1.00

0.00

1.00

2.00

3.00

4.00

5.00

6.00

New Zealand

Real GDP growth Inflation

Year

Growth rate, inflation rate

Figure 2: Growth in GDP and inflation in New Zealand (1995-2015)

The growth and inflation series of New Zealand in summarized in figure 2. The real GDP

growth rate in the year 1995 was recorded to be 4.58 percent. The associated inflation rate in the

year 1995 is 3.76 percent. In the next three years, the GDP growth declined on a continuous

phase. The growth rate though recovered in the year 1999 with growth rate reaching to 5.19

percent. The associated inflation rate was very low at 0.28. After that economic growth rate and

associated inflation rate mostly moved in opposite direction (Pradhan, Arvin and Bahmani,

2015). It is in the year 2009, when both inflation and GDP growth rate remained at a

significantly low level. The economic slow-down can be explained by the recessionary effect of

global financial crisis in the year 2008. Real GDP growth in New Zealand gradually speeded up

thereafter. In 2015, the economy grew at a rate of 4.43 percent. The monetary policy design of

central bank however helped to keep mitigate the inflationary pressure on the economy

(Benetrix, Lane and Shambaugh, 2015).

Analysis of unemployment rate in Australia and New Zealand

Rate of unemployment is used as an indicator of labor market performance in the

economy. It is number of unemployed people in the labor market expressed as a percentage of

total labor force. In a nation, unemployment rate in the economy depends on state of the

economy. The external economic condition often affects the condition of unemployment in a

nation. The influence of unemployment in one nation on another nation is subject to the relation

between two nations (Bernanke, Antonovics and Frank, 2015) Australia and New Zealand shares

a good economic relation in terms of foreign trade and investment. New Zealand is considered as

fourth largest destination of export for Australian goods and the largest export destination for

service. New Zealand makes significant investment in the Australian economy compared to other

nation in the world. Australia also is the largest source of foreign investment in New Zealand

(New Zealand Ministry of Foreign Affairs and Trade, 2018).

The rate of unemployment in New Zealand and Australia is summarized in the table below

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS ASSIGNMENT

Table 3: Summary of unemployment rate in Australia and New Zealand

Australia New Zealand

Mean 6.09 Mean 5.53

Standard Error 0.28 Standard Error 0.25

Median 5.93 Median 5.76

Mode #N/A Mode 6.14

Standard Deviation 1.29 Standard Deviation 1.16

Sample Variance 1.66 Sample Variance 1.35

Kurtosis -0.37 Kurtosis -0.73

Skewness 0.68 Skewness -0.20

Range 4.28 Range 4.12

Minimum 4.23 Minimum 3.60

Maximum 8.51 Maximum 7.72

Sum

127.8

8 Sum

116.1

4

Count 21 Count 21

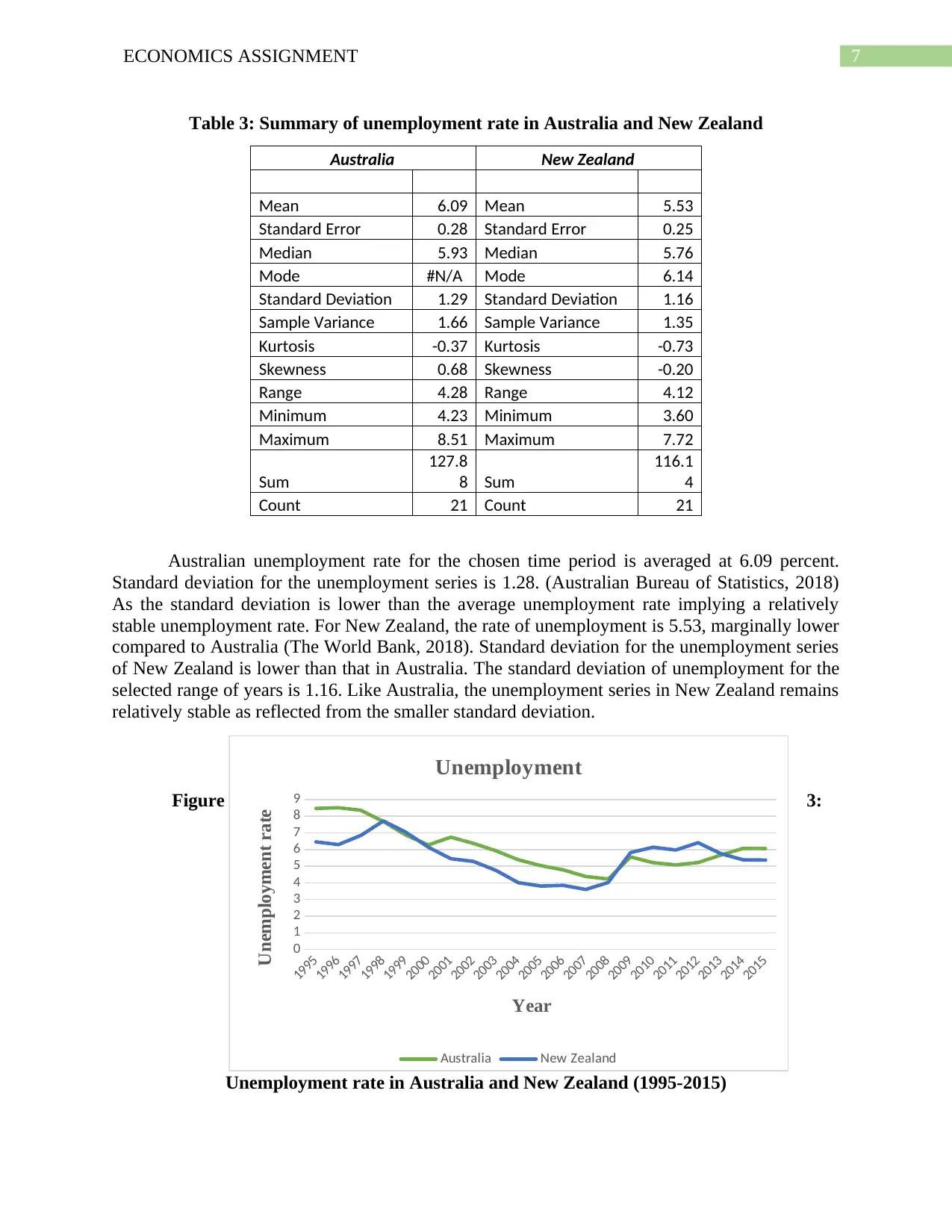

Australian unemployment rate for the chosen time period is averaged at 6.09 percent.

Standard deviation for the unemployment series is 1.28. (Australian Bureau of Statistics, 2018)

As the standard deviation is lower than the average unemployment rate implying a relatively

stable unemployment rate. For New Zealand, the rate of unemployment is 5.53, marginally lower

compared to Australia (The World Bank, 2018). Standard deviation for the unemployment series

of New Zealand is lower than that in Australia. The standard deviation of unemployment for the

selected range of years is 1.16. Like Australia, the unemployment series in New Zealand remains

relatively stable as reflected from the smaller standard deviation.

Figure 3:

Unemployment rate in Australia and New Zealand (1995-2015)

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0

1

2

3

4

5

6

7

8

9

Unemployment

Australia New Zealand

Year

Unemployment rate

Table 3: Summary of unemployment rate in Australia and New Zealand

Australia New Zealand

Mean 6.09 Mean 5.53

Standard Error 0.28 Standard Error 0.25

Median 5.93 Median 5.76

Mode #N/A Mode 6.14

Standard Deviation 1.29 Standard Deviation 1.16

Sample Variance 1.66 Sample Variance 1.35

Kurtosis -0.37 Kurtosis -0.73

Skewness 0.68 Skewness -0.20

Range 4.28 Range 4.12

Minimum 4.23 Minimum 3.60

Maximum 8.51 Maximum 7.72

Sum

127.8

8 Sum

116.1

4

Count 21 Count 21

Australian unemployment rate for the chosen time period is averaged at 6.09 percent.

Standard deviation for the unemployment series is 1.28. (Australian Bureau of Statistics, 2018)

As the standard deviation is lower than the average unemployment rate implying a relatively

stable unemployment rate. For New Zealand, the rate of unemployment is 5.53, marginally lower

compared to Australia (The World Bank, 2018). Standard deviation for the unemployment series

of New Zealand is lower than that in Australia. The standard deviation of unemployment for the

selected range of years is 1.16. Like Australia, the unemployment series in New Zealand remains

relatively stable as reflected from the smaller standard deviation.

Figure 3:

Unemployment rate in Australia and New Zealand (1995-2015)

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0

1

2

3

4

5

6

7

8

9

Unemployment

Australia New Zealand

Year

Unemployment rate

8ECONOMICS ASSIGNMENT

In New Zealand, unemployment rate is mostly lower as compared to the unemployment

rate in Australia. From 1995 to 1997, unemployment rate in Australia was significantly higher

than New Zealand. Unemployment in Australia was very close to that in New Zealand for the

three consecutive years of 1998, 1999 and 2000. During this time, unemployment rate in

Australia continued to decline while unemployment rate in New Zealand continued to increases

(Uddin, Alam and Gow, 2016). Economic growth in New Zealand helps to reduce

unemployment in later years. As a result unemployment rate in New Zealand again went below

that in Australia. Following the shock of global financial crisis unemployment in New Zealand

increased from 2009 onwards and exceeds the corresponding unemployment in Australia. The

New Zealand economy gradually recovered the recessionary shock. With improvement in

economic growth unemployment has declined as well. The decline in unemployment rate in New

Zealand causes unemployment to fall below the unemployment rate in Australia (Baker, Bloom

and Davis, 2016).

Cash rate and Official Cash rate

Cash rate and official cash rate both are instruments of monetary policy used by central

bank of Australia and New Zealand respectively. In Australia, the decision regarding monetary

policy is taken by setting a targeted cash rate. Cash rate is the overnight rate charged on the

borrowed sum of money. The Reserve Bank of Australia reviews the inflationary condition in the

economy and then adjust the cash rate in accordance to the targeted inflation rate (Reserve Bank

of Australia, 2018). If actual inflation rate is above the targeted rate then RBA reduces the rate.

In situation where actual inflation is below the targeted rate, the RBA takes the ease monetary

policy and lowers the cash rate. Monetary policy in New Zealand is designed to achieve stability

in prices. Current target of the Central Bank is to keep the inflation rate ranged from 1 to 3

percent. The central bank designs monetary policy by adjusting the official cash rate. Central

bank of New Zealand reviews the official cash rate eight times in a year (Reserve Bank of New

Zealand, 2018).

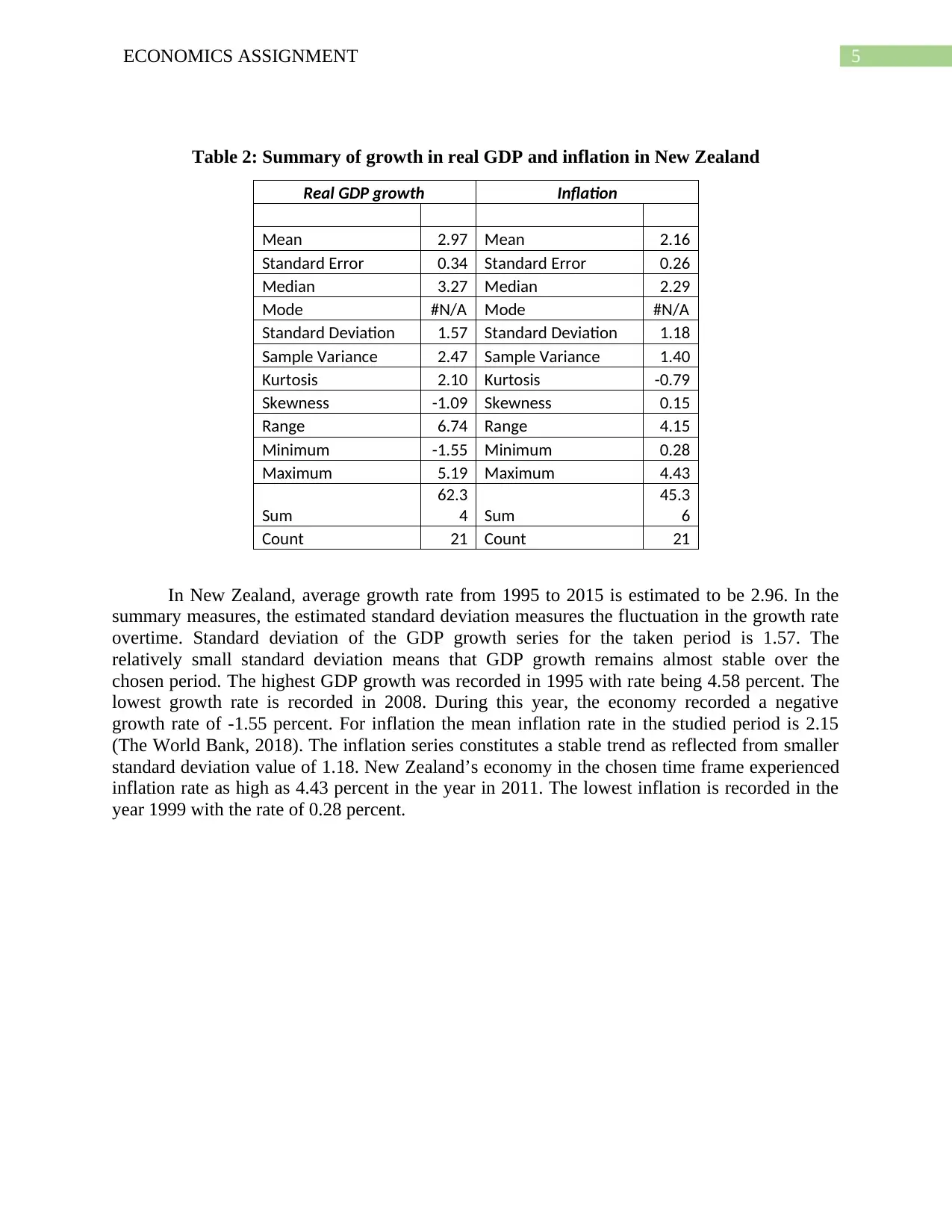

The summary of cash rate and official cash rate is given in the following table:

Table 4: Summary statistics of official cash rate and cash rate

Cash rate Official cash rate

Mean 4.85 Mean 4.84

Standard Error 0.31 Standard Error 0.38

Median 5.00 Median 5.00

Mode 5.25 Mode 4.75

Standard Deviation 1.42 Standard Deviation 1.74

Sample Variance 2.03 Sample Variance 3.04

Kurtosis -0.35 Kurtosis -1.09

Skewness -0.33 Skewness 0.08

Range 5.38 Range 5.44

Minimum 2.13 Minimum 2.50

Maximum 7.50 Maximum 7.94

Sum 101.8 Sum 101.5

In New Zealand, unemployment rate is mostly lower as compared to the unemployment

rate in Australia. From 1995 to 1997, unemployment rate in Australia was significantly higher

than New Zealand. Unemployment in Australia was very close to that in New Zealand for the

three consecutive years of 1998, 1999 and 2000. During this time, unemployment rate in

Australia continued to decline while unemployment rate in New Zealand continued to increases

(Uddin, Alam and Gow, 2016). Economic growth in New Zealand helps to reduce

unemployment in later years. As a result unemployment rate in New Zealand again went below

that in Australia. Following the shock of global financial crisis unemployment in New Zealand

increased from 2009 onwards and exceeds the corresponding unemployment in Australia. The

New Zealand economy gradually recovered the recessionary shock. With improvement in

economic growth unemployment has declined as well. The decline in unemployment rate in New

Zealand causes unemployment to fall below the unemployment rate in Australia (Baker, Bloom

and Davis, 2016).

Cash rate and Official Cash rate

Cash rate and official cash rate both are instruments of monetary policy used by central

bank of Australia and New Zealand respectively. In Australia, the decision regarding monetary

policy is taken by setting a targeted cash rate. Cash rate is the overnight rate charged on the

borrowed sum of money. The Reserve Bank of Australia reviews the inflationary condition in the

economy and then adjust the cash rate in accordance to the targeted inflation rate (Reserve Bank

of Australia, 2018). If actual inflation rate is above the targeted rate then RBA reduces the rate.

In situation where actual inflation is below the targeted rate, the RBA takes the ease monetary

policy and lowers the cash rate. Monetary policy in New Zealand is designed to achieve stability

in prices. Current target of the Central Bank is to keep the inflation rate ranged from 1 to 3

percent. The central bank designs monetary policy by adjusting the official cash rate. Central

bank of New Zealand reviews the official cash rate eight times in a year (Reserve Bank of New

Zealand, 2018).

The summary of cash rate and official cash rate is given in the following table:

Table 4: Summary statistics of official cash rate and cash rate

Cash rate Official cash rate

Mean 4.85 Mean 4.84

Standard Error 0.31 Standard Error 0.38

Median 5.00 Median 5.00

Mode 5.25 Mode 4.75

Standard Deviation 1.42 Standard Deviation 1.74

Sample Variance 2.03 Sample Variance 3.04

Kurtosis -0.35 Kurtosis -1.09

Skewness -0.33 Skewness 0.08

Range 5.38 Range 5.44

Minimum 2.13 Minimum 2.50

Maximum 7.50 Maximum 7.94

Sum 101.8 Sum 101.5

9ECONOMICS ASSIGNMENT

1 9

Count 21 Count 21

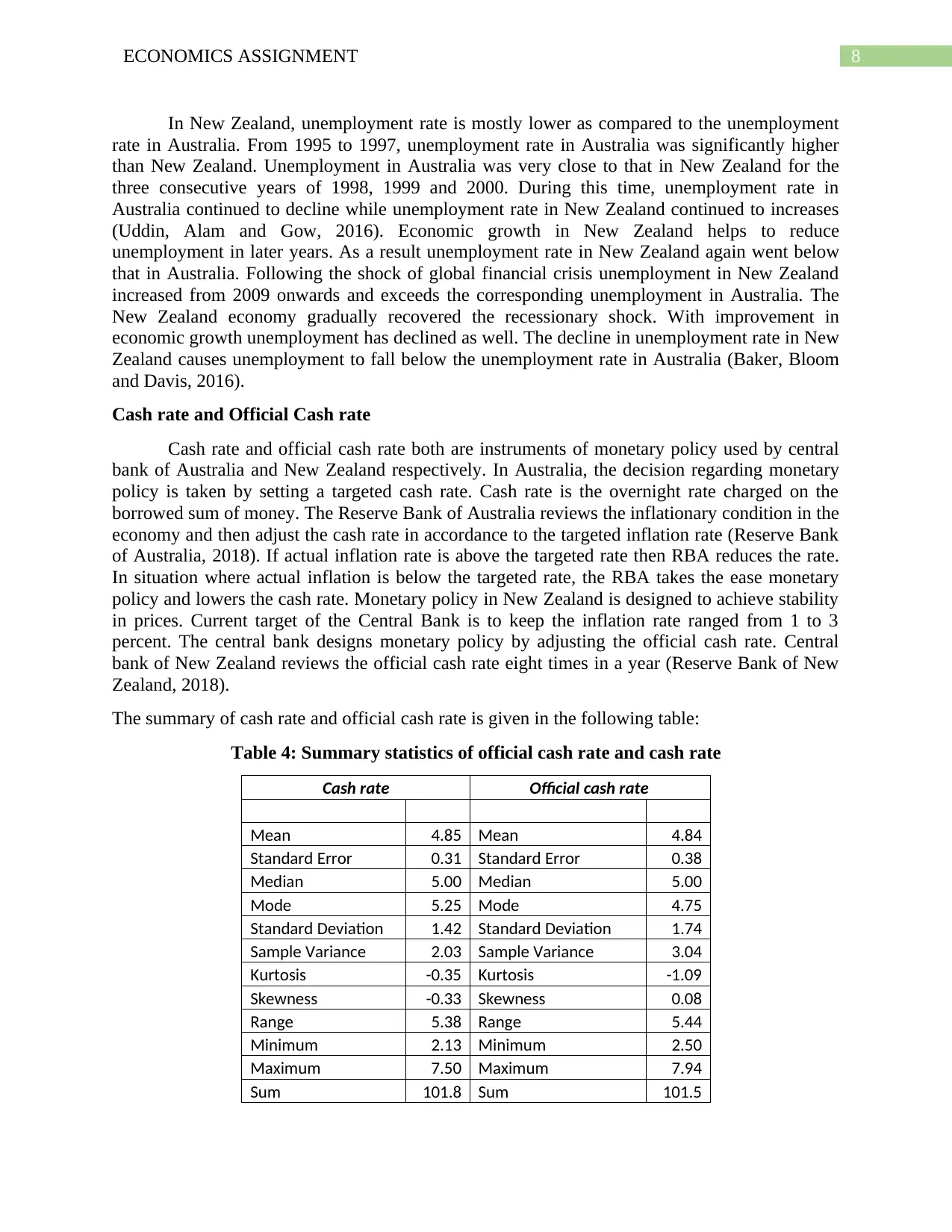

The average overnight rate in Australia is almost same as that in New Zealand. The

average cash rate is obtained as 4.85. The same for Official Cash Rate is 4.84. For both the series

of cash rate and official cash rate standard deviation is less than that of the average overnight rate

implying the central bank in both Australia and New Zealand has maintained a relatively stable

trend in the cash rate.

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

Cash rate and Official cash rate

Cash rate Official cash rate

Year

Interest rate

Figure 4: Trend in cash rate and official cash rate (1995-2015)

Previously, cash rate and official cash rate constitutes the same trend. It was then

believed that the Central Bank’s policy in New Zealand follows the policy initiative taken by

central bank of Australia. The leader followers’ trend in designing monetary policy however

marked a break at the ending note of 2001 (Murray, 2017) The monetary policy coordination

between the two nations had broken down since then. In the may quarter of 2002 central bank of

both the nation took the independent decision of implementing a tight monetary policy. The

central bank of New Zealand increased the cash rate by 0.25 basis point with the cash rate

becoming 5.00 percent. During this time Reserve Bank of Australia also raised the cash rate from

4.25 in April, 2002 to 4.50 in May, 2002. The decision in New Zealand however was taken in

advance to that in Australia. Both the nation again took a coordinated decision of lowering the

interest rate in 2006. In New Zealand, the official cash rate ranged around 3 percent. The same in

Australia during that period averaged around 2 percent.

In the phase of tight monetary policy, Reserve Bank raises the overnight cash rate. The

higher increases rate by increasing the cost of borrowed fund restricts economic activity and

control inflationary pressure (Heijdra, 2017). As evidenced from the data series of cash rate and

official cash rate, in the past decade the settled bank rate in New Zealand is higher as compared

to cash rate in Australia. The economic growth is relatively stronger in New Zealand. The slow

growth rate in Australia induces the Reserve Bank to set the interest rate at a relatively low level.

1 9

Count 21 Count 21

The average overnight rate in Australia is almost same as that in New Zealand. The

average cash rate is obtained as 4.85. The same for Official Cash Rate is 4.84. For both the series

of cash rate and official cash rate standard deviation is less than that of the average overnight rate

implying the central bank in both Australia and New Zealand has maintained a relatively stable

trend in the cash rate.

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

Cash rate and Official cash rate

Cash rate Official cash rate

Year

Interest rate

Figure 4: Trend in cash rate and official cash rate (1995-2015)

Previously, cash rate and official cash rate constitutes the same trend. It was then

believed that the Central Bank’s policy in New Zealand follows the policy initiative taken by

central bank of Australia. The leader followers’ trend in designing monetary policy however

marked a break at the ending note of 2001 (Murray, 2017) The monetary policy coordination

between the two nations had broken down since then. In the may quarter of 2002 central bank of

both the nation took the independent decision of implementing a tight monetary policy. The

central bank of New Zealand increased the cash rate by 0.25 basis point with the cash rate

becoming 5.00 percent. During this time Reserve Bank of Australia also raised the cash rate from

4.25 in April, 2002 to 4.50 in May, 2002. The decision in New Zealand however was taken in

advance to that in Australia. Both the nation again took a coordinated decision of lowering the

interest rate in 2006. In New Zealand, the official cash rate ranged around 3 percent. The same in

Australia during that period averaged around 2 percent.

In the phase of tight monetary policy, Reserve Bank raises the overnight cash rate. The

higher increases rate by increasing the cost of borrowed fund restricts economic activity and

control inflationary pressure (Heijdra, 2017). As evidenced from the data series of cash rate and

official cash rate, in the past decade the settled bank rate in New Zealand is higher as compared

to cash rate in Australia. The economic growth is relatively stronger in New Zealand. The slow

growth rate in Australia induces the Reserve Bank to set the interest rate at a relatively low level.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ECONOMICS ASSIGNMENT

Economic outlook for Australia and New Zealand

The outlook for Australian economy remains relatively stronger compared to other peer

countries in the OECD group. The economists predict real GDP growth rate to be around 2,8

percent for the next two years. The string growth position of the Australian economy is expected

to be supported by the investment is sectors other than mining sector. The future economic

growth of the nation is largely dependent on export sector and activity outside mining or

construction. Condition of the labor market is expected to improve with rate of unemployment

being declined to 5.3 percent (Bernanke, et al., 2018) Given the uncertainty of China’s economy,

sectors linked to the China is expected to experience an environment of uncertainty and risk.

Like Australia, the outlook for New Zealand economy is positive and strong with the

economy forecasted to grow at a steady pace over the next five years. There are several factors

that are expected to support economic growth in future. New Zealand experiences a higher

inflow of migrants. This strengthens the labor market in New Zealand. Besides, low interest rate

provides support to the private investment and consumption (Simon-Kumar, 2015). The service

export in terms of increased number of tourists contributes to economic growth of the nation.

Growth is expected to be accelerated to 3.8% by 2019. Steady economic growth along with a

moderate inflationary pressure and low unemployment rate ensures strong economic position.

Conclusion

Analysis of economic environment of Australia and New Zealand from 1995 to 2015

reveals that economic environment in Australian is quite similar to that in New Zealand. In both

the nation inflation is likely to be inversely related to that of the real GDP growth rate. The

inflation in both the nation in recent years is in control because of the design of monetary policy

in both the nation. The labor market condition in New Zealand is stronger than that in Australia.

The trend unemployment in Australia mostly lies above the trend rate in New Zealand with

exception in only few years. RBA uses cash rate to achieve its inflation target. Central bank of

New Zealand achieves attains the inflationary goal using official cash rate. Average bank rate in

Australia is close to the average rate in New Zealand. Previously, there was a dependency in the

monetary policy decision of both the central banks. The independent decision of monetary

authority shows tendency towards an ease monetary policy to attain flawless economic growth.

Both the economy tends to constitute an overall steady performance in the upcoming years.

Economic outlook for Australia and New Zealand

The outlook for Australian economy remains relatively stronger compared to other peer

countries in the OECD group. The economists predict real GDP growth rate to be around 2,8

percent for the next two years. The string growth position of the Australian economy is expected

to be supported by the investment is sectors other than mining sector. The future economic

growth of the nation is largely dependent on export sector and activity outside mining or

construction. Condition of the labor market is expected to improve with rate of unemployment

being declined to 5.3 percent (Bernanke, et al., 2018) Given the uncertainty of China’s economy,

sectors linked to the China is expected to experience an environment of uncertainty and risk.

Like Australia, the outlook for New Zealand economy is positive and strong with the

economy forecasted to grow at a steady pace over the next five years. There are several factors

that are expected to support economic growth in future. New Zealand experiences a higher

inflow of migrants. This strengthens the labor market in New Zealand. Besides, low interest rate

provides support to the private investment and consumption (Simon-Kumar, 2015). The service

export in terms of increased number of tourists contributes to economic growth of the nation.

Growth is expected to be accelerated to 3.8% by 2019. Steady economic growth along with a

moderate inflationary pressure and low unemployment rate ensures strong economic position.

Conclusion

Analysis of economic environment of Australia and New Zealand from 1995 to 2015

reveals that economic environment in Australian is quite similar to that in New Zealand. In both

the nation inflation is likely to be inversely related to that of the real GDP growth rate. The

inflation in both the nation in recent years is in control because of the design of monetary policy

in both the nation. The labor market condition in New Zealand is stronger than that in Australia.

The trend unemployment in Australia mostly lies above the trend rate in New Zealand with

exception in only few years. RBA uses cash rate to achieve its inflation target. Central bank of

New Zealand achieves attains the inflationary goal using official cash rate. Average bank rate in

Australia is close to the average rate in New Zealand. Previously, there was a dependency in the

monetary policy decision of both the central banks. The independent decision of monetary

authority shows tendency towards an ease monetary policy to attain flawless economic growth.

Both the economy tends to constitute an overall steady performance in the upcoming years.

11ECONOMICS ASSIGNMENT

References list

Australian Bureau of Statistics, 2018. 6202.0 - Labour Force, Australia, Jul 2018. [online]

Abs.gov.au. Available at:

<http://www.abs.gov.au/ausstats/abs%40.nsf/mediareleasesbyCatalogue/

46DFE12FCDB783D9CA256B740082AA6C> [Accessed 11 September 2018].

Baker, S.R., Bloom, N. and Davis, S.J., 2016. Measuring economic policy uncertainty. The

Quarterly Journal of Economics, 131(4), pp.1593-1636.

Benetrix, A.S., Lane, P.R. and Shambaugh, J.C., 2015. International currency exposures,

valuation effects and the global financial crisis. Journal of International Economics, 96, pp.S98-

S109.

Bernanke, B., Antonovics, K. and Frank, R., 2015. Principles of macroeconomics. McGraw-Hill

Higher Education.

Bernanke, B.S., Laubach, T., Mishkin, F.S. and Posen, A.S., 2018. Inflation targeting: lessons

from the international experience. Princeton University Press.

Easterly, W. and Levine, R., 2016. The European origins of economic development. Journal of

Economic Growth, 21(3), pp.225-257.

Ellis, L., 2018. Where is the growth going to come from? Economic Papers: A journal of

applied economics and policy, 37(1), pp.4-16.

Goodwin, N., Harris, J.M., Nelson, J.A., Roach, B. and Torras, M., 2015. Macroeconomics in

context. Routledge.

Heijdra, B.J., 2017. Foundations of modern macroeconomics. Oxford university press.

Kenourgios, D. and Dimitriou, D., 2015. Contagion of the Global Financial Crisis and the real

economy: A regional analysis. Economic Modelling, 44, pp.283-293.

Manalo, J., Perera, D. and Rees, D.M., 2015. Exchange rate movements and the Australian

economy. Economic Modelling, 47, pp.53-62.

Murray, G., 2017. Capitalist networks and social power in Australia and New Zealand.

Routledge.

New Zealand Ministry of Foreign Affairs and Trade, 2018. New Zealand: Foreign Trade and

Affairs. [online] Available at:

<https://www.mfat.govt.nz/en/countries-and-regions/australia/#trade> [Accessed 11 September

2018].

Pradhan, R.P., Arvin, M.B. and Bahmani, S., 2015. Causal nexus between economic growth,

inflation, and stock market development: The case of OECD countries. Global Finance

Journal, 27, pp.98-111.

Reserve Bank of Australia, 2018. Cash Rate | RBA. [online] Reserve Bank of Australia.

Available at: <https://www.rba.gov.au/statistics/cash-rate/> [Accessed 11 September 2018].

References list

Australian Bureau of Statistics, 2018. 6202.0 - Labour Force, Australia, Jul 2018. [online]

Abs.gov.au. Available at:

<http://www.abs.gov.au/ausstats/abs%40.nsf/mediareleasesbyCatalogue/

46DFE12FCDB783D9CA256B740082AA6C> [Accessed 11 September 2018].

Baker, S.R., Bloom, N. and Davis, S.J., 2016. Measuring economic policy uncertainty. The

Quarterly Journal of Economics, 131(4), pp.1593-1636.

Benetrix, A.S., Lane, P.R. and Shambaugh, J.C., 2015. International currency exposures,

valuation effects and the global financial crisis. Journal of International Economics, 96, pp.S98-

S109.

Bernanke, B., Antonovics, K. and Frank, R., 2015. Principles of macroeconomics. McGraw-Hill

Higher Education.

Bernanke, B.S., Laubach, T., Mishkin, F.S. and Posen, A.S., 2018. Inflation targeting: lessons

from the international experience. Princeton University Press.

Easterly, W. and Levine, R., 2016. The European origins of economic development. Journal of

Economic Growth, 21(3), pp.225-257.

Ellis, L., 2018. Where is the growth going to come from? Economic Papers: A journal of

applied economics and policy, 37(1), pp.4-16.

Goodwin, N., Harris, J.M., Nelson, J.A., Roach, B. and Torras, M., 2015. Macroeconomics in

context. Routledge.

Heijdra, B.J., 2017. Foundations of modern macroeconomics. Oxford university press.

Kenourgios, D. and Dimitriou, D., 2015. Contagion of the Global Financial Crisis and the real

economy: A regional analysis. Economic Modelling, 44, pp.283-293.

Manalo, J., Perera, D. and Rees, D.M., 2015. Exchange rate movements and the Australian

economy. Economic Modelling, 47, pp.53-62.

Murray, G., 2017. Capitalist networks and social power in Australia and New Zealand.

Routledge.

New Zealand Ministry of Foreign Affairs and Trade, 2018. New Zealand: Foreign Trade and

Affairs. [online] Available at:

<https://www.mfat.govt.nz/en/countries-and-regions/australia/#trade> [Accessed 11 September

2018].

Pradhan, R.P., Arvin, M.B. and Bahmani, S., 2015. Causal nexus between economic growth,

inflation, and stock market development: The case of OECD countries. Global Finance

Journal, 27, pp.98-111.

Reserve Bank of Australia, 2018. Cash Rate | RBA. [online] Reserve Bank of Australia.

Available at: <https://www.rba.gov.au/statistics/cash-rate/> [Accessed 11 September 2018].

12ECONOMICS ASSIGNMENT

Reserve Bank of New Zealand, 2018. What Is The Official Cash Rate? - Reserve Bank of New

Zealand. [online] Rbnz.govt.nz. Available at: <https://www.rbnz.govt.nz/research-and-

publications/fact-sheets-and-guides/factsheet-what-is-the-official-cash-rate> [Accessed 11

September 2018].

Simon-Kumar, R., 2015. Neoliberalism and the new race politics of migration policy: changing

profiles of the desirable migrant in New Zealand. Journal of Ethnic and Migration

Studies, 41(7), pp.1172-1191.

The Word Bank, 2018. GDP (Constant 2010 US$) | Data. [online] Data.worldbank.org.

Available at: <https://data.worldbank.org/indicator/NY.GDP.MKTP.KD?locations=AU-NZ>

[Accessed 11 September 2018].

The World Bank, 2018. Inflation, Consumer Prices (Annual %) | Data. [online]

Data.worldbank.org. Available at: <https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?

locations=AU-NZ> [Accessed 11 September 2018].

Uddin, G.A., Alam, K. and Gow, J., 2016. Population age structure and savings rate impacts on

economic growth: Evidence from Australia. Economic Analysis and Policy, 52, pp.23-33.

Reserve Bank of New Zealand, 2018. What Is The Official Cash Rate? - Reserve Bank of New

Zealand. [online] Rbnz.govt.nz. Available at: <https://www.rbnz.govt.nz/research-and-

publications/fact-sheets-and-guides/factsheet-what-is-the-official-cash-rate> [Accessed 11

September 2018].

Simon-Kumar, R., 2015. Neoliberalism and the new race politics of migration policy: changing

profiles of the desirable migrant in New Zealand. Journal of Ethnic and Migration

Studies, 41(7), pp.1172-1191.

The Word Bank, 2018. GDP (Constant 2010 US$) | Data. [online] Data.worldbank.org.

Available at: <https://data.worldbank.org/indicator/NY.GDP.MKTP.KD?locations=AU-NZ>

[Accessed 11 September 2018].

The World Bank, 2018. Inflation, Consumer Prices (Annual %) | Data. [online]

Data.worldbank.org. Available at: <https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?

locations=AU-NZ> [Accessed 11 September 2018].

Uddin, G.A., Alam, K. and Gow, J., 2016. Population age structure and savings rate impacts on

economic growth: Evidence from Australia. Economic Analysis and Policy, 52, pp.23-33.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.