Economic Principles and Decision Making

VerifiedAdded on 2022/12/29

|19

|1325

|79

Presentation

AI Summary

This presentation discusses the economic principles and decision making process in Australia. It covers the growth performance of Australia, current performance of the Australian economy, factors behind the decline in economic growth, housing market, slowdown in economic growth of China, decline in household consumption, decline in average wage growth, and the impact of monetary policy on economic growth. The presentation provides an overview of the current status of the economy and justifies the decision of monetary policy expansion.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Economic Principles and Decision

Making

Name of the Student

Name of the University

Course ID

Making

Name of the Student

Name of the University

Course ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Introduction

Growth performance of Australia in 2018

Average growth rate of 3.8 percent in the first half

Growth of export and a strong performance of the household sector

Sudden break in growth performance of Australia in the latter half of 2018

A number of different factors

Housing market

China’s slow down

Low wage growth

Decline in household consumption

Monetary policy expansion.

Growth performance of Australia in 2018

Average growth rate of 3.8 percent in the first half

Growth of export and a strong performance of the household sector

Sudden break in growth performance of Australia in the latter half of 2018

A number of different factors

Housing market

China’s slow down

Low wage growth

Decline in household consumption

Monetary policy expansion.

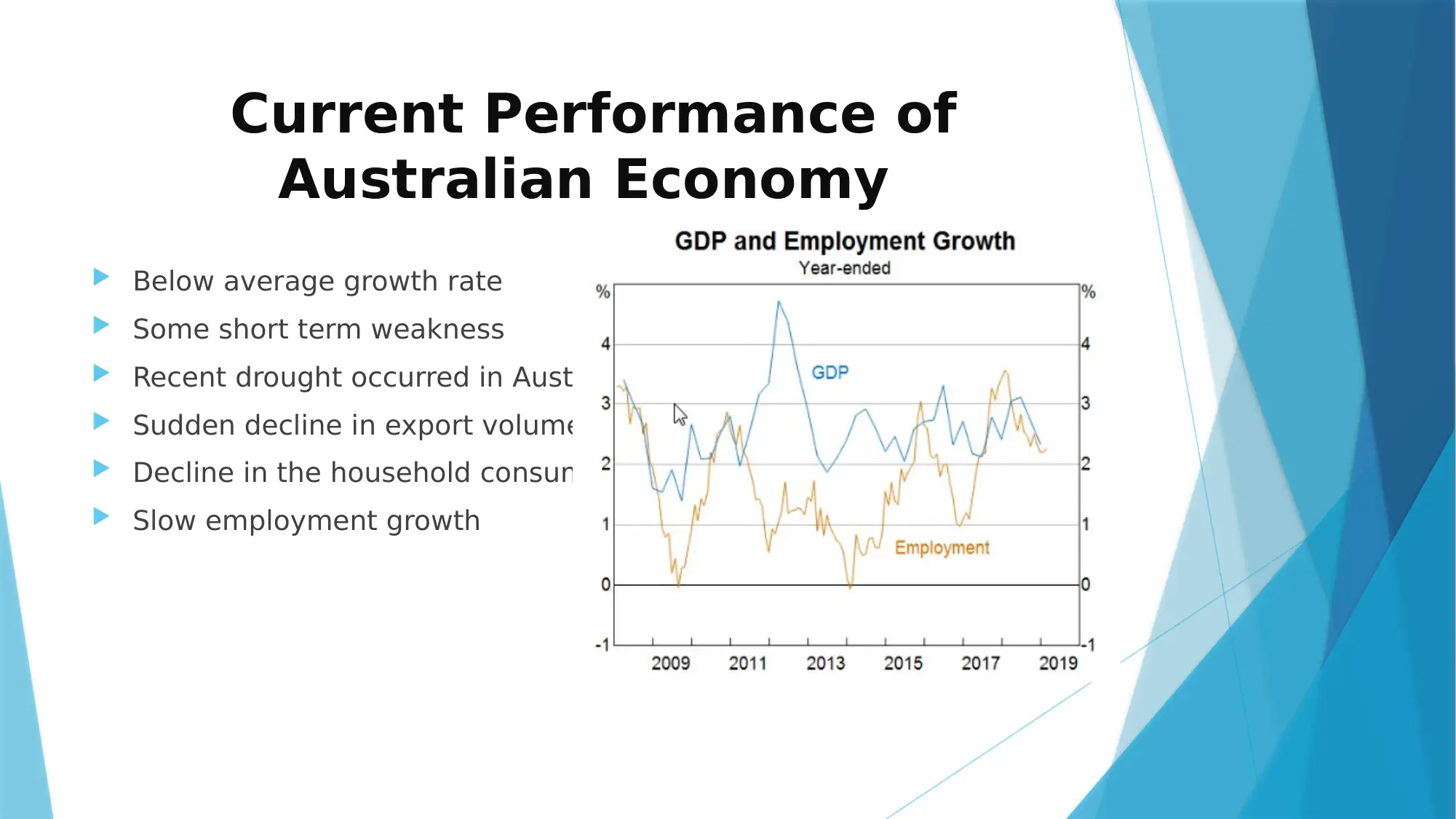

Current Performance of

Australian Economy

Below average growth rate

Some short term weakness

Recent drought occurred in Australia

Sudden decline in export volume

Decline in the household consumption

Slow employment growth

Australian Economy

Below average growth rate

Some short term weakness

Recent drought occurred in Australia

Sudden decline in export volume

Decline in the household consumption

Slow employment growth

Current Performance of

Australian Economy

Poor performance of housing market

Sharp decline in the housing prices

Investment, government spending and net export

Expansion of investment in non-mining sectors

Prospect growth of LNG exports

Growth of manufacturing export

Australian Economy

Poor performance of housing market

Sharp decline in the housing prices

Investment, government spending and net export

Expansion of investment in non-mining sectors

Prospect growth of LNG exports

Growth of manufacturing export

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Factors behind decline in

Economic Growth

Ongoing debate discussing slow economic growth of Australia

slowdown in domestic housing market

decline in economic growth of China

There are other factors as well

Global economic slowdown

Decline in household consumption

Persistently slow wage growth.

Economic Growth

Ongoing debate discussing slow economic growth of Australia

slowdown in domestic housing market

decline in economic growth of China

There are other factors as well

Global economic slowdown

Decline in household consumption

Persistently slow wage growth.

Housing Market

An important part of Australian economy

Continuous increase in dwelling investment

Steady upward trend of housing price

Housing price has started to decline

Sydney and Melbourne

First downward movement in price in the last five years

Increase in supply of houses in the capital cities

Difference in housing market of Sydney and Melbourne

Absorption of excess supply

An important part of Australian economy

Continuous increase in dwelling investment

Steady upward trend of housing price

Housing price has started to decline

Sydney and Melbourne

First downward movement in price in the last five years

Increase in supply of houses in the capital cities

Difference in housing market of Sydney and Melbourne

Absorption of excess supply

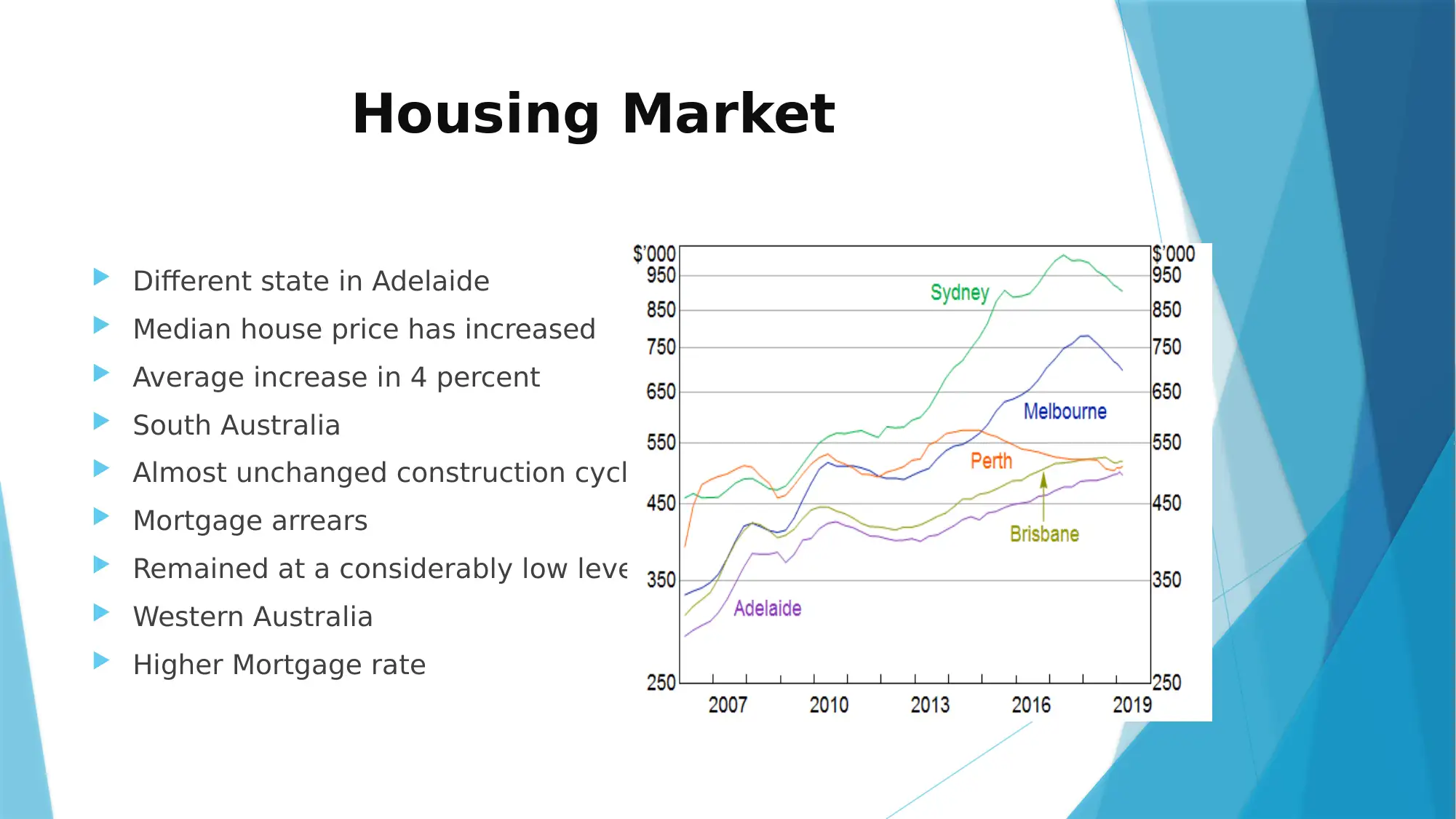

Housing Market

Different state in Adelaide

Median house price has increased

Average increase in 4 percent

South Australia

Almost unchanged construction cycle

Mortgage arrears

Remained at a considerably low level

Western Australia

Higher Mortgage rate

Different state in Adelaide

Median house price has increased

Average increase in 4 percent

South Australia

Almost unchanged construction cycle

Mortgage arrears

Remained at a considerably low level

Western Australia

Higher Mortgage rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Slowdown in Economic Growth

of China

Steady economic growth in China

Industrialization, urbanization and openness of China

Comparative advantage of Australia

Export minerals to China

iron ore and coking coal

One major trading partner of Australia

Strong interrelation between Australia and China

Economic uncertainty in China

Interruption in Australia’s economic growth

of China

Steady economic growth in China

Industrialization, urbanization and openness of China

Comparative advantage of Australia

Export minerals to China

iron ore and coking coal

One major trading partner of Australia

Strong interrelation between Australia and China

Economic uncertainty in China

Interruption in Australia’s economic growth

Slowdown in Economic Growth

of China

Change in composition of growth

From manufacturing to consumption

Slow economic growth in China

Huge amount of debt

Increase in consumption share

Trade war between China and USA

Different channels to impact Australian economy.

International trade, global commodity market and global financial market

Decline in demand for exported good

Decline in MTP.

of China

Change in composition of growth

From manufacturing to consumption

Slow economic growth in China

Huge amount of debt

Increase in consumption share

Trade war between China and USA

Different channels to impact Australian economy.

International trade, global commodity market and global financial market

Decline in demand for exported good

Decline in MTP.

Decline in Household

Consumption

Sharp decline in household consumption

Household consumption

One vital component of GDP

Accounts nearly 60 percent of GDP

Adverse effect on Australia’s economic growth

Slow growth in household consumption

Less than expected growth rate

Consumption

Sharp decline in household consumption

Household consumption

One vital component of GDP

Accounts nearly 60 percent of GDP

Adverse effect on Australia’s economic growth

Slow growth in household consumption

Less than expected growth rate

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Decline in Household

Consumption

Primarily depends on income

Slow growth of real income

Weak growth in household spending

Decline in share of income to employees

Decrease in disposable income

Spending growth exceeds income growth

Spending financed out of saving

Decline in saving to income ratio

Slow growth of real income

Consumption

Primarily depends on income

Slow growth of real income

Weak growth in household spending

Decline in share of income to employees

Decrease in disposable income

Spending growth exceeds income growth

Spending financed out of saving

Decline in saving to income ratio

Slow growth of real income

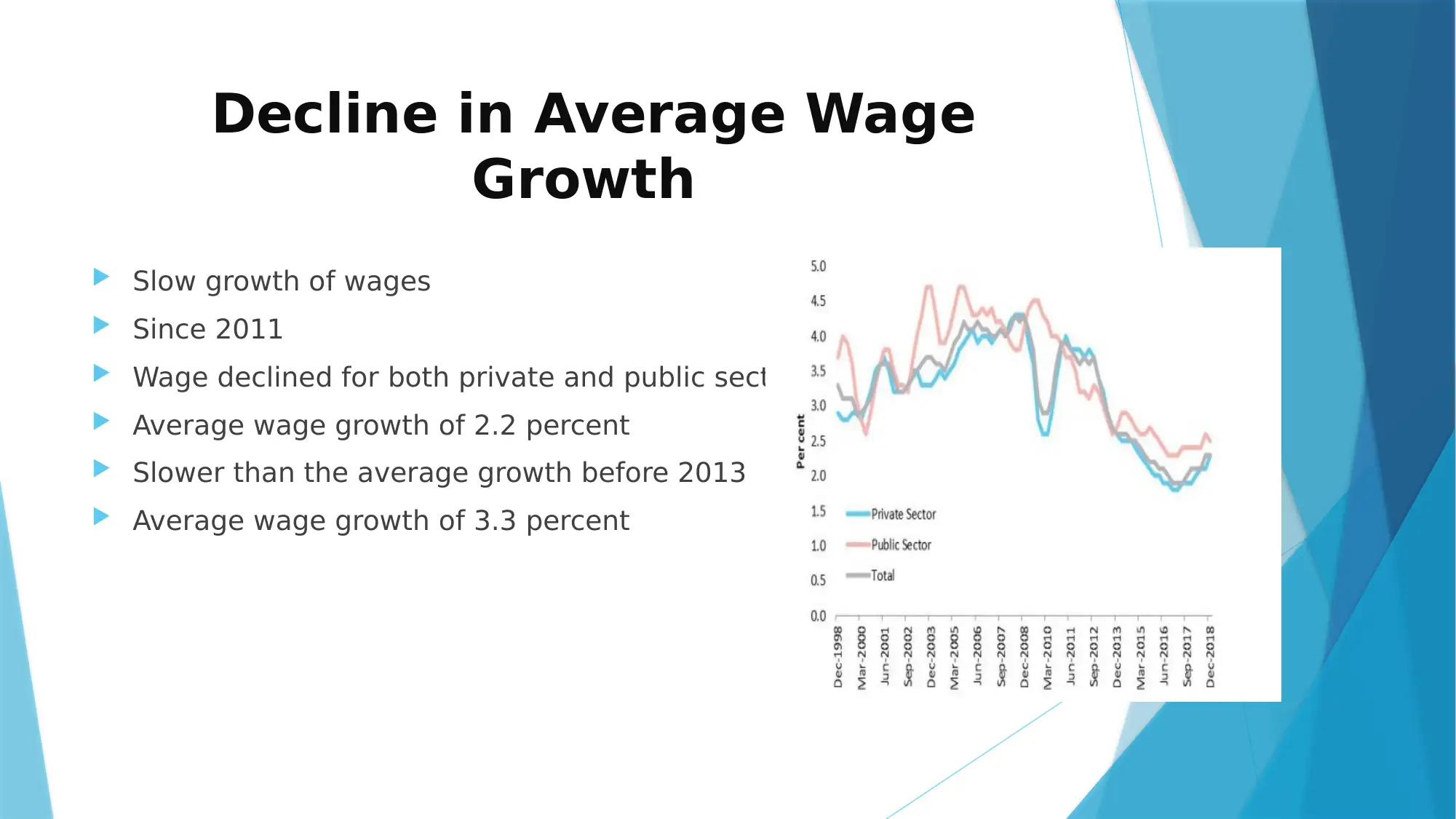

Decline in Average Wage

Growth

Slow growth of wages

Since 2011

Wage declined for both private and public sector

Average wage growth of 2.2 percent

Slower than the average growth before 2013

Average wage growth of 3.3 percent

Growth

Slow growth of wages

Since 2011

Wage declined for both private and public sector

Average wage growth of 2.2 percent

Slower than the average growth before 2013

Average wage growth of 3.3 percent

Decline in Average Wage

Growth

Fall in nominal wage

Modest inflation rate

Decline in real wage

Fall in inflation, cash rate and real wage

Low cash rate of 1.5 percent

Decline in terms of trade

End of mining boom

Firms give low wage to workers

Excess supply or spare capacity of labor market

Growth

Fall in nominal wage

Modest inflation rate

Decline in real wage

Fall in inflation, cash rate and real wage

Low cash rate of 1.5 percent

Decline in terms of trade

End of mining boom

Firms give low wage to workers

Excess supply or spare capacity of labor market

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Economic Growth and Monetary

Policy

Monetary policy

Important policy tool

Stabilize economic performance

Stability in price level

Stable growth and employment

RBA designs monetary policy

Stabilize price and currency

Maintain full employment

Maximize economic welfare and prosperity

Inflation target within 3 percent

Policy

Monetary policy

Important policy tool

Stabilize economic performance

Stability in price level

Stable growth and employment

RBA designs monetary policy

Stabilize price and currency

Maintain full employment

Maximize economic welfare and prosperity

Inflation target within 3 percent

Economic Growth and Monetary

Policy

Cash rate: Main monetary policy instrument

RBA considers both internal and external economic condition

Current decision of monetary policy expansion

RBA tends to low the cash rate

Increase in investment spending

Supportive for investors and mortgage payers

Side effects of the policy

Hurt savers

Lower profitability of banks

Adversely affects shareholder

Policy

Cash rate: Main monetary policy instrument

RBA considers both internal and external economic condition

Current decision of monetary policy expansion

RBA tends to low the cash rate

Increase in investment spending

Supportive for investors and mortgage payers

Side effects of the policy

Hurt savers

Lower profitability of banks

Adversely affects shareholder

Conclusion

Current status of the economy

Provides explanation for RBA’s decision of monetary policy expansion.

Economic growth decline after second quarter of 2018

Discussed different factors explaining economic growth

Both domestic and global economic factor

Slow growth justifies RBA’s decision

Both positive and negative effect

Should evaluate both sides of the policy measure.

Current status of the economy

Provides explanation for RBA’s decision of monetary policy expansion.

Economic growth decline after second quarter of 2018

Discussed different factors explaining economic growth

Both domestic and global economic factor

Slow growth justifies RBA’s decision

Both positive and negative effect

Should evaluate both sides of the policy measure.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

References

Agenor, P. R., & Montiel, P. J. (2015). Development macroeconomics. Princeton

University Press.

Andrews, D., Deutscher, N., Hambur, J., & Hansell, D. (2019, July). Wage Growth

in Australia: Lessons from Longitudinal Microdata. In RBA Annual Conference

Papers (No. acp2019-08). Reserve Bank of Australia.

Carson, E., Fargher, N., & Zhang, Y. (2016). Trends in auditor reporting in

Australia: a synthesis and opportunities for research. Australian Accounting

Review, 26(3), 226-242.

Cassidy, N. (2019, July). Low Wages Growth in Australia–An Overview. In RBA

Annual Conference Papers (No. acp2019-01). Reserve Bank of Australia.

Finlay, R., & Price, F. (2015). Household saving in Australia. The BE Journal of

Macroeconomics, 15(2), 677-704.

Guilmi, C. D., Gallegati, M., & Landini, S. (2017). Interactive

Macroeconomics. Cambridge Books.

Guttmann, R., Hickie, K., Rickards, P., & Roberts, I. (2019). Spillovers to Australia

from the Chinese Economy| Bulletin–June Quarter 2019. Bulletin, (June).

Agenor, P. R., & Montiel, P. J. (2015). Development macroeconomics. Princeton

University Press.

Andrews, D., Deutscher, N., Hambur, J., & Hansell, D. (2019, July). Wage Growth

in Australia: Lessons from Longitudinal Microdata. In RBA Annual Conference

Papers (No. acp2019-08). Reserve Bank of Australia.

Carson, E., Fargher, N., & Zhang, Y. (2016). Trends in auditor reporting in

Australia: a synthesis and opportunities for research. Australian Accounting

Review, 26(3), 226-242.

Cassidy, N. (2019, July). Low Wages Growth in Australia–An Overview. In RBA

Annual Conference Papers (No. acp2019-01). Reserve Bank of Australia.

Finlay, R., & Price, F. (2015). Household saving in Australia. The BE Journal of

Macroeconomics, 15(2), 677-704.

Guilmi, C. D., Gallegati, M., & Landini, S. (2017). Interactive

Macroeconomics. Cambridge Books.

Guttmann, R., Hickie, K., Rickards, P., & Roberts, I. (2019). Spillovers to Australia

from the Chinese Economy| Bulletin–June Quarter 2019. Bulletin, (June).

References

Kohler, M., & Van Der Merwe, M. (2015). Long-run trends in housing price

growth. Reserve Bank Bulletin, 2015, 21-30.

Lardy, N. R. (2016). China: Toward a consumption-driven growth path. In Seeking

Changes: The Economic Development in Contemporary China (pp. 85-111).

Lin, W., & Cheng, Y. (2016). The Bank Credit Transmission Channel of Monetary

Policy in Australia. International Journal of Financial Economics, 5(2), 61-65.

Loukoianova, M. E., Wong, Y. C., & Hussiada, I. (2019). Household Debt,

Consumption, and Monetary Policy in Australia. International Monetary Fund.

Stapledon, N. (2016). The inexorable rise in house prices in Australia since 1970:

Unique or not?. Australian Economic Review, 49(3), 317-327.

Wu, J. C., & Xia, F. D. (2016). Measuring the macroeconomic impact of monetary

policy at the zero lower bound. Journal of Money, Credit and Banking, 48(2-3),

253-291.

Kohler, M., & Van Der Merwe, M. (2015). Long-run trends in housing price

growth. Reserve Bank Bulletin, 2015, 21-30.

Lardy, N. R. (2016). China: Toward a consumption-driven growth path. In Seeking

Changes: The Economic Development in Contemporary China (pp. 85-111).

Lin, W., & Cheng, Y. (2016). The Bank Credit Transmission Channel of Monetary

Policy in Australia. International Journal of Financial Economics, 5(2), 61-65.

Loukoianova, M. E., Wong, Y. C., & Hussiada, I. (2019). Household Debt,

Consumption, and Monetary Policy in Australia. International Monetary Fund.

Stapledon, N. (2016). The inexorable rise in house prices in Australia since 1970:

Unique or not?. Australian Economic Review, 49(3), 317-327.

Wu, J. C., & Xia, F. D. (2016). Measuring the macroeconomic impact of monetary

policy at the zero lower bound. Journal of Money, Credit and Banking, 48(2-3),

253-291.

Thank You

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.