Report on Current Economic Situation in Australia (ECON6000)

VerifiedAdded on 2022/12/29

|17

|4384

|1

Report

AI Summary

This report provides a comprehensive analysis of the Australian economy, examining its performance in 2018 and beyond. It delves into the factors contributing to economic slowdown, including the housing market's performance in Sydney and Melbourne, the decline in China's economic growth, and its impact on Australian exports. The report also explores the Reserve Bank of Australia's monetary policy, particularly the use of the cash rate to stimulate economic growth. It discusses the decline in household consumption, employment growth, and the impact of drought on agricultural exports. Furthermore, the analysis covers the interplay between domestic and global economic factors, offering insights into the current economic landscape and potential future trends. The report also looks at the impact of the decline in housing prices and the impact of the slowdown in the Chinese economy on Australia. The report is a detailed analysis of the economic principles and decision-making processes in Australia.

Running head: ECONOMIC PRINCIPLES AND DECISION MAKING

Economic Principles and Decision Making

Name of the Student

Name of the University

Course ID

Economic Principles and Decision Making

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIC PRINCIPLES AND DECISION MAKING

Table of Contents

Introduction................................................................................................................................2

Current performance of Australian economy.............................................................................3

Factors behind decline in economic growth...............................................................................5

Housing market......................................................................................................................5

Slowdown in economic growth of China...............................................................................7

Decline in household consumption........................................................................................9

Decline in average wage growth..........................................................................................10

Expectation about economic growth and monetary policy......................................................11

Conclusion................................................................................................................................12

Reference list............................................................................................................................13

Table of Contents

Introduction................................................................................................................................2

Current performance of Australian economy.............................................................................3

Factors behind decline in economic growth...............................................................................5

Housing market......................................................................................................................5

Slowdown in economic growth of China...............................................................................7

Decline in household consumption........................................................................................9

Decline in average wage growth..........................................................................................10

Expectation about economic growth and monetary policy......................................................11

Conclusion................................................................................................................................12

Reference list............................................................................................................................13

2ECONOMIC PRINCIPLES AND DECISION MAKING

Introduction

Australia’s economic performance in the year 2018 can be segregated into two parts.

The economy of Australia recorded a standard performance in the beginning of 2018.

Australia in the beginning of the year maintained an average growth rate of 3.8 percent.

During the first two quarters of 2018, GDP growth rate of Australia was above 3 percent.

Different reasons explain the steady economic performance during the first half. The

particular factors that need to be mentioned include growth of export and a strong

performance of the household sector. After maintaining the stable performance in the first

half, there was a sudden break in growth performance of Australia in the latter half of 2018.

Economic growth during this time started to decline. This was the slowest growth rate for

Australian economy since 2008.

Economic slowdown in Australia can be explained by a number of different factors.

One widely held believe regarding slow economic growth of Australia is that economic slow-

down of China mostly explain the slow growth of Australia. Apart China’s slow economic

growth there are other reasons explaining decline in economic growth of Australia. One

significant factor is an economic slowdown is the slow growth of global economy during the

second half of 2019. Apart from global economic slowdown domestic economic factors

explaining economic performance of Australia during latter half of 2018 include poor

performance of housing market specially that in Melbourne and Sydney.

In order to stabilize economic performance of Australia Reserve Bank of Australia

designs monetary policy. The main instrument of RBA’s monetary policy is the cash rate

which in turn affects all other interest rate in the economy. Realizing the present economic

slowdown of Australia RBA is focusing to design an expansionary monetary policy by

Introduction

Australia’s economic performance in the year 2018 can be segregated into two parts.

The economy of Australia recorded a standard performance in the beginning of 2018.

Australia in the beginning of the year maintained an average growth rate of 3.8 percent.

During the first two quarters of 2018, GDP growth rate of Australia was above 3 percent.

Different reasons explain the steady economic performance during the first half. The

particular factors that need to be mentioned include growth of export and a strong

performance of the household sector. After maintaining the stable performance in the first

half, there was a sudden break in growth performance of Australia in the latter half of 2018.

Economic growth during this time started to decline. This was the slowest growth rate for

Australian economy since 2008.

Economic slowdown in Australia can be explained by a number of different factors.

One widely held believe regarding slow economic growth of Australia is that economic slow-

down of China mostly explain the slow growth of Australia. Apart China’s slow economic

growth there are other reasons explaining decline in economic growth of Australia. One

significant factor is an economic slowdown is the slow growth of global economy during the

second half of 2019. Apart from global economic slowdown domestic economic factors

explaining economic performance of Australia during latter half of 2018 include poor

performance of housing market specially that in Melbourne and Sydney.

In order to stabilize economic performance of Australia Reserve Bank of Australia

designs monetary policy. The main instrument of RBA’s monetary policy is the cash rate

which in turn affects all other interest rate in the economy. Realizing the present economic

slowdown of Australia RBA is focusing to design an expansionary monetary policy by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIC PRINCIPLES AND DECISION MAKING

lowering the cash rate to 1.5 percent. The report discusses factors responsible for economic

slowdown in Australia.

Current performance of Australian economy

Australian economy since the latter half of 2018 started to account a growth rate

which is below the expected average growth rate. Some of the weaknesses of economic

performances are short term. The temporary factors for economic slowdown are recent

drought occurred in Australia and sudden decline in export volume. Household consumption

is one of the important components of Australian GDP. Decline in the household

consumption contributed to a decline in economic growth. At the beginning of the year,

household consumption though follows its usual pattern in the latter half however household

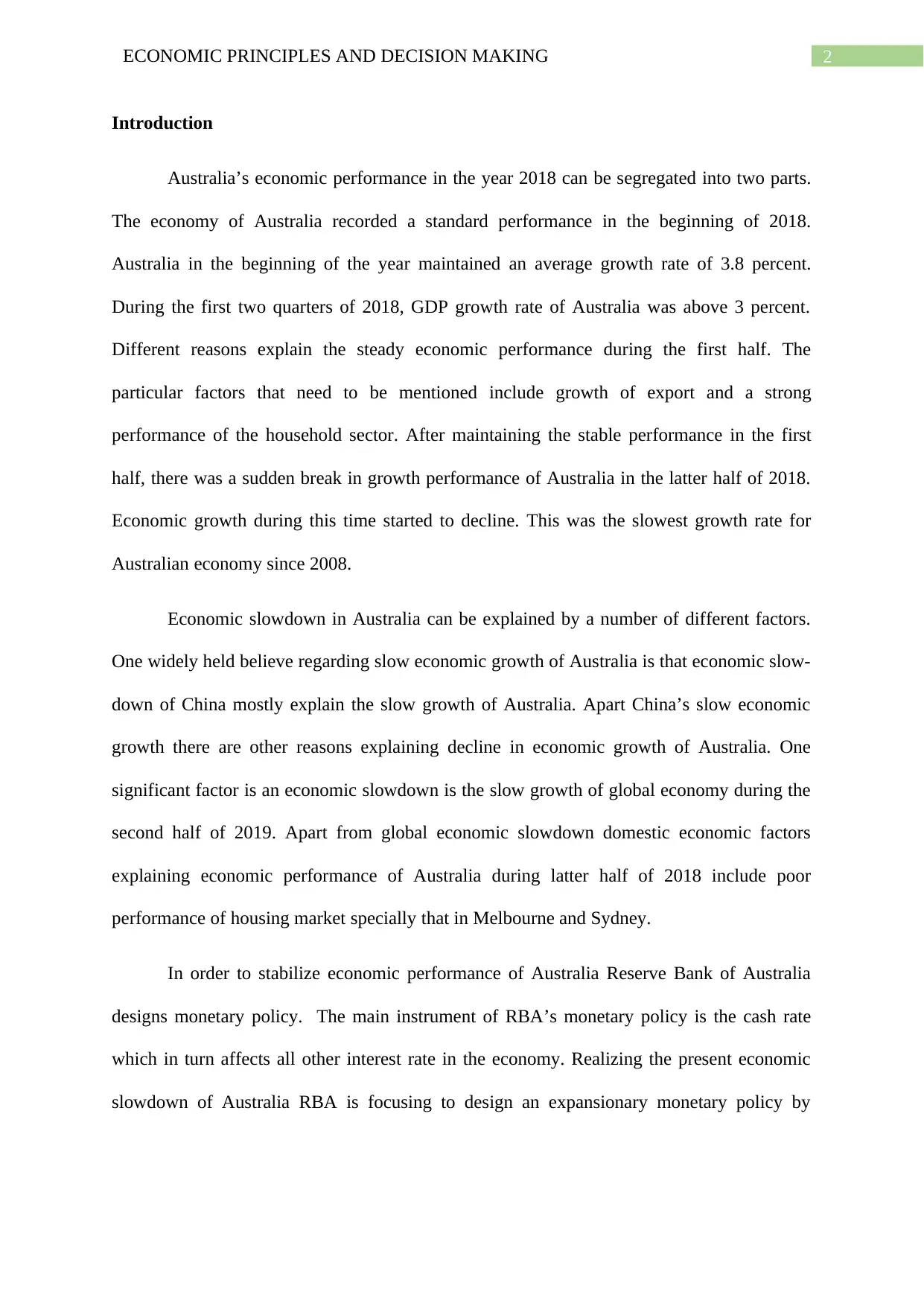

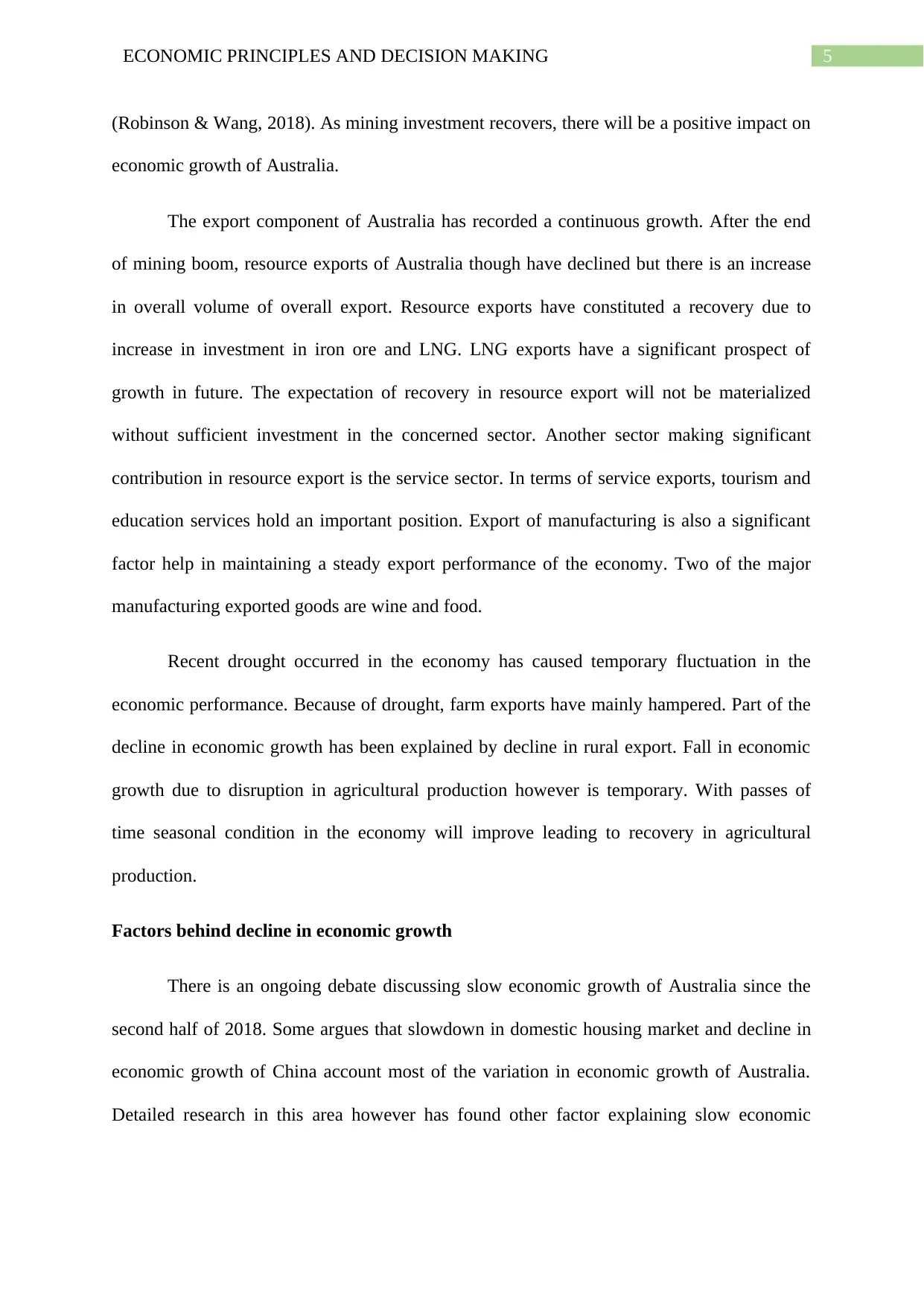

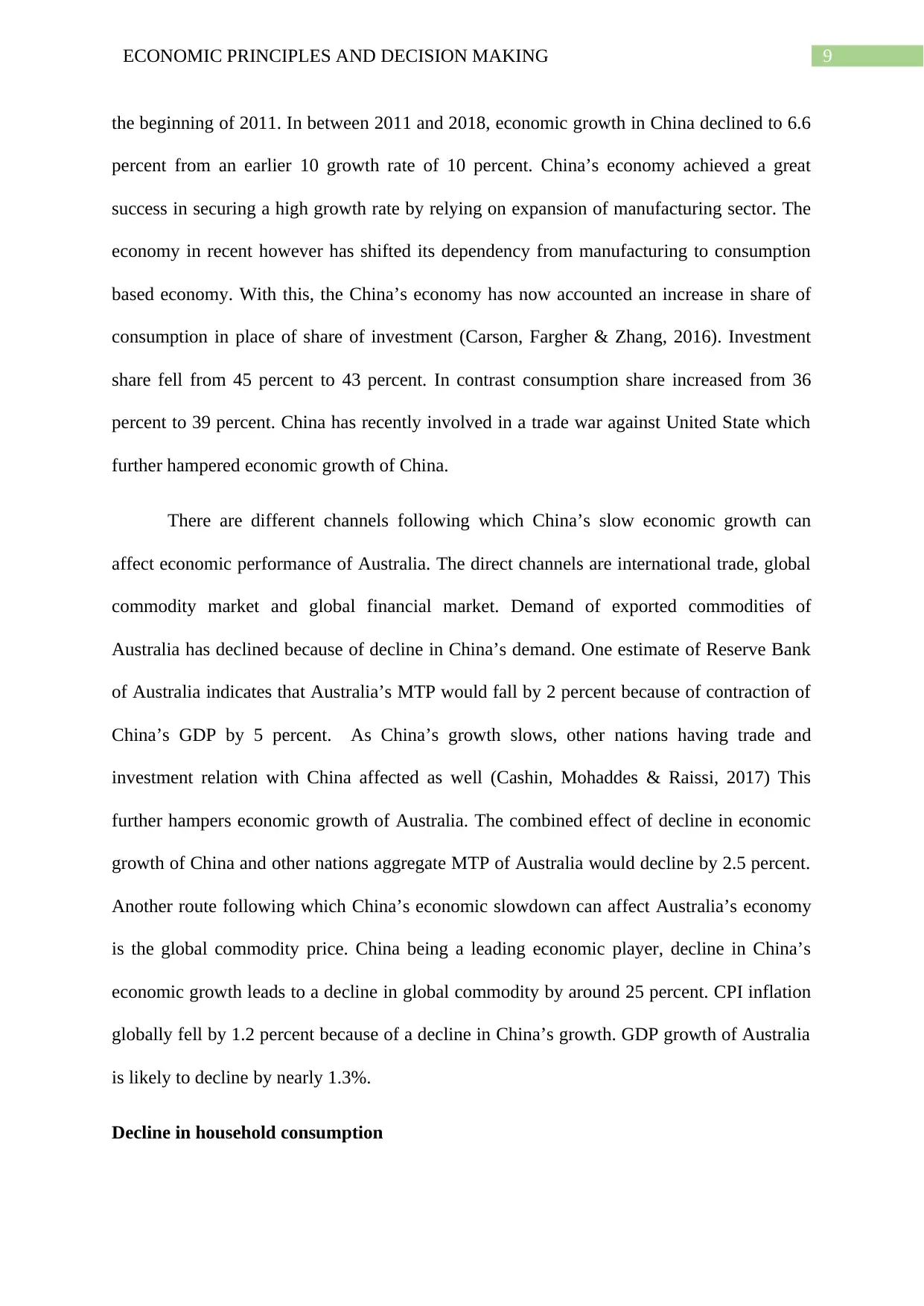

consumption fell below average trend (Nguyen & Wang, 2019). Employment growth in

Australia is below the GDP growth which partly explains decline in household consumption.

This is shown in the figure below.

lowering the cash rate to 1.5 percent. The report discusses factors responsible for economic

slowdown in Australia.

Current performance of Australian economy

Australian economy since the latter half of 2018 started to account a growth rate

which is below the expected average growth rate. Some of the weaknesses of economic

performances are short term. The temporary factors for economic slowdown are recent

drought occurred in Australia and sudden decline in export volume. Household consumption

is one of the important components of Australian GDP. Decline in the household

consumption contributed to a decline in economic growth. At the beginning of the year,

household consumption though follows its usual pattern in the latter half however household

consumption fell below average trend (Nguyen & Wang, 2019). Employment growth in

Australia is below the GDP growth which partly explains decline in household consumption.

This is shown in the figure below.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIC PRINCIPLES AND DECISION MAKING

Figure 1: Comparison of Employment and GDP growth

(Source: Rba.gov.au., 2019)

In addition to a decline in household consumption, performance of housing market

was not satisfactory. The turmoil in housing market is particularly visible in two of the major

capital cities of Australia namely Sydney and Melbourne. After recording a steady increase

housing market suddenly experienced a slowdown due to decline in sharp decline in the

housing prices especially in capital cities. As housing market seems to be less attractive place

of investment people started to invest less on housing. With a decline in housing investment

spending of people on thing related to household furnishing also declined significantly.

Australian during this time also reduced their spending on cars. The phenomenon of housing

market slowdown however differs regionally. In New South Wales spending of household is

relatively low compared to that in Victoria (Rba.gov.au., 2019). Some of the difference in the

impact of decline in household performance has been accounted by the difference in

population growth between New South Wales and Victoria. A relatively slow growth of

household income is mainly responsible for decline in consumption of household. Going by

the ongoing trend, household income is expected to remain lower for upcoming year as well.

Except consumption, other factor explaining variation in GDP include investment,

government spending and net export (Agenor & Montiel, 2015). Variation in performance of

these factors account for changes in growth of GDP in the economy. Consumption growth

though remains low but performance of other components remains satisfactory. End of

mining boom in the beginning of the decade adversely affected Australia’s economic growth.

This adverse effect was offset by expansion of investment in non-mining sectors and service

sectors. Besides, there is a possibility of recovery in investment in the mining sector

Figure 1: Comparison of Employment and GDP growth

(Source: Rba.gov.au., 2019)

In addition to a decline in household consumption, performance of housing market

was not satisfactory. The turmoil in housing market is particularly visible in two of the major

capital cities of Australia namely Sydney and Melbourne. After recording a steady increase

housing market suddenly experienced a slowdown due to decline in sharp decline in the

housing prices especially in capital cities. As housing market seems to be less attractive place

of investment people started to invest less on housing. With a decline in housing investment

spending of people on thing related to household furnishing also declined significantly.

Australian during this time also reduced their spending on cars. The phenomenon of housing

market slowdown however differs regionally. In New South Wales spending of household is

relatively low compared to that in Victoria (Rba.gov.au., 2019). Some of the difference in the

impact of decline in household performance has been accounted by the difference in

population growth between New South Wales and Victoria. A relatively slow growth of

household income is mainly responsible for decline in consumption of household. Going by

the ongoing trend, household income is expected to remain lower for upcoming year as well.

Except consumption, other factor explaining variation in GDP include investment,

government spending and net export (Agenor & Montiel, 2015). Variation in performance of

these factors account for changes in growth of GDP in the economy. Consumption growth

though remains low but performance of other components remains satisfactory. End of

mining boom in the beginning of the decade adversely affected Australia’s economic growth.

This adverse effect was offset by expansion of investment in non-mining sectors and service

sectors. Besides, there is a possibility of recovery in investment in the mining sector

5ECONOMIC PRINCIPLES AND DECISION MAKING

(Robinson & Wang, 2018). As mining investment recovers, there will be a positive impact on

economic growth of Australia.

The export component of Australia has recorded a continuous growth. After the end

of mining boom, resource exports of Australia though have declined but there is an increase

in overall volume of overall export. Resource exports have constituted a recovery due to

increase in investment in iron ore and LNG. LNG exports have a significant prospect of

growth in future. The expectation of recovery in resource export will not be materialized

without sufficient investment in the concerned sector. Another sector making significant

contribution in resource export is the service sector. In terms of service exports, tourism and

education services hold an important position. Export of manufacturing is also a significant

factor help in maintaining a steady export performance of the economy. Two of the major

manufacturing exported goods are wine and food.

Recent drought occurred in the economy has caused temporary fluctuation in the

economic performance. Because of drought, farm exports have mainly hampered. Part of the

decline in economic growth has been explained by decline in rural export. Fall in economic

growth due to disruption in agricultural production however is temporary. With passes of

time seasonal condition in the economy will improve leading to recovery in agricultural

production.

Factors behind decline in economic growth

There is an ongoing debate discussing slow economic growth of Australia since the

second half of 2018. Some argues that slowdown in domestic housing market and decline in

economic growth of China account most of the variation in economic growth of Australia.

Detailed research in this area however has found other factor explaining slow economic

(Robinson & Wang, 2018). As mining investment recovers, there will be a positive impact on

economic growth of Australia.

The export component of Australia has recorded a continuous growth. After the end

of mining boom, resource exports of Australia though have declined but there is an increase

in overall volume of overall export. Resource exports have constituted a recovery due to

increase in investment in iron ore and LNG. LNG exports have a significant prospect of

growth in future. The expectation of recovery in resource export will not be materialized

without sufficient investment in the concerned sector. Another sector making significant

contribution in resource export is the service sector. In terms of service exports, tourism and

education services hold an important position. Export of manufacturing is also a significant

factor help in maintaining a steady export performance of the economy. Two of the major

manufacturing exported goods are wine and food.

Recent drought occurred in the economy has caused temporary fluctuation in the

economic performance. Because of drought, farm exports have mainly hampered. Part of the

decline in economic growth has been explained by decline in rural export. Fall in economic

growth due to disruption in agricultural production however is temporary. With passes of

time seasonal condition in the economy will improve leading to recovery in agricultural

production.

Factors behind decline in economic growth

There is an ongoing debate discussing slow economic growth of Australia since the

second half of 2018. Some argues that slowdown in domestic housing market and decline in

economic growth of China account most of the variation in economic growth of Australia.

Detailed research in this area however has found other factor explaining slow economic

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIC PRINCIPLES AND DECISION MAKING

growth for the nation. Important factors behind slow economic growth of Australia are briefly

discussed in the following section.

Housing market

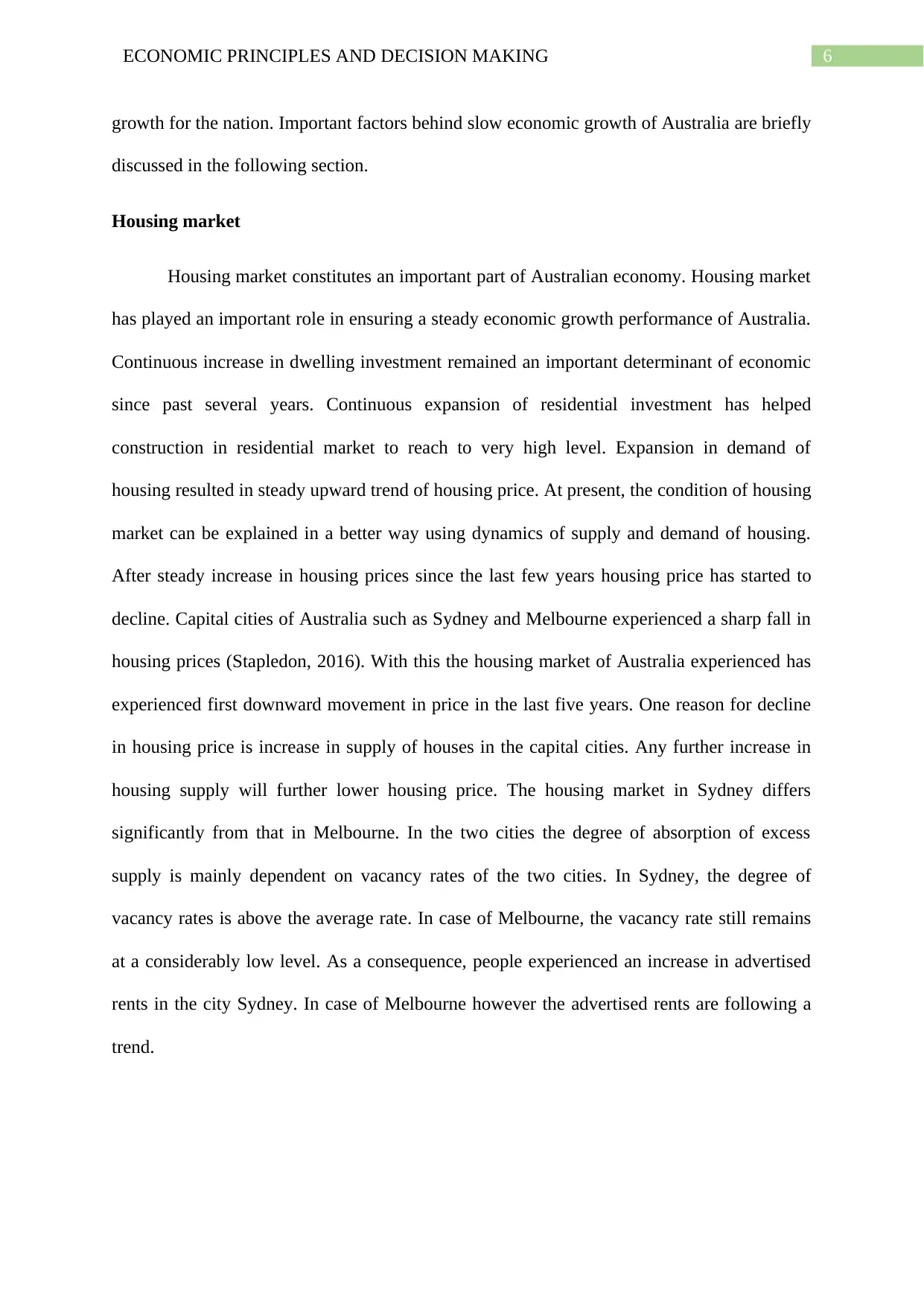

Housing market constitutes an important part of Australian economy. Housing market

has played an important role in ensuring a steady economic growth performance of Australia.

Continuous increase in dwelling investment remained an important determinant of economic

since past several years. Continuous expansion of residential investment has helped

construction in residential market to reach to very high level. Expansion in demand of

housing resulted in steady upward trend of housing price. At present, the condition of housing

market can be explained in a better way using dynamics of supply and demand of housing.

After steady increase in housing prices since the last few years housing price has started to

decline. Capital cities of Australia such as Sydney and Melbourne experienced a sharp fall in

housing prices (Stapledon, 2016). With this the housing market of Australia experienced has

experienced first downward movement in price in the last five years. One reason for decline

in housing price is increase in supply of houses in the capital cities. Any further increase in

housing supply will further lower housing price. The housing market in Sydney differs

significantly from that in Melbourne. In the two cities the degree of absorption of excess

supply is mainly dependent on vacancy rates of the two cities. In Sydney, the degree of

vacancy rates is above the average rate. In case of Melbourne, the vacancy rate still remains

at a considerably low level. As a consequence, people experienced an increase in advertised

rents in the city Sydney. In case of Melbourne however the advertised rents are following a

trend.

growth for the nation. Important factors behind slow economic growth of Australia are briefly

discussed in the following section.

Housing market

Housing market constitutes an important part of Australian economy. Housing market

has played an important role in ensuring a steady economic growth performance of Australia.

Continuous increase in dwelling investment remained an important determinant of economic

since past several years. Continuous expansion of residential investment has helped

construction in residential market to reach to very high level. Expansion in demand of

housing resulted in steady upward trend of housing price. At present, the condition of housing

market can be explained in a better way using dynamics of supply and demand of housing.

After steady increase in housing prices since the last few years housing price has started to

decline. Capital cities of Australia such as Sydney and Melbourne experienced a sharp fall in

housing prices (Stapledon, 2016). With this the housing market of Australia experienced has

experienced first downward movement in price in the last five years. One reason for decline

in housing price is increase in supply of houses in the capital cities. Any further increase in

housing supply will further lower housing price. The housing market in Sydney differs

significantly from that in Melbourne. In the two cities the degree of absorption of excess

supply is mainly dependent on vacancy rates of the two cities. In Sydney, the degree of

vacancy rates is above the average rate. In case of Melbourne, the vacancy rate still remains

at a considerably low level. As a consequence, people experienced an increase in advertised

rents in the city Sydney. In case of Melbourne however the advertised rents are following a

trend.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIC PRINCIPLES AND DECISION MAKING

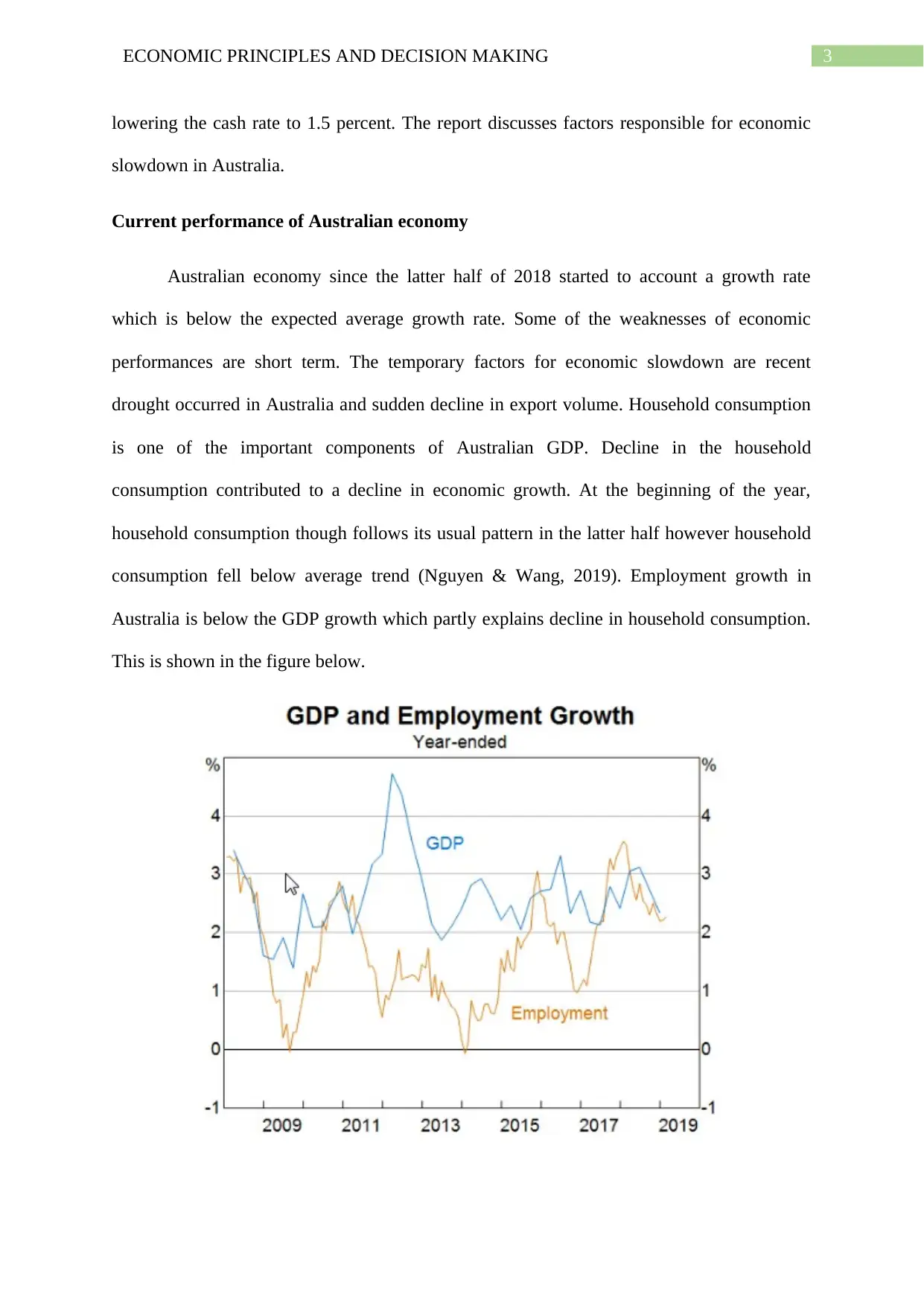

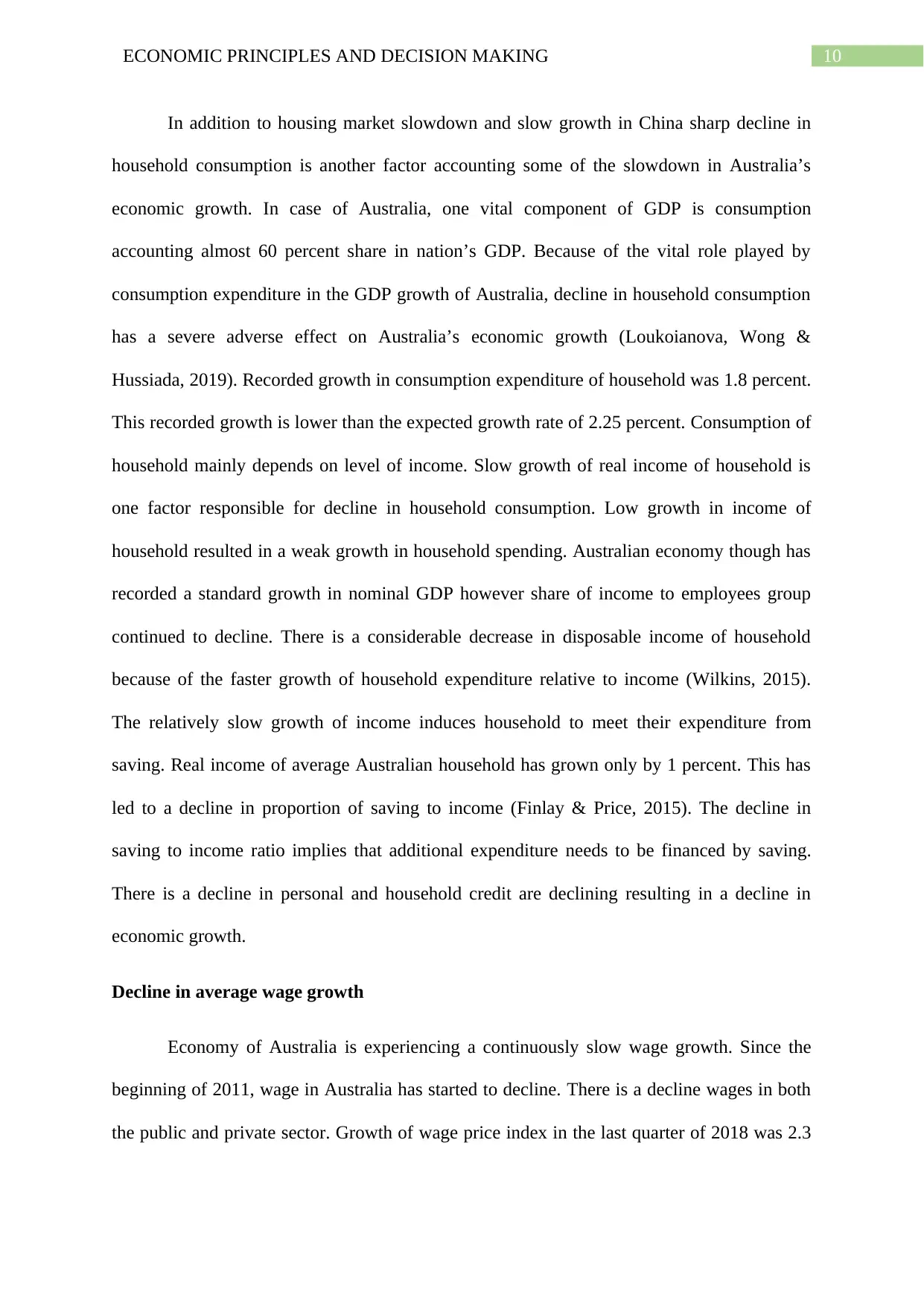

Figure 2: State of housing market in Australia

(Source: Businessinsider.com.au., 2019)

In Adelaide, the condition of housing market is not so pronounced. Median house

price in the city has constituted an increasing trend in the past few years. The growth rate of

housing price in Adelaide is close to 4 percent. For South Australia, the construction cycle

remained almost unchanged relative to other Australian states. Mortgage arrears is another

significant factors to be considered in the context of housing market (Kohler & Van Der

Merwe, 2015). Despite slow increase in mortgage rates, it mostly remained at a considerably

low level. Higher rate of increase in the mortgage rates has been experienced in Western

Australia.

At present, housing price in Australia has reached to the historically lowest level ever.

Housing price has experienced a continuous downfall in the last 20 months. In May, housing

price declined by 0.4 percent. There is a cumulative decline in price of housing by 8.2

percent. The recent downfall in housing price is much severe than that occurred during 1980s.

This is the longest ever decline in housing price (Wood & Ong, 2017). Considering the

current trend, housing price in Australia forecasted to decline further by 10 percent. With a

Figure 2: State of housing market in Australia

(Source: Businessinsider.com.au., 2019)

In Adelaide, the condition of housing market is not so pronounced. Median house

price in the city has constituted an increasing trend in the past few years. The growth rate of

housing price in Adelaide is close to 4 percent. For South Australia, the construction cycle

remained almost unchanged relative to other Australian states. Mortgage arrears is another

significant factors to be considered in the context of housing market (Kohler & Van Der

Merwe, 2015). Despite slow increase in mortgage rates, it mostly remained at a considerably

low level. Higher rate of increase in the mortgage rates has been experienced in Western

Australia.

At present, housing price in Australia has reached to the historically lowest level ever.

Housing price has experienced a continuous downfall in the last 20 months. In May, housing

price declined by 0.4 percent. There is a cumulative decline in price of housing by 8.2

percent. The recent downfall in housing price is much severe than that occurred during 1980s.

This is the longest ever decline in housing price (Wood & Ong, 2017). Considering the

current trend, housing price in Australia forecasted to decline further by 10 percent. With a

8ECONOMIC PRINCIPLES AND DECISION MAKING

contraction in housing market construction sector of the economy is likely to contract causing

a considerable slowdown for the economy as a whole.

Slowdown in economic growth of China

Another factor explaining a relatively slow growth of Australian economy is the

decline in economic growth of China. China’s economy in the last few decades experienced

steady economic growth. Rapid expansion of economic growth of China is due to

industrialization, urbanization and openness of China towards international trade (Lardy,

2016). The expansion of manufacturing sector of China was highly dependent on imported

natural resources. This created a vast export market of Australia. Australia experiences a

comparative advantage in exporting different minerals because of its huge stock of minerals.

China mainly import a huge amount of iron ore and coking coal from Australia. With a

growing volume Australian export to China, China has become one major trading partner of

Australia. China account almost one third of total Australian export. Besides export, one fifth

of Australian imports comes from China. The trade relation strengthens economic relation

between the two nation making the nations interdependent in terms of economic

performances (Cheng, 2019). Growing uncertainty in the China’s economy thus puts a great

threat towards economic expansion of Australia.

After recording a steady growth for a long period, the economy of China now has

entered to a pace of slow economic growth. Economic slowdown of China is mainly due to a

change in growth composition. Economic growth of China initially was largely attributed

from expansion of manufacturing sector. After the financial crisis, economic recovery of

China mostly relied on the investment in infrastructural and residential area. This left the

economy with a large amount of debt (Guttmann et al., 2019). This resulted in a huge demand

for goods exported from Australia. China’s economic growth however started to decline since

contraction in housing market construction sector of the economy is likely to contract causing

a considerable slowdown for the economy as a whole.

Slowdown in economic growth of China

Another factor explaining a relatively slow growth of Australian economy is the

decline in economic growth of China. China’s economy in the last few decades experienced

steady economic growth. Rapid expansion of economic growth of China is due to

industrialization, urbanization and openness of China towards international trade (Lardy,

2016). The expansion of manufacturing sector of China was highly dependent on imported

natural resources. This created a vast export market of Australia. Australia experiences a

comparative advantage in exporting different minerals because of its huge stock of minerals.

China mainly import a huge amount of iron ore and coking coal from Australia. With a

growing volume Australian export to China, China has become one major trading partner of

Australia. China account almost one third of total Australian export. Besides export, one fifth

of Australian imports comes from China. The trade relation strengthens economic relation

between the two nation making the nations interdependent in terms of economic

performances (Cheng, 2019). Growing uncertainty in the China’s economy thus puts a great

threat towards economic expansion of Australia.

After recording a steady growth for a long period, the economy of China now has

entered to a pace of slow economic growth. Economic slowdown of China is mainly due to a

change in growth composition. Economic growth of China initially was largely attributed

from expansion of manufacturing sector. After the financial crisis, economic recovery of

China mostly relied on the investment in infrastructural and residential area. This left the

economy with a large amount of debt (Guttmann et al., 2019). This resulted in a huge demand

for goods exported from Australia. China’s economic growth however started to decline since

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMIC PRINCIPLES AND DECISION MAKING

the beginning of 2011. In between 2011 and 2018, economic growth in China declined to 6.6

percent from an earlier 10 growth rate of 10 percent. China’s economy achieved a great

success in securing a high growth rate by relying on expansion of manufacturing sector. The

economy in recent however has shifted its dependency from manufacturing to consumption

based economy. With this, the China’s economy has now accounted an increase in share of

consumption in place of share of investment (Carson, Fargher & Zhang, 2016). Investment

share fell from 45 percent to 43 percent. In contrast consumption share increased from 36

percent to 39 percent. China has recently involved in a trade war against United State which

further hampered economic growth of China.

There are different channels following which China’s slow economic growth can

affect economic performance of Australia. The direct channels are international trade, global

commodity market and global financial market. Demand of exported commodities of

Australia has declined because of decline in China’s demand. One estimate of Reserve Bank

of Australia indicates that Australia’s MTP would fall by 2 percent because of contraction of

China’s GDP by 5 percent. As China’s growth slows, other nations having trade and

investment relation with China affected as well (Cashin, Mohaddes & Raissi, 2017) This

further hampers economic growth of Australia. The combined effect of decline in economic

growth of China and other nations aggregate MTP of Australia would decline by 2.5 percent.

Another route following which China’s economic slowdown can affect Australia’s economy

is the global commodity price. China being a leading economic player, decline in China’s

economic growth leads to a decline in global commodity by around 25 percent. CPI inflation

globally fell by 1.2 percent because of a decline in China’s growth. GDP growth of Australia

is likely to decline by nearly 1.3%.

Decline in household consumption

the beginning of 2011. In between 2011 and 2018, economic growth in China declined to 6.6

percent from an earlier 10 growth rate of 10 percent. China’s economy achieved a great

success in securing a high growth rate by relying on expansion of manufacturing sector. The

economy in recent however has shifted its dependency from manufacturing to consumption

based economy. With this, the China’s economy has now accounted an increase in share of

consumption in place of share of investment (Carson, Fargher & Zhang, 2016). Investment

share fell from 45 percent to 43 percent. In contrast consumption share increased from 36

percent to 39 percent. China has recently involved in a trade war against United State which

further hampered economic growth of China.

There are different channels following which China’s slow economic growth can

affect economic performance of Australia. The direct channels are international trade, global

commodity market and global financial market. Demand of exported commodities of

Australia has declined because of decline in China’s demand. One estimate of Reserve Bank

of Australia indicates that Australia’s MTP would fall by 2 percent because of contraction of

China’s GDP by 5 percent. As China’s growth slows, other nations having trade and

investment relation with China affected as well (Cashin, Mohaddes & Raissi, 2017) This

further hampers economic growth of Australia. The combined effect of decline in economic

growth of China and other nations aggregate MTP of Australia would decline by 2.5 percent.

Another route following which China’s economic slowdown can affect Australia’s economy

is the global commodity price. China being a leading economic player, decline in China’s

economic growth leads to a decline in global commodity by around 25 percent. CPI inflation

globally fell by 1.2 percent because of a decline in China’s growth. GDP growth of Australia

is likely to decline by nearly 1.3%.

Decline in household consumption

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMIC PRINCIPLES AND DECISION MAKING

In addition to housing market slowdown and slow growth in China sharp decline in

household consumption is another factor accounting some of the slowdown in Australia’s

economic growth. In case of Australia, one vital component of GDP is consumption

accounting almost 60 percent share in nation’s GDP. Because of the vital role played by

consumption expenditure in the GDP growth of Australia, decline in household consumption

has a severe adverse effect on Australia’s economic growth (Loukoianova, Wong &

Hussiada, 2019). Recorded growth in consumption expenditure of household was 1.8 percent.

This recorded growth is lower than the expected growth rate of 2.25 percent. Consumption of

household mainly depends on level of income. Slow growth of real income of household is

one factor responsible for decline in household consumption. Low growth in income of

household resulted in a weak growth in household spending. Australian economy though has

recorded a standard growth in nominal GDP however share of income to employees group

continued to decline. There is a considerable decrease in disposable income of household

because of the faster growth of household expenditure relative to income (Wilkins, 2015).

The relatively slow growth of income induces household to meet their expenditure from

saving. Real income of average Australian household has grown only by 1 percent. This has

led to a decline in proportion of saving to income (Finlay & Price, 2015). The decline in

saving to income ratio implies that additional expenditure needs to be financed by saving.

There is a decline in personal and household credit are declining resulting in a decline in

economic growth.

Decline in average wage growth

Economy of Australia is experiencing a continuously slow wage growth. Since the

beginning of 2011, wage in Australia has started to decline. There is a decline wages in both

the public and private sector. Growth of wage price index in the last quarter of 2018 was 2.3

In addition to housing market slowdown and slow growth in China sharp decline in

household consumption is another factor accounting some of the slowdown in Australia’s

economic growth. In case of Australia, one vital component of GDP is consumption

accounting almost 60 percent share in nation’s GDP. Because of the vital role played by

consumption expenditure in the GDP growth of Australia, decline in household consumption

has a severe adverse effect on Australia’s economic growth (Loukoianova, Wong &

Hussiada, 2019). Recorded growth in consumption expenditure of household was 1.8 percent.

This recorded growth is lower than the expected growth rate of 2.25 percent. Consumption of

household mainly depends on level of income. Slow growth of real income of household is

one factor responsible for decline in household consumption. Low growth in income of

household resulted in a weak growth in household spending. Australian economy though has

recorded a standard growth in nominal GDP however share of income to employees group

continued to decline. There is a considerable decrease in disposable income of household

because of the faster growth of household expenditure relative to income (Wilkins, 2015).

The relatively slow growth of income induces household to meet their expenditure from

saving. Real income of average Australian household has grown only by 1 percent. This has

led to a decline in proportion of saving to income (Finlay & Price, 2015). The decline in

saving to income ratio implies that additional expenditure needs to be financed by saving.

There is a decline in personal and household credit are declining resulting in a decline in

economic growth.

Decline in average wage growth

Economy of Australia is experiencing a continuously slow wage growth. Since the

beginning of 2011, wage in Australia has started to decline. There is a decline wages in both

the public and private sector. Growth of wage price index in the last quarter of 2018 was 2.3

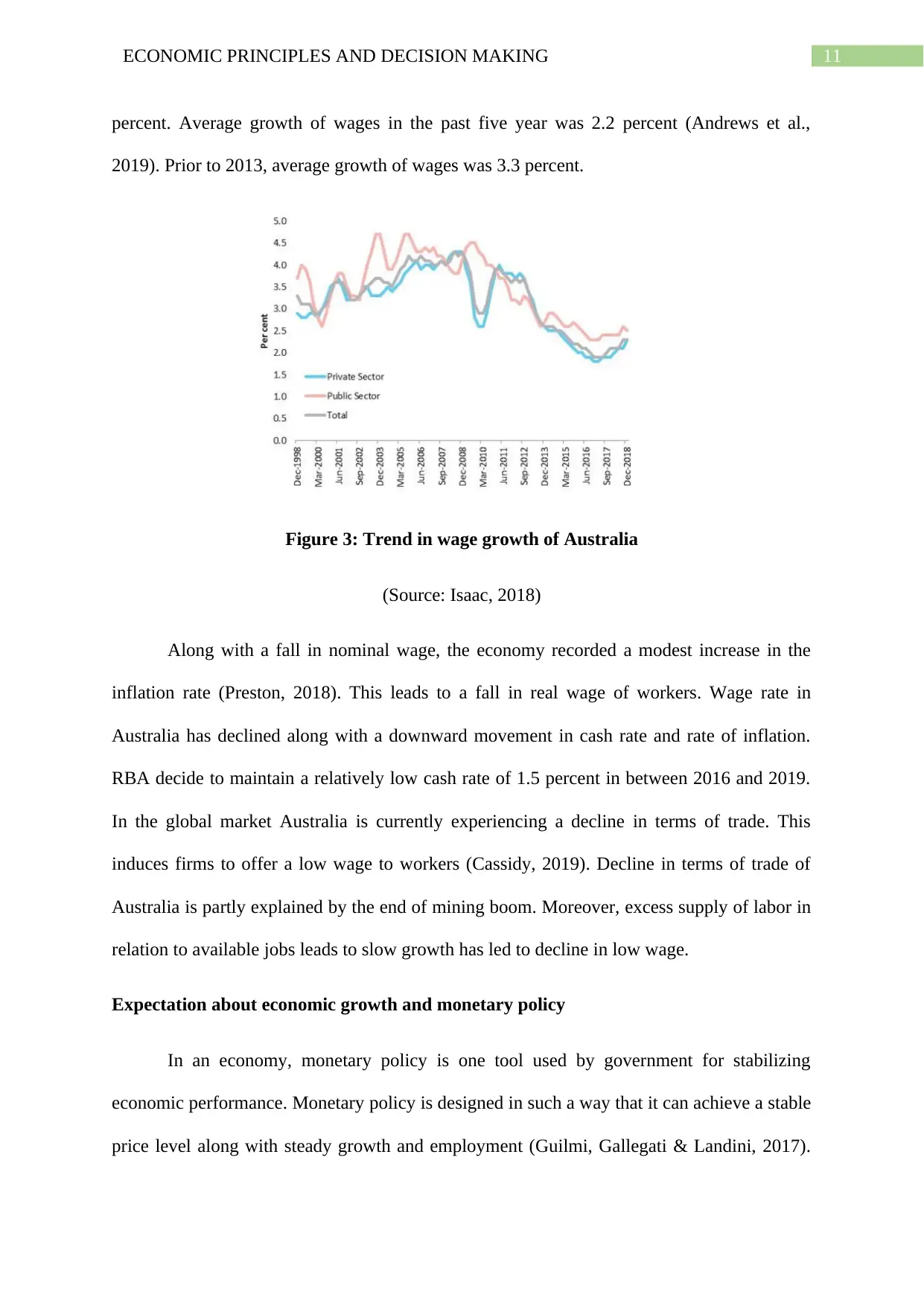

11ECONOMIC PRINCIPLES AND DECISION MAKING

percent. Average growth of wages in the past five year was 2.2 percent (Andrews et al.,

2019). Prior to 2013, average growth of wages was 3.3 percent.

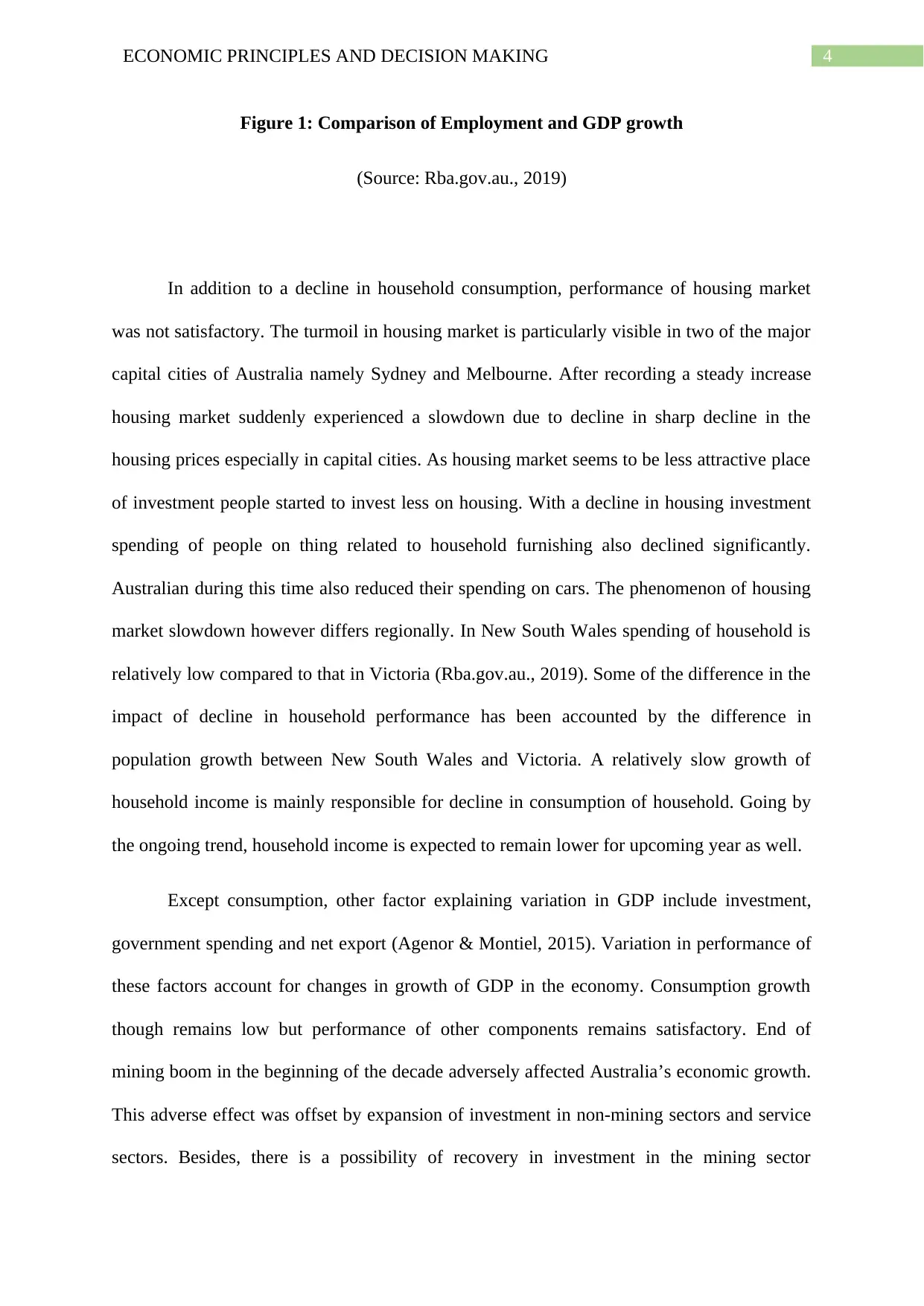

Figure 3: Trend in wage growth of Australia

(Source: Isaac, 2018)

Along with a fall in nominal wage, the economy recorded a modest increase in the

inflation rate (Preston, 2018). This leads to a fall in real wage of workers. Wage rate in

Australia has declined along with a downward movement in cash rate and rate of inflation.

RBA decide to maintain a relatively low cash rate of 1.5 percent in between 2016 and 2019.

In the global market Australia is currently experiencing a decline in terms of trade. This

induces firms to offer a low wage to workers (Cassidy, 2019). Decline in terms of trade of

Australia is partly explained by the end of mining boom. Moreover, excess supply of labor in

relation to available jobs leads to slow growth has led to decline in low wage.

Expectation about economic growth and monetary policy

In an economy, monetary policy is one tool used by government for stabilizing

economic performance. Monetary policy is designed in such a way that it can achieve a stable

price level along with steady growth and employment (Guilmi, Gallegati & Landini, 2017).

percent. Average growth of wages in the past five year was 2.2 percent (Andrews et al.,

2019). Prior to 2013, average growth of wages was 3.3 percent.

Figure 3: Trend in wage growth of Australia

(Source: Isaac, 2018)

Along with a fall in nominal wage, the economy recorded a modest increase in the

inflation rate (Preston, 2018). This leads to a fall in real wage of workers. Wage rate in

Australia has declined along with a downward movement in cash rate and rate of inflation.

RBA decide to maintain a relatively low cash rate of 1.5 percent in between 2016 and 2019.

In the global market Australia is currently experiencing a decline in terms of trade. This

induces firms to offer a low wage to workers (Cassidy, 2019). Decline in terms of trade of

Australia is partly explained by the end of mining boom. Moreover, excess supply of labor in

relation to available jobs leads to slow growth has led to decline in low wage.

Expectation about economic growth and monetary policy

In an economy, monetary policy is one tool used by government for stabilizing

economic performance. Monetary policy is designed in such a way that it can achieve a stable

price level along with steady growth and employment (Guilmi, Gallegati & Landini, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.