BUS702, Semester 2 Assignment: Food Taxes and Fiscal Fallacies

VerifiedAdded on 2020/05/01

|8

|1477

|34

Homework Assignment

AI Summary

This assignment explores the economic implications of food taxes and fiscal policy, drawing on economic theory and real-world examples. The first part analyzes the arguments for and against food taxes and subsidies aimed at encouraging healthy eating, considering the concept of price elasticity of demand for various food categories. The second part examines excerpts from Tony Makin's "Fiscal Fallacies," addressing the effectiveness of government spending, the challenges of distinguishing between discretionary and automatic fiscal changes, the impact of fiscal contraction, and the relative roles of fiscal and monetary policy in influencing macroeconomic activity. Diagrams are used to support the arguments. The assignment highlights the complexities of government intervention in the economy, the importance of considering economic principles, and the trade-offs involved in policy decisions.

BUS702 2017

Answer BOTH questions.

Each question carries equal weighting.

MAXIMUM TIME ALLOWED for writing answers:

TWO to THREE HOURS

Notes

(1) This is not a traditional exam but is a “take home exam” or assignment. Please read all

instructions carefully.

(2) You should read the questions and the articles before setting aside time (probably on a different

day) to write your answers.

(3) This exam is “open book” but “researched” answers are not required and, in fact, no research

should be undertaken; that is, you should write from your own understanding without references.

SafeAssign checks submitted files for plagiarism so be careful to write in your own words and

complete this assignment individually.

(4) Draw appropriate links to the economic theory you have learned in the course and do not offer

unsubstantiated opinion.

(5) Use diagrams where appropriate. Hand-drawn ones are acceptable, being faster to draw, and

may be scanned in (as pdfs, please – no other file formats!).

(6) The DEADLINE for upload of your answers is: FRIDAY 27 October by 2 pm.Please do not leave it

to the last minute. Upload only WORD files or PDFs; NO other formats, including PAGES, please! If

your file is unreadable, then it cannot not be marked.

Page 1 of 8

Answer BOTH questions.

Each question carries equal weighting.

MAXIMUM TIME ALLOWED for writing answers:

TWO to THREE HOURS

Notes

(1) This is not a traditional exam but is a “take home exam” or assignment. Please read all

instructions carefully.

(2) You should read the questions and the articles before setting aside time (probably on a different

day) to write your answers.

(3) This exam is “open book” but “researched” answers are not required and, in fact, no research

should be undertaken; that is, you should write from your own understanding without references.

SafeAssign checks submitted files for plagiarism so be careful to write in your own words and

complete this assignment individually.

(4) Draw appropriate links to the economic theory you have learned in the course and do not offer

unsubstantiated opinion.

(5) Use diagrams where appropriate. Hand-drawn ones are acceptable, being faster to draw, and

may be scanned in (as pdfs, please – no other file formats!).

(6) The DEADLINE for upload of your answers is: FRIDAY 27 October by 2 pm.Please do not leave it

to the last minute. Upload only WORD files or PDFs; NO other formats, including PAGES, please! If

your file is unreadable, then it cannot not be marked.

Page 1 of 8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. A tax on sugar intended to shift consumption towards a healthier diet has been

suggested and even implemented in some countries. Some people think that

individuals should make their own choices and, if they prefer unhealthy products, the

government should not interfere. On the other hand, those who become ill from

obesity will impose costs on the health service so that others argue that the

government has a role to play.

Read the following article:

http://theconversation.com/why-the-government-should-tax-unhealthy-foods-and-subsidise-

nutritious-ones-72790

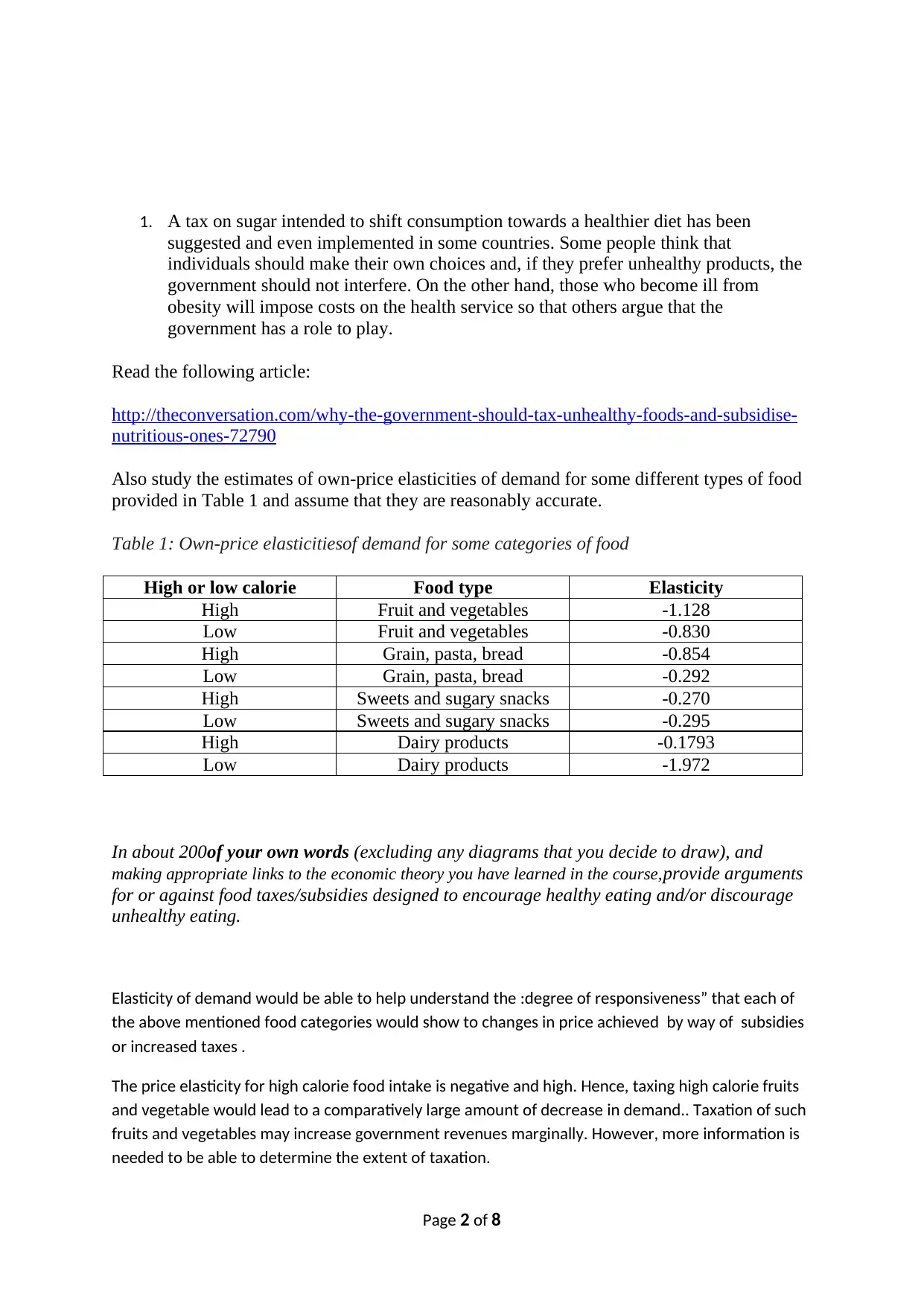

Also study the estimates of own-price elasticities of demand for some different types of food

provided in Table 1 and assume that they are reasonably accurate.

Table 1: Own-price elasticitiesof demand for some categories of food

High or low calorie Food type Elasticity

High Fruit and vegetables -1.128

Low Fruit and vegetables -0.830

High Grain, pasta, bread -0.854

Low Grain, pasta, bread -0.292

High Sweets and sugary snacks -0.270

Low Sweets and sugary snacks -0.295

High Dairy products -0.1793

Low Dairy products -1.972

In about 200of your own words (excluding any diagrams that you decide to draw), and

making appropriate links to the economic theory you have learned in the course,provide arguments

for or against food taxes/subsidies designed to encourage healthy eating and/or discourage

unhealthy eating.

Elasticity of demand would be able to help understand the :degree of responsiveness” that each of

the above mentioned food categories would show to changes in price achieved by way of subsidies

or increased taxes .

The price elasticity for high calorie food intake is negative and high. Hence, taxing high calorie fruits

and vegetable would lead to a comparatively large amount of decrease in demand.. Taxation of such

fruits and vegetables may increase government revenues marginally. However, more information is

needed to be able to determine the extent of taxation.

Page 2 of 8

suggested and even implemented in some countries. Some people think that

individuals should make their own choices and, if they prefer unhealthy products, the

government should not interfere. On the other hand, those who become ill from

obesity will impose costs on the health service so that others argue that the

government has a role to play.

Read the following article:

http://theconversation.com/why-the-government-should-tax-unhealthy-foods-and-subsidise-

nutritious-ones-72790

Also study the estimates of own-price elasticities of demand for some different types of food

provided in Table 1 and assume that they are reasonably accurate.

Table 1: Own-price elasticitiesof demand for some categories of food

High or low calorie Food type Elasticity

High Fruit and vegetables -1.128

Low Fruit and vegetables -0.830

High Grain, pasta, bread -0.854

Low Grain, pasta, bread -0.292

High Sweets and sugary snacks -0.270

Low Sweets and sugary snacks -0.295

High Dairy products -0.1793

Low Dairy products -1.972

In about 200of your own words (excluding any diagrams that you decide to draw), and

making appropriate links to the economic theory you have learned in the course,provide arguments

for or against food taxes/subsidies designed to encourage healthy eating and/or discourage

unhealthy eating.

Elasticity of demand would be able to help understand the :degree of responsiveness” that each of

the above mentioned food categories would show to changes in price achieved by way of subsidies

or increased taxes .

The price elasticity for high calorie food intake is negative and high. Hence, taxing high calorie fruits

and vegetable would lead to a comparatively large amount of decrease in demand.. Taxation of such

fruits and vegetables may increase government revenues marginally. However, more information is

needed to be able to determine the extent of taxation.

Page 2 of 8

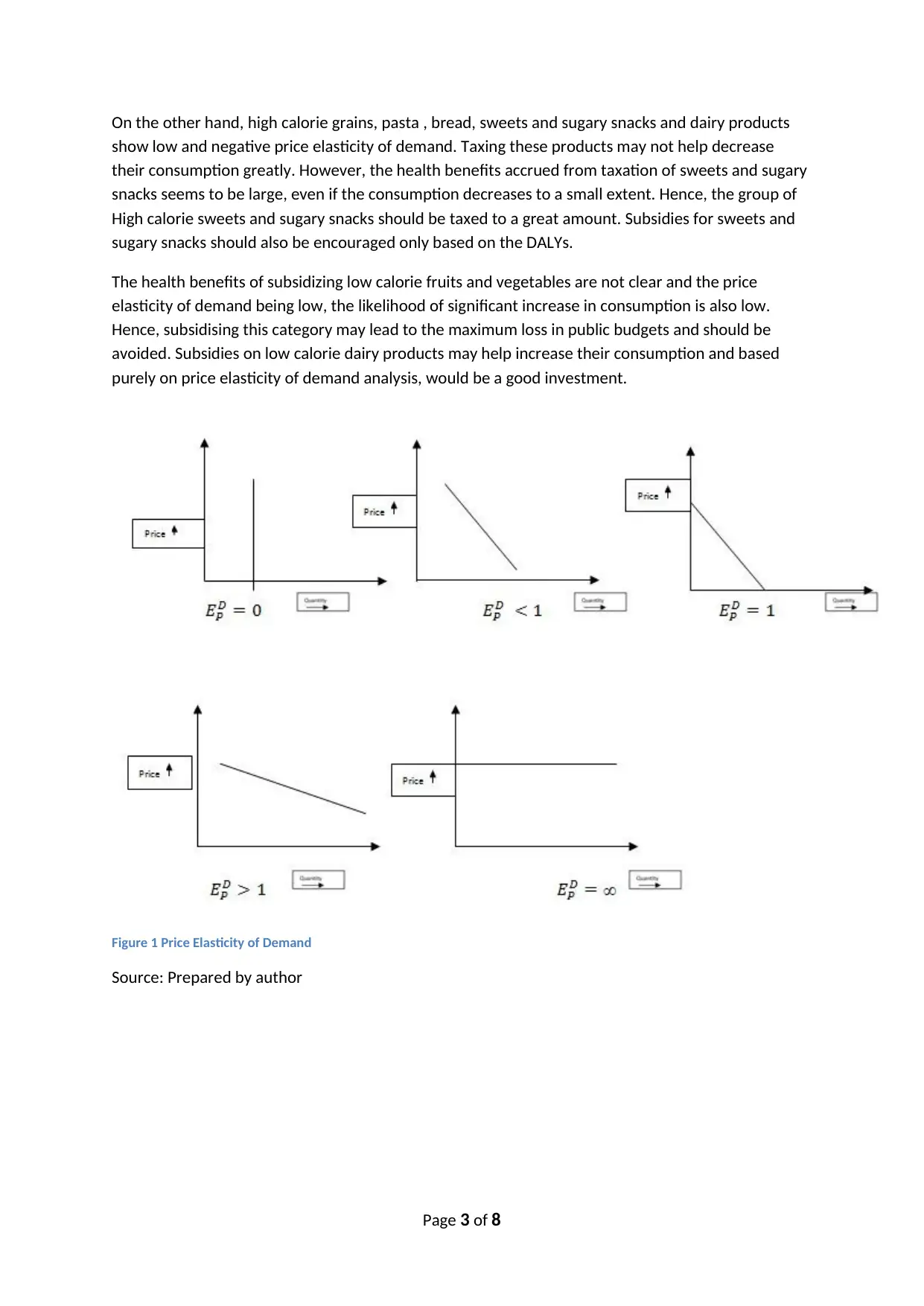

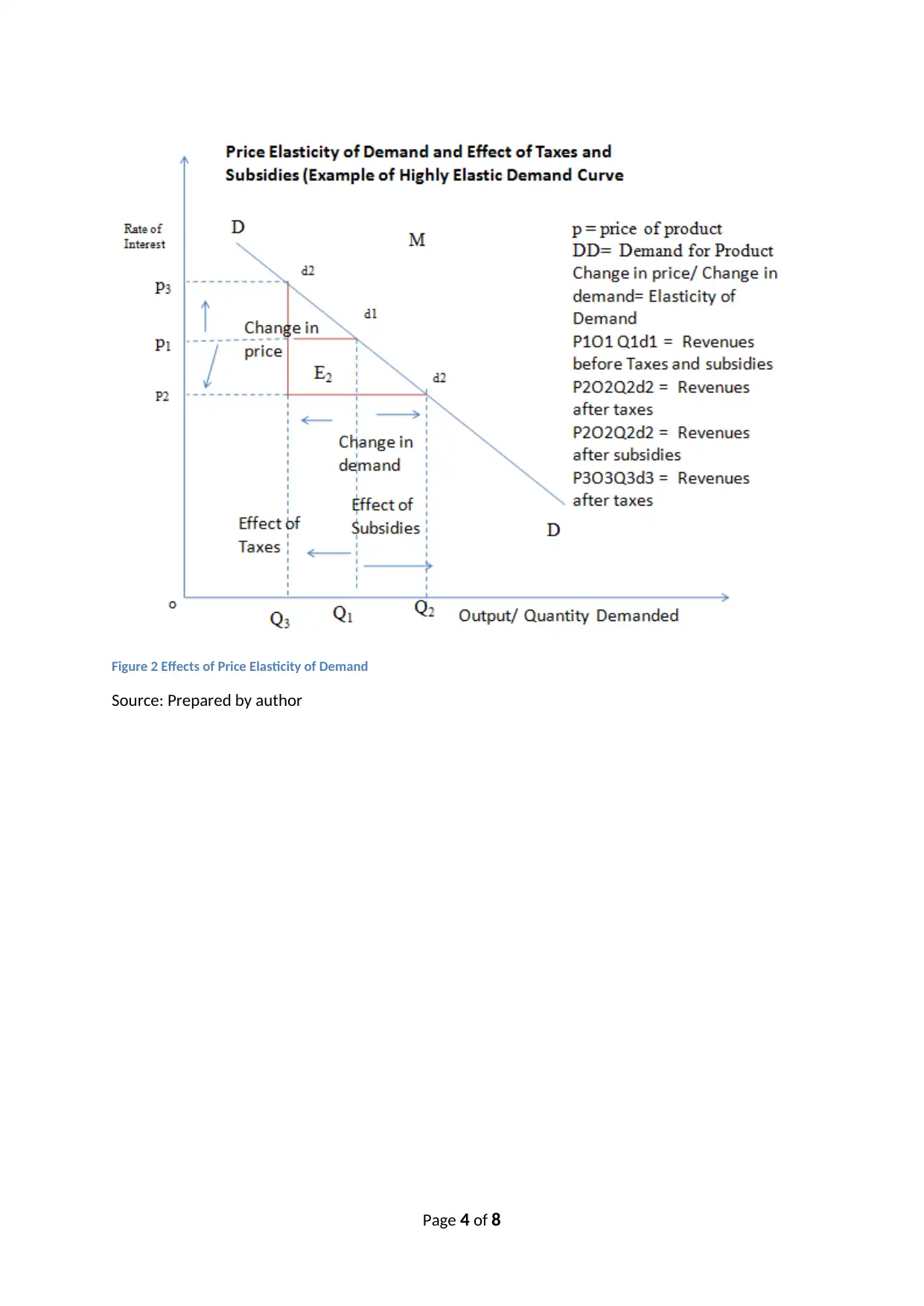

On the other hand, high calorie grains, pasta , bread, sweets and sugary snacks and dairy products

show low and negative price elasticity of demand. Taxing these products may not help decrease

their consumption greatly. However, the health benefits accrued from taxation of sweets and sugary

snacks seems to be large, even if the consumption decreases to a small extent. Hence, the group of

High calorie sweets and sugary snacks should be taxed to a great amount. Subsidies for sweets and

sugary snacks should also be encouraged only based on the DALYs.

The health benefits of subsidizing low calorie fruits and vegetables are not clear and the price

elasticity of demand being low, the likelihood of significant increase in consumption is also low.

Hence, subsidising this category may lead to the maximum loss in public budgets and should be

avoided. Subsidies on low calorie dairy products may help increase their consumption and based

purely on price elasticity of demand analysis, would be a good investment.

Figure 1 Price Elasticity of Demand

Source: Prepared by author

Page 3 of 8

show low and negative price elasticity of demand. Taxing these products may not help decrease

their consumption greatly. However, the health benefits accrued from taxation of sweets and sugary

snacks seems to be large, even if the consumption decreases to a small extent. Hence, the group of

High calorie sweets and sugary snacks should be taxed to a great amount. Subsidies for sweets and

sugary snacks should also be encouraged only based on the DALYs.

The health benefits of subsidizing low calorie fruits and vegetables are not clear and the price

elasticity of demand being low, the likelihood of significant increase in consumption is also low.

Hence, subsidising this category may lead to the maximum loss in public budgets and should be

avoided. Subsidies on low calorie dairy products may help increase their consumption and based

purely on price elasticity of demand analysis, would be a good investment.

Figure 1 Price Elasticity of Demand

Source: Prepared by author

Page 3 of 8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Figure 2 Effects of Price Elasticity of Demand

Source: Prepared by author

Page 4 of 8

Source: Prepared by author

Page 4 of 8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2. Read the articleFlawed Fiscal Fundamentalismby Tony Makin, pages 21 to 29 of the

document Fiscal Fallacies,which can be downloadedfrom The Centre of Independent

Studiesat:

https://www.cis.org.au/publications/policy-forum/fiscal-fallacies-the-failure-of-activist-

fiscal-policy/

Each of the questions below contains a quote from Makin. Answer the questionfollowing

each quote, in around 100of your own words for each part, making appropriate links to the

economic theory you have learned in the course.

(a) “The simple idea that by pumping up total spending, government can supplement

depressed private spending and temporarily boost economic activity has appealed to

economists and governments since the Great Depression of the 1930s.” (Page 22)

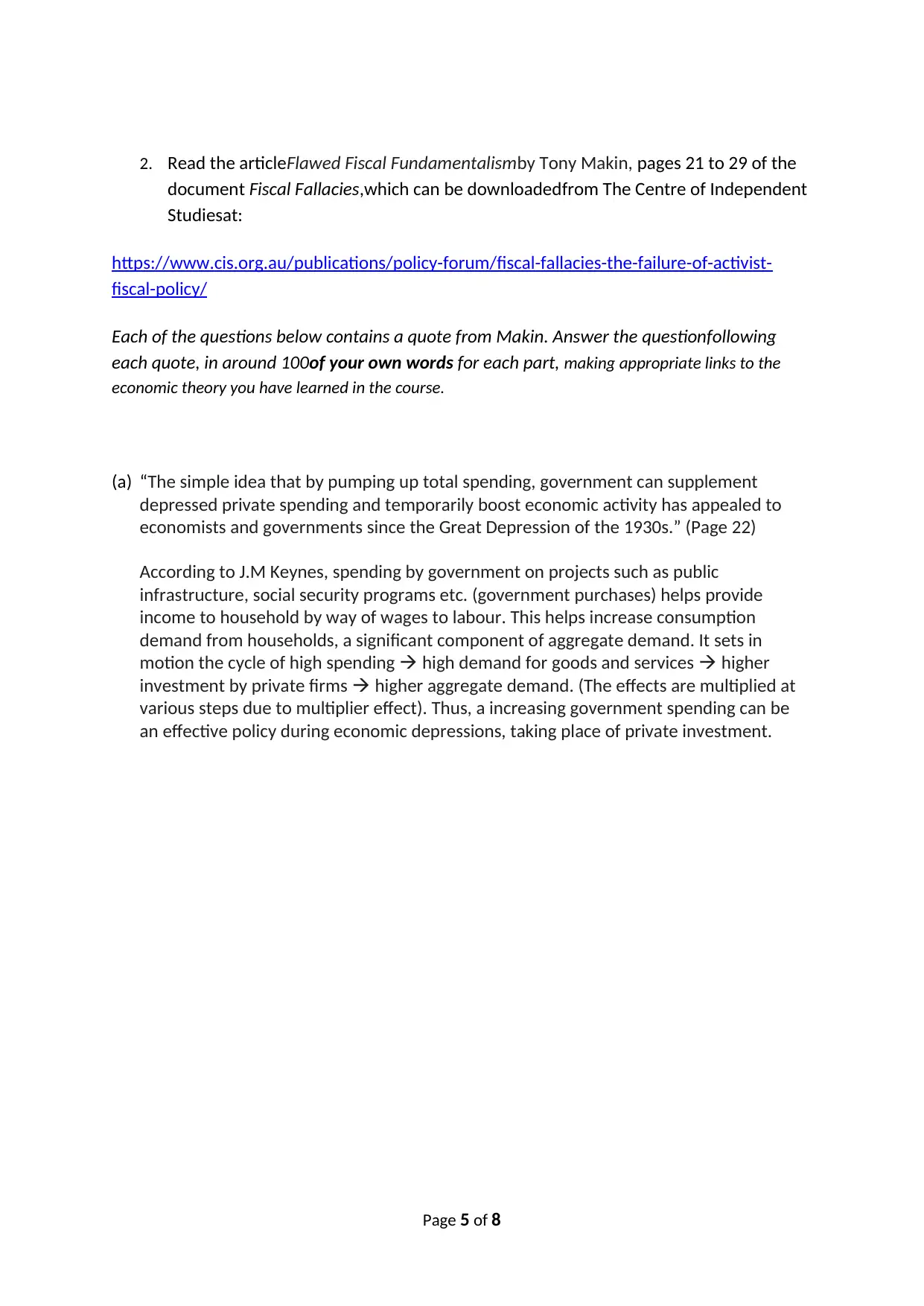

According to J.M Keynes, spending by government on projects such as public

infrastructure, social security programs etc. (government purchases) helps provide

income to household by way of wages to labour. This helps increase consumption

demand from households, a significant component of aggregate demand. It sets in

motion the cycle of high spending high demand for goods and services higher

investment by private firms higher aggregate demand. (The effects are multiplied at

various steps due to multiplier effect). Thus, a increasing government spending can be

an effective policy during economic depressions, taking place of private investment.

Page 5 of 8

document Fiscal Fallacies,which can be downloadedfrom The Centre of Independent

Studiesat:

https://www.cis.org.au/publications/policy-forum/fiscal-fallacies-the-failure-of-activist-

fiscal-policy/

Each of the questions below contains a quote from Makin. Answer the questionfollowing

each quote, in around 100of your own words for each part, making appropriate links to the

economic theory you have learned in the course.

(a) “The simple idea that by pumping up total spending, government can supplement

depressed private spending and temporarily boost economic activity has appealed to

economists and governments since the Great Depression of the 1930s.” (Page 22)

According to J.M Keynes, spending by government on projects such as public

infrastructure, social security programs etc. (government purchases) helps provide

income to household by way of wages to labour. This helps increase consumption

demand from households, a significant component of aggregate demand. It sets in

motion the cycle of high spending high demand for goods and services higher

investment by private firms higher aggregate demand. (The effects are multiplied at

various steps due to multiplier effect). Thus, a increasing government spending can be

an effective policy during economic depressions, taking place of private investment.

Page 5 of 8

Figure 3 Effects of Increased Government Spending on Aggregate Demand

Source: Prepared by author

(b) “Separating out the automatic changes in the fiscal position from the discretionary ones

is difficult, and it is impossible to assess the counterfactual of how the economy would

have performed had there been no fiscal response.” (Page 24)

The level of economic activity declines during a recession and aggregate demand lowers.

The level of taxes paid by households and firms is lower and government revenues decline.

This is particularly highlighted, if the economy has automatic stabilizers such as progressive

taxation. Additionally, if government spending remains same, there may be a budget deficit.

An example of a non-discretionary taxation is progressive taxation. During a recession, if the

income of the lowermost groups declines substantially, they may not pay any taxes.

Similarly, the middle and higher income groups may also contribute substantially less to

taxes, thereby reducing revenues.

(c) “What has been ignored in current debate is that fiscal contraction that targets wasteful

government programs improves macroeconomic performance.” (Page 25)

Page 6 of 8

Source: Prepared by author

(b) “Separating out the automatic changes in the fiscal position from the discretionary ones

is difficult, and it is impossible to assess the counterfactual of how the economy would

have performed had there been no fiscal response.” (Page 24)

The level of economic activity declines during a recession and aggregate demand lowers.

The level of taxes paid by households and firms is lower and government revenues decline.

This is particularly highlighted, if the economy has automatic stabilizers such as progressive

taxation. Additionally, if government spending remains same, there may be a budget deficit.

An example of a non-discretionary taxation is progressive taxation. During a recession, if the

income of the lowermost groups declines substantially, they may not pay any taxes.

Similarly, the middle and higher income groups may also contribute substantially less to

taxes, thereby reducing revenues.

(c) “What has been ignored in current debate is that fiscal contraction that targets wasteful

government programs improves macroeconomic performance.” (Page 25)

Page 6 of 8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

“Fiscal Contraction” may decrease the crowding-out effect that fiscal policies , generally,

tend to have. Thus, in a developed country like Australia, fiscal contraction may reduce the

demand for money which will in turn lower interest rates and provide a boost to private

investment and capital inflows from other countries. This also helps in reducing budget

deficit. It may also help decrease any “appreciation pressures” on the national currency. If

“national currency” depreciates, there is an increase in “trade competiveness” which tends

to boost exports.

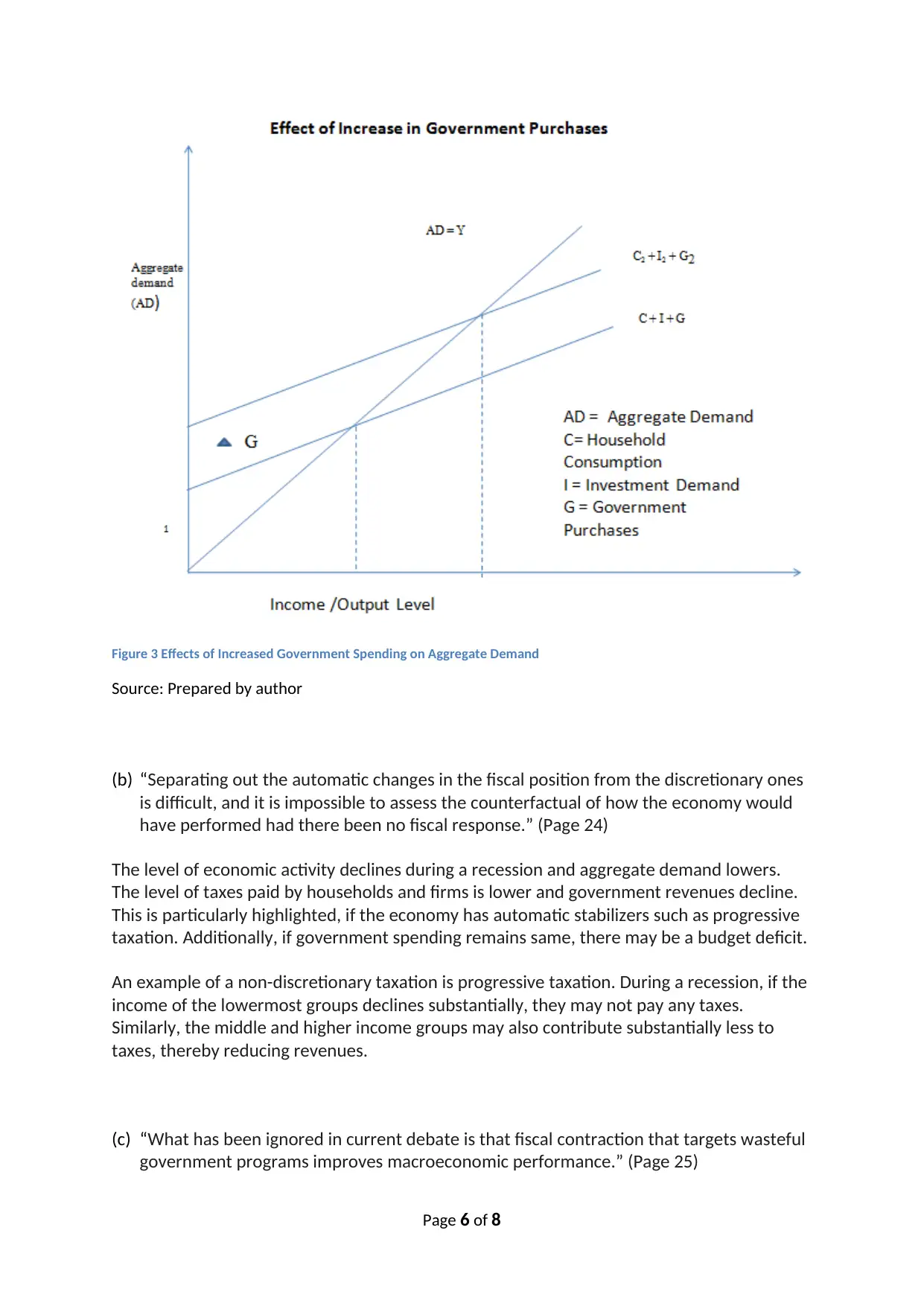

(d) “The key question is whether Australia really needs fiscal ‘stimulus’ in the form of

budgetary outlays when monetary policy is best placed to influence short-run

macroeconomic activity.” (Page 26)

Monetary policy targets the supply and demand of money in the economy by way of interest rate. A

decline in interest rates, according to IS-LM Model will increase loanable funds in the economy

(liquidity preference being unchanged) , which in turn would stimulate investment in production

capacity by entrepreneurs due to easy availability of funds. This would stimulate the aggregare

demand.

Figure 4 the IS-LM (closed economy) Model

Page 7 of 8

tend to have. Thus, in a developed country like Australia, fiscal contraction may reduce the

demand for money which will in turn lower interest rates and provide a boost to private

investment and capital inflows from other countries. This also helps in reducing budget

deficit. It may also help decrease any “appreciation pressures” on the national currency. If

“national currency” depreciates, there is an increase in “trade competiveness” which tends

to boost exports.

(d) “The key question is whether Australia really needs fiscal ‘stimulus’ in the form of

budgetary outlays when monetary policy is best placed to influence short-run

macroeconomic activity.” (Page 26)

Monetary policy targets the supply and demand of money in the economy by way of interest rate. A

decline in interest rates, according to IS-LM Model will increase loanable funds in the economy

(liquidity preference being unchanged) , which in turn would stimulate investment in production

capacity by entrepreneurs due to easy availability of funds. This would stimulate the aggregare

demand.

Figure 4 the IS-LM (closed economy) Model

Page 7 of 8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Source: Prepared by author

According to Mankin, Fiscal policy comes with risks and is effective, largely when the government

spending is on productive investments. Monetary policy, contrarily, brings about automatic shifts,

and is more effective in the short-run die to the lack of “time-lag” of fiscal policy.

Page 8 of 8

According to Mankin, Fiscal policy comes with risks and is effective, largely when the government

spending is on productive investments. Monetary policy, contrarily, brings about automatic shifts,

and is more effective in the short-run die to the lack of “time-lag” of fiscal policy.

Page 8 of 8

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.