Peter Faber Uni BAFN205 Report: Australian Financial Institutions

VerifiedAdded on 2023/01/16

|9

|2178

|65

Report

AI Summary

This report provides an overview of Australian financial institutions, classifying them according to the Reserve Bank of Australia (RBA) into Authorized Deposit-taking Institutions (ADIs), fund managers, and non-ADI financial institutions. It analyzes the performance of the Commonwealth Bank of Australia, discussing its financial services, recent scandals, and overall financial performance, including key financial metrics and strategic partnerships. The report also examines the term structure of interest rates in Australia, explaining its importance and the factors influencing it, such as investor expectations and risk premia, and references the RBA's approach to modeling these rates. The analysis incorporates insights from various sources, including the RBA, APRA, and academic literature, providing a comprehensive understanding of the Australian financial landscape.

Running head: ECONOMICS 1

BAFN205

Name of the student:

Name of the University:

Authors Note:

BAFN205

Name of the student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS

Report on Australian Financial Institutions

AS per the classification of the reserve bank of Australia, there are basically three types of

financial institutions and they include among others; the funds and insurers managers, Non

ADA financial institutions and the authorized Deposit taking institutions. The authorized

deposit taking institutions (ADIs) are under the 1959 banking act as explained in the

prudential regulation authority of Australia. The authorized deposit taking institutions just

like banks are subject to similar standards of prudential. Example of authorized deposits

taking institutions includes credit unions, Building societies and Banks. All of which are

under the APRA supervision. The authorized deposit taking instructions offer various

services that are financial in nature in the various economic sectors like insurance and

management of funds , they also provides payment services to members, housing or person

loan and others(Viney &Phillips,2015).

The fund managers and insurers comprises of friendly societies, common funds, trusts of

cash management, public unit trusts , health insurance organizations or companies,

superannuation and approved deposit funds, Life insurance organizations and General

insurance companies. The institutions under the insurers and fund managers are supervised

by the APRA, ASIC and state and authorities. The insurance and fund managers offer super

annulations products, provide disability, life and accident insurance, Basing on fiduciary

basis for example, life insurance companies are able to manage assets which are most put in

debt and equity secures. Equities, Government securities, deposits and loans are where

most assets are commonly invested by General insurance.

On top of that, General insurance offers employer's liability, property and motor vehicles

insurance (Viney &Phillips, 2015). Employer’s contributions are accepted and at the same

Report on Australian Financial Institutions

AS per the classification of the reserve bank of Australia, there are basically three types of

financial institutions and they include among others; the funds and insurers managers, Non

ADA financial institutions and the authorized Deposit taking institutions. The authorized

deposit taking institutions (ADIs) are under the 1959 banking act as explained in the

prudential regulation authority of Australia. The authorized deposit taking institutions just

like banks are subject to similar standards of prudential. Example of authorized deposits

taking institutions includes credit unions, Building societies and Banks. All of which are

under the APRA supervision. The authorized deposit taking instructions offer various

services that are financial in nature in the various economic sectors like insurance and

management of funds , they also provides payment services to members, housing or person

loan and others(Viney &Phillips,2015).

The fund managers and insurers comprises of friendly societies, common funds, trusts of

cash management, public unit trusts , health insurance organizations or companies,

superannuation and approved deposit funds, Life insurance organizations and General

insurance companies. The institutions under the insurers and fund managers are supervised

by the APRA, ASIC and state and authorities. The insurance and fund managers offer super

annulations products, provide disability, life and accident insurance, Basing on fiduciary

basis for example, life insurance companies are able to manage assets which are most put in

debt and equity secures. Equities, Government securities, deposits and loans are where

most assets are commonly invested by General insurance.

On top of that, General insurance offers employer's liability, property and motor vehicles

insurance (Viney &Phillips, 2015). Employer’s contributions are accepted and at the same

2ECONOMICS

time managed by the superannuation funds. The trustees control the funds and in most

cases utilize fund managers that are very professional. Public trusts engage in the pooling of

the investor's capital into various or given kinds of assets like oversee securities, mortgages,

equities, cash, property and investments in money markets. The cash management trustees

are under the governance of the overall trust deed

The non -ADI financial institutions comprises of the Securitisers, money market

corporations like the broker dealers and the Finance companies like the pastoral finance

companies and the general financiers all of which are under the supervision of the ASIC.

The non ADA financial institutions offer credit enhanced secures, offer loans to various

small, medium and large scale enterprises and households. They also lend to Government

agencies and large corporations. The above corporations usually undertake their overall

operations in the whole sale markets. Other services offered by the Non -ADI financial

institutions include; borrowing to government agencies and big corporations. Hence forth

the above are main types of financial institutions as classified by the Reserve Bank of

Australia.

Report on the performance of a major bank in Australia

The major bank to be focused on is the common wealth bank of Australia. The common

wealth bank of Australia has various ventures in the United Kingdom, United States, Asia

and New Zealand. The bank offers a number of financial facilities and services such as

broking services, investment, insurance, superannuation funds, management, institution

banking, business, retail and other forms of financial services. In the period of April 2018,

the common wealth bank of Australia registered a big fall in its overall equities or shares. It

is important to note that in the year 2014, there was failure to comply with the introduced

time managed by the superannuation funds. The trustees control the funds and in most

cases utilize fund managers that are very professional. Public trusts engage in the pooling of

the investor's capital into various or given kinds of assets like oversee securities, mortgages,

equities, cash, property and investments in money markets. The cash management trustees

are under the governance of the overall trust deed

The non -ADI financial institutions comprises of the Securitisers, money market

corporations like the broker dealers and the Finance companies like the pastoral finance

companies and the general financiers all of which are under the supervision of the ASIC.

The non ADA financial institutions offer credit enhanced secures, offer loans to various

small, medium and large scale enterprises and households. They also lend to Government

agencies and large corporations. The above corporations usually undertake their overall

operations in the whole sale markets. Other services offered by the Non -ADI financial

institutions include; borrowing to government agencies and big corporations. Hence forth

the above are main types of financial institutions as classified by the Reserve Bank of

Australia.

Report on the performance of a major bank in Australia

The major bank to be focused on is the common wealth bank of Australia. The common

wealth bank of Australia has various ventures in the United Kingdom, United States, Asia

and New Zealand. The bank offers a number of financial facilities and services such as

broking services, investment, insurance, superannuation funds, management, institution

banking, business, retail and other forms of financial services. In the period of April 2018,

the common wealth bank of Australia registered a big fall in its overall equities or shares. It

is important to note that in the year 2014, there was failure to comply with the introduced

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS

law by the CBA aimed at providing retirement funds at relatively lower costs. These were

targeting specific customers that had not chosen a particular product retirement savings.

There was also a general fall in the profits mainly emanating from regulatory expenses in all

most ten years. This was a result of the bank’s failure to abide with the money laundering

regulations

It is important to note that the common wealth bank of Australia has of recent years been

involved in various cooperation agreements strategically with and Hangzhou and Jinan city

commercial bank. Forty nine percent stake of colonial national bank was also acquired by

the bank in period of January 2006. The bank also opened another outlet or branch in Ho

Chi Minh City, Vietnam in the beginning of the year 2008. The bank has also engaged it’s self

in various partnership with other institutions like Aussie Home Loans. The common wealth

bank of Australia was listed in the 2010-11 preferred employers making it the only financial

sector to be cited in the top twenty lists of Dream employers. The scandals in the year 2018

revealed that the Common wealth bank of Australia was involved in charging financial

service advice on dead people as per the information obtained from the royal commission

into misconduct in the financial services, superannuation and banking industry (Cusbert and

Kendall, 2018). There net bank services being offered by the bank making online banking

easy. This enables various customers to access liabilities and assets, engage in the proper

management of their accounts and be able to transfer funds (Debelle, 2017).It is imperative

to note that the common wealth bank of Australia in a bid to expand its overall levels of

operations has engaged in a number of takeovers, acquisitions and partnerships. The overall

performance being exhibited by the bank in the industry has been mainly due to various

techniques such as team spirit, trust, growth in the levels of profitability, business banking,

law by the CBA aimed at providing retirement funds at relatively lower costs. These were

targeting specific customers that had not chosen a particular product retirement savings.

There was also a general fall in the profits mainly emanating from regulatory expenses in all

most ten years. This was a result of the bank’s failure to abide with the money laundering

regulations

It is important to note that the common wealth bank of Australia has of recent years been

involved in various cooperation agreements strategically with and Hangzhou and Jinan city

commercial bank. Forty nine percent stake of colonial national bank was also acquired by

the bank in period of January 2006. The bank also opened another outlet or branch in Ho

Chi Minh City, Vietnam in the beginning of the year 2008. The bank has also engaged it’s self

in various partnership with other institutions like Aussie Home Loans. The common wealth

bank of Australia was listed in the 2010-11 preferred employers making it the only financial

sector to be cited in the top twenty lists of Dream employers. The scandals in the year 2018

revealed that the Common wealth bank of Australia was involved in charging financial

service advice on dead people as per the information obtained from the royal commission

into misconduct in the financial services, superannuation and banking industry (Cusbert and

Kendall, 2018). There net bank services being offered by the bank making online banking

easy. This enables various customers to access liabilities and assets, engage in the proper

management of their accounts and be able to transfer funds (Debelle, 2017).It is imperative

to note that the common wealth bank of Australia in a bid to expand its overall levels of

operations has engaged in a number of takeovers, acquisitions and partnerships. The overall

performance being exhibited by the bank in the industry has been mainly due to various

techniques such as team spirit, trust, growth in the levels of profitability, business banking,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS

operational and technology efficiency and effectiveness and high levels of customer

satisfaction. Basing on the financial perspective, the common wealth bank of Australia has

registered tremendous success (Gillitzer and Simon, 2015). For in the financial year 2011/12

the overall net earnings of the common wealth bank of Australia stood at 6,394 million

dollars registering a thirteen percent increment when compared to the other year

(Kent,2018). The level of return on the earning per share and equity stood at 411.2 cents

and 18.4 percent respectively registering a twelve percent increment as compared to the

previous year. A final dividend amounting to $ 1.88 on each and every share was also

registered by the bank reflecting an increment of eleven percent as compared to the other

year. The bank had a stable interest margin due to proper strategies of risk management. It

should be noted that the overall rise in the level of net margin was due to bills discounted,

loans plus other receivables.

None the less, of recent the common wealth bank of Australia has engaged in a number of

scandals which has weakened its overall credibility among the general public. In the year

2015, the bank was reported to be part of the Australia’s largest banks that invested heavily

in the overall risky fossil fuel project financings. The bank's staff was also in the year 2016

found to have engaged in the Ponzi scheme fraud of $76 million (Daley and

Parsonage ,2016). The insurance division of CBA also registers systematic issues ranging

from the presence of outdated medical data in the insurance policy. None the less in spite of

some of the above weakness, it is still the biggest bank in the area of Australia and has over

the years demonstrated its financial and management capabilities (Gray and Malone,2008).

The recent cases at the bank cannot rule out the various achievements registered by the

common wealth bank of Australia in ensuring that households, small, medium and large

operational and technology efficiency and effectiveness and high levels of customer

satisfaction. Basing on the financial perspective, the common wealth bank of Australia has

registered tremendous success (Gillitzer and Simon, 2015). For in the financial year 2011/12

the overall net earnings of the common wealth bank of Australia stood at 6,394 million

dollars registering a thirteen percent increment when compared to the other year

(Kent,2018). The level of return on the earning per share and equity stood at 411.2 cents

and 18.4 percent respectively registering a twelve percent increment as compared to the

previous year. A final dividend amounting to $ 1.88 on each and every share was also

registered by the bank reflecting an increment of eleven percent as compared to the other

year. The bank had a stable interest margin due to proper strategies of risk management. It

should be noted that the overall rise in the level of net margin was due to bills discounted,

loans plus other receivables.

None the less, of recent the common wealth bank of Australia has engaged in a number of

scandals which has weakened its overall credibility among the general public. In the year

2015, the bank was reported to be part of the Australia’s largest banks that invested heavily

in the overall risky fossil fuel project financings. The bank's staff was also in the year 2016

found to have engaged in the Ponzi scheme fraud of $76 million (Daley and

Parsonage ,2016). The insurance division of CBA also registers systematic issues ranging

from the presence of outdated medical data in the insurance policy. None the less in spite of

some of the above weakness, it is still the biggest bank in the area of Australia and has over

the years demonstrated its financial and management capabilities (Gray and Malone,2008).

The recent cases at the bank cannot rule out the various achievements registered by the

common wealth bank of Australia in ensuring that households, small, medium and large

5ECONOMICS

enterprises are able to access funds for purposes of financing there business activities(Viney

&Phillips,2015). .

The Term structure of interest rates in Australia

In simple terms the relationship between various maturities or terms and the bond yields or

interest rates is defined as the structure of interest rates. The term structure of interest

rates is very important in an economy and acts as a vital bench mark in the world of income.

In other words the overall the collective expectations of market participants regarding

monitory policy conditions, inflation and interest rates is reflected in the term structure (ain-

Chandra et al, 2009).

The expected and current short term rates determine the overall long term interest rates in

the economy. Such brings about indifferences among rational investors when deciding on

in short and long term bonds investments due to similar investment returns for all the

options (Mankiw, 2014). The term structure of interest rates is affected by various variables

like the risk premier and the overall investor expectations. Risk expectations are usually

brought about by changes in yields which make the overall interpretation and modelling of

the interest rate structure a bit complex (Reserve Bank of Australia, 2009). The reserve bank

of Australia of recent adopted the ATSM model and was able to identify that there has been

a decline the real interest rates medium and long term expectations. It is also clear that

premia risk changes have a strong impact compared to observed yields movement

expectations while expectations for future real, short term nominal and inflation rate

change over time It also found out that since the 1990's there has been a fall in the

expectations of long term inflation mainly die increased credibility of the RBA targeting

inflation frame work (Viney &Phillip,s2015).

enterprises are able to access funds for purposes of financing there business activities(Viney

&Phillips,2015). .

The Term structure of interest rates in Australia

In simple terms the relationship between various maturities or terms and the bond yields or

interest rates is defined as the structure of interest rates. The term structure of interest

rates is very important in an economy and acts as a vital bench mark in the world of income.

In other words the overall the collective expectations of market participants regarding

monitory policy conditions, inflation and interest rates is reflected in the term structure (ain-

Chandra et al, 2009).

The expected and current short term rates determine the overall long term interest rates in

the economy. Such brings about indifferences among rational investors when deciding on

in short and long term bonds investments due to similar investment returns for all the

options (Mankiw, 2014). The term structure of interest rates is affected by various variables

like the risk premier and the overall investor expectations. Risk expectations are usually

brought about by changes in yields which make the overall interpretation and modelling of

the interest rate structure a bit complex (Reserve Bank of Australia, 2009). The reserve bank

of Australia of recent adopted the ATSM model and was able to identify that there has been

a decline the real interest rates medium and long term expectations. It is also clear that

premia risk changes have a strong impact compared to observed yields movement

expectations while expectations for future real, short term nominal and inflation rate

change over time It also found out that since the 1990's there has been a fall in the

expectations of long term inflation mainly die increased credibility of the RBA targeting

inflation frame work (Viney &Phillip,s2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS

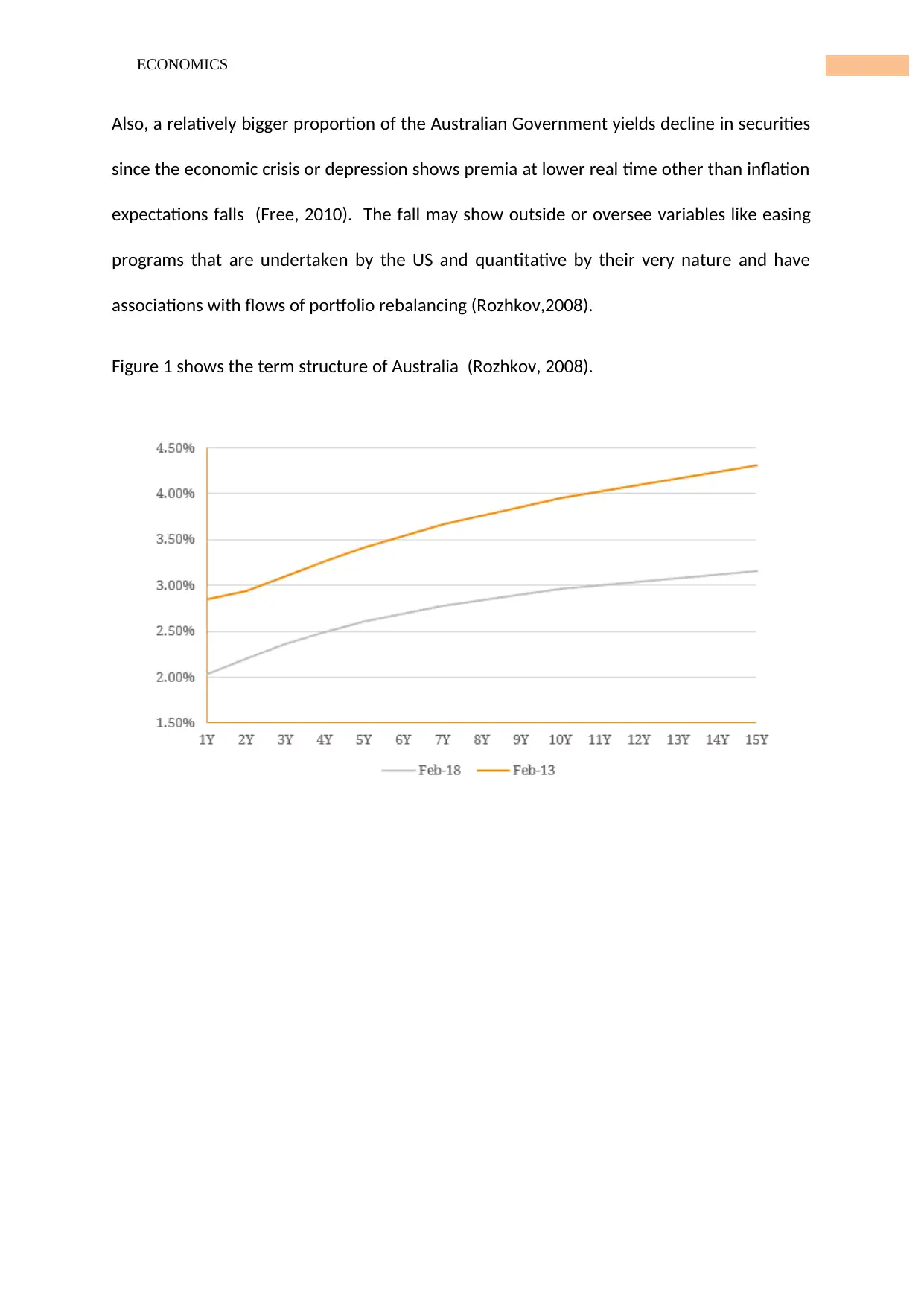

Also, a relatively bigger proportion of the Australian Government yields decline in securities

since the economic crisis or depression shows premia at lower real time other than inflation

expectations falls (Free, 2010). The fall may show outside or oversee variables like easing

programs that are undertaken by the US and quantitative by their very nature and have

associations with flows of portfolio rebalancing (Rozhkov,2008).

Figure 1 shows the term structure of Australia (Rozhkov, 2008).

Also, a relatively bigger proportion of the Australian Government yields decline in securities

since the economic crisis or depression shows premia at lower real time other than inflation

expectations falls (Free, 2010). The fall may show outside or oversee variables like easing

programs that are undertaken by the US and quantitative by their very nature and have

associations with flows of portfolio rebalancing (Rozhkov,2008).

Figure 1 shows the term structure of Australia (Rozhkov, 2008).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS

References

Viney,C.&Phillips,P.(2015).Financialinstitutions,instruments,andmarkets,8thedn,McGraw-

HillAustralia, Sydney, ISBN:9781743079959

Gray, D., and . Malone,S.(2008).Microfinancial Risk Analysis, Chichester, West Sussex, England;

Hoboken, NJ: J. Wiley & Sons Inc.

ain-Chandra, S., P. N’Diaye, and .Oura,H. (20090. “How Vulnerable is Corporate Asia?,” Chapter 3,

Regional Economic Outlook, Asia and Pacific: Global Crisis: the Asian Context, (Washington:

International Monetary Fund).

Reserve Bank of Australia. (2009). Financial Stability Report: March 2009 (Sydney: Reserve Bank of

Australia).

Rozhkov, D.(2008).“Australian Banks: Weathering the Global Storm,” Australia: Selected Issues, IMF

Country Report No. 08/311 (Washington: International Monetary Fund)

Daley J, D,. and Parsonage, H.(2016). Hot Property: Negative Gearing and Capital Gains Tax Reform,

Grattan Institute Report No 2016-8, Grattan Institute, Melbourne.

Gillitzer, C., and Simon.J.(2015).‘Inflation Targeting: A Victim of Its Own Success?’, RBA Research

Discussion Paper No 2015-09.

Cusbert,T., and Kendall, E.(2018). ‘Meet MARTIN, the RBA’s New Macroeconomic Model’, RBA

Bulletin, March, viewed.

References

Viney,C.&Phillips,P.(2015).Financialinstitutions,instruments,andmarkets,8thedn,McGraw-

HillAustralia, Sydney, ISBN:9781743079959

Gray, D., and . Malone,S.(2008).Microfinancial Risk Analysis, Chichester, West Sussex, England;

Hoboken, NJ: J. Wiley & Sons Inc.

ain-Chandra, S., P. N’Diaye, and .Oura,H. (20090. “How Vulnerable is Corporate Asia?,” Chapter 3,

Regional Economic Outlook, Asia and Pacific: Global Crisis: the Asian Context, (Washington:

International Monetary Fund).

Reserve Bank of Australia. (2009). Financial Stability Report: March 2009 (Sydney: Reserve Bank of

Australia).

Rozhkov, D.(2008).“Australian Banks: Weathering the Global Storm,” Australia: Selected Issues, IMF

Country Report No. 08/311 (Washington: International Monetary Fund)

Daley J, D,. and Parsonage, H.(2016). Hot Property: Negative Gearing and Capital Gains Tax Reform,

Grattan Institute Report No 2016-8, Grattan Institute, Melbourne.

Gillitzer, C., and Simon.J.(2015).‘Inflation Targeting: A Victim of Its Own Success?’, RBA Research

Discussion Paper No 2015-09.

Cusbert,T., and Kendall, E.(2018). ‘Meet MARTIN, the RBA’s New Macroeconomic Model’, RBA

Bulletin, March, viewed.

8ECONOMICS

Debelle, G. (2017). ‘Global Influences on Domestic Monetary Policy’, Committee for Economic

Development of Australia (CEDA) Mid-Year Economic Update, Adelaide, 21 July.

Kent, C .(2018). ‘Australian Fixed Income Securities in a Low Rate World’, Address to the Debt

Capital Markets Summit, Sydney, 14 March.

Free, R .(2010). 21st Century Economics: A Reference Handbook. Volume 1. SAGE Publications. p. 8.

ISBN 978-1-4129-6142-4.

Mankiw, N. (2014). Principles of Microeconomics. Cengage Learning. p. 32

Debelle, G. (2017). ‘Global Influences on Domestic Monetary Policy’, Committee for Economic

Development of Australia (CEDA) Mid-Year Economic Update, Adelaide, 21 July.

Kent, C .(2018). ‘Australian Fixed Income Securities in a Low Rate World’, Address to the Debt

Capital Markets Summit, Sydney, 14 March.

Free, R .(2010). 21st Century Economics: A Reference Handbook. Volume 1. SAGE Publications. p. 8.

ISBN 978-1-4129-6142-4.

Mankiw, N. (2014). Principles of Microeconomics. Cengage Learning. p. 32

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.