Assessing Monopoly Power and Government Intervention in the Economy

VerifiedAdded on 2023/04/19

|13

|3027

|274

Essay

AI Summary

This essay examines the concept of monopoly power within the Australian industry, using the Australian postal services as an example of a monopoly market structure and the Australian banking sector as an oligopoly. It identifies the inefficiencies, such as allocative inefficiency and deadweight loss, that arise from the exercise of monopoly power. The essay further explains how government intervention, through measures like regulation of service quality, merger policies, breaking up monopolies, rate-of-return regulation, and probing the abuse of monopoly power, is used to curb this power and promote a more efficient outcome for the economy. The analysis includes diagrams to illustrate allocative efficiency and inefficiency in monopoly markets, highlighting the impact on consumer surplus and overall economic welfare.

Running Head: ECONOMICS. 1

ECONOMICS FOR BUSINESS

Name:

Institution:

Date:

ECONOMICS FOR BUSINESS

Name:

Institution:

Date:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS. 2

Economics for Business.

Introduction.

A Monopoly market structure is categorised by a solitary trader, who is trading in a

distinctive product in the market. In such a market, the trader encounters no competition,

because he is the only trader of that particular good which has no close substitutes. On the

other hand, when the other firms engage in trading of that particular goods and services, the

industry eventually transform into oligopoly where few firms dominate and have the

authority of the market (Wei-hua, 2014).

The Australian postal services are an example of monopoly market structure. They

offer very perfect services which deter other potential firms from entering the market. The

postal service organization in Australia commands the whole postal service industry and

therefore, acts as a price maker in the industry (Lovelock, 2015). Sole proprietors and

individuals cannot establish a monopoly business and make it for very long time in the

market industry, this is because other few organizations would facsimile the idea and start

immediately the business and this would now mean that the market would shift from

monopoly to oligopoly market structure (Çakır, 2015). The monopoly business is very

successful when being implemented by the government, this is so because the government

will create barriers to entry and remain in the business alone like the case of Postal services

of Australia being dominated by the government. The postal corporation has been given the

mandate to distribute letter post in Australia. This approval came after the amendment and

ratification of an act in the year 1989 (Alexander, 2017). The government enjoys the

monopoly in the postal industry due to the fact that it has the power to pass the approval act

and it also has a remarkable fast and reliable services. The government also acts as a price

maker because they have the solitary ability to effect the prices in the market. This is

Economics for Business.

Introduction.

A Monopoly market structure is categorised by a solitary trader, who is trading in a

distinctive product in the market. In such a market, the trader encounters no competition,

because he is the only trader of that particular good which has no close substitutes. On the

other hand, when the other firms engage in trading of that particular goods and services, the

industry eventually transform into oligopoly where few firms dominate and have the

authority of the market (Wei-hua, 2014).

The Australian postal services are an example of monopoly market structure. They

offer very perfect services which deter other potential firms from entering the market. The

postal service organization in Australia commands the whole postal service industry and

therefore, acts as a price maker in the industry (Lovelock, 2015). Sole proprietors and

individuals cannot establish a monopoly business and make it for very long time in the

market industry, this is because other few organizations would facsimile the idea and start

immediately the business and this would now mean that the market would shift from

monopoly to oligopoly market structure (Çakır, 2015). The monopoly business is very

successful when being implemented by the government, this is so because the government

will create barriers to entry and remain in the business alone like the case of Postal services

of Australia being dominated by the government. The postal corporation has been given the

mandate to distribute letter post in Australia. This approval came after the amendment and

ratification of an act in the year 1989 (Alexander, 2017). The government enjoys the

monopoly in the postal industry due to the fact that it has the power to pass the approval act

and it also has a remarkable fast and reliable services. The government also acts as a price

maker because they have the solitary ability to effect the prices in the market. This is

ECONOMICS. 3

although very dangerous because not all the citizens can afford when prices slog, which is a

common trend with the Australian postal services (Whincop, 2017).

The Australian Banking sector follows an oligopoly market structure. In oligopoly

market structure, the market is dictated by very few firm and it is usually said to be

concentrated. Many other small firms also operate in the market despite the dominance

attributed to the few firms who have solitary authority in the market. In Australia, few banks

operate in the banking sector, they are prospective in nature and strive very hard to maximize

profits they include ANZ Bank, NAB Bank, Westpac bank and the Commonwealth Bank of

Australia (Seltzer, 2017). The firms are known in making abnormal profits. The four banks

operate in the market and share profits amongst themselves. Withstanding the hard economic

times in the banking industry discourages many other prospective entrants to the market. The

small banks that intends to enter the banking industry find it very hard due to the enormous

capital venture required for a start-up. The big four banks of Australia operate in a joint

manner and stakeholders venture in fruitful ventures after thorough analysis of different

investments (Zhang, 2017). The Banking industry is dominated by few firms that causes

unfair competition in the sector resulting to a deadweight loss in the economy and other

negative aspect in the Australian economy. The oligopoly banks acts as the price makers and

rules the industry and therefore, discourages the new entrants in the industry (Abbott, 2018).

Major inefficiencies associated with monopolies.

Allocative Efficiency

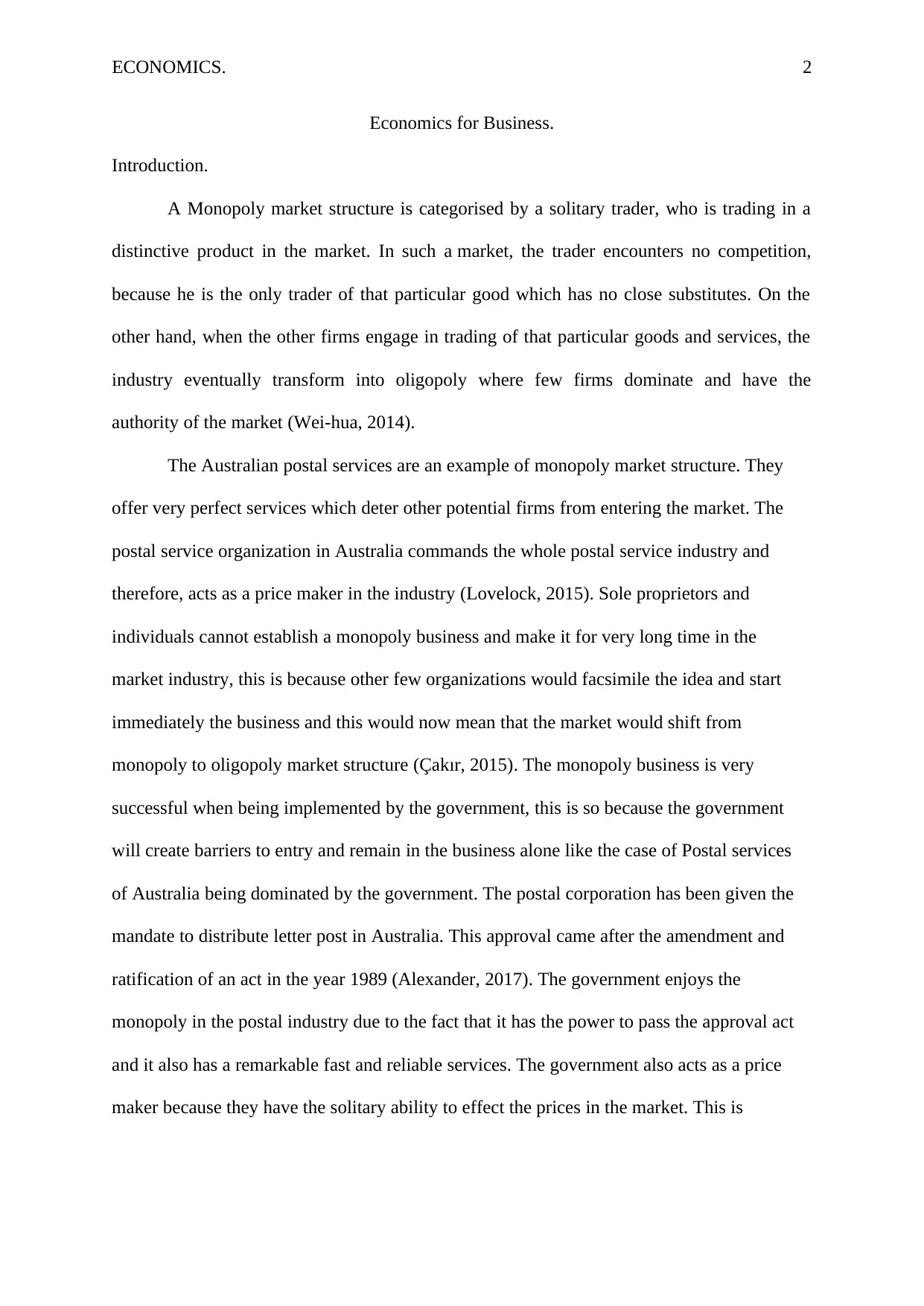

This happens when there is an ideal sharing of products, considering the fact that

purchaser’s favourites. Allocative efficiency can also be referred to as the production level

where the cost is equivalent to the Marginal Cost of production (P=MC). It is assumed that

the cost the purchasers are confident spending in a particular goods and services is

corresponding to the marginal utility they are expecting to get from the consumption of the

although very dangerous because not all the citizens can afford when prices slog, which is a

common trend with the Australian postal services (Whincop, 2017).

The Australian Banking sector follows an oligopoly market structure. In oligopoly

market structure, the market is dictated by very few firm and it is usually said to be

concentrated. Many other small firms also operate in the market despite the dominance

attributed to the few firms who have solitary authority in the market. In Australia, few banks

operate in the banking sector, they are prospective in nature and strive very hard to maximize

profits they include ANZ Bank, NAB Bank, Westpac bank and the Commonwealth Bank of

Australia (Seltzer, 2017). The firms are known in making abnormal profits. The four banks

operate in the market and share profits amongst themselves. Withstanding the hard economic

times in the banking industry discourages many other prospective entrants to the market. The

small banks that intends to enter the banking industry find it very hard due to the enormous

capital venture required for a start-up. The big four banks of Australia operate in a joint

manner and stakeholders venture in fruitful ventures after thorough analysis of different

investments (Zhang, 2017). The Banking industry is dominated by few firms that causes

unfair competition in the sector resulting to a deadweight loss in the economy and other

negative aspect in the Australian economy. The oligopoly banks acts as the price makers and

rules the industry and therefore, discourages the new entrants in the industry (Abbott, 2018).

Major inefficiencies associated with monopolies.

Allocative Efficiency

This happens when there is an ideal sharing of products, considering the fact that

purchaser’s favourites. Allocative efficiency can also be referred to as the production level

where the cost is equivalent to the Marginal Cost of production (P=MC). It is assumed that

the cost the purchasers are confident spending in a particular goods and services is

corresponding to the marginal utility they are expecting to get from the consumption of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS. 4

product or the utility they are going to derive from the service usage (Fernández-Blanco,

2018). For that reason, the ideal sharing of products is attained when the marginal utility of

the products and services is equivalent to the marginal cost (Svensson, 2017). This can be

explained using a graph below.

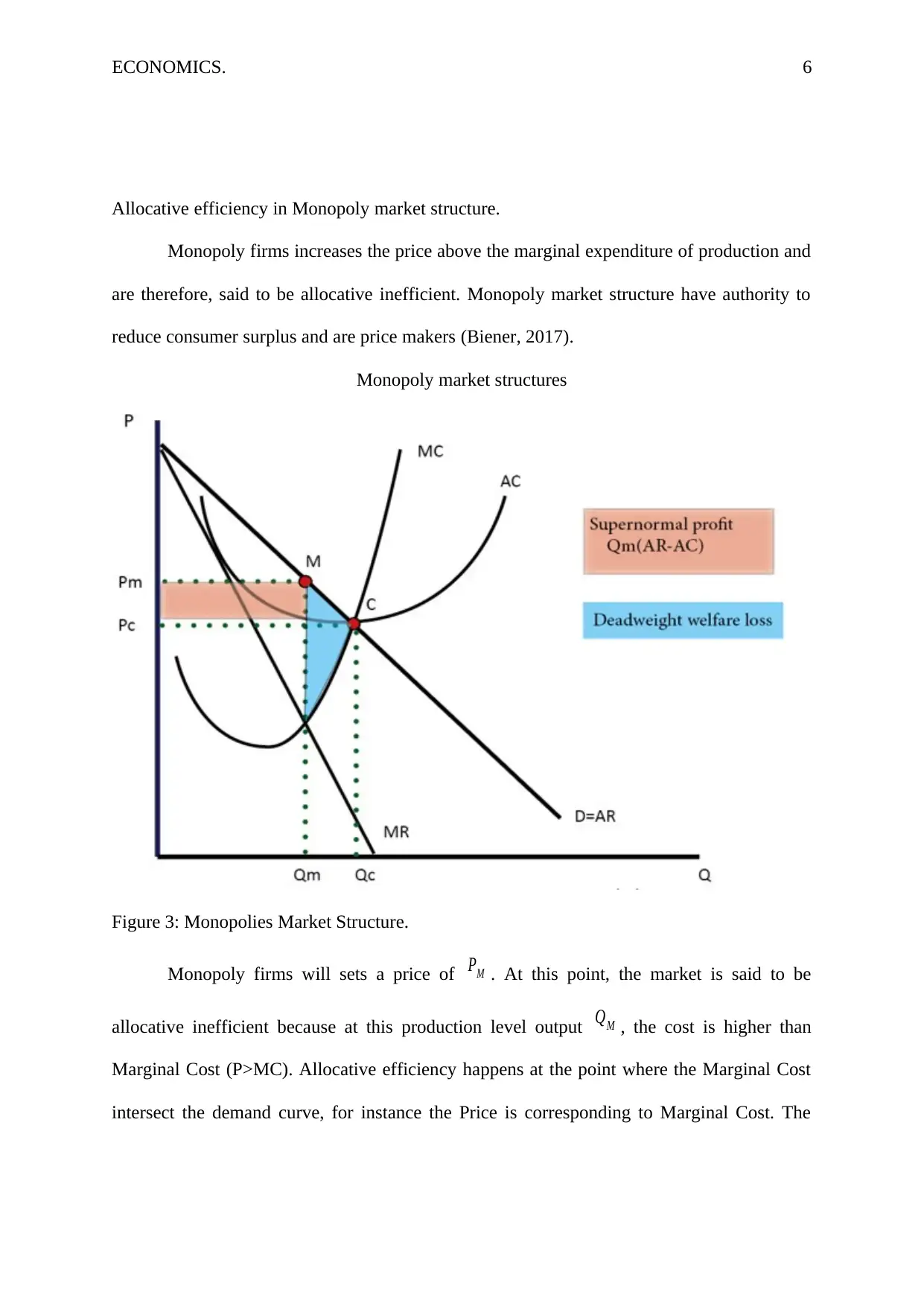

Allocatively efficiency

Figure 1: Allocatively inefficient MU>MC.

At a production output of 40 units, the marginal expenditure of the good and services

is $6, with the same production output purchasers would be ready to part with a price

amounting to $15 at this point the sector is allocatively inefficient because the Marginal

benefit is greater than the Marginal Cost. The cost reveals that the products marginal utility is

greater than marginal expenditure which clearly indicate that there is minimal consumption of

goods and services in the market. When the production of output is increased from 40 units to

70 units the price of the goods and services also decreases from $15 to $11. The society

benefits from the increased production of output as it results to price reduction and hence

product or the utility they are going to derive from the service usage (Fernández-Blanco,

2018). For that reason, the ideal sharing of products is attained when the marginal utility of

the products and services is equivalent to the marginal cost (Svensson, 2017). This can be

explained using a graph below.

Allocatively efficiency

Figure 1: Allocatively inefficient MU>MC.

At a production output of 40 units, the marginal expenditure of the good and services

is $6, with the same production output purchasers would be ready to part with a price

amounting to $15 at this point the sector is allocatively inefficient because the Marginal

benefit is greater than the Marginal Cost. The cost reveals that the products marginal utility is

greater than marginal expenditure which clearly indicate that there is minimal consumption of

goods and services in the market. When the production of output is increased from 40 units to

70 units the price of the goods and services also decreases from $15 to $11. The society

benefits from the increased production of output as it results to price reduction and hence

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS. 5

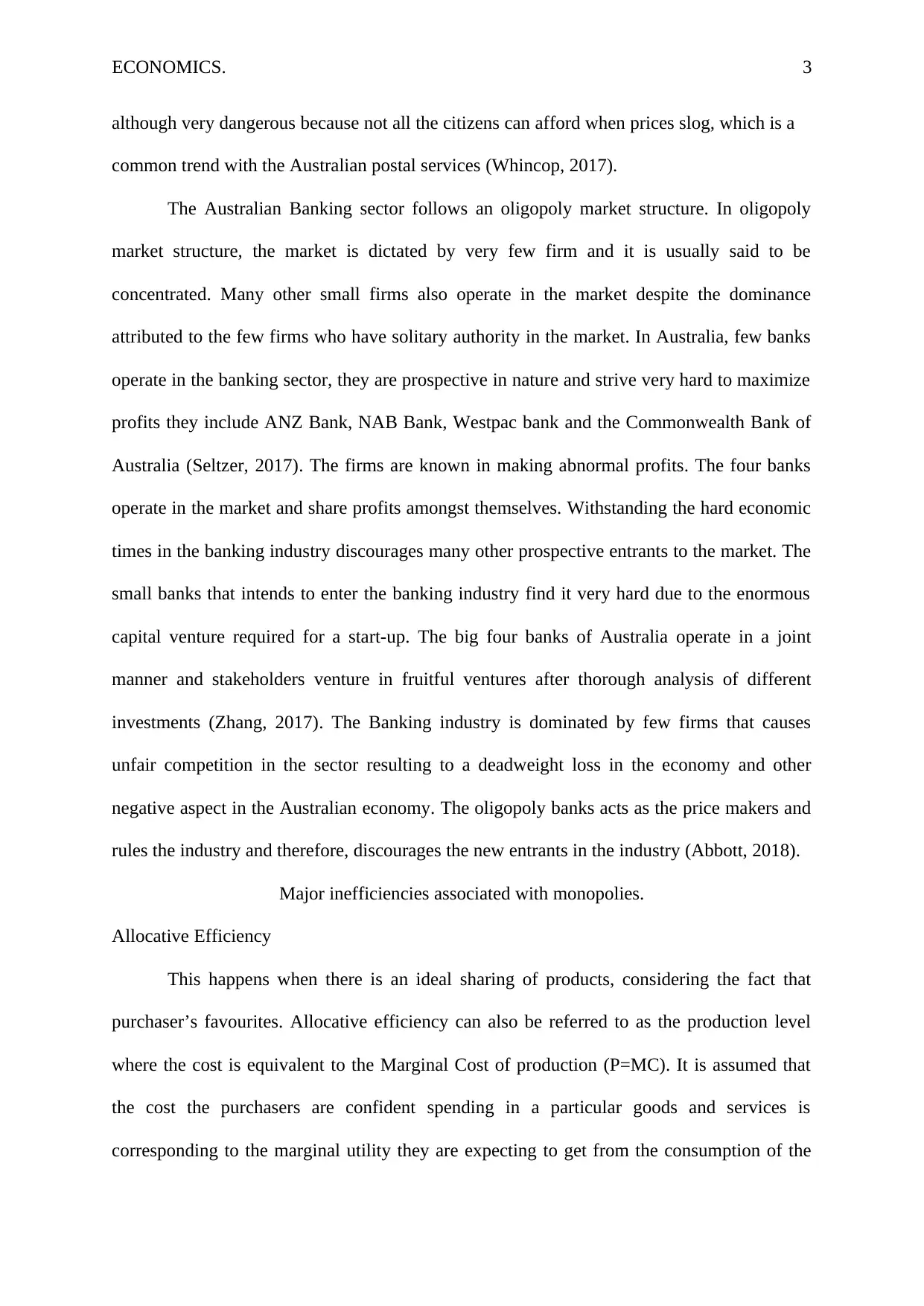

more will likely afford to purchase. The reason is that the market is Allocatively efficient, the

Marginal utility is equal to the marginal cost.

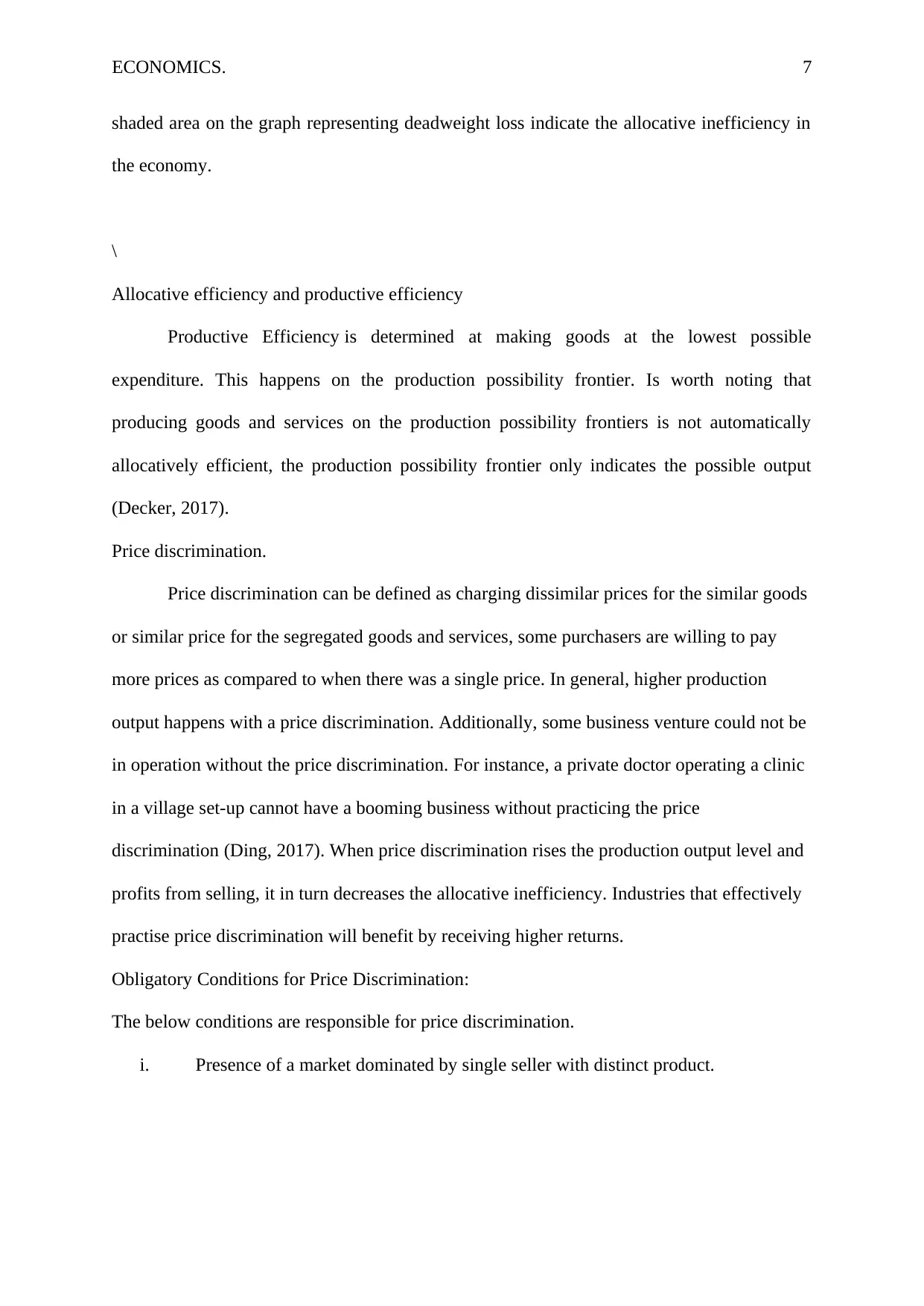

Allocatively efficiency.

Figure 2: Allocatively inefficient MC>MU

At a production output of 110 units, the marginal expenditure is $17, but the cost at

which consumers are comfortable incurring is only $7 the market is said to be allocatively

inefficient and the Marginal cost is greater than the marginal utility. At this production level,

the marginal cost $17 exceed the marginal benefits which is $7 there is excess consumption

of the product. It therefore, implies that the society at large producing more of the product.

The Allocative efficiency in this case happens at the price of $11 where the marginal cost is

equivalent to marginal utility MU=MC.

more will likely afford to purchase. The reason is that the market is Allocatively efficient, the

Marginal utility is equal to the marginal cost.

Allocatively efficiency.

Figure 2: Allocatively inefficient MC>MU

At a production output of 110 units, the marginal expenditure is $17, but the cost at

which consumers are comfortable incurring is only $7 the market is said to be allocatively

inefficient and the Marginal cost is greater than the marginal utility. At this production level,

the marginal cost $17 exceed the marginal benefits which is $7 there is excess consumption

of the product. It therefore, implies that the society at large producing more of the product.

The Allocative efficiency in this case happens at the price of $11 where the marginal cost is

equivalent to marginal utility MU=MC.

ECONOMICS. 6

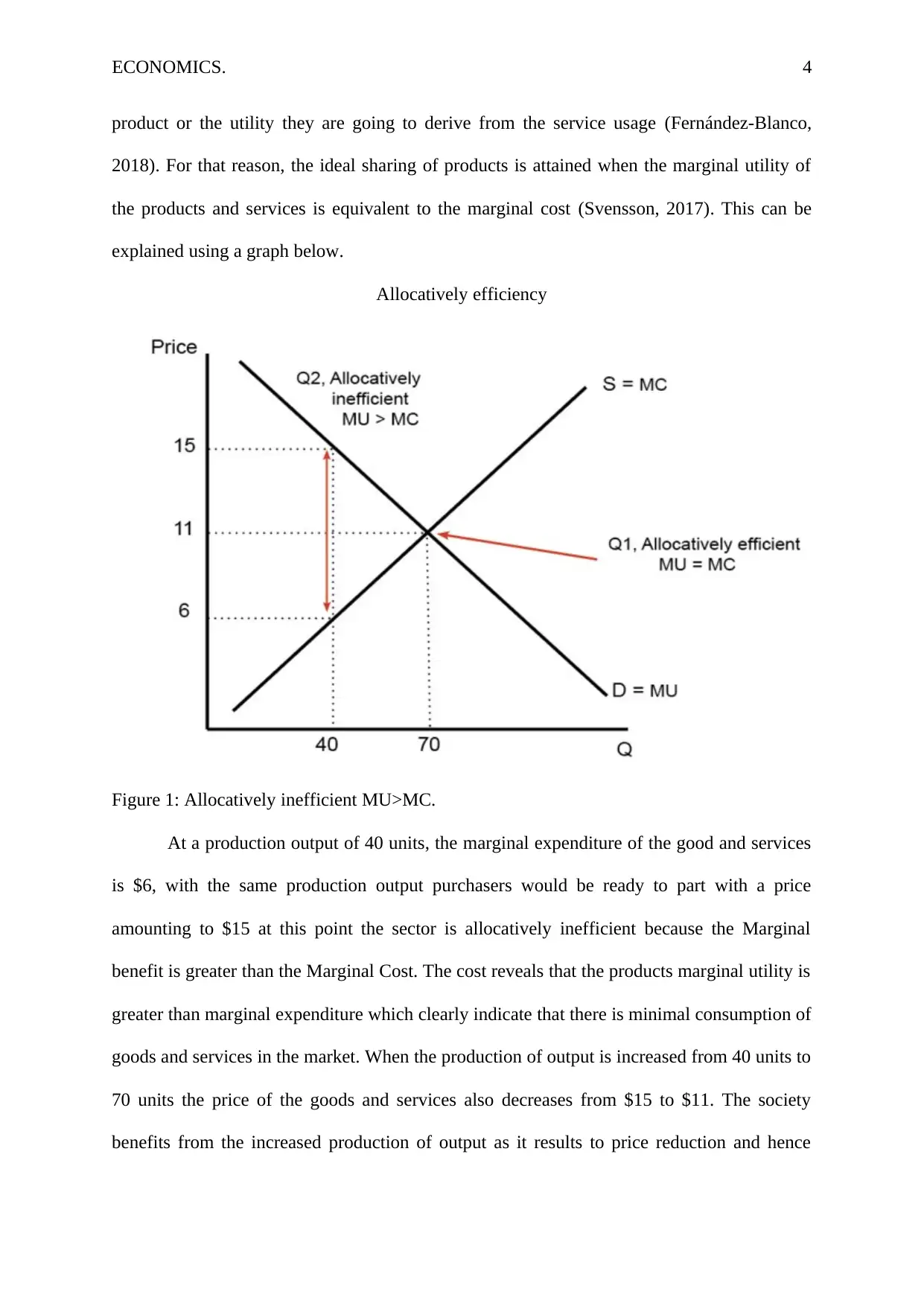

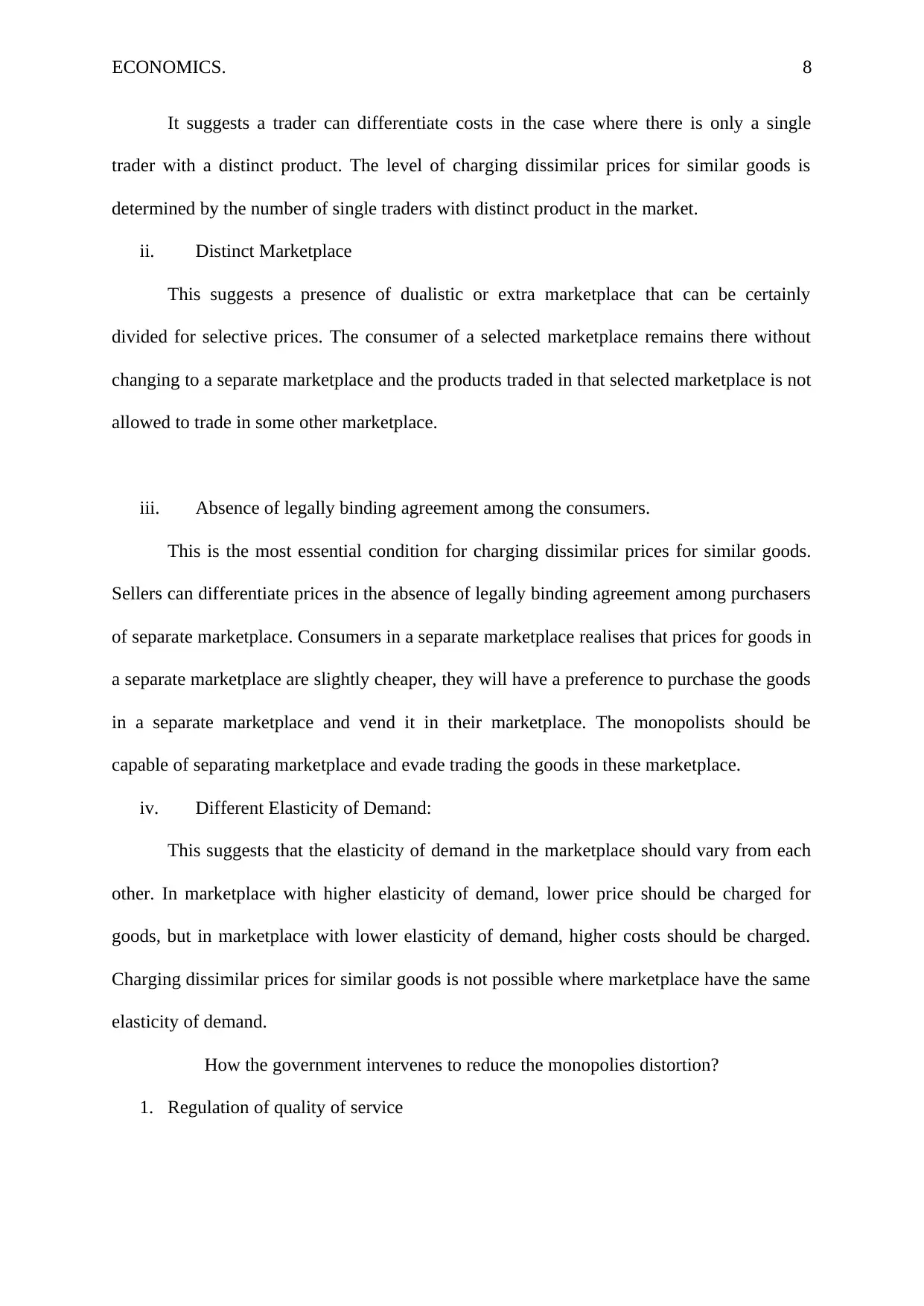

Allocative efficiency in Monopoly market structure.

Monopoly firms increases the price above the marginal expenditure of production and

are therefore, said to be allocative inefficient. Monopoly market structure have authority to

reduce consumer surplus and are price makers (Biener, 2017).

Monopoly market structures

Figure 3: Monopolies Market Structure.

Monopoly firms will sets a price of PM . At this point, the market is said to be

allocative inefficient because at this production level output QM , the cost is higher than

Marginal Cost (P>MC). Allocative efficiency happens at the point where the Marginal Cost

intersect the demand curve, for instance the Price is corresponding to Marginal Cost. The

Allocative efficiency in Monopoly market structure.

Monopoly firms increases the price above the marginal expenditure of production and

are therefore, said to be allocative inefficient. Monopoly market structure have authority to

reduce consumer surplus and are price makers (Biener, 2017).

Monopoly market structures

Figure 3: Monopolies Market Structure.

Monopoly firms will sets a price of PM . At this point, the market is said to be

allocative inefficient because at this production level output QM , the cost is higher than

Marginal Cost (P>MC). Allocative efficiency happens at the point where the Marginal Cost

intersect the demand curve, for instance the Price is corresponding to Marginal Cost. The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS. 7

shaded area on the graph representing deadweight loss indicate the allocative inefficiency in

the economy.

\

Allocative efficiency and productive efficiency

Productive Efficiency is determined at making goods at the lowest possible

expenditure. This happens on the production possibility frontier. Is worth noting that

producing goods and services on the production possibility frontiers is not automatically

allocatively efficient, the production possibility frontier only indicates the possible output

(Decker, 2017).

Price discrimination.

Price discrimination can be defined as charging dissimilar prices for the similar goods

or similar price for the segregated goods and services, some purchasers are willing to pay

more prices as compared to when there was a single price. In general, higher production

output happens with a price discrimination. Additionally, some business venture could not be

in operation without the price discrimination. For instance, a private doctor operating a clinic

in a village set-up cannot have a booming business without practicing the price

discrimination (Ding, 2017). When price discrimination rises the production output level and

profits from selling, it in turn decreases the allocative inefficiency. Industries that effectively

practise price discrimination will benefit by receiving higher returns.

Obligatory Conditions for Price Discrimination:

The below conditions are responsible for price discrimination.

i. Presence of a market dominated by single seller with distinct product.

shaded area on the graph representing deadweight loss indicate the allocative inefficiency in

the economy.

\

Allocative efficiency and productive efficiency

Productive Efficiency is determined at making goods at the lowest possible

expenditure. This happens on the production possibility frontier. Is worth noting that

producing goods and services on the production possibility frontiers is not automatically

allocatively efficient, the production possibility frontier only indicates the possible output

(Decker, 2017).

Price discrimination.

Price discrimination can be defined as charging dissimilar prices for the similar goods

or similar price for the segregated goods and services, some purchasers are willing to pay

more prices as compared to when there was a single price. In general, higher production

output happens with a price discrimination. Additionally, some business venture could not be

in operation without the price discrimination. For instance, a private doctor operating a clinic

in a village set-up cannot have a booming business without practicing the price

discrimination (Ding, 2017). When price discrimination rises the production output level and

profits from selling, it in turn decreases the allocative inefficiency. Industries that effectively

practise price discrimination will benefit by receiving higher returns.

Obligatory Conditions for Price Discrimination:

The below conditions are responsible for price discrimination.

i. Presence of a market dominated by single seller with distinct product.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS. 8

It suggests a trader can differentiate costs in the case where there is only a single

trader with a distinct product. The level of charging dissimilar prices for similar goods is

determined by the number of single traders with distinct product in the market.

ii. Distinct Marketplace

This suggests a presence of dualistic or extra marketplace that can be certainly

divided for selective prices. The consumer of a selected marketplace remains there without

changing to a separate marketplace and the products traded in that selected marketplace is not

allowed to trade in some other marketplace.

iii. Absence of legally binding agreement among the consumers.

This is the most essential condition for charging dissimilar prices for similar goods.

Sellers can differentiate prices in the absence of legally binding agreement among purchasers

of separate marketplace. Consumers in a separate marketplace realises that prices for goods in

a separate marketplace are slightly cheaper, they will have a preference to purchase the goods

in a separate marketplace and vend it in their marketplace. The monopolists should be

capable of separating marketplace and evade trading the goods in these marketplace.

iv. Different Elasticity of Demand:

This suggests that the elasticity of demand in the marketplace should vary from each

other. In marketplace with higher elasticity of demand, lower price should be charged for

goods, but in marketplace with lower elasticity of demand, higher costs should be charged.

Charging dissimilar prices for similar goods is not possible where marketplace have the same

elasticity of demand.

How the government intervenes to reduce the monopolies distortion?

1. Regulation of quality of service

It suggests a trader can differentiate costs in the case where there is only a single

trader with a distinct product. The level of charging dissimilar prices for similar goods is

determined by the number of single traders with distinct product in the market.

ii. Distinct Marketplace

This suggests a presence of dualistic or extra marketplace that can be certainly

divided for selective prices. The consumer of a selected marketplace remains there without

changing to a separate marketplace and the products traded in that selected marketplace is not

allowed to trade in some other marketplace.

iii. Absence of legally binding agreement among the consumers.

This is the most essential condition for charging dissimilar prices for similar goods.

Sellers can differentiate prices in the absence of legally binding agreement among purchasers

of separate marketplace. Consumers in a separate marketplace realises that prices for goods in

a separate marketplace are slightly cheaper, they will have a preference to purchase the goods

in a separate marketplace and vend it in their marketplace. The monopolists should be

capable of separating marketplace and evade trading the goods in these marketplace.

iv. Different Elasticity of Demand:

This suggests that the elasticity of demand in the marketplace should vary from each

other. In marketplace with higher elasticity of demand, lower price should be charged for

goods, but in marketplace with lower elasticity of demand, higher costs should be charged.

Charging dissimilar prices for similar goods is not possible where marketplace have the same

elasticity of demand.

How the government intervenes to reduce the monopolies distortion?

1. Regulation of quality of service

ECONOMICS. 9

Government regulators inspect the quality of goods and service delivered by the

monopoly firms on regular basis. A case where the railway regulator inspects the welfare

performance of railway companies to confirm that they use the required materials during

construction of railway lines.

In the other energy sectors like gas and electricity sectors, the regulators will ensure that the

people of a country are treated with concern and they get the value of their expenditure. for

instance, not agree to a monopoly firm to take off gas supplies during winter season (O'Toole,

2018).

2. Merger policy

The state has a rule mandate to probe unions that intend to dominate and make monopoly

power. If a new union makes a company with more than 30% of market share, it is by design

reported to the commission responsible for competition. The commission therefore, has the

authority to make decision whether to let them operate in the market or disapprove the

merger (Mini, 2018).

3. Breaking up a monopoly

In some cases, the government might resolve to break up a monopoly firm when they

deem that the firm has become too powerful in the market and it is causing more harm than

good to the consumers of their goods and services. This type of resolution occurs in rare

cases. For instance, the United States probed Microsoft and look into possibilities of breaking

up the monopoly, but later they decided to do away with the decision (Hawley, 2015). This

action is very harsh because the government too enjoys the taxes and the Microsoft users too,

get exclusive services from Microsoft providers. Again the United States government were

not sure whether the new firms would not collude in the market.

4. Rate-of- Return Regulation

Government regulators inspect the quality of goods and service delivered by the

monopoly firms on regular basis. A case where the railway regulator inspects the welfare

performance of railway companies to confirm that they use the required materials during

construction of railway lines.

In the other energy sectors like gas and electricity sectors, the regulators will ensure that the

people of a country are treated with concern and they get the value of their expenditure. for

instance, not agree to a monopoly firm to take off gas supplies during winter season (O'Toole,

2018).

2. Merger policy

The state has a rule mandate to probe unions that intend to dominate and make monopoly

power. If a new union makes a company with more than 30% of market share, it is by design

reported to the commission responsible for competition. The commission therefore, has the

authority to make decision whether to let them operate in the market or disapprove the

merger (Mini, 2018).

3. Breaking up a monopoly

In some cases, the government might resolve to break up a monopoly firm when they

deem that the firm has become too powerful in the market and it is causing more harm than

good to the consumers of their goods and services. This type of resolution occurs in rare

cases. For instance, the United States probed Microsoft and look into possibilities of breaking

up the monopoly, but later they decided to do away with the decision (Hawley, 2015). This

action is very harsh because the government too enjoys the taxes and the Microsoft users too,

get exclusive services from Microsoft providers. Again the United States government were

not sure whether the new firms would not collude in the market.

4. Rate-of- Return Regulation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS. 10

Rate-of-return regulation is a structure to set the prices charged by state

controlled markets for single trader with distinct products like water and electricity. If the

companies continue to uncontrolled, they could simply charge much higher amounts since

buyers would be willing to pay any price for products and services such as electricity or

water. A drawback of rate of return regulation is that it may result to cost padding, a situation

where firms let prices to rise so that return margins are not considered extreme. Rate of return

regulation provides a slight encouragement to be efficient and increase returns. Rate of return

regulation may fail to assess how much returns is sensible. When they fix too high, then

companies can exploit their monopoly power (O'Toole, 2018).

5. Probing the abuse of monopoly power

United Kingdom has the office of fair trading and has the mandate to probe the abuse

of monopoly power by firms operating under monopoly (Tigar, 2018). This abuses comprise

of discriminating trading practices like collusion where firms operating in a market agrees

with one another to set higher prices, Collusive tendering where companies enters into

contract to fix the bid at which they will tender for a certain project then the companies will

take in turns to get the contract at much more prices, Predatory pricing which entails fixing

the price very low this discourages and ejects out the other competitor companies out of the

business and lastly the selective distribution where the companies enter into selective and

special distribution to some few selected to keep the prices high in the market for instance the

United Kingdom cars are speculated to be expensive than other European countries (Tigar,

2018).

In conclusion, the Australian postal services are an example of monopoly market

structure. They offer very perfect services which deter other potential firms from entering the

market. The postal service organization in Australia commands the whole postal service

industry and therefore, acts as a price maker in the industry. The government use various

Rate-of-return regulation is a structure to set the prices charged by state

controlled markets for single trader with distinct products like water and electricity. If the

companies continue to uncontrolled, they could simply charge much higher amounts since

buyers would be willing to pay any price for products and services such as electricity or

water. A drawback of rate of return regulation is that it may result to cost padding, a situation

where firms let prices to rise so that return margins are not considered extreme. Rate of return

regulation provides a slight encouragement to be efficient and increase returns. Rate of return

regulation may fail to assess how much returns is sensible. When they fix too high, then

companies can exploit their monopoly power (O'Toole, 2018).

5. Probing the abuse of monopoly power

United Kingdom has the office of fair trading and has the mandate to probe the abuse

of monopoly power by firms operating under monopoly (Tigar, 2018). This abuses comprise

of discriminating trading practices like collusion where firms operating in a market agrees

with one another to set higher prices, Collusive tendering where companies enters into

contract to fix the bid at which they will tender for a certain project then the companies will

take in turns to get the contract at much more prices, Predatory pricing which entails fixing

the price very low this discourages and ejects out the other competitor companies out of the

business and lastly the selective distribution where the companies enter into selective and

special distribution to some few selected to keep the prices high in the market for instance the

United Kingdom cars are speculated to be expensive than other European countries (Tigar,

2018).

In conclusion, the Australian postal services are an example of monopoly market

structure. They offer very perfect services which deter other potential firms from entering the

market. The postal service organization in Australia commands the whole postal service

industry and therefore, acts as a price maker in the industry. The government use various

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS. 11

methods to reduce monopoly power which include merger policy, rate of return regulation,

breaking up monopoly and regulation of quality services.

References

Abbott, M. (2018). Markets and the State: Microeconomic Policy in Australia. Routledge.

Alexander, D. W. (2017). Challenges to domestic air freight in Australia: Evaluating air

traffic markets with gravity modelling. Journal of Air Transport Management, 61, 41-

52.

Biener, C. E. (2017). The structure of the global reinsurance market: An analysis of

efficiency, scale, and scope. Journal of Banking & Finance, 77, 213-229.

Çakır, S. P. (2015). Evaluating the comparative efficiency of the postal services in OECD

countries using context-dependent and measure-specific data envelopment analysis.

Benchmarking: An International Journal, 22(5), 839-856.

Decker, R. A. (2017). Declining dynamism, allocative efficiency, and the productivity

slowdown. American Economic Review, 107(5), 322-326.

Ding, R. &. (2017). Payment card interchange fees and price discrimination. The Journal of

Industrial Economics, 65(1), 39-72.

Fernández-Blanco, V. &.-Á. (2018). Measuring allocative efficiency in Cultural Economics:

the case of “Fundación Princesa de Asturias”(The Princess of Asturias Foundation).

Journal of Cultural Economics, 42(1), 91-110.

methods to reduce monopoly power which include merger policy, rate of return regulation,

breaking up monopoly and regulation of quality services.

References

Abbott, M. (2018). Markets and the State: Microeconomic Policy in Australia. Routledge.

Alexander, D. W. (2017). Challenges to domestic air freight in Australia: Evaluating air

traffic markets with gravity modelling. Journal of Air Transport Management, 61, 41-

52.

Biener, C. E. (2017). The structure of the global reinsurance market: An analysis of

efficiency, scale, and scope. Journal of Banking & Finance, 77, 213-229.

Çakır, S. P. (2015). Evaluating the comparative efficiency of the postal services in OECD

countries using context-dependent and measure-specific data envelopment analysis.

Benchmarking: An International Journal, 22(5), 839-856.

Decker, R. A. (2017). Declining dynamism, allocative efficiency, and the productivity

slowdown. American Economic Review, 107(5), 322-326.

Ding, R. &. (2017). Payment card interchange fees and price discrimination. The Journal of

Industrial Economics, 65(1), 39-72.

Fernández-Blanco, V. &.-Á. (2018). Measuring allocative efficiency in Cultural Economics:

the case of “Fundación Princesa de Asturias”(The Princess of Asturias Foundation).

Journal of Cultural Economics, 42(1), 91-110.

ECONOMICS. 12

Hawley, E. W. (2015). The New Deal and the problem of monopoly. Princeton University

Press.

Lovelock, C. &. (2015). Services marketing. Pearson Australia.

Mini, F. (2018). Fifty is the New Forty: EU Merger Policy Permits Higher Market Shares

After the 2004 Reform. Review of Industrial Organization, 53(3), 535-561.

O'Toole, N. (2018). Consumers in Shock: How Federal Government Overregulation Led

Mylan to Acquire a Monopoly over Epinephrine Autoinjectors. DePaul Business and

Commercial Law Journal, 16(1), 5-17.

Seltzer, A. J. (2017). Implicit contracts and acquisitions: An econometric case study of the

19th century Australian banking industry. German Journal of Human Resource

Management, 31(2), 185-208.

Svensson, L. E. (2017). Cost-benefit analysis of leaning against the wind. Journal of

Monetary Economics, 90, 193-213.

Tigar, M. (2018). Mythologies of State and Monopoly Power. NYU Press.

Wei-hua, C. H. (2014). A Review on the Definition of “Relevant Market” in the Era of

Network Economy Anti-monopoly. Journal of Hangzhou Dianzi University (Social

Sciences), 4(6).

Whincop, M. J. (2017). From bureaucracy to business enterprise: Legal and policy issues in

the transformation of government services. Routledge.

Zhang, Y. (2017). Client importance and audit quality, office level evidence from the banking

industry: a pitch. Accounting Research Journal, 30(2), 147-152.

Hawley, E. W. (2015). The New Deal and the problem of monopoly. Princeton University

Press.

Lovelock, C. &. (2015). Services marketing. Pearson Australia.

Mini, F. (2018). Fifty is the New Forty: EU Merger Policy Permits Higher Market Shares

After the 2004 Reform. Review of Industrial Organization, 53(3), 535-561.

O'Toole, N. (2018). Consumers in Shock: How Federal Government Overregulation Led

Mylan to Acquire a Monopoly over Epinephrine Autoinjectors. DePaul Business and

Commercial Law Journal, 16(1), 5-17.

Seltzer, A. J. (2017). Implicit contracts and acquisitions: An econometric case study of the

19th century Australian banking industry. German Journal of Human Resource

Management, 31(2), 185-208.

Svensson, L. E. (2017). Cost-benefit analysis of leaning against the wind. Journal of

Monetary Economics, 90, 193-213.

Tigar, M. (2018). Mythologies of State and Monopoly Power. NYU Press.

Wei-hua, C. H. (2014). A Review on the Definition of “Relevant Market” in the Era of

Network Economy Anti-monopoly. Journal of Hangzhou Dianzi University (Social

Sciences), 4(6).

Whincop, M. J. (2017). From bureaucracy to business enterprise: Legal and policy issues in

the transformation of government services. Routledge.

Zhang, Y. (2017). Client importance and audit quality, office level evidence from the banking

industry: a pitch. Accounting Research Journal, 30(2), 147-152.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.