Economics and International Trade: Australian Mining Industry Report

VerifiedAdded on 2021/06/17

|9

|2936

|25

Report

AI Summary

This report provides a comprehensive economic analysis of the Australian mining industry, with a specific focus on iron ore. It begins with an introduction highlighting the industry's significance to the Australian economy, including its contribution to GDP and exports. The report then delves into the market structure, characterizing the iron ore market as oligopolistic, dominated by a few major players like BHP and Rio Tinto, and examines the cost curves and barriers to entry. The report identifies the determinants of iron ore demand, such as steel production and economic growth in emerging markets like China, and the determinants of supply, including global demand and the number of producers. It also discusses the inelastic demand for iron ore. Finally, the report analyzes a recent event, the Brazil dam disaster, and its potential impact on Australian iron ore prices and global supply chains, concluding with a discussion on the industry's current state and future outlook.

0ECONOMICS

Economics and International Trade

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Economics and International Trade

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS

Table of Contents

Introduction…………………………………………………………………………………..3

Background.................................................................................................................3

Market structure of the industry……………………………………………………………4

Factors that influence demand for the industry’s product………………………………5

Factors that influence supply of the industry’s product(s)………………………………5

Elasticity……………………………………………………………………………………...6

Impacts of an event on the industry……………………………………………………….7

Conclusion…………………………………………………………………………………...8

References…………………………………………………………………………………...9

Appendix…………………………………………………………………………………….10

Table of Contents

Introduction…………………………………………………………………………………..3

Background.................................................................................................................3

Market structure of the industry……………………………………………………………4

Factors that influence demand for the industry’s product………………………………5

Factors that influence supply of the industry’s product(s)………………………………5

Elasticity……………………………………………………………………………………...6

Impacts of an event on the industry……………………………………………………….7

Conclusion…………………………………………………………………………………...8

References…………………………………………………………………………………...9

Appendix…………………………………………………………………………………….10

2ECONOMICS

Introduction

Australian regards mining as an important contributor and primary industry in its

economy. As of 2018, there was a general increase in mining production to a level of

6.10 percent. The average mineral production in Australia from 1978 to the year

2018 stands at a rate of 4.97 percent. Australia experienced the highest level of

mineral production in the year 1987 standing at a rate of 25.20 percent and in the

year 1986 it registered the lowest record of mineral production at a level of negative

16.90 percent. From the period of 1974-2018 the total average gross product from

mining stands at AUD Million 15254.40. The highest level of GDP from mining was

experienced in the year 2018 standing at a level of AUD Million 36287 and in the

year 1974 is when the lowest level of GDP from the mining industry was experienced

at a level of AUD Million 5144. Therefore the overall total contribution of mining to

the Australian economy stands at a rate of 5.6 percent of the Gross domestic

product (Maria et al 2013,pp 30). In regards to Australian exports, the overall total

contribution of minerals stands at a rate of thirty five percent. Globally, Australia is

being regarded as the world leading coal, Zirconium, Zinc, Rutile and iron ore

exporter. It is also the second leading uranium and gold exporter and aluminum third

world leading exporter (Hall 2014, pp 20).

Background

The main exporter of Australian mineral products in the 1990's was Japan. Over a

quarter millions of Australians derive their livelihood from the mining industry.

However, the mining importance in Australia does not mean that a number of people

are employed in the sector (Austmine 2013, pp 15). The mining sector employs an

estimated total of 129,000 individuals which is just 2.2 percent of the overall

Australian total workforce. Recent statistics show that the overall 8.8 percent of

Australian growth value in the year 2017 was a result of mining which higher than

that of the period between 1994 and 1995 by eighty seven percent. The main mining

companies in Australia include among others Rio Tinto and BHP Billiton (Bartos

2007, pp 149). Therefore it basing upon this background that this paper shall provide

a comprehensive analysis and overview of the mining industry market structure,

two determinants of demand, and two determinants of supply for mining products,

demand elasticity for the mining product and the recent event with a substantial

impact on the mining industry.

Analysis of the market structure and its characteristics

Iron ore (oligopoly market structure)

For this section of the paper, iron ore will be used as representative product when

analyzing the market structure of the mining industry. The Australian iron ore

industry is oligopolistic by its very nature. Majority of the share market is possessed

by FMG, BHP and Rio Tinto. There characteristics of monopolistic behavior in the

market (Boudreau-Trudel et al 2014, pp 31). A as result of lower unit costs and

improved productivity the above firms sit comfortably on the lost cost due curve. Low

cost units is brought about by reductions in service and goods expenses through

low or reduced volumes and prices , high levels of productivity in terms of labor ,

minimizing over head costs, maximizing unit productivity and utilization of suppliers

in the emerging markets. It is clear that there well positioning on the cost curve of the

market which will further become flat over time by many Australian miners with

further improvements in technology and cost cutting initiatives.

The average variable costs of production for every mine determine the costs curves .

Ground support consumables, the costs of transportation, processing costs,

royalties, fuel are the main costs variable production costs. More so, the industry is

Introduction

Australian regards mining as an important contributor and primary industry in its

economy. As of 2018, there was a general increase in mining production to a level of

6.10 percent. The average mineral production in Australia from 1978 to the year

2018 stands at a rate of 4.97 percent. Australia experienced the highest level of

mineral production in the year 1987 standing at a rate of 25.20 percent and in the

year 1986 it registered the lowest record of mineral production at a level of negative

16.90 percent. From the period of 1974-2018 the total average gross product from

mining stands at AUD Million 15254.40. The highest level of GDP from mining was

experienced in the year 2018 standing at a level of AUD Million 36287 and in the

year 1974 is when the lowest level of GDP from the mining industry was experienced

at a level of AUD Million 5144. Therefore the overall total contribution of mining to

the Australian economy stands at a rate of 5.6 percent of the Gross domestic

product (Maria et al 2013,pp 30). In regards to Australian exports, the overall total

contribution of minerals stands at a rate of thirty five percent. Globally, Australia is

being regarded as the world leading coal, Zirconium, Zinc, Rutile and iron ore

exporter. It is also the second leading uranium and gold exporter and aluminum third

world leading exporter (Hall 2014, pp 20).

Background

The main exporter of Australian mineral products in the 1990's was Japan. Over a

quarter millions of Australians derive their livelihood from the mining industry.

However, the mining importance in Australia does not mean that a number of people

are employed in the sector (Austmine 2013, pp 15). The mining sector employs an

estimated total of 129,000 individuals which is just 2.2 percent of the overall

Australian total workforce. Recent statistics show that the overall 8.8 percent of

Australian growth value in the year 2017 was a result of mining which higher than

that of the period between 1994 and 1995 by eighty seven percent. The main mining

companies in Australia include among others Rio Tinto and BHP Billiton (Bartos

2007, pp 149). Therefore it basing upon this background that this paper shall provide

a comprehensive analysis and overview of the mining industry market structure,

two determinants of demand, and two determinants of supply for mining products,

demand elasticity for the mining product and the recent event with a substantial

impact on the mining industry.

Analysis of the market structure and its characteristics

Iron ore (oligopoly market structure)

For this section of the paper, iron ore will be used as representative product when

analyzing the market structure of the mining industry. The Australian iron ore

industry is oligopolistic by its very nature. Majority of the share market is possessed

by FMG, BHP and Rio Tinto. There characteristics of monopolistic behavior in the

market (Boudreau-Trudel et al 2014, pp 31). A as result of lower unit costs and

improved productivity the above firms sit comfortably on the lost cost due curve. Low

cost units is brought about by reductions in service and goods expenses through

low or reduced volumes and prices , high levels of productivity in terms of labor ,

minimizing over head costs, maximizing unit productivity and utilization of suppliers

in the emerging markets. It is clear that there well positioning on the cost curve of the

market which will further become flat over time by many Australian miners with

further improvements in technology and cost cutting initiatives.

The average variable costs of production for every mine determine the costs curves .

Ground support consumables, the costs of transportation, processing costs,

royalties, fuel are the main costs variable production costs. More so, the industry is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS

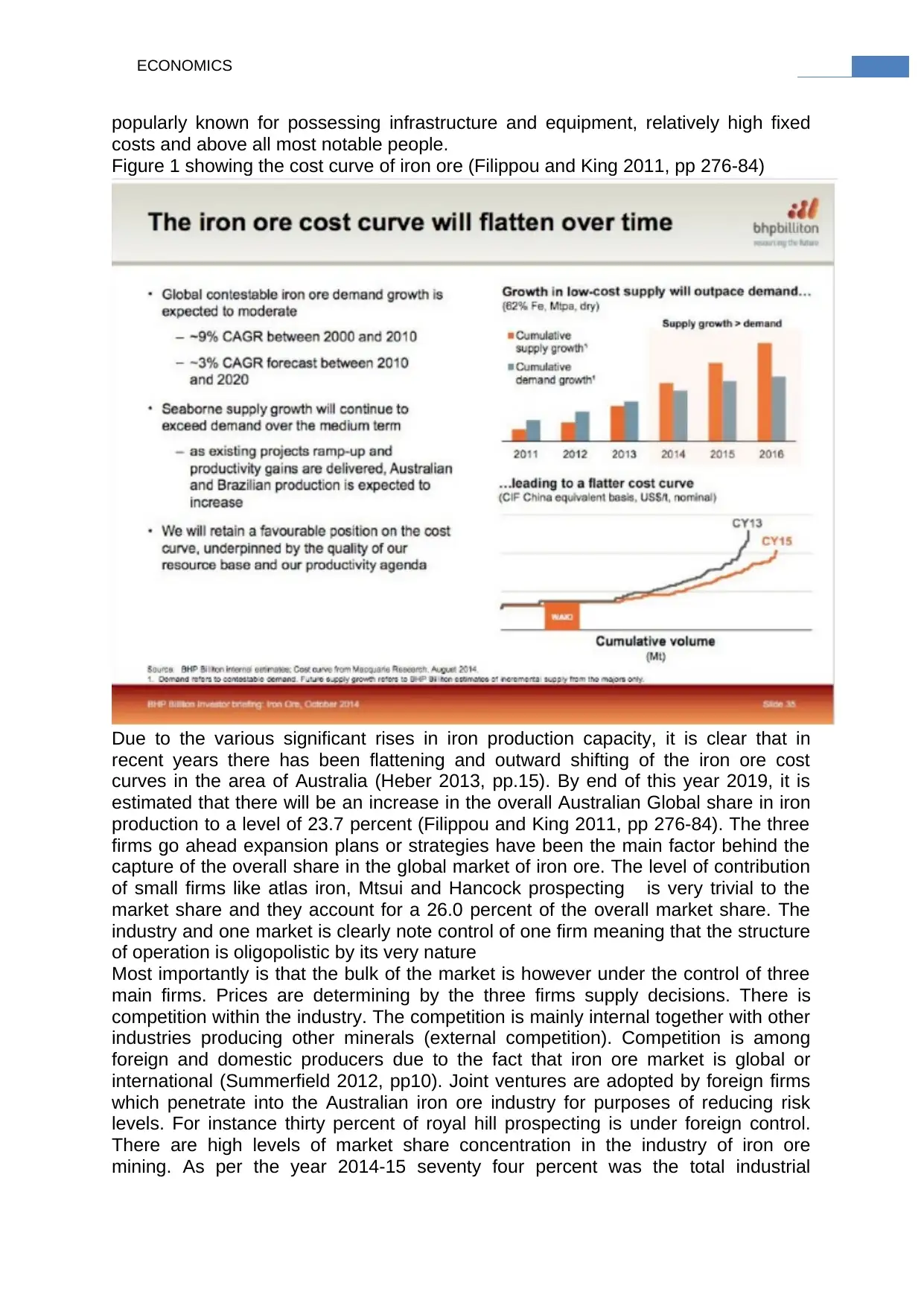

popularly known for possessing infrastructure and equipment, relatively high fixed

costs and above all most notable people.

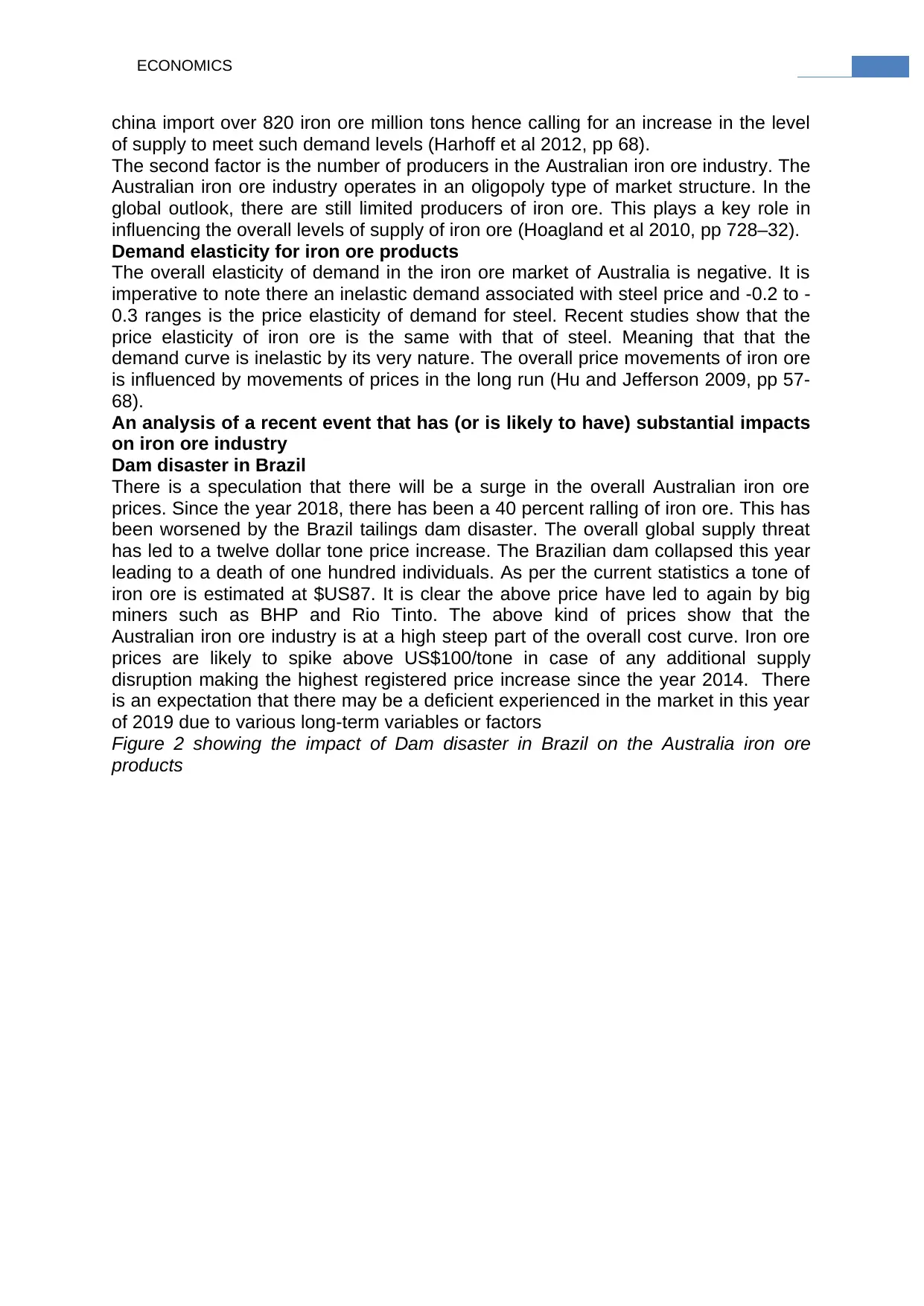

Figure 1 showing the cost curve of iron ore (Filippou and King 2011, pp 276-84)

Due to the various significant rises in iron production capacity, it is clear that in

recent years there has been flattening and outward shifting of the iron ore cost

curves in the area of Australia (Heber 2013, pp.15). By end of this year 2019, it is

estimated that there will be an increase in the overall Australian Global share in iron

production to a level of 23.7 percent (Filippou and King 2011, pp 276-84). The three

firms go ahead expansion plans or strategies have been the main factor behind the

capture of the overall share in the global market of iron ore. The level of contribution

of small firms like atlas iron, Mtsui and Hancock prospecting is very trivial to the

market share and they account for a 26.0 percent of the overall market share. The

industry and one market is clearly note control of one firm meaning that the structure

of operation is oligopolistic by its very nature

Most importantly is that the bulk of the market is however under the control of three

main firms. Prices are determining by the three firms supply decisions. There is

competition within the industry. The competition is mainly internal together with other

industries producing other minerals (external competition). Competition is among

foreign and domestic producers due to the fact that iron ore market is global or

international (Summerfield 2012, pp10). Joint ventures are adopted by foreign firms

which penetrate into the Australian iron ore industry for purposes of reducing risk

levels. For instance thirty percent of royal hill prospecting is under foreign control.

There are high levels of market share concentration in the industry of iron ore

mining. As per the year 2014-15 seventy four percent was the total industrial

popularly known for possessing infrastructure and equipment, relatively high fixed

costs and above all most notable people.

Figure 1 showing the cost curve of iron ore (Filippou and King 2011, pp 276-84)

Due to the various significant rises in iron production capacity, it is clear that in

recent years there has been flattening and outward shifting of the iron ore cost

curves in the area of Australia (Heber 2013, pp.15). By end of this year 2019, it is

estimated that there will be an increase in the overall Australian Global share in iron

production to a level of 23.7 percent (Filippou and King 2011, pp 276-84). The three

firms go ahead expansion plans or strategies have been the main factor behind the

capture of the overall share in the global market of iron ore. The level of contribution

of small firms like atlas iron, Mtsui and Hancock prospecting is very trivial to the

market share and they account for a 26.0 percent of the overall market share. The

industry and one market is clearly note control of one firm meaning that the structure

of operation is oligopolistic by its very nature

Most importantly is that the bulk of the market is however under the control of three

main firms. Prices are determining by the three firms supply decisions. There is

competition within the industry. The competition is mainly internal together with other

industries producing other minerals (external competition). Competition is among

foreign and domestic producers due to the fact that iron ore market is global or

international (Summerfield 2012, pp10). Joint ventures are adopted by foreign firms

which penetrate into the Australian iron ore industry for purposes of reducing risk

levels. For instance thirty percent of royal hill prospecting is under foreign control.

There are high levels of market share concentration in the industry of iron ore

mining. As per the year 2014-15 seventy four percent was the total industrial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS

revenue obtained by the three dormant firms. South Australia has small quantities of

iron ore and the biggest is obtained in Western Australia accounting for over 97.6

percent. The overall significance of economies of scale and the large size of the

mines of the operators in the industry is effectively reflected by the high levels of

concentration in the industry. Price competition within the industry reflects the

increasing levels of profitability and the overall struggle for market share. It very clear

that due to slow growth in china, the prices of iron ore have come under serious

pressure (ACA 2009, pp 75)

There also exist high levels of barriers to entry in the Australian iron ore industry.

There high levels of capital requirements needed to acquire or establish an iron ore

mine in Australian. Meaning that firms that have limited financial muscle cannot enter

and effectively compete in the industry. The iron ore market is also under heavily

regulation from the Australian Government. Certain royalties are supposed to be

paid by each and every firm basing on the value and volume of production of the

mine. In the industry, it is clear that firms engage in a number of bilateral contracts in

order to be able to sale to traders and dealers who are superior. Ceiling prices and

negotiated floor are some of the bilateral contracts engaged in by the firms in the

Australian iron ore industry (Morris 2012, pp 73-235). Through focusing on specialty

products and added value, firms in this industry are able to engage in differentiation

especially in mature market.

Determinants of iron ore demand

The presence of complements and substitutes, the overall volumes of steel

production has a huge impact on iron ore demand in the area of Australia (Mining

industry report 2017, pp12). It is important to note that the overall activities being

undertaken in heavy constructions determine the demand for steel. It is clear that

substitute materials posses a less impact on the overall iron ore demand when there

is limited substitute competition. It is easy to indeterminately recycle metals that are

produced through iron ore. The scale of economies which can be achieved in the

metals production offer a big advantage though some materials can substitute and

replace the metals. It is clear that in most cases steel engage in competition with

more expensive materials possessing a big performance advantage or will less

expensive non mettalic materials. Examples of such products include among others

motor vehicle composites, plastics and aluminum. None the less, not each and every

buy is capable of replacing metals with the above product or material alternatives

given that they do not offer properties which are similar all of them and neither any

substitute which is direct (Scott-Kemmis 2013, pp 70).

The second factor influencing the demand of iron ore has been the growth being

evidenced in emerging economies such as china. It is clear that the increase

investment in china have had a strong impact on Australia and the overall globe

commerce. It is clear that there was surge china’s overall economic growth in the

year 2005 which led to increase in the overall demand of iron ore mines in the area

of Australia. Hence forth one can argue that china has a much impact on the overall

iron ore demand in Australia (Julius and de Rassenfosse 2014, pp57).

Determinants of supply for Iron ore

The first determinant of supply is the global iron ore demand. It is clear that the

dramatic developments in the level of steel production have a major impact on the

overall supply of iron ore especially in the industrial equipment, automotive, non

residential and public sectors. Therefore such developments have led t a general

increase in the overall level of demand of iron ore hence high supply. Countries like

revenue obtained by the three dormant firms. South Australia has small quantities of

iron ore and the biggest is obtained in Western Australia accounting for over 97.6

percent. The overall significance of economies of scale and the large size of the

mines of the operators in the industry is effectively reflected by the high levels of

concentration in the industry. Price competition within the industry reflects the

increasing levels of profitability and the overall struggle for market share. It very clear

that due to slow growth in china, the prices of iron ore have come under serious

pressure (ACA 2009, pp 75)

There also exist high levels of barriers to entry in the Australian iron ore industry.

There high levels of capital requirements needed to acquire or establish an iron ore

mine in Australian. Meaning that firms that have limited financial muscle cannot enter

and effectively compete in the industry. The iron ore market is also under heavily

regulation from the Australian Government. Certain royalties are supposed to be

paid by each and every firm basing on the value and volume of production of the

mine. In the industry, it is clear that firms engage in a number of bilateral contracts in

order to be able to sale to traders and dealers who are superior. Ceiling prices and

negotiated floor are some of the bilateral contracts engaged in by the firms in the

Australian iron ore industry (Morris 2012, pp 73-235). Through focusing on specialty

products and added value, firms in this industry are able to engage in differentiation

especially in mature market.

Determinants of iron ore demand

The presence of complements and substitutes, the overall volumes of steel

production has a huge impact on iron ore demand in the area of Australia (Mining

industry report 2017, pp12). It is important to note that the overall activities being

undertaken in heavy constructions determine the demand for steel. It is clear that

substitute materials posses a less impact on the overall iron ore demand when there

is limited substitute competition. It is easy to indeterminately recycle metals that are

produced through iron ore. The scale of economies which can be achieved in the

metals production offer a big advantage though some materials can substitute and

replace the metals. It is clear that in most cases steel engage in competition with

more expensive materials possessing a big performance advantage or will less

expensive non mettalic materials. Examples of such products include among others

motor vehicle composites, plastics and aluminum. None the less, not each and every

buy is capable of replacing metals with the above product or material alternatives

given that they do not offer properties which are similar all of them and neither any

substitute which is direct (Scott-Kemmis 2013, pp 70).

The second factor influencing the demand of iron ore has been the growth being

evidenced in emerging economies such as china. It is clear that the increase

investment in china have had a strong impact on Australia and the overall globe

commerce. It is clear that there was surge china’s overall economic growth in the

year 2005 which led to increase in the overall demand of iron ore mines in the area

of Australia. Hence forth one can argue that china has a much impact on the overall

iron ore demand in Australia (Julius and de Rassenfosse 2014, pp57).

Determinants of supply for Iron ore

The first determinant of supply is the global iron ore demand. It is clear that the

dramatic developments in the level of steel production have a major impact on the

overall supply of iron ore especially in the industrial equipment, automotive, non

residential and public sectors. Therefore such developments have led t a general

increase in the overall level of demand of iron ore hence high supply. Countries like

5ECONOMICS

china import over 820 iron ore million tons hence calling for an increase in the level

of supply to meet such demand levels (Harhoff et al 2012, pp 68).

The second factor is the number of producers in the Australian iron ore industry. The

Australian iron ore industry operates in an oligopoly type of market structure. In the

global outlook, there are still limited producers of iron ore. This plays a key role in

influencing the overall levels of supply of iron ore (Hoagland et al 2010, pp 728–32).

Demand elasticity for iron ore products

The overall elasticity of demand in the iron ore market of Australia is negative. It is

imperative to note there an inelastic demand associated with steel price and -0.2 to -

0.3 ranges is the price elasticity of demand for steel. Recent studies show that the

price elasticity of iron ore is the same with that of steel. Meaning that that the

demand curve is inelastic by its very nature. The overall price movements of iron ore

is influenced by movements of prices in the long run (Hu and Jefferson 2009, pp 57-

68).

An analysis of a recent event that has (or is likely to have) substantial impacts

on iron ore industry

Dam disaster in Brazil

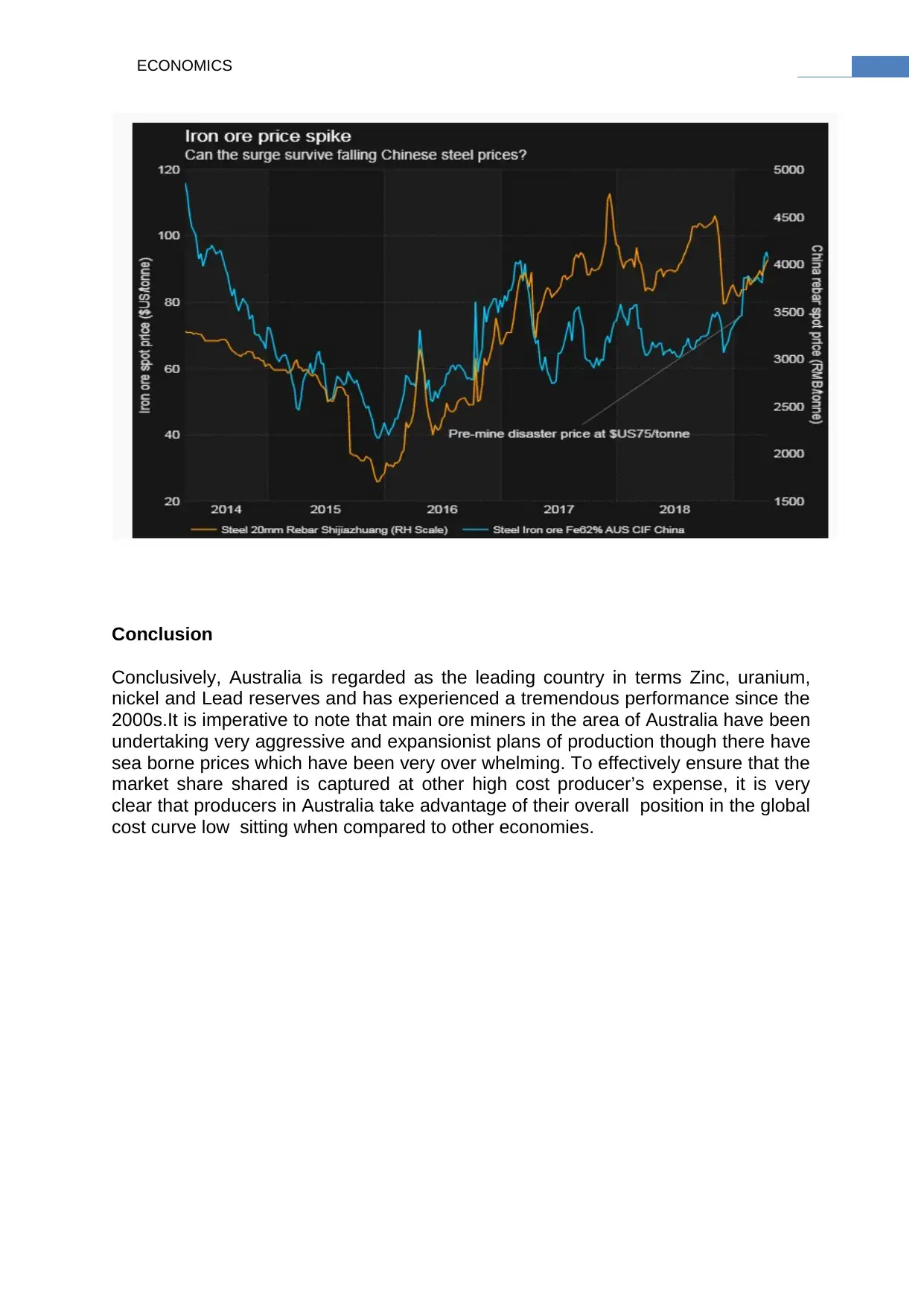

There is a speculation that there will be a surge in the overall Australian iron ore

prices. Since the year 2018, there has been a 40 percent ralling of iron ore. This has

been worsened by the Brazil tailings dam disaster. The overall global supply threat

has led to a twelve dollar tone price increase. The Brazilian dam collapsed this year

leading to a death of one hundred individuals. As per the current statistics a tone of

iron ore is estimated at $US87. It is clear the above price have led to again by big

miners such as BHP and Rio Tinto. The above kind of prices show that the

Australian iron ore industry is at a high steep part of the overall cost curve. Iron ore

prices are likely to spike above US$100/tone in case of any additional supply

disruption making the highest registered price increase since the year 2014. There

is an expectation that there may be a deficient experienced in the market in this year

of 2019 due to various long-term variables or factors

Figure 2 showing the impact of Dam disaster in Brazil on the Australia iron ore

products

china import over 820 iron ore million tons hence calling for an increase in the level

of supply to meet such demand levels (Harhoff et al 2012, pp 68).

The second factor is the number of producers in the Australian iron ore industry. The

Australian iron ore industry operates in an oligopoly type of market structure. In the

global outlook, there are still limited producers of iron ore. This plays a key role in

influencing the overall levels of supply of iron ore (Hoagland et al 2010, pp 728–32).

Demand elasticity for iron ore products

The overall elasticity of demand in the iron ore market of Australia is negative. It is

imperative to note there an inelastic demand associated with steel price and -0.2 to -

0.3 ranges is the price elasticity of demand for steel. Recent studies show that the

price elasticity of iron ore is the same with that of steel. Meaning that that the

demand curve is inelastic by its very nature. The overall price movements of iron ore

is influenced by movements of prices in the long run (Hu and Jefferson 2009, pp 57-

68).

An analysis of a recent event that has (or is likely to have) substantial impacts

on iron ore industry

Dam disaster in Brazil

There is a speculation that there will be a surge in the overall Australian iron ore

prices. Since the year 2018, there has been a 40 percent ralling of iron ore. This has

been worsened by the Brazil tailings dam disaster. The overall global supply threat

has led to a twelve dollar tone price increase. The Brazilian dam collapsed this year

leading to a death of one hundred individuals. As per the current statistics a tone of

iron ore is estimated at $US87. It is clear the above price have led to again by big

miners such as BHP and Rio Tinto. The above kind of prices show that the

Australian iron ore industry is at a high steep part of the overall cost curve. Iron ore

prices are likely to spike above US$100/tone in case of any additional supply

disruption making the highest registered price increase since the year 2014. There

is an expectation that there may be a deficient experienced in the market in this year

of 2019 due to various long-term variables or factors

Figure 2 showing the impact of Dam disaster in Brazil on the Australia iron ore

products

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS

Conclusion

Conclusively, Australia is regarded as the leading country in terms Zinc, uranium,

nickel and Lead reserves and has experienced a tremendous performance since the

2000s.It is imperative to note that main ore miners in the area of Australia have been

undertaking very aggressive and expansionist plans of production though there have

sea borne prices which have been very over whelming. To effectively ensure that the

market share shared is captured at other high cost producer’s expense, it is very

clear that producers in Australia take advantage of their overall position in the global

cost curve low sitting when compared to other economies.

Conclusion

Conclusively, Australia is regarded as the leading country in terms Zinc, uranium,

nickel and Lead reserves and has experienced a tremendous performance since the

2000s.It is imperative to note that main ore miners in the area of Australia have been

undertaking very aggressive and expansionist plans of production though there have

sea borne prices which have been very over whelming. To effectively ensure that the

market share shared is captured at other high cost producer’s expense, it is very

clear that producers in Australia take advantage of their overall position in the global

cost curve low sitting when compared to other economies.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS

References

ACA. 2009. The Australian Coal Industry - Black Coal Resources. Australian Coal

Association (ACA),www.australiancoal.com.au/the-australian-coal-industry_coal-

resources.aspx, pp.75.

Austmine. 2013. ‘Australia's New Driver for Growth: Mining, Equipment, Technology

and Services’. Austmine and Department of Industry and Science Survey. pp.15.

Bartos, P. J 2007. ‘Is mining a high-tech industry?: Investigations into innovation and

productivity advance’, Resources Policy, vol 32(4), pp.149–58

Boudreau-Trudel, B., Zaras, K., Nadeau, S., and Deschamps, I 2014. ‘Introduction of

Innovative Equipment in Mining: Impact on Productivity’ American Journal of

Industrial and Business Management, vol. 4, pp. 31 9Cooperative Research Centres

(CRC) Programme

Filippou, D., and King, M. 2011. ‘R&D prospects in the mining and metals industry’

Resources Policy, vol 36(3), pp.276-84

Hall, M. 2014. ‘Forget self-driving Google cars, Australia has self-driving trucks’ The

Age, pp.20

Harhoff, D., Mueller, E., and Van Reenen, J. 2012. ‘What are the channels for

technology sourcing? Panel data evidence from German companies’,Frankfurt

School of Finance and Management, Working Paper Series 187. , pp.68

Heber, A. 2013. ‘METS to make up the difference’ Mining Australia, pp.15

Hoagland, P., Beaulieu, S,, Tivey, M,A., Eggert, R,G, German, C, Glowka, L and Lin,

J. 2010, ‘Deep-sea mining of seafloor massive sulfides’ Marine Policy, vol 34(3), pp.

728–32

Hu, A,G., and Jefferson, G,H. 2009 . A great wall of patents: What is behind China's

recent patent explosion?'Journal of Development Economics, 90(1), (2009):pp.57-68

Julius, T,D., and de Rassenfosse, G. 2014. ‘Harmonising and Matching IPR Holders

at IP Australia’, Melbourne Institute Working Paper No. 15/14, Melbourne Institute of

Applied Economic and Social Research, The University of Melbourne. pp.57

María, J, A., Carsten, F., Bronwyn, H., Christian, H. 2013.The Use of Intellectual

Property in Chile.Economic Research Working Paper No. 11, pp.30

Mining industry report. 2017. Retrieved from . pp.12.

Morris, R. C. 2012. “Genesis of iron ore in bandediron-formation by supergene and

supergene-metamorphic processes – a conceptual model. Handbook of Strata-

bound and stratiform ore deposits, (13).pp.73-235.

Scott-Kemmis, D. 2013. ‘How about those METS? Leveraging Australia’s mining

equipment, technology and services sector’, Minerals Council of Australia, pp.70

Summerfield, D. 2012. "Iron Ore". Australian Atlas of Minerals Resources, Mines &

Processing Centres. Geoscience Australia. pp.10.

References

ACA. 2009. The Australian Coal Industry - Black Coal Resources. Australian Coal

Association (ACA),www.australiancoal.com.au/the-australian-coal-industry_coal-

resources.aspx, pp.75.

Austmine. 2013. ‘Australia's New Driver for Growth: Mining, Equipment, Technology

and Services’. Austmine and Department of Industry and Science Survey. pp.15.

Bartos, P. J 2007. ‘Is mining a high-tech industry?: Investigations into innovation and

productivity advance’, Resources Policy, vol 32(4), pp.149–58

Boudreau-Trudel, B., Zaras, K., Nadeau, S., and Deschamps, I 2014. ‘Introduction of

Innovative Equipment in Mining: Impact on Productivity’ American Journal of

Industrial and Business Management, vol. 4, pp. 31 9Cooperative Research Centres

(CRC) Programme

Filippou, D., and King, M. 2011. ‘R&D prospects in the mining and metals industry’

Resources Policy, vol 36(3), pp.276-84

Hall, M. 2014. ‘Forget self-driving Google cars, Australia has self-driving trucks’ The

Age, pp.20

Harhoff, D., Mueller, E., and Van Reenen, J. 2012. ‘What are the channels for

technology sourcing? Panel data evidence from German companies’,Frankfurt

School of Finance and Management, Working Paper Series 187. , pp.68

Heber, A. 2013. ‘METS to make up the difference’ Mining Australia, pp.15

Hoagland, P., Beaulieu, S,, Tivey, M,A., Eggert, R,G, German, C, Glowka, L and Lin,

J. 2010, ‘Deep-sea mining of seafloor massive sulfides’ Marine Policy, vol 34(3), pp.

728–32

Hu, A,G., and Jefferson, G,H. 2009 . A great wall of patents: What is behind China's

recent patent explosion?'Journal of Development Economics, 90(1), (2009):pp.57-68

Julius, T,D., and de Rassenfosse, G. 2014. ‘Harmonising and Matching IPR Holders

at IP Australia’, Melbourne Institute Working Paper No. 15/14, Melbourne Institute of

Applied Economic and Social Research, The University of Melbourne. pp.57

María, J, A., Carsten, F., Bronwyn, H., Christian, H. 2013.The Use of Intellectual

Property in Chile.Economic Research Working Paper No. 11, pp.30

Mining industry report. 2017. Retrieved from . pp.12.

Morris, R. C. 2012. “Genesis of iron ore in bandediron-formation by supergene and

supergene-metamorphic processes – a conceptual model. Handbook of Strata-

bound and stratiform ore deposits, (13).pp.73-235.

Scott-Kemmis, D. 2013. ‘How about those METS? Leveraging Australia’s mining

equipment, technology and services sector’, Minerals Council of Australia, pp.70

Summerfield, D. 2012. "Iron Ore". Australian Atlas of Minerals Resources, Mines &

Processing Centres. Geoscience Australia. pp.10.

8ECONOMICS

Appendix

Figure three showing global iron ore products costs

Appendix

Figure three showing global iron ore products costs

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.