Economics Assignment: Interest Rates and Exchange Rate Determination

VerifiedAdded on 2023/05/30

|13

|1819

|281

Homework Assignment

AI Summary

This economics assignment delves into various aspects of international finance, starting with the differentiation between foreign exchange swaps and currency swaps, highlighting their economic motives and balance sheet implications. It explores the International Fisher Effect (IFE) theory, emphasizing the relationship between interest rates and exchange rate depreciation. The assignment critically examines the Purchasing Power Parity (PPP) theory, discussing reasons for its failure and differentiating between absolute and relative PPP. Practical calculations of cross rates are demonstrated, followed by an analysis of arbitrage opportunities arising from interest rate differentials between Singapore and the US. The impact of changes in foreign interest rates and expected appreciation in exchange rates on arbitrage opportunities is graphically illustrated. Furthermore, the assignment discusses the effects of changes in the rate of money growth on price levels, interest rates, and exchange rates, and it empirically tests the absolute PPP theory using data from different planets. Finally, the assignment analyzes the effects of permanent increases in government spending on exchange rates and provides a comparative analysis of price indices and spot exchange rates across the United States, Euro Area, China, and India, concluding with a critique of the absolute PPP theory's applicability.

Running head: ECONOMICS ASSIGNMENT

Economics Assignment

Name of the Student:

Name of the University:

Authors Note:

Economics Assignment

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ECONOMICS ASSIGNMENT

Contents

Part 1:...............................................................................................................................................2

Part 2:...............................................................................................................................................2

Part 3:...............................................................................................................................................3

Part 4:...............................................................................................................................................3

Part 5:...............................................................................................................................................4

Part 6:...............................................................................................................................................6

Part 7:...............................................................................................................................................7

Part 8:...............................................................................................................................................9

Part 9:...............................................................................................................................................9

Part 10:...........................................................................................................................................10

Part 11:...........................................................................................................................................11

References:....................................................................................................................................13

ECONOMICS ASSIGNMENT

Contents

Part 1:...............................................................................................................................................2

Part 2:...............................................................................................................................................2

Part 3:...............................................................................................................................................3

Part 4:...............................................................................................................................................3

Part 5:...............................................................................................................................................4

Part 6:...............................................................................................................................................6

Part 7:...............................................................................................................................................7

Part 8:...............................................................................................................................................9

Part 9:...............................................................................................................................................9

Part 10:...........................................................................................................................................10

Part 11:...........................................................................................................................................11

References:....................................................................................................................................13

2

ECONOMICS ASSIGNMENT

Part 1:

Concurrent purchase and sale of one currency with another currency having different value dates

and identical amount can be termed as foreign exchange swap. Exchange of interest amount in

one currency for another currency on fixed dates is referred to as currency swap. Thus, foreign

exchange swap takes place with different value dates whereas in currency swap it is about

exchange of interest amount and sometimes even principal amount from one currency to another

on fixed dates. Currency swaps are considered as foreign exchange transactions and not required

to be shown in the Balance sheet of a company. Foreign exchange swap is generally for short

duration unlike currency swap which is generally long term transaction.

One economic motive of engaging into swap is to exchange cash flows between parties on the

basis of notional principal amount. Economic motives include reducing the risk of interest rate

fluctuation and risk of foreign exchange rate fluctuations on the financial position of the parties

entering into such swap.

Part 2:

The rate of interest in a country generally dictate the rate of inflation and value of money. The

higher the rate of interest in a country the higher would be the inflation rate and depreciation to

the value of money and currency. As per the International Fisher Effects (IFE) theory the

exchange rate in a country would depend to a large extent on the interest rate prevailing in the

country. High rate of interest in the country would depreciate the domestic currency at higher

rate. Thus, between two countries the country that will have higher interest rate in comparison to

the rate of interest of the other would have higher depreciation to its currency. Hence, the

exchange rate between the two currencies would be accordingly effected. The value of currency

ECONOMICS ASSIGNMENT

Part 1:

Concurrent purchase and sale of one currency with another currency having different value dates

and identical amount can be termed as foreign exchange swap. Exchange of interest amount in

one currency for another currency on fixed dates is referred to as currency swap. Thus, foreign

exchange swap takes place with different value dates whereas in currency swap it is about

exchange of interest amount and sometimes even principal amount from one currency to another

on fixed dates. Currency swaps are considered as foreign exchange transactions and not required

to be shown in the Balance sheet of a company. Foreign exchange swap is generally for short

duration unlike currency swap which is generally long term transaction.

One economic motive of engaging into swap is to exchange cash flows between parties on the

basis of notional principal amount. Economic motives include reducing the risk of interest rate

fluctuation and risk of foreign exchange rate fluctuations on the financial position of the parties

entering into such swap.

Part 2:

The rate of interest in a country generally dictate the rate of inflation and value of money. The

higher the rate of interest in a country the higher would be the inflation rate and depreciation to

the value of money and currency. As per the International Fisher Effects (IFE) theory the

exchange rate in a country would depend to a large extent on the interest rate prevailing in the

country. High rate of interest in the country would depreciate the domestic currency at higher

rate. Thus, between two countries the country that will have higher interest rate in comparison to

the rate of interest of the other would have higher depreciation to its currency. Hence, the

exchange rate between the two currencies would be accordingly effected. The value of currency

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ECONOMICS ASSIGNMENT

of the country with higher interest rate would depreciate faster to appreciate the currency of other

country. Thus, it would be wrong to claim that the country with higher interest rate compared to

others will experience appreciation in exchange rate. It is in-fact other way around positive

interest rate differential will result in depreciation in exchange rate as the currency of the country

will be depreciated faster. The present value of c currency after n year would be less in the

country with high interest rate as compared to the present value of the currency of the country

with low interest rate. The purchasing power will be significantly less of domestic currency of

the country with high interest rate thus, it will accompanies by an exchange rate depreciation.

Part 3:

There are number of reasons that might result in the failure of Purchasing Power Parity theory;

few of these are as following:

I. Tastes and behavior are different in different countries.

II. Impact of real economic events on changes in exchange rate are not considered in PPP.

III. Movements in individual prices in index are often different thus, using price index may not

be relevant in such instances (Li, Lin & Hsiao, 2015).

Part 4:

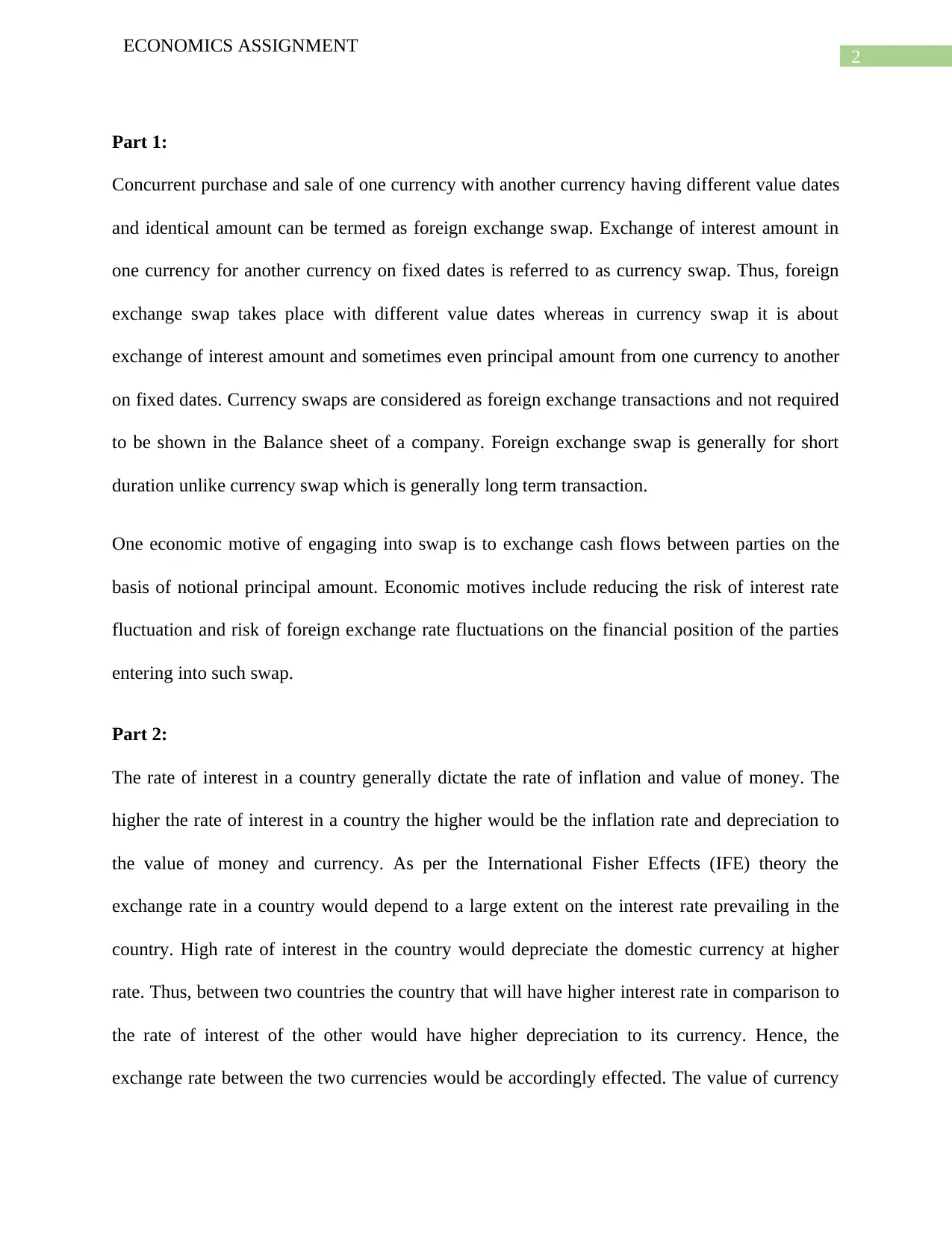

Absolute PPP assumes that the purchasing powers of two currencies will be equal due to the

equilibrium in exchange rate of two currencies. Relative PPP is the dynamic version of PPP used

to predict the movement in the exchange rate between two currencies by tracking the inflation

rates of the respective countries. In order to derive the relative PPP relation from absolute PPP

following equation can be used:

ECONOMICS ASSIGNMENT

of the country with higher interest rate would depreciate faster to appreciate the currency of other

country. Thus, it would be wrong to claim that the country with higher interest rate compared to

others will experience appreciation in exchange rate. It is in-fact other way around positive

interest rate differential will result in depreciation in exchange rate as the currency of the country

will be depreciated faster. The present value of c currency after n year would be less in the

country with high interest rate as compared to the present value of the currency of the country

with low interest rate. The purchasing power will be significantly less of domestic currency of

the country with high interest rate thus, it will accompanies by an exchange rate depreciation.

Part 3:

There are number of reasons that might result in the failure of Purchasing Power Parity theory;

few of these are as following:

I. Tastes and behavior are different in different countries.

II. Impact of real economic events on changes in exchange rate are not considered in PPP.

III. Movements in individual prices in index are often different thus, using price index may not

be relevant in such instances (Li, Lin & Hsiao, 2015).

Part 4:

Absolute PPP assumes that the purchasing powers of two currencies will be equal due to the

equilibrium in exchange rate of two currencies. Relative PPP is the dynamic version of PPP used

to predict the movement in the exchange rate between two currencies by tracking the inflation

rates of the respective countries. In order to derive the relative PPP relation from absolute PPP

following equation can be used:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ECONOMICS ASSIGNMENT

PPP equation

Where, P = price in a country,

Q = Quantity,

S = Value of currency.

And C is the constant.

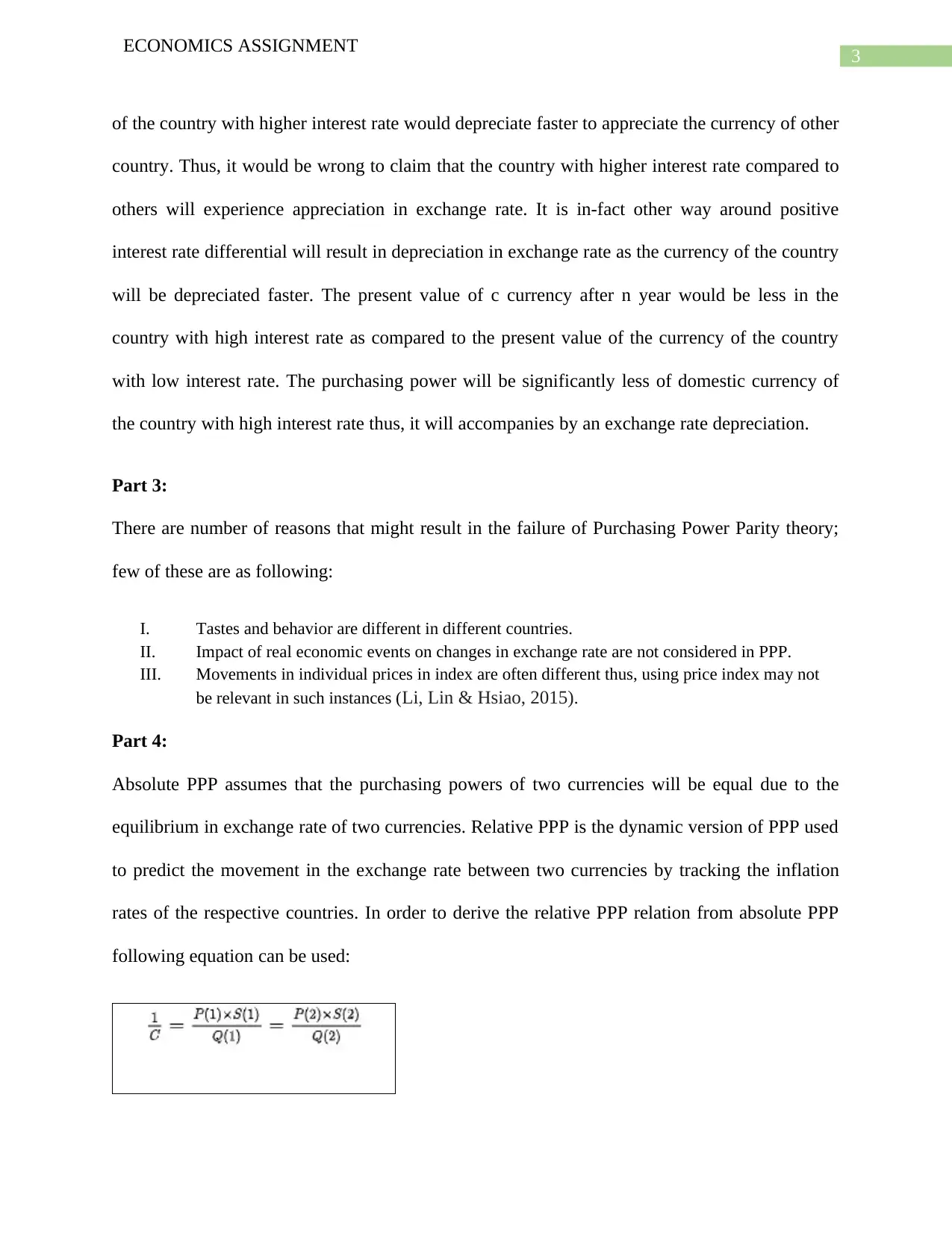

Part 5:

USD to EEK 11.6971/7076

EUR to USD 1.1339/43

GBP to USD 1.2789/93

Cross rate for:

Estonian Kroon to the Euro

1 Euro to USD (1.1339/43) 0.026369767

1 USD to EER (7076/11.6971) 0.001653067

1 Euro to EER (0.02637 x 0.001653) 0.0000435

ECONOMICS ASSIGNMENT

PPP equation

Where, P = price in a country,

Q = Quantity,

S = Value of currency.

And C is the constant.

Part 5:

USD to EEK 11.6971/7076

EUR to USD 1.1339/43

GBP to USD 1.2789/93

Cross rate for:

Estonian Kroon to the Euro

1 Euro to USD (1.1339/43) 0.026369767

1 USD to EER (7076/11.6971) 0.001653067

1 Euro to EER (0.02637 x 0.001653) 0.0000435

5

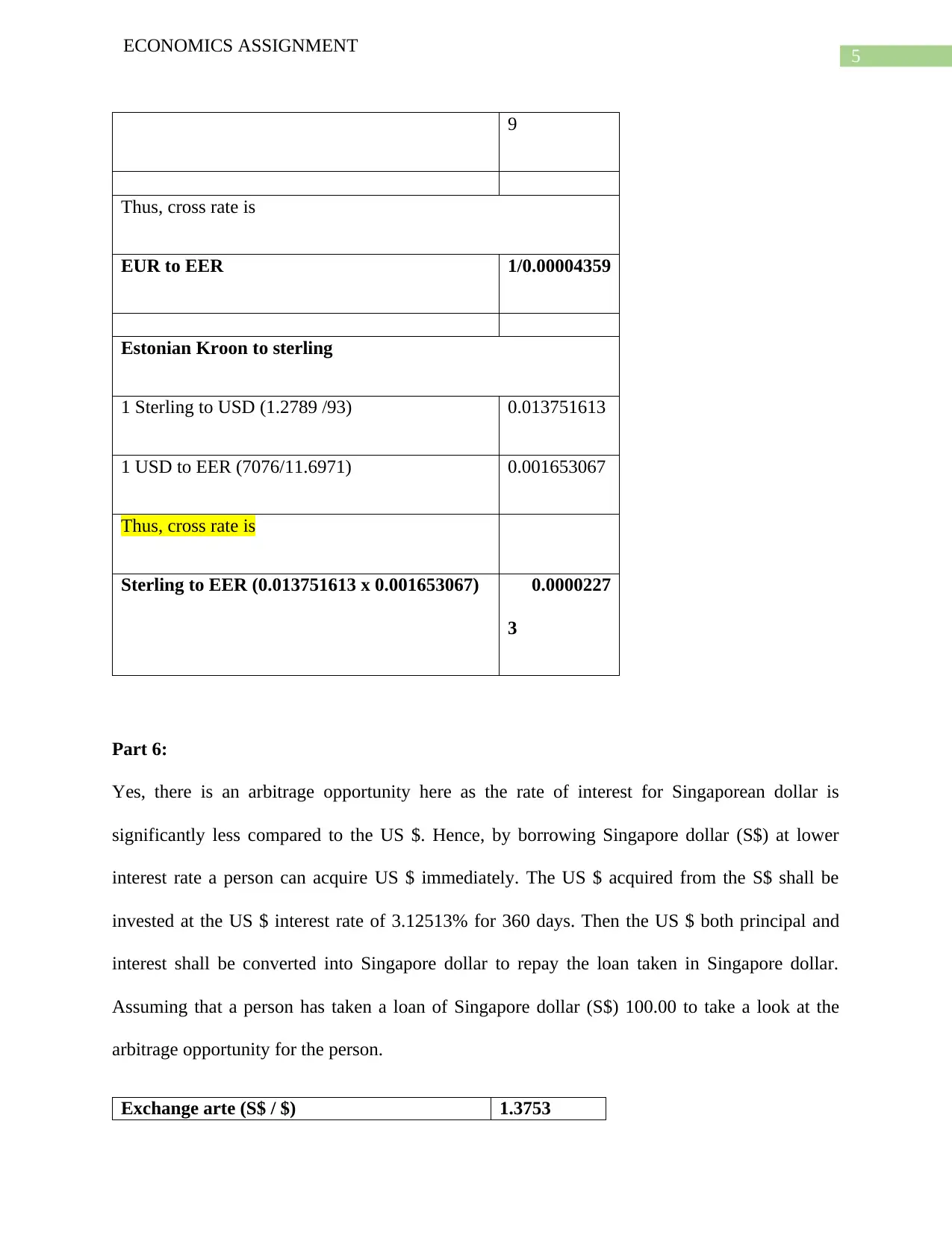

ECONOMICS ASSIGNMENT

9

Thus, cross rate is

EUR to EER 1/0.00004359

Estonian Kroon to sterling

1 Sterling to USD (1.2789 /93) 0.013751613

1 USD to EER (7076/11.6971) 0.001653067

Thus, cross rate is

Sterling to EER (0.013751613 x 0.001653067) 0.0000227

3

Part 6:

Yes, there is an arbitrage opportunity here as the rate of interest for Singaporean dollar is

significantly less compared to the US $. Hence, by borrowing Singapore dollar (S$) at lower

interest rate a person can acquire US $ immediately. The US $ acquired from the S$ shall be

invested at the US $ interest rate of 3.12513% for 360 days. Then the US $ both principal and

interest shall be converted into Singapore dollar to repay the loan taken in Singapore dollar.

Assuming that a person has taken a loan of Singapore dollar (S$) 100.00 to take a look at the

arbitrage opportunity for the person.

Exchange arte (S$ / $) 1.3753

ECONOMICS ASSIGNMENT

9

Thus, cross rate is

EUR to EER 1/0.00004359

Estonian Kroon to sterling

1 Sterling to USD (1.2789 /93) 0.013751613

1 USD to EER (7076/11.6971) 0.001653067

Thus, cross rate is

Sterling to EER (0.013751613 x 0.001653067) 0.0000227

3

Part 6:

Yes, there is an arbitrage opportunity here as the rate of interest for Singaporean dollar is

significantly less compared to the US $. Hence, by borrowing Singapore dollar (S$) at lower

interest rate a person can acquire US $ immediately. The US $ acquired from the S$ shall be

invested at the US $ interest rate of 3.12513% for 360 days. Then the US $ both principal and

interest shall be converted into Singapore dollar to repay the loan taken in Singapore dollar.

Assuming that a person has taken a loan of Singapore dollar (S$) 100.00 to take a look at the

arbitrage opportunity for the person.

Exchange arte (S$ / $) 1.3753

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ECONOMICS ASSIGNMENT

Interest:

US 3.12513%

Singapore 2.06400%

Borrowing Singapore dollar 100

Add: Interest (100 x 2.0640%) 2.064

Singapore dollar to be repaid 102.064

Buy US $ (100 x 1.3753) 137.53

Add: interest (137.53 x 3.12513%) 4.297991289

US $ to be received 141.8279913

Thus, forward rate S$ / $ 1.3609

Singapore dollar to be received

(141.8279913/1.3609)

104.216321

Less: Singapore dollar to be repaid 102.064

ECONOMICS ASSIGNMENT

Interest:

US 3.12513%

Singapore 2.06400%

Borrowing Singapore dollar 100

Add: Interest (100 x 2.0640%) 2.064

Singapore dollar to be repaid 102.064

Buy US $ (100 x 1.3753) 137.53

Add: interest (137.53 x 3.12513%) 4.297991289

US $ to be received 141.8279913

Thus, forward rate S$ / $ 1.3609

Singapore dollar to be received

(141.8279913/1.3609)

104.216321

Less: Singapore dollar to be repaid 102.064

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ECONOMICS ASSIGNMENT

Net gain (Singapore dollar) 2.152321029

Thus, the person has the opportunity to gain S$2.152321029 by taking a simple loan of S$ 100.

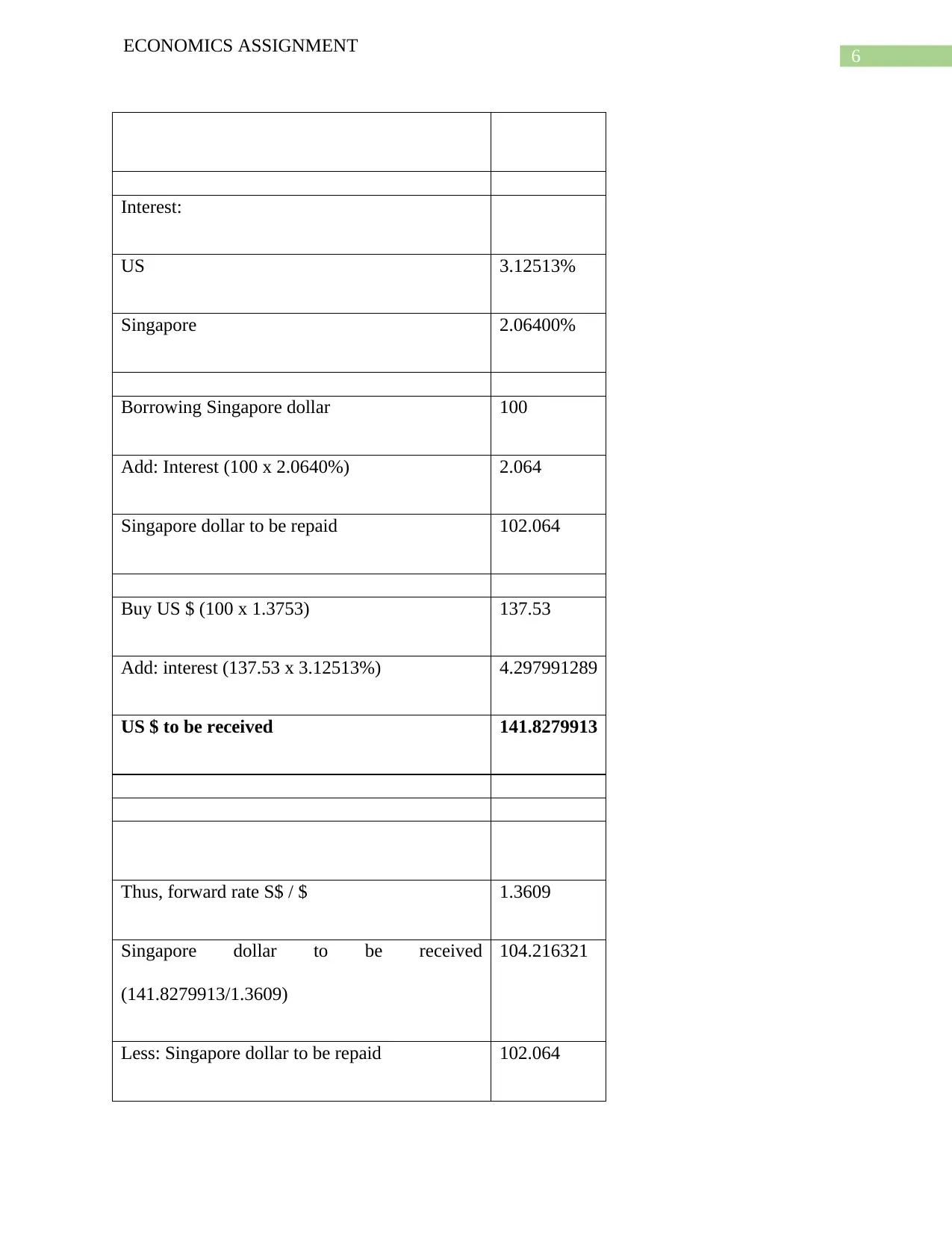

Part 7:

Fall in foreign interest rate:

A fall in foreign interest rate shall provide an arbitrage opportunity to a person to borrow foreign

exchange to invest in domestic currency and then to convert the domestic currency to repay the

foreign exchange loan. The graph below would indicate the effects of decline in foreign interest

rate.

Fund now Fund a year later

9400

9600

9800

10000

10200

10400

10600

10800

11000

11200

Chart Title

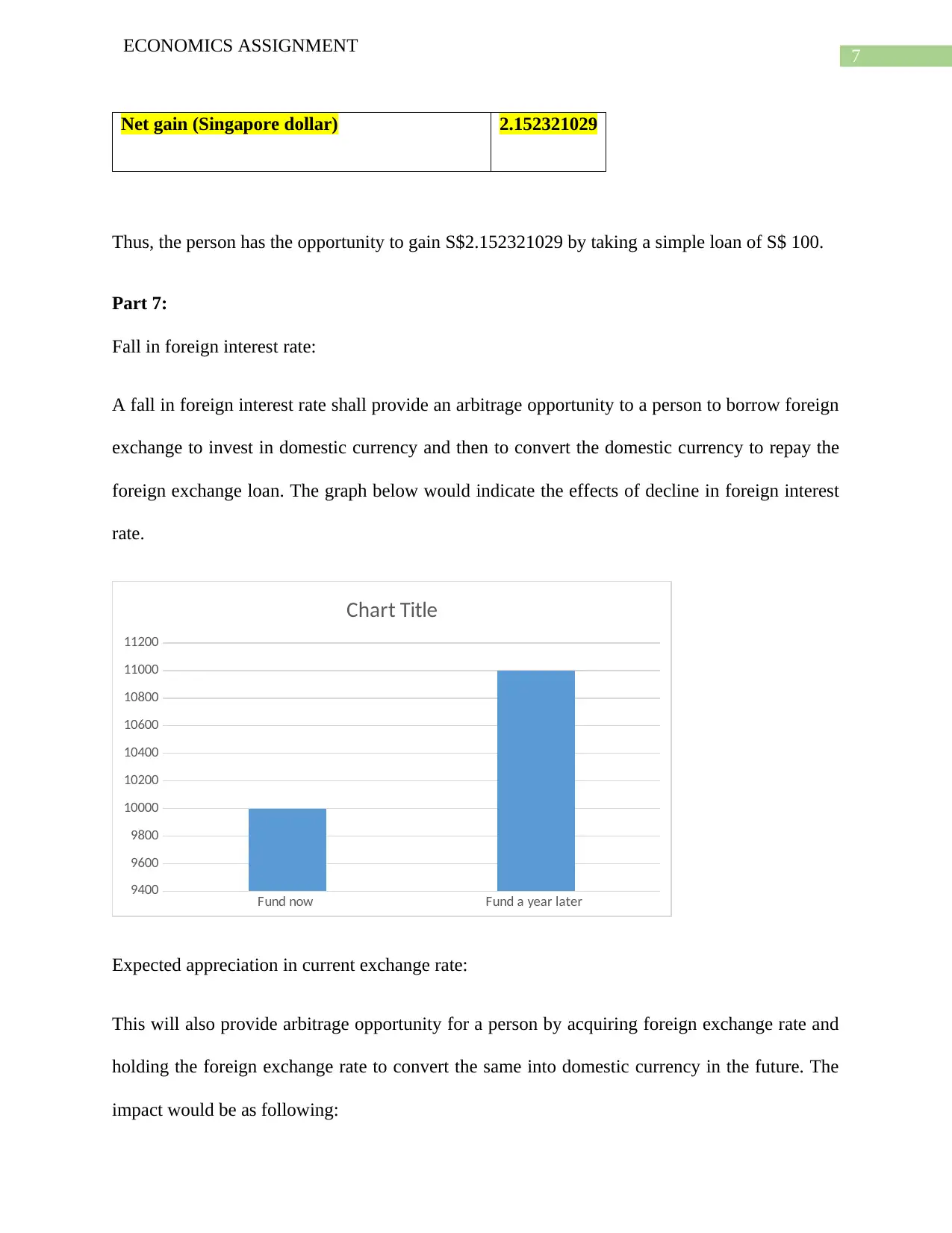

Expected appreciation in current exchange rate:

This will also provide arbitrage opportunity for a person by acquiring foreign exchange rate and

holding the foreign exchange rate to convert the same into domestic currency in the future. The

impact would be as following:

ECONOMICS ASSIGNMENT

Net gain (Singapore dollar) 2.152321029

Thus, the person has the opportunity to gain S$2.152321029 by taking a simple loan of S$ 100.

Part 7:

Fall in foreign interest rate:

A fall in foreign interest rate shall provide an arbitrage opportunity to a person to borrow foreign

exchange to invest in domestic currency and then to convert the domestic currency to repay the

foreign exchange loan. The graph below would indicate the effects of decline in foreign interest

rate.

Fund now Fund a year later

9400

9600

9800

10000

10200

10400

10600

10800

11000

11200

Chart Title

Expected appreciation in current exchange rate:

This will also provide arbitrage opportunity for a person by acquiring foreign exchange rate and

holding the foreign exchange rate to convert the same into domestic currency in the future. The

impact would be as following:

8

ECONOMICS ASSIGNMENT

Fund now Fund a year later

9400

9600

9800

10000

10200

10400

10600

10800

11000

11200

Chart Title

Part 8:

(a) The price level rises with decrease in the rate of growth in money as the general purchasing

power of money will decline. Monetary neutrality drives price level.

(b) Interest rate will increase with decrease in the rate of growth in money as the demand for money

will be more in the economy. Demand and supply of capital drives the interest rate in the country.

(c) Exchange rate will depreciate with the decrease in the rate of growth in money. Inflation in the

country drives exchange rate.

Part 9:

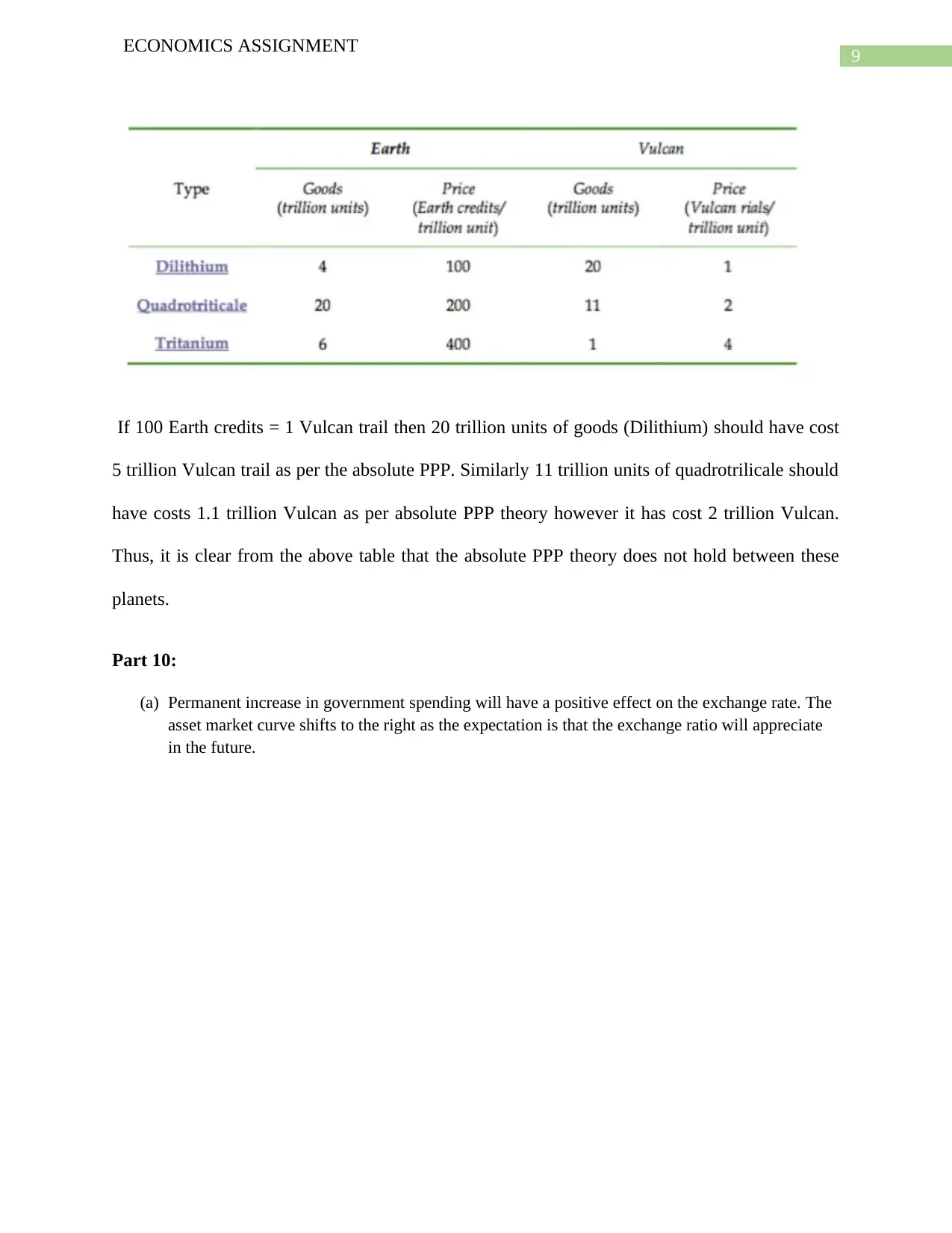

No, it is clear from the following table that the absolute Purchasing Power Parity (PPP) theory

does not hold between these planets. The absolute purchasing power parity theory means that the

purchasing power of two currencies would be equal. However, as can be seen in the table below

that it is not that case.

ECONOMICS ASSIGNMENT

Fund now Fund a year later

9400

9600

9800

10000

10200

10400

10600

10800

11000

11200

Chart Title

Part 8:

(a) The price level rises with decrease in the rate of growth in money as the general purchasing

power of money will decline. Monetary neutrality drives price level.

(b) Interest rate will increase with decrease in the rate of growth in money as the demand for money

will be more in the economy. Demand and supply of capital drives the interest rate in the country.

(c) Exchange rate will depreciate with the decrease in the rate of growth in money. Inflation in the

country drives exchange rate.

Part 9:

No, it is clear from the following table that the absolute Purchasing Power Parity (PPP) theory

does not hold between these planets. The absolute purchasing power parity theory means that the

purchasing power of two currencies would be equal. However, as can be seen in the table below

that it is not that case.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ECONOMICS ASSIGNMENT

If 100 Earth credits = 1 Vulcan trail then 20 trillion units of goods (Dilithium) should have cost

5 trillion Vulcan trail as per the absolute PPP. Similarly 11 trillion units of quadrotrilicale should

have costs 1.1 trillion Vulcan as per absolute PPP theory however it has cost 2 trillion Vulcan.

Thus, it is clear from the above table that the absolute PPP theory does not hold between these

planets.

Part 10:

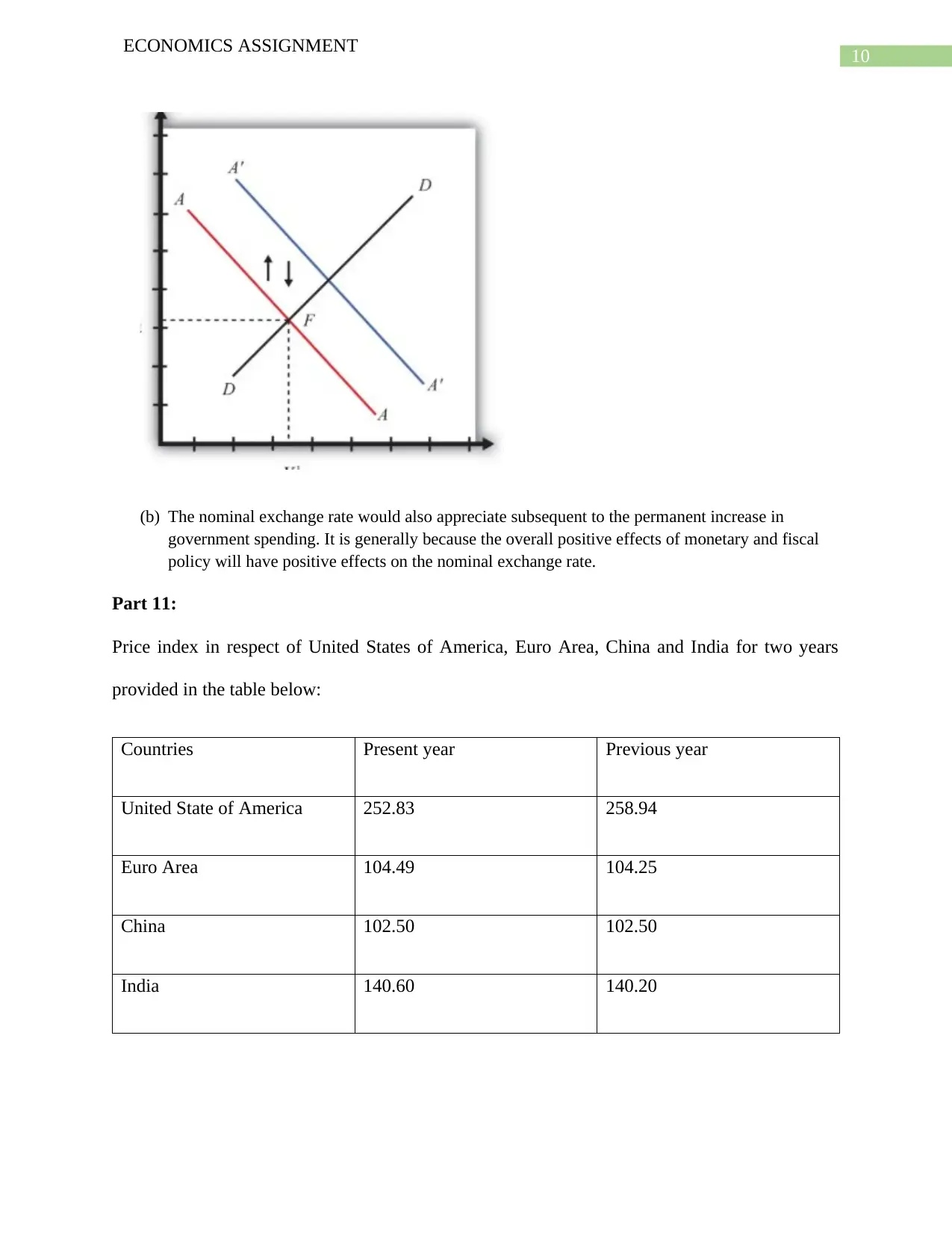

(a) Permanent increase in government spending will have a positive effect on the exchange rate. The

asset market curve shifts to the right as the expectation is that the exchange ratio will appreciate

in the future.

ECONOMICS ASSIGNMENT

If 100 Earth credits = 1 Vulcan trail then 20 trillion units of goods (Dilithium) should have cost

5 trillion Vulcan trail as per the absolute PPP. Similarly 11 trillion units of quadrotrilicale should

have costs 1.1 trillion Vulcan as per absolute PPP theory however it has cost 2 trillion Vulcan.

Thus, it is clear from the above table that the absolute PPP theory does not hold between these

planets.

Part 10:

(a) Permanent increase in government spending will have a positive effect on the exchange rate. The

asset market curve shifts to the right as the expectation is that the exchange ratio will appreciate

in the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ECONOMICS ASSIGNMENT

(b) The nominal exchange rate would also appreciate subsequent to the permanent increase in

government spending. It is generally because the overall positive effects of monetary and fiscal

policy will have positive effects on the nominal exchange rate.

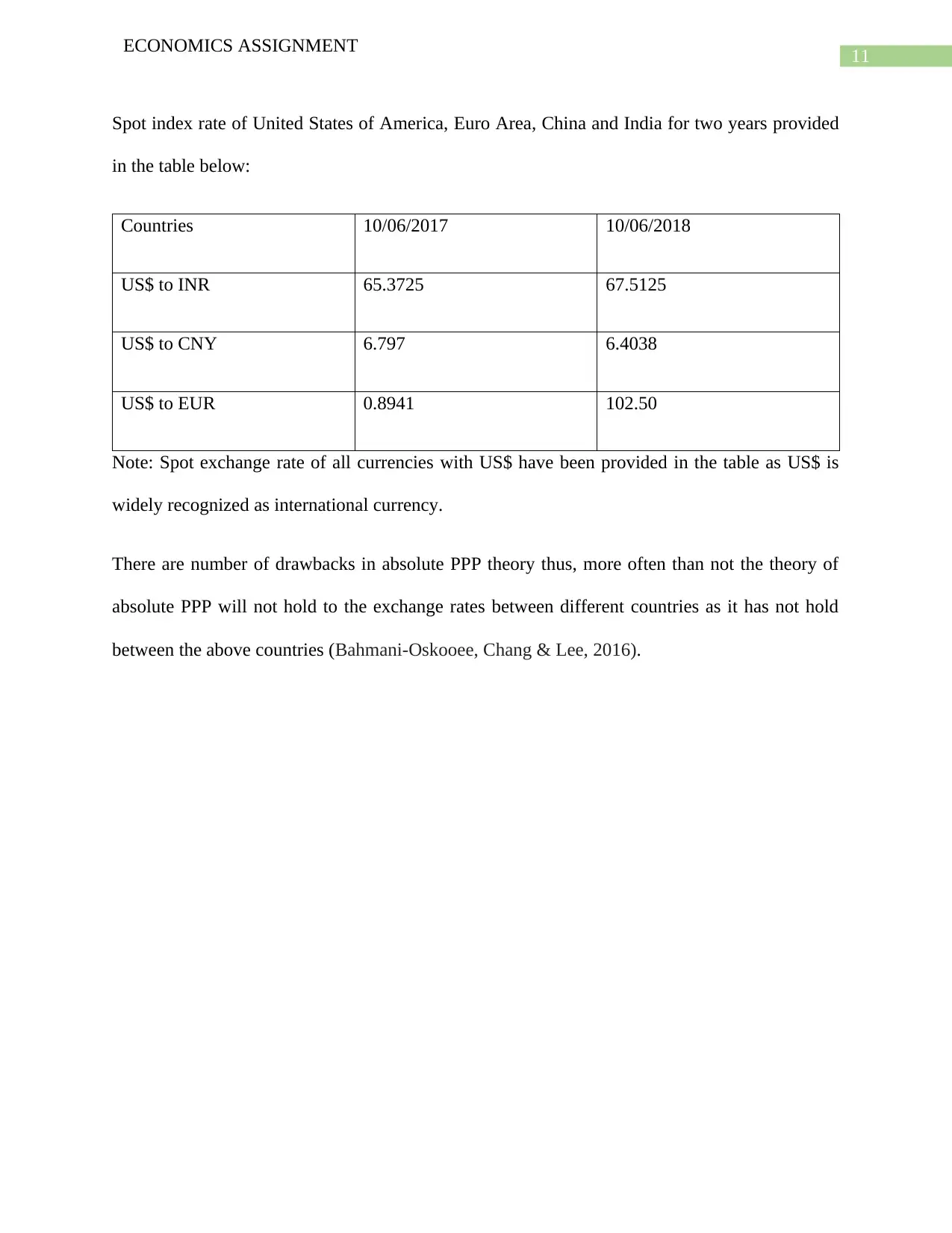

Part 11:

Price index in respect of United States of America, Euro Area, China and India for two years

provided in the table below:

Countries Present year Previous year

United State of America 252.83 258.94

Euro Area 104.49 104.25

China 102.50 102.50

India 140.60 140.20

ECONOMICS ASSIGNMENT

(b) The nominal exchange rate would also appreciate subsequent to the permanent increase in

government spending. It is generally because the overall positive effects of monetary and fiscal

policy will have positive effects on the nominal exchange rate.

Part 11:

Price index in respect of United States of America, Euro Area, China and India for two years

provided in the table below:

Countries Present year Previous year

United State of America 252.83 258.94

Euro Area 104.49 104.25

China 102.50 102.50

India 140.60 140.20

11

ECONOMICS ASSIGNMENT

Spot index rate of United States of America, Euro Area, China and India for two years provided

in the table below:

Countries 10/06/2017 10/06/2018

US$ to INR 65.3725 67.5125

US$ to CNY 6.797 6.4038

US$ to EUR 0.8941 102.50

Note: Spot exchange rate of all currencies with US$ have been provided in the table as US$ is

widely recognized as international currency.

There are number of drawbacks in absolute PPP theory thus, more often than not the theory of

absolute PPP will not hold to the exchange rates between different countries as it has not hold

between the above countries (Bahmani-Oskooee, Chang & Lee, 2016).

ECONOMICS ASSIGNMENT

Spot index rate of United States of America, Euro Area, China and India for two years provided

in the table below:

Countries 10/06/2017 10/06/2018

US$ to INR 65.3725 67.5125

US$ to CNY 6.797 6.4038

US$ to EUR 0.8941 102.50

Note: Spot exchange rate of all currencies with US$ have been provided in the table as US$ is

widely recognized as international currency.

There are number of drawbacks in absolute PPP theory thus, more often than not the theory of

absolute PPP will not hold to the exchange rates between different countries as it has not hold

between the above countries (Bahmani-Oskooee, Chang & Lee, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.