The US-China Trade War and Its Economic Effects on Singapore's Economy

VerifiedAdded on 2022/09/09

|14

|2900

|18

Report

AI Summary

This report analyzes the impact of the US-China trade war on Singapore's economy. It explores the relationship between Singapore, the US, and China, highlighting Singapore's reliance on trade with both nations. The report examines the effects of trade tensions on Singapore's GDP, exports, and balance of payments, as well as the rise in unemployment. It discusses the implications of trade restrictions, particularly on the industrial sectors and the positive impacts for firms in South East Asia. The report also delves into the importance of financial institutions in mitigating the economic effects and uses economic theories to illustrate the consequences of trade tariffs. It concludes by assessing the shift in business strategies and potential impacts on the price of consumer goods and offers an overview of economic implications, including the impact on non-oil exports.

Running head: ECONOMICS ASSIGNMENT

Economics Assignment

Name of Student:

Name of University:

Course ID:

Author Note:

Economics Assignment

Name of Student:

Name of University:

Course ID:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

Trade War is a political conflict between the two biggest economies in the world, China

and United States of America. The conflict aroused when US President, trump announced on

putting huge amounts of tariff on imported goods from China. China has been accused of

undergoing unfair trade practices against the US economy that has made US, impose punitive

tariffs on its goods. US people has a high demand for Chinese products, which have increased

the trade deficit of US. Most of the inputs for these goods are exported from US to China. Thus,

it leads to a technological transfer of US goods to the Chinese economy.

In order to stop this dependency on the Chinese products, US started imposing greater

amounts of tariff on the Chinese goods and force people to use the Chinese goods. On the

contrary, China responded by imposing huge amounts of tariffs on the US goods as a retaliation

effect of US trade restriction policies (South China Morning Post.com 2018). China blamed US

for trade war which has significantly hampered the level of GDP and export earnings of global

economies. This has affected the performance of business environment in the global market. A

significant impact has been seen in Malaysia, who heavily relies on China for its earnings. The

aim of the paper is to explore and understand the spill-over effects of trade tensions on Singapore

economy.

Discussion

China and Singapore has quality relationship with each other due to their forced

agreements in free trade and exchange of goods and services in the economy. Singapore has

joined the people’s republic of China that provides and assists Singapore with various services

and trainings that helps the economy to maintain an advancing rate of growth. China provides a

Trade War is a political conflict between the two biggest economies in the world, China

and United States of America. The conflict aroused when US President, trump announced on

putting huge amounts of tariff on imported goods from China. China has been accused of

undergoing unfair trade practices against the US economy that has made US, impose punitive

tariffs on its goods. US people has a high demand for Chinese products, which have increased

the trade deficit of US. Most of the inputs for these goods are exported from US to China. Thus,

it leads to a technological transfer of US goods to the Chinese economy.

In order to stop this dependency on the Chinese products, US started imposing greater

amounts of tariff on the Chinese goods and force people to use the Chinese goods. On the

contrary, China responded by imposing huge amounts of tariffs on the US goods as a retaliation

effect of US trade restriction policies (South China Morning Post.com 2018). China blamed US

for trade war which has significantly hampered the level of GDP and export earnings of global

economies. This has affected the performance of business environment in the global market. A

significant impact has been seen in Malaysia, who heavily relies on China for its earnings. The

aim of the paper is to explore and understand the spill-over effects of trade tensions on Singapore

economy.

Discussion

China and Singapore has quality relationship with each other due to their forced

agreements in free trade and exchange of goods and services in the economy. Singapore has

joined the people’s republic of China that provides and assists Singapore with various services

and trainings that helps the economy to maintain an advancing rate of growth. China provides a

wide range of facilities for the people of Singapore such as providing military training,

education, investment, trading structure and many more. Singapore has supported China for the

establishment of peaceful developments in the regions (The Economic Times. 2019). Moreover,

Singapore depends on China for the provision of goods and services that could only be given by

China at a lower price.

Dependency of Singapore on US and China

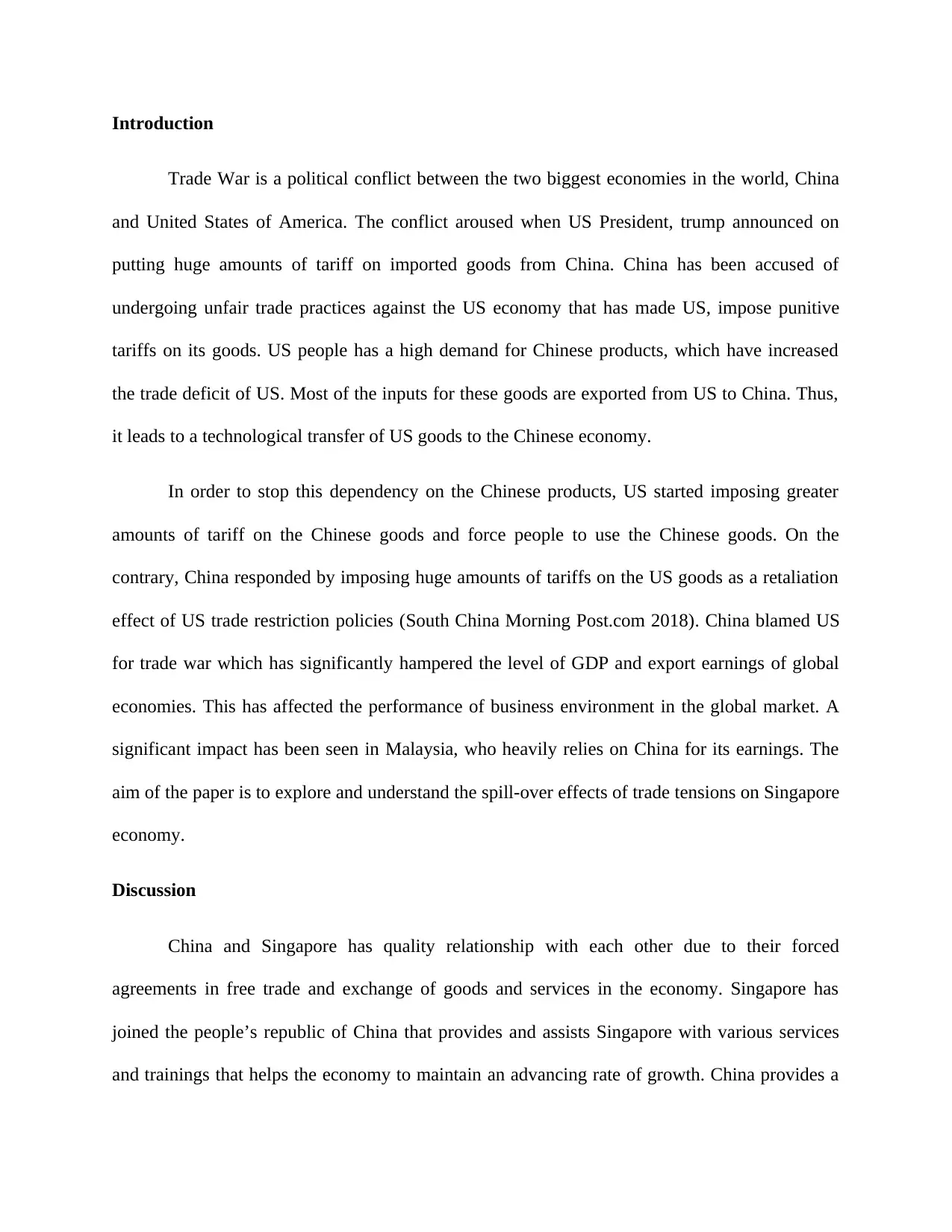

The products mostly comprise of advanced technological goods in which China has

comparative advantage and produces at a lower cost than most other economies. However, trade

conflicts between US and China have affected the overall performance of Singapore economy.

Figure 1: Trend in the growth rate of Singapore

Source: (Tradingeconomics.com. (2019).

The Singapore economy is heavily dependent on imports from China for various products

such as Crude Petroleum, Refined Petroleum, Computers, Integrated Circuits and Gold.

Singapore exports huge amounts of non-oil exports to China which makes up most of its

education, investment, trading structure and many more. Singapore has supported China for the

establishment of peaceful developments in the regions (The Economic Times. 2019). Moreover,

Singapore depends on China for the provision of goods and services that could only be given by

China at a lower price.

Dependency of Singapore on US and China

The products mostly comprise of advanced technological goods in which China has

comparative advantage and produces at a lower cost than most other economies. However, trade

conflicts between US and China have affected the overall performance of Singapore economy.

Figure 1: Trend in the growth rate of Singapore

Source: (Tradingeconomics.com. (2019).

The Singapore economy is heavily dependent on imports from China for various products

such as Crude Petroleum, Refined Petroleum, Computers, Integrated Circuits and Gold.

Singapore exports huge amounts of non-oil exports to China which makes up most of its

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

earnings for Singapore (Sen, 2019). The trade war has made an impact on the overall trade

market by making quality changes in the exchange of goods among economies. As a result,

goods could not be transferred from one country to another such that demand and supply of gods

are highly affected by the change in market demand and supply of goods among the economies

which resulted in a fall in Singapore growth rates, as shown in Figure 1. For example, the value

of exports went down by 8.9% in August, 2019, which further went down by 4% in next three

months. This has resulted in a sharp increase in the value of trade deficit, which can be seen from

the aggregate fall in balance of payments.

The effect of US-China trade war on Singapore

The economy of Singapore is heavily dependent on non-oily exports, which makes up

most of Singapore’s annual revenue and generates the economic growth. US is the largest

investor of Chinese economy and China serves as the greatest trading partner of US. These two

big economies acts as the sole center for business developments due to their high resource value

and provision of goods at low opportunity costs (Tradingeconomics.com., 2019). The growth of

other economies are significantly dependent on the growth of China and US, which serves as the

power house for business development. Singapore is one of the greatest economies to be greatly

affected by trade tensions because Singapore economy is mainly focused on the export and

import to US and China respectively.

market by making quality changes in the exchange of goods among economies. As a result,

goods could not be transferred from one country to another such that demand and supply of gods

are highly affected by the change in market demand and supply of goods among the economies

which resulted in a fall in Singapore growth rates, as shown in Figure 1. For example, the value

of exports went down by 8.9% in August, 2019, which further went down by 4% in next three

months. This has resulted in a sharp increase in the value of trade deficit, which can be seen from

the aggregate fall in balance of payments.

The effect of US-China trade war on Singapore

The economy of Singapore is heavily dependent on non-oily exports, which makes up

most of Singapore’s annual revenue and generates the economic growth. US is the largest

investor of Chinese economy and China serves as the greatest trading partner of US. These two

big economies acts as the sole center for business developments due to their high resource value

and provision of goods at low opportunity costs (Tradingeconomics.com., 2019). The growth of

other economies are significantly dependent on the growth of China and US, which serves as the

power house for business development. Singapore is one of the greatest economies to be greatly

affected by trade tensions because Singapore economy is mainly focused on the export and

import to US and China respectively.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 2: Change in the rate of Balance of Payments (BOP) after the Trade War

Source: (Tradingeconomics.com. 2019)

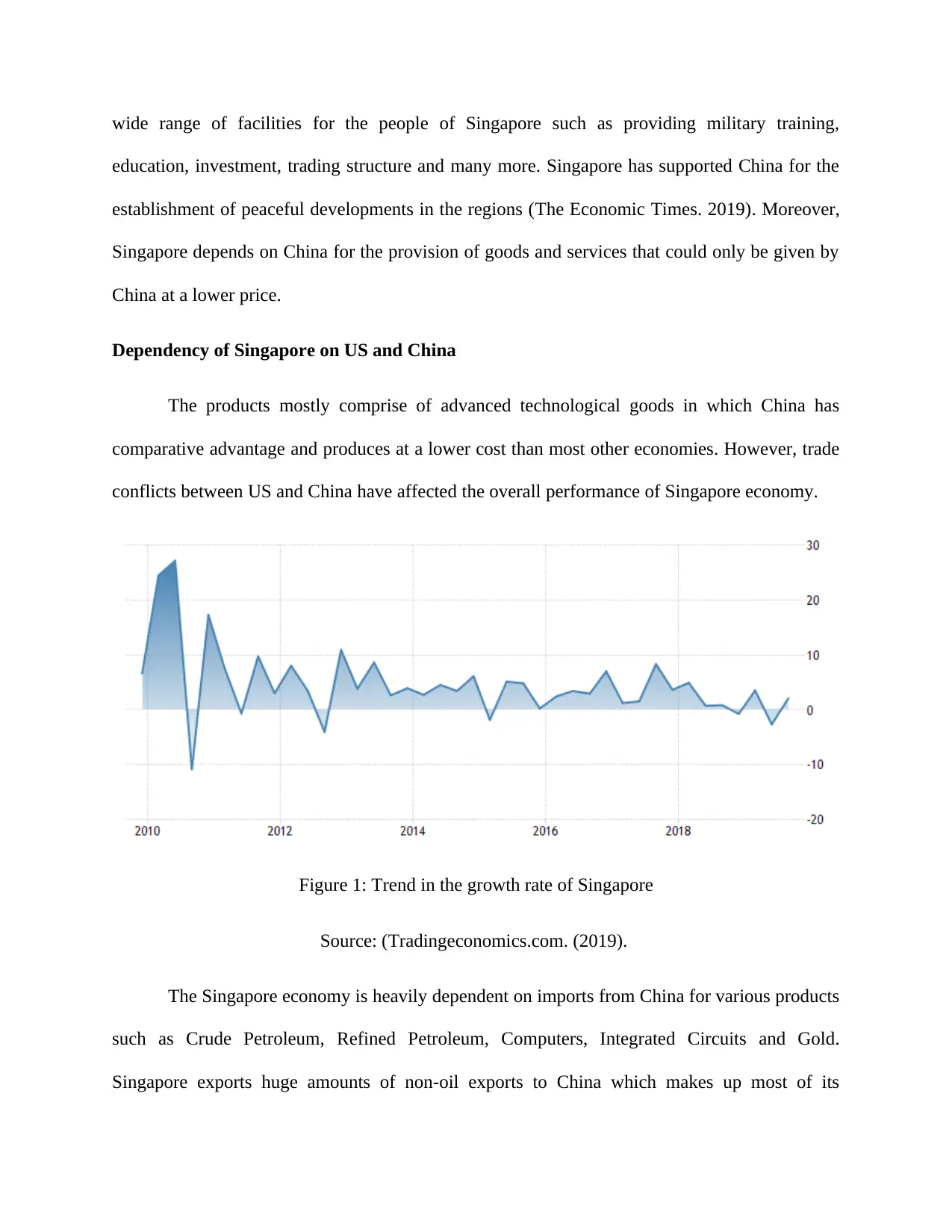

Singapore is highly affected by the trade tension between the two biggest economies as

most of the growth is generated from the two economies. Singapore’s business environment is

reflected by the change in the overall market structure of the two economies. Singapore exports

most of its intermediate goods to China for processing as China can make the goods at a low

cost. These goods are then returned back to Singapore and then ultimately sold to United States.

These manufacturing firms has to go through 25 percent of trade tariffs that is proposed by both

US and China due to their trade tensions (YI, S. 2019). The value of BOP fluctuated within

8000-4000 between 2014 and 2016. After which the value started degrading due to its fall in

economic growth, which further decreased with rise in trade tensions after 2018. Figure 2, the

continuous fall in BOP value after 2018 till the end of 2019. The growth of businesses have

significantly fallen as they cannot import or export high amount of goods and retain positive

profits. The companies have reported about the fallen orders of 25-30percent which have

changed their production output ration relatively.

Source: (Tradingeconomics.com. 2019)

Singapore is highly affected by the trade tension between the two biggest economies as

most of the growth is generated from the two economies. Singapore’s business environment is

reflected by the change in the overall market structure of the two economies. Singapore exports

most of its intermediate goods to China for processing as China can make the goods at a low

cost. These goods are then returned back to Singapore and then ultimately sold to United States.

These manufacturing firms has to go through 25 percent of trade tariffs that is proposed by both

US and China due to their trade tensions (YI, S. 2019). The value of BOP fluctuated within

8000-4000 between 2014 and 2016. After which the value started degrading due to its fall in

economic growth, which further decreased with rise in trade tensions after 2018. Figure 2, the

continuous fall in BOP value after 2018 till the end of 2019. The growth of businesses have

significantly fallen as they cannot import or export high amount of goods and retain positive

profits. The companies have reported about the fallen orders of 25-30percent which have

changed their production output ration relatively.

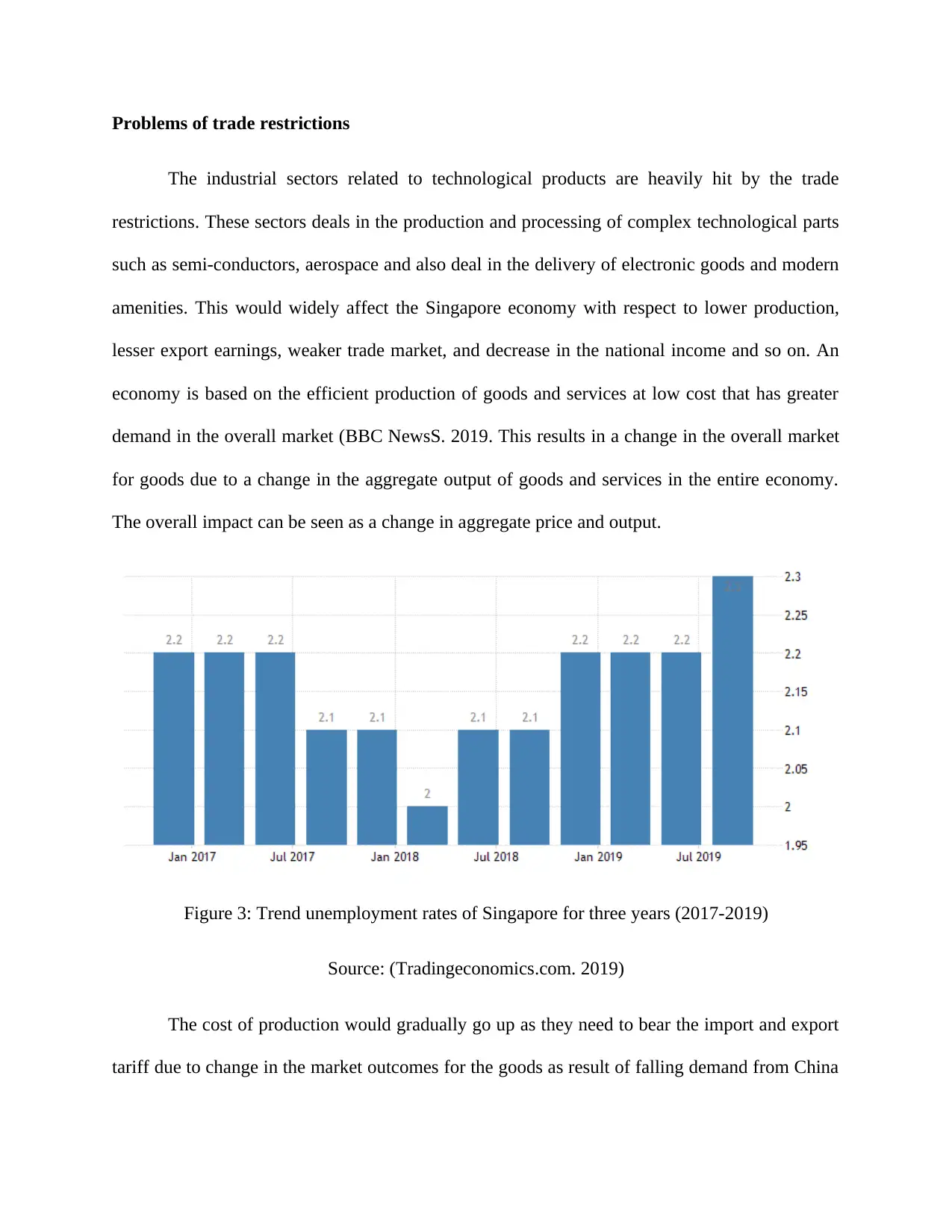

Problems of trade restrictions

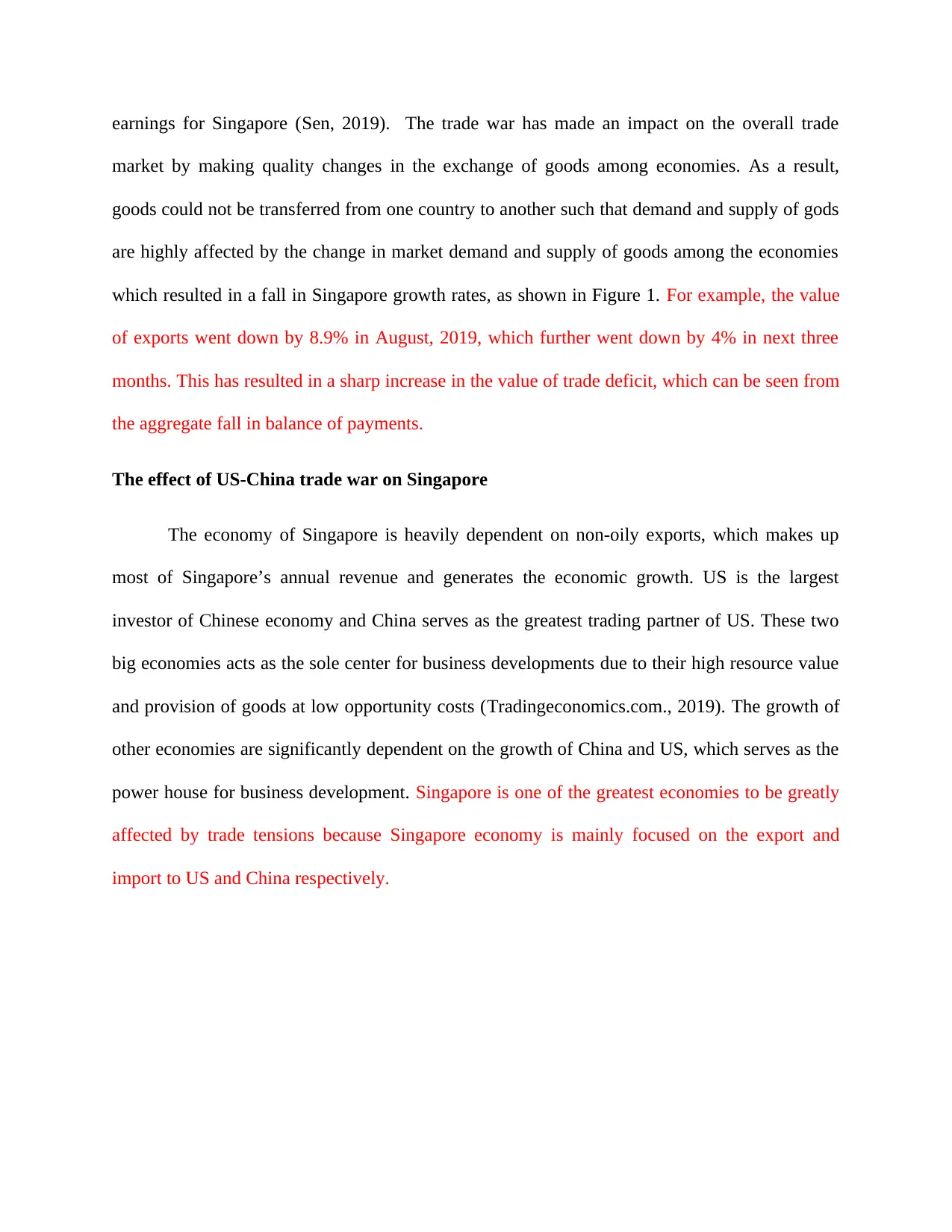

The industrial sectors related to technological products are heavily hit by the trade

restrictions. These sectors deals in the production and processing of complex technological parts

such as semi-conductors, aerospace and also deal in the delivery of electronic goods and modern

amenities. This would widely affect the Singapore economy with respect to lower production,

lesser export earnings, weaker trade market, and decrease in the national income and so on. An

economy is based on the efficient production of goods and services at low cost that has greater

demand in the overall market (BBC NewsS. 2019. This results in a change in the overall market

for goods due to a change in the aggregate output of goods and services in the entire economy.

The overall impact can be seen as a change in aggregate price and output.

Figure 3: Trend unemployment rates of Singapore for three years (2017-2019)

Source: (Tradingeconomics.com. 2019)

The cost of production would gradually go up as they need to bear the import and export

tariff due to change in the market outcomes for the goods as result of falling demand from China

The industrial sectors related to technological products are heavily hit by the trade

restrictions. These sectors deals in the production and processing of complex technological parts

such as semi-conductors, aerospace and also deal in the delivery of electronic goods and modern

amenities. This would widely affect the Singapore economy with respect to lower production,

lesser export earnings, weaker trade market, and decrease in the national income and so on. An

economy is based on the efficient production of goods and services at low cost that has greater

demand in the overall market (BBC NewsS. 2019. This results in a change in the overall market

for goods due to a change in the aggregate output of goods and services in the entire economy.

The overall impact can be seen as a change in aggregate price and output.

Figure 3: Trend unemployment rates of Singapore for three years (2017-2019)

Source: (Tradingeconomics.com. 2019)

The cost of production would gradually go up as they need to bear the import and export

tariff due to change in the market outcomes for the goods as result of falling demand from China

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and USA. However, the market for gods would significantly go down although there would be a

rise in the aggregate price level. Lack of demand reduces the revenue and profit margin of

businesses and often leads to recessionary implications. Business cycle slows down along with a

fall in productivity and output in most of the firms that depends on US and China for generation

of supernormal profits (BBC News. 2019). It could lead to joblessness with a reduction in

employment opportunities for the people of Singapore, which could start with a fall in the real

wage rates. The number of unemployed workers went up from 64,200 to 65,000 in September

2019. The number of jobless residents gradually increased from 72,600 to about 74,700 in

September, 2019 within three months. This can be seen from Figure 3, where unemployment

rates started rising from 2018, signifying the effects of trade tensions, which started in 2018.

Positive impact for firms in South East Asia

The US suppliers are moving the South East Asian countries for growing their business

and generate huge amounts of profits for the US economy. This is because US does not need to

bear high import tariffs that might hamper the growth of these business. Businesses are unable to

invest in new tools due to falling revenues (BBC News. (2019). This widely hampers the growth

of businesses due to change in the market outcomes that hampers the business environment of

the economies. Therefore, markets are hugely affected by trade tensions that changes the price

level, market input and output for goods.

rise in the aggregate price level. Lack of demand reduces the revenue and profit margin of

businesses and often leads to recessionary implications. Business cycle slows down along with a

fall in productivity and output in most of the firms that depends on US and China for generation

of supernormal profits (BBC News. 2019). It could lead to joblessness with a reduction in

employment opportunities for the people of Singapore, which could start with a fall in the real

wage rates. The number of unemployed workers went up from 64,200 to 65,000 in September

2019. The number of jobless residents gradually increased from 72,600 to about 74,700 in

September, 2019 within three months. This can be seen from Figure 3, where unemployment

rates started rising from 2018, signifying the effects of trade tensions, which started in 2018.

Positive impact for firms in South East Asia

The US suppliers are moving the South East Asian countries for growing their business

and generate huge amounts of profits for the US economy. This is because US does not need to

bear high import tariffs that might hamper the growth of these business. Businesses are unable to

invest in new tools due to falling revenues (BBC News. (2019). This widely hampers the growth

of businesses due to change in the market outcomes that hampers the business environment of

the economies. Therefore, markets are hugely affected by trade tensions that changes the price

level, market input and output for goods.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

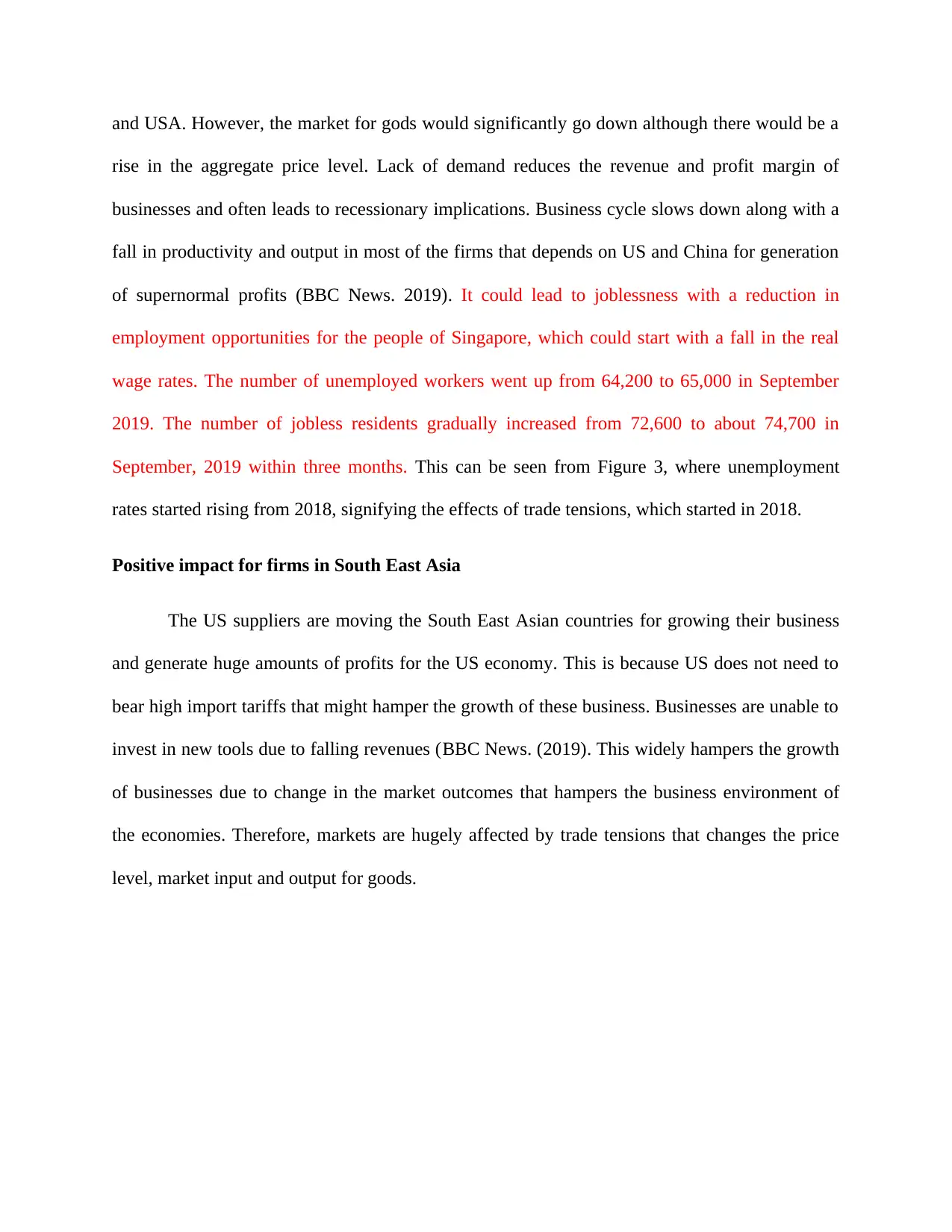

Figure 4: Trend in inflation rate

Source: (Tradingeconomics.com. 2019)

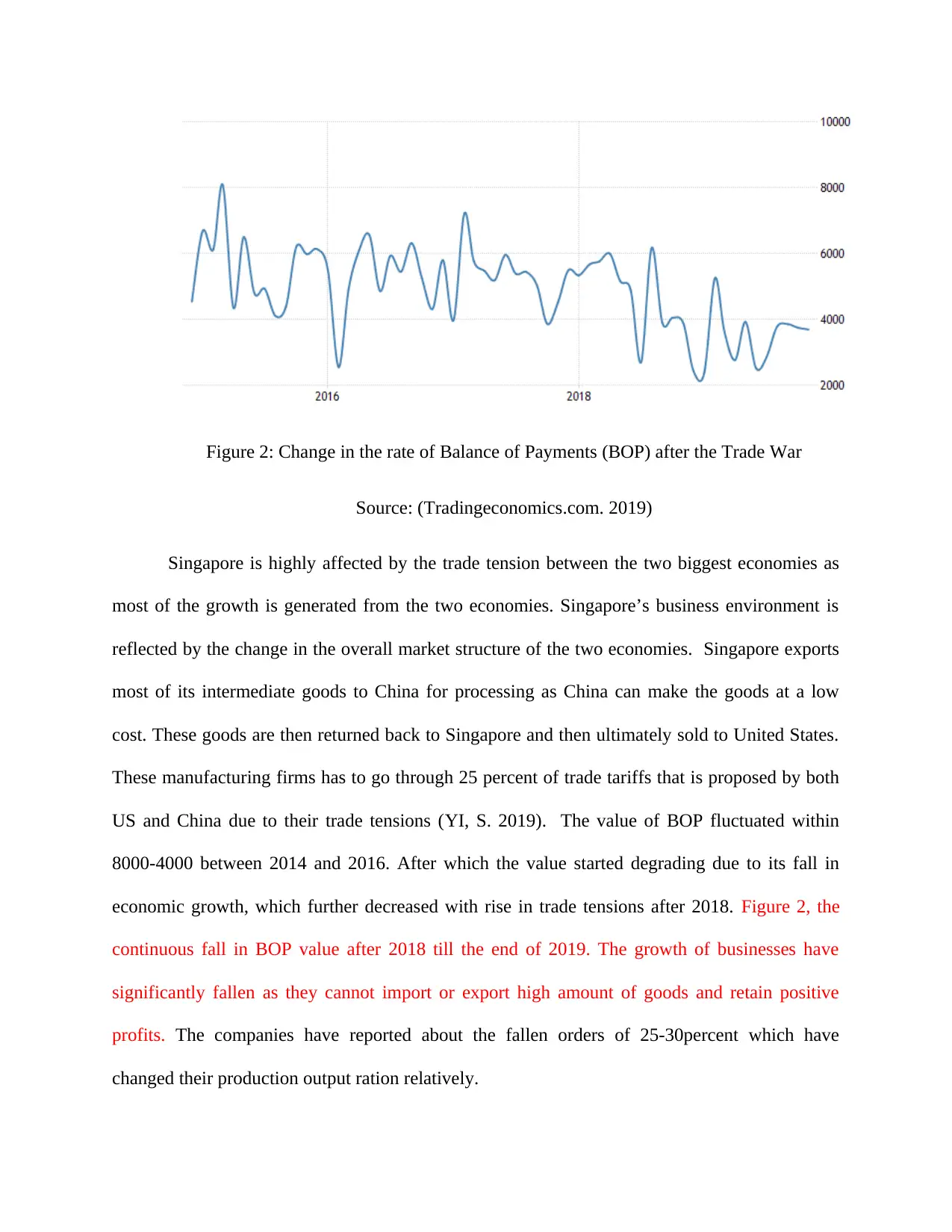

The price of consumer items would be hugely affected as US imports its input products

from other economies and sell it in the world market, which has high demand. Fall in aggregate

demand lowers the price level of goods as seen in Figure 4. Trade restrictions raises the input

prices, which would raise the aggregate price of goods. The price of electronics goods would

increase in the world markets because of lower production and a rise in production cost. That is

why big companies are expanding their business ventures in Singapore and relocate their supply

chains as well as headquarters in Singapore as they cannot grow their businesses in China.

Singapore could be a hub for business developers would shift their business for getting huge

profits and revenues. For example, the price index increased by 0.6% in January 2019, which

happened to be less than 0.5% in December, 2018.

Source: (Tradingeconomics.com. 2019)

The price of consumer items would be hugely affected as US imports its input products

from other economies and sell it in the world market, which has high demand. Fall in aggregate

demand lowers the price level of goods as seen in Figure 4. Trade restrictions raises the input

prices, which would raise the aggregate price of goods. The price of electronics goods would

increase in the world markets because of lower production and a rise in production cost. That is

why big companies are expanding their business ventures in Singapore and relocate their supply

chains as well as headquarters in Singapore as they cannot grow their businesses in China.

Singapore could be a hub for business developers would shift their business for getting huge

profits and revenues. For example, the price index increased by 0.6% in January 2019, which

happened to be less than 0.5% in December, 2018.

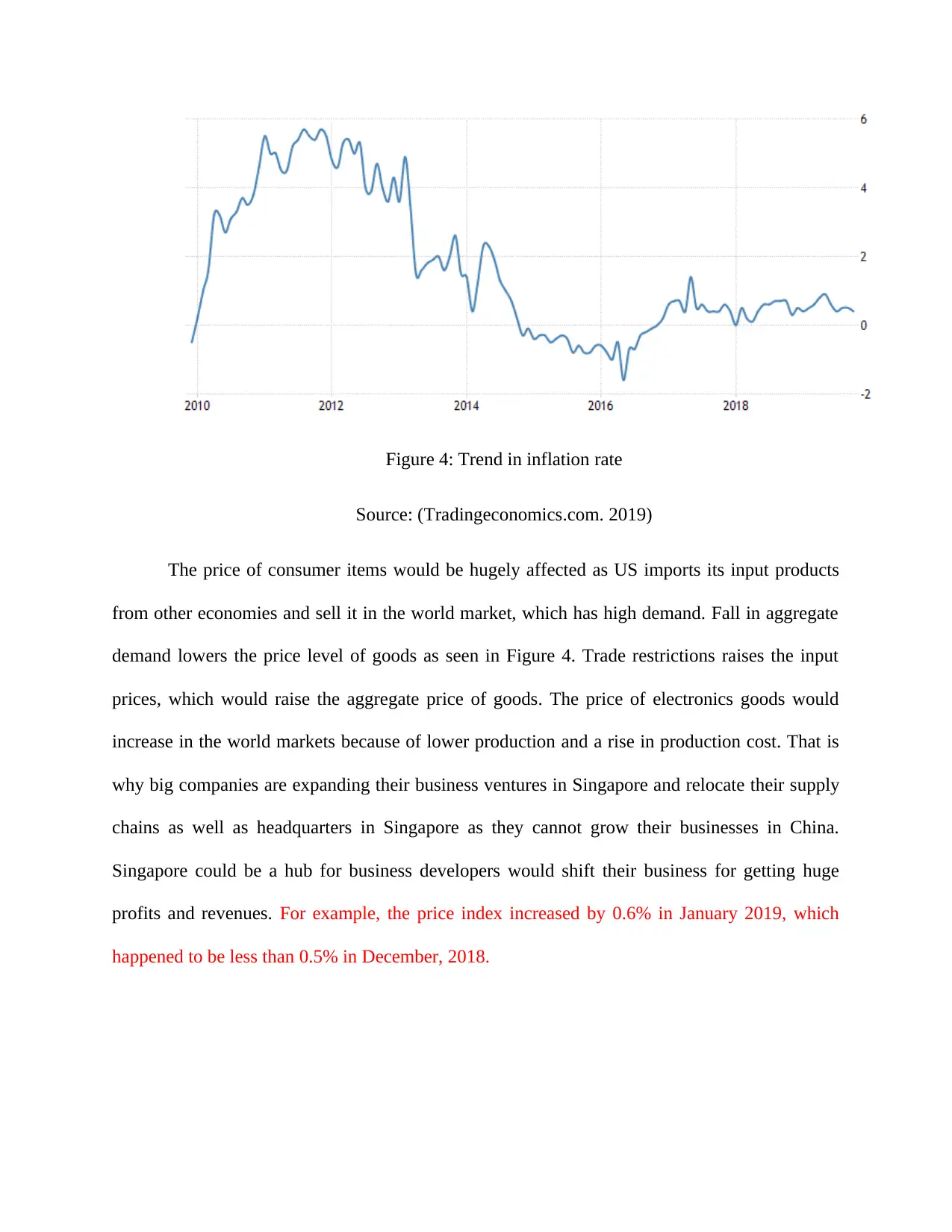

Importance of financial institutions for funding

US could refer to banks for the funding and investing their supply chains and business

ventures in a new region, which could strengthen the performance of the banks. This would

improve the financial condition of the economy and create more employment opportunities for

the residents of Singapore. However, shifting business in other economies is always not easy

because there are lot of other factors that comes in play whenever, a business tries to change in

operating area. Moreover, businesses needs to source goods from various sectors which requires

huge cost that can negatively impact the revenues of the economies. This would often lead to

changing market outcome as a result of the overall output of goods and services. For example,

companies in Singapore must exercise the financial prudence and relate it with the corporate

balance sheets which has remained stable with a supportive work environment. According to the

financial institutions, loan growth has been healthy over the last years instead of ongoing trade

tensions.

Economic implications of the trade and its consequences on the Singapore economy

US could refer to banks for the funding and investing their supply chains and business

ventures in a new region, which could strengthen the performance of the banks. This would

improve the financial condition of the economy and create more employment opportunities for

the residents of Singapore. However, shifting business in other economies is always not easy

because there are lot of other factors that comes in play whenever, a business tries to change in

operating area. Moreover, businesses needs to source goods from various sectors which requires

huge cost that can negatively impact the revenues of the economies. This would often lead to

changing market outcome as a result of the overall output of goods and services. For example,

companies in Singapore must exercise the financial prudence and relate it with the corporate

balance sheets which has remained stable with a supportive work environment. According to the

financial institutions, loan growth has been healthy over the last years instead of ongoing trade

tensions.

Economic implications of the trade and its consequences on the Singapore economy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Quantity

Price

DB

DA

QA

A

QB

PA

PB

SA

Figure 5: Effect of trade tariff on demand of goods

Source: As created by the author

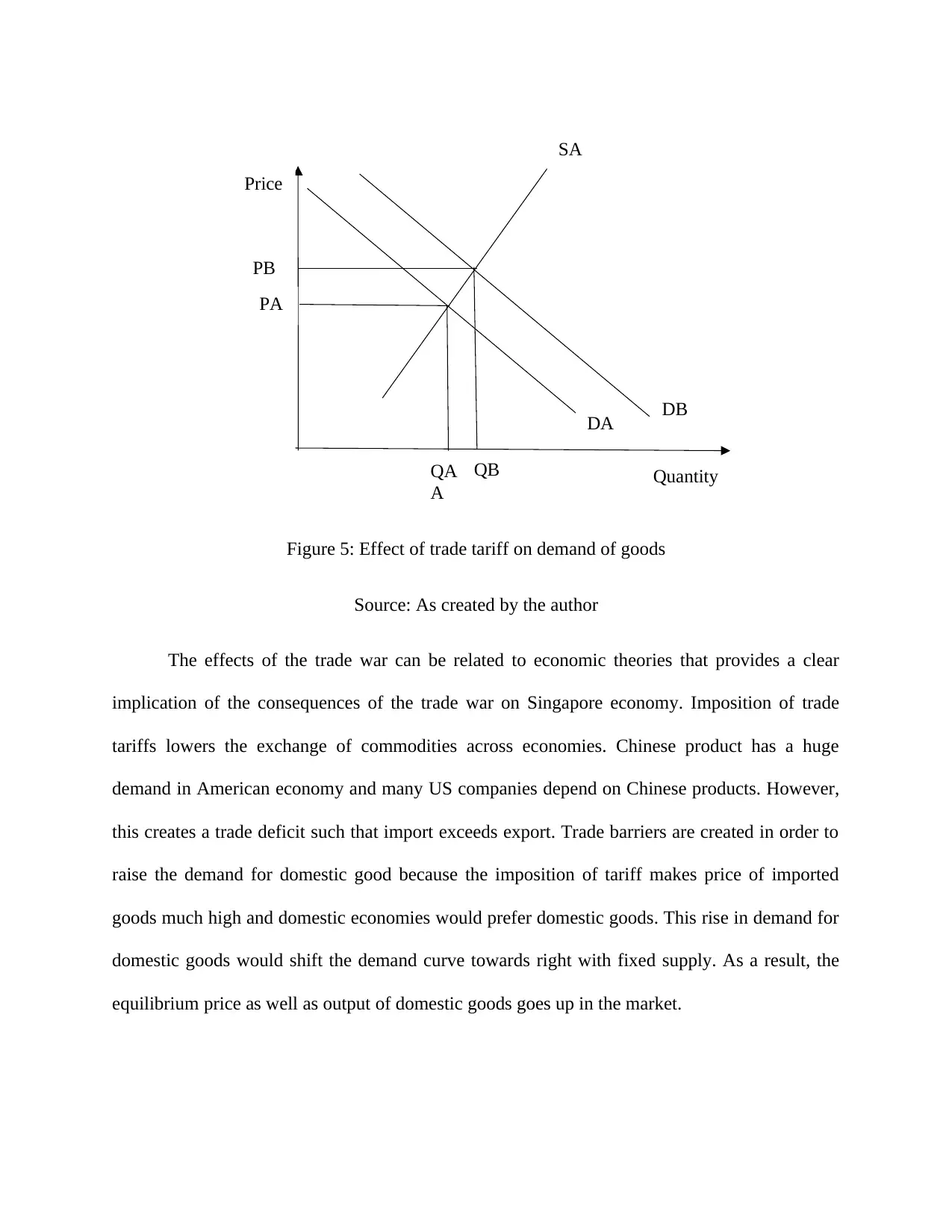

The effects of the trade war can be related to economic theories that provides a clear

implication of the consequences of the trade war on Singapore economy. Imposition of trade

tariffs lowers the exchange of commodities across economies. Chinese product has a huge

demand in American economy and many US companies depend on Chinese products. However,

this creates a trade deficit such that import exceeds export. Trade barriers are created in order to

raise the demand for domestic good because the imposition of tariff makes price of imported

goods much high and domestic economies would prefer domestic goods. This rise in demand for

domestic goods would shift the demand curve towards right with fixed supply. As a result, the

equilibrium price as well as output of domestic goods goes up in the market.

Price

DB

DA

QA

A

QB

PA

PB

SA

Figure 5: Effect of trade tariff on demand of goods

Source: As created by the author

The effects of the trade war can be related to economic theories that provides a clear

implication of the consequences of the trade war on Singapore economy. Imposition of trade

tariffs lowers the exchange of commodities across economies. Chinese product has a huge

demand in American economy and many US companies depend on Chinese products. However,

this creates a trade deficit such that import exceeds export. Trade barriers are created in order to

raise the demand for domestic good because the imposition of tariff makes price of imported

goods much high and domestic economies would prefer domestic goods. This rise in demand for

domestic goods would shift the demand curve towards right with fixed supply. As a result, the

equilibrium price as well as output of domestic goods goes up in the market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

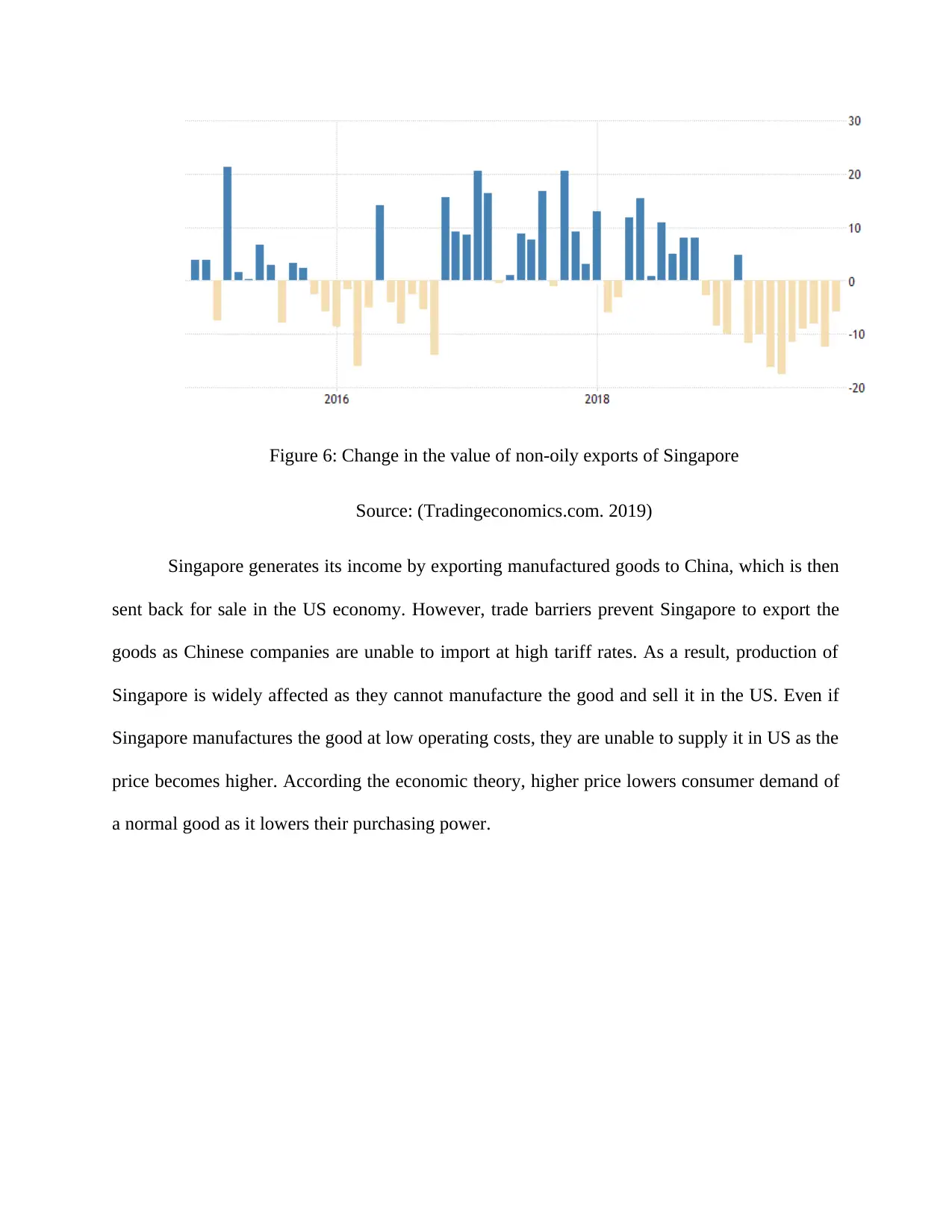

Figure 6: Change in the value of non-oily exports of Singapore

Source: (Tradingeconomics.com. 2019)

Singapore generates its income by exporting manufactured goods to China, which is then

sent back for sale in the US economy. However, trade barriers prevent Singapore to export the

goods as Chinese companies are unable to import at high tariff rates. As a result, production of

Singapore is widely affected as they cannot manufacture the good and sell it in the US. Even if

Singapore manufactures the good at low operating costs, they are unable to supply it in US as the

price becomes higher. According the economic theory, higher price lowers consumer demand of

a normal good as it lowers their purchasing power.

Source: (Tradingeconomics.com. 2019)

Singapore generates its income by exporting manufactured goods to China, which is then

sent back for sale in the US economy. However, trade barriers prevent Singapore to export the

goods as Chinese companies are unable to import at high tariff rates. As a result, production of

Singapore is widely affected as they cannot manufacture the good and sell it in the US. Even if

Singapore manufactures the good at low operating costs, they are unable to supply it in US as the

price becomes higher. According the economic theory, higher price lowers consumer demand of

a normal good as it lowers their purchasing power.

Quantity

Price

DB DA

QB QA

PB

PA

SA

SB

Figure 7: Effect of trade tensions in the overall supply market

Source: As created by the author

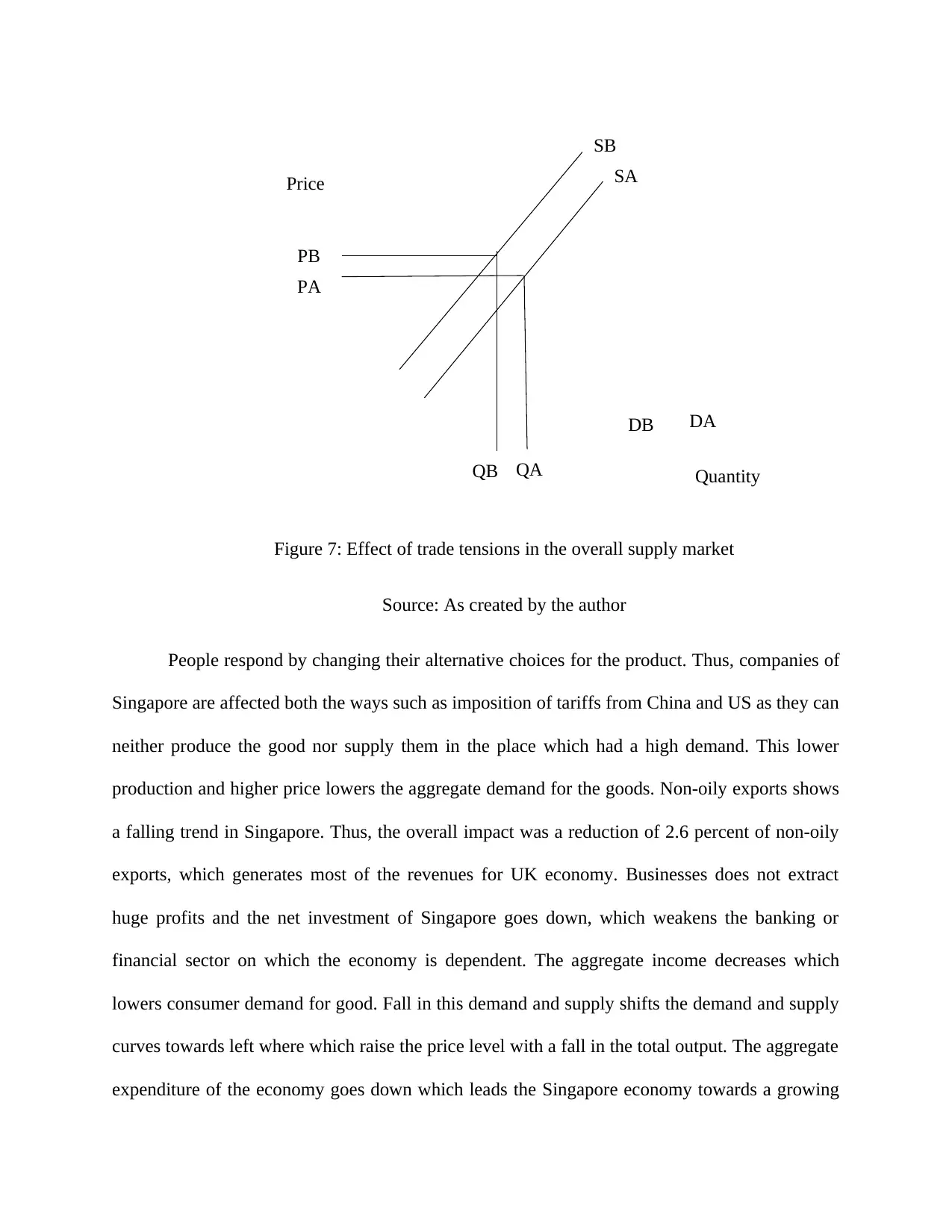

People respond by changing their alternative choices for the product. Thus, companies of

Singapore are affected both the ways such as imposition of tariffs from China and US as they can

neither produce the good nor supply them in the place which had a high demand. This lower

production and higher price lowers the aggregate demand for the goods. Non-oily exports shows

a falling trend in Singapore. Thus, the overall impact was a reduction of 2.6 percent of non-oily

exports, which generates most of the revenues for UK economy. Businesses does not extract

huge profits and the net investment of Singapore goes down, which weakens the banking or

financial sector on which the economy is dependent. The aggregate income decreases which

lowers consumer demand for good. Fall in this demand and supply shifts the demand and supply

curves towards left where which raise the price level with a fall in the total output. The aggregate

expenditure of the economy goes down which leads the Singapore economy towards a growing

Price

DB DA

QB QA

PB

PA

SA

SB

Figure 7: Effect of trade tensions in the overall supply market

Source: As created by the author

People respond by changing their alternative choices for the product. Thus, companies of

Singapore are affected both the ways such as imposition of tariffs from China and US as they can

neither produce the good nor supply them in the place which had a high demand. This lower

production and higher price lowers the aggregate demand for the goods. Non-oily exports shows

a falling trend in Singapore. Thus, the overall impact was a reduction of 2.6 percent of non-oily

exports, which generates most of the revenues for UK economy. Businesses does not extract

huge profits and the net investment of Singapore goes down, which weakens the banking or

financial sector on which the economy is dependent. The aggregate income decreases which

lowers consumer demand for good. Fall in this demand and supply shifts the demand and supply

curves towards left where which raise the price level with a fall in the total output. The aggregate

expenditure of the economy goes down which leads the Singapore economy towards a growing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.