(pdf) Sample Assignment on Economics

VerifiedAdded on 2021/06/17

|15

|3510

|31

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: ECONOMICS ASSIGNMENT

Economics Assignment

Name of the Student

Name of the University

Course ID

Economics Assignment

Name of the Student

Name of the University

Course ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ECONOMICS ASSIGNMENT

Table of Contents

Introduction......................................................................................................................................2

GDP composition of Australia.........................................................................................................2

Trend in Australian GDP and economic growth.............................................................................3

Factors explaining trend in GDP.....................................................................................................6

Consequences of slow economic growth.........................................................................................8

Economic growth and government policy.......................................................................................8

Policy of Australian government toward economic growth............................................................9

Conclusion.....................................................................................................................................10

References......................................................................................................................................12

Table of Contents

Introduction......................................................................................................................................2

GDP composition of Australia.........................................................................................................2

Trend in Australian GDP and economic growth.............................................................................3

Factors explaining trend in GDP.....................................................................................................6

Consequences of slow economic growth.........................................................................................8

Economic growth and government policy.......................................................................................8

Policy of Australian government toward economic growth............................................................9

Conclusion.....................................................................................................................................10

References......................................................................................................................................12

2ECONOMICS ASSIGNMENT

Introduction

Gross Domestic Product signifies total market values of goods and services produced in a

nation in a given year. In order to compute market value of goods and services, the market price

of these goods and services needs to be used. Goods and services valued at current year market

price gives nominal GDP (Heijdra, 2017). When the values are computed based on prices of a

fixed base year, and then it is called real GDP. GDP being one of the representative measures of

overall output is used to trace overall performance of a nation. Rate of change in GDP from one

year to another is taken as a measure to capture economic growth of a nation. The performance

of an economy can be understood from observing the trend in GDP growth rate. A gradual

increase in GDP indicates growth of a nation and hence an improvement in living standard

(Rostow, Baker & Baker, 2016). The report analyzes trend in GDP and economic growth in

context of Australian economy.

Australia considered as one of the highly developed nations with prevalence of a mixed

market economies. The economy has experienced an uninterrupted growth rate for a long period

of 26 years. Australia is the only nation in the list of OECD nation that successfully escaped

from the recessionary impact of global financial crisis. The nation ranked 13 in among the

developed nations of the world. According to IMF report, GDP of Australia grew at a rate of

2.2% in 2017 (Hartwell, 2017). The slowing growth in Australia has resulted from slowing

housing investment and decline in mining export. Household and consumption spending in

Australia are struggling because of a low growth in wage. The paper discusses GDP and growth

performance of Australian economy along with consequences of slow growth and possible

government policy measure to ensure a sustained economic growth.

Introduction

Gross Domestic Product signifies total market values of goods and services produced in a

nation in a given year. In order to compute market value of goods and services, the market price

of these goods and services needs to be used. Goods and services valued at current year market

price gives nominal GDP (Heijdra, 2017). When the values are computed based on prices of a

fixed base year, and then it is called real GDP. GDP being one of the representative measures of

overall output is used to trace overall performance of a nation. Rate of change in GDP from one

year to another is taken as a measure to capture economic growth of a nation. The performance

of an economy can be understood from observing the trend in GDP growth rate. A gradual

increase in GDP indicates growth of a nation and hence an improvement in living standard

(Rostow, Baker & Baker, 2016). The report analyzes trend in GDP and economic growth in

context of Australian economy.

Australia considered as one of the highly developed nations with prevalence of a mixed

market economies. The economy has experienced an uninterrupted growth rate for a long period

of 26 years. Australia is the only nation in the list of OECD nation that successfully escaped

from the recessionary impact of global financial crisis. The nation ranked 13 in among the

developed nations of the world. According to IMF report, GDP of Australia grew at a rate of

2.2% in 2017 (Hartwell, 2017). The slowing growth in Australia has resulted from slowing

housing investment and decline in mining export. Household and consumption spending in

Australia are struggling because of a low growth in wage. The paper discusses GDP and growth

performance of Australian economy along with consequences of slow growth and possible

government policy measure to ensure a sustained economic growth.

3ECONOMICS ASSIGNMENT

GDP composition of Australia

The three main sectors contributing to gross domestic product of a nation include

agricultural, industry and service sector. Australia is a modern economy when considered in

terms industry mix. The contribution of agriculture in GDP of Australia is only 4%. However,

when values from food and other primary product processing industry added the share rises to

12%. More than 60% of the farm products in Australia are exported. Since 2013-15,

Agriculture, Fishing and Forestry industry is considered as the second strongest industry of the

nation. The sector also accounts for a considerable employment generation. The contribution of

industrial sector in Australian GDP is around 26.6% (ibisworld.com.au, 2018). Mining is one of

the most vial industry of Australia comprising 8.8% of GDP. Queensland, Victoria and New

South Wales are the three nations known primarily for coal mining. Australia exports 54% of

coal mined to different nation particularly nations belonging to East Asia. Manufacturing

constitutes 5.9 share of industry. Other import industries of the nation include construction,

wholesaling, retailing and other. Australia is a service sector dominated economy with share of

service sector being 69.4%. In the service sector maximum contribution comes from finance and

insurable with a share of 8.8 percent (Nevile, 2016). The big four banks of Australia are

considered in among the list of 50 safest banks of the world. Other important sub-sectors in

service sector include tourism, media, tourism, education, logistics, rental, hiring and real estate

service, professional and technical service and others.

Trend in Australian GDP and economic growth

GDP composition of Australia

The three main sectors contributing to gross domestic product of a nation include

agricultural, industry and service sector. Australia is a modern economy when considered in

terms industry mix. The contribution of agriculture in GDP of Australia is only 4%. However,

when values from food and other primary product processing industry added the share rises to

12%. More than 60% of the farm products in Australia are exported. Since 2013-15,

Agriculture, Fishing and Forestry industry is considered as the second strongest industry of the

nation. The sector also accounts for a considerable employment generation. The contribution of

industrial sector in Australian GDP is around 26.6% (ibisworld.com.au, 2018). Mining is one of

the most vial industry of Australia comprising 8.8% of GDP. Queensland, Victoria and New

South Wales are the three nations known primarily for coal mining. Australia exports 54% of

coal mined to different nation particularly nations belonging to East Asia. Manufacturing

constitutes 5.9 share of industry. Other import industries of the nation include construction,

wholesaling, retailing and other. Australia is a service sector dominated economy with share of

service sector being 69.4%. In the service sector maximum contribution comes from finance and

insurable with a share of 8.8 percent (Nevile, 2016). The big four banks of Australia are

considered in among the list of 50 safest banks of the world. Other important sub-sectors in

service sector include tourism, media, tourism, education, logistics, rental, hiring and real estate

service, professional and technical service and others.

Trend in Australian GDP and economic growth

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ECONOMICS ASSIGNMENT

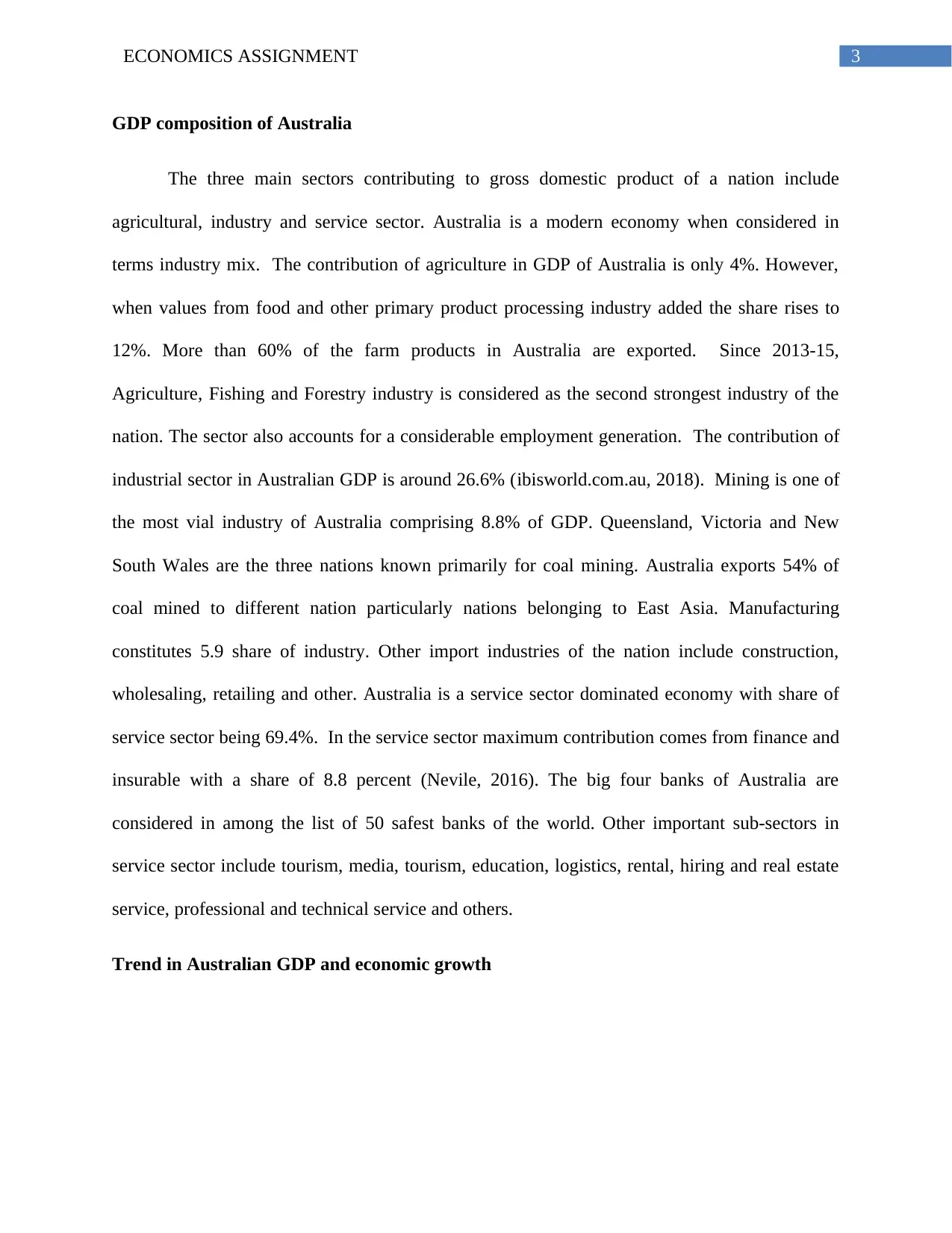

Figure 1: GDP of Australia in last five years

(Source: tradingeconomics.com, 2018)

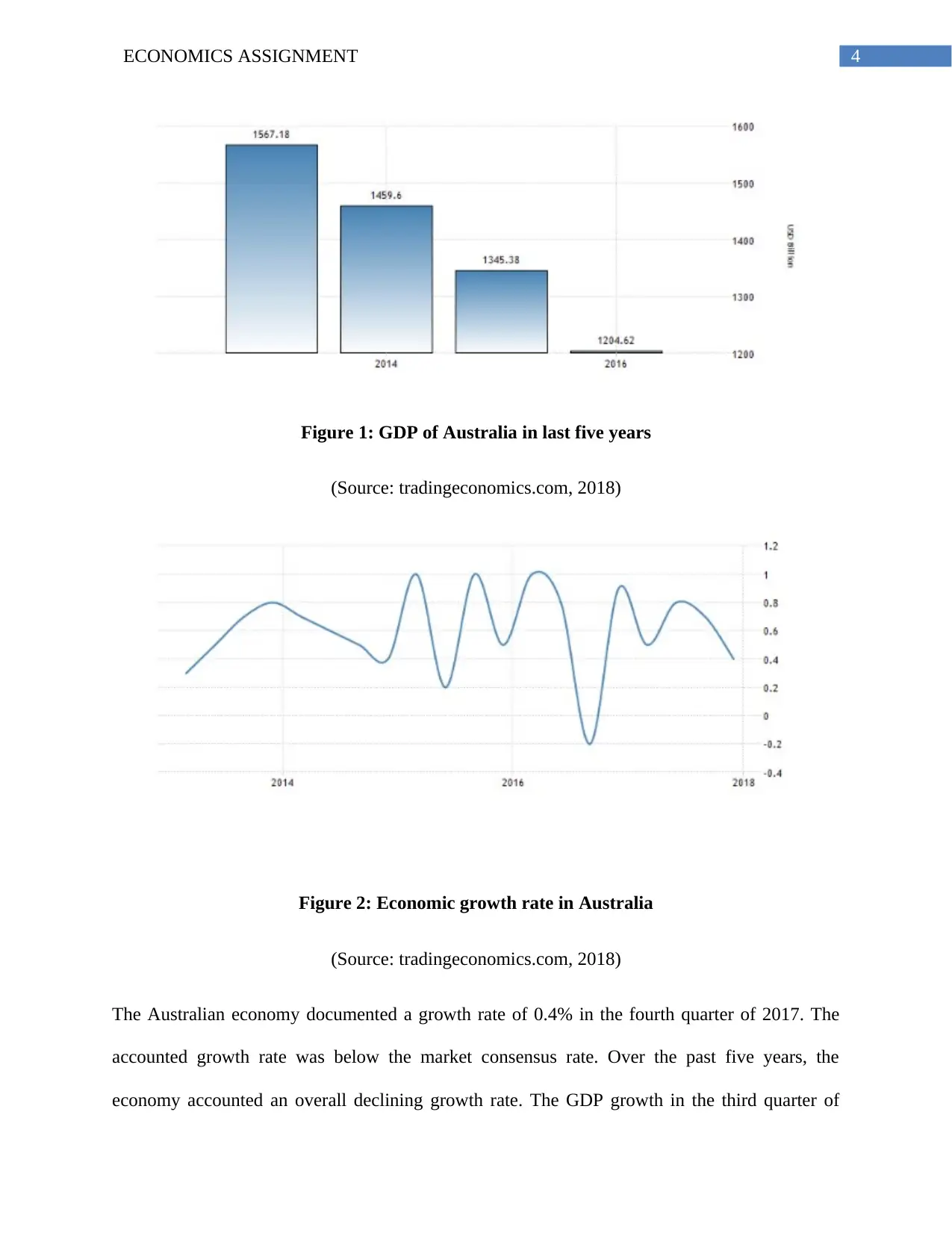

Figure 2: Economic growth rate in Australia

(Source: tradingeconomics.com, 2018)

The Australian economy documented a growth rate of 0.4% in the fourth quarter of 2017. The

accounted growth rate was below the market consensus rate. Over the past five years, the

economy accounted an overall declining growth rate. The GDP growth in the third quarter of

Figure 1: GDP of Australia in last five years

(Source: tradingeconomics.com, 2018)

Figure 2: Economic growth rate in Australia

(Source: tradingeconomics.com, 2018)

The Australian economy documented a growth rate of 0.4% in the fourth quarter of 2017. The

accounted growth rate was below the market consensus rate. Over the past five years, the

economy accounted an overall declining growth rate. The GDP growth in the third quarter of

5ECONOMICS ASSIGNMENT

2017 was 0.7 percent. This is considered as the weakest growth after the contraction of economic

growth in fourth quarter of 2016. The positive contribution in economic growth has mainly come

from an increase in household consumption expenditure. In contrast, net trade and non-dwelling

construction continue to push economic growth in downward direction. Factor having positive

influence on economic growth include household consumption, private and public investment

and government expenditure. Household consumption has grown at a rate of 0.6%. The recorded

increases in public and private investment are 0.3% and 0.1% respectively

(tradingeconomics.com, 2018). The government spending accounts a growth rate of 0.3

percentage point. The slow-down of non-dwelling construction, investment and net trade are

dragging the economic growth of Australia (Hatfield-Dodds et al., 2015). The non-dwelling

construction and net trade accounted a negative growth rate of -5.5%. Along with this,

investment in dwellings declined by 0.1% point.

After experiencing a considerable slow-down, household spending in recent year has

increased by 1 percent point. Household spending has revived following an increase in spending

on heath, hotels, restaurant, cafes, recreation and culture. Spending however are declined in

electricity, food, goods and other fuels. Government spending has increased by 1.7 percent at all

levels of government. The state and local government have increased by 0.7 5 while that of

national government has increased by 3.1 percent. There is a decline in gross fixed capital

formation by 1.2 percent (businessinsider.com.au, 2018). This led to a decline in private

investment by 2.2 percent. The decline in private investment has mainly contributed from a

decline in non-dwelling construction by 8.0 percent. Public investment has increased by 2.9

percent. The assets were transferred from public to public to private sector. There is a 3.3 percent

increase in investment in machinery and equipment (tradingeconomics.com, 2018).

2017 was 0.7 percent. This is considered as the weakest growth after the contraction of economic

growth in fourth quarter of 2016. The positive contribution in economic growth has mainly come

from an increase in household consumption expenditure. In contrast, net trade and non-dwelling

construction continue to push economic growth in downward direction. Factor having positive

influence on economic growth include household consumption, private and public investment

and government expenditure. Household consumption has grown at a rate of 0.6%. The recorded

increases in public and private investment are 0.3% and 0.1% respectively

(tradingeconomics.com, 2018). The government spending accounts a growth rate of 0.3

percentage point. The slow-down of non-dwelling construction, investment and net trade are

dragging the economic growth of Australia (Hatfield-Dodds et al., 2015). The non-dwelling

construction and net trade accounted a negative growth rate of -5.5%. Along with this,

investment in dwellings declined by 0.1% point.

After experiencing a considerable slow-down, household spending in recent year has

increased by 1 percent point. Household spending has revived following an increase in spending

on heath, hotels, restaurant, cafes, recreation and culture. Spending however are declined in

electricity, food, goods and other fuels. Government spending has increased by 1.7 percent at all

levels of government. The state and local government have increased by 0.7 5 while that of

national government has increased by 3.1 percent. There is a decline in gross fixed capital

formation by 1.2 percent (businessinsider.com.au, 2018). This led to a decline in private

investment by 2.2 percent. The decline in private investment has mainly contributed from a

decline in non-dwelling construction by 8.0 percent. Public investment has increased by 2.9

percent. The assets were transferred from public to public to private sector. There is a 3.3 percent

increase in investment in machinery and equipment (tradingeconomics.com, 2018).

6ECONOMICS ASSIGNMENT

Goods and service exports are declined by 1.8%. Export of goods declined by 1.7 percent

while that of services fell by 1.9 percent. In contrast to a decline in export growth, import of

goods and services have increased. This worsens the trade balance adversely affecting gross

domestic product and economic growth of the nation. Mining industry recently accounted a

growth of 1.3 percent. The mining industry growth has driven by coal and iron mining followed

by the contraction of oil and gas contraction (Kydland, Rupert & Sustek, 2016). In the service

sector, telecommunication, media and information have grown by 2.9 percent. The

telecommunication service grown by 3.5 percent while the growth of media and information

services is 2.2 percent. The accounted growth in financial and insurance service is 0.1 percent.

This is the lowest since fourth quarter of 2014. No growth has been recorded in finance while

insurance and financial service grew only by 0.2 percent. Health services in the economy have

advanced with the growth of both private and public services (Thorpe & Leitao, 2014). Growth

of agriculture, fishing and forestry has declined by 2.7 percent. Manufacturing sector has slowed

down by 1 percent. The economy in the fourth quarter of 2017 grew by 2.4 percent. The

economic growth has slowed by 0.5 percentage point as compared to growth of 2.9% in the

previous quarter. The accounted growth rate was below the expected growth rate 2.5 percent.

Factors explaining trend in GDP

Over the last few years, the Australia has experienced a sluggish growth rate. The

accounted growth rate remained around 2 to 3 percent. The last recorded growth in 2017 was 2.4

percent. The growth rate was lower than that the previous year. The quarterly growth though

slightly was slightly recovered by gain in consumption and public investment (Rodrik, 2014).

The growth effect however has been outweighed by a soft housing sector and business sector

Goods and service exports are declined by 1.8%. Export of goods declined by 1.7 percent

while that of services fell by 1.9 percent. In contrast to a decline in export growth, import of

goods and services have increased. This worsens the trade balance adversely affecting gross

domestic product and economic growth of the nation. Mining industry recently accounted a

growth of 1.3 percent. The mining industry growth has driven by coal and iron mining followed

by the contraction of oil and gas contraction (Kydland, Rupert & Sustek, 2016). In the service

sector, telecommunication, media and information have grown by 2.9 percent. The

telecommunication service grown by 3.5 percent while the growth of media and information

services is 2.2 percent. The accounted growth in financial and insurance service is 0.1 percent.

This is the lowest since fourth quarter of 2014. No growth has been recorded in finance while

insurance and financial service grew only by 0.2 percent. Health services in the economy have

advanced with the growth of both private and public services (Thorpe & Leitao, 2014). Growth

of agriculture, fishing and forestry has declined by 2.7 percent. Manufacturing sector has slowed

down by 1 percent. The economy in the fourth quarter of 2017 grew by 2.4 percent. The

economic growth has slowed by 0.5 percentage point as compared to growth of 2.9% in the

previous quarter. The accounted growth rate was below the expected growth rate 2.5 percent.

Factors explaining trend in GDP

Over the last few years, the Australia has experienced a sluggish growth rate. The

accounted growth rate remained around 2 to 3 percent. The last recorded growth in 2017 was 2.4

percent. The growth rate was lower than that the previous year. The quarterly growth though

slightly was slightly recovered by gain in consumption and public investment (Rodrik, 2014).

The growth effect however has been outweighed by a soft housing sector and business sector

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS ASSIGNMENT

along with a large contraction of net export. The Australian economy has continued to resist

recession calls. The economy though has successful in resisted recessionary outlook but has

accounted a growth rate that is lower than the potential growth rate. Growth in per capita GDP is

only 0.8% (theconversation.com, 2018). This is lower than the per capita growth of most of

advanced nations.

Several factors are responsible for a below average growth rate of Australia. In the year

2013-14, the economy had seen a strong performance of construction sector. Growth in housing

construction has however been faded in recent years. The economy is gradually moving towards

a housing crisis. The average prices of house started to fall with expectation of a much deeper

housing price crash in future (Shafiullah, Selvanathan & Naranpanawa, 2017). The Reserve

Bank of Australia have done mistake. It has raised the rates to a high level. In the absence of a

surge in supply, the high rate results in high unemployment. The decline in housing price in

Melbourne and Sydney is expected to be limited to 5-10%. The other cities are expected to

experience a more positive outlook for the housing sector. The low wage growth has constrained

consumer-spending leading to a weak outlook for economic growth (theconversation.com,

2018). The prevailing underemployment and slow gain in wages are the other factors responsible

for a weak economic household spending and slow growth. Consumers decline their saving

helped with rising wealth. The trend however is unlikely to persist in the long-run following the

expectation that price of property in Melbourne and Sydney will decline. Investment in the

mining sector is continued to fall. The relative price of Australian dollar increased to USD 0.78

(theconversation.com, 2018). The depreciated currency posed a threat to export growth of

Australia worsening trade balance. Sectors such as tourism. Manufacturing and agriculture are

more exposed to trade and hence are likely to suffer from AUD depreciation.

along with a large contraction of net export. The Australian economy has continued to resist

recession calls. The economy though has successful in resisted recessionary outlook but has

accounted a growth rate that is lower than the potential growth rate. Growth in per capita GDP is

only 0.8% (theconversation.com, 2018). This is lower than the per capita growth of most of

advanced nations.

Several factors are responsible for a below average growth rate of Australia. In the year

2013-14, the economy had seen a strong performance of construction sector. Growth in housing

construction has however been faded in recent years. The economy is gradually moving towards

a housing crisis. The average prices of house started to fall with expectation of a much deeper

housing price crash in future (Shafiullah, Selvanathan & Naranpanawa, 2017). The Reserve

Bank of Australia have done mistake. It has raised the rates to a high level. In the absence of a

surge in supply, the high rate results in high unemployment. The decline in housing price in

Melbourne and Sydney is expected to be limited to 5-10%. The other cities are expected to

experience a more positive outlook for the housing sector. The low wage growth has constrained

consumer-spending leading to a weak outlook for economic growth (theconversation.com,

2018). The prevailing underemployment and slow gain in wages are the other factors responsible

for a weak economic household spending and slow growth. Consumers decline their saving

helped with rising wealth. The trend however is unlikely to persist in the long-run following the

expectation that price of property in Melbourne and Sydney will decline. Investment in the

mining sector is continued to fall. The relative price of Australian dollar increased to USD 0.78

(theconversation.com, 2018). The depreciated currency posed a threat to export growth of

Australia worsening trade balance. Sectors such as tourism. Manufacturing and agriculture are

more exposed to trade and hence are likely to suffer from AUD depreciation.

8ECONOMICS ASSIGNMENT

The falling inflationary pressure is another factor contributing to a slower economic

growth. The low inflation expectation further hurt wage growth. Under this situation, the strong

Aussie dollar fails to make any better off for the economy (Nakamura, Steinsson & Liu, 2016).

Consequences of slow economic growth

The implication of a low growth figure is more than just being a number. Slow economic

growth over a long period has detrimental effect on future prospective growth and other

prospects of a nation. The slow economic growth marked by contraction of industrial and service

sectors creates the problem of unemployment. The unemployment problem is most severe for the

mining industry (McCombie & Thirlwall, 2016). The decline in mining investment and growth

slow-down of mining industry has caused thousand of people to lose their jobs. The slow

economic growth has a social consequence in the form of rising economic inequality measure in

terms of consumption, investment and wealth distribution.

Economic growth and government policy

Government can influence economic growth by multiple ways. Two most common tool

used by government to stabilize economic growth are fiscal and monetary policy. In times of

expanding growth, government generally takes expansionary policies. In order to achieve a

stable growth rate through increasing aggregate demand government can either reduce tax or

raise government expenditure (Johnson, 2017). When government lowers tax, the increases

disposable income of households who the can spend a higher income on consumption of goods

and services. A higher government spending in the form of higher public investment creates

more job opportunities leading to economic expansion. The fiscal policy however can be ended

up with a deficit in government as spending exceeds earned revenue. A comparatively easier

The falling inflationary pressure is another factor contributing to a slower economic

growth. The low inflation expectation further hurt wage growth. Under this situation, the strong

Aussie dollar fails to make any better off for the economy (Nakamura, Steinsson & Liu, 2016).

Consequences of slow economic growth

The implication of a low growth figure is more than just being a number. Slow economic

growth over a long period has detrimental effect on future prospective growth and other

prospects of a nation. The slow economic growth marked by contraction of industrial and service

sectors creates the problem of unemployment. The unemployment problem is most severe for the

mining industry (McCombie & Thirlwall, 2016). The decline in mining investment and growth

slow-down of mining industry has caused thousand of people to lose their jobs. The slow

economic growth has a social consequence in the form of rising economic inequality measure in

terms of consumption, investment and wealth distribution.

Economic growth and government policy

Government can influence economic growth by multiple ways. Two most common tool

used by government to stabilize economic growth are fiscal and monetary policy. In times of

expanding growth, government generally takes expansionary policies. In order to achieve a

stable growth rate through increasing aggregate demand government can either reduce tax or

raise government expenditure (Johnson, 2017). When government lowers tax, the increases

disposable income of households who the can spend a higher income on consumption of goods

and services. A higher government spending in the form of higher public investment creates

more job opportunities leading to economic expansion. The fiscal policy however can be ended

up with a deficit in government as spending exceeds earned revenue. A comparatively easier

9ECONOMICS ASSIGNMENT

policy tool is the use if expansionary monetary policy. The central bank designs and control

monetary policy. Under expansionary monetary policy, the central bank lowers interest rate. The

lower interest rate by reducing the borrowing cost encourage investment. The low interest rate

discourage consumers to save raising the consumption spending (Mankiw, 2014). If interest rate

on mortgage payment reduces, then households are left with a higher disposable income and a

higher aggregate demand. Government thus can use monetary and fiscal policy to influence

inflation and economic growth.

Policy of Australian government toward economic growth

The projection regarding ageing population is posing direct challenges to economic

growth. With an increase in ageing population, the labor-force participation rate is projected to

fall further. The proportion of population aged over 65 is expected to increase at a rapid pace.

The burden of aged population lead to a lower GDP growth. The GDP per capita is capita in the

next 40 years will be lower than that in the past 40 years. The growth prospects need to be

improved to raise the living standard along with social and economic well-being. The objective

to improve economic growth relied on 3Ps – population, participants and productivity

(treasury.gov.au, 2018). Any changes in any of the three factors influence the pressure on growth

and spending in a different way. A range of government policy can affect the three growth

components. The coalition government though is campaigning for promoting job and growth, the

growth program however is unreliable. Government policy to cut company tax rate would

increase national income by around 0.6% The cut in business tax however drags national income

up to a decade. This is because foreign investors pay a lower tax from beginning and the benefits

from the investment realizes after a considerably long period. The government plans to announce

policy tool is the use if expansionary monetary policy. The central bank designs and control

monetary policy. Under expansionary monetary policy, the central bank lowers interest rate. The

lower interest rate by reducing the borrowing cost encourage investment. The low interest rate

discourage consumers to save raising the consumption spending (Mankiw, 2014). If interest rate

on mortgage payment reduces, then households are left with a higher disposable income and a

higher aggregate demand. Government thus can use monetary and fiscal policy to influence

inflation and economic growth.

Policy of Australian government toward economic growth

The projection regarding ageing population is posing direct challenges to economic

growth. With an increase in ageing population, the labor-force participation rate is projected to

fall further. The proportion of population aged over 65 is expected to increase at a rapid pace.

The burden of aged population lead to a lower GDP growth. The GDP per capita is capita in the

next 40 years will be lower than that in the past 40 years. The growth prospects need to be

improved to raise the living standard along with social and economic well-being. The objective

to improve economic growth relied on 3Ps – population, participants and productivity

(treasury.gov.au, 2018). Any changes in any of the three factors influence the pressure on growth

and spending in a different way. A range of government policy can affect the three growth

components. The coalition government though is campaigning for promoting job and growth, the

growth program however is unreliable. Government policy to cut company tax rate would

increase national income by around 0.6% The cut in business tax however drags national income

up to a decade. This is because foreign investors pay a lower tax from beginning and the benefits

from the investment realizes after a considerably long period. The government plans to announce

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ECONOMICS ASSIGNMENT

agendas for innovation and competition policy. It agrees to implement the plan of TPP. In order

to speed the economic growth, government needs to change fiscal policy outlook.

First, focus should be given to shift the tax base to the taxes having less contribution in

discouraging work and investment. For example, reducing the discount of capital gains to 25%

with a limit to negative gearing can be used to eliminate other distortionary taxes. The stamp

duties should replace general property tax. The government should encourage people to stay in

the workforce or get back to the work. In Australia, female labor-force participation is much

lower as compared to other advanced nations. The low wage rate discourages females to join

full-time employment. The childcare and family repayment system should be developed to

increase female participation (theconversation.com, 2018). Policies should be taken to eliminate

impediments towards flexibility. In order to promote productivity growth government should

encourage innovation. Funds should be allocated only to areas that can actually help in

productivity growth. Sector specific reforms should be conducted to overcome barriers to smooth

economic growth.

Conclusion

Australia despite being one of the developed nations are experiencing a slow-down in the

growth trend in the last five years. In GDP of Australia, service sector especially financial

services make the highest contribution followed by industrial and agricultural sector. Economic

growth in the fourth quarter of 2017 was stood at 2.4 percent. Several factors are a play for

slower economic growth of Australia. Mining and construction are the two vital sectors of the

economy. Both the sectors are experiencing a decline in trend growth rate. The average housing

prices are declining leading to a decline in non-dwelling investment. The mining sector has

experienced a lower price and depressed demand following a China’s growth slow-down. Value

agendas for innovation and competition policy. It agrees to implement the plan of TPP. In order

to speed the economic growth, government needs to change fiscal policy outlook.

First, focus should be given to shift the tax base to the taxes having less contribution in

discouraging work and investment. For example, reducing the discount of capital gains to 25%

with a limit to negative gearing can be used to eliminate other distortionary taxes. The stamp

duties should replace general property tax. The government should encourage people to stay in

the workforce or get back to the work. In Australia, female labor-force participation is much

lower as compared to other advanced nations. The low wage rate discourages females to join

full-time employment. The childcare and family repayment system should be developed to

increase female participation (theconversation.com, 2018). Policies should be taken to eliminate

impediments towards flexibility. In order to promote productivity growth government should

encourage innovation. Funds should be allocated only to areas that can actually help in

productivity growth. Sector specific reforms should be conducted to overcome barriers to smooth

economic growth.

Conclusion

Australia despite being one of the developed nations are experiencing a slow-down in the

growth trend in the last five years. In GDP of Australia, service sector especially financial

services make the highest contribution followed by industrial and agricultural sector. Economic

growth in the fourth quarter of 2017 was stood at 2.4 percent. Several factors are a play for

slower economic growth of Australia. Mining and construction are the two vital sectors of the

economy. Both the sectors are experiencing a decline in trend growth rate. The average housing

prices are declining leading to a decline in non-dwelling investment. The mining sector has

experienced a lower price and depressed demand following a China’s growth slow-down. Value

11ECONOMICS ASSIGNMENT

of Australian dollar in recent years has increased. This though strengthen domestic currency

relative to other currency but hurt export demand. The declining mining and housing investment

along with a decline in net export significantly reduces growth prospects of the economy. The

gain in consumer spending, public and private investment offset by the negative growth of non-

dwelling investment and net export. Australia though has escaped from any severe recession but

slow growth has a detrimental economic and social impact. Reforms needs to be undertaken to

recover economic growth and bring it back to its previous path.

of Australian dollar in recent years has increased. This though strengthen domestic currency

relative to other currency but hurt export demand. The declining mining and housing investment

along with a decline in net export significantly reduces growth prospects of the economy. The

gain in consumer spending, public and private investment offset by the negative growth of non-

dwelling investment and net export. Australia though has escaped from any severe recession but

slow growth has a detrimental economic and social impact. Reforms needs to be undertaken to

recover economic growth and bring it back to its previous path.

12ECONOMICS ASSIGNMENT

References

Australia GDP Growth Rate | 1959-2018 | Data | Chart | Calendar | Forecast. (2018). Retrieved

from https://tradingeconomics.com/australia/gdp-growth

Australia's economy is slowing: what you need to know. (2018). Retrieved from

https://theconversation.com/australias-economy-is-slowing-what-you-need-to-know-

47036

Hartwell, R. M. (2017). The industrial revolution and economic growth (Vol. 4). Taylor &

Francis.

Hatfield-Dodds, S., Schandl, H., Adams, P. D., Baynes, T. M., Brinsmead, T. S., Bryan, B. A., ...

& McCallum, R. (2015). Australia is ‘free to choose’economic growth and falling

environmental pressures. Nature, 527(7576), 49.

Heijdra, B. J. (2017). Foundations of modern macroeconomics. Oxford university press.

Johnson, H. G. (2017). Macroeconomics and monetary theory. Routledge.

Kydland, F. E., Rupert, P., & Šustek, R. (2016). Housing dynamics over the business

cycle. International Economic Review, 57(4), 1149-1177.

Mankiw, N. G. (2014). Principles of macroeconomics. Cengage Learning.

McCombie, J., & Thirlwall, A. P. (2016). Economic growth and the balance-of-payments

constraint. Springer.

Nakamura, E., Steinsson, J., & Liu, M. (2016). Are chinese growth and inflation too smooth?

evidence from engel curves. American Economic Journal: Macroeconomics, 8(3), 113-

44.

References

Australia GDP Growth Rate | 1959-2018 | Data | Chart | Calendar | Forecast. (2018). Retrieved

from https://tradingeconomics.com/australia/gdp-growth

Australia's economy is slowing: what you need to know. (2018). Retrieved from

https://theconversation.com/australias-economy-is-slowing-what-you-need-to-know-

47036

Hartwell, R. M. (2017). The industrial revolution and economic growth (Vol. 4). Taylor &

Francis.

Hatfield-Dodds, S., Schandl, H., Adams, P. D., Baynes, T. M., Brinsmead, T. S., Bryan, B. A., ...

& McCallum, R. (2015). Australia is ‘free to choose’economic growth and falling

environmental pressures. Nature, 527(7576), 49.

Heijdra, B. J. (2017). Foundations of modern macroeconomics. Oxford university press.

Johnson, H. G. (2017). Macroeconomics and monetary theory. Routledge.

Kydland, F. E., Rupert, P., & Šustek, R. (2016). Housing dynamics over the business

cycle. International Economic Review, 57(4), 1149-1177.

Mankiw, N. G. (2014). Principles of macroeconomics. Cengage Learning.

McCombie, J., & Thirlwall, A. P. (2016). Economic growth and the balance-of-payments

constraint. Springer.

Nakamura, E., Steinsson, J., & Liu, M. (2016). Are chinese growth and inflation too smooth?

evidence from engel curves. American Economic Journal: Macroeconomics, 8(3), 113-

44.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13ECONOMICS ASSIGNMENT

Nevile, J. W. (2016). A Simple Econometric Model of the Australian Economy. In Post-

Keynesian Essays from Down Under Volume II: Essays on Policy and Applied

Economics(pp. 121-137). Palgrave Macmillan, London.

Part 4: Sustainability — fiscal policy and economic growth. (2018). Retrieved from

http://archive.treasury.gov.au/documents/1239/HTML/docshell.asp?URL=05_Part_4.htm

Rodrik, D. (2014). The past, present, and future of economic growth. Challenge, 57(3), 5-39.

Rostow, W., Baker Jr, R., & Baker Jr, R. G. (Eds.). (2016). The economics of take-off into

sustained growth. Springer.

Ruthven, P. (2018). Australia’s Growth Industries : Media Centre. Retrieved from

https://www.ibisworld.com.au/media/2016/08/10/australias-growth-industries/

Scutt, D. (2018). Australia's economy is growing at its slowest rate since the GFC. Retrieved

from https://www.businessinsider.com.au/australia-economic-growth-q1-gdp-2017-6

Shafiullah, M., Selvanathan, S., & Naranpanawa, A. (2017). The role of export composition in

export-led growth in Australia and its regions. Economic Analysis and Policy, 53, 62-76.

Thorpe, M., & Leitao, N. C. (2014). Economic growth in Australia: Globalisation, trade and

foreign direct investment. Global Business and Economics Review, 16(1), 75-86.

Uncertainty isn't causing slow economic growth, for now. (2018). Retrieved from

https://theconversation.com/uncertainty-isnt-causing-slow-economic-growth-for-now-

79407

Nevile, J. W. (2016). A Simple Econometric Model of the Australian Economy. In Post-

Keynesian Essays from Down Under Volume II: Essays on Policy and Applied

Economics(pp. 121-137). Palgrave Macmillan, London.

Part 4: Sustainability — fiscal policy and economic growth. (2018). Retrieved from

http://archive.treasury.gov.au/documents/1239/HTML/docshell.asp?URL=05_Part_4.htm

Rodrik, D. (2014). The past, present, and future of economic growth. Challenge, 57(3), 5-39.

Rostow, W., Baker Jr, R., & Baker Jr, R. G. (Eds.). (2016). The economics of take-off into

sustained growth. Springer.

Ruthven, P. (2018). Australia’s Growth Industries : Media Centre. Retrieved from

https://www.ibisworld.com.au/media/2016/08/10/australias-growth-industries/

Scutt, D. (2018). Australia's economy is growing at its slowest rate since the GFC. Retrieved

from https://www.businessinsider.com.au/australia-economic-growth-q1-gdp-2017-6

Shafiullah, M., Selvanathan, S., & Naranpanawa, A. (2017). The role of export composition in

export-led growth in Australia and its regions. Economic Analysis and Policy, 53, 62-76.

Thorpe, M., & Leitao, N. C. (2014). Economic growth in Australia: Globalisation, trade and

foreign direct investment. Global Business and Economics Review, 16(1), 75-86.

Uncertainty isn't causing slow economic growth, for now. (2018). Retrieved from

https://theconversation.com/uncertainty-isnt-causing-slow-economic-growth-for-now-

79407

14ECONOMICS ASSIGNMENT

What the government should do now: economic growth. (2018). Retrieved from

https://theconversation.com/what-the-government-should-do-now-economic-growth-

61517

What the government should do now: economic growth. (2018). Retrieved from

https://theconversation.com/what-the-government-should-do-now-economic-growth-

61517

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.