Economics Assignment: GDP Calculation, Market Analysis, and Growth

VerifiedAdded on 2023/01/05

|7

|1121

|44

Homework Assignment

AI Summary

This economics assignment solution addresses several key macroeconomic and microeconomic concepts. It begins with calculations of nominal and real GDP, percentage growth, CPI, and the GDP deflator, providing a comprehensive analysis of economic performance. The assignment then delves into insurance market problems such as moral hazard and adverse selection, risk management methods, and the application of the Rule of 70 for economic growth and investment returns. Furthermore, it explains the Efficient Market Hypothesis and differentiates between microeconomics and macroeconomics, using examples to illustrate the concepts. The solution also includes calculations of inflation rates using CPI data and the present value of stock prices. Finally, it analyzes economic growth and employment rates of the United Kingdom and Japan based on a provided diagram, comparing their business cycles and economic trends.

Running head: Economics Assignment

Economics Assignment

Name of the Student

Name of the University

Student ID

Economics Assignment

Name of the Student

Name of the University

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1Economics Assignment

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................3

Answer 3..........................................................................................................................................5

Answer 4..........................................................................................................................................6

Answer 5..........................................................................................................................................6

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................3

Answer 3..........................................................................................................................................5

Answer 4..........................................................................................................................................6

Answer 5..........................................................................................................................................6

2Economics Assignment

Answer 1

(a) Nominal GDP for Year 1 is given by summation of total value of X, Y and Z of year 1.

Nominal GDP for year1= ( 150× 20 ) + ( 10 ×1 ) +(12× 4)

¿ , Nominal GDP for year 1=3000+10+48

¿ , Nominal GDP for year 1=$ 3 0 58

Nominal GDP for Year 2 is given by summation of total value of X, Y and Z of year 2

Nominal GDP for year 2= ( 200 ×20 ) + ( 12 ×3 ) +(9 ×5)

¿ , Nominal GDP for year 2=4 0 00+ 36+45

¿ , Nominal GDP for year 2=$ 4 0 91

(b) Percentage of growth in nominal GDP from Year 1 to Year 2

Percentage growth∈GDP ¿ year 1¿ year 2=(4 0 91−3 0 58)

3 0 58 ×100

¿ , Percentage growth∈GDP ¿ year 1¿ year 2= 1 0 33

3 0 58 × 100

¿ , Percentage growth∈GDP ¿ year 1¿ year 2=33 . 78 %

(c) CPI of Year 2 is given by

CPI Year 2= 221

172 ×100

¿ , CPI Year 2=128.49

Therefore, inflation rate is 28.49%

Answer 1

(a) Nominal GDP for Year 1 is given by summation of total value of X, Y and Z of year 1.

Nominal GDP for year1= ( 150× 20 ) + ( 10 ×1 ) +(12× 4)

¿ , Nominal GDP for year 1=3000+10+48

¿ , Nominal GDP for year 1=$ 3 0 58

Nominal GDP for Year 2 is given by summation of total value of X, Y and Z of year 2

Nominal GDP for year 2= ( 200 ×20 ) + ( 12 ×3 ) +(9 ×5)

¿ , Nominal GDP for year 2=4 0 00+ 36+45

¿ , Nominal GDP for year 2=$ 4 0 91

(b) Percentage of growth in nominal GDP from Year 1 to Year 2

Percentage growth∈GDP ¿ year 1¿ year 2=(4 0 91−3 0 58)

3 0 58 ×100

¿ , Percentage growth∈GDP ¿ year 1¿ year 2= 1 0 33

3 0 58 × 100

¿ , Percentage growth∈GDP ¿ year 1¿ year 2=33 . 78 %

(c) CPI of Year 2 is given by

CPI Year 2= 221

172 ×100

¿ , CPI Year 2=128.49

Therefore, inflation rate is 28.49%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3Economics Assignment

Therefore,

Real GDP∈Year 2= 4 0 91

28.49

Real GDP∈Year 2=$ 143.59(¿)

(d) GDP deflator of Year 2 is given by

GDP deflator of Year 2= Nominal GDP of Year 2

Real GDPof Year 2 × 100

GDP deflator of Year 2= 4 0 91

143.59 × 100

GDP deflator of Year 2=2849.08

(e) The inflation rate between Year 1 and Year 2 was 28.49%.

Answer 2

(A)

The two major problems in the insurance market are (i) Moral hazard and (ii) Adverse

selection. Moral hazard is the phenomena that occurs when an individual makes oneself more

exposed to risks because some other individual or group takes the burden of the cost of risk.

Thus, when a person opts for an insurance he/ she takes more risk and the chance of insuring

company’s loss increases. However, it is difficult for the insurance companies to predict the post

insurance action of the individuals and that increases the risk for the insurance companies and

thereby creates problem. On the other hand, adverse selection is the situation where difference in

information creates inefficient allocation of insurance. For example, price of premiums for life

insurance for alcoholic and non-alcoholic. Alcoholics should be charged more than non-

Therefore,

Real GDP∈Year 2= 4 0 91

28.49

Real GDP∈Year 2=$ 143.59(¿)

(d) GDP deflator of Year 2 is given by

GDP deflator of Year 2= Nominal GDP of Year 2

Real GDPof Year 2 × 100

GDP deflator of Year 2= 4 0 91

143.59 × 100

GDP deflator of Year 2=2849.08

(e) The inflation rate between Year 1 and Year 2 was 28.49%.

Answer 2

(A)

The two major problems in the insurance market are (i) Moral hazard and (ii) Adverse

selection. Moral hazard is the phenomena that occurs when an individual makes oneself more

exposed to risks because some other individual or group takes the burden of the cost of risk.

Thus, when a person opts for an insurance he/ she takes more risk and the chance of insuring

company’s loss increases. However, it is difficult for the insurance companies to predict the post

insurance action of the individuals and that increases the risk for the insurance companies and

thereby creates problem. On the other hand, adverse selection is the situation where difference in

information creates inefficient allocation of insurance. For example, price of premiums for life

insurance for alcoholic and non-alcoholic. Alcoholics should be charged more than non-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4Economics Assignment

alcoholics, but if price is increased then non-alcoholics will not purchase the insurance and the

insurance company will have to serve the alcoholics only and thus the company will face the

problem of adverse selection.

(B) The main risk management methods are:

Avoidance

Retention

Transferring

Reduction

Sharing

(C) The Rule of 70 can be used to calculate the number of years required to double the amount of

economic growth. Economic growth is measured by real GDP growth. Suppose, country has a

real GDP growth of 7%. Then the economy become twice of its current size can be calculated by

Rule of 70 and is given by

Time required by the country ¿ beome double its current economic ¿70

7

Time required by the country ¿ beome double its current economic ¿ 10 years

Similarly, if a sum of money is invested at a rate of return of 5%, then the number of years

required for the invested some of money to become double is given by

Time required for the∑ of money invested ¿ become double= 70

5

Time required for the∑ of money invested ¿ become double=14 years

alcoholics, but if price is increased then non-alcoholics will not purchase the insurance and the

insurance company will have to serve the alcoholics only and thus the company will face the

problem of adverse selection.

(B) The main risk management methods are:

Avoidance

Retention

Transferring

Reduction

Sharing

(C) The Rule of 70 can be used to calculate the number of years required to double the amount of

economic growth. Economic growth is measured by real GDP growth. Suppose, country has a

real GDP growth of 7%. Then the economy become twice of its current size can be calculated by

Rule of 70 and is given by

Time required by the country ¿ beome double its current economic ¿70

7

Time required by the country ¿ beome double its current economic ¿ 10 years

Similarly, if a sum of money is invested at a rate of return of 5%, then the number of years

required for the invested some of money to become double is given by

Time required for the∑ of money invested ¿ become double= 70

5

Time required for the∑ of money invested ¿ become double=14 years

5Economics Assignment

(D) Efficient market hypothesis is common in financial economics. The hypothesis states that all

information regarding any asset that is traded is reflected in the price of the asset and thus trading

of assets and stocks are done without any unfair means of trading. Efficient market hypothesis is

categorized into weak, semi-strong and strong form. Under weak form trading information is

reflected in the price, under semi-strong only public information are reflected in to case of price.

On the other hand, under strong form the information regarding all public and non-public is

viable and the thus expectation of return is high in this category and weak from provides lowest

return.

(E) Macroeconomics studies an economy as a whole, whereas microeconomics studies structure

of markets. Macroeconomics also deals on understanding he aggregate behavior of an economy,

on the other hand microeconomics provides understanding of individual or firm behavior.

Macroeconomic measures the economic variables like GDO, economic growth and may more.

Alternatively, microeconomics deals on the individual firm level variables such as price,

quantity, cost.

Answer 3

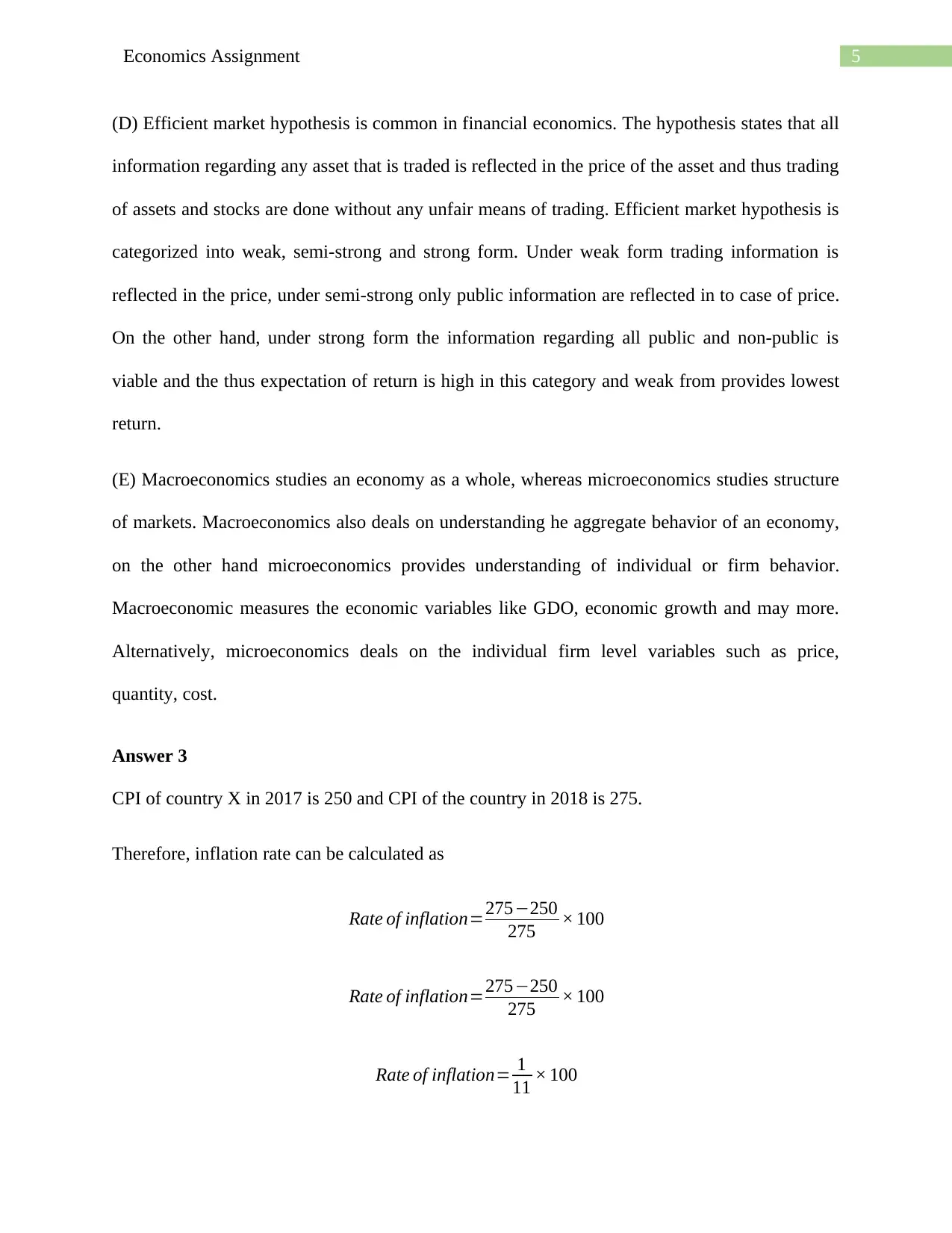

CPI of country X in 2017 is 250 and CPI of the country in 2018 is 275.

Therefore, inflation rate can be calculated as

Rate of inflation=275−250

275 × 100

Rate of inflation=275−250

275 × 100

Rate of inflation= 1

11 × 100

(D) Efficient market hypothesis is common in financial economics. The hypothesis states that all

information regarding any asset that is traded is reflected in the price of the asset and thus trading

of assets and stocks are done without any unfair means of trading. Efficient market hypothesis is

categorized into weak, semi-strong and strong form. Under weak form trading information is

reflected in the price, under semi-strong only public information are reflected in to case of price.

On the other hand, under strong form the information regarding all public and non-public is

viable and the thus expectation of return is high in this category and weak from provides lowest

return.

(E) Macroeconomics studies an economy as a whole, whereas microeconomics studies structure

of markets. Macroeconomics also deals on understanding he aggregate behavior of an economy,

on the other hand microeconomics provides understanding of individual or firm behavior.

Macroeconomic measures the economic variables like GDO, economic growth and may more.

Alternatively, microeconomics deals on the individual firm level variables such as price,

quantity, cost.

Answer 3

CPI of country X in 2017 is 250 and CPI of the country in 2018 is 275.

Therefore, inflation rate can be calculated as

Rate of inflation=275−250

275 × 100

Rate of inflation=275−250

275 × 100

Rate of inflation= 1

11 × 100

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6Economics Assignment

Rate of inflation=9.8 %

Answer 4

Price of XYZ stock today is to be find by calculation of using formula. Future stock price is

given as $5000 and the dividend is $100 at end of year each year for the three years.

Presnt value of stock price= D+ E

(1+r )Y

¿ , Present value of stock price= 300+5000

( 1+ 0.10 ) 3

¿ , Present value of stock price=$ 3981.97

Answer 5

From the diagram it is evident that the economic growth curve along with percentage

change in employment rate of United Kingdom and Japan are similar only during the initial stage

the percentage employment rate in Japan was high in comparison to the United Kingdom.

However, the rest of the graph shows that economic growth and employment rate is similar.

Therefore, it can be said that both the country faces similar problems and have same business

cycle.

Rate of inflation=9.8 %

Answer 4

Price of XYZ stock today is to be find by calculation of using formula. Future stock price is

given as $5000 and the dividend is $100 at end of year each year for the three years.

Presnt value of stock price= D+ E

(1+r )Y

¿ , Present value of stock price= 300+5000

( 1+ 0.10 ) 3

¿ , Present value of stock price=$ 3981.97

Answer 5

From the diagram it is evident that the economic growth curve along with percentage

change in employment rate of United Kingdom and Japan are similar only during the initial stage

the percentage employment rate in Japan was high in comparison to the United Kingdom.

However, the rest of the graph shows that economic growth and employment rate is similar.

Therefore, it can be said that both the country faces similar problems and have same business

cycle.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.