Economic Performance Analysis of Singapore: A Detailed Report

VerifiedAdded on 2023/04/21

|13

|2910

|370

Essay

AI Summary

This essay provides a detailed analysis of Singapore's economic performance, focusing on GDP, unemployment rates, and inflation. It examines the trends in real GDP, GDP per capita, and GDP growth rates, highlighting the fluctuations and overall economic growth patterns. The analysis extends to the labor market, assessing unemployment types such as demand-deficient, structural, and frictional unemployment, and discusses government policies to mitigate joblessness, including fiscal and monetary measures, education, and training programs. Furthermore, the essay explores inflation, distinguishing between demand-pull and cost-push inflation, and evaluates the effectiveness of monetary, fiscal, and supply-side policies in combating inflationary pressures in Singapore. The conclusion summarizes the key findings, emphasizing the interplay between economic indicators and policy interventions in shaping Singapore's economic landscape. Desklib offers a platform for students to access this and many other solved assignments.

Running head: ECONOMICS

Economics

Economics

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS 2

Introduction

This essay presents the production output performance analysis by GDP, GDP per

capita and GDP growth rate. It also presents the labor market analysis by the

unemployment rate. It demonstrates the price level analysis by inflation.

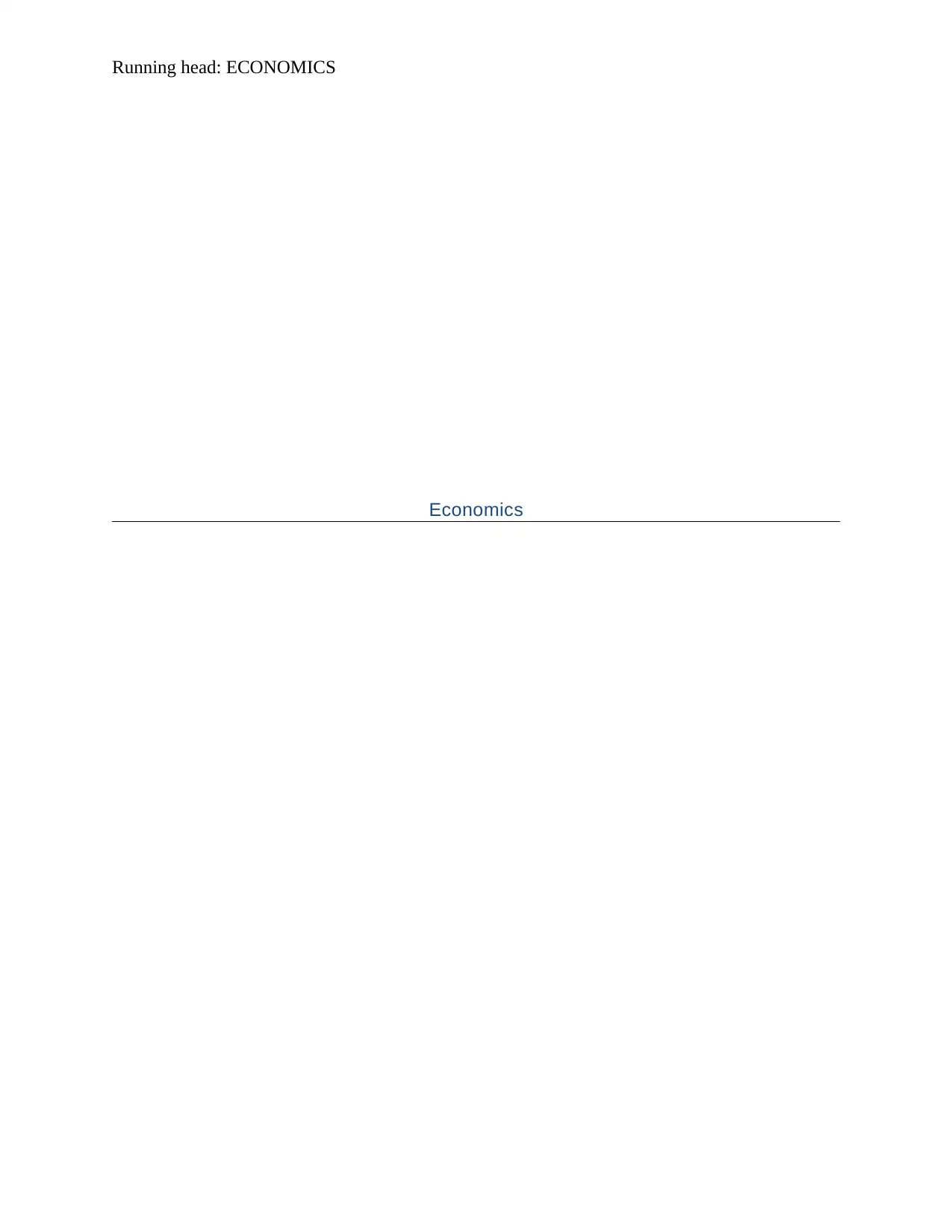

Real GDP

(Sources: Trading economics, 2018).

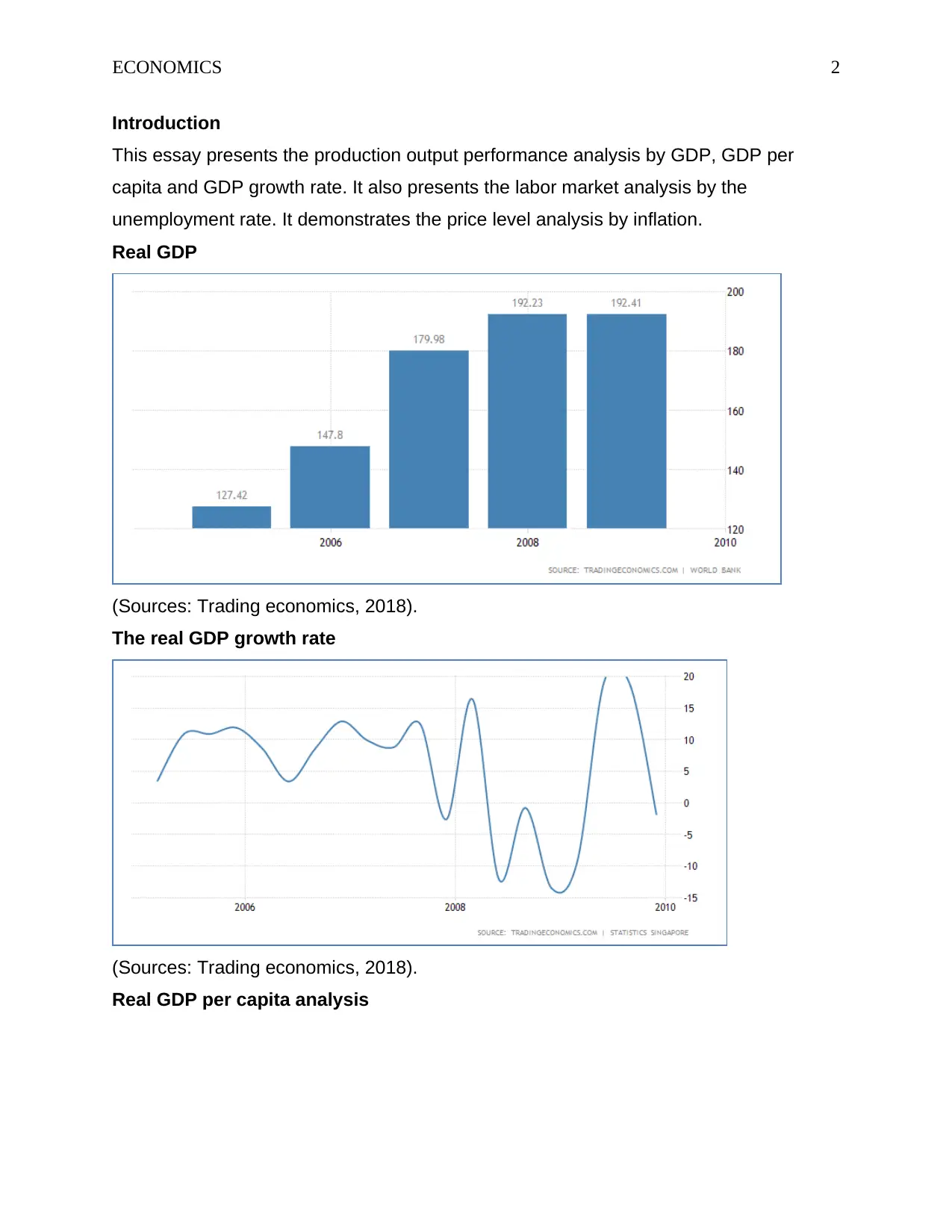

The real GDP growth rate

(Sources: Trading economics, 2018).

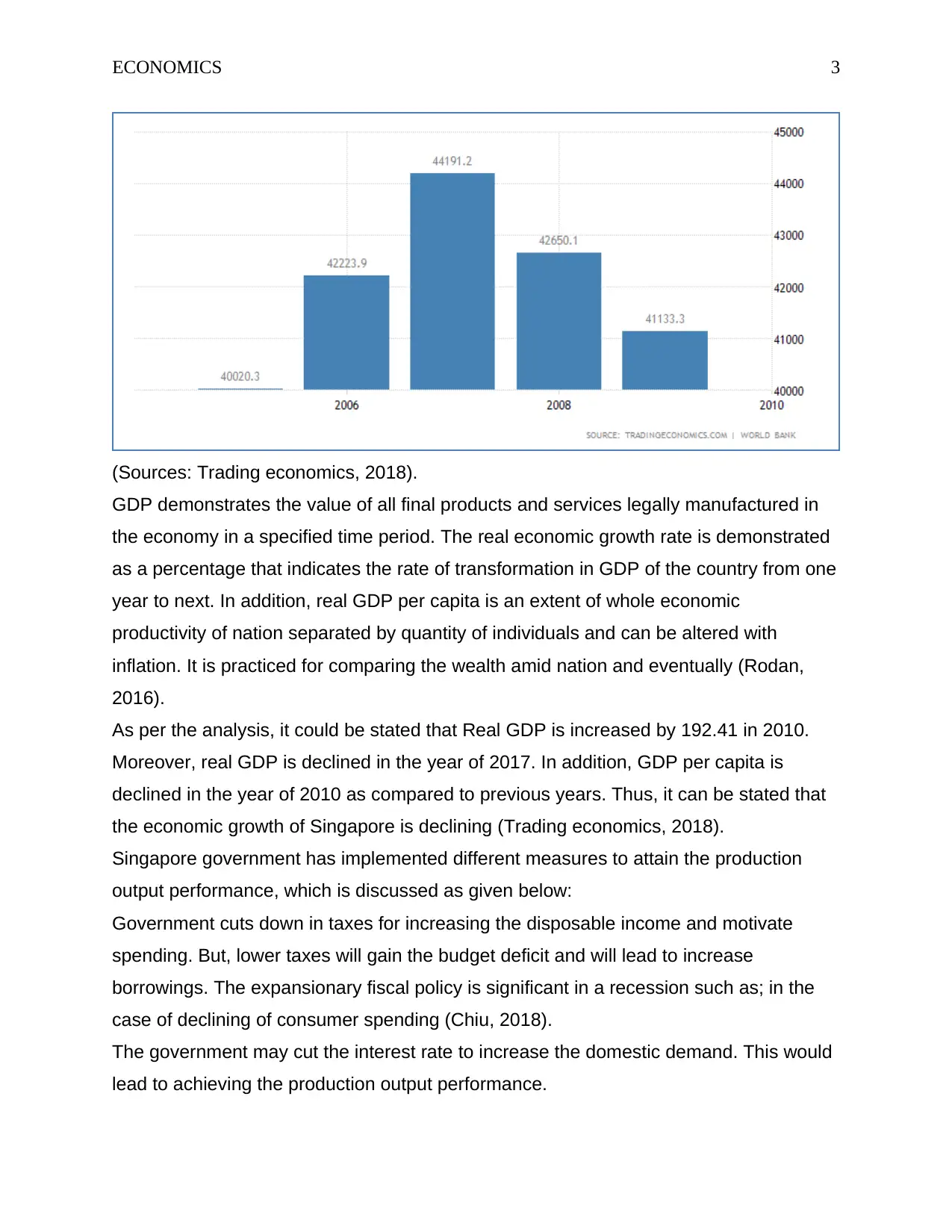

Real GDP per capita analysis

Introduction

This essay presents the production output performance analysis by GDP, GDP per

capita and GDP growth rate. It also presents the labor market analysis by the

unemployment rate. It demonstrates the price level analysis by inflation.

Real GDP

(Sources: Trading economics, 2018).

The real GDP growth rate

(Sources: Trading economics, 2018).

Real GDP per capita analysis

ECONOMICS 3

(Sources: Trading economics, 2018).

GDP demonstrates the value of all final products and services legally manufactured in

the economy in a specified time period. The real economic growth rate is demonstrated

as a percentage that indicates the rate of transformation in GDP of the country from one

year to next. In addition, real GDP per capita is an extent of whole economic

productivity of nation separated by quantity of individuals and can be altered with

inflation. It is practiced for comparing the wealth amid nation and eventually (Rodan,

2016).

As per the analysis, it could be stated that Real GDP is increased by 192.41 in 2010.

Moreover, real GDP is declined in the year of 2017. In addition, GDP per capita is

declined in the year of 2010 as compared to previous years. Thus, it can be stated that

the economic growth of Singapore is declining (Trading economics, 2018).

Singapore government has implemented different measures to attain the production

output performance, which is discussed as given below:

Government cuts down in taxes for increasing the disposable income and motivate

spending. But, lower taxes will gain the budget deficit and will lead to increase

borrowings. The expansionary fiscal policy is significant in a recession such as; in the

case of declining of consumer spending (Chiu, 2018).

The government may cut the interest rate to increase the domestic demand. This would

lead to achieving the production output performance.

(Sources: Trading economics, 2018).

GDP demonstrates the value of all final products and services legally manufactured in

the economy in a specified time period. The real economic growth rate is demonstrated

as a percentage that indicates the rate of transformation in GDP of the country from one

year to next. In addition, real GDP per capita is an extent of whole economic

productivity of nation separated by quantity of individuals and can be altered with

inflation. It is practiced for comparing the wealth amid nation and eventually (Rodan,

2016).

As per the analysis, it could be stated that Real GDP is increased by 192.41 in 2010.

Moreover, real GDP is declined in the year of 2017. In addition, GDP per capita is

declined in the year of 2010 as compared to previous years. Thus, it can be stated that

the economic growth of Singapore is declining (Trading economics, 2018).

Singapore government has implemented different measures to attain the production

output performance, which is discussed as given below:

Government cuts down in taxes for increasing the disposable income and motivate

spending. But, lower taxes will gain the budget deficit and will lead to increase

borrowings. The expansionary fiscal policy is significant in a recession such as; in the

case of declining of consumer spending (Chiu, 2018).

The government may cut the interest rate to increase the domestic demand. This would

lead to achieving the production output performance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS 4

Government plays important role in offering the political and economic stability that

makes competent in usual economic practices to take place. In addition, political stress

and uncertainty may discourage the economic expansion (Su, Ang, & Li, 2017).

The government can invest in infrastructure to gain the productive capacity and declines

obstruction. It can use deregulation and privatization for gaining the productivity and

efficiency (Friedman, 2017).

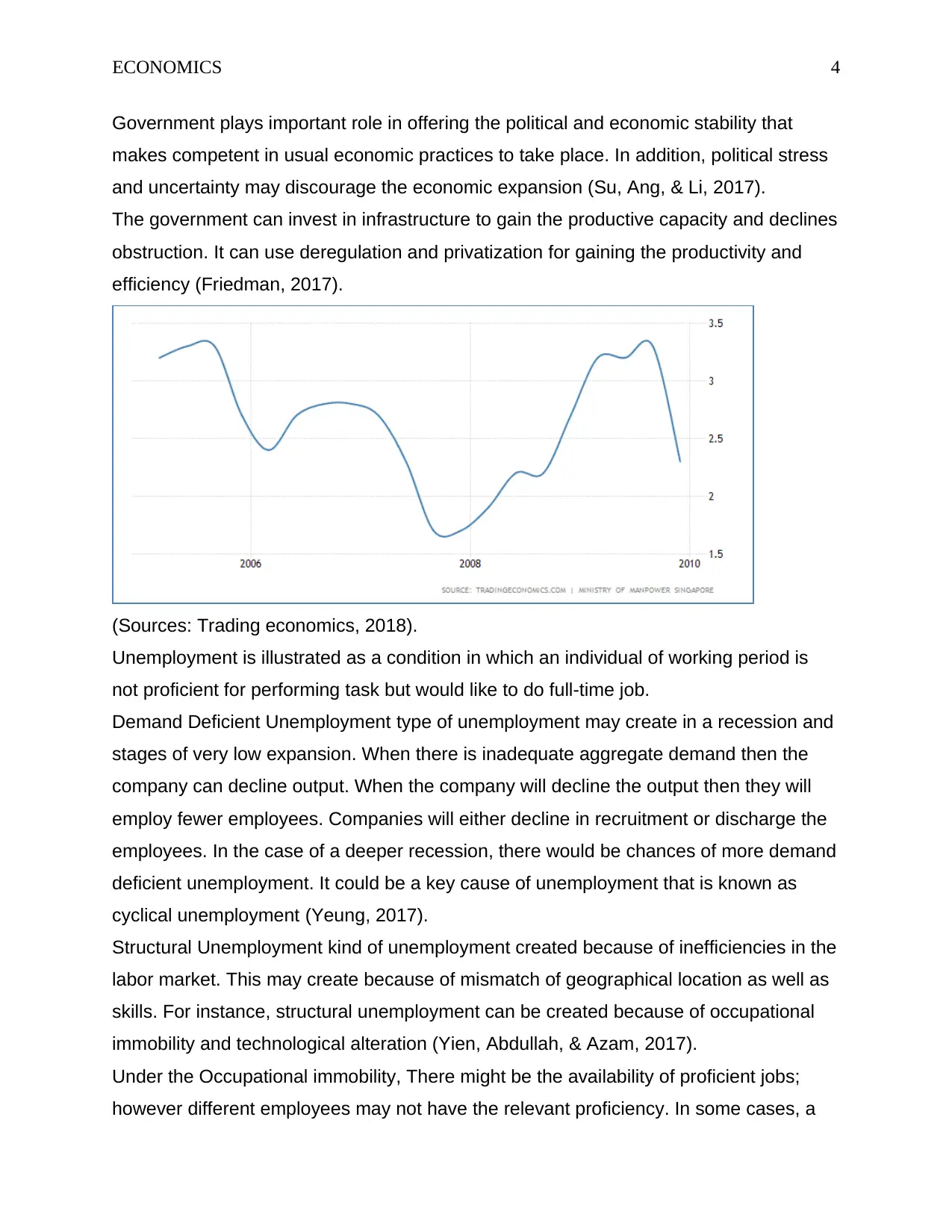

(Sources: Trading economics, 2018).

Unemployment is illustrated as a condition in which an individual of working period is

not proficient for performing task but would like to do full-time job.

Demand Deficient Unemployment type of unemployment may create in a recession and

stages of very low expansion. When there is inadequate aggregate demand then the

company can decline output. When the company will decline the output then they will

employ fewer employees. Companies will either decline in recruitment or discharge the

employees. In the case of a deeper recession, there would be chances of more demand

deficient unemployment. It could be a key cause of unemployment that is known as

cyclical unemployment (Yeung, 2017).

Structural Unemployment kind of unemployment created because of inefficiencies in the

labor market. This may create because of mismatch of geographical location as well as

skills. For instance, structural unemployment can be created because of occupational

immobility and technological alteration (Yien, Abdullah, & Azam, 2017).

Under the Occupational immobility, There might be the availability of proficient jobs;

however different employees may not have the relevant proficiency. In some cases, a

Government plays important role in offering the political and economic stability that

makes competent in usual economic practices to take place. In addition, political stress

and uncertainty may discourage the economic expansion (Su, Ang, & Li, 2017).

The government can invest in infrastructure to gain the productive capacity and declines

obstruction. It can use deregulation and privatization for gaining the productivity and

efficiency (Friedman, 2017).

(Sources: Trading economics, 2018).

Unemployment is illustrated as a condition in which an individual of working period is

not proficient for performing task but would like to do full-time job.

Demand Deficient Unemployment type of unemployment may create in a recession and

stages of very low expansion. When there is inadequate aggregate demand then the

company can decline output. When the company will decline the output then they will

employ fewer employees. Companies will either decline in recruitment or discharge the

employees. In the case of a deeper recession, there would be chances of more demand

deficient unemployment. It could be a key cause of unemployment that is known as

cyclical unemployment (Yeung, 2017).

Structural Unemployment kind of unemployment created because of inefficiencies in the

labor market. This may create because of mismatch of geographical location as well as

skills. For instance, structural unemployment can be created because of occupational

immobility and technological alteration (Yien, Abdullah, & Azam, 2017).

Under the Occupational immobility, There might be the availability of proficient jobs;

however different employees may not have the relevant proficiency. In some cases, a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS 5

company can struggle for recruiting during the periods of high unemployment. It occurs

due to occupational immobility (Harvie & Van Hoa, 2016).

When an economy may go through the technological alteration then the performance of

some industries would decline. It would likely to lead the structural unemployment. For

instance, new technology can make coal mines for closing down and leaving different

coal miners unemployed (Zhang, 2018).

Frictional unemployment may create when employees are in among jobs such as

school leavers may find by taking time. This is known as frictional unemployment in the

economy as an individual takes time for finding a job as per their competencies (Irpan,

Saad, Nor, Noor, & Ibrahim, 2016).

In current times, Singapore is facing different types of unemployment such as cyclical,

structural and frictional unemployment. In this way, frictional unemployment is

transitional unemployment because people moving between jobs. For instance, newly

redundant employees entering into labor market can take time for addressing the

feasible jobs at wage rate they are organized to accept. There are different people who

are jobless for a shorter period whilst entailed in the finding of job (Irpan, Saad, R. &

Ibrahim, 2016).

Cyclical unemployment is unintentional joblessness because of inadequate aggregate

demand for products and services. In addition, In Singapore, there is growing cyclical

unemployment at the time of international economic disaster of 2008 and during 2011 in

which its key trading associate such as USA faced attacks of violence. It may decline

deal with Singapore because of the narrowing the economy of US (Singh, & Singh,

2015).

Automation can create the structural joblessness as an individual are ready jobless due

to capital-labor exchange. Along with this, there are high amount of jobless in low

proficiency industry hence it is difficult for increasing re-job rather than investing into re-

training. This issue is key professional immobility (Harvie, & Van Hoa, 2016).

Fiscal policy can decline joblessness by supporting to gain AD with the time of

economic growth. The regime would require tracking expansionary fiscal policy. It

entails to cut down the taxes and gaining government spending. Lower taxes gain

disposable income such as VAT cut to 15% in the year 2008. Hence, it helps to decline

company can struggle for recruiting during the periods of high unemployment. It occurs

due to occupational immobility (Harvie & Van Hoa, 2016).

When an economy may go through the technological alteration then the performance of

some industries would decline. It would likely to lead the structural unemployment. For

instance, new technology can make coal mines for closing down and leaving different

coal miners unemployed (Zhang, 2018).

Frictional unemployment may create when employees are in among jobs such as

school leavers may find by taking time. This is known as frictional unemployment in the

economy as an individual takes time for finding a job as per their competencies (Irpan,

Saad, Nor, Noor, & Ibrahim, 2016).

In current times, Singapore is facing different types of unemployment such as cyclical,

structural and frictional unemployment. In this way, frictional unemployment is

transitional unemployment because people moving between jobs. For instance, newly

redundant employees entering into labor market can take time for addressing the

feasible jobs at wage rate they are organized to accept. There are different people who

are jobless for a shorter period whilst entailed in the finding of job (Irpan, Saad, R. &

Ibrahim, 2016).

Cyclical unemployment is unintentional joblessness because of inadequate aggregate

demand for products and services. In addition, In Singapore, there is growing cyclical

unemployment at the time of international economic disaster of 2008 and during 2011 in

which its key trading associate such as USA faced attacks of violence. It may decline

deal with Singapore because of the narrowing the economy of US (Singh, & Singh,

2015).

Automation can create the structural joblessness as an individual are ready jobless due

to capital-labor exchange. Along with this, there are high amount of jobless in low

proficiency industry hence it is difficult for increasing re-job rather than investing into re-

training. This issue is key professional immobility (Harvie, & Van Hoa, 2016).

Fiscal policy can decline joblessness by supporting to gain AD with the time of

economic growth. The regime would require tracking expansionary fiscal policy. It

entails to cut down the taxes and gaining government spending. Lower taxes gain

disposable income such as VAT cut to 15% in the year 2008. Hence, it helps to decline

ECONOMICS 6

the consumption and leading to increasing aggregate demand (AD) (Yien, Abdullah, &

Azam, 2017).

Monetary policy will entail cutting the interest rate. In addition, lower rates may decline

the borrowing costs and encourages an individual for spending and investing. It gains

aggregate demand and supports for gaining GDP. It declines demand deficient

joblessness. Furthermore, declining interest rates will decline the exchange rate and

create exports more viable (Yeung, 2017).

The aim of Education and training is to provide the long-standing jobless new

proficiency that makes competent to address jobs for building industries such as retrain

jobless steel employees to have basic IT proficiency that helps to address work in

service segment. But, despite offering an education and training plan, the unemployed

might be unwilling or unable to learn new proficiency. It should take a different year for

reducing unemployment (Friedman, 2017).

Companies can provide tax breaks and subsidies to take on enduring unemployed. It

facilitates new confidence and one the job training. But, it would be costly and it may

motivate the company to replace the existing employees with the long-term

unemployment to get advantageous from the tax cut down (Chiu, 2018).

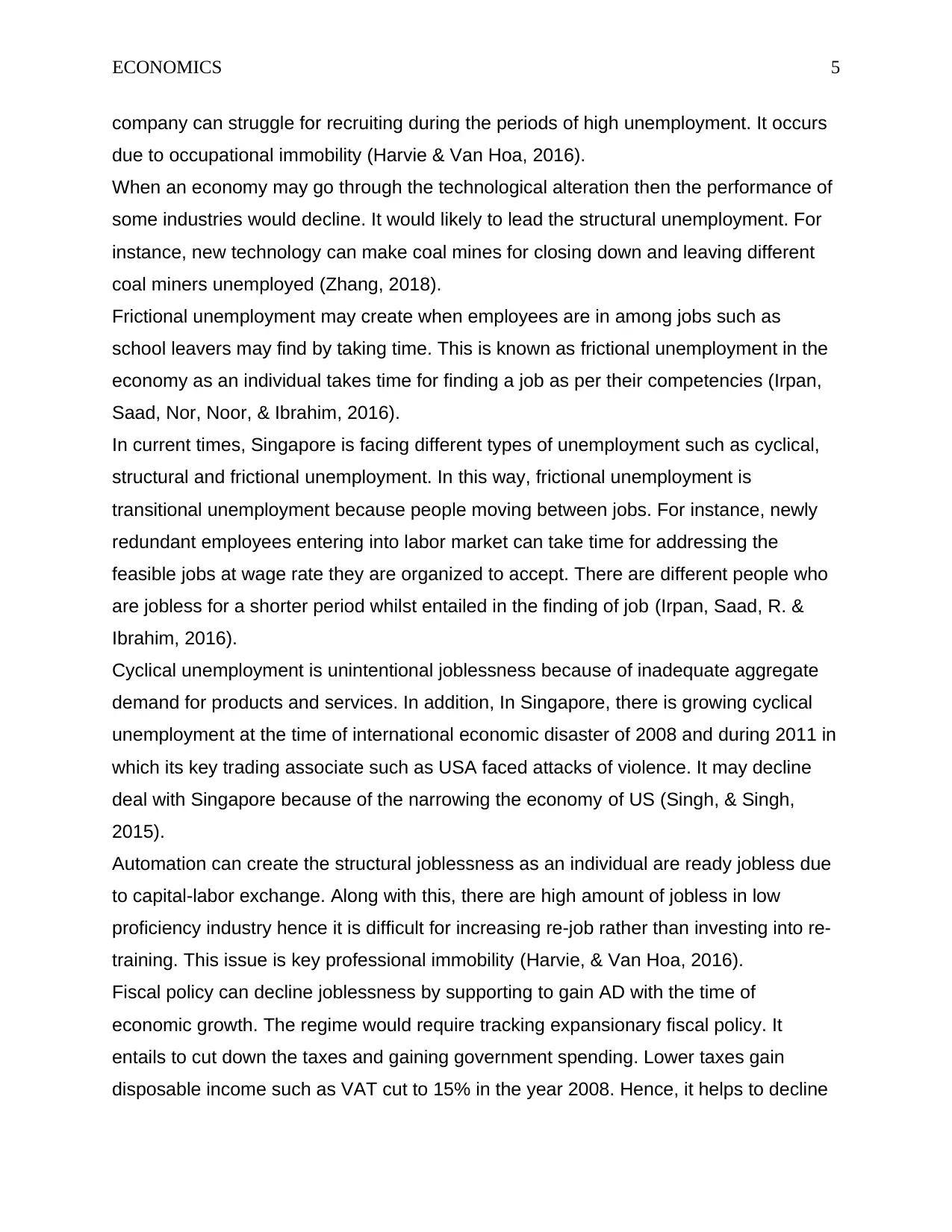

Inflation trends

(Sources: Trading economics, 2018).

Inflation is defined as increases in price. Moreover, inflation is a circumstance of

sustainably increase in the general price level in an economy. Moreover, inflation

the consumption and leading to increasing aggregate demand (AD) (Yien, Abdullah, &

Azam, 2017).

Monetary policy will entail cutting the interest rate. In addition, lower rates may decline

the borrowing costs and encourages an individual for spending and investing. It gains

aggregate demand and supports for gaining GDP. It declines demand deficient

joblessness. Furthermore, declining interest rates will decline the exchange rate and

create exports more viable (Yeung, 2017).

The aim of Education and training is to provide the long-standing jobless new

proficiency that makes competent to address jobs for building industries such as retrain

jobless steel employees to have basic IT proficiency that helps to address work in

service segment. But, despite offering an education and training plan, the unemployed

might be unwilling or unable to learn new proficiency. It should take a different year for

reducing unemployment (Friedman, 2017).

Companies can provide tax breaks and subsidies to take on enduring unemployed. It

facilitates new confidence and one the job training. But, it would be costly and it may

motivate the company to replace the existing employees with the long-term

unemployment to get advantageous from the tax cut down (Chiu, 2018).

Inflation trends

(Sources: Trading economics, 2018).

Inflation is defined as increases in price. Moreover, inflation is a circumstance of

sustainably increase in the general price level in an economy. Moreover, inflation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS 7

indicates that an increase in the cost of living as the prices increase in goods and

services. The main cause of inflation can be either increase in aggregate demand or

cost-push factor (Su, Ang, & Li, 2017).

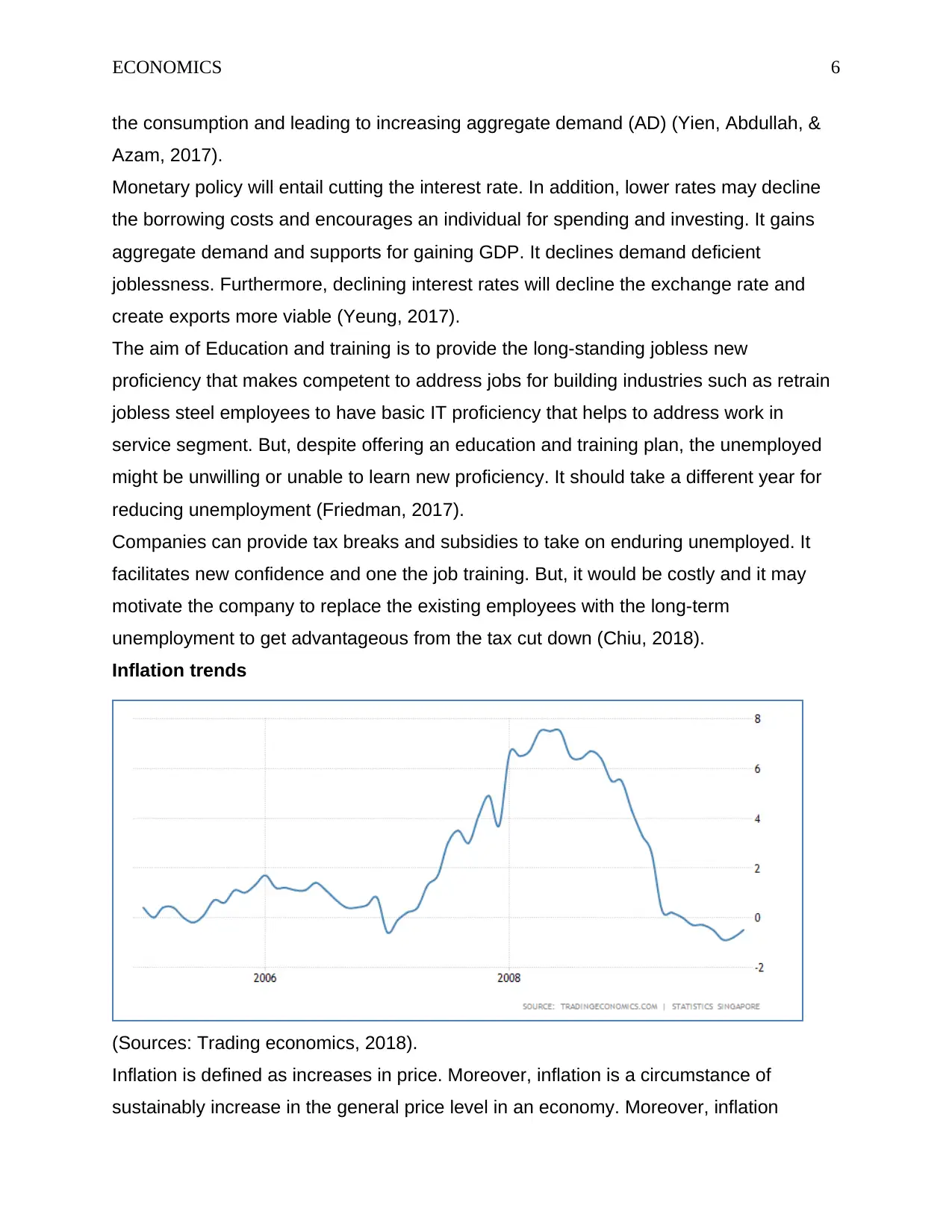

Under the Demand-pull inflation, when an economy is nearest to full time job then

increases in AD may lead to increases in the level of price. As the company arrives at

full capacity then they can increase in the prices of goods and services. It may lead to

inflation. In addition, when a nation has a high rate of full employment but there is a

shortage of workers, then employees can get higher wages. This may lead to an

increase in the spending power (Friedman, 2017).

(Sources: Friedman, 2017).

AD can gain because of increases in different elements such as C+I+G+X-M. This tends

to increase in the demand-pull inflation when growth of economic is greater than the

long-run tendency growth rate. In addition, the longer time movement rate of economic

growth can be assessed by enlargement in productivity (Yeung, 2017).

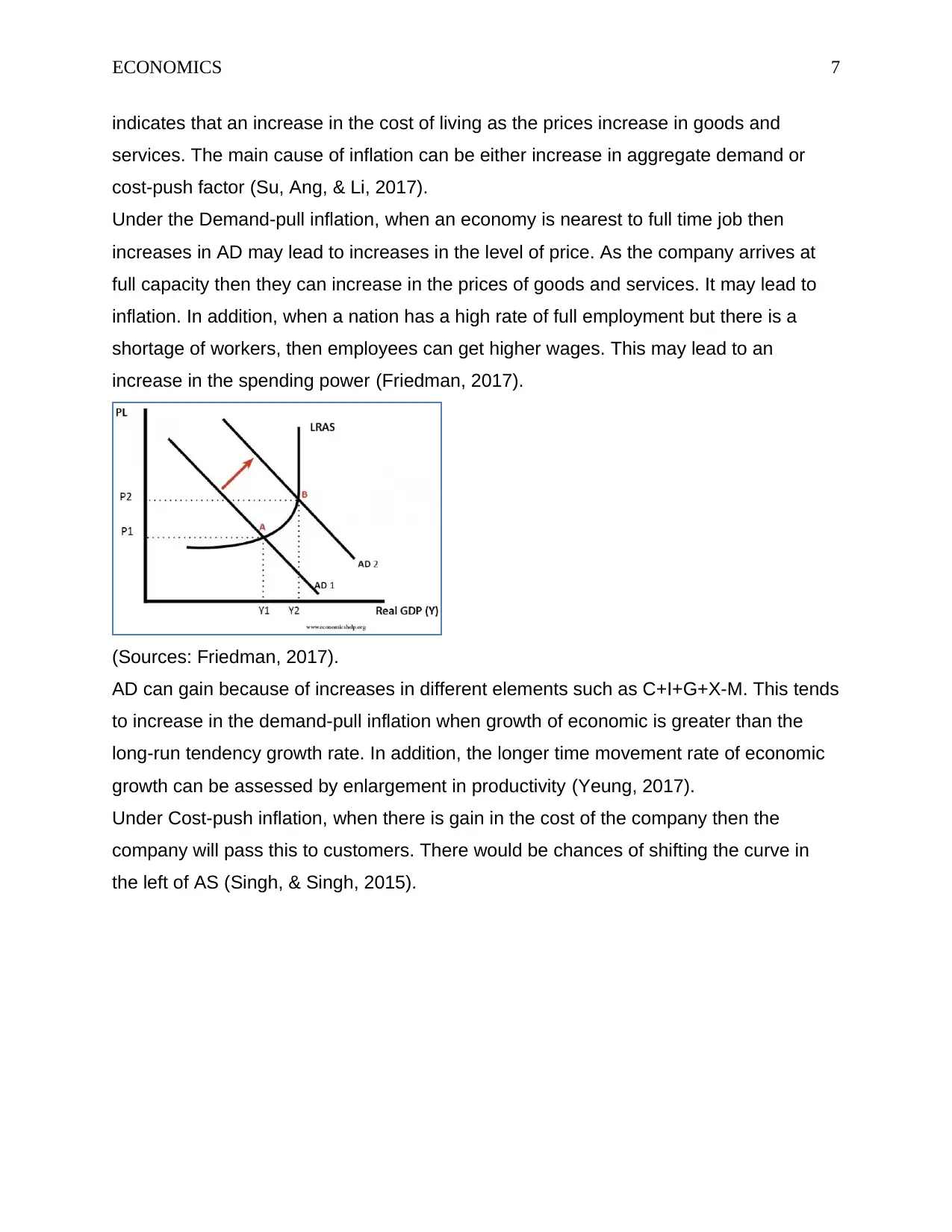

Under Cost-push inflation, when there is gain in the cost of the company then the

company will pass this to customers. There would be chances of shifting the curve in

the left of AS (Singh, & Singh, 2015).

indicates that an increase in the cost of living as the prices increase in goods and

services. The main cause of inflation can be either increase in aggregate demand or

cost-push factor (Su, Ang, & Li, 2017).

Under the Demand-pull inflation, when an economy is nearest to full time job then

increases in AD may lead to increases in the level of price. As the company arrives at

full capacity then they can increase in the prices of goods and services. It may lead to

inflation. In addition, when a nation has a high rate of full employment but there is a

shortage of workers, then employees can get higher wages. This may lead to an

increase in the spending power (Friedman, 2017).

(Sources: Friedman, 2017).

AD can gain because of increases in different elements such as C+I+G+X-M. This tends

to increase in the demand-pull inflation when growth of economic is greater than the

long-run tendency growth rate. In addition, the longer time movement rate of economic

growth can be assessed by enlargement in productivity (Yeung, 2017).

Under Cost-push inflation, when there is gain in the cost of the company then the

company will pass this to customers. There would be chances of shifting the curve in

the left of AS (Singh, & Singh, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS 8

(Sources: Singh, & Singh, 2015).

There are different causes of Cost-push inflation:

Rising wages is causes of Cost-push inflation. When trades union can demonstrate by

the union then they can negotiate to get maximum wages. Furthermore, the rising wage

is a key reason for cost-push inflation as wages could essential cost for different firms.

Moreover, higher wages can lead to increasing the demand (Harvie, & Van Hoa, 2016).

Rising house price cannot directly create inflation, however, it can create facourable

wealth effect and motivate for economic growth related to consumer-led. It may

ultimately reason of demand-pull inflation (Irpan, Saad, & Ibrahim, 2016).

Inflation is the constant increases in general level of price for a set of goods in over a

time period and could be caused of increasing aggregate demand at the higher rate as

compared to aggregate supply, and import- price push inflation (Zhang, 2018).

(Sources: Zhang, 2018).

While aggregate demand increases faster than the aggregate supply then there would

be higher chances of increasing the price level and it would be a key cause of inflation

in Singapore.

(Sources: Singh, & Singh, 2015).

There are different causes of Cost-push inflation:

Rising wages is causes of Cost-push inflation. When trades union can demonstrate by

the union then they can negotiate to get maximum wages. Furthermore, the rising wage

is a key reason for cost-push inflation as wages could essential cost for different firms.

Moreover, higher wages can lead to increasing the demand (Harvie, & Van Hoa, 2016).

Rising house price cannot directly create inflation, however, it can create facourable

wealth effect and motivate for economic growth related to consumer-led. It may

ultimately reason of demand-pull inflation (Irpan, Saad, & Ibrahim, 2016).

Inflation is the constant increases in general level of price for a set of goods in over a

time period and could be caused of increasing aggregate demand at the higher rate as

compared to aggregate supply, and import- price push inflation (Zhang, 2018).

(Sources: Zhang, 2018).

While aggregate demand increases faster than the aggregate supply then there would

be higher chances of increasing the price level and it would be a key cause of inflation

in Singapore.

ECONOMICS 9

Furthermore, inflation could be increased in Singapore in the form of import price push

inflation. It is an effective reason of Singapore. This nation is highly relied on import

from other nations such as China and Malaysia because of small and open financial

system that have some natural resources. It imports and exports the expenditure in over

three times of GDP in Singapore. It indicates that while the inflation rate in another

nation is moderately higher then it will have import at a comparatively higher rate. It may

cause increases in the price of a given set of products. There may be inflation due to

import price push inflation. For combating the inflation in the nation, Singapore can use

integration of monetary, fiscal and supply-side policies (Singh & Singh, 2015).

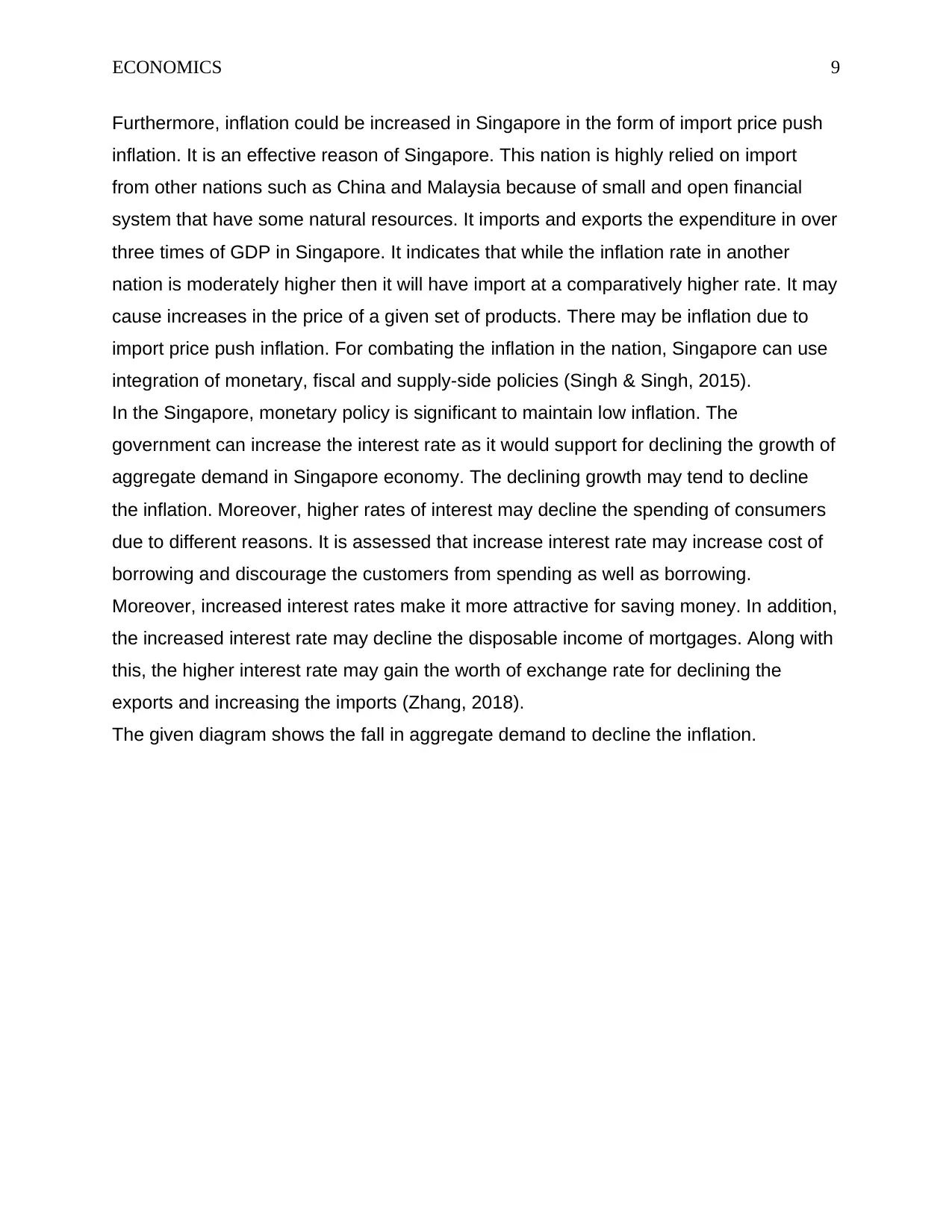

In the Singapore, monetary policy is significant to maintain low inflation. The

government can increase the interest rate as it would support for declining the growth of

aggregate demand in Singapore economy. The declining growth may tend to decline

the inflation. Moreover, higher rates of interest may decline the spending of consumers

due to different reasons. It is assessed that increase interest rate may increase cost of

borrowing and discourage the customers from spending as well as borrowing.

Moreover, increased interest rates make it more attractive for saving money. In addition,

the increased interest rate may decline the disposable income of mortgages. Along with

this, the higher interest rate may gain the worth of exchange rate for declining the

exports and increasing the imports (Zhang, 2018).

The given diagram shows the fall in aggregate demand to decline the inflation.

Furthermore, inflation could be increased in Singapore in the form of import price push

inflation. It is an effective reason of Singapore. This nation is highly relied on import

from other nations such as China and Malaysia because of small and open financial

system that have some natural resources. It imports and exports the expenditure in over

three times of GDP in Singapore. It indicates that while the inflation rate in another

nation is moderately higher then it will have import at a comparatively higher rate. It may

cause increases in the price of a given set of products. There may be inflation due to

import price push inflation. For combating the inflation in the nation, Singapore can use

integration of monetary, fiscal and supply-side policies (Singh & Singh, 2015).

In the Singapore, monetary policy is significant to maintain low inflation. The

government can increase the interest rate as it would support for declining the growth of

aggregate demand in Singapore economy. The declining growth may tend to decline

the inflation. Moreover, higher rates of interest may decline the spending of consumers

due to different reasons. It is assessed that increase interest rate may increase cost of

borrowing and discourage the customers from spending as well as borrowing.

Moreover, increased interest rates make it more attractive for saving money. In addition,

the increased interest rate may decline the disposable income of mortgages. Along with

this, the higher interest rate may gain the worth of exchange rate for declining the

exports and increasing the imports (Zhang, 2018).

The given diagram shows the fall in aggregate demand to decline the inflation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS 10

Supply-side policies are used for increasing the long-term competitiveness as well as

productivity. For instance, it was expected that deregulation and privatization will enable

the company to become more productive as well as competitive. Hence, supply-side

policies can support to decline the inflationary stresses in the long-time. But, supply-side

policies are highly used in the long-run and it cannot be practiced for declining sudden

increases in the inflation rate. There is no guarantee of government supply-side policies

for reducing the inflation (Harvie & Van Hoa, 2016).

It is another demand-side policy that entails the government changing tax with spending

level for influencing the level of AD. For declining inflationary pressures, government

can gain tax and decline spending of government. It would decline AD (Yeung, 2017).

Conclusion

From the above interpretation, it can be concluded that real GDP is increasing and GDP

per capita is declining. It can be summarised that there are certain government

measures for increasing economic growth such as Expansionary fiscal policy,

Expansionary monetary policy, Stability, and Supply-side policies. It can be summarised

that unemployment rates are declining due to different causes such as cyclical,

structural and frictional unemployment. Certain policies can decline the unemployment

rates such as Fiscal Policy, Fiscal Policy, Education and training, and Employment

subsidies. Furthermore, the inflation rate is declining due to certain causes of inflation in

Supply-side policies are used for increasing the long-term competitiveness as well as

productivity. For instance, it was expected that deregulation and privatization will enable

the company to become more productive as well as competitive. Hence, supply-side

policies can support to decline the inflationary stresses in the long-time. But, supply-side

policies are highly used in the long-run and it cannot be practiced for declining sudden

increases in the inflation rate. There is no guarantee of government supply-side policies

for reducing the inflation (Harvie & Van Hoa, 2016).

It is another demand-side policy that entails the government changing tax with spending

level for influencing the level of AD. For declining inflationary pressures, government

can gain tax and decline spending of government. It would decline AD (Yeung, 2017).

Conclusion

From the above interpretation, it can be concluded that real GDP is increasing and GDP

per capita is declining. It can be summarised that there are certain government

measures for increasing economic growth such as Expansionary fiscal policy,

Expansionary monetary policy, Stability, and Supply-side policies. It can be summarised

that unemployment rates are declining due to different causes such as cyclical,

structural and frictional unemployment. Certain policies can decline the unemployment

rates such as Fiscal Policy, Fiscal Policy, Education and training, and Employment

subsidies. Furthermore, the inflation rate is declining due to certain causes of inflation in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS 11

Singapore like AD rises at the higher rate as compared to AS, and import- price push

inflation. Certain strategies used by the Singapore government for avoiding the inflation

such as Monetary Policy, Supply Side Policies, and Fiscal Policy.

Singapore like AD rises at the higher rate as compared to AS, and import- price push

inflation. Certain strategies used by the Singapore government for avoiding the inflation

such as Monetary Policy, Supply Side Policies, and Fiscal Policy.

ECONOMICS 12

References

Chiu, S. W. K. (2018). City states in the global economy: Industrial restructuring in Hong

Kong and Singapore. UK: Routledge.

Friedman, B. M. (2017). The moral consequences of economic growth. In Markets,

Morals, and Religion (pp. 29-42). UK: Routledge.

Harvie, C., & Van Hoa, T. (2016). The causes and impact of the Asian financial crisis.

UK: Springer.

Irpan, H. M., Saad, R. M., & Ibrahim, N. (2016). Investigating Relationship between

Unemployment Rate and GDP Growth in Malaysia. International Information Institute

(Tokyo). Information, 19(9B), 4057.

Irpan, H. M., Saad, R. M., Nor, A. H. S. M., Noor, A. H. M., & Ibrahim, N. (2016, April).

Impact of foreign direct investment on the unemployment rate in Malaysia. In Journal of

Physics: Conference Series (Vol. 710, No. 1, p. 012028). UK: IOP Publishing.

Rodan, G. (2016). The political economy of Singapore's industrialization: national state

and international capital. USA: Springer.

Singh, S., & Singh, A. (2015). Causal Nexus between Inflation and Economic Growth of

Japan. Iranian Economic Review, 19(3), 265-278.

Su, B., Ang, B. W., & Li, Y. (2017). Input-output and structural decomposition analysis of

Singapore's carbon emissions. Energy Policy, 105, 484-492.

Trading economics. (2018). GDP growth. Retrieved from:

https://tradingeconomics.com/singapore/gdp-growth

Trading economics. (2018). GDP per capita. Retrieved from:

https://tradingeconomics.com/singapore/gdp-per-capita

Trading economics. (2018). GDP. Retrieved from:

https://tradingeconomics.com/singapore/gdp

Trading economics. (2018). Inflation. Retrieved from:

https://tradingeconomics.com/singapore/inflation-cpi

Trading economics. (2018). unemployment rate. Retrieved from:

https://tradingeconomics.com/singapore/unemployment-rate

References

Chiu, S. W. K. (2018). City states in the global economy: Industrial restructuring in Hong

Kong and Singapore. UK: Routledge.

Friedman, B. M. (2017). The moral consequences of economic growth. In Markets,

Morals, and Religion (pp. 29-42). UK: Routledge.

Harvie, C., & Van Hoa, T. (2016). The causes and impact of the Asian financial crisis.

UK: Springer.

Irpan, H. M., Saad, R. M., & Ibrahim, N. (2016). Investigating Relationship between

Unemployment Rate and GDP Growth in Malaysia. International Information Institute

(Tokyo). Information, 19(9B), 4057.

Irpan, H. M., Saad, R. M., Nor, A. H. S. M., Noor, A. H. M., & Ibrahim, N. (2016, April).

Impact of foreign direct investment on the unemployment rate in Malaysia. In Journal of

Physics: Conference Series (Vol. 710, No. 1, p. 012028). UK: IOP Publishing.

Rodan, G. (2016). The political economy of Singapore's industrialization: national state

and international capital. USA: Springer.

Singh, S., & Singh, A. (2015). Causal Nexus between Inflation and Economic Growth of

Japan. Iranian Economic Review, 19(3), 265-278.

Su, B., Ang, B. W., & Li, Y. (2017). Input-output and structural decomposition analysis of

Singapore's carbon emissions. Energy Policy, 105, 484-492.

Trading economics. (2018). GDP growth. Retrieved from:

https://tradingeconomics.com/singapore/gdp-growth

Trading economics. (2018). GDP per capita. Retrieved from:

https://tradingeconomics.com/singapore/gdp-per-capita

Trading economics. (2018). GDP. Retrieved from:

https://tradingeconomics.com/singapore/gdp

Trading economics. (2018). Inflation. Retrieved from:

https://tradingeconomics.com/singapore/inflation-cpi

Trading economics. (2018). unemployment rate. Retrieved from:

https://tradingeconomics.com/singapore/unemployment-rate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.