ECON 11026 Macroeconomics: RBA Interest Rate Decision Case Study

VerifiedAdded on 2023/04/21

|12

|3288

|400

Case Study

AI Summary

This case study delves into the Reserve Bank of Australia's (RBA) monetary policy decisions, particularly focusing on interest rate adjustments and their impact on the Australian economy. It examines the objectives of the RBA, including price stability, full employment, and economic prosperity, and how these objectives are pursued through monetary policy tools. The study analyzes the factors influencing the RBA's cash rate decisions, such as inflation, unemployment, wage growth, and the exchange rate. It further discusses the monetary transmission mechanism, illustrating how changes in the cash rate affect economic activity and inflation. The case study also considers the global economic context and domestic indicators that inform the RBA's policy choices. It references real-world data and potential economic scenarios to provide a comprehensive understanding of the RBA's role in managing the Australian economy.

Running head: ECONOMICS

Economics

Name of the student

Name of the university

Author note

Economics

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2ECONOMICS

Table of Contents

The Australian economy............................................................................................................3

Question 1..................................................................................................................................3

Answer 2....................................................................................................................................5

Answer 3....................................................................................................................................6

Answer 4....................................................................................................................................8

Answer 5....................................................................................................................................9

Reference list............................................................................................................................11

Table of Contents

The Australian economy............................................................................................................3

Question 1..................................................................................................................................3

Answer 2....................................................................................................................................5

Answer 3....................................................................................................................................6

Answer 4....................................................................................................................................8

Answer 5....................................................................................................................................9

Reference list............................................................................................................................11

3ECONOMICS

The Australian economy

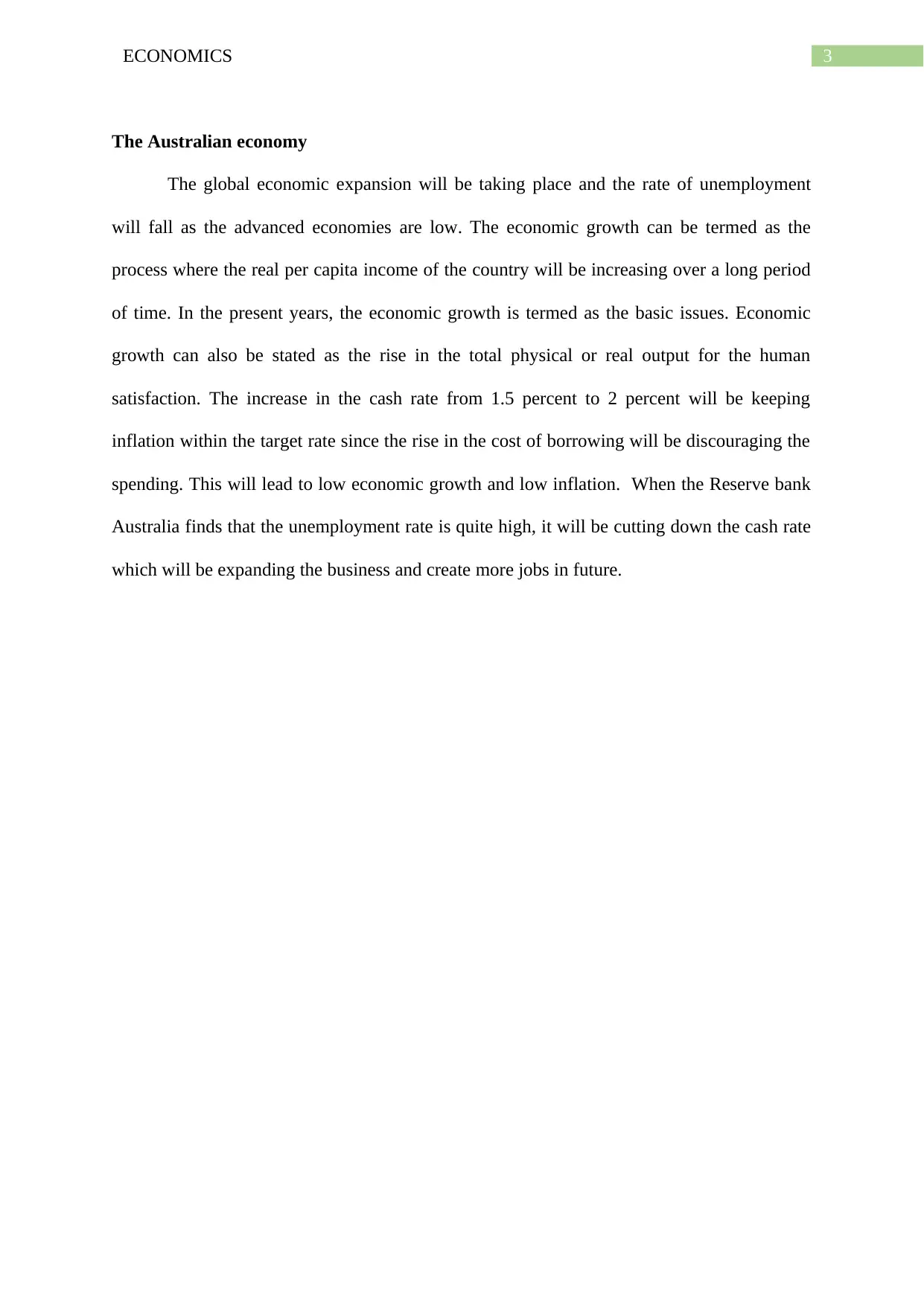

The global economic expansion will be taking place and the rate of unemployment

will fall as the advanced economies are low. The economic growth can be termed as the

process where the real per capita income of the country will be increasing over a long period

of time. In the present years, the economic growth is termed as the basic issues. Economic

growth can also be stated as the rise in the total physical or real output for the human

satisfaction. The increase in the cash rate from 1.5 percent to 2 percent will be keeping

inflation within the target rate since the rise in the cost of borrowing will be discouraging the

spending. This will lead to low economic growth and low inflation. When the Reserve bank

Australia finds that the unemployment rate is quite high, it will be cutting down the cash rate

which will be expanding the business and create more jobs in future.

The Australian economy

The global economic expansion will be taking place and the rate of unemployment

will fall as the advanced economies are low. The economic growth can be termed as the

process where the real per capita income of the country will be increasing over a long period

of time. In the present years, the economic growth is termed as the basic issues. Economic

growth can also be stated as the rise in the total physical or real output for the human

satisfaction. The increase in the cash rate from 1.5 percent to 2 percent will be keeping

inflation within the target rate since the rise in the cost of borrowing will be discouraging the

spending. This will lead to low economic growth and low inflation. When the Reserve bank

Australia finds that the unemployment rate is quite high, it will be cutting down the cash rate

which will be expanding the business and create more jobs in future.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4ECONOMICS

Figure 1 Cash rate of Australia

Question 1

The Reserve Bank of Australia will try to formulate and implement the monetary

policy of Australia. The monetary policy decisions will be such that it is known to set the rate

of interest on the loans of the money market. The monetary policy usually implies those

measures that have been designed for ensuring an efficient operation of the economic system.

This particular policy is known to influence the level along with the composition of the

aggregate demand by manipulating the interest rates along with credit availability.

Figure 1 Cash rate of Australia

Question 1

The Reserve Bank of Australia will try to formulate and implement the monetary

policy of Australia. The monetary policy decisions will be such that it is known to set the rate

of interest on the loans of the money market. The monetary policy usually implies those

measures that have been designed for ensuring an efficient operation of the economic system.

This particular policy is known to influence the level along with the composition of the

aggregate demand by manipulating the interest rates along with credit availability.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5ECONOMICS

The Reserve Bank Board will be setting the rate of interest in order to achieve the

objectives set out in the Reserve Bank Act 1959 for maintaining full employment and the

stabilization of the currency of Australia. It is also known to maintain economic prosperity

along with welfare of the Australian people. One of the objectives of the monetary is for

targeting the consumer price inflation of 2-3 percent per annum. The objective of the

monetary policy is to achieve the rate of inflation for encouraging strong growth of the

economy. When the rate of inflation is under controlled, it will also be preserving the value of

money. For controlling the inflation it is required to preserve the value of money as during

long run, it can be said that the monetary policy will be helping to form bias for the long term

growth in the economy. One of the main objective of the monetary policy is controlling

inflation is an inflation target. The other objectives of the monetary policy is to attain huge

economic, full employment, neutrality of money with equal distribution of income and

equilibrium of the balance of payments. The Reserve Bank of Australia will be conducting

operations in financial market. Therefore the objectives of the monetary policy are:

Price stability: one of the main objectives of the monetary policy is stabilizing the

price level. The reason behind this is that price fluctuations will be bringing

uncertainty and instability to the economy. Price stability will be promoting business

activity and will also ensure equitable distribution on wealth and income. Price

stability can be stated as the most genuine objective of the monetary policy. Price

stability will also be discouraging exports and encourage imports. A little increase in

the price level will be providing tonic for the growth of the economy.

Growth of the economy: another important objective of the monetary policy is to

maintain rapid economic growth of the economy. The economic growth can be

termed as the process where the real per capita income of the country will be

increasing over a long period of time. In the present years, the economic growth is

The Reserve Bank Board will be setting the rate of interest in order to achieve the

objectives set out in the Reserve Bank Act 1959 for maintaining full employment and the

stabilization of the currency of Australia. It is also known to maintain economic prosperity

along with welfare of the Australian people. One of the objectives of the monetary is for

targeting the consumer price inflation of 2-3 percent per annum. The objective of the

monetary policy is to achieve the rate of inflation for encouraging strong growth of the

economy. When the rate of inflation is under controlled, it will also be preserving the value of

money. For controlling the inflation it is required to preserve the value of money as during

long run, it can be said that the monetary policy will be helping to form bias for the long term

growth in the economy. One of the main objective of the monetary policy is controlling

inflation is an inflation target. The other objectives of the monetary policy is to attain huge

economic, full employment, neutrality of money with equal distribution of income and

equilibrium of the balance of payments. The Reserve Bank of Australia will be conducting

operations in financial market. Therefore the objectives of the monetary policy are:

Price stability: one of the main objectives of the monetary policy is stabilizing the

price level. The reason behind this is that price fluctuations will be bringing

uncertainty and instability to the economy. Price stability will be promoting business

activity and will also ensure equitable distribution on wealth and income. Price

stability can be stated as the most genuine objective of the monetary policy. Price

stability will also be discouraging exports and encourage imports. A little increase in

the price level will be providing tonic for the growth of the economy.

Growth of the economy: another important objective of the monetary policy is to

maintain rapid economic growth of the economy. The economic growth can be

termed as the process where the real per capita income of the country will be

increasing over a long period of time. In the present years, the economic growth is

6ECONOMICS

termed as the basic issues. Economic growth can also be stated as the rise in the total

physical or real output for the human satisfaction.

Balance of payments: one of the objective of the monetary policy is maintaining

equilibrium in case of balance in payments. This can take place when there will be a

problem in case of international liquidity. Monetary authority will be making effort

where equilibrium can be maintained in case of balance of payments.

Full employment: the monetary policy can achieve the full employment. When the

monetary policy is known to be expansionary, the credit supply will be encouraged. It

will also help in creation of more jobs in various sectors of the economy. The full

employment can be stated as the main goal of the monetary policy. The achievement

of the full employment will also include exchange stability and the prices.

Answer 2

The inflation target of Australia aims to keep the annual consumer price inflation

between 2 to 3 percent on average over time. The rate of interest and inflation are often

linked together. When the Reserve Bank will be lowering the cash rate, this will lead to fall in

the economy and lower rate of interest will be stimulating spending. The banks need to

charge on overnight loans to the commercial banks. The monetary mechanism is the process

in which the asset prices and the general economic conditions will be affected as a result of

the monetary policies. This kind of decisions will be influencing the aggregate demand,

amount of the money and the interest rate. This will be affecting the rate of interest and cost

of borrowing. The demand will be affected which is affected with credit markets. The

monetary transmission mechanism which can be defined as the link between the monetary

policies along with the aggregate demand. The Reserve Bank of Australia will be deciding

the cash rate every month of the year. The cash rate is known to affect the rate of interest for

the savings on the large scale. The cash rate is known to influence the interest rate in the

termed as the basic issues. Economic growth can also be stated as the rise in the total

physical or real output for the human satisfaction.

Balance of payments: one of the objective of the monetary policy is maintaining

equilibrium in case of balance in payments. This can take place when there will be a

problem in case of international liquidity. Monetary authority will be making effort

where equilibrium can be maintained in case of balance of payments.

Full employment: the monetary policy can achieve the full employment. When the

monetary policy is known to be expansionary, the credit supply will be encouraged. It

will also help in creation of more jobs in various sectors of the economy. The full

employment can be stated as the main goal of the monetary policy. The achievement

of the full employment will also include exchange stability and the prices.

Answer 2

The inflation target of Australia aims to keep the annual consumer price inflation

between 2 to 3 percent on average over time. The rate of interest and inflation are often

linked together. When the Reserve Bank will be lowering the cash rate, this will lead to fall in

the economy and lower rate of interest will be stimulating spending. The banks need to

charge on overnight loans to the commercial banks. The monetary mechanism is the process

in which the asset prices and the general economic conditions will be affected as a result of

the monetary policies. This kind of decisions will be influencing the aggregate demand,

amount of the money and the interest rate. This will be affecting the rate of interest and cost

of borrowing. The demand will be affected which is affected with credit markets. The

monetary transmission mechanism which can be defined as the link between the monetary

policies along with the aggregate demand. The Reserve Bank of Australia will be deciding

the cash rate every month of the year. The cash rate is known to affect the rate of interest for

the savings on the large scale. The cash rate is known to influence the interest rate in the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7ECONOMICS

economy affecting the behaviour of the lender as well as the borrower of the economy

activity and also the rate of inflation. When the cash rate will be falling the Reserve Bank of

Australia be will be trying to boost the economic activity and inflation by encouraging the

consumer spending and the business investment. The increase in the cash rate from 1.5

percent to 2 percent will be keeping inflation within the target rate since the rise in the cost of

borrowing will be discouraging the spending. This will lead to low economic growth and low

inflation. When the interest rate will be low people will be borrowing huge amount of money

for this reason the consumers will be having huge money to spend and this will make the

economy to grow and therefore inflation will rise. The transmission of the4 monetary policy

refers to that change where the cash rate will be affecting the economic activity and inflation.

As low amount of cash rate will be stimulating the household spending and the

housing investment by raising the wealth and the cash flows of the households. For this

reason it can be said that a decrease in the cash rate from 1.5 percent to 1 percent will help in

stimulating the economy. The transmission of the monetary policy takes place in two ways

that is either by changing the cash rate which will be affecting the rate of interest in the

economy and changes in interest rate which will be affecting the economic activity and

inflation. The Reserve Bank of Australia usually conducts the monetary policies in Australia

for achieving the objectives of the price stability, full employment and economic prosperity.

Although when the cash rate will be low it will also lead to depreciation of the exchange rate

which will in term lead to high amount of net exports along with imported inflation. The

Australian economy is performing well. The central scenario is for GDP growth to average

around 3½ per cent over this year and next, before slowing in 2020 due to slower growth in

exports of resources. In order to control the inflation in the economy, it is required for

preserving the value of money during the long run as the monetary policy will help in

forming bias for the long term growth in the economy.

economy affecting the behaviour of the lender as well as the borrower of the economy

activity and also the rate of inflation. When the cash rate will be falling the Reserve Bank of

Australia be will be trying to boost the economic activity and inflation by encouraging the

consumer spending and the business investment. The increase in the cash rate from 1.5

percent to 2 percent will be keeping inflation within the target rate since the rise in the cost of

borrowing will be discouraging the spending. This will lead to low economic growth and low

inflation. When the interest rate will be low people will be borrowing huge amount of money

for this reason the consumers will be having huge money to spend and this will make the

economy to grow and therefore inflation will rise. The transmission of the4 monetary policy

refers to that change where the cash rate will be affecting the economic activity and inflation.

As low amount of cash rate will be stimulating the household spending and the

housing investment by raising the wealth and the cash flows of the households. For this

reason it can be said that a decrease in the cash rate from 1.5 percent to 1 percent will help in

stimulating the economy. The transmission of the monetary policy takes place in two ways

that is either by changing the cash rate which will be affecting the rate of interest in the

economy and changes in interest rate which will be affecting the economic activity and

inflation. The Reserve Bank of Australia usually conducts the monetary policies in Australia

for achieving the objectives of the price stability, full employment and economic prosperity.

Although when the cash rate will be low it will also lead to depreciation of the exchange rate

which will in term lead to high amount of net exports along with imported inflation. The

Australian economy is performing well. The central scenario is for GDP growth to average

around 3½ per cent over this year and next, before slowing in 2020 due to slower growth in

exports of resources. In order to control the inflation in the economy, it is required for

preserving the value of money during the long run as the monetary policy will help in

forming bias for the long term growth in the economy.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8ECONOMICS

Answer 3

It have been found out that the reserve bank of Australia are known to change the cash

rate depending on factors like the domestic indicators and the macroeconomic indicators.

The domestic indicator here states about the Australian dollar and the global macroeconomic

indicators are the include the growth rate of the gross domestic products, investment,

consumption of the households and the exchange rates. The Reserve bank of Australia

known to have changed the cash rates with the following indicators. That particular effect

will be having on the Describe the circumstances in which the RBA Board might increase the

cash rate.

The factors that affect the cash rate are rate of unemployment, inflation, growth of

wage, overseas demand, Consumer Confidence index, household debt and the Australian

dollar. These factors are known to affect the cash rate. The inflation is the rising price of the

goods and services which states that when it takes place the purchasing power of the

consumer will go on diminishing as the cost of living will rise. The reserve bank of Australia

are known to monitor the rate of inflation and also take into account the figures of the

inflation for deciding the movement of the rate of interest. When the reserve bank of

Australia finds that the rate of inflation is quite high, it will be slowing the economic growth

in the economy. The inflation rate targeted by Australia is around 2-3 percent. Another factor

that affects the cash rate is the unemployment rate. When the Reserve bank Australia finds

that the unemployment rate is quite high, it will be cutting down the cash rate which will be

expanding the business and create more jobs in future. In Australia the full unemployment

rate is known to be at 5 percent. The unemployment rate fell from 5.5 per cent in the previous

month. This reflects strong employment conditions in the Australian labour market. The third

factor is the wage growth which is known to affect the cash rate movement in Australia. This

states that when the wage growth is weak, it will be slowing down to per cent. This particular

Answer 3

It have been found out that the reserve bank of Australia are known to change the cash

rate depending on factors like the domestic indicators and the macroeconomic indicators.

The domestic indicator here states about the Australian dollar and the global macroeconomic

indicators are the include the growth rate of the gross domestic products, investment,

consumption of the households and the exchange rates. The Reserve bank of Australia

known to have changed the cash rates with the following indicators. That particular effect

will be having on the Describe the circumstances in which the RBA Board might increase the

cash rate.

The factors that affect the cash rate are rate of unemployment, inflation, growth of

wage, overseas demand, Consumer Confidence index, household debt and the Australian

dollar. These factors are known to affect the cash rate. The inflation is the rising price of the

goods and services which states that when it takes place the purchasing power of the

consumer will go on diminishing as the cost of living will rise. The reserve bank of Australia

are known to monitor the rate of inflation and also take into account the figures of the

inflation for deciding the movement of the rate of interest. When the reserve bank of

Australia finds that the rate of inflation is quite high, it will be slowing the economic growth

in the economy. The inflation rate targeted by Australia is around 2-3 percent. Another factor

that affects the cash rate is the unemployment rate. When the Reserve bank Australia finds

that the unemployment rate is quite high, it will be cutting down the cash rate which will be

expanding the business and create more jobs in future. In Australia the full unemployment

rate is known to be at 5 percent. The unemployment rate fell from 5.5 per cent in the previous

month. This reflects strong employment conditions in the Australian labour market. The third

factor is the wage growth which is known to affect the cash rate movement in Australia. This

states that when the wage growth is weak, it will be slowing down to per cent. This particular

9ECONOMICS

factor of the weak growth is the factor that the reserve bank of Australia will be considering

without the higher wages where the household consumption is also limited. In order to

strengthen the economy, the wage growth needs to go up when the price of the house also

goes up. These particular factors are the major concern for inflation. The Reserve Bank of

Australia also known to monitor the Australian dollar where it helps them for adjusting the

rate of interest in accordance to how the exchange rate will be performing. When the cash

rate will be too low, it will be encouraging the investors for investing in the Australian dollar

that will also push up the Australian dollar. When the Australian dollar will be quite high, it

will be staying competitive in the international markets.

Answer 4

The Reserve Bank of Australia decided for keeping the cash rate at 1.5 percent as the

dollar rate known to be falling to the lowest level over the years. All the major banks of

Australia have known to raise the variable rate of the home loan after the introduction of the

tougher capital requirements in case of the financial crisis. The Central Bank had also state

that it will not be lifting the rates until the labour markets tightens enough for boosting wages

and inflation. The Reserve Bank of Australia have lower the emergency low interest rate

setting in even in the year leaving the official cash rate on hold at 1.5 percent. It have been

noted that growth in china have slowed down a little. The reasons for which the Australian

reserve bank cannot raise the cash rate is because the banks of Australia had already raised

taxes. Another reason is that the Reserve Bank of Australia will be wanting weaker dollar.

The Australian dollar will be able to gain grounds against the major currencies or the US

dollars. In the present situation the economy of the United States will be known to grow and

also expected to advance further where the tax cuts were accelerating. The economy of

Australia is also known to be highly dependent on china and therefore the protectionism

between the countries is quite concerning for the Australians. The cash rate is one of the main

factor of the weak growth is the factor that the reserve bank of Australia will be considering

without the higher wages where the household consumption is also limited. In order to

strengthen the economy, the wage growth needs to go up when the price of the house also

goes up. These particular factors are the major concern for inflation. The Reserve Bank of

Australia also known to monitor the Australian dollar where it helps them for adjusting the

rate of interest in accordance to how the exchange rate will be performing. When the cash

rate will be too low, it will be encouraging the investors for investing in the Australian dollar

that will also push up the Australian dollar. When the Australian dollar will be quite high, it

will be staying competitive in the international markets.

Answer 4

The Reserve Bank of Australia decided for keeping the cash rate at 1.5 percent as the

dollar rate known to be falling to the lowest level over the years. All the major banks of

Australia have known to raise the variable rate of the home loan after the introduction of the

tougher capital requirements in case of the financial crisis. The Central Bank had also state

that it will not be lifting the rates until the labour markets tightens enough for boosting wages

and inflation. The Reserve Bank of Australia have lower the emergency low interest rate

setting in even in the year leaving the official cash rate on hold at 1.5 percent. It have been

noted that growth in china have slowed down a little. The reasons for which the Australian

reserve bank cannot raise the cash rate is because the banks of Australia had already raised

taxes. Another reason is that the Reserve Bank of Australia will be wanting weaker dollar.

The Australian dollar will be able to gain grounds against the major currencies or the US

dollars. In the present situation the economy of the United States will be known to grow and

also expected to advance further where the tax cuts were accelerating. The economy of

Australia is also known to be highly dependent on china and therefore the protectionism

between the countries is quite concerning for the Australians. The cash rate is one of the main

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10ECONOMICS

instrument of the Reserve Bank of Australia and will be having a powerful impact on the

other interest rates in the economy of Australia which includes mortgages and the business

borrowing rates.

Although there is an issue with the lower interest rate where they will be encouraging the

people to borrow. Although it may support the economy but it also creates a huge risk. The

reason behind this is that the levels of the household borrowing is extremely high as a result

of the low rate of interest along with strong demand of housing. There is a problem with

huge amount of borrowing since it will be leading to a number of distortions in the economy

which can create huge economic problems when the rates will be rising. When the rates will

be rising borrowers will be then concerned about the further rise and this will create a huge

problem for the reserve bank of Australia. The Reserve Bank of Australia is quite

responsible for the monetary policy and sets the interest rates for overnight loans that it will

be proving to the commercial banks.

Answer 5

Economic growth can be termed as the rise in the amount of goods and services which

are producing the population on a time period. It can be termed as the increase in the capacity

of the economy for producing goods and services. The economic growth can be measured

with the help of gross domestic product and it will also take into account the entire economic

output for the entire economy. The rate of the economic growth will be referred to the

geometrical annual rate of growth in gross domestic product over the price. The cash rate of

Australia has been known to be all time low for the past few years around 1.5 per cent low

since august as a result of the continued world contraction of the economy which had started

with the GFC. Over the past few years it was expected that the cash rate would have been

significantly lowered. Low rate of interest can be either harmful or good depending on

various factors. One of the benefit of the low rate of interest is that it will be improving the

instrument of the Reserve Bank of Australia and will be having a powerful impact on the

other interest rates in the economy of Australia which includes mortgages and the business

borrowing rates.

Although there is an issue with the lower interest rate where they will be encouraging the

people to borrow. Although it may support the economy but it also creates a huge risk. The

reason behind this is that the levels of the household borrowing is extremely high as a result

of the low rate of interest along with strong demand of housing. There is a problem with

huge amount of borrowing since it will be leading to a number of distortions in the economy

which can create huge economic problems when the rates will be rising. When the rates will

be rising borrowers will be then concerned about the further rise and this will create a huge

problem for the reserve bank of Australia. The Reserve Bank of Australia is quite

responsible for the monetary policy and sets the interest rates for overnight loans that it will

be proving to the commercial banks.

Answer 5

Economic growth can be termed as the rise in the amount of goods and services which

are producing the population on a time period. It can be termed as the increase in the capacity

of the economy for producing goods and services. The economic growth can be measured

with the help of gross domestic product and it will also take into account the entire economic

output for the entire economy. The rate of the economic growth will be referred to the

geometrical annual rate of growth in gross domestic product over the price. The cash rate of

Australia has been known to be all time low for the past few years around 1.5 per cent low

since august as a result of the continued world contraction of the economy which had started

with the GFC. Over the past few years it was expected that the cash rate would have been

significantly lowered. Low rate of interest can be either harmful or good depending on

various factors. One of the benefit of the low rate of interest is that it will be improving the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11ECONOMICS

bank balance sheets and will also change the capacity of the bank to lend. However, it must

be kept in mind that when the interest rate will be low it will be discouraging any kind of

investment spending. Variation in the rate of interest affect the public's demand for goods and

services and by this way it will also be lowering the spending. When the interest rate will be

low it will be reducing the cost of capital and will also boost consumption along with the

investment activities. This can lead to improve economic activities. On the other hand when

the rate of interest will be too high it will reduce the wealth of the company which means that

their ability for solving their economic activities will be going down. When the interest rates

will be declining the opposite impacts can be anticipated. When the interest rates are low it

will be a good sign for the savers, for the people who are the first time buyers as the high cost

of buying a house and deposit are required which are not affordable . When the federal funds

will be decreasing it will be lowering the value of the dollar of the market of foreign

exchange.

The Reserve Bank of Australia usually conducts the monetary policies in Australia

for achieving the objectives of the price stability ad full employment along with economic

prosperity. Although when the cash rate will be low it will also lead to depreciation of the

exchange rate which will in term lead to high amount of net exports along with imported

inflation. The economic growth can be measured with the help of gross domestic product and

it will also take into account the entire economic output for the entire economy. The rate of

the economic growth will be referred to the geometrical annual rate of growth in gross

domestic product over the price.

bank balance sheets and will also change the capacity of the bank to lend. However, it must

be kept in mind that when the interest rate will be low it will be discouraging any kind of

investment spending. Variation in the rate of interest affect the public's demand for goods and

services and by this way it will also be lowering the spending. When the interest rate will be

low it will be reducing the cost of capital and will also boost consumption along with the

investment activities. This can lead to improve economic activities. On the other hand when

the rate of interest will be too high it will reduce the wealth of the company which means that

their ability for solving their economic activities will be going down. When the interest rates

will be declining the opposite impacts can be anticipated. When the interest rates are low it

will be a good sign for the savers, for the people who are the first time buyers as the high cost

of buying a house and deposit are required which are not affordable . When the federal funds

will be decreasing it will be lowering the value of the dollar of the market of foreign

exchange.

The Reserve Bank of Australia usually conducts the monetary policies in Australia

for achieving the objectives of the price stability ad full employment along with economic

prosperity. Although when the cash rate will be low it will also lead to depreciation of the

exchange rate which will in term lead to high amount of net exports along with imported

inflation. The economic growth can be measured with the help of gross domestic product and

it will also take into account the entire economic output for the entire economy. The rate of

the economic growth will be referred to the geometrical annual rate of growth in gross

domestic product over the price.

12ECONOMICS

Reference list

Allen, D. (2015). The sharing economy. Institute of Public Affairs Review: A Quarterly

Review of Politics and Public Affairs, The, 67(3), 24.

Ally, M., Gardiner, M., & Lane, M. (2016). The potential impact of digital currencies on the

Australian economy. arXiv preprint arXiv:1606.02462.

Bajada, C. (2017). Australia's Cash Economy: A Troubling Issue for Policymakers: A

Troubling Issue for Policymakers. Routledge.

Black, S., Chapman, B., & Windsor, C. (2017). Australian Capital Flows. RBA Bulletin, June,

23-34.

Poon, A. (2017). Three Applications of Time-Varying Parameter and Stochastic Volatility

Models to the Malaysian and Australian Economy.

Rees, D. M., Smith, P., & Hall, J. (2016). A Multi‐sector Model of the Australian Economy. Economic

Record, 92(298), 374-408.

Robinson, T., Nguyen, V. H., & Wang, J. (2017). The Australian economy in 2016–17:

Looking beyond the apartment construction boom. Australian Economic

Review, 50(1), 5-20.

Schroeder, S. (2018). Just how fragile is the Australian economy?. Australian Options, (87),

18.

Sheen, J., Trück, S., & Wang, B. Z. (2015). Daily business and external condition indices for

the Australian economy. Economic Record, 91, 38-53.

Reference list

Allen, D. (2015). The sharing economy. Institute of Public Affairs Review: A Quarterly

Review of Politics and Public Affairs, The, 67(3), 24.

Ally, M., Gardiner, M., & Lane, M. (2016). The potential impact of digital currencies on the

Australian economy. arXiv preprint arXiv:1606.02462.

Bajada, C. (2017). Australia's Cash Economy: A Troubling Issue for Policymakers: A

Troubling Issue for Policymakers. Routledge.

Black, S., Chapman, B., & Windsor, C. (2017). Australian Capital Flows. RBA Bulletin, June,

23-34.

Poon, A. (2017). Three Applications of Time-Varying Parameter and Stochastic Volatility

Models to the Malaysian and Australian Economy.

Rees, D. M., Smith, P., & Hall, J. (2016). A Multi‐sector Model of the Australian Economy. Economic

Record, 92(298), 374-408.

Robinson, T., Nguyen, V. H., & Wang, J. (2017). The Australian economy in 2016–17:

Looking beyond the apartment construction boom. Australian Economic

Review, 50(1), 5-20.

Schroeder, S. (2018). Just how fragile is the Australian economy?. Australian Options, (87),

18.

Sheen, J., Trück, S., & Wang, B. Z. (2015). Daily business and external condition indices for

the Australian economy. Economic Record, 91, 38-53.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.