Macroeconomic Analysis: Investing in the Canadian Mining Sector Report

VerifiedAdded on 2023/04/03

|32

|6861

|416

Report

AI Summary

This report conducts a thorough analysis of the Canadian mining sector as a potential investment opportunity, focusing on macroeconomic factors and the business environment. It begins with an executive summary and introduction, highlighting Canada's strong economic indicators and mineral resource abundance. The analysis delves into various aspects of the Canadian economy, including ease of doing business, economic growth, unemployment, wage rates, inflation, interest rates, government expenditures, taxation policies, and exchange rate regimes. The report also examines monetary policies, the effects of the Global Financial Crisis, and the political stability, which makes Canada an attractive investment destination. The report then offers a conclusion and recommendation, suggesting that the Australian investors should consider investing in Canada due to the country's resource wealth, political stability, and favorable business conditions. The report utilizes various data sources and references to support its findings, providing a comprehensive overview of the investment potential in the Canadian mining sector.

Running head: ECONOMICS

Economics

Name of the student

Name of the university

Economics

Name of the student

Name of the university

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2ECONOMICS

Table of Contents

Section 1: Executive summary...................................................................................................3

Section 2: Introduction...............................................................................................................3

Reasons to invest in the mining sector of Canada..................................................................3

Section 3: Analysis and discussion............................................................................................6

General business environment...............................................................................................6

Starting a business:.................................................................................................................6

Ease of doing business-..........................................................................................................7

Getting electricity-.................................................................................................................7

Registering property:..............................................................................................................8

Dealing with the construction permits:..................................................................................8

Protecting minority investors:................................................................................................8

Getting credit:.........................................................................................................................8

Enforcing contracts:...............................................................................................................9

Resolving insolvency:................................................................................................................9

Trading across borders:..........................................................................................................9

Getting electricity-...............................................................................................................10

Paying taxes:........................................................................................................................10

General conclusion:..............................................................................................................10

Economic growth and business cycle......................................................................................11

Unemployment.....................................................................................................................13

Average wage rate................................................................................................................14

Table of Contents

Section 1: Executive summary...................................................................................................3

Section 2: Introduction...............................................................................................................3

Reasons to invest in the mining sector of Canada..................................................................3

Section 3: Analysis and discussion............................................................................................6

General business environment...............................................................................................6

Starting a business:.................................................................................................................6

Ease of doing business-..........................................................................................................7

Getting electricity-.................................................................................................................7

Registering property:..............................................................................................................8

Dealing with the construction permits:..................................................................................8

Protecting minority investors:................................................................................................8

Getting credit:.........................................................................................................................8

Enforcing contracts:...............................................................................................................9

Resolving insolvency:................................................................................................................9

Trading across borders:..........................................................................................................9

Getting electricity-...............................................................................................................10

Paying taxes:........................................................................................................................10

General conclusion:..............................................................................................................10

Economic growth and business cycle......................................................................................11

Unemployment.....................................................................................................................13

Average wage rate................................................................................................................14

3ECONOMICS

Human capital......................................................................................................................15

Inflation................................................................................................................................16

Real interest rate...................................................................................................................18

Government expenditures....................................................................................................19

Taxation policy of Canada...................................................................................................20

Exchange rate regime and exchange rate fluctuation...........................................................22

Two examples of monetary policies in your target country in recent years............................22

Effects of the Global Financial Crisis (GFC) on your target country......................................23

Section 4: Conclusion and recommendation............................................................................23

Recommendation..................................................................................................................25

Reference list............................................................................................................................26

Human capital......................................................................................................................15

Inflation................................................................................................................................16

Real interest rate...................................................................................................................18

Government expenditures....................................................................................................19

Taxation policy of Canada...................................................................................................20

Exchange rate regime and exchange rate fluctuation...........................................................22

Two examples of monetary policies in your target country in recent years............................22

Effects of the Global Financial Crisis (GFC) on your target country......................................23

Section 4: Conclusion and recommendation............................................................................23

Recommendation..................................................................................................................25

Reference list............................................................................................................................26

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4ECONOMICS

Investing in Canada

Section 1: Executive summary

This particular paper analyses the potential of investing in the mining sector of Canada. The

obtained results shows that the Australian should be investing in Canada since this country

has abundant of mineral resources. Therefore, investing in the mining sector would help the

Australians earn a huge amount of profit. The report have found that Canada is a very good

place to do business. Although Australia have some benefits over Canada, due to the end of

the commodity boom , the economy of Australia is facing a stagnant growth. Therefore, it is

highly recommended that the Australian investors should be investing in Canada.

Section 2: Introduction

The Canadian economy is a highly developed mixed economy with the 10th largest gross

domestic product by PPP in the world. The economy of the country is mostly dominated by

the service industry. The service sector is the largest which employs more than three quarters

of Canadians. Canada is a very good country for investing because of the strong geographic

and sectoral clusters. It also have one of the soundest banking system in the world. This

country is one of the world’s most open countries in terms of trade as well as investment in

case of mining. In the year 2015, Canada had been the world’s top destination for

exploration of the non ferrous minerals. Easy access to all the reliable suppliers and the

service contributes leads to the investment success for all the stages (Krupoves, Camus and

De Guire 2015). The top mineral products of Canada were gold, copper, potash, coal as well

as iron ore whose combines value had been more than $24 billion. Therefore, it can be said

that Australia should be investing in the mining sector in Canada since it is one of the

profitable sector for investing.

Investing in Canada

Section 1: Executive summary

This particular paper analyses the potential of investing in the mining sector of Canada. The

obtained results shows that the Australian should be investing in Canada since this country

has abundant of mineral resources. Therefore, investing in the mining sector would help the

Australians earn a huge amount of profit. The report have found that Canada is a very good

place to do business. Although Australia have some benefits over Canada, due to the end of

the commodity boom , the economy of Australia is facing a stagnant growth. Therefore, it is

highly recommended that the Australian investors should be investing in Canada.

Section 2: Introduction

The Canadian economy is a highly developed mixed economy with the 10th largest gross

domestic product by PPP in the world. The economy of the country is mostly dominated by

the service industry. The service sector is the largest which employs more than three quarters

of Canadians. Canada is a very good country for investing because of the strong geographic

and sectoral clusters. It also have one of the soundest banking system in the world. This

country is one of the world’s most open countries in terms of trade as well as investment in

case of mining. In the year 2015, Canada had been the world’s top destination for

exploration of the non ferrous minerals. Easy access to all the reliable suppliers and the

service contributes leads to the investment success for all the stages (Krupoves, Camus and

De Guire 2015). The top mineral products of Canada were gold, copper, potash, coal as well

as iron ore whose combines value had been more than $24 billion. Therefore, it can be said

that Australia should be investing in the mining sector in Canada since it is one of the

profitable sector for investing.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5ECONOMICS

Australia and Canada are known to grant each other preferential tariffs on a limited range of

products which are known to be under the Canadian Australia Trade Agreement.

This particular report is known to provide an insight that whether investing in the mining

sector of Australia will provide the company with significant returns that will be enough to

warrant the investment decisions.

Reasons to invest in the mining sector of Canada

Canada is known to be second largest country where the population is known to exceed more

than 30 million. The business presently benefits as a result of low rate of interest, availability

of credit along with the sound expanding economy. The banks in Canada also have a strong

balance sheet as result of regulation, conservative practice and strong capitalization in the

economy. Australia should be investing in Canada because of the attractive business

environment, strong growth record where Canada is known to lead all G7 countries in the

economic growth. Highly educated workforce, low tax rates, financial stability and incredible

market access. Canada is regarded as one of the best destinations in the world for the mineral

investment. The huge range of commodities along with stable investment climate makes

Canada the leading exporter of metals and minerals. The rich endowment of Canada led to

the development of major mining regions like Labrador Trough on the Quebec

Newfoundland, the nickel copper platinum group elements mines of Ontario, metallurgical

coal belt in Columbia are some of the examples which have abundant of mineral resources in

Canada. Canada has a n immense mineral potential ranging from aluminium to zinc. It is also

the world’s number one producer of potash and the leading producers of aluminium, nickel,

platinum, cobalt, diamond and uranium. Since the year 2002, Canada is known to rank 1st in

Australia and Canada are known to grant each other preferential tariffs on a limited range of

products which are known to be under the Canadian Australia Trade Agreement.

This particular report is known to provide an insight that whether investing in the mining

sector of Australia will provide the company with significant returns that will be enough to

warrant the investment decisions.

Reasons to invest in the mining sector of Canada

Canada is known to be second largest country where the population is known to exceed more

than 30 million. The business presently benefits as a result of low rate of interest, availability

of credit along with the sound expanding economy. The banks in Canada also have a strong

balance sheet as result of regulation, conservative practice and strong capitalization in the

economy. Australia should be investing in Canada because of the attractive business

environment, strong growth record where Canada is known to lead all G7 countries in the

economic growth. Highly educated workforce, low tax rates, financial stability and incredible

market access. Canada is regarded as one of the best destinations in the world for the mineral

investment. The huge range of commodities along with stable investment climate makes

Canada the leading exporter of metals and minerals. The rich endowment of Canada led to

the development of major mining regions like Labrador Trough on the Quebec

Newfoundland, the nickel copper platinum group elements mines of Ontario, metallurgical

coal belt in Columbia are some of the examples which have abundant of mineral resources in

Canada. Canada has a n immense mineral potential ranging from aluminium to zinc. It is also

the world’s number one producer of potash and the leading producers of aluminium, nickel,

platinum, cobalt, diamond and uranium. Since the year 2002, Canada is known to rank 1st in

6ECONOMICS

the non ferrous mineral exploration budgets. In the year 2015, more than 40 companies from

13 countries have known to invested in the mining sector of Canada.

Canada is known to maintain an open economy which is based on the principles and

recognition of the effectiveness of the marketplace. This place can also meet the huge

demand for minerals in the world. This country is the producer of more than sixty different

types of minerals where it is known to produce metals with more than two hundred mines.

For this reason, it can be said that Canada is one of the leading sectors of mining in the world.

This particular country is rich in natural resources. In the year 2017, Canada have produced

more than $8 billion of the mine products which is known to include coal, copper, silver,

molybdenum and other mining products. British Columbia is mainly the centre of mineral

exploration and the world leader in mine health and safety practices. This country is also

known to have a robust venture capital market with a culture of innovation. The Canadian

cities like Toronto as well as Vancouver is known to provide regional bases in order to

support mining as well as allied activities through the financial and other service sectors.

The government of Canada is known to work for accelerating the pace of innovation in the

mining sector through large number of programs which will be encouraging the collaboration

with the private sector companies. For this reason, the foreign mining firms will be able to

take advantage of the Canada’s expertise through research and development programme.

Potica structure: Canada is one of the most politically stable countries in the world. The

budget deficit of Canada is moderate relative to any other jurisdiction in the world. The BoP

of Canada is also quite small enough. This country is known to enjoy a huge trade surplus in

its trade. The volatility in Canada is also comparatively small in nature. over the past few

years Canada also had the smallest downturn of any of the G7 counties.

the non ferrous mineral exploration budgets. In the year 2015, more than 40 companies from

13 countries have known to invested in the mining sector of Canada.

Canada is known to maintain an open economy which is based on the principles and

recognition of the effectiveness of the marketplace. This place can also meet the huge

demand for minerals in the world. This country is the producer of more than sixty different

types of minerals where it is known to produce metals with more than two hundred mines.

For this reason, it can be said that Canada is one of the leading sectors of mining in the world.

This particular country is rich in natural resources. In the year 2017, Canada have produced

more than $8 billion of the mine products which is known to include coal, copper, silver,

molybdenum and other mining products. British Columbia is mainly the centre of mineral

exploration and the world leader in mine health and safety practices. This country is also

known to have a robust venture capital market with a culture of innovation. The Canadian

cities like Toronto as well as Vancouver is known to provide regional bases in order to

support mining as well as allied activities through the financial and other service sectors.

The government of Canada is known to work for accelerating the pace of innovation in the

mining sector through large number of programs which will be encouraging the collaboration

with the private sector companies. For this reason, the foreign mining firms will be able to

take advantage of the Canada’s expertise through research and development programme.

Potica structure: Canada is one of the most politically stable countries in the world. The

budget deficit of Canada is moderate relative to any other jurisdiction in the world. The BoP

of Canada is also quite small enough. This country is known to enjoy a huge trade surplus in

its trade. The volatility in Canada is also comparatively small in nature. over the past few

years Canada also had the smallest downturn of any of the G7 counties.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7ECONOMICS

An economy to bank on : Canada is known to rank 13 out of the 144 countries in the world

economic forum’s global competitiveness index. The competitiveness of Canada is mainly

fuelled by the strong financial market development. Canada is also known to rank first as it

have the soundest banking system out of the 144 global economies.

Mining sector: Canada is known to be the world’s largest source of many minerals which

includes zinc, nickel uranium and lot more. There are than 60 companies in S&P/ TSX

matrials sector (Krupoves, Camus and De Guire 2015). Canada is also known to bee the

major gold producer in the word. For this reason, it can be said that investing in the mining

sector becomes a very resourceful way for investing in the emerging markets without

presence of any political risk since the Canadian listed companies are known to be subject to

the investment rules and regulations of Canada.

Least corrupted country: Canada is known to rank 9th in terms of least corrupted country in

the world. According to the 2018 corruption Index, it can be said that Canada ranks 9th in

terms of least corrupted nation out of the 175 countries. The index is reported by thee

Transparency International. The corruption index in Canada is known to be 8.38 till the year

2018.

sound banking system: the rating agencies ranks Canadas’ banking system as number one in

the world for the financial strength as well as for safety. The world economic forum is also

known to rank Canada’s banking system to be the soundest in the world. During the time of

the global financial service, none of the Canadian bank nor the insurance company had been

affected. The banks in Canada usually operates in oligopoly which leads to very high profit

margins and there is also an implicit promise of the government protection in case of any

drop off.

An economy to bank on : Canada is known to rank 13 out of the 144 countries in the world

economic forum’s global competitiveness index. The competitiveness of Canada is mainly

fuelled by the strong financial market development. Canada is also known to rank first as it

have the soundest banking system out of the 144 global economies.

Mining sector: Canada is known to be the world’s largest source of many minerals which

includes zinc, nickel uranium and lot more. There are than 60 companies in S&P/ TSX

matrials sector (Krupoves, Camus and De Guire 2015). Canada is also known to bee the

major gold producer in the word. For this reason, it can be said that investing in the mining

sector becomes a very resourceful way for investing in the emerging markets without

presence of any political risk since the Canadian listed companies are known to be subject to

the investment rules and regulations of Canada.

Least corrupted country: Canada is known to rank 9th in terms of least corrupted country in

the world. According to the 2018 corruption Index, it can be said that Canada ranks 9th in

terms of least corrupted nation out of the 175 countries. The index is reported by thee

Transparency International. The corruption index in Canada is known to be 8.38 till the year

2018.

sound banking system: the rating agencies ranks Canadas’ banking system as number one in

the world for the financial strength as well as for safety. The world economic forum is also

known to rank Canada’s banking system to be the soundest in the world. During the time of

the global financial service, none of the Canadian bank nor the insurance company had been

affected. The banks in Canada usually operates in oligopoly which leads to very high profit

margins and there is also an implicit promise of the government protection in case of any

drop off.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8ECONOMICS

Canada means business: Canada is known to rank 7th in terms of the best country to do

business in the world. This country is known to rank first in the world for personal freedom,

third in the world for red tape, sixth in terms of investor protection. Canada is known to rank

7th in the world of trade freedom and 9th in the world for tax burden and property rights. The

stable economy, high standards of living, high quality education and a successful business

culture promotes growth and innovation attracts foreign investors.

Section 3: Analysis and discussion

General business environment

Canada is known to be a highly mixed developed economy in the world where it is ranked to

be the 10th largest in terms of the gross domestic product. The manufacturing, mining and the

service sector mainly dominates the Canadian economy. It has been found out that Canada

maintains a liberal trade regime in the economy. There are no restrictions in case of foreign

exchange. There is however a need of the import license for only a limited number of goods.

Starting a business:

starting a business takes into account the number of procedures, cost, time and minimum

capital needed for a small to medium sized company too start up and also formally operate

in each of the economy’s largest business city. This particular indicator is known to measure

the procedures for legally starting and also formally operating a company. It helps in

registration in the economy’s largest business city. Canada is known to rank in terms of

starting a new business. The paid in minimum capital requirement is CAD 0 that takes place

in Toronto (Doingbusiness.org. 2019). Officially there are no cost and no bribes for

completing the procedure and no professional fees are taken until and unless the service

required by the law or are commonly practiced. The funds which are deposited in the bank or

with the third party before registration up to 3 months after the incorporation.

Canada means business: Canada is known to rank 7th in terms of the best country to do

business in the world. This country is known to rank first in the world for personal freedom,

third in the world for red tape, sixth in terms of investor protection. Canada is known to rank

7th in the world of trade freedom and 9th in the world for tax burden and property rights. The

stable economy, high standards of living, high quality education and a successful business

culture promotes growth and innovation attracts foreign investors.

Section 3: Analysis and discussion

General business environment

Canada is known to be a highly mixed developed economy in the world where it is ranked to

be the 10th largest in terms of the gross domestic product. The manufacturing, mining and the

service sector mainly dominates the Canadian economy. It has been found out that Canada

maintains a liberal trade regime in the economy. There are no restrictions in case of foreign

exchange. There is however a need of the import license for only a limited number of goods.

Starting a business:

starting a business takes into account the number of procedures, cost, time and minimum

capital needed for a small to medium sized company too start up and also formally operate

in each of the economy’s largest business city. This particular indicator is known to measure

the procedures for legally starting and also formally operating a company. It helps in

registration in the economy’s largest business city. Canada is known to rank in terms of

starting a new business. The paid in minimum capital requirement is CAD 0 that takes place

in Toronto (Doingbusiness.org. 2019). Officially there are no cost and no bribes for

completing the procedure and no professional fees are taken until and unless the service

required by the law or are commonly practiced. The funds which are deposited in the bank or

with the third party before registration up to 3 months after the incorporation.

9ECONOMICS

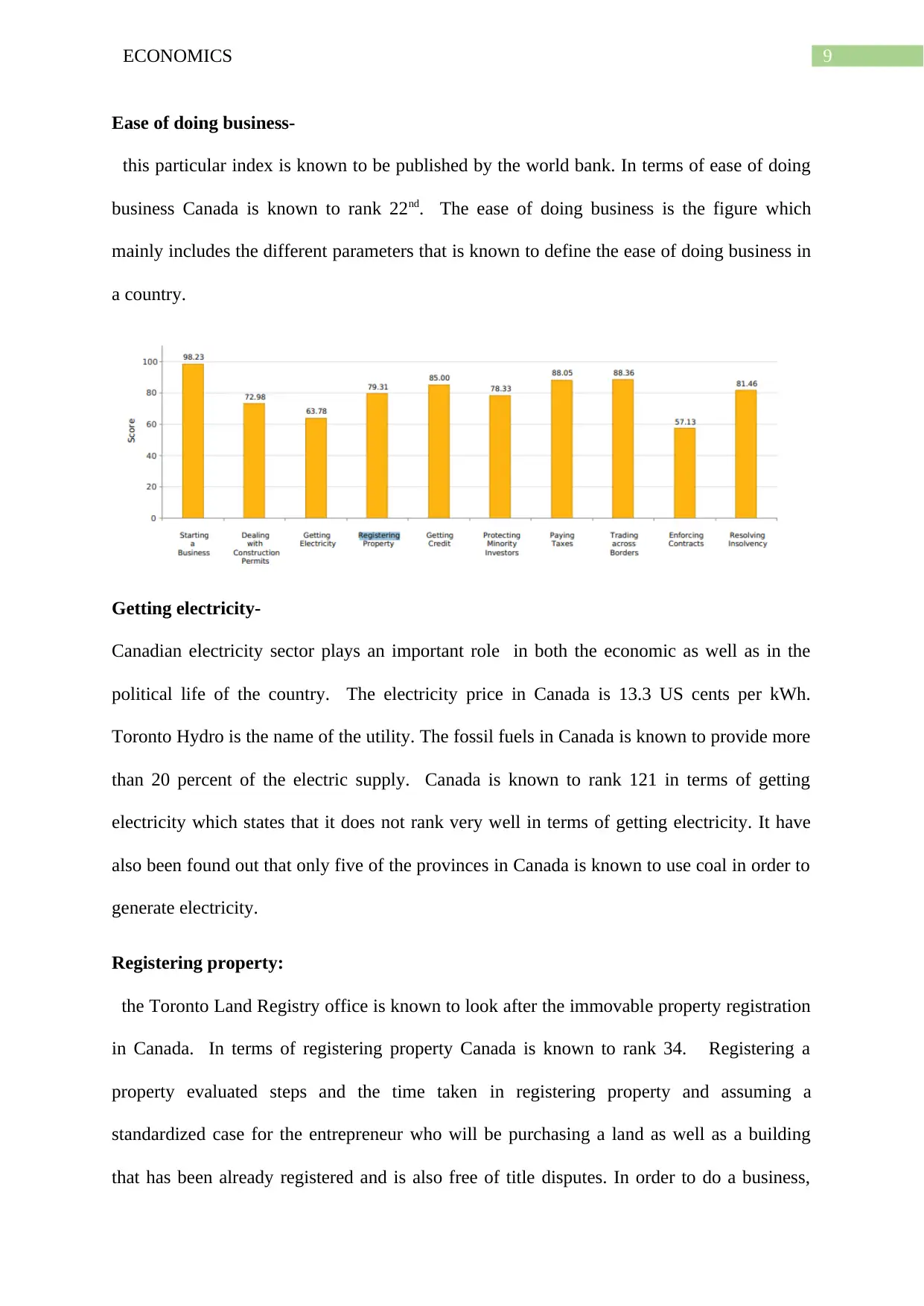

Ease of doing business-

this particular index is known to be published by the world bank. In terms of ease of doing

business Canada is known to rank 22nd. The ease of doing business is the figure which

mainly includes the different parameters that is known to define the ease of doing business in

a country.

Getting electricity-

Canadian electricity sector plays an important role in both the economic as well as in the

political life of the country. The electricity price in Canada is 13.3 US cents per kWh.

Toronto Hydro is the name of the utility. The fossil fuels in Canada is known to provide more

than 20 percent of the electric supply. Canada is known to rank 121 in terms of getting

electricity which states that it does not rank very well in terms of getting electricity. It have

also been found out that only five of the provinces in Canada is known to use coal in order to

generate electricity.

Registering property:

the Toronto Land Registry office is known to look after the immovable property registration

in Canada. In terms of registering property Canada is known to rank 34. Registering a

property evaluated steps and the time taken in registering property and assuming a

standardized case for the entrepreneur who will be purchasing a land as well as a building

that has been already registered and is also free of title disputes. In order to do a business,

Ease of doing business-

this particular index is known to be published by the world bank. In terms of ease of doing

business Canada is known to rank 22nd. The ease of doing business is the figure which

mainly includes the different parameters that is known to define the ease of doing business in

a country.

Getting electricity-

Canadian electricity sector plays an important role in both the economic as well as in the

political life of the country. The electricity price in Canada is 13.3 US cents per kWh.

Toronto Hydro is the name of the utility. The fossil fuels in Canada is known to provide more

than 20 percent of the electric supply. Canada is known to rank 121 in terms of getting

electricity which states that it does not rank very well in terms of getting electricity. It have

also been found out that only five of the provinces in Canada is known to use coal in order to

generate electricity.

Registering property:

the Toronto Land Registry office is known to look after the immovable property registration

in Canada. In terms of registering property Canada is known to rank 34. Registering a

property evaluated steps and the time taken in registering property and assuming a

standardized case for the entrepreneur who will be purchasing a land as well as a building

that has been already registered and is also free of title disputes. In order to do a business,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10ECONOMICS

registering a property is very essential. There are also presence of procedures of pre

registration like checking for liens along with paying for property transfer taxes.

Dealing with the construction permits:

the regulation of construction is known to matter a lot for the public safety. When the

procedures will be getting too much complicated, builders can proceed without any permit. In

most of the countries.

Protecting minority investors:

Canada is known to rank 11th in terms of protecting the minority investors

(Doingbusiness.org. 2019) The protection of minority investors is the score which is used for

measuring the strength of the protections of the minority shareholders against the mis usage

of the corporate asses for their personal gain. The Board of Directors is known to take

decisions in order to approve the transaction of both the buyer as well as the sellers.

Getting credit:

this particular criteria is known to explore any of the two sets of issues related to the

strength of the credit reporting system. The other issue is the effectiveness of collateral and

the laws which are very well related to bankruptcy in order to facilitate lending. Therefore,

for getting credit in order to do business, Canada is known to rank 12th. thee credit score is the

three digit number which is known to allow the lender to determine the credit risk for the

potential borrowers. Thee name of the two famous credit bureaus are Equifax and

TransUnion.

Enforcing contracts:

the enforcing contracts claim value of Canada is CAD 110,205 where the court’s name is

Ontario Superior Court of Justice. The time taken for enforcing contracts is more than 900

days. Canada is known to rank 96 in terms of enforcing contracts.

registering a property is very essential. There are also presence of procedures of pre

registration like checking for liens along with paying for property transfer taxes.

Dealing with the construction permits:

the regulation of construction is known to matter a lot for the public safety. When the

procedures will be getting too much complicated, builders can proceed without any permit. In

most of the countries.

Protecting minority investors:

Canada is known to rank 11th in terms of protecting the minority investors

(Doingbusiness.org. 2019) The protection of minority investors is the score which is used for

measuring the strength of the protections of the minority shareholders against the mis usage

of the corporate asses for their personal gain. The Board of Directors is known to take

decisions in order to approve the transaction of both the buyer as well as the sellers.

Getting credit:

this particular criteria is known to explore any of the two sets of issues related to the

strength of the credit reporting system. The other issue is the effectiveness of collateral and

the laws which are very well related to bankruptcy in order to facilitate lending. Therefore,

for getting credit in order to do business, Canada is known to rank 12th. thee credit score is the

three digit number which is known to allow the lender to determine the credit risk for the

potential borrowers. Thee name of the two famous credit bureaus are Equifax and

TransUnion.

Enforcing contracts:

the enforcing contracts claim value of Canada is CAD 110,205 where the court’s name is

Ontario Superior Court of Justice. The time taken for enforcing contracts is more than 900

days. Canada is known to rank 96 in terms of enforcing contracts.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11ECONOMICS

Resolving insolvency:

this is the time, cost as well as the outcome recovery rate in case of a commercial insolvency

along with the strength of the legal framework for the insolvency. For determining the

present value of the amount that is known to be recovered by the creditors, doing business in

known to use the lending rates from the international monetary fund. Canada is known to

rank 13 in terms of resolving insolvency.

Trading across borders:

The trading across borders is known to take into account the time and cost needed for

exporting the products of comparative advantage and then import the auto parts. The doing

business is known to measure the cost and time associated with the three set of producers

which are the documentary compliance, domestic transport as well as border compliance.

This takes place within the overall process of exporting and importing the shipment of goods

(Doingbusiness.org. 2019). The documentary compliance is known to obtain, prepare and

submit the documents during the time of transportation , inspection and clearance it is known

to cover all the documents that is required by law and practice which also incudes electronic

submission of information. Here in this case of trading across borders Canada is known to

rank 50.

Getting electricity-

Canadian electricity sector plays an important role in both the economic as well as in the

political life of the country (Doingbusiness.org. 2019). The electricity price in Canada is 13.3

US cents per kWh. Toronto Hydro is the name of the utility. The fossil fuels in Canada is

known to provide more than 20 percent of the electric supply. Canada is known to rank 121

in terms of getting electricity which states that it does not rank very well in terms of getting

electricity. It have also been found out that only five of the provinces in Canada is known to

use coal in order to generate electricity.

Resolving insolvency:

this is the time, cost as well as the outcome recovery rate in case of a commercial insolvency

along with the strength of the legal framework for the insolvency. For determining the

present value of the amount that is known to be recovered by the creditors, doing business in

known to use the lending rates from the international monetary fund. Canada is known to

rank 13 in terms of resolving insolvency.

Trading across borders:

The trading across borders is known to take into account the time and cost needed for

exporting the products of comparative advantage and then import the auto parts. The doing

business is known to measure the cost and time associated with the three set of producers

which are the documentary compliance, domestic transport as well as border compliance.

This takes place within the overall process of exporting and importing the shipment of goods

(Doingbusiness.org. 2019). The documentary compliance is known to obtain, prepare and

submit the documents during the time of transportation , inspection and clearance it is known

to cover all the documents that is required by law and practice which also incudes electronic

submission of information. Here in this case of trading across borders Canada is known to

rank 50.

Getting electricity-

Canadian electricity sector plays an important role in both the economic as well as in the

political life of the country (Doingbusiness.org. 2019). The electricity price in Canada is 13.3

US cents per kWh. Toronto Hydro is the name of the utility. The fossil fuels in Canada is

known to provide more than 20 percent of the electric supply. Canada is known to rank 121

in terms of getting electricity which states that it does not rank very well in terms of getting

electricity. It have also been found out that only five of the provinces in Canada is known to

use coal in order to generate electricity.

12ECONOMICS

Paying taxes:

the topic of paying the taxes is known to record the taxes along with the mandatory

contributions which a medium sized company should be paying or withholding in a given

period of time. The administrative burden of paying the taxes and the contributions comply

with the post filing procedures. This particular indicator is known to measure the tax

payments for a manufacturing company in the year 2017. It also takes into account the total

number of taxes and the contribution paid or withheld. The three most important kind off

taxes are value added tax, sales tax and the goods and service tax. Canada is known to rank

19 in terms of paying taxes.

General conclusion:

from the above categories from doing business it can be said that Canada is a very suitable

place for doing business. It is known to rank third in terms of starting a new business which

implies that there will be no difficulty in investing in the mining sectors of Canada. There is

absence of any cost for starting a new business in Canada. However, in terms of getting

electricity Canada is known to rank 121, which means getting electricity is little difficult

here. In terms of trading across border Canada is known to rank 50 which states that the

difficulty in exporting and importing business will be little difficult in nature. in terms of

payment of tax Canada is known to rank 19 which is also quite good in nature. Canada ranks

11th in terms of protecting the minority businesses. Therefore the small to medium sized

companies will not be facing too much difficulty in terms of starting a new business.

Registering a new property is also not very difficult in Canada although it is known to rank

34.

Paying taxes:

the topic of paying the taxes is known to record the taxes along with the mandatory

contributions which a medium sized company should be paying or withholding in a given

period of time. The administrative burden of paying the taxes and the contributions comply

with the post filing procedures. This particular indicator is known to measure the tax

payments for a manufacturing company in the year 2017. It also takes into account the total

number of taxes and the contribution paid or withheld. The three most important kind off

taxes are value added tax, sales tax and the goods and service tax. Canada is known to rank

19 in terms of paying taxes.

General conclusion:

from the above categories from doing business it can be said that Canada is a very suitable

place for doing business. It is known to rank third in terms of starting a new business which

implies that there will be no difficulty in investing in the mining sectors of Canada. There is

absence of any cost for starting a new business in Canada. However, in terms of getting

electricity Canada is known to rank 121, which means getting electricity is little difficult

here. In terms of trading across border Canada is known to rank 50 which states that the

difficulty in exporting and importing business will be little difficult in nature. in terms of

payment of tax Canada is known to rank 19 which is also quite good in nature. Canada ranks

11th in terms of protecting the minority businesses. Therefore the small to medium sized

companies will not be facing too much difficulty in terms of starting a new business.

Registering a new property is also not very difficult in Canada although it is known to rank

34.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 32

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.