ECO511 Economics for Business: Market Structures & Policy Analysis

VerifiedAdded on 2023/06/12

|15

|3631

|173

Homework Assignment

AI Summary

This assignment delves into various economic concepts within the context of business, focusing on market structures and government policies in Australia. It analyzes the impact of excise tax increases on the tobacco industry, examining supply and demand dynamics and the incidence of tax burden. Furthermore, it explores different market structures like perfect competition, monopolistic competition, and oligopoly, providing examples and equilibrium analysis. The assignment also discusses the economic rationale behind merging local government councils in Australia, highlighting economies of scale and capacity. Desklib offers a platform for students to access similar solved assignments and past papers for comprehensive study support.

Running head: ECONOMICS FOR BUSINESS

Economics for business

Name of the student

Name of the university

Author Note

Economics for business

Name of the student

Name of the university

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR BUSINESS

Table of Contents

Assignment 2:.............................................................................................................................2

Answer 1:...................................................................................................................................2

Answer 2:...................................................................................................................................5

a).............................................................................................................................................5

b)............................................................................................................................................6

Answer 3:...................................................................................................................................8

References:...............................................................................................................................10

Table of Contents

Assignment 2:.............................................................................................................................2

Answer 1:...................................................................................................................................2

Answer 2:...................................................................................................................................5

a).............................................................................................................................................5

b)............................................................................................................................................6

Answer 3:...................................................................................................................................8

References:...............................................................................................................................10

2ECONOMICS FOR BUSINESS

Assignment 2:

Answer 1:

The Australian government has increased the excise rate of tobacco by 12.5% as at 1st

January, 2018 (Health.gov.au, 2018). Hence, the producer has charged the price of a standard

20 packet of cigarettes including this tax rate.

Here, the price of a standard packet of cigarette is $ 30 including 12.5% tax rate.

Let, the before tax price of a standard packet of cigarette is $ X.

Hence, after imposition of tax, this price has become $ (X+ 12.5% of X), which is

equal to $ 30, that is, (X+ 12.5% of X) = 30…… (1).

By calculating equating 1, the value of X can be obtained.

(X+ 12.5% of X) = 30

X + (X/8) = 30

8X + X = 30 * 8

9X = 240

X = 240/9

X = 26.67

Thus, from this calculation, it can be stated that the before tax price is $ 26.67.

After imposition of a tax, the supplier can reduce the supply of this product, as it leads

the production cost of tobacco to increase further (Ross, Tesche & Vellios, 2017). This

can be discussed with the help of a suitable diagram of demand and supply.

Assignment 2:

Answer 1:

The Australian government has increased the excise rate of tobacco by 12.5% as at 1st

January, 2018 (Health.gov.au, 2018). Hence, the producer has charged the price of a standard

20 packet of cigarettes including this tax rate.

Here, the price of a standard packet of cigarette is $ 30 including 12.5% tax rate.

Let, the before tax price of a standard packet of cigarette is $ X.

Hence, after imposition of tax, this price has become $ (X+ 12.5% of X), which is

equal to $ 30, that is, (X+ 12.5% of X) = 30…… (1).

By calculating equating 1, the value of X can be obtained.

(X+ 12.5% of X) = 30

X + (X/8) = 30

8X + X = 30 * 8

9X = 240

X = 240/9

X = 26.67

Thus, from this calculation, it can be stated that the before tax price is $ 26.67.

After imposition of a tax, the supplier can reduce the supply of this product, as it leads

the production cost of tobacco to increase further (Ross, Tesche & Vellios, 2017). This

can be discussed with the help of a suitable diagram of demand and supply.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR BUSINESS

Figure 1: shift in supply of tobacco

Source: (created by author)

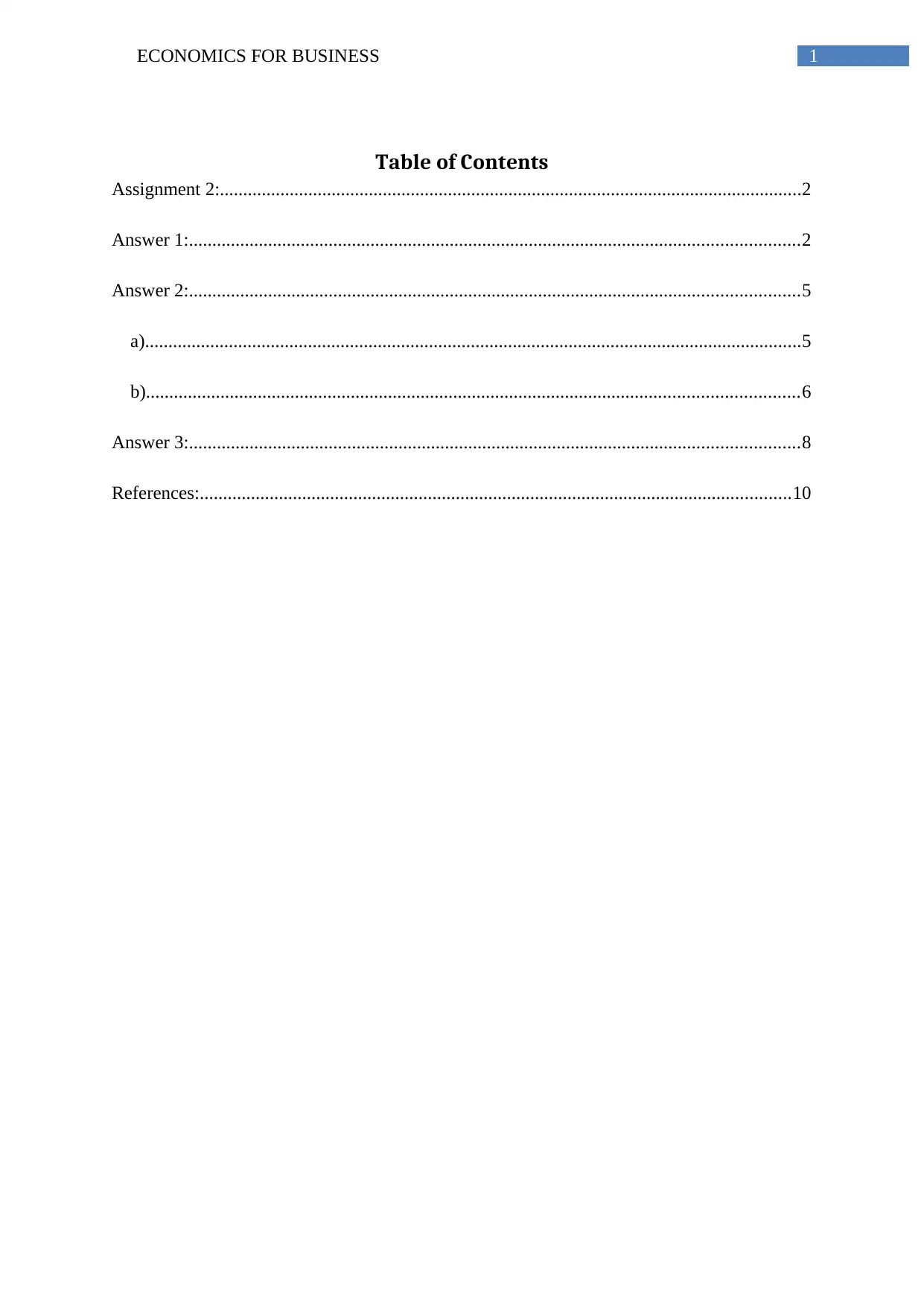

In figure 1, the demand and supply of tobacco has been drawn. The initial supply

curve is denoted by S0 along with the initial demand curve D0. The amount of market

equilibrium can be determined by equating these two curves. In the above figure,

equilibrium level of output is Q0 and corresponding level of price is P0. However, after

imposition of tax, supplier has reduced the supply of tobacco and this in turn has shifted

the supply curve toward left, that is, from S0 to S1. Consequently, price has increased by

P0 P1 unit while the quantity supplied of tobacco has decreased by Q0 Q1 unit (Zoutman,

Gavrilova & Hopland, 2018). Thus, after imposition of tax, the cost of tobacco production

has increased consequently and to cover this excess cost, the seller has increased the price

of this concerned product.

To determine the actual taxpayer, it is essential to discuss about the impact and

incidence of tax to analyze the share of tax burden between sellers and buyers (Farrell,

2017). In this context, the tax is imposed on the seller and this in turn has increased the

cost of production of this concerned person. Consequently, the seller has increased the

price of tobacco, as it is an inelastic good. This means, after increase in price, the demand

Figure 1: shift in supply of tobacco

Source: (created by author)

In figure 1, the demand and supply of tobacco has been drawn. The initial supply

curve is denoted by S0 along with the initial demand curve D0. The amount of market

equilibrium can be determined by equating these two curves. In the above figure,

equilibrium level of output is Q0 and corresponding level of price is P0. However, after

imposition of tax, supplier has reduced the supply of tobacco and this in turn has shifted

the supply curve toward left, that is, from S0 to S1. Consequently, price has increased by

P0 P1 unit while the quantity supplied of tobacco has decreased by Q0 Q1 unit (Zoutman,

Gavrilova & Hopland, 2018). Thus, after imposition of tax, the cost of tobacco production

has increased consequently and to cover this excess cost, the seller has increased the price

of this concerned product.

To determine the actual taxpayer, it is essential to discuss about the impact and

incidence of tax to analyze the share of tax burden between sellers and buyers (Farrell,

2017). In this context, the tax is imposed on the seller and this in turn has increased the

cost of production of this concerned person. Consequently, the seller has increased the

price of tobacco, as it is an inelastic good. This means, after increase in price, the demand

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR BUSINESS

for this product cannot be decreased. Hence, by paying higher amount of price, buyers are

bearing this tax. Thus, it is an indirect tax, where tax is imposed on one person and is paid

by another one.

The demand for tobacco can be obtained from the perspective of a consumer.

According to the law of demand, price of a product has inverse relation with its quantity

demanded while other factors are considered as fixed (Kannai & Selden, 2014). Here,

other factors are consumers’ income along with their tastes and preferences and price of

relative commodities. However, increase in price of tobacco does not influence its

demand by large extend for those people, who are addicted to it. Hence, the demand law

is not strongly applicable in this situation (Doogan, Wewers & Berman, 2018). For this

reason, inelastic demand curve for this specified product can be observed. This means, the

percentage change in quantity demanded for tobacco is less compare to its percentage

change in its price. Hence, the demand curve is a steeper one with negative slope (Gray et

al., 2017). Consequently, by increasing the price with significant amount, the demand for

tobacco cannot be reduced within the market. The above figure has supported the view,

where the degree of price has changed, that is P0P1 unit, is greater compare to the amount

of change in quantity demanded, that is Q0Q1 unit.

That is, Own-price elasticity of tobacco (Et) = percentage change in quantity demand

for tobacco/ percentage change in its

price

Where, the amount of P0P1 > the amount of Q0Q1

Thus, this phenomenon has helped seller to shift the tax on consumers.

for this product cannot be decreased. Hence, by paying higher amount of price, buyers are

bearing this tax. Thus, it is an indirect tax, where tax is imposed on one person and is paid

by another one.

The demand for tobacco can be obtained from the perspective of a consumer.

According to the law of demand, price of a product has inverse relation with its quantity

demanded while other factors are considered as fixed (Kannai & Selden, 2014). Here,

other factors are consumers’ income along with their tastes and preferences and price of

relative commodities. However, increase in price of tobacco does not influence its

demand by large extend for those people, who are addicted to it. Hence, the demand law

is not strongly applicable in this situation (Doogan, Wewers & Berman, 2018). For this

reason, inelastic demand curve for this specified product can be observed. This means, the

percentage change in quantity demanded for tobacco is less compare to its percentage

change in its price. Hence, the demand curve is a steeper one with negative slope (Gray et

al., 2017). Consequently, by increasing the price with significant amount, the demand for

tobacco cannot be reduced within the market. The above figure has supported the view,

where the degree of price has changed, that is P0P1 unit, is greater compare to the amount

of change in quantity demanded, that is Q0Q1 unit.

That is, Own-price elasticity of tobacco (Et) = percentage change in quantity demand

for tobacco/ percentage change in its

price

Where, the amount of P0P1 > the amount of Q0Q1

Thus, this phenomenon has helped seller to shift the tax on consumers.

5ECONOMICS FOR BUSINESS

Answer 2:

a)

Q TC ATC(TC/

Q)

TFC AFC(TFC =

50/Q)

TVC (TC-

TFC)

AVC

(TVC/Q)

MC

0 50 50 50 50 0 0 50

1 100 100 50 50 50 50 50

2 140 70 50 25 90 45 40

3 170 56.666666

67

50 16.66666667 120 40 30

4 190 47.5 50 12.5 140 35 20

5 210 42 50 10 160 32 20

6 230 38.333333

33

50 8.333333333 180 30 20

7 260 37.142857

14

50 7.142857143 210 30 30

8 300 37.5 50 6.25 250 31.25 40

9 350 38.888888

89

50 5.555555556 300 33.333333

33

50

10 410 41 50 5 360 36 60

Table 1: ATC, AFC, AVC, MC of a perfectly competitive firm

In table 1, Q and TC denote different levels of output and total cost, respectively.

With the help of those data, average total costs (ATC), average fixed costs (AFC), average

variable costs (AVC) and marginal costs (MC) have been determined. For different level of

output, ATC can be obtained by dividing total cost with its corresponding output (de Jong et

al., 2017). Moreover, the firm has bear 50 amount of total cost, when output has remained nil.

This implies that the total fixed cost of this firm is 50 units, which is fixed for each level of

output. Hence, by dividing total fixed cost with the number of output of each level, average

fixed cost can be obtained. Total variable costs, on the other side, can be determined as well.

The difference between total cost and total fixed cost of each output level has provided the

total variable cost (Garmon, 2017). This cost is required to divide with the number of output

by which, average variable cost can be obtained. Marginal cost represents the difference

between total costs when one unit of extra output has been produced.

Answer 2:

a)

Q TC ATC(TC/

Q)

TFC AFC(TFC =

50/Q)

TVC (TC-

TFC)

AVC

(TVC/Q)

MC

0 50 50 50 50 0 0 50

1 100 100 50 50 50 50 50

2 140 70 50 25 90 45 40

3 170 56.666666

67

50 16.66666667 120 40 30

4 190 47.5 50 12.5 140 35 20

5 210 42 50 10 160 32 20

6 230 38.333333

33

50 8.333333333 180 30 20

7 260 37.142857

14

50 7.142857143 210 30 30

8 300 37.5 50 6.25 250 31.25 40

9 350 38.888888

89

50 5.555555556 300 33.333333

33

50

10 410 41 50 5 360 36 60

Table 1: ATC, AFC, AVC, MC of a perfectly competitive firm

In table 1, Q and TC denote different levels of output and total cost, respectively.

With the help of those data, average total costs (ATC), average fixed costs (AFC), average

variable costs (AVC) and marginal costs (MC) have been determined. For different level of

output, ATC can be obtained by dividing total cost with its corresponding output (de Jong et

al., 2017). Moreover, the firm has bear 50 amount of total cost, when output has remained nil.

This implies that the total fixed cost of this firm is 50 units, which is fixed for each level of

output. Hence, by dividing total fixed cost with the number of output of each level, average

fixed cost can be obtained. Total variable costs, on the other side, can be determined as well.

The difference between total cost and total fixed cost of each output level has provided the

total variable cost (Garmon, 2017). This cost is required to divide with the number of output

by which, average variable cost can be obtained. Marginal cost represents the difference

between total costs when one unit of extra output has been produced.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR BUSINESS

Under perfect competition, short-run equilibrium can be determined at a particular

level, where price and marginal cost equate with each other. Here, the marginal cost for 7 unit

of output is $ 30 and for 8 unit of output, this cost is $40. Thus, at $35 dollar price level, the

producer can produce any amount of output between 7 and 8 (Huang, Ueng & Hu, 2017).

However, for the long run, the firm has obtained its equilibrium position when price equates

with marginal cost while the average cost has remained at its minimum level. This is because,

under long run, each firm has received the normal profit only. This means, at long run

equilibrium, price, marginal cost and average become equal. From the above table, it can be

seen that the minimum AC is $ 37.14285714 at output level 7 while at output level 8, it has

become $ 37.5. Hence, the amount of equilibrium output for this perfectly competitive firm

cannot be obtained in the long run (Kolmar & Hoffmann, 2018). Rather, the firm can exit

from the market due to its higher level of cost.

b)

Monopolistic competition:

This market structure has consisted with the characteristics of both perfectly

competitive market along with monopoly one. Hence, under this monopolistic competitive

market, large numbers of sellers or firms can be seen while they can freely exist from the

market or can enter into the one. In addition to this, the market has also possessed large

numbers of buyers (Bertoletti & Etro, 2017). These characteristics are similar like the

perfectly competitive one. However, the chief feature of this monopolistic competitive firm is

the ability to sale slightly different products, which are close substitute but cannot perfectly

substitute. From this perspective, each firm has enjoyed monopoly nature (Mahoney & Weyl,

2017). Hence, it has possessed negatively sloped demand curve and consequently can charge

higher or lower prices compare to other firms. Thus, to sell their products in market, firms

have required to advertising those, due to strong level of competition among them.

Under perfect competition, short-run equilibrium can be determined at a particular

level, where price and marginal cost equate with each other. Here, the marginal cost for 7 unit

of output is $ 30 and for 8 unit of output, this cost is $40. Thus, at $35 dollar price level, the

producer can produce any amount of output between 7 and 8 (Huang, Ueng & Hu, 2017).

However, for the long run, the firm has obtained its equilibrium position when price equates

with marginal cost while the average cost has remained at its minimum level. This is because,

under long run, each firm has received the normal profit only. This means, at long run

equilibrium, price, marginal cost and average become equal. From the above table, it can be

seen that the minimum AC is $ 37.14285714 at output level 7 while at output level 8, it has

become $ 37.5. Hence, the amount of equilibrium output for this perfectly competitive firm

cannot be obtained in the long run (Kolmar & Hoffmann, 2018). Rather, the firm can exit

from the market due to its higher level of cost.

b)

Monopolistic competition:

This market structure has consisted with the characteristics of both perfectly

competitive market along with monopoly one. Hence, under this monopolistic competitive

market, large numbers of sellers or firms can be seen while they can freely exist from the

market or can enter into the one. In addition to this, the market has also possessed large

numbers of buyers (Bertoletti & Etro, 2017). These characteristics are similar like the

perfectly competitive one. However, the chief feature of this monopolistic competitive firm is

the ability to sale slightly different products, which are close substitute but cannot perfectly

substitute. From this perspective, each firm has enjoyed monopoly nature (Mahoney & Weyl,

2017). Hence, it has possessed negatively sloped demand curve and consequently can charge

higher or lower prices compare to other firms. Thus, to sell their products in market, firms

have required to advertising those, due to strong level of competition among them.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR BUSINESS

Figure 2: Monopolistic competitive market

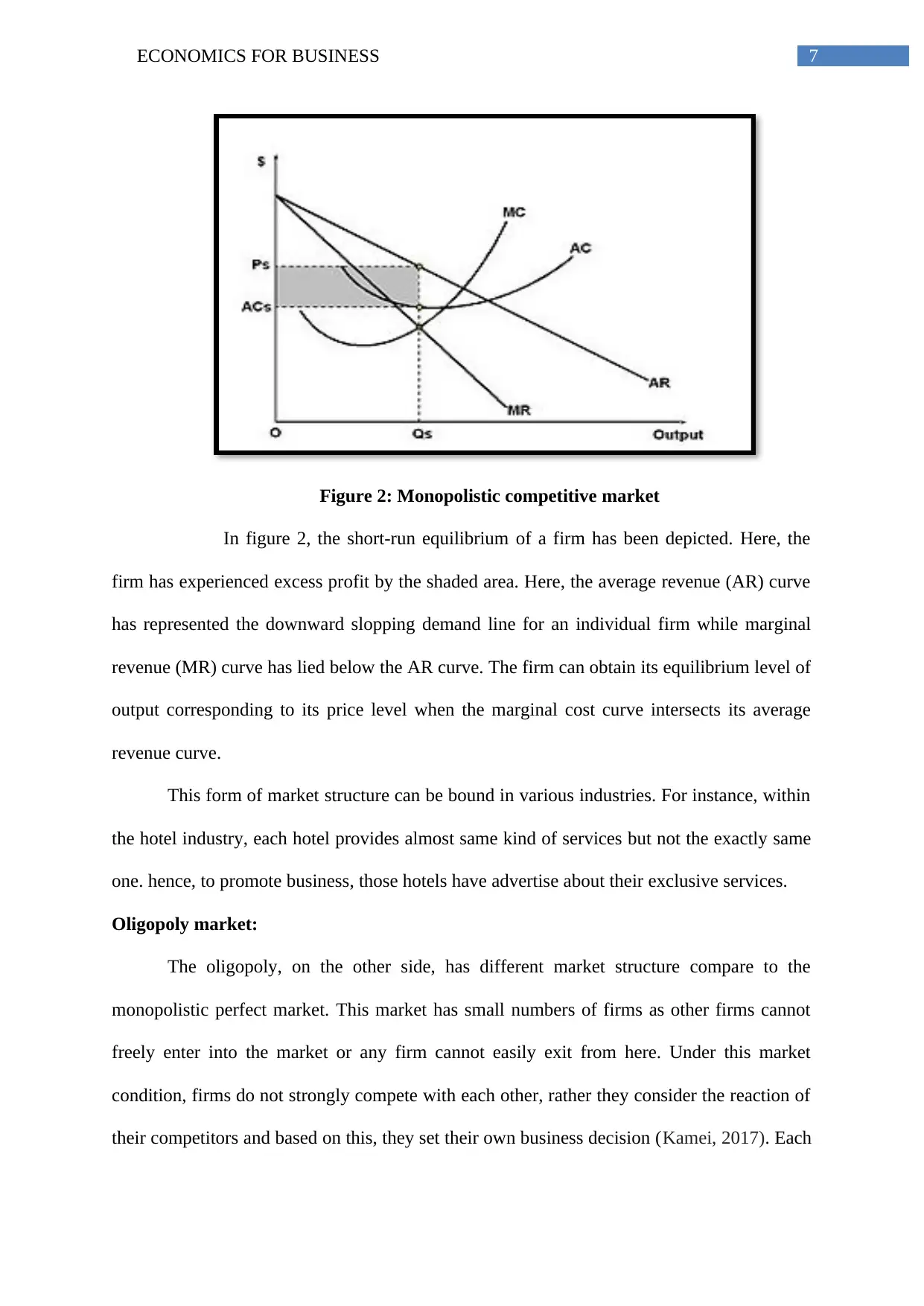

In figure 2, the short-run equilibrium of a firm has been depicted. Here, the

firm has experienced excess profit by the shaded area. Here, the average revenue (AR) curve

has represented the downward slopping demand line for an individual firm while marginal

revenue (MR) curve has lied below the AR curve. The firm can obtain its equilibrium level of

output corresponding to its price level when the marginal cost curve intersects its average

revenue curve.

This form of market structure can be bound in various industries. For instance, within

the hotel industry, each hotel provides almost same kind of services but not the exactly same

one. hence, to promote business, those hotels have advertise about their exclusive services.

Oligopoly market:

The oligopoly, on the other side, has different market structure compare to the

monopolistic perfect market. This market has small numbers of firms as other firms cannot

freely enter into the market or any firm cannot easily exit from here. Under this market

condition, firms do not strongly compete with each other, rather they consider the reaction of

their competitors and based on this, they set their own business decision (Kamei, 2017). Each

Figure 2: Monopolistic competitive market

In figure 2, the short-run equilibrium of a firm has been depicted. Here, the

firm has experienced excess profit by the shaded area. Here, the average revenue (AR) curve

has represented the downward slopping demand line for an individual firm while marginal

revenue (MR) curve has lied below the AR curve. The firm can obtain its equilibrium level of

output corresponding to its price level when the marginal cost curve intersects its average

revenue curve.

This form of market structure can be bound in various industries. For instance, within

the hotel industry, each hotel provides almost same kind of services but not the exactly same

one. hence, to promote business, those hotels have advertise about their exclusive services.

Oligopoly market:

The oligopoly, on the other side, has different market structure compare to the

monopolistic perfect market. This market has small numbers of firms as other firms cannot

freely enter into the market or any firm cannot easily exit from here. Under this market

condition, firms do not strongly compete with each other, rather they consider the reaction of

their competitors and based on this, they set their own business decision (Kamei, 2017). Each

8ECONOMICS FOR BUSINESS

firm, within its market strategy, has considered two chief decisions regarding competition and

prices.

In Australia, banking sector has experienced this kind of market structure, where four

large banks have operated their business, viz., Commonwealth Bank of Australia, Australian

and New Zealand Banking Group, Westpac and the National Australian Bank (Bakir, 2017).

Answer 3:

The economic rationale for merging local government councils in some states of

Australia can be described with the help of some economical concepts(Li, Cui & Lu, 2018).

For instance, economies of scale, the capacity of local government, economies of scope along

with administrative and compliance costs can be described over here.

Economies of scale: Under the concept of economies of scale, production cost per unit of

output has decreased when total output has increased simultaneously (Baumers, Dickens,

Tuck & Hague, 2016). This is considered as the chief factor behind mergeing. Within the

concept of optimal size of local governments, economies of scale represent a decline in the

cost per person based on a particular amount of service, while service related population has

increased. Hence, the larger unit of jurisdiction can decrease per capita costs related to

service provision, significantly (Blesse & Baskaran, 2016). In general, economies of scale are

chiefly depended on the technological nature related to production system.

firm, within its market strategy, has considered two chief decisions regarding competition and

prices.

In Australia, banking sector has experienced this kind of market structure, where four

large banks have operated their business, viz., Commonwealth Bank of Australia, Australian

and New Zealand Banking Group, Westpac and the National Australian Bank (Bakir, 2017).

Answer 3:

The economic rationale for merging local government councils in some states of

Australia can be described with the help of some economical concepts(Li, Cui & Lu, 2018).

For instance, economies of scale, the capacity of local government, economies of scope along

with administrative and compliance costs can be described over here.

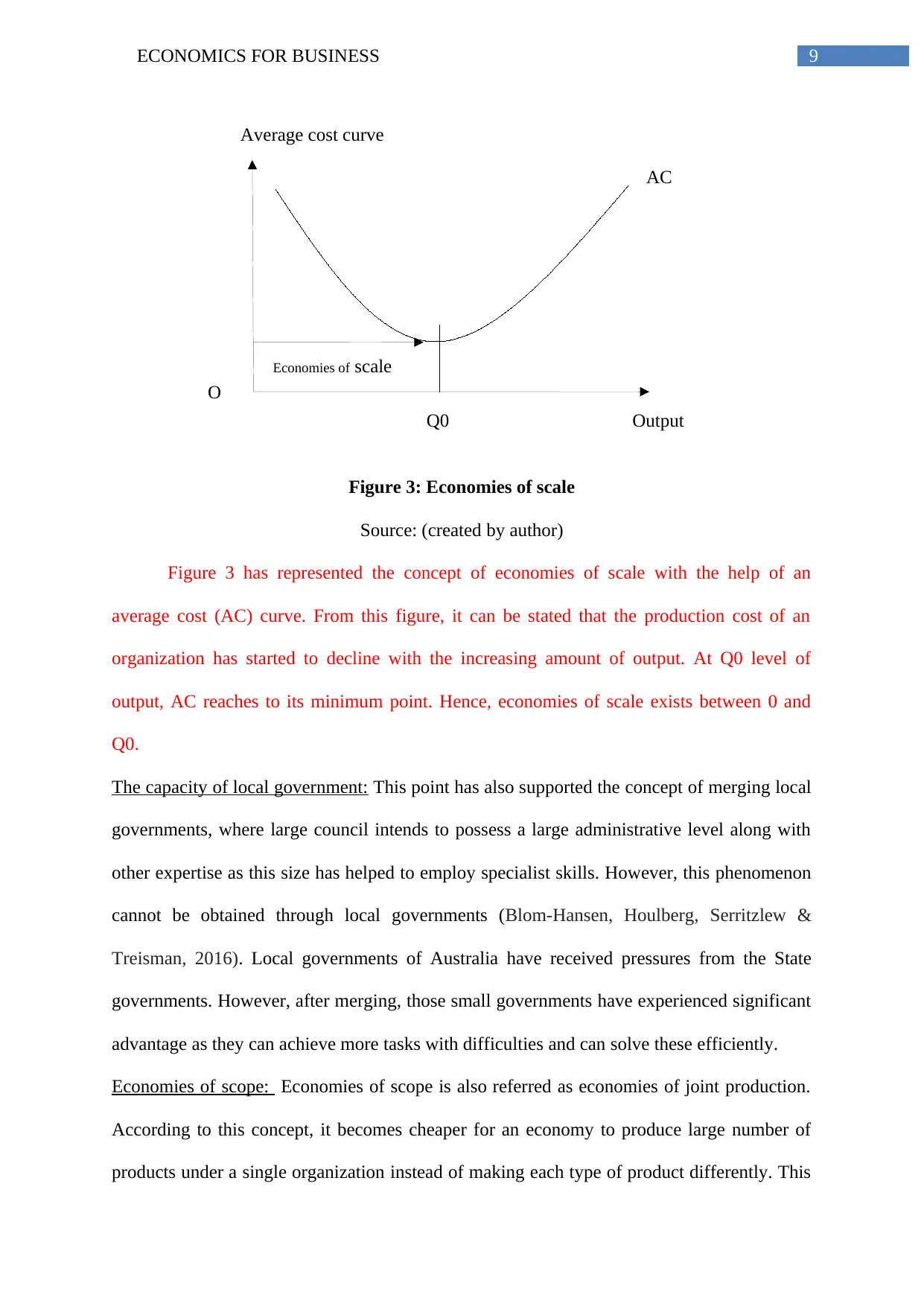

Economies of scale: Under the concept of economies of scale, production cost per unit of

output has decreased when total output has increased simultaneously (Baumers, Dickens,

Tuck & Hague, 2016). This is considered as the chief factor behind mergeing. Within the

concept of optimal size of local governments, economies of scale represent a decline in the

cost per person based on a particular amount of service, while service related population has

increased. Hence, the larger unit of jurisdiction can decrease per capita costs related to

service provision, significantly (Blesse & Baskaran, 2016). In general, economies of scale are

chiefly depended on the technological nature related to production system.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR BUSINESS

Average cost curve

O

Output

AC

Q0

Economies of scale

Figure 3: Economies of scale

Source: (created by author)

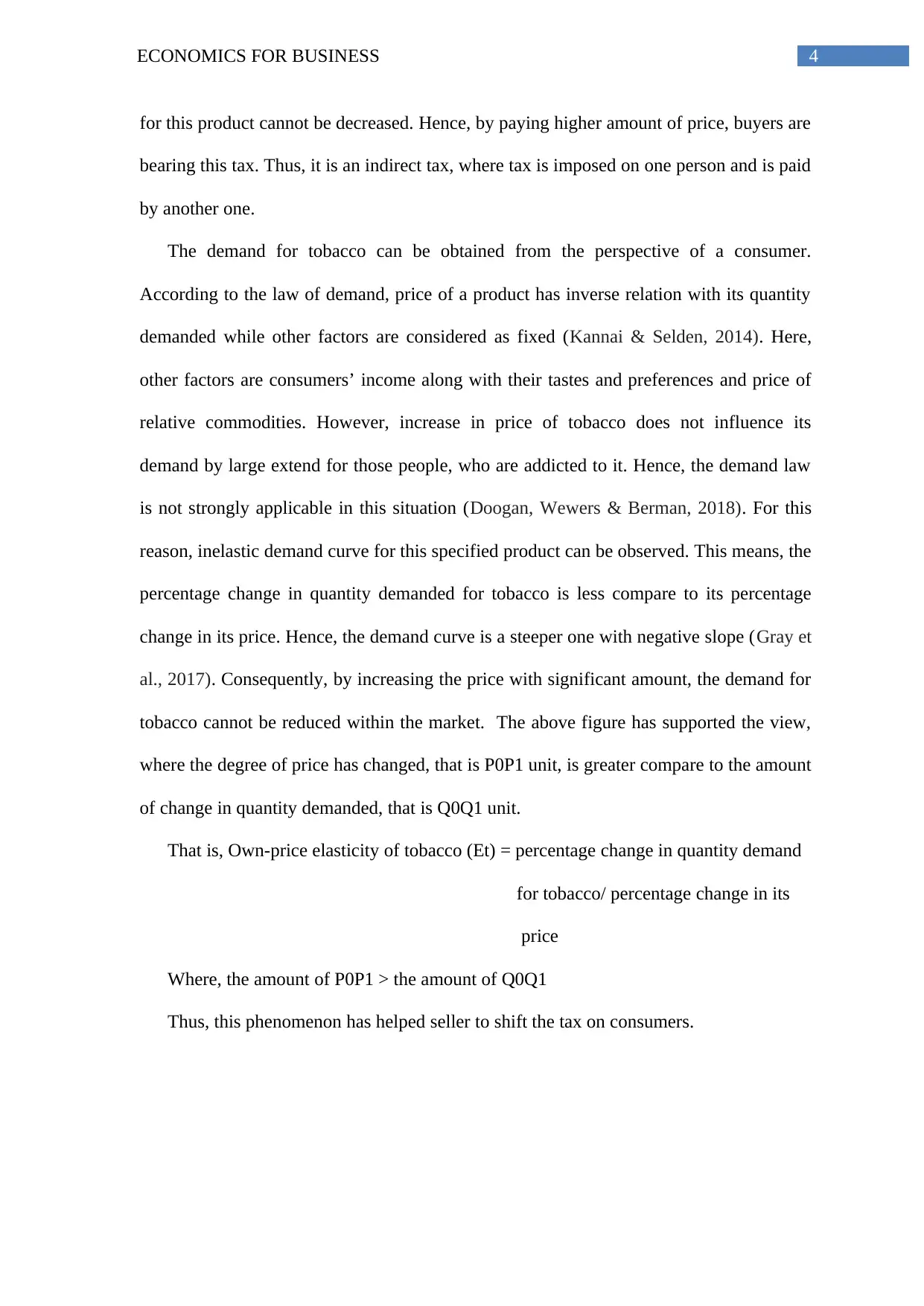

Figure 3 has represented the concept of economies of scale with the help of an

average cost (AC) curve. From this figure, it can be stated that the production cost of an

organization has started to decline with the increasing amount of output. At Q0 level of

output, AC reaches to its minimum point. Hence, economies of scale exists between 0 and

Q0.

The capacity of local government: This point has also supported the concept of merging local

governments, where large council intends to possess a large administrative level along with

other expertise as this size has helped to employ specialist skills. However, this phenomenon

cannot be obtained through local governments (Blom-Hansen, Houlberg, Serritzlew &

Treisman, 2016). Local governments of Australia have received pressures from the State

governments. However, after merging, those small governments have experienced significant

advantage as they can achieve more tasks with difficulties and can solve these efficiently.

Economies of scope: Economies of scope is also referred as economies of joint production.

According to this concept, it becomes cheaper for an economy to produce large number of

products under a single organization instead of making each type of product differently. This

Average cost curve

O

Output

AC

Q0

Economies of scale

Figure 3: Economies of scale

Source: (created by author)

Figure 3 has represented the concept of economies of scale with the help of an

average cost (AC) curve. From this figure, it can be stated that the production cost of an

organization has started to decline with the increasing amount of output. At Q0 level of

output, AC reaches to its minimum point. Hence, economies of scale exists between 0 and

Q0.

The capacity of local government: This point has also supported the concept of merging local

governments, where large council intends to possess a large administrative level along with

other expertise as this size has helped to employ specialist skills. However, this phenomenon

cannot be obtained through local governments (Blom-Hansen, Houlberg, Serritzlew &

Treisman, 2016). Local governments of Australia have received pressures from the State

governments. However, after merging, those small governments have experienced significant

advantage as they can achieve more tasks with difficulties and can solve these efficiently.

Economies of scope: Economies of scope is also referred as economies of joint production.

According to this concept, it becomes cheaper for an economy to produce large number of

products under a single organization instead of making each type of product differently. This

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR BUSINESS

Costs

OutputO

C0

C1

Q0 Q1

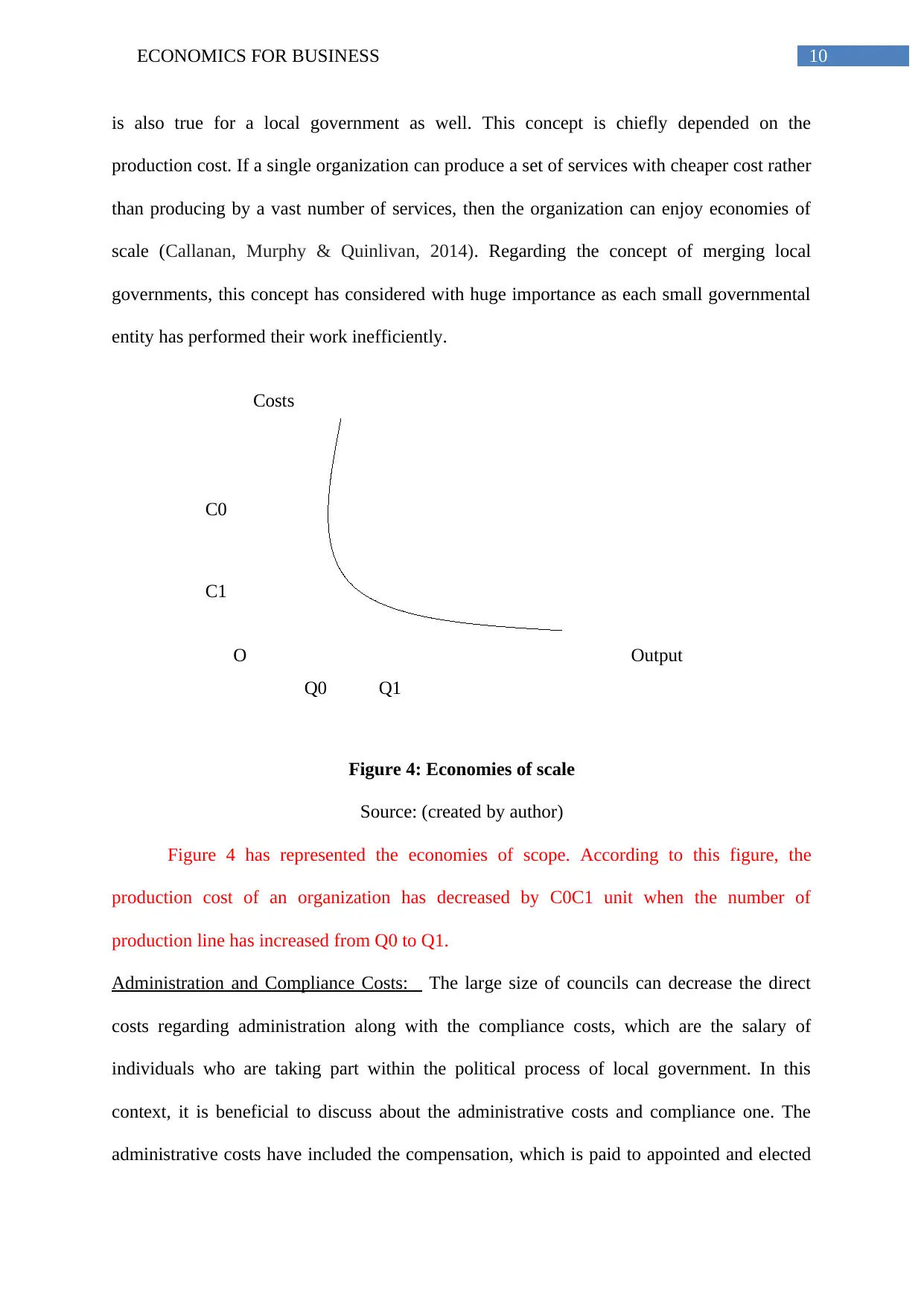

is also true for a local government as well. This concept is chiefly depended on the

production cost. If a single organization can produce a set of services with cheaper cost rather

than producing by a vast number of services, then the organization can enjoy economies of

scale (Callanan, Murphy & Quinlivan, 2014). Regarding the concept of merging local

governments, this concept has considered with huge importance as each small governmental

entity has performed their work inefficiently.

Figure 4: Economies of scale

Source: (created by author)

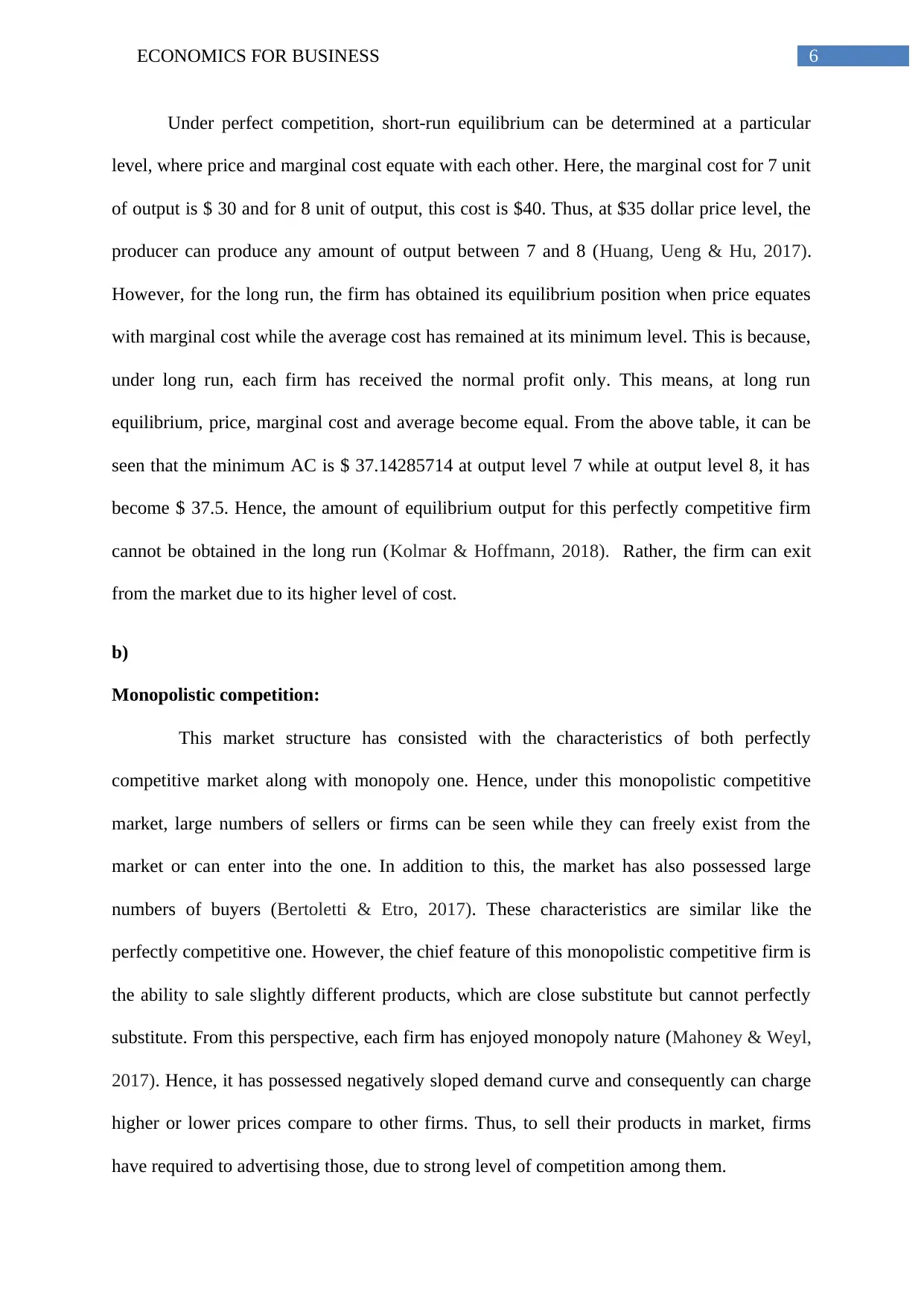

Figure 4 has represented the economies of scope. According to this figure, the

production cost of an organization has decreased by C0C1 unit when the number of

production line has increased from Q0 to Q1.

Administration and Compliance Costs: The large size of councils can decrease the direct

costs regarding administration along with the compliance costs, which are the salary of

individuals who are taking part within the political process of local government. In this

context, it is beneficial to discuss about the administrative costs and compliance one. The

administrative costs have included the compensation, which is paid to appointed and elected

Costs

OutputO

C0

C1

Q0 Q1

is also true for a local government as well. This concept is chiefly depended on the

production cost. If a single organization can produce a set of services with cheaper cost rather

than producing by a vast number of services, then the organization can enjoy economies of

scale (Callanan, Murphy & Quinlivan, 2014). Regarding the concept of merging local

governments, this concept has considered with huge importance as each small governmental

entity has performed their work inefficiently.

Figure 4: Economies of scale

Source: (created by author)

Figure 4 has represented the economies of scope. According to this figure, the

production cost of an organization has decreased by C0C1 unit when the number of

production line has increased from Q0 to Q1.

Administration and Compliance Costs: The large size of councils can decrease the direct

costs regarding administration along with the compliance costs, which are the salary of

individuals who are taking part within the political process of local government. In this

context, it is beneficial to discuss about the administrative costs and compliance one. The

administrative costs have included the compensation, which is paid to appointed and elected

11ECONOMICS FOR BUSINESS

staffs and officials, who are needed to support those officials (LOIS-GONZÁLEZ &

AYMERICH-CANO, 2018). On the other side, compliance costs incorporate the costs, which

are incurred by voters of local governments to obtain information about issues and candidate

positions. These costs also include time cost and potential cash for registering an opinion

through participating in meeting, hearing and voting and so on.

staffs and officials, who are needed to support those officials (LOIS-GONZÁLEZ &

AYMERICH-CANO, 2018). On the other side, compliance costs incorporate the costs, which

are incurred by voters of local governments to obtain information about issues and candidate

positions. These costs also include time cost and potential cash for registering an opinion

through participating in meeting, hearing and voting and so on.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.