Qantas Monopoly Power: Inefficiencies and Government Intervention

VerifiedAdded on 2023/04/20

|11

|2374

|182

Essay

AI Summary

This essay analyzes the monopoly power of Qantas in the Australian aviation industry. It begins by defining monopoly and explaining how Qantas exhibits significant market dominance. The essay then identifies the inefficiencies that arise from Qantas' monopoly power, such as higher prices, reduced output, and deadweight welfare loss, supported by graphical representations. The analysis covers Qantas' advantages from monopoly power, including innovation and economies of scale. The study further explores how government intervention, specifically price capping regulation, market liberalization, and merger policies, can be used to curb Qantas' monopoly power and promote a more efficient outcome for the economy. The essay concludes by summarizing the key findings regarding Qantas' monopoly power, its impact, and the government's role in regulating the industry. This essay provides a comprehensive overview of the economic principles and their application in the context of Qantas' market position and the government's regulatory responses.

Running head: ECONOMICS FOR BUSINESS

Economics for Business

Name of the Student

Name of the University

Authors Note

Economics for Business

Name of the Student

Name of the University

Authors Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR BUSINESS

Introduction

The present essay provides an overview on the firm that has considerable monopoly

power in Australia. The chosen firm for this study is Qantas Pure monopoly refers to the market

situation in which single entity is a sole manufacturer and seller of commodity or service in the

entire market. The monopolist possess monopoly power being the only seller in the market.

Monopoly Power usually occurs in the firm where it has market dominance in the sector.

Monopolies usually derive their market or monopoly power from the entry barriers to the market

(Adler et al., 2015). These barriers can be classified into four types based on few sources such

as- specific resources, natural monopoly, government regulation and deliberate actions. Abuse of

the monopoly power might involve setting of higher prices or limiting total output. Moreover,

abuse of this monopoly power might lead to problems for suppliers, deadweight welfare loss and

less choice. The inefficiencies in outcome that might occur if the firm was free to exercise such

monopoly power is analyzed in this study. The government intervention used or can be used for

curbing monopoly power and provide efficient outcome of the economy is also explained in this

essay.

Analysis

Monopoly relates to the market structure that is characterized by single seller that sells

unique commodity. In the monopoly market, sellers usually face no competition since he is the

only seller of products with no substitute. In this market, factors such as- ownership of resources,

government license, high startup cost restrict other seller’s entry in this market.

Introduction

The present essay provides an overview on the firm that has considerable monopoly

power in Australia. The chosen firm for this study is Qantas Pure monopoly refers to the market

situation in which single entity is a sole manufacturer and seller of commodity or service in the

entire market. The monopolist possess monopoly power being the only seller in the market.

Monopoly Power usually occurs in the firm where it has market dominance in the sector.

Monopolies usually derive their market or monopoly power from the entry barriers to the market

(Adler et al., 2015). These barriers can be classified into four types based on few sources such

as- specific resources, natural monopoly, government regulation and deliberate actions. Abuse of

the monopoly power might involve setting of higher prices or limiting total output. Moreover,

abuse of this monopoly power might lead to problems for suppliers, deadweight welfare loss and

less choice. The inefficiencies in outcome that might occur if the firm was free to exercise such

monopoly power is analyzed in this study. The government intervention used or can be used for

curbing monopoly power and provide efficient outcome of the economy is also explained in this

essay.

Analysis

Monopoly relates to the market structure that is characterized by single seller that sells

unique commodity. In the monopoly market, sellers usually face no competition since he is the

only seller of products with no substitute. In this market, factors such as- ownership of resources,

government license, high startup cost restrict other seller’s entry in this market.

2ECONOMICS FOR BUSINESS

D=AR

MR

AC

MC

Quantity

Price

QcQm

Pc

Pm

Deadweight loss

Supernormal Profit

Figure 1: Monopoly graph

Source: (As created by author)

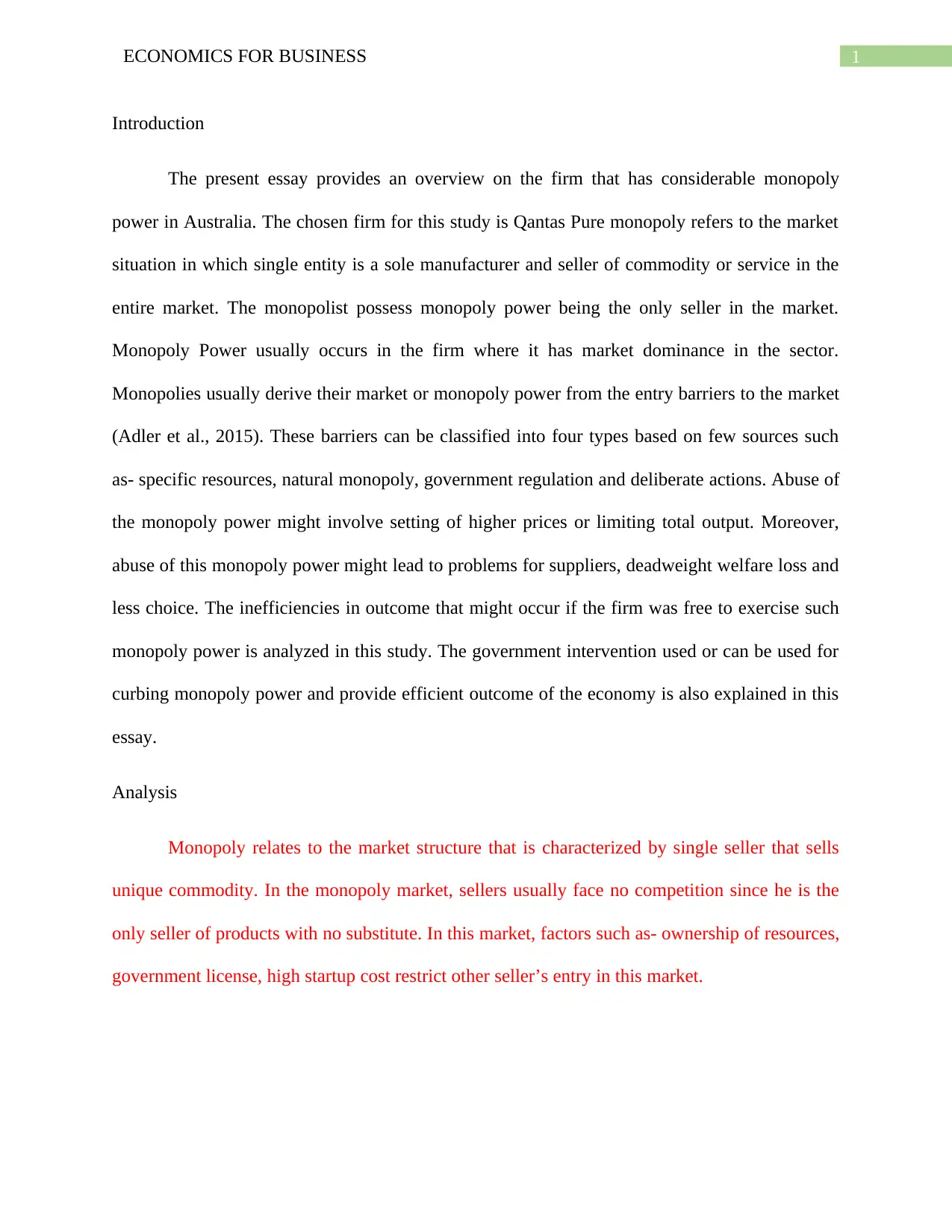

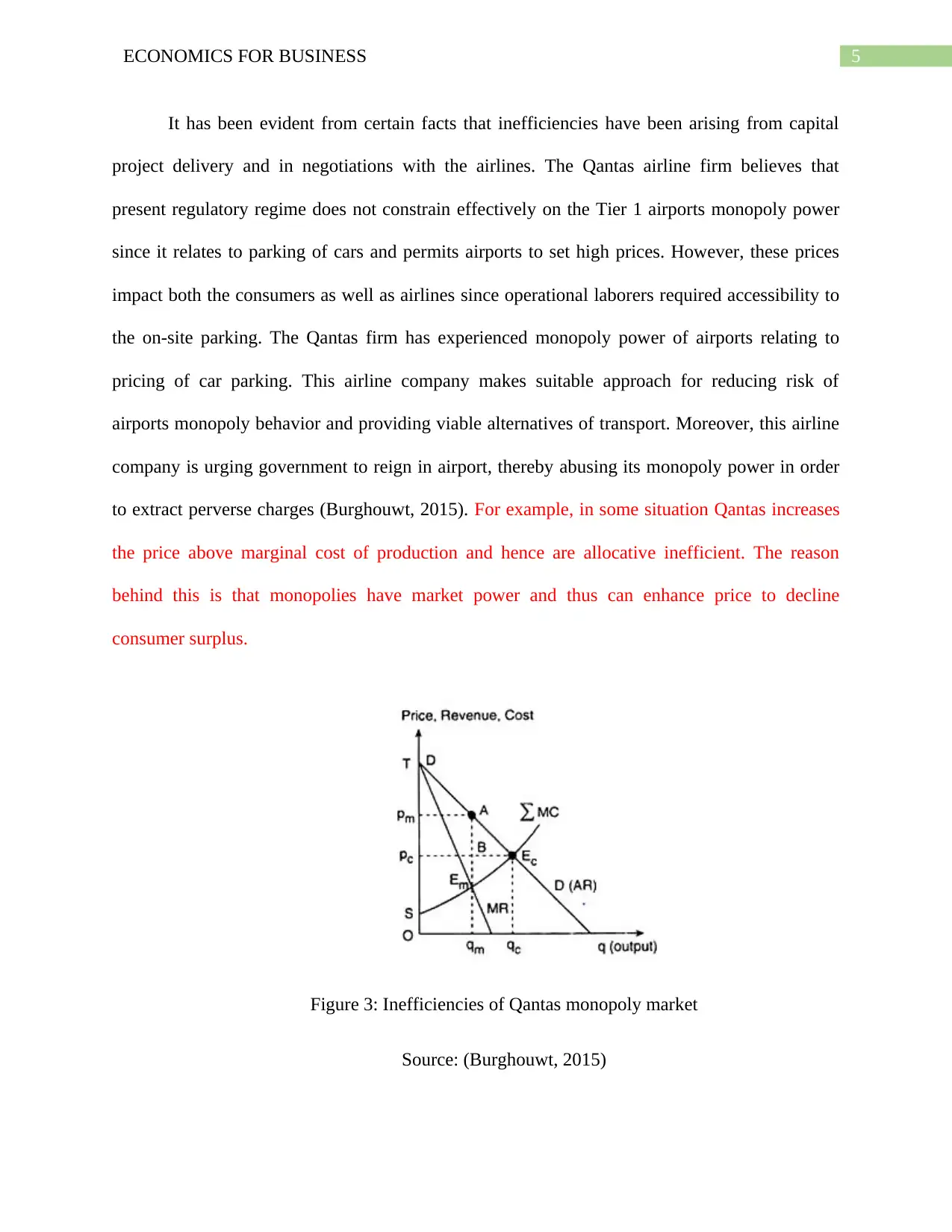

The monopolist might seek to attain profit by setting total output at which MR=MC. At

this point, price of the product is Pm and output is Qm. As compared to perfectly competitive

market, monopolist enhances price and decreases output. The deadweight welfare loss occurs in

comparison to the competitive market.

Over the last few years, there have been huge changes in the aviation industry of

Australia. The total number of travelers as well as freight volume that mainly passes through the

Australian airports have been doubled over the years. Karier (2016) has found out that all

Australian airport sector explicitly as well as implicitly possess market power to different

degrees. The Australian passengers, manufacturers, communities and economy have been mainly

paying price of monopoly power through high airport charges as well as freight costs, low

connectivity and less opportunity for national employment creation. The monopoly power of

D=AR

MR

AC

MC

Quantity

Price

QcQm

Pc

Pm

Deadweight loss

Supernormal Profit

Figure 1: Monopoly graph

Source: (As created by author)

The monopolist might seek to attain profit by setting total output at which MR=MC. At

this point, price of the product is Pm and output is Qm. As compared to perfectly competitive

market, monopolist enhances price and decreases output. The deadweight welfare loss occurs in

comparison to the competitive market.

Over the last few years, there have been huge changes in the aviation industry of

Australia. The total number of travelers as well as freight volume that mainly passes through the

Australian airports have been doubled over the years. Karier (2016) has found out that all

Australian airport sector explicitly as well as implicitly possess market power to different

degrees. The Australian passengers, manufacturers, communities and economy have been mainly

paying price of monopoly power through high airport charges as well as freight costs, low

connectivity and less opportunity for national employment creation. The monopoly power of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR BUSINESS

Australian airports is mainly amplified by inelastic demand for the airport services and lack of

airlines power in negotiating conditions and terms that are reasonable. The Qantas group has

been the first wave of the airport privatization and also sparked enhance in efficiencies as well as

productivity. At present Qantas group has huge market dominance in the Australian airline

sector. This airline entity presents threat to the economic well- being of Australia and strains on

its productivity. The Qantas Group has entrenched its monopoly power as it becomes impossible

for other airlines to access arbitration under National Access Regime. The network of Qantas

Group has important strategic imperative involving connecting foreign routes with trunk routes

that permit larger frequencies as well as more destinations. This airline firm believes the present

regulatory model applying to the airports has been effective in constraining monopoly power of

the airport operators (Taussig, 2013). Qantas also believes that the airport operators give set of

infrastructure-based services at airport. As several airport users need huge range of services, the

market power of airport is mainly observed in group of services provided. This airline entity

have considerable monopoly power in regards to sites for the parking services. According to

ACCC review of the aeronautical charges, Qantas has been abnormally earning high profits

specially from the car park services. In fact, the prices that Qantas charges for this services are

usually unrelated to costs. In fact, this airline entity has large maintenance facilities at total

number of airport locations. These facilities are mainly substantial and signify sunk investment.

This entity acknowledges that with respect to future investment in the heavy maintenance

facilities, it has been able to exercise level of choice relating to location of future investment.

However, with respect to these investments, Qantas has been captive to monopoly power of the

airport operators. The market power of Qantas has enabled to generate excessive returns from its

aeronautical assets (Laibson & List, 2015).

Australian airports is mainly amplified by inelastic demand for the airport services and lack of

airlines power in negotiating conditions and terms that are reasonable. The Qantas group has

been the first wave of the airport privatization and also sparked enhance in efficiencies as well as

productivity. At present Qantas group has huge market dominance in the Australian airline

sector. This airline entity presents threat to the economic well- being of Australia and strains on

its productivity. The Qantas Group has entrenched its monopoly power as it becomes impossible

for other airlines to access arbitration under National Access Regime. The network of Qantas

Group has important strategic imperative involving connecting foreign routes with trunk routes

that permit larger frequencies as well as more destinations. This airline firm believes the present

regulatory model applying to the airports has been effective in constraining monopoly power of

the airport operators (Taussig, 2013). Qantas also believes that the airport operators give set of

infrastructure-based services at airport. As several airport users need huge range of services, the

market power of airport is mainly observed in group of services provided. This airline entity

have considerable monopoly power in regards to sites for the parking services. According to

ACCC review of the aeronautical charges, Qantas has been abnormally earning high profits

specially from the car park services. In fact, the prices that Qantas charges for this services are

usually unrelated to costs. In fact, this airline entity has large maintenance facilities at total

number of airport locations. These facilities are mainly substantial and signify sunk investment.

This entity acknowledges that with respect to future investment in the heavy maintenance

facilities, it has been able to exercise level of choice relating to location of future investment.

However, with respect to these investments, Qantas has been captive to monopoly power of the

airport operators. The market power of Qantas has enabled to generate excessive returns from its

aeronautical assets (Laibson & List, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR BUSINESS

D

D

AC

Q2Q1

C2

C1

P2

P1

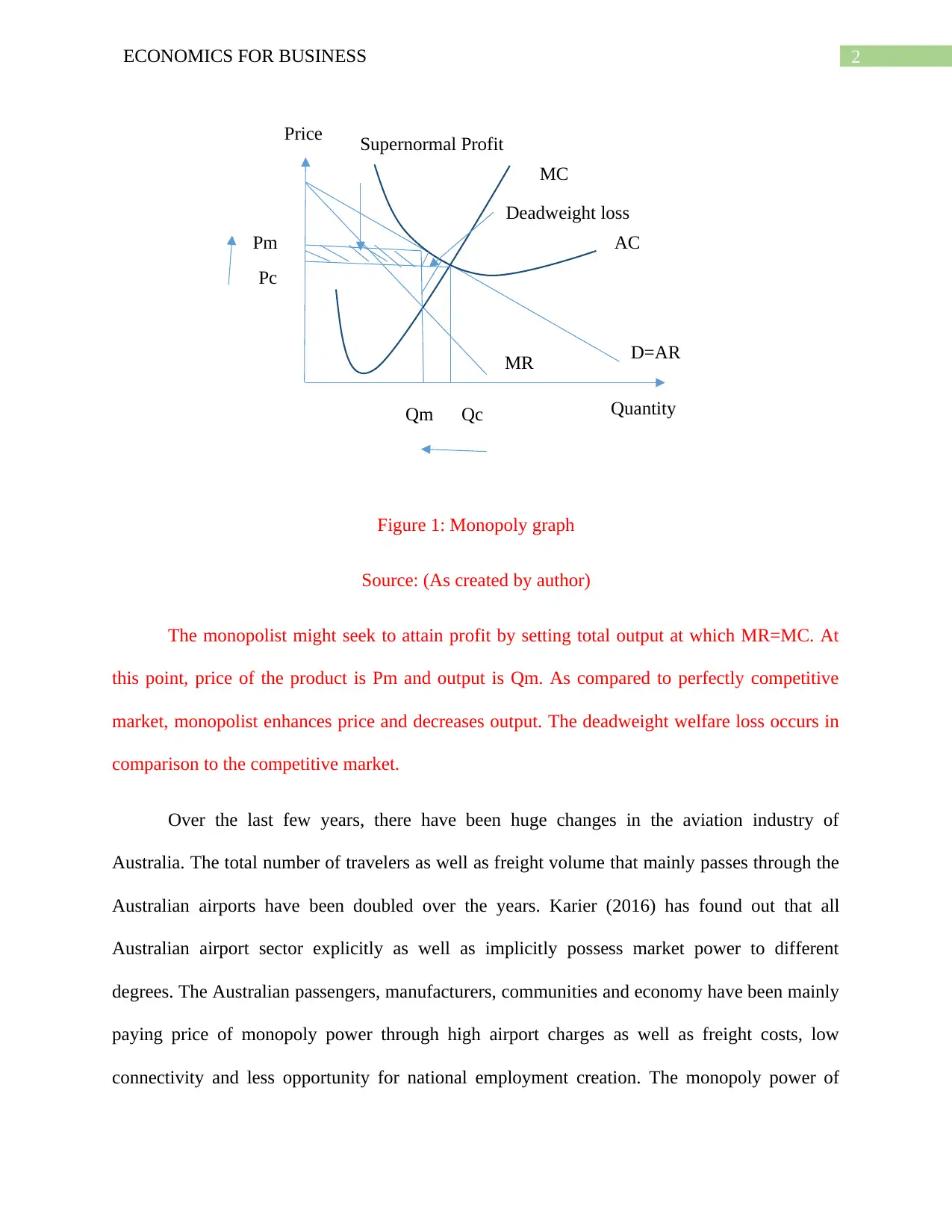

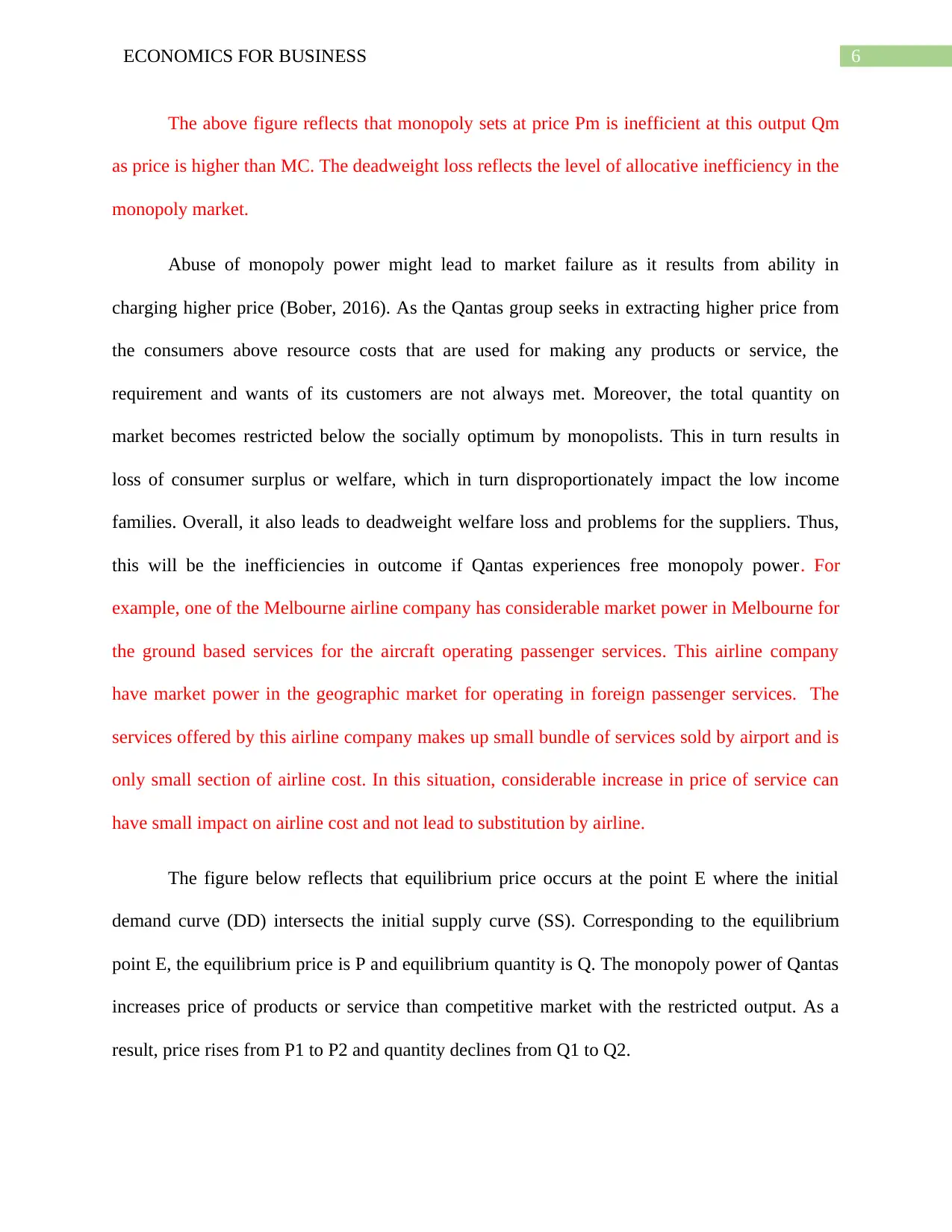

Qantas attains some possible benefits from monopoly power in the market. The profits

that the company attains is further used for funding innovation with spillover benefits. This in

turn leads to achievement of dynamic efficiency. The manufacturers of Qantas might attain

economies of scale, thereby leading to lower average cost. Furthermore, they might be subject to

regulation of price that limits its profitability. The figure below reflects economies of scale

achieved by Qantas producers-

Figure 2 : Economies of scale achieved by Qantas producers

Source: (As created by Author)

The above diagram shows that Qantas producer gains total profit at point P2 when the

economies of scale have been attained. Moreover, attainment of economies of scale leads to

lower average cost from C1 to C2 but increase in total output from Q1 to Q2.

D

D

AC

Q2Q1

C2

C1

P2

P1

Qantas attains some possible benefits from monopoly power in the market. The profits

that the company attains is further used for funding innovation with spillover benefits. This in

turn leads to achievement of dynamic efficiency. The manufacturers of Qantas might attain

economies of scale, thereby leading to lower average cost. Furthermore, they might be subject to

regulation of price that limits its profitability. The figure below reflects economies of scale

achieved by Qantas producers-

Figure 2 : Economies of scale achieved by Qantas producers

Source: (As created by Author)

The above diagram shows that Qantas producer gains total profit at point P2 when the

economies of scale have been attained. Moreover, attainment of economies of scale leads to

lower average cost from C1 to C2 but increase in total output from Q1 to Q2.

5ECONOMICS FOR BUSINESS

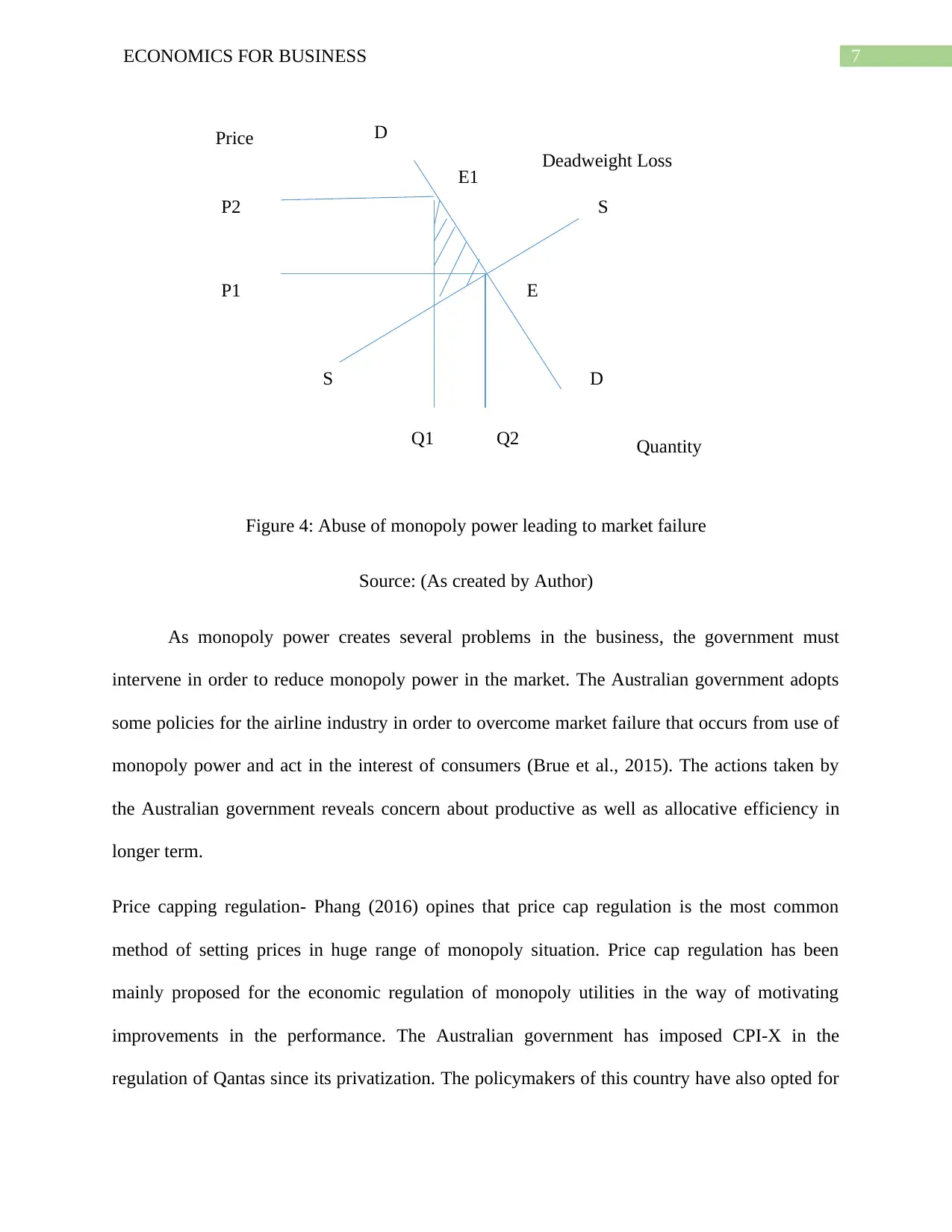

It has been evident from certain facts that inefficiencies have been arising from capital

project delivery and in negotiations with the airlines. The Qantas airline firm believes that

present regulatory regime does not constrain effectively on the Tier 1 airports monopoly power

since it relates to parking of cars and permits airports to set high prices. However, these prices

impact both the consumers as well as airlines since operational laborers required accessibility to

the on-site parking. The Qantas firm has experienced monopoly power of airports relating to

pricing of car parking. This airline company makes suitable approach for reducing risk of

airports monopoly behavior and providing viable alternatives of transport. Moreover, this airline

company is urging government to reign in airport, thereby abusing its monopoly power in order

to extract perverse charges (Burghouwt, 2015). For example, in some situation Qantas increases

the price above marginal cost of production and hence are allocative inefficient. The reason

behind this is that monopolies have market power and thus can enhance price to decline

consumer surplus.

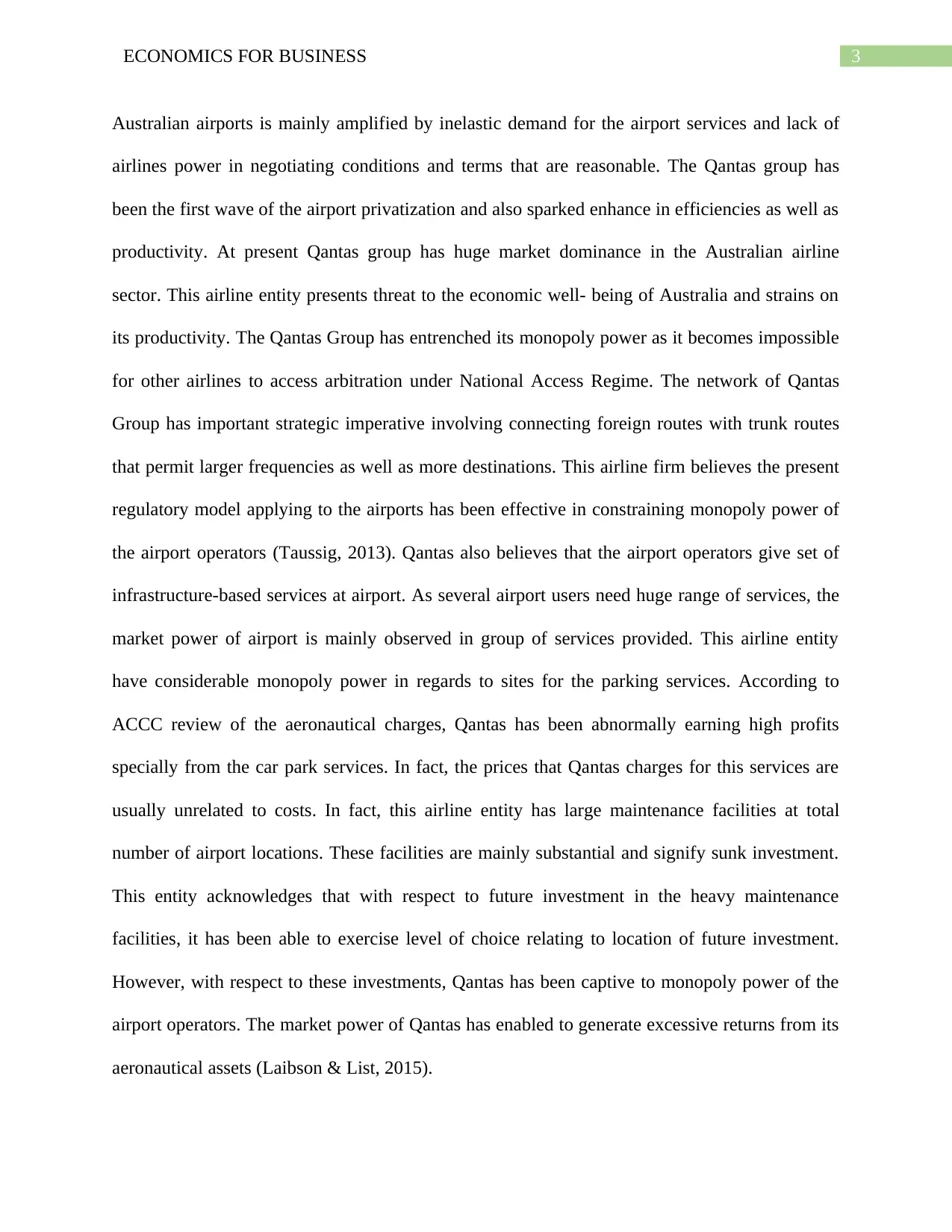

Figure 3: Inefficiencies of Qantas monopoly market

Source: (Burghouwt, 2015)

It has been evident from certain facts that inefficiencies have been arising from capital

project delivery and in negotiations with the airlines. The Qantas airline firm believes that

present regulatory regime does not constrain effectively on the Tier 1 airports monopoly power

since it relates to parking of cars and permits airports to set high prices. However, these prices

impact both the consumers as well as airlines since operational laborers required accessibility to

the on-site parking. The Qantas firm has experienced monopoly power of airports relating to

pricing of car parking. This airline company makes suitable approach for reducing risk of

airports monopoly behavior and providing viable alternatives of transport. Moreover, this airline

company is urging government to reign in airport, thereby abusing its monopoly power in order

to extract perverse charges (Burghouwt, 2015). For example, in some situation Qantas increases

the price above marginal cost of production and hence are allocative inefficient. The reason

behind this is that monopolies have market power and thus can enhance price to decline

consumer surplus.

Figure 3: Inefficiencies of Qantas monopoly market

Source: (Burghouwt, 2015)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR BUSINESS

The above figure reflects that monopoly sets at price Pm is inefficient at this output Qm

as price is higher than MC. The deadweight loss reflects the level of allocative inefficiency in the

monopoly market.

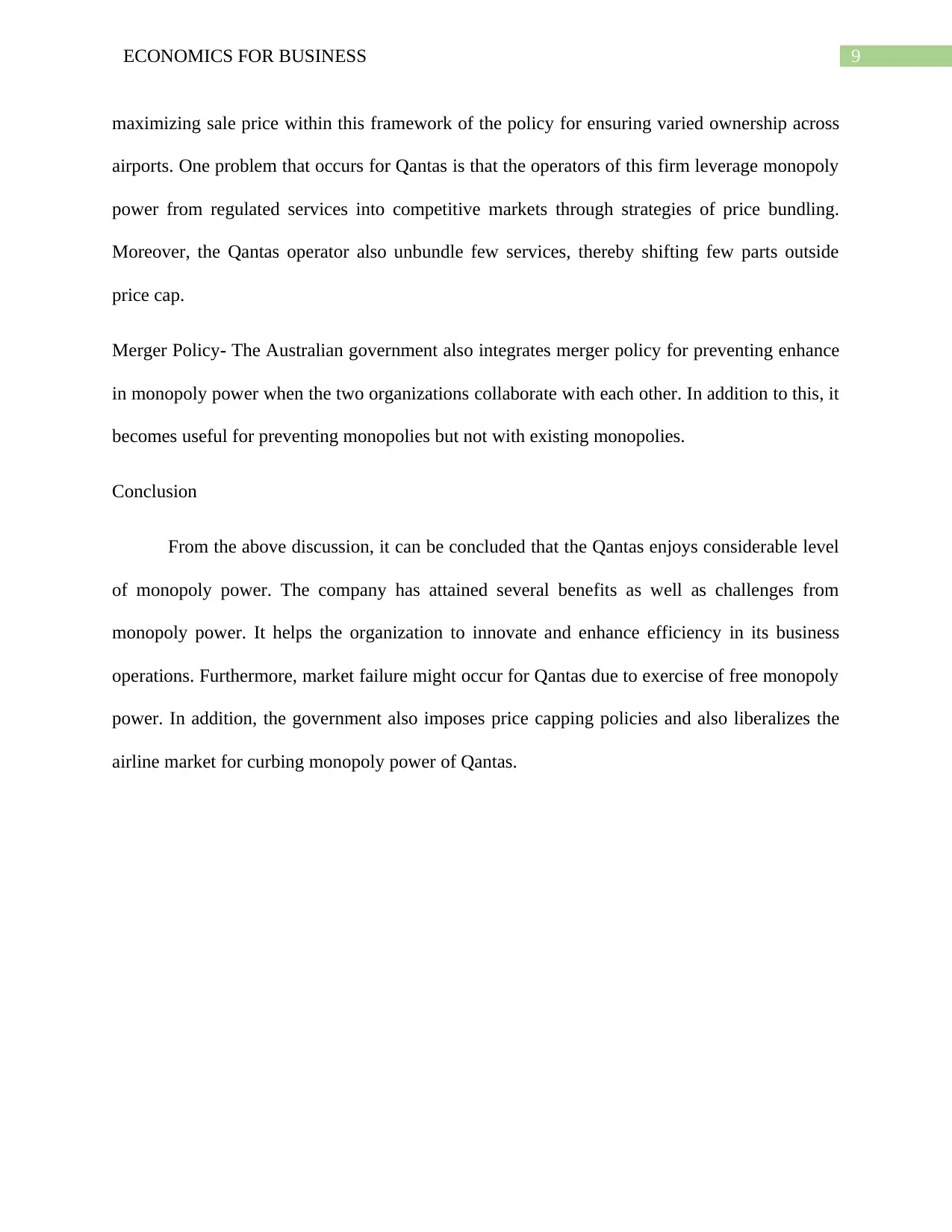

Abuse of monopoly power might lead to market failure as it results from ability in

charging higher price (Bober, 2016). As the Qantas group seeks in extracting higher price from

the consumers above resource costs that are used for making any products or service, the

requirement and wants of its customers are not always met. Moreover, the total quantity on

market becomes restricted below the socially optimum by monopolists. This in turn results in

loss of consumer surplus or welfare, which in turn disproportionately impact the low income

families. Overall, it also leads to deadweight welfare loss and problems for the suppliers. Thus,

this will be the inefficiencies in outcome if Qantas experiences free monopoly power. For

example, one of the Melbourne airline company has considerable market power in Melbourne for

the ground based services for the aircraft operating passenger services. This airline company

have market power in the geographic market for operating in foreign passenger services. The

services offered by this airline company makes up small bundle of services sold by airport and is

only small section of airline cost. In this situation, considerable increase in price of service can

have small impact on airline cost and not lead to substitution by airline.

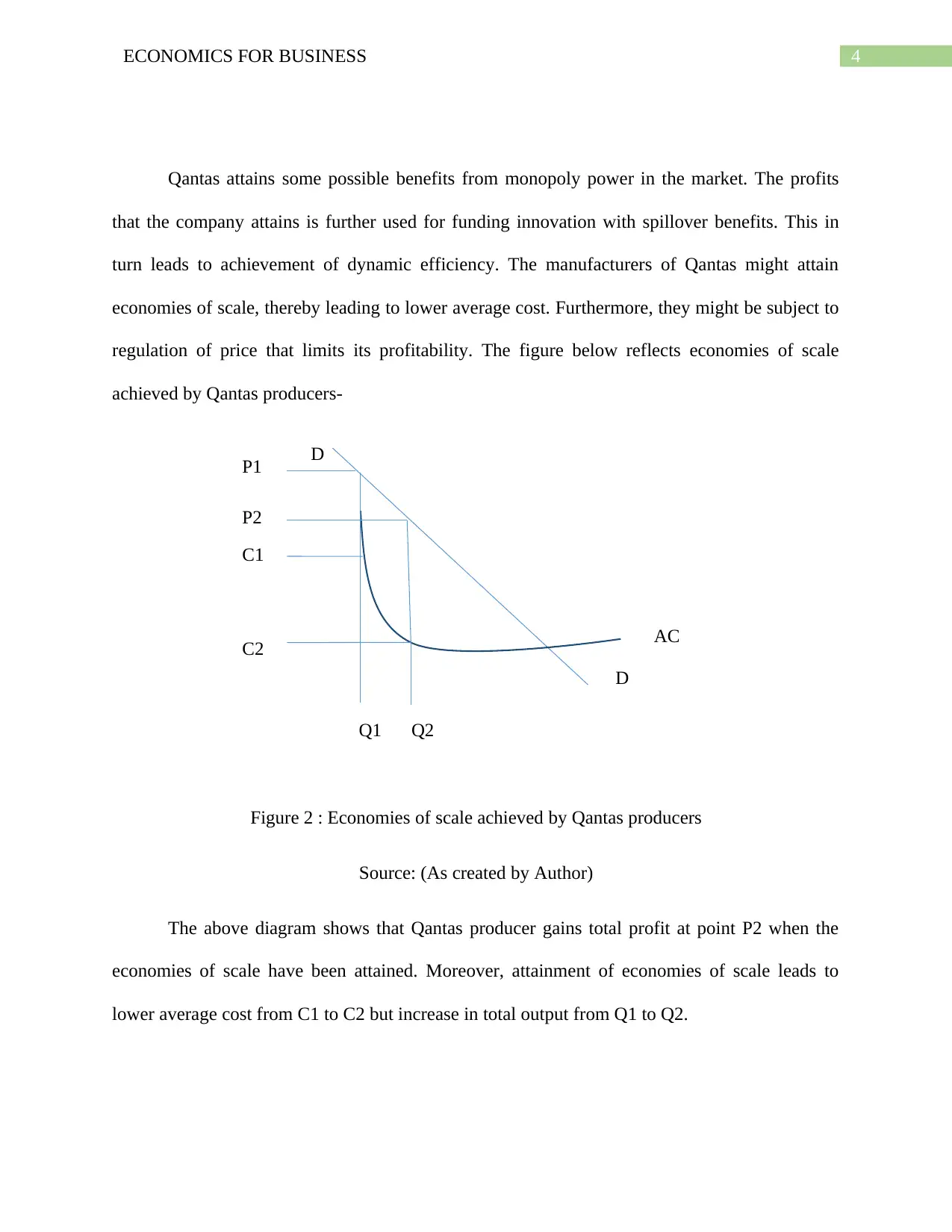

The figure below reflects that equilibrium price occurs at the point E where the initial

demand curve (DD) intersects the initial supply curve (SS). Corresponding to the equilibrium

point E, the equilibrium price is P and equilibrium quantity is Q. The monopoly power of Qantas

increases price of products or service than competitive market with the restricted output. As a

result, price rises from P1 to P2 and quantity declines from Q1 to Q2.

The above figure reflects that monopoly sets at price Pm is inefficient at this output Qm

as price is higher than MC. The deadweight loss reflects the level of allocative inefficiency in the

monopoly market.

Abuse of monopoly power might lead to market failure as it results from ability in

charging higher price (Bober, 2016). As the Qantas group seeks in extracting higher price from

the consumers above resource costs that are used for making any products or service, the

requirement and wants of its customers are not always met. Moreover, the total quantity on

market becomes restricted below the socially optimum by monopolists. This in turn results in

loss of consumer surplus or welfare, which in turn disproportionately impact the low income

families. Overall, it also leads to deadweight welfare loss and problems for the suppliers. Thus,

this will be the inefficiencies in outcome if Qantas experiences free monopoly power. For

example, one of the Melbourne airline company has considerable market power in Melbourne for

the ground based services for the aircraft operating passenger services. This airline company

have market power in the geographic market for operating in foreign passenger services. The

services offered by this airline company makes up small bundle of services sold by airport and is

only small section of airline cost. In this situation, considerable increase in price of service can

have small impact on airline cost and not lead to substitution by airline.

The figure below reflects that equilibrium price occurs at the point E where the initial

demand curve (DD) intersects the initial supply curve (SS). Corresponding to the equilibrium

point E, the equilibrium price is P and equilibrium quantity is Q. The monopoly power of Qantas

increases price of products or service than competitive market with the restricted output. As a

result, price rises from P1 to P2 and quantity declines from Q1 to Q2.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR BUSINESS

Quantity

Price

D

D

S

S

P1

P2

Q1 Q2

Deadweight Loss

E

E1

Figure 4: Abuse of monopoly power leading to market failure

Source: (As created by Author)

As monopoly power creates several problems in the business, the government must

intervene in order to reduce monopoly power in the market. The Australian government adopts

some policies for the airline industry in order to overcome market failure that occurs from use of

monopoly power and act in the interest of consumers (Brue et al., 2015). The actions taken by

the Australian government reveals concern about productive as well as allocative efficiency in

longer term.

Price capping regulation- Phang (2016) opines that price cap regulation is the most common

method of setting prices in huge range of monopoly situation. Price cap regulation has been

mainly proposed for the economic regulation of monopoly utilities in the way of motivating

improvements in the performance. The Australian government has imposed CPI-X in the

regulation of Qantas since its privatization. The policymakers of this country have also opted for

Quantity

Price

D

D

S

S

P1

P2

Q1 Q2

Deadweight Loss

E

E1

Figure 4: Abuse of monopoly power leading to market failure

Source: (As created by Author)

As monopoly power creates several problems in the business, the government must

intervene in order to reduce monopoly power in the market. The Australian government adopts

some policies for the airline industry in order to overcome market failure that occurs from use of

monopoly power and act in the interest of consumers (Brue et al., 2015). The actions taken by

the Australian government reveals concern about productive as well as allocative efficiency in

longer term.

Price capping regulation- Phang (2016) opines that price cap regulation is the most common

method of setting prices in huge range of monopoly situation. Price cap regulation has been

mainly proposed for the economic regulation of monopoly utilities in the way of motivating

improvements in the performance. The Australian government has imposed CPI-X in the

regulation of Qantas since its privatization. The policymakers of this country have also opted for

8ECONOMICS FOR BUSINESS

Q2Q1

C1

P1

Capped price

C2

AR

MR

MC

AC

Output

Price

revenue- weighted average price approach. But shortcomings of the price cap regulation that

occurs is that it might be profitable for operators for reducing quality below socially optimal

level. For example, price capping regulation adopted by the Australian government leads to

increase in travel costs of Qantas Airline companies. Price capping is explained in the diagram

below-

Figure 5: Price capping reducing monopoly profits

Source: (As created by author)

From the above diagram, it can be seen that initial equilibrium price is P1 and

equilibrium output is Q1 where MR=MC. After imposition of price capping, the monopoly

profits reduces which leads to decline in capital investment by businesses. Ultimately, the

customers of Qantas suffers due to increase in price of air ticket.

Liberalization of markets- The policymakers of Australia deregulating airline market enables

new entities to enter as well as compete with existing monopoly. This in turn helped to promote

huge competition in the airline industry of this nation. The policymakers even sought in

Q2Q1

C1

P1

Capped price

C2

AR

MR

MC

AC

Output

Price

revenue- weighted average price approach. But shortcomings of the price cap regulation that

occurs is that it might be profitable for operators for reducing quality below socially optimal

level. For example, price capping regulation adopted by the Australian government leads to

increase in travel costs of Qantas Airline companies. Price capping is explained in the diagram

below-

Figure 5: Price capping reducing monopoly profits

Source: (As created by author)

From the above diagram, it can be seen that initial equilibrium price is P1 and

equilibrium output is Q1 where MR=MC. After imposition of price capping, the monopoly

profits reduces which leads to decline in capital investment by businesses. Ultimately, the

customers of Qantas suffers due to increase in price of air ticket.

Liberalization of markets- The policymakers of Australia deregulating airline market enables

new entities to enter as well as compete with existing monopoly. This in turn helped to promote

huge competition in the airline industry of this nation. The policymakers even sought in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR BUSINESS

maximizing sale price within this framework of the policy for ensuring varied ownership across

airports. One problem that occurs for Qantas is that the operators of this firm leverage monopoly

power from regulated services into competitive markets through strategies of price bundling.

Moreover, the Qantas operator also unbundle few services, thereby shifting few parts outside

price cap.

Merger Policy- The Australian government also integrates merger policy for preventing enhance

in monopoly power when the two organizations collaborate with each other. In addition to this, it

becomes useful for preventing monopolies but not with existing monopolies.

Conclusion

From the above discussion, it can be concluded that the Qantas enjoys considerable level

of monopoly power. The company has attained several benefits as well as challenges from

monopoly power. It helps the organization to innovate and enhance efficiency in its business

operations. Furthermore, market failure might occur for Qantas due to exercise of free monopoly

power. In addition, the government also imposes price capping policies and also liberalizes the

airline market for curbing monopoly power of Qantas.

maximizing sale price within this framework of the policy for ensuring varied ownership across

airports. One problem that occurs for Qantas is that the operators of this firm leverage monopoly

power from regulated services into competitive markets through strategies of price bundling.

Moreover, the Qantas operator also unbundle few services, thereby shifting few parts outside

price cap.

Merger Policy- The Australian government also integrates merger policy for preventing enhance

in monopoly power when the two organizations collaborate with each other. In addition to this, it

becomes useful for preventing monopolies but not with existing monopolies.

Conclusion

From the above discussion, it can be concluded that the Qantas enjoys considerable level

of monopoly power. The company has attained several benefits as well as challenges from

monopoly power. It helps the organization to innovate and enhance efficiency in its business

operations. Furthermore, market failure might occur for Qantas due to exercise of free monopoly

power. In addition, the government also imposes price capping policies and also liberalizes the

airline market for curbing monopoly power of Qantas.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR BUSINESS

References

Adler, N., Forsyth, P., Mueller, J., & Niemeier, H. M. (2015). An economic assessment of airport

incentive regulation. Transport Policy, 41, 5-15.

Bober, S. (2016). Alternative principles of economics. Routledge.

Brue, S. L., McConnell, C. R., Flynn, S. M., & Grant, R. R. (2014). Essentials of economics.

McGraw-Hill Irwin.

Burghouwt, G. (2016). Airline network development in Europe and its implications for airport

planning. Routledge.

Karier, T. (2016). Beyond Competition: Economics of Mergers and Monopoly Power:

Economics of Mergers and Monopoly Power. Routledge.

Laibson, D., & List, J. A. (2015). Principles of (behavioral) economics. American Economic

Review, 105(5), 385-90.

Phang, S. Y. (2016). A general framework for price regulation of airports. Journal of Air

Transport Management, 51, 39-45.

Taussig, F. W. (2013). Principles of economics (Vol. 2). Cosimo, Inc..

References

Adler, N., Forsyth, P., Mueller, J., & Niemeier, H. M. (2015). An economic assessment of airport

incentive regulation. Transport Policy, 41, 5-15.

Bober, S. (2016). Alternative principles of economics. Routledge.

Brue, S. L., McConnell, C. R., Flynn, S. M., & Grant, R. R. (2014). Essentials of economics.

McGraw-Hill Irwin.

Burghouwt, G. (2016). Airline network development in Europe and its implications for airport

planning. Routledge.

Karier, T. (2016). Beyond Competition: Economics of Mergers and Monopoly Power:

Economics of Mergers and Monopoly Power. Routledge.

Laibson, D., & List, J. A. (2015). Principles of (behavioral) economics. American Economic

Review, 105(5), 385-90.

Phang, S. Y. (2016). A general framework for price regulation of airports. Journal of Air

Transport Management, 51, 39-45.

Taussig, F. W. (2013). Principles of economics (Vol. 2). Cosimo, Inc..

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.