ECO10250 S2 2018: A Comprehensive Report on Australian Economy

VerifiedAdded on 2023/06/07

|12

|2395

|500

Report

AI Summary

This report provides a detailed analysis of the Australian economy, focusing on key macroeconomic indicators from 2017 and 2018. It examines the GDP growth, unemployment rate, inflation, and trade balance, comparing the performance to the previous year. The report utilizes data from the Reserve Bank of Australia (RBA) and other sources to assess the country's economic health. It discusses the impact of RBA's monetary policies, government expenditure, and global economic conditions on Australia's performance. The report includes statistical figures and diagrams to illustrate the trends in various economic indicators. The report also identifies three major problems facing the Australian economy and offers predictions about its future economic condition, including potential impacts on inflation, current account balance, public debt, and wages. The author concludes with a summary of the current economic state and potential future challenges for Australia.

Running head: ECONOMICS FOR DECISION MAKING

Economics for decision-making

Name of the Student

Name of the University

Author Note

Economics for decision-making

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR DECISION MAKING

Executive Summary:

This paper has described about present economic condition of Australia through analysing

various data collected from the Reserve Bank of India. Through comparing present economic

condition of this country with previous year, based on some macroeconomic variables, this

report has drawn a conclusion. Moreover, the paper has also predicted about the future

economic condition of this country based on this discussion.

Executive Summary:

This paper has described about present economic condition of Australia through analysing

various data collected from the Reserve Bank of India. Through comparing present economic

condition of this country with previous year, based on some macroeconomic variables, this

report has drawn a conclusion. Moreover, the paper has also predicted about the future

economic condition of this country based on this discussion.

2ECONOMICS FOR DECISION MAKING

Table of Contents

Introduction:...............................................................................................................................3

GDP growth of Australia:..........................................................................................................3

Unemployment:..........................................................................................................................5

Inflation:.....................................................................................................................................6

Australian trade:.........................................................................................................................7

Three major problems of Australian economy:.........................................................................8

Conclusion:................................................................................................................................9

References:...............................................................................................................................10

Table of Contents

Introduction:...............................................................................................................................3

GDP growth of Australia:..........................................................................................................3

Unemployment:..........................................................................................................................5

Inflation:.....................................................................................................................................6

Australian trade:.........................................................................................................................7

Three major problems of Australian economy:.........................................................................8

Conclusion:................................................................................................................................9

References:...............................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR DECISION MAKING

Introduction:

The Sydney Morning Herald has published an article in 2017 where many economists

have discussed, analysed and predicted about the economic condition of Australia since 2016.

Through observing the trend of national income or gross domestic product of this country,

many of them have predicted that national income of this country can increase by 2018, as

the Reserve Bank of Australia has increased its interest rates by applying monetary policy

(Meyer 2018). However, other economists have contradicted this statement and stated that

Australia has not experienced any economic growth between 2016 and 2017, as the rate of

real GDP growth of this country has remained same between these two years. This has

happened because of the tax cut of the RBA (Reserve Bank of Australia 2018). Consequently,

the country is not going to experience a fall in investment sector due to slow consumption

expenditure and restricted construction of houses.

To analyse this argument, the report intends to observe Australia’s economic

performance in recent years, which is, August and September of 2018 and that of August

2017 for comparing the economic performance of this country. The entire discussion will

consider four macroeconomic indicators, which are, real GDP growth, unemployment, along

with inflation as well as trade of Australia.

GDP growth of Australia:

According to the RBA, the global economy is going to face robust growth in coming

years, though other macroeconomic factors like inflation or interest rate may remain almost

same. Australia’s performance during its first quarter of 2018 has remained better compare to

previous year and consequently the annual rate of GDP growth has become 3.4% in this year.

In this context, huge investment in non-mining sectors, public expenditure as well as housing

market has influenced Australia’s aggregate demand to develop significantly in recent year.

Furthermore, strong labour market as well as monetary policies of the RBA has helped the

Introduction:

The Sydney Morning Herald has published an article in 2017 where many economists

have discussed, analysed and predicted about the economic condition of Australia since 2016.

Through observing the trend of national income or gross domestic product of this country,

many of them have predicted that national income of this country can increase by 2018, as

the Reserve Bank of Australia has increased its interest rates by applying monetary policy

(Meyer 2018). However, other economists have contradicted this statement and stated that

Australia has not experienced any economic growth between 2016 and 2017, as the rate of

real GDP growth of this country has remained same between these two years. This has

happened because of the tax cut of the RBA (Reserve Bank of Australia 2018). Consequently,

the country is not going to experience a fall in investment sector due to slow consumption

expenditure and restricted construction of houses.

To analyse this argument, the report intends to observe Australia’s economic

performance in recent years, which is, August and September of 2018 and that of August

2017 for comparing the economic performance of this country. The entire discussion will

consider four macroeconomic indicators, which are, real GDP growth, unemployment, along

with inflation as well as trade of Australia.

GDP growth of Australia:

According to the RBA, the global economy is going to face robust growth in coming

years, though other macroeconomic factors like inflation or interest rate may remain almost

same. Australia’s performance during its first quarter of 2018 has remained better compare to

previous year and consequently the annual rate of GDP growth has become 3.4% in this year.

In this context, huge investment in non-mining sectors, public expenditure as well as housing

market has influenced Australia’s aggregate demand to develop significantly in recent year.

Furthermore, strong labour market as well as monetary policies of the RBA has helped the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR DECISION MAKING

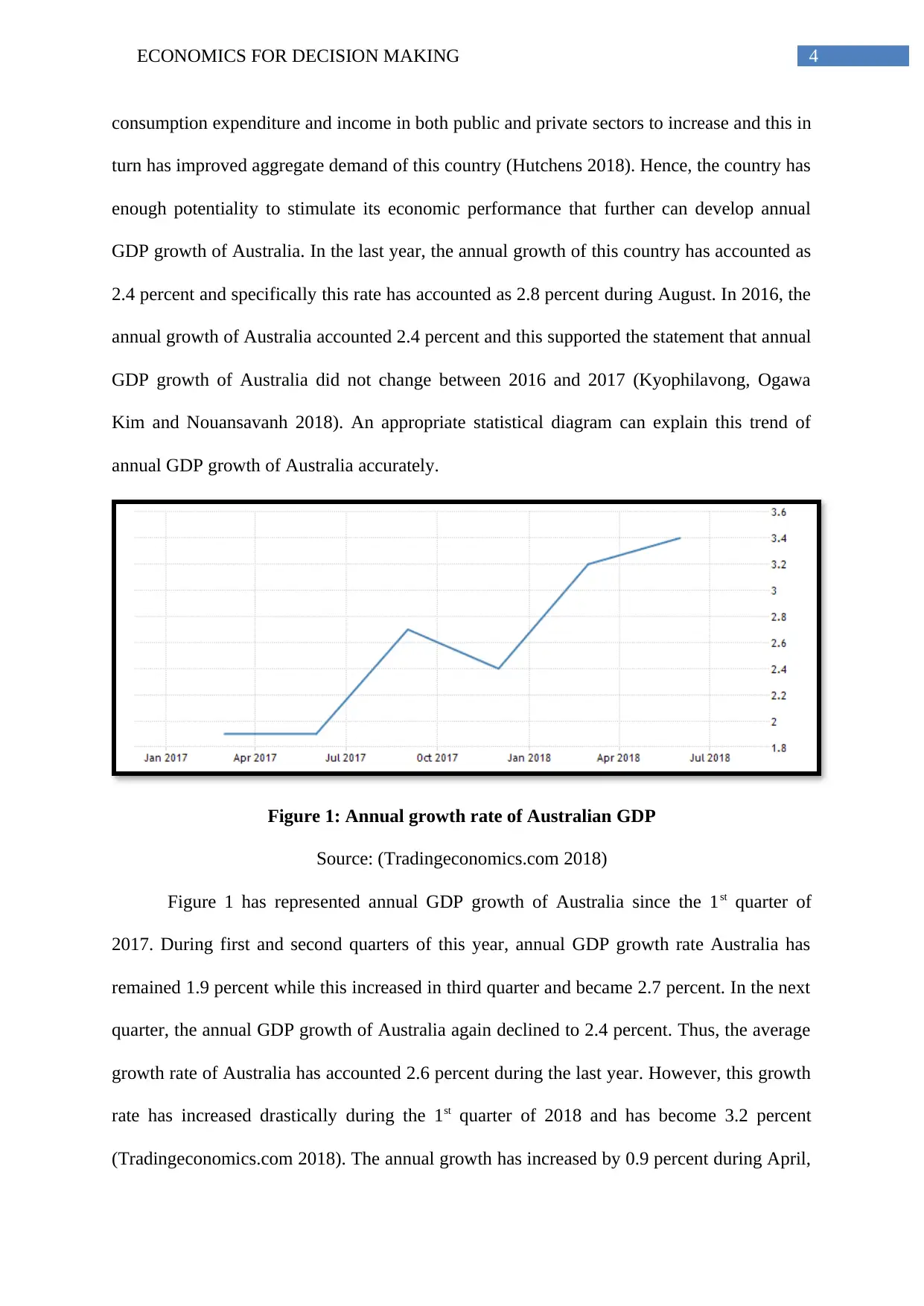

consumption expenditure and income in both public and private sectors to increase and this in

turn has improved aggregate demand of this country (Hutchens 2018). Hence, the country has

enough potentiality to stimulate its economic performance that further can develop annual

GDP growth of Australia. In the last year, the annual growth of this country has accounted as

2.4 percent and specifically this rate has accounted as 2.8 percent during August. In 2016, the

annual growth of Australia accounted 2.4 percent and this supported the statement that annual

GDP growth of Australia did not change between 2016 and 2017 (Kyophilavong, Ogawa

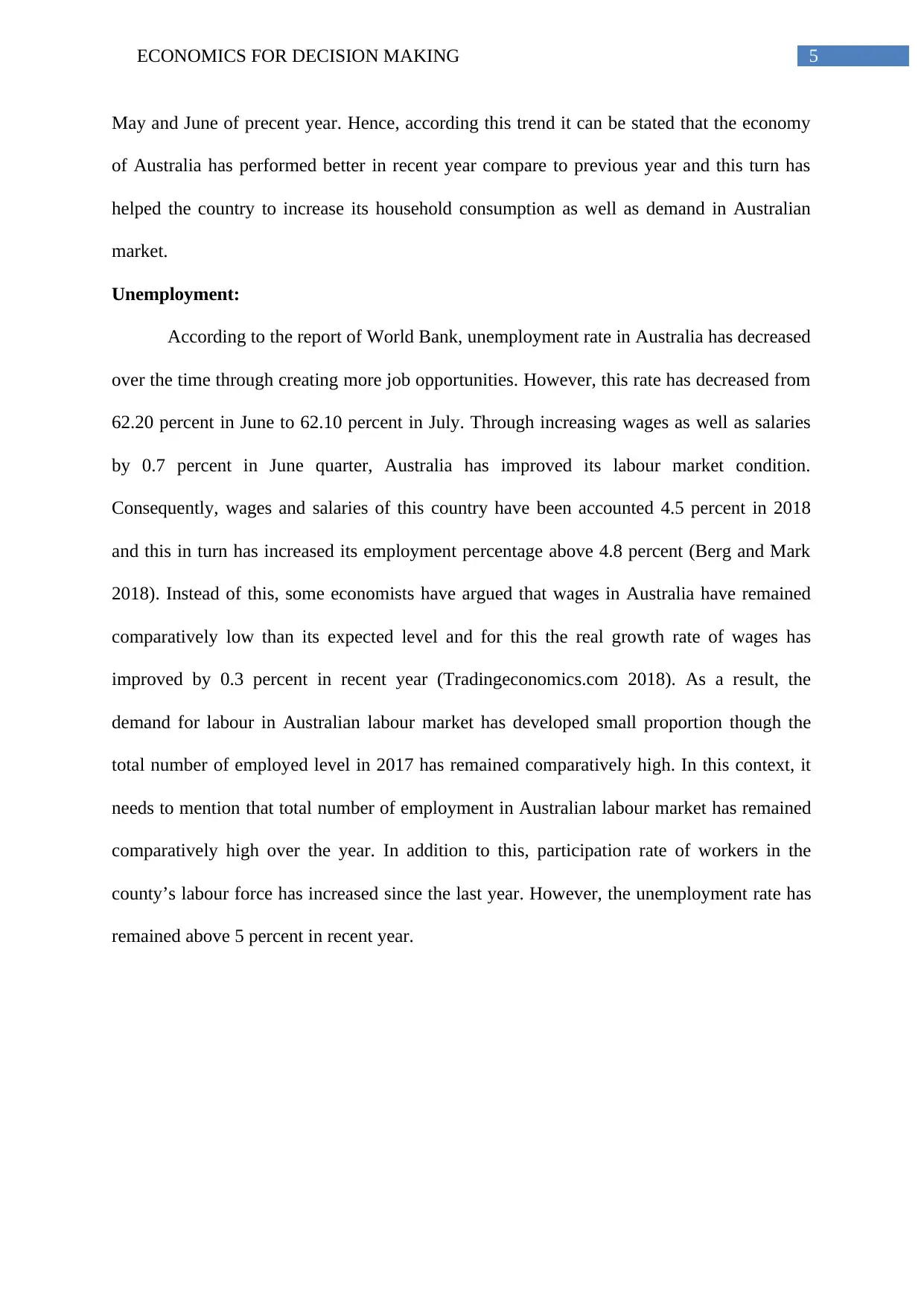

Kim and Nouansavanh 2018). An appropriate statistical diagram can explain this trend of

annual GDP growth of Australia accurately.

Figure 1: Annual growth rate of Australian GDP

Source: (Tradingeconomics.com 2018)

Figure 1 has represented annual GDP growth of Australia since the 1st quarter of

2017. During first and second quarters of this year, annual GDP growth rate Australia has

remained 1.9 percent while this increased in third quarter and became 2.7 percent. In the next

quarter, the annual GDP growth of Australia again declined to 2.4 percent. Thus, the average

growth rate of Australia has accounted 2.6 percent during the last year. However, this growth

rate has increased drastically during the 1st quarter of 2018 and has become 3.2 percent

(Tradingeconomics.com 2018). The annual growth has increased by 0.9 percent during April,

consumption expenditure and income in both public and private sectors to increase and this in

turn has improved aggregate demand of this country (Hutchens 2018). Hence, the country has

enough potentiality to stimulate its economic performance that further can develop annual

GDP growth of Australia. In the last year, the annual growth of this country has accounted as

2.4 percent and specifically this rate has accounted as 2.8 percent during August. In 2016, the

annual growth of Australia accounted 2.4 percent and this supported the statement that annual

GDP growth of Australia did not change between 2016 and 2017 (Kyophilavong, Ogawa

Kim and Nouansavanh 2018). An appropriate statistical diagram can explain this trend of

annual GDP growth of Australia accurately.

Figure 1: Annual growth rate of Australian GDP

Source: (Tradingeconomics.com 2018)

Figure 1 has represented annual GDP growth of Australia since the 1st quarter of

2017. During first and second quarters of this year, annual GDP growth rate Australia has

remained 1.9 percent while this increased in third quarter and became 2.7 percent. In the next

quarter, the annual GDP growth of Australia again declined to 2.4 percent. Thus, the average

growth rate of Australia has accounted 2.6 percent during the last year. However, this growth

rate has increased drastically during the 1st quarter of 2018 and has become 3.2 percent

(Tradingeconomics.com 2018). The annual growth has increased by 0.9 percent during April,

5ECONOMICS FOR DECISION MAKING

May and June of precent year. Hence, according this trend it can be stated that the economy

of Australia has performed better in recent year compare to previous year and this turn has

helped the country to increase its household consumption as well as demand in Australian

market.

Unemployment:

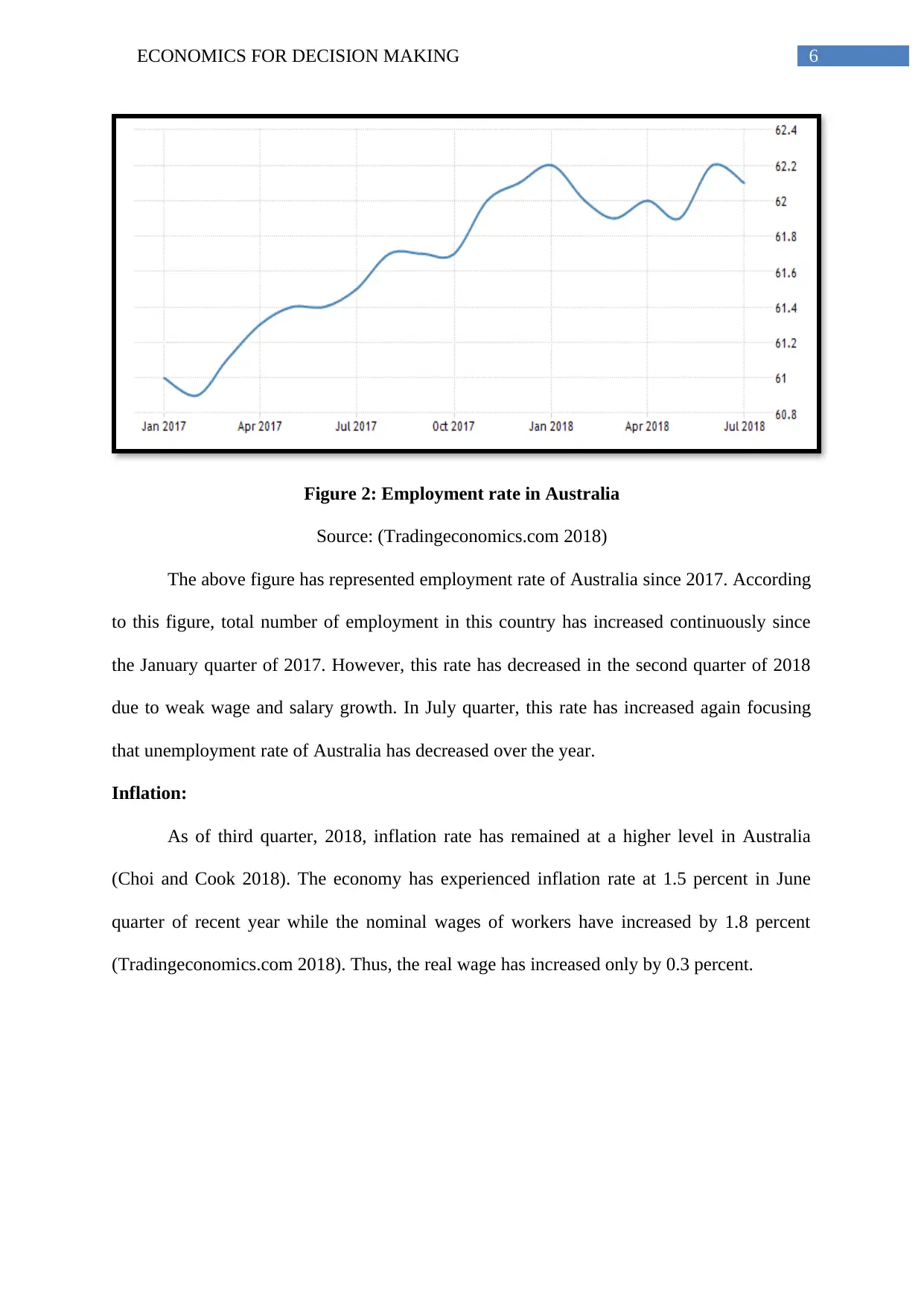

According to the report of World Bank, unemployment rate in Australia has decreased

over the time through creating more job opportunities. However, this rate has decreased from

62.20 percent in June to 62.10 percent in July. Through increasing wages as well as salaries

by 0.7 percent in June quarter, Australia has improved its labour market condition.

Consequently, wages and salaries of this country have been accounted 4.5 percent in 2018

and this in turn has increased its employment percentage above 4.8 percent (Berg and Mark

2018). Instead of this, some economists have argued that wages in Australia have remained

comparatively low than its expected level and for this the real growth rate of wages has

improved by 0.3 percent in recent year (Tradingeconomics.com 2018). As a result, the

demand for labour in Australian labour market has developed small proportion though the

total number of employed level in 2017 has remained comparatively high. In this context, it

needs to mention that total number of employment in Australian labour market has remained

comparatively high over the year. In addition to this, participation rate of workers in the

county’s labour force has increased since the last year. However, the unemployment rate has

remained above 5 percent in recent year.

May and June of precent year. Hence, according this trend it can be stated that the economy

of Australia has performed better in recent year compare to previous year and this turn has

helped the country to increase its household consumption as well as demand in Australian

market.

Unemployment:

According to the report of World Bank, unemployment rate in Australia has decreased

over the time through creating more job opportunities. However, this rate has decreased from

62.20 percent in June to 62.10 percent in July. Through increasing wages as well as salaries

by 0.7 percent in June quarter, Australia has improved its labour market condition.

Consequently, wages and salaries of this country have been accounted 4.5 percent in 2018

and this in turn has increased its employment percentage above 4.8 percent (Berg and Mark

2018). Instead of this, some economists have argued that wages in Australia have remained

comparatively low than its expected level and for this the real growth rate of wages has

improved by 0.3 percent in recent year (Tradingeconomics.com 2018). As a result, the

demand for labour in Australian labour market has developed small proportion though the

total number of employed level in 2017 has remained comparatively high. In this context, it

needs to mention that total number of employment in Australian labour market has remained

comparatively high over the year. In addition to this, participation rate of workers in the

county’s labour force has increased since the last year. However, the unemployment rate has

remained above 5 percent in recent year.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR DECISION MAKING

Figure 2: Employment rate in Australia

Source: (Tradingeconomics.com 2018)

The above figure has represented employment rate of Australia since 2017. According

to this figure, total number of employment in this country has increased continuously since

the January quarter of 2017. However, this rate has decreased in the second quarter of 2018

due to weak wage and salary growth. In July quarter, this rate has increased again focusing

that unemployment rate of Australia has decreased over the year.

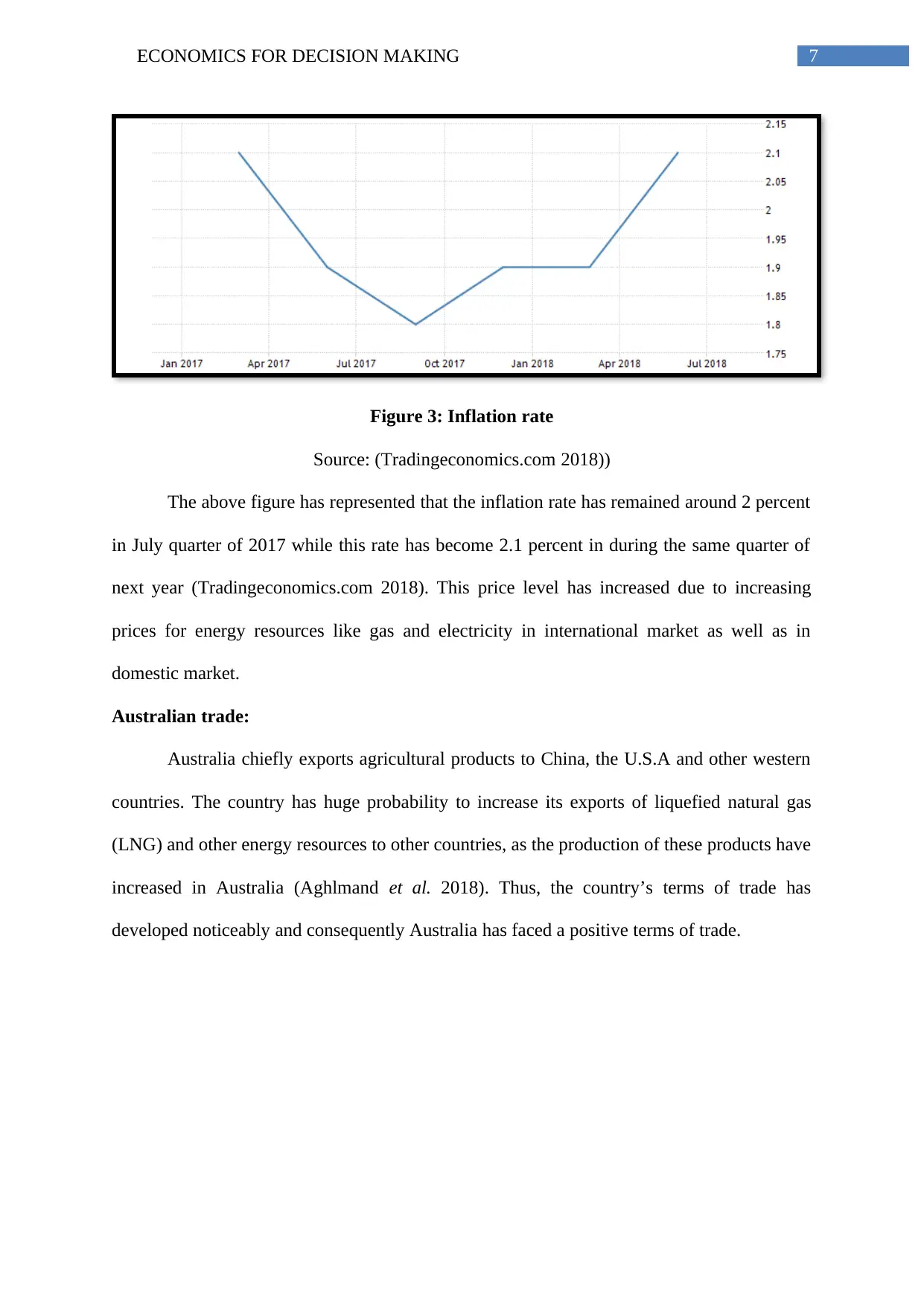

Inflation:

As of third quarter, 2018, inflation rate has remained at a higher level in Australia

(Choi and Cook 2018). The economy has experienced inflation rate at 1.5 percent in June

quarter of recent year while the nominal wages of workers have increased by 1.8 percent

(Tradingeconomics.com 2018). Thus, the real wage has increased only by 0.3 percent.

Figure 2: Employment rate in Australia

Source: (Tradingeconomics.com 2018)

The above figure has represented employment rate of Australia since 2017. According

to this figure, total number of employment in this country has increased continuously since

the January quarter of 2017. However, this rate has decreased in the second quarter of 2018

due to weak wage and salary growth. In July quarter, this rate has increased again focusing

that unemployment rate of Australia has decreased over the year.

Inflation:

As of third quarter, 2018, inflation rate has remained at a higher level in Australia

(Choi and Cook 2018). The economy has experienced inflation rate at 1.5 percent in June

quarter of recent year while the nominal wages of workers have increased by 1.8 percent

(Tradingeconomics.com 2018). Thus, the real wage has increased only by 0.3 percent.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR DECISION MAKING

Figure 3: Inflation rate

Source: (Tradingeconomics.com 2018))

The above figure has represented that the inflation rate has remained around 2 percent

in July quarter of 2017 while this rate has become 2.1 percent in during the same quarter of

next year (Tradingeconomics.com 2018). This price level has increased due to increasing

prices for energy resources like gas and electricity in international market as well as in

domestic market.

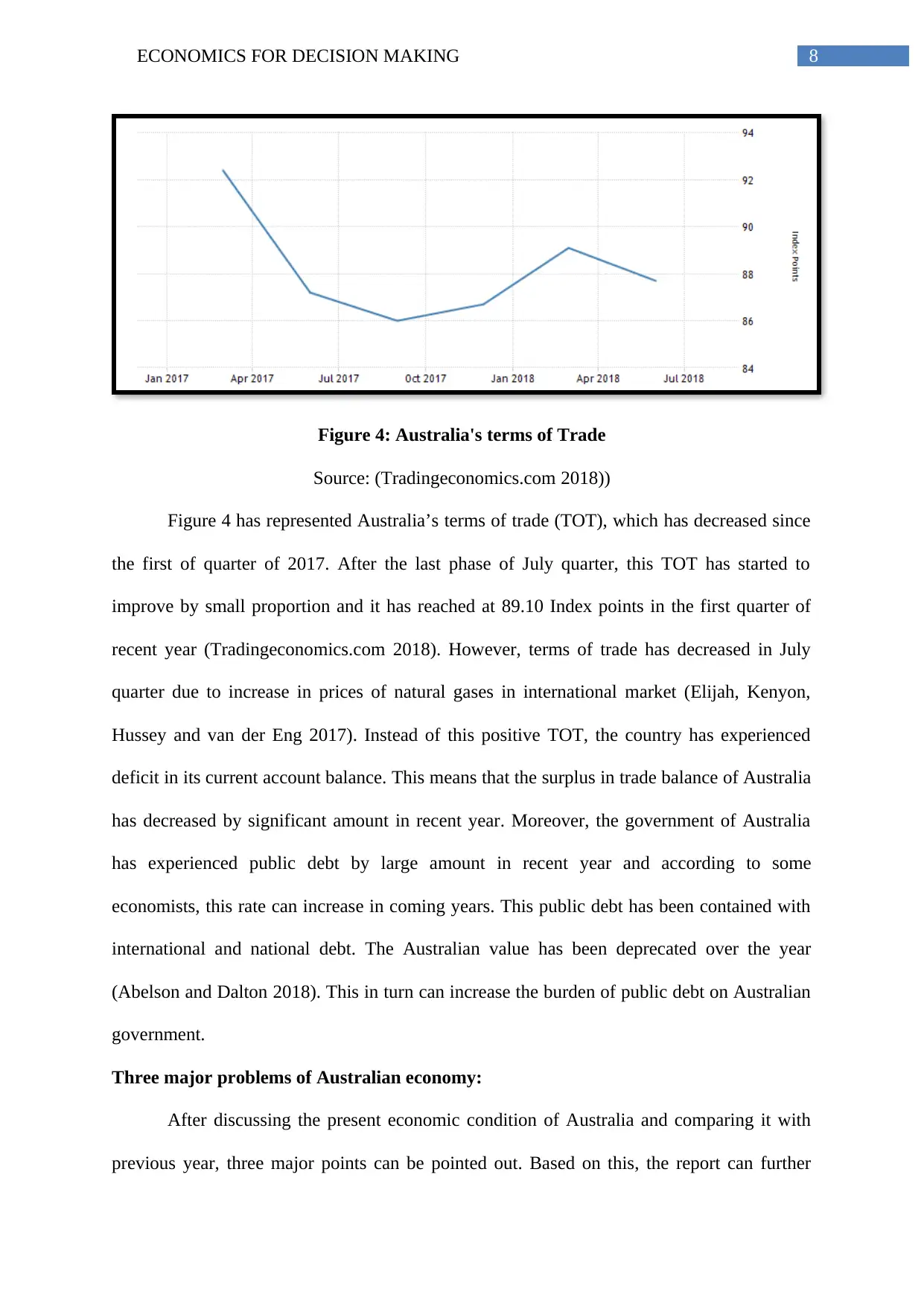

Australian trade:

Australia chiefly exports agricultural products to China, the U.S.A and other western

countries. The country has huge probability to increase its exports of liquefied natural gas

(LNG) and other energy resources to other countries, as the production of these products have

increased in Australia (Aghlmand et al. 2018). Thus, the country’s terms of trade has

developed noticeably and consequently Australia has faced a positive terms of trade.

Figure 3: Inflation rate

Source: (Tradingeconomics.com 2018))

The above figure has represented that the inflation rate has remained around 2 percent

in July quarter of 2017 while this rate has become 2.1 percent in during the same quarter of

next year (Tradingeconomics.com 2018). This price level has increased due to increasing

prices for energy resources like gas and electricity in international market as well as in

domestic market.

Australian trade:

Australia chiefly exports agricultural products to China, the U.S.A and other western

countries. The country has huge probability to increase its exports of liquefied natural gas

(LNG) and other energy resources to other countries, as the production of these products have

increased in Australia (Aghlmand et al. 2018). Thus, the country’s terms of trade has

developed noticeably and consequently Australia has faced a positive terms of trade.

8ECONOMICS FOR DECISION MAKING

Figure 4: Australia's terms of Trade

Source: (Tradingeconomics.com 2018))

Figure 4 has represented Australia’s terms of trade (TOT), which has decreased since

the first of quarter of 2017. After the last phase of July quarter, this TOT has started to

improve by small proportion and it has reached at 89.10 Index points in the first quarter of

recent year (Tradingeconomics.com 2018). However, terms of trade has decreased in July

quarter due to increase in prices of natural gases in international market (Elijah, Kenyon,

Hussey and van der Eng 2017). Instead of this positive TOT, the country has experienced

deficit in its current account balance. This means that the surplus in trade balance of Australia

has decreased by significant amount in recent year. Moreover, the government of Australia

has experienced public debt by large amount in recent year and according to some

economists, this rate can increase in coming years. This public debt has been contained with

international and national debt. The Australian value has been deprecated over the year

(Abelson and Dalton 2018). This in turn can increase the burden of public debt on Australian

government.

Three major problems of Australian economy:

After discussing the present economic condition of Australia and comparing it with

previous year, three major points can be pointed out. Based on this, the report can further

Figure 4: Australia's terms of Trade

Source: (Tradingeconomics.com 2018))

Figure 4 has represented Australia’s terms of trade (TOT), which has decreased since

the first of quarter of 2017. After the last phase of July quarter, this TOT has started to

improve by small proportion and it has reached at 89.10 Index points in the first quarter of

recent year (Tradingeconomics.com 2018). However, terms of trade has decreased in July

quarter due to increase in prices of natural gases in international market (Elijah, Kenyon,

Hussey and van der Eng 2017). Instead of this positive TOT, the country has experienced

deficit in its current account balance. This means that the surplus in trade balance of Australia

has decreased by significant amount in recent year. Moreover, the government of Australia

has experienced public debt by large amount in recent year and according to some

economists, this rate can increase in coming years. This public debt has been contained with

international and national debt. The Australian value has been deprecated over the year

(Abelson and Dalton 2018). This in turn can increase the burden of public debt on Australian

government.

Three major problems of Australian economy:

After discussing the present economic condition of Australia and comparing it with

previous year, three major points can be pointed out. Based on this, the report can further

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR DECISION MAKING

predict Australia’s economic condition for the next 12 months. The RBA has predicted that

the inflation will increase in future by 2.4 percent (Tradingeconomics.com 2018). However,

this rate of inflation growth can be stabled in future. Moreover, global inflation can affect the

country while increase in GDP of this country can further depreciate the value of Australian

currency. As a result, Australia’s current account balance can experience deficit in coming

year (Forbes, Hjortsoe and Nenova 2017). Thus, the RBA can implement suitable monetary

as well as fiscal policies to reduce inflation rate further that can further control current

account balance of this economy (McFarlane, Blackwell and Mounter 2018). Moreover,

increasing amount of public debt and comparatively lower wages can also hamper Australian

economy adversely in future.

Conclusion:

Thus, after discussion the entire paper, it can be described that the Australian

economy has performed in recent year compare to previous one. The annual GDP growth of

this country has increased over the year while the number of unemployed people has reduced,

as the economy has offered wages due to increasing demand in labour market. On the

contrary, inflation rate of Australia has reduced and the RBA has predicted that in can reduce

further in future. The TOT has also fluctuated over the year indicating that export of this

country has reduced at present. From this, the paper has derived three major problems that the

Australian economy can experience in coming months, related to these before mentioned

macroeconomic indicators.

predict Australia’s economic condition for the next 12 months. The RBA has predicted that

the inflation will increase in future by 2.4 percent (Tradingeconomics.com 2018). However,

this rate of inflation growth can be stabled in future. Moreover, global inflation can affect the

country while increase in GDP of this country can further depreciate the value of Australian

currency. As a result, Australia’s current account balance can experience deficit in coming

year (Forbes, Hjortsoe and Nenova 2017). Thus, the RBA can implement suitable monetary

as well as fiscal policies to reduce inflation rate further that can further control current

account balance of this economy (McFarlane, Blackwell and Mounter 2018). Moreover,

increasing amount of public debt and comparatively lower wages can also hamper Australian

economy adversely in future.

Conclusion:

Thus, after discussion the entire paper, it can be described that the Australian

economy has performed in recent year compare to previous one. The annual GDP growth of

this country has increased over the year while the number of unemployed people has reduced,

as the economy has offered wages due to increasing demand in labour market. On the

contrary, inflation rate of Australia has reduced and the RBA has predicted that in can reduce

further in future. The TOT has also fluctuated over the year indicating that export of this

country has reduced at present. From this, the paper has derived three major problems that the

Australian economy can experience in coming months, related to these before mentioned

macroeconomic indicators.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR DECISION MAKING

References:

Abelson, P. and Dalton, T., 2018. Choosing the Social Discount Rate for

Australia. Australian Economic Review, 51(1), pp.52-67.

Aghlmand, S., Rahimi, B., Farrokh-Eslamlou, H., Nabilou, B. and Yusefzadeh, H., 2018.

Determinants of Iran’s bilateral intra-industry trade in pharmaceutical industry. Iranian

journal of pharmaceutical research: IJPR, 17(2), p.822.

Berg, K.A. and Mark, N.C., 2018. Global macro risks in currency excess returns. Journal of

Empirical Finance, 45, pp.300-315.

Choi, W.G. and Cook, M.D., 2018. Policy conflicts and inflation targeting: the role of credit

markets. International Monetary Fund.

Elijah, A., Kenyon, D., Hussey, K. and van der Eng, P. eds., 2017. Australia, the European

Union and the New Trade Agenda. ANU Press.

Forbes, K., Hjortsoe, I. and Nenova, T., 2017. Current account deficits during heightened

risk: menacing or mitigating?. The Economic Journal, 127(601), pp.571-623.

Hutchens, G. 2018. Australia's GDP growth jumps to 3.1% on back of mining exports.

[online] the Guardian. Available at:

https://www.theguardian.com/business/2018/jun/06/australias-gdp-growth-jumps-to-31-on-

back-of-mining-exports [Accessed 11 Sep. 2018].

Kyophilavong, P., Ogawa, K., Kim, B. and Nouansavanh, K., 2018. Does Education Promote

Economic Growth in Lao PDR?: Evidence From Cointegration And Granger Causality

Approaches. The Journal of Developing Areas, 52(2), pp.1-11.

McFarlane, J., Blackwell, B. and Mounter, S., 2018. Good Gardening for a Perennial

Economy: What's the Optimal Growth Path for a Regional Economy?. The Journal of

Developing Areas, 52(1), pp.29-44.

Meyer, J. 2018. Economists deeply divided over Australia's economic path in 2017.

[online] The Sydney Morning Herald. Available at:

https://www.smh.com.au/business/markets/economists-deeply-divided-over-australias-

References:

Abelson, P. and Dalton, T., 2018. Choosing the Social Discount Rate for

Australia. Australian Economic Review, 51(1), pp.52-67.

Aghlmand, S., Rahimi, B., Farrokh-Eslamlou, H., Nabilou, B. and Yusefzadeh, H., 2018.

Determinants of Iran’s bilateral intra-industry trade in pharmaceutical industry. Iranian

journal of pharmaceutical research: IJPR, 17(2), p.822.

Berg, K.A. and Mark, N.C., 2018. Global macro risks in currency excess returns. Journal of

Empirical Finance, 45, pp.300-315.

Choi, W.G. and Cook, M.D., 2018. Policy conflicts and inflation targeting: the role of credit

markets. International Monetary Fund.

Elijah, A., Kenyon, D., Hussey, K. and van der Eng, P. eds., 2017. Australia, the European

Union and the New Trade Agenda. ANU Press.

Forbes, K., Hjortsoe, I. and Nenova, T., 2017. Current account deficits during heightened

risk: menacing or mitigating?. The Economic Journal, 127(601), pp.571-623.

Hutchens, G. 2018. Australia's GDP growth jumps to 3.1% on back of mining exports.

[online] the Guardian. Available at:

https://www.theguardian.com/business/2018/jun/06/australias-gdp-growth-jumps-to-31-on-

back-of-mining-exports [Accessed 11 Sep. 2018].

Kyophilavong, P., Ogawa, K., Kim, B. and Nouansavanh, K., 2018. Does Education Promote

Economic Growth in Lao PDR?: Evidence From Cointegration And Granger Causality

Approaches. The Journal of Developing Areas, 52(2), pp.1-11.

McFarlane, J., Blackwell, B. and Mounter, S., 2018. Good Gardening for a Perennial

Economy: What's the Optimal Growth Path for a Regional Economy?. The Journal of

Developing Areas, 52(1), pp.29-44.

Meyer, J. 2018. Economists deeply divided over Australia's economic path in 2017.

[online] The Sydney Morning Herald. Available at:

https://www.smh.com.au/business/markets/economists-deeply-divided-over-australias-

11ECONOMICS FOR DECISION MAKING

economic-path-in-2017-20170207-gu72ev.html [Accessed 11 Sep. 2018]. – The main

article

Reserve Bank of Australia 2018. Economic Outlook | Statement on Monetary Policy –

August 2018 | RBA. [online] Reserve Bank of Australia. Available at:

https://www.rba.gov.au/publications/smp/2018/aug/economic-outlook.html [Accessed 11

Sep. 2018].

Tradingeconomics.com 2018. Australia - Economic Indicators. [online]

Tradingeconomics.com. Available at: https://tradingeconomics.com/australia/indicators

[Accessed 11 Sep. 2018].

economic-path-in-2017-20170207-gu72ev.html [Accessed 11 Sep. 2018]. – The main

article

Reserve Bank of Australia 2018. Economic Outlook | Statement on Monetary Policy –

August 2018 | RBA. [online] Reserve Bank of Australia. Available at:

https://www.rba.gov.au/publications/smp/2018/aug/economic-outlook.html [Accessed 11

Sep. 2018].

Tradingeconomics.com 2018. Australia - Economic Indicators. [online]

Tradingeconomics.com. Available at: https://tradingeconomics.com/australia/indicators

[Accessed 11 Sep. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.