The Bursting of the Housing Bubble and Its Consequences on the US Economy

VerifiedAdded on 2019/11/19

|12

|2843

|303

Report

AI Summary

The Great Recession was a significant economic downturn that started in the United States in 2006. The housing market bubble burst, leading to a sharp decline in housing prices and a subsequent crash of the stock market. This had severe consequences for the economy, including high levels of unemployment, foreclosure, and bank failures. The recession led to a loss of $16 trillion, resulting in widespread job losses and economic instability. The government and Federal Reserve intervened to stabilize the economy, but it took years to recover from the effects of the Great Recession.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ECONOMICS FOR MANAGERS

Economics for Managers

Name of the Student

Name of the University

Author Note

Economics for Managers

Name of the Student

Name of the University

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ECONOMICS FOR MANAGERS

Introduction

An economy, by nature is expected to be dynamic and deals with the mutual interactions

of the demand and the supply forces existing in the framework. The dynamic stability of any

economy depends on the dynamics of these two forces and how they come in agreement to reach

an equilibrium state, in the short run as well as in the long run. However, apart from these two

forces, there are other variables, which can cause fluctuations in the economy, giving rise to

special conditions in the economy for the time being. One such abnormal economic condition is

known as recession (Eaton et al 2016). By the term recession, a temporary economic decline is

meant, when the general economic activities are reduced and the implications are seen in the

reduced GDP and GDP growth rate of the concerned economy for that particular period.

Recession, however, depending upon the nature and magnitude, can have long term implications

(mostly negative) on the concerned economy (Rabie 2013). The essay tries to analyze the

phenomenon of Great Recession, which occurred in the United States of America, during the

time period of 2007-2008 and had huge implications on the economy of the country and in the

global economic scenario as a whole. The essay emphasizes on discussing the causes of this

Great Recession and analyzing these causes in terms of economic theories and concepts.

What is a recession?

The term recession, in terms of economics, means an overall slowdown of the economy

in terms of the productive, trading and industrial activities, due to a loss of the confidence from

the consumer as well as producer sides over the economy. This in turn, leads to an overall

reduction in aggregated demand, which results in a lowered supply, low wages, employment and

Introduction

An economy, by nature is expected to be dynamic and deals with the mutual interactions

of the demand and the supply forces existing in the framework. The dynamic stability of any

economy depends on the dynamics of these two forces and how they come in agreement to reach

an equilibrium state, in the short run as well as in the long run. However, apart from these two

forces, there are other variables, which can cause fluctuations in the economy, giving rise to

special conditions in the economy for the time being. One such abnormal economic condition is

known as recession (Eaton et al 2016). By the term recession, a temporary economic decline is

meant, when the general economic activities are reduced and the implications are seen in the

reduced GDP and GDP growth rate of the concerned economy for that particular period.

Recession, however, depending upon the nature and magnitude, can have long term implications

(mostly negative) on the concerned economy (Rabie 2013). The essay tries to analyze the

phenomenon of Great Recession, which occurred in the United States of America, during the

time period of 2007-2008 and had huge implications on the economy of the country and in the

global economic scenario as a whole. The essay emphasizes on discussing the causes of this

Great Recession and analyzing these causes in terms of economic theories and concepts.

What is a recession?

The term recession, in terms of economics, means an overall slowdown of the economy

in terms of the productive, trading and industrial activities, due to a loss of the confidence from

the consumer as well as producer sides over the economy. This in turn, leads to an overall

reduction in aggregated demand, which results in a lowered supply, low wages, employment and

2ECONOMICS FOR MANAGERS

low standard of living of the residents of the concerned economy. The negative performance of

the country in the different economic aspects can be clearly seen in the unimpressive GDP

statistics of the country at that period. However, the declining GDP is the effect of recession and

should not be taken to be one of the factors contributing to it, as is confused to be, because GDP

is generally recorded after the initiation of the event (Auerbach and Gorodnichenko 2012).

Often, recession, due to its nature of creating negative events in cyclical manner, leads to the

creation of a viscous cycle, which spirally takes the economy towards the path of economic

downturn. The process goes on if the governing bodies and the monetary authorities of the

economy do not intervene and take abrupt actions to reduce the effects of this economic

phenomenon (Allen 2016).

In general, there may be many factors, which cumulatively contribute to the initiation of

recessionary situations in an economy. Few of the important ones are as follows:

a) High interest rates prevalence- Existence of an overall high level of interest rate in the

economy encourages people to save more, which, in turn affects the demand conditions of the

economy, thereby reducing the supply side activities of the economy eventually and taking the

economy on the path of initiation of recession in the future periods.

b) Crash in the stock market- Recession can also be caused by a sudden loss of confidence of the

investors, which may result in draining away of capital from the market, slowing down the

economy (Cynamon, Fazzari and Setterfield 2013).

c) House market irregularities- A sudden and long term fall in the prices of the residential assets

can also trigger recession as housings are also seen as a type of asset building. If the prices of

these assets start to decline, the customers start losing out confidence over the market, thereby

low standard of living of the residents of the concerned economy. The negative performance of

the country in the different economic aspects can be clearly seen in the unimpressive GDP

statistics of the country at that period. However, the declining GDP is the effect of recession and

should not be taken to be one of the factors contributing to it, as is confused to be, because GDP

is generally recorded after the initiation of the event (Auerbach and Gorodnichenko 2012).

Often, recession, due to its nature of creating negative events in cyclical manner, leads to the

creation of a viscous cycle, which spirally takes the economy towards the path of economic

downturn. The process goes on if the governing bodies and the monetary authorities of the

economy do not intervene and take abrupt actions to reduce the effects of this economic

phenomenon (Allen 2016).

In general, there may be many factors, which cumulatively contribute to the initiation of

recessionary situations in an economy. Few of the important ones are as follows:

a) High interest rates prevalence- Existence of an overall high level of interest rate in the

economy encourages people to save more, which, in turn affects the demand conditions of the

economy, thereby reducing the supply side activities of the economy eventually and taking the

economy on the path of initiation of recession in the future periods.

b) Crash in the stock market- Recession can also be caused by a sudden loss of confidence of the

investors, which may result in draining away of capital from the market, slowing down the

economy (Cynamon, Fazzari and Setterfield 2013).

c) House market irregularities- A sudden and long term fall in the prices of the residential assets

can also trigger recession as housings are also seen as a type of asset building. If the prices of

these assets start to decline, the customers start losing out confidence over the market, thereby

3ECONOMICS FOR MANAGERS

leading to foreclosures and an overall slowdown of the investing activities. The problem

becomes even more acute in the populous developed countries as a significant share of the total

investment amount of these countries is comprised of residential investments, which poses as an

avenue of channelizing investment and building up of assets (Danziger, Chavez and

Cumberworth 2012).

Apart from the above mentioned factors, recession can also be caused in a country, due to

factors like wage controls, asset bubbles, crunches in the credit markets and abnormal

phenomenon like slowdown due to state of war or huge natural or man-made catastrophe.

The Great Recession of the USA:

The economy of the United States of America, has been and still is considered to be one

of the strongest economies in the global scenario. The country has significant influence on the

global economy as much of the global conditions depend on the economic strategies taken by the

country. However, the more or less stable economy of the country has had its share of turmoil

and fluctuations, two of which are of immense implications on the economy. One of these events

is the Great Depression of 1930s and the other one is the Great Recession, which the country

faced from 2007 to 2009-2010 (Jenkins et al 2012).

According to the data provided by the National Bureau of Economic Research, the USA

started experiencing the initiation of this recessionary situation from the last quarter (specifically

from December) of the year 2007. The recession led to a tremendous backlash in the economy,

with the GDP statistics of the country stooping to new lows. The GDP of the country contracted

by 51% during that period of time, the rates being the worst the country had experienced since

leading to foreclosures and an overall slowdown of the investing activities. The problem

becomes even more acute in the populous developed countries as a significant share of the total

investment amount of these countries is comprised of residential investments, which poses as an

avenue of channelizing investment and building up of assets (Danziger, Chavez and

Cumberworth 2012).

Apart from the above mentioned factors, recession can also be caused in a country, due to

factors like wage controls, asset bubbles, crunches in the credit markets and abnormal

phenomenon like slowdown due to state of war or huge natural or man-made catastrophe.

The Great Recession of the USA:

The economy of the United States of America, has been and still is considered to be one

of the strongest economies in the global scenario. The country has significant influence on the

global economy as much of the global conditions depend on the economic strategies taken by the

country. However, the more or less stable economy of the country has had its share of turmoil

and fluctuations, two of which are of immense implications on the economy. One of these events

is the Great Depression of 1930s and the other one is the Great Recession, which the country

faced from 2007 to 2009-2010 (Jenkins et al 2012).

According to the data provided by the National Bureau of Economic Research, the USA

started experiencing the initiation of this recessionary situation from the last quarter (specifically

from December) of the year 2007. The recession led to a tremendous backlash in the economy,

with the GDP statistics of the country stooping to new lows. The GDP of the country contracted

by 51% during that period of time, the rates being the worst the country had experienced since

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ECONOMICS FOR MANAGERS

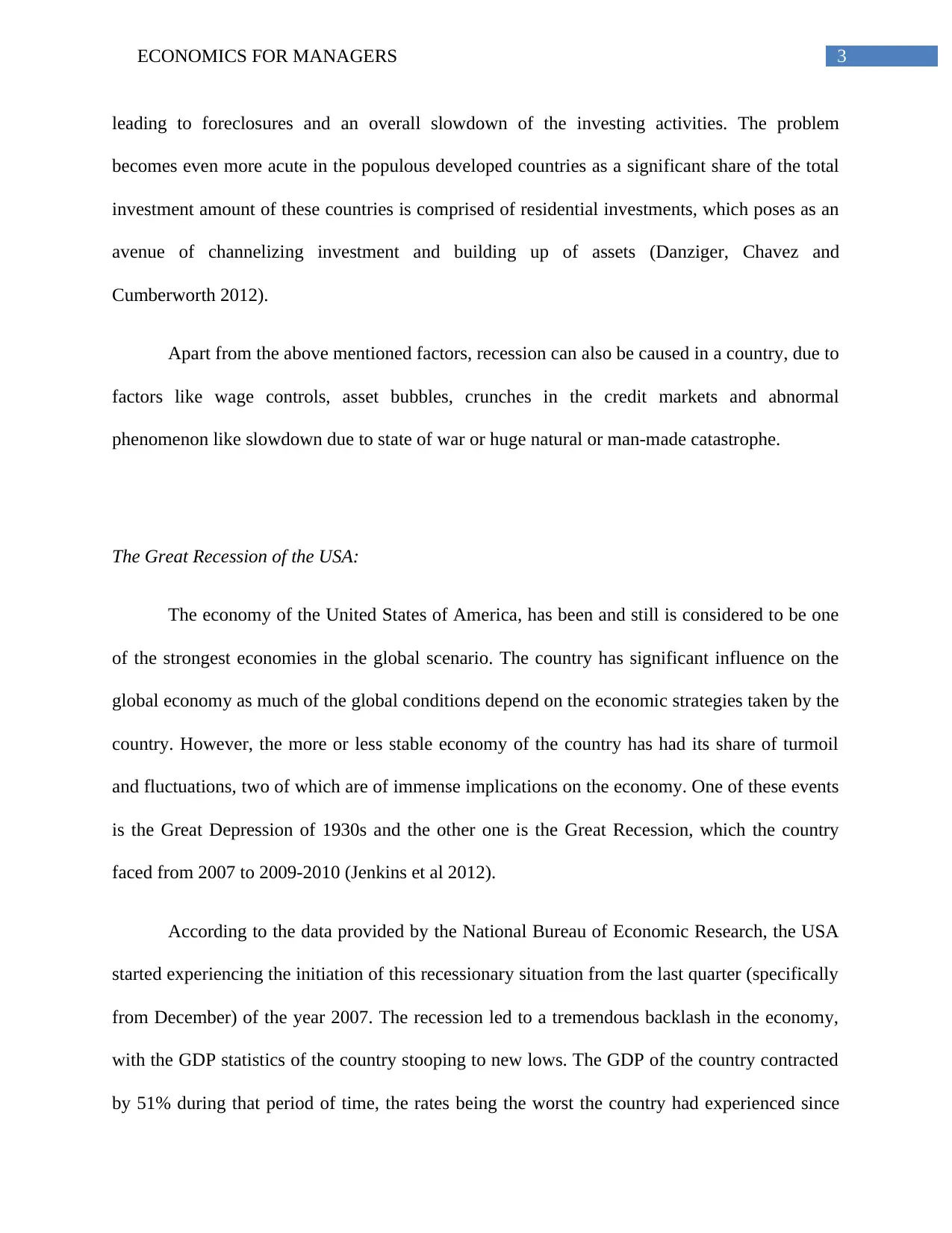

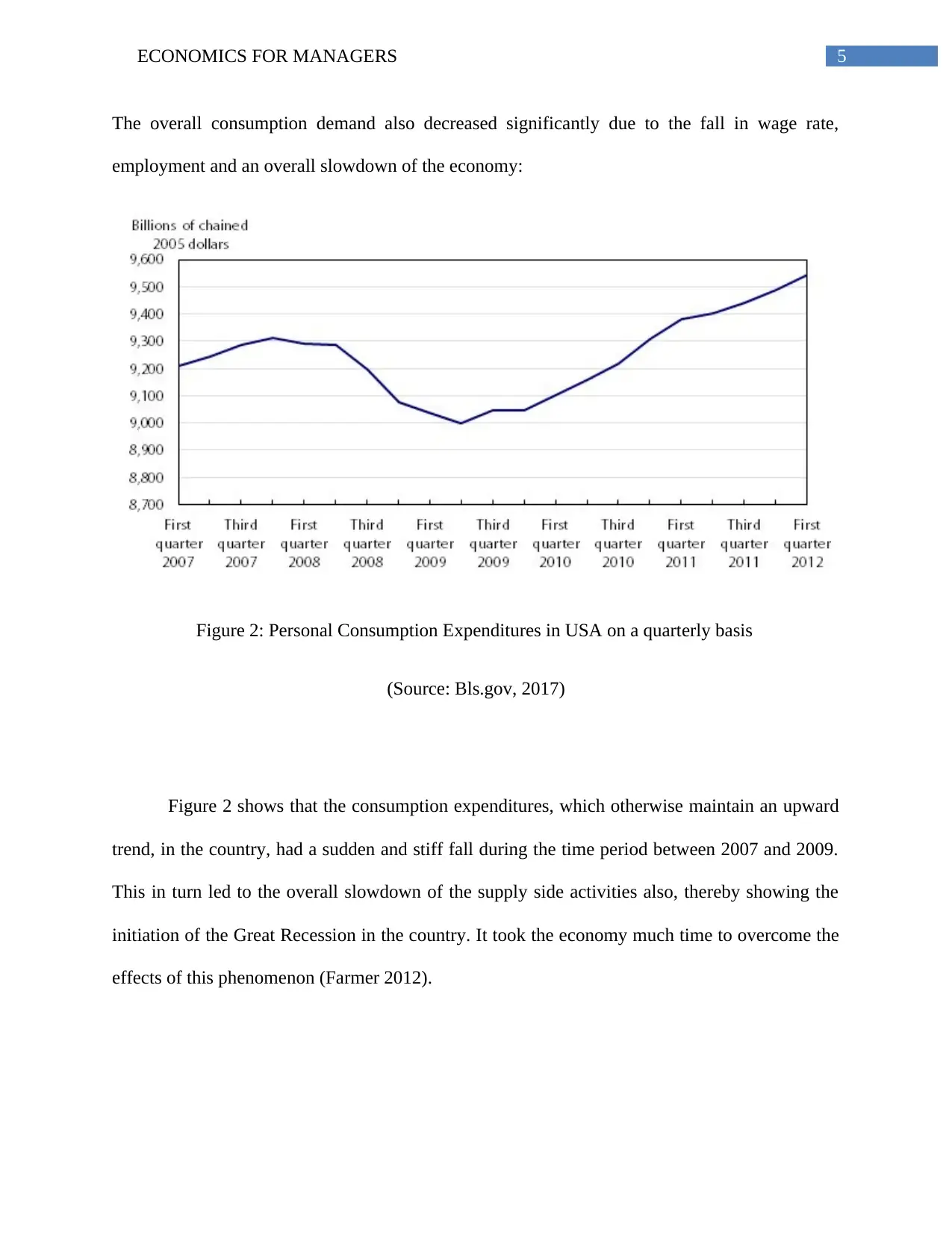

the Great Depression of the 1930s (O'higgins 2012). Apart from the GDP, the employment

scenario of the country also decreased to a huge extent during that period, as can be seen in the

following graph:

Figure 1: Employment Population Ratio of USA 1900-2016

(Source: Bls.gov, 2017)

As can be seen from the above figure, the employment population ratio of the country,

remaining otherwise stable and having a general upward trend over time, experienced a steep

decline in the period between 2007-2009, with the rate reaching stability at a significantly lower

level, in 2010. The country slowly is gaining back in this aspect but the implication of the

recession has been huge and long term on the employment sector of the country as is evident

from the above figure (Boldrin et al 2013).

the Great Depression of the 1930s (O'higgins 2012). Apart from the GDP, the employment

scenario of the country also decreased to a huge extent during that period, as can be seen in the

following graph:

Figure 1: Employment Population Ratio of USA 1900-2016

(Source: Bls.gov, 2017)

As can be seen from the above figure, the employment population ratio of the country,

remaining otherwise stable and having a general upward trend over time, experienced a steep

decline in the period between 2007-2009, with the rate reaching stability at a significantly lower

level, in 2010. The country slowly is gaining back in this aspect but the implication of the

recession has been huge and long term on the employment sector of the country as is evident

from the above figure (Boldrin et al 2013).

5ECONOMICS FOR MANAGERS

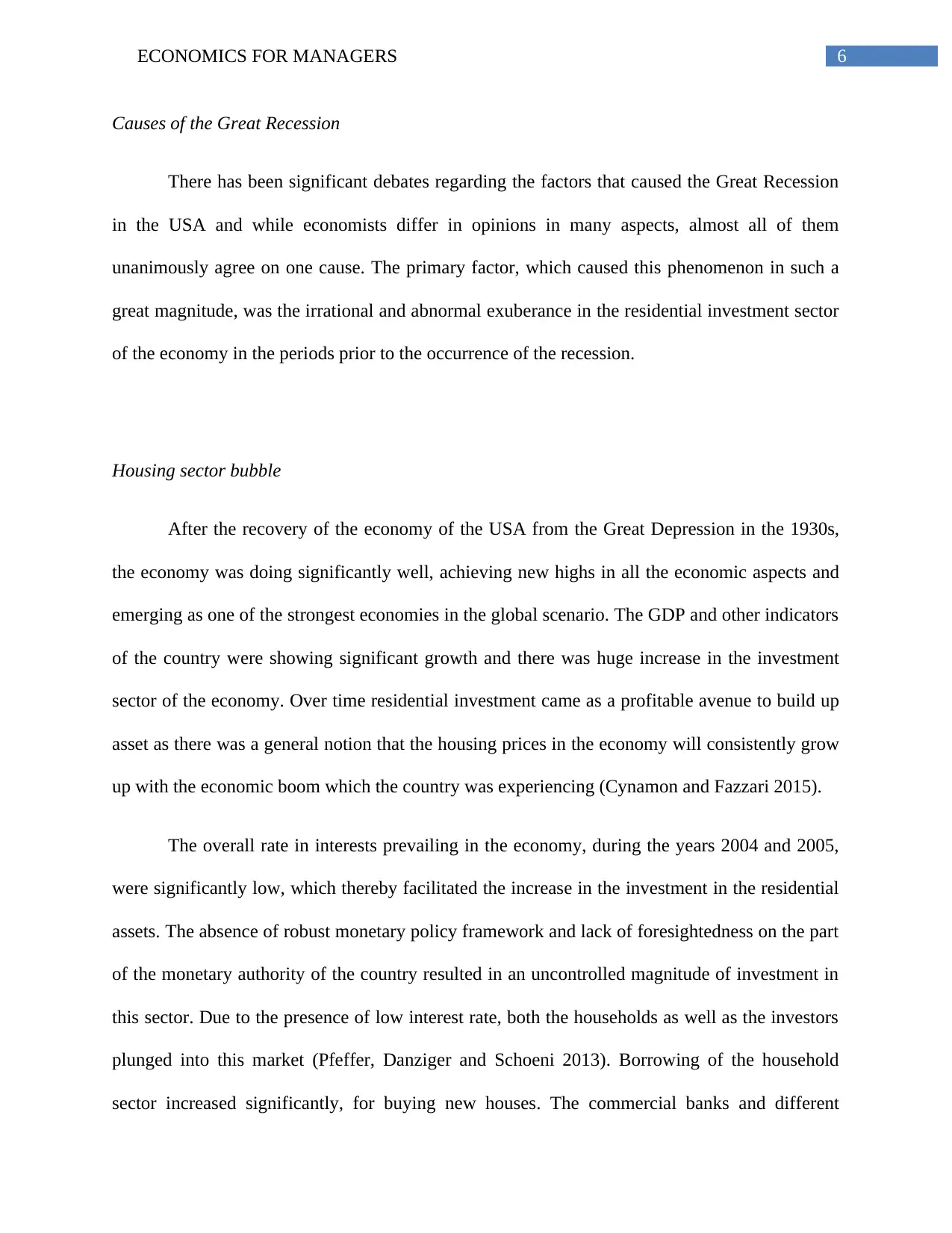

The overall consumption demand also decreased significantly due to the fall in wage rate,

employment and an overall slowdown of the economy:

Figure 2: Personal Consumption Expenditures in USA on a quarterly basis

(Source: Bls.gov, 2017)

Figure 2 shows that the consumption expenditures, which otherwise maintain an upward

trend, in the country, had a sudden and stiff fall during the time period between 2007 and 2009.

This in turn led to the overall slowdown of the supply side activities also, thereby showing the

initiation of the Great Recession in the country. It took the economy much time to overcome the

effects of this phenomenon (Farmer 2012).

The overall consumption demand also decreased significantly due to the fall in wage rate,

employment and an overall slowdown of the economy:

Figure 2: Personal Consumption Expenditures in USA on a quarterly basis

(Source: Bls.gov, 2017)

Figure 2 shows that the consumption expenditures, which otherwise maintain an upward

trend, in the country, had a sudden and stiff fall during the time period between 2007 and 2009.

This in turn led to the overall slowdown of the supply side activities also, thereby showing the

initiation of the Great Recession in the country. It took the economy much time to overcome the

effects of this phenomenon (Farmer 2012).

6ECONOMICS FOR MANAGERS

Causes of the Great Recession

There has been significant debates regarding the factors that caused the Great Recession

in the USA and while economists differ in opinions in many aspects, almost all of them

unanimously agree on one cause. The primary factor, which caused this phenomenon in such a

great magnitude, was the irrational and abnormal exuberance in the residential investment sector

of the economy in the periods prior to the occurrence of the recession.

Housing sector bubble

After the recovery of the economy of the USA from the Great Depression in the 1930s,

the economy was doing significantly well, achieving new highs in all the economic aspects and

emerging as one of the strongest economies in the global scenario. The GDP and other indicators

of the country were showing significant growth and there was huge increase in the investment

sector of the economy. Over time residential investment came as a profitable avenue to build up

asset as there was a general notion that the housing prices in the economy will consistently grow

up with the economic boom which the country was experiencing (Cynamon and Fazzari 2015).

The overall rate in interests prevailing in the economy, during the years 2004 and 2005,

were significantly low, which thereby facilitated the increase in the investment in the residential

assets. The absence of robust monetary policy framework and lack of foresightedness on the part

of the monetary authority of the country resulted in an uncontrolled magnitude of investment in

this sector. Due to the presence of low interest rate, both the households as well as the investors

plunged into this market (Pfeffer, Danziger and Schoeni 2013). Borrowing of the household

sector increased significantly, for buying new houses. The commercial banks and different

Causes of the Great Recession

There has been significant debates regarding the factors that caused the Great Recession

in the USA and while economists differ in opinions in many aspects, almost all of them

unanimously agree on one cause. The primary factor, which caused this phenomenon in such a

great magnitude, was the irrational and abnormal exuberance in the residential investment sector

of the economy in the periods prior to the occurrence of the recession.

Housing sector bubble

After the recovery of the economy of the USA from the Great Depression in the 1930s,

the economy was doing significantly well, achieving new highs in all the economic aspects and

emerging as one of the strongest economies in the global scenario. The GDP and other indicators

of the country were showing significant growth and there was huge increase in the investment

sector of the economy. Over time residential investment came as a profitable avenue to build up

asset as there was a general notion that the housing prices in the economy will consistently grow

up with the economic boom which the country was experiencing (Cynamon and Fazzari 2015).

The overall rate in interests prevailing in the economy, during the years 2004 and 2005,

were significantly low, which thereby facilitated the increase in the investment in the residential

assets. The absence of robust monetary policy framework and lack of foresightedness on the part

of the monetary authority of the country resulted in an uncontrolled magnitude of investment in

this sector. Due to the presence of low interest rate, both the households as well as the investors

plunged into this market (Pfeffer, Danziger and Schoeni 2013). Borrowing of the household

sector increased significantly, for buying new houses. The commercial banks and different

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR MANAGERS

insurance companies came up with mortgage facilities, which required the households to make a

very small down payment as much of the amount, were lent to them by these institutions. The

introduction of the interest-only loans, in turn led many people to buy houses, which they could

not actually afford. On the other hand, the investors started investing more in this sector, as the

low interest rates on borrowing were apparently beneficial to expand their economic prospects. A

section of businesspersons prospered immensely by buying homes and selling them at higher

prices as the prices of the residential assets were consistently going up. This cumulatively

formed a bubble in the housing market and the speculations of the people in general that the

prices will always go up, along with the low interest rates, contributed even more in the

formation of this bubble (McDonald and Stokes 2013).

Bursting of the bubble in the housing market

The housing bubble, in 2006, burst, much to the shock of the residents, as the housing

prices started declining sharply, having significant implications (mostly negative) on the overall

economy of the country. The sudden fall in the prices led to huge rate of foreclosure by the

customers of the housing assets. These foreclosure activities in turn took the banks and financial

institutions to the state of panic as they faced immense losses on the mortgage backed securities

that they had on secondary markets. The banks eventually became skeptic to lend out money,

which led to bailing out of more than 700 billion dollars from the market (Kivedal 2013).

By the end quarter of 2008, many commercial investment institutions faced bankruptcy,

including the fourth largest of the investment banks of the country, the Lehman Brothers. The

share market of the country faced a crash, which was never seen before in the economy of the

insurance companies came up with mortgage facilities, which required the households to make a

very small down payment as much of the amount, were lent to them by these institutions. The

introduction of the interest-only loans, in turn led many people to buy houses, which they could

not actually afford. On the other hand, the investors started investing more in this sector, as the

low interest rates on borrowing were apparently beneficial to expand their economic prospects. A

section of businesspersons prospered immensely by buying homes and selling them at higher

prices as the prices of the residential assets were consistently going up. This cumulatively

formed a bubble in the housing market and the speculations of the people in general that the

prices will always go up, along with the low interest rates, contributed even more in the

formation of this bubble (McDonald and Stokes 2013).

Bursting of the bubble in the housing market

The housing bubble, in 2006, burst, much to the shock of the residents, as the housing

prices started declining sharply, having significant implications (mostly negative) on the overall

economy of the country. The sudden fall in the prices led to huge rate of foreclosure by the

customers of the housing assets. These foreclosure activities in turn took the banks and financial

institutions to the state of panic as they faced immense losses on the mortgage backed securities

that they had on secondary markets. The banks eventually became skeptic to lend out money,

which led to bailing out of more than 700 billion dollars from the market (Kivedal 2013).

By the end quarter of 2008, many commercial investment institutions faced bankruptcy,

including the fourth largest of the investment banks of the country, the Lehman Brothers. The

share market of the country faced a crash, which was never seen before in the economy of the

8ECONOMICS FOR MANAGERS

USA. The residents of the country, by the year 2009, lost an astonishing amount of 16 trillion

dollars, which made the stock market conditions even more worse and the implications were

farfetched and tremendously long term. The bubble burst, indirectly decreased the employment

of the country in a threatening way by decreasing the economic activities of the country

significantly. The country alone lost around 7.5 million jobs, which in its turn doubled the

previously existing employment rate (Kivedal 2013).

The effects of the Great Recession took substantially long time to wither out from the

economy and the government of the country along with the apex monetary institution, the

Federal Reserve, had to intervene in the market and had to adapt and implement huge reforms

before the economy again gained stability and sustainability in the long run (Farmer 2012).

Conclusion

The Great Recession, which started in the USA had hugely adverse impacts on the

country and percolated to the global economic scenario as well. The entire economy experiences

a massive slowdown in every aspect, especially in terms GDP, share market and employment

scenarios. The main cause of this huge recessionary situation was the bursting of the housing

sector bubble, which was highly unanticipated by the residents of the country. The phenomenon

came as a lesson to the governing authorities as well as the residents of the country, who were

before that, unaware of what repercussions the economy could face with an abnormal turn in the

economy. The worst sufferers were the insurance companies and the financial enterprises, who,

based on their speculations of huge expected prosperity of the housing market, started mortgage

based operating and took high risks. Many of these companies had to file bankruptcy and some

USA. The residents of the country, by the year 2009, lost an astonishing amount of 16 trillion

dollars, which made the stock market conditions even more worse and the implications were

farfetched and tremendously long term. The bubble burst, indirectly decreased the employment

of the country in a threatening way by decreasing the economic activities of the country

significantly. The country alone lost around 7.5 million jobs, which in its turn doubled the

previously existing employment rate (Kivedal 2013).

The effects of the Great Recession took substantially long time to wither out from the

economy and the government of the country along with the apex monetary institution, the

Federal Reserve, had to intervene in the market and had to adapt and implement huge reforms

before the economy again gained stability and sustainability in the long run (Farmer 2012).

Conclusion

The Great Recession, which started in the USA had hugely adverse impacts on the

country and percolated to the global economic scenario as well. The entire economy experiences

a massive slowdown in every aspect, especially in terms GDP, share market and employment

scenarios. The main cause of this huge recessionary situation was the bursting of the housing

sector bubble, which was highly unanticipated by the residents of the country. The phenomenon

came as a lesson to the governing authorities as well as the residents of the country, who were

before that, unaware of what repercussions the economy could face with an abnormal turn in the

economy. The worst sufferers were the insurance companies and the financial enterprises, who,

based on their speculations of huge expected prosperity of the housing market, started mortgage

based operating and took high risks. Many of these companies had to file bankruptcy and some

9ECONOMICS FOR MANAGERS

of them even faced a permanent shut down. The lax financial regulations of the country along

with the strategy of keeping interest rates at low levels, to increase borrowing and investments,

contributed significantly to the occurrence of the Great Recession in the USA, which later,

affected many other countries, including Europe and had massive negative impact on the global

economic scenario.

of them even faced a permanent shut down. The lax financial regulations of the country along

with the strategy of keeping interest rates at low levels, to increase borrowing and investments,

contributed significantly to the occurrence of the Great Recession in the USA, which later,

affected many other countries, including Europe and had massive negative impact on the global

economic scenario.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ECONOMICS FOR MANAGERS

References

Allen, R.E., 2016. Financial crises and recession in the global economy. Edward Elgar

Publishing.

Auerbach, A.J. and Gorodnichenko, Y., 2012. Fiscal multipliers in recession and expansion.

In Fiscal Policy after the Financial crisis (pp. 63-98). University of Chicago press.

Bls.gov (2017). [online] Available at: https://www.bls.gov/web/empsit/cps_charts.pdf [Accessed

7 Sep. 2017].

Boldrin, M., Garriga, C., Peralta-Alva, A. and Sánchez, J.M., 2013. Reconstructing the great

recession.

Cynamon, B.Z. and Fazzari, S.M., 2015. Inequality, the Great Recession and slow

recovery. Cambridge Journal of Economics, 40(2), pp.373-399.

Cynamon, B.Z., Fazzari, S. and Setterfield, M. eds., 2013. After the great recession: the struggle

for economic recovery and growth. Cambridge University Press.

Danziger, S., Chavez, K. and Cumberworth, E., 2012. Poverty and the great recession. Stanford,

CA: Stanford Center on Poverty and Inequality. Retrieved March, 1, p.2015.

Eaton, J., Kortum, S., Neiman, B. and Romalis, J., 2016. Trade and the global recession. The

American Economic Review, 106(11), pp.3401-3438.

Farmer, R.E., 2012. The stock market crash of 2008 caused the Great Recession: Theory and

evidence. Journal of Economic Dynamics and Control, 36(5), pp.693-707.

References

Allen, R.E., 2016. Financial crises and recession in the global economy. Edward Elgar

Publishing.

Auerbach, A.J. and Gorodnichenko, Y., 2012. Fiscal multipliers in recession and expansion.

In Fiscal Policy after the Financial crisis (pp. 63-98). University of Chicago press.

Bls.gov (2017). [online] Available at: https://www.bls.gov/web/empsit/cps_charts.pdf [Accessed

7 Sep. 2017].

Boldrin, M., Garriga, C., Peralta-Alva, A. and Sánchez, J.M., 2013. Reconstructing the great

recession.

Cynamon, B.Z. and Fazzari, S.M., 2015. Inequality, the Great Recession and slow

recovery. Cambridge Journal of Economics, 40(2), pp.373-399.

Cynamon, B.Z., Fazzari, S. and Setterfield, M. eds., 2013. After the great recession: the struggle

for economic recovery and growth. Cambridge University Press.

Danziger, S., Chavez, K. and Cumberworth, E., 2012. Poverty and the great recession. Stanford,

CA: Stanford Center on Poverty and Inequality. Retrieved March, 1, p.2015.

Eaton, J., Kortum, S., Neiman, B. and Romalis, J., 2016. Trade and the global recession. The

American Economic Review, 106(11), pp.3401-3438.

Farmer, R.E., 2012. The stock market crash of 2008 caused the Great Recession: Theory and

evidence. Journal of Economic Dynamics and Control, 36(5), pp.693-707.

11ECONOMICS FOR MANAGERS

Jenkins, S.P., Brandolini, A., Micklewright, J. and Nolan, B. eds., 2012. The great recession and

the distribution of household income. OUP Oxford.

Kivedal, B.K., 2013. Testing for rational bubbles in the US housing market. Journal of

Macroeconomics, 38, pp.369-381.

McDonald, J.F. and Stokes, H.H., 2013. Monetary policy and the housing bubble. The Journal of

Real Estate Finance and Economics, 46(3), pp.437-451.

O'higgins, N., 2012. This time it's different? Youth labour markets during ‘the Great

Recession’. Comparative Economic Studies, 54(2), pp.395-412.

Pfeffer, F.T., Danziger, S. and Schoeni, R.F., 2013. Wealth Disparities before and after the Great

Recession. The ANNALS of the American Academy of Political and Social Science, 650(1),

pp.98-123.

Rabie, M., 2013. The Great Recession. In Saving Capitalism and Democracy(pp. 103-115).

Palgrave Macmillan US.

Farmer, R.E., 2012. The stock market crash of 2008 caused the Great Recession: Theory and

evidence. Journal of Economic Dynamics and Control, 36(5), pp.693-707.

Jenkins, S.P., Brandolini, A., Micklewright, J. and Nolan, B. eds., 2012. The great recession and

the distribution of household income. OUP Oxford.

Kivedal, B.K., 2013. Testing for rational bubbles in the US housing market. Journal of

Macroeconomics, 38, pp.369-381.

McDonald, J.F. and Stokes, H.H., 2013. Monetary policy and the housing bubble. The Journal of

Real Estate Finance and Economics, 46(3), pp.437-451.

O'higgins, N., 2012. This time it's different? Youth labour markets during ‘the Great

Recession’. Comparative Economic Studies, 54(2), pp.395-412.

Pfeffer, F.T., Danziger, S. and Schoeni, R.F., 2013. Wealth Disparities before and after the Great

Recession. The ANNALS of the American Academy of Political and Social Science, 650(1),

pp.98-123.

Rabie, M., 2013. The Great Recession. In Saving Capitalism and Democracy(pp. 103-115).

Palgrave Macmillan US.

Farmer, R.E., 2012. The stock market crash of 2008 caused the Great Recession: Theory and

evidence. Journal of Economic Dynamics and Control, 36(5), pp.693-707.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.