Economics for Managers Report

VerifiedAdded on 2019/11/08

|7

|1449

|151

Report

AI Summary

This report examines the effects of the Reserve Bank of Australia's (RBA) interest rate decisions on the Australian economy. It focuses on how the RBA's lowering of interest rates to a record low of 1.5% in 2017, in response to a government budget deficit and investor reluctance, impacts business investment. The report details how lower interest rates encourage borrowing, increase spending and investment, and influence the aggregate demand curve, real GDP, and price levels. Using figures to illustrate the relationship between interest rates, business investment, and macroeconomic indicators, the report concludes that the RBA's policy of lowering interest rates positively impacts the Australian economy by stimulating investment, increasing aggregate demand, and raising real GDP, although it may also lead to inflation.

ECONOMICS FOR MANAGERS 1

Economics for Managers

Student’s Name

Course ID

University

Date

Economics for Managers

Student’s Name

Course ID

University

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR MANAGERS 2

In this particular discussion paper, the economic scenario of Australia has been critically

analysed based on interest rate decisions of the Reserve Bank of Australia. The mounting

pressure of government budget deficit can be identified as one of the largest economic challenges

for Turnbull government. Under the current circumstances, in order to reduce the budget deficit,

Prime Minister Malcolm Turnbull has cut down the government expenditure in all fronts. As a

result of the consequences, investors are reluctant to invest in the economy. In order to tackle the

uncertainties of the Australian economy, the RBA has kept the benchmark interest rate to record

low at 1.5 percent so that the borrowers will be encouraged to invest in the market (Letts, 2017).

Precisely, the impact of the fall in the interest rate on the business investment in Australia has

been elaborated in the study. At the same time, the study discusses the effect of increasing

business investment due to lower interest rates on the aggregated demand curve, real GDP, and

price level in the Australian economy.

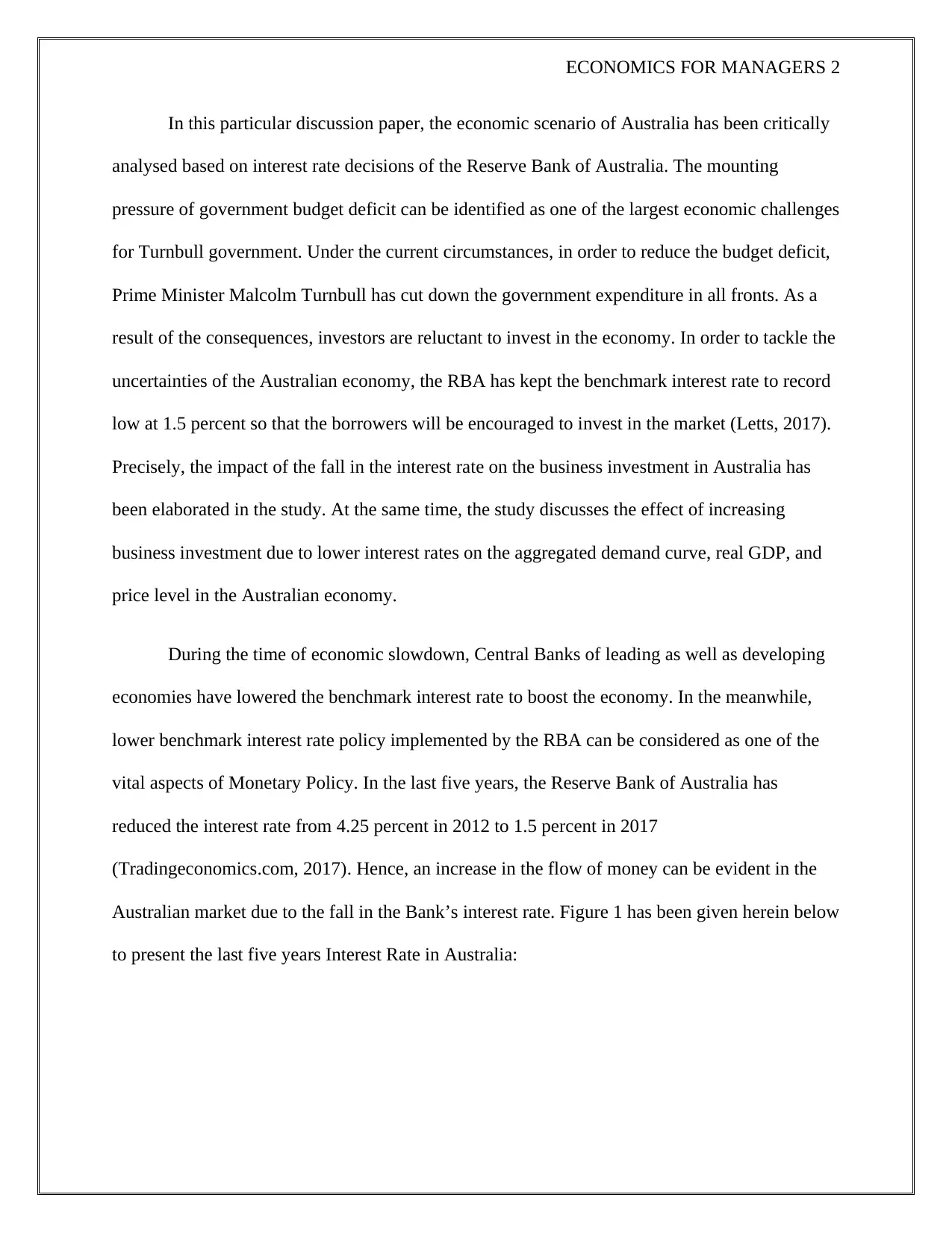

During the time of economic slowdown, Central Banks of leading as well as developing

economies have lowered the benchmark interest rate to boost the economy. In the meanwhile,

lower benchmark interest rate policy implemented by the RBA can be considered as one of the

vital aspects of Monetary Policy. In the last five years, the Reserve Bank of Australia has

reduced the interest rate from 4.25 percent in 2012 to 1.5 percent in 2017

(Tradingeconomics.com, 2017). Hence, an increase in the flow of money can be evident in the

Australian market due to the fall in the Bank’s interest rate. Figure 1 has been given herein below

to present the last five years Interest Rate in Australia:

In this particular discussion paper, the economic scenario of Australia has been critically

analysed based on interest rate decisions of the Reserve Bank of Australia. The mounting

pressure of government budget deficit can be identified as one of the largest economic challenges

for Turnbull government. Under the current circumstances, in order to reduce the budget deficit,

Prime Minister Malcolm Turnbull has cut down the government expenditure in all fronts. As a

result of the consequences, investors are reluctant to invest in the economy. In order to tackle the

uncertainties of the Australian economy, the RBA has kept the benchmark interest rate to record

low at 1.5 percent so that the borrowers will be encouraged to invest in the market (Letts, 2017).

Precisely, the impact of the fall in the interest rate on the business investment in Australia has

been elaborated in the study. At the same time, the study discusses the effect of increasing

business investment due to lower interest rates on the aggregated demand curve, real GDP, and

price level in the Australian economy.

During the time of economic slowdown, Central Banks of leading as well as developing

economies have lowered the benchmark interest rate to boost the economy. In the meanwhile,

lower benchmark interest rate policy implemented by the RBA can be considered as one of the

vital aspects of Monetary Policy. In the last five years, the Reserve Bank of Australia has

reduced the interest rate from 4.25 percent in 2012 to 1.5 percent in 2017

(Tradingeconomics.com, 2017). Hence, an increase in the flow of money can be evident in the

Australian market due to the fall in the Bank’s interest rate. Figure 1 has been given herein below

to present the last five years Interest Rate in Australia:

ECONOMICS FOR MANAGERS 3

Figure 1: Australia Interest Rate (2012 – 2017)

Source: (Tradingeconomics.com, 2017)

Precisely, due to the lower rate of benchmark interest, borrowing will be cheaper

(Catalán, Guajardo and Hoffmaister, 2008). As a result of the consequences, both the spending

and investment will increase boosting the economic progress and stability. Invariably, lower

interest rate provides a smaller return from savings. Therefore, the social public tends to spend

the money or invest the money rather than holding the capital (Forstater, 2016). In this way,

spending, as well as investment in the market, has been increased.

Furthermore, the lower rate of interest rate encourages the consumers and business firms

to take loans as borrowing costs are reduced. As a result of the scenario, spending and

investments are encouraged leading to greater finance. In addition, lower interest rates contribute

to the rising prices of assets such as housing. Due to asset buying, the price of housing will

increase so as the consumer confidence (Heath, 2017). Thus, the consumer spending will be

higher as well. Based on such aspects, it can be said that lower rate of interest implemented by

the RBA will certainly encourage higher investment and spending in the Australian economy.

Figure 1: Australia Interest Rate (2012 – 2017)

Source: (Tradingeconomics.com, 2017)

Precisely, due to the lower rate of benchmark interest, borrowing will be cheaper

(Catalán, Guajardo and Hoffmaister, 2008). As a result of the consequences, both the spending

and investment will increase boosting the economic progress and stability. Invariably, lower

interest rate provides a smaller return from savings. Therefore, the social public tends to spend

the money or invest the money rather than holding the capital (Forstater, 2016). In this way,

spending, as well as investment in the market, has been increased.

Furthermore, the lower rate of interest rate encourages the consumers and business firms

to take loans as borrowing costs are reduced. As a result of the scenario, spending and

investments are encouraged leading to greater finance. In addition, lower interest rates contribute

to the rising prices of assets such as housing. Due to asset buying, the price of housing will

increase so as the consumer confidence (Heath, 2017). Thus, the consumer spending will be

higher as well. Based on such aspects, it can be said that lower rate of interest implemented by

the RBA will certainly encourage higher investment and spending in the Australian economy.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS FOR MANAGERS 4

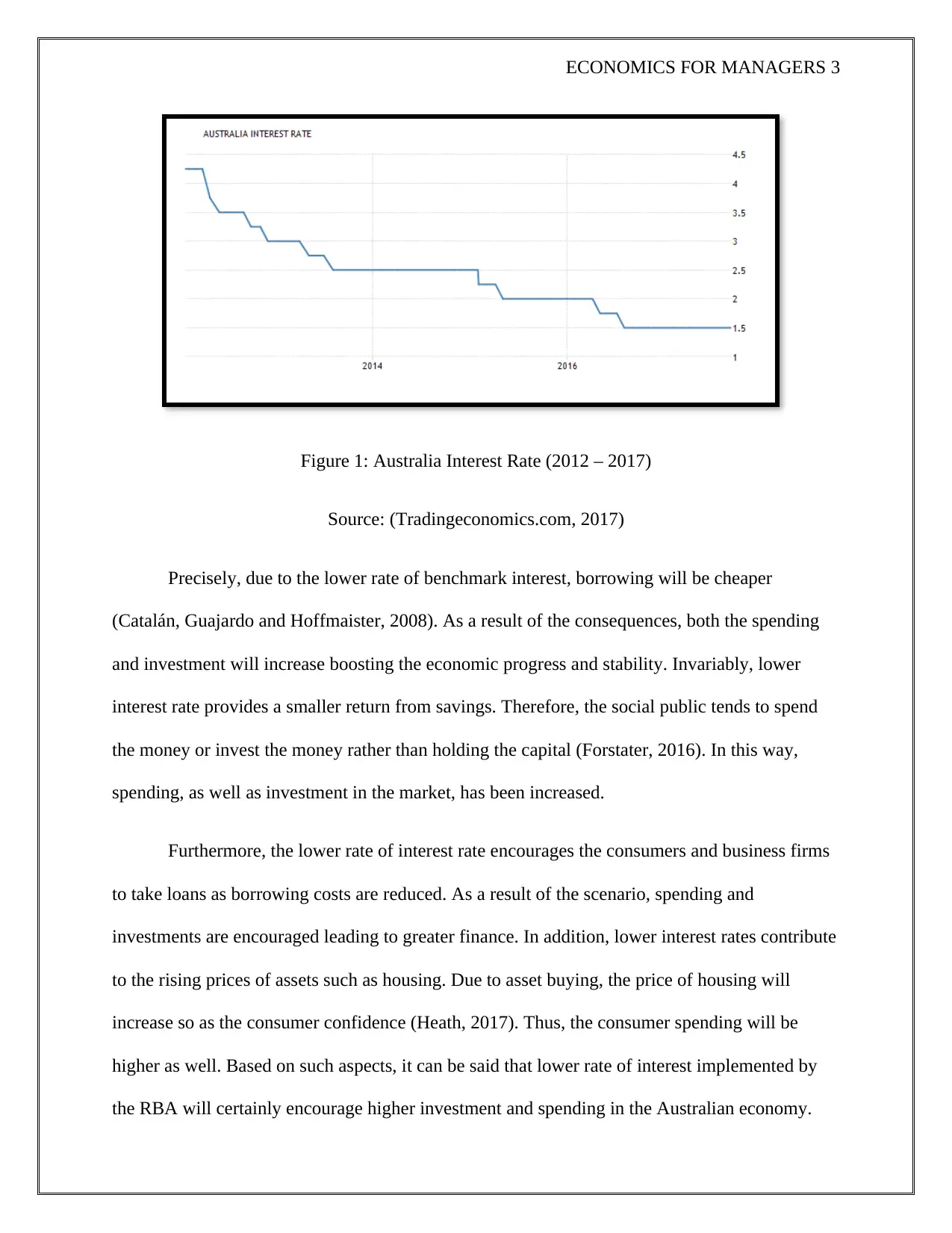

On the basis of the above discussion, it can be assumed that the lower interest rate will

increase the business investment in Australian economy. However, the increase in business

investment will have certain impact on aggregated demand curve, real Gross Domestic Product,

and price level in the Australian economy. The impact of the increase in business investment on

the aggregate demand, GDP and Price level has been demonstrated using the figure 2 as below:

Figure 2: Impact of increase business investment on Aggregated Demand curve, real Gross

Domestic Product, and Price Level

Source: (Forstater, 2016)

Due to increase in business investment followed by lower benchmark interest rate, the

money supply will be increased in the economy. For instance, the increase in business

investment will increase the income of the people in Australia resulting in an increase in the

purchasing power of the buyers. As a result, the aggregated demand curve will be shifted

towards right side from AD to AD1 indicating an increase aggregated demand (Forstater, 2016).

On the basis of the above discussion, it can be assumed that the lower interest rate will

increase the business investment in Australian economy. However, the increase in business

investment will have certain impact on aggregated demand curve, real Gross Domestic Product,

and price level in the Australian economy. The impact of the increase in business investment on

the aggregate demand, GDP and Price level has been demonstrated using the figure 2 as below:

Figure 2: Impact of increase business investment on Aggregated Demand curve, real Gross

Domestic Product, and Price Level

Source: (Forstater, 2016)

Due to increase in business investment followed by lower benchmark interest rate, the

money supply will be increased in the economy. For instance, the increase in business

investment will increase the income of the people in Australia resulting in an increase in the

purchasing power of the buyers. As a result, the aggregated demand curve will be shifted

towards right side from AD to AD1 indicating an increase aggregated demand (Forstater, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS FOR MANAGERS 5

Convincingly, as shown in figure 1, the increase in monetary flow due to lower interest rate will

cause a rise in aggregated demand. However, the aggregate supply will remain constant in the

short run as there is no chance of utilisation more resources in a shorter period of time (Phan,

2014). Hence, the aggregate supply curve will remain constant at ‘AS’ as presented in the above

figure.

By following the theory of demand and supply, the rise in the aggregate demand in the

market due to the fall in the borrowing rate and increase in the flow of money, the aggregate

price level of the product in the Australian economy is expected to increase. On the basis of

figure 2, it can be seen that the shift in the aggregate demand curve from AD to AD1 leads to an

increase in the aggregate price level from P1 to P2. Therefore, an increase in inflation can be

evident in the Australian economy (Fender, 2012). Moreover, the rise in the aggregate demand

will also lead to increase in the aggregate consumption that will further increase the real GDP of

the nation. For instance, it can be seen from figure 2 that the real GDP of Australia will increase

from Q1 to Q2 due to the increase in the aggregate consumption because of the rise in aggregate

demand (Scott, Rabanal and Kannan, 2009). Hence, it can be clearly seen from the above

illustration that the fall in the interest rate by the Reserve Bank of Australia will lead to increase

in the business investment in the nation that will further increase the aggregate demand, real

GDP and price level.

By considering the above analysis, it can be seen that the decision of reducing the interest

rate works in the favour of the Australian economy. The fall in the interest rate will increase the

flow of money in the market that will gradually increase business investment. Additionally, the

increase in the business investment will increase the earning of the people and enhance the

buyer’s purchasing power. Furthermore, the increase in business investment will boost up the

Convincingly, as shown in figure 1, the increase in monetary flow due to lower interest rate will

cause a rise in aggregated demand. However, the aggregate supply will remain constant in the

short run as there is no chance of utilisation more resources in a shorter period of time (Phan,

2014). Hence, the aggregate supply curve will remain constant at ‘AS’ as presented in the above

figure.

By following the theory of demand and supply, the rise in the aggregate demand in the

market due to the fall in the borrowing rate and increase in the flow of money, the aggregate

price level of the product in the Australian economy is expected to increase. On the basis of

figure 2, it can be seen that the shift in the aggregate demand curve from AD to AD1 leads to an

increase in the aggregate price level from P1 to P2. Therefore, an increase in inflation can be

evident in the Australian economy (Fender, 2012). Moreover, the rise in the aggregate demand

will also lead to increase in the aggregate consumption that will further increase the real GDP of

the nation. For instance, it can be seen from figure 2 that the real GDP of Australia will increase

from Q1 to Q2 due to the increase in the aggregate consumption because of the rise in aggregate

demand (Scott, Rabanal and Kannan, 2009). Hence, it can be clearly seen from the above

illustration that the fall in the interest rate by the Reserve Bank of Australia will lead to increase

in the business investment in the nation that will further increase the aggregate demand, real

GDP and price level.

By considering the above analysis, it can be seen that the decision of reducing the interest

rate works in the favour of the Australian economy. The fall in the interest rate will increase the

flow of money in the market that will gradually increase business investment. Additionally, the

increase in the business investment will increase the earning of the people and enhance the

buyer’s purchasing power. Furthermore, the increase in business investment will boost up the

ECONOMICS FOR MANAGERS 6

Australian economy by increasing the aggregate demand, price level of products and services

and the real GDP of the nation.

Australian economy by increasing the aggregate demand, price level of products and services

and the real GDP of the nation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS FOR MANAGERS 7

References

Catalán, M., Guajardo, J. and Hoffmaister, A. (2008). Global aging and declining world interest

rates. 4th ed. Washington, D.C.: International Monetary Fund, IMF Institute and European Dept.

Fender, J. (2012). Monetary policy. 3rd ed. Chichester, West Sussex: Wiley.

Forstater, M. (2016). Economics. 5th ed. London: A. & C. Black.

Heath, M. (2017). Australia's interest rates aren't as stimulatory as RBA thinks. [online] The

Sydney Morning Herald. Available at: http://www.smh.com.au/business/the-economy/australias-

interest-rates-arent-as-stimulatory-as-rba-thinks-20170730-gxlxjo.html [Accessed Sep. 2017].

Letts, S. (2017). RBA holds rates at record low 1.5pc, warns of high dollar risks. [online] ABC

News. Available at: http://www.abc.net.au/news/2017-08-01/rba-holds-rates-at-historic-low/

8763628 [Accessed Sep. 2017].

Phan, T. (2014). Output Composition of the Monetary Policy Transmission Mechanism: Is

Australia Different?. Economic Record, 90(290), pp.382-399.

Scott, A., Rabanal, P. and Kannan, P. (2009). Macroeconomic Patterns and Monetary Policy in

the Run-up to Asset Price Busts. 3rd ed. Washington: International Monetary Fund.

Tradingeconomics.com. (2017). Australia Interest Rate | 1990-2017 | Data | Chart | Calendar |

Forecast. [online] Available at: https://tradingeconomics.com/australia/interest-rate [Accessed

Sep. 2017].

References

Catalán, M., Guajardo, J. and Hoffmaister, A. (2008). Global aging and declining world interest

rates. 4th ed. Washington, D.C.: International Monetary Fund, IMF Institute and European Dept.

Fender, J. (2012). Monetary policy. 3rd ed. Chichester, West Sussex: Wiley.

Forstater, M. (2016). Economics. 5th ed. London: A. & C. Black.

Heath, M. (2017). Australia's interest rates aren't as stimulatory as RBA thinks. [online] The

Sydney Morning Herald. Available at: http://www.smh.com.au/business/the-economy/australias-

interest-rates-arent-as-stimulatory-as-rba-thinks-20170730-gxlxjo.html [Accessed Sep. 2017].

Letts, S. (2017). RBA holds rates at record low 1.5pc, warns of high dollar risks. [online] ABC

News. Available at: http://www.abc.net.au/news/2017-08-01/rba-holds-rates-at-historic-low/

8763628 [Accessed Sep. 2017].

Phan, T. (2014). Output Composition of the Monetary Policy Transmission Mechanism: Is

Australia Different?. Economic Record, 90(290), pp.382-399.

Scott, A., Rabanal, P. and Kannan, P. (2009). Macroeconomic Patterns and Monetary Policy in

the Run-up to Asset Price Busts. 3rd ed. Washington: International Monetary Fund.

Tradingeconomics.com. (2017). Australia Interest Rate | 1990-2017 | Data | Chart | Calendar |

Forecast. [online] Available at: https://tradingeconomics.com/australia/interest-rate [Accessed

Sep. 2017].

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.