Comparative Analysis: Oligopoly and Monopolistic Competition Markets

VerifiedAdded on 2023/06/12

|24

|4446

|206

Essay

AI Summary

This essay provides a comprehensive analysis of oligopoly and monopolistic competition market structures, highlighting key distinguishing factors such as the number of sellers, market size, control, and entry barriers. It uses case studies from India, focusing on the FMCG (Fast Moving Consumer Goods) industry to illustrate monopolistic competition and the aviation industry to represent oligopoly. The essay examines short-run and long-run equilibrium conditions in both market structures, using diagrams to explain profit maximization and resource allocation. Additionally, the essay addresses the issue of housing affordability, outlining government solutions and suggesting alternative approaches based on economic theory. This resource is available on Desklib, where students can find a wealth of similar solved assignments and study materials.

Running Head: ECONOMICS FOR MANAGERS

Economics for Managers

Name of the Student

Name of the University

Course ID

Economics for Managers

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR MANAGERS

Part A

The economc definition of market structure differs from that understood by marketers.

Marketers view market as competetive device and hence focuses on only marketing strategies or

plan. Economists on the other hand comsiders the overall structure of market beyond only

competition with an attempt to analyze and anticipate behaviours market participants. The

concept of market in economics thus extended beyond just a simple place of exchanging goods

and services (Goodwin et al., 2015). The four common form of market structure based on

number of participants in the market include perfectly cometitive market, monopoly, oligopoly

and monopolstic competition.

Oligopoly

The oligopoly market is a representative market structure containimg small number of

competiting firm with each enjoying a relatively large size in the market. High level of

concenration is an obivios feature of oligopoly market. Firms in the oligopoly market do not

have large number of competitiors. Rather there are intense competition among the few large

firms. Each firm keeps a close look on strategy of its rival firms (Baumol & Blinder, 2015).

Strategy of the firms are interdepenent on each other. For this, if one firm decide to lower price

to increases its share of market the competiting firms follow the same and this iften results in a

price war in the market place. Apart from price competion firms in this form of market are

engage in non-price competition in terms of product differentiation, investment in advertisimg

and others.

The oliopolistic firms need to take decision regarding price and competition. The firms in

the market place decides whether to compete with other firms or to agree on a mutually

Part A

The economc definition of market structure differs from that understood by marketers.

Marketers view market as competetive device and hence focuses on only marketing strategies or

plan. Economists on the other hand comsiders the overall structure of market beyond only

competition with an attempt to analyze and anticipate behaviours market participants. The

concept of market in economics thus extended beyond just a simple place of exchanging goods

and services (Goodwin et al., 2015). The four common form of market structure based on

number of participants in the market include perfectly cometitive market, monopoly, oligopoly

and monopolstic competition.

Oligopoly

The oligopoly market is a representative market structure containimg small number of

competiting firm with each enjoying a relatively large size in the market. High level of

concenration is an obivios feature of oligopoly market. Firms in the oligopoly market do not

have large number of competitiors. Rather there are intense competition among the few large

firms. Each firm keeps a close look on strategy of its rival firms (Baumol & Blinder, 2015).

Strategy of the firms are interdepenent on each other. For this, if one firm decide to lower price

to increases its share of market the competiting firms follow the same and this iften results in a

price war in the market place. Apart from price competion firms in this form of market are

engage in non-price competition in terms of product differentiation, investment in advertisimg

and others.

The oliopolistic firms need to take decision regarding price and competition. The firms in

the market place decides whether to compete with other firms or to agree on a mutually

2ECONOMICS FOR MANAGERS

beneficial understanding. When firm in the oligopoly market takes their joint decision about

price and outout combination then they it is called collusive oligopoly. In contrast, if the fims

decode to compete with each other then it is called non-collusive oligopoly (McKenzie & Lee,

2016). Firms in a pure oligopoly market sell homogenous products while firms in differentiated

oligopoly sells heteregenous or differentiated product.

Monopolistic Competition

The monopolistically competetive market structure has several small firms in the market.

The firms in the monopolistically competitive market exercise a freedom to enter or exit the

market. Each firm in the market has large number of competitors with each sellling a

differentiated product. Each seller in the market takes decision of price and outpt if its own

product indepent of other competitors. The seller in the monopolistic competition thus enjoy

some degree of monopoly power over its own product (Friedman, 2017). Again they face intense

competition like the perfectly comprtitive market. The monopolistically competitive market thus

is comsidered to have characteristics of both monopoly and perfectly comprtitive market.

One exclusive feature of monopolistic competition is product differentaition. Each seller

in the market tries to make its own product as much different as possiblr from its competitors.

With product differenatition firms attempts to make its perceive demand curve less elastic. Aprt

from physical product differentiation firms also engage in marketing differentiation,

differentation of human capital or differentiation in the distribution. The mnopolistically

competitive firms faces a downward sloping demand curve as they are able to chragge a higher

or lower price than its competitors (Moulin, 2014). However, because of availability of close

substitute firms usually do not engage in such price competition. Rather they focus on

advertising, brand promotion or other forms of non-price competition.

beneficial understanding. When firm in the oligopoly market takes their joint decision about

price and outout combination then they it is called collusive oligopoly. In contrast, if the fims

decode to compete with each other then it is called non-collusive oligopoly (McKenzie & Lee,

2016). Firms in a pure oligopoly market sell homogenous products while firms in differentiated

oligopoly sells heteregenous or differentiated product.

Monopolistic Competition

The monopolistically competetive market structure has several small firms in the market.

The firms in the monopolistically competitive market exercise a freedom to enter or exit the

market. Each firm in the market has large number of competitors with each sellling a

differentiated product. Each seller in the market takes decision of price and outpt if its own

product indepent of other competitors. The seller in the monopolistic competition thus enjoy

some degree of monopoly power over its own product (Friedman, 2017). Again they face intense

competition like the perfectly comprtitive market. The monopolistically competitive market thus

is comsidered to have characteristics of both monopoly and perfectly comprtitive market.

One exclusive feature of monopolistic competition is product differentaition. Each seller

in the market tries to make its own product as much different as possiblr from its competitors.

With product differenatition firms attempts to make its perceive demand curve less elastic. Aprt

from physical product differentiation firms also engage in marketing differentiation,

differentation of human capital or differentiation in the distribution. The mnopolistically

competitive firms faces a downward sloping demand curve as they are able to chragge a higher

or lower price than its competitors (Moulin, 2014). However, because of availability of close

substitute firms usually do not engage in such price competition. Rather they focus on

advertising, brand promotion or other forms of non-price competition.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR MANAGERS

Both the above discussed market structures represent imperfect competition. These two forms of

markets are however differs in a number of ways. The key factors distingusing oligopoly and

monopolistic competition are given below

Number of sellers

The oligopoly market is characterized as having a few large sellerswhile in the

monopolistically competitive market there present a large number of small sellers (Rader, 2014).

Because of dufferences in number of sellers the degree of competition differ in the two form of

market.

Market size and market control

Difference in the two firm of market exists in terms of their relative size and market

control devised by each of these firms. There is though no speific size to clearly defining the two

form of market but in general a monpolistically competitive firm is relatively large in size as

compared to an oligopoly market. Because of presence of large number of firms in the market,

the market share is divided between these firms with each having a relatively small share in the

market. As each firms have a small market share decision of any signle firm does not have much

impact on the entire market (Stoneman, Bartoloni & Baussola, 2018). The oligopoly market on

the other hand is chsaracterized by dominance of few large sellers. The sellers in the oligopoly

market enjoy a considerble share of market and thus devices a greater control in the mrket.

Entry barriers

The incumbant firms in the oligopoly market maintains a high barriers to entry of the new

firms in the market. The need for government authorization often acts as a major entry barrier in

the market. Government often limits the number of competitors in the oligopoly market. Apart

Both the above discussed market structures represent imperfect competition. These two forms of

markets are however differs in a number of ways. The key factors distingusing oligopoly and

monopolistic competition are given below

Number of sellers

The oligopoly market is characterized as having a few large sellerswhile in the

monopolistically competitive market there present a large number of small sellers (Rader, 2014).

Because of dufferences in number of sellers the degree of competition differ in the two form of

market.

Market size and market control

Difference in the two firm of market exists in terms of their relative size and market

control devised by each of these firms. There is though no speific size to clearly defining the two

form of market but in general a monpolistically competitive firm is relatively large in size as

compared to an oligopoly market. Because of presence of large number of firms in the market,

the market share is divided between these firms with each having a relatively small share in the

market. As each firms have a small market share decision of any signle firm does not have much

impact on the entire market (Stoneman, Bartoloni & Baussola, 2018). The oligopoly market on

the other hand is chsaracterized by dominance of few large sellers. The sellers in the oligopoly

market enjoy a considerble share of market and thus devices a greater control in the mrket.

Entry barriers

The incumbant firms in the oligopoly market maintains a high barriers to entry of the new

firms in the market. The need for government authorization often acts as a major entry barrier in

the market. Government often limits the number of competitors in the oligopoly market. Apart

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR MANAGERS

from government regulation there exists other forms of barriers as well. The existing firms might

enjoys exclusive owenership over a specific input. With lack of access to such input new firms

cannot enter the market. The presence of high fixed cost likely to discourage new seller to enter

the industry (Cowen & Tabarrok, 2015). The exising firms enjoys advantages of economies of

scale which help them to recover huge fixed cost. The new entrants however cannot have the

benefits of economies of scale and hence fear to enter the industry.

The entry or exit in a monopolostically competitive market is less cumbersome process.

Depending on the short run profit or loss firms decides whether to enter or exit the market. The

economic profit in the short run encourages new firm to enter while in presence of economic loss

firms leave the the industry.

State of equilibrium in monopolistically competitive market

Short run

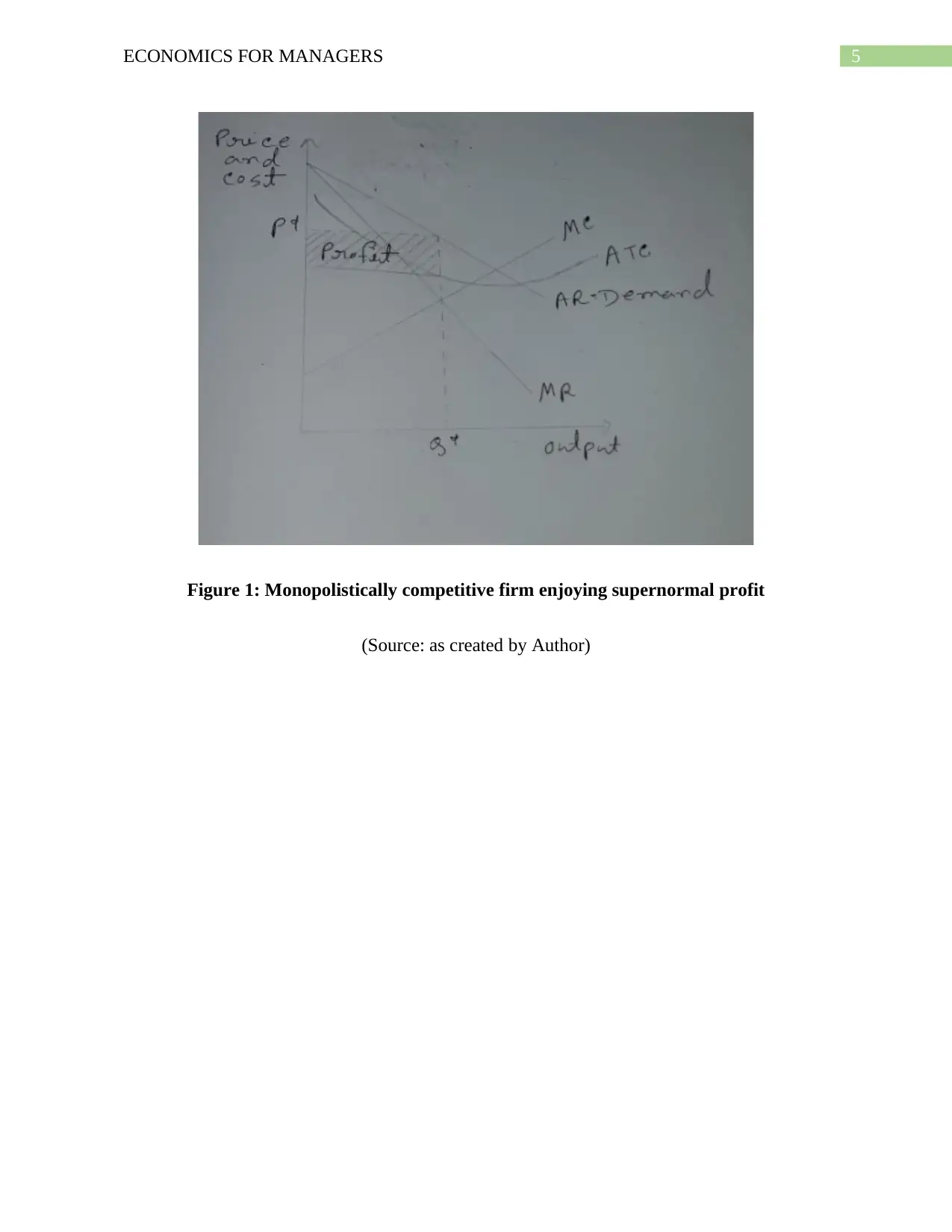

Firms in any form of market have the common objective of maximizing profit. The

marginal revenue and average revenue curve in the monopolistic competition slope downward.

The standard profit maximization condition require marginal revenue to be equal to marginal

cost and marginal cost curve cuts the the marginal revenue curve from below that is at the profit

maximizing level of output slope of MC curve is greater than slope of MR curve (Nicholson &

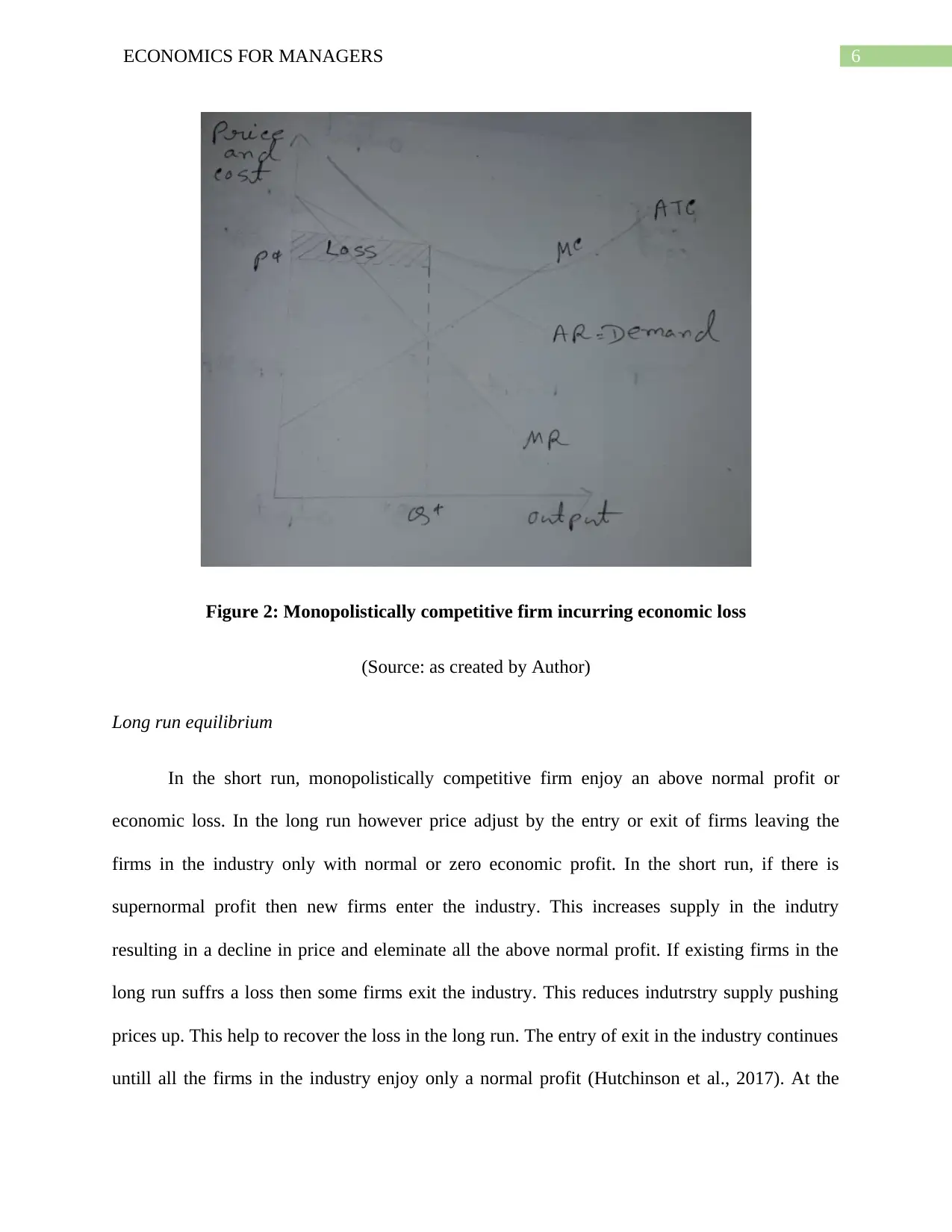

Snyder, 2014). Because of indeoendent price output decision existing firms in the short run have

the opportunity to enjoy profit above the normal profit. Firms also can incurr a loss in the short

run is price is set below the total average cost.

from government regulation there exists other forms of barriers as well. The existing firms might

enjoys exclusive owenership over a specific input. With lack of access to such input new firms

cannot enter the market. The presence of high fixed cost likely to discourage new seller to enter

the industry (Cowen & Tabarrok, 2015). The exising firms enjoys advantages of economies of

scale which help them to recover huge fixed cost. The new entrants however cannot have the

benefits of economies of scale and hence fear to enter the industry.

The entry or exit in a monopolostically competitive market is less cumbersome process.

Depending on the short run profit or loss firms decides whether to enter or exit the market. The

economic profit in the short run encourages new firm to enter while in presence of economic loss

firms leave the the industry.

State of equilibrium in monopolistically competitive market

Short run

Firms in any form of market have the common objective of maximizing profit. The

marginal revenue and average revenue curve in the monopolistic competition slope downward.

The standard profit maximization condition require marginal revenue to be equal to marginal

cost and marginal cost curve cuts the the marginal revenue curve from below that is at the profit

maximizing level of output slope of MC curve is greater than slope of MR curve (Nicholson &

Snyder, 2014). Because of indeoendent price output decision existing firms in the short run have

the opportunity to enjoy profit above the normal profit. Firms also can incurr a loss in the short

run is price is set below the total average cost.

5ECONOMICS FOR MANAGERS

Figure 1: Monopolistically competitive firm enjoying supernormal profit

(Source: as created by Author)

Figure 1: Monopolistically competitive firm enjoying supernormal profit

(Source: as created by Author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR MANAGERS

Figure 2: Monopolistically competitive firm incurring economic loss

(Source: as created by Author)

Long run equilibrium

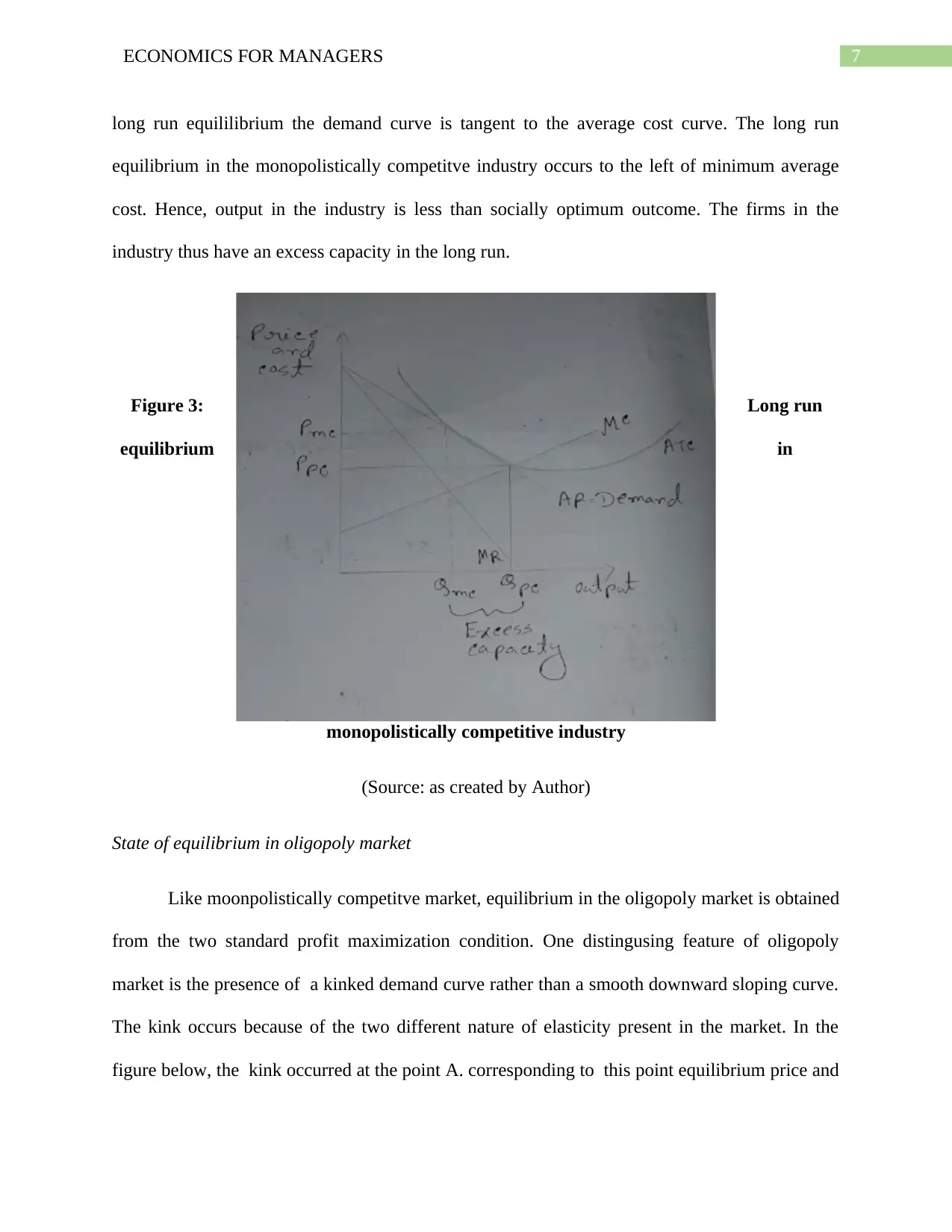

In the short run, monopolistically competitive firm enjoy an above normal profit or

economic loss. In the long run however price adjust by the entry or exit of firms leaving the

firms in the industry only with normal or zero economic profit. In the short run, if there is

supernormal profit then new firms enter the industry. This increases supply in the indutry

resulting in a decline in price and eleminate all the above normal profit. If existing firms in the

long run suffrs a loss then some firms exit the industry. This reduces indutrstry supply pushing

prices up. This help to recover the loss in the long run. The entry of exit in the industry continues

untill all the firms in the industry enjoy only a normal profit (Hutchinson et al., 2017). At the

Figure 2: Monopolistically competitive firm incurring economic loss

(Source: as created by Author)

Long run equilibrium

In the short run, monopolistically competitive firm enjoy an above normal profit or

economic loss. In the long run however price adjust by the entry or exit of firms leaving the

firms in the industry only with normal or zero economic profit. In the short run, if there is

supernormal profit then new firms enter the industry. This increases supply in the indutry

resulting in a decline in price and eleminate all the above normal profit. If existing firms in the

long run suffrs a loss then some firms exit the industry. This reduces indutrstry supply pushing

prices up. This help to recover the loss in the long run. The entry of exit in the industry continues

untill all the firms in the industry enjoy only a normal profit (Hutchinson et al., 2017). At the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR MANAGERS

long run equililibrium the demand curve is tangent to the average cost curve. The long run

equilibrium in the monopolistically competitve industry occurs to the left of minimum average

cost. Hence, output in the industry is less than socially optimum outcome. The firms in the

industry thus have an excess capacity in the long run.

Figure 3: Long run

equilibrium in

monopolistically competitive industry

(Source: as created by Author)

State of equilibrium in oligopoly market

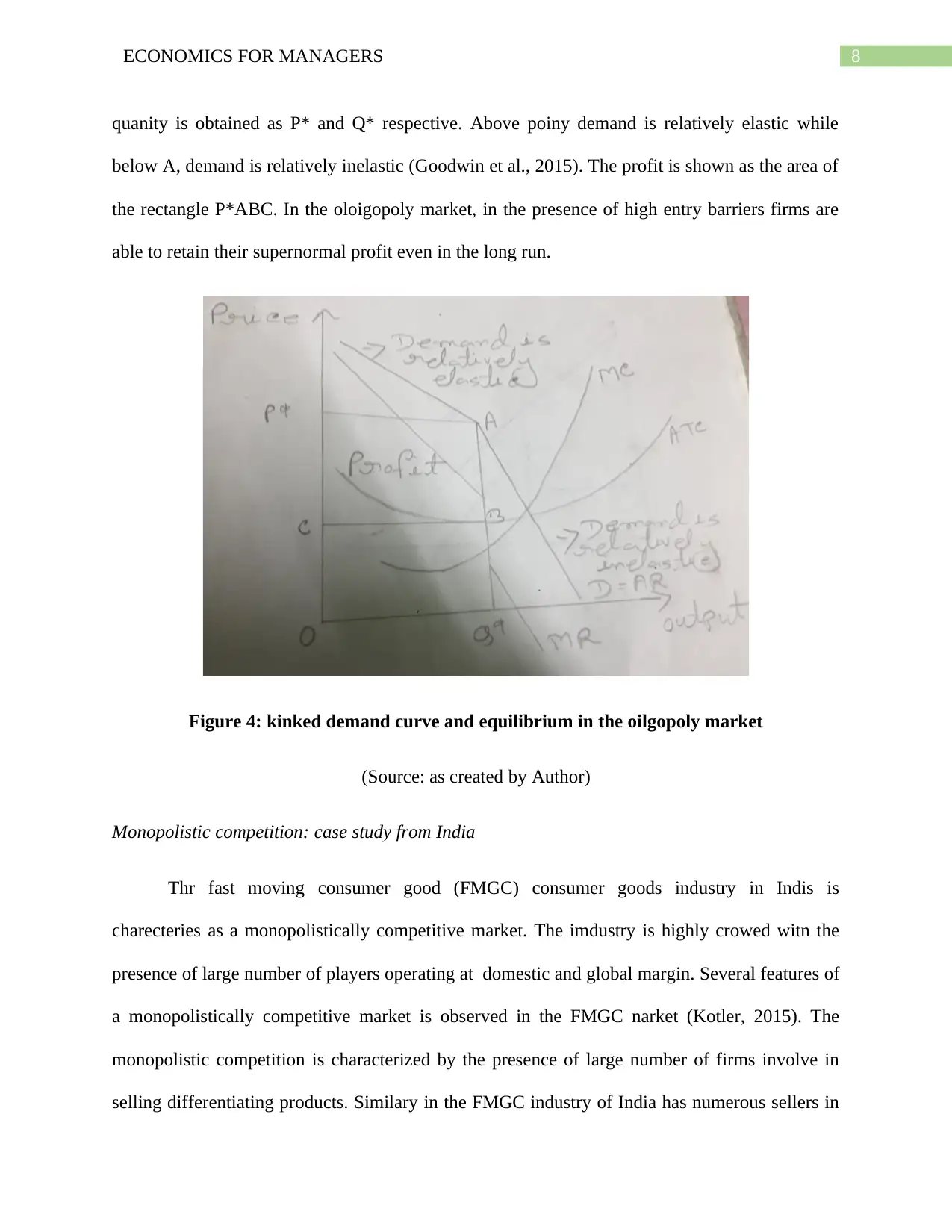

Like moonpolistically competitve market, equilibrium in the oligopoly market is obtained

from the two standard profit maximization condition. One distingusing feature of oligopoly

market is the presence of a kinked demand curve rather than a smooth downward sloping curve.

The kink occurs because of the two different nature of elasticity present in the market. In the

figure below, the kink occurred at the point A. corresponding to this point equilibrium price and

long run equililibrium the demand curve is tangent to the average cost curve. The long run

equilibrium in the monopolistically competitve industry occurs to the left of minimum average

cost. Hence, output in the industry is less than socially optimum outcome. The firms in the

industry thus have an excess capacity in the long run.

Figure 3: Long run

equilibrium in

monopolistically competitive industry

(Source: as created by Author)

State of equilibrium in oligopoly market

Like moonpolistically competitve market, equilibrium in the oligopoly market is obtained

from the two standard profit maximization condition. One distingusing feature of oligopoly

market is the presence of a kinked demand curve rather than a smooth downward sloping curve.

The kink occurs because of the two different nature of elasticity present in the market. In the

figure below, the kink occurred at the point A. corresponding to this point equilibrium price and

8ECONOMICS FOR MANAGERS

quanity is obtained as P* and Q* respective. Above poiny demand is relatively elastic while

below A, demand is relatively inelastic (Goodwin et al., 2015). The profit is shown as the area of

the rectangle P*ABC. In the oloigopoly market, in the presence of high entry barriers firms are

able to retain their supernormal profit even in the long run.

Figure 4: kinked demand curve and equilibrium in the oilgopoly market

(Source: as created by Author)

Monopolistic competition: case study from India

Thr fast moving consumer good (FMGC) consumer goods industry in Indis is

charecteries as a monopolistically competitive market. The imdustry is highly crowed witn the

presence of large number of players operating at domestic and global margin. Several features of

a monopolistically competitive market is observed in the FMGC narket (Kotler, 2015). The

monopolistic competition is characterized by the presence of large number of firms involve in

selling differentiating products. Similary in the FMGC industry of India has numerous sellers in

quanity is obtained as P* and Q* respective. Above poiny demand is relatively elastic while

below A, demand is relatively inelastic (Goodwin et al., 2015). The profit is shown as the area of

the rectangle P*ABC. In the oloigopoly market, in the presence of high entry barriers firms are

able to retain their supernormal profit even in the long run.

Figure 4: kinked demand curve and equilibrium in the oilgopoly market

(Source: as created by Author)

Monopolistic competition: case study from India

Thr fast moving consumer good (FMGC) consumer goods industry in Indis is

charecteries as a monopolistically competitive market. The imdustry is highly crowed witn the

presence of large number of players operating at domestic and global margin. Several features of

a monopolistically competitive market is observed in the FMGC narket (Kotler, 2015). The

monopolistic competition is characterized by the presence of large number of firms involve in

selling differentiating products. Similary in the FMGC industry of India has numerous sellers in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR MANAGERS

the industry. This fact is highlighted from the presence of more than 700 companies in the

Indian soap and detergent market. Some of the major players in the industry include ITC limited,

Hindustan Unilever Limited and Procter & Gamble (Dey & Sharma, 2017).

Like monopolistically competitive market firms in the industry are allowed to freely enter

or exit the market. The propect of rising income from rural and urban consumers make the

industry an atrractive one with several new companies entering the business. The mechanism of

free entry or exit result lead to only a normal profit in the industry (Roshif, 2015). For example,

the brand Nirma was introduced a low priced detergent to capture customer group belonging to

middle income class. The successful strategy of Nirma was encouraged other companies to

launch product with a much lower price.

Another feature of monopolistic competition is product differentiation. The products in

the industry differs in terms of packaging, size, color, associate discount and shape. Ariel, a

product of P&G group is avaible in different variety. Ariel color, Ariel strain remover and Ariel

Quiclwash are the different sub product each having at least one distingushing characteristic

((Dey & Sharma, 2017).

The other features of a monopolistically competitive market that are found in the

concerned industry include investment in advertising, promotion of sales, absence of

interdependece and a downward sloping demand curve.

Oligopoly: case study from India

The aviation industry in India has characteristics similar to a oligopoly market. The

airlinbe industry is dominated by a few large airline companies. The degree of competition in the

industry is indenfied from the concentreation ratio in the industry. Four to eight airline

the industry. This fact is highlighted from the presence of more than 700 companies in the

Indian soap and detergent market. Some of the major players in the industry include ITC limited,

Hindustan Unilever Limited and Procter & Gamble (Dey & Sharma, 2017).

Like monopolistically competitive market firms in the industry are allowed to freely enter

or exit the market. The propect of rising income from rural and urban consumers make the

industry an atrractive one with several new companies entering the business. The mechanism of

free entry or exit result lead to only a normal profit in the industry (Roshif, 2015). For example,

the brand Nirma was introduced a low priced detergent to capture customer group belonging to

middle income class. The successful strategy of Nirma was encouraged other companies to

launch product with a much lower price.

Another feature of monopolistic competition is product differentiation. The products in

the industry differs in terms of packaging, size, color, associate discount and shape. Ariel, a

product of P&G group is avaible in different variety. Ariel color, Ariel strain remover and Ariel

Quiclwash are the different sub product each having at least one distingushing characteristic

((Dey & Sharma, 2017).

The other features of a monopolistically competitive market that are found in the

concerned industry include investment in advertising, promotion of sales, absence of

interdependece and a downward sloping demand curve.

Oligopoly: case study from India

The aviation industry in India has characteristics similar to a oligopoly market. The

airlinbe industry is dominated by a few large airline companies. The degree of competition in the

industry is indenfied from the concentreation ratio in the industry. Four to eight airline

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR MANAGERS

companies in India capture 80 percent share in the market (Jain & Natarajan, 2015) Major player

in the industry include Indigo (30%), Air India (19%), Spice jet (20%), Go Air (17%), Jet

Airways (17%) and Jetlite (5%).

In the oligopoly market there are only few seller selling homogenous product or service.

In the Indian airline industry there are only eight domestic carriers. Like an oligopoly market,

entry of new firms in the industry is limited by permit of government. Similar to collusive

oligopoly, the existing sellers in the forms a cartel with an attemp to fix prices at a relatively high

level (Albers et al., 2017).

Productive and Allocative efficiency

Productive efficiency is concerned with efficient allocation of resources. This sugeests

production needs to be done in such a way that no amlunt of resoources is wasted. In a market

productive efficieny is achieved only when the price charged in the long run equals the minimum

of average cost. Allocative efficiency on the other hand is concerned with socially preferred

production and distribution of a good (McKenzie & Lee, 2016).

companies in India capture 80 percent share in the market (Jain & Natarajan, 2015) Major player

in the industry include Indigo (30%), Air India (19%), Spice jet (20%), Go Air (17%), Jet

Airways (17%) and Jetlite (5%).

In the oligopoly market there are only few seller selling homogenous product or service.

In the Indian airline industry there are only eight domestic carriers. Like an oligopoly market,

entry of new firms in the industry is limited by permit of government. Similar to collusive

oligopoly, the existing sellers in the forms a cartel with an attemp to fix prices at a relatively high

level (Albers et al., 2017).

Productive and Allocative efficiency

Productive efficiency is concerned with efficient allocation of resources. This sugeests

production needs to be done in such a way that no amlunt of resoources is wasted. In a market

productive efficieny is achieved only when the price charged in the long run equals the minimum

of average cost. Allocative efficiency on the other hand is concerned with socially preferred

production and distribution of a good (McKenzie & Lee, 2016).

11ECONOMICS FOR MANAGERS

Figure 5: Productive efficieny

(Source: as created by author)

Figure 6: Allocative efficieny

(Source: as created by Author)

Figure 5: Productive efficieny

(Source: as created by author)

Figure 6: Allocative efficieny

(Source: as created by Author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.