Economics for Managers: Analysis of Market Structures and Outcomes

VerifiedAdded on 2023/04/21

|21

|3971

|408

Report

AI Summary

This report provides a detailed analysis of market structures, covering perfect competition, monopoly, and oligopoly. It defines and contrasts the key characteristics of each market type, including the number of buyers and sellers, product homogeneity, market power, and barriers to entry. The report examines short-run and long-run profit and loss scenarios for firms under perfect competition and monopoly, illustrating these concepts with figures. It then compares market outcomes, such as price and quantity, and economic surplus in both market structures, highlighting the impact of monopoly on consumer and producer surplus, and the resulting deadweight loss. Furthermore, the report includes a case study on the oligopoly market in Australia, specifically focusing on the food retail sector, with examples of Woolworths and Coles, and the role of advertising in this market. The report also explores the strategic interdependence among firms and barriers to entry in the oligopoly market.

Running head: ECONOMICS FOR MANAGERS

Economics for Managers

Name of the Student

Name of the University

Course ID

Economics for Managers

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR MANAGERS

Question a

Perfectly competitive market

Perfectly competitive market is a special form of market characterized by large

number of buyers and sellers competing in the marketplace with a homogenous product. The

main characteristics of perfectly competitive market are as follows

Number of buyers and sellers

In the perfectly competitive market, there is a considerably large number of buyers

and sellers in the market. The presence of large number of buyers indicate intense

competition among them.

Type of product

All the sellers in the perfectly competitive market sells a homogenous or identical

product.

Market power

As there are large number of buyers and sellers in the market, each enjoys a very

small share in the market (Baumol & Blinder, 2015) Neither sellers nor buyers have any

market power. Sellers are price takers and have to accept the price determined in the market.

Free entry and exit

Firms are allowed to freely enter or exit the market. This feature of perfectly

competitive market eliminates all the supernormal profits or loss from the market in the long

run. Firms enjoy only normal profit in the market.

Monopoly

Question a

Perfectly competitive market

Perfectly competitive market is a special form of market characterized by large

number of buyers and sellers competing in the marketplace with a homogenous product. The

main characteristics of perfectly competitive market are as follows

Number of buyers and sellers

In the perfectly competitive market, there is a considerably large number of buyers

and sellers in the market. The presence of large number of buyers indicate intense

competition among them.

Type of product

All the sellers in the perfectly competitive market sells a homogenous or identical

product.

Market power

As there are large number of buyers and sellers in the market, each enjoys a very

small share in the market (Baumol & Blinder, 2015) Neither sellers nor buyers have any

market power. Sellers are price takers and have to accept the price determined in the market.

Free entry and exit

Firms are allowed to freely enter or exit the market. This feature of perfectly

competitive market eliminates all the supernormal profits or loss from the market in the long

run. Firms enjoy only normal profit in the market.

Monopoly

2ECONOMICS FOR MANAGERS

Monopoly is market condition characterized by a single seller in the market with no

close substitute (Sloman & Jones, 2017) The main characteristics of monopoly market are

given as follows

Single seller and large number of buyers

In a monopoly market, only one firm exits in the market. The number of buyers in the

market are however large. The single seller serves the large group of buyers.

Nature of the product

In order to sustain monopoly power in the market, the monopolist has to sell a unique

product having no close substitute.

Barriers to entry

In the monopoly market there are significant barriers for entry of new firms. The entry

barriers in the market are either natural or artificial.

Market power

Being the single firm in the market, monopolist has the maximum market power (Hill

& Schiller, 2015) The monopolist can influence the market price and acts as a price maker.

Short run and long run profit and losses under perfect competition

Short run

Competitive firms face an elastic demand curve which given by a horizontal line. As

sellers are price takers in the market both average and marginal revenue are same as price

line. The first order condition for short run equilibrium is price is equal to the marginal cost

of production. In order to satisfy the second order condition for maximizing profit under

perfect competition marginal cost curve should cut the marginal revenue curve from below

Monopoly is market condition characterized by a single seller in the market with no

close substitute (Sloman & Jones, 2017) The main characteristics of monopoly market are

given as follows

Single seller and large number of buyers

In a monopoly market, only one firm exits in the market. The number of buyers in the

market are however large. The single seller serves the large group of buyers.

Nature of the product

In order to sustain monopoly power in the market, the monopolist has to sell a unique

product having no close substitute.

Barriers to entry

In the monopoly market there are significant barriers for entry of new firms. The entry

barriers in the market are either natural or artificial.

Market power

Being the single firm in the market, monopolist has the maximum market power (Hill

& Schiller, 2015) The monopolist can influence the market price and acts as a price maker.

Short run and long run profit and losses under perfect competition

Short run

Competitive firms face an elastic demand curve which given by a horizontal line. As

sellers are price takers in the market both average and marginal revenue are same as price

line. The first order condition for short run equilibrium is price is equal to the marginal cost

of production. In order to satisfy the second order condition for maximizing profit under

perfect competition marginal cost curve should cut the marginal revenue curve from below

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR MANAGERS

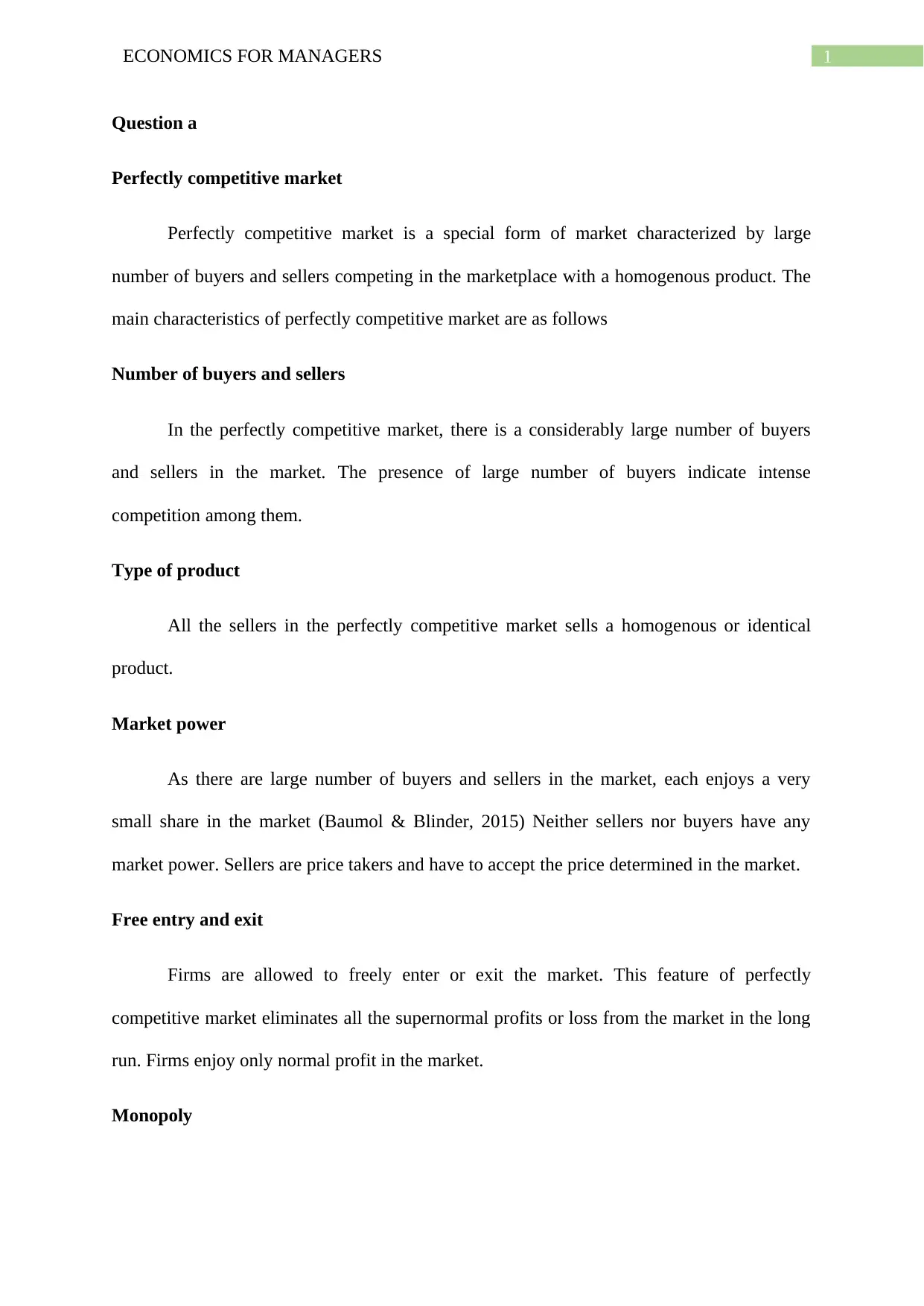

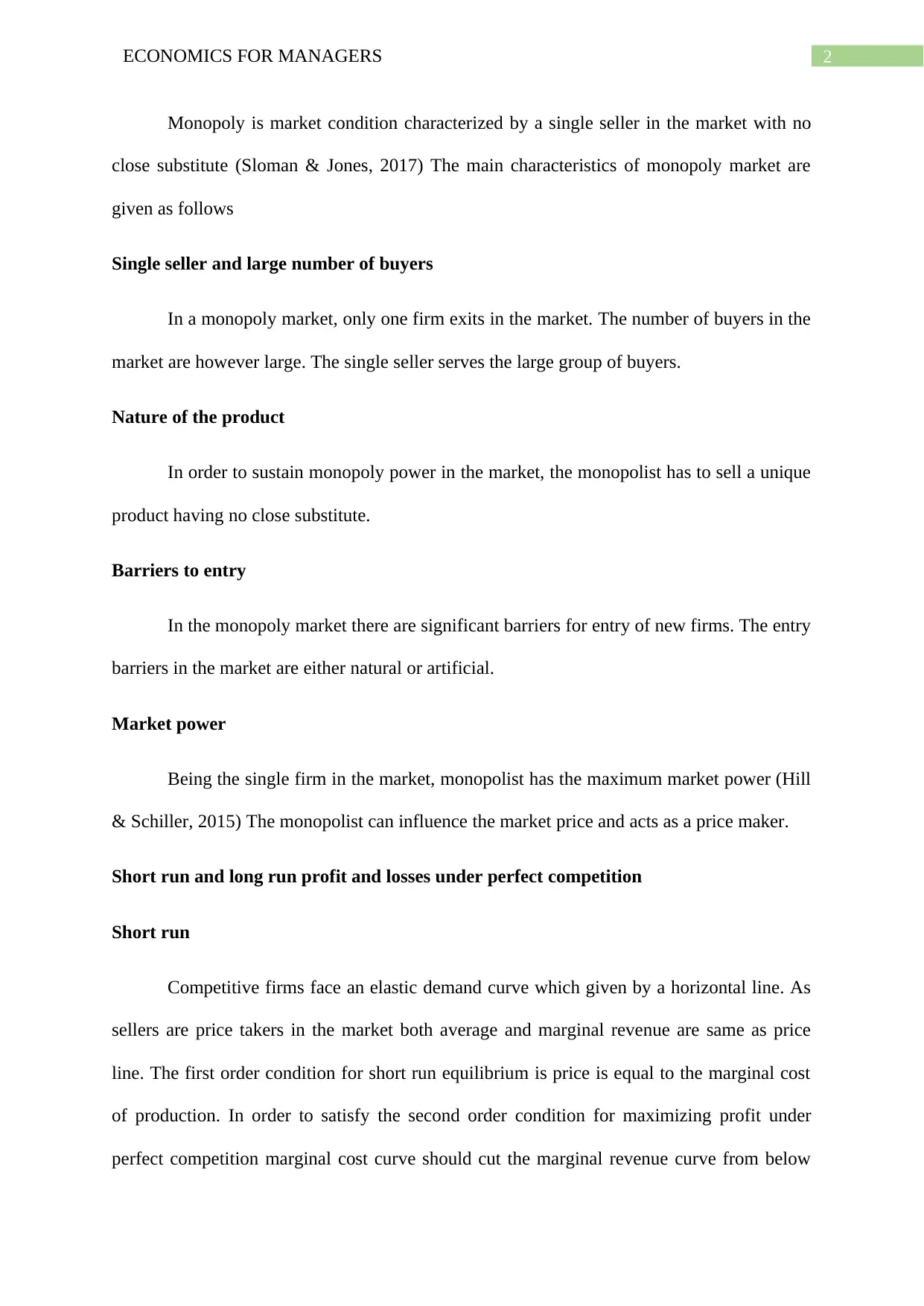

(Cowen & Tabarrok, 2015) In the short run, the competitive firms have the opportunity to

enjoy profit above the normal profit or economic loss or to earn just normal profit.

Figure 1: Above normal profit in competitive market

Figure 2: Economic loss in competitive market

(Cowen & Tabarrok, 2015) In the short run, the competitive firms have the opportunity to

enjoy profit above the normal profit or economic loss or to earn just normal profit.

Figure 1: Above normal profit in competitive market

Figure 2: Economic loss in competitive market

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR MANAGERS

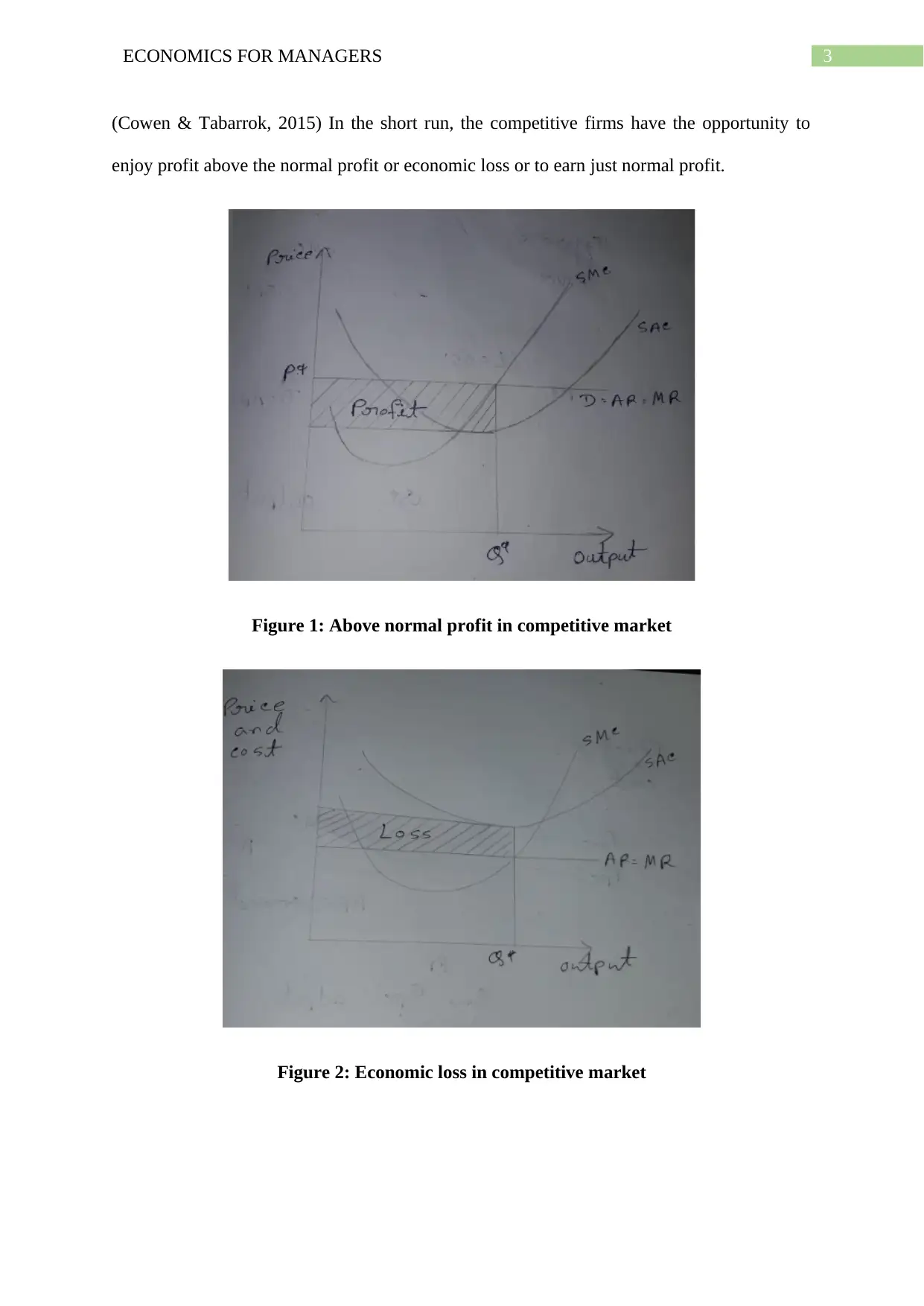

Figure 3: Normal profit in short run

Long run

In contrast to short run, competitive firms in the long-run earns a normal profit. As

firms are free to enter or exit the industry, above normal profit or economic loss eliminates

and there is only normal profit in the industry (Mochrie, 2015).

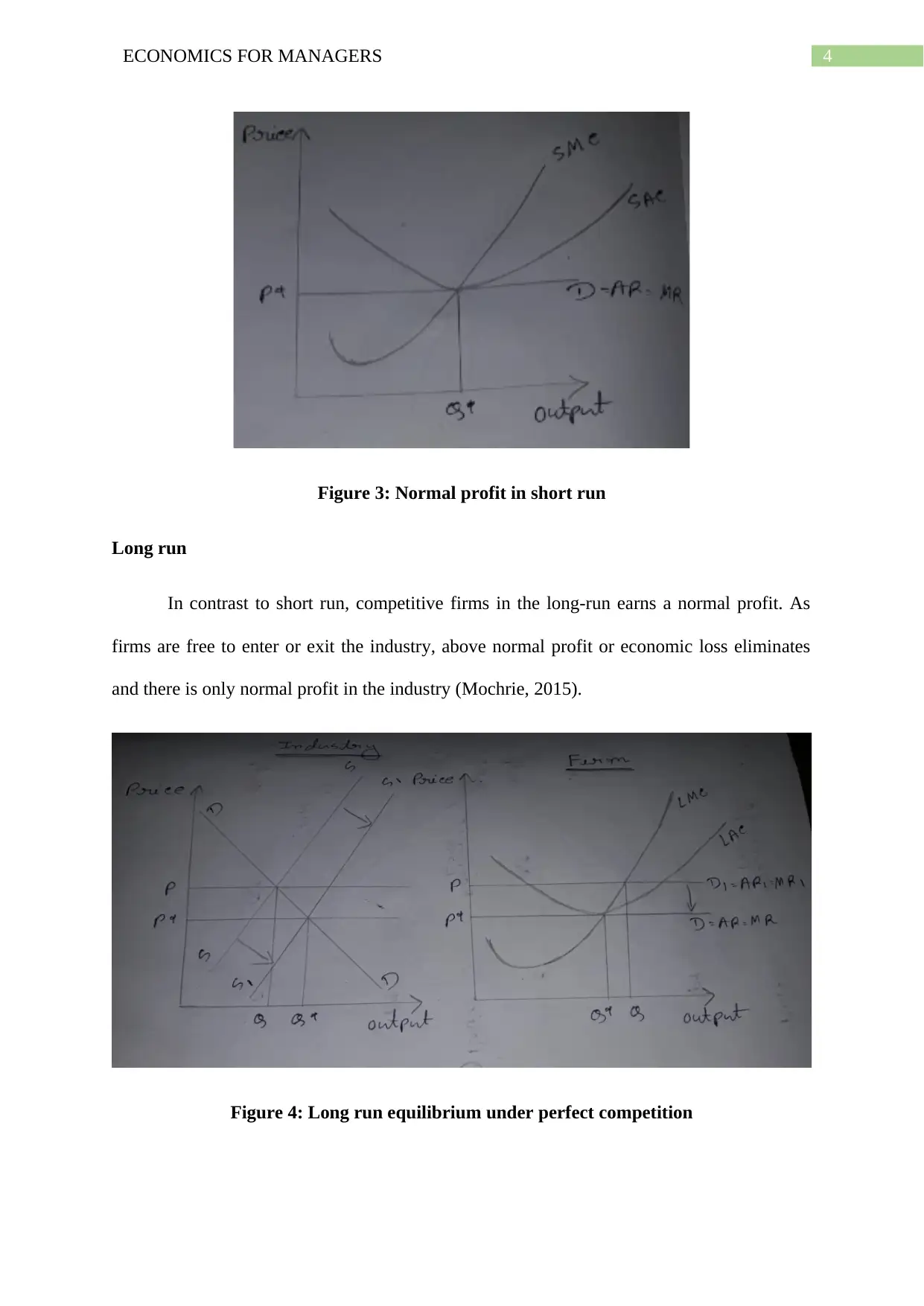

Figure 4: Long run equilibrium under perfect competition

Figure 3: Normal profit in short run

Long run

In contrast to short run, competitive firms in the long-run earns a normal profit. As

firms are free to enter or exit the industry, above normal profit or economic loss eliminates

and there is only normal profit in the industry (Mochrie, 2015).

Figure 4: Long run equilibrium under perfect competition

5ECONOMICS FOR MANAGERS

The figure above shows the long run equilibrium for both a firm and industry in a

competitive market. Suppose in the short run price for competitive firm is at P. At this price,

firms earn a supernormal profit. The profit prospective profits attract new firms in the

industry. As new firms enter the industry, supply increases shifting the supply curve to the

right (Maurice & Thomas, 2015). This lowers the price. Firms continue to enter the industry

unless profit reduces to normal profit.

Short run and long run profit and losses under monopoly

Short run

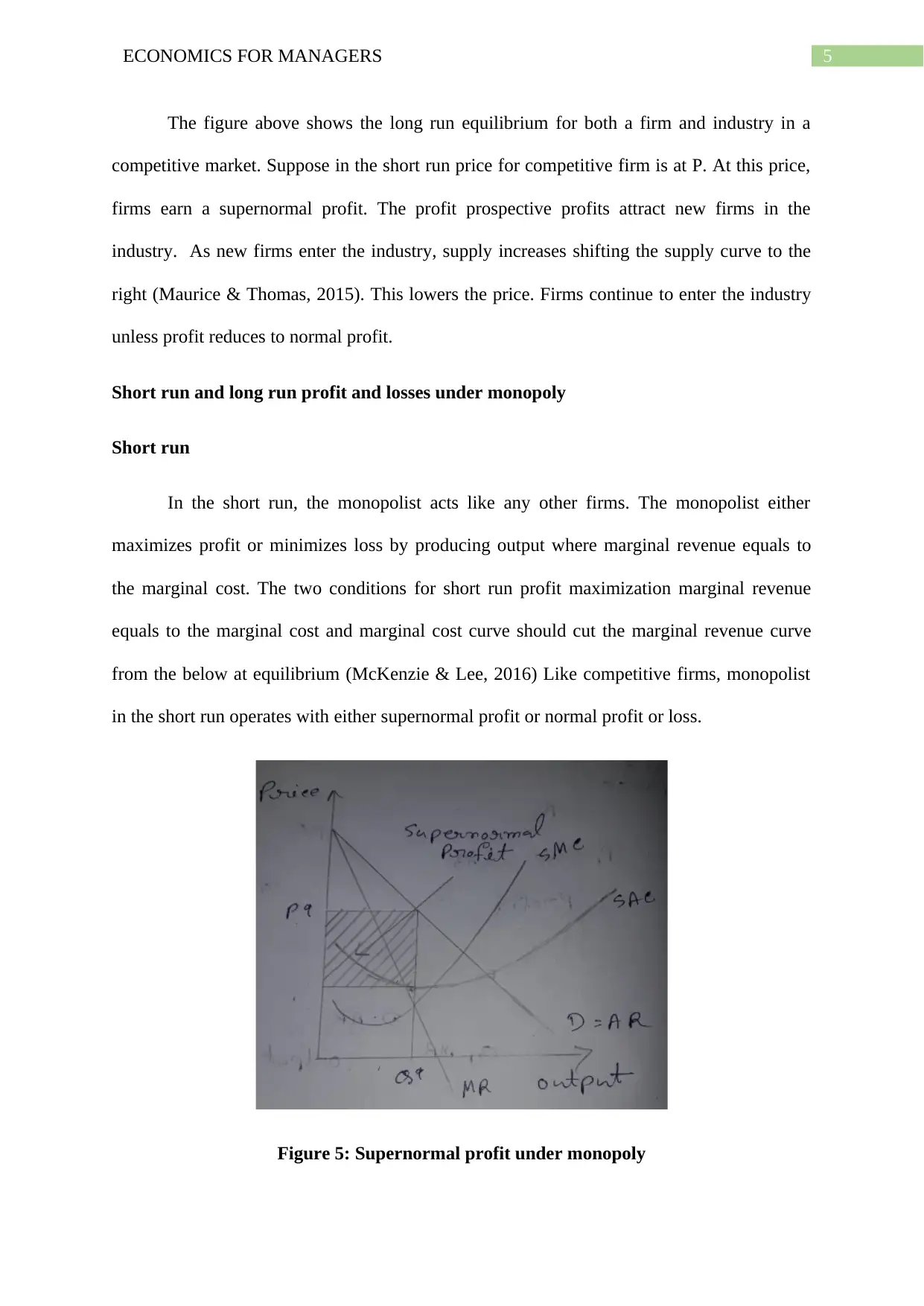

In the short run, the monopolist acts like any other firms. The monopolist either

maximizes profit or minimizes loss by producing output where marginal revenue equals to

the marginal cost. The two conditions for short run profit maximization marginal revenue

equals to the marginal cost and marginal cost curve should cut the marginal revenue curve

from the below at equilibrium (McKenzie & Lee, 2016) Like competitive firms, monopolist

in the short run operates with either supernormal profit or normal profit or loss.

Figure 5: Supernormal profit under monopoly

The figure above shows the long run equilibrium for both a firm and industry in a

competitive market. Suppose in the short run price for competitive firm is at P. At this price,

firms earn a supernormal profit. The profit prospective profits attract new firms in the

industry. As new firms enter the industry, supply increases shifting the supply curve to the

right (Maurice & Thomas, 2015). This lowers the price. Firms continue to enter the industry

unless profit reduces to normal profit.

Short run and long run profit and losses under monopoly

Short run

In the short run, the monopolist acts like any other firms. The monopolist either

maximizes profit or minimizes loss by producing output where marginal revenue equals to

the marginal cost. The two conditions for short run profit maximization marginal revenue

equals to the marginal cost and marginal cost curve should cut the marginal revenue curve

from the below at equilibrium (McKenzie & Lee, 2016) Like competitive firms, monopolist

in the short run operates with either supernormal profit or normal profit or loss.

Figure 5: Supernormal profit under monopoly

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR MANAGERS

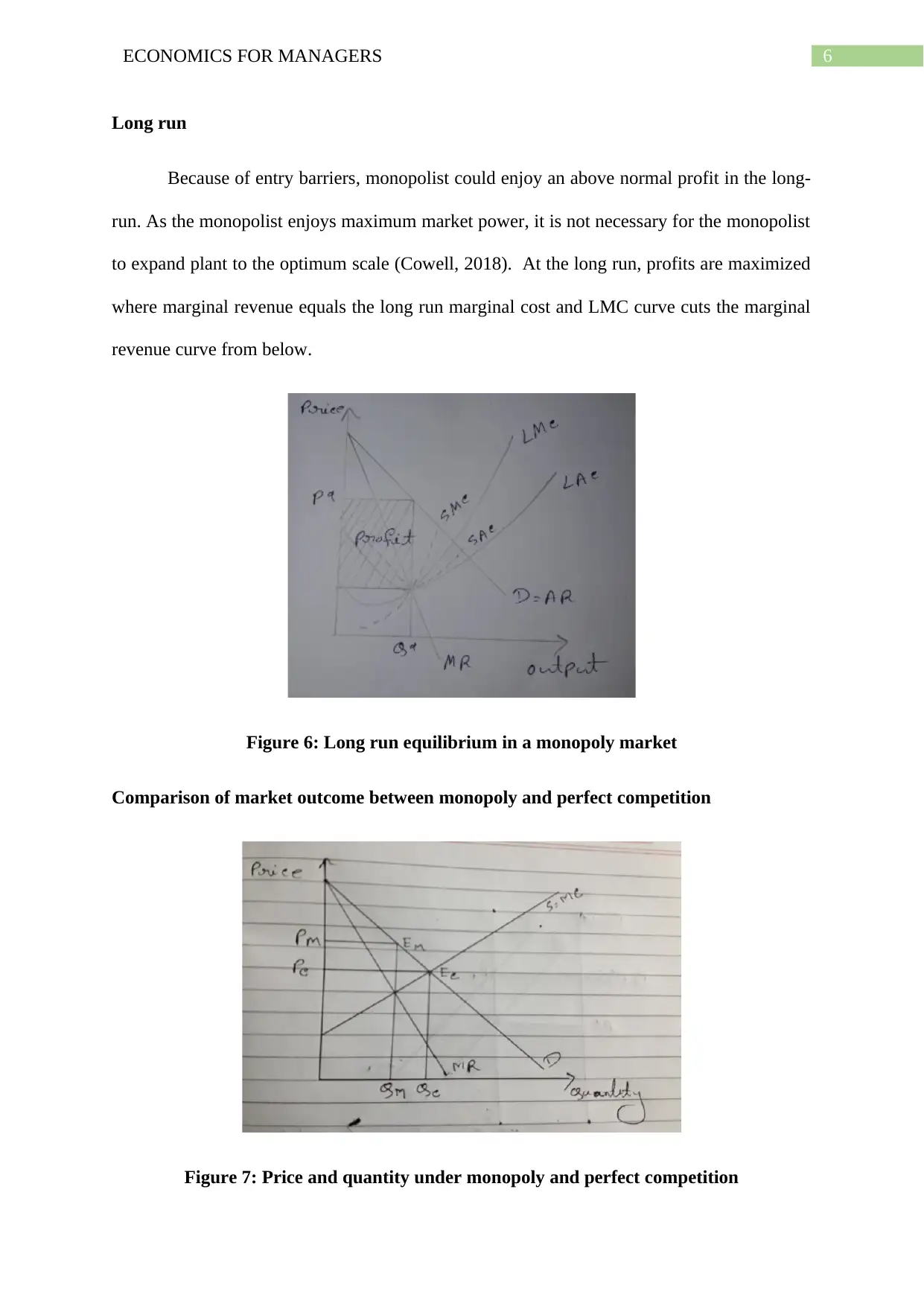

Long run

Because of entry barriers, monopolist could enjoy an above normal profit in the long-

run. As the monopolist enjoys maximum market power, it is not necessary for the monopolist

to expand plant to the optimum scale (Cowell, 2018). At the long run, profits are maximized

where marginal revenue equals the long run marginal cost and LMC curve cuts the marginal

revenue curve from below.

Figure 6: Long run equilibrium in a monopoly market

Comparison of market outcome between monopoly and perfect competition

Figure 7: Price and quantity under monopoly and perfect competition

Long run

Because of entry barriers, monopolist could enjoy an above normal profit in the long-

run. As the monopolist enjoys maximum market power, it is not necessary for the monopolist

to expand plant to the optimum scale (Cowell, 2018). At the long run, profits are maximized

where marginal revenue equals the long run marginal cost and LMC curve cuts the marginal

revenue curve from below.

Figure 6: Long run equilibrium in a monopoly market

Comparison of market outcome between monopoly and perfect competition

Figure 7: Price and quantity under monopoly and perfect competition

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR MANAGERS

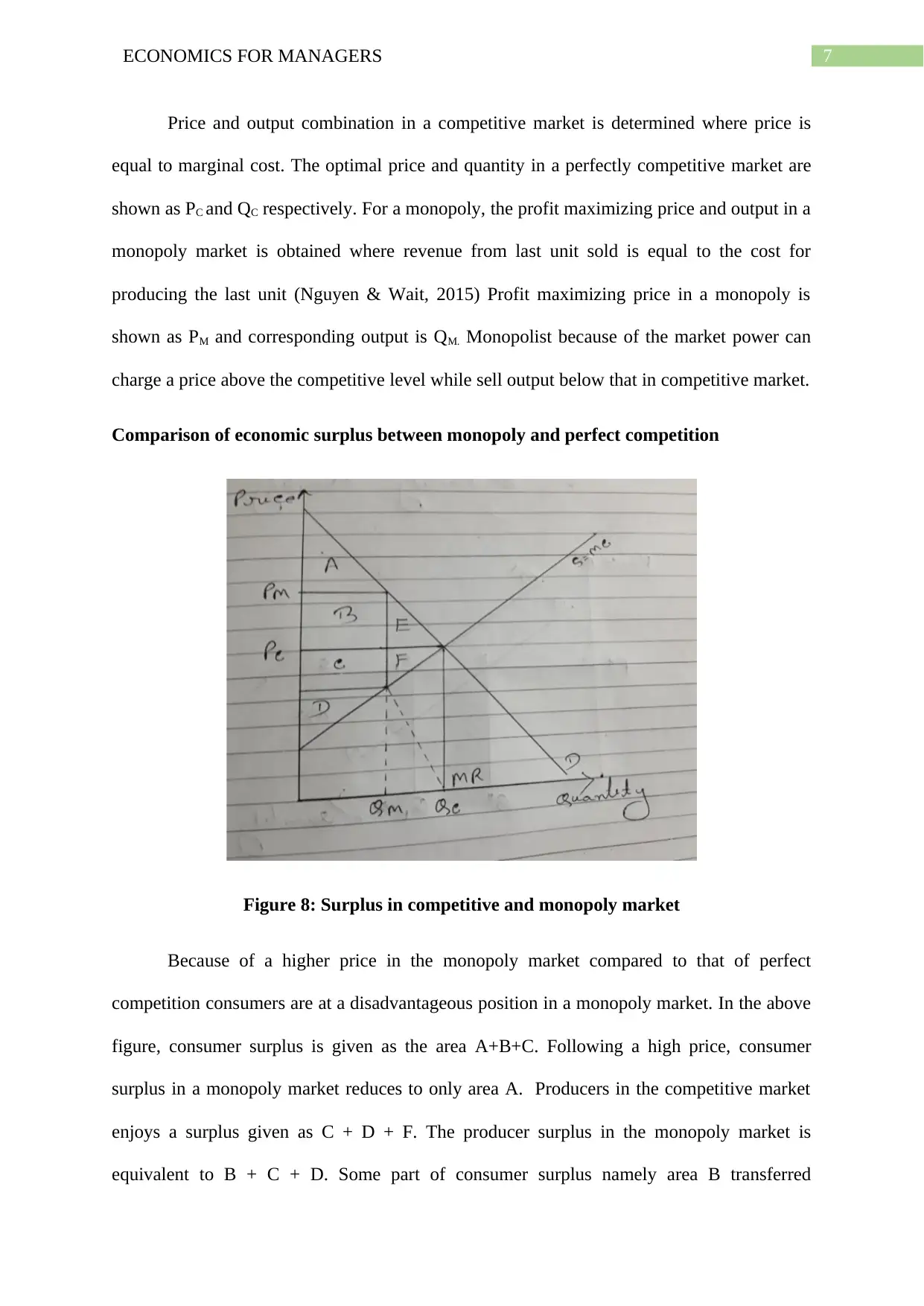

Price and output combination in a competitive market is determined where price is

equal to marginal cost. The optimal price and quantity in a perfectly competitive market are

shown as PC and QC respectively. For a monopoly, the profit maximizing price and output in a

monopoly market is obtained where revenue from last unit sold is equal to the cost for

producing the last unit (Nguyen & Wait, 2015) Profit maximizing price in a monopoly is

shown as PM and corresponding output is QM. Monopolist because of the market power can

charge a price above the competitive level while sell output below that in competitive market.

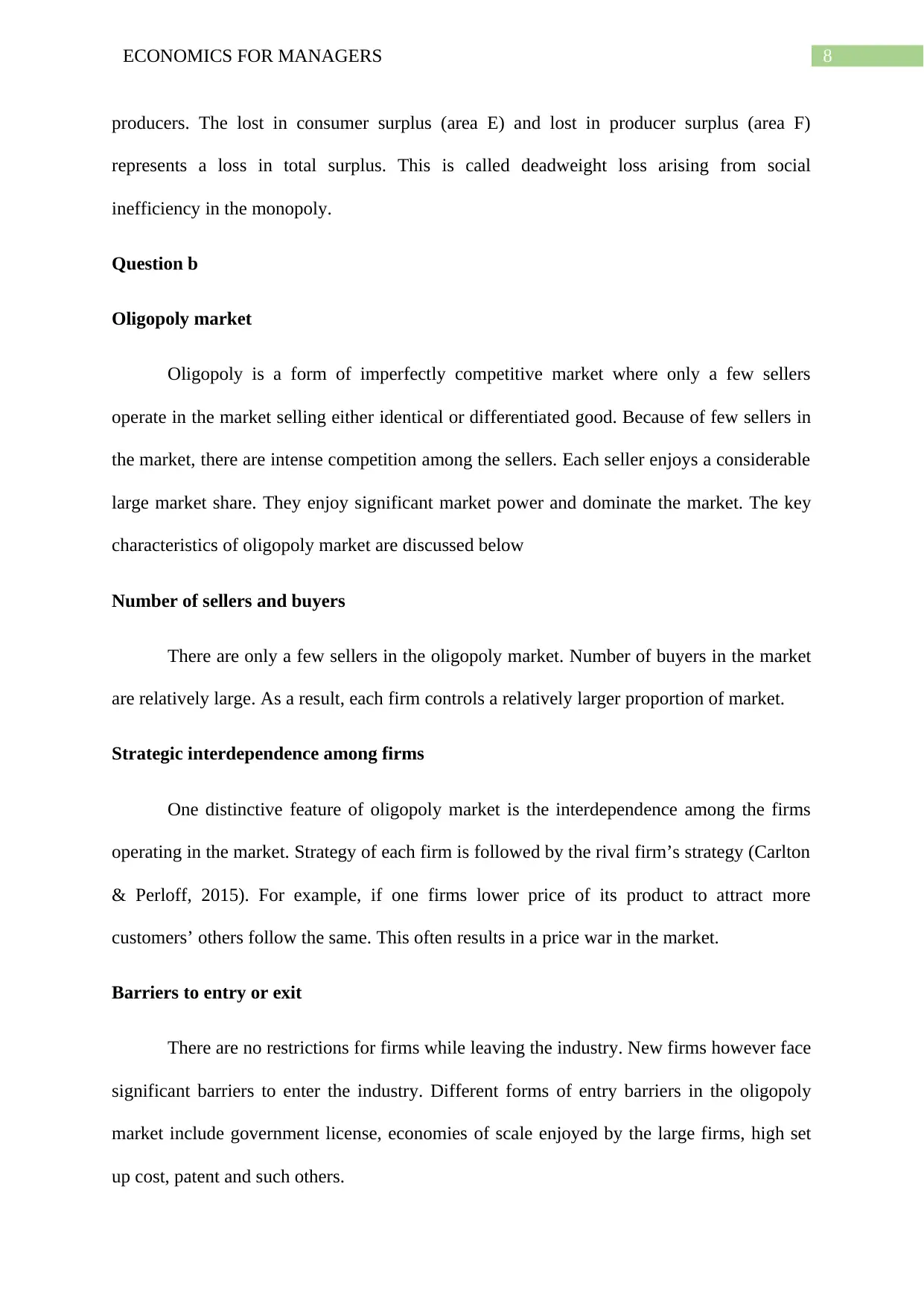

Comparison of economic surplus between monopoly and perfect competition

Figure 8: Surplus in competitive and monopoly market

Because of a higher price in the monopoly market compared to that of perfect

competition consumers are at a disadvantageous position in a monopoly market. In the above

figure, consumer surplus is given as the area A+B+C. Following a high price, consumer

surplus in a monopoly market reduces to only area A. Producers in the competitive market

enjoys a surplus given as C + D + F. The producer surplus in the monopoly market is

equivalent to B + C + D. Some part of consumer surplus namely area B transferred

Price and output combination in a competitive market is determined where price is

equal to marginal cost. The optimal price and quantity in a perfectly competitive market are

shown as PC and QC respectively. For a monopoly, the profit maximizing price and output in a

monopoly market is obtained where revenue from last unit sold is equal to the cost for

producing the last unit (Nguyen & Wait, 2015) Profit maximizing price in a monopoly is

shown as PM and corresponding output is QM. Monopolist because of the market power can

charge a price above the competitive level while sell output below that in competitive market.

Comparison of economic surplus between monopoly and perfect competition

Figure 8: Surplus in competitive and monopoly market

Because of a higher price in the monopoly market compared to that of perfect

competition consumers are at a disadvantageous position in a monopoly market. In the above

figure, consumer surplus is given as the area A+B+C. Following a high price, consumer

surplus in a monopoly market reduces to only area A. Producers in the competitive market

enjoys a surplus given as C + D + F. The producer surplus in the monopoly market is

equivalent to B + C + D. Some part of consumer surplus namely area B transferred

8ECONOMICS FOR MANAGERS

producers. The lost in consumer surplus (area E) and lost in producer surplus (area F)

represents a loss in total surplus. This is called deadweight loss arising from social

inefficiency in the monopoly.

Question b

Oligopoly market

Oligopoly is a form of imperfectly competitive market where only a few sellers

operate in the market selling either identical or differentiated good. Because of few sellers in

the market, there are intense competition among the sellers. Each seller enjoys a considerable

large market share. They enjoy significant market power and dominate the market. The key

characteristics of oligopoly market are discussed below

Number of sellers and buyers

There are only a few sellers in the oligopoly market. Number of buyers in the market

are relatively large. As a result, each firm controls a relatively larger proportion of market.

Strategic interdependence among firms

One distinctive feature of oligopoly market is the interdependence among the firms

operating in the market. Strategy of each firm is followed by the rival firm’s strategy (Carlton

& Perloff, 2015). For example, if one firms lower price of its product to attract more

customers’ others follow the same. This often results in a price war in the market.

Barriers to entry or exit

There are no restrictions for firms while leaving the industry. New firms however face

significant barriers to enter the industry. Different forms of entry barriers in the oligopoly

market include government license, economies of scale enjoyed by the large firms, high set

up cost, patent and such others.

producers. The lost in consumer surplus (area E) and lost in producer surplus (area F)

represents a loss in total surplus. This is called deadweight loss arising from social

inefficiency in the monopoly.

Question b

Oligopoly market

Oligopoly is a form of imperfectly competitive market where only a few sellers

operate in the market selling either identical or differentiated good. Because of few sellers in

the market, there are intense competition among the sellers. Each seller enjoys a considerable

large market share. They enjoy significant market power and dominate the market. The key

characteristics of oligopoly market are discussed below

Number of sellers and buyers

There are only a few sellers in the oligopoly market. Number of buyers in the market

are relatively large. As a result, each firm controls a relatively larger proportion of market.

Strategic interdependence among firms

One distinctive feature of oligopoly market is the interdependence among the firms

operating in the market. Strategy of each firm is followed by the rival firm’s strategy (Carlton

& Perloff, 2015). For example, if one firms lower price of its product to attract more

customers’ others follow the same. This often results in a price war in the market.

Barriers to entry or exit

There are no restrictions for firms while leaving the industry. New firms however face

significant barriers to enter the industry. Different forms of entry barriers in the oligopoly

market include government license, economies of scale enjoyed by the large firms, high set

up cost, patent and such others.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR MANAGERS

Nature of product

In the oligopoly market, sellers sell either identical or differentiated product.

Oligopoly market with identical product is called pure oligopoly. Oligopoly markets selling

differentiated products are called differentiated oligopoly.

Advertising

In the oligopoly market, in order to increase market share firms need to adapt various

defensive and aggressive marketing strategy. To accomplish this objective, firms need to

incur a significantly high cost on the advertising and other promotional strategy. Advertising

has a great importance in the oligopoly market. The effectiveness of advertising in the market

depends on the degree of product differentiation (Belleflamme & Peitz, 2015) When

consumers have varying preferences for products having different characteristics but are

unaware of specific characteristics of certain brands, then firms use informative

advertisement. The persuasive advertisement has a long-term effect on sales and ensures that

buyers do not shift to other competing brand.

The oligopolistic firms have opportunities to enjoy significant gain from advertising.

The primary benefit of advertising is it helps firm to increase their market share by attracting

more customers. In the oligopoly market, increase in market share requires firms to establish

a different identity compared to its rivals. Advertising helps them to build the notion among

customers that their products are better than their rivals are. Advertisement also benefit the

buyers in the oligopoly market (Dockner & Jorgensen, 2018) It helps customers in their

decision making process. Advertisement is a cost effective way of providing all the necessary

information related to a product to the consumers. In a market like oligopoly where intensive

rivalry exits among firm advertising plays an important role.

Oligopoly in Australia: a case study of Australian supermarket

Nature of product

In the oligopoly market, sellers sell either identical or differentiated product.

Oligopoly market with identical product is called pure oligopoly. Oligopoly markets selling

differentiated products are called differentiated oligopoly.

Advertising

In the oligopoly market, in order to increase market share firms need to adapt various

defensive and aggressive marketing strategy. To accomplish this objective, firms need to

incur a significantly high cost on the advertising and other promotional strategy. Advertising

has a great importance in the oligopoly market. The effectiveness of advertising in the market

depends on the degree of product differentiation (Belleflamme & Peitz, 2015) When

consumers have varying preferences for products having different characteristics but are

unaware of specific characteristics of certain brands, then firms use informative

advertisement. The persuasive advertisement has a long-term effect on sales and ensures that

buyers do not shift to other competing brand.

The oligopolistic firms have opportunities to enjoy significant gain from advertising.

The primary benefit of advertising is it helps firm to increase their market share by attracting

more customers. In the oligopoly market, increase in market share requires firms to establish

a different identity compared to its rivals. Advertising helps them to build the notion among

customers that their products are better than their rivals are. Advertisement also benefit the

buyers in the oligopoly market (Dockner & Jorgensen, 2018) It helps customers in their

decision making process. Advertisement is a cost effective way of providing all the necessary

information related to a product to the consumers. In a market like oligopoly where intensive

rivalry exits among firm advertising plays an important role.

Oligopoly in Australia: a case study of Australian supermarket

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR MANAGERS

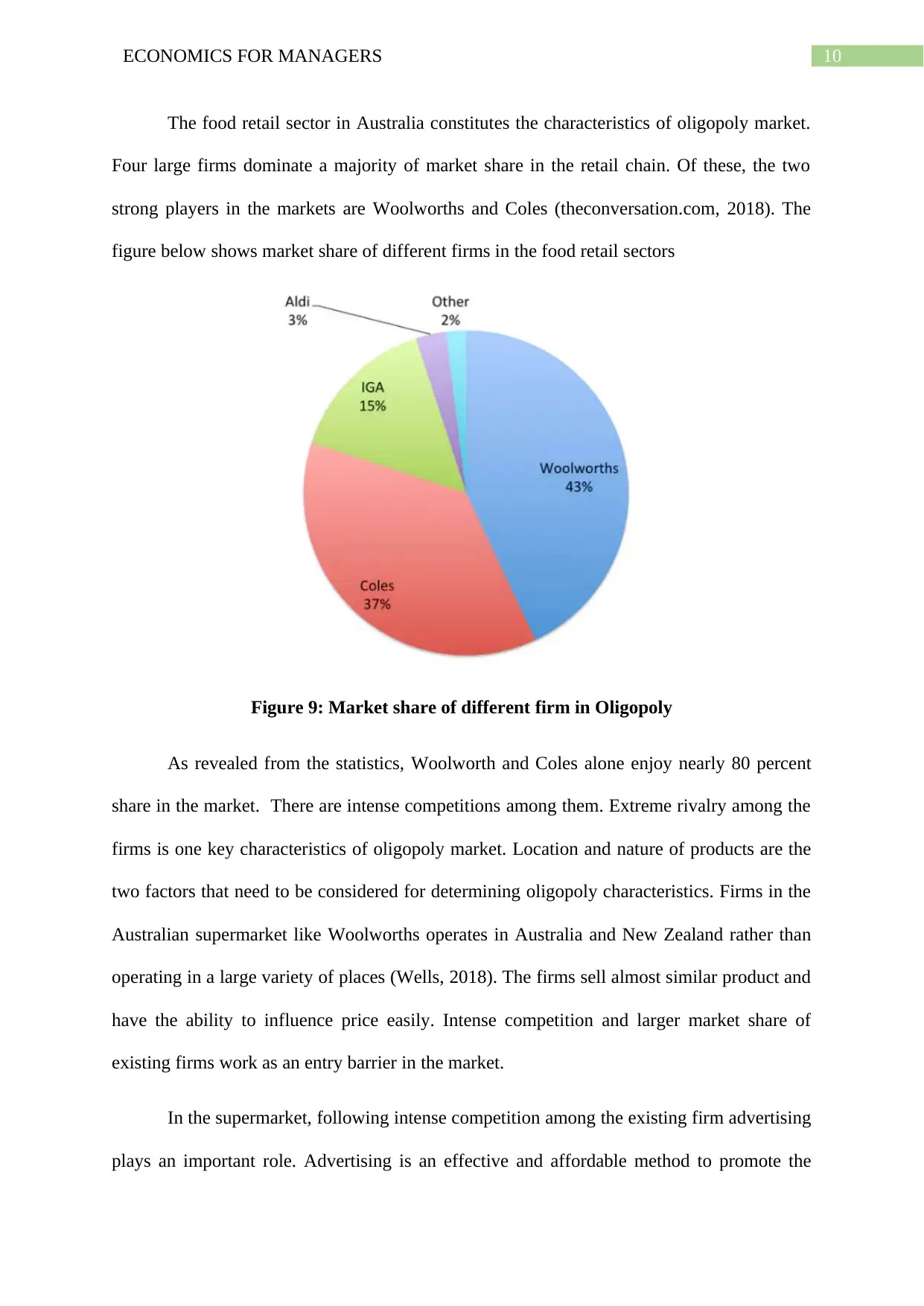

The food retail sector in Australia constitutes the characteristics of oligopoly market.

Four large firms dominate a majority of market share in the retail chain. Of these, the two

strong players in the markets are Woolworths and Coles (theconversation.com, 2018). The

figure below shows market share of different firms in the food retail sectors

Figure 9: Market share of different firm in Oligopoly

As revealed from the statistics, Woolworth and Coles alone enjoy nearly 80 percent

share in the market. There are intense competitions among them. Extreme rivalry among the

firms is one key characteristics of oligopoly market. Location and nature of products are the

two factors that need to be considered for determining oligopoly characteristics. Firms in the

Australian supermarket like Woolworths operates in Australia and New Zealand rather than

operating in a large variety of places (Wells, 2018). The firms sell almost similar product and

have the ability to influence price easily. Intense competition and larger market share of

existing firms work as an entry barrier in the market.

In the supermarket, following intense competition among the existing firm advertising

plays an important role. Advertising is an effective and affordable method to promote the

The food retail sector in Australia constitutes the characteristics of oligopoly market.

Four large firms dominate a majority of market share in the retail chain. Of these, the two

strong players in the markets are Woolworths and Coles (theconversation.com, 2018). The

figure below shows market share of different firms in the food retail sectors

Figure 9: Market share of different firm in Oligopoly

As revealed from the statistics, Woolworth and Coles alone enjoy nearly 80 percent

share in the market. There are intense competitions among them. Extreme rivalry among the

firms is one key characteristics of oligopoly market. Location and nature of products are the

two factors that need to be considered for determining oligopoly characteristics. Firms in the

Australian supermarket like Woolworths operates in Australia and New Zealand rather than

operating in a large variety of places (Wells, 2018). The firms sell almost similar product and

have the ability to influence price easily. Intense competition and larger market share of

existing firms work as an entry barrier in the market.

In the supermarket, following intense competition among the existing firm advertising

plays an important role. Advertising is an effective and affordable method to promote the

11ECONOMICS FOR MANAGERS

brand image. In the supermarket chain, Woolworths and Coles are two of biggest spender on

advertising. Coles launched “Down Down” advertising campaign in 2010. The firms also

change their advertising strategy depending on state of the market (Hatch, 2018). For

example, Coles has now shifted from their earlier strategy of “Down Down”. The company

through their advertisements now are trying to convey positive experience of their customers.

In these advertisement old customers share their own stories. Both Woolworths and Coles

involve sports stars in their advertising. Coles and Woolworth though in recent years cut back

still they spent a significant amount in their advertisement spending. In order to increase its

market share, the advertising spending by Aldi has increased to $34.7 million. German based

competitor Aldi increased its advertising spending by 17 percent (Heffernan, 2018). Aldi

broadcasts its advertisements on radio, television, newspapers, magazines and other online

media. Along with its expansion in the Australian market, advertisement spending of Aldi

grew up. The digital advertising remains the most preferred medium of reaching to the

customers. In the advertising budget of Aldi, digital advertising accounts for $1.37 million

(news.com.au, 2018). For Woolworths and Coles, this amount is $3.7million and $1.7

million.

In contrast to oligopolistic firms in retail supermarket chain, there are also examples

of oligopolistic industries involve little advertisement. Examples include banking industry.

Banking industry in Australia is also an oligopoly industry. Four big banks namely

Commonwealth Bank of Australia, Australia and New Zealand Banking Group. Westpac and

National Australian Banks are the big four banks controlling almost 80 percent share in the

market. Given importance of banking sector and necessity for different banking services

consumers have to rely on bank. As there is not much variation in services banks need to

advertise less compared to other oligopoly industry.

Question c

brand image. In the supermarket chain, Woolworths and Coles are two of biggest spender on

advertising. Coles launched “Down Down” advertising campaign in 2010. The firms also

change their advertising strategy depending on state of the market (Hatch, 2018). For

example, Coles has now shifted from their earlier strategy of “Down Down”. The company

through their advertisements now are trying to convey positive experience of their customers.

In these advertisement old customers share their own stories. Both Woolworths and Coles

involve sports stars in their advertising. Coles and Woolworth though in recent years cut back

still they spent a significant amount in their advertisement spending. In order to increase its

market share, the advertising spending by Aldi has increased to $34.7 million. German based

competitor Aldi increased its advertising spending by 17 percent (Heffernan, 2018). Aldi

broadcasts its advertisements on radio, television, newspapers, magazines and other online

media. Along with its expansion in the Australian market, advertisement spending of Aldi

grew up. The digital advertising remains the most preferred medium of reaching to the

customers. In the advertising budget of Aldi, digital advertising accounts for $1.37 million

(news.com.au, 2018). For Woolworths and Coles, this amount is $3.7million and $1.7

million.

In contrast to oligopolistic firms in retail supermarket chain, there are also examples

of oligopolistic industries involve little advertisement. Examples include banking industry.

Banking industry in Australia is also an oligopoly industry. Four big banks namely

Commonwealth Bank of Australia, Australia and New Zealand Banking Group. Westpac and

National Australian Banks are the big four banks controlling almost 80 percent share in the

market. Given importance of banking sector and necessity for different banking services

consumers have to rely on bank. As there is not much variation in services banks need to

advertise less compared to other oligopoly industry.

Question c

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.