Economics Report: Australian Dollar Tumbles to Ten-Year Low

VerifiedAdded on 2023/04/19

|15

|3717

|425

Report

AI Summary

This report analyzes the factors contributing to the decline of the Australian dollar (AUD) to a ten-year low, examining the impact of weaker manufacturing output from China and the European Union on the AUD-USD exchange rate. It delves into the determination of exchange rates using the demand and supply model, analyzing historical movements and identifying factors such as inflation and interest rates. The report discusses the effects of the AUD's depreciation on businesses and the broader Australian economy, and it explores potential actions the Reserve Bank of Australia could take to stabilize the currency. The analysis highlights the interconnectedness of global economic conditions and their influence on national currency values, emphasizing the role of market forces and economic indicators in shaping exchange rate dynamics.

ECONOMICS FOR

PROFESSIONAL

(AUSTRALIAN DOLLAR

TRUMBLES TO TEN YEAR LOW)

PROFESSIONAL

(AUSTRALIAN DOLLAR

TRUMBLES TO TEN YEAR LOW)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The sudden drop in the value of An Australian dollar is evaluated with the help of this

assignment to get to know about all the reasons behind the uncertain decrease in the value.

The reasons come in the bigger picture that weaker growth of the industry’s output from

China and the European Union are behind the sudden decrease in the value of an Australian

dollar. The article published in the Sydney morning herald draw light on this topic. The

authenticity of the information mentions in the article will help with further research. With

the help of this research, RBI of Australia is suggested to improve the value of an Australian

dollar.

2

The sudden drop in the value of An Australian dollar is evaluated with the help of this

assignment to get to know about all the reasons behind the uncertain decrease in the value.

The reasons come in the bigger picture that weaker growth of the industry’s output from

China and the European Union are behind the sudden decrease in the value of an Australian

dollar. The article published in the Sydney morning herald draw light on this topic. The

authenticity of the information mentions in the article will help with further research. With

the help of this research, RBI of Australia is suggested to improve the value of an Australian

dollar.

2

TABLE OF CONTENTS

ASSIGNMENT 1.......................................................................................................................1

1. Discuss issues discussed in the article and explain how AUD and USD exchange rates

are determined by market forces using demand and supply model of exchange rates...........1

2. Analyse movement in AUD-USD exchange rates and describe factors contributing to the

behaviour of exchange rates...................................................................................................2

3. Summarize driving factors behind the movement of AUD in the article and explain how

these factors affect the demand or supply of AUD-USD market...........................................6

4. Explain the impact of recent drop in AUD on the business and describe how depreciation

of AUD will affect the entire Australian economy................................................................7

5. What actions reserve bank of Australia could take to increase the AUD from 70C per

AUD to 73C per AUD and its side effects that might affect Australian economy................8

REFERENCES...........................................................................................................................9

APPENDICES..........................................................................................................................11

ASSIGNMENT 1.......................................................................................................................1

1. Discuss issues discussed in the article and explain how AUD and USD exchange rates

are determined by market forces using demand and supply model of exchange rates...........1

2. Analyse movement in AUD-USD exchange rates and describe factors contributing to the

behaviour of exchange rates...................................................................................................2

3. Summarize driving factors behind the movement of AUD in the article and explain how

these factors affect the demand or supply of AUD-USD market...........................................6

4. Explain the impact of recent drop in AUD on the business and describe how depreciation

of AUD will affect the entire Australian economy................................................................7

5. What actions reserve bank of Australia could take to increase the AUD from 70C per

AUD to 73C per AUD and its side effects that might affect Australian economy................8

REFERENCES...........................................................................................................................9

APPENDICES..........................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Current report is about the evaluation of an article on different criteria’s used in the

assignment to tests the authenticity of the information mention in the article. Sudden decrease

in the Australian dollar has witnessed which decline to 70C per Australian dollar which is

consider as the lowest value in a period of 1 decade (Cuestas & Gil-Alana, 2009). The whole

world is shocked that how this much decrease has witnessed by the Australian economy. This

report will stresses on several aspects such as determination of exchange rates by market

forces, factors contributing to its impact on the Australian economy.

ASSIGNMENT 1

1. Discuss issues discussed in the article and explain how AUD and USD exchange rates are

determined by market forces using demand and supply model of exchange rates.

The prominent reason behind this sudden decline is weaker production of

manufacturing industries set up in China and the European Union (Australian dollar tumbles

to ten-year low, 2019). Australia’s revenue comes from these two important sources which

help in increasing the global growth of the nation (Ramsay & Leslie, 2008). But sudden

decreasing of revenue from this source affects the entire economy due to which the currency

value of the Australian dollar faces decline.

A Drop in the growth of industries in China and the European Union covering two

major countries in this region such as Spain and Italy (Valadkhani & Smyth, 2018).

Uncertainty imposed on the Australian economy will result into a declining value of its own

currency. This will, in turn, affects the entire market demand of Australia’s output to sell in

the foreign market.

But due to this drop in the currency value of the Australian dollar, the value of the

Euro gets increases as the value of the Euro gets increases. As this tragedy, opens up a new

path for Eurozone manufacturing industries in comparison to the Australian dollar

manufacturing region (Ramsay, Richman & Leslie, 2017).

The demand for the supply model helps an economy in estimating the exchange rate

of the future period by knowing its future demand and the supply (Bahmani‐Oskooee &

Nayeri, 2018). This model will help in identifying two exchange rates of two currencies such

as the Australian Dollar and US dollar.

1

Current report is about the evaluation of an article on different criteria’s used in the

assignment to tests the authenticity of the information mention in the article. Sudden decrease

in the Australian dollar has witnessed which decline to 70C per Australian dollar which is

consider as the lowest value in a period of 1 decade (Cuestas & Gil-Alana, 2009). The whole

world is shocked that how this much decrease has witnessed by the Australian economy. This

report will stresses on several aspects such as determination of exchange rates by market

forces, factors contributing to its impact on the Australian economy.

ASSIGNMENT 1

1. Discuss issues discussed in the article and explain how AUD and USD exchange rates are

determined by market forces using demand and supply model of exchange rates.

The prominent reason behind this sudden decline is weaker production of

manufacturing industries set up in China and the European Union (Australian dollar tumbles

to ten-year low, 2019). Australia’s revenue comes from these two important sources which

help in increasing the global growth of the nation (Ramsay & Leslie, 2008). But sudden

decreasing of revenue from this source affects the entire economy due to which the currency

value of the Australian dollar faces decline.

A Drop in the growth of industries in China and the European Union covering two

major countries in this region such as Spain and Italy (Valadkhani & Smyth, 2018).

Uncertainty imposed on the Australian economy will result into a declining value of its own

currency. This will, in turn, affects the entire market demand of Australia’s output to sell in

the foreign market.

But due to this drop in the currency value of the Australian dollar, the value of the

Euro gets increases as the value of the Euro gets increases. As this tragedy, opens up a new

path for Eurozone manufacturing industries in comparison to the Australian dollar

manufacturing region (Ramsay, Richman & Leslie, 2017).

The demand for the supply model helps an economy in estimating the exchange rate

of the future period by knowing its future demand and the supply (Bahmani‐Oskooee &

Nayeri, 2018). This model will help in identifying two exchange rates of two currencies such

as the Australian Dollar and US dollar.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

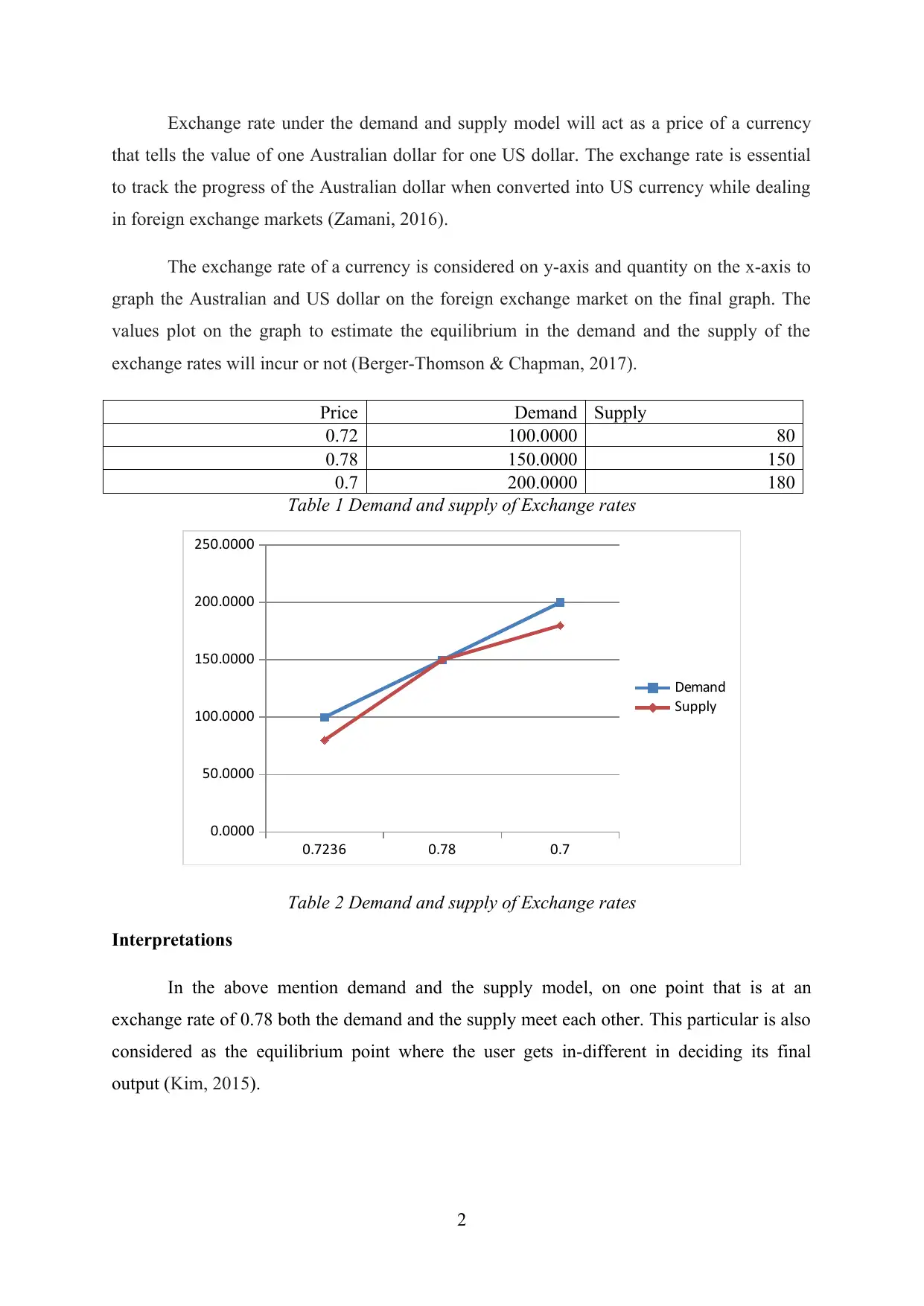

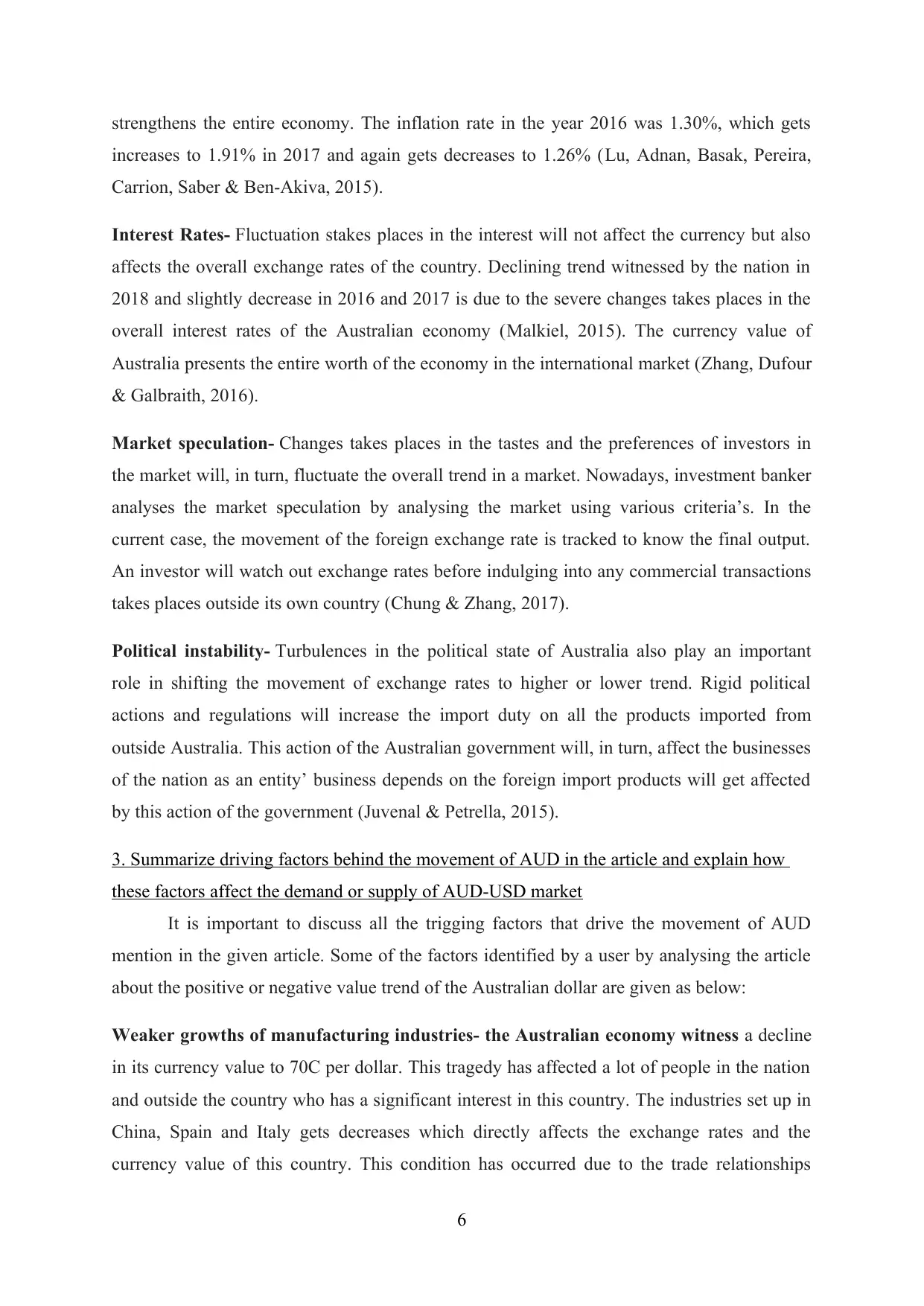

Exchange rate under the demand and supply model will act as a price of a currency

that tells the value of one Australian dollar for one US dollar. The exchange rate is essential

to track the progress of the Australian dollar when converted into US currency while dealing

in foreign exchange markets (Zamani, 2016).

The exchange rate of a currency is considered on y-axis and quantity on the x-axis to

graph the Australian and US dollar on the foreign exchange market on the final graph. The

values plot on the graph to estimate the equilibrium in the demand and the supply of the

exchange rates will incur or not (Berger-Thomson & Chapman, 2017).

Price Demand Supply

0.72 100.0000 80

0.78 150.0000 150

0.7 200.0000 180

Table 1 Demand and supply of Exchange rates

0.7236 0.78 0.7

0.0000

50.0000

100.0000

150.0000

200.0000

250.0000

Demand

Supply

Table 2 Demand and supply of Exchange rates

Interpretations

In the above mention demand and the supply model, on one point that is at an

exchange rate of 0.78 both the demand and the supply meet each other. This particular is also

considered as the equilibrium point where the user gets in-different in deciding its final

output (Kim, 2015).

2

that tells the value of one Australian dollar for one US dollar. The exchange rate is essential

to track the progress of the Australian dollar when converted into US currency while dealing

in foreign exchange markets (Zamani, 2016).

The exchange rate of a currency is considered on y-axis and quantity on the x-axis to

graph the Australian and US dollar on the foreign exchange market on the final graph. The

values plot on the graph to estimate the equilibrium in the demand and the supply of the

exchange rates will incur or not (Berger-Thomson & Chapman, 2017).

Price Demand Supply

0.72 100.0000 80

0.78 150.0000 150

0.7 200.0000 180

Table 1 Demand and supply of Exchange rates

0.7236 0.78 0.7

0.0000

50.0000

100.0000

150.0000

200.0000

250.0000

Demand

Supply

Table 2 Demand and supply of Exchange rates

Interpretations

In the above mention demand and the supply model, on one point that is at an

exchange rate of 0.78 both the demand and the supply meet each other. This particular is also

considered as the equilibrium point where the user gets in-different in deciding its final

output (Kim, 2015).

2

2. Analyse movement in AUD-USD exchange rates and describe factors contributing to the

behaviour of exchange rates.

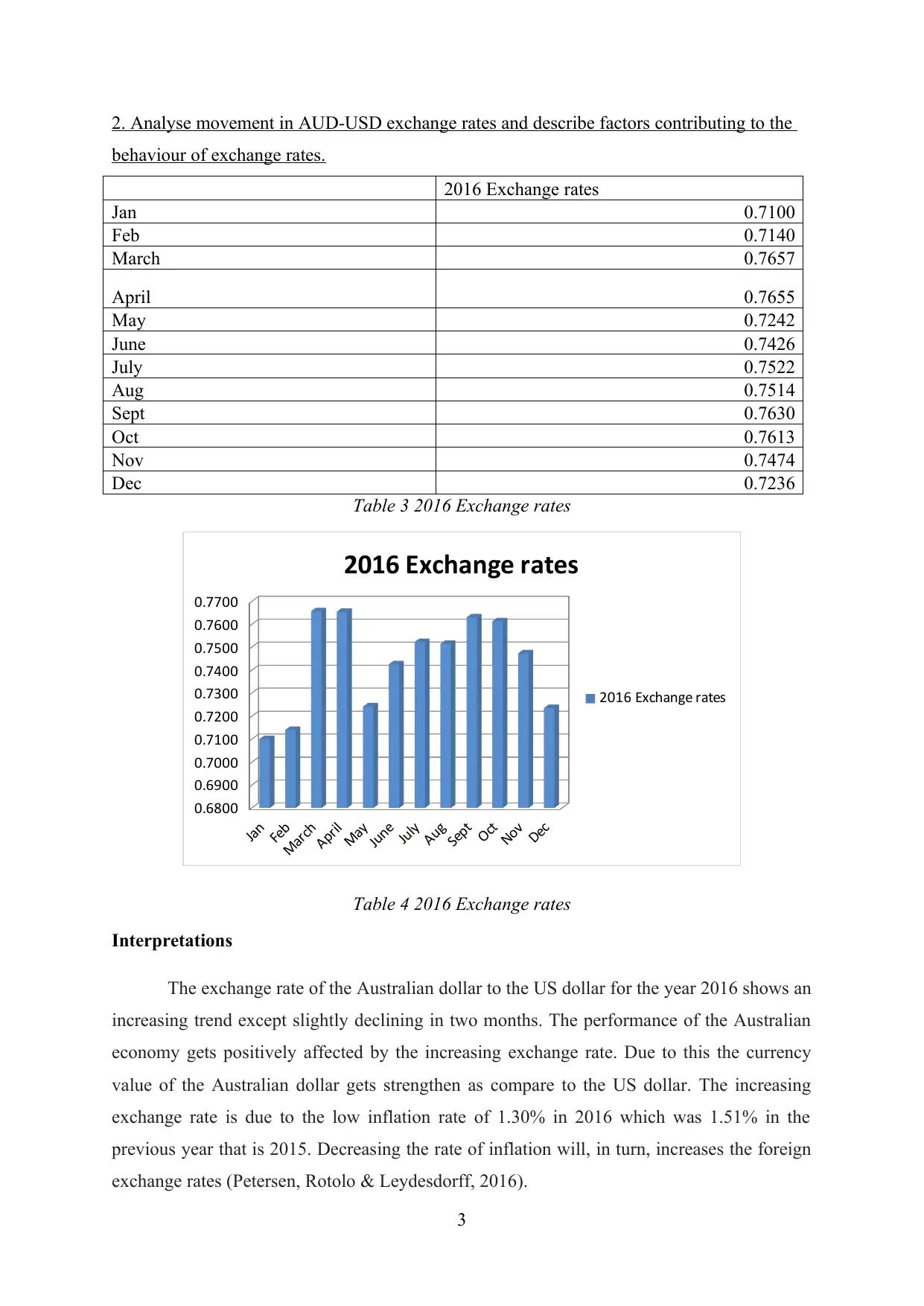

2016 Exchange rates

Jan 0.7100

Feb 0.7140

March 0.7657

April 0.7655

May 0.7242

June 0.7426

July 0.7522

Aug 0.7514

Sept 0.7630

Oct 0.7613

Nov 0.7474

Dec 0.7236

Table 3 2016 Exchange rates

Jan

Feb

March

April

May

June

July

Aug

Sept

Oct

Nov

Dec

0.6800

0.6900

0.7000

0.7100

0.7200

0.7300

0.7400

0.7500

0.7600

0.7700

2016 Exchange rates

2016 Exchange rates

Table 4 2016 Exchange rates

Interpretations

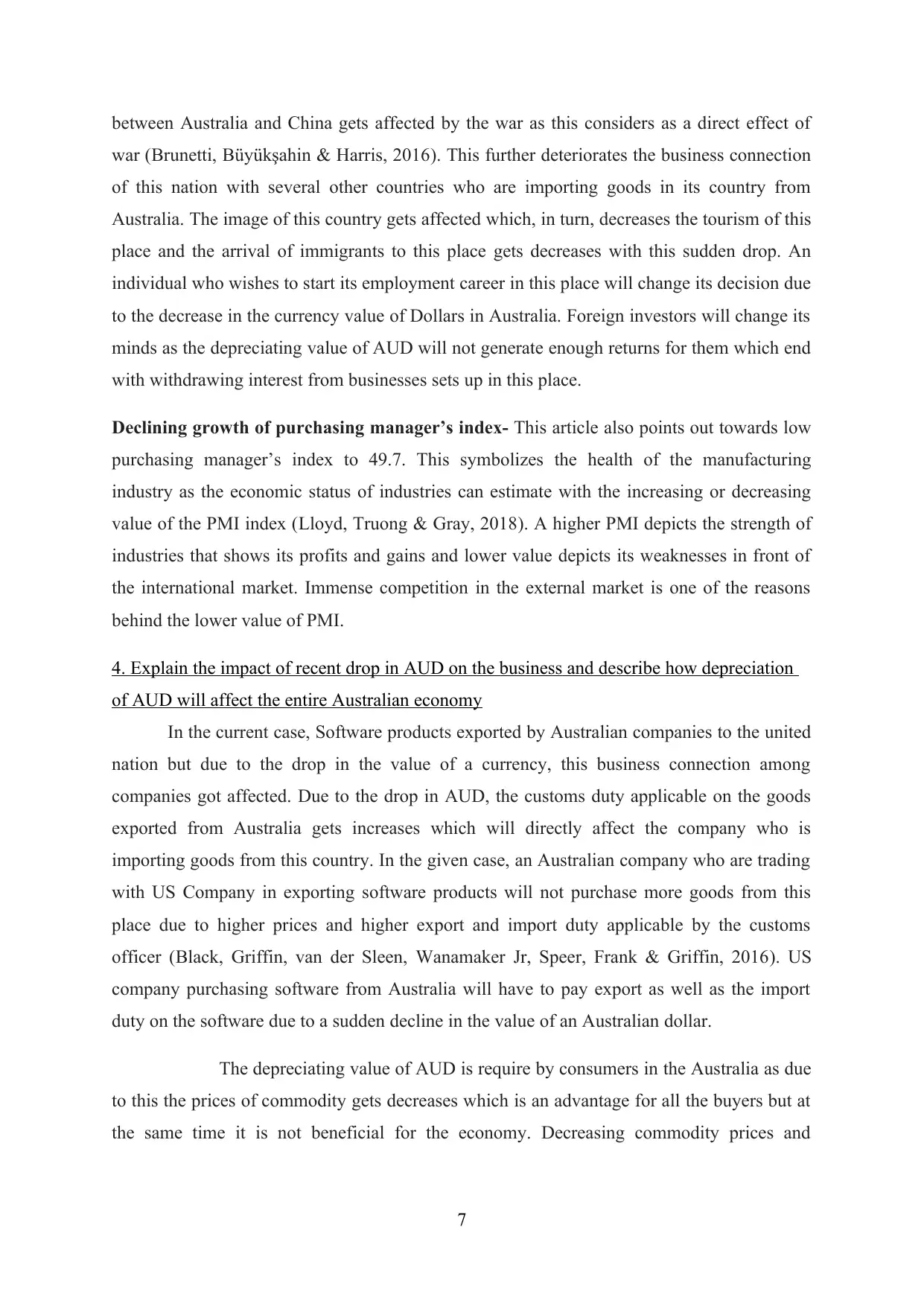

The exchange rate of the Australian dollar to the US dollar for the year 2016 shows an

increasing trend except slightly declining in two months. The performance of the Australian

economy gets positively affected by the increasing exchange rate. Due to this the currency

value of the Australian dollar gets strengthen as compare to the US dollar. The increasing

exchange rate is due to the low inflation rate of 1.30% in 2016 which was 1.51% in the

previous year that is 2015. Decreasing the rate of inflation will, in turn, increases the foreign

exchange rates (Petersen, Rotolo & Leydesdorff, 2016).

3

behaviour of exchange rates.

2016 Exchange rates

Jan 0.7100

Feb 0.7140

March 0.7657

April 0.7655

May 0.7242

June 0.7426

July 0.7522

Aug 0.7514

Sept 0.7630

Oct 0.7613

Nov 0.7474

Dec 0.7236

Table 3 2016 Exchange rates

Jan

Feb

March

April

May

June

July

Aug

Sept

Oct

Nov

Dec

0.6800

0.6900

0.7000

0.7100

0.7200

0.7300

0.7400

0.7500

0.7600

0.7700

2016 Exchange rates

2016 Exchange rates

Table 4 2016 Exchange rates

Interpretations

The exchange rate of the Australian dollar to the US dollar for the year 2016 shows an

increasing trend except slightly declining in two months. The performance of the Australian

economy gets positively affected by the increasing exchange rate. Due to this the currency

value of the Australian dollar gets strengthen as compare to the US dollar. The increasing

exchange rate is due to the low inflation rate of 1.30% in 2016 which was 1.51% in the

previous year that is 2015. Decreasing the rate of inflation will, in turn, increases the foreign

exchange rates (Petersen, Rotolo & Leydesdorff, 2016).

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

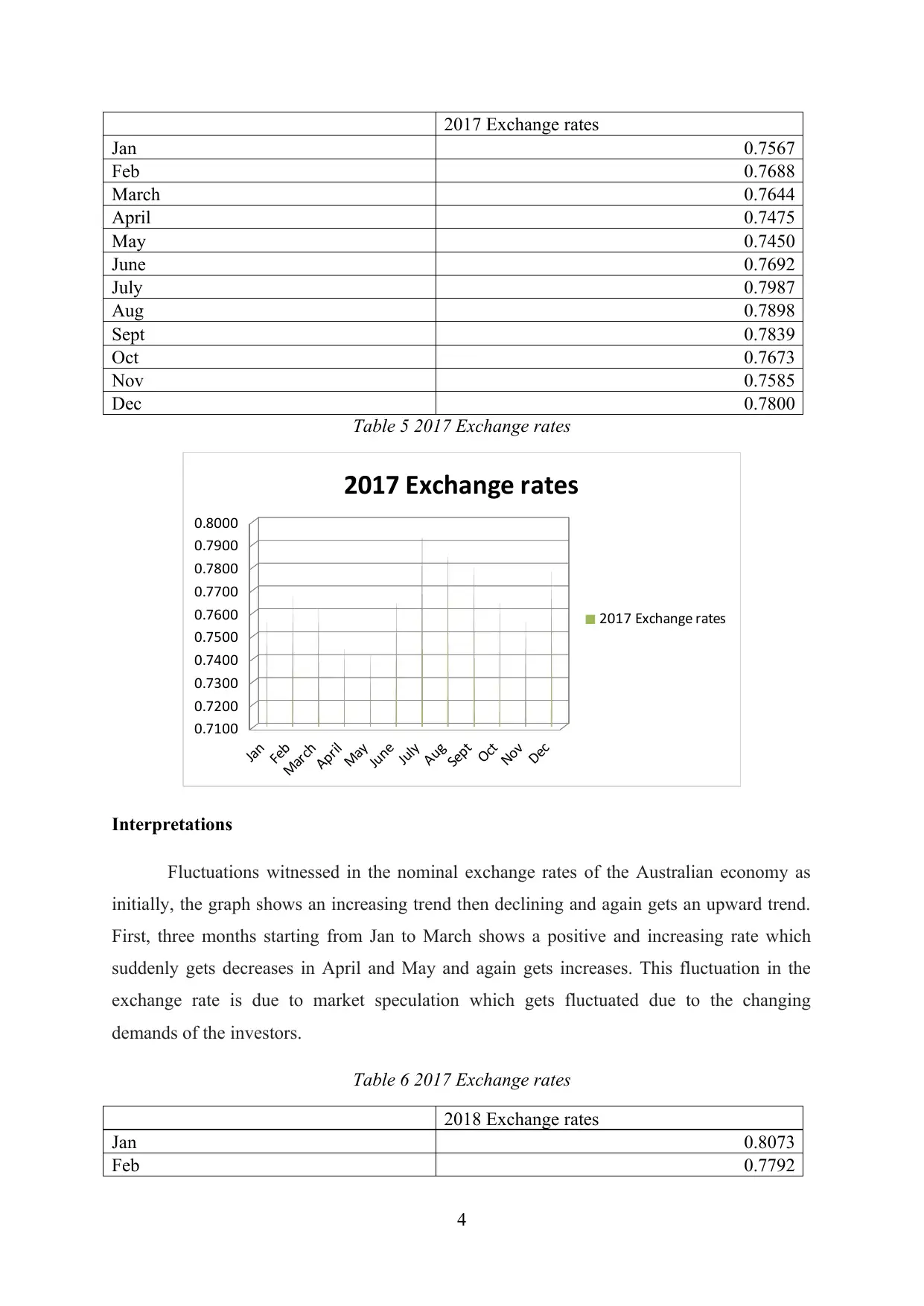

2017 Exchange rates

Jan 0.7567

Feb 0.7688

March 0.7644

April 0.7475

May 0.7450

June 0.7692

July 0.7987

Aug 0.7898

Sept 0.7839

Oct 0.7673

Nov 0.7585

Dec 0.7800

Table 5 2017 Exchange rates

Jan

Feb

March

April

May

June

July

Aug

Sept

Oct

Nov

Dec

0.7100

0.7200

0.7300

0.7400

0.7500

0.7600

0.7700

0.7800

0.7900

0.8000

2017 Exchange rates

2017 Exchange rates

Interpretations

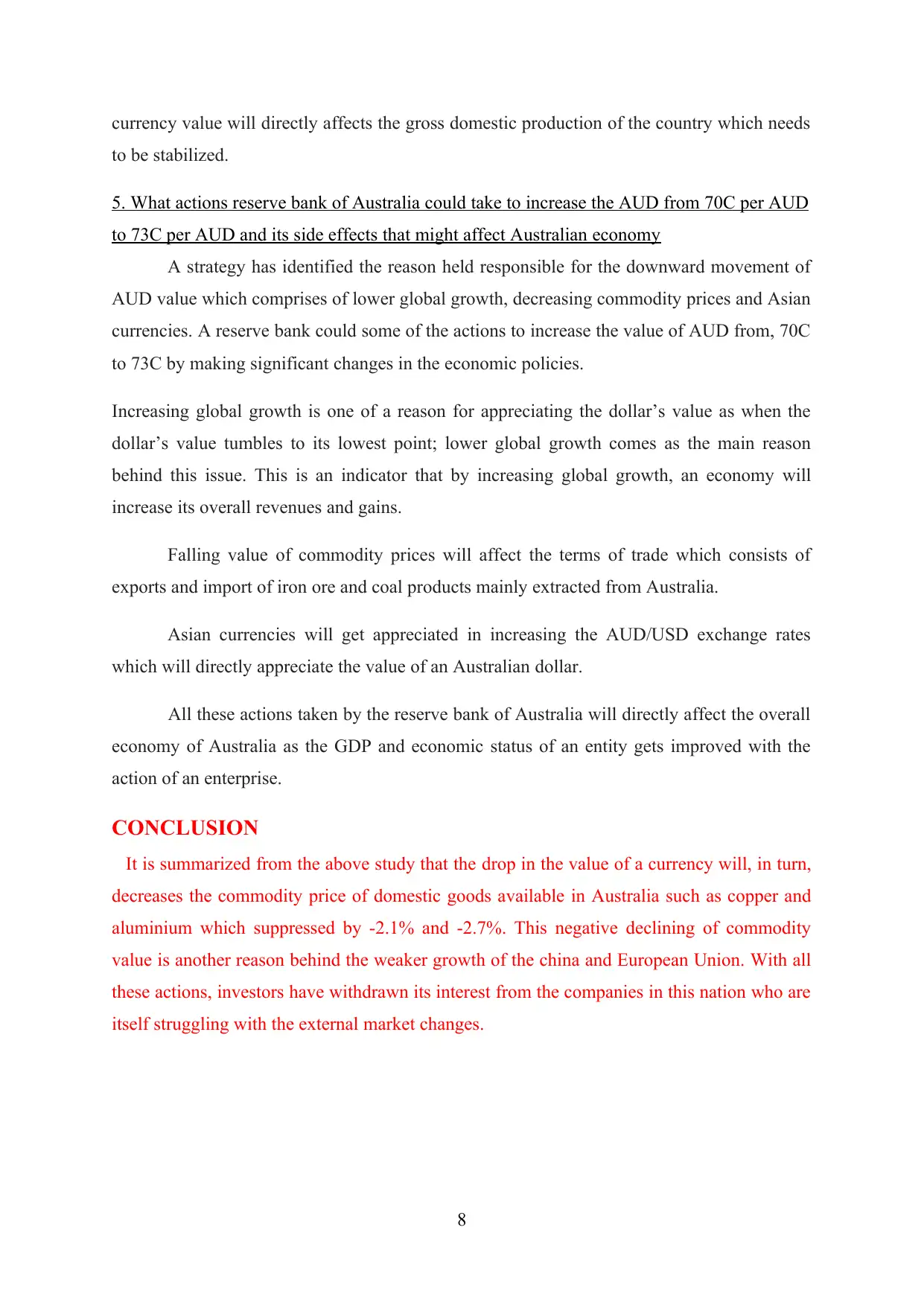

Fluctuations witnessed in the nominal exchange rates of the Australian economy as

initially, the graph shows an increasing trend then declining and again gets an upward trend.

First, three months starting from Jan to March shows a positive and increasing rate which

suddenly gets decreases in April and May and again gets increases. This fluctuation in the

exchange rate is due to market speculation which gets fluctuated due to the changing

demands of the investors.

Table 6 2017 Exchange rates

2018 Exchange rates

Jan 0.8073

Feb 0.7792

4

Jan 0.7567

Feb 0.7688

March 0.7644

April 0.7475

May 0.7450

June 0.7692

July 0.7987

Aug 0.7898

Sept 0.7839

Oct 0.7673

Nov 0.7585

Dec 0.7800

Table 5 2017 Exchange rates

Jan

Feb

March

April

May

June

July

Aug

Sept

Oct

Nov

Dec

0.7100

0.7200

0.7300

0.7400

0.7500

0.7600

0.7700

0.7800

0.7900

0.8000

2017 Exchange rates

2017 Exchange rates

Interpretations

Fluctuations witnessed in the nominal exchange rates of the Australian economy as

initially, the graph shows an increasing trend then declining and again gets an upward trend.

First, three months starting from Jan to March shows a positive and increasing rate which

suddenly gets decreases in April and May and again gets increases. This fluctuation in the

exchange rate is due to market speculation which gets fluctuated due to the changing

demands of the investors.

Table 6 2017 Exchange rates

2018 Exchange rates

Jan 0.8073

Feb 0.7792

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

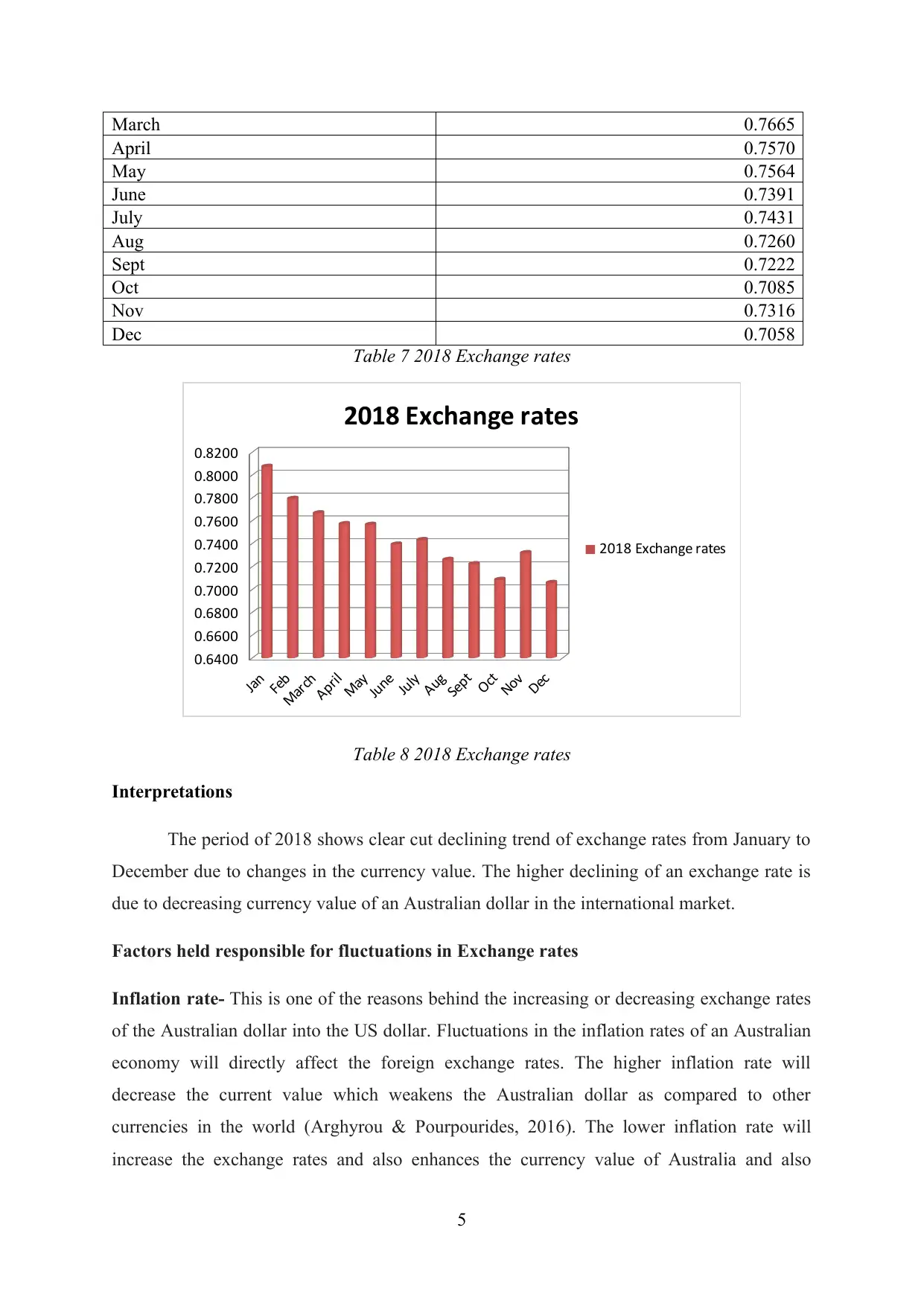

March 0.7665

April 0.7570

May 0.7564

June 0.7391

July 0.7431

Aug 0.7260

Sept 0.7222

Oct 0.7085

Nov 0.7316

Dec 0.7058

Table 7 2018 Exchange rates

Jan

Feb

March

April

May

June

July

Aug

Sept

Oct

Nov

Dec

0.6400

0.6600

0.6800

0.7000

0.7200

0.7400

0.7600

0.7800

0.8000

0.8200

2018 Exchange rates

2018 Exchange rates

Table 8 2018 Exchange rates

Interpretations

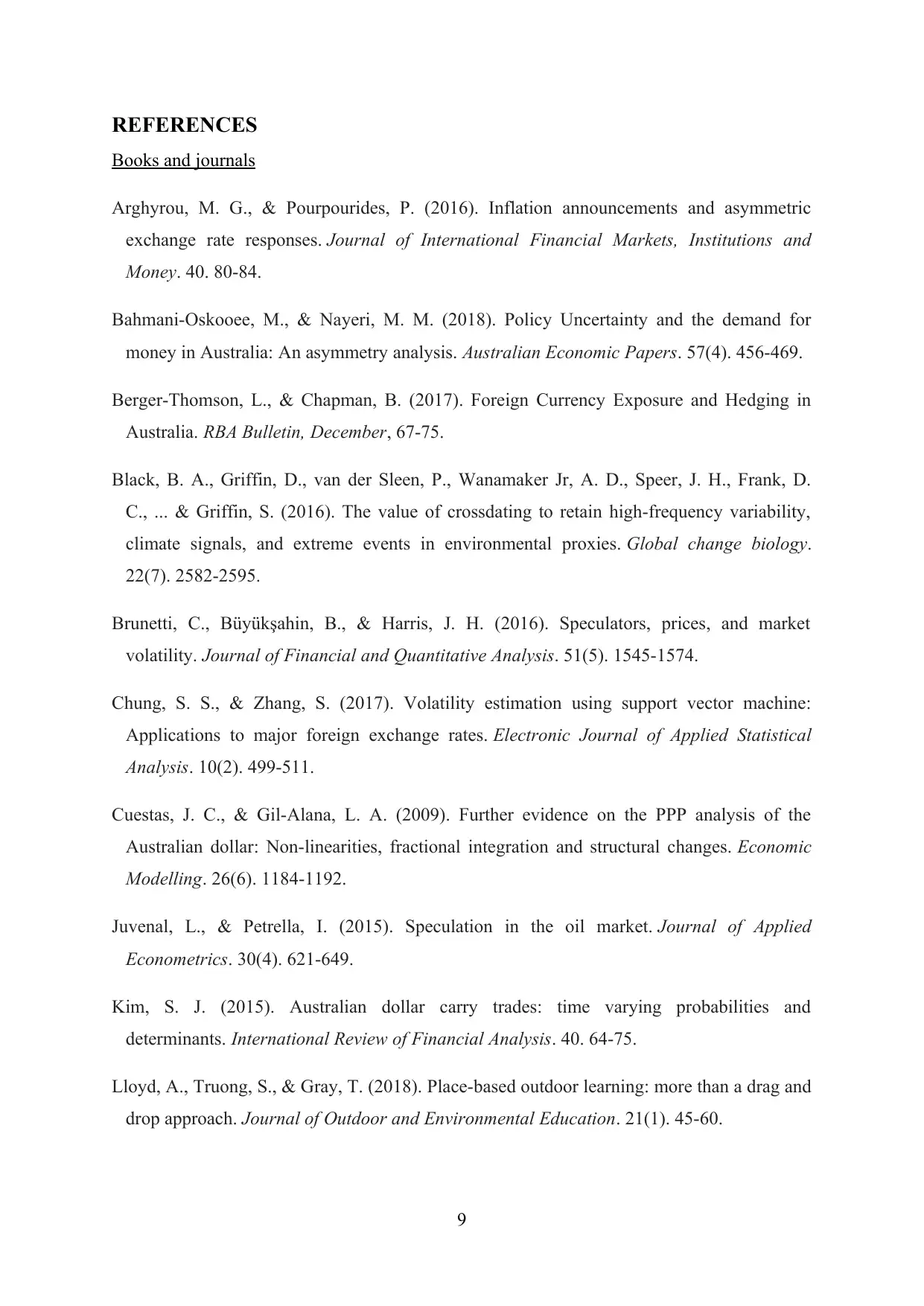

The period of 2018 shows clear cut declining trend of exchange rates from January to

December due to changes in the currency value. The higher declining of an exchange rate is

due to decreasing currency value of an Australian dollar in the international market.

Factors held responsible for fluctuations in Exchange rates

Inflation rate- This is one of the reasons behind the increasing or decreasing exchange rates

of the Australian dollar into the US dollar. Fluctuations in the inflation rates of an Australian

economy will directly affect the foreign exchange rates. The higher inflation rate will

decrease the current value which weakens the Australian dollar as compared to other

currencies in the world (Arghyrou & Pourpourides, 2016). The lower inflation rate will

increase the exchange rates and also enhances the currency value of Australia and also

5

April 0.7570

May 0.7564

June 0.7391

July 0.7431

Aug 0.7260

Sept 0.7222

Oct 0.7085

Nov 0.7316

Dec 0.7058

Table 7 2018 Exchange rates

Jan

Feb

March

April

May

June

July

Aug

Sept

Oct

Nov

Dec

0.6400

0.6600

0.6800

0.7000

0.7200

0.7400

0.7600

0.7800

0.8000

0.8200

2018 Exchange rates

2018 Exchange rates

Table 8 2018 Exchange rates

Interpretations

The period of 2018 shows clear cut declining trend of exchange rates from January to

December due to changes in the currency value. The higher declining of an exchange rate is

due to decreasing currency value of an Australian dollar in the international market.

Factors held responsible for fluctuations in Exchange rates

Inflation rate- This is one of the reasons behind the increasing or decreasing exchange rates

of the Australian dollar into the US dollar. Fluctuations in the inflation rates of an Australian

economy will directly affect the foreign exchange rates. The higher inflation rate will

decrease the current value which weakens the Australian dollar as compared to other

currencies in the world (Arghyrou & Pourpourides, 2016). The lower inflation rate will

increase the exchange rates and also enhances the currency value of Australia and also

5

strengthens the entire economy. The inflation rate in the year 2016 was 1.30%, which gets

increases to 1.91% in 2017 and again gets decreases to 1.26% (Lu, Adnan, Basak, Pereira,

Carrion, Saber & Ben-Akiva, 2015).

Interest Rates- Fluctuation stakes places in the interest will not affect the currency but also

affects the overall exchange rates of the country. Declining trend witnessed by the nation in

2018 and slightly decrease in 2016 and 2017 is due to the severe changes takes places in the

overall interest rates of the Australian economy (Malkiel, 2015). The currency value of

Australia presents the entire worth of the economy in the international market (Zhang, Dufour

& Galbraith, 2016).

Market speculation- Changes takes places in the tastes and the preferences of investors in

the market will, in turn, fluctuate the overall trend in a market. Nowadays, investment banker

analyses the market speculation by analysing the market using various criteria’s. In the

current case, the movement of the foreign exchange rate is tracked to know the final output.

An investor will watch out exchange rates before indulging into any commercial transactions

takes places outside its own country (Chung & Zhang, 2017).

Political instability- Turbulences in the political state of Australia also play an important

role in shifting the movement of exchange rates to higher or lower trend. Rigid political

actions and regulations will increase the import duty on all the products imported from

outside Australia. This action of the Australian government will, in turn, affect the businesses

of the nation as an entity’ business depends on the foreign import products will get affected

by this action of the government (Juvenal & Petrella, 2015).

3. Summarize driving factors behind the movement of AUD in the article and explain how

these factors affect the demand or supply of AUD-USD market

It is important to discuss all the trigging factors that drive the movement of AUD

mention in the given article. Some of the factors identified by a user by analysing the article

about the positive or negative value trend of the Australian dollar are given as below:

Weaker growths of manufacturing industries- the Australian economy witness a decline

in its currency value to 70C per dollar. This tragedy has affected a lot of people in the nation

and outside the country who has a significant interest in this country. The industries set up in

China, Spain and Italy gets decreases which directly affects the exchange rates and the

currency value of this country. This condition has occurred due to the trade relationships

6

increases to 1.91% in 2017 and again gets decreases to 1.26% (Lu, Adnan, Basak, Pereira,

Carrion, Saber & Ben-Akiva, 2015).

Interest Rates- Fluctuation stakes places in the interest will not affect the currency but also

affects the overall exchange rates of the country. Declining trend witnessed by the nation in

2018 and slightly decrease in 2016 and 2017 is due to the severe changes takes places in the

overall interest rates of the Australian economy (Malkiel, 2015). The currency value of

Australia presents the entire worth of the economy in the international market (Zhang, Dufour

& Galbraith, 2016).

Market speculation- Changes takes places in the tastes and the preferences of investors in

the market will, in turn, fluctuate the overall trend in a market. Nowadays, investment banker

analyses the market speculation by analysing the market using various criteria’s. In the

current case, the movement of the foreign exchange rate is tracked to know the final output.

An investor will watch out exchange rates before indulging into any commercial transactions

takes places outside its own country (Chung & Zhang, 2017).

Political instability- Turbulences in the political state of Australia also play an important

role in shifting the movement of exchange rates to higher or lower trend. Rigid political

actions and regulations will increase the import duty on all the products imported from

outside Australia. This action of the Australian government will, in turn, affect the businesses

of the nation as an entity’ business depends on the foreign import products will get affected

by this action of the government (Juvenal & Petrella, 2015).

3. Summarize driving factors behind the movement of AUD in the article and explain how

these factors affect the demand or supply of AUD-USD market

It is important to discuss all the trigging factors that drive the movement of AUD

mention in the given article. Some of the factors identified by a user by analysing the article

about the positive or negative value trend of the Australian dollar are given as below:

Weaker growths of manufacturing industries- the Australian economy witness a decline

in its currency value to 70C per dollar. This tragedy has affected a lot of people in the nation

and outside the country who has a significant interest in this country. The industries set up in

China, Spain and Italy gets decreases which directly affects the exchange rates and the

currency value of this country. This condition has occurred due to the trade relationships

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

between Australia and China gets affected by the war as this considers as a direct effect of

war (Brunetti, Büyükşahin & Harris, 2016). This further deteriorates the business connection

of this nation with several other countries who are importing goods in its country from

Australia. The image of this country gets affected which, in turn, decreases the tourism of this

place and the arrival of immigrants to this place gets decreases with this sudden drop. An

individual who wishes to start its employment career in this place will change its decision due

to the decrease in the currency value of Dollars in Australia. Foreign investors will change its

minds as the depreciating value of AUD will not generate enough returns for them which end

with withdrawing interest from businesses sets up in this place.

Declining growth of purchasing manager’s index- This article also points out towards low

purchasing manager’s index to 49.7. This symbolizes the health of the manufacturing

industry as the economic status of industries can estimate with the increasing or decreasing

value of the PMI index (Lloyd, Truong & Gray, 2018). A higher PMI depicts the strength of

industries that shows its profits and gains and lower value depicts its weaknesses in front of

the international market. Immense competition in the external market is one of the reasons

behind the lower value of PMI.

4. Explain the impact of recent drop in AUD on the business and describe how depreciation

of AUD will affect the entire Australian economy

In the current case, Software products exported by Australian companies to the united

nation but due to the drop in the value of a currency, this business connection among

companies got affected. Due to the drop in AUD, the customs duty applicable on the goods

exported from Australia gets increases which will directly affect the company who is

importing goods from this country. In the given case, an Australian company who are trading

with US Company in exporting software products will not purchase more goods from this

place due to higher prices and higher export and import duty applicable by the customs

officer (Black, Griffin, van der Sleen, Wanamaker Jr, Speer, Frank & Griffin, 2016). US

company purchasing software from Australia will have to pay export as well as the import

duty on the software due to a sudden decline in the value of an Australian dollar.

The depreciating value of AUD is require by consumers in the Australia as due

to this the prices of commodity gets decreases which is an advantage for all the buyers but at

the same time it is not beneficial for the economy. Decreasing commodity prices and

7

war (Brunetti, Büyükşahin & Harris, 2016). This further deteriorates the business connection

of this nation with several other countries who are importing goods in its country from

Australia. The image of this country gets affected which, in turn, decreases the tourism of this

place and the arrival of immigrants to this place gets decreases with this sudden drop. An

individual who wishes to start its employment career in this place will change its decision due

to the decrease in the currency value of Dollars in Australia. Foreign investors will change its

minds as the depreciating value of AUD will not generate enough returns for them which end

with withdrawing interest from businesses sets up in this place.

Declining growth of purchasing manager’s index- This article also points out towards low

purchasing manager’s index to 49.7. This symbolizes the health of the manufacturing

industry as the economic status of industries can estimate with the increasing or decreasing

value of the PMI index (Lloyd, Truong & Gray, 2018). A higher PMI depicts the strength of

industries that shows its profits and gains and lower value depicts its weaknesses in front of

the international market. Immense competition in the external market is one of the reasons

behind the lower value of PMI.

4. Explain the impact of recent drop in AUD on the business and describe how depreciation

of AUD will affect the entire Australian economy

In the current case, Software products exported by Australian companies to the united

nation but due to the drop in the value of a currency, this business connection among

companies got affected. Due to the drop in AUD, the customs duty applicable on the goods

exported from Australia gets increases which will directly affect the company who is

importing goods from this country. In the given case, an Australian company who are trading

with US Company in exporting software products will not purchase more goods from this

place due to higher prices and higher export and import duty applicable by the customs

officer (Black, Griffin, van der Sleen, Wanamaker Jr, Speer, Frank & Griffin, 2016). US

company purchasing software from Australia will have to pay export as well as the import

duty on the software due to a sudden decline in the value of an Australian dollar.

The depreciating value of AUD is require by consumers in the Australia as due

to this the prices of commodity gets decreases which is an advantage for all the buyers but at

the same time it is not beneficial for the economy. Decreasing commodity prices and

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

currency value will directly affects the gross domestic production of the country which needs

to be stabilized.

5. What actions reserve bank of Australia could take to increase the AUD from 70C per AUD

to 73C per AUD and its side effects that might affect Australian economy

A strategy has identified the reason held responsible for the downward movement of

AUD value which comprises of lower global growth, decreasing commodity prices and Asian

currencies. A reserve bank could some of the actions to increase the value of AUD from, 70C

to 73C by making significant changes in the economic policies.

Increasing global growth is one of a reason for appreciating the dollar’s value as when the

dollar’s value tumbles to its lowest point; lower global growth comes as the main reason

behind this issue. This is an indicator that by increasing global growth, an economy will

increase its overall revenues and gains.

Falling value of commodity prices will affect the terms of trade which consists of

exports and import of iron ore and coal products mainly extracted from Australia.

Asian currencies will get appreciated in increasing the AUD/USD exchange rates

which will directly appreciate the value of an Australian dollar.

All these actions taken by the reserve bank of Australia will directly affect the overall

economy of Australia as the GDP and economic status of an entity gets improved with the

action of an enterprise.

CONCLUSION

It is summarized from the above study that the drop in the value of a currency will, in turn,

decreases the commodity price of domestic goods available in Australia such as copper and

aluminium which suppressed by -2.1% and -2.7%. This negative declining of commodity

value is another reason behind the weaker growth of the china and European Union. With all

these actions, investors have withdrawn its interest from the companies in this nation who are

itself struggling with the external market changes.

8

to be stabilized.

5. What actions reserve bank of Australia could take to increase the AUD from 70C per AUD

to 73C per AUD and its side effects that might affect Australian economy

A strategy has identified the reason held responsible for the downward movement of

AUD value which comprises of lower global growth, decreasing commodity prices and Asian

currencies. A reserve bank could some of the actions to increase the value of AUD from, 70C

to 73C by making significant changes in the economic policies.

Increasing global growth is one of a reason for appreciating the dollar’s value as when the

dollar’s value tumbles to its lowest point; lower global growth comes as the main reason

behind this issue. This is an indicator that by increasing global growth, an economy will

increase its overall revenues and gains.

Falling value of commodity prices will affect the terms of trade which consists of

exports and import of iron ore and coal products mainly extracted from Australia.

Asian currencies will get appreciated in increasing the AUD/USD exchange rates

which will directly appreciate the value of an Australian dollar.

All these actions taken by the reserve bank of Australia will directly affect the overall

economy of Australia as the GDP and economic status of an entity gets improved with the

action of an enterprise.

CONCLUSION

It is summarized from the above study that the drop in the value of a currency will, in turn,

decreases the commodity price of domestic goods available in Australia such as copper and

aluminium which suppressed by -2.1% and -2.7%. This negative declining of commodity

value is another reason behind the weaker growth of the china and European Union. With all

these actions, investors have withdrawn its interest from the companies in this nation who are

itself struggling with the external market changes.

8

REFERENCES

Books and journals

Arghyrou, M. G., & Pourpourides, P. (2016). Inflation announcements and asymmetric

exchange rate responses. Journal of International Financial Markets, Institutions and

Money. 40. 80-84.

Bahmani‐Oskooee, M., & Nayeri, M. M. (2018). Policy Uncertainty and the demand for

money in Australia: An asymmetry analysis. Australian Economic Papers. 57(4). 456-469.

Berger-Thomson, L., & Chapman, B. (2017). Foreign Currency Exposure and Hedging in

Australia. RBA Bulletin, December, 67-75.

Black, B. A., Griffin, D., van der Sleen, P., Wanamaker Jr, A. D., Speer, J. H., Frank, D.

C., ... & Griffin, S. (2016). The value of crossdating to retain high‐frequency variability,

climate signals, and extreme events in environmental proxies. Global change biology.

22(7). 2582-2595.

Brunetti, C., Büyükşahin, B., & Harris, J. H. (2016). Speculators, prices, and market

volatility. Journal of Financial and Quantitative Analysis. 51(5). 1545-1574.

Chung, S. S., & Zhang, S. (2017). Volatility estimation using support vector machine:

Applications to major foreign exchange rates. Electronic Journal of Applied Statistical

Analysis. 10(2). 499-511.

Cuestas, J. C., & Gil-Alana, L. A. (2009). Further evidence on the PPP analysis of the

Australian dollar: Non-linearities, fractional integration and structural changes. Economic

Modelling. 26(6). 1184-1192.

Juvenal, L., & Petrella, I. (2015). Speculation in the oil market. Journal of Applied

Econometrics. 30(4). 621-649.

Kim, S. J. (2015). Australian dollar carry trades: time varying probabilities and

determinants. International Review of Financial Analysis. 40. 64-75.

Lloyd, A., Truong, S., & Gray, T. (2018). Place-based outdoor learning: more than a drag and

drop approach. Journal of Outdoor and Environmental Education. 21(1). 45-60.

9

Books and journals

Arghyrou, M. G., & Pourpourides, P. (2016). Inflation announcements and asymmetric

exchange rate responses. Journal of International Financial Markets, Institutions and

Money. 40. 80-84.

Bahmani‐Oskooee, M., & Nayeri, M. M. (2018). Policy Uncertainty and the demand for

money in Australia: An asymmetry analysis. Australian Economic Papers. 57(4). 456-469.

Berger-Thomson, L., & Chapman, B. (2017). Foreign Currency Exposure and Hedging in

Australia. RBA Bulletin, December, 67-75.

Black, B. A., Griffin, D., van der Sleen, P., Wanamaker Jr, A. D., Speer, J. H., Frank, D.

C., ... & Griffin, S. (2016). The value of crossdating to retain high‐frequency variability,

climate signals, and extreme events in environmental proxies. Global change biology.

22(7). 2582-2595.

Brunetti, C., Büyükşahin, B., & Harris, J. H. (2016). Speculators, prices, and market

volatility. Journal of Financial and Quantitative Analysis. 51(5). 1545-1574.

Chung, S. S., & Zhang, S. (2017). Volatility estimation using support vector machine:

Applications to major foreign exchange rates. Electronic Journal of Applied Statistical

Analysis. 10(2). 499-511.

Cuestas, J. C., & Gil-Alana, L. A. (2009). Further evidence on the PPP analysis of the

Australian dollar: Non-linearities, fractional integration and structural changes. Economic

Modelling. 26(6). 1184-1192.

Juvenal, L., & Petrella, I. (2015). Speculation in the oil market. Journal of Applied

Econometrics. 30(4). 621-649.

Kim, S. J. (2015). Australian dollar carry trades: time varying probabilities and

determinants. International Review of Financial Analysis. 40. 64-75.

Lloyd, A., Truong, S., & Gray, T. (2018). Place-based outdoor learning: more than a drag and

drop approach. Journal of Outdoor and Environmental Education. 21(1). 45-60.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.