ECON910 Assignment 1: Analysis of the AUD-USD Exchange Rate

VerifiedAdded on 2023/01/12

|12

|2984

|69

Report

AI Summary

This report analyzes the AUD-USD exchange rate, focusing on the factors influencing its fluctuations. It begins with a summary of the main issues discussed in the provided article, including the depreciation of the Australian dollar. The report then uses the demand and supply model to explain how the exchange rate is determined in the foreign exchange market. A detailed analysis of the AUD-USD exchange rate movement over the past three years, using data from the Reserve Bank of Australia, is presented, along with an identification of the contributing factors behind the exchange rate's behavior. The report further explores the driving forces behind the recent depreciation of the AUD, including global economic conditions and interest rate policies. The impact of the depreciation on the Australian economy is then examined, followed by a discussion of potential policies to increase the value of the AUD. The report concludes with relevant references.

Running head: ECONOMICS FOR PROFESSIONALS

Economics for Professionals

Name of the Student

Name of the University

Course ID

Economics for Professionals

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR PROFESSIONALS

Table of Contents

Question a........................................................................................................................................2

Main issues of the article.............................................................................................................2

Determination of exchange rate...................................................................................................2

Question b........................................................................................................................................4

Nominal exchange rate between USD and AUD........................................................................4

Question c........................................................................................................................................5

Driving factors behind recent movement of AUD......................................................................5

Question d........................................................................................................................................7

Effect of depreciation of AUD on Australian economy..............................................................7

Question e........................................................................................................................................8

Policies to increase value of AUD...............................................................................................8

References......................................................................................................................................10

Table of Contents

Question a........................................................................................................................................2

Main issues of the article.............................................................................................................2

Determination of exchange rate...................................................................................................2

Question b........................................................................................................................................4

Nominal exchange rate between USD and AUD........................................................................4

Question c........................................................................................................................................5

Driving factors behind recent movement of AUD......................................................................5

Question d........................................................................................................................................7

Effect of depreciation of AUD on Australian economy..............................................................7

Question e........................................................................................................................................8

Policies to increase value of AUD...............................................................................................8

References......................................................................................................................................10

2ECONOMICS FOR PROFESSIONALS

Question a

Main issues of the article

The article summarizes recent drop in the value of the Australian dollar with respect to

US dollar. Australian dollar has dropped below US 70 cents to the lowest point in the last ten

years. Breaking the lowest benchmark value, AUD fell to US 67.49 cents. The value though

recovered somewhat to US 68.71 cents it is still below the lowest value. Australian dollar hit

badly by the sign of weaker growth in China that of European region especially in Italy and

Spain. The slower economic growth in these nations results in a decline in export demand of

Australia. The situation further worsens by the economic downturn in Germany. The new orders

in these nations are falling with deterioration of output growth (Moore 2019). The state of global

manufacturing indicated by PMI showed a downfall reaching to the lowest level since the last

two years. The deterioration of trade flow further added to a currency depreciation. Capital

Economic stated that since the second half of 2018, manufacturing indices declined in almost all

the major countries. Not only Aussies, there is a decline in value of pound and euro. There is a

sharp drop in prices of aluminum and copper hurting the sentiment of AUD. Reserve Bank of

Australia is expected to be in a position of raising interest rate however, the bank remained less

upbeat in this direction. Economist predicts economic growth to decline to 2.7 percent in 2020

while Australian dollar is forecasted to fall below US 70 cents in the next year.

Determination of exchange rate

Australia follows a floating exchange rate system where exchange rate between two

countries are determined from the demand and supply in the foreign exchange market (Goodwin

et al. 2015). In the foreign exchange market determining AUD-USD exchange rate demand for

Question a

Main issues of the article

The article summarizes recent drop in the value of the Australian dollar with respect to

US dollar. Australian dollar has dropped below US 70 cents to the lowest point in the last ten

years. Breaking the lowest benchmark value, AUD fell to US 67.49 cents. The value though

recovered somewhat to US 68.71 cents it is still below the lowest value. Australian dollar hit

badly by the sign of weaker growth in China that of European region especially in Italy and

Spain. The slower economic growth in these nations results in a decline in export demand of

Australia. The situation further worsens by the economic downturn in Germany. The new orders

in these nations are falling with deterioration of output growth (Moore 2019). The state of global

manufacturing indicated by PMI showed a downfall reaching to the lowest level since the last

two years. The deterioration of trade flow further added to a currency depreciation. Capital

Economic stated that since the second half of 2018, manufacturing indices declined in almost all

the major countries. Not only Aussies, there is a decline in value of pound and euro. There is a

sharp drop in prices of aluminum and copper hurting the sentiment of AUD. Reserve Bank of

Australia is expected to be in a position of raising interest rate however, the bank remained less

upbeat in this direction. Economist predicts economic growth to decline to 2.7 percent in 2020

while Australian dollar is forecasted to fall below US 70 cents in the next year.

Determination of exchange rate

Australia follows a floating exchange rate system where exchange rate between two

countries are determined from the demand and supply in the foreign exchange market (Goodwin

et al. 2015). In the foreign exchange market determining AUD-USD exchange rate demand for

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR PROFESSIONALS

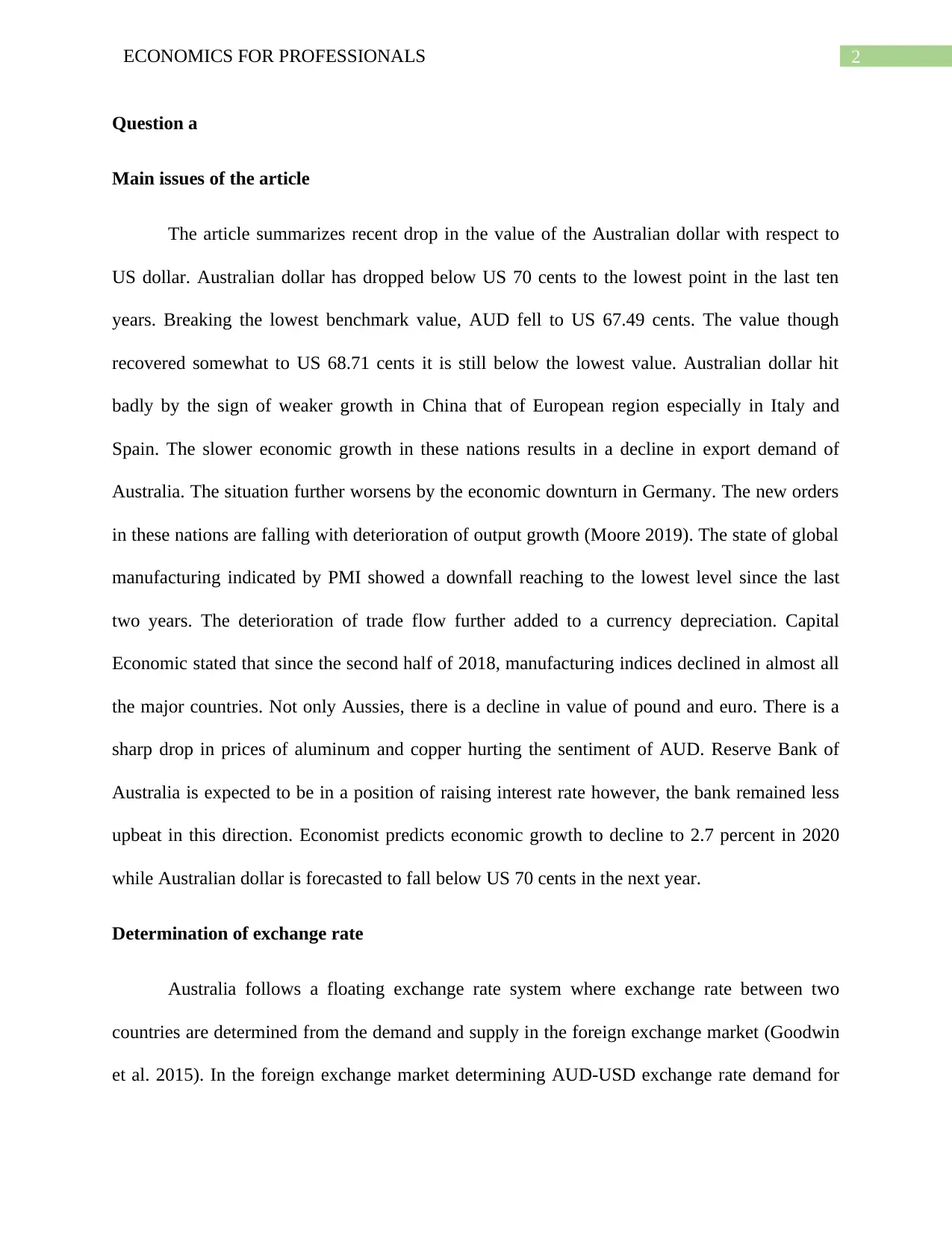

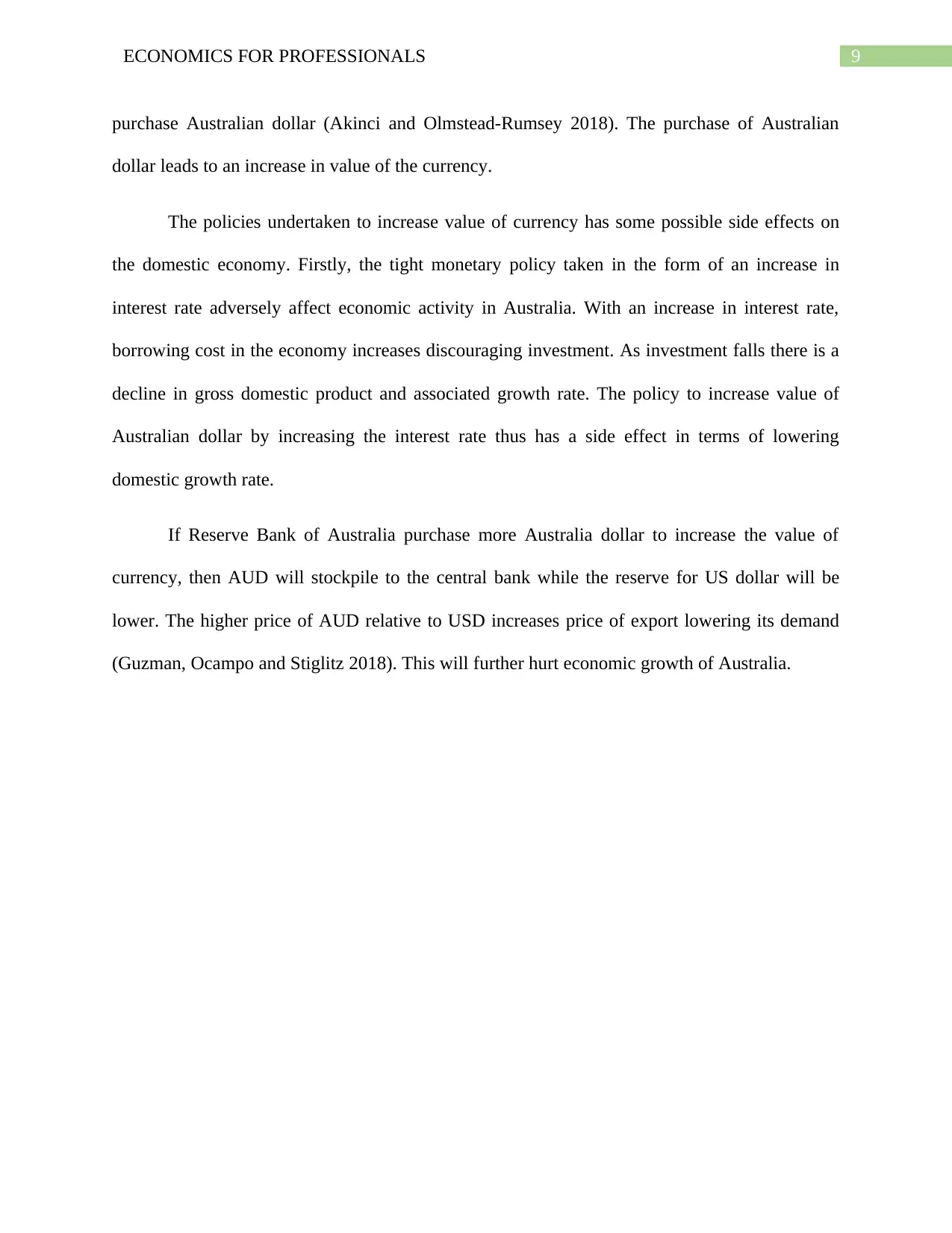

USD is determined from any transaction leading to outflow USD from Australia. In Australia,

US dollar is demanded when residents and government are willing to spend in terms of US

dollar, for making payment to US residents working in Australia, to make payment for loans and

other. Demand curve of exchange rate slopes downward because of the inverse association

between demand of foreign reserve and exchange rate. Any transaction that causes an inflow of

US dollar in the Australian market adds to supply of foreign reserve. The supply of US dollar

depends on export to US, payment to Australian working in US, interest on loan given to US

residents and other. Supply curve slopes upward because of the positive relation between

exchange rate and supply of foreign reserve. Like commodity market, equilibrium in the foreign

exchange market is determined where demand matches with the supply (Uribe and Schmitt-

Grohe 2017). In the figure below, the equilibrium value of AUD-USD exchange is given as E.

Figure 1: Determination of equilibrium exchange rate

USD is determined from any transaction leading to outflow USD from Australia. In Australia,

US dollar is demanded when residents and government are willing to spend in terms of US

dollar, for making payment to US residents working in Australia, to make payment for loans and

other. Demand curve of exchange rate slopes downward because of the inverse association

between demand of foreign reserve and exchange rate. Any transaction that causes an inflow of

US dollar in the Australian market adds to supply of foreign reserve. The supply of US dollar

depends on export to US, payment to Australian working in US, interest on loan given to US

residents and other. Supply curve slopes upward because of the positive relation between

exchange rate and supply of foreign reserve. Like commodity market, equilibrium in the foreign

exchange market is determined where demand matches with the supply (Uribe and Schmitt-

Grohe 2017). In the figure below, the equilibrium value of AUD-USD exchange is given as E.

Figure 1: Determination of equilibrium exchange rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR PROFESSIONALS

Question b

Nominal exchange rate between USD and AUD

01-Jan-2016

01-Mar-2016

01-May-2016

01-Jul-2016

01-Sep-2016

01-Nov-2016

01-Jan-2017

01-Mar-2017

01-May-2017

01-Jul-2017

01-Sep-2017

01-Nov-2017

01-Jan-2018

01-Mar-2018

01-May-2018

01-Jul-2018

01-Sep-2018

01-Nov-2018

0.6400

0.6600

0.6800

0.7000

0.7200

0.7400

0.7600

0.7800

0.8000

0.8200

AUD/USD Exchange rate

Months

Exchange rate

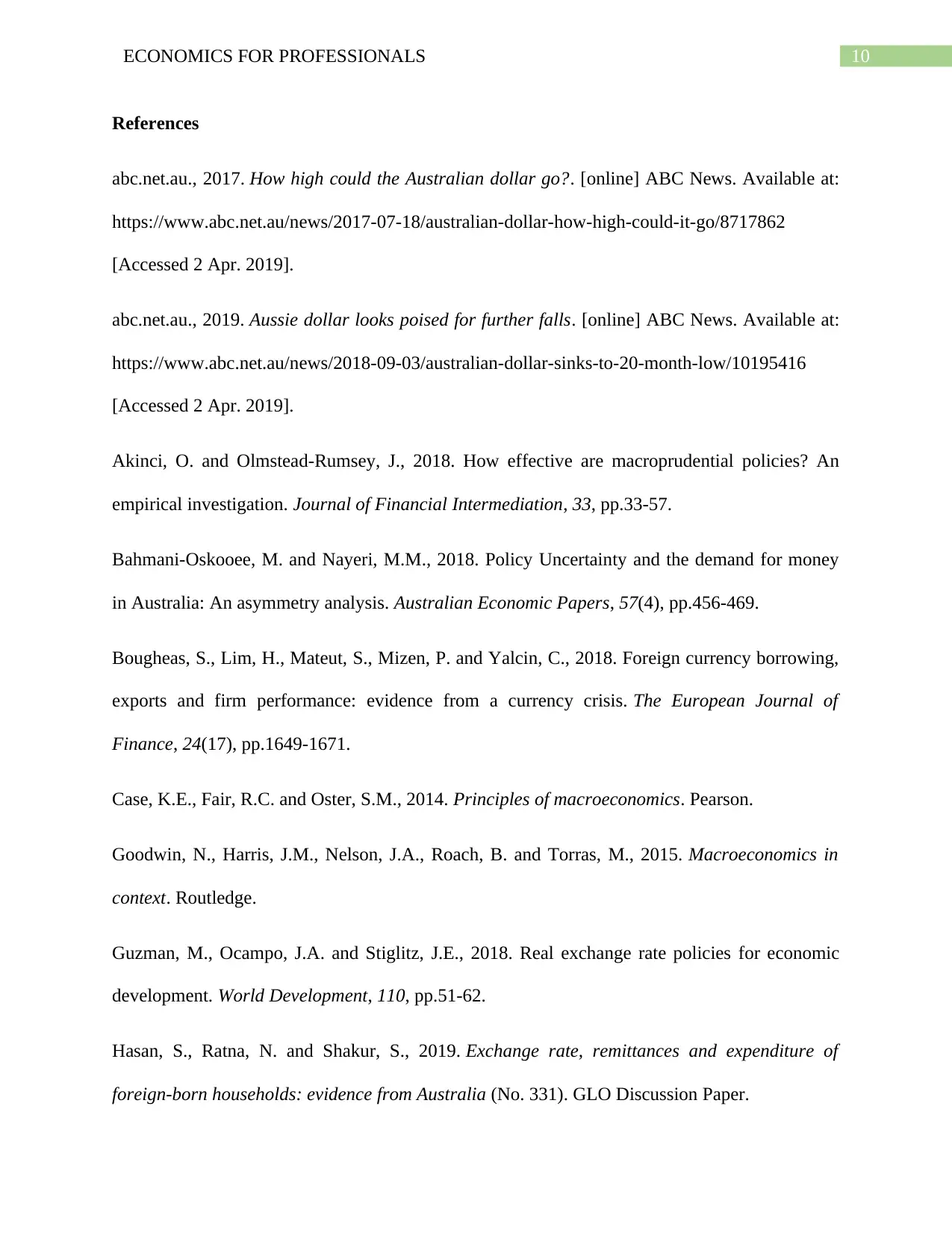

Figure 2: Movement of AUD-USD exchange rate

(Source: rba.gov.au 2019)

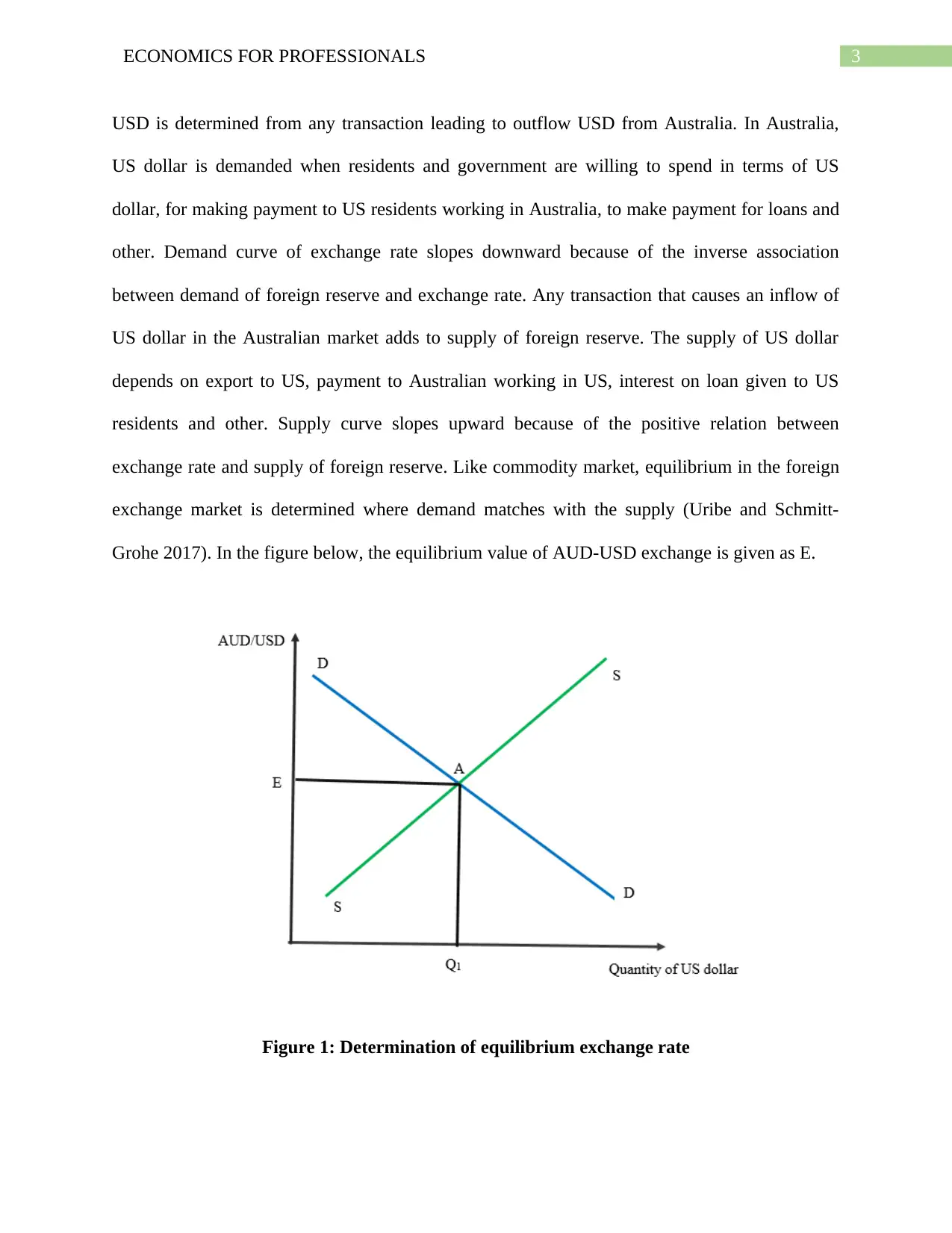

Figure 2 summarizes movement of AUD-USD in the last three years. At the beginning of

2016, exchange rate between AUD and USD was estimated as 0.71. In this year, exchange rate

reached to the highest level in the month of April with recorded exchange rate being 0.77. That

means then 1 AUD was traded at 77 US cents. One primary reason for stronger Australian dollar

is the increased volume of trade in Australia. In the April 2016, trade of Australian dollar

globally averaged around USD 350 billion. This made Aussie as the fifth most traded currency

globally making AUD/USD as the fourth most traded pair of currency (Jakob 2016). AUD-SD

exchange rate though fluctuated in different months of 2016, the exchange rate remains above

Question b

Nominal exchange rate between USD and AUD

01-Jan-2016

01-Mar-2016

01-May-2016

01-Jul-2016

01-Sep-2016

01-Nov-2016

01-Jan-2017

01-Mar-2017

01-May-2017

01-Jul-2017

01-Sep-2017

01-Nov-2017

01-Jan-2018

01-Mar-2018

01-May-2018

01-Jul-2018

01-Sep-2018

01-Nov-2018

0.6400

0.6600

0.6800

0.7000

0.7200

0.7400

0.7600

0.7800

0.8000

0.8200

AUD/USD Exchange rate

Months

Exchange rate

Figure 2: Movement of AUD-USD exchange rate

(Source: rba.gov.au 2019)

Figure 2 summarizes movement of AUD-USD in the last three years. At the beginning of

2016, exchange rate between AUD and USD was estimated as 0.71. In this year, exchange rate

reached to the highest level in the month of April with recorded exchange rate being 0.77. That

means then 1 AUD was traded at 77 US cents. One primary reason for stronger Australian dollar

is the increased volume of trade in Australia. In the April 2016, trade of Australian dollar

globally averaged around USD 350 billion. This made Aussie as the fifth most traded currency

globally making AUD/USD as the fourth most traded pair of currency (Jakob 2016). AUD-SD

exchange rate though fluctuated in different months of 2016, the exchange rate remains above

5ECONOMICS FOR PROFESSIONALS

US 70 cents. In December 2016, 1 AUD was traded at US 72 cents. The Australia dollar

continued to appreciate in 2017 with exchange rate being 0.75 in January 2017. Since then AUD

continued to appreciate. Australian dollar reached to the highest level in January 2018. 1 AUD

was then traded for US 80 cents. The strong Australian dollar provided significant support to the

economy. Increases in interest rate acts as a magnet for foreign currency. Higher the interest rate,

there is more inflow of foreign currency. Decline in interest rate by Federal Reserve induced

investors to withdraw their funds out of and invest the same elsewhere (rba.gov.au. 2018). The

weakness in US dollar in turn strengthened Australian dollar. The second factor that contributed

to currency appreciation in 2017 was an above expected growth rate of China. In June, China

grew at a rate of 6.9 percent as against the predicted rate of 6.8 percent. Higher growth in China

means a higher potential demand Australian dollar (abc.net.au 2017). This raised the demand for

Australian dollar causing AUD to appreciate. However, since February 2018, AUD-USD

exchange rate started to decline indicating depreciation of currency. Value of AUD fell to 70 US

cent in December 2018. The likely decline in value of Australian dollar was resulted due to

combined effect of stronger US dollar, prediction of a relatively slower growth of the global

economy and decline in global commodity prices followed a slowdown in China’s economic

growth.

Question c

Driving factors behind recent movement of AUD

In recent days, AUD has constituted a downward movement against USD. The

depreciation of AUD is not the result of any one factor. Rather it is the result of a number of

factors. The sign of weaker economic growth in China badly hit Aussie dollar. Besides China,

some countries in Eurozone has also recorded a decline in economic growth. Economic growth

US 70 cents. In December 2016, 1 AUD was traded at US 72 cents. The Australia dollar

continued to appreciate in 2017 with exchange rate being 0.75 in January 2017. Since then AUD

continued to appreciate. Australian dollar reached to the highest level in January 2018. 1 AUD

was then traded for US 80 cents. The strong Australian dollar provided significant support to the

economy. Increases in interest rate acts as a magnet for foreign currency. Higher the interest rate,

there is more inflow of foreign currency. Decline in interest rate by Federal Reserve induced

investors to withdraw their funds out of and invest the same elsewhere (rba.gov.au. 2018). The

weakness in US dollar in turn strengthened Australian dollar. The second factor that contributed

to currency appreciation in 2017 was an above expected growth rate of China. In June, China

grew at a rate of 6.9 percent as against the predicted rate of 6.8 percent. Higher growth in China

means a higher potential demand Australian dollar (abc.net.au 2017). This raised the demand for

Australian dollar causing AUD to appreciate. However, since February 2018, AUD-USD

exchange rate started to decline indicating depreciation of currency. Value of AUD fell to 70 US

cent in December 2018. The likely decline in value of Australian dollar was resulted due to

combined effect of stronger US dollar, prediction of a relatively slower growth of the global

economy and decline in global commodity prices followed a slowdown in China’s economic

growth.

Question c

Driving factors behind recent movement of AUD

In recent days, AUD has constituted a downward movement against USD. The

depreciation of AUD is not the result of any one factor. Rather it is the result of a number of

factors. The sign of weaker economic growth in China badly hit Aussie dollar. Besides China,

some countries in Eurozone has also recorded a decline in economic growth. Economic growth

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR PROFESSIONALS

has been particularly lowered in Spain and Italy. The global manufacturing index or PMI

indicated an overnight decline in the index reaching to the lowest in the last two years. With

decline in manufacturing, output remained low globally. There is a significant decline in rate of

increase in the new orders globally. Along with this employment growth lowered and there is a

deterioration of trade flows. The decline in business confidence resulted in a gloomy outlook for

the currency. Except India, manufacturing indices lowered significantly globally since the

second quarter of 2018. Since mid-2018, the official manufacturing PMIS declined for China and

continued the declining trend. China showed sign of further economic slowdown in the next

year. China being one of the major importer of Australia, contraction of economic growth of

China led to a decline in export demand from Australia. As the demand for Australian export

falls, there is a decline in demand for Australian dollar. The slowdown in global economic

growth has caused commodity price to decline in the global market (Bougheas et al. 2018).

Sharp fall in the price of aluminum and copper further weakened currency of Australia. Another

factor affecting currency trading is the prevailing interest rate within the economy. A higher

interest rate encourages foreign investors to invest in the nation (Heijdra 2017). This increases

demand for currency leading to an increase in value of domestic currency relative to foreign

currency. In Australia, RBA has maintained a low interest rate for a considerably long period.

Reserve Bank of Australia though expects to increase the interest rate, yet no steps have been

taken in the direction. The lower interest rate is another reason for less attractiveness of

Australian dollar and hence, a lower demand for Australian dollar. Following the standard theory

of exchange rate determination, the lower demand for Australian dollar reduces the supply of

foreign exchange reserve in the market. The lower demand reduces the value of Australian dollar

relative to US dollar. In other words, the supply shortage of foreign exchange reserve increases

has been particularly lowered in Spain and Italy. The global manufacturing index or PMI

indicated an overnight decline in the index reaching to the lowest in the last two years. With

decline in manufacturing, output remained low globally. There is a significant decline in rate of

increase in the new orders globally. Along with this employment growth lowered and there is a

deterioration of trade flows. The decline in business confidence resulted in a gloomy outlook for

the currency. Except India, manufacturing indices lowered significantly globally since the

second quarter of 2018. Since mid-2018, the official manufacturing PMIS declined for China and

continued the declining trend. China showed sign of further economic slowdown in the next

year. China being one of the major importer of Australia, contraction of economic growth of

China led to a decline in export demand from Australia. As the demand for Australian export

falls, there is a decline in demand for Australian dollar. The slowdown in global economic

growth has caused commodity price to decline in the global market (Bougheas et al. 2018).

Sharp fall in the price of aluminum and copper further weakened currency of Australia. Another

factor affecting currency trading is the prevailing interest rate within the economy. A higher

interest rate encourages foreign investors to invest in the nation (Heijdra 2017). This increases

demand for currency leading to an increase in value of domestic currency relative to foreign

currency. In Australia, RBA has maintained a low interest rate for a considerably long period.

Reserve Bank of Australia though expects to increase the interest rate, yet no steps have been

taken in the direction. The lower interest rate is another reason for less attractiveness of

Australian dollar and hence, a lower demand for Australian dollar. Following the standard theory

of exchange rate determination, the lower demand for Australian dollar reduces the supply of

foreign exchange reserve in the market. The lower demand reduces the value of Australian dollar

relative to US dollar. In other words, the supply shortage of foreign exchange reserve increases

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR PROFESSIONALS

the price of US dollar causing USD to appreciate. The appreciation of USD in turn means a

depreciation of Australian dollar in the AUD-USD framework.

Question d

Effect of depreciation of AUD on Australian economy

Depreciation of a currency though indicates weak state of domestic currency and hence, a

weak position of the currency in the global market, currency depreciation has some beneficial

effect on the economy (Case, Fair and Oster 2014). Currently, Australian dollar has accounted a

decline in its value following a contraction in global trade and decline in economic growth of

China and other trading partners. Weak Australian currency however is what the economy is

needed right now given the current states of the economy as characterized by a decline in home

prices, lower wage grows and substantially low inflation (abc.net.au 2019). The weak Australian

dollar helps to make Australian assets from bonds to infrastructure to real estate more attractive

to the foreign funds. With a fall in value of Australia dollar, Australian investor having exposure

to the market in US get comfort to switch back their holing into Australian dollar. The weak

currency helps Australian government to borrow funds from United State at a relatively lower

cost. Despite rapidly growing government debt, Australian can still borrow funds at a lower cost

externally. Following this, the purchase of offshore bonds in Australia is the largest since 2015.

The weak Australian dollar has a multiplying effect on economic growth of Australia through

export multiplier. As majority of exports in Australia are valued at US dollar, weak Aussie dollar

in turn means a lower relative price of export boosting the export demand of Australia. The fall

in Aussie thus benefits the exporters providing huge windfall in national income and profit.

Increase in operating profits of exporting companies is one of the major factors driving economic

growth of Australia since June 2018 (Bahmani‐Oskooee and Nayeri 2018). The economic

the price of US dollar causing USD to appreciate. The appreciation of USD in turn means a

depreciation of Australian dollar in the AUD-USD framework.

Question d

Effect of depreciation of AUD on Australian economy

Depreciation of a currency though indicates weak state of domestic currency and hence, a

weak position of the currency in the global market, currency depreciation has some beneficial

effect on the economy (Case, Fair and Oster 2014). Currently, Australian dollar has accounted a

decline in its value following a contraction in global trade and decline in economic growth of

China and other trading partners. Weak Australian currency however is what the economy is

needed right now given the current states of the economy as characterized by a decline in home

prices, lower wage grows and substantially low inflation (abc.net.au 2019). The weak Australian

dollar helps to make Australian assets from bonds to infrastructure to real estate more attractive

to the foreign funds. With a fall in value of Australia dollar, Australian investor having exposure

to the market in US get comfort to switch back their holing into Australian dollar. The weak

currency helps Australian government to borrow funds from United State at a relatively lower

cost. Despite rapidly growing government debt, Australian can still borrow funds at a lower cost

externally. Following this, the purchase of offshore bonds in Australia is the largest since 2015.

The weak Australian dollar has a multiplying effect on economic growth of Australia through

export multiplier. As majority of exports in Australia are valued at US dollar, weak Aussie dollar

in turn means a lower relative price of export boosting the export demand of Australia. The fall

in Aussie thus benefits the exporters providing huge windfall in national income and profit.

Increase in operating profits of exporting companies is one of the major factors driving economic

growth of Australia since June 2018 (Bahmani‐Oskooee and Nayeri 2018). The economic

8ECONOMICS FOR PROFESSIONALS

growth has become even ahead of that in United State. The profit bonanza resulted from weak

Aussie dollar has helped to increase value of country’s benchmark equity index dominated by

banks, miners and other service.

As far as the discussion made, a decline in value of Australian dollar increase demand for

Australia dollar by lowering the relative price of export. The firm that exports software products

to United State thus experience an increase in demand for its products in the United State

(Hasan, Ratna and Shakur 2019). As demand increases, there is an increase in sales volume for

company resulting in a higher profit. The weak currency thus is not bad entirely as is entails a

potential benefit to the export oriented sectors by boosting demand.

Question e

Policies to increase value of AUD

Reserve Bank of Australia can intervene in the foreign exchange market to influence

value of the currency. It is given that exchange rate is currently stabilizing at US 70C per AUD.

Objective of the central bank is to increase the exchange rate to US 73C per AUD meaning an

appreciation of currency. One possible instrument policy to do this is to take a tight monetary

policy. Currency tends to appreciate if interest rate in the country is larger relative to foreign

country. In order to increase the value of Australian dollar RBA should increase the interest rate

(Treasury.gov.au 2019). Higher interest rate attracts foreign investors to invest in Australian

dollar. The increased demand for Australian dollar increases the value of Australian dollar

resulting in appreciation of AUD with respect to USD.

RBA can further raises value of AUD by purchase of foreign reserves. If government is

willing to increase the value of Australian dollar then it should sell its reserve of US dollar and

growth has become even ahead of that in United State. The profit bonanza resulted from weak

Aussie dollar has helped to increase value of country’s benchmark equity index dominated by

banks, miners and other service.

As far as the discussion made, a decline in value of Australian dollar increase demand for

Australia dollar by lowering the relative price of export. The firm that exports software products

to United State thus experience an increase in demand for its products in the United State

(Hasan, Ratna and Shakur 2019). As demand increases, there is an increase in sales volume for

company resulting in a higher profit. The weak currency thus is not bad entirely as is entails a

potential benefit to the export oriented sectors by boosting demand.

Question e

Policies to increase value of AUD

Reserve Bank of Australia can intervene in the foreign exchange market to influence

value of the currency. It is given that exchange rate is currently stabilizing at US 70C per AUD.

Objective of the central bank is to increase the exchange rate to US 73C per AUD meaning an

appreciation of currency. One possible instrument policy to do this is to take a tight monetary

policy. Currency tends to appreciate if interest rate in the country is larger relative to foreign

country. In order to increase the value of Australian dollar RBA should increase the interest rate

(Treasury.gov.au 2019). Higher interest rate attracts foreign investors to invest in Australian

dollar. The increased demand for Australian dollar increases the value of Australian dollar

resulting in appreciation of AUD with respect to USD.

RBA can further raises value of AUD by purchase of foreign reserves. If government is

willing to increase the value of Australian dollar then it should sell its reserve of US dollar and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR PROFESSIONALS

purchase Australian dollar (Akinci and Olmstead-Rumsey 2018). The purchase of Australian

dollar leads to an increase in value of the currency.

The policies undertaken to increase value of currency has some possible side effects on

the domestic economy. Firstly, the tight monetary policy taken in the form of an increase in

interest rate adversely affect economic activity in Australia. With an increase in interest rate,

borrowing cost in the economy increases discouraging investment. As investment falls there is a

decline in gross domestic product and associated growth rate. The policy to increase value of

Australian dollar by increasing the interest rate thus has a side effect in terms of lowering

domestic growth rate.

If Reserve Bank of Australia purchase more Australia dollar to increase the value of

currency, then AUD will stockpile to the central bank while the reserve for US dollar will be

lower. The higher price of AUD relative to USD increases price of export lowering its demand

(Guzman, Ocampo and Stiglitz 2018). This will further hurt economic growth of Australia.

purchase Australian dollar (Akinci and Olmstead-Rumsey 2018). The purchase of Australian

dollar leads to an increase in value of the currency.

The policies undertaken to increase value of currency has some possible side effects on

the domestic economy. Firstly, the tight monetary policy taken in the form of an increase in

interest rate adversely affect economic activity in Australia. With an increase in interest rate,

borrowing cost in the economy increases discouraging investment. As investment falls there is a

decline in gross domestic product and associated growth rate. The policy to increase value of

Australian dollar by increasing the interest rate thus has a side effect in terms of lowering

domestic growth rate.

If Reserve Bank of Australia purchase more Australia dollar to increase the value of

currency, then AUD will stockpile to the central bank while the reserve for US dollar will be

lower. The higher price of AUD relative to USD increases price of export lowering its demand

(Guzman, Ocampo and Stiglitz 2018). This will further hurt economic growth of Australia.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR PROFESSIONALS

References

abc.net.au., 2017. How high could the Australian dollar go?. [online] ABC News. Available at:

https://www.abc.net.au/news/2017-07-18/australian-dollar-how-high-could-it-go/8717862

[Accessed 2 Apr. 2019].

abc.net.au., 2019. Aussie dollar looks poised for further falls. [online] ABC News. Available at:

https://www.abc.net.au/news/2018-09-03/australian-dollar-sinks-to-20-month-low/10195416

[Accessed 2 Apr. 2019].

Akinci, O. and Olmstead-Rumsey, J., 2018. How effective are macroprudential policies? An

empirical investigation. Journal of Financial Intermediation, 33, pp.33-57.

Bahmani‐Oskooee, M. and Nayeri, M.M., 2018. Policy Uncertainty and the demand for money

in Australia: An asymmetry analysis. Australian Economic Papers, 57(4), pp.456-469.

Bougheas, S., Lim, H., Mateut, S., Mizen, P. and Yalcin, C., 2018. Foreign currency borrowing,

exports and firm performance: evidence from a currency crisis. The European Journal of

Finance, 24(17), pp.1649-1671.

Case, K.E., Fair, R.C. and Oster, S.M., 2014. Principles of macroeconomics. Pearson.

Goodwin, N., Harris, J.M., Nelson, J.A., Roach, B. and Torras, M., 2015. Macroeconomics in

context. Routledge.

Guzman, M., Ocampo, J.A. and Stiglitz, J.E., 2018. Real exchange rate policies for economic

development. World Development, 110, pp.51-62.

Hasan, S., Ratna, N. and Shakur, S., 2019. Exchange rate, remittances and expenditure of

foreign-born households: evidence from Australia (No. 331). GLO Discussion Paper.

References

abc.net.au., 2017. How high could the Australian dollar go?. [online] ABC News. Available at:

https://www.abc.net.au/news/2017-07-18/australian-dollar-how-high-could-it-go/8717862

[Accessed 2 Apr. 2019].

abc.net.au., 2019. Aussie dollar looks poised for further falls. [online] ABC News. Available at:

https://www.abc.net.au/news/2018-09-03/australian-dollar-sinks-to-20-month-low/10195416

[Accessed 2 Apr. 2019].

Akinci, O. and Olmstead-Rumsey, J., 2018. How effective are macroprudential policies? An

empirical investigation. Journal of Financial Intermediation, 33, pp.33-57.

Bahmani‐Oskooee, M. and Nayeri, M.M., 2018. Policy Uncertainty and the demand for money

in Australia: An asymmetry analysis. Australian Economic Papers, 57(4), pp.456-469.

Bougheas, S., Lim, H., Mateut, S., Mizen, P. and Yalcin, C., 2018. Foreign currency borrowing,

exports and firm performance: evidence from a currency crisis. The European Journal of

Finance, 24(17), pp.1649-1671.

Case, K.E., Fair, R.C. and Oster, S.M., 2014. Principles of macroeconomics. Pearson.

Goodwin, N., Harris, J.M., Nelson, J.A., Roach, B. and Torras, M., 2015. Macroeconomics in

context. Routledge.

Guzman, M., Ocampo, J.A. and Stiglitz, J.E., 2018. Real exchange rate policies for economic

development. World Development, 110, pp.51-62.

Hasan, S., Ratna, N. and Shakur, S., 2019. Exchange rate, remittances and expenditure of

foreign-born households: evidence from Australia (No. 331). GLO Discussion Paper.

11ECONOMICS FOR PROFESSIONALS

Heijdra, B.J., 2017. Foundations of modern macroeconomics. Oxford university press.

Jakob, B., 2016. Impact of exchange rate regimes on economic growth. Undergraduate

Economic Review, 12(1), p.11.

Moore, T. 2019. Australian dollar tumbles to ten-year low. [online] The Sydney Morning

Herald. Available at: https://www.smh.com.au/business/markets/australian-dollar-slides-below-

us70c-20190103-p50pbq.html [Accessed 2 Apr. 2019].

rba.gov.au., 2018. The Exchange Rate and the Reserve Bank's Role in the Foreign Exchange

Market | RBA. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/mkt-

operations/ex-rate-rba-role-fx-mkt.html [Accessed 2 Apr. 2019].

rba.gov.au., 2019. Historical Data. [online] Reserve Bank of Australia. Available at:

https://www.rba.gov.au/statistics/historical-data.html#exchange-rates [Accessed 2 Apr. 2019].

Treasury.gov.au., 2019. Understanding the appreciation of the Australian dollar and its policy

implications | Treasury.gov.au. [online] Treasury.gov.au. Available at:

https://treasury.gov.au/publication/economic-roundup-issue-2-2012-2/economic-roundup-issue-

2-2012/understanding-the-appreciation-of-the-australian-dollar-and-its-policy-implications

[Accessed 2 Apr. 2019].

Uribe, M. and Schmitt-Grohe, S., 2017. Open economy macroeconomics. Princeton University

Press.

Heijdra, B.J., 2017. Foundations of modern macroeconomics. Oxford university press.

Jakob, B., 2016. Impact of exchange rate regimes on economic growth. Undergraduate

Economic Review, 12(1), p.11.

Moore, T. 2019. Australian dollar tumbles to ten-year low. [online] The Sydney Morning

Herald. Available at: https://www.smh.com.au/business/markets/australian-dollar-slides-below-

us70c-20190103-p50pbq.html [Accessed 2 Apr. 2019].

rba.gov.au., 2018. The Exchange Rate and the Reserve Bank's Role in the Foreign Exchange

Market | RBA. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/mkt-

operations/ex-rate-rba-role-fx-mkt.html [Accessed 2 Apr. 2019].

rba.gov.au., 2019. Historical Data. [online] Reserve Bank of Australia. Available at:

https://www.rba.gov.au/statistics/historical-data.html#exchange-rates [Accessed 2 Apr. 2019].

Treasury.gov.au., 2019. Understanding the appreciation of the Australian dollar and its policy

implications | Treasury.gov.au. [online] Treasury.gov.au. Available at:

https://treasury.gov.au/publication/economic-roundup-issue-2-2012-2/economic-roundup-issue-

2-2012/understanding-the-appreciation-of-the-australian-dollar-and-its-policy-implications

[Accessed 2 Apr. 2019].

Uribe, M. and Schmitt-Grohe, S., 2017. Open economy macroeconomics. Princeton University

Press.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.