Comparative Analysis of Macroeconomic Policies: USA vs Australia

VerifiedAdded on 2020/04/01

|23

|4019

|35

Report

AI Summary

This report offers a comprehensive comparative macroeconomic analysis of the United States of America and Australia, examining their economic performance from 1985 to 2015. It delves into the significance of macroeconomic policies, including fiscal and monetary strategies, in both countries. The analysis includes a discussion of key economic indicators such as GDP growth rates, interest rates, net export growth, and exchange rate movements to assess the impact of the USA's economic trends on Australia's performance. The report highlights that the USA and Australia are significant trading partners, with the USA's economic fluctuations significantly influencing Australia's economy, either directly or indirectly. The study also provides a detailed comparative study of the macroeconomic policies of both countries, their effectiveness and their impact on the economic conditions of the nations. The conclusion summarizes the comparative study and findings.

Running head: COMPARATIVE MACROECONOMIC ANALYSIS

COMPARATIVE MACROECONOMIC ANALYSIS

Name of Student:

Name of University:

Author Note:

COMPARATIVE MACROECONOMIC ANALYSIS

Name of Student:

Name of University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

COMPARATIVE MACROECONOMIC ANALYSIS

EXECUTIVE SUMMARY

In the modern world, economic policies play pivotal role in the functioning of the economy

as a whole taking care of the all the national economic challenges. Securing equilibrium and

driving the equilibrium towards stability are something greatly depend on what and how the

macroeconomic policies are undertaken. Role of fiscal and monetary policies are the tools

implemented in achieving so. The report analyses and compares the economic performance

of USA and Australia based on the major economic indicators. The motive is to analyse if

and how the economic movement of the USA impacts Australian performance. It has been

found that Australia and USA are greater trade partners of each other. USA is being world

largest GDP holder, creates much of the impact on the countries associated with trade if any

downfall appears in the economy. Australia is one such small country being greatly impacted

by the USA not always directly but indirectly due to the impact of crises.

COMPARATIVE MACROECONOMIC ANALYSIS

EXECUTIVE SUMMARY

In the modern world, economic policies play pivotal role in the functioning of the economy

as a whole taking care of the all the national economic challenges. Securing equilibrium and

driving the equilibrium towards stability are something greatly depend on what and how the

macroeconomic policies are undertaken. Role of fiscal and monetary policies are the tools

implemented in achieving so. The report analyses and compares the economic performance

of USA and Australia based on the major economic indicators. The motive is to analyse if

and how the economic movement of the USA impacts Australian performance. It has been

found that Australia and USA are greater trade partners of each other. USA is being world

largest GDP holder, creates much of the impact on the countries associated with trade if any

downfall appears in the economy. Australia is one such small country being greatly impacted

by the USA not always directly but indirectly due to the impact of crises.

2

COMPARATIVE MACROECONOMIC ANALYSIS

TABLE OF CONTENT

INTRODUCTION:....................................................................................................................3

DISCUSSION:...........................................................................................................................3

IMPORTANCE OF MACROECONOMIC POLICIES:.......................................................3

MACROECONOMUC POLICIES OF AUSTRALIA:.........................................................4

MACROECONOMUC POLICIES OF USA.........................................................................7

COMPARATIVE STUDY: AUSTRALIA & USA...................................................................9

CONCLUISON:.......................................................................................................................16

REFERENCE...........................................................................................................................17

COMPARATIVE MACROECONOMIC ANALYSIS

TABLE OF CONTENT

INTRODUCTION:....................................................................................................................3

DISCUSSION:...........................................................................................................................3

IMPORTANCE OF MACROECONOMIC POLICIES:.......................................................3

MACROECONOMUC POLICIES OF AUSTRALIA:.........................................................4

MACROECONOMUC POLICIES OF USA.........................................................................7

COMPARATIVE STUDY: AUSTRALIA & USA...................................................................9

CONCLUISON:.......................................................................................................................16

REFERENCE...........................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

COMPARATIVE MACROECONOMIC ANALYSIS

INTRODUCTION:

Australia and USA are two significant economies of the world in modern days, former

already world’s largest economy in terms of nominal GDP and the latter owe sits importance

in the very fact that it is a small economy with huge untapped potential to grow. The

Australian economy consists of world’s one of the biggest mixed market economy possessing

the rank of second wealthiest nation in terms of wealth held per adult. The country is mostly

service sector driven that contributes 61% to GDP. These facts reveal how important these

national economies are to the world economy.

This report aims to present an analytical discussion of both the national economies’

performance over the years and what implication the individual national economic condition

has on each other.

The paper depicts the operating macroeconomic policies of these countries and their

analysis in meeting the economic issues the nations are suffering from. In order to critically

analyse whether USA is having a recessionary trend in its GDP and Australia an

expansionary one, a comparative study of various economic indicators like GDP growth rate,

interest rates, net export growth rate and annual exchange rate movement have been

conducted based on the data collected from various sources.

DISCUSSION:

IMPORTANCE OF MACROECONOMIC POLICIES:

Any country broadly consists of two types of market, goods market and money

market. The economic performance of the country depends on the simultaneous equilibrium

of both the markets. Whenever the economy is found not to be in equilibrium it implies the

COMPARATIVE MACROECONOMIC ANALYSIS

INTRODUCTION:

Australia and USA are two significant economies of the world in modern days, former

already world’s largest economy in terms of nominal GDP and the latter owe sits importance

in the very fact that it is a small economy with huge untapped potential to grow. The

Australian economy consists of world’s one of the biggest mixed market economy possessing

the rank of second wealthiest nation in terms of wealth held per adult. The country is mostly

service sector driven that contributes 61% to GDP. These facts reveal how important these

national economies are to the world economy.

This report aims to present an analytical discussion of both the national economies’

performance over the years and what implication the individual national economic condition

has on each other.

The paper depicts the operating macroeconomic policies of these countries and their

analysis in meeting the economic issues the nations are suffering from. In order to critically

analyse whether USA is having a recessionary trend in its GDP and Australia an

expansionary one, a comparative study of various economic indicators like GDP growth rate,

interest rates, net export growth rate and annual exchange rate movement have been

conducted based on the data collected from various sources.

DISCUSSION:

IMPORTANCE OF MACROECONOMIC POLICIES:

Any country broadly consists of two types of market, goods market and money

market. The economic performance of the country depends on the simultaneous equilibrium

of both the markets. Whenever the economy is found not to be in equilibrium it implies the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

COMPARATIVE MACROECONOMIC ANALYSIS

country is has not arrived at its stability. To push the economic operation towards stability

that is to boost the national GDP consistent with full employment level, the government

undertakes macroeconomic policies. These policies are implemented through two sets of

channel: Fiscal &Monetary Policies.

While the monetary policy take care of the level of money supply in the economy

fiscal policies plays instrumental role to influence economic activity carried out by

government expenditure. The level of money supply is pivotal element to determine the rate

of interest and price level operating in the economy. Based on the economic situations,

government adopts expansionary or contractionary monetary policies by buying bonds and

assets or selling them respectively. More money supply implies low interest rate that boosts

investment and production that further boosts consumption. To influence overall economy the

fiscal policy plays important role that helps economy reach its full employment equilibrium if

it is away from it. Government expenditure in forms of initiation of any public project or

application or removal of tax are the important instruments of fiscal policies that impacts the

overall income and consumption level further.

MACROECONOMUC POLICIES OF AUSTRALIA:

Monetary:

Monetary policies are the principal tool that supports the aggregate demand of

Australia throughout years. The Reserve Bank of Australia is responsible for adopting

monetary policies that bring money market equilibrium which further contributes to the

national equilibrium. The broader function of monetary policy is to design interest rate

applicable in money market credits. The cash rate further impacts other interest rates which

reflects in the behaviours of the borrower and lender, investors influencing the economic

activity as a whole and price level issues leading to inflation.

COMPARATIVE MACROECONOMIC ANALYSIS

country is has not arrived at its stability. To push the economic operation towards stability

that is to boost the national GDP consistent with full employment level, the government

undertakes macroeconomic policies. These policies are implemented through two sets of

channel: Fiscal &Monetary Policies.

While the monetary policy take care of the level of money supply in the economy

fiscal policies plays instrumental role to influence economic activity carried out by

government expenditure. The level of money supply is pivotal element to determine the rate

of interest and price level operating in the economy. Based on the economic situations,

government adopts expansionary or contractionary monetary policies by buying bonds and

assets or selling them respectively. More money supply implies low interest rate that boosts

investment and production that further boosts consumption. To influence overall economy the

fiscal policy plays important role that helps economy reach its full employment equilibrium if

it is away from it. Government expenditure in forms of initiation of any public project or

application or removal of tax are the important instruments of fiscal policies that impacts the

overall income and consumption level further.

MACROECONOMUC POLICIES OF AUSTRALIA:

Monetary:

Monetary policies are the principal tool that supports the aggregate demand of

Australia throughout years. The Reserve Bank of Australia is responsible for adopting

monetary policies that bring money market equilibrium which further contributes to the

national equilibrium. The broader function of monetary policy is to design interest rate

applicable in money market credits. The cash rate further impacts other interest rates which

reflects in the behaviours of the borrower and lender, investors influencing the economic

activity as a whole and price level issues leading to inflation.

5

COMPARATIVE MACROECONOMIC ANALYSIS

The biggest motive behind adopting specific monetary policies is to maintain stable

price level in the economy with presence of full employment leading to economic prosperity

and general welfare of Australia. To materialise these objectives, the RBA follows an

inflation target that allows the consumer price inflation to lie between 2-3% over the medium

term of the economy. The underlying motivation behind such target is to check the money

supply level in the economy that not only keeps the inflation within control but also preserves

the value of money encouraging strong growth with sustainability over long term in the

economy.

The monetary policy reflects partially the success of fiscal policy being able to curb

the deficits arising from the expansionary fiscal policy to fight back the glob financial crisis

giving birth to larger public debt. The controlled inflation leads to higher rate of interest that

USA. Monetary stimulus has been consistent with the RBA’s medium-term inflation target

band of 2% to 3% (Figure 7), as inflation has been low, and interest rates are higher in

Australia than in the United States or the euro area (Figure 14). Unless downside risks

materialise, the current supportive stance of monetary policy remains appropriate at present,

particularly in the absence of inflationary pressures. However, a side effect is a risk that

accommodative policy may be increasingly distorting financial markets and, especially,

house prices (which have risen to very high levels). Eventually, rates will need to be

normalised, but the timing and pace will depend on developments in growth, employment,

inflation, and the housing market.

Fiscal:

Australia enjoys comparatively lower tax burden, public spending and public in the

recent times among other OECD countries.

COMPARATIVE MACROECONOMIC ANALYSIS

The biggest motive behind adopting specific monetary policies is to maintain stable

price level in the economy with presence of full employment leading to economic prosperity

and general welfare of Australia. To materialise these objectives, the RBA follows an

inflation target that allows the consumer price inflation to lie between 2-3% over the medium

term of the economy. The underlying motivation behind such target is to check the money

supply level in the economy that not only keeps the inflation within control but also preserves

the value of money encouraging strong growth with sustainability over long term in the

economy.

The monetary policy reflects partially the success of fiscal policy being able to curb

the deficits arising from the expansionary fiscal policy to fight back the glob financial crisis

giving birth to larger public debt. The controlled inflation leads to higher rate of interest that

USA. Monetary stimulus has been consistent with the RBA’s medium-term inflation target

band of 2% to 3% (Figure 7), as inflation has been low, and interest rates are higher in

Australia than in the United States or the euro area (Figure 14). Unless downside risks

materialise, the current supportive stance of monetary policy remains appropriate at present,

particularly in the absence of inflationary pressures. However, a side effect is a risk that

accommodative policy may be increasingly distorting financial markets and, especially,

house prices (which have risen to very high levels). Eventually, rates will need to be

normalised, but the timing and pace will depend on developments in growth, employment,

inflation, and the housing market.

Fiscal:

Australia enjoys comparatively lower tax burden, public spending and public in the

recent times among other OECD countries.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

COMPARATIVE MACROECONOMIC ANALYSIS

The global financial crisis ruptured economic stability in Australia whuch came back to

normalcy only when the Australian government provided fiscal support to avoid recessionary

pressure on economic output. This has led to increasing fiscal deficit over time reaching 2.4%

of GDP in financial year 2015-16. Fiscal policy of Australia is ruled by broad target of

acheieving balanced budget or budget surplus in the federal budget. State governments have .

been able to manage only small balance as a result, they don’t impact the fiscal stance

substantially. The recent target of the government is adoption of operational goal that would

help the budget surplus reach 1% of GDP which is efficient enough to bring down the debt-

GDP ratio to a minimum level. The prediction suggests that 1% of the budget surplus in the

future years would cause the debt ratio to reach 25% of GDP by 20215-26 and further reach

to zero by 2040. The balanced budget of Australia has implication of longstanding preference

regarding achieving low debt burdens. The tax reform of recent time focuses more on the

reduced corporate tax combating the base erosion and shift of profit under corporate taxation.

The GST has been made applicable to online digital product purchase and low-value

imported goods by making legislation by the government. Economic and efficient public

spending creates a strong basis for public finance increasing the effectiveness of transfer

payment and welfare. Government of Australia spends more to incur additional investment

for public projects that have substantial long term returns conducting cost benefit analysis

prior,

COMPARATIVE MACROECONOMIC ANALYSIS

The global financial crisis ruptured economic stability in Australia whuch came back to

normalcy only when the Australian government provided fiscal support to avoid recessionary

pressure on economic output. This has led to increasing fiscal deficit over time reaching 2.4%

of GDP in financial year 2015-16. Fiscal policy of Australia is ruled by broad target of

acheieving balanced budget or budget surplus in the federal budget. State governments have .

been able to manage only small balance as a result, they don’t impact the fiscal stance

substantially. The recent target of the government is adoption of operational goal that would

help the budget surplus reach 1% of GDP which is efficient enough to bring down the debt-

GDP ratio to a minimum level. The prediction suggests that 1% of the budget surplus in the

future years would cause the debt ratio to reach 25% of GDP by 20215-26 and further reach

to zero by 2040. The balanced budget of Australia has implication of longstanding preference

regarding achieving low debt burdens. The tax reform of recent time focuses more on the

reduced corporate tax combating the base erosion and shift of profit under corporate taxation.

The GST has been made applicable to online digital product purchase and low-value

imported goods by making legislation by the government. Economic and efficient public

spending creates a strong basis for public finance increasing the effectiveness of transfer

payment and welfare. Government of Australia spends more to incur additional investment

for public projects that have substantial long term returns conducting cost benefit analysis

prior,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

COMPARATIVE MACROECONOMIC ANALYSIS

MACROECONOMUC POLICIES OF USA

Macroeconomic policies of USA are of great importance as the country has been

home ground to biggest recessions and depression in the history of world economy. To

recover from the shackle of great depression occurring in 1930 and prevailing over longer

period of time the fiscal and monetary policies undertaken by subsequent policy maker and

government was crucial. As per the Keynes, the recession could be greatly fought with

boosted aggregate demand. He brought the solution tapped in demand side of the economy

which could bring the nation out of the halted production and activities. Expansionary fiscal

and monetary policies have been major instrument adopted by the nation. Increase in the

expenditure made by government and removing tax created opportunity for more production,

employment and increased income that further increased the consumption spending of the

economy. The idea was more the consumption greater is the production. Moreover increase

in the money supply as part of expansionary fiscal policy has been one of the important

measure adopted by the Federal Reserve. Increased money supply leads to fall in interest rate

that makes investment cheaper and encourages it more.

Over the time the expansionary monetary policy increased the public debt of the

country increasing. From the beginning of 1980s, the major focus of the policymakers has

been on reducing fiscal deficits predominantly. The country has been doing great in terms of

foreign trade. Moreover, technological advancement and resultant innovative products of

USA has bigger share in the world market. So growth stimulating policies were not as

important as the domestic condition of the economy in terms of growing deficit. It was

assumed that lower deficit would reduce the borrowings made by government ad this further

woud bring down the rate of interest. This makes investment and capital accessibility easier

and advantageous by the business entities. However, the country faced a budget surplus in

1998 that led to tax cut in the fiscal policies. Amidst the mess of great financial recession

COMPARATIVE MACROECONOMIC ANALYSIS

MACROECONOMUC POLICIES OF USA

Macroeconomic policies of USA are of great importance as the country has been

home ground to biggest recessions and depression in the history of world economy. To

recover from the shackle of great depression occurring in 1930 and prevailing over longer

period of time the fiscal and monetary policies undertaken by subsequent policy maker and

government was crucial. As per the Keynes, the recession could be greatly fought with

boosted aggregate demand. He brought the solution tapped in demand side of the economy

which could bring the nation out of the halted production and activities. Expansionary fiscal

and monetary policies have been major instrument adopted by the nation. Increase in the

expenditure made by government and removing tax created opportunity for more production,

employment and increased income that further increased the consumption spending of the

economy. The idea was more the consumption greater is the production. Moreover increase

in the money supply as part of expansionary fiscal policy has been one of the important

measure adopted by the Federal Reserve. Increased money supply leads to fall in interest rate

that makes investment cheaper and encourages it more.

Over the time the expansionary monetary policy increased the public debt of the

country increasing. From the beginning of 1980s, the major focus of the policymakers has

been on reducing fiscal deficits predominantly. The country has been doing great in terms of

foreign trade. Moreover, technological advancement and resultant innovative products of

USA has bigger share in the world market. So growth stimulating policies were not as

important as the domestic condition of the economy in terms of growing deficit. It was

assumed that lower deficit would reduce the borrowings made by government ad this further

woud bring down the rate of interest. This makes investment and capital accessibility easier

and advantageous by the business entities. However, the country faced a budget surplus in

1998 that led to tax cut in the fiscal policies. Amidst the mess of great financial recession

8

COMPARATIVE MACROECONOMIC ANALYSIS

stemming from falling of greater American financial companies, the government enforced

Emergency Economic Stabilization Act of 2008 which incorporated a buyback program of

the troubled or bad assets from these companies.

The expansionary fiscal policies targeted to bring growth in the income and

employment of the economy led to adoption of expansionary fiscal policy.

Increased level of money supply caused inflation to rise high. This led to

tightening of monetary policy by the early of 1980s that only reflected into sharp

recession appearing in 1981-1982. The inflation rate did fall down which enable

Fed to pursue expansionary policy again but presence of pretty high level of

interest rate actually increase the budget deficit and following deficit financing of

the government. By 1990s the deficits narrowed and almost disappeared with

reduced rate of interest rate.

It was growingly evident that fighting inflation with the presence of fiscal

policies fighting unemployment was much difficult. Inflation reduction required

tax hike or reduction in spending where as the fiscal policy aims at increasing the

level of spending and cut tax rate to boost production.

COMPARATIVE MACROECONOMIC ANALYSIS

stemming from falling of greater American financial companies, the government enforced

Emergency Economic Stabilization Act of 2008 which incorporated a buyback program of

the troubled or bad assets from these companies.

The expansionary fiscal policies targeted to bring growth in the income and

employment of the economy led to adoption of expansionary fiscal policy.

Increased level of money supply caused inflation to rise high. This led to

tightening of monetary policy by the early of 1980s that only reflected into sharp

recession appearing in 1981-1982. The inflation rate did fall down which enable

Fed to pursue expansionary policy again but presence of pretty high level of

interest rate actually increase the budget deficit and following deficit financing of

the government. By 1990s the deficits narrowed and almost disappeared with

reduced rate of interest rate.

It was growingly evident that fighting inflation with the presence of fiscal

policies fighting unemployment was much difficult. Inflation reduction required

tax hike or reduction in spending where as the fiscal policy aims at increasing the

level of spending and cut tax rate to boost production.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

COMPARATIVE MACROECONOMIC ANALYSIS

COMPARATIVE STUDY: AUSTRALIA & USA

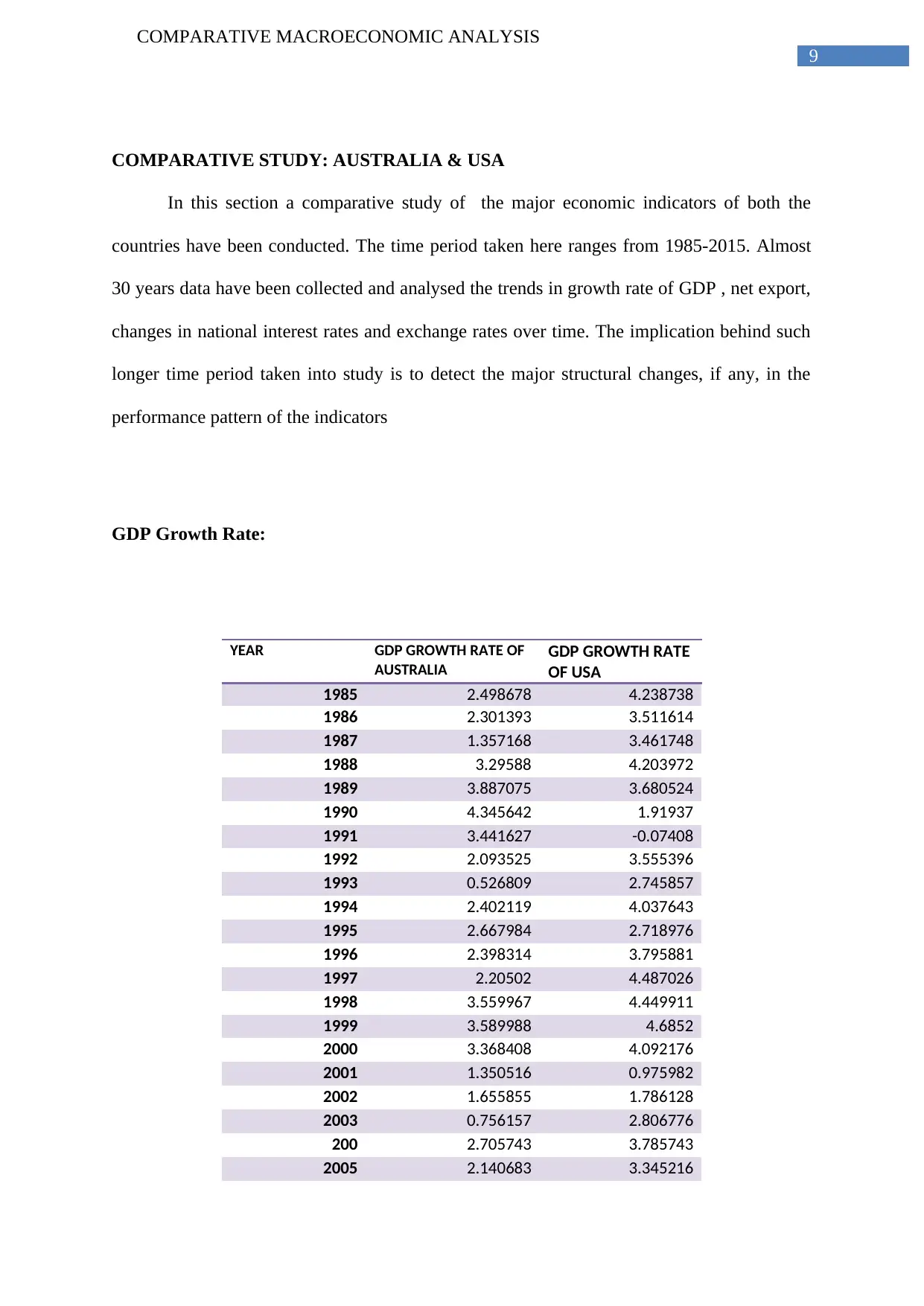

In this section a comparative study of the major economic indicators of both the

countries have been conducted. The time period taken here ranges from 1985-2015. Almost

30 years data have been collected and analysed the trends in growth rate of GDP , net export,

changes in national interest rates and exchange rates over time. The implication behind such

longer time period taken into study is to detect the major structural changes, if any, in the

performance pattern of the indicators

GDP Growth Rate:

YEAR GDP GROWTH RATE OF

AUSTRALIA

GDP GROWTH RATE

OF USA

1985 2.498678 4.238738

1986 2.301393 3.511614

1987 1.357168 3.461748

1988 3.29588 4.203972

1989 3.887075 3.680524

1990 4.345642 1.91937

1991 3.441627 -0.07408

1992 2.093525 3.555396

1993 0.526809 2.745857

1994 2.402119 4.037643

1995 2.667984 2.718976

1996 2.398314 3.795881

1997 2.20502 4.487026

1998 3.559967 4.449911

1999 3.589988 4.6852

2000 3.368408 4.092176

2001 1.350516 0.975982

2002 1.655855 1.786128

2003 0.756157 2.806776

200 2.705743 3.785743

2005 2.140683 3.345216

COMPARATIVE MACROECONOMIC ANALYSIS

COMPARATIVE STUDY: AUSTRALIA & USA

In this section a comparative study of the major economic indicators of both the

countries have been conducted. The time period taken here ranges from 1985-2015. Almost

30 years data have been collected and analysed the trends in growth rate of GDP , net export,

changes in national interest rates and exchange rates over time. The implication behind such

longer time period taken into study is to detect the major structural changes, if any, in the

performance pattern of the indicators

GDP Growth Rate:

YEAR GDP GROWTH RATE OF

AUSTRALIA

GDP GROWTH RATE

OF USA

1985 2.498678 4.238738

1986 2.301393 3.511614

1987 1.357168 3.461748

1988 3.29588 4.203972

1989 3.887075 3.680524

1990 4.345642 1.91937

1991 3.441627 -0.07408

1992 2.093525 3.555396

1993 0.526809 2.745857

1994 2.402119 4.037643

1995 2.667984 2.718976

1996 2.398314 3.795881

1997 2.20502 4.487026

1998 3.559967 4.449911

1999 3.589988 4.6852

2000 3.368408 4.092176

2001 1.350516 0.975982

2002 1.655855 1.786128

2003 0.756157 2.806776

200 2.705743 3.785743

2005 2.140683 3.345216

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

COMPARATIVE MACROECONOMIC ANALYSIS

2006 3.350831 2.666626

2007 3.62151 1.77857

2008 1.547264 -0.29162

2009 -3.79908 -2.77553

2010 1.928673 2.531921

2011 2.808 1.601455

2012 0.745756 2.224031

2013 0.124224 1.677332

2014 0.644845 2.370458

2015 0.963058 2.596148

2016 1.480731 1.615656

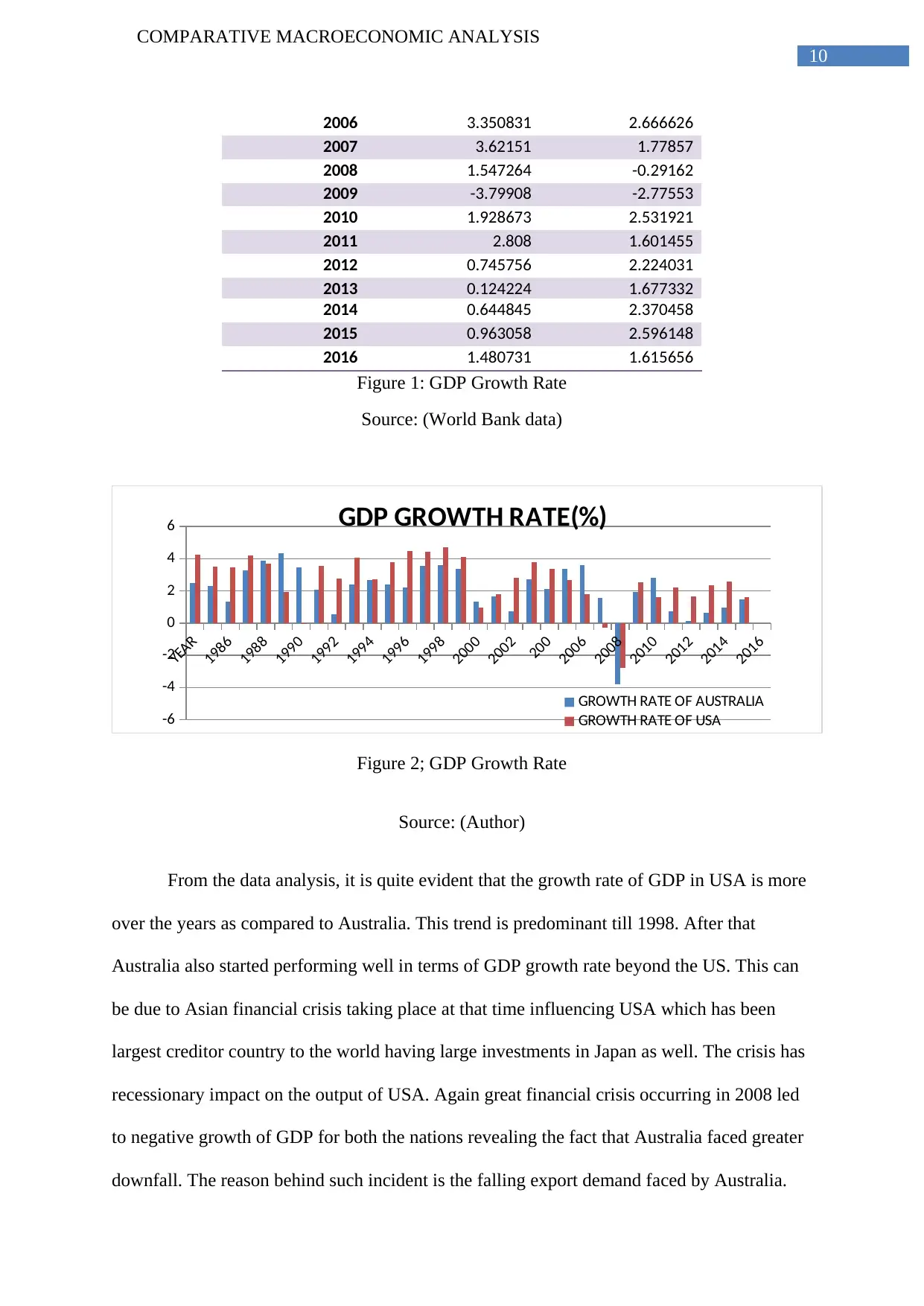

Figure 1: GDP Growth Rate

Source: (World Bank data)

YEAR

1986

1988

1990

1992

1994

1996

1998

2000

2002

200

2006

2008

2010

2012

2014

2016

-6

-4

-2

0

2

4

6 GDP GROWTH RATE(%)

GROWTH RATE OF AUSTRALIA

GROWTH RATE OF USA

Figure 2; GDP Growth Rate

Source: (Author)

From the data analysis, it is quite evident that the growth rate of GDP in USA is more

over the years as compared to Australia. This trend is predominant till 1998. After that

Australia also started performing well in terms of GDP growth rate beyond the US. This can

be due to Asian financial crisis taking place at that time influencing USA which has been

largest creditor country to the world having large investments in Japan as well. The crisis has

recessionary impact on the output of USA. Again great financial crisis occurring in 2008 led

to negative growth of GDP for both the nations revealing the fact that Australia faced greater

downfall. The reason behind such incident is the falling export demand faced by Australia.

COMPARATIVE MACROECONOMIC ANALYSIS

2006 3.350831 2.666626

2007 3.62151 1.77857

2008 1.547264 -0.29162

2009 -3.79908 -2.77553

2010 1.928673 2.531921

2011 2.808 1.601455

2012 0.745756 2.224031

2013 0.124224 1.677332

2014 0.644845 2.370458

2015 0.963058 2.596148

2016 1.480731 1.615656

Figure 1: GDP Growth Rate

Source: (World Bank data)

YEAR

1986

1988

1990

1992

1994

1996

1998

2000

2002

200

2006

2008

2010

2012

2014

2016

-6

-4

-2

0

2

4

6 GDP GROWTH RATE(%)

GROWTH RATE OF AUSTRALIA

GROWTH RATE OF USA

Figure 2; GDP Growth Rate

Source: (Author)

From the data analysis, it is quite evident that the growth rate of GDP in USA is more

over the years as compared to Australia. This trend is predominant till 1998. After that

Australia also started performing well in terms of GDP growth rate beyond the US. This can

be due to Asian financial crisis taking place at that time influencing USA which has been

largest creditor country to the world having large investments in Japan as well. The crisis has

recessionary impact on the output of USA. Again great financial crisis occurring in 2008 led

to negative growth of GDP for both the nations revealing the fact that Australia faced greater

downfall. The reason behind such incident is the falling export demand faced by Australia.

11

COMPARATIVE MACROECONOMIC ANALYSIS

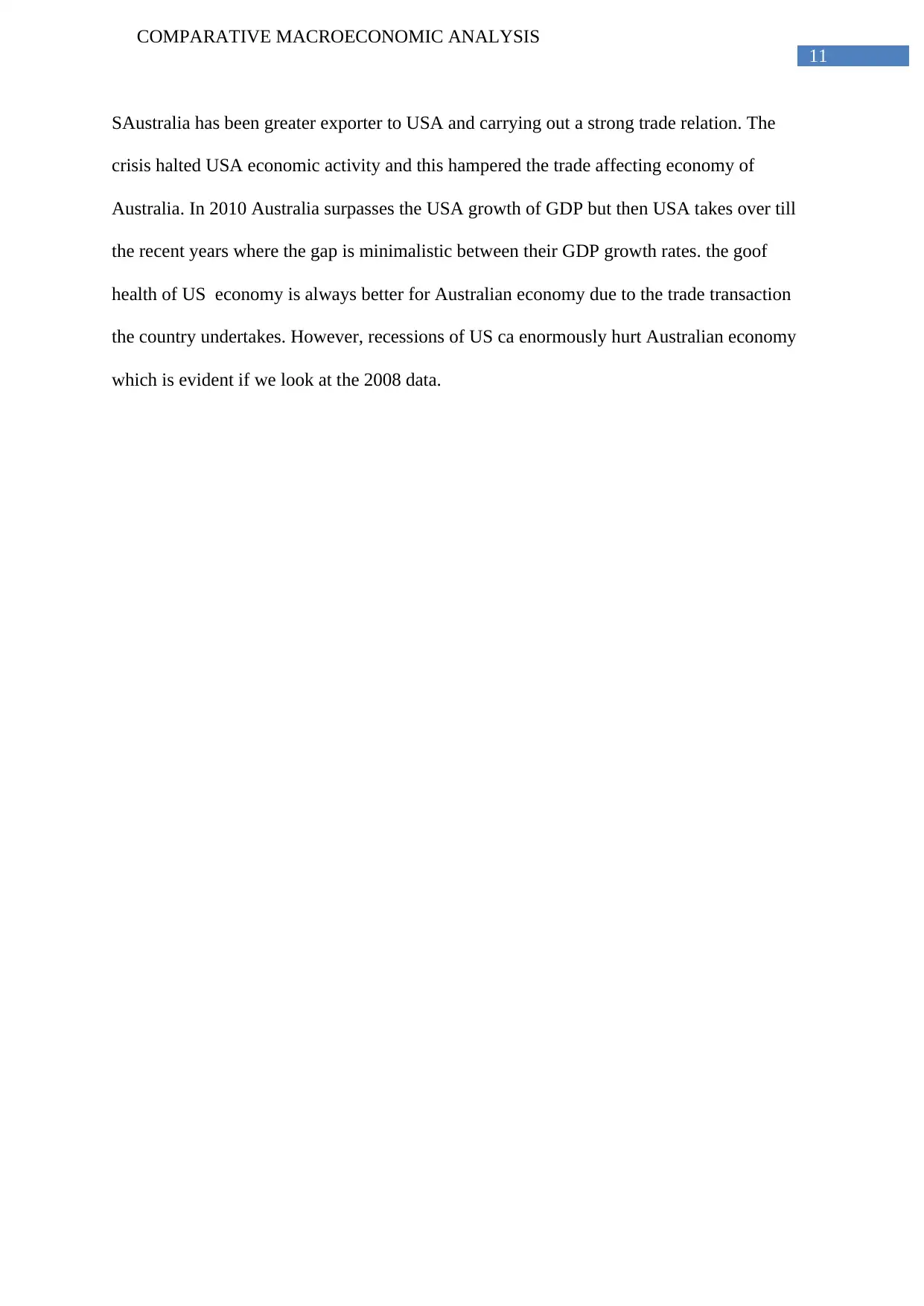

SAustralia has been greater exporter to USA and carrying out a strong trade relation. The

crisis halted USA economic activity and this hampered the trade affecting economy of

Australia. In 2010 Australia surpasses the USA growth of GDP but then USA takes over till

the recent years where the gap is minimalistic between their GDP growth rates. the goof

health of US economy is always better for Australian economy due to the trade transaction

the country undertakes. However, recessions of US ca enormously hurt Australian economy

which is evident if we look at the 2008 data.

COMPARATIVE MACROECONOMIC ANALYSIS

SAustralia has been greater exporter to USA and carrying out a strong trade relation. The

crisis halted USA economic activity and this hampered the trade affecting economy of

Australia. In 2010 Australia surpasses the USA growth of GDP but then USA takes over till

the recent years where the gap is minimalistic between their GDP growth rates. the goof

health of US economy is always better for Australian economy due to the trade transaction

the country undertakes. However, recessions of US ca enormously hurt Australian economy

which is evident if we look at the 2008 data.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.