Financial Management Report: Dividend Policy, Markets, and Derivatives

VerifiedAdded on 2020/02/05

|10

|2513

|326

Report

AI Summary

This report provides a comprehensive overview of financial management, encompassing key concepts such as dividend policy, financial markets, and financial derivatives. It begins by defining financial management and its role in effective resource utilization. The report then delves into dividend policy, exploring different models like residual, stable, and hybrid dividend policies, and their implications for shareholders and companies. The discussion extends to financial markets, differentiating between money and capital markets, and primary and secondary markets. Finally, the report examines financial derivatives, including options, futures, swaps, and credit derivatives, highlighting their role in risk management. The content is supported by academic references, making it a valuable resource for finance students and professionals. This report, contributed by a student, is available on Desklib, a platform offering AI-based study tools and resources for students.

FINANCIAL

MANAGEMENT

1 | P a g e

MANAGEMENT

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................1

DIVIDEND POLICY.................................................................................................................1

FINANCIAL MARKET............................................................................................................2

FINANCIAL DERIVATIVES...................................................................................................4

CONCLUSION..........................................................................................................................6

REFERENCES...........................................................................................................................7

2 | P a g e

INTRODUCTION......................................................................................................................1

DIVIDEND POLICY.................................................................................................................1

FINANCIAL MARKET............................................................................................................2

FINANCIAL DERIVATIVES...................................................................................................4

CONCLUSION..........................................................................................................................6

REFERENCES...........................................................................................................................7

2 | P a g e

INTRODUCTION

Financial management is the process of effective utilization of monetary resources.

Present project report will explain the role of management of funds in the organization. This

report will discusses dividend policy, financial markets and derivatives for effective and

efficient management of collected funds.

DIVIDEND POLICY

Dividend policy is the combination of certain guidelines which companies have to

follow when they are distributing part of their profits to their shareholders (Deshmukh, Goel.

and Howe, 2013). All the organizations generally do not allocate all their earnings as

dividend to their investors so this policy assists managers to determine the amount of

organizational earnings to be paid to the shareholders. There are various types of dividend

policy which have been described hereunder:

Residual dividend policy

This policy is based on three key elements that are mentioned below:

Target capital structure.

Investment opportunity model.

Cost of external capital.

Initially, residual-dividend model primarily aims at deciding a target dividend payout

ratio. Thereafter, managers determine the equity which will be needed to construct an optimal

capital structure (Renneboog and Szilagyi, 2015). Primarily, equity funds will be collected

through the use of retained earnings. Management decide optimal capital expenditures level

to manage their cost of capital. As per this policy, companies use their total earnings for

meeting business operational as-well-as expansion expenditures and if any surplus is left then

it will be called as residual which will be use for dividend distribution. Henceforth, it seems

to be very useful in capital projects while its disadvantage is fluctuations in business earnings

that contribute to bring instability in dividend.

Stable dividend policy

This policy overcomes with the limitation of residual dividend model because it helps

to maintain stability in dividend. Stability policy says that companies have to provide regular

and stable dividend to the investors (Loudermilk, 2012). Henceforth, it reduces uncertainty in

the shareholders return. It is adopted by the organizations who attempt to share their earnings

with the investors rather than retaining this for future purpose.

3 | P a g e

Financial management is the process of effective utilization of monetary resources.

Present project report will explain the role of management of funds in the organization. This

report will discusses dividend policy, financial markets and derivatives for effective and

efficient management of collected funds.

DIVIDEND POLICY

Dividend policy is the combination of certain guidelines which companies have to

follow when they are distributing part of their profits to their shareholders (Deshmukh, Goel.

and Howe, 2013). All the organizations generally do not allocate all their earnings as

dividend to their investors so this policy assists managers to determine the amount of

organizational earnings to be paid to the shareholders. There are various types of dividend

policy which have been described hereunder:

Residual dividend policy

This policy is based on three key elements that are mentioned below:

Target capital structure.

Investment opportunity model.

Cost of external capital.

Initially, residual-dividend model primarily aims at deciding a target dividend payout

ratio. Thereafter, managers determine the equity which will be needed to construct an optimal

capital structure (Renneboog and Szilagyi, 2015). Primarily, equity funds will be collected

through the use of retained earnings. Management decide optimal capital expenditures level

to manage their cost of capital. As per this policy, companies use their total earnings for

meeting business operational as-well-as expansion expenditures and if any surplus is left then

it will be called as residual which will be use for dividend distribution. Henceforth, it seems

to be very useful in capital projects while its disadvantage is fluctuations in business earnings

that contribute to bring instability in dividend.

Stable dividend policy

This policy overcomes with the limitation of residual dividend model because it helps

to maintain stability in dividend. Stability policy says that companies have to provide regular

and stable dividend to the investors (Loudermilk, 2012). Henceforth, it reduces uncertainty in

the shareholders return. It is adopted by the organizations who attempt to share their earnings

with the investors rather than retaining this for future purpose.

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

NASDAQ international organizations follow stable dividend policy in which

managers ensure regular and stable dividend distribution to the shareholders. It is because;

managers believe that continuous increase in dividend is not possible because of existing

market uncertainties (Engombe, 2014). Therefore, they strive for maintaining balanced

payment of investors return which ultimately impact on firm's corporate value.

Hybrid dividend policy

It is the combination of both residual and stable dividend policy. As per this model,

companies set a minimum dividend which is relatively a small proportion of total business

earnings so that managers will be able to maintain it easily (Naser, Nuseibeh and Rashed,

2013). Moreover, they can offer extra dividend to the shareholders if actual incomes exceed

the minimum set level. In this policy, companies use and maintain their debt/equity ratio for

long term purpose. In present uncertain market, this is highly used approach of international

organizations. It is because; cyclical fluctuations have a great impact on business incomes

which ultimately affects investors return in the way of dividend (Murto and Terviö, 2014). It

allows flexibility in dividend distribution according to the business performance.

FINANCIAL MARKET

It is the place at which people trade for various securities and commodities. Securities

involve bonds and stocks while commodities include agricultural products and metals (Segal,

Shaliastovich and Yaron, 2015). In this market, large number of buyers and sellers trade their

equities, bonds, currency, derivatives and others at lower cost. There are various types of

financial markets that have been explained hereunder:

Money market

It is a market segment at where financial instruments with high liquidity and short

maturities are traded. Participants use this market for short-term borrowing and lending

purpose (Dieckmann and Plank, 2012). It can vary from many years to a time period of

twelve months. For example, following securities can be traded in money market:

Negotiable Certificate of Deposits (CDs),

Treasury bills,

Commercial Papers (CP)

bankers acceptance

Municipal notes

Repurchase agreements (repos)

Eurodollars

4 | P a g e

managers ensure regular and stable dividend distribution to the shareholders. It is because;

managers believe that continuous increase in dividend is not possible because of existing

market uncertainties (Engombe, 2014). Therefore, they strive for maintaining balanced

payment of investors return which ultimately impact on firm's corporate value.

Hybrid dividend policy

It is the combination of both residual and stable dividend policy. As per this model,

companies set a minimum dividend which is relatively a small proportion of total business

earnings so that managers will be able to maintain it easily (Naser, Nuseibeh and Rashed,

2013). Moreover, they can offer extra dividend to the shareholders if actual incomes exceed

the minimum set level. In this policy, companies use and maintain their debt/equity ratio for

long term purpose. In present uncertain market, this is highly used approach of international

organizations. It is because; cyclical fluctuations have a great impact on business incomes

which ultimately affects investors return in the way of dividend (Murto and Terviö, 2014). It

allows flexibility in dividend distribution according to the business performance.

FINANCIAL MARKET

It is the place at which people trade for various securities and commodities. Securities

involve bonds and stocks while commodities include agricultural products and metals (Segal,

Shaliastovich and Yaron, 2015). In this market, large number of buyers and sellers trade their

equities, bonds, currency, derivatives and others at lower cost. There are various types of

financial markets that have been explained hereunder:

Money market

It is a market segment at where financial instruments with high liquidity and short

maturities are traded. Participants use this market for short-term borrowing and lending

purpose (Dieckmann and Plank, 2012). It can vary from many years to a time period of

twelve months. For example, following securities can be traded in money market:

Negotiable Certificate of Deposits (CDs),

Treasury bills,

Commercial Papers (CP)

bankers acceptance

Municipal notes

Repurchase agreements (repos)

Eurodollars

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

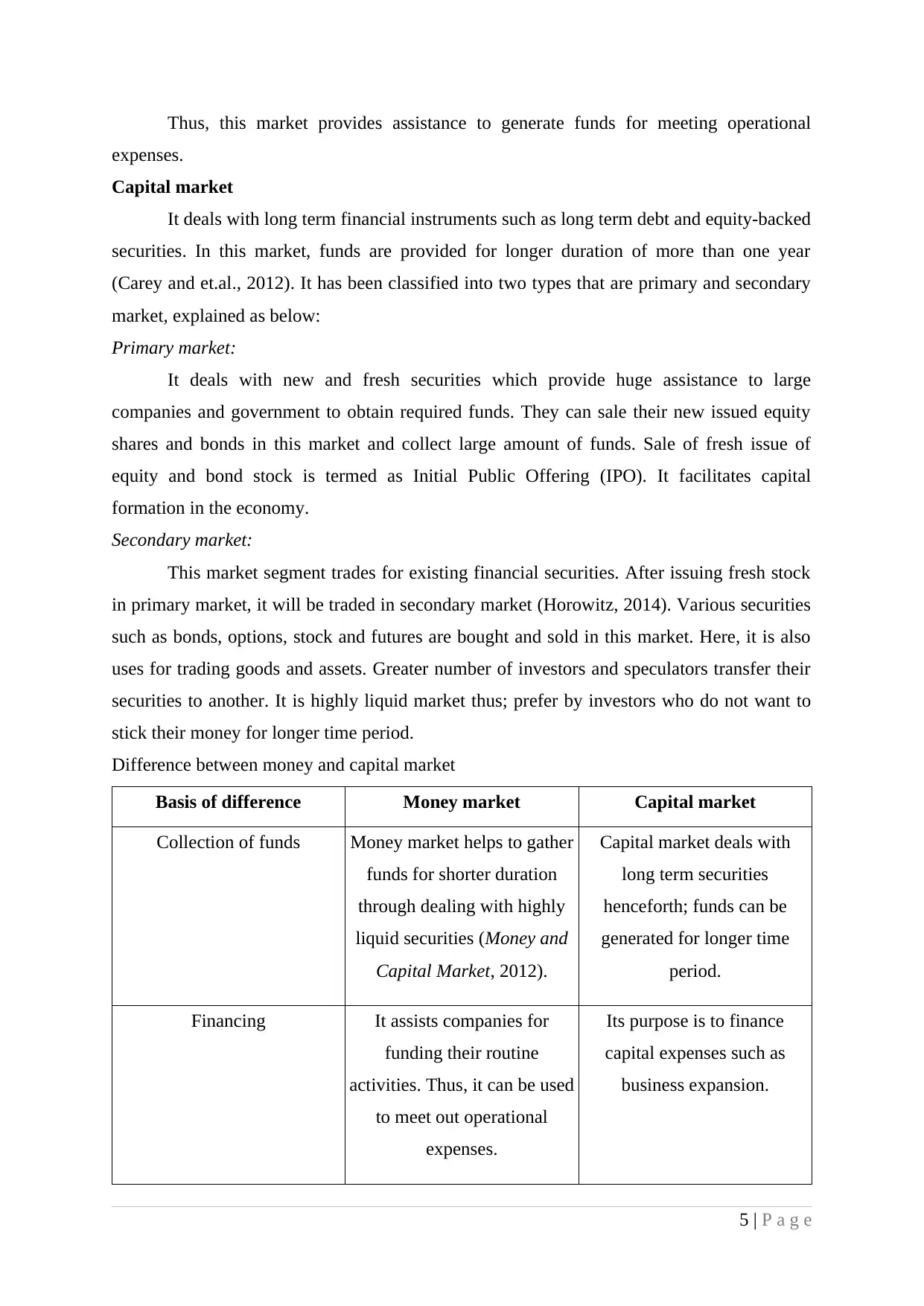

Thus, this market provides assistance to generate funds for meeting operational

expenses.

Capital market

It deals with long term financial instruments such as long term debt and equity-backed

securities. In this market, funds are provided for longer duration of more than one year

(Carey and et.al., 2012). It has been classified into two types that are primary and secondary

market, explained as below:

Primary market:

It deals with new and fresh securities which provide huge assistance to large

companies and government to obtain required funds. They can sale their new issued equity

shares and bonds in this market and collect large amount of funds. Sale of fresh issue of

equity and bond stock is termed as Initial Public Offering (IPO). It facilitates capital

formation in the economy.

Secondary market:

This market segment trades for existing financial securities. After issuing fresh stock

in primary market, it will be traded in secondary market (Horowitz, 2014). Various securities

such as bonds, options, stock and futures are bought and sold in this market. Here, it is also

uses for trading goods and assets. Greater number of investors and speculators transfer their

securities to another. It is highly liquid market thus; prefer by investors who do not want to

stick their money for longer time period.

Difference between money and capital market

Basis of difference Money market Capital market

Collection of funds Money market helps to gather

funds for shorter duration

through dealing with highly

liquid securities (Money and

Capital Market, 2012).

Capital market deals with

long term securities

henceforth; funds can be

generated for longer time

period.

Financing It assists companies for

funding their routine

activities. Thus, it can be used

to meet out operational

expenses.

Its purpose is to finance

capital expenses such as

business expansion.

5 | P a g e

expenses.

Capital market

It deals with long term financial instruments such as long term debt and equity-backed

securities. In this market, funds are provided for longer duration of more than one year

(Carey and et.al., 2012). It has been classified into two types that are primary and secondary

market, explained as below:

Primary market:

It deals with new and fresh securities which provide huge assistance to large

companies and government to obtain required funds. They can sale their new issued equity

shares and bonds in this market and collect large amount of funds. Sale of fresh issue of

equity and bond stock is termed as Initial Public Offering (IPO). It facilitates capital

formation in the economy.

Secondary market:

This market segment trades for existing financial securities. After issuing fresh stock

in primary market, it will be traded in secondary market (Horowitz, 2014). Various securities

such as bonds, options, stock and futures are bought and sold in this market. Here, it is also

uses for trading goods and assets. Greater number of investors and speculators transfer their

securities to another. It is highly liquid market thus; prefer by investors who do not want to

stick their money for longer time period.

Difference between money and capital market

Basis of difference Money market Capital market

Collection of funds Money market helps to gather

funds for shorter duration

through dealing with highly

liquid securities (Money and

Capital Market, 2012).

Capital market deals with

long term securities

henceforth; funds can be

generated for longer time

period.

Financing It assists companies for

funding their routine

activities. Thus, it can be used

to meet out operational

expenses.

Its purpose is to finance

capital expenses such as

business expansion.

5 | P a g e

Difference between primary and secondary market

Basis of difference Primary market Secondary market

Securities It trades with new and fresh

securities.

It deals with existed securities

which are currently trading in

the market (Handtke, 2012).

Purchases Investors purchase shares and

bonds through issuing

companies.

Investors purchase securities

from other investors rather

than issuing organizations.

Dealing It deals through registering

securities in the stock

exchange.

Securities are dealing at

Over-the-Counter market

(OTC). It refers to the

securities that are not traded

at stock exchanges.

FINANCIAL DERIVATIVES

Derivative is the contract of various assets which will be settled between two or more

parties in the future period to manage associated risk. Assets comprise bonds, stocks,

commodities, currencies and interest rates. Financial derivatives are the instrument or

indicators through which financial risks can be minimized (Hirsa and Neftci, 2013). It can be

traded at Over-The-Counter (OTC) market and any stock exchange. It enables parties to trade

various financial risks such as currency, equity, price risks, credit risk and interest rate risk.

There are number of available financial derivatives which can be used by

organizations for controlling and eliminating their financial risk, given as below:

Options

Futures

Swaps Credit derivatives

Options

It is an agreement which gives right and opportunity but not the obligation to the

option holder to buy or sell any financial security at a specified future date at prevailing strike

price (Chellaboina, Bhat and Shikha, 2014). These rights can be purchased by paying its

6 | P a g e

Basis of difference Primary market Secondary market

Securities It trades with new and fresh

securities.

It deals with existed securities

which are currently trading in

the market (Handtke, 2012).

Purchases Investors purchase shares and

bonds through issuing

companies.

Investors purchase securities

from other investors rather

than issuing organizations.

Dealing It deals through registering

securities in the stock

exchange.

Securities are dealing at

Over-the-Counter market

(OTC). It refers to the

securities that are not traded

at stock exchanges.

FINANCIAL DERIVATIVES

Derivative is the contract of various assets which will be settled between two or more

parties in the future period to manage associated risk. Assets comprise bonds, stocks,

commodities, currencies and interest rates. Financial derivatives are the instrument or

indicators through which financial risks can be minimized (Hirsa and Neftci, 2013). It can be

traded at Over-The-Counter (OTC) market and any stock exchange. It enables parties to trade

various financial risks such as currency, equity, price risks, credit risk and interest rate risk.

There are number of available financial derivatives which can be used by

organizations for controlling and eliminating their financial risk, given as below:

Options

Futures

Swaps Credit derivatives

Options

It is an agreement which gives right and opportunity but not the obligation to the

option holder to buy or sell any financial security at a specified future date at prevailing strike

price (Chellaboina, Bhat and Shikha, 2014). These rights can be purchased by paying its

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

charges, called premium. There are two types of options that are call and put option,

described underneath:

Call option

It gives the holder right to purchase a security at a specified price for a fixed time

interval. It is often used by investors if they assume that in future period, share prices may

raise.

Put option

Put option is the selling right of option holder to sell an underlying assets at a

specified strike price before the expiration date or maturity period. When investors feel that

share prices may be fall in future years, then they buy put option to sell their stock at high

prices.

Futures

It is the most significant type of derivatives which is generally used in the market.

Future contract is an agreement that can be exercised between two parties for sale of assets

(Sullivan, 2013). The contract will be settle down at agreed prices and on predetermined date

in future. It is highly used by corporations to mitigate or hedge their financial risk at a

particular point of time.

Swaps

It is a contract or agreement in which two parties are agreeing for trade loan terms and

exchange their associated cash flows to each other. It is greatly used to manage financial risk

which can be arising due to fluctuation in interest rates. It is because; high interest rate

imposes high financial obligations to the company and vice versa. Under the interest rate

swaps, counter-parties will be agreeing to exchange their variable interest rate loan with the

fixed interest rate loan (Chance and Brooks, 2015). Thereafter, both the parties will pay

towards other person obligations upon mutually agreed rate. Lastly, on the maturity date,

principle amount will be again transferred to the original party. It is very risky method

because; if one party may fail or goes default of bankruptcy then it will force other party to

get back to their original loan (Subrahmanyam, Tang and Wang, 2016).

Credit derivatives

Credit derivatives are the contract between counter-parties allowing them to manage

their credit risk. For example; if bank feels that customers are unable to repay their

borrowings then bank may use credit derivatives to transfer credit risk to another party. It will

provide huge assistance to financial institutions to protect towards foreseen credit risk.

7 | P a g e

described underneath:

Call option

It gives the holder right to purchase a security at a specified price for a fixed time

interval. It is often used by investors if they assume that in future period, share prices may

raise.

Put option

Put option is the selling right of option holder to sell an underlying assets at a

specified strike price before the expiration date or maturity period. When investors feel that

share prices may be fall in future years, then they buy put option to sell their stock at high

prices.

Futures

It is the most significant type of derivatives which is generally used in the market.

Future contract is an agreement that can be exercised between two parties for sale of assets

(Sullivan, 2013). The contract will be settle down at agreed prices and on predetermined date

in future. It is highly used by corporations to mitigate or hedge their financial risk at a

particular point of time.

Swaps

It is a contract or agreement in which two parties are agreeing for trade loan terms and

exchange their associated cash flows to each other. It is greatly used to manage financial risk

which can be arising due to fluctuation in interest rates. It is because; high interest rate

imposes high financial obligations to the company and vice versa. Under the interest rate

swaps, counter-parties will be agreeing to exchange their variable interest rate loan with the

fixed interest rate loan (Chance and Brooks, 2015). Thereafter, both the parties will pay

towards other person obligations upon mutually agreed rate. Lastly, on the maturity date,

principle amount will be again transferred to the original party. It is very risky method

because; if one party may fail or goes default of bankruptcy then it will force other party to

get back to their original loan (Subrahmanyam, Tang and Wang, 2016).

Credit derivatives

Credit derivatives are the contract between counter-parties allowing them to manage

their credit risk. For example; if bank feels that customers are unable to repay their

borrowings then bank may use credit derivatives to transfer credit risk to another party. It will

provide huge assistance to financial institutions to protect towards foreseen credit risk.

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

Presented report concluded that dividend policy greatly assist management to manage

regular dividend. Financial market helps to collect required funds for different time duration

whereas derivatives are the effective tools to hedge financial risk. Thus, it can be concluded

that all the techniques help to ensure effective management of funds in the businesses.

8 | P a g e

Presented report concluded that dividend policy greatly assist management to manage

regular dividend. Financial market helps to collect required funds for different time duration

whereas derivatives are the effective tools to hedge financial risk. Thus, it can be concluded

that all the techniques help to ensure effective management of funds in the businesses.

8 | P a g e

REFERENCES

Books and Journals

Carey, M. and et.al., 2012. Market institutions, financial market risks, and the financial crisis.

Journal of Financial Economics. 104(3). pp. 421-424.

Chance, D. and Brooks, R., 2015. Introduction to derivatives and risk management. Cengage

Learning.

Chellaboina, V., Bhat, S. P. and Shikha, D., 2014. On pricing and optimal hedging of path-

dependent financial derivatives. Nonlinear Studies. 21(2).

Deshmukh, S., Goel, A. M. and Howe, K. M., 2013. CEO overconfidence and dividend

policy. Journal of Financial Intermediation. 22(3). pp. 440-463.

Dieckmann, S. and Plank, T., 2012. Default risk of advanced economies: An empirical

analysis of credit default swaps during the financial crisis. Review of Finance. 16(4).

pp. 903-934.

Hirsa, A. and Neftci, S. N., 2013. An introduction to the mathematics of financial derivatives.

Academic Press.

Horowitz, N., 2014. Art of the deal: Contemporary art in a global financial market. Princeton

University Press.

Loudermilk, M. S., 2012. Estimation of fractional dependent variables in dynamic panel data

models with an application to firm dividend policy. Journal of Business & Economic

Statistics.

Murto, P. and Terviö, M., 2014. Exit options and dividend policy under liquidity constraints.

International Economic Review. 55(1). pp. 197-221.

Naser, K., Nuseibeh, R. and Rashed, W., 2013. Managers' perception of dividend policy:

Evidence from companies listed on Abu Dhabi Securities Exchange. Issues in

Business Management and Economics. 1(1). pp. 1-12.

Renneboog, L. and Szilagyi, P. G., 2015. How relevant is dividend policy under low

shareholder protection?. Journal of International Financial Markets, Institutions and

Money.

Segal, G., Shaliastovich, I. and Yaron, A., 2015. Good and bad uncertainty: Macroeconomic

and financial market implications. Journal of Financial Economics. 117(2). pp. 369-

397.

Subrahmanyam, M. G., Tang, D. Y. and Wang, S. Q., 2016. Does the tail wag the dog? The

effect of credit default swaps on credit risk. In Development in India. Springer India.

pp. 199-236

Sullivan, S., 2013. Banking nature? The spectacular financialisation of environmental

conservation. Antipode. 45(1). pp. 198-217.

9 | P a g e

Books and Journals

Carey, M. and et.al., 2012. Market institutions, financial market risks, and the financial crisis.

Journal of Financial Economics. 104(3). pp. 421-424.

Chance, D. and Brooks, R., 2015. Introduction to derivatives and risk management. Cengage

Learning.

Chellaboina, V., Bhat, S. P. and Shikha, D., 2014. On pricing and optimal hedging of path-

dependent financial derivatives. Nonlinear Studies. 21(2).

Deshmukh, S., Goel, A. M. and Howe, K. M., 2013. CEO overconfidence and dividend

policy. Journal of Financial Intermediation. 22(3). pp. 440-463.

Dieckmann, S. and Plank, T., 2012. Default risk of advanced economies: An empirical

analysis of credit default swaps during the financial crisis. Review of Finance. 16(4).

pp. 903-934.

Hirsa, A. and Neftci, S. N., 2013. An introduction to the mathematics of financial derivatives.

Academic Press.

Horowitz, N., 2014. Art of the deal: Contemporary art in a global financial market. Princeton

University Press.

Loudermilk, M. S., 2012. Estimation of fractional dependent variables in dynamic panel data

models with an application to firm dividend policy. Journal of Business & Economic

Statistics.

Murto, P. and Terviö, M., 2014. Exit options and dividend policy under liquidity constraints.

International Economic Review. 55(1). pp. 197-221.

Naser, K., Nuseibeh, R. and Rashed, W., 2013. Managers' perception of dividend policy:

Evidence from companies listed on Abu Dhabi Securities Exchange. Issues in

Business Management and Economics. 1(1). pp. 1-12.

Renneboog, L. and Szilagyi, P. G., 2015. How relevant is dividend policy under low

shareholder protection?. Journal of International Financial Markets, Institutions and

Money.

Segal, G., Shaliastovich, I. and Yaron, A., 2015. Good and bad uncertainty: Macroeconomic

and financial market implications. Journal of Financial Economics. 117(2). pp. 369-

397.

Subrahmanyam, M. G., Tang, D. Y. and Wang, S. Q., 2016. Does the tail wag the dog? The

effect of credit default swaps on credit risk. In Development in India. Springer India.

pp. 199-236

Sullivan, S., 2013. Banking nature? The spectacular financialisation of environmental

conservation. Antipode. 45(1). pp. 198-217.

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Online

Engombe, M. T., 2014. Dividend policy and its impact on firms value: A review of theories

and Empiricalm Evidence. [PDF]. Available through:

<http://www.academia.edu/8447440/Dividend_policy_and_its_impact_on_firm_valu

e_A_Review_of_Theories_and_Empirical_Evidence>. [Accessed on 3rd March,

2016].

Handtke, K. E., 2012. Primary and secondary market. [PDF]. Available through:

<http://www.levyinstitute.org/pubs/wp_741.pdf>. [Accessed on 3rd March, 2016].

Money and Capital Market. 2012. [PDF]. Available through:

<https://www.dst.dk/Site/Dst/Udgivelser/GetPubFile.aspx?id=16251&sid=18mon>.

[Accessed on 3rd March, 2016].

10 | P a g e

Engombe, M. T., 2014. Dividend policy and its impact on firms value: A review of theories

and Empiricalm Evidence. [PDF]. Available through:

<http://www.academia.edu/8447440/Dividend_policy_and_its_impact_on_firm_valu

e_A_Review_of_Theories_and_Empirical_Evidence>. [Accessed on 3rd March,

2016].

Handtke, K. E., 2012. Primary and secondary market. [PDF]. Available through:

<http://www.levyinstitute.org/pubs/wp_741.pdf>. [Accessed on 3rd March, 2016].

Money and Capital Market. 2012. [PDF]. Available through:

<https://www.dst.dk/Site/Dst/Udgivelser/GetPubFile.aspx?id=16251&sid=18mon>.

[Accessed on 3rd March, 2016].

10 | P a g e

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.