Microeconomics 101 Essay: Perfect Competition vs Monopoly

VerifiedAdded on 2023/06/03

|11

|2800

|195

Essay

AI Summary

This essay delves into the concept of efficient market structures, contrasting the models of perfect competition and monopoly within the field of microeconomics. The analysis encompasses the key parameters of efficiency, namely allocative, productive, and technological efficiency, to evaluate the performance of each market structure. The essay highlights the characteristics of perfect competition, including a large number of firms, homogeneous products, and free entry, and contrasts them with the characteristics of a monopoly. It examines allocative efficiency by comparing the equilibrium conditions (P=MC) in perfect competition with the price-making power of monopolies. Productive efficiency is assessed through the lens of production possibility curves, while technological efficiency is evaluated by considering cost minimization and innovation incentives. Furthermore, the essay acknowledges exceptions and complexities, such as contestable markets, externalities, and price discrimination, to provide a comprehensive understanding of market efficiency in real-world scenarios. Ultimately, the essay concludes by summarizing the relative strengths and weaknesses of each market structure, considering factors like market power and barriers to entry, and their implications for economic outcomes.

Running head: MICROECONOMICS 101

Microeconomics 101: Economics Essay

Name of the Student:

Name of the University:

Authors Note:

Microeconomics 101: Economics Essay

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MICROECONOMICS 101

What is meant by an efficient market structure and compare and contrast perfectly

competitive model with monopoly in the market place?

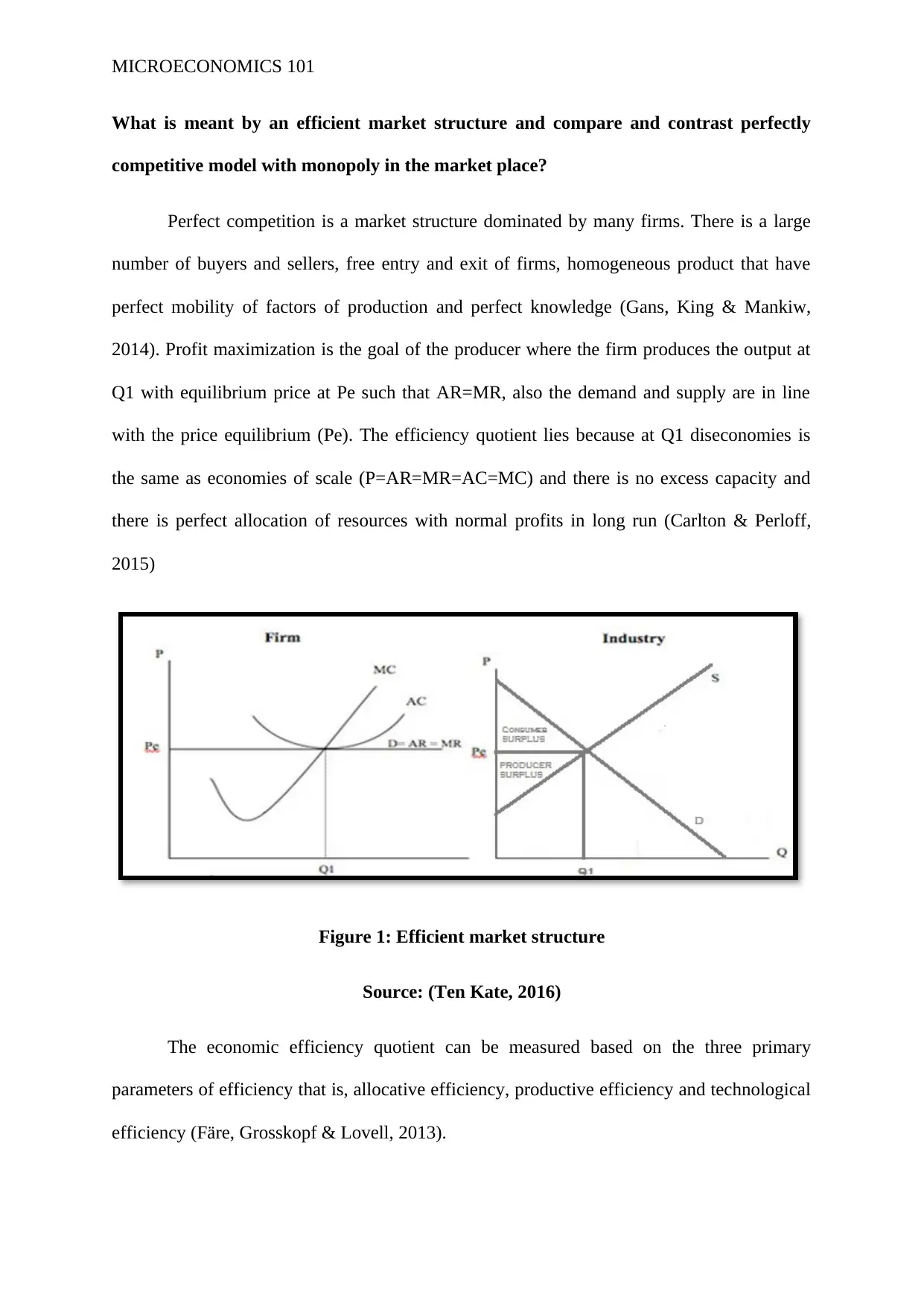

Perfect competition is a market structure dominated by many firms. There is a large

number of buyers and sellers, free entry and exit of firms, homogeneous product that have

perfect mobility of factors of production and perfect knowledge (Gans, King & Mankiw,

2014). Profit maximization is the goal of the producer where the firm produces the output at

Q1 with equilibrium price at Pe such that AR=MR, also the demand and supply are in line

with the price equilibrium (Pe). The efficiency quotient lies because at Q1 diseconomies is

the same as economies of scale (P=AR=MR=AC=MC) and there is no excess capacity and

there is perfect allocation of resources with normal profits in long run (Carlton & Perloff,

2015)

Figure 1: Efficient market structure

Source: (Ten Kate, 2016)

The economic efficiency quotient can be measured based on the three primary

parameters of efficiency that is, allocative efficiency, productive efficiency and technological

efficiency (Färe, Grosskopf & Lovell, 2013).

What is meant by an efficient market structure and compare and contrast perfectly

competitive model with monopoly in the market place?

Perfect competition is a market structure dominated by many firms. There is a large

number of buyers and sellers, free entry and exit of firms, homogeneous product that have

perfect mobility of factors of production and perfect knowledge (Gans, King & Mankiw,

2014). Profit maximization is the goal of the producer where the firm produces the output at

Q1 with equilibrium price at Pe such that AR=MR, also the demand and supply are in line

with the price equilibrium (Pe). The efficiency quotient lies because at Q1 diseconomies is

the same as economies of scale (P=AR=MR=AC=MC) and there is no excess capacity and

there is perfect allocation of resources with normal profits in long run (Carlton & Perloff,

2015)

Figure 1: Efficient market structure

Source: (Ten Kate, 2016)

The economic efficiency quotient can be measured based on the three primary

parameters of efficiency that is, allocative efficiency, productive efficiency and technological

efficiency (Färe, Grosskopf & Lovell, 2013).

MICROECONOMICS 101

For allocative efficiency, the market structure should fulfil two criteria’s one is

Marginal social benefit is equal to marginal social cost (MSB = MSC) and price and marginal

cost should be equal (P = MC) (Waldman & Jensen, 2016). Then for productive efficiency,

the resources should be optimally utilized which can be well depicted by production

possibility curve (PPC) and lastly technological efficiency is achieved when each firm in the

industry produce at the minimum of Average Total Cost (ATC) Curve (Becker, 2017). When

comparing the market structure for perfectly competitive market and monopoly, the economic

efficiency can be achieved if all the three efficiencies are fulfilled.

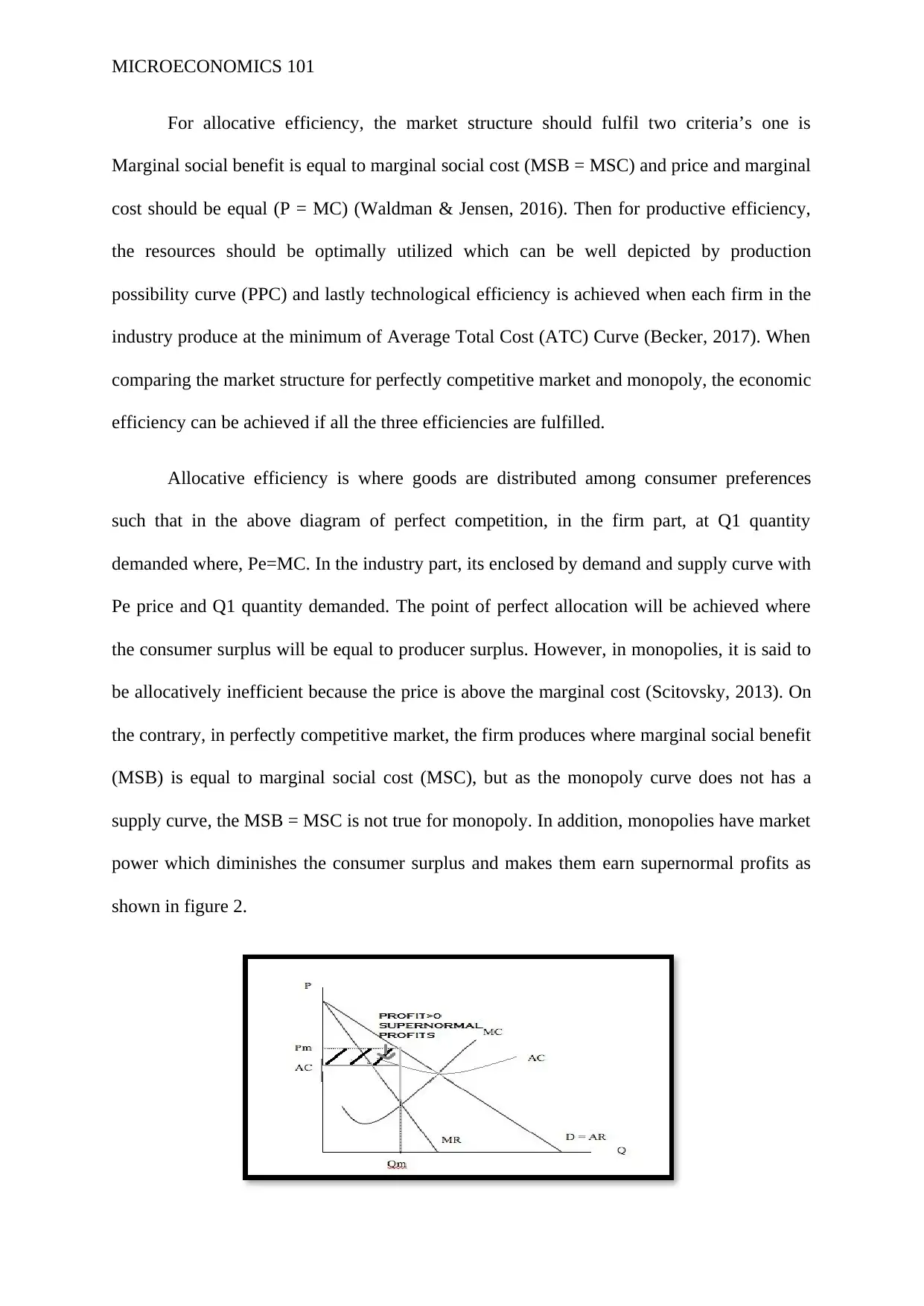

Allocative efficiency is where goods are distributed among consumer preferences

such that in the above diagram of perfect competition, in the firm part, at Q1 quantity

demanded where, Pe=MC. In the industry part, its enclosed by demand and supply curve with

Pe price and Q1 quantity demanded. The point of perfect allocation will be achieved where

the consumer surplus will be equal to producer surplus. However, in monopolies, it is said to

be allocatively inefficient because the price is above the marginal cost (Scitovsky, 2013). On

the contrary, in perfectly competitive market, the firm produces where marginal social benefit

(MSB) is equal to marginal social cost (MSC), but as the monopoly curve does not has a

supply curve, the MSB = MSC is not true for monopoly. In addition, monopolies have market

power which diminishes the consumer surplus and makes them earn supernormal profits as

shown in figure 2.

For allocative efficiency, the market structure should fulfil two criteria’s one is

Marginal social benefit is equal to marginal social cost (MSB = MSC) and price and marginal

cost should be equal (P = MC) (Waldman & Jensen, 2016). Then for productive efficiency,

the resources should be optimally utilized which can be well depicted by production

possibility curve (PPC) and lastly technological efficiency is achieved when each firm in the

industry produce at the minimum of Average Total Cost (ATC) Curve (Becker, 2017). When

comparing the market structure for perfectly competitive market and monopoly, the economic

efficiency can be achieved if all the three efficiencies are fulfilled.

Allocative efficiency is where goods are distributed among consumer preferences

such that in the above diagram of perfect competition, in the firm part, at Q1 quantity

demanded where, Pe=MC. In the industry part, its enclosed by demand and supply curve with

Pe price and Q1 quantity demanded. The point of perfect allocation will be achieved where

the consumer surplus will be equal to producer surplus. However, in monopolies, it is said to

be allocatively inefficient because the price is above the marginal cost (Scitovsky, 2013). On

the contrary, in perfectly competitive market, the firm produces where marginal social benefit

(MSB) is equal to marginal social cost (MSC), but as the monopoly curve does not has a

supply curve, the MSB = MSC is not true for monopoly. In addition, monopolies have market

power which diminishes the consumer surplus and makes them earn supernormal profits as

shown in figure 2.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MICROECONOMICS 101

Figure 2: Allocative inefficiency in Monopoly

Source: (Scitovsky, 2013)

Mathematically, allocative efficiency can even be studied using Pareto Optimality

where by describing specific levels of consumptions for a consumer can be determined with

specific input with each producers output level. Although, pareto optimality is the basis for

welfare economics but it cannot be used to increase the utility of an individual without

decreasing the utility of others. Nevertheless, if individually in perfectly competitive market,

the rate of consumer substitution (RCS) is analysed for a pair of goods on a price ratio, it can

be given as:

RCSjk = pj/ pk (where j and k are commodities/ factors)

However, when the firms are profit maximisers then,

RPTjk (Rate of product transformation) = pj/ pk

MPjk (Marginal Product) = pj/ pk (Both j and k refers to factors)

RPTjk = RCSjk. (Hence, as per the condition, pareto optimality is seen in perfectly

competitive market) (Henderson & Quandt, 2013).

On the contrary, if prices were not equal to Marginal Cost then prices are proportional

to MC. Equating in terms of pi/ pj = (1/ θ)*MPij ; pi/ pk = (1/ θ)*MPik (j and k commodities and

i is factor). Therefore, perfect competition characterizes to be a welfare ideal for requirements

of Pareto optimality if the assumptions are not violated. It cannot be said the same for

imperfect competition or monopoly because in commodity market or factor market it does

not satisfy the optimal resource allocation,

MP = r/p = RCS

Figure 2: Allocative inefficiency in Monopoly

Source: (Scitovsky, 2013)

Mathematically, allocative efficiency can even be studied using Pareto Optimality

where by describing specific levels of consumptions for a consumer can be determined with

specific input with each producers output level. Although, pareto optimality is the basis for

welfare economics but it cannot be used to increase the utility of an individual without

decreasing the utility of others. Nevertheless, if individually in perfectly competitive market,

the rate of consumer substitution (RCS) is analysed for a pair of goods on a price ratio, it can

be given as:

RCSjk = pj/ pk (where j and k are commodities/ factors)

However, when the firms are profit maximisers then,

RPTjk (Rate of product transformation) = pj/ pk

MPjk (Marginal Product) = pj/ pk (Both j and k refers to factors)

RPTjk = RCSjk. (Hence, as per the condition, pareto optimality is seen in perfectly

competitive market) (Henderson & Quandt, 2013).

On the contrary, if prices were not equal to Marginal Cost then prices are proportional

to MC. Equating in terms of pi/ pj = (1/ θ)*MPij ; pi/ pk = (1/ θ)*MPik (j and k commodities and

i is factor). Therefore, perfect competition characterizes to be a welfare ideal for requirements

of Pareto optimality if the assumptions are not violated. It cannot be said the same for

imperfect competition or monopoly because in commodity market or factor market it does

not satisfy the optimal resource allocation,

MP = r/p = RCS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MICROECONOMICS 101

p = r/ MP = MC

p * MP = r, this equation does not satisfy for one or more sellers making it pareto

nonoptimal for the monopoly market structure (Henderson & Quandt, 2013).

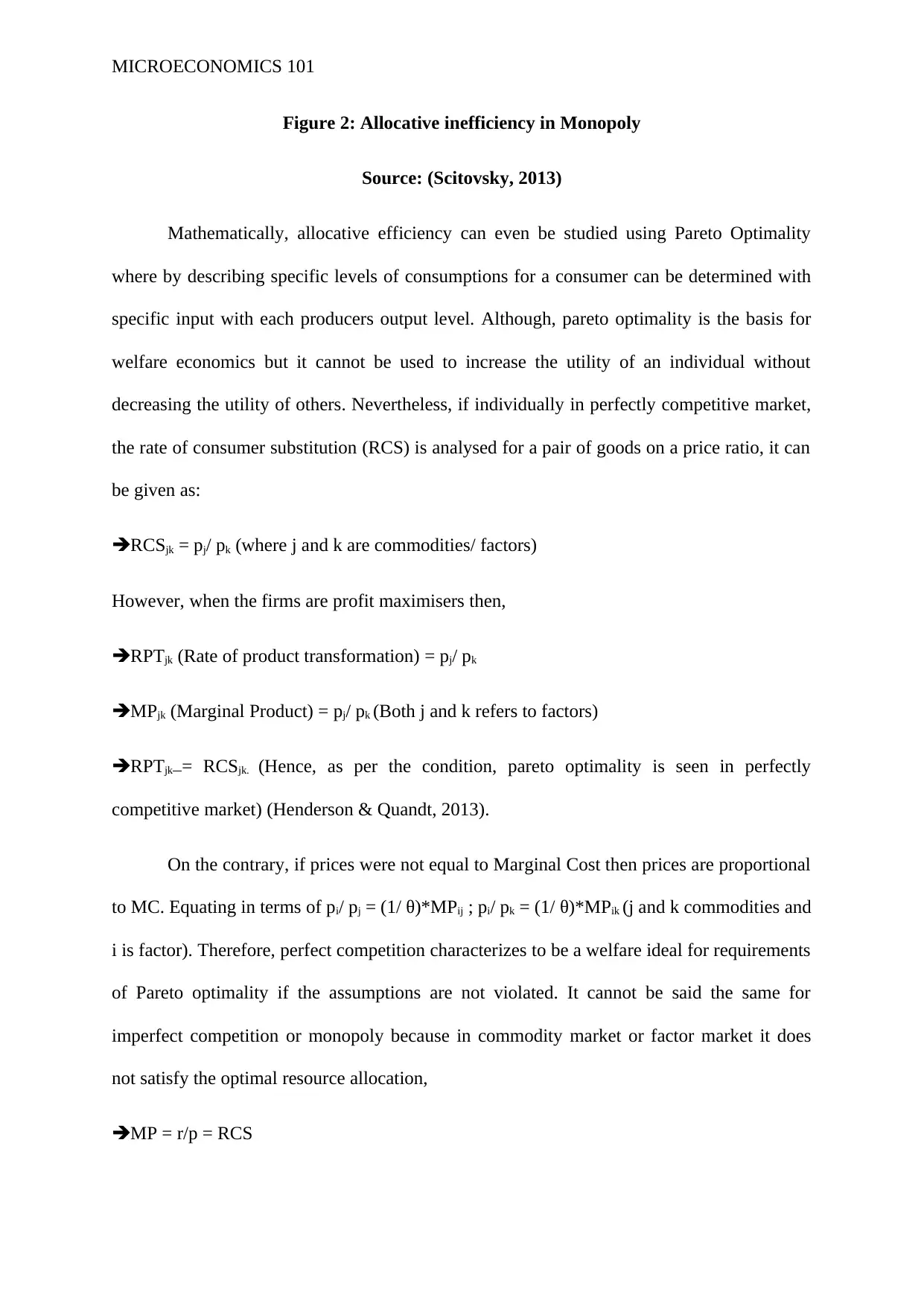

On the other hand, productive efficiency is the optimal combination of the goods

produced with the inputs to produce maximum output for the minimum cost. Productive

efficiency can be explained with production possibility frontier (PPC) where loss of output on

one good leads to gain of output of other (Stryk, 2013).

Figure 3: Production Possibility Curve

Source: (Pindyck & Rubinfeld, 2015)

Diagrammatically in figure 3, it can be explained that point A is productively efficient

whereas B and C are productively inefficient because more of goods and services can be

utilized with no opportunity cost. Based on the analysis of market structure, perfect

competition is productively efficient where AC is at its minimum whereas the same cannot be

said for monopoly (Waldman & Jensen, 2016).

Thirdly, technological efficiency can be stated in two ways whether with given the

output produced, the costs of production are minimized or whether given the costs of

production, the output is maximized. In perfectly competitive market, the firms are producing

p = r/ MP = MC

p * MP = r, this equation does not satisfy for one or more sellers making it pareto

nonoptimal for the monopoly market structure (Henderson & Quandt, 2013).

On the other hand, productive efficiency is the optimal combination of the goods

produced with the inputs to produce maximum output for the minimum cost. Productive

efficiency can be explained with production possibility frontier (PPC) where loss of output on

one good leads to gain of output of other (Stryk, 2013).

Figure 3: Production Possibility Curve

Source: (Pindyck & Rubinfeld, 2015)

Diagrammatically in figure 3, it can be explained that point A is productively efficient

whereas B and C are productively inefficient because more of goods and services can be

utilized with no opportunity cost. Based on the analysis of market structure, perfect

competition is productively efficient where AC is at its minimum whereas the same cannot be

said for monopoly (Waldman & Jensen, 2016).

Thirdly, technological efficiency can be stated in two ways whether with given the

output produced, the costs of production are minimized or whether given the costs of

production, the output is maximized. In perfectly competitive market, the firms are producing

MICROECONOMICS 101

on their cost curves and all the firms wishes to minimize the costs so that the profits are not

maximised. In addition, the perfectly competitive market gives zero profit in the long run.

However, profit in the industry are producing at the minimum point on ATC to not be driven

out of business in long run by its efficiently placed competitors (Pindyck & Rubinfeld, 2015).

Whereas in a monopoly, the firms are not producing on their cost curves because a

monopoly operates on minimizing costs and increasing profits and the industry is even not

producing on the minimum point on the cost curve ATC because the Pm >AC. Hence, its

producing too little at a high price (Zeuthen, 2018).

According to the comparisons between perfectly competitive market and monopoly,

the perfectly competitive market is efficient because they have the least market power and

yield the efficient outcome whereas the same cannot be said for monopoly. Monopoly is a

“Price Maker” and deals with one commodity whereas perfectly competitive market is a

“Price Taker” and deals with homogeneous products (Waldman & Jensen, 2016). In the

actual world perfect competition is a myth but there is prevalence of perfect competition in

agriculture and local farm products where there are many fruits and vegetables sold at the

same price with no competition at all.

However, there are certain exceptions to the analysis that needs to be examined

because there are times when the perfectly competitive market cannot be as efficient as

understood and monopoly cannot be inefficient as presumed (Kirzner, 2015). There are

exception of both types that can be described additional to the given analysis. When in terms

of contestable markets, it has single or less firms which produce a product with no close

substitutes and there is no competition from other firms (Mahoney & Weyl, 2017). Also, it

keeps the costs under control with minimum wastage of the resources and even from further

exploitation of the consumers by setting high prices and gaining from its profit margins. As a

result, there are no barriers to entry, that is, entry and exit are cost free and exhibits level of

on their cost curves and all the firms wishes to minimize the costs so that the profits are not

maximised. In addition, the perfectly competitive market gives zero profit in the long run.

However, profit in the industry are producing at the minimum point on ATC to not be driven

out of business in long run by its efficiently placed competitors (Pindyck & Rubinfeld, 2015).

Whereas in a monopoly, the firms are not producing on their cost curves because a

monopoly operates on minimizing costs and increasing profits and the industry is even not

producing on the minimum point on the cost curve ATC because the Pm >AC. Hence, its

producing too little at a high price (Zeuthen, 2018).

According to the comparisons between perfectly competitive market and monopoly,

the perfectly competitive market is efficient because they have the least market power and

yield the efficient outcome whereas the same cannot be said for monopoly. Monopoly is a

“Price Maker” and deals with one commodity whereas perfectly competitive market is a

“Price Taker” and deals with homogeneous products (Waldman & Jensen, 2016). In the

actual world perfect competition is a myth but there is prevalence of perfect competition in

agriculture and local farm products where there are many fruits and vegetables sold at the

same price with no competition at all.

However, there are certain exceptions to the analysis that needs to be examined

because there are times when the perfectly competitive market cannot be as efficient as

understood and monopoly cannot be inefficient as presumed (Kirzner, 2015). There are

exception of both types that can be described additional to the given analysis. When in terms

of contestable markets, it has single or less firms which produce a product with no close

substitutes and there is no competition from other firms (Mahoney & Weyl, 2017). Also, it

keeps the costs under control with minimum wastage of the resources and even from further

exploitation of the consumers by setting high prices and gaining from its profit margins. As a

result, there are no barriers to entry, that is, entry and exit are cost free and exhibits level of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MICROECONOMICS 101

economic efficiency in long run (Page, 2013). Hence, a monopoly will not raise its price to its

monopoly price because there is no threat for the competition that exists.

Externalities, can be other point, where the exchange happening between buyer and

seller can be affected to the third party whether negatively or positively. In regards to positive

externality, the third party has gained from the exchange because there is no demand curve

but only private advantage of the product (Okun, 2015). In this case, MSB exceeds the

demand curve. In contrast to this, negative externality is when the third party has suffered

loss from the exchange because the cost is not equal to the supply curve as it only includes

the costs of production of the product to the sellers making marginal social cost higher than

supply curve. When analysed from the perspective of allocative efficiency in perfectly

competitive market, there will be misallocation of resources such that there will be less

output at a low price (positive externality) or more output at a low price (negative externality)

(Pindyck & Rubinfeld, 2015).

A monopolist can charge different price from different customers. The maximum

price which a consumer is willing to pay is knows as Reservation Price. This happens

because cost of production differs. For example, the people who go to see a movie in a

matinee hall will be charged a lower price than the people who go to see a movie in a

multiplex. This helps in increasing the efficiencies of monopoly and is done on the basis of

people who wish to give away their consumer surplus (Waldman & Jensen, 2016).

Alternatively, natural monopoly termed as monopoly of a firm can price the entire

output of the market at a cost lower than other several firms. This kind of monopoly arises

due to strong economies of scale. A single large firm always has lower average costs than do

smaller firms, the larger firm will always be able to drive out smaller, less cost-effective,

competitors (Hayek, 2016). A monopolized industry will be the natural result of this process.

economic efficiency in long run (Page, 2013). Hence, a monopoly will not raise its price to its

monopoly price because there is no threat for the competition that exists.

Externalities, can be other point, where the exchange happening between buyer and

seller can be affected to the third party whether negatively or positively. In regards to positive

externality, the third party has gained from the exchange because there is no demand curve

but only private advantage of the product (Okun, 2015). In this case, MSB exceeds the

demand curve. In contrast to this, negative externality is when the third party has suffered

loss from the exchange because the cost is not equal to the supply curve as it only includes

the costs of production of the product to the sellers making marginal social cost higher than

supply curve. When analysed from the perspective of allocative efficiency in perfectly

competitive market, there will be misallocation of resources such that there will be less

output at a low price (positive externality) or more output at a low price (negative externality)

(Pindyck & Rubinfeld, 2015).

A monopolist can charge different price from different customers. The maximum

price which a consumer is willing to pay is knows as Reservation Price. This happens

because cost of production differs. For example, the people who go to see a movie in a

matinee hall will be charged a lower price than the people who go to see a movie in a

multiplex. This helps in increasing the efficiencies of monopoly and is done on the basis of

people who wish to give away their consumer surplus (Waldman & Jensen, 2016).

Alternatively, natural monopoly termed as monopoly of a firm can price the entire

output of the market at a cost lower than other several firms. This kind of monopoly arises

due to strong economies of scale. A single large firm always has lower average costs than do

smaller firms, the larger firm will always be able to drive out smaller, less cost-effective,

competitors (Hayek, 2016). A monopolized industry will be the natural result of this process.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MICROECONOMICS 101

Economies of scope arise in terms of a single situation when one good is profitable and other

is not and both can be produced at lower average cost than the other small competitors

(becker, 2013). The scope of production, in contrast to the scale of production, prefers not to

increasing the quantity produced but to increasing the number of products produced by the

firm. For example, railways, hospitals, etc.

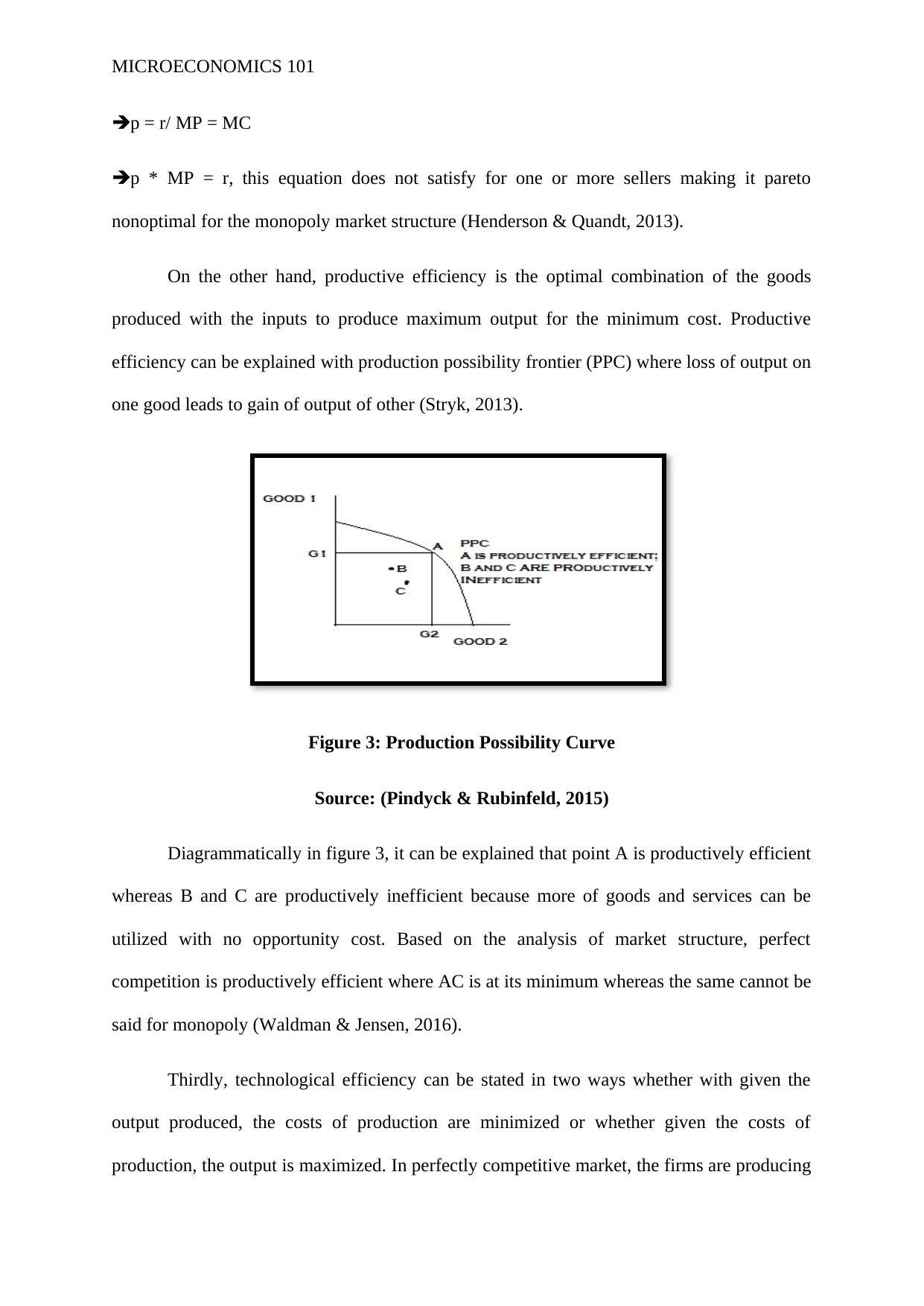

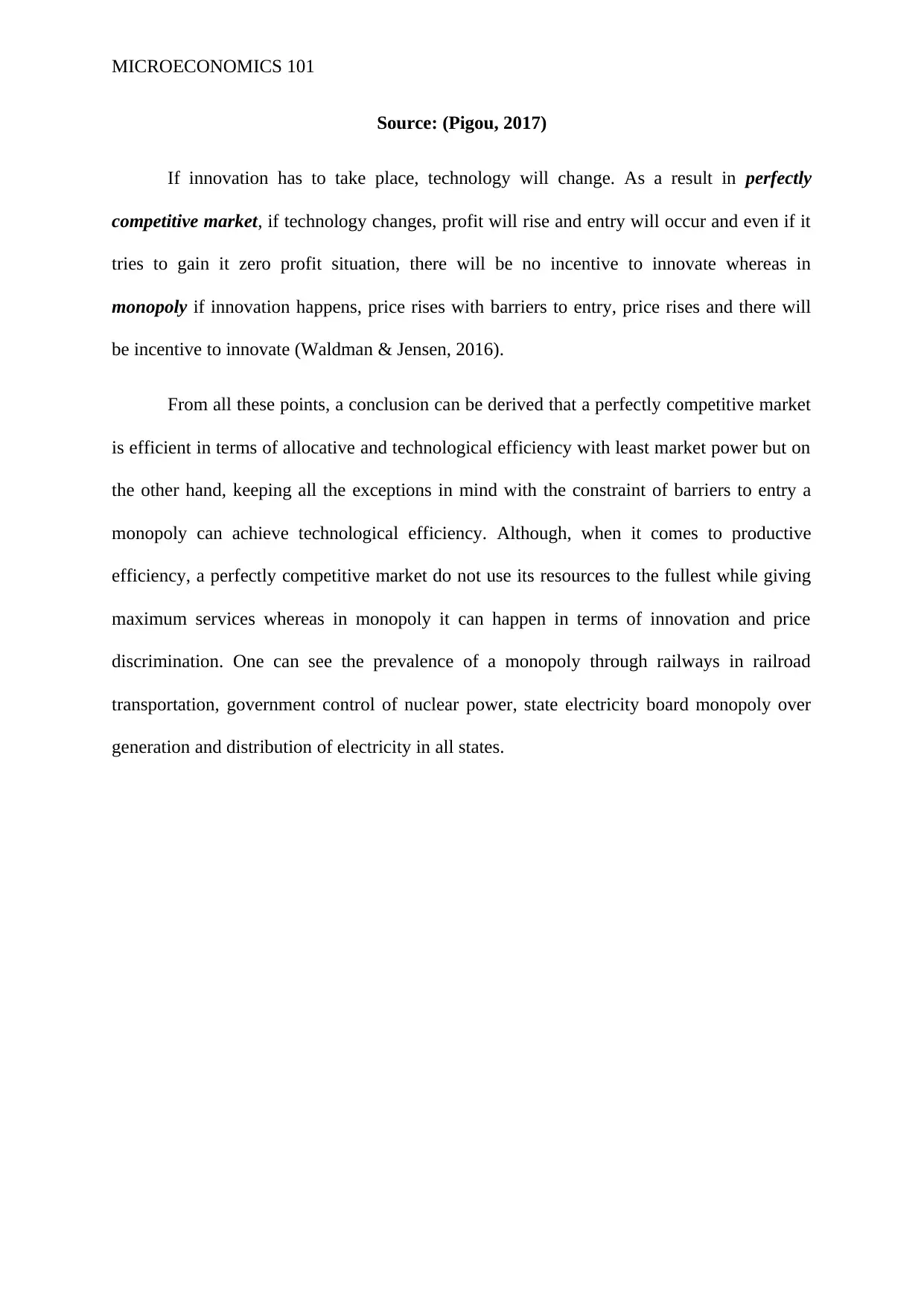

Price discrimination is other factor where a different price is charged to a different

customer even though the cost of production remains the same (Pigou, 2017). This is one

exception that supports monopoly’s efficiency based on three requirements – one is that the

firm should have some market power not importantly a monopolist but not even a perfectly

competitive firms; second firms must be able to separate the market in two groups at least to

identify the group who will pay higher or lower and third is reselling of the products are

important. However, if perfect price discrimination is considered then a minimum of two

groups have been made upon knowledge. In this case, when discriminating price, marginal

revenue will be equal to demand because the price charged to first customer would be the

same irrespective of the price to the following customers (Weyl & Fabinger, 2013).

Diagrammatically in figure 4, P = MR and P = MC creating allocative efficient output.

Figure 4: Perfect Price Discrimination

Economies of scope arise in terms of a single situation when one good is profitable and other

is not and both can be produced at lower average cost than the other small competitors

(becker, 2013). The scope of production, in contrast to the scale of production, prefers not to

increasing the quantity produced but to increasing the number of products produced by the

firm. For example, railways, hospitals, etc.

Price discrimination is other factor where a different price is charged to a different

customer even though the cost of production remains the same (Pigou, 2017). This is one

exception that supports monopoly’s efficiency based on three requirements – one is that the

firm should have some market power not importantly a monopolist but not even a perfectly

competitive firms; second firms must be able to separate the market in two groups at least to

identify the group who will pay higher or lower and third is reselling of the products are

important. However, if perfect price discrimination is considered then a minimum of two

groups have been made upon knowledge. In this case, when discriminating price, marginal

revenue will be equal to demand because the price charged to first customer would be the

same irrespective of the price to the following customers (Weyl & Fabinger, 2013).

Diagrammatically in figure 4, P = MR and P = MC creating allocative efficient output.

Figure 4: Perfect Price Discrimination

MICROECONOMICS 101

Source: (Pigou, 2017)

If innovation has to take place, technology will change. As a result in perfectly

competitive market, if technology changes, profit will rise and entry will occur and even if it

tries to gain it zero profit situation, there will be no incentive to innovate whereas in

monopoly if innovation happens, price rises with barriers to entry, price rises and there will

be incentive to innovate (Waldman & Jensen, 2016).

From all these points, a conclusion can be derived that a perfectly competitive market

is efficient in terms of allocative and technological efficiency with least market power but on

the other hand, keeping all the exceptions in mind with the constraint of barriers to entry a

monopoly can achieve technological efficiency. Although, when it comes to productive

efficiency, a perfectly competitive market do not use its resources to the fullest while giving

maximum services whereas in monopoly it can happen in terms of innovation and price

discrimination. One can see the prevalence of a monopoly through railways in railroad

transportation, government control of nuclear power, state electricity board monopoly over

generation and distribution of electricity in all states.

Source: (Pigou, 2017)

If innovation has to take place, technology will change. As a result in perfectly

competitive market, if technology changes, profit will rise and entry will occur and even if it

tries to gain it zero profit situation, there will be no incentive to innovate whereas in

monopoly if innovation happens, price rises with barriers to entry, price rises and there will

be incentive to innovate (Waldman & Jensen, 2016).

From all these points, a conclusion can be derived that a perfectly competitive market

is efficient in terms of allocative and technological efficiency with least market power but on

the other hand, keeping all the exceptions in mind with the constraint of barriers to entry a

monopoly can achieve technological efficiency. Although, when it comes to productive

efficiency, a perfectly competitive market do not use its resources to the fullest while giving

maximum services whereas in monopoly it can happen in terms of innovation and price

discrimination. One can see the prevalence of a monopoly through railways in railroad

transportation, government control of nuclear power, state electricity board monopoly over

generation and distribution of electricity in all states.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MICROECONOMICS 101

References

Becker, G. S. (2017). Economic theory. New York: Routledge.

Carlton, D. W., & Perloff, J. M. (2015). Modern industrial organization. Massachusetts:

Pearson Higher Ed.

Färe, R., Grosskopf, S., & Lovell, C. K. (2013). The measurement of efficiency of production

(Vol. 6). New York: Springer Science & Business Media.

Gans, J., King, S., & Mankiw, N. (2014). Principles of Microeconomics. Australia: Cengage

Learning.

Hayek, F. A. (2016). The meaning of competition. Econ Journal Watch, 13(2), 360-373.

Henderson, J. M., & Quandt, R. E. (2013). Microeconomic theory: A mathematical approach.

New York: McGraw-Hill

Kirzner, I. M. (2015). Competition and entrepreneurship. London: University of Chicago

press.

Mahoney, N., & Weyl, E. G. (2017). Imperfect competition in selection markets. Review of

Economics and Statistics, 99(4), 637-651.

Okun, A. M. (2015). Equality and efficiency: The big tradeoff. Washington: Brookings

Institution Press.

Page, T. (2013). Conservation and economic efficiency: an approach to materials policy.

New York: RFF Press.

Pigou, A. (2017). The economics of welfare. London: Routledge.

Pindyck, R., & Rubinfeld, D. (2015). Microeconomics, Global Edition (8th ed). Essex:

Pearson Education Limited.

References

Becker, G. S. (2017). Economic theory. New York: Routledge.

Carlton, D. W., & Perloff, J. M. (2015). Modern industrial organization. Massachusetts:

Pearson Higher Ed.

Färe, R., Grosskopf, S., & Lovell, C. K. (2013). The measurement of efficiency of production

(Vol. 6). New York: Springer Science & Business Media.

Gans, J., King, S., & Mankiw, N. (2014). Principles of Microeconomics. Australia: Cengage

Learning.

Hayek, F. A. (2016). The meaning of competition. Econ Journal Watch, 13(2), 360-373.

Henderson, J. M., & Quandt, R. E. (2013). Microeconomic theory: A mathematical approach.

New York: McGraw-Hill

Kirzner, I. M. (2015). Competition and entrepreneurship. London: University of Chicago

press.

Mahoney, N., & Weyl, E. G. (2017). Imperfect competition in selection markets. Review of

Economics and Statistics, 99(4), 637-651.

Okun, A. M. (2015). Equality and efficiency: The big tradeoff. Washington: Brookings

Institution Press.

Page, T. (2013). Conservation and economic efficiency: an approach to materials policy.

New York: RFF Press.

Pigou, A. (2017). The economics of welfare. London: Routledge.

Pindyck, R., & Rubinfeld, D. (2015). Microeconomics, Global Edition (8th ed). Essex:

Pearson Education Limited.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MICROECONOMICS 101

Scitovsky, T. (2013). Welfare & Competition. New York: Routledge.

Stryk, D. (2013). International Economics Study Guide and Workbook. London: Routledge.

Ten Kate, A. (2016). Economic Efficiency as the Ultimate Goal of Competition Policy.

Available at SSRN: https://ssrn.com/abstract=2740523 or

http://dx.doi.org/10.2139/ssrn.2740523

Waldman, D., & Jensen, E. (2016). Industrial organization: theory and practice. New York:

Routledge.

Weyl, E. G., & Fabinger, M. (2013). Pass-through as an economic tool: Principles of

incidence under imperfect competition. Journal of Political Economy, 121(3), 528-

583.

Zeuthen, F. (2018). Problems of monopoly and economic warfare. London: Routledge.

Scitovsky, T. (2013). Welfare & Competition. New York: Routledge.

Stryk, D. (2013). International Economics Study Guide and Workbook. London: Routledge.

Ten Kate, A. (2016). Economic Efficiency as the Ultimate Goal of Competition Policy.

Available at SSRN: https://ssrn.com/abstract=2740523 or

http://dx.doi.org/10.2139/ssrn.2740523

Waldman, D., & Jensen, E. (2016). Industrial organization: theory and practice. New York:

Routledge.

Weyl, E. G., & Fabinger, M. (2013). Pass-through as an economic tool: Principles of

incidence under imperfect competition. Journal of Political Economy, 121(3), 528-

583.

Zeuthen, F. (2018). Problems of monopoly and economic warfare. London: Routledge.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.