Emirates Airlines Company and Industry Overview

VerifiedAdded on 2023/06/14

|11

|3593

|85

AI Summary

This article provides an overview of Emirates Airlines Company and Industry. It includes the company profile, vision, mission, goals, and business strategy. It also discusses the Porter Analysis of Emirates Airlines, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: Company and Industry Overview

Company and

Industry Overview

Emirates Airlines Company

Company and

Industry Overview

Emirates Airlines Company

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Company and Industry Overview 1

Contents

Question 1: Emirates Airlines Company profile...........................................................................................1

Question 2: Industry Analysis of Emirates Airlines......................................................................................2

References...................................................................................................................................................6

Contents

Question 1: Emirates Airlines Company profile...........................................................................................1

Question 2: Industry Analysis of Emirates Airlines......................................................................................2

References...................................................................................................................................................6

Company and Industry Overview 2

Question 1: Emirates Airlines Company profile

Emirates is an airlines based in Dubai, United Arab Emirates. The airlines are a subsidiary of

The Emirates Group that is a wholly owned government company. The company is the last

organization in the Middle East working with 3600 flights every week from its hub of Dubai

International Airport. The company is involved in more than 140 cities in total 81 countries and

six continents as well. Further, the cargo activities are done by Emirates SkyCargo (Emirates

UAE, 2018). The company was founded in the year 1985 and is now renowned as the fourth

largest airline company in the world in terms of international passengers carried and the second

largest in terms of freight tonne kilometers flown. The company has the longest commercial

flight running from Dubai to Auckland. In the current era, the company flies world biggest fleet

of Airbus A380s and Boeing 777s, and it provides a greater degree of satisfaction level to the

customers by providing comfort services (Farouk, Cherian, & Shaaban, 2017).

The company was established in October 1985 in Dubai, United Arab Emirates. Emirates in now

known as world largest airlines that provides fastest growing carrier services worldwide. The

company is known for its luxury class services provided to its customers worldwide. The

company i also growing its network aggressively so as to provide their efficient services to

maximum customers worldwide. The airlines operate with a fleet of widebody equipment and as

discussed above it is the largest operator of Airbus A380 aircraft type. The company maintains

their hub at the Dubai International Airport; the airport provides an extension network of services

in different areas like Middle East along with Asia, North America, Africa, South Pacific,

Europe and lastly South America. The SkyCargo airfreight division of Emirates currently serves

around 40 destinations (Beik, & Galbraith, 2016).

Vision mission goals business strategy

Further, the vision of the company is to become the leader in the aviation industry. They aim to

initiate their activities innovatively that keeps environment as their first priority. Apart from that,

the company aims to make a global coverage through their activities. They want to reach in

every country and provide services to people. The vision statement of Emirates also includes that

follows strict compliance to keep the customers feel safe while travelling. They have employed a

Question 1: Emirates Airlines Company profile

Emirates is an airlines based in Dubai, United Arab Emirates. The airlines are a subsidiary of

The Emirates Group that is a wholly owned government company. The company is the last

organization in the Middle East working with 3600 flights every week from its hub of Dubai

International Airport. The company is involved in more than 140 cities in total 81 countries and

six continents as well. Further, the cargo activities are done by Emirates SkyCargo (Emirates

UAE, 2018). The company was founded in the year 1985 and is now renowned as the fourth

largest airline company in the world in terms of international passengers carried and the second

largest in terms of freight tonne kilometers flown. The company has the longest commercial

flight running from Dubai to Auckland. In the current era, the company flies world biggest fleet

of Airbus A380s and Boeing 777s, and it provides a greater degree of satisfaction level to the

customers by providing comfort services (Farouk, Cherian, & Shaaban, 2017).

The company was established in October 1985 in Dubai, United Arab Emirates. Emirates in now

known as world largest airlines that provides fastest growing carrier services worldwide. The

company is known for its luxury class services provided to its customers worldwide. The

company i also growing its network aggressively so as to provide their efficient services to

maximum customers worldwide. The airlines operate with a fleet of widebody equipment and as

discussed above it is the largest operator of Airbus A380 aircraft type. The company maintains

their hub at the Dubai International Airport; the airport provides an extension network of services

in different areas like Middle East along with Asia, North America, Africa, South Pacific,

Europe and lastly South America. The SkyCargo airfreight division of Emirates currently serves

around 40 destinations (Beik, & Galbraith, 2016).

Vision mission goals business strategy

Further, the vision of the company is to become the leader in the aviation industry. They aim to

initiate their activities innovatively that keeps environment as their first priority. Apart from that,

the company aims to make a global coverage through their activities. They want to reach in

every country and provide services to people. The vision statement of Emirates also includes that

follows strict compliance to keep the customers feel safe while travelling. They have employed a

Company and Industry Overview 3

responsible team that holds the responsibility to provide best, safe and reliable experience to

customer during flight, and before and after that as well (Park, Lee, & Park, 2015).

The mission statement of the company Emirates states that they want to enact their activities in

such a way that they successfully fulfill their vision statement. Their mission is to achive the

following targets that are discussed below:

Grow as the most loved aviation service worldwide

Deliver high value in their products and services. In addition, their products and services offered

to customer should reflect the vision and objective of the company (Lohmann, & Spasojevic,

2018).

Improve the satisfaction level of clients

Sustain their competitive edge in the target market

Invest in the field of technology to provide better services to the customers

Reduce the count of accidents and crashes

Focus on better environmental strategies and use of bio-fuel to emit less air pollution

Lastly, to invest in the employee to attain a competitive staff that serves customers better.

The company has a single goal that is to reach at the topmost position by doing what they do.

Emirates Airlines has an extremely attractive business model that paves way for the faster

growing international airlines. Quality control is the most important department that is the reason

of fundamental success of Emirates. This department maintains and creates state of the art airline

fleet. Quality of products and services are kept at the highest level (Merkert, & Hensher, 2011).

The extensive aviation-training department of the company provides aviation education to the

talented employees of the company. Resort, Hotel and Tourism Strategy helped them to

successfully shift into resort and tourism sector as well. This strategy is a complete package that

helps business to use innovation and technology and target the customer to increase their sales in

the market (Sun, & Wandelt, 2018).

responsible team that holds the responsibility to provide best, safe and reliable experience to

customer during flight, and before and after that as well (Park, Lee, & Park, 2015).

The mission statement of the company Emirates states that they want to enact their activities in

such a way that they successfully fulfill their vision statement. Their mission is to achive the

following targets that are discussed below:

Grow as the most loved aviation service worldwide

Deliver high value in their products and services. In addition, their products and services offered

to customer should reflect the vision and objective of the company (Lohmann, & Spasojevic,

2018).

Improve the satisfaction level of clients

Sustain their competitive edge in the target market

Invest in the field of technology to provide better services to the customers

Reduce the count of accidents and crashes

Focus on better environmental strategies and use of bio-fuel to emit less air pollution

Lastly, to invest in the employee to attain a competitive staff that serves customers better.

The company has a single goal that is to reach at the topmost position by doing what they do.

Emirates Airlines has an extremely attractive business model that paves way for the faster

growing international airlines. Quality control is the most important department that is the reason

of fundamental success of Emirates. This department maintains and creates state of the art airline

fleet. Quality of products and services are kept at the highest level (Merkert, & Hensher, 2011).

The extensive aviation-training department of the company provides aviation education to the

talented employees of the company. Resort, Hotel and Tourism Strategy helped them to

successfully shift into resort and tourism sector as well. This strategy is a complete package that

helps business to use innovation and technology and target the customer to increase their sales in

the market (Sun, & Wandelt, 2018).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Company and Industry Overview 4

Question 2: Industry Analysis of Emirates Airlines

Porter Analysis

Threat of New Entrants

Threats of new entrants refer to the risk attained with the company with the entrance of new

companies in the target market. Relating it to the analysis of the company Emirates, it should be

noted that, the company faces low degree of threat in the market. Looking at the attributes of the

airlines industry it is evaluated that the company requires huge capital investments. As is

difficult for the organizations to purchase new airplanes, it is the requirement of the company to

invest huge capital so as to earn optimum revenue in the market (Flouris, & Oswald, 2016). The

company faces threat to some extent due to the low cost carrier service providing companies in

market like Easyjet. The companies that enter in this market initially require two most important

aspects that are capital requirement and goodwill in the market. Capital investment is requiring

procuring raw material and initiating easy flow of internal activities of the company (Brueckner,

Lee, & Singer, 2014).

Moreover, goodwill will help the company to attract customers in the market; a person will travel

with the airline only when they have trust on the activities of the company. Many people face

fear while traveling through air due to which they prefer flying with the company whose services

they have experienced before. Apart from that, it is important for the company to provide on

flight good experience to the customer that can be only attained if the customers have trust on the

company. Good brand image in the market helps the company to attain customers. Therefore, it

is next to impossible for a new organization to enter in this and attract customers. Thus, due to

these following aspects les companies prefer entering in the aviation industry that result in

benefits to the company already present in the industry (Assaf, & Josiassen, 2011).

Bargaining Power of Buyer

The bargaining power of the buyers in this industry is medium. As the industry includes many

companies in the market providing their services to the customers at similar prices which

decreases the bargaining power of the buyer and they cannot negotiate with on organization

Question 2: Industry Analysis of Emirates Airlines

Porter Analysis

Threat of New Entrants

Threats of new entrants refer to the risk attained with the company with the entrance of new

companies in the target market. Relating it to the analysis of the company Emirates, it should be

noted that, the company faces low degree of threat in the market. Looking at the attributes of the

airlines industry it is evaluated that the company requires huge capital investments. As is

difficult for the organizations to purchase new airplanes, it is the requirement of the company to

invest huge capital so as to earn optimum revenue in the market (Flouris, & Oswald, 2016). The

company faces threat to some extent due to the low cost carrier service providing companies in

market like Easyjet. The companies that enter in this market initially require two most important

aspects that are capital requirement and goodwill in the market. Capital investment is requiring

procuring raw material and initiating easy flow of internal activities of the company (Brueckner,

Lee, & Singer, 2014).

Moreover, goodwill will help the company to attract customers in the market; a person will travel

with the airline only when they have trust on the activities of the company. Many people face

fear while traveling through air due to which they prefer flying with the company whose services

they have experienced before. Apart from that, it is important for the company to provide on

flight good experience to the customer that can be only attained if the customers have trust on the

company. Good brand image in the market helps the company to attain customers. Therefore, it

is next to impossible for a new organization to enter in this and attract customers. Thus, due to

these following aspects les companies prefer entering in the aviation industry that result in

benefits to the company already present in the industry (Assaf, & Josiassen, 2011).

Bargaining Power of Buyer

The bargaining power of the buyers in this industry is medium. As the industry includes many

companies in the market providing their services to the customers at similar prices which

decreases the bargaining power of the buyer and they cannot negotiate with on organization

Company and Industry Overview 5

about their prices because the other organization is also providing services at similar range.

Further, as discussed above there are two sectors in the aviation industry, one is high class

quality service provider and the other is low cost carrier service provider companies. Due to the

presence of low cost carrier companies, the customers prefer their services as they are cheap and

beneficial to them (Reggiani, Nijkamp, & Cento, 2010). However, if a person wants to travel in

premium quality services then their power decreases because these companies provide good

quality to customers at varied ranges. Further, it should also be noted that many times the

customer are obliged to book their tickets are heavy prices when there is less availability of

flights in that area. The customers who like travelling in peace and luxury travels in premium

class and such premium class services are provided at high prices as well. The airlines companies

also hold a brand image in the market so the customers cannot deny to the prices offered by them

in the market. So, it should be noted that the buyers hold medium powers in their hand, as once

they can change the face of the market by increasing the demand of certain services and on the

other hand they are driven by the market changes made by the companies in the market

(O'Connell, & Williams, 2016).

Bargaining Power of Supplier

Boeing and Airbus are two major suppliers present in the industry. Based on their activities

whole market fluctuates that show that there is high degree of power present in the hands of

suppliers in the market. As there are only two suppliers present in the industry, so if one of them

also cancels the contract then the company can face high degree of risk for their existence in the

market as well. The companies struggle between these two organizations only, although both the

companies shows an impression that they want to sustain their business terms with all the

orgaizations present in the aviation industry, but change in any terms of the contract make the

airlines company liable to agree. Because, if they will not agree on the terms then there are

chances that the suppliers might cancel the contract (Grant, 2016).

Also, the power is in hand of suppliers because they are countable in numbers whereas the

airlines industry includes many companies so if contract gets cancel then get the chance to

initiate contract with other competitors on better terms. Further, the probability of a provider that

integrates vertically is remote. The negotiation position, which is also called market outcomes, is

very difficult in this industry. The suppliers have a choice to contract with the companies with

about their prices because the other organization is also providing services at similar range.

Further, as discussed above there are two sectors in the aviation industry, one is high class

quality service provider and the other is low cost carrier service provider companies. Due to the

presence of low cost carrier companies, the customers prefer their services as they are cheap and

beneficial to them (Reggiani, Nijkamp, & Cento, 2010). However, if a person wants to travel in

premium quality services then their power decreases because these companies provide good

quality to customers at varied ranges. Further, it should also be noted that many times the

customer are obliged to book their tickets are heavy prices when there is less availability of

flights in that area. The customers who like travelling in peace and luxury travels in premium

class and such premium class services are provided at high prices as well. The airlines companies

also hold a brand image in the market so the customers cannot deny to the prices offered by them

in the market. So, it should be noted that the buyers hold medium powers in their hand, as once

they can change the face of the market by increasing the demand of certain services and on the

other hand they are driven by the market changes made by the companies in the market

(O'Connell, & Williams, 2016).

Bargaining Power of Supplier

Boeing and Airbus are two major suppliers present in the industry. Based on their activities

whole market fluctuates that show that there is high degree of power present in the hands of

suppliers in the market. As there are only two suppliers present in the industry, so if one of them

also cancels the contract then the company can face high degree of risk for their existence in the

market as well. The companies struggle between these two organizations only, although both the

companies shows an impression that they want to sustain their business terms with all the

orgaizations present in the aviation industry, but change in any terms of the contract make the

airlines company liable to agree. Because, if they will not agree on the terms then there are

chances that the suppliers might cancel the contract (Grant, 2016).

Also, the power is in hand of suppliers because they are countable in numbers whereas the

airlines industry includes many companies so if contract gets cancel then get the chance to

initiate contract with other competitors on better terms. Further, the probability of a provider that

integrates vertically is remote. The negotiation position, which is also called market outcomes, is

very difficult in this industry. The suppliers have a choice to contract with the companies with

Company and Industry Overview 6

whom they wish but the airlines companies do not have the choice to choose the suppliers. They

are obliged to agree on the term presented by the company even if it is decreasing their amount

of profits (Belobaba, Odoni, & Barnhart, 2015). This acts as major issue for the companies as

well, as the market is ruled by their activities, they can turn the face of market any time they

want to. If the suppliers increase the prices of the products and services then the companies have

to automatically increase their prices of bear losses. The suppliers have domination in the

aviation industry. In addition, it depends upon their discretion to provide products and services to

the companies according to their interest. They can charge high prices from one organization and

on the other hand provide similar services to another company at comparatively lower rates due

to their good term with that organization. Thus, it should be noted the suppliers hold high degree

of power in this industry (Holloway, 2017).

Threat of a Substitute

Just like low degree of entrants, the threat of substitutes is also low. As the companies cannot

enter in aviation market which reduces the opportunities of the customers to shift to another

company. Further, another aspect should be noted that the customers prefer showing loyalty

towards the companies present in market. It should be noted that the aviation industry is risky

anytime crashes can happen with the airplane, so the customers prefers flying with the

companies whom they trust the most. Resulting to which there is low risk for substitutes in the

market (Vogel, 2016).

Looking at another aspect of low cost carriers and premium service provider companies in the

market, it should be noted that the company that prefer premium services will not shift to LCC at

any condition that reduces the risk. The buyers are segmented in the market according to their

income levels, high class customers prefer companies like Emirates, Qantas etc. where are low or

medium class people prefer LCC services provider companies like Easyjet, British Airways etc.

Further, the customers prefer companies with whom they have fled before without any issue as

they trust those companies and show their loyalty towards them as well (Lee, Seo, & Sharma,

2013). A normal company that sells retail usually faces the problem of substitutes present in the

market because all companies provide similar services and common products. However, in case

of aviation industry, all organizations have their differential ways to welcome the clients and

deal with them due to which the threat of substitution reduces to some extent. Nevertheless,

whom they wish but the airlines companies do not have the choice to choose the suppliers. They

are obliged to agree on the term presented by the company even if it is decreasing their amount

of profits (Belobaba, Odoni, & Barnhart, 2015). This acts as major issue for the companies as

well, as the market is ruled by their activities, they can turn the face of market any time they

want to. If the suppliers increase the prices of the products and services then the companies have

to automatically increase their prices of bear losses. The suppliers have domination in the

aviation industry. In addition, it depends upon their discretion to provide products and services to

the companies according to their interest. They can charge high prices from one organization and

on the other hand provide similar services to another company at comparatively lower rates due

to their good term with that organization. Thus, it should be noted the suppliers hold high degree

of power in this industry (Holloway, 2017).

Threat of a Substitute

Just like low degree of entrants, the threat of substitutes is also low. As the companies cannot

enter in aviation market which reduces the opportunities of the customers to shift to another

company. Further, another aspect should be noted that the customers prefer showing loyalty

towards the companies present in market. It should be noted that the aviation industry is risky

anytime crashes can happen with the airplane, so the customers prefers flying with the

companies whom they trust the most. Resulting to which there is low risk for substitutes in the

market (Vogel, 2016).

Looking at another aspect of low cost carriers and premium service provider companies in the

market, it should be noted that the company that prefer premium services will not shift to LCC at

any condition that reduces the risk. The buyers are segmented in the market according to their

income levels, high class customers prefer companies like Emirates, Qantas etc. where are low or

medium class people prefer LCC services provider companies like Easyjet, British Airways etc.

Further, the customers prefer companies with whom they have fled before without any issue as

they trust those companies and show their loyalty towards them as well (Lee, Seo, & Sharma,

2013). A normal company that sells retail usually faces the problem of substitutes present in the

market because all companies provide similar services and common products. However, in case

of aviation industry, all organizations have their differential ways to welcome the clients and

deal with them due to which the threat of substitution reduces to some extent. Nevertheless,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Company and Industry Overview 7

threat can occur to the company if the competitor organization reduce the prices of their products

and services and provides additional services to customers as well. However, chances of such

happening are low therefore there is low degree of risk present with the companies in aviation

industry in case of substation (Williams, 2017).

Industry Rivalry

The airlines industry is generally very competitive that shows the high degree of industry rivalry.

As there are large number of organizations are already present in the industry that gives a choice

to the customers to opt for the company with which they want to fly. Further, it should be noted

that many organizations want to increase the price of their products and services offered but they

cannot do so because with this effect, their customers will directly shift to other companies

providing similar services. All customers want the companies to provide safe and secure services

at lower prices in the market (Shaban, 2015). Therefore, the organization that provides premium

services at low prices wins the race. In addition, it is difficult for the companies to maintain their

competitive edge in the market as well.

Analyzing the features of the industry, it should be noted that the customers prefers the

companies whom they trust the most and customer loyalty is very important in this industry, as

with the help off this aspect only the company can conquer industry rivalry. Once, the company

in the market attains loyalty, and then it becomes easy for them to deal with the competition

present in the environment. Etihad and Qatar Airways are the two major competitors of the

company Emirates in the market. All three companies provide premium services to the customers

present in the market but Emirates is ranked best among them. Thus, it should be noted that there

is high degree of competition in this industry (Borenstein, & Rose, 2014).

Furthermore, talking about the favorableness of the industry on the company Emirates it should

be noted this organization is successfully running the target market. The attributes of the industry

supports the activities of company that increases the output from the services rendered. The

company Emirates is known for their services in the market as they provide best high class

services to their customers. Therefore, segmenting the target market, it should be noted that there

are two types of customers present in the market that are high income level people and lower

income level. The company target high income level people by providing premium quality

threat can occur to the company if the competitor organization reduce the prices of their products

and services and provides additional services to customers as well. However, chances of such

happening are low therefore there is low degree of risk present with the companies in aviation

industry in case of substation (Williams, 2017).

Industry Rivalry

The airlines industry is generally very competitive that shows the high degree of industry rivalry.

As there are large number of organizations are already present in the industry that gives a choice

to the customers to opt for the company with which they want to fly. Further, it should be noted

that many organizations want to increase the price of their products and services offered but they

cannot do so because with this effect, their customers will directly shift to other companies

providing similar services. All customers want the companies to provide safe and secure services

at lower prices in the market (Shaban, 2015). Therefore, the organization that provides premium

services at low prices wins the race. In addition, it is difficult for the companies to maintain their

competitive edge in the market as well.

Analyzing the features of the industry, it should be noted that the customers prefers the

companies whom they trust the most and customer loyalty is very important in this industry, as

with the help off this aspect only the company can conquer industry rivalry. Once, the company

in the market attains loyalty, and then it becomes easy for them to deal with the competition

present in the environment. Etihad and Qatar Airways are the two major competitors of the

company Emirates in the market. All three companies provide premium services to the customers

present in the market but Emirates is ranked best among them. Thus, it should be noted that there

is high degree of competition in this industry (Borenstein, & Rose, 2014).

Furthermore, talking about the favorableness of the industry on the company Emirates it should

be noted this organization is successfully running the target market. The attributes of the industry

supports the activities of company that increases the output from the services rendered. The

company Emirates is known for their services in the market as they provide best high class

services to their customers. Therefore, segmenting the target market, it should be noted that there

are two types of customers present in the market that are high income level people and lower

income level. The company target high income level people by providing premium quality

Company and Industry Overview 8

services in the market, no other competitor can match to their services provided in the market.

Resulting to which, the company earned competitiveness in the market (Shaban, 2015). Emirates

earned goodwill in the market that helped them to reduce the competition and the threat of

supplies as well.

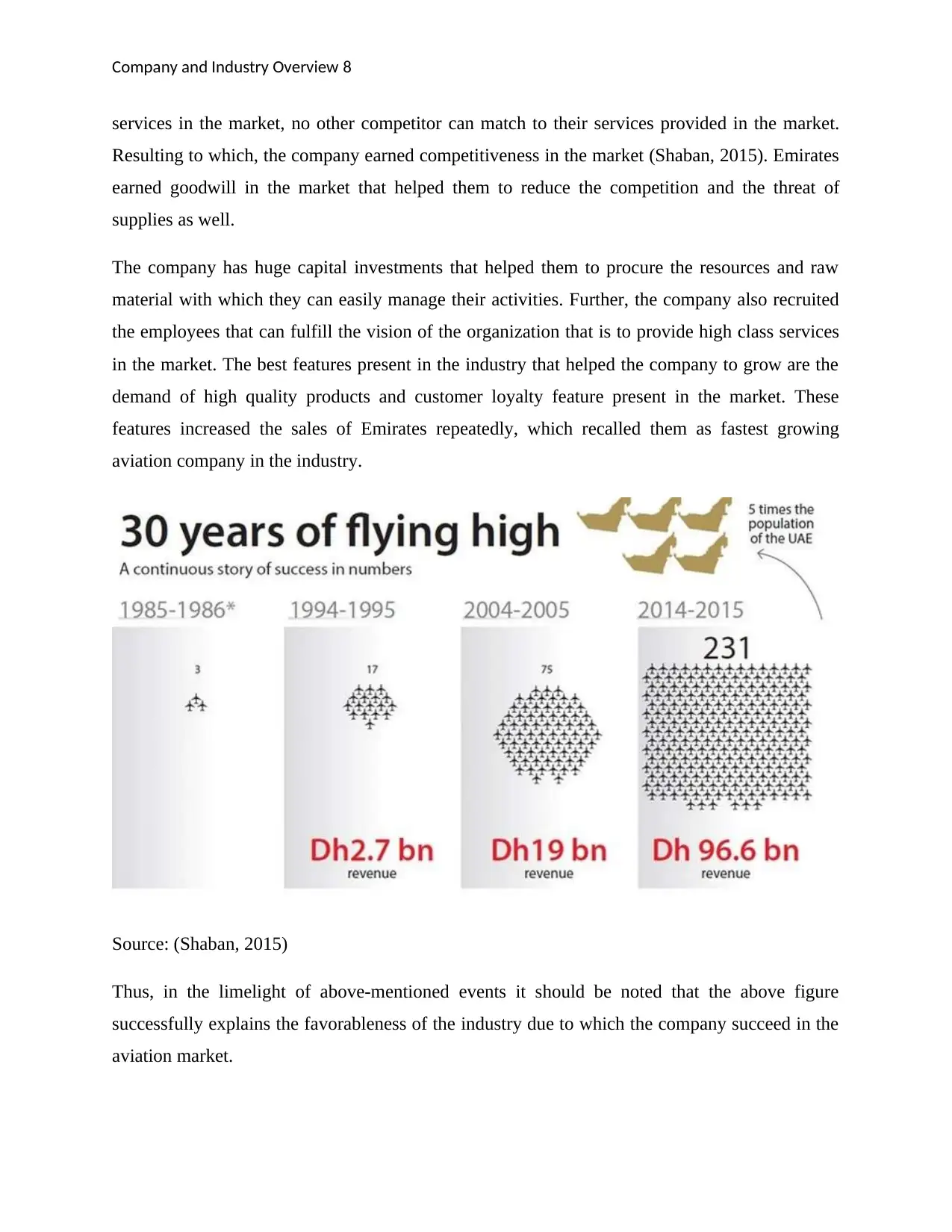

The company has huge capital investments that helped them to procure the resources and raw

material with which they can easily manage their activities. Further, the company also recruited

the employees that can fulfill the vision of the organization that is to provide high class services

in the market. The best features present in the industry that helped the company to grow are the

demand of high quality products and customer loyalty feature present in the market. These

features increased the sales of Emirates repeatedly, which recalled them as fastest growing

aviation company in the industry.

Source: (Shaban, 2015)

Thus, in the limelight of above-mentioned events it should be noted that the above figure

successfully explains the favorableness of the industry due to which the company succeed in the

aviation market.

services in the market, no other competitor can match to their services provided in the market.

Resulting to which, the company earned competitiveness in the market (Shaban, 2015). Emirates

earned goodwill in the market that helped them to reduce the competition and the threat of

supplies as well.

The company has huge capital investments that helped them to procure the resources and raw

material with which they can easily manage their activities. Further, the company also recruited

the employees that can fulfill the vision of the organization that is to provide high class services

in the market. The best features present in the industry that helped the company to grow are the

demand of high quality products and customer loyalty feature present in the market. These

features increased the sales of Emirates repeatedly, which recalled them as fastest growing

aviation company in the industry.

Source: (Shaban, 2015)

Thus, in the limelight of above-mentioned events it should be noted that the above figure

successfully explains the favorableness of the industry due to which the company succeed in the

aviation market.

Company and Industry Overview 9

References

Assaf, A. G., & Josiassen, A. (2011). The operational performance of UK airlines: 2002-

2007. Journal of Economic Studies, 38(1), 5-16.

Beik, N., & Galbraith, J. (2016). Fan identification and the perception of the sponsor-team fit:

The case of Emirates Airlines and Arsenal FC.

Belobaba, P., Odoni, A., & Barnhart, C. (Eds.). (2015). The global airline industry. John Wiley

& Sons.

Borenstein, S., & Rose, N. L. (2014). How airline markets work… or do they? Regulatory

reform in the airline industry. In Economic Regulation and Its Reform: What Have We

Learned? (pp. 63-135). University of Chicago Press.

Brueckner, J. K., Lee, D., & Singer, E. (2014). City-pairs versus airport-pairs: a market-

definition methodology for the airline industry. Review of Industrial Organization, 44(1),

1-25.

Emirates UAE, (2018). About Us. Viewed on 13 April 2018 from

https://www.emirates.com/ae/english/about-us/

Farouk, S., Cherian, J., & Shaaban, I. (2017). Low cost carriers versus traditional carriers and its

impact on financial performance: a comparative study on the UAE airlines

companies. International Journal of Value Chain Management, 8(4), 325-341.

Flouris, T. G., & Oswald, S. L. (2016). Designing and executing strategy in aviation

management. Routledge.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Holloway, S. (2017). Straight and Level: Practical Airline Economics: Practical Airline

Economics. Routledge.

References

Assaf, A. G., & Josiassen, A. (2011). The operational performance of UK airlines: 2002-

2007. Journal of Economic Studies, 38(1), 5-16.

Beik, N., & Galbraith, J. (2016). Fan identification and the perception of the sponsor-team fit:

The case of Emirates Airlines and Arsenal FC.

Belobaba, P., Odoni, A., & Barnhart, C. (Eds.). (2015). The global airline industry. John Wiley

& Sons.

Borenstein, S., & Rose, N. L. (2014). How airline markets work… or do they? Regulatory

reform in the airline industry. In Economic Regulation and Its Reform: What Have We

Learned? (pp. 63-135). University of Chicago Press.

Brueckner, J. K., Lee, D., & Singer, E. (2014). City-pairs versus airport-pairs: a market-

definition methodology for the airline industry. Review of Industrial Organization, 44(1),

1-25.

Emirates UAE, (2018). About Us. Viewed on 13 April 2018 from

https://www.emirates.com/ae/english/about-us/

Farouk, S., Cherian, J., & Shaaban, I. (2017). Low cost carriers versus traditional carriers and its

impact on financial performance: a comparative study on the UAE airlines

companies. International Journal of Value Chain Management, 8(4), 325-341.

Flouris, T. G., & Oswald, S. L. (2016). Designing and executing strategy in aviation

management. Routledge.

Grant, R. M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Holloway, S. (2017). Straight and Level: Practical Airline Economics: Practical Airline

Economics. Routledge.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Company and Industry Overview 10

Lee, S., Seo, K., & Sharma, A. (2013). Corporate social responsibility and firm performance in

the airline industry: The moderating role of oil prices. Tourism management, 38, 20-30.

Lohmann, G., & Spasojevic, B. (2018). Airline business strategy. The Routledge Companion to

Air Transport Management, 139.

Merkert, R., & Hensher, D. A. (2011). The impact of strategic management and fleet planning on

airline efficiency–A random effects Tobit model based on DEA efficiency

scores. Transportation Research Part A: Policy and Practice, 45(7), 686-695.

O'Connell, J. F., & Williams, G. (2016). Airline Strategy: Keeping the Legacy Carrier

Competitive. How Can Mature Airlines Stay Ahead in the Low-fare Airline Era?. In Air

Transport in the 21st Century (pp. 179-194). Routledge.

Park, N. K., Lee, J., & Park, U. D. (2015). Korean Air Cargo: Strategic Challenges in an

Evolving Environment. Asian Case Research Journal, 19(01), 127-154.

Reggiani, A., Nijkamp, P., & Cento, A. (2010). Connectivity and concentration in airline

networks: a complexity analysis of Lufthansa's network. European Journal of

Information Systems, 19(4), 449-461.

Shaban, S. (2015). Emirates is the fastest growing airline in the world. Viewed on 13 April 2018

from < https://www.khaleejtimes.com/business/aviation/emirates-is-the-fastest-growing-

airline-in-the-world>

Sun, X., & Wandelt, S. (2018). Complementary strengths of airlines under network

disruptions. Safety Science, 103, 76-87.

Vogel, H. L. (2016). Travel industry economics: A guide for financial analysis. Springer.

Williams, G., 2017. The airline industry and the impact of deregulation. Routledge.

Lee, S., Seo, K., & Sharma, A. (2013). Corporate social responsibility and firm performance in

the airline industry: The moderating role of oil prices. Tourism management, 38, 20-30.

Lohmann, G., & Spasojevic, B. (2018). Airline business strategy. The Routledge Companion to

Air Transport Management, 139.

Merkert, R., & Hensher, D. A. (2011). The impact of strategic management and fleet planning on

airline efficiency–A random effects Tobit model based on DEA efficiency

scores. Transportation Research Part A: Policy and Practice, 45(7), 686-695.

O'Connell, J. F., & Williams, G. (2016). Airline Strategy: Keeping the Legacy Carrier

Competitive. How Can Mature Airlines Stay Ahead in the Low-fare Airline Era?. In Air

Transport in the 21st Century (pp. 179-194). Routledge.

Park, N. K., Lee, J., & Park, U. D. (2015). Korean Air Cargo: Strategic Challenges in an

Evolving Environment. Asian Case Research Journal, 19(01), 127-154.

Reggiani, A., Nijkamp, P., & Cento, A. (2010). Connectivity and concentration in airline

networks: a complexity analysis of Lufthansa's network. European Journal of

Information Systems, 19(4), 449-461.

Shaban, S. (2015). Emirates is the fastest growing airline in the world. Viewed on 13 April 2018

from < https://www.khaleejtimes.com/business/aviation/emirates-is-the-fastest-growing-

airline-in-the-world>

Sun, X., & Wandelt, S. (2018). Complementary strengths of airlines under network

disruptions. Safety Science, 103, 76-87.

Vogel, H. L. (2016). Travel industry economics: A guide for financial analysis. Springer.

Williams, G., 2017. The airline industry and the impact of deregulation. Routledge.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.