Australia's Embrace of Enhanced Auditor Reporting: An Analysis

VerifiedAdded on 2020/11/23

|13

|3416

|105

Report

AI Summary

This report provides an analysis of enhanced auditor reporting practices in Australia, using Myer Holding Limited as a case study. It examines the auditor's compliance with independence requirements, non-audit services, and the analysis of auditor remuneration. The report delves into key audit matters, including impairment of tangible assets, accounting estimates, inventory valuation, and supplier rebates, along with the associated audit procedures. It also represents the role of the audit committee and the audit opinion. Furthermore, the report highlights the differences in responsibilities between the auditor, management, and directors, and assesses the effectiveness of material information disclosure. The report concludes with follow-up questions for the auditor at the company's Annual General Meeting. The analysis is comprehensive, covering various aspects of auditing and financial reporting, making it a valuable resource for understanding the implementation of enhanced auditor reporting within the Australian context. This report is a contribution to Desklib, a platform providing study tools for students.

How is Enhanced Auditor

Reporting being embraced in

Australia?

Reporting being embraced in

Australia?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

Auditing always helps in ensuring about procedures and policies which are to be

followed and non compliance is directly reported to management for corrective action. The

present report had analysed auditor section of Myre Holding Limited. It is considered that final

information is always considered in annual financial statement which elaborates responsibility of

management for purpose of accurate representation and preparation of financial statements. Last

but not least, key judgements and estimates must be articulated as effective disclosure.

Auditing always helps in ensuring about procedures and policies which are to be

followed and non compliance is directly reported to management for corrective action. The

present report had analysed auditor section of Myre Holding Limited. It is considered that final

information is always considered in annual financial statement which elaborates responsibility of

management for purpose of accurate representation and preparation of financial statements. Last

but not least, key judgements and estimates must be articulated as effective disclosure.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Auditor compilation with independence requirements...............................................................1

Non Audit Services.....................................................................................................................1

Analysis of Auditor's remuneration............................................................................................2

Represent key audit matter along with audit procedure .............................................................3

Represent audit committee with its role of non-executive directors...........................................5

Audit Opinion..............................................................................................................................5

Difference between responsibility of auditor, management and director ..................................6

Presence of material subsequent events......................................................................................7

Assessment of effectiveness of material information.................................................................7

Disclosure of material information which are effective for financial statements.......................8

Follow-up questions for Auditor at the company’s Annual General Meeting............................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Auditor compilation with independence requirements...............................................................1

Non Audit Services.....................................................................................................................1

Analysis of Auditor's remuneration............................................................................................2

Represent key audit matter along with audit procedure .............................................................3

Represent audit committee with its role of non-executive directors...........................................5

Audit Opinion..............................................................................................................................5

Difference between responsibility of auditor, management and director ..................................6

Presence of material subsequent events......................................................................................7

Assessment of effectiveness of material information.................................................................7

Disclosure of material information which are effective for financial statements.......................8

Follow-up questions for Auditor at the company’s Annual General Meeting............................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Auditing plays major role in every organization along with each industry. It helps in

improving communication among investors and auditors. The present report would be discussing

about standard set in many jurisdictions which includes New Zealand and Australia along with

issuance of requirements with similar effective date. It will be reflecting Myer holding Limited

annual report which is listed on ASX for analysing major areas of auditing. It would be reflecting

auditor compliance with independent requirements along with presence of non-audit services. It

will also reflect key audit matter and procedure with appropriate classification of its test of

control. In this organization, there is presence of audit, finance and risk committee. The

remuneration of auditor has raised in year 2016 but in 2017 it decreased with huge proportion.

MAIN BODY

Auditor compilation with independence requirements

Myer Holding Limited has conducted audit with context of Australian Auditing

standards. They are independent of its group according to auditor's independence requirements of

its corporation Act 2001. In the same series, its ethical requirements linked to accounting

professional and ethical Standards Board's APES 110 Code of ethics which are relevant to its

audit of financial report with reference to Australia. Further they have complied their ethical

responsibilities in context of code (Chan and Vasarhelyi, 2018).

Non Audit Services

Myer Holdings Limited might decide for employing its external auditor with context of

additional assignments along with statutory audit duties where is presence of expertise and

experience of auditor with group is significant. There is presentation about amount payable or

paid to its auditor for purpose of audit and non-audit services had been stated in financial

statements. Generally, board has considered its position with context of advice extracted via

Audit, finance and Risk Committee. The provision of non-audit services is directly compatible

along with general standards which were imposed through Corporations Act 2001. The nature of

non-audit services had been provided with satisfaction of directors which did not compromise on

basis of independence requirements of Corporation Act 2001 with review of non-audit services

via Audit, Finance and Risk Committee for ensuring about giving less impact on objectivity and

impartiality of auditor (Understanding a financial statement audit, 2017). Services does not

1

Auditing plays major role in every organization along with each industry. It helps in

improving communication among investors and auditors. The present report would be discussing

about standard set in many jurisdictions which includes New Zealand and Australia along with

issuance of requirements with similar effective date. It will be reflecting Myer holding Limited

annual report which is listed on ASX for analysing major areas of auditing. It would be reflecting

auditor compliance with independent requirements along with presence of non-audit services. It

will also reflect key audit matter and procedure with appropriate classification of its test of

control. In this organization, there is presence of audit, finance and risk committee. The

remuneration of auditor has raised in year 2016 but in 2017 it decreased with huge proportion.

MAIN BODY

Auditor compilation with independence requirements

Myer Holding Limited has conducted audit with context of Australian Auditing

standards. They are independent of its group according to auditor's independence requirements of

its corporation Act 2001. In the same series, its ethical requirements linked to accounting

professional and ethical Standards Board's APES 110 Code of ethics which are relevant to its

audit of financial report with reference to Australia. Further they have complied their ethical

responsibilities in context of code (Chan and Vasarhelyi, 2018).

Non Audit Services

Myer Holdings Limited might decide for employing its external auditor with context of

additional assignments along with statutory audit duties where is presence of expertise and

experience of auditor with group is significant. There is presentation about amount payable or

paid to its auditor for purpose of audit and non-audit services had been stated in financial

statements. Generally, board has considered its position with context of advice extracted via

Audit, finance and Risk Committee. The provision of non-audit services is directly compatible

along with general standards which were imposed through Corporations Act 2001. The nature of

non-audit services had been provided with satisfaction of directors which did not compromise on

basis of independence requirements of Corporation Act 2001 with review of non-audit services

via Audit, Finance and Risk Committee for ensuring about giving less impact on objectivity and

impartiality of auditor (Understanding a financial statement audit, 2017). Services does not

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

undermine its general principles related to auditor independence on basis of APES 110 Code of

Ethics for different professional Accountants.

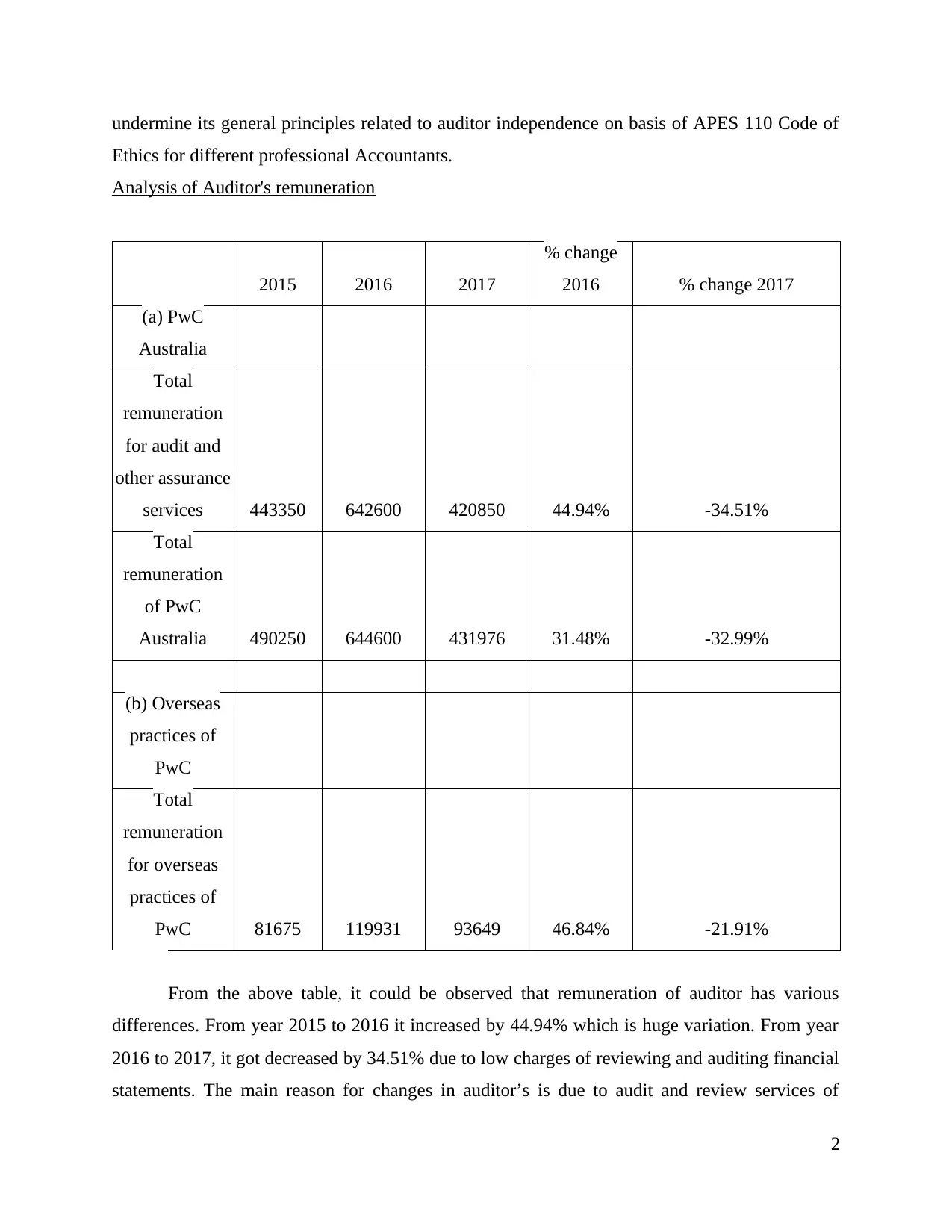

Analysis of Auditor's remuneration

2015 2016 2017

% change

2016 % change 2017

(a) PwC

Australia

Total

remuneration

for audit and

other assurance

services 443350 642600 420850 44.94% -34.51%

Total

remuneration

of PwC

Australia 490250 644600 431976 31.48% -32.99%

(b) Overseas

practices of

PwC

Total

remuneration

for overseas

practices of

PwC 81675 119931 93649 46.84% -21.91%

From the above table, it could be observed that remuneration of auditor has various

differences. From year 2015 to 2016 it increased by 44.94% which is huge variation. From year

2016 to 2017, it got decreased by 34.51% due to low charges of reviewing and auditing financial

statements. The main reason for changes in auditor’s is due to audit and review services of

2

Ethics for different professional Accountants.

Analysis of Auditor's remuneration

2015 2016 2017

% change

2016 % change 2017

(a) PwC

Australia

Total

remuneration

for audit and

other assurance

services 443350 642600 420850 44.94% -34.51%

Total

remuneration

of PwC

Australia 490250 644600 431976 31.48% -32.99%

(b) Overseas

practices of

PwC

Total

remuneration

for overseas

practices of

PwC 81675 119931 93649 46.84% -21.91%

From the above table, it could be observed that remuneration of auditor has various

differences. From year 2015 to 2016 it increased by 44.94% which is huge variation. From year

2016 to 2017, it got decreased by 34.51% due to low charges of reviewing and auditing financial

statements. The main reason for changes in auditor’s is due to audit and review services of

2

financial statements. The trend of past three consecutive year had been observed above. In year

2017, remuneration to auditors was reduced by huge proportion (Annual report of Myre Holding

Limited, 2015).

Represent key audit matter along with audit procedure

Impairment of tangible assets:

Audit matter

The magnitude balance of intangible assets and value applicable for calculation aspect

with requirement of significant judgement via group for estimation of future trading cash flow

was considered as major matter for audit.

Audit procedure

Testing over mathematical accuracy of basic impairment model had been

performed.

Discount rate had been compared from long term growth rate which is applied on

impairments of assessment for every CGU of its benchmark data.

Forecast of annual growth rate is compared to projected cash flow.

Consideration of projection of financial data like cost of sale, salaries, sales and

occupancy cost which is considered in impairment models.

Sensitivity analysis has been performed over key assumption.

Allocation of impairment charge to bid assets and SASS had been considered.

It would be classified in substantive analytical procedure due to consideration of

every financial data along with mathematical accuracy in above audit matter

(Substantive Analaytical procedures, 2018).

Accounting estimate and disclosure related to implementation of new Myer strategy

Audit matter

There are various assumptions and judgements which were applied through group for

estimating provisioning level required to be recognized as on 29 July 2017.

Audit Procedure

It would consider assumptions and judgements which are applied for identifying

recognition of provision on basis of committed status and approval of strategic action

plans.

3

2017, remuneration to auditors was reduced by huge proportion (Annual report of Myre Holding

Limited, 2015).

Represent key audit matter along with audit procedure

Impairment of tangible assets:

Audit matter

The magnitude balance of intangible assets and value applicable for calculation aspect

with requirement of significant judgement via group for estimation of future trading cash flow

was considered as major matter for audit.

Audit procedure

Testing over mathematical accuracy of basic impairment model had been

performed.

Discount rate had been compared from long term growth rate which is applied on

impairments of assessment for every CGU of its benchmark data.

Forecast of annual growth rate is compared to projected cash flow.

Consideration of projection of financial data like cost of sale, salaries, sales and

occupancy cost which is considered in impairment models.

Sensitivity analysis has been performed over key assumption.

Allocation of impairment charge to bid assets and SASS had been considered.

It would be classified in substantive analytical procedure due to consideration of

every financial data along with mathematical accuracy in above audit matter

(Substantive Analaytical procedures, 2018).

Accounting estimate and disclosure related to implementation of new Myer strategy

Audit matter

There are various assumptions and judgements which were applied through group for

estimating provisioning level required to be recognized as on 29 July 2017.

Audit Procedure

It would consider assumptions and judgements which are applied for identifying

recognition of provision on basis of committed status and approval of strategic action

plans.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Assumption and judgement were compared for calculating new provision of Myer

holdings for: board minutes, historic data, landlord agreements and other supporting

evidence of audit.

It had undertaken in substantive analytical procedure as it has presence of consideration

of assumptions and judgements for each provision.

Inventory valuation and provision

Audit matter

In this matter, group has applied various judgements and assumption for projecting sell

via inventory rates in hand at ending for estimating inventory valuation which could be sold

under its actual cost in the future. The estimate of inventory shrinkage is directly based on actual

loss which is realised as outcome of inventory counts cycle.

Audit Procedure

It has effective and designed operation of useful key inventory control.

It had attended numerous inventory counts at a retail stores and distribution centre.

The group's inventory provisioning policy has been assessed.

Historical accuracy has been considered by providing comparison from its provision of

inventory to sold inventory.

It would be classified in substantive testing which examines financial statements and it

supports documentation. There is requirement of evidence for supporting assertion about

whole financial records of business entity in valid, complete and accurate aspect.

Inventory valuation is major part in this classification (Fitzgerald, Omer and Thompson,

2018).

Supplier rebates

Audit matters

It was referred as key audit matter due to supplier arrangement which is complex in

nature and variable among suppliers. There is requirement of judgement for identifying amount

of rebate of supplier which is recognised in profit and loss statement and amount is deferred to

inventory. There is huge requirement of detail understanding on its contractual arrangements

with appropriate sell and purchase via information.

Audit procedure

4

holdings for: board minutes, historic data, landlord agreements and other supporting

evidence of audit.

It had undertaken in substantive analytical procedure as it has presence of consideration

of assumptions and judgements for each provision.

Inventory valuation and provision

Audit matter

In this matter, group has applied various judgements and assumption for projecting sell

via inventory rates in hand at ending for estimating inventory valuation which could be sold

under its actual cost in the future. The estimate of inventory shrinkage is directly based on actual

loss which is realised as outcome of inventory counts cycle.

Audit Procedure

It has effective and designed operation of useful key inventory control.

It had attended numerous inventory counts at a retail stores and distribution centre.

The group's inventory provisioning policy has been assessed.

Historical accuracy has been considered by providing comparison from its provision of

inventory to sold inventory.

It would be classified in substantive testing which examines financial statements and it

supports documentation. There is requirement of evidence for supporting assertion about

whole financial records of business entity in valid, complete and accurate aspect.

Inventory valuation is major part in this classification (Fitzgerald, Omer and Thompson,

2018).

Supplier rebates

Audit matters

It was referred as key audit matter due to supplier arrangement which is complex in

nature and variable among suppliers. There is requirement of judgement for identifying amount

of rebate of supplier which is recognised in profit and loss statement and amount is deferred to

inventory. There is huge requirement of detail understanding on its contractual arrangements

with appropriate sell and purchase via information.

Audit procedure

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It would agree on sample of rebate of suppliers which is traced on relevant

agreement of supplier

Comparison of sample of rebate terms which is applicable for its calculations in

relevant arrangements of supplier and purchase of group's inventory volume data.

Specific range of group's buyers are interviewed for developing an understanding

about awareness of buying policies of organization. In the same series, nature of

rebate which is It would be classified as test of control, because auditor had taken

sample on its capital expenditure and nature of rebate had been inspected.

Represent audit committee with its role of non-executive directors

Myer Holdings limited have Audit, Finance and Risk committee which consists of

various non-executive directors.

Joanne Stephenson (Independent Non-executive director): Experience of more than

25 years and strength in accounting, finance, governance and risk management. She is a

member of Australian Institute of Company Directors and Chartered Accountants in New

Zealand and Australia.

Anne Brennan (Independent Non-Executive director): Chairman of Audit, Finance

and Risk Committee. Her major role is to bring strong financial credentials and provides

quickness and keenness for dealing and understanding business situations. It comprises

senior management role in professional services and large corporate organizations. In the

same series, she has executive role at CSR as Chief Financial Officer.

Bob Thorn (Independent Non-Executive director): His major role is to bring business

as he has experience of senior retail management as Managing Director.

Dave Whittle (Independent Non-Executive director): His major role is to provide

innovative data, advice and software for helping business entities for engaging and

understanding its customers.

Audit Opinion

Myer Holding's opinion was to accompanying its financial report along with controlled

business entities in context of Corporations Act 2001. It provides fair and true aspect of financial

position of group and its performance for year end. It is directly complied with Australian

Accounting Standards and Corporations Regulations 2001. They have audited its consolidated

financial statements along with its notes and director's declaration.

5

agreement of supplier

Comparison of sample of rebate terms which is applicable for its calculations in

relevant arrangements of supplier and purchase of group's inventory volume data.

Specific range of group's buyers are interviewed for developing an understanding

about awareness of buying policies of organization. In the same series, nature of

rebate which is It would be classified as test of control, because auditor had taken

sample on its capital expenditure and nature of rebate had been inspected.

Represent audit committee with its role of non-executive directors

Myer Holdings limited have Audit, Finance and Risk committee which consists of

various non-executive directors.

Joanne Stephenson (Independent Non-executive director): Experience of more than

25 years and strength in accounting, finance, governance and risk management. She is a

member of Australian Institute of Company Directors and Chartered Accountants in New

Zealand and Australia.

Anne Brennan (Independent Non-Executive director): Chairman of Audit, Finance

and Risk Committee. Her major role is to bring strong financial credentials and provides

quickness and keenness for dealing and understanding business situations. It comprises

senior management role in professional services and large corporate organizations. In the

same series, she has executive role at CSR as Chief Financial Officer.

Bob Thorn (Independent Non-Executive director): His major role is to bring business

as he has experience of senior retail management as Managing Director.

Dave Whittle (Independent Non-Executive director): His major role is to provide

innovative data, advice and software for helping business entities for engaging and

understanding its customers.

Audit Opinion

Myer Holding's opinion was to accompanying its financial report along with controlled

business entities in context of Corporations Act 2001. It provides fair and true aspect of financial

position of group and its performance for year end. It is directly complied with Australian

Accounting Standards and Corporations Regulations 2001. They have audited its consolidated

financial statements along with its notes and director's declaration.

5

audit was conducted with context of Australian Auditing Standards. Their main

responsibility under these standards is to provide description about Auditor's responsibility for

audit of financial report. The main objective is to extract reasonable assurance from its material

misstatement, it might be because of error or fraud. The report of remuneration of Myer holdings

limited via PwC is complied with Section 300A of Corporation Act 2001.

Difference between responsibility of auditor, management and director

The final information is always considered in annual financial statement which elaborates

responsibility of management for purpose of accurate representation and preparation of financial

statements. Generally, this statement marks particular division of its responsibilities which are

directly involved through financial statement's publication. For the purpose of forming financial

statements, management is highly responsible along with estimation of useful life of plant,

equipment and property which is applicable for extracting depreciation (Financial and

accounting duties and responsibilities of directors, 2018).

On the contrary, independent auditor has responsibility for examining its information of

financial statement which is formed via management. It also comprises reasonableness of

estimates and provides opinion on accuracy aspect. Auditors might assist management in

preparing financial statements. For example, auditor could give guidance on following

accounting standards which would impact presentation of financial statements and disclosure of

information. However, preparing financial statement is responsibility of management.

Usually, management is responsible for objectivity and integrity of financial statements.

The estimates are essential requirement for preparing statements on basis of careful observation

which are appropriately affected. Management has framed system of internal control for

providing reasonable assurance through which assets are protected from unauthorised use and

loss. In the same series, it generates reliable records of accounting for purpose of preparing

financial information.

The directors are responsible for ensuring about fulfilling its major responsibility for

internal control and financial reporting. The board's audit committee consists of solely directors

but not company's employees as they are appointed through board of directors on annual basis.

There is regular meeting of board's audit committee, financial management of organization and

shareholder's independent auditor for discussing on its audit matters, internal control, auditor

remuneration, audit scope and issues of financial reporting. The auditor of independent

6

responsibility under these standards is to provide description about Auditor's responsibility for

audit of financial report. The main objective is to extract reasonable assurance from its material

misstatement, it might be because of error or fraud. The report of remuneration of Myer holdings

limited via PwC is complied with Section 300A of Corporation Act 2001.

Difference between responsibility of auditor, management and director

The final information is always considered in annual financial statement which elaborates

responsibility of management for purpose of accurate representation and preparation of financial

statements. Generally, this statement marks particular division of its responsibilities which are

directly involved through financial statement's publication. For the purpose of forming financial

statements, management is highly responsible along with estimation of useful life of plant,

equipment and property which is applicable for extracting depreciation (Financial and

accounting duties and responsibilities of directors, 2018).

On the contrary, independent auditor has responsibility for examining its information of

financial statement which is formed via management. It also comprises reasonableness of

estimates and provides opinion on accuracy aspect. Auditors might assist management in

preparing financial statements. For example, auditor could give guidance on following

accounting standards which would impact presentation of financial statements and disclosure of

information. However, preparing financial statement is responsibility of management.

Usually, management is responsible for objectivity and integrity of financial statements.

The estimates are essential requirement for preparing statements on basis of careful observation

which are appropriately affected. Management has framed system of internal control for

providing reasonable assurance through which assets are protected from unauthorised use and

loss. In the same series, it generates reliable records of accounting for purpose of preparing

financial information.

The directors are responsible for ensuring about fulfilling its major responsibility for

internal control and financial reporting. The board's audit committee consists of solely directors

but not company's employees as they are appointed through board of directors on annual basis.

There is regular meeting of board's audit committee, financial management of organization and

shareholder's independent auditor for discussing on its audit matters, internal control, auditor

remuneration, audit scope and issues of financial reporting. The auditor of independent

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

shareholder has unrestricted access on its Board audit committee. This annual financial

statements and reporting are reviewed through audit committee and recommendations are framed

with context of acceptance. Recommendations are also given to board by committee for

remuneration and appointment of auditor of organization (D'Onza and Sarens, 2018).

Furthermore, management recognizes its major duty for conducting affairs of

organization in compliance with framed financial standards and applicable laws. In the same

series, proper standards are maintained to conduct its activities.

Presence of material subsequent events

There is presence of subsequent events which had incurred after specific reporting period

as dividends on the organization's ordinary shares. In this context, directors have identified

payment of final dividend of 2 cents per share, fully franked at 30% corporate income tax rate

which is payable for period ending on 29 July 2017.

These subsequent events are adjusted in statements of financial position in equity as

dividends. Its aggregate amount of dividend proposed which is expected payment after period

ending but not considered as liability.

The above material subsequent event would represent franking accounts balance at its

reporting date. The franking credit would raise from payment of provision for income tax of

specific amount and its debit would have arisen via payment of dividends which is considered as

liability and credits by receipt of dividends as receivables of report.

The franking account would impact on dividend which is recommended through directors

at end of reporting period but it would not be considered as liability on reporting data. It would

be directly reduced by franking account.

Assessment of effectiveness of material information

There would be application of component materiality for audit and review of its financial

information. The information could be termed as material when its omission or misstatement

might influence user's economic decision which are taken with context of financial statements. It

directly depends on nature and size of item or identified mistake in specific circumstances of its

misstatements and omission (Annual report of Myre Holding Limited, 2017).

Overall group's materiality was of $4.9 million, which is approx. 5% of profit before tax

which is adjusted for separate material item disclosed as store exit costs, impairment of assets,

7

statements and reporting are reviewed through audit committee and recommendations are framed

with context of acceptance. Recommendations are also given to board by committee for

remuneration and appointment of auditor of organization (D'Onza and Sarens, 2018).

Furthermore, management recognizes its major duty for conducting affairs of

organization in compliance with framed financial standards and applicable laws. In the same

series, proper standards are maintained to conduct its activities.

Presence of material subsequent events

There is presence of subsequent events which had incurred after specific reporting period

as dividends on the organization's ordinary shares. In this context, directors have identified

payment of final dividend of 2 cents per share, fully franked at 30% corporate income tax rate

which is payable for period ending on 29 July 2017.

These subsequent events are adjusted in statements of financial position in equity as

dividends. Its aggregate amount of dividend proposed which is expected payment after period

ending but not considered as liability.

The above material subsequent event would represent franking accounts balance at its

reporting date. The franking credit would raise from payment of provision for income tax of

specific amount and its debit would have arisen via payment of dividends which is considered as

liability and credits by receipt of dividends as receivables of report.

The franking account would impact on dividend which is recommended through directors

at end of reporting period but it would not be considered as liability on reporting data. It would

be directly reduced by franking account.

Assessment of effectiveness of material information

There would be application of component materiality for audit and review of its financial

information. The information could be termed as material when its omission or misstatement

might influence user's economic decision which are taken with context of financial statements. It

directly depends on nature and size of item or identified mistake in specific circumstances of its

misstatements and omission (Annual report of Myre Holding Limited, 2017).

Overall group's materiality was of $4.9 million, which is approx. 5% of profit before tax

which is adjusted for separate material item disclosed as store exit costs, impairment of assets,

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

onerous lease expense and restructuring. In the same series, threshold has been applied along

with qualitative consideration for identifying scope and nature of audit. The timing and extent of

procedure of audit has been determined for evaluating impact of misstatements on whole

financial report. Its profit before tax had been selected and there is disclosure of individual

material items due to performance of group referred as very common measure through its users.

Individual material items are adjusted as these incur on infrequent or unusual aspect

which impacts loss and profit. In the same series, 5% on basis of noting of professional

judgement in specific range of profit which is commonly acceptable associated to materiality

thresholds.

Disclosure of material information which are effective for financial statements

It must disclose about key management personnel compensation along with transactions

of related party. In the same series, there was uncertainty with context to going concern. It must

state significant accounting policies which are relevant and specific to organization. Along with

materiality of transaction or balance which is impacted through policy factors consist on

company's operation with consideration of its nature. Method of applying policies must be

specific and clear. Last but not least, key judgements and estimates must be articulated as

effective disclosure (Mock, Ragothaman and Srivastava, 2018).

Follow-up questions for Auditor at the company’s Annual General Meeting

What are the disagreements among management and external auditors? How it is

resolved?

The organizations internal control has been monitored through audit committee or not? Is

there any discussion about restructuring or downsizing external control?

Does audit committee obtain similar comments on internal control by its auditor and

management as well?

Is there any extraction of issues via external auditors which are essential for enhancing

procedure of fraud?

CONCLUSION

From the above study, it has been concluded that communication among investor and

auditor is improved through auditing. It is shown that assurance has been provided which is

8

with qualitative consideration for identifying scope and nature of audit. The timing and extent of

procedure of audit has been determined for evaluating impact of misstatements on whole

financial report. Its profit before tax had been selected and there is disclosure of individual

material items due to performance of group referred as very common measure through its users.

Individual material items are adjusted as these incur on infrequent or unusual aspect

which impacts loss and profit. In the same series, 5% on basis of noting of professional

judgement in specific range of profit which is commonly acceptable associated to materiality

thresholds.

Disclosure of material information which are effective for financial statements

It must disclose about key management personnel compensation along with transactions

of related party. In the same series, there was uncertainty with context to going concern. It must

state significant accounting policies which are relevant and specific to organization. Along with

materiality of transaction or balance which is impacted through policy factors consist on

company's operation with consideration of its nature. Method of applying policies must be

specific and clear. Last but not least, key judgements and estimates must be articulated as

effective disclosure (Mock, Ragothaman and Srivastava, 2018).

Follow-up questions for Auditor at the company’s Annual General Meeting

What are the disagreements among management and external auditors? How it is

resolved?

The organizations internal control has been monitored through audit committee or not? Is

there any discussion about restructuring or downsizing external control?

Does audit committee obtain similar comments on internal control by its auditor and

management as well?

Is there any extraction of issues via external auditors which are essential for enhancing

procedure of fraud?

CONCLUSION

From the above study, it has been concluded that communication among investor and

auditor is improved through auditing. It is shown that assurance has been provided which is

8

presented by management is true and fair aspect. In the same series, it enhances degree of

confidence in its financial statements which consist of qualified external party. Further it has

been articulated that there must be appropriate disclosure of material information which is

effective for Myer Holding limited. In the same series, it had also shown percentage change in

remuneration of auditor as it is decreasing from year 2016 to 2017. This organization has

presence of subsequent material events which are treated in efficient aspect. It could be summed

by stating that auditor plays very important role for enhancing financial report.

9

confidence in its financial statements which consist of qualified external party. Further it has

been articulated that there must be appropriate disclosure of material information which is

effective for Myer Holding limited. In the same series, it had also shown percentage change in

remuneration of auditor as it is decreasing from year 2016 to 2017. This organization has

presence of subsequent material events which are treated in efficient aspect. It could be summed

by stating that auditor plays very important role for enhancing financial report.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.