Corporate Accounting Analysis: Commonwealth & Westpac Banks Report

VerifiedAdded on 2023/06/05

|20

|4359

|477

Report

AI Summary

This report provides a detailed analysis of the financial statements of two prominent Australian banks, Commonwealth Bank and Westpac Bank. The analysis covers key components of their financial reports, including equity, cash flow statements, comprehensive income, and corporate income tax. The equity section examines share capital, reserves, and retained earnings, comparing debt-equity ratios. The cash flow analysis assesses operating, investing, and financing activities over a three-year period, highlighting trends and significant changes. Furthermore, the report delves into the comprehensive income statement, examining items reported outside of profit and loss, and discusses the implications of corporate income tax, including effective tax rates and deferred tax liabilities. The report offers insights into the financial performance and position of both banks, providing valuable information for investors and stakeholders. This report is a comprehensive analysis of the financial statements of two major Australian banks and is available on Desklib, a platform offering past papers and solved assignments.

Corporate Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

The following discussion is made on two listed companies belonging to the same industry in

Australia. We have chosen Commonwealth and Westpac banks in order to conduct an

analysis on various parts of a financial report. This analysis can also be done for other parts

not discussed in the report. The following discussion will help the investors and other users of

the financial statements to have an insight into the working of these two organisations.

2

The following discussion is made on two listed companies belonging to the same industry in

Australia. We have chosen Commonwealth and Westpac banks in order to conduct an

analysis on various parts of a financial report. This analysis can also be done for other parts

not discussed in the report. The following discussion will help the investors and other users of

the financial statements to have an insight into the working of these two organisations.

2

Contents

Introduction................................................................................................................................5

Analysis of Equity......................................................................................................................6

Discussion on each item of equity for both the companies....................................................6

Discussion and debt and equity of both the companies..........................................................7

Analysis of Cash flow statement................................................................................................9

Discussion on the cash flow statement of both the companies..............................................9

Comparison of cash flow of three years of both the companies...........................................10

Description of analysis of cash flow of both the companies................................................11

Analysis of comprehensive income statement.........................................................................13

Items reported in the other comprehensive income statement.............................................13

Reasons for not reporting these items in the profit and loss statement................................13

Comparative analysis of the items of the other comprehensive income statement..............13

Use of other comprehensive income in evaluation of performance of managers................14

Analysis of corporate income tax.............................................................................................14

Tax expense for the companies for the current year.............................................................14

Effective income tax rate......................................................................................................14

Deferred tax liabilities and assets.........................................................................................14

Increase in DTA and DTL....................................................................................................15

Calculation of cash tax using the book tax...........................................................................15

Calculation of cash tax rate..................................................................................................17

Difference in cash tax and book tax.....................................................................................17

Conclusion................................................................................................................................18

Bibliography.............................................................................................................................19

3

Introduction................................................................................................................................5

Analysis of Equity......................................................................................................................6

Discussion on each item of equity for both the companies....................................................6

Discussion and debt and equity of both the companies..........................................................7

Analysis of Cash flow statement................................................................................................9

Discussion on the cash flow statement of both the companies..............................................9

Comparison of cash flow of three years of both the companies...........................................10

Description of analysis of cash flow of both the companies................................................11

Analysis of comprehensive income statement.........................................................................13

Items reported in the other comprehensive income statement.............................................13

Reasons for not reporting these items in the profit and loss statement................................13

Comparative analysis of the items of the other comprehensive income statement..............13

Use of other comprehensive income in evaluation of performance of managers................14

Analysis of corporate income tax.............................................................................................14

Tax expense for the companies for the current year.............................................................14

Effective income tax rate......................................................................................................14

Deferred tax liabilities and assets.........................................................................................14

Increase in DTA and DTL....................................................................................................15

Calculation of cash tax using the book tax...........................................................................15

Calculation of cash tax rate..................................................................................................17

Difference in cash tax and book tax.....................................................................................17

Conclusion................................................................................................................................18

Bibliography.............................................................................................................................19

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The financial reports of the companies comprise of many parts. It is important that we learn

about the nature and characteristics of such pieces of the financial report (Alvarez, 2013). In

our discussion below we have discussed about few financial parts of companies in Australia

that belong to same sector. The following discussion is done on Commonwealth group and

Westpac group of Australia.

Commonwealth bank of Australia is the biggest bank of Australia which has its business

spread across Australia, New Zealand, Asia, United sates and United Kingdom. This is not

only the largest bank in Australia, but also in the whole of southern hemisphere. The bank is

involved in providing a lot of services such as insurance, superannuation, fund management,

institutional banking, retail, broking services, etc. this bank was first established in 1911, and

later in 1991 it was listed in the Australian stock exchange. The bank has more than 1100

branches spread across the world along with 51800 people working for it.

Westpac bank is an Australian based bank which has its headquarters located in Sydney. The

bank is one of the top four banks in Australia. The bank has been consecutively for four years

ranked as the most sustainable bank globally. The bank was first established in 1817 as Bank

of New South Wales, later it in 1982, t was remained Westpac. They got listed on the

Australian stock exchange in 1970. The bank has about 1490 branches with 32620

employees. The vision of the company is set as to be the world great service company which

helps customers and communities and helps them to prosper and grow. The bank has about

14 million people being associated with it.

In the following discussion we have discussed few parts of the financial statements of both

these companies in order to have a better understanding (Bragg, 2015).

4

The financial reports of the companies comprise of many parts. It is important that we learn

about the nature and characteristics of such pieces of the financial report (Alvarez, 2013). In

our discussion below we have discussed about few financial parts of companies in Australia

that belong to same sector. The following discussion is done on Commonwealth group and

Westpac group of Australia.

Commonwealth bank of Australia is the biggest bank of Australia which has its business

spread across Australia, New Zealand, Asia, United sates and United Kingdom. This is not

only the largest bank in Australia, but also in the whole of southern hemisphere. The bank is

involved in providing a lot of services such as insurance, superannuation, fund management,

institutional banking, retail, broking services, etc. this bank was first established in 1911, and

later in 1991 it was listed in the Australian stock exchange. The bank has more than 1100

branches spread across the world along with 51800 people working for it.

Westpac bank is an Australian based bank which has its headquarters located in Sydney. The

bank is one of the top four banks in Australia. The bank has been consecutively for four years

ranked as the most sustainable bank globally. The bank was first established in 1817 as Bank

of New South Wales, later it in 1982, t was remained Westpac. They got listed on the

Australian stock exchange in 1970. The bank has about 1490 branches with 32620

employees. The vision of the company is set as to be the world great service company which

helps customers and communities and helps them to prosper and grow. The bank has about

14 million people being associated with it.

In the following discussion we have discussed few parts of the financial statements of both

these companies in order to have a better understanding (Bragg, 2015).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Analysis of Equity

The equity shareholders fund represents the monies raised by the company by issuing equity

shares and other kinds of shares, along with reserves and retained profits (Donohue, 2015).

Discussion on each item of equity for both the companies

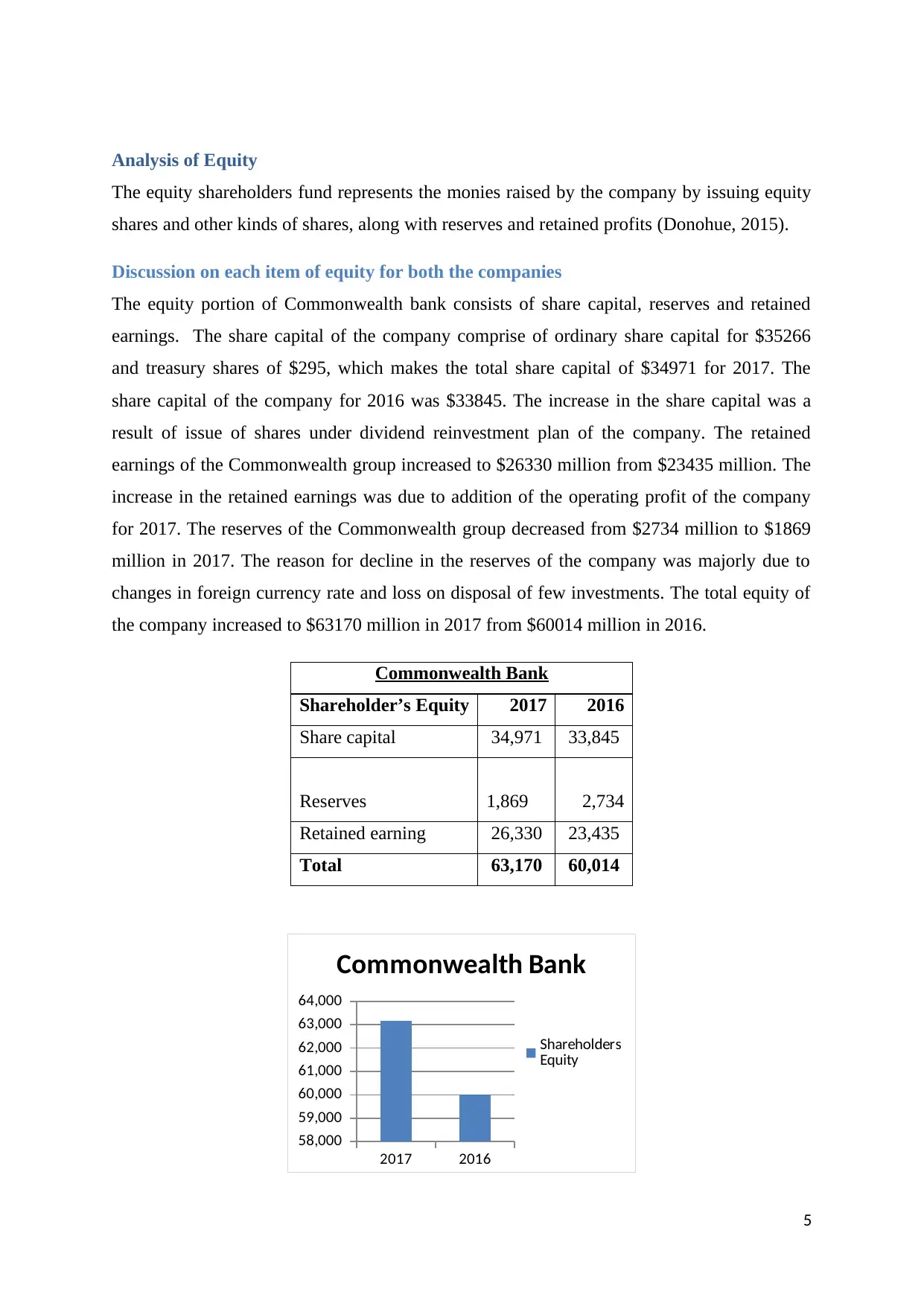

The equity portion of Commonwealth bank consists of share capital, reserves and retained

earnings. The share capital of the company comprise of ordinary share capital for $35266

and treasury shares of $295, which makes the total share capital of $34971 for 2017. The

share capital of the company for 2016 was $33845. The increase in the share capital was a

result of issue of shares under dividend reinvestment plan of the company. The retained

earnings of the Commonwealth group increased to $26330 million from $23435 million. The

increase in the retained earnings was due to addition of the operating profit of the company

for 2017. The reserves of the Commonwealth group decreased from $2734 million to $1869

million in 2017. The reason for decline in the reserves of the company was majorly due to

changes in foreign currency rate and loss on disposal of few investments. The total equity of

the company increased to $63170 million in 2017 from $60014 million in 2016.

Commonwealth Bank

Shareholder’s Equity 2017 2016

Share capital 34,971 33,845

Reserves 1,869 2,734

Retained earning 26,330 23,435

Total 63,170 60,014

2017 2016

58,000

59,000

60,000

61,000

62,000

63,000

64,000

Commonwealth Bank

Shareholders

Equity

5

The equity shareholders fund represents the monies raised by the company by issuing equity

shares and other kinds of shares, along with reserves and retained profits (Donohue, 2015).

Discussion on each item of equity for both the companies

The equity portion of Commonwealth bank consists of share capital, reserves and retained

earnings. The share capital of the company comprise of ordinary share capital for $35266

and treasury shares of $295, which makes the total share capital of $34971 for 2017. The

share capital of the company for 2016 was $33845. The increase in the share capital was a

result of issue of shares under dividend reinvestment plan of the company. The retained

earnings of the Commonwealth group increased to $26330 million from $23435 million. The

increase in the retained earnings was due to addition of the operating profit of the company

for 2017. The reserves of the Commonwealth group decreased from $2734 million to $1869

million in 2017. The reason for decline in the reserves of the company was majorly due to

changes in foreign currency rate and loss on disposal of few investments. The total equity of

the company increased to $63170 million in 2017 from $60014 million in 2016.

Commonwealth Bank

Shareholder’s Equity 2017 2016

Share capital 34,971 33,845

Reserves 1,869 2,734

Retained earning 26,330 23,435

Total 63,170 60,014

2017 2016

58,000

59,000

60,000

61,000

62,000

63,000

64,000

Commonwealth Bank

Shareholders

Equity

5

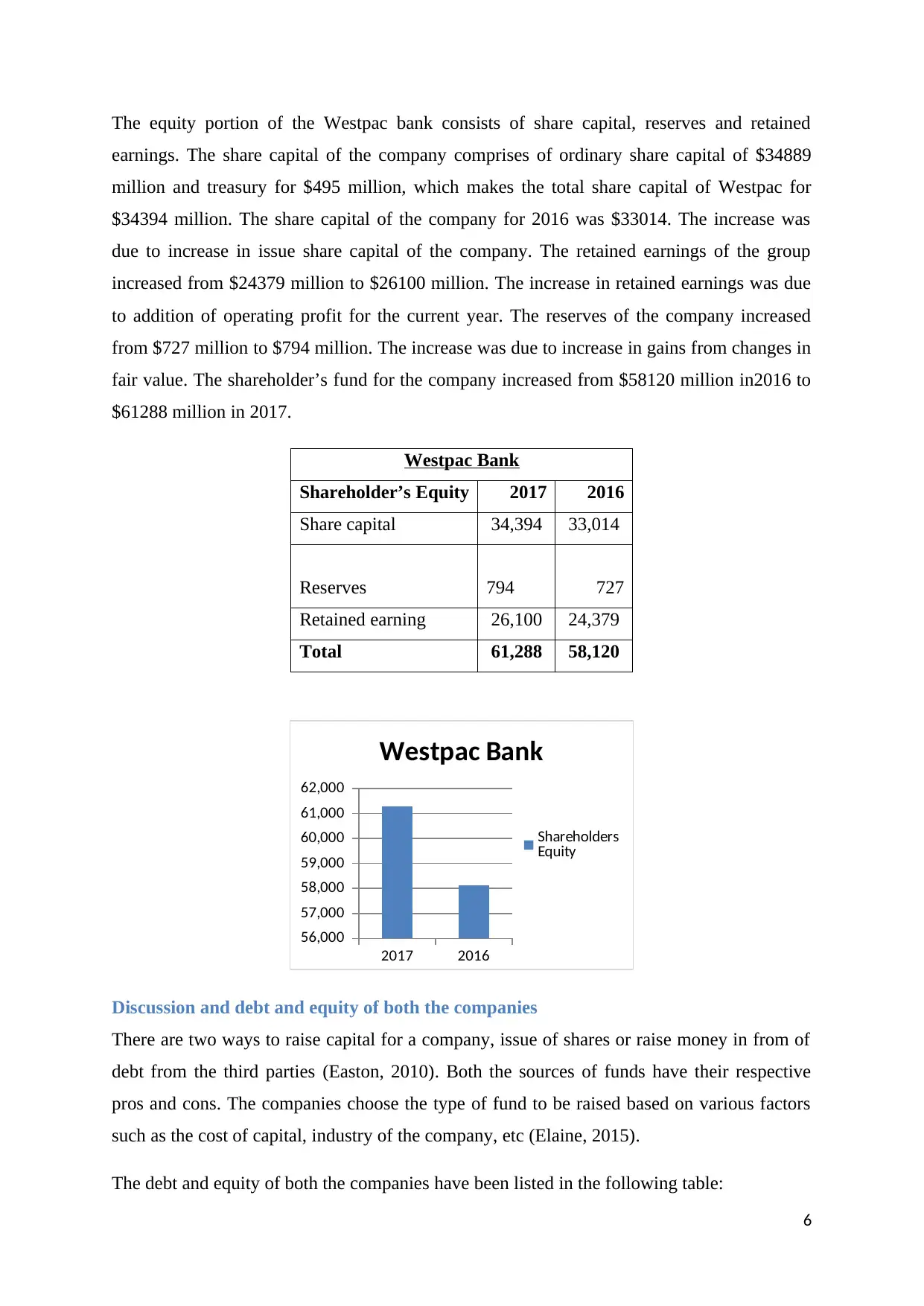

The equity portion of the Westpac bank consists of share capital, reserves and retained

earnings. The share capital of the company comprises of ordinary share capital of $34889

million and treasury for $495 million, which makes the total share capital of Westpac for

$34394 million. The share capital of the company for 2016 was $33014. The increase was

due to increase in issue share capital of the company. The retained earnings of the group

increased from $24379 million to $26100 million. The increase in retained earnings was due

to addition of operating profit for the current year. The reserves of the company increased

from $727 million to $794 million. The increase was due to increase in gains from changes in

fair value. The shareholder’s fund for the company increased from $58120 million in2016 to

$61288 million in 2017.

Westpac Bank

Shareholder’s Equity 2017 2016

Share capital 34,394 33,014

Reserves 794 727

Retained earning 26,100 24,379

Total 61,288 58,120

2017 2016

56,000

57,000

58,000

59,000

60,000

61,000

62,000

Westpac Bank

Shareholders

Equity

Discussion and debt and equity of both the companies

There are two ways to raise capital for a company, issue of shares or raise money in from of

debt from the third parties (Easton, 2010). Both the sources of funds have their respective

pros and cons. The companies choose the type of fund to be raised based on various factors

such as the cost of capital, industry of the company, etc (Elaine, 2015).

The debt and equity of both the companies have been listed in the following table:

6

earnings. The share capital of the company comprises of ordinary share capital of $34889

million and treasury for $495 million, which makes the total share capital of Westpac for

$34394 million. The share capital of the company for 2016 was $33014. The increase was

due to increase in issue share capital of the company. The retained earnings of the group

increased from $24379 million to $26100 million. The increase in retained earnings was due

to addition of operating profit for the current year. The reserves of the company increased

from $727 million to $794 million. The increase was due to increase in gains from changes in

fair value. The shareholder’s fund for the company increased from $58120 million in2016 to

$61288 million in 2017.

Westpac Bank

Shareholder’s Equity 2017 2016

Share capital 34,394 33,014

Reserves 794 727

Retained earning 26,100 24,379

Total 61,288 58,120

2017 2016

56,000

57,000

58,000

59,000

60,000

61,000

62,000

Westpac Bank

Shareholders

Equity

Discussion and debt and equity of both the companies

There are two ways to raise capital for a company, issue of shares or raise money in from of

debt from the third parties (Easton, 2010). Both the sources of funds have their respective

pros and cons. The companies choose the type of fund to be raised based on various factors

such as the cost of capital, industry of the company, etc (Elaine, 2015).

The debt and equity of both the companies have been listed in the following table:

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

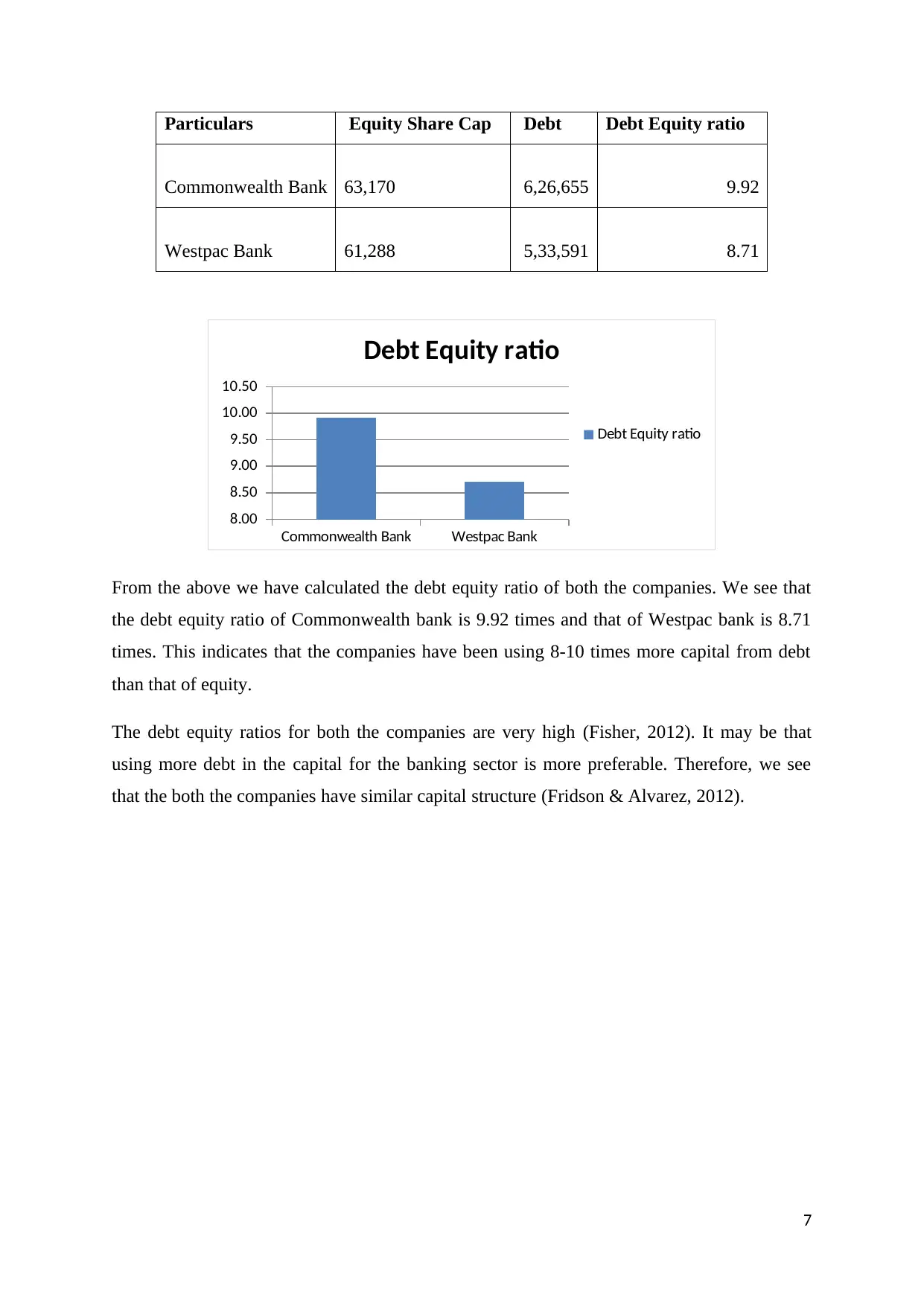

Particulars Equity Share Cap Debt Debt Equity ratio

Commonwealth Bank 63,170 6,26,655 9.92

Westpac Bank 61,288 5,33,591 8.71

Commonwealth Bank Westpac Bank

8.00

8.50

9.00

9.50

10.00

10.50

Debt Equity ratio

Debt Equity ratio

From the above we have calculated the debt equity ratio of both the companies. We see that

the debt equity ratio of Commonwealth bank is 9.92 times and that of Westpac bank is 8.71

times. This indicates that the companies have been using 8-10 times more capital from debt

than that of equity.

The debt equity ratios for both the companies are very high (Fisher, 2012). It may be that

using more debt in the capital for the banking sector is more preferable. Therefore, we see

that the both the companies have similar capital structure (Fridson & Alvarez, 2012).

7

Commonwealth Bank 63,170 6,26,655 9.92

Westpac Bank 61,288 5,33,591 8.71

Commonwealth Bank Westpac Bank

8.00

8.50

9.00

9.50

10.00

10.50

Debt Equity ratio

Debt Equity ratio

From the above we have calculated the debt equity ratio of both the companies. We see that

the debt equity ratio of Commonwealth bank is 9.92 times and that of Westpac bank is 8.71

times. This indicates that the companies have been using 8-10 times more capital from debt

than that of equity.

The debt equity ratios for both the companies are very high (Fisher, 2012). It may be that

using more debt in the capital for the banking sector is more preferable. Therefore, we see

that the both the companies have similar capital structure (Fridson & Alvarez, 2012).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Analysis of Cash flow statement

The books of accounts of the companies are made on accrual basis. In order to identify the

cash flow of the company from various functions, the cash flow statement is prepared. The

cash flow of the company plays a very important role in maintaining the liquidity of the

company (Girard, 2014).

Discussion on the cash flow statement of both the companies

The cash outflow from operating activities of the Commonwealth bank declined from $4561

million in 2016 to $807 million in 2017. The major decline in cash outflows of the company

was due to increased inflow from investment and interest incomes. The cash flows from

operating activities of the bank mainly comprise of income from investments and payments

for interest as they form the core part of the business activities of the bank.

The cash flow from investing activities of Commonwealth bank mainly comprise of cash

flows from acquisition and sale of associates and subsidiaries, fixed assets, investments and

dividend incomes on the investments made. The cash outflow from investment activities of

the bank declined from $2032 million in 2016 to $677 in 2017. The major decline in cash

outflow from investing activities was a result of declined payments for acquisition of

controlled entities, fewer purchases of plant and property and intangible assets.

The cash flow from financing activities of the Commonwealth bank mainly comprised of

cash flow relating to proceeds and repayments of equity and debt instruments. The cash flow

from financing activities of the bank increased from $1620 million to $10472 million in

2017. The increase in cash inflow from financing activities of the bank was due to lower

outflow form redemption of debt securities.

The overall cash flow of the Commonwealth bank increased for negative $4973million to

positive $8988 million in 2017.

The cash flow from operating activities of the Westpac bank mainly comprise of cash flows

from interest, insurance proceeds and income tax. The cash inflow from the operating

activities of the company declined from $5497 million to $2820 million in 2017. The major

decline in the cash from operating activities was due to losses from the fair value valuations

of the investments.

8

The books of accounts of the companies are made on accrual basis. In order to identify the

cash flow of the company from various functions, the cash flow statement is prepared. The

cash flow of the company plays a very important role in maintaining the liquidity of the

company (Girard, 2014).

Discussion on the cash flow statement of both the companies

The cash outflow from operating activities of the Commonwealth bank declined from $4561

million in 2016 to $807 million in 2017. The major decline in cash outflows of the company

was due to increased inflow from investment and interest incomes. The cash flows from

operating activities of the bank mainly comprise of income from investments and payments

for interest as they form the core part of the business activities of the bank.

The cash flow from investing activities of Commonwealth bank mainly comprise of cash

flows from acquisition and sale of associates and subsidiaries, fixed assets, investments and

dividend incomes on the investments made. The cash outflow from investment activities of

the bank declined from $2032 million in 2016 to $677 in 2017. The major decline in cash

outflow from investing activities was a result of declined payments for acquisition of

controlled entities, fewer purchases of plant and property and intangible assets.

The cash flow from financing activities of the Commonwealth bank mainly comprised of

cash flow relating to proceeds and repayments of equity and debt instruments. The cash flow

from financing activities of the bank increased from $1620 million to $10472 million in

2017. The increase in cash inflow from financing activities of the bank was due to lower

outflow form redemption of debt securities.

The overall cash flow of the Commonwealth bank increased for negative $4973million to

positive $8988 million in 2017.

The cash flow from operating activities of the Westpac bank mainly comprise of cash flows

from interest, insurance proceeds and income tax. The cash inflow from the operating

activities of the company declined from $5497 million to $2820 million in 2017. The major

decline in the cash from operating activities was due to losses from the fair value valuations

of the investments.

8

The cash flow from the investing activities of the Westpac bank comprise of cash flows for

purchase and sale of various securities, assets- tangible and intangible and that in associates

and subsidiaries. The cash outflow from investing activities of the bank declined from $7245

million to $1698 million. The major decline in cash outflow was due to increased proceeds

from sale of securities and associates.

The cash flow from the financing activities of the Westpac bank comprises of proceeds and

repayment made in connection with equity and debt securities. The cash inflow from

financing activities of the group declined from $4573 million to $552 million. The major

reason for decline in cash inflow was due to increased outflows of redemption of loan capital

and lower debt issues during the year.

The net cash flow of the Westpac group declined from $2825 million in 2016 to $1674

million in 2017.

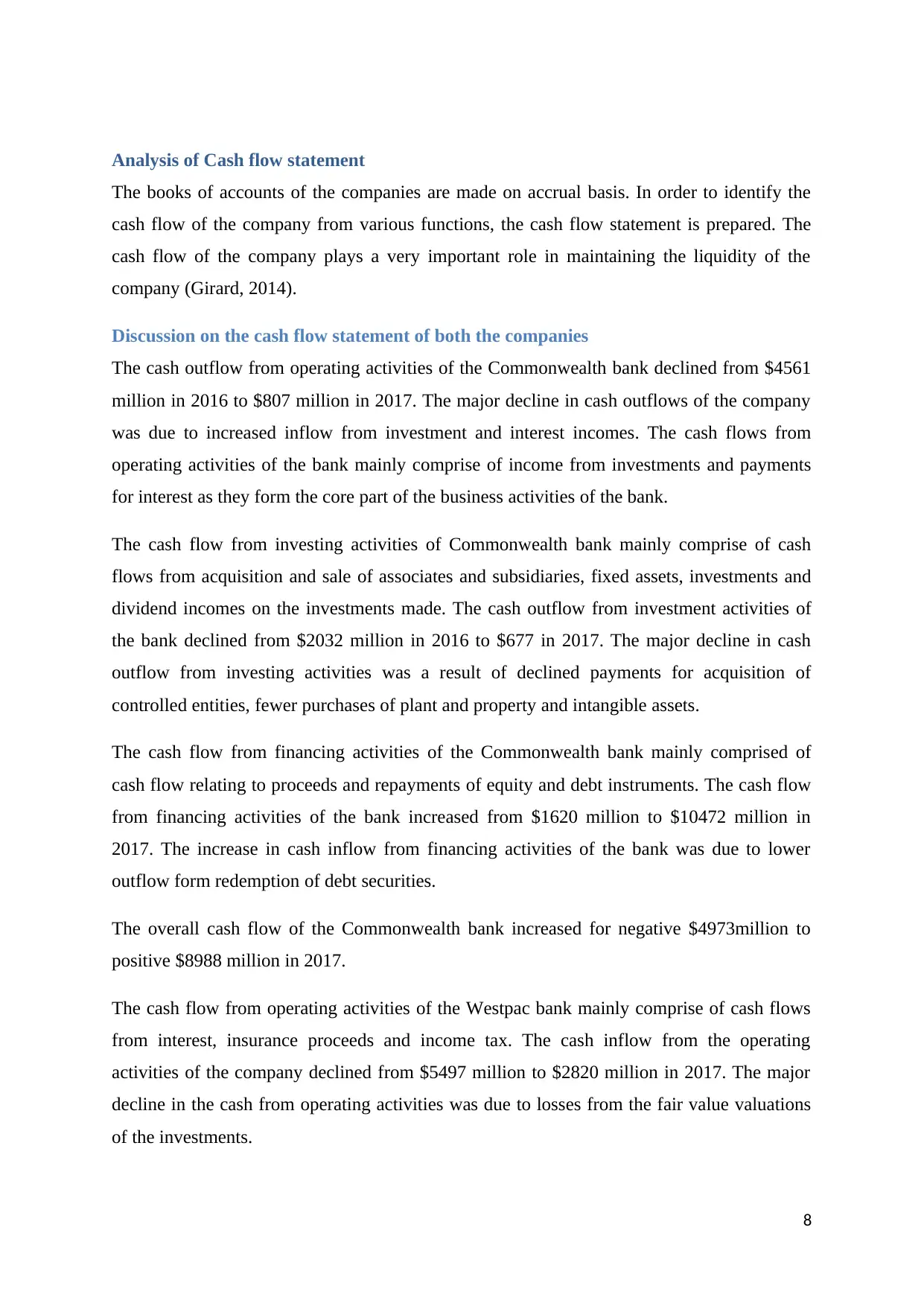

Comparison of cash flow of three years of both the companies

The cash flow from operating activities of both the companies is provided under:

Cash flow from operating Activities

Particulars 2017 2016 2015

Commonwealth -807 -4561 7183

Westpac 2820 5497 -541

2017 2016 2015

-6000

-4000

-2000

0

2000

4000

6000

8000

Commonwealth

Westpac

There is no trend in the operating cash flows of both the companies.

The cash flow from investing activities of both the companies is provided under:

Cash flow from Investing Activities

9

purchase and sale of various securities, assets- tangible and intangible and that in associates

and subsidiaries. The cash outflow from investing activities of the bank declined from $7245

million to $1698 million. The major decline in cash outflow was due to increased proceeds

from sale of securities and associates.

The cash flow from the financing activities of the Westpac bank comprises of proceeds and

repayment made in connection with equity and debt securities. The cash inflow from

financing activities of the group declined from $4573 million to $552 million. The major

reason for decline in cash inflow was due to increased outflows of redemption of loan capital

and lower debt issues during the year.

The net cash flow of the Westpac group declined from $2825 million in 2016 to $1674

million in 2017.

Comparison of cash flow of three years of both the companies

The cash flow from operating activities of both the companies is provided under:

Cash flow from operating Activities

Particulars 2017 2016 2015

Commonwealth -807 -4561 7183

Westpac 2820 5497 -541

2017 2016 2015

-6000

-4000

-2000

0

2000

4000

6000

8000

Commonwealth

Westpac

There is no trend in the operating cash flows of both the companies.

The cash flow from investing activities of both the companies is provided under:

Cash flow from Investing Activities

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

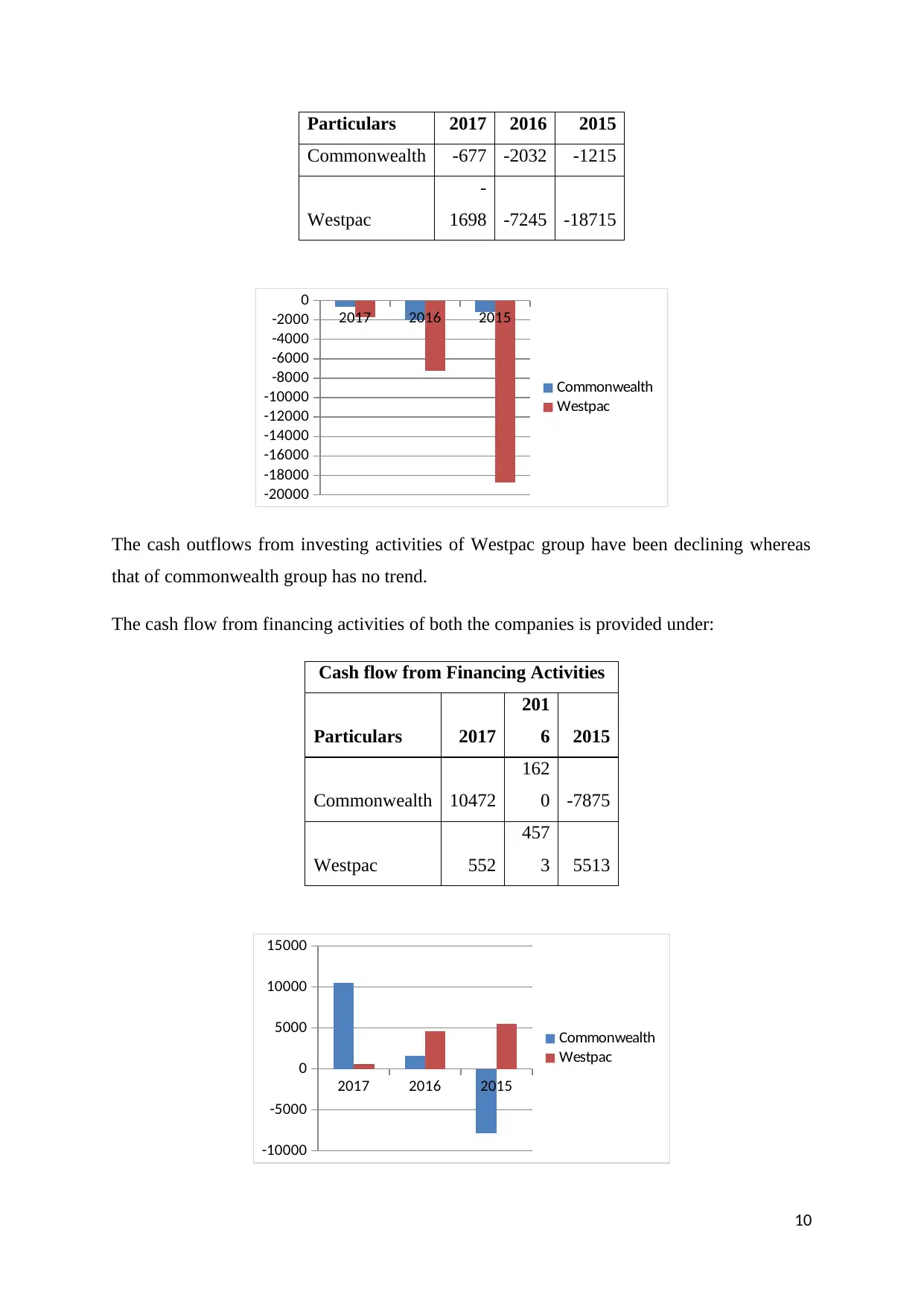

Particulars 2017 2016 2015

Commonwealth -677 -2032 -1215

Westpac

-

1698 -7245 -18715

2017 2016 2015

-20000

-18000

-16000

-14000

-12000

-10000

-8000

-6000

-4000

-2000

0

Commonwealth

Westpac

The cash outflows from investing activities of Westpac group have been declining whereas

that of commonwealth group has no trend.

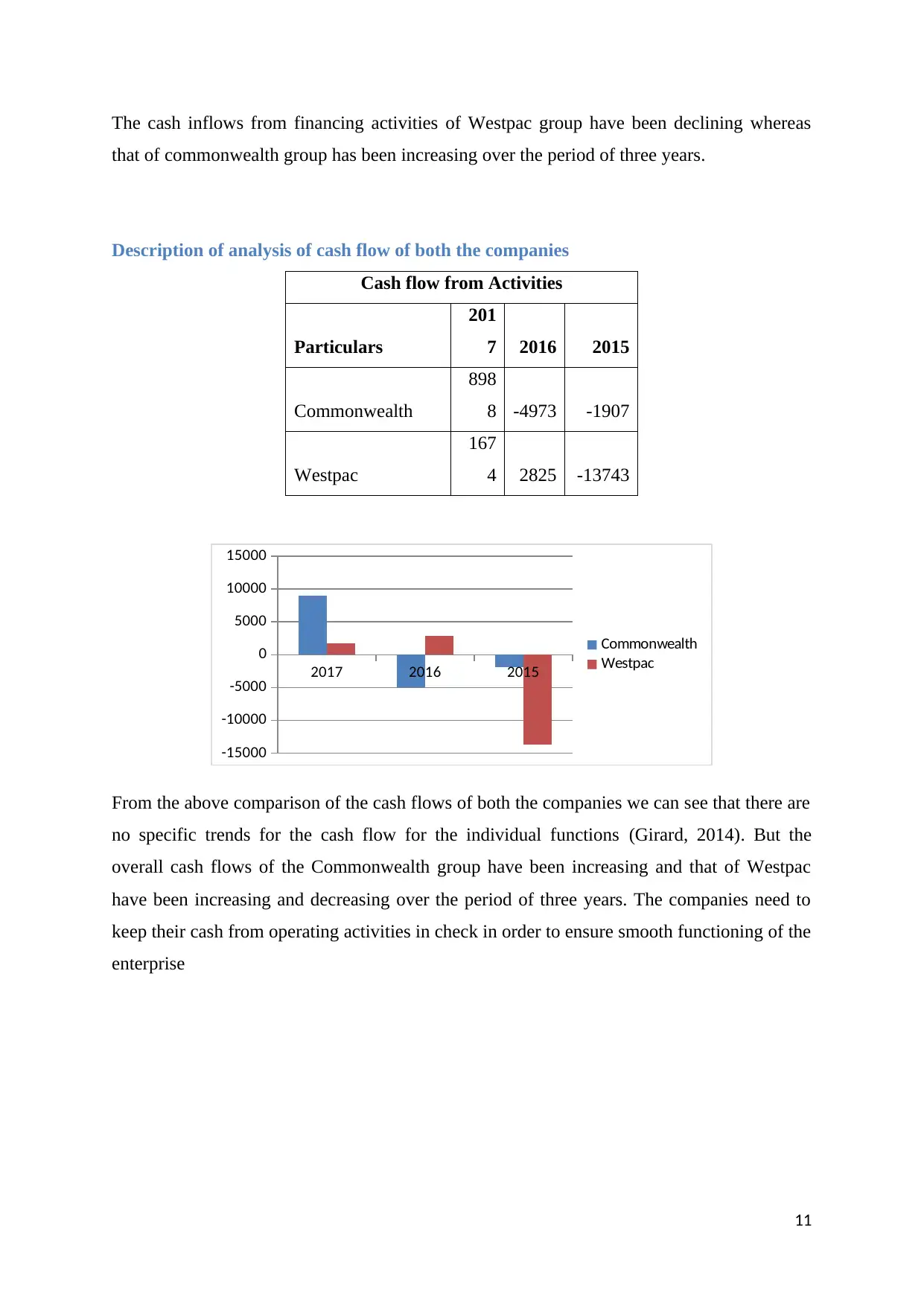

The cash flow from financing activities of both the companies is provided under:

Cash flow from Financing Activities

Particulars 2017

201

6 2015

Commonwealth 10472

162

0 -7875

Westpac 552

457

3 5513

2017 2016 2015

-10000

-5000

0

5000

10000

15000

Commonwealth

Westpac

10

Commonwealth -677 -2032 -1215

Westpac

-

1698 -7245 -18715

2017 2016 2015

-20000

-18000

-16000

-14000

-12000

-10000

-8000

-6000

-4000

-2000

0

Commonwealth

Westpac

The cash outflows from investing activities of Westpac group have been declining whereas

that of commonwealth group has no trend.

The cash flow from financing activities of both the companies is provided under:

Cash flow from Financing Activities

Particulars 2017

201

6 2015

Commonwealth 10472

162

0 -7875

Westpac 552

457

3 5513

2017 2016 2015

-10000

-5000

0

5000

10000

15000

Commonwealth

Westpac

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The cash inflows from financing activities of Westpac group have been declining whereas

that of commonwealth group has been increasing over the period of three years.

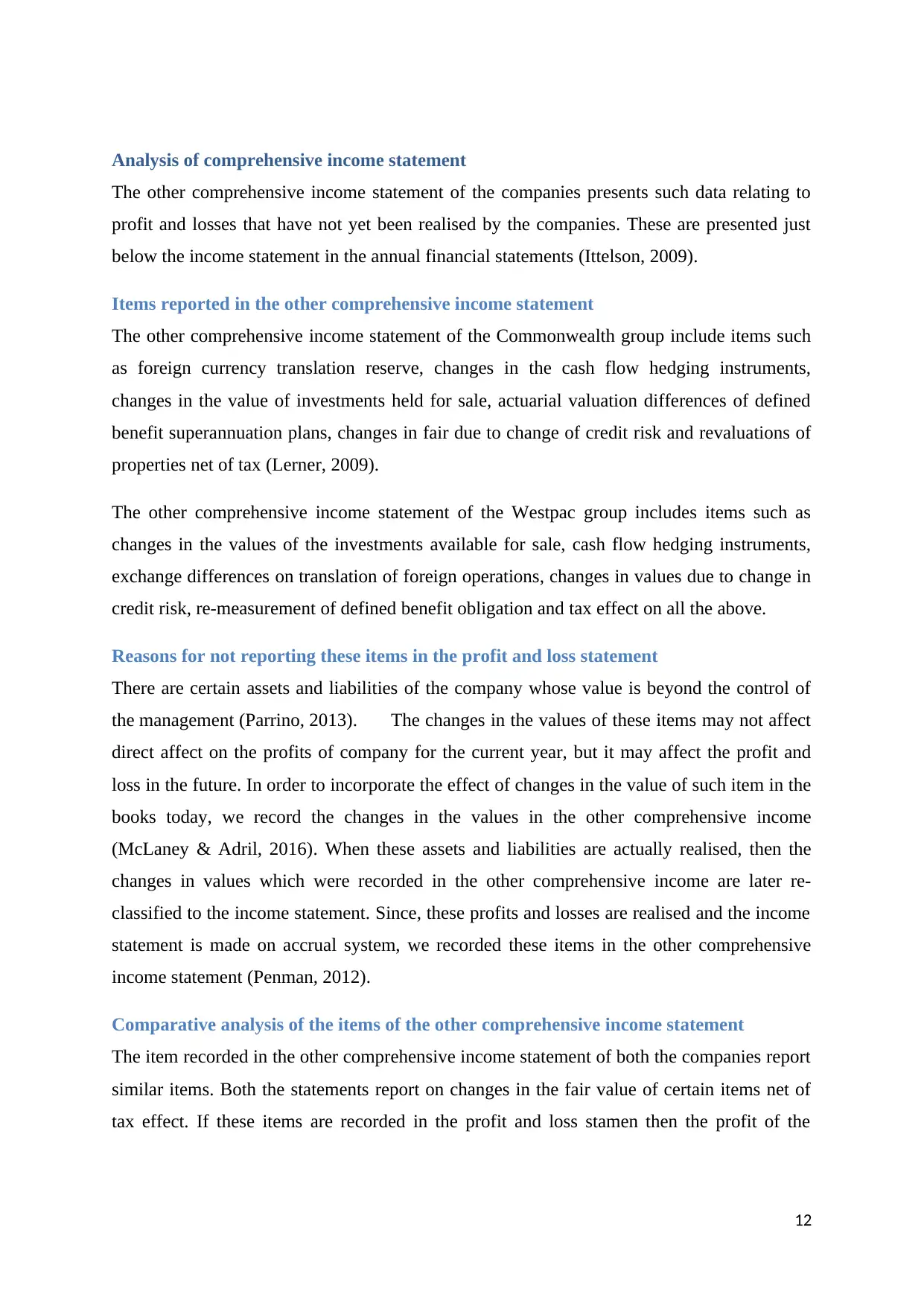

Description of analysis of cash flow of both the companies

Cash flow from Activities

Particulars

201

7 2016 2015

Commonwealth

898

8 -4973 -1907

Westpac

167

4 2825 -13743

2017 2016 2015

-15000

-10000

-5000

0

5000

10000

15000

Commonwealth

Westpac

From the above comparison of the cash flows of both the companies we can see that there are

no specific trends for the cash flow for the individual functions (Girard, 2014). But the

overall cash flows of the Commonwealth group have been increasing and that of Westpac

have been increasing and decreasing over the period of three years. The companies need to

keep their cash from operating activities in check in order to ensure smooth functioning of the

enterprise

11

that of commonwealth group has been increasing over the period of three years.

Description of analysis of cash flow of both the companies

Cash flow from Activities

Particulars

201

7 2016 2015

Commonwealth

898

8 -4973 -1907

Westpac

167

4 2825 -13743

2017 2016 2015

-15000

-10000

-5000

0

5000

10000

15000

Commonwealth

Westpac

From the above comparison of the cash flows of both the companies we can see that there are

no specific trends for the cash flow for the individual functions (Girard, 2014). But the

overall cash flows of the Commonwealth group have been increasing and that of Westpac

have been increasing and decreasing over the period of three years. The companies need to

keep their cash from operating activities in check in order to ensure smooth functioning of the

enterprise

11

Analysis of comprehensive income statement

The other comprehensive income statement of the companies presents such data relating to

profit and losses that have not yet been realised by the companies. These are presented just

below the income statement in the annual financial statements (Ittelson, 2009).

Items reported in the other comprehensive income statement

The other comprehensive income statement of the Commonwealth group include items such

as foreign currency translation reserve, changes in the cash flow hedging instruments,

changes in the value of investments held for sale, actuarial valuation differences of defined

benefit superannuation plans, changes in fair due to change of credit risk and revaluations of

properties net of tax (Lerner, 2009).

The other comprehensive income statement of the Westpac group includes items such as

changes in the values of the investments available for sale, cash flow hedging instruments,

exchange differences on translation of foreign operations, changes in values due to change in

credit risk, re-measurement of defined benefit obligation and tax effect on all the above.

Reasons for not reporting these items in the profit and loss statement

There are certain assets and liabilities of the company whose value is beyond the control of

the management (Parrino, 2013). The changes in the values of these items may not affect

direct affect on the profits of company for the current year, but it may affect the profit and

loss in the future. In order to incorporate the effect of changes in the value of such item in the

books today, we record the changes in the values in the other comprehensive income

(McLaney & Adril, 2016). When these assets and liabilities are actually realised, then the

changes in values which were recorded in the other comprehensive income are later re-

classified to the income statement. Since, these profits and losses are realised and the income

statement is made on accrual system, we recorded these items in the other comprehensive

income statement (Penman, 2012).

Comparative analysis of the items of the other comprehensive income statement

The item recorded in the other comprehensive income statement of both the companies report

similar items. Both the statements report on changes in the fair value of certain items net of

tax effect. If these items are recorded in the profit and loss stamen then the profit of the

12

The other comprehensive income statement of the companies presents such data relating to

profit and losses that have not yet been realised by the companies. These are presented just

below the income statement in the annual financial statements (Ittelson, 2009).

Items reported in the other comprehensive income statement

The other comprehensive income statement of the Commonwealth group include items such

as foreign currency translation reserve, changes in the cash flow hedging instruments,

changes in the value of investments held for sale, actuarial valuation differences of defined

benefit superannuation plans, changes in fair due to change of credit risk and revaluations of

properties net of tax (Lerner, 2009).

The other comprehensive income statement of the Westpac group includes items such as

changes in the values of the investments available for sale, cash flow hedging instruments,

exchange differences on translation of foreign operations, changes in values due to change in

credit risk, re-measurement of defined benefit obligation and tax effect on all the above.

Reasons for not reporting these items in the profit and loss statement

There are certain assets and liabilities of the company whose value is beyond the control of

the management (Parrino, 2013). The changes in the values of these items may not affect

direct affect on the profits of company for the current year, but it may affect the profit and

loss in the future. In order to incorporate the effect of changes in the value of such item in the

books today, we record the changes in the values in the other comprehensive income

(McLaney & Adril, 2016). When these assets and liabilities are actually realised, then the

changes in values which were recorded in the other comprehensive income are later re-

classified to the income statement. Since, these profits and losses are realised and the income

statement is made on accrual system, we recorded these items in the other comprehensive

income statement (Penman, 2012).

Comparative analysis of the items of the other comprehensive income statement

The item recorded in the other comprehensive income statement of both the companies report

similar items. Both the statements report on changes in the fair value of certain items net of

tax effect. If these items are recorded in the profit and loss stamen then the profit of the

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.