Business Decision Making Essay: Capital Budgeting for DDK Plc Projects

VerifiedAdded on 2022/12/13

|8

|1305

|191

Essay

AI Summary

This essay examines the business decision-making process, focusing on DDK Plc's investment in manufacturing belts and trainers. It utilizes capital budgeting tools, specifically the payback period and net present value (NPV), to evaluate the profitability of two potential projects, Project A and Project B. The analysis includes detailed calculations for both projects, comparing their financial returns and timeframes for recouping the initial investment. The essay also delves into the financial factors, such as earnings and expenditure, and non-financial factors, including resources and relationships, that influence investment choices. The conclusion recommends Project B due to its superior financial performance, emphasizing the importance of considering both financial and non-financial aspects for sound business decisions.

Business decision Marketing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................2

MAIN BODY..................................................................................................................................2

Pay back period............................................................................................................................2

Net present value (NPV)..............................................................................................................3

Financial factors...........................................................................................................................5

Non-financial factors...................................................................................................................5

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION...........................................................................................................................2

MAIN BODY..................................................................................................................................2

Pay back period............................................................................................................................2

Net present value (NPV)..............................................................................................................3

Financial factors...........................................................................................................................5

Non-financial factors...................................................................................................................5

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION

Business decision making is the step by step process that is used by the professionals

which also enable them to solve problem by weighing evidence and choosing the correct path for

the company. In the present study, DDK Plc is also investing upon project manufacturing in belts

and trainers. For that, there are two projects used by the company and by using capital budgeting

tools, it determines which is fruitful or not. Further, the study also describes some financial and

non-financial factors which needs to be taken which help to make better decision for the

company.

MAIN BODY

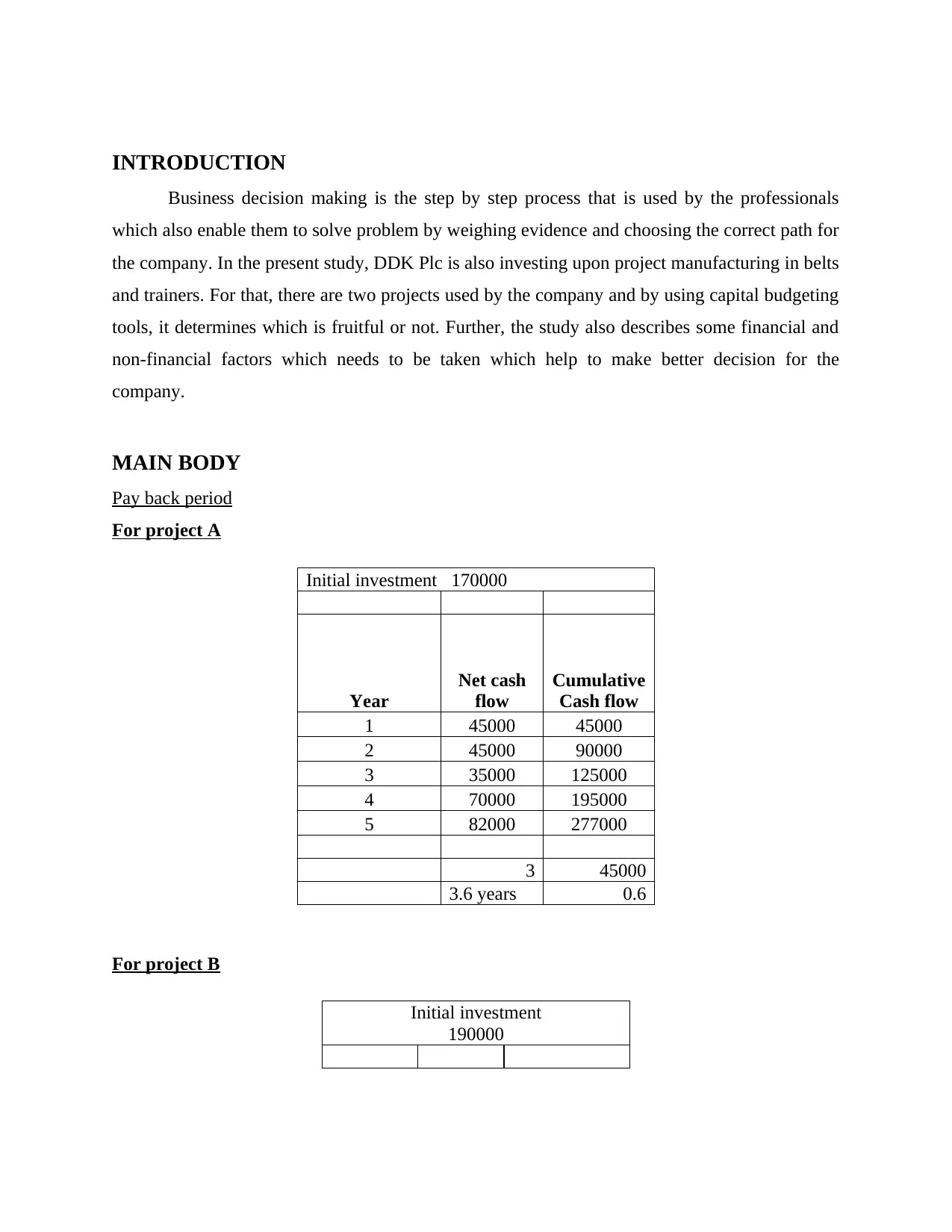

Pay back period

For project A

Initial investment 170000

Year

Net cash

flow

Cumulative

Cash flow

1 45000 45000

2 45000 90000

3 35000 125000

4 70000 195000

5 82000 277000

3 45000

3.6 years 0.6

For project B

Initial investment

190000

Business decision making is the step by step process that is used by the professionals

which also enable them to solve problem by weighing evidence and choosing the correct path for

the company. In the present study, DDK Plc is also investing upon project manufacturing in belts

and trainers. For that, there are two projects used by the company and by using capital budgeting

tools, it determines which is fruitful or not. Further, the study also describes some financial and

non-financial factors which needs to be taken which help to make better decision for the

company.

MAIN BODY

Pay back period

For project A

Initial investment 170000

Year

Net cash

flow

Cumulative

Cash flow

1 45000 45000

2 45000 90000

3 35000 125000

4 70000 195000

5 82000 277000

3 45000

3.6 years 0.6

For project B

Initial investment

190000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

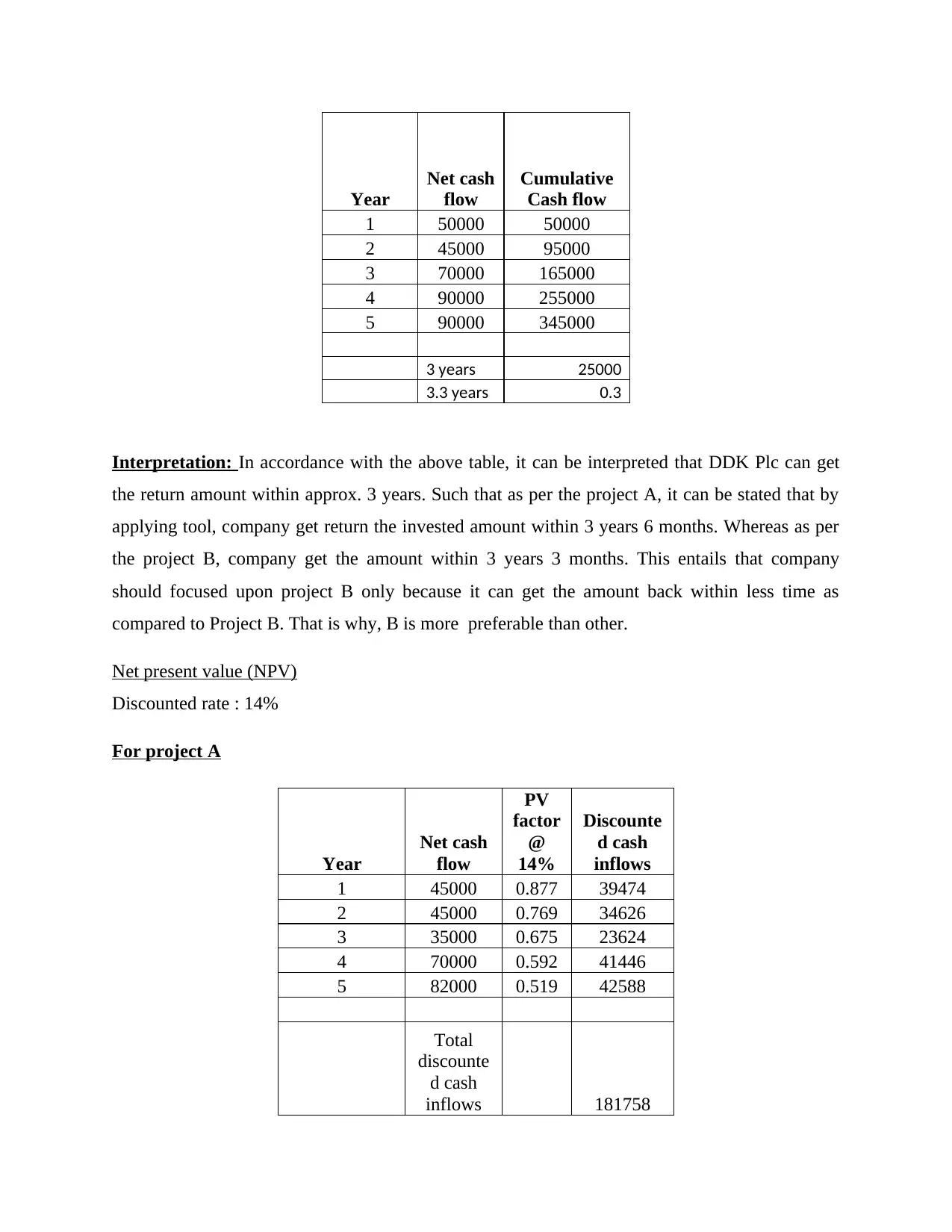

Year

Net cash

flow

Cumulative

Cash flow

1 50000 50000

2 45000 95000

3 70000 165000

4 90000 255000

5 90000 345000

3 years 25000

3.3 years 0.3

Interpretation: In accordance with the above table, it can be interpreted that DDK Plc can get

the return amount within approx. 3 years. Such that as per the project A, it can be stated that by

applying tool, company get return the invested amount within 3 years 6 months. Whereas as per

the project B, company get the amount within 3 years 3 months. This entails that company

should focused upon project B only because it can get the amount back within less time as

compared to Project B. That is why, B is more preferable than other.

Net present value (NPV)

Discounted rate : 14%

For project A

Year

Net cash

flow

PV

factor

@

14%

Discounte

d cash

inflows

1 45000 0.877 39474

2 45000 0.769 34626

3 35000 0.675 23624

4 70000 0.592 41446

5 82000 0.519 42588

Total

discounte

d cash

inflows 181758

Net cash

flow

Cumulative

Cash flow

1 50000 50000

2 45000 95000

3 70000 165000

4 90000 255000

5 90000 345000

3 years 25000

3.3 years 0.3

Interpretation: In accordance with the above table, it can be interpreted that DDK Plc can get

the return amount within approx. 3 years. Such that as per the project A, it can be stated that by

applying tool, company get return the invested amount within 3 years 6 months. Whereas as per

the project B, company get the amount within 3 years 3 months. This entails that company

should focused upon project B only because it can get the amount back within less time as

compared to Project B. That is why, B is more preferable than other.

Net present value (NPV)

Discounted rate : 14%

For project A

Year

Net cash

flow

PV

factor

@

14%

Discounte

d cash

inflows

1 45000 0.877 39474

2 45000 0.769 34626

3 35000 0.675 23624

4 70000 0.592 41446

5 82000 0.519 42588

Total

discounte

d cash

inflows 181758

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less:

initial

investmen

t 170000

NPV 11758

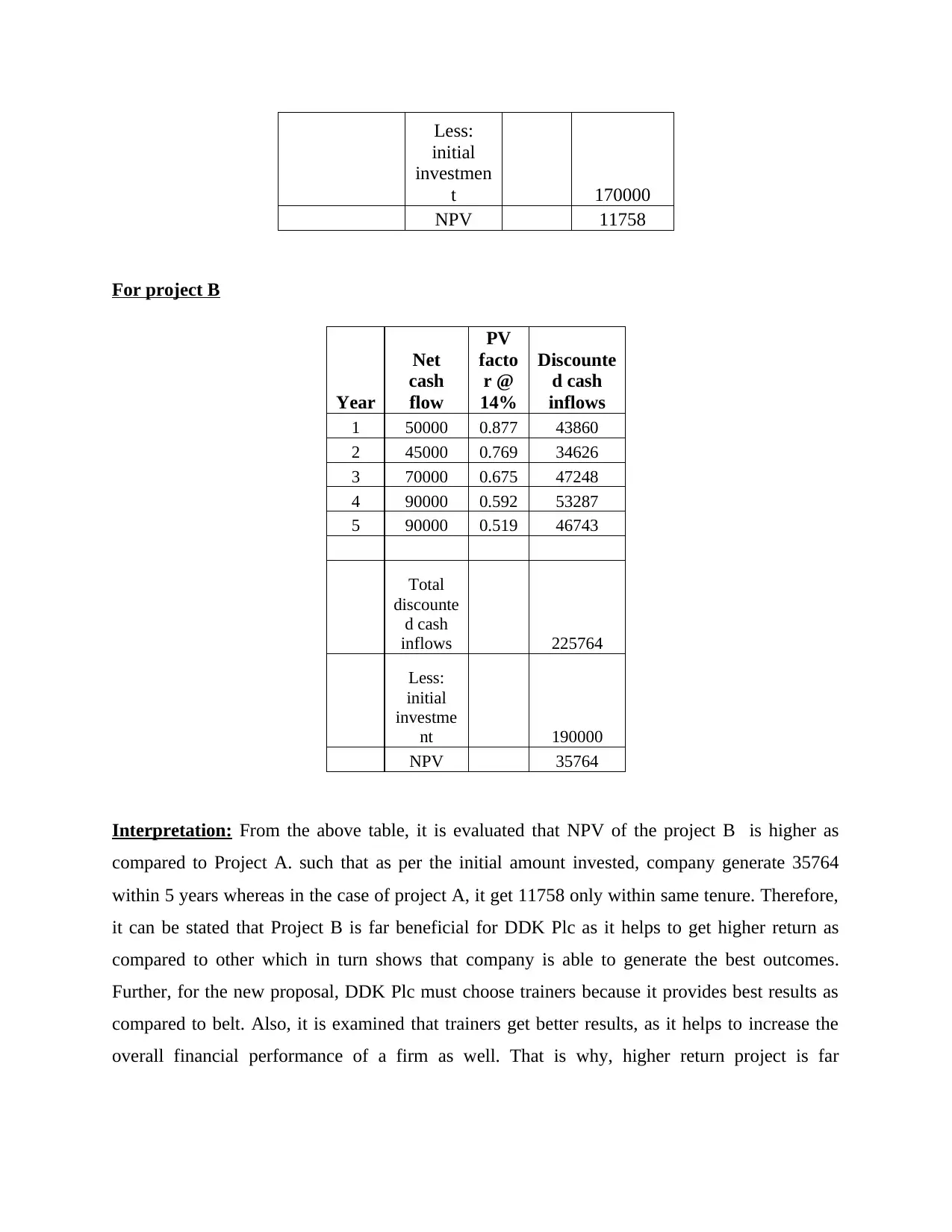

For project B

Year

Net

cash

flow

PV

facto

r @

14%

Discounte

d cash

inflows

1 50000 0.877 43860

2 45000 0.769 34626

3 70000 0.675 47248

4 90000 0.592 53287

5 90000 0.519 46743

Total

discounte

d cash

inflows 225764

Less:

initial

investme

nt 190000

NPV 35764

Interpretation: From the above table, it is evaluated that NPV of the project B is higher as

compared to Project A. such that as per the initial amount invested, company generate 35764

within 5 years whereas in the case of project A, it get 11758 only within same tenure. Therefore,

it can be stated that Project B is far beneficial for DDK Plc as it helps to get higher return as

compared to other which in turn shows that company is able to generate the best outcomes.

Further, for the new proposal, DDK Plc must choose trainers because it provides best results as

compared to belt. Also, it is examined that trainers get better results, as it helps to increase the

overall financial performance of a firm as well. That is why, higher return project is far

initial

investmen

t 170000

NPV 11758

For project B

Year

Net

cash

flow

PV

facto

r @

14%

Discounte

d cash

inflows

1 50000 0.877 43860

2 45000 0.769 34626

3 70000 0.675 47248

4 90000 0.592 53287

5 90000 0.519 46743

Total

discounte

d cash

inflows 225764

Less:

initial

investme

nt 190000

NPV 35764

Interpretation: From the above table, it is evaluated that NPV of the project B is higher as

compared to Project A. such that as per the initial amount invested, company generate 35764

within 5 years whereas in the case of project A, it get 11758 only within same tenure. Therefore,

it can be stated that Project B is far beneficial for DDK Plc as it helps to get higher return as

compared to other which in turn shows that company is able to generate the best outcomes.

Further, for the new proposal, DDK Plc must choose trainers because it provides best results as

compared to belt. Also, it is examined that trainers get better results, as it helps to increase the

overall financial performance of a firm as well. That is why, higher return project is far

preferable as compared to low return. Hence, Project B i.e. trainer is opted by DDK Plc because

it provide higher return by low investment which is not possible in Project A.

Financial factors

There are numerous financial factors which needs to be consider while investing a

project. Some of them are as mentioned below:

Earning: In order to looking for any investment, company must consider the earning or

net income of the company within a year. This is one of the highly financial factor that

affect the investment appraisal (Xiaolong, Guanghe and Wei, 2017). Such that if the

income of the company is not good, then it affect the investment in adverse manner. This

is also analyzed that through positive sales activity, company is able to make further

investment decision because it causes positive impact upon brand as well.

Expenditure: For any investment, company must consider expenses incurred by the firm

which affect the overall performance of a company. Such that if sales activity of a entity

reflects negative and expenses are high then it is not worthy to invest within such

investment. As it leads to cause negative impact upon the chosen investment (Arif-Ur-

Rahman and Inaba, 2020).

Non-financial factors

Resources: It is analyzed that in order to invest within any project, company must look

for the available resources that helps the company to improve the performance. In the

same way, employees and enough financial as well as physical resources should be

considered in order to generate the best outcomes (Burkhanov, 2020). That is why, before

any investment, there is a need to ensure that resources are available for the company that

leads to minimize the error. Relationship: For any investment, there is a need to monitor all the changes within

market and have suppliers that assist to make investment successful. Similarly, having a

brand image at market will also lead to generate the best relationship with customers by

offering best variety of products. This in turn also helps to meet the defined aim as well.

it provide higher return by low investment which is not possible in Project A.

Financial factors

There are numerous financial factors which needs to be consider while investing a

project. Some of them are as mentioned below:

Earning: In order to looking for any investment, company must consider the earning or

net income of the company within a year. This is one of the highly financial factor that

affect the investment appraisal (Xiaolong, Guanghe and Wei, 2017). Such that if the

income of the company is not good, then it affect the investment in adverse manner. This

is also analyzed that through positive sales activity, company is able to make further

investment decision because it causes positive impact upon brand as well.

Expenditure: For any investment, company must consider expenses incurred by the firm

which affect the overall performance of a company. Such that if sales activity of a entity

reflects negative and expenses are high then it is not worthy to invest within such

investment. As it leads to cause negative impact upon the chosen investment (Arif-Ur-

Rahman and Inaba, 2020).

Non-financial factors

Resources: It is analyzed that in order to invest within any project, company must look

for the available resources that helps the company to improve the performance. In the

same way, employees and enough financial as well as physical resources should be

considered in order to generate the best outcomes (Burkhanov, 2020). That is why, before

any investment, there is a need to ensure that resources are available for the company that

leads to minimize the error. Relationship: For any investment, there is a need to monitor all the changes within

market and have suppliers that assist to make investment successful. Similarly, having a

brand image at market will also lead to generate the best relationship with customers by

offering best variety of products. This in turn also helps to meet the defined aim as well.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Meet the requirement of current legislation: It is examined that, for any investment

there is a need to comply with current legislation which assist in smooth running of a

company (Roychowdhury, Shroff and Verdi, 2019). Moreover, it is also analyzed that

with the help of effective laws and regulations, company is able to meet the defined aim

and able to invest accordingly.

CONCLUSION

By summing up above report it has been concluded that Project B should be chosen by

DDK Plc because the amount which is invested for the firm can be return in less duration as

compared to project A. On the other side, through the NPV it is also examined that company can

get high return as compared to project A even after investing high amount. Further, through the

above it has been summarized that DDK Plc must look for different financial as well as non-

financial factors in order to make any investment decision. So that it causes positive impact upon

financial performance of a firm.

there is a need to comply with current legislation which assist in smooth running of a

company (Roychowdhury, Shroff and Verdi, 2019). Moreover, it is also analyzed that

with the help of effective laws and regulations, company is able to meet the defined aim

and able to invest accordingly.

CONCLUSION

By summing up above report it has been concluded that Project B should be chosen by

DDK Plc because the amount which is invested for the firm can be return in less duration as

compared to project A. On the other side, through the NPV it is also examined that company can

get high return as compared to project A even after investing high amount. Further, through the

above it has been summarized that DDK Plc must look for different financial as well as non-

financial factors in order to make any investment decision. So that it causes positive impact upon

financial performance of a firm.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Arif-Ur-Rahman, M. and Inaba, K., 2020. Financial integration and total factor productivity: in

consideration of different capital controls and foreign direct investment. Journal of

Economic Structures. 9(1). pp.1-20.

Burkhanov, A., 2020. Practice of investment funds development in developed countries. Архив

научных исследований. (23).

Roychowdhury, S., Shroff, N. and Verdi, R.S., 2019. The effects of financial reporting and

disclosure on corporate investment: A review. Journal of Accounting and Economics. 68(2-

3). p.101246.

Xiaolong, L., Guanghe, R. and Wei, Z., 2017. How Does Financial Factor Distortion Affect

Enterprise Innovation Investment?——Analysis from the Perspective of Financing

Constraints. Studies of International Finance, p.12.

Books and Journals

Arif-Ur-Rahman, M. and Inaba, K., 2020. Financial integration and total factor productivity: in

consideration of different capital controls and foreign direct investment. Journal of

Economic Structures. 9(1). pp.1-20.

Burkhanov, A., 2020. Practice of investment funds development in developed countries. Архив

научных исследований. (23).

Roychowdhury, S., Shroff, N. and Verdi, R.S., 2019. The effects of financial reporting and

disclosure on corporate investment: A review. Journal of Accounting and Economics. 68(2-

3). p.101246.

Xiaolong, L., Guanghe, R. and Wei, Z., 2017. How Does Financial Factor Distortion Affect

Enterprise Innovation Investment?——Analysis from the Perspective of Financing

Constraints. Studies of International Finance, p.12.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.