Statistical Analysis of Residential Property Prices: Assignment

VerifiedAdded on 2021/05/30

|6

|1035

|164

Homework Assignment

AI Summary

This assignment provides a comprehensive statistical analysis of residential property prices. It begins with a hypothesis test comparing average prices in two cities using a two-sample t-test, concluding no significant difference. The second part analyzes the relationship between house prices and internal area using simple linear regression, demonstrating a strong positive correlation. The final section constructs a multiple regression model including internal area, number of bedrooms, and property type (house or unit), concluding this model is the best fit. The analysis includes the interpretation of coefficients, R-squared, and p-values, with references to relevant statistical literature.

Question 1

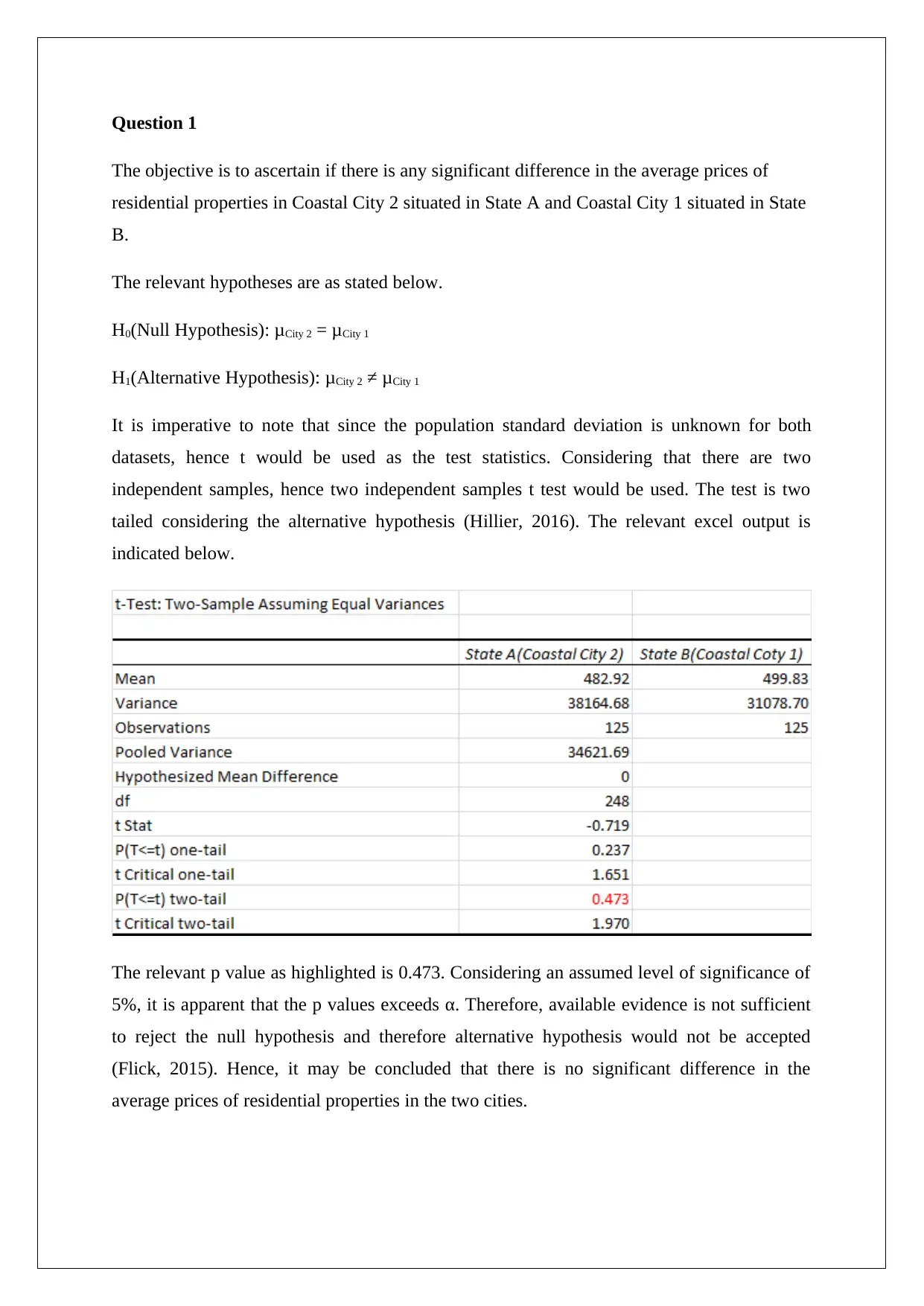

The objective is to ascertain if there is any significant difference in the average prices of

residential properties in Coastal City 2 situated in State A and Coastal City 1 situated in State

B.

The relevant hypotheses are as stated below.

H0(Null Hypothesis): μCity 2 = μCity 1

H1(Alternative Hypothesis): μCity 2 ≠ μCity 1

It is imperative to note that since the population standard deviation is unknown for both

datasets, hence t would be used as the test statistics. Considering that there are two

independent samples, hence two independent samples t test would be used. The test is two

tailed considering the alternative hypothesis (Hillier, 2016). The relevant excel output is

indicated below.

The relevant p value as highlighted is 0.473. Considering an assumed level of significance of

5%, it is apparent that the p values exceeds α. Therefore, available evidence is not sufficient

to reject the null hypothesis and therefore alternative hypothesis would not be accepted

(Flick, 2015). Hence, it may be concluded that there is no significant difference in the

average prices of residential properties in the two cities.

The objective is to ascertain if there is any significant difference in the average prices of

residential properties in Coastal City 2 situated in State A and Coastal City 1 situated in State

B.

The relevant hypotheses are as stated below.

H0(Null Hypothesis): μCity 2 = μCity 1

H1(Alternative Hypothesis): μCity 2 ≠ μCity 1

It is imperative to note that since the population standard deviation is unknown for both

datasets, hence t would be used as the test statistics. Considering that there are two

independent samples, hence two independent samples t test would be used. The test is two

tailed considering the alternative hypothesis (Hillier, 2016). The relevant excel output is

indicated below.

The relevant p value as highlighted is 0.473. Considering an assumed level of significance of

5%, it is apparent that the p values exceeds α. Therefore, available evidence is not sufficient

to reject the null hypothesis and therefore alternative hypothesis would not be accepted

(Flick, 2015). Hence, it may be concluded that there is no significant difference in the

average prices of residential properties in the two cities.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 2

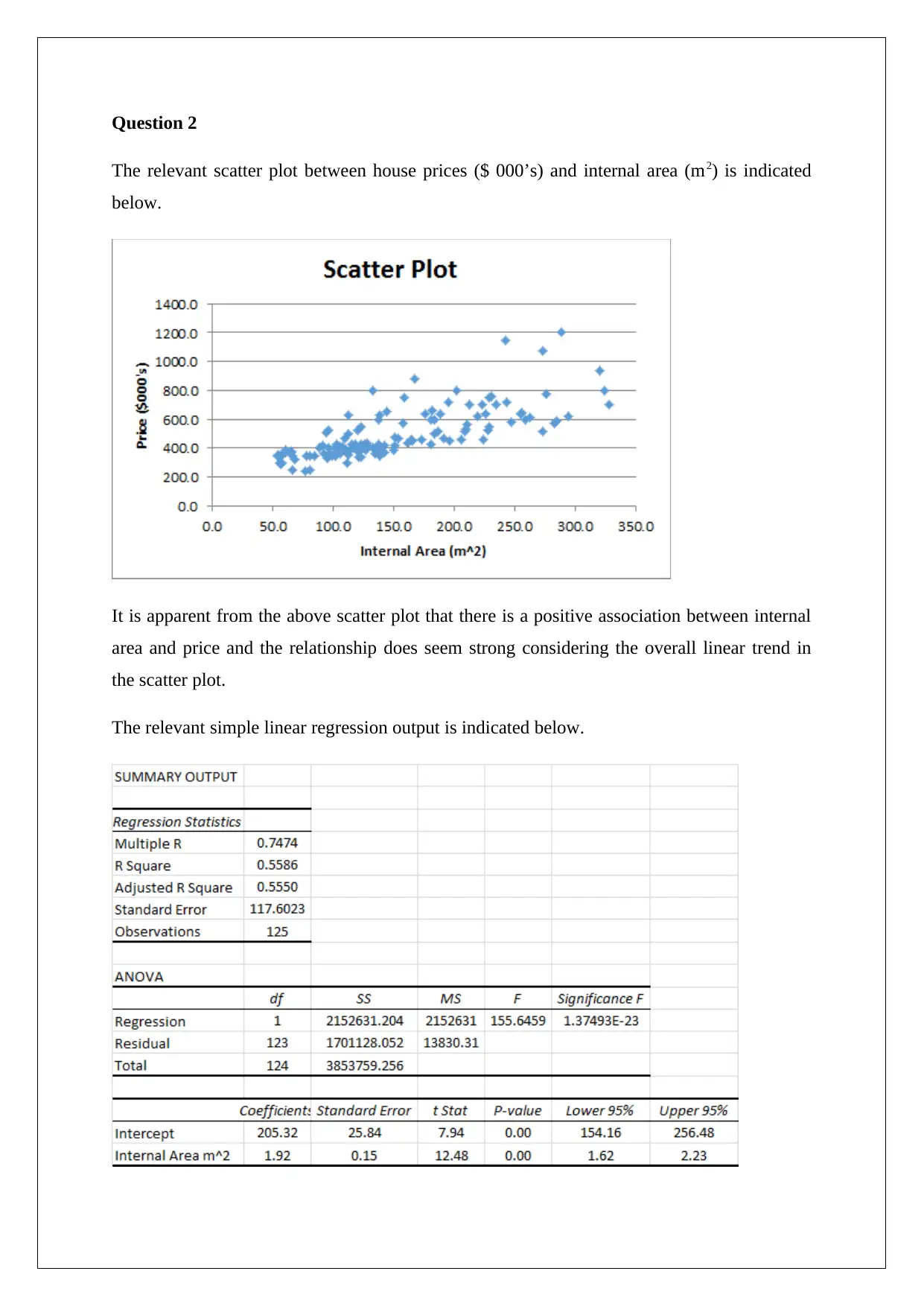

The relevant scatter plot between house prices ($ 000’s) and internal area (m2) is indicated

below.

It is apparent from the above scatter plot that there is a positive association between internal

area and price and the relationship does seem strong considering the overall linear trend in

the scatter plot.

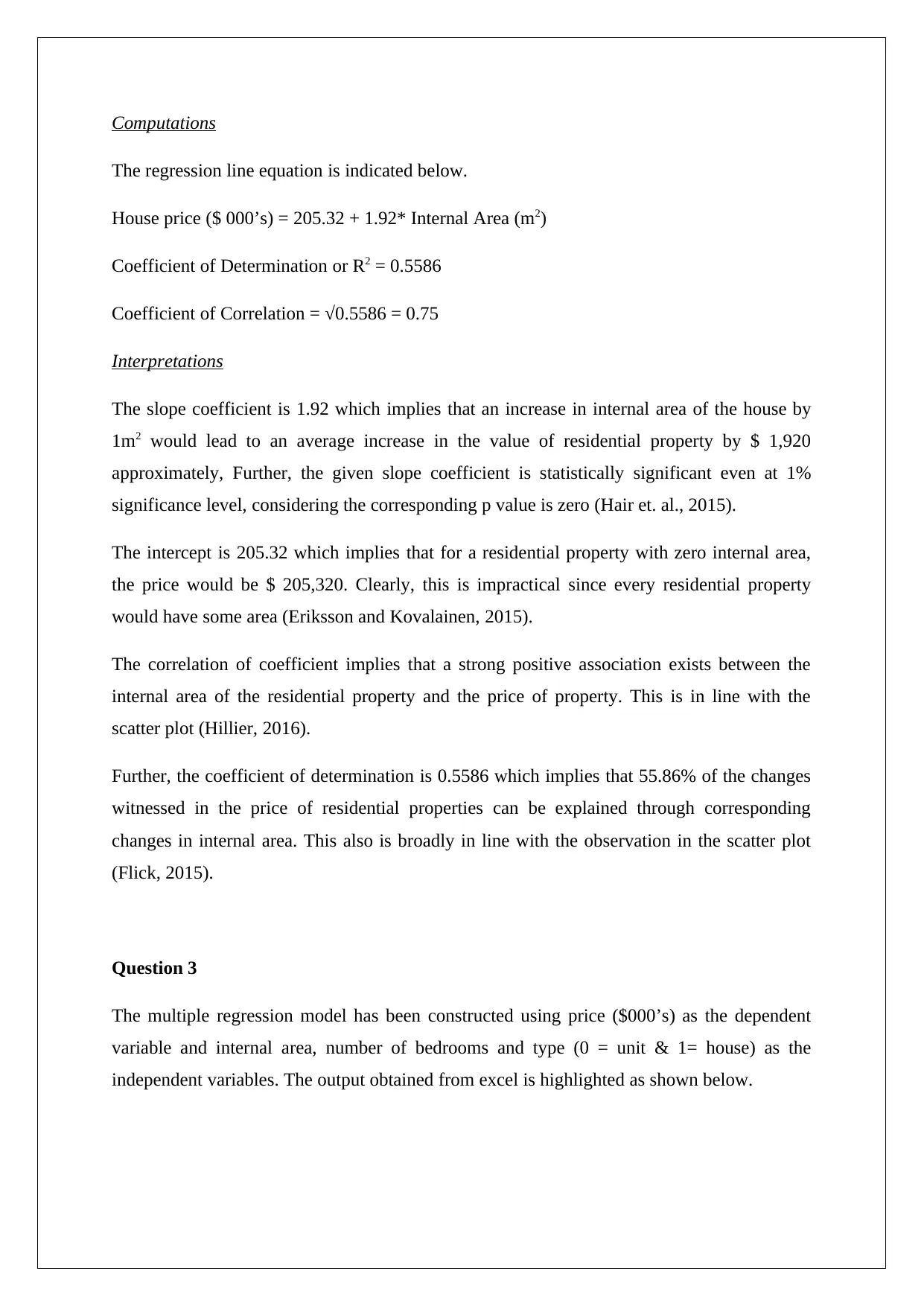

The relevant simple linear regression output is indicated below.

The relevant scatter plot between house prices ($ 000’s) and internal area (m2) is indicated

below.

It is apparent from the above scatter plot that there is a positive association between internal

area and price and the relationship does seem strong considering the overall linear trend in

the scatter plot.

The relevant simple linear regression output is indicated below.

Computations

The regression line equation is indicated below.

House price ($ 000’s) = 205.32 + 1.92* Internal Area (m2)

Coefficient of Determination or R2 = 0.5586

Coefficient of Correlation = √0.5586 = 0.75

Interpretations

The slope coefficient is 1.92 which implies that an increase in internal area of the house by

1m2 would lead to an average increase in the value of residential property by $ 1,920

approximately, Further, the given slope coefficient is statistically significant even at 1%

significance level, considering the corresponding p value is zero (Hair et. al., 2015).

The intercept is 205.32 which implies that for a residential property with zero internal area,

the price would be $ 205,320. Clearly, this is impractical since every residential property

would have some area (Eriksson and Kovalainen, 2015).

The correlation of coefficient implies that a strong positive association exists between the

internal area of the residential property and the price of property. This is in line with the

scatter plot (Hillier, 2016).

Further, the coefficient of determination is 0.5586 which implies that 55.86% of the changes

witnessed in the price of residential properties can be explained through corresponding

changes in internal area. This also is broadly in line with the observation in the scatter plot

(Flick, 2015).

Question 3

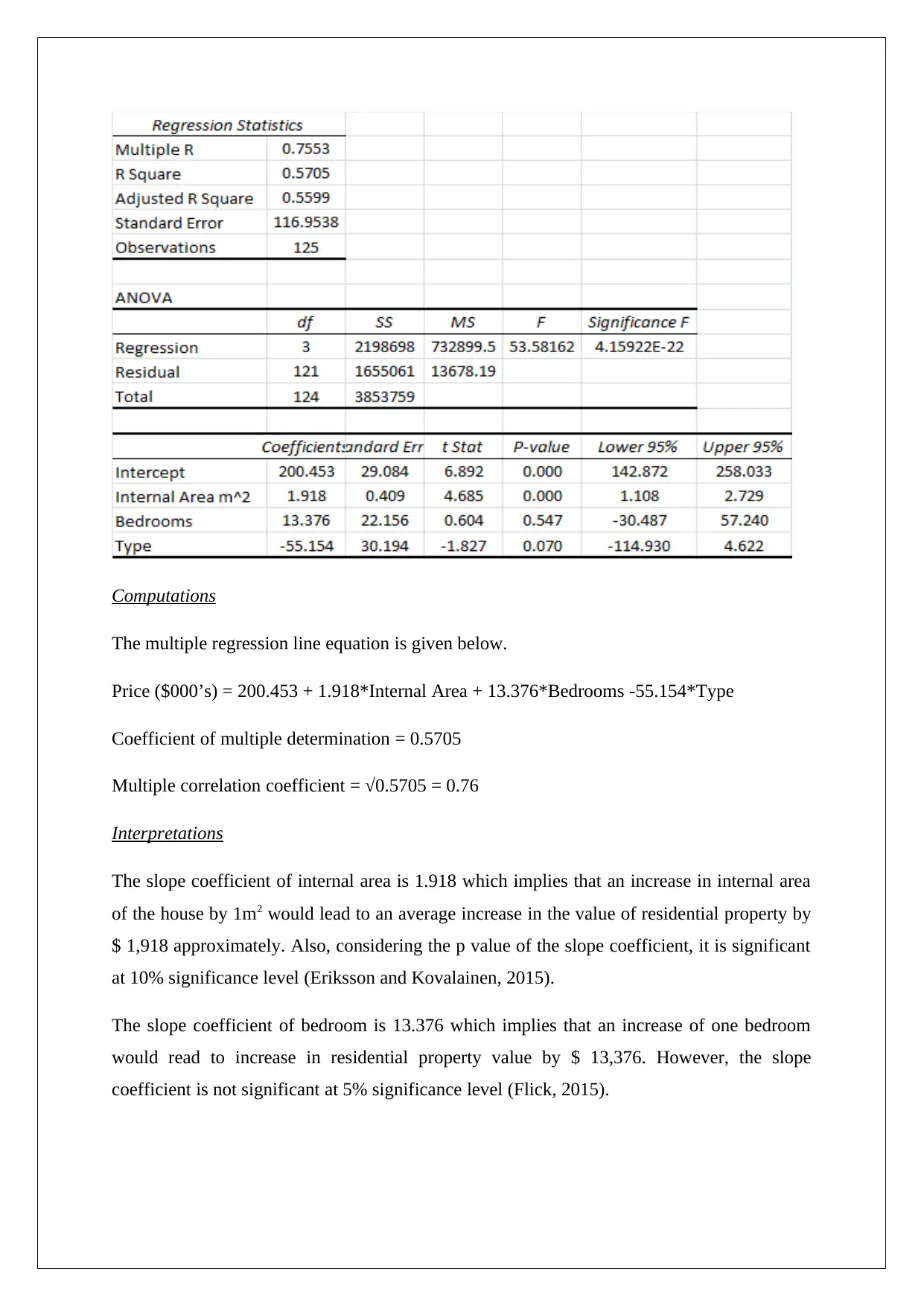

The multiple regression model has been constructed using price ($000’s) as the dependent

variable and internal area, number of bedrooms and type (0 = unit & 1= house) as the

independent variables. The output obtained from excel is highlighted as shown below.

The regression line equation is indicated below.

House price ($ 000’s) = 205.32 + 1.92* Internal Area (m2)

Coefficient of Determination or R2 = 0.5586

Coefficient of Correlation = √0.5586 = 0.75

Interpretations

The slope coefficient is 1.92 which implies that an increase in internal area of the house by

1m2 would lead to an average increase in the value of residential property by $ 1,920

approximately, Further, the given slope coefficient is statistically significant even at 1%

significance level, considering the corresponding p value is zero (Hair et. al., 2015).

The intercept is 205.32 which implies that for a residential property with zero internal area,

the price would be $ 205,320. Clearly, this is impractical since every residential property

would have some area (Eriksson and Kovalainen, 2015).

The correlation of coefficient implies that a strong positive association exists between the

internal area of the residential property and the price of property. This is in line with the

scatter plot (Hillier, 2016).

Further, the coefficient of determination is 0.5586 which implies that 55.86% of the changes

witnessed in the price of residential properties can be explained through corresponding

changes in internal area. This also is broadly in line with the observation in the scatter plot

(Flick, 2015).

Question 3

The multiple regression model has been constructed using price ($000’s) as the dependent

variable and internal area, number of bedrooms and type (0 = unit & 1= house) as the

independent variables. The output obtained from excel is highlighted as shown below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Computations

The multiple regression line equation is given below.

Price ($000’s) = 200.453 + 1.918*Internal Area + 13.376*Bedrooms -55.154*Type

Coefficient of multiple determination = 0.5705

Multiple correlation coefficient = √0.5705 = 0.76

Interpretations

The slope coefficient of internal area is 1.918 which implies that an increase in internal area

of the house by 1m2 would lead to an average increase in the value of residential property by

$ 1,918 approximately. Also, considering the p value of the slope coefficient, it is significant

at 10% significance level (Eriksson and Kovalainen, 2015).

The slope coefficient of bedroom is 13.376 which implies that an increase of one bedroom

would read to increase in residential property value by $ 13,376. However, the slope

coefficient is not significant at 5% significance level (Flick, 2015).

The multiple regression line equation is given below.

Price ($000’s) = 200.453 + 1.918*Internal Area + 13.376*Bedrooms -55.154*Type

Coefficient of multiple determination = 0.5705

Multiple correlation coefficient = √0.5705 = 0.76

Interpretations

The slope coefficient of internal area is 1.918 which implies that an increase in internal area

of the house by 1m2 would lead to an average increase in the value of residential property by

$ 1,918 approximately. Also, considering the p value of the slope coefficient, it is significant

at 10% significance level (Eriksson and Kovalainen, 2015).

The slope coefficient of bedroom is 13.376 which implies that an increase of one bedroom

would read to increase in residential property value by $ 13,376. However, the slope

coefficient is not significant at 5% significance level (Flick, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The slope coefficient of type is -55.154 which implies that a house on an average is price

$55,154 lower than the unit with similar other attributes. The p value highlights that slope is

significant at 10% significance level (Hillier, 2016).

The coefficient of determination implies that 57.05% of all variations in price of residential

properties can be jointly explained by internal area, number of bedrooms and type. The

multiple correlation coefficient also suggests that a strong association result is present (Hair

et. al., 2015).

Best Model

Considering that R2 and R tend to be higher for multiple regression model as compared to

simple regression model, hence the multiple regression model represents the best model. The

significance of the slope of the type independent variable also provides evidence in this

regards (Hastie, Tibshirani and Friedman, 2011).

$55,154 lower than the unit with similar other attributes. The p value highlights that slope is

significant at 10% significance level (Hillier, 2016).

The coefficient of determination implies that 57.05% of all variations in price of residential

properties can be jointly explained by internal area, number of bedrooms and type. The

multiple correlation coefficient also suggests that a strong association result is present (Hair

et. al., 2015).

Best Model

Considering that R2 and R tend to be higher for multiple regression model as compared to

simple regression model, hence the multiple regression model represents the best model. The

significance of the slope of the type independent variable also provides evidence in this

regards (Hastie, Tibshirani and Friedman, 2011).

References

Eriksson, P. and Kovalainen, A. (2015) Quantitative methods in business research 3rd ed.

London: Sage Publications.

Flick, U. (2015) Introducing research methodology: A beginner's guide to doing a research

project. 4th ed. New York: Sage Publications.

Hair, J. F., Wolfinbarger, M., Money, A. H., Samouel, P., and Page, M. J. (2015) Essentials

of business research methods. 2nd ed. New York: Routledge.

Hastie, T., Tibshirani, R. and Friedman, J. (2011) The Elements of Statistical Learning. 4th

ed. New York: Springer Publications.

Hillier, F. (2016) Introduction to Operations Research. 6th ed. New York: McGraw Hill

Publications.

Eriksson, P. and Kovalainen, A. (2015) Quantitative methods in business research 3rd ed.

London: Sage Publications.

Flick, U. (2015) Introducing research methodology: A beginner's guide to doing a research

project. 4th ed. New York: Sage Publications.

Hair, J. F., Wolfinbarger, M., Money, A. H., Samouel, P., and Page, M. J. (2015) Essentials

of business research methods. 2nd ed. New York: Routledge.

Hastie, T., Tibshirani, R. and Friedman, J. (2011) The Elements of Statistical Learning. 4th

ed. New York: Springer Publications.

Hillier, F. (2016) Introduction to Operations Research. 6th ed. New York: McGraw Hill

Publications.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6