Taxation Law Assignment: Income Tax and Property Rental Analysis

VerifiedAdded on 2020/04/07

|9

|2215

|56

Homework Assignment

AI Summary

This taxation law assignment addresses several scenarios to assess tax implications. Question 1 focuses on calculating net capital profit or loss from asset sales, differentiating between personal use assets and collectibles, and determining taxability based on acquisition costs and holding periods. Question 2 analyzes a loan provided by an employer, calculating fringe benefits based on the difference between statutory and actual interest rates, considering tax deductible interest expenses, and determining the final taxation amount. Question 3 examines a property rental agreement between a husband and wife, clarifying the distribution of profit and loss and the tax liabilities of each party. Question 4 discusses the legal principles of tax avoidance, referencing the IRC v Duke of Westminster case and its relevance in modern scenarios. Finally, Question 5 evaluates the tax treatment of income received from timber clearing, distinguishing between lump-sum payments (capital receipts) and recurring payments, and determining the applicable tax rates.

1

Taxation Law

<Student ID>

<Student Name>

<University Name>

Taxation Law

<Student ID>

<Student Name>

<University Name>

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Contents

Question 1..................................................................................................................................3

Question 2..................................................................................................................................4

Question 3..................................................................................................................................5

Question 4..................................................................................................................................6

Question 5..................................................................................................................................7

References..................................................................................................................................8

Contents

Question 1..................................................................................................................................3

Question 2..................................................................................................................................4

Question 3..................................................................................................................................5

Question 4..................................................................................................................................6

Question 5..................................................................................................................................7

References..................................................................................................................................8

3

Question 1

Estimation of annual net capital profit or loss:

Issue

Eric has depicted instances of procuring assets in the last one year. Therefore it can be

observed that the possession of the assets with Eric was valid for a period less than a year.

The concerns of taxability of capital gains in this case can be realized only in response to the

condition of the asset’s selling price being greater than the cost base at which it was acquired

(Aguilar Rubio, 2016). One important condition that could be observed in the case of Eric is

the inability to obtain indexation benefit since the assets were held for less than a year. The

assets could be reviewed for taxability as follows:

Rule

The assets which are purchased by individuals for fulfilling personal objectives or enjoyment

and recreation could be termed as assets for personal use. Collectibles are not included

among the assets meant for personal use (Andersen & Cohen, 2013). The sale of assets that

have procurement costs less than $10000 cannot be subject to taxation on the capital profits

gained from profits. The assets purchased by Eric for personal use include the shares of a

listed company at the cost of $5000 and the home sound system at $12000.

Application

The assets which are procured for fulfilling additional objectives such as self efficacies as

well as providing enjoyment just as in case of personal assets. The capital gains acquired

from the sale of collectibles obtained at costs equal to or less than $500 cannot be subject to

taxation (Deak, 2014). The collectibles which were procured by Eric include an antique chair

at the cost of $3000, an antique vase at the cost of $2000 and a painting at the cost of $9000.

The information regarding the procurement costs of personal assets and collectibles could be

utilized for computing capital profits on the assets that were with Eric for less than a year

(Demin, 2014).

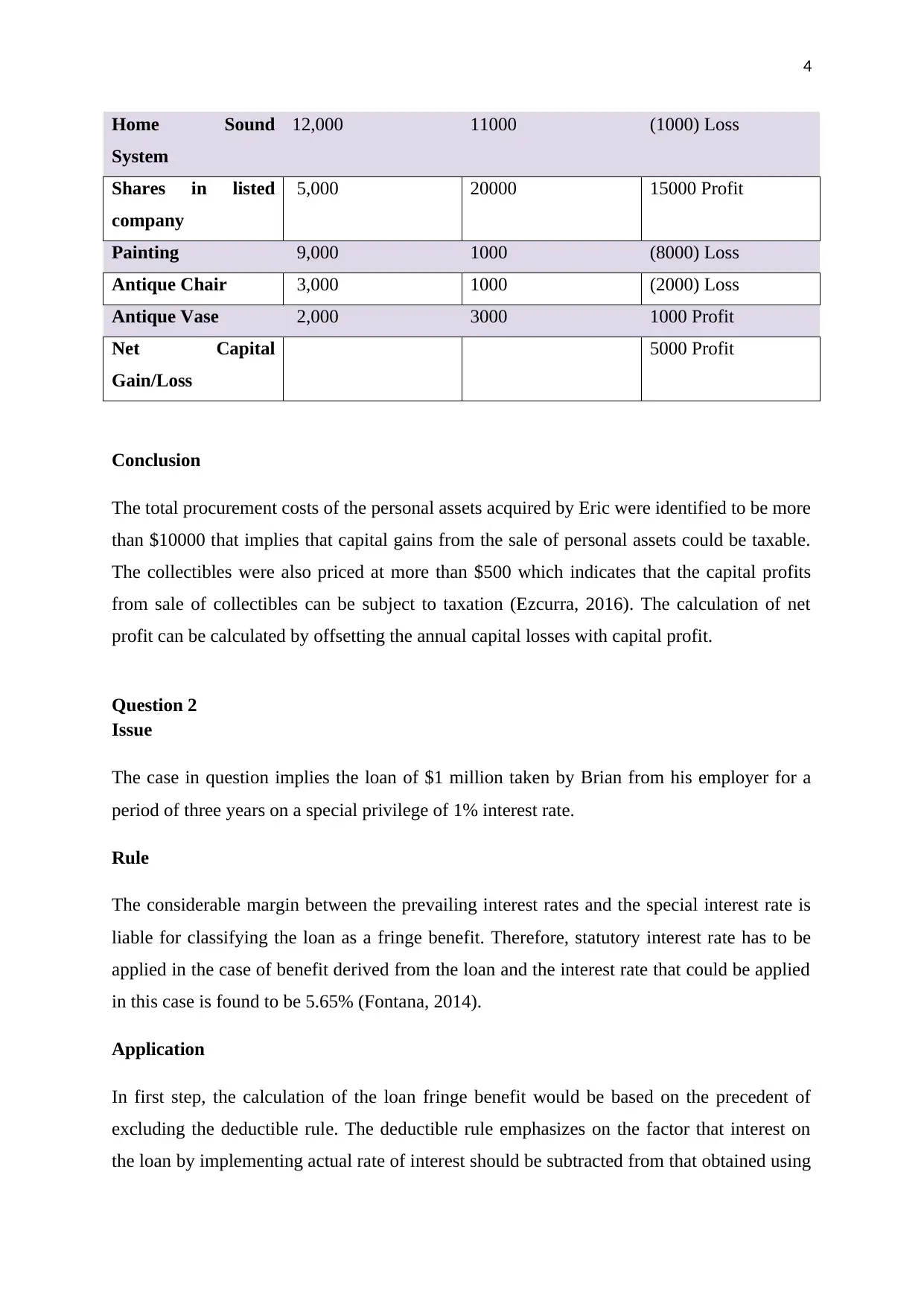

Capital data of the assets

Asset Cost Base of Assets Capital Proceeds of

Assets

Net Capital Profit/

(Net Capital Loss)

Question 1

Estimation of annual net capital profit or loss:

Issue

Eric has depicted instances of procuring assets in the last one year. Therefore it can be

observed that the possession of the assets with Eric was valid for a period less than a year.

The concerns of taxability of capital gains in this case can be realized only in response to the

condition of the asset’s selling price being greater than the cost base at which it was acquired

(Aguilar Rubio, 2016). One important condition that could be observed in the case of Eric is

the inability to obtain indexation benefit since the assets were held for less than a year. The

assets could be reviewed for taxability as follows:

Rule

The assets which are purchased by individuals for fulfilling personal objectives or enjoyment

and recreation could be termed as assets for personal use. Collectibles are not included

among the assets meant for personal use (Andersen & Cohen, 2013). The sale of assets that

have procurement costs less than $10000 cannot be subject to taxation on the capital profits

gained from profits. The assets purchased by Eric for personal use include the shares of a

listed company at the cost of $5000 and the home sound system at $12000.

Application

The assets which are procured for fulfilling additional objectives such as self efficacies as

well as providing enjoyment just as in case of personal assets. The capital gains acquired

from the sale of collectibles obtained at costs equal to or less than $500 cannot be subject to

taxation (Deak, 2014). The collectibles which were procured by Eric include an antique chair

at the cost of $3000, an antique vase at the cost of $2000 and a painting at the cost of $9000.

The information regarding the procurement costs of personal assets and collectibles could be

utilized for computing capital profits on the assets that were with Eric for less than a year

(Demin, 2014).

Capital data of the assets

Asset Cost Base of Assets Capital Proceeds of

Assets

Net Capital Profit/

(Net Capital Loss)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Home Sound

System

12,000 11000 (1000) Loss

Shares in listed

company

5,000 20000 15000 Profit

Painting 9,000 1000 (8000) Loss

Antique Chair 3,000 1000 (2000) Loss

Antique Vase 2,000 3000 1000 Profit

Net Capital

Gain/Loss

5000 Profit

Conclusion

The total procurement costs of the personal assets acquired by Eric were identified to be more

than $10000 that implies that capital gains from the sale of personal assets could be taxable.

The collectibles were also priced at more than $500 which indicates that the capital profits

from sale of collectibles can be subject to taxation (Ezcurra, 2016). The calculation of net

profit can be calculated by offsetting the annual capital losses with capital profit.

Question 2

Issue

The case in question implies the loan of $1 million taken by Brian from his employer for a

period of three years on a special privilege of 1% interest rate.

Rule

The considerable margin between the prevailing interest rates and the special interest rate is

liable for classifying the loan as a fringe benefit. Therefore, statutory interest rate has to be

applied in the case of benefit derived from the loan and the interest rate that could be applied

in this case is found to be 5.65% (Fontana, 2014).

Application

In first step, the calculation of the loan fringe benefit would be based on the precedent of

excluding the deductible rule. The deductible rule emphasizes on the factor that interest on

the loan by implementing actual rate of interest should be subtracted from that obtained using

Home Sound

System

12,000 11000 (1000) Loss

Shares in listed

company

5,000 20000 15000 Profit

Painting 9,000 1000 (8000) Loss

Antique Chair 3,000 1000 (2000) Loss

Antique Vase 2,000 3000 1000 Profit

Net Capital

Gain/Loss

5000 Profit

Conclusion

The total procurement costs of the personal assets acquired by Eric were identified to be more

than $10000 that implies that capital gains from the sale of personal assets could be taxable.

The collectibles were also priced at more than $500 which indicates that the capital profits

from sale of collectibles can be subject to taxation (Ezcurra, 2016). The calculation of net

profit can be calculated by offsetting the annual capital losses with capital profit.

Question 2

Issue

The case in question implies the loan of $1 million taken by Brian from his employer for a

period of three years on a special privilege of 1% interest rate.

Rule

The considerable margin between the prevailing interest rates and the special interest rate is

liable for classifying the loan as a fringe benefit. Therefore, statutory interest rate has to be

applied in the case of benefit derived from the loan and the interest rate that could be applied

in this case is found to be 5.65% (Fontana, 2014).

Application

In first step, the calculation of the loan fringe benefit would be based on the precedent of

excluding the deductible rule. The deductible rule emphasizes on the factor that interest on

the loan by implementing actual rate of interest should be subtracted from that obtained using

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

the statutory interest rate. Interest calculated with statutory rate of interest=

$1000000*5.65%= $56,500. Therefore, loan fringe benefits = $56,500- $10,000= $46,500

(Garroy, 2017). 2nd step shows that Interest based on statutory interest rate =

$1000000*5.65%= $56,500. The assumption in this stage is based on the factor that the

interest would be real amount payable. 3rd Step is all about, Brian who has invested 40% of

the loan to address his future obligations and hence, Tax deductible interest expense =

$56,500*40%= $22,600 which can be considered hypothetical. In 4th Step, the real tax

deductible interest expense can be calculated on the interest based on actual rate of interest

which is: $10000*40%= $4000. In 5th Step its seen that, the subtraction of real tax deductible

interest expense from the hypothetical figure could be presented as, $22,600- $4000=

$18,600. The final taxation amount payable by Brian could be calculated through subtracting

the figure obtained in the fifth step from the loan fringe benefits established in the first step.

Therefore, final tax amount = $46,500- $18,600= $27,900 (Marchgraber, 2014). If the

interest is paid at the termination of the period of the loan then the deemed period is

estimated from the instance when the interest is payable.

Concussion

On the contrary, if the interest is paid in monthly instalments then the deemed period is

estimated from the time when the payment of interests start (Ringstad, 2014). Another case

could be considered if Brian is not obliged to repay the interest in which the approach for

calculation of net tax payable would be based on the steps described above with the

assumption of a zero percent actual interest rate.

Question 3

Issue

The case under concern involves a husband and wife, Jack and Jill, who are tied in an

agreement over renting a property.

Rule

The essential details to be observed in this case refer to the distribution of profit share which

is 10% for Jack and 90% for Jill as well as the exclusion of any responsibilities for loss for

Jill.

Application

the statutory interest rate. Interest calculated with statutory rate of interest=

$1000000*5.65%= $56,500. Therefore, loan fringe benefits = $56,500- $10,000= $46,500

(Garroy, 2017). 2nd step shows that Interest based on statutory interest rate =

$1000000*5.65%= $56,500. The assumption in this stage is based on the factor that the

interest would be real amount payable. 3rd Step is all about, Brian who has invested 40% of

the loan to address his future obligations and hence, Tax deductible interest expense =

$56,500*40%= $22,600 which can be considered hypothetical. In 4th Step, the real tax

deductible interest expense can be calculated on the interest based on actual rate of interest

which is: $10000*40%= $4000. In 5th Step its seen that, the subtraction of real tax deductible

interest expense from the hypothetical figure could be presented as, $22,600- $4000=

$18,600. The final taxation amount payable by Brian could be calculated through subtracting

the figure obtained in the fifth step from the loan fringe benefits established in the first step.

Therefore, final tax amount = $46,500- $18,600= $27,900 (Marchgraber, 2014). If the

interest is paid at the termination of the period of the loan then the deemed period is

estimated from the instance when the interest is payable.

Concussion

On the contrary, if the interest is paid in monthly instalments then the deemed period is

estimated from the time when the payment of interests start (Ringstad, 2014). Another case

could be considered if Brian is not obliged to repay the interest in which the approach for

calculation of net tax payable would be based on the steps described above with the

assumption of a zero percent actual interest rate.

Question 3

Issue

The case under concern involves a husband and wife, Jack and Jill, who are tied in an

agreement over renting a property.

Rule

The essential details to be observed in this case refer to the distribution of profit share which

is 10% for Jack and 90% for Jill as well as the exclusion of any responsibilities for loss for

Jill.

Application

6

The rental property depicted a loss of $10000 last year which can be attributed as the sole

responsibility of Jack. Jack has two potential options to address the loss among which the

offsetting of loss from Jack’s other sources of income is one (Szudoczky, 2016). The other

solution could be identified in carrying the loss forward to another year in the future until the

sale of the profit. On the other hand, if the property facilitates profits then the acquired

amount must be distributed proportionately among Jack and Jill in the ratio of 1:9. It is also

interesting to observe that Jack could also offset the loss of $10000 with the gains from sale

of the property (Umenweke & Ifediora, 2016).

Conclusion

Therefore, Jill could not be accounted for any responsibilities with respect to the implications

of taxation on the proceedings of the rental property while Jack has to assume responsibilities

for losses incurred through the property.

Question 4

Issue

The case of IRC v Duke of Westminster [1936] AC 1reflected on the rightful entitlement of

an individual to implement legal means and strategies to depreciate their net income at the

end of a year. The significant principles that can be observed from the case could be

highlighted as follows:

Rule

The rightful eligibility of an individual to implement strategic changes in accounting

management is for decreasing their total income. Adoption of ethical measures exempts an

individual from payment of additional taxes (Villios, 2016). Application of legal resources

and strategies for decreasing the total income on which tax could be calculated excludes the

probabilities of questioning by authorities such as the Commissioner of Inland Revenue.

Application

On the contrary, the application of these above stated precedents in the modern scenario

could be questioned by the inferences from new case laws. The application of new case laws

suggests that an organization experiencing losses could modify its balance sheet statistics

alongside writing off the fixed assets according to desired values.

The rental property depicted a loss of $10000 last year which can be attributed as the sole

responsibility of Jack. Jack has two potential options to address the loss among which the

offsetting of loss from Jack’s other sources of income is one (Szudoczky, 2016). The other

solution could be identified in carrying the loss forward to another year in the future until the

sale of the profit. On the other hand, if the property facilitates profits then the acquired

amount must be distributed proportionately among Jack and Jill in the ratio of 1:9. It is also

interesting to observe that Jack could also offset the loss of $10000 with the gains from sale

of the property (Umenweke & Ifediora, 2016).

Conclusion

Therefore, Jill could not be accounted for any responsibilities with respect to the implications

of taxation on the proceedings of the rental property while Jack has to assume responsibilities

for losses incurred through the property.

Question 4

Issue

The case of IRC v Duke of Westminster [1936] AC 1reflected on the rightful entitlement of

an individual to implement legal means and strategies to depreciate their net income at the

end of a year. The significant principles that can be observed from the case could be

highlighted as follows:

Rule

The rightful eligibility of an individual to implement strategic changes in accounting

management is for decreasing their total income. Adoption of ethical measures exempts an

individual from payment of additional taxes (Villios, 2016). Application of legal resources

and strategies for decreasing the total income on which tax could be calculated excludes the

probabilities of questioning by authorities such as the Commissioner of Inland Revenue.

Application

On the contrary, the application of these above stated precedents in the modern scenario

could be questioned by the inferences from new case laws. The application of new case laws

suggests that an organization experiencing losses could modify its balance sheet statistics

alongside writing off the fixed assets according to desired values.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Conclusion

However, it is imperative for the organization to adopt ethical means for avoiding any

penalizing action. The rules also exempt the transactions of an organization that support the

operational aspects of the organization from questioning by legal authorities.

Question 5

Issue

The case to be reviewed for taxation in this question refers to the large piece of land owned

by Bill that is populated abundantly with big pine trees. Bill intends to transform the piece of

land for the purpose of sheep grazing for which Bill hired the services of a logging company.

Rule

The payment received by Bill from the logging company indicates two distinct scenarios in

which one involves the payment of a lump sum amount of $50000 for clearing off the big

pine trees from the property while the other involves recurring payments of $1000 for 100

metres of timber cleared by the logging company (Villios, 2016).

Application

The case of receiving a lump sum amount of $50000 could be assumed as a capital receipt for

Bill alongside implying the fact of assigning rights to other party for cutting off trees from the

property. Another profound factor that must be considered for the eligibility of the lump sum

amount for capital gains tax can be observed in the on-time nature of the receipt since the

period required for regrowth of trees could be substantial.

Conclusion

Therefore the precedents of capital gain tax imply that the lump sum amount classified as

capital receipt can be subject to taxation. The second case in which Bill receives recurring

receipts implies that the rules for capital gains tax cannot be applied. The income obtained by

Bill with recurring receipts would ensure that the income would be subject to taxation

according to normal interest rates.

Conclusion

However, it is imperative for the organization to adopt ethical means for avoiding any

penalizing action. The rules also exempt the transactions of an organization that support the

operational aspects of the organization from questioning by legal authorities.

Question 5

Issue

The case to be reviewed for taxation in this question refers to the large piece of land owned

by Bill that is populated abundantly with big pine trees. Bill intends to transform the piece of

land for the purpose of sheep grazing for which Bill hired the services of a logging company.

Rule

The payment received by Bill from the logging company indicates two distinct scenarios in

which one involves the payment of a lump sum amount of $50000 for clearing off the big

pine trees from the property while the other involves recurring payments of $1000 for 100

metres of timber cleared by the logging company (Villios, 2016).

Application

The case of receiving a lump sum amount of $50000 could be assumed as a capital receipt for

Bill alongside implying the fact of assigning rights to other party for cutting off trees from the

property. Another profound factor that must be considered for the eligibility of the lump sum

amount for capital gains tax can be observed in the on-time nature of the receipt since the

period required for regrowth of trees could be substantial.

Conclusion

Therefore the precedents of capital gain tax imply that the lump sum amount classified as

capital receipt can be subject to taxation. The second case in which Bill receives recurring

receipts implies that the rules for capital gains tax cannot be applied. The income obtained by

Bill with recurring receipts would ensure that the income would be subject to taxation

according to normal interest rates.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

References

Aguilar Rubio, M., 2016. Cooperative taxation and European Union Law. International

Association Of Cooperativa Law Journal, 50, pp.49-71.

Andersen, C. and Cohen, A., 2013. The Government and Administration of Africa, 1880–

1939. 5 Volumes: A collection of rare sources on British administration in Africa. With

commentary and comprehensive introductions. VOL 1: Recruitment and Training; VOL 2:

Governance and Law; VOL 3: Taxation and Revenue; VOL 4: Urban and Rural Lands; VOL

5: Health, Labour and Other Issues of Administration. Pickering & Chatto (Publishers) Ltd.

Deak, D., 2014. Abuse of Law in Hungarian Taxation.

Demin, A., 2014. Soft Law and Modern Taxation: A Russian Point of View. Browser

Download This Paper.

Ezcurra, M.V., 2016. Energy Taxation and State Aid Law. In State Aid Law and Business

Taxation (pp. 197-220). Springer Berlin Heidelberg.

Fontana, G., 2014. Review of the meeting: Soft law and inherent clauses in international

taxation: is there a silent tax law?: Faculty of Political Sciences, Sociology, Communication

of Sapienza University of Rome, December 18, 2015. Rivista di diritto tributario

internazionale=, 3(3), pp.231-238.

Garroy, S., 2017. Tax law in light of civil law: a positive and prospective study of the Belgian

income taxation for social enterprises.

Marchgraber, C., 2014. The Avoidance of Double Non-taxation in Double Tax Treaty Law:

A Critical Analysis of the Subject-To-Tax Clause Recommended by the European

Commission. EC Tax Review, 23(5), pp.293-302.

Ringstad, P.H., 2014. Between soft law and a hard place-EU influence on taxation policies in

Cyprus before, during and after the bank crisis (Master's thesis).

Szudoczky, R., 2016. Double Taxation Relief, Transfer Pricing Adjustments and State Aid

Law: Comments. In State Aid Law and Business Taxation (pp. 163-184). Springer Berlin

Heidelberg.

References

Aguilar Rubio, M., 2016. Cooperative taxation and European Union Law. International

Association Of Cooperativa Law Journal, 50, pp.49-71.

Andersen, C. and Cohen, A., 2013. The Government and Administration of Africa, 1880–

1939. 5 Volumes: A collection of rare sources on British administration in Africa. With

commentary and comprehensive introductions. VOL 1: Recruitment and Training; VOL 2:

Governance and Law; VOL 3: Taxation and Revenue; VOL 4: Urban and Rural Lands; VOL

5: Health, Labour and Other Issues of Administration. Pickering & Chatto (Publishers) Ltd.

Deak, D., 2014. Abuse of Law in Hungarian Taxation.

Demin, A., 2014. Soft Law and Modern Taxation: A Russian Point of View. Browser

Download This Paper.

Ezcurra, M.V., 2016. Energy Taxation and State Aid Law. In State Aid Law and Business

Taxation (pp. 197-220). Springer Berlin Heidelberg.

Fontana, G., 2014. Review of the meeting: Soft law and inherent clauses in international

taxation: is there a silent tax law?: Faculty of Political Sciences, Sociology, Communication

of Sapienza University of Rome, December 18, 2015. Rivista di diritto tributario

internazionale=, 3(3), pp.231-238.

Garroy, S., 2017. Tax law in light of civil law: a positive and prospective study of the Belgian

income taxation for social enterprises.

Marchgraber, C., 2014. The Avoidance of Double Non-taxation in Double Tax Treaty Law:

A Critical Analysis of the Subject-To-Tax Clause Recommended by the European

Commission. EC Tax Review, 23(5), pp.293-302.

Ringstad, P.H., 2014. Between soft law and a hard place-EU influence on taxation policies in

Cyprus before, during and after the bank crisis (Master's thesis).

Szudoczky, R., 2016. Double Taxation Relief, Transfer Pricing Adjustments and State Aid

Law: Comments. In State Aid Law and Business Taxation (pp. 163-184). Springer Berlin

Heidelberg.

9

Umenweke, M.N. and Ifediora, E.S., 2016. The law and practice of electronic taxation in

Nigeria: The gains and challenges. Nnamdi Azikiwe University Journal of International Law

and Jurisprudence, 7, pp.101-112.

Villios, S., 2016. A framework for corporate insolvency taxation: the crossroads of the

theoretical perspectives in taxation law and insolvency law(Doctoral dissertation).

Umenweke, M.N. and Ifediora, E.S., 2016. The law and practice of electronic taxation in

Nigeria: The gains and challenges. Nnamdi Azikiwe University Journal of International Law

and Jurisprudence, 7, pp.101-112.

Villios, S., 2016. A framework for corporate insolvency taxation: the crossroads of the

theoretical perspectives in taxation law and insolvency law(Doctoral dissertation).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.