7247AFE: Apple Company Alternative Investment Report for QLD Titanium

VerifiedAdded on 2022/12/14

|22

|5218

|491

Report

AI Summary

This report serves as an investment analysis of Apple Corporation, evaluating its potential as an alternative investment for QLD Titanium Equity Management. The report begins with an executive summary and an introduction outlining the report's purpose: to provide QLD Titanium with an investment opportunity that maximizes returns and minimizes losses. The report provides a detailed literature review of Apple, including its history, products, services, and global market position. The body of the report focuses on Apple's liquidity ratios (cash ratio, current ratio, quick ratio) and historical returns. The analysis includes tables of financial data and performance summaries, providing a comprehensive overview of Apple's financial health and investment potential. The report highlights Apple's unique characteristics, its consumer satisfaction, and its global achievements, supporting the justification for its selection as an alternative investment. The report concludes with an assessment of Apple's strengths and weaknesses to assist QLD Titanium in making an informed investment decision.

ETHICS AND ALTERNATIVE

INVESTMENTS.

NAME:

EMAIL:

STUDENT ID:

DATE OF REPORT:

WORD COUNT:

INVESTMENTS.

NAME:

EMAIL:

STUDENT ID:

DATE OF REPORT:

WORD COUNT:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY.

The report explains different points and ideas. It comprises of an alternative investment which is

Apple Company for QLD Equity Management. The report outlines the different characteristics of

Apple Company showing both its strengths and weakness. They is also a literature review indicating

when the company was founded and also indicating the core owners. The report mainly aims at giving

QLD Titanium Equity Management an alternative investment in which the organization can invest in

without fear of losing.

INTRODUCTION.

The report aims at providing QLD Titanium Equity Management an alternative investment where the

company can make more profits than losses. The investment alternative to be chosen should possess

unique characteristics that promote maximization and diminished loses. In this report, Apple

Corporation was the alternative investment decision made for the QLD Titanium Equity Management.

Also, the report aims at providing the alternative investment details in parts of returns, risk Skewness,

kurtosis, correlation, Sharpe ratio, and the company’s liquidity. The report also explains the

alternative investment background information Example the owners or the year it started it is

operation.

JUSTIFICATIONS.

Apple Company is a global organization that has significantly developed due to its unique practices

and characteristics. The companies aim to ensure consumer satisfaction by producing quality products

that make a purchaser life more comfortable and relaxed. The company is known globally for its

achievements over the years since it is the foundation (Iglesias, O., & Saleem, F. Z, 2015).

LITERATURE REVIEW.

Apple Company is an American intercontinental applied science incorporation whose headquarters

are in California Cupertino. Apple designs sell and enhance the development of purchaser’s needs,

online services, and various computer software. The company globally is considered as one of the big

four corporations alongside Google, Facebook, and Amazon (Iglesias, O., & Saleem, F. Z., 2015).

The report explains different points and ideas. It comprises of an alternative investment which is

Apple Company for QLD Equity Management. The report outlines the different characteristics of

Apple Company showing both its strengths and weakness. They is also a literature review indicating

when the company was founded and also indicating the core owners. The report mainly aims at giving

QLD Titanium Equity Management an alternative investment in which the organization can invest in

without fear of losing.

INTRODUCTION.

The report aims at providing QLD Titanium Equity Management an alternative investment where the

company can make more profits than losses. The investment alternative to be chosen should possess

unique characteristics that promote maximization and diminished loses. In this report, Apple

Corporation was the alternative investment decision made for the QLD Titanium Equity Management.

Also, the report aims at providing the alternative investment details in parts of returns, risk Skewness,

kurtosis, correlation, Sharpe ratio, and the company’s liquidity. The report also explains the

alternative investment background information Example the owners or the year it started it is

operation.

JUSTIFICATIONS.

Apple Company is a global organization that has significantly developed due to its unique practices

and characteristics. The companies aim to ensure consumer satisfaction by producing quality products

that make a purchaser life more comfortable and relaxed. The company is known globally for its

achievements over the years since it is the foundation (Iglesias, O., & Saleem, F. Z, 2015).

LITERATURE REVIEW.

Apple Company is an American intercontinental applied science incorporation whose headquarters

are in California Cupertino. Apple designs sell and enhance the development of purchaser’s needs,

online services, and various computer software. The company globally is considered as one of the big

four corporations alongside Google, Facebook, and Amazon (Iglesias, O., & Saleem, F. Z., 2015).

The corporation hardware products that it produces and sells the iPad, the Apple smart watch, the air

pod wireless ear buds, the home pod smart speaker, the Apple TV digital and media player. Apples

also manufacture software that includes tvOS, watchOS, Ipad, Ios, macOS operating systems, the

shazam fingerprint feature, the safari internet browser, iWork productivity, and creativity suites,

though the multinational company also has professional applications that include Xcode, logic pro and

the final cut pro. The corporation services that are usually conducted online include the Apple TV,

and I cloud, I Message, Ios App Store, Apple Music, and mac app store. The company other

commonly used services globally include the famous apple care, apple card, apple pay, apple pay

cash, genius bar, and apple store (Fogliasso, C. E., & Williams, A, 2014).

The company was formed by Ronald Wayne, Steve Wozniak and Steve Jobs in the year 1976 April

purposely to sell and bloom apples one desktop computer, though Ronald Wayne sold his whole

shares in the company back in the years within 12 days. The entire organization was incorporated as

apple incorporation in 1977 January in which the overall sales of the company grew substantially. In a

few years after the establishment, the remaining two partners had acquired the ability to hire qualified

that included designers and software engineers (Kahney and Leander, 2014). In 1980 Apple

Corporation made it is a financial breakthrough in which the years that followed the company started

shipping to other continents, the computers possessed unique features such as the 1984 original

Macintosh. The company’s marketing prowess lead to widespread positive criticism on their products

and also increased acceptance. However, the Apple products high prices lead to limited purchases and

even power disputes between the executives in which led to the exit of Wozniak while the remaining

owner Steve Jobs also departed to found neXT (Guiso, L., Sapienza, P., & Zingales, L, 2015).

Through the years of the 1990s as the market for minicomputers extensively grew and evolved, the

company lost sales due to the availability of Microsoft Windows on Intel pc clones that are lowlier

priced than their organization. The management then employed CEO Gil Amelio with the aims of the

CEO, ensuring the improvement of the company in terms of sales, employee’s recruitment, executive

restructuring, and customer retention. In the year 1997, the new chief executive officer bought neXT

pod wireless ear buds, the home pod smart speaker, the Apple TV digital and media player. Apples

also manufacture software that includes tvOS, watchOS, Ipad, Ios, macOS operating systems, the

shazam fingerprint feature, the safari internet browser, iWork productivity, and creativity suites,

though the multinational company also has professional applications that include Xcode, logic pro and

the final cut pro. The corporation services that are usually conducted online include the Apple TV,

and I cloud, I Message, Ios App Store, Apple Music, and mac app store. The company other

commonly used services globally include the famous apple care, apple card, apple pay, apple pay

cash, genius bar, and apple store (Fogliasso, C. E., & Williams, A, 2014).

The company was formed by Ronald Wayne, Steve Wozniak and Steve Jobs in the year 1976 April

purposely to sell and bloom apples one desktop computer, though Ronald Wayne sold his whole

shares in the company back in the years within 12 days. The entire organization was incorporated as

apple incorporation in 1977 January in which the overall sales of the company grew substantially. In a

few years after the establishment, the remaining two partners had acquired the ability to hire qualified

that included designers and software engineers (Kahney and Leander, 2014). In 1980 Apple

Corporation made it is a financial breakthrough in which the years that followed the company started

shipping to other continents, the computers possessed unique features such as the 1984 original

Macintosh. The company’s marketing prowess lead to widespread positive criticism on their products

and also increased acceptance. However, the Apple products high prices lead to limited purchases and

even power disputes between the executives in which led to the exit of Wozniak while the remaining

owner Steve Jobs also departed to found neXT (Guiso, L., Sapienza, P., & Zingales, L, 2015).

Through the years of the 1990s as the market for minicomputers extensively grew and evolved, the

company lost sales due to the availability of Microsoft Windows on Intel pc clones that are lowlier

priced than their organization. The management then employed CEO Gil Amelio with the aims of the

CEO, ensuring the improvement of the company in terms of sales, employee’s recruitment, executive

restructuring, and customer retention. In the year 1997, the new chief executive officer bought neXT

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

which solved the need for an operating system that did not fail quickly and the chief executive officer

also brought one of the initial core founders, Steve Jobs, back to the company( Koblin and John

(March 25, 2018).Steve Jobs consequently gained back his leadership role in the company, becoming

the company’s chief executive officer in 2000.The company after the changes regained its market

through its unique and quality mini computers under the campaign of think differently, by the launch

of the popular iMac software in 1998, and also the company merged uniquely small companies that

helped it in advertising its different products( K Pearce, R Golley, L Lewis, L Cassidy,2018).In 2007

January Steve Job being the chief executive officer renamed the corporation Apple Inc., which in turn

shifted it is major concerns to producing consumer electronics and the introduction of the iPhone

phone that created financial success and globally acceptance. In the year 2011 august after the

numerous changes and success of the company Steve Job resigned as the chief executive officer

because of complicated health problems whereby Tim cook took over as the new chief executive

officer. Then almost two months after the founder and former Chief executive officer of Apple Steve

Jobs had resigned, he died (ML Guckian, DA Chapman, and B Lickel, 2018).

Presently Apple is known for it is revenues and size; globally, annual income is approximately $265

in the year 2018. The company is the world’s most enormous technology corporation by income

annually, and also it’s the most unique and contains valuable products worldwide. The company is the

world third largest smartphone manufactures following Huawei and Samsung closely. As at 2018 the

company was employing 12300 full-time personnel with over 504 retail stores in about 24 countries

globally. Apple also becomes the first United States company to be valued at over $1 trillion. As of

2018 January, over 1.3 billion apple products are used globally by its consumers as it operates the

famous iTunes stores, which are known globally to be the most significant music store. The

Cooperation enjoys a lot of consumer loyalty due to its unique products and valuable assets (Schein,

E. H, 2010).

also brought one of the initial core founders, Steve Jobs, back to the company( Koblin and John

(March 25, 2018).Steve Jobs consequently gained back his leadership role in the company, becoming

the company’s chief executive officer in 2000.The company after the changes regained its market

through its unique and quality mini computers under the campaign of think differently, by the launch

of the popular iMac software in 1998, and also the company merged uniquely small companies that

helped it in advertising its different products( K Pearce, R Golley, L Lewis, L Cassidy,2018).In 2007

January Steve Job being the chief executive officer renamed the corporation Apple Inc., which in turn

shifted it is major concerns to producing consumer electronics and the introduction of the iPhone

phone that created financial success and globally acceptance. In the year 2011 august after the

numerous changes and success of the company Steve Job resigned as the chief executive officer

because of complicated health problems whereby Tim cook took over as the new chief executive

officer. Then almost two months after the founder and former Chief executive officer of Apple Steve

Jobs had resigned, he died (ML Guckian, DA Chapman, and B Lickel, 2018).

Presently Apple is known for it is revenues and size; globally, annual income is approximately $265

in the year 2018. The company is the world’s most enormous technology corporation by income

annually, and also it’s the most unique and contains valuable products worldwide. The company is the

world third largest smartphone manufactures following Huawei and Samsung closely. As at 2018 the

company was employing 12300 full-time personnel with over 504 retail stores in about 24 countries

globally. Apple also becomes the first United States company to be valued at over $1 trillion. As of

2018 January, over 1.3 billion apple products are used globally by its consumers as it operates the

famous iTunes stores, which are known globally to be the most significant music store. The

Cooperation enjoys a lot of consumer loyalty due to its unique products and valuable assets (Schein,

E. H, 2010).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BODY.

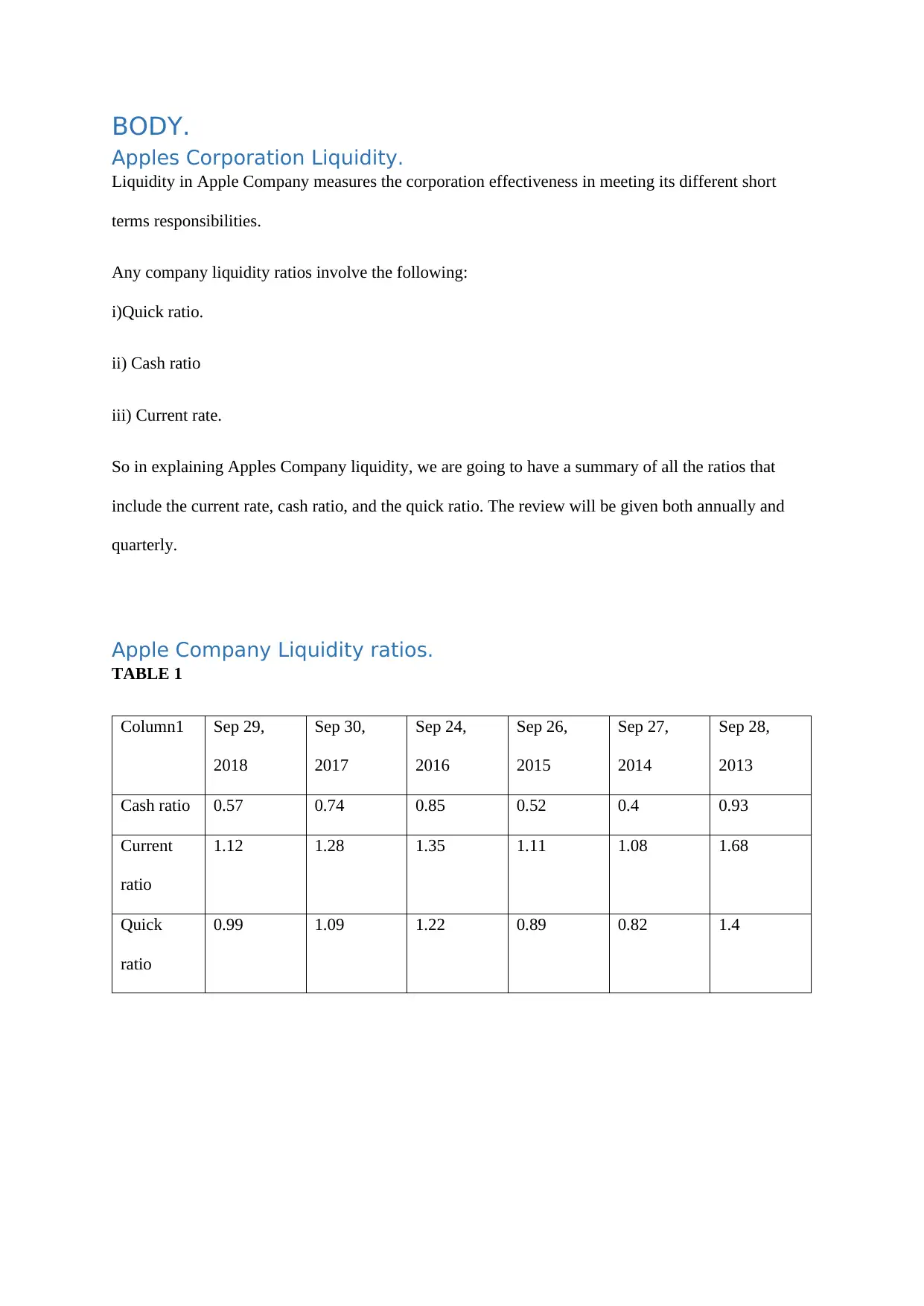

Apples Corporation Liquidity.

Liquidity in Apple Company measures the corporation effectiveness in meeting its different short

terms responsibilities.

Any company liquidity ratios involve the following:

i)Quick ratio.

ii) Cash ratio

iii) Current rate.

So in explaining Apples Company liquidity, we are going to have a summary of all the ratios that

include the current rate, cash ratio, and the quick ratio. The review will be given both annually and

quarterly.

Apple Company Liquidity ratios.

TABLE 1

Column1 Sep 29,

2018

Sep 30,

2017

Sep 24,

2016

Sep 26,

2015

Sep 27,

2014

Sep 28,

2013

Cash ratio 0.57 0.74 0.85 0.52 0.4 0.93

Current

ratio

1.12 1.28 1.35 1.11 1.08 1.68

Quick

ratio

0.99 1.09 1.22 0.89 0.82 1.4

Apples Corporation Liquidity.

Liquidity in Apple Company measures the corporation effectiveness in meeting its different short

terms responsibilities.

Any company liquidity ratios involve the following:

i)Quick ratio.

ii) Cash ratio

iii) Current rate.

So in explaining Apples Company liquidity, we are going to have a summary of all the ratios that

include the current rate, cash ratio, and the quick ratio. The review will be given both annually and

quarterly.

Apple Company Liquidity ratios.

TABLE 1

Column1 Sep 29,

2018

Sep 30,

2017

Sep 24,

2016

Sep 26,

2015

Sep 27,

2014

Sep 28,

2013

Cash ratio 0.57 0.74 0.85 0.52 0.4 0.93

Current

ratio

1.12 1.28 1.35 1.11 1.08 1.68

Quick

ratio

0.99 1.09 1.22 0.89 0.82 1.4

Cash ratio. This is a liquidity ratio that is always calculated by dividing the cash equivalents and cash

of any company over its current liabilities. Apple company cash ratio experienced deterioration from

2016 to 2017 and also from 2017 to 2018(W Lazonick, M Mazzucato, and Ö Tulum, 2013).

Current ratio. This is a liquidity ratio that is usually calculated by dividing the existing assets by the

current liabilities. Apple company in 2016 to 2017 it is current rate also deteriorated in 2017 to 2018

the same was experienced (S Orellana, 2019).

Quick ratio. This is a liquidity ratio calculated by dividing the current total assets over the total

current liabilities. In Apple Company, the quick ratio deteriorated from 2016 to 2017, and the same

thing happened in 2017 to 2018(U.S. Department of Commerce, 2019).

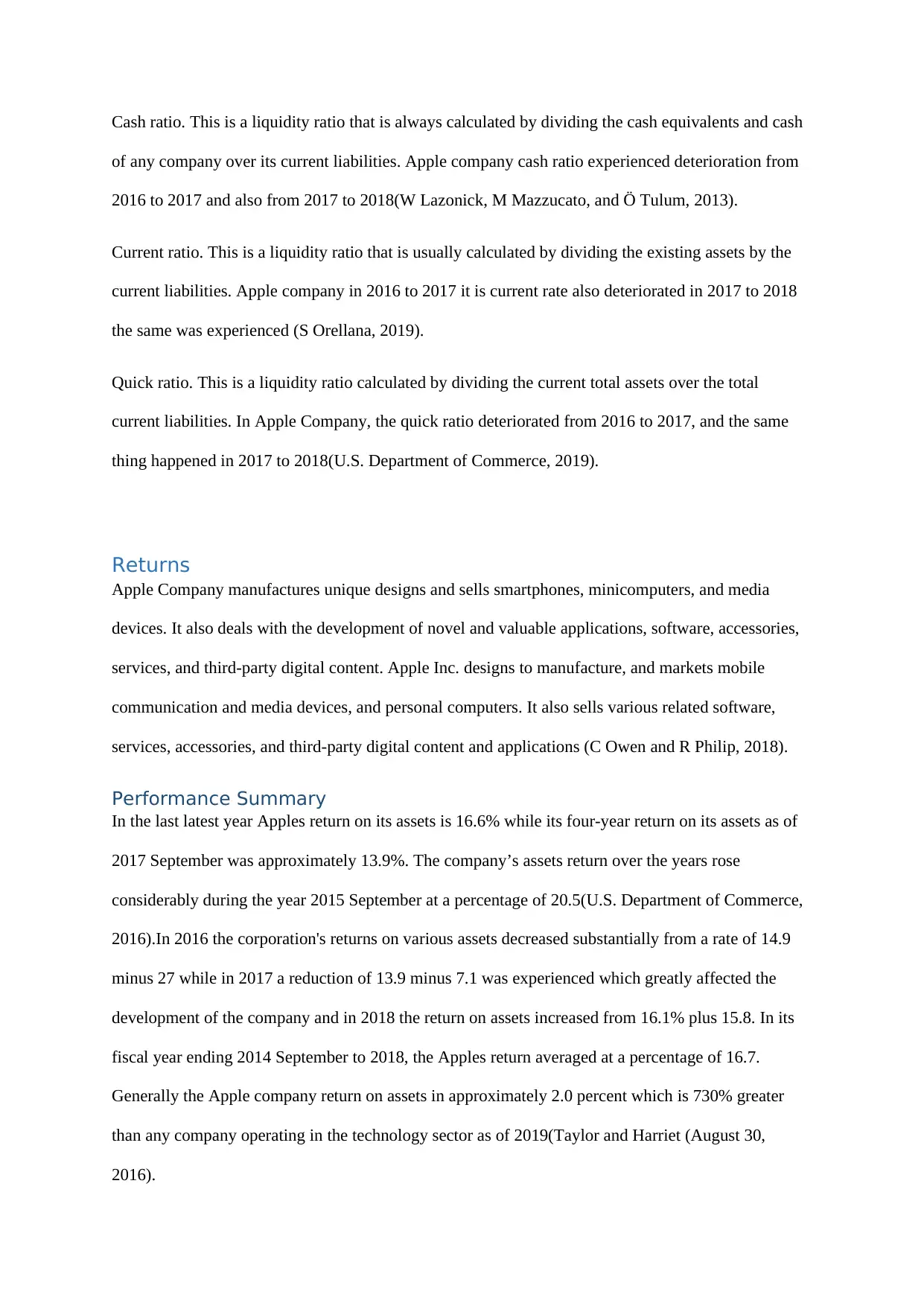

Returns

Apple Company manufactures unique designs and sells smartphones, minicomputers, and media

devices. It also deals with the development of novel and valuable applications, software, accessories,

services, and third-party digital content. Apple Inc. designs to manufacture, and markets mobile

communication and media devices, and personal computers. It also sells various related software,

services, accessories, and third-party digital content and applications (C Owen and R Philip, 2018).

Performance Summary

In the last latest year Apples return on its assets is 16.6% while its four-year return on its assets as of

2017 September was approximately 13.9%. The company’s assets return over the years rose

considerably during the year 2015 September at a percentage of 20.5(U.S. Department of Commerce,

2016).In 2016 the corporation's returns on various assets decreased substantially from a rate of 14.9

minus 27 while in 2017 a reduction of 13.9 minus 7.1 was experienced which greatly affected the

development of the company and in 2018 the return on assets increased from 16.1% plus 15.8. In its

fiscal year ending 2014 September to 2018, the Apples return averaged at a percentage of 16.7.

Generally the Apple company return on assets in approximately 2.0 percent which is 730% greater

than any company operating in the technology sector as of 2019(Taylor and Harriet (August 30,

2016).

of any company over its current liabilities. Apple company cash ratio experienced deterioration from

2016 to 2017 and also from 2017 to 2018(W Lazonick, M Mazzucato, and Ö Tulum, 2013).

Current ratio. This is a liquidity ratio that is usually calculated by dividing the existing assets by the

current liabilities. Apple company in 2016 to 2017 it is current rate also deteriorated in 2017 to 2018

the same was experienced (S Orellana, 2019).

Quick ratio. This is a liquidity ratio calculated by dividing the current total assets over the total

current liabilities. In Apple Company, the quick ratio deteriorated from 2016 to 2017, and the same

thing happened in 2017 to 2018(U.S. Department of Commerce, 2019).

Returns

Apple Company manufactures unique designs and sells smartphones, minicomputers, and media

devices. It also deals with the development of novel and valuable applications, software, accessories,

services, and third-party digital content. Apple Inc. designs to manufacture, and markets mobile

communication and media devices, and personal computers. It also sells various related software,

services, accessories, and third-party digital content and applications (C Owen and R Philip, 2018).

Performance Summary

In the last latest year Apples return on its assets is 16.6% while its four-year return on its assets as of

2017 September was approximately 13.9%. The company’s assets return over the years rose

considerably during the year 2015 September at a percentage of 20.5(U.S. Department of Commerce,

2016).In 2016 the corporation's returns on various assets decreased substantially from a rate of 14.9

minus 27 while in 2017 a reduction of 13.9 minus 7.1 was experienced which greatly affected the

development of the company and in 2018 the return on assets increased from 16.1% plus 15.8. In its

fiscal year ending 2014 September to 2018, the Apples return averaged at a percentage of 16.7.

Generally the Apple company return on assets in approximately 2.0 percent which is 730% greater

than any company operating in the technology sector as of 2019(Taylor and Harriet (August 30,

2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

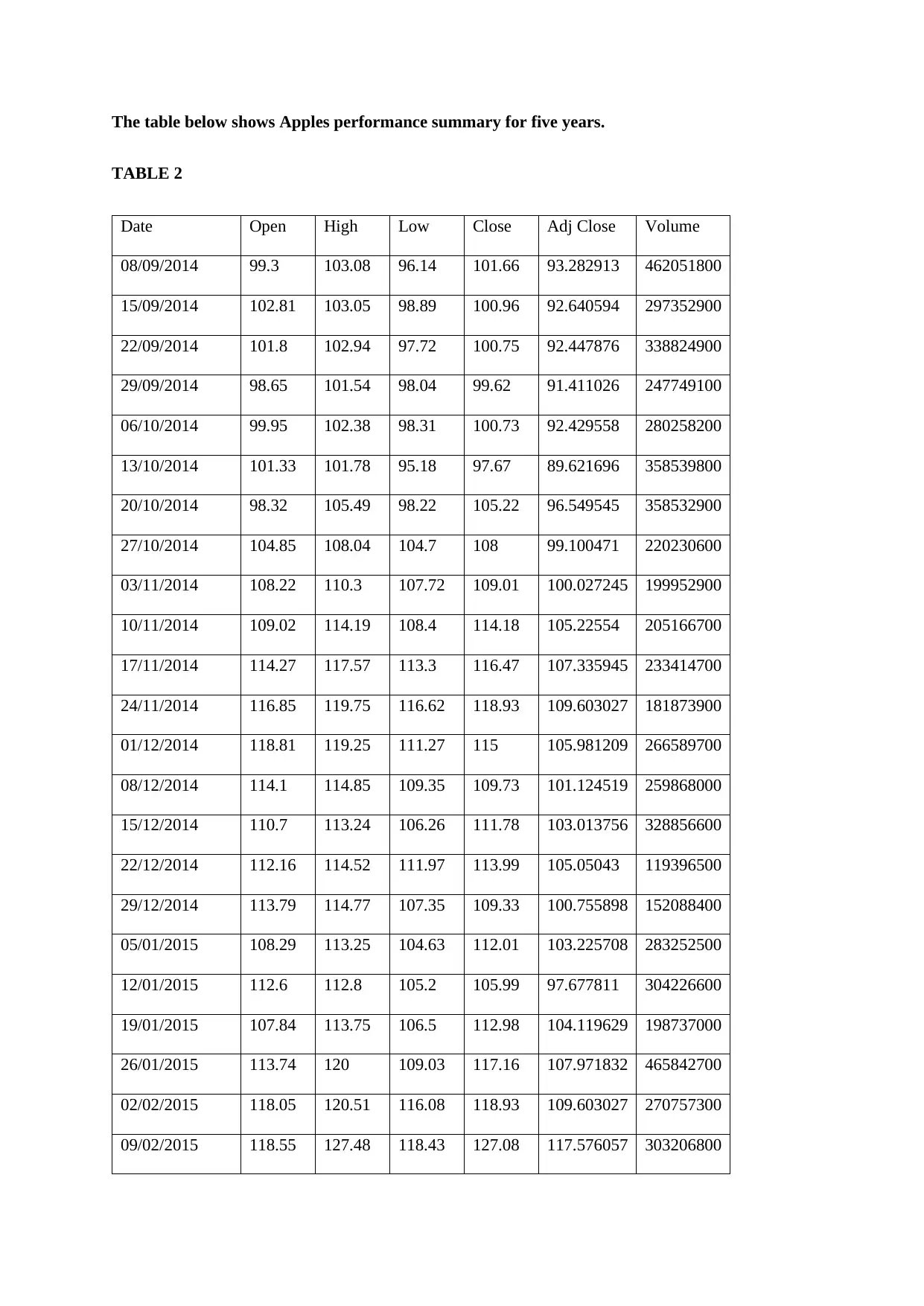

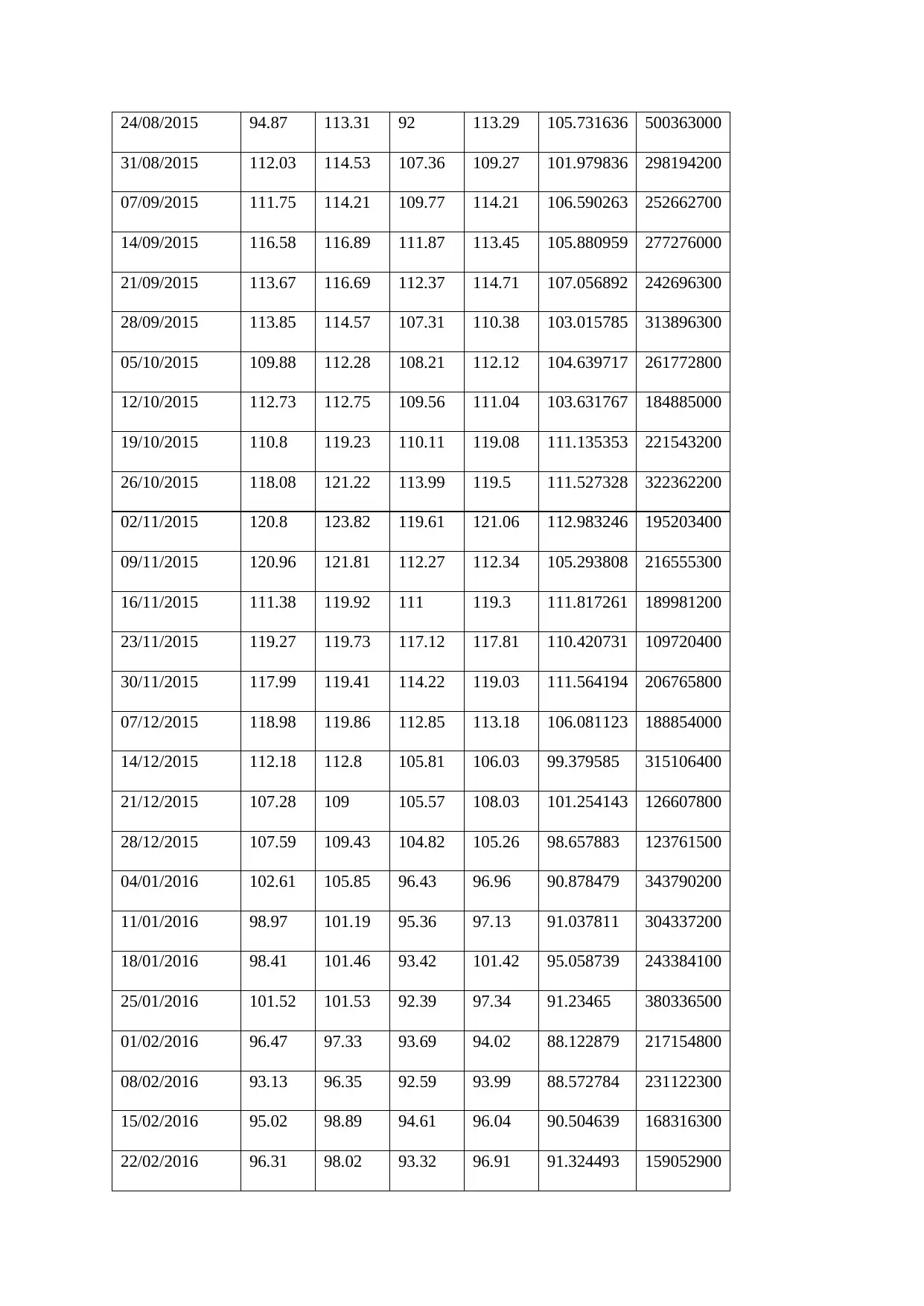

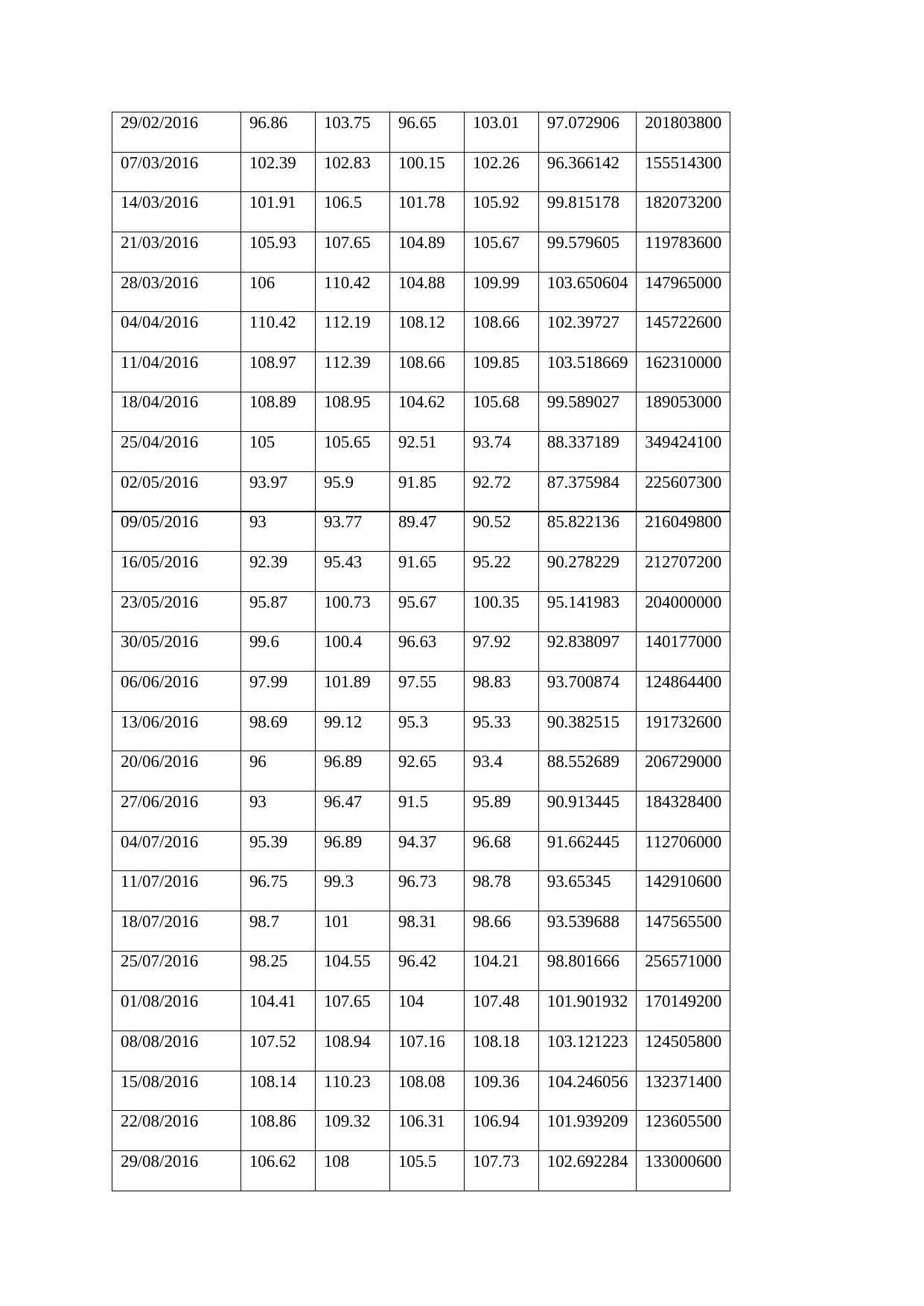

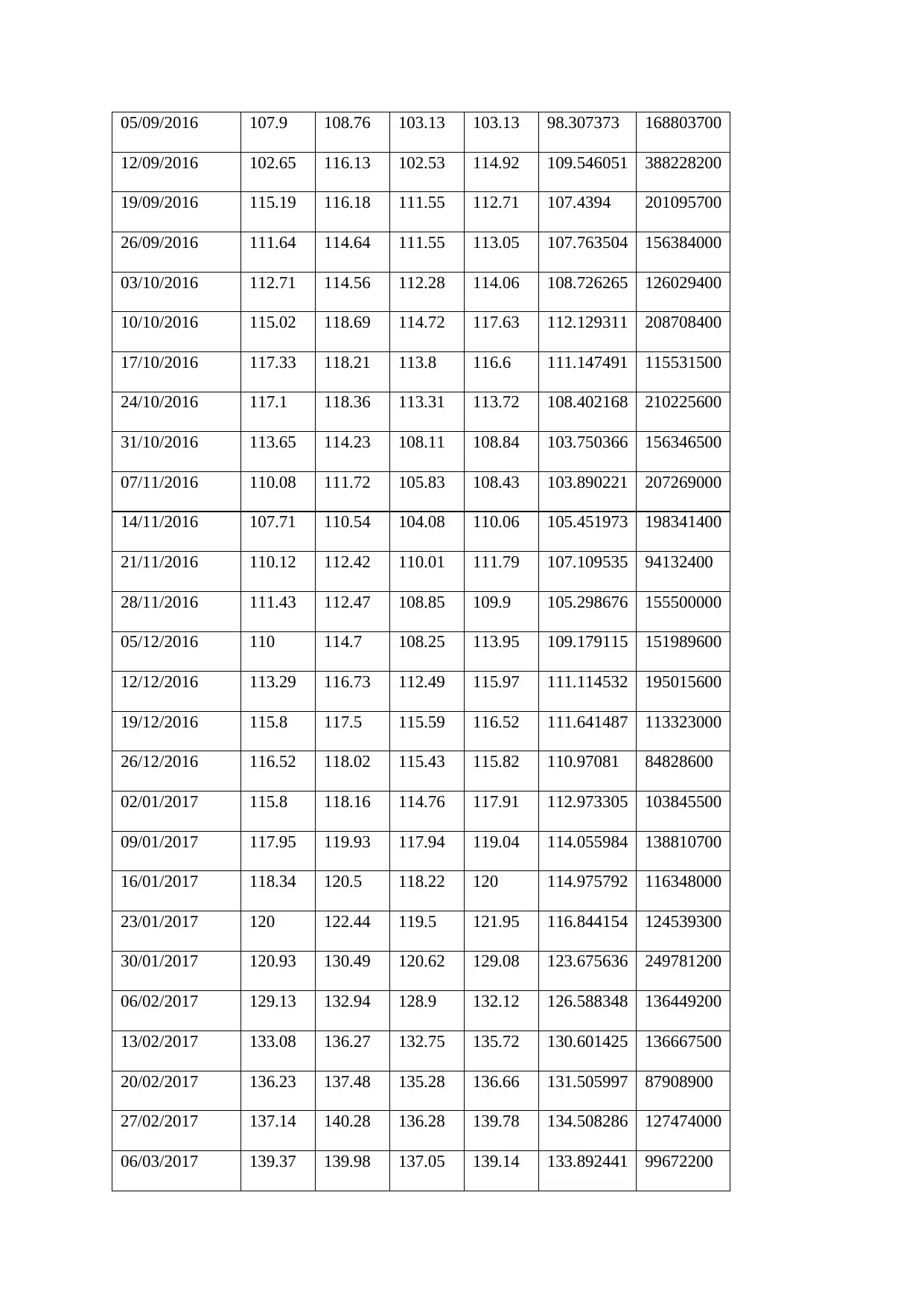

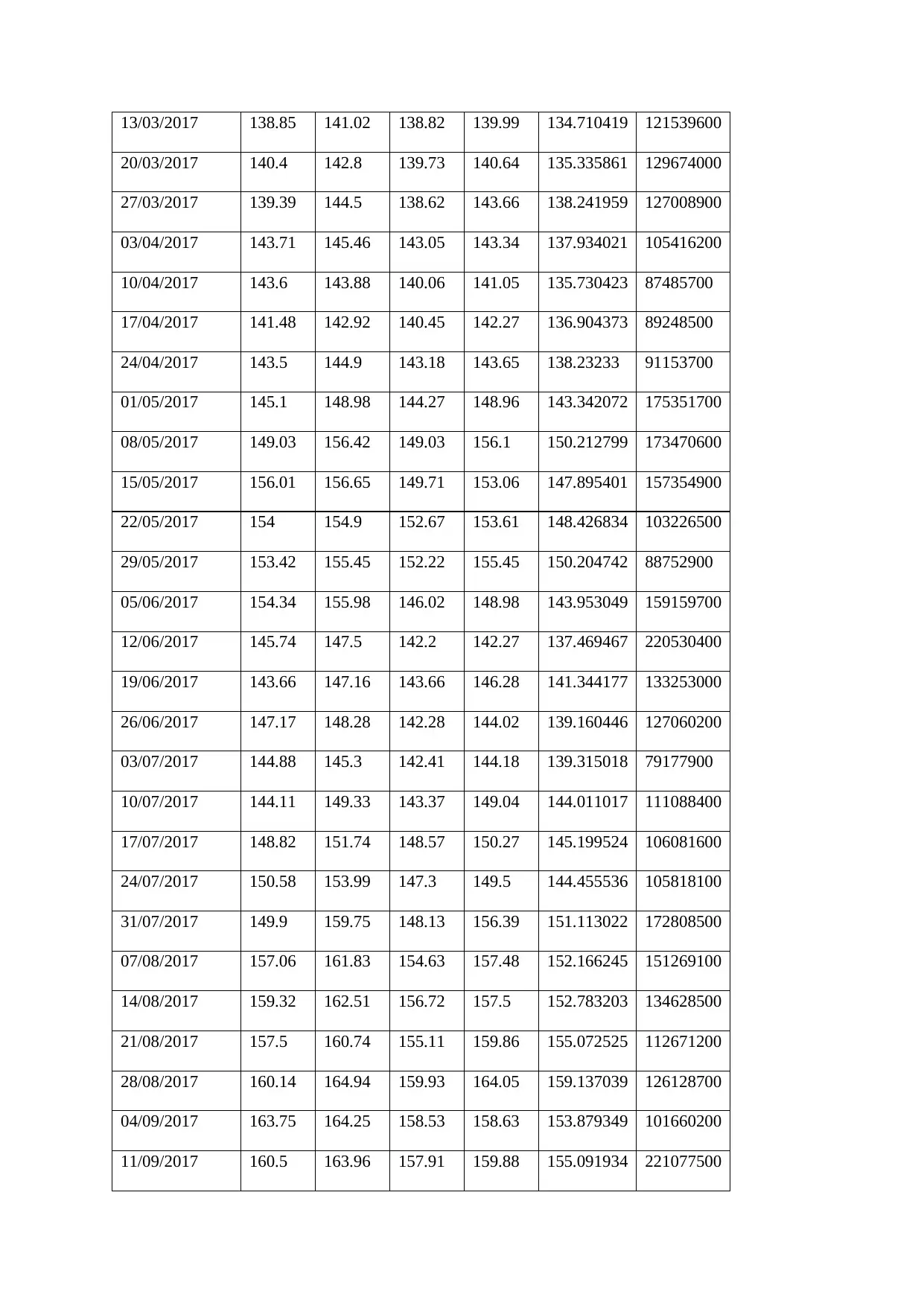

The table below shows Apples performance summary for five years.

TABLE 2

Date Open High Low Close Adj Close Volume

08/09/2014 99.3 103.08 96.14 101.66 93.282913 462051800

15/09/2014 102.81 103.05 98.89 100.96 92.640594 297352900

22/09/2014 101.8 102.94 97.72 100.75 92.447876 338824900

29/09/2014 98.65 101.54 98.04 99.62 91.411026 247749100

06/10/2014 99.95 102.38 98.31 100.73 92.429558 280258200

13/10/2014 101.33 101.78 95.18 97.67 89.621696 358539800

20/10/2014 98.32 105.49 98.22 105.22 96.549545 358532900

27/10/2014 104.85 108.04 104.7 108 99.100471 220230600

03/11/2014 108.22 110.3 107.72 109.01 100.027245 199952900

10/11/2014 109.02 114.19 108.4 114.18 105.22554 205166700

17/11/2014 114.27 117.57 113.3 116.47 107.335945 233414700

24/11/2014 116.85 119.75 116.62 118.93 109.603027 181873900

01/12/2014 118.81 119.25 111.27 115 105.981209 266589700

08/12/2014 114.1 114.85 109.35 109.73 101.124519 259868000

15/12/2014 110.7 113.24 106.26 111.78 103.013756 328856600

22/12/2014 112.16 114.52 111.97 113.99 105.05043 119396500

29/12/2014 113.79 114.77 107.35 109.33 100.755898 152088400

05/01/2015 108.29 113.25 104.63 112.01 103.225708 283252500

12/01/2015 112.6 112.8 105.2 105.99 97.677811 304226600

19/01/2015 107.84 113.75 106.5 112.98 104.119629 198737000

26/01/2015 113.74 120 109.03 117.16 107.971832 465842700

02/02/2015 118.05 120.51 116.08 118.93 109.603027 270757300

09/02/2015 118.55 127.48 118.43 127.08 117.576057 303206800

TABLE 2

Date Open High Low Close Adj Close Volume

08/09/2014 99.3 103.08 96.14 101.66 93.282913 462051800

15/09/2014 102.81 103.05 98.89 100.96 92.640594 297352900

22/09/2014 101.8 102.94 97.72 100.75 92.447876 338824900

29/09/2014 98.65 101.54 98.04 99.62 91.411026 247749100

06/10/2014 99.95 102.38 98.31 100.73 92.429558 280258200

13/10/2014 101.33 101.78 95.18 97.67 89.621696 358539800

20/10/2014 98.32 105.49 98.22 105.22 96.549545 358532900

27/10/2014 104.85 108.04 104.7 108 99.100471 220230600

03/11/2014 108.22 110.3 107.72 109.01 100.027245 199952900

10/11/2014 109.02 114.19 108.4 114.18 105.22554 205166700

17/11/2014 114.27 117.57 113.3 116.47 107.335945 233414700

24/11/2014 116.85 119.75 116.62 118.93 109.603027 181873900

01/12/2014 118.81 119.25 111.27 115 105.981209 266589700

08/12/2014 114.1 114.85 109.35 109.73 101.124519 259868000

15/12/2014 110.7 113.24 106.26 111.78 103.013756 328856600

22/12/2014 112.16 114.52 111.97 113.99 105.05043 119396500

29/12/2014 113.79 114.77 107.35 109.33 100.755898 152088400

05/01/2015 108.29 113.25 104.63 112.01 103.225708 283252500

12/01/2015 112.6 112.8 105.2 105.99 97.677811 304226600

19/01/2015 107.84 113.75 106.5 112.98 104.119629 198737000

26/01/2015 113.74 120 109.03 117.16 107.971832 465842700

02/02/2015 118.05 120.51 116.08 118.93 109.603027 270757300

09/02/2015 118.55 127.48 118.43 127.08 117.576057 303206800

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

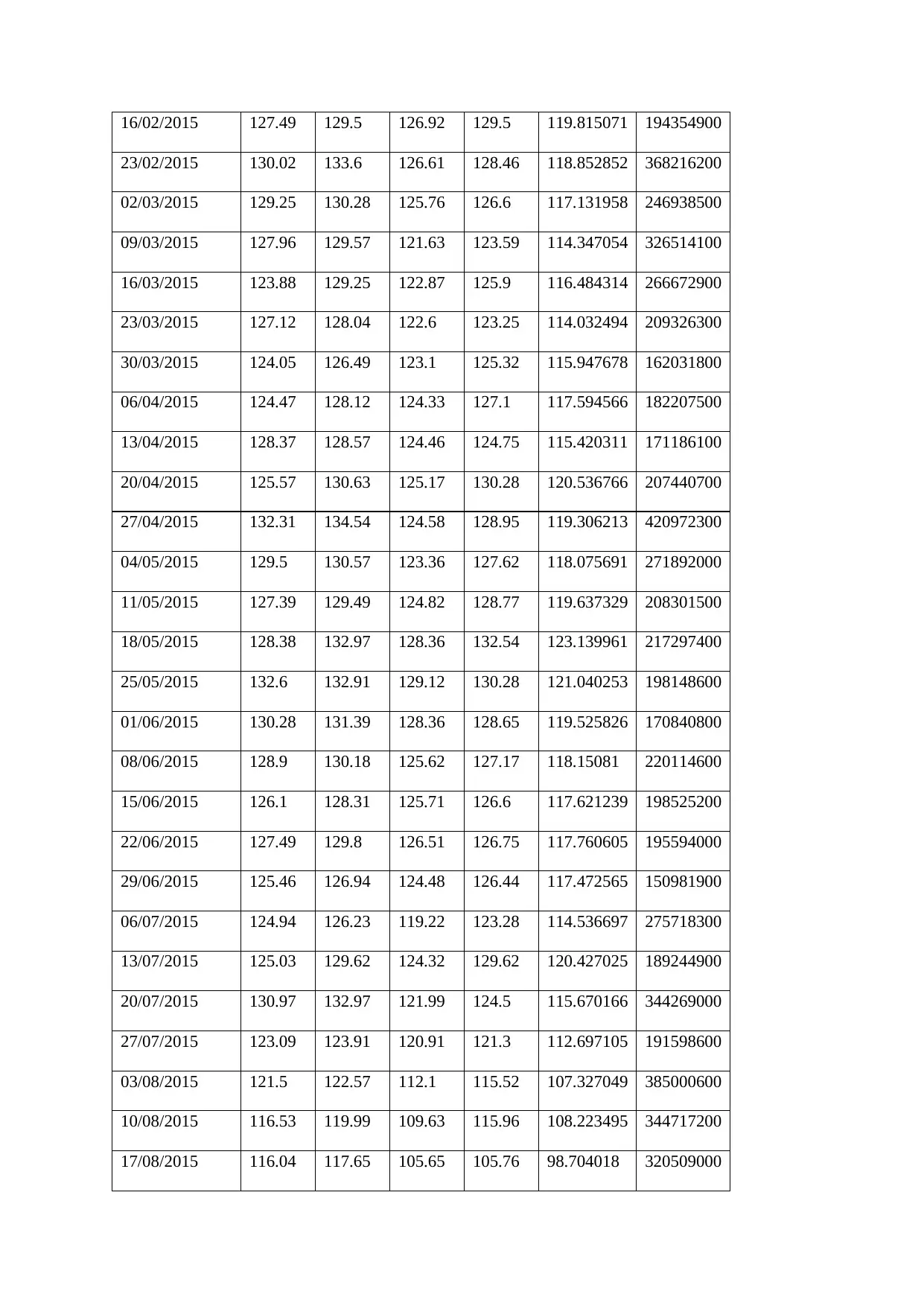

16/02/2015 127.49 129.5 126.92 129.5 119.815071 194354900

23/02/2015 130.02 133.6 126.61 128.46 118.852852 368216200

02/03/2015 129.25 130.28 125.76 126.6 117.131958 246938500

09/03/2015 127.96 129.57 121.63 123.59 114.347054 326514100

16/03/2015 123.88 129.25 122.87 125.9 116.484314 266672900

23/03/2015 127.12 128.04 122.6 123.25 114.032494 209326300

30/03/2015 124.05 126.49 123.1 125.32 115.947678 162031800

06/04/2015 124.47 128.12 124.33 127.1 117.594566 182207500

13/04/2015 128.37 128.57 124.46 124.75 115.420311 171186100

20/04/2015 125.57 130.63 125.17 130.28 120.536766 207440700

27/04/2015 132.31 134.54 124.58 128.95 119.306213 420972300

04/05/2015 129.5 130.57 123.36 127.62 118.075691 271892000

11/05/2015 127.39 129.49 124.82 128.77 119.637329 208301500

18/05/2015 128.38 132.97 128.36 132.54 123.139961 217297400

25/05/2015 132.6 132.91 129.12 130.28 121.040253 198148600

01/06/2015 130.28 131.39 128.36 128.65 119.525826 170840800

08/06/2015 128.9 130.18 125.62 127.17 118.15081 220114600

15/06/2015 126.1 128.31 125.71 126.6 117.621239 198525200

22/06/2015 127.49 129.8 126.51 126.75 117.760605 195594000

29/06/2015 125.46 126.94 124.48 126.44 117.472565 150981900

06/07/2015 124.94 126.23 119.22 123.28 114.536697 275718300

13/07/2015 125.03 129.62 124.32 129.62 120.427025 189244900

20/07/2015 130.97 132.97 121.99 124.5 115.670166 344269000

27/07/2015 123.09 123.91 120.91 121.3 112.697105 191598600

03/08/2015 121.5 122.57 112.1 115.52 107.327049 385000600

10/08/2015 116.53 119.99 109.63 115.96 108.223495 344717200

17/08/2015 116.04 117.65 105.65 105.76 98.704018 320509000

23/02/2015 130.02 133.6 126.61 128.46 118.852852 368216200

02/03/2015 129.25 130.28 125.76 126.6 117.131958 246938500

09/03/2015 127.96 129.57 121.63 123.59 114.347054 326514100

16/03/2015 123.88 129.25 122.87 125.9 116.484314 266672900

23/03/2015 127.12 128.04 122.6 123.25 114.032494 209326300

30/03/2015 124.05 126.49 123.1 125.32 115.947678 162031800

06/04/2015 124.47 128.12 124.33 127.1 117.594566 182207500

13/04/2015 128.37 128.57 124.46 124.75 115.420311 171186100

20/04/2015 125.57 130.63 125.17 130.28 120.536766 207440700

27/04/2015 132.31 134.54 124.58 128.95 119.306213 420972300

04/05/2015 129.5 130.57 123.36 127.62 118.075691 271892000

11/05/2015 127.39 129.49 124.82 128.77 119.637329 208301500

18/05/2015 128.38 132.97 128.36 132.54 123.139961 217297400

25/05/2015 132.6 132.91 129.12 130.28 121.040253 198148600

01/06/2015 130.28 131.39 128.36 128.65 119.525826 170840800

08/06/2015 128.9 130.18 125.62 127.17 118.15081 220114600

15/06/2015 126.1 128.31 125.71 126.6 117.621239 198525200

22/06/2015 127.49 129.8 126.51 126.75 117.760605 195594000

29/06/2015 125.46 126.94 124.48 126.44 117.472565 150981900

06/07/2015 124.94 126.23 119.22 123.28 114.536697 275718300

13/07/2015 125.03 129.62 124.32 129.62 120.427025 189244900

20/07/2015 130.97 132.97 121.99 124.5 115.670166 344269000

27/07/2015 123.09 123.91 120.91 121.3 112.697105 191598600

03/08/2015 121.5 122.57 112.1 115.52 107.327049 385000600

10/08/2015 116.53 119.99 109.63 115.96 108.223495 344717200

17/08/2015 116.04 117.65 105.65 105.76 98.704018 320509000

24/08/2015 94.87 113.31 92 113.29 105.731636 500363000

31/08/2015 112.03 114.53 107.36 109.27 101.979836 298194200

07/09/2015 111.75 114.21 109.77 114.21 106.590263 252662700

14/09/2015 116.58 116.89 111.87 113.45 105.880959 277276000

21/09/2015 113.67 116.69 112.37 114.71 107.056892 242696300

28/09/2015 113.85 114.57 107.31 110.38 103.015785 313896300

05/10/2015 109.88 112.28 108.21 112.12 104.639717 261772800

12/10/2015 112.73 112.75 109.56 111.04 103.631767 184885000

19/10/2015 110.8 119.23 110.11 119.08 111.135353 221543200

26/10/2015 118.08 121.22 113.99 119.5 111.527328 322362200

02/11/2015 120.8 123.82 119.61 121.06 112.983246 195203400

09/11/2015 120.96 121.81 112.27 112.34 105.293808 216555300

16/11/2015 111.38 119.92 111 119.3 111.817261 189981200

23/11/2015 119.27 119.73 117.12 117.81 110.420731 109720400

30/11/2015 117.99 119.41 114.22 119.03 111.564194 206765800

07/12/2015 118.98 119.86 112.85 113.18 106.081123 188854000

14/12/2015 112.18 112.8 105.81 106.03 99.379585 315106400

21/12/2015 107.28 109 105.57 108.03 101.254143 126607800

28/12/2015 107.59 109.43 104.82 105.26 98.657883 123761500

04/01/2016 102.61 105.85 96.43 96.96 90.878479 343790200

11/01/2016 98.97 101.19 95.36 97.13 91.037811 304337200

18/01/2016 98.41 101.46 93.42 101.42 95.058739 243384100

25/01/2016 101.52 101.53 92.39 97.34 91.23465 380336500

01/02/2016 96.47 97.33 93.69 94.02 88.122879 217154800

08/02/2016 93.13 96.35 92.59 93.99 88.572784 231122300

15/02/2016 95.02 98.89 94.61 96.04 90.504639 168316300

22/02/2016 96.31 98.02 93.32 96.91 91.324493 159052900

31/08/2015 112.03 114.53 107.36 109.27 101.979836 298194200

07/09/2015 111.75 114.21 109.77 114.21 106.590263 252662700

14/09/2015 116.58 116.89 111.87 113.45 105.880959 277276000

21/09/2015 113.67 116.69 112.37 114.71 107.056892 242696300

28/09/2015 113.85 114.57 107.31 110.38 103.015785 313896300

05/10/2015 109.88 112.28 108.21 112.12 104.639717 261772800

12/10/2015 112.73 112.75 109.56 111.04 103.631767 184885000

19/10/2015 110.8 119.23 110.11 119.08 111.135353 221543200

26/10/2015 118.08 121.22 113.99 119.5 111.527328 322362200

02/11/2015 120.8 123.82 119.61 121.06 112.983246 195203400

09/11/2015 120.96 121.81 112.27 112.34 105.293808 216555300

16/11/2015 111.38 119.92 111 119.3 111.817261 189981200

23/11/2015 119.27 119.73 117.12 117.81 110.420731 109720400

30/11/2015 117.99 119.41 114.22 119.03 111.564194 206765800

07/12/2015 118.98 119.86 112.85 113.18 106.081123 188854000

14/12/2015 112.18 112.8 105.81 106.03 99.379585 315106400

21/12/2015 107.28 109 105.57 108.03 101.254143 126607800

28/12/2015 107.59 109.43 104.82 105.26 98.657883 123761500

04/01/2016 102.61 105.85 96.43 96.96 90.878479 343790200

11/01/2016 98.97 101.19 95.36 97.13 91.037811 304337200

18/01/2016 98.41 101.46 93.42 101.42 95.058739 243384100

25/01/2016 101.52 101.53 92.39 97.34 91.23465 380336500

01/02/2016 96.47 97.33 93.69 94.02 88.122879 217154800

08/02/2016 93.13 96.35 92.59 93.99 88.572784 231122300

15/02/2016 95.02 98.89 94.61 96.04 90.504639 168316300

22/02/2016 96.31 98.02 93.32 96.91 91.324493 159052900

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

29/02/2016 96.86 103.75 96.65 103.01 97.072906 201803800

07/03/2016 102.39 102.83 100.15 102.26 96.366142 155514300

14/03/2016 101.91 106.5 101.78 105.92 99.815178 182073200

21/03/2016 105.93 107.65 104.89 105.67 99.579605 119783600

28/03/2016 106 110.42 104.88 109.99 103.650604 147965000

04/04/2016 110.42 112.19 108.12 108.66 102.39727 145722600

11/04/2016 108.97 112.39 108.66 109.85 103.518669 162310000

18/04/2016 108.89 108.95 104.62 105.68 99.589027 189053000

25/04/2016 105 105.65 92.51 93.74 88.337189 349424100

02/05/2016 93.97 95.9 91.85 92.72 87.375984 225607300

09/05/2016 93 93.77 89.47 90.52 85.822136 216049800

16/05/2016 92.39 95.43 91.65 95.22 90.278229 212707200

23/05/2016 95.87 100.73 95.67 100.35 95.141983 204000000

30/05/2016 99.6 100.4 96.63 97.92 92.838097 140177000

06/06/2016 97.99 101.89 97.55 98.83 93.700874 124864400

13/06/2016 98.69 99.12 95.3 95.33 90.382515 191732600

20/06/2016 96 96.89 92.65 93.4 88.552689 206729000

27/06/2016 93 96.47 91.5 95.89 90.913445 184328400

04/07/2016 95.39 96.89 94.37 96.68 91.662445 112706000

11/07/2016 96.75 99.3 96.73 98.78 93.65345 142910600

18/07/2016 98.7 101 98.31 98.66 93.539688 147565500

25/07/2016 98.25 104.55 96.42 104.21 98.801666 256571000

01/08/2016 104.41 107.65 104 107.48 101.901932 170149200

08/08/2016 107.52 108.94 107.16 108.18 103.121223 124505800

15/08/2016 108.14 110.23 108.08 109.36 104.246056 132371400

22/08/2016 108.86 109.32 106.31 106.94 101.939209 123605500

29/08/2016 106.62 108 105.5 107.73 102.692284 133000600

07/03/2016 102.39 102.83 100.15 102.26 96.366142 155514300

14/03/2016 101.91 106.5 101.78 105.92 99.815178 182073200

21/03/2016 105.93 107.65 104.89 105.67 99.579605 119783600

28/03/2016 106 110.42 104.88 109.99 103.650604 147965000

04/04/2016 110.42 112.19 108.12 108.66 102.39727 145722600

11/04/2016 108.97 112.39 108.66 109.85 103.518669 162310000

18/04/2016 108.89 108.95 104.62 105.68 99.589027 189053000

25/04/2016 105 105.65 92.51 93.74 88.337189 349424100

02/05/2016 93.97 95.9 91.85 92.72 87.375984 225607300

09/05/2016 93 93.77 89.47 90.52 85.822136 216049800

16/05/2016 92.39 95.43 91.65 95.22 90.278229 212707200

23/05/2016 95.87 100.73 95.67 100.35 95.141983 204000000

30/05/2016 99.6 100.4 96.63 97.92 92.838097 140177000

06/06/2016 97.99 101.89 97.55 98.83 93.700874 124864400

13/06/2016 98.69 99.12 95.3 95.33 90.382515 191732600

20/06/2016 96 96.89 92.65 93.4 88.552689 206729000

27/06/2016 93 96.47 91.5 95.89 90.913445 184328400

04/07/2016 95.39 96.89 94.37 96.68 91.662445 112706000

11/07/2016 96.75 99.3 96.73 98.78 93.65345 142910600

18/07/2016 98.7 101 98.31 98.66 93.539688 147565500

25/07/2016 98.25 104.55 96.42 104.21 98.801666 256571000

01/08/2016 104.41 107.65 104 107.48 101.901932 170149200

08/08/2016 107.52 108.94 107.16 108.18 103.121223 124505800

15/08/2016 108.14 110.23 108.08 109.36 104.246056 132371400

22/08/2016 108.86 109.32 106.31 106.94 101.939209 123605500

29/08/2016 106.62 108 105.5 107.73 102.692284 133000600

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

05/09/2016 107.9 108.76 103.13 103.13 98.307373 168803700

12/09/2016 102.65 116.13 102.53 114.92 109.546051 388228200

19/09/2016 115.19 116.18 111.55 112.71 107.4394 201095700

26/09/2016 111.64 114.64 111.55 113.05 107.763504 156384000

03/10/2016 112.71 114.56 112.28 114.06 108.726265 126029400

10/10/2016 115.02 118.69 114.72 117.63 112.129311 208708400

17/10/2016 117.33 118.21 113.8 116.6 111.147491 115531500

24/10/2016 117.1 118.36 113.31 113.72 108.402168 210225600

31/10/2016 113.65 114.23 108.11 108.84 103.750366 156346500

07/11/2016 110.08 111.72 105.83 108.43 103.890221 207269000

14/11/2016 107.71 110.54 104.08 110.06 105.451973 198341400

21/11/2016 110.12 112.42 110.01 111.79 107.109535 94132400

28/11/2016 111.43 112.47 108.85 109.9 105.298676 155500000

05/12/2016 110 114.7 108.25 113.95 109.179115 151989600

12/12/2016 113.29 116.73 112.49 115.97 111.114532 195015600

19/12/2016 115.8 117.5 115.59 116.52 111.641487 113323000

26/12/2016 116.52 118.02 115.43 115.82 110.97081 84828600

02/01/2017 115.8 118.16 114.76 117.91 112.973305 103845500

09/01/2017 117.95 119.93 117.94 119.04 114.055984 138810700

16/01/2017 118.34 120.5 118.22 120 114.975792 116348000

23/01/2017 120 122.44 119.5 121.95 116.844154 124539300

30/01/2017 120.93 130.49 120.62 129.08 123.675636 249781200

06/02/2017 129.13 132.94 128.9 132.12 126.588348 136449200

13/02/2017 133.08 136.27 132.75 135.72 130.601425 136667500

20/02/2017 136.23 137.48 135.28 136.66 131.505997 87908900

27/02/2017 137.14 140.28 136.28 139.78 134.508286 127474000

06/03/2017 139.37 139.98 137.05 139.14 133.892441 99672200

12/09/2016 102.65 116.13 102.53 114.92 109.546051 388228200

19/09/2016 115.19 116.18 111.55 112.71 107.4394 201095700

26/09/2016 111.64 114.64 111.55 113.05 107.763504 156384000

03/10/2016 112.71 114.56 112.28 114.06 108.726265 126029400

10/10/2016 115.02 118.69 114.72 117.63 112.129311 208708400

17/10/2016 117.33 118.21 113.8 116.6 111.147491 115531500

24/10/2016 117.1 118.36 113.31 113.72 108.402168 210225600

31/10/2016 113.65 114.23 108.11 108.84 103.750366 156346500

07/11/2016 110.08 111.72 105.83 108.43 103.890221 207269000

14/11/2016 107.71 110.54 104.08 110.06 105.451973 198341400

21/11/2016 110.12 112.42 110.01 111.79 107.109535 94132400

28/11/2016 111.43 112.47 108.85 109.9 105.298676 155500000

05/12/2016 110 114.7 108.25 113.95 109.179115 151989600

12/12/2016 113.29 116.73 112.49 115.97 111.114532 195015600

19/12/2016 115.8 117.5 115.59 116.52 111.641487 113323000

26/12/2016 116.52 118.02 115.43 115.82 110.97081 84828600

02/01/2017 115.8 118.16 114.76 117.91 112.973305 103845500

09/01/2017 117.95 119.93 117.94 119.04 114.055984 138810700

16/01/2017 118.34 120.5 118.22 120 114.975792 116348000

23/01/2017 120 122.44 119.5 121.95 116.844154 124539300

30/01/2017 120.93 130.49 120.62 129.08 123.675636 249781200

06/02/2017 129.13 132.94 128.9 132.12 126.588348 136449200

13/02/2017 133.08 136.27 132.75 135.72 130.601425 136667500

20/02/2017 136.23 137.48 135.28 136.66 131.505997 87908900

27/02/2017 137.14 140.28 136.28 139.78 134.508286 127474000

06/03/2017 139.37 139.98 137.05 139.14 133.892441 99672200

13/03/2017 138.85 141.02 138.82 139.99 134.710419 121539600

20/03/2017 140.4 142.8 139.73 140.64 135.335861 129674000

27/03/2017 139.39 144.5 138.62 143.66 138.241959 127008900

03/04/2017 143.71 145.46 143.05 143.34 137.934021 105416200

10/04/2017 143.6 143.88 140.06 141.05 135.730423 87485700

17/04/2017 141.48 142.92 140.45 142.27 136.904373 89248500

24/04/2017 143.5 144.9 143.18 143.65 138.23233 91153700

01/05/2017 145.1 148.98 144.27 148.96 143.342072 175351700

08/05/2017 149.03 156.42 149.03 156.1 150.212799 173470600

15/05/2017 156.01 156.65 149.71 153.06 147.895401 157354900

22/05/2017 154 154.9 152.67 153.61 148.426834 103226500

29/05/2017 153.42 155.45 152.22 155.45 150.204742 88752900

05/06/2017 154.34 155.98 146.02 148.98 143.953049 159159700

12/06/2017 145.74 147.5 142.2 142.27 137.469467 220530400

19/06/2017 143.66 147.16 143.66 146.28 141.344177 133253000

26/06/2017 147.17 148.28 142.28 144.02 139.160446 127060200

03/07/2017 144.88 145.3 142.41 144.18 139.315018 79177900

10/07/2017 144.11 149.33 143.37 149.04 144.011017 111088400

17/07/2017 148.82 151.74 148.57 150.27 145.199524 106081600

24/07/2017 150.58 153.99 147.3 149.5 144.455536 105818100

31/07/2017 149.9 159.75 148.13 156.39 151.113022 172808500

07/08/2017 157.06 161.83 154.63 157.48 152.166245 151269100

14/08/2017 159.32 162.51 156.72 157.5 152.783203 134628500

21/08/2017 157.5 160.74 155.11 159.86 155.072525 112671200

28/08/2017 160.14 164.94 159.93 164.05 159.137039 126128700

04/09/2017 163.75 164.25 158.53 158.63 153.879349 101660200

11/09/2017 160.5 163.96 157.91 159.88 155.091934 221077500

20/03/2017 140.4 142.8 139.73 140.64 135.335861 129674000

27/03/2017 139.39 144.5 138.62 143.66 138.241959 127008900

03/04/2017 143.71 145.46 143.05 143.34 137.934021 105416200

10/04/2017 143.6 143.88 140.06 141.05 135.730423 87485700

17/04/2017 141.48 142.92 140.45 142.27 136.904373 89248500

24/04/2017 143.5 144.9 143.18 143.65 138.23233 91153700

01/05/2017 145.1 148.98 144.27 148.96 143.342072 175351700

08/05/2017 149.03 156.42 149.03 156.1 150.212799 173470600

15/05/2017 156.01 156.65 149.71 153.06 147.895401 157354900

22/05/2017 154 154.9 152.67 153.61 148.426834 103226500

29/05/2017 153.42 155.45 152.22 155.45 150.204742 88752900

05/06/2017 154.34 155.98 146.02 148.98 143.953049 159159700

12/06/2017 145.74 147.5 142.2 142.27 137.469467 220530400

19/06/2017 143.66 147.16 143.66 146.28 141.344177 133253000

26/06/2017 147.17 148.28 142.28 144.02 139.160446 127060200

03/07/2017 144.88 145.3 142.41 144.18 139.315018 79177900

10/07/2017 144.11 149.33 143.37 149.04 144.011017 111088400

17/07/2017 148.82 151.74 148.57 150.27 145.199524 106081600

24/07/2017 150.58 153.99 147.3 149.5 144.455536 105818100

31/07/2017 149.9 159.75 148.13 156.39 151.113022 172808500

07/08/2017 157.06 161.83 154.63 157.48 152.166245 151269100

14/08/2017 159.32 162.51 156.72 157.5 152.783203 134628500

21/08/2017 157.5 160.74 155.11 159.86 155.072525 112671200

28/08/2017 160.14 164.94 159.93 164.05 159.137039 126128700

04/09/2017 163.75 164.25 158.53 158.63 153.879349 101660200

11/09/2017 160.5 163.96 157.91 159.88 155.091934 221077500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.