Corporate Governance at Asaleo Care Limited

VerifiedAdded on 2023/03/31

|16

|3211

|376

AI Summary

This report examines the corporate governance policies and procedures of Asaleo Care Limited, an ASX listed entity. It analyzes the board composition, orientation, and remuneration structure of the company. The report also evaluates the voluntary disclosures provided by the company and their impact on stakeholders.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Ethics and Governance

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

Executive Summary.....................................................................................................................................3

Part 1: Introduction.....................................................................................................................................4

Part 2: Summary of Corporate Governance at Asaleo Care Limited............................................................5

Board Independence...............................................................................................................................5

Information from the reports of Chairperson and CEO...........................................................................6

Remuneration report...............................................................................................................................6

Immediate Priorities of the company and actions taken.........................................................................9

Part 3: Board Orientation..........................................................................................................................10

Part 4: Evaluation of communications made by the company through using the legitimacy theory.........12

Conclusion.................................................................................................................................................14

References.................................................................................................................................................15

2

Executive Summary.....................................................................................................................................3

Part 1: Introduction.....................................................................................................................................4

Part 2: Summary of Corporate Governance at Asaleo Care Limited............................................................5

Board Independence...............................................................................................................................5

Information from the reports of Chairperson and CEO...........................................................................6

Remuneration report...............................................................................................................................6

Immediate Priorities of the company and actions taken.........................................................................9

Part 3: Board Orientation..........................................................................................................................10

Part 4: Evaluation of communications made by the company through using the legitimacy theory.........12

Conclusion.................................................................................................................................................14

References.................................................................................................................................................15

2

Executive Summary

This report is developed for the purpose of examining the corporate governance policies

and procedures of an ASX listed entity, that is, Asaleo Care Limited. In this context, it has

demonstrated the corporate governance structure of the company by examining the board

composition, board orientation and the remuneration structure. It has been identified that the

company possess shareholder-agency orientation where Board is directed and controlled by the

shareholders and the main focus is to increase the returns from them. However, it develops and

provides its voluntary disclosures for promoting communication in relation to its societal and

environmental implications and developing a legitimate image in the mind of its stakeholders.

3

This report is developed for the purpose of examining the corporate governance policies

and procedures of an ASX listed entity, that is, Asaleo Care Limited. In this context, it has

demonstrated the corporate governance structure of the company by examining the board

composition, board orientation and the remuneration structure. It has been identified that the

company possess shareholder-agency orientation where Board is directed and controlled by the

shareholders and the main focus is to increase the returns from them. However, it develops and

provides its voluntary disclosures for promoting communication in relation to its societal and

environmental implications and developing a legitimate image in the mind of its stakeholders.

3

Part 1: Introduction

The purpose of the report is to conduct a research relating to the significance of voluntary

disclosures provided by a publicly listed company relating to its governance and ethical outlook.

The businesses are placing increasing importance on providing information about the manner in

which they conduct their operational activities for ensuring that they have carried out their

diverse functions in an ethical and responsible manner. This is necessary for a company to create

a positive image in the mind of different stakeholders of an organization such as customers,

suppliers, investors, government and others. This results in achieving a continuous support from

the stakeholders and thus supporting the sustainable growth and development of an organization.

The investors seeking to invest in companies are placing large emphasis on examining the impact

of their different business activities on the society and environment in which they are operating

in addition to analyzing their financial position.

As such, the voluntary disclosures provided by a company are essential to seek the

interests of the investors and promoting its sustainable growth and development by actively

seeking support of its different stakeholders. In this context, the report has undertaken an

evaluation of the annual report of a selected ASX listed entity for examining its corporate

governance structure, orientation of Board and information provided by it in that can lead to

legitimizing its operations in the mind of stakeholders. The ASX listed entity selected for the

purpose is Asaleo Care Limited, a personal care and hygiene company. It is involved in

manufacturing, marketing, and distribution and selling of consumer products related to personal

care, hygiene and tissue products. The major consumer products of the company includes facial

tissues, paper towels, napkins, tampons, pads and other safety and hygiene products. The

company operates within the healthcare sector of Australia and is listed under the ASX. It has the

presence of about 11 distribution centers and about five manufacturing sites across Australia,

New Zealand and Fiji. The company provides its product to the customers through its extensive

distribution network such as retail stores and also to business end users such as schools,

restaurants, airports, aged care facilities, hospitals and others. It has been established in the year

1932 by the name of PEPSCA Limited and has then transformed its name to Asaelo Care

Limited in the year 2014 (Annual Report, 2018).

4

The purpose of the report is to conduct a research relating to the significance of voluntary

disclosures provided by a publicly listed company relating to its governance and ethical outlook.

The businesses are placing increasing importance on providing information about the manner in

which they conduct their operational activities for ensuring that they have carried out their

diverse functions in an ethical and responsible manner. This is necessary for a company to create

a positive image in the mind of different stakeholders of an organization such as customers,

suppliers, investors, government and others. This results in achieving a continuous support from

the stakeholders and thus supporting the sustainable growth and development of an organization.

The investors seeking to invest in companies are placing large emphasis on examining the impact

of their different business activities on the society and environment in which they are operating

in addition to analyzing their financial position.

As such, the voluntary disclosures provided by a company are essential to seek the

interests of the investors and promoting its sustainable growth and development by actively

seeking support of its different stakeholders. In this context, the report has undertaken an

evaluation of the annual report of a selected ASX listed entity for examining its corporate

governance structure, orientation of Board and information provided by it in that can lead to

legitimizing its operations in the mind of stakeholders. The ASX listed entity selected for the

purpose is Asaleo Care Limited, a personal care and hygiene company. It is involved in

manufacturing, marketing, and distribution and selling of consumer products related to personal

care, hygiene and tissue products. The major consumer products of the company includes facial

tissues, paper towels, napkins, tampons, pads and other safety and hygiene products. The

company operates within the healthcare sector of Australia and is listed under the ASX. It has the

presence of about 11 distribution centers and about five manufacturing sites across Australia,

New Zealand and Fiji. The company provides its product to the customers through its extensive

distribution network such as retail stores and also to business end users such as schools,

restaurants, airports, aged care facilities, hospitals and others. It has been established in the year

1932 by the name of PEPSCA Limited and has then transformed its name to Asaelo Care

Limited in the year 2014 (Annual Report, 2018).

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The report in the context of voluntary disclosures provided by the company has

researched about the corporate governance policies and applied the legitimacy theory in

regarding to examining the legitimacy of its different activities. The report in general aims to

provide the results relating to Board orientation, remuneration report and type of voluntary

disclosures provided by the company that helps in illustrating its legitimacy to the stakeholders.

As such, it presents an evaluation of the ethical and governance outlook of the selected company

through evaluation of its own disclosures and relevant theoretical frameworks that leads to

analysis of the impact of the company’s operations on the society and environment.

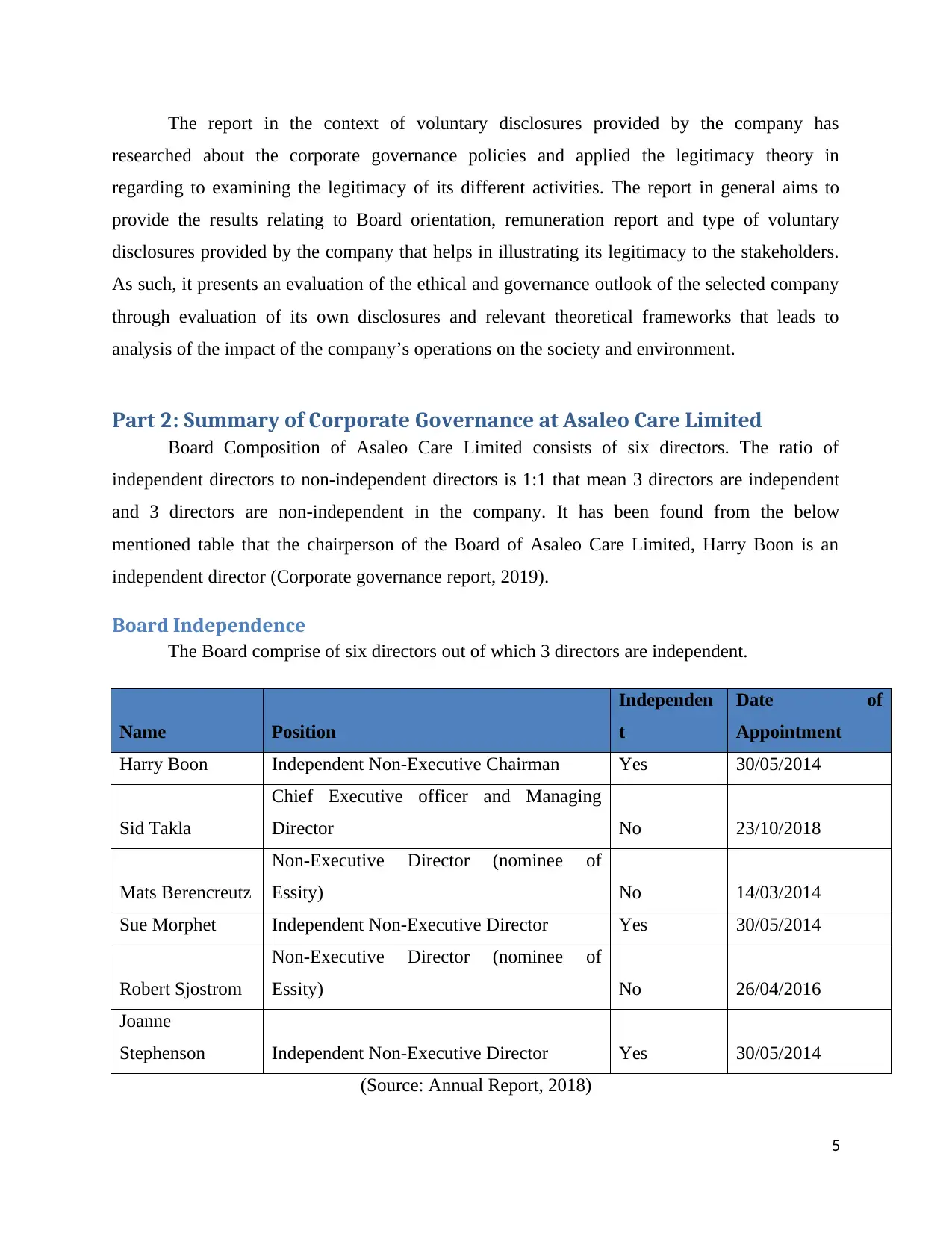

Part 2: Summary of Corporate Governance at Asaleo Care Limited

Board Composition of Asaleo Care Limited consists of six directors. The ratio of

independent directors to non-independent directors is 1:1 that mean 3 directors are independent

and 3 directors are non-independent in the company. It has been found from the below

mentioned table that the chairperson of the Board of Asaleo Care Limited, Harry Boon is an

independent director (Corporate governance report, 2019).

Board Independence

The Board comprise of six directors out of which 3 directors are independent.

Name Position

Independen

t

Date of

Appointment

Harry Boon Independent Non-Executive Chairman Yes 30/05/2014

Sid Takla

Chief Executive officer and Managing

Director No 23/10/2018

Mats Berencreutz

Non-Executive Director (nominee of

Essity) No 14/03/2014

Sue Morphet Independent Non-Executive Director Yes 30/05/2014

Robert Sjostrom

Non-Executive Director (nominee of

Essity) No 26/04/2016

Joanne

Stephenson Independent Non-Executive Director Yes 30/05/2014

(Source: Annual Report, 2018)

5

researched about the corporate governance policies and applied the legitimacy theory in

regarding to examining the legitimacy of its different activities. The report in general aims to

provide the results relating to Board orientation, remuneration report and type of voluntary

disclosures provided by the company that helps in illustrating its legitimacy to the stakeholders.

As such, it presents an evaluation of the ethical and governance outlook of the selected company

through evaluation of its own disclosures and relevant theoretical frameworks that leads to

analysis of the impact of the company’s operations on the society and environment.

Part 2: Summary of Corporate Governance at Asaleo Care Limited

Board Composition of Asaleo Care Limited consists of six directors. The ratio of

independent directors to non-independent directors is 1:1 that mean 3 directors are independent

and 3 directors are non-independent in the company. It has been found from the below

mentioned table that the chairperson of the Board of Asaleo Care Limited, Harry Boon is an

independent director (Corporate governance report, 2019).

Board Independence

The Board comprise of six directors out of which 3 directors are independent.

Name Position

Independen

t

Date of

Appointment

Harry Boon Independent Non-Executive Chairman Yes 30/05/2014

Sid Takla

Chief Executive officer and Managing

Director No 23/10/2018

Mats Berencreutz

Non-Executive Director (nominee of

Essity) No 14/03/2014

Sue Morphet Independent Non-Executive Director Yes 30/05/2014

Robert Sjostrom

Non-Executive Director (nominee of

Essity) No 26/04/2016

Joanne

Stephenson Independent Non-Executive Director Yes 30/05/2014

(Source: Annual Report, 2018)

5

Information from the reports of Chairperson and CEO

It has been analyzed from the Chairperson and CEO report that the company is

emphasizing on conducting its operational activities in a safe, ethical and transparent manner. It

is continuously focusing on making a positive contribution towards improving the environment

and meeting the social needs. In this context, the company places importance on resourcing its

products in a sustainable manner. As such, it has complied with the policy of No Deforestation,

No peat and No exploitation for protecting the forests form any type of negative impact of its

different operations. It has also stained a potion of sustainability leadership in the Down Jones

Sustainability Australia Index (DJSI). It promotes social and economic development of the

communities’ thorough making charities and also supporting the economic growth and

development of its families of framers from which it source its raw materials (Annual Report,

2018).

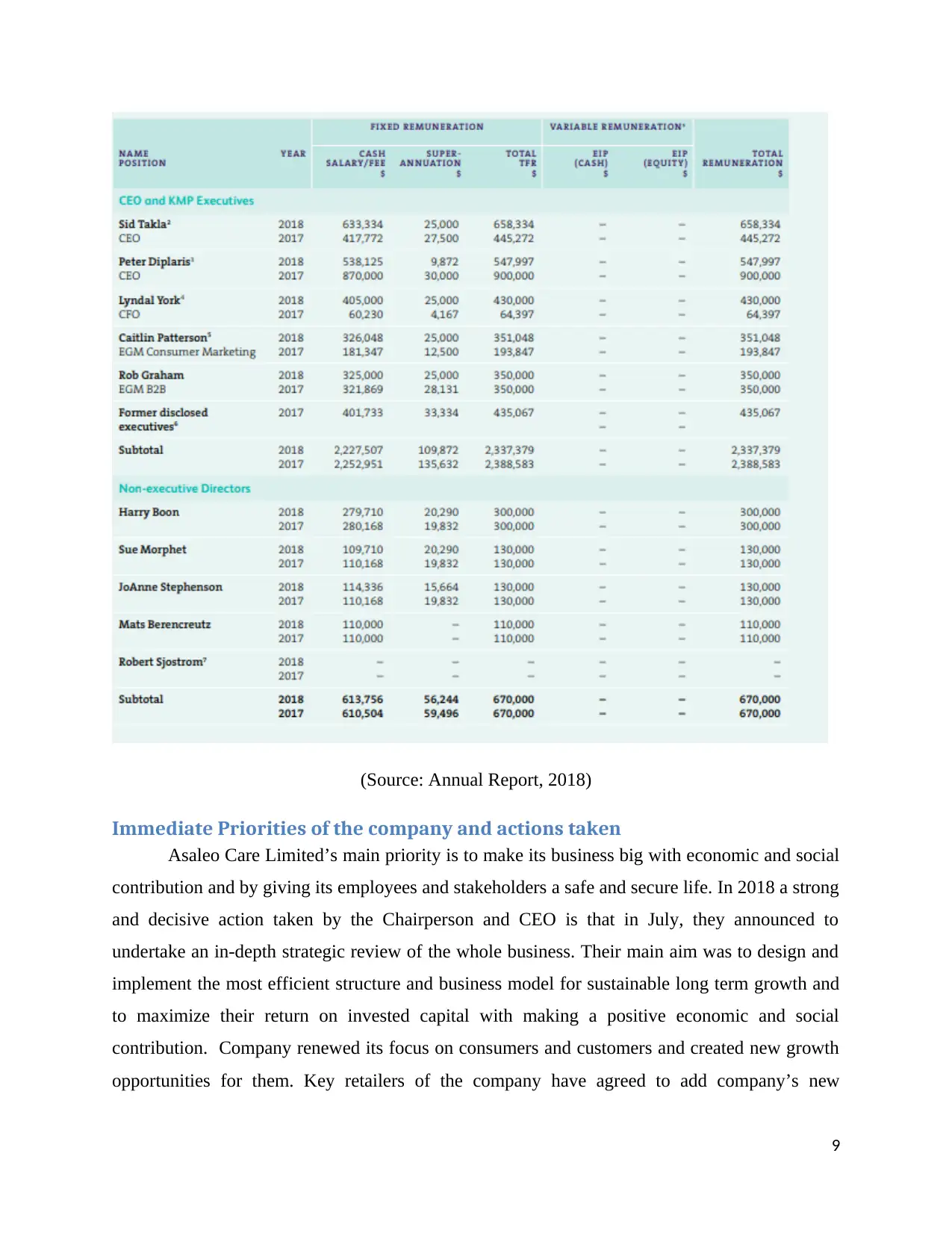

Remuneration report

Company is following a fixed remuneration policy for all executive and non-executive

directors. Fixed remuneration comprises base salary and superannuation. Variable remuneration

is structured to provide executives with competitive performance-based remuneration (Corporate

governance report, 2019).

Below is the list of directors and key managerial personnel (KMP)

6

It has been analyzed from the Chairperson and CEO report that the company is

emphasizing on conducting its operational activities in a safe, ethical and transparent manner. It

is continuously focusing on making a positive contribution towards improving the environment

and meeting the social needs. In this context, the company places importance on resourcing its

products in a sustainable manner. As such, it has complied with the policy of No Deforestation,

No peat and No exploitation for protecting the forests form any type of negative impact of its

different operations. It has also stained a potion of sustainability leadership in the Down Jones

Sustainability Australia Index (DJSI). It promotes social and economic development of the

communities’ thorough making charities and also supporting the economic growth and

development of its families of framers from which it source its raw materials (Annual Report,

2018).

Remuneration report

Company is following a fixed remuneration policy for all executive and non-executive

directors. Fixed remuneration comprises base salary and superannuation. Variable remuneration

is structured to provide executives with competitive performance-based remuneration (Corporate

governance report, 2019).

Below is the list of directors and key managerial personnel (KMP)

6

(Source: Annual Report, 2018)

Asaleo Care Limited has defined some objectives for the group remuneration policy.

These objectives are followed by below principles:

Remuneration policy should be motivating to pursue company’s long term growth and

success.

Policy should demonstrate a clear relationship between the company’s overall

performance and the remuneration of senior management.

Remuneration policy should be such that aligns interest of executives with the creation of

value for shareholders.

Complying with all relevant legal and regulatory provisions (Annual Report, 2018)

Asaleo Care Limited has given its executives remuneration in three forms- fixed

remuneration, cash incentive and equity incentive that can be seen from the below chart:

7

Asaleo Care Limited has defined some objectives for the group remuneration policy.

These objectives are followed by below principles:

Remuneration policy should be motivating to pursue company’s long term growth and

success.

Policy should demonstrate a clear relationship between the company’s overall

performance and the remuneration of senior management.

Remuneration policy should be such that aligns interest of executives with the creation of

value for shareholders.

Complying with all relevant legal and regulatory provisions (Annual Report, 2018)

Asaleo Care Limited has given its executives remuneration in three forms- fixed

remuneration, cash incentive and equity incentive that can be seen from the below chart:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Source: Annual Report, 2018)

Below mention is the report of total remuneration of all directors and executives:

8

Below mention is the report of total remuneration of all directors and executives:

8

(Source: Annual Report, 2018)

Immediate Priorities of the company and actions taken

Asaleo Care Limited’s main priority is to make its business big with economic and social

contribution and by giving its employees and stakeholders a safe and secure life. In 2018 a strong

and decisive action taken by the Chairperson and CEO is that in July, they announced to

undertake an in-depth strategic review of the whole business. Their main aim was to design and

implement the most efficient structure and business model for sustainable long term growth and

to maximize their return on invested capital with making a positive economic and social

contribution. Company renewed its focus on consumers and customers and created new growth

opportunities for them. Key retailers of the company have agreed to add company’s new

9

Immediate Priorities of the company and actions taken

Asaleo Care Limited’s main priority is to make its business big with economic and social

contribution and by giving its employees and stakeholders a safe and secure life. In 2018 a strong

and decisive action taken by the Chairperson and CEO is that in July, they announced to

undertake an in-depth strategic review of the whole business. Their main aim was to design and

implement the most efficient structure and business model for sustainable long term growth and

to maximize their return on invested capital with making a positive economic and social

contribution. Company renewed its focus on consumers and customers and created new growth

opportunities for them. Key retailers of the company have agreed to add company’s new

9

products, as range addition in Tissue and Personal Care categories. Market Share for Feminine

Care business stabilized with the investment in trade spends. Company has successfully launched

new Tena products, new pants and lights to make their customers life better (Annual Report,

2018).

Part 3: Board Orientation

The orientation of Board refers to process of providing information regarding the various

roles and responsibilities of the Board members. It aims to provide depiction regarding the

strategic direction and the type of relationship that is present between the board and

management. There are various types of Board Orientation that are used in the context of a

company that are shareholder-agency, shareholder-stewardship, stakeholder-managerial,

stakeholder-ethical and resources. The shareholder-agency type of board orientation refers to the

presence of high proportion of independent directors within the Board who are installed by the

shareholders. The orientation is governed on the basis of theory of agency which has stated that

there is presence of a principal, that is shareholders, and the agent, that are the business

managers, who governs the working of an entity (Desender, 2009).

The Board is appointed by the shareholders and the emphasis is to increase the return for

them. This type of orientation of Board adopts the use of communication strategies such as

remuneration report, income statement and balance sheet for disclosing the useful information to

the stakeholders. The next type of Board Orientation is shareholder-stewardship which has the

presence of greater proportion of non-independent directors having the responsibility of

promoting growth and development of a company (Effross, 2014). The focus of the Board is to

promote internal growth of a business and conduct adequate capital management. The major

communication strategies used by the Board for depicting the business results includes report of

Chairperson’s, balance sheet and cash flows.

On the other hand, stakeholder-managerial orientation of Board indicates the presence of

majority of independent directors who are mainly appointed for satisfying the needs of most

influential stakeholders. The Board mainly develops and publishes voluntary disclosures for

meeting the interest of end-users such as investors and other stakeholders. The stakeholder-

ethical orientation indicates that majority independent directors reflect the stakeholder’s diversity

10

Care business stabilized with the investment in trade spends. Company has successfully launched

new Tena products, new pants and lights to make their customers life better (Annual Report,

2018).

Part 3: Board Orientation

The orientation of Board refers to process of providing information regarding the various

roles and responsibilities of the Board members. It aims to provide depiction regarding the

strategic direction and the type of relationship that is present between the board and

management. There are various types of Board Orientation that are used in the context of a

company that are shareholder-agency, shareholder-stewardship, stakeholder-managerial,

stakeholder-ethical and resources. The shareholder-agency type of board orientation refers to the

presence of high proportion of independent directors within the Board who are installed by the

shareholders. The orientation is governed on the basis of theory of agency which has stated that

there is presence of a principal, that is shareholders, and the agent, that are the business

managers, who governs the working of an entity (Desender, 2009).

The Board is appointed by the shareholders and the emphasis is to increase the return for

them. This type of orientation of Board adopts the use of communication strategies such as

remuneration report, income statement and balance sheet for disclosing the useful information to

the stakeholders. The next type of Board Orientation is shareholder-stewardship which has the

presence of greater proportion of non-independent directors having the responsibility of

promoting growth and development of a company (Effross, 2014). The focus of the Board is to

promote internal growth of a business and conduct adequate capital management. The major

communication strategies used by the Board for depicting the business results includes report of

Chairperson’s, balance sheet and cash flows.

On the other hand, stakeholder-managerial orientation of Board indicates the presence of

majority of independent directors who are mainly appointed for satisfying the needs of most

influential stakeholders. The Board mainly develops and publishes voluntary disclosures for

meeting the interest of end-users such as investors and other stakeholders. The stakeholder-

ethical orientation indicates that majority independent directors reflect the stakeholder’s diversity

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

and the Board publishes the voluntary disclosures having focus on CSR. Lastly, the resources

orientation refers to the mix of independent and non-independent directors and has an adequate

mix of skills and expertise for securing the vital resource flows into the company. The major

focus of the Board is to regulate the resources flow by adequate management of capital. The key

communication used is providing disclosures regarding the ways adopted by it for securing

resources for the company (Zhao, 2011).

As analyzed from the above types of Board orientation, it can be said that there is

presence of shareholder-agency orientation within Asaelo Care Limited. This is because the

Board composition of the company has revealed that it consists of mainly independent directors

appointed by the shareholders for conducting the various operations of the company. The

shareholders as such represent the principal who has appointed Board members for conducting

the business operations. This type of orientation can be explained adequately by the use of

agency theory as per which there is a principal-agent relationship between the shareholders and

the business managers. The theory has stated that it is the responsibility of agents to act in the

best interests of principal and maximize their interests and welfare (Heracleous, 2010).

As such, the shareholder-agency orientation indicates that Board of a company holds the

position of agent who acts on the behalf of the shareholders and the major focus is to maximizing

the interest of the shareholders. The Board in turn appoints the business managers who are

ultimate agent acting for meeting the strategic goals and objectives of the shareholders by

promoting the growth and development of the company. The Board aims to reduce the agency

cost by aligning the interest of the shareholders as per the business managers with the use of

different remuneration plans such as adopting the use of incentives and rewards. The rewards

and incentives should be aligned with the long-term performance of the business and thus it

helps in reducing the conflict of interest between the two as the business manager’s aims to

achieve the strategic goals and priorities provided to them by the Board for maximizing their

incentives or rewards and as such increasing their own personal monetary benefits (Rezaee,

2008). The shareholders as such tend to appoint large number of independent directors within

Board with the aim of decrease in the stake of managers. The independent directors will act in

the best interests of the company by developing ethical policies and guidelines that helps in

strengthening corporate governance and thus reducing the possibility of occurrence of any type

11

orientation refers to the mix of independent and non-independent directors and has an adequate

mix of skills and expertise for securing the vital resource flows into the company. The major

focus of the Board is to regulate the resources flow by adequate management of capital. The key

communication used is providing disclosures regarding the ways adopted by it for securing

resources for the company (Zhao, 2011).

As analyzed from the above types of Board orientation, it can be said that there is

presence of shareholder-agency orientation within Asaelo Care Limited. This is because the

Board composition of the company has revealed that it consists of mainly independent directors

appointed by the shareholders for conducting the various operations of the company. The

shareholders as such represent the principal who has appointed Board members for conducting

the business operations. This type of orientation can be explained adequately by the use of

agency theory as per which there is a principal-agent relationship between the shareholders and

the business managers. The theory has stated that it is the responsibility of agents to act in the

best interests of principal and maximize their interests and welfare (Heracleous, 2010).

As such, the shareholder-agency orientation indicates that Board of a company holds the

position of agent who acts on the behalf of the shareholders and the major focus is to maximizing

the interest of the shareholders. The Board in turn appoints the business managers who are

ultimate agent acting for meeting the strategic goals and objectives of the shareholders by

promoting the growth and development of the company. The Board aims to reduce the agency

cost by aligning the interest of the shareholders as per the business managers with the use of

different remuneration plans such as adopting the use of incentives and rewards. The rewards

and incentives should be aligned with the long-term performance of the business and thus it

helps in reducing the conflict of interest between the two as the business manager’s aims to

achieve the strategic goals and priorities provided to them by the Board for maximizing their

incentives or rewards and as such increasing their own personal monetary benefits (Rezaee,

2008). The shareholders as such tend to appoint large number of independent directors within

Board with the aim of decrease in the stake of managers. The independent directors will act in

the best interests of the company by developing ethical policies and guidelines that helps in

strengthening corporate governance and thus reducing the possibility of occurrence of any type

11

of unethical practices. The independent nature of Board ensures that its focus on promoting long-

term growth of the company rather than maximization of personal interests of business

managers. This helps in enhancing the accountability and integrity within business operations

and leads in developing a strong governance system (Corporate governance report, 2019).

The presence of large number of independent director ensures that Board act in an

independent manner and does not have any materialistic interest within company operations. The

Board receives its remuneration as per the remuneration policy developed for directors and does

not have any stake within company finanacil outcomes. Therefore, it can be said that Board acts

a complete neutral in proving direction to the management regarding the ways of conducting

different business operations and providing them strategic goals and priorities to be achieved for

meeting the interests of the shareholders (Zhao, 2011). Asaleo Care Limited possesses 6 director

out which three are independent and thus has maintained a equal proportion between dependent

and independent directors. The independent directors are appointed by shareholders and there

exist large control by the shareholders over the Board. It can be said that though the company has

maintained an equal balance between independent and non-independent directors but the focus is

to meet the shareholders needs due to the appointment by the shareholders of Board members.

The key communication strategy used by the Board for providing information to the shareholders

about the business outcomes ate financial statements and remuneration report. The remuneration

report provides details regarding the remuneration provided to the director and business

managers for maintaining accountability in the mind of shareholders (Corporate governance

report, 2019).

Part 4: Evaluation of communications made by the company through

using the legitimacy theory

In order to evaluate the communication made by Asaleo Care Limited through using the

legitimacy theory, it is important to understand the true meaning of legitimacy theory in context

of various communication made by the companies. Some of the important communications that

are made by companies with regards to prove their legitimacy are financial report, corporate

governance report, sustainability report and other specific disclosure pertaining to the specific

industry or company (Deegan, 2002).

12

term growth of the company rather than maximization of personal interests of business

managers. This helps in enhancing the accountability and integrity within business operations

and leads in developing a strong governance system (Corporate governance report, 2019).

The presence of large number of independent director ensures that Board act in an

independent manner and does not have any materialistic interest within company operations. The

Board receives its remuneration as per the remuneration policy developed for directors and does

not have any stake within company finanacil outcomes. Therefore, it can be said that Board acts

a complete neutral in proving direction to the management regarding the ways of conducting

different business operations and providing them strategic goals and priorities to be achieved for

meeting the interests of the shareholders (Zhao, 2011). Asaleo Care Limited possesses 6 director

out which three are independent and thus has maintained a equal proportion between dependent

and independent directors. The independent directors are appointed by shareholders and there

exist large control by the shareholders over the Board. It can be said that though the company has

maintained an equal balance between independent and non-independent directors but the focus is

to meet the shareholders needs due to the appointment by the shareholders of Board members.

The key communication strategy used by the Board for providing information to the shareholders

about the business outcomes ate financial statements and remuneration report. The remuneration

report provides details regarding the remuneration provided to the director and business

managers for maintaining accountability in the mind of shareholders (Corporate governance

report, 2019).

Part 4: Evaluation of communications made by the company through

using the legitimacy theory

In order to evaluate the communication made by Asaleo Care Limited through using the

legitimacy theory, it is important to understand the true meaning of legitimacy theory in context

of various communication made by the companies. Some of the important communications that

are made by companies with regards to prove their legitimacy are financial report, corporate

governance report, sustainability report and other specific disclosure pertaining to the specific

industry or company (Deegan, 2002).

12

Legitimacy can be applied in various subject matters and it provides anything which is

according to the law is acceptable. Legitimacy is often used in context to prove the organization

commitment towards to the society and all other stakeholders. In this context, legitimacy has

been defined as set of perceptions and assumptions that proves that activities of an entity are

appropriate and desirable as per the social norms, definitions, beliefs and values. So as per the

legitimacy theory organization must perform the actions and activities that does not harm the

values, norms and beliefs of the society. It can be said that legitimacy theory is based on idea that

ensure that entity works in boundaries set by the society and entities must provide enough

evidence that proves that their actions and activities are legitimate (Milne & Patten, 2002). There

are many ways that helps to prove that organization is working as per the legitimate norms such

as disclosures made in annual report about the sustainability, corporate governance and all the

financial disclosures. Disclosure requirement can differ to according to the requirement of

stakeholders and society. Stakeholders are mainly concerned with the financial performance and

corporate governance disclosures made by the company but society in which company operates

is mainly concerned with sustainability and climate disclosures. As per the Global Reporting

Initiative it is important that entities should include all the financial as well as non financial

disclosures in the annual report so that stakeholders can make their decisions wisely (Deegan,

Rankin & Tobin, 2002).

Asaleo Care Limited has made sufficient disclosures to prove its legitimacy and also to

prove its concern towards the society it works for. Asaleo Care Limited is highly concerned to

the environment and it is clearly seen in its environmental policy. It has been disclosed by the

company that its major sustainability goal is to promote the more sustainable organization

through using the products and business operations. Asaleo Care Limited has also provided steps

it takes to make ensure that all their activities and actions are performed within the context of

societal norms, beliefs and perceptions to prove its legitimacy (Environment Policy, 2019).

Corporate disclosures have also been made in separate corporate governance statement but there

was no detailed disclosures regarding the corporate governance in the annual report of Asaleo

Care Limited (Annual Report, 2018). So overall it can be said that company has made enough

efforts to make sure that proper communication has been established between stakeholders and

company. It is the duty of board of directors to provide the detailed disclosures in annual report

and other reports to make the society believes that company is performing its actions under given

13

according to the law is acceptable. Legitimacy is often used in context to prove the organization

commitment towards to the society and all other stakeholders. In this context, legitimacy has

been defined as set of perceptions and assumptions that proves that activities of an entity are

appropriate and desirable as per the social norms, definitions, beliefs and values. So as per the

legitimacy theory organization must perform the actions and activities that does not harm the

values, norms and beliefs of the society. It can be said that legitimacy theory is based on idea that

ensure that entity works in boundaries set by the society and entities must provide enough

evidence that proves that their actions and activities are legitimate (Milne & Patten, 2002). There

are many ways that helps to prove that organization is working as per the legitimate norms such

as disclosures made in annual report about the sustainability, corporate governance and all the

financial disclosures. Disclosure requirement can differ to according to the requirement of

stakeholders and society. Stakeholders are mainly concerned with the financial performance and

corporate governance disclosures made by the company but society in which company operates

is mainly concerned with sustainability and climate disclosures. As per the Global Reporting

Initiative it is important that entities should include all the financial as well as non financial

disclosures in the annual report so that stakeholders can make their decisions wisely (Deegan,

Rankin & Tobin, 2002).

Asaleo Care Limited has made sufficient disclosures to prove its legitimacy and also to

prove its concern towards the society it works for. Asaleo Care Limited is highly concerned to

the environment and it is clearly seen in its environmental policy. It has been disclosed by the

company that its major sustainability goal is to promote the more sustainable organization

through using the products and business operations. Asaleo Care Limited has also provided steps

it takes to make ensure that all their activities and actions are performed within the context of

societal norms, beliefs and perceptions to prove its legitimacy (Environment Policy, 2019).

Corporate disclosures have also been made in separate corporate governance statement but there

was no detailed disclosures regarding the corporate governance in the annual report of Asaleo

Care Limited (Annual Report, 2018). So overall it can be said that company has made enough

efforts to make sure that proper communication has been established between stakeholders and

company. It is the duty of board of directors to provide the detailed disclosures in annual report

and other reports to make the society believes that company is performing its actions under given

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

laws and regulations. Overall it can be said that Asaleo Care Limited has been successful in

communicating the corporate actions to prove its legitimacy.

Conclusion

The overall discussion conducted in the report has inferred that Asaleo Care Limited

possess a strong corporate governance structure that emphasizes on conducting business

operations in an ethical manner and meeting the diverse needs and explanations of the

stakeholders. The orientation of Board reflects that there is high control of the shareholders and

focuses on increasing the returns for them. The Board focuses on protecting the interests of the

shareholders and the key communications strategy adopted are remuneration report and financial

statements. Also, the voluntary disclosures are undertaken by the company for legitimizing its

actions in the context of society and environment in which it conducts its operations.

14

communicating the corporate actions to prove its legitimacy.

Conclusion

The overall discussion conducted in the report has inferred that Asaleo Care Limited

possess a strong corporate governance structure that emphasizes on conducting business

operations in an ethical manner and meeting the diverse needs and explanations of the

stakeholders. The orientation of Board reflects that there is high control of the shareholders and

focuses on increasing the returns for them. The Board focuses on protecting the interests of the

shareholders and the key communications strategy adopted are remuneration report and financial

statements. Also, the voluntary disclosures are undertaken by the company for legitimizing its

actions in the context of society and environment in which it conducts its operations.

14

References

Asaleo Care Limited. (2018). Annual Report. Retrieved June 1, 2019, from

https://www.asaleocare.com/investor-relations/company-reports/

Corporate governance report. (2019). Asaleo Care Limited. Retrieved June 1 2019, from

http://www.asaleocare.com/investor-relations/corporate-governance/

Deegan, C. (2002). Introduction: The legitimising effect of social and environmental disclosures

- a theoretical foundation. Accounting, Auditing & Accountability Journal, 15(3), 282-

311.

Deegan, C., Rankin, M., & Tobin, J. (2002). An examination of the corporate social and

environmental disclosures of BHP from 1983–1997. Accounting, Auditing &

Accountability, 15(3), 312-343.

Desender, K. (2009). The relationship between the ownership structure and the role of the board.

Retrieved 3 September, 2018, from

http://www.business.illinois.edu/Working_Papers/papers/09-0105.pdf

Effross, W. (2014). Corporate Governance: Principles and Practice. Wolters Kluwer Law &

Business.

Environment Policy. (2019). Sustainability: Asaleo Care Limited. Retrieved June 6, 2019, from

http://www.asaleocare.com/sustainability/environmental-policy/

Heracleous, L. (2010). Rethinking Agency Theory: The View from Law. The Academy of

Management Review 35(2), pp. 294-314.

Milne, M. J., & Patten, D. M. (2002). Securing organizational legitimacy: An experimental

decision case examining the impact of environmental disclosures. Accounting, Auditing

& Accountability, 15(3), 372-405.

Rezaee, Z. (2008). Corporate Governance and Ethics. US: John Wiley & Sons.

15

Asaleo Care Limited. (2018). Annual Report. Retrieved June 1, 2019, from

https://www.asaleocare.com/investor-relations/company-reports/

Corporate governance report. (2019). Asaleo Care Limited. Retrieved June 1 2019, from

http://www.asaleocare.com/investor-relations/corporate-governance/

Deegan, C. (2002). Introduction: The legitimising effect of social and environmental disclosures

- a theoretical foundation. Accounting, Auditing & Accountability Journal, 15(3), 282-

311.

Deegan, C., Rankin, M., & Tobin, J. (2002). An examination of the corporate social and

environmental disclosures of BHP from 1983–1997. Accounting, Auditing &

Accountability, 15(3), 312-343.

Desender, K. (2009). The relationship between the ownership structure and the role of the board.

Retrieved 3 September, 2018, from

http://www.business.illinois.edu/Working_Papers/papers/09-0105.pdf

Effross, W. (2014). Corporate Governance: Principles and Practice. Wolters Kluwer Law &

Business.

Environment Policy. (2019). Sustainability: Asaleo Care Limited. Retrieved June 6, 2019, from

http://www.asaleocare.com/sustainability/environmental-policy/

Heracleous, L. (2010). Rethinking Agency Theory: The View from Law. The Academy of

Management Review 35(2), pp. 294-314.

Milne, M. J., & Patten, D. M. (2002). Securing organizational legitimacy: An experimental

decision case examining the impact of environmental disclosures. Accounting, Auditing

& Accountability, 15(3), 372-405.

Rezaee, Z. (2008). Corporate Governance and Ethics. US: John Wiley & Sons.

15

Zhao, Y. (2011). Corporate Governance and Directors' Independence. Netherlands: Kluwer Law

International.

16

International.

16

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.